23

Confidential

Forward Looking Language

Cautionary Statement and Certain Risk Factors to Consider

In addition to the information set forth in this presentation, you should carefully consider the risk factors and risks and uncertainties included in the

Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, as well as in this presentation.

This presentation contains forward-looking information. These statements may be identified by such forward-looking terminology as “expect,”

“achieve,” “plan,” “look,” “believe,” “anticipate,” “outlook,” “will,” “would,” “should,” “potential” or similar statements or variations of such terms. All

of the information concerning our outlook, future liquidity, future financial performance and results, future credit facilities and availability, future

cash flows and cash needs, and other future financial performance or financial position, as well as our assumptions underlying such information,

constitute forward-looking information. Our forward looking statements are based on a series of expectations, assumptions, estimates and

projections about the Company, are not guarantees of future results or performance, and involve substantial risks and uncertainty, including

assumptions and projections concerning our liquidity, internal plan, regular-price and markdown selling, operating cash flows, and credit

availability for all forward periods. Our business and our forward-looking statements involve substantial known and unknown risks and

uncertainties, including the following risks and uncertainties:

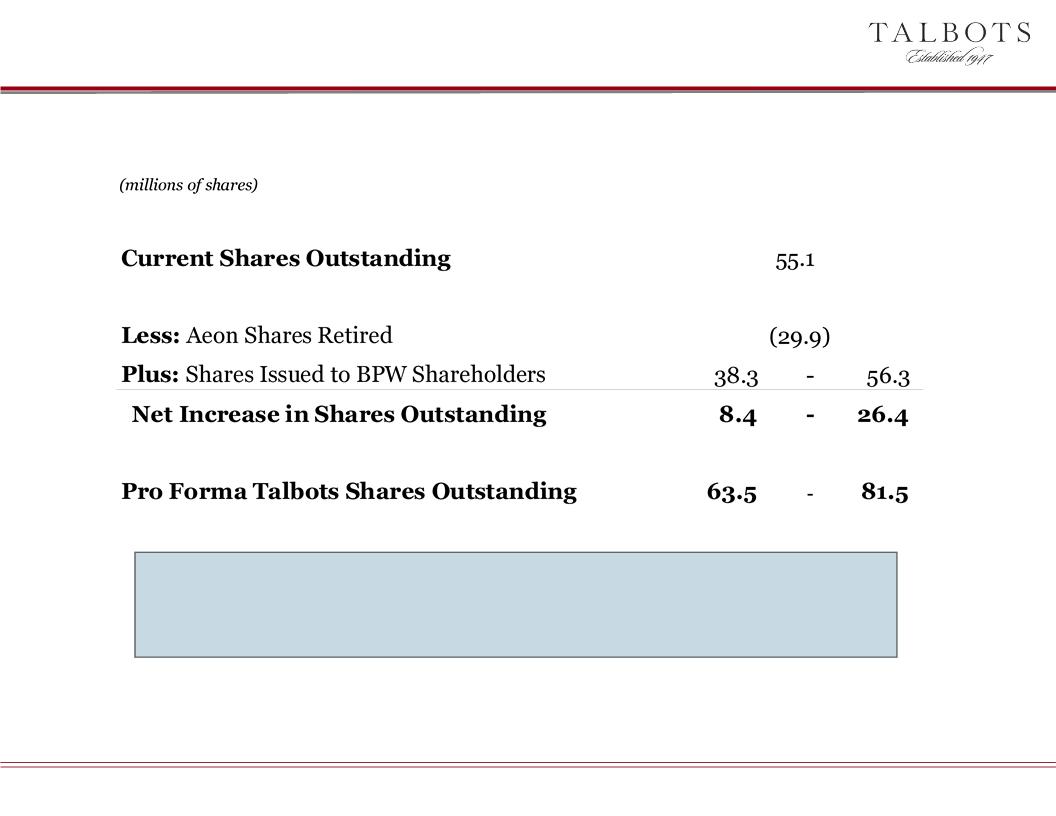

• our ability to satisfy the conditions to consummation of the BPW and related transactions;

• BPW’s ability to obtain the necessary support of its stockholders to approve the transactions, including the risk that the exercise of conversion rights

by BPW’s stockholders, together with transaction costs incurred by BPW, may cause the balance of the BPW trust account to fall below the level

necessary to consummate the transaction;

• BPW’s and our ability to obtain the necessary participation of BPW warrant holders in the exchange of BPW warrants for Talbots stock or warrants;

• our ability to satisfy the conditions to the $200 million credit commitment provided by GE or, failing that, to obtain sufficient alternative financing

on a timely basis;

• the availability of proceeds of the BPW trust account following any exercise by stockholder of their conversion rights and the incurrence of

transaction expenses;

• the continuing material impact of the deterioration in the U.S. economic environment over the past two years on our business, continuing operations,

liquidity, financing plans, and financial results, including substantial negative impact on consumer discretionary spending and consumer

confidence, substantial loss of household wealth and savings, the disruption and significant tightening in the U.S. credit and lending markets, and

potential long-term unemployment levels;

• our level of indebtedness and our ability to refinance or otherwise address our short-term debt maturities, including all Aeon short-term

indebtedness, on the terms or in amounts needed to satisfy these maturities and to address our longer-term maturities, as well as our working

capital, strategic initiatives and other cash requirements;

• any lack of sufficiency of available cash flows and other internal cash resources to satisfy all future operating needs and other Company cash

requirements;

• satisfaction of all borrowing conditions under all Aeon credit facilities including no events of default, accuracy of all representations and warranties,

solvency conditions, absence of material adverse effect or change, and all other borrowing conditions;