Table of Contents

As filed with the Securities and Exchange Commission on November 30, 2007

Registration No. 333-147351

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 3 TO

FORM F-1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

WSP Holdings Limited

(Exact name of registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

| Cayman Islands | 3533 | Not Applicable | ||||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

No.38 Zhujiang Road

Xinqu, Wuxi

Jiangsu Province

People’s Republic of China

(86 510) 8522-6351

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

CT Corporation System

111 Eighth Avenue

New York, New York 10011

(212) 664-1666

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

David T. Zhang

Latham & Watkins LLP

41st Floor, One Exchange Square

8 Connaught Place, Central

Hong Kong

(852) 2912-2503

Show-Mao Chen

Davis Polk & Wardwell

18th Floor, The Hong Kong Club Building

3A Chater Road, Central

Hong Kong

(852) 2533-3300

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ![]()

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ![]()

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ![]()

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earliest effective registration statement for the same offering. ![]()

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered (2) (3) | Amount to be registered | Proposed maximum offering price | Proposed maximum aggregate offering price (1) | Amount of registration fee | ||||||||||||||||||||

| Ordinary shares, par value $0.0001 per share | 57,500,000 | $ | 6.25 | $ | 359,375,000 | $ | 11,033(4 | ) | ||||||||||||||||

| (1) | Estimated solely for the purpose of determining the amount of registration fee in accordance with Rule 457(a) under the Securities Act of 1933. |

| (2) | Includes (i) ordinary shares initially offered and sold outside the United States that may be resold from time to time in the United States either as part of their distribution or within 40 days after the later of the effective date of this registration statement and the date the shares are first bona fide offered to the public and (ii) ordinary shares that may be purchased by the underwriters pursuant to an over-allotment option. These ordinary shares are not being registered for the purposes of sales outside of the United States. |

| (3) | American depositary shares issuable upon deposit of the ordinary shares registered hereby have been registered under a separate registration statement on Form F-6 (Registration No.333- ). Each American depositary share represents ordinary shares. |

| (4) | Paid previously. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to such Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and we are not soliciting an offer to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

Subject to completion, dated November , 2007

Prospectus

25,000,000 American Depositary Shares

Representing 50,000,000 Ordinary Shares

WSP Holdings Limited

This is an initial public offering of American depositary shares, or ADSs, by WSP Holdings Limited. WSP Holdings is offering 25,000,000 ADSs. Each ADS represents two ordinary shares. The estimated initial public offering price is between $10.50 and $12.50 per ADS.

Prior to this offering, there has been no public market for the ADSs. Our ordinary shares have not been listed on any exchange. We have applied to list the ADSs on the New York Stock Exchange under the symbol ‘‘WH.’’

| Per ADS | Total | |||||||||||

| Initial public offering price | $ | $ | ||||||||||

| Underwriting discounts and commissions | $ | $ | ||||||||||

| Proceeds to WSP Holdings, before expenses | $ | $ | ||||||||||

WSP Holdings has granted the underwriters an option for a period of 30 days from the date of this prospectus to purchase from WSP Holdings up to 3,750,000 additional ADSs.

Investing in our ADSs and ordinary shares involves a high degree of risk. See ‘‘Risk factors’’ beginning on page 11.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

JPMorgan

CIBC World Markets

| Aseambankers Malaysia Berhad | First Shanghai Securities Limited |

, 2007

Table of contents

You should rely only on the information contained in this prospectus. Neither we nor the underwriters have authorized anyone to provide you with information that is different from that contained in this prospectus. This prospectus may only be used where it is legal to offer and sell these securities. The information in this prospectus is only accurate as of the date of this prospectus.

i

Table of Contents

Conventions that apply to this prospectus

Unless the context otherwise requires, in this prospectus,

| • | ‘‘we,’’ ‘‘us,’’ ‘‘our company,’’ ‘‘our’’ or ‘‘WSP Holdings’’ refers to WSP Holdings Limited, which, unless otherwise required under the context, includes its predecessor entities and its consolidated subsidiaries; |

| • | ‘‘ADSs’’ refers to our American depositary shares, each of which represents ordinary shares; |

| • | ‘‘China’’ or ‘‘PRC’’ refers to the People’s Republic of China, excluding, for the purpose of this prospectus only, Taiwan, Hong Kong and Macau; |

| • | ‘‘Oil Country Tubular Goods,’’ or ‘‘OCTG,’’ refers to pipes and other tubular products used in the exploration, drilling and extraction of oil, gas and other hydrocarbon products. OCTG mainly consist of casing, tubing and drill pipes. Unless otherwise indicated, discussions relating to OCTG in this prospectus are limited to these three types of OCTG; |

| • | ‘‘Production capacity’’ refers to the maximum production capacity that can be achieved at the optimal level of operations of a production line, calculated using an estimated product mix for such production line, which may differ from its actual product mix; |

| • | ‘‘RMB’’ or ‘‘Renminbi’’ refers to the legal currency of China, ‘‘HK$’’ refers to the legal currency of Hong Kong, and ‘‘$,’’ ‘‘US$’’ or ‘‘U.S. dollars’’ refers to the legal currency of the United States; and |

| • | ‘‘shares’’ or ‘‘ordinary shares’’ refers to our ordinary shares, par value $0.0001 per share. |

Some names of companies given in this prospectus are translated or transliterated from Chinese if the original legal name is only in Chinese.

Unless the context otherwise requires, all translations from Renminbi amounts into U.S. dollars were made at the noon buying rate in New York, New York for cable transfers in Renminbi per U.S. dollar as certified for customs purposes by the Federal Reserve Bank of New York, or the noon buying rate, on June 29, 2007, which was RMB 7.6120 to $1.00. We make no representation that the Renminbi amounts in this prospectus could have been or could be converted into U.S. dollars at any particular rate or at all. On November 29, 2007, the noon buying rate was RMB 7.3800 to $1.00.

ii

Table of Contents

Prospectus summary

You should read the following summary together with the entire prospectus, including the more detailed information regarding us, the ADSs being sold in this offering, and our financial statements and related notes appearing elsewhere in this prospectus.

Overview

We are a leading Chinese manufacturer of seamless casing, tubing and drill pipes used for oil and natural gas exploration, drilling and extraction, which we refer to as Oil Country Tubular Goods, or OCTG. We sell our products in both the domestic and international markets. In China, we target sales of our products primarily at leading Chinese oil companies. In 2006, we were the third largest OCTG supplier to China National Petroleum Corporation, or CNPC, which, according to China Economics Yearbook 2006, accounted for approximately 59% of the oil output and 73% of the gas output in China in 2005. In addition, we are a major PRC exporter of seamless OCTG, accounting for over 15% of OCTG exports from China in 2006, according to a report by Preston Publishing Company, or Preston, an independent market research and consulting firm. We commissioned this report to provide us with industry data of the seamless OCTG market. In the international markets, we have establis hed an extensive overseas customer base, covering oilfields in North America, the Middle East, Asia, Africa and Russia.

We offer a comprehensive range of seamless OCTG products to our customers. Our product portfolio can generally be divided into two categories:

| • | API products, which are products manufactured according to the standards formulated by the American Petroleum Institute, or API; and |

| • | non-API products, which are products tailor-made to meet our customers’ specifications, and are generally manufactured to a higher standard than API products. |

To offer our customers a one-stop-shop solution for their OCTG requirements for oil and gas drilling and extraction, we focus our research and development efforts on producing higher margin, higher value-added non-API products. We have developed six series of non-API products that are suitable for diverse, challenging drilling conditions, including deep or super-deep wells, high temperature, highly pressurized and highly corrosive conditions. For example, our non-API products have been used in wells with a depth of over 7,000 meters in Puguang gas fields in Sichuan Province, China. Sales of non-API products as a percentage of our net revenues increased from 5.1% in 2004 to 6.4% in 2005, 11.3% in 2006 and 28.8% in the six months ended June 30, 2007. For the same periods, sales of API products accounted for 82.4%, 80.8%, 81.6% and 64.2%, respectively, of our net revenues.

As of June 30, 2007, our key operating assets included eight threading lines and one drill pipe production line with an aggregate annual production capacity of approximately 572,000 tonnes of seamless OCTG. Our annual production capacity increased from 220,000 tonnes as of December 31, 2004 to 310,000 tonnes as of December 31, 2005 to 452,000 tonnes as of December 31, 2006. In addition, since 2006 we have acquired or constructed three production lines with an aggregate annual production capacity of 650,000 tonnes for the manufacturing of green pipes, which are semi-finished pipes that can be further processed into end-products. We plan to expand our manufacturing facilities by constructing a new drill pipe production line and a new threading line in Wuxi, China and a new threading line in Vancouver, Canada. We also

1

Table of Contents

plan to establish a production facility in Houston, Texas, a joint venture with production lines in Saudi Arabia and additional production facilities in China.

We believe that we have a strong reputation in the OCTG industry in China and have been building a growing reputation internationally. We distinguish ourselves by the quality of our products, our customer-oriented research and development and technical capabilities, our competent and technical sales team, our experienced management team, our ability to timely meet customers’ production requirements, and the quality of our after-sales support. We provide our customers located in China with on-site support that includes engineering assistance to address technical difficulties that may arise during the installation or operation of our new products.

We have grown significantly since our inception in 1999. In 2004, 2005 and 2006, our net revenues were $128.5 million, $241.0 million and $366.5 million, respectively, representing a compound annual growth rate, or CAGR, of 68.9%. In the same periods, our net income was $6.5 million, $24.3 million and $58.9 million, respectively, representing a CAGR of 201.6%. For the six months ended June 30, 2007, our net revenues were $228.1 million and our net income was $36.8 million.

Our industry

We believe that we are well positioned to benefit from the growing demand for seamless OCTG, especially non-API products. This demand is being driven by the rapid growth of capital expenditures on oil and gas exploration, drilling and extraction. The combined capital expenditures on oil and gas exploration, drilling and production of China’s three largest domestic oil and gas exploration and production companies have grown at a CAGR of 21.6% between 2002 and 2006. Global rig count is also expected to increase at a CAGR of 5.3% between 2006 and 2010. This growth in capital expenditures is fundamentally driven by the increasing demand and expanding oil and gas markets. Between 1997 and 2006, China’s crude oil consumption grew at a CAGR of 6.6%, and gas consumption grew at a CAGR of 13.0%. China’s strong demand for oil and gas is expected to drive global oil and gas demand and, therefore, demand for seamless OCTG.

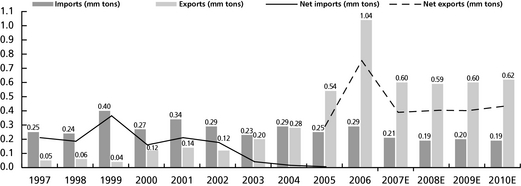

According to Preston, global seamless OCTG consumption is expected to grow from 8.9 million tonnes in 2006 to 11.8 million tonnes in 2010, representing a CAGR of approximately 7.3%. However, the global seamless OCTG price is expected to decrease from $1,876 per tonne in 2006 to $1,712 per tonne in 2010. The consumption of non-API products, which are more technology-intensive and of higher quality than API products, is expected to increase at an even higher CAGR during the same period. According to Preston, China will remain a net exporter of seamless OCTG products from 2006 to 2010. However, China will remain a net importer of non-API OCTG during the same period, presenting us with opportunities for import substitution.

Our strengths

We believe that the following strengths enable us to capture opportunities in the rapidly growing seamless OCTG industry and to compete effectively in the Chinese and international markets:

| • | dedication to OCTG manufacturing and comprehensive seamless OCTG product offerings; |

| • | strong customer-oriented research and development capabilities; |

| • | long-standing and strong customer relationships in China; |

2

Table of Contents

| • | flexible and scalable production capacity responsive to market demands; |

| • | established long-term access to raw material supplies; and |

| • | experienced management team with extensive industry knowledge and strong track record. |

Our strategy

Our goal is to become a global leader in the OCTG industry by delivering quality products and services. To achieve this goal, we plan to implement the following strategies:

| • | broaden our geographical revenue base and build and enhance brand recognition, both domestically and internationally; |

| • | enhance our research and development capabilities in order to better capture the market potential of OCTG products; |

| • | expand our production capacity of seamless OCTG products to meet increasing demand in both domestic and overseas OCTG markets; and |

| • | continue to recruit and retain employees experienced in management, technology, sales and marketing. |

Our challenges

We believe the following are some of the major risks and uncertainties that may materially affect our business, financial condition, results of operations and prospects:

| • | declines in domestic and international oil and natural gas prices, or declines in domestic and international exploration, drilling and production activities; |

| • | increases in steel prices; |

| • | failure to maintain relationships with our large customers; |

| • | intense competition in the industry; |

| • | inability to implement our future expansion plans, in particular our plans for international expansion and overseas sales, or to manage our growth; |

| • | inability to retain services of members of our senior management team and other key personnel; |

| • | inability to obtain raw materials that meet our product quality standards on a timely basis; and |

| • | inability to continue developing our production technology or adopt new production technology. |

In addition to the above risks and uncertainties, you should also consider the risks discussed in ‘‘Risk factors’’ and elsewhere in this prospectus.

Corporate structure and history

We are a holding company incorporated in the Cayman Islands and conduct substantially all of our operations through our subsidiaries in China. Wuxi Seamless Oil Pipes Company Limited, or WSP China, was initially set up as a Sino-foreign joint venture under PRC laws on November 17, 1999. WSP China underwent a series of corporate restructurings and, in August 2006, became a

3

Table of Contents

wholly-owned subsidiary of First Space Holdings Limited, or FSHL, a company incorporated in the British Virgin Islands on June 12, 2006. In preparation for our initial public offering, WSP Holdings was incorporated in the Cayman Islands on November 16, 2006. WSP Holdings was owned 69.4% and 30.6% by Expert Master Holdings Limited, or EMH, and UMW China Ventures (L) Ltd., or UMW Ventures, respectively, at the time of its incorporation. EMH is wholly owned by Mr. Longhua Piao, or Mr. Piao, and UMW Ventures is a wholly-owned subsidiary of UMW Holdings Berhad, or UMW. On December 1, 2006, WSP Holdings acquired the entire share capital of FSHL from its shareholders through a share exchange and became the ultimate holding company of our businesses.

Our principal operating subsidiaries in China consist of WSP China, which designs, manufactures, processes and sells seamless OCTG, and Jiangsu Fanli Pipe Co., Ltd., or Jiangsu Fanli, which manufactures and sells green pipes. WSP China is a wholly-owned subsidiary of FSHL, and Jiangsu Fanli is a 70%-owned subsidiary of WSP China.

As an initial step of our overseas expansion, on January 16, 2007, we and three other investors established WSP Industries Canada Inc., or WSP Industries, a limited liability company incorporated in British Columbia. We hold a 70% equity interest in WSP Industries.

The following diagram illustrates our current corporate structure.

| (1) | UMW is a public company listed on the Malaysian Stock Exchange. |

| (2) | The remaining 30% of WSP Industries is owned 10% each by Mr. Ling Li, Mr. Michael Liu and Mr. Larry Wang. |

| (3) | The remaining 30% of Jiangsu Fanli is owned by Mr. Cheng Huang (24%), Mr. Xiang Huang (4%) and Mr. Jianming Gu (2%). |

4

Table of Contents

Corporate information

Our principal executive offices are located at No.38 Zhujiang Road, Xinqu, Wuxi, Jiangsu Province, People’s Republic of China. Our telephone number at this address is (86 510) 8522 6351 and our fax number is (86 510) 8522 6351. Our registered office is located at the offices of Codan Trust Company (Cayman) Limited, Cricket Square, Hutchins Drive, PO Box 2681, Grand Cayman, KYI-1111, Cayman Islands. Our agent for service of process in the United States is CT Corporation System, located at 111 Eighth Avenue, New York, New York 10011.

You should direct all inquiries to us at the address and telephone number of our principal executive offices set forth above. Our website address is www.wsphl.com. The information contained on our website does not form part of this prospectus.

5

Table of Contents

The offering

| The offering | 25,000,000 ADSs offered by WSP Holdings. | |

| The ADSs | Each ADS represents two ordinary shares, par value $0.0001 per share. The ADSs are evidenced by American depositary receipts issued by the depositary. | |

| ADSs outstanding immediately after the offering | 25,000,000 ADSs | |

| Ordinary shares outstanding immediately after the offering | 200,000,000 ordinary shares | |

| Use of proceeds | We intend to use the proceeds of this offering as follows: | |

| • | approximately $55 million for overseas expansion in Canada, the United States and the Middle East; | ||

| • | approximately $50 million for capital expenditures and expansion and improvements of our production facilities in China; | ||

| • | approximately $18.5 million for the full repayment of our loans from UMW ACE(L) Ltd., or UMW ACE, and approximately $34.8 million for the repayment of a portion of our bank borrowings from Agricultural Bank of China; | ||

| • | an undetermined amount for strategic investment in and acquisitions of complementary businesses. At this time, we have not entered into advanced discussions or negotiations with respect to any potential acquisitions; and | ||

| • | the balance of the proceeds for other working capital purposes. | ||

| The foregoing represents our intentions to use and allocate the net proceeds of this offering based upon our present plans and business conditions. | ||

| Depositary | JPMorgan Chase Bank, N.A. | |

| Risk factors | See ‘‘Risk factors’’ and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in the ADSs. | |

| Listing | We have applied to have our ADSs listed on the New York Stock Exchange. Our ordinary shares will not be listed on any exchange or quoted for trading on any over-the-counter trading system. | |

6

Table of Contents

| Proposed New York Stock Exchange symbol | WH | |

The number of ADSs and ordinary shares outstanding immediately after this offering excludes ordinary shares reserved for future issuance under our 2007 share incentive plan. Unless otherwise indicated, all information in this prospectus assumes no exercise by the underwriters of their option to purchase up to 3,750,000 ADSs in this offering to cover over-allotments.

7

Table of Contents

Summary consolidated financial and operating data

The following summary consolidated financial and operating data should be read in conjunction with our consolidated financial statements and notes to those consolidated financial statements included elsewhere in this prospectus and ‘‘Management’s discussion and analysis of financial condition and results of operations.’’ The summary consolidated statement of operations data for the years ended December 31, 2004, 2005 and 2006 are derived from our audited consolidated financial statements, which are included elsewhere in this prospectus. The summary consolidated statement of operations data for the six months ended June 30, 2006 and 2007 and the summary consolidated balance sheet data as of June 30, 2007 are derived from our unaudited condensed consolidated financial statements, which are included elsewhere in this prospectus. Our audited and unaudited condensed consolidated financial statements are prepared and presented in acc ordance with generally accepted accounting principles in the United States, or U.S. GAAP. Our historical results do not necessarily indicate the results that may be expected for any future periods.

8

Table of Contents

| For the year ended December 31, | For the six months ended June 30, | |||||||||||||||||||||||||||||

| (in thousands, except for share and per share data) | 2004 | 2005 | 2006 | 2006 | 2007 | |||||||||||||||||||||||||

| Consolidated income statement data | ||||||||||||||||||||||||||||||

| Net revenues | $ | 128,497 | $ | 241,012 | $ | 366,501 | $ | 168,257 | $ | 228,108 | ||||||||||||||||||||

| Cost of revenues | (116,943 | ) | (198,550 | ) | (281,106 | ) | (129,446 | ) | (168,803 | ) | ||||||||||||||||||||

| Gross profit | 11,554 | 42,462 | 85,395 | 38,811 | 59,305 | |||||||||||||||||||||||||

| Selling and marketing expenses | (1,032 | ) | (2,056 | ) | (4,102 | ) | (1,700 | ) | (3,083 | ) | ||||||||||||||||||||

| General and administrative expenses | (2,243 | ) | (6,356 | ) | (9,799 | ) | (4,138 | ) | (5,932 | ) | ||||||||||||||||||||

| Other operating income (expenses) | 706 | (499 | ) | (549 | ) | (246 | ) | 1,122 | ||||||||||||||||||||||

| Income from operations | 8,985 | 33,551 | 70,945 | 32,727 | 51,412 | |||||||||||||||||||||||||

| Interest income (expense), net | (1,241 | ) | (1,901 | ) | (1,735 | ) | 26 | (4,490 | ) | |||||||||||||||||||||

| Other income (expense) | (3 | ) | (86 | ) | 4 | — | — | |||||||||||||||||||||||

| Exchange differences | (32 | ) | 741 | 357 | 270 | (530 | ) | |||||||||||||||||||||||

| Income from continuing operations(1) | 7,709 | 32,305 | 69,571 | 33,023 | 46,392 | |||||||||||||||||||||||||

| Provision for income taxes | (630 | ) | (4,198 | ) | (10,582 | ) | (5,027 | ) | (8,937 | ) | ||||||||||||||||||||

| Earnings in equity investments | 260 | 266 | 67 | (101 | ) | — | ||||||||||||||||||||||||

| Minority interest | — | 47 | (371 | ) | 8 | (618 | ) | |||||||||||||||||||||||

| Net income from continuing operations | 7,339 | 28,420 | 58,685 | 27,903 | 36,837 | |||||||||||||||||||||||||

| Net income (expense) from discontinued operations | (862 | ) | (4,104 | ) | 233 | 106 | — | |||||||||||||||||||||||

| Net income | 6,477 | 24,316 | 58,918 | 28,009 | 36,837 | |||||||||||||||||||||||||

| Earnings per share | ||||||||||||||||||||||||||||||

| Earnings per ordinary share: | ||||||||||||||||||||||||||||||

| Basic | 0.07 | 0.27 | 0.40 | 0.20 | 0.25 | |||||||||||||||||||||||||

| Diluted | 0.07 | 0.27 | 0.40 | 0.20 | 0.25 | |||||||||||||||||||||||||

| Weighted average ordinary shares outstanding: | ||||||||||||||||||||||||||||||

| Basic | 86,447,932 | 91,315,420 | 145,954,406 | 141,898,503 | 150,000,000 | |||||||||||||||||||||||||

| Diluted | 86,447,932 | 91,315,420 | 145,954,406 | 141,898,503 | 150,000,000 | |||||||||||||||||||||||||

| (1) | Income from continuing operations is before provision for income taxes, earnings in equity investments and minority interest. |

9

Table of Contents

| For the year ended December 31, | For the six months ended June 30, | |||||||||||||||||||||||||||||

| 2004 | 2005 | 2006 | 2006 | 2007 | ||||||||||||||||||||||||||

| Selected operating data | ||||||||||||||||||||||||||||||

| API net revenues (in thousands) | $ | 105,918 | $ | 194,858 | $ | 299,158 | $ | 141,611 | $ | 146,460 | ||||||||||||||||||||

| Sales volume (tonne) | 143,139 | 203,359 | 288,116 | 143,531 | 135,853 | |||||||||||||||||||||||||

| Average selling price | $ | 740 | $ | 958 | $ | 1,038 | $ | 987 | $ | 1,078 | ||||||||||||||||||||

| Non-API net revenues (in thousands) | $ | 6,606 | $ | 15,465 | $ | 41,311 | $ | 14,521 | $ | 65,792 | ||||||||||||||||||||

| Sales volume (tonne) | 7,820 | 11,069 | 22,910 | 6,923 | 42,624 | |||||||||||||||||||||||||

| Average selling price | $ | 845 | $ | 1,397 | $ | 1,803 | $ | 2,098 | $ | 1,544 | ||||||||||||||||||||

The following table presents a summary of the balance sheet data as of June 30, 2007:

| • | on an actual basis; and |

| • | on an as adjusted basis to give effect to (i) the issuance and sale of 50,000,000 ordinary shares in the form of ADSs by us in this offering, at an initial public offering price of $11.50 per ADS, which is the midpoint of the estimated range of the initial public offering price, after deducting underwriting discounts and commissions and estimated aggregate offering expenses payable by us and assuming no exercise of the underwriters’ over-allotment option and no other change to the number of ADSs sold by us as set forth on the cover page of this prospectus; and (ii) $18.5 million for the full repayment of our loans to UMW ACE and $34.8 million for the repayment of a portion of our bank borrowings from Agricultural Bank of China. |

| As of June 30, 2007 (in thousands) | Actual | As adjusted | ||||||||||

| Consolidated balance sheet data | ||||||||||||

| Cash and cash equivalents | $ | 32,069 | $ | 240,937 | ||||||||

| Restricted cash | 91,499 | 91,499 | ||||||||||

| Accounts and bills receivable, net | 110,203 | 110,203 | ||||||||||

| Advances to suppliers | 17,911 | 17,911 | ||||||||||

| Inventory | 128,303 | 128,303 | ||||||||||

| Total current assets | 392,117 | 600,985 | ||||||||||

| Property and equipment, net | 170,867 | 170,867 | ||||||||||

| Total assets | 577,537 | 786,405 | ||||||||||

| Accounts payable | 195,970 | 195,970 | ||||||||||

| Borrowings – due within one year | 135,492 | 135,492 | ||||||||||

| Total current liabilities | 364,875 | 364,875 | ||||||||||

| Borrowings – due after one year | 71,024 | 17,724 | ||||||||||

| Total liabilities | 438,253 | 384,953 | ||||||||||

| Minority interest | 3,431 | 3,431 | ||||||||||

| Total shareholders’ equity | 135,853 | 398,021 | ||||||||||

| Total liabilities, minority interest, and shareholders’ equity | $ | 577,537 | $ | 786,405 | ||||||||

10

Table of Contents

Risk factors

You should consider carefully all of the information in this prospectus, including the risks and uncertainties described below and our consolidated financial statements and related notes, before making an investment in our ADSs. Any of the following risks could have a material adverse effect on our business, financial condition, results of operations or liquidity. In any such case, the market price of our ADSs could decline, and you may lose all or part of your investment.

Risks related to our business

Declines in domestic and international oil and natural gas prices, or domestic and international exploration, drilling and production activities, would adversely affect our profitability.

Demand for our OCTG products depends significantly on the number of domestic and worldwide oil and gas wells being drilled, completed and re-worked, as well as the depth and drilling conditions of these wells. The level of such drilling activities in turn depends on the level of capital spending by major oil and gas companies. A decline in domestic and worldwide oil and gas exploration, drilling and production activities would adversely affect our results of operations. Decreased demand for our products would be expected to result not only from periods of decreased capital spending and activities in exploration, drilling and production, but also from the resulting build up of customer inventory, as certain OCTG products associated with idle rigs such as tubing can be re-used on active rigs instead of new purchases.

Capital spending on OCTG used for oil and natural gas exploration, drilling and production activities is driven in part by the prevailing prices for oil and natural gas and the perceived stability and sustainability of those prices. Our revenues and net income have increased significantly in the past three years, due in part to increases in oil and natural gas prices, which have also reached historically high levels during this period. However, oil and natural gas prices have also been subject to significant volatility in recent years due to numerous factors beyond our control, including, but not limited to, changes in the supply and demand for oil and natural gas, market uncertainty, world events, regulatory control (including by the PRC government), political developments in petroleum producing regions and the price and availability of alternative energy sources. For more details on world oil and gas prices, see ‘‘Industry — Oil & gas mar ket overview — Oil and gas prices.’’

We can provide no assurance that oil and natural gas prices will not decline from the historical highs reached in recent periods or that such prices will otherwise remain at sufficiently high levels to support demand for our products. Any declines in the price of oil and natural gas, even for a short period of time, may reduce or curtail expenditures by oil and gas companies in connection with exploration, drilling and production activities, which may result in lower sales volumes and prices for our products in the PRC and overseas and materially and adversely affect our results of operations and financial condition.

Our results of operations may be adversely affected by increases in steel prices.

Steel is the principal raw material for our products. Raw materials accounted for 91.2%, 91.5%, 86.1% and 81.3% of our cost of revenues in 2004, 2005, 2006 and the six months ended June 30, 2007, respectively. We currently purchase all of our steel in the PRC in the form of round steel billets and green pipes. Any price increase in steel could reduce our profit margin if we are unable to pass such increased costs on to our customers. Since the end of 2003, the price of steel has increased substantially due in part to increasing demand in the PRC resulting from rapid economic development, which significantly affected our gross margin in the first half of 2004 as

11

Table of Contents

we were unable to increase our domestic sales prices until April 2004 to pass on the increases in costs to our customers. The price of steel has had, and will continue to have, a significant impact on our cost of revenues. If we are unable to manage our purchases of steel at prices acceptable to us or if the prices of steel increase significantly and we are not able to pass on all or part of any such price increases to our customers, our profit margins may decrease and our results of operations would be materially and adversely affected.

Our quarterly operating results may fluctuate and if we do not meet financial expectations of securities analysts or investors, the price of our ADSs will likely decline.

Our quarterly operating results may fluctuate as a result of a number of factors, many of which are beyond our control. Our net revenues have generally decreased in the first quarter and the third quarter of the year. Our customers tend to build up their inventories of our products during the fourth quarter in anticipation of the Chinese New Year holiday which generally takes place in late January or early February of the following year. In addition, business activities in China generally slow down in the first quarter of each year during the Chinese New Year period, which adversely affects our sales and results of operations during that period. Hot summer months may also impact the productivity of the employees working in our production facilities. The above-described seasonal trends that we have experienced in the past may not apply to, or be indicative of, our future operating results. If we do not meet financial expectations of securities analysts or investo rs, the price of our ADSs may decline.

We depend on a limited number of customers, and any loss of these customers could materially and adversely affect our revenue and profitability.

Our customers include oil and gas companies in the PRC and abroad. Aggregate sales attributable to our five largest customers represented approximately 80.3%, 71.4%, 60.5% and 60.1% of our net revenues for the years ended December 31, 2004, 2005, 2006 and the six months ended June 30, 2007, respectively. We cannot assure you that we will be able to maintain or improve our relationships with these customers, or that we will be able to continue to supply products to these customers at current levels or at all. In addition, our business is affected by competition in the oil and gas industry, and any decline in our major customers’ businesses in these markets could lead to a decline in purchase orders from these customers. If any of our key customers were to substantially reduce the size or amount of the orders they place with us or were to terminate their business relationship with us entirely, we cannot assure you that we would be able to obta in orders from other customers to replace any such lost sales on comparable terms or at all. If any of these relationships were to be so altered and we were unable to obtain replacement orders, our business, results of operations and financial condition would be materially and adversely affected.

Our sales contracts typically have a term of less than six months and, as a result, customers may reduce their orders or terminate their relationships with us almost immediately.

Sales of our products are typically conducted either through purchase orders or sales contracts with a term less than six months. As a result, our customers may choose to terminate their relationship with us after completion of the shipment or expiration of the contract, as the case may be. Our customers are also not obligated in any way to continue placing orders with us at historical levels or at all. If any of our customers, particularly our key customers, were to materially reduce their orders with us or were to terminate entirely their business relationship with us with short notice, we might not have sufficient time to locate alternative customers and our business and results of operations could be materially and adversely affected.

12

Table of Contents

We cannot assure you that our products will pass the periodic inspection by API or the qualification process of potential customers, and our failure to pass such inspection or qualification will adversely affect our business prospects and results of operations.

We have obtained certificates from API to use the official API monogram on our products to demonstrate that our products meet the API standards. These certificates are subject to periodic inspections by API. Furthermore, our growth strategies include increasing our sales in the PRC domestic market, as well as expanding into international markets such as North America, the Middle East, Asia, Africa and Russia. It is standard industry practice that an OCTG manufacturer must first pass a qualification process to become an approved supplier of an oil and gas company before providing OCTG products to that company. We cannot assure you that we will be able to obtain the necessary certifications from API or approvals for new products from our existing customers or approvals from any new customers. Even if we can ultimately secure such approvals or certifications, we cannot assure you that such certifications and approvals can be obtained in a timely manner or can be ma intained. In addition, even if we become an approved supplier of a company, it does not necessarily mean that we will receive purchase orders from that company. If we fail to become an approved supplier of our potential customers, or if we are unable to obtain or maintain such approval in a timely manner, or if we do not receive purchase orders from the oil and gas companies from which we received such approval, we may not be able to execute our expansion plans and our business prospects and results of operations may be materially and adversely affected.

If we are unable to compete effectively in the OCTG industry, our revenue and profits may decrease.

We face intense competition in the domestic and international markets in which we operate. Domestically, we face competition from a number of manufacturers that produce OCTG that are similar to ours. Our major domestic competitors, such as Tianjin Pipe (Group) Corporation, Shanghai Baosteel Group Corporation, and Pangang Group Chengdu Iron & Steel Co., Ltd, are mostly state-owned enterprises, which may have greater resources and brand recognition than we do. We also face competition from international manufacturers, such as Tenaris in Argentina, Vallourec & Mannesmann Tubes in France, TMK in Russia, Sumitomo and JFE in Japan, and U.S. Steel in the United States, who may have substantially greater resources and brand recognition than we do, especially with respect to the high-end products. Our major competitors may have longer operating history, larger customer base, stronger customer relationships, greater brand or name recognition and greater financial, technical, marketing and public relations resources than we do. Some of our competitors may also be better positioned to develop superior product features and technological innovations and able to better adapt to market trends than we are.

Our ability to compete depends on, among other things, high product quality, short lead-time, timely delivery, competitive pricing, range of product offerings and superior customer service and support. Increased competition may require us to reduce our prices or increase our costs and may have a material adverse effect on our financial condition and results of operations. Any decrease in the quality of our products or level of our service to our customers or any occurrence of a price war among our competitors and us may adversely affect our business and results of operations. If we are unable to remain competitive, we may not be able to increase or even maintain our current share of the OCTG market in China or overseas or continue to achieve our current level of profitability.

13

Table of Contents

We cannot assure you that we will be successful in implementing our future expansion plans, in particular our plans for international expansion and overseas sales, or in managing our growth.

A principal component of our future strategy is to continue to grow by expanding our production capacity and further developing our overseas sales. Our future growth will depend on a number of factors, including, but not limited to, our ability to manage expansion and overseas operations, obtain any required financing, achieve operational efficiencies, and secure sufficient access to raw materials. Some of these factors are beyond our control. As a result, we may not be able to successfully manage our growth or expand our operations, which could have a material adverse effect on our business, financial condition and results of operations.

In addition, we may need to increase the number of our employees and enhance our operational and financial systems to handle the increased complexity and the expanded geographical coverage of our operations associated with our growth. We cannot assure you that we will be able to attract and retain qualified management staff and employees or that our current operational and financial systems and controls will be adequate to accommodate future growth. This could have a material adverse effect on our business, financial condition and results of operations.

We face risks associated with the marketing, distribution and sale of our products internationally, and if we are unable to manage these risks effectively, they could impair our ability to expand our business overseas.

Our international expansion targets are mature markets in terms of OCTG production. In order for us to succeed, we need to take significant market share away from the existing suppliers of seamless OCTG in these markets. We cannot assure you that we will be able to do so in these competitive markets.

Moreover, our plans for international expansion may be hindered by the following:

| • | cultural differences and other difficulties in staffing and managing overseas operations; |

| • | inherent difficulties and delays in contract enforcement and collection of receivables through the use of foreign legal systems; |

| • | volatility in currency exchange rates; |

| • | the risk that foreign countries may impose withholding taxes (or otherwise tax our foreign income or place restrictions on repatriation of profit); |

| • | the risk of barriers, such as anti-dumping and other tariffs or other restrictions being imposed on foreign trade; |

| • | changes in the political, regulatory, or economic conditions in a foreign country or region; and |

| • | the burden of complying with foreign laws and regulations. |

If we are unable to manage these risks effectively, our ability to conduct or expand our business overseas would be impaired, which may in turn materially and adversely affect our business, financial condition, results of operations and prospects.

Our business depends on our ability to attract and retain members of our senior management team and other key personnel.

Our future success is dependent on the efforts, performance and abilities of our key management team, particularly Mr. Piao, our chairman and chief executive officer. Mr. Piao founded our

14

Table of Contents

company and has approximately 13 years of relevant industry experience, including the past seven years as our chief executive officer. We do not maintain key man insurance on any of our management personnel. As the OCTG industry in the PRC continues to become more competitive, we expect the competition for management and other skilled personnel to intensify. Failure to attract and retain qualified employees or the loss of any member of our senior management may result in a loss of organizational focus, poor operating execution or an inability to identify and execute potential strategic initiatives such as overseas expansion and non-API product offerings. This could, in turn, materially and adversely affect our business, financial condition and results of operations.

Our business relies on our ability to retain and attract experienced sales staff and our ability to maintain and expand our existing sales networks both domestically and overseas.

Our experienced sales staff constitutes an essential part of our business. In the domestic PRC market, our sales staff possesses strong technical backgrounds in the OCTG industry, which enable them to provide and deliver on-site technical support to our customers. We rely on our four sales offices located in the Daqing, Changqing, Xinjiang and Sichuan oilfields to directly sell our products to major oilfields in the PRC. In addition to providing on-site services to our customers throughout the sales process, including after-sales support, our sales staff also helps us maintain good relationships with our customers. Internationally, we sell our products through our distributors and sales agents and rely on maintaining good relationships with them to sell our products. The loss of services of any of our experienced sales staff without timely replacement, the inability to attract and retain sales personnel, or the loss of any of our major distributors or sales agen ts may have an adverse effect on our business. If we are unable to maintain our existing sales network, our operations may be materially and adversely affected.

We depend on a limited number of suppliers for a majority of our raw material requirements, and interruption of raw material delivery could prevent us from delivering our products in a timely manner to our customers in the required quantities, and in turn result in order cancellations, decreased revenue and loss of market share.

Our operations depend on our ability to obtain adequate and quality supplies of our primary raw materials, namely round steel billets and green pipes, in a timely manner. If our suppliers fail to meet our quality standards or our quantity demands, our production and sales volume and our results of operation will be adversely affected. We currently expect to rely on two major suppliers to supply round billets to us with which we have entered into long-term arrangements. See ‘‘Business — Suppliers of raw materials.’’ However, we cannot guarantee our long-term arrangements with these two suppliers will provide us with a reliable supply of raw materials we need. If there is any supply shortage, we may be unable to deliver our products in a timely manner to our customers in the required quantities, which in turn could result in order cancellations, decreased revenue and loss of market share.

We may be unable to prevent possible resales or transfers of our products to countries, governments, entities, or persons targeted by United States economic sanctions, especially when we sell our products to distributors over which we have limited control.

The U.S. Department of the Treasury’s Office of Foreign Assets Control, or OFAC, administers certain laws and regulations, or U.S. Economic Sanctions Laws, that impose restrictions upon U.S. persons and, in some instances, foreign entities owned or controlled by U.S. persons, with respect to activities or transactions with certain countries, governments, entities and individuals that are the subject of U.S. Economic Sanctions Laws, or Sanctions Targets. U.S. persons are also generally prohibited from facilitating such activities or transactions. We will not use any proceeds from the

15

Table of Contents

sale of our ADSs to fund any activities or business with any Sanctions Targets with respect to which U.S. persons or, as appropriate, foreign entities owned or controlled by U.S. persons, are prohibited by U.S. Economic Sanctions Laws from conducting such activities or transacting such business. We sell our products in international markets primarily through independent non-U.S. distributors which are responsible for interacting with the end customers of our products. We sold indirectly a portion of our products to Sanctions Targets in the three years ended December 31, 2006 and in the six months ended June 30, 2007. In 2004, 2005, 2006 and the six months ended June 30, 2007, we did not have any direct sales to Sanctions Targets. To the best of our knowledge, in 2006 and the six months ended June 30, 2007, our indirect sales to Sanctions Targets, including Burma, Cuba, Sudan and Syria, accounted for approximately 9% and 6%, respectively, of our net revenues. While we believ e that U.S. Economic Sanctions Laws under their current terms are not applicable to our activities, we have nonetheless decided to take measures to prevent any future sales of our products, either directly or indirectly, to Sanctions Targets. See ‘‘Management’s discussion and analysis of financial condition and results of operations — Internal control over distribution of our products.’’ However, we cannot assure you that our measures will be able to prevent all sales of our products, directly or indirectly, to Sanctions Targets in the future. We do not always know the end customers to whom our distributors resell our products, and our distributors may breach their covenant to us not to resell our products to Sanctions Targets. If such resales occur in the future, our reputation could be adversely affected, some of our U.S. investors may be required to sell their interests in our company under the laws of certain U.S. states or under internal investment policies or may dec ide for reputational reasons to sell such interests, and some U.S. institutional investors may forego the purchase of our ADSs, all of which could materially and adversely affect the value of our ADSs and your investment in us.

Protectionist measures such as initiation of anti-dumping and anti-subsidy proceedings and imposition of anti-dumping and/or countervailing duties by governments in our overseas markets could materially and adversely affect our export sales.

Anti-dumping and anti-subsidy proceedings have been initiated by some countries in relation to steel products, resulting in anti-dumping and/or countervailing duties being imposed by those countries on steel products. Those and other similar measures could trigger trade disputes in the international steel product markets that could adversely affect our exports.

The Canada Border Services Agency, or CBSA, initiated an investigation on August 13, 2007 on the alleged dumping and subsidizing of certain seamless carbon and alloy steel oil and gas well casings from China after receiving a complaint from TenarisAlgomaTubes Inc., a Canadian manufacturer of these goods. We were named as one of the 30 exporters of the goods from China subject to the investigation. The Canadian International Trade Tribunal, or CITT, has conducted a preliminary inquiry and determined, on October 12, 2007, that the evidence disclosed a reasonable indication that the alleged dumping and subsidizing of the goods has caused or is threatening to cause injury to the Canadian industry. On November 9, 2007, the CBSA made its preliminary determination that exports of carbon and alloy steel seamless oil and gas well casings were being dumped and were subsidized. These preliminary findings resulted in the imposition of a 44% preliminary duty on our products imported into Canada, which will adversely affect our sales in Canada. These preliminary findings also lead to final investigations being initiated by each body in which additional data will be gathered, information will be verified and the injury portion will be subject to a full adversarial hearing on the merits of the case. The final determinations are expected in March 2008. We and the other exporters are contesting these findings. In 2006 and for the six months ended June 30, 2007, products exported to Canada accounted for 4.1% and 0.6% of our net revenues, respectively. Should the CITT and

16

Table of Contents

CBSA make final determinations in favor of the complainant and impose definitive anti-dumping and countervailing duties on the subject goods, our sales in Canada of these goods may suffer and our export business to Canada may be materially and adversely affected.

In addition, there is no assurance that there will not be similar actions taken in the future in other countries against Chinese-made seamless OCTG products. For example, in March 2002, the U.S. government imposed certain quotas and tariffs on imports of a range of steel products. Although the United States lifted those tariffs in December 2003, there can be no assurance that the United States or other countries will not impose other quotas or tariffs. Furthermore, some U.S. producers of welded steel pipes have recently filed petitions with the U.S. Department of Commerce and the U.S. International Trade Commission alleging that exports of welded steel pipe products by Chinese companies into the United States were subsidized by the Chinese government. We do not currently produce any welded steel pipe products. If there is any such action filed against us in the future, even without merit, it will divert significant company resources and management’s attent ion and could have an adverse impact on the prices and sales of our OCTG products in such countries, which could adversely affect our business prospects and results of operations. If any judgment is entered into against us in such an action, we may be subject to fines and penalties and restrictions on sales activities, and our overseas sales would be materially and adversely affected.

If we are unable to continue developing our production technology or adopt new production technology, our business and prospects may be harmed.

The OCTG industry is competitive and the production technology underlying the industry is evolving. As customers’ needs, related technologies and market trends are subject to change, we cannot assure you that we will be able to correctly predict the trends in a timely manner. If we fail to correctly predict changes in the production technology or develop or adopt competitive technology on a timely basis, whether developed in-house or through license, we may not be able to respond effectively to competitive industry conditions and changing customer demands.

Responding and adapting to technological developments and changes in the OCTG industry, and the integration of new technologies or industry standards, may require substantial investment of resources, time and capital. Even if we implement such measures, there can be no assurance that we will succeed in adequately responding and adapting to such technological and industry developments. In the event that we are unable to respond successfully to technological and industry developments, our business, results of operations and competitiveness may be materially and adversely affected.

Failure to protect our intellectual property rights may materially and adversely affect our competitive position and operations and we may be exposed to infringement or misappropriation claims by third parties.

Our success is in part attributable to the technologies, know-how and other intellectual properties that we have developed or acquired. As of June 30, 2007, we had seven patents registered under our name and one pending patent application in China. We also have one PRC patent and three PRC patent applications granted to or applied under the names of our employees who invented the technologies covered by the patent or applications using our resources. We and the employees are in the process of transferring these patent and patent applications to our name without consideration. In addition, we had two trademarks in Colombia, one trademark in Hong Kong, one trademark in Saudi Arabia, one trademark in Kazakhstan and 27 pending trademark applications in China, Malaysia, United States, Canada and several other countries, as well as one registered domain name. Although we rely upon a

17

Table of Contents

combination of trade secrets, confidentiality policies, non-disclosure and other contractual arrangements, and patent and trademark laws to protect our intellectual property rights, there can be no assurance that the steps we have taken to protect our intellectual property rights are adequate to prevent or deter infringement or other misappropriation of our intellectual property. We may not be able to detect unauthorized uses or take appropriate and timely steps to enforce our intellectual property rights. Any significant infringement of our proprietary technologies and processes or our intellectual property rights could weaken our competitive position and have an adverse effect on our operations. To protect our intellectual property rights, we may have to commence legal proceedings against any misappropriation or infringement. However, there can be no assurance that we will prevail in such proceedings. Furthermore, as we only hold PRC patents, if third parties manufacture and sell products using our technol ogy outside of the PRC in competition against us, we would not have a legal cause of action against them.

Furthermore, we may be subject to litigation involving claims of patent infringement or the violation of other intellectual property rights of third parties. The defense of intellectual property suits, patent opposition proceedings and related legal and administrative proceedings can be both costly and time-consuming and may significantly divert the efforts and resources of our technical and management personnel. An adverse determination in any such litigation or proceedings to which we may become a party could subject us to significant liability to third parties, require us to seek licenses from third parties, to pay ongoing royalties, or to redesign our products or subject us to injunctions prohibiting the manufacture and sale of our products or the use of our technologies, which could materially and adversely affect our business, financial condition or results of operations. Protracted litigation could also result in our customers or potential customers defer ring or limiting their purchase or use of our products until resolution of such litigation, which could adversely affect our business.

Failure to maintain an effective quality control system at our manufacturing facilities could have a material adverse effect on our business and operations.

The performance, quality and safety of our products are critical to the success of our business. These factors depend significantly on the effectiveness of our quality control systems, which in turn depend on a number of factors, including the design of our quality control systems, our quality-training program, and our ability to ensure that our employees adhere to the quality control policies and guidelines. Any significant failure or deterioration of our quality control systems could have a material adverse effect on our business reputation, results of operations and financial condition.

Significant product liability claims made against us, regardless of their success, could harm our business reputation, results of operations and financial condition.

Our oil and gas casing, tubing and drill pipe products are sold primarily for use in oil and gas exploration, drilling and extraction activities. These activities are subject to inherent risks, including well failures, line pipe leaks and fires, that could result in death, personal injury, property damage, pollution or loss of production, all of which could result in liability claims made against us. We typically offer warranties on our products for a period of up to one year. During the warranty period, faulty products are repaired or replaced by us, or returned to us. Actual defects or allegations of defects in our products may give rise to claims against us for losses and expose us to claims for damages. Any such claims, regardless of their merits, could cause us to incur significant costs, divert our management’s attention, harm our business reputation or cause significant disruption to our operations. Furthermore, we can provide no assurance that we w ill be able to successfully defend against such claims, and we do not have any product liability

18

Table of Contents

insurance covering our products, except insurance covering those products sold in North America. If any such claims were successful, we could be subject to substantial liabilities, which could materially and adversely affect our results of operations and our financial condition.

We may not be able to obtain the necessary PRC government authorization, land use rights certificate or the building ownership certificate for one of our properties.

We have not obtained PRC government authorization, land use rights certificate or building ownership certificate with respect to one of our warehouse facilities with a gross floor area of approximately 1,000 square meters. There is no assurance that we will be able to obtain PRC government authorization, land use rights certificate or building ownership certificate for this property. If we fail to obtain such authorization or certificates in a timely manner, or at all, we may be required to relocate this warehouse facility, which could materially and adversely affect our financial condition and results of operations.

If disruptions in our transportation network occur or our shipping costs substantially increase, we may be unable to deliver our products in a timely manner and our cost of revenues could increase.

We are highly dependent upon the transportation systems we use to ship our products, including train, truck and ocean shipping. We usually deliver our finished products to customers in China by train or by truck in circumstances requiring urgent delivery. Our deliveries made overseas are primarily made by ship. We have engaged a number of overseas shipping agents to transport our finished products overseas. The transportation network is potentially exposed to disruption from a variety of causes, including labor disputes or port strikes, acts of war or terrorism and natural disasters. For example, our net revenues declined in the third quarter of 2006 partly due to reduced export sales volume as a result of our inability to secure shipping on time for our products due to increased demand for overseas shipping in China. If our delivery times increase unexpectedly for these or any other reasons, our ability to deliver products on time could be materially and advers ely affected and result in delayed or lost revenue.

Our growth strategies require significant capital investments and may require us to seek external financing, which may not be available on terms favorable to us.

Our business operations and growth strategies require substantial capital investments, the availability of which depends on our ability to generate cash flow from operations, borrow funds on satisfactory terms and raise funds in the capital markets. We plan to expand our manufacturing facilities by constructing a new threading line in each of Wuxi, China and Vancouver, Canada. We expect the threading line in Vancouver to commence production in the first half of 2008 and the threading line in Wuxi to commence production in September 2008. We plan to establish a production facility in Houston, Texas, a joint venture with production lines in Saudi Arabia and additional production facilities in China. We estimate our capital expenditures will be approximately $37.0 million and $46.8 million in 2007 and 2008, respectively. Our ability to arrange for financing to support our capital expenditures and the cost of such financing are dependent on numerous factors, includi ng general economic and capital markets conditions, interest rates and credit availability from banks or other lenders, many of which are beyond our control. In addition, increases in interest rates or failure to obtain external financing on terms favorable to us will affect our financing costs and our results of operations.

As of June 30, 2007, our total bank and other borrowings amounted to $206.5 million. In the event we are unable to obtain extensions of these borrowings when they become due, or if we are unable to obtain sufficient alternative funding at reasonable terms to make repayments, we

19

Table of Contents

will have to repay these borrowings with cash generated by our operating activities. Our business might not generate sufficient cash flow from operations to repay these borrowings, some of which are secured by significant amounts of our assets. In addition, repaying these borrowings with cash generated by our operating activities will divert our financial resources from the requirements of our ongoing operations and future growth, and would have a material adverse effect on our business, financial condition and future prospects.

Our financial leverage may hamper our ability to expand and may materially affect our results of operations.

Our ability to make scheduled payments under our financing agreements and any future financing transactions and our ability to refinance our debts, if necessary, will depend, among other things, on our future operating performance. From time to time, we will be required to repay our short-term borrowings and, as a result, we may need to allocate a portion of our cash flow to service these obligations. This could impair our ability to make necessary capital expenditures, develop business opportunities or make strategic acquisitions.

As of December 31, 2006, we had net current liabilities of $11.1 million because we primarily used cash generated from our operations rather than long-term borrowings to finance our capital expenditures. As of June 30, 2007, we had net current assets of $27.2 million. We cannot assure you that our business will generate sufficient cash flow from operations in the future to service our debts and make necessary capital expenditures, in which case we may seek additional financing, dispose of certain assets or seek to refinance some or all of our debts. We cannot assure you that any of these alternatives can be implemented on satisfactory terms, if at all, or without breach of the terms and conditions of existing or future financing transactions. In the event that we are unable to meet our liabilities when they are due or if our creditors take legal action against us for payment, we may have to liquidate our long-term assets to repay our creditors. We may have difficulty converting our long-term assets into current assets in such a situation and may suffer losses upon the sale of our long-term assets. This would materially and adversely affect our operations and prevent us from successfully implementing our business strategy.

We have entered into guarantees in favor of various third parties for their bank borrowings and are subject to contingent liabilities, which may be beyond our control.

Commercial banks in the PRC often require bank borrowings to be secured by guarantees as a precondition for obtaining bank borrowings on terms more favorable to the borrower. In addition, bank loans may be unavailable unless the potential borrower is able to secure a guarantor. As such, we have entered into guarantee agreements with PRC commercial banks in favor of various third parties, including certain of our suppliers. Pursuant to these guarantee agreements, we are subject to contingent liabilities in the amount of $7.7 million as of June 30, 2007. The third party bank borrowings guaranteed by us have matured by the end of October 2007. We are exposed to default by any of these third party borrowers and cannot assure you that these third party borrowers will meet their repayment obligations on time or in full. See ‘‘Business — Proceedings’’ for legal proceedings relating to guarantees we provided for certain loans of Huayua n Jiangsu, an independent third party, which later defaulted on its loans. Any inability on the part of these third party borrowers to repay on time the amounts due to the bank may cause our financial performance and cash flow to be adversely affected.

20

Table of Contents

As a holding company, our ability to make distributions and other payments to our shareholders depend to a significant extent upon the distribution of earnings and other payments made by WSP China.

We declared a dividend of $15.0 million in January 2005, which was in turn contributed by our shareholders to increase the registered capital of WSP China. We declared dividends in the aggregate of $28.8 million in June and August 2006 and $32.5 million in October 2007. On November 30, 2006, our board of directors announced that it intends to approve an annual dividend up to 50% of our annual profits. However, our ability to distribute future dividends will be subject to various factors including, but not limited to, available cash and distributable reserves, investment requirements, and cash flow and working capital requirements. These factors depend on other factors that are beyond our control, including a possible economic downturn and delays in the payments made by customers. If we encounter any of these problems or others, we may not be able to declare and pay dividends in the future as currently planned.

Our ability to make distributions or other payments to our shareholders depends on payments from WSP China, whose ability to make such payments is subject to PRC regulations. Under PRC laws and accounting rules, dividends may be paid only out of distributable profits. Distributable profits with respect to WSP China refers to its after-tax profits as determined under PRC GAAP, less any recovery of accumulated losses and allocations to statutory funds that it is required to make. Any distributable profits that are not distributed in a given year are retained and are available for distribution in subsequent years. WSP China is required under PRC laws and regulations to allocate a portion of its annual after-tax profits, if any, to certain statutory reserves and funds prior to declaring and remitting dividends. For example, it is required to allocate 10% of its after-tax profit to statutory reserves until such reserves reach 50% of WSP China’s registered capit al. Allocations to these statutory reserves and funds can only be used for specific purposes and are not transferable to us in the form of loans, advances or cash dividends. The calculation of distributable profits of WSP China under PRC GAAP differs in many respects from the equivalent calculation under U.S. GAAP. As a result, WSP China may not be able to pay dividends in any given year to us if it does not have distributable profits as determined under PRC GAAP, even if we have profits for the relevant year as determined under U.S. GAAP. Accordingly, if we do not receive dividend distributions from WSP China, our liquidity, financial condition and ability to make dividend distributions will be materially and adversely affected.

We may not be successful in our future acquisitions and investments.

If we are presented with appropriate opportunities, we may acquire additional businesses or assets as part of our growth strategy. In May 2007, we signed a Memorandum of Understanding with Al Tuwairqi Contracting Establishment, or ATCE, a company based in Saudi Arabia and a member of the Al Tuwairqi Group. Under this Memorandum of Understanding, we agreed to invest in a 50% interest in a new joint venture with ATCE for the construction and operation of a seamless pipes manufacturing plant in Saudi Arabia. The joint venture is planned to have an annual production capacity of 750,000 tonnes of seamless pipes, with phase one expected to begin commercial operations in the fourth quarter of 2008 with an annual production capacity of 200,000 tonnes of seamless OCTG. We also plan to construct a production facility in Canada through our subsidiary WSP Industries, in the first half of 2008, a production facility in Houston, Texas and additional production facilities in C hina. Future acquisitions, investments and joint ventures may expose us to potential risks, and the success of our acquisitions, investments and joint ventures depend on a number of factors, including:

21

Table of Contents

| • | our ability to identify suitable opportunities for acquisitions, investments or joint ventures; |

| • | whether we are able to reach an acquisition, investment or joint venture agreement on terms that are satisfactory to us; |

| • | the extent to which we are able to exercise control over the acquired company or business; |

| • | the economic, business or other strategic objectives and goals of the acquired company or business compared to those of our company; |

| • | the diversion of management attention and resources from our existing business; |

| • | our ability to finance the acquisition, investment or joint venture; and |

| • | our ability to integrate successfully the acquired company or business. |

If we fail to make acquisitions or investments or form joint ventures that are strategically important to us, our growth and business prospects may be limited. If we encounter difficulties in integrating the business we acquired, our financial condition and results of operations may be materially and adversely affected.

There have been material weaknesses and deficiencies in our internal control over financial reporting and there remain areas of our internal and disclosure controls that require improvement. If we fail to establish or maintain an effective system of internal controls, we may be unable to accurately report our financial results or prevent fraud, and investor confidence and the market price of our ADSs may be adversely impacted.

We will be subject to reporting obligations under U.S. securities laws. The U.S. Securities and Exchange Commission, or the SEC, as required by Section 404 of the Sarbanes-Oxley Act of 2002, adopted rules requiring every public company to include a management report on such company’s internal control over financial reporting in its annual report, which contains management’s assessment of the effectiveness of the company’s internal control over financial reporting. In addition, an independent registered public accounting firm must audit and report on the effectiveness of the company’s internal control over financial reporting. These requirements will first apply to our annual report on Form 20-F for the fiscal year ending on December 31, 2008. Our reporting obligations as a public company will place a significant strain on our management, operational and financial resources and systems for the foreseeable future.

Prior to this offering, we were a private company with limited accounting personnel and other resources with which to address our internal controls and procedures. Our independent registered public accounting firm has not conducted an audit of our internal control over financial reporting. However, in connection with the audits of our consolidated financial statements for the years ended December 31, 2004, 2005 and 2006, we and our auditors, an independent registered public accounting firm, have identified two material weaknesses in our internal control over financial reporting, as defined in the standards established by the Public Company Accounting Oversight Board. The material weaknesses identified relate to (i) our inadequate accounting personnel with a good understanding of U.S. GAAP and SEC reporting requirements, and (ii) our lack of a comprehensive accounting policies and procedures manual. In addition, our auditors also identified a significant deficien cy relating to the lack of certain accounting controls in Jiangsu Fanli. If we had performed a thorough assessment of our internal control over financial reporting or if our independent registered public accounting firm had performed an audit of our internal control over financial reporting, additional material weaknesses, significant deficiencies or control deficiencies might be identified.

22

Table of Contents