As filed with the Securities and Exchange Commission on December 20, 2007

File No. 000-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10

GENERAL FORM FOR REGISTRATION OF SECURITIES PURSUANT TO SECTION 12(B) OR 12(G) OF THE SECURITIES EXCHANGE ACT OF 1934

Hard Rock Hotel Holdings, LLC

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 16-1782658 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

| 4455 Paradise Road, Las Vegas, NV | | 89109 |

| (Address of principal executive office) | | (Zip Code) |

(702) 693-5000

(Registrant’s telephone number, including area code)

Copies of correspondence to:

| | |

David Smail, Esq. Morgans Hotel Group Co. 475 Tenth Avenue New York, New York 10018 | | Thomas C. Sadler Latham & Watkins LLP 633 West Fifth Street, Suite 4000 Los Angeles, CA 90071 |

SECURITIES TO BE REGISTERED PURSUANT TO SECTION 12(B) OF THE ACT:

| | |

Title of each class To be so registered | | Name of each exchange on which Each class to be registered |

| NOT APPLICABLE | | NOT APPLICABLE |

SECURITIES TO BE REGISTERED PURSUANT TO SECTION 12(G) OF THE ACT:

CLASS A MEMBERSHIP INTERESTS

(Title of class)

TABLE OF CONTENTS

i

CAUTIONARY STATEMENT FOR PURPOSES OF THE “SAFE HARBOR” PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

This document includes various “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which represent our expectations or beliefs concerning future events. Statements containing expressions such as “believes,” “anticipates” or “expects” used in this Registration Statement are intended to identify forward-looking statements. All forward-looking statements involve risks and uncertainties. Although we believe our expectations are based upon reasonable assumptions within the bounds of our knowledge of our business and operations, our actual results may materially differ from expected results. We caution that these and similar statements included in this Registration Statement are further qualified by important factors that could cause actual results to differ materially from those in the forward-looking statements. Such factors include, without limitation, the risk factors discussed under “Business—Risk Factors.” Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date thereof. We undertake no obligation to publicly release any revisions to such forward-looking statements to reflect events or circumstances after the date hereof.

THE COMPANY

Hard Rock Hotel Holdings, LLC (the “Company,” “we,” “us” or “our”) is a Delaware limited liability company that was formed by DLJ Merchant Banking Partners (“DLJMBP”) and Morgans Hotel Group Co. (“Morgans”) to acquire Hard Rock Hotel, Inc. (“HRHI” or the “Predecessor”) and certain related assets. HRHI owns the Hard Rock Hotel & Casino in Las Vegas (the “Hard Rock”). As a result of the acquisition, the Company is the successor (the “Successor”) to HRHI.

The Acquisition

On May 11, 2006, Morgans, MHG HR Acquisition Corp. (“Merger Sub”), HRHI and Peter A. Morton entered into an Agreement and Plan of Merger (as amended in January 2007, the “Merger Agreement”) pursuant to which Morgans would acquire the Hard Rock through the merger of Merger Sub with and into HRHI (the “Merger”). Additionally, Morgans Group LLC, an affiliate of Morgans (“Morgans LLC”), entered into three purchase and sale agreements (the “Purchase and Sale Agreements”) with affiliates of Mr. Morton to acquire an approximately 23-acre parcel of land adjacent to the Hard Rock, the parcel of land on which the Hard Rock Cafe restaurant in Las Vegas is situated and plans, specifications and other documents related to a former proposal for a condominium development on the property adjacent to the Hard Rock. The transactions contemplated by the Merger Agreement and the Purchase and Sale Agreements are collectively referred to as the “Acquisition” and the agreements are collectively referred to as the “Acquisition Agreements.” The aggregate purchase price for the Acquisition was approximately $770 million. In addition, we incurred approximately $81 million in costs and expenses associated with the Acquisition.

On November 7, 2006, Morgans and an affiliate of DLJMBP entered into a Contribution Agreement (which was amended and restated in December 2006) under which they agreed to form a joint venture in connection with the Acquisition and the further development of the Hard Rock. Pursuant to the Contribution Agreement, Morgans and the affiliate of DLJMBP agreed to invest one-third and two-thirds, respectively, of the equity capital required to finance the Acquisition.

Prior to the closing of the Acquisition, Morgans and its affiliates assigned the Merger Agreement to us and the Purchase and Sale Agreements to certain of our subsidiaries. Morgans also contributed the equity of Merger Sub to us.

1

The closing of the Acquisition occurred on February 2, 2007, which we refer to as the “Closing Date.” On the Closing Date, pursuant to the terms of the Acquisition Agreements:

| | • | | Merger Sub merged with and into HRHI, with HRHI continuing as the surviving corporation after the Merger. As a result of the Merger, HRHI became our wholly owned subsidiary. Each share of common stock of HRHI issued and outstanding immediately prior to the effective time of the Merger was canceled and converted into the right to receive a pro rata amount of approximately $150 million, subject to post-closing working capital and cage cash adjustments. In December 2007, Morgans, the Company, HRHI and Lily Pond Investments, Inc., the shareholder representative under the Merger Agreement, agreed upon the final working capital and cage cash adjustments under the Merger Agreement. Pursuant to the final adjustments, HRHI has received $2.3 million out of the escrow established under the Merger Agreement for such adjustments. On the Closing Date, Morgans also deposited $15 million into an indemnification escrow fund to be disbursed in accordance with the Merger Agreement and the applicable escrow agreement, with the remaining funds from the indemnification escrow fund to be released on the one-year anniversary of the Closing Date. Pursuant to the Merger Agreement, Mr. Morton also sold certain intellectual property rights to one of our indirect, wholly owned subsidiaries for approximately $69 million, including the exclusive, royalty-free and perpetual right to use and exploit the “Hard Rock Hotel” and the “Hard Rock Casino” registered trademarks in connection with our operations in Las Vegas, and in connection with hotel/casino operations and casino operations in certain other locations. See “—Trademarks.” |

| | • | | One of our subsidiaries acquired for $259 million the approximately 23-acre parcel of land adjacent to the Hard Rock. At the time of the execution of the Acquisition Agreements, Morgans LLC deposited $18.5 million into an escrow account. On the Closing Date, $3.5 million of the deposit was released and credited towards the purchase price and the remaining $15 million of the deposit was retained as part of an indemnification escrow fund to be disbursed in accordance with the applicable Purchase and Sale Agreement and escrow agreement, with the remaining funds from the indemnification escrow fund to be released on the 18-month anniversary of the Closing Date. |

| | • | | One of our subsidiaries acquired for $20 million the adjacent parcel of land (including improvements) on which the Hard Rock Cafe restaurant in Las Vegas is situated. In connection with the transaction, we also acquired the lease with the operator of the Hard Rock Cafe. See “—Agreements Governing the Operation of the Hard Rock—Cafe Lease.” At the time of the execution of the Acquisition Agreements, Morgans LLC deposited $1.5 million in an escrow account, which was released to the seller on the Closing Date. |

| | • | | One of our subsidiaries acquired for $1 million plans, specifications and other documents related to the proposal for a condominium development on the real property adjacent to the Hard Rock. |

On the Closing Date, pursuant to the Contribution Agreement, Morgans and Morgans LLC were deemed to have contributed to us one-third of the equity, or approximately $57.5 million, to fund a portion of the purchase price for the Acquisition by virtue of the application of the escrow deposits under the Acquisition Agreements to the purchase price for the Acquisition and by virtue of the credit given for the expenses Morgans LLC incurred in connection with the Acquisition. Affiliates of DLJMBP contributed to us two-thirds of the equity, or approximately $115 million, to fund the remaining amount of the equity contribution for the Acquisition. In consideration for these contributions, we issued Class A Membership Interests and Class B Membership Interests to the affiliates of DLJMBP and Morgans and Morgans LLC. See “—Agreements Governing the Operation of the Hard Rock—Joint Venture Agreement—Initial Capital Contributions.”

The remainder of the approximately $770 million purchase price and $81 million in costs and expenses associated with the Acquisition was financed with mortgage financing under a real estate financing (“CMBS”) facility entered into by our subsidiaries. Subject to the satisfaction of certain conditions, our CMBS facility also provides funds to be used for future project expansion and construction of the Hard Rock, with the total amount available under our CMBS facility not to exceed $1.36 billion. In November 2007, certain of our subsidiaries

2

refinanced $350 million of the amount borrowed under the financing from the proceeds of three mezzanine loans made to our mezzanine subsidiaries, and the lender increased the maximum amount of the loan that may be funded in the future by $35 million. See “Financial Information—Liquidity and Capital Resources—Acquisition Financing.”

Also on the Closing Date, DLJ MB IV HRH, LLC (“DLJMB IV HRH”), DLJ Merchant Banking Partners IV, L.P. (“DLJMB Partners”), DLJMB HRH VoteCo, LLC (“DLJMB VoteCo”), Morgans and Morgans LLC entered into an Amended and Restated Limited Liability Company Agreement, which governs their relationship as members of the Company. DLJMB IV HRH, DLJMB Partners and DLJMB VoteCo are referred to as the “DLJMB Parties” and Morgans and Morgans LLC are referred to as the “Morgans Parties.”

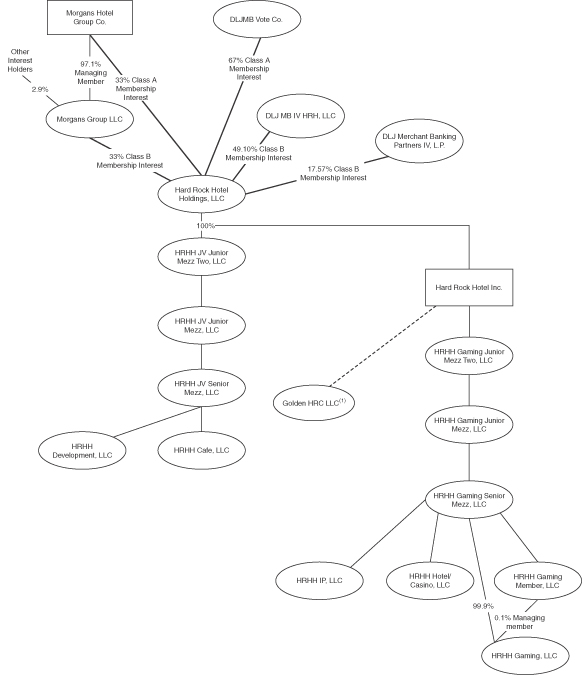

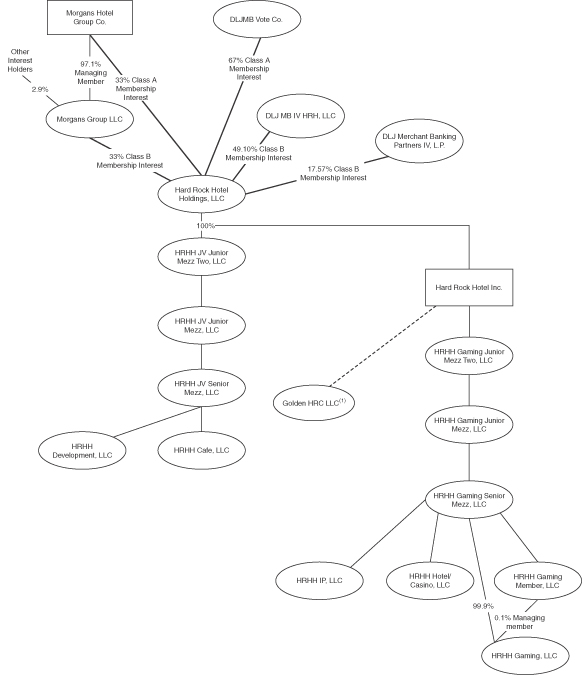

Corporate Structure

Many of the aspects of the corporate structure of the Company and its subsidiaries were implemented to facilitate the CMBS financing for the Acquisition. Before the closing, DLJMB IV HRH and Morgans formed several special purpose vehicles, which are reflected in the chart below as subsidiaries of the Company or Merger Sub, and before the finance restructuring we completed in November 2007, we formed two additional special purpose vehicles, which are also reflected in the chart below as subsidiaries of the Company or Merger Sub.

As discussed above, prior to the Closing Date, Morgans contributed the equity it held in Merger Sub to the Company. As a result, upon consummation of the merger of Merger Sub with and into HRHI, HRHI became a directly owned subsidiary of the Company. Immediately thereafter, through a series of downstream assignments, the assets held by HRHI were transferred to two of the special purpose vehicles formed by DLJMB IV HRH and Morgans. HRHH Hotel/Casino, LLC (“HRHH Hotel/Casino”) became the owner of the Hard Rock and HRHH IP, LLC (“HRHH IP”) became the owner of certain intellectual property used in connection with the Hard Rock. Pursuant to the Merger Agreement, Mr. Morton also sold certain intellectual property to HRHH IP, including rights relating to the use and exploitation of the “Hard Rock Hotel” and “Hard Rock Casino” registered trademarks. See “—Trademarks.”

In addition, prior to the Closing Date, Morgans LLC assigned the Purchase and Sale Agreements relating to the property adjacent to the Hard Rock and the documents related to the former proposal for a condominium development on such property to HRHH Development, LLC (“HRHH Development”) and assigned the Purchase and Sale Agreement relating to the land on which the Hard Rock Cafe restaurant is situated to HRHH Cafe, LLC (“HRHH Cafe”). As a result, upon completion of the transactions under those agreements, HRHH Development became the owner of the parcel of land adjacent to the Hard Rock and the condominium documents, and HRHH Cafe became the owner of the Hard Rock Cafe parcel.

HRHH Hotel/Casino, HRHH IP, HRHH Development and HRHH Cafe are co-borrowers under our CMBS facility. The transfers of the assets to these borrowers facilitated the securitization of the loans under our CMBS facility. HRHH Gaming, LLC (“HRHH Gaming”) is also a borrower. HRHH Gaming has been formed to assume gaming operations at the Hard Rock following its licensure under applicable gaming laws. The gaming operations at the Hard Rock are being conducted by a third party operator until we have completed the licensing process. See “—Nevada Gaming Regulation and Licensing” and “—Agreements Governing the Operation of the Hard Rock—Casino Sublease.”

The remaining special purpose vehicles consist of senior, junior and subordinated junior mezzanine entities that have incurred senior, junior and subordinated junior mezzanine debt under our CMBS facility. See “Financial Information—Liquidity and Capital Resources—Acquisition Financing.”

3

Corporate Structure

As of November 30, 2007

| (1) | Golden HRC, LLC is currently the third party operator of all gaming operations at the Hard Rock. We do not own any interest in Golden HRC, LLC. However, since we believe that we are the primary beneficiary of the gaming operations because we are ultimately responsible for a majority of the operations’ losses and are entitled to a majority of the operations’ residual returns, the gaming operations are consolidated in our financial statements. We anticipate that we will assume the gaming operations once we receive approval from and are licensed by the Nevada Gaming Authorities. We cannot assure you that we will obtain all required approvals and licenses on a timely basis or at all. See “—Nevada Gaming Regulation and Licensing” and “—Agreements Governing the Operation of the Hard Rock—Casino Sublease.” |

4

FORM 10 REGISTRATION

The Company is not required to file this Registration Statement pursuant to the Securities Act or the Exchange Act, or the rules and regulations of the Securities and Exchange Commission (the“SEC”) promulgated thereunder.

Upon the effectiveness of this Registration Statement, the Company’s voting Class A Membership Interests would be registered under Section 12(g) of the Exchange Act. Because such Class A Membership Interests would be registered under the Exchange Act, the Company would be a “publicly traded corporation” under the gaming laws of the State of Nevada (the “Nevada Act”). Any beneficial owner of the Company’s voting securities or other equity securities may be required to file an application, be investigated, and have such holder’s suitability as a beneficial owner of the Company’s voting securities or other equity securities determined if the Nevada Gaming Commission (the “Nevada Commission”) has reason to believe that such ownership would otherwise be inconsistent with the declared policies of the State of Nevada. However, as the Company would be a “publicly traded corporation,” the Company expects that the Nevada Commission will require only that certain beneficial owners of the Company’s Class A Membership Interests be found suitable, and, since the holders of Class B Membership Interests will have no voting or other control, it is anticipated that the holders of Class B Membership Interests will not be subject to licensure or registration under the Nevada Act. It is customary practice of Clark County to defer to Nevada Gaming Authorities with respect to the background and suitability investigation of applications of the nature filed by the Company. Holders of Class B Membership Interests will, however, remain subject to the discretionary authority of the Nevada Gaming Authorities and Clark County and may be required to file an application and have their suitability determined. Therefore, we anticipate that the Nevada Commission and Clark County will require only DLJMB VoteCo, Morgans and our directors to be found suitable in connection with the Acquisition. See “—Nevada Gaming Regulation and Licensing.”

We are prohibited from receiving any revenues of the casino at the Hard Rock until we have obtained the necessary gaming approvals. As such, we have entered into a definitive lease agreement with a third party Casino Operator, Golden HRC, LLC, for all gaming and related activities at the casino. A portion of our revenues from our operations, therefore, is dependent on our ability to collect lease payments from the Casino Operator. Once we have satisfied all conditions to obtain all necessary gaming approvals, including becoming a “publicly traded corporation,” we anticipate that we will assume the gaming operations at the casino. The Casino Operator has provided us with a notice of termination purporting to terminate the lease as of February 2, 2008. We do not believe the Casino Operator has the right to terminate the lease agreement on that date. However, we are seeking to obtain our license to serve as the operator of the casino at the Hard Rock as soon after that date as practicable and we have entered into an agreement with a replacement operator should its services become necessary. We cannot assure you that we will be able to obtain the license on a timely basis or at all.

Following effectiveness of this Registration Statement, the Company will be required and expects to file annual, quarterly and current reports and other information with the SEC. You may read and copy any reports, statements or other information filed by the Company at the SEC’s public reference facilities at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference rooms. The Company’s filings are also available to the public from commercial document retrieval services and at the world wide web site maintained by the SEC at http://www.sec.gov.

OVERVIEW OF HARD ROCK HOTEL AND CASINO

We own and operate the Hard Rock Hotel and Casino in Las Vegas, Nevada, which we believe is a premier destination entertainment resort with a rock music theme. Commencing operations in 1995, the resort is modeled after the highly successful Hard Rock Cafe restaurant chain and is decorated with an extensive collection of rare rock memorabilia. The original Hard Rock Cafe was co-founded in 1971 by Peter Morton, and the “Hard Rock” name has grown to become widely recognized throughout the world. Since opening, the resort has developed a strong following among its target customer base, generally between the ages of 25 and 45, who seek a vibrant,

5

energetic entertainment and gaming experience with the services and amenities associated with a boutique luxury resort hotel. As evidence of its appeal to its target customer base, the resort was selected in 2001 and 2002 by theTravel Channel as having one of “The Top 10 Pools” in the world. The resort has also been recognized in 2003 byWhat’s On for having the “Favorite Hotel Pool,” “Favorite Hotel Overall,” “Favorite Hotel Staff,” “Favorite Retail Store” and “Favorite Dance Club.”

The resort commenced operations March 9, 1995. An approximately $100 million expansion of the resort was completed during May 1999, which significantly enhanced and enlarged the resort. As of September 30, 2007, the resort consists of:

| | • | | an eleven-story hotel tower with 646 stylishly furnished hotel rooms averaging 500 square feet in size (including 63 suites and one 4,500 square foot “mega suite”); |

| | • | | an approximately 30,000 square-foot uniquely styled circular casino with 553 slot machines and 92 table games, for Las Vegas locals, as well as tourists, where rock music is played continuously to provide the casino with an energetic and entertaining, club-like atmosphere; |

| | • | | an approximately 3,600 square-foot retail store, a jewelry store and a lingerie store; |

| | • | | an approximately 8,500 square-foot nightclub, called “Body English,” with a capacity of 1,100 persons; |

| | • | | an approximately 6,000 square-foot banquet facility with a capacity of 390 persons; |

| | • | | a premier live music concert hall, called “The Joint,” with a capacity of 2,050 persons which successfully draws audiences from Las Vegas visitors, as well as the local Las Vegas population; |

| | • | | a beach club including a 300-foot long sand bottomed tropical theme outdoor swimming pool area, with a water slide, water fall, a running stream and underwater rock music (the “Beach Club”); |

| | • | | four high quality restaurants at multiple price points (Nobu, AJ’s Steakhouse, Pink Taco and Mr. Lucky’s), and a Starbucks; |

| | • | | three cocktail lounges, including an elevated Center Bar surrounded by the circular gaming floor; and |

| | • | | an approximately 8,000 square-foot spa/salon/fitness center, called the “Rock Spa.” |

BUSINESS STRATEGY

We believe our continued success in the Las Vegas marketplace is attributable to our unique positioning of the resort. Our business and marketing strategy for the resort is to create a vibrant and energetic entertainment and gaming environment that primarily appeals to a customer base of youthful individuals. We successfully use the Hard Rock theme, vibrant atmosphere and personalized service to differentiate the resort from the substantially larger “mega resorts” approximately one mile west on the Las Vegas Strip. Key elements of our strategy include the following:

Target Clientele

We believe that we have successfully differentiated the resort in the Las Vegas market by targeting a predominantly youthful and “hip” customer base, which consists primarily of rock music fans and youthful individuals, as well as actors, musicians and other members of the entertainment industry. To attract this target audience, we promote the resort as “the place to be” in Las Vegas. The “Hard Rock Hotel” trademark, the “Hard Rock Casino” trademark along with an extensive network of contacts in the music and entertainment industry have helped to attract a number of famous actors, musicians and celebrities to the resort. We believe these customers form a combined demographic group that continues to be underserved by competing facilities despite recent competition from other properties in Las Vegas.

6

Entertainment

As a live music venue with a capacity for 2,050 persons, The Joint successfully draws audiences from Las Vegas visitors and from the local Las Vegas population. We believe that as a result of hosting concerts by famous musicians which in 2007 included, among others, legends such as Steve Winwood, Mary J. Blige, BB King, Willie Nelson, more recent phenomena such as AFI, Korn, Three Days Grace, Jimmy Eat World, and cutting edge groups such as the Kottonmouth Kings and Interpol, The Joint continues to be a premier venue in Las Vegas for live popular music. We also believe The Joint continues to be a favorite venue for musicians due to its intimacy and relatively small capacity. The resort has in the past year also hosted special events such as 944 magazine’s two-year anniversary party, televised mixed martial arts and boxing events, and Rolling Stone magazine’s 40th anniversary celebration. We believe The Joint’s concerts and the resort’s special events generate significant worldwide publicity and reinforce the resort’s marquee image and unique position in the Las Vegas marketplace and provide an added source of visitors for the hotel, casino, retail and food and beverage operations.

Gaming Mix Targeted To Customer Base

As of September 30, 2007, our casino housed 553 slot machines, 92 table games and an approximately 1,200 square-foot race and sports book. Our target gaming customer has a higher propensity to play table games and we strive to create a fun and enthusiastic gaming environment through the use of music themed gaming chips and playing surfaces and by promoting interaction between table game dealers and customers. The casino also features the latest slot machines, some of which reflect the resort’s rock music theme, as well as more traditional machines.

Significant Revenues From Non-Gaming Operations

We derive significant revenues from non-gaming operations. Our hotel, beach club, retail, food and beverage, and other operations allow us to market the resort as a full-service destination. Our diversified revenue base should allow us to be less dependent on the casino as a source of revenues and profits once we are licensed as a gaming operator, which we believe may result in less volatility in our earnings.

Emphasis on Customer Service

We believe that one of the cornerstones of our business strategy is providing our customers with a high level of personal service. Our management trains our employees to interact with guests and continually strives to instill in each employee a dedication to superior service designed to exceed guests’ expectations. Our senior management is a visible proponent of the resort’s emphasis on customer service and regularly speaks to employees and customers. In addition, management personally responds to suggestions made on comment cards placed in each of the resort’s hotel rooms.

LOCATION

The resort occupies what we believe is one of the most highly visible and easily accessible sites in Las Vegas. The resort is located on approximately 41 acres of land near the intersection of Paradise Road and Harmon Avenue, approximately two miles from McCarran International Airport and approximately one mile east of the Las Vegas Strip, the main tourist area in Las Vegas. We believe the resort represents an attractive alternative for tourists, business travelers and locals who wish to avoid the crowds and congestion of the Las Vegas Strip, while maintaining close and easy access to the Las Vegas Strip. We have agreements with major hotels and casinos and retail establishments pursuant to which shuttle services are provided between such locations and the resort. We believe the resort’s location is particularly attractive due to its proximity to:

| | • | | a high concentration of popular Las Vegas restaurants and nightclubs; |

| | • | | the Las Vegas Convention Center; |

7

| | • | | the Thomas & Mack Center at the University of Nevada Las Vegas, Las Vegas’ primary sporting and special events arena; and |

| | • | | a number of non-gaming hotels, which have an aggregate of more than 1,000 guest rooms. |

The principal executive offices of the Hard Rock are located at 4455 Paradise Road, Las Vegas, Nevada 89169 and the telephone number is (702) 693-5000. The Hard Rock’s Internet website is located at www.hardrockhotel.com.

THE RESORT

As of September 30, 2007, the resort consists of the hotel, casino, retail stores, Body English, banquet facility, The Joint, Beach Club, four restaurants, three cocktail lounges, Rock Spa, Brannon Hair and a Starbucks.

The Hotel

The hotel’s eleven-story tower houses 646 spacious hotel rooms, including 582 guest rooms and 63 suites and one 4,500 square foot “mega suite.” The guest rooms and deluxe suites average approximately 500 square feet in size, which is larger than the size of the average Las Vegas hotel room. Our “mega suite” is approximately 4,500 square feet in size and includes numerous amenities. Consistent with the resort’s distinctive decor, the hotel rooms are stylishly furnished with stainless steel bathroom sinks, pedestal beds with leather headboards and black-and-white photos of famous rock musicians. The rooms also include special amenities such as large 42-inch plasma screen televisions with high speed internet access, stereo systems and French doors that open to the outdoors. A full-service concierge and 24-hour room service are available to all guests of the hotel.

The following table illustrates certain historical information relating to the hotel for the period from February 2, 2007 to September 30, 2007 and for the preceding three fiscal years:

| | | | | | | | | | | | | | | | |

| | | Period From February 2, 2007 to

September 30, 2007 | | | Year Ended | |

| | | | December 31,

2006 | | | December 31,

2005 | | | December 31,

2004 | |

Average number of hotel rooms | | | 638 | | | | 642 | | | | 642 | | | | 648 | |

Average occupancy rate(1) | | | 95.4 | % | | | 95.3 | % | | | 94.4 | % | | | 93.5 | % |

Average daily rate(1) | | $ | 221 | | | $ | 183 | | | $ | 169 | | | $ | 151 | |

| (1) | As customary for companies in the gaming industry, average occupancy rate and average daily rate include rooms provided on a complimentary basis. |

The Casino

Gaming operations at the Hard Rock are currently operated by Golden HRC, LLC (“Casino Operator”) pursuant to a Casino Sublease (as amended on January 9, 2007 and as modified by a Recognition Agreement, dated as of February 2, 2007, among Column Financial, Inc., HRHH Hotel/Casino, HRHI and the Casino Operator), effective as of February 2, 2007 (the “Casino Sublease”). The Casino Operator has purchased from HRHI the gaming assets located within the premises for a purchase price amount set by HRHI’s net book value. The purchase price is secured by a promissory note, accruing interest monthly at a rate of 10.0% per annum, executed by the Casino Operator in favor of HRHI (the “Gaming Asset Note”). Upon termination of the Casino Sublease, the Casino Operator must relinquish all of the gaming assets to us or our designee and, in return, we must forgive any remaining balance on the Gaming Asset Note. In addition, where and to the extent that the monthly Casino EBITDAR (as defined in the Casino Sublease) for the previous month falls below the base rent under the Casino Sublease, the Casino Operator will provide us with the difference between the base rent and the Casino EBITDAR in monthly shortfall notes (“Shortfall Notes”). In contrast, where and to the extent that monthly Casino EBITDAR exceeds the base rent, the Casino Operator will establish a reserve account for excess

8

cash flow, which will be applied toward satisfying certain amounts due under the Shortfall Notes. Once the Casino Operator has paid out such amounts as become due under the Shortfall Notes, 75.0% of any surplus fund reserves remaining will be earmarked for repayment of the Gaming Asset Note and a Working Capital Note, according to the terms contained in the Casino Sublease. Upon expiration or earlier termination of the Casino Sublease, our share of any funds remaining in the surplus fund reserve will be our sole property. We believe that we are the primary beneficiary of the gaming operations because we are ultimately responsible for a majority of the operations’ losses and are entitled to a majority of the operations’ residual returns. Therefore, the gaming operations are consolidated in our financial statements. We anticipate that we will assume gaming operations at the Hard Rock once we receive approval from and are licensed by the Nevada Gaming Authorities. We cannot assure you that we will obtain all required approvals and licenses on a timely basis or at all. See “—Nevada Gaming Regulation and Licensing” and “—Agreements Governing the Operation of the Hard Rock—Casino Sublease.”

We believe that the innovative, distinctive style of the 30,000 square-foot circular casino at the Hard Rock is a major attraction for both Las Vegas visitors and local residents. The casino is designed with an innovative circular layout around the elevated Center Bar, which allows the casino’s patrons to see and be seen from nearly every area of the casino as well as play Blackjack at three gaming tables in the bar. Rock music is played continuously to provide the casino with an energetic and entertaining club-like atmosphere. In addition, the casino promotes a friendly, intimate atmosphere by encouraging its employees to smile at and interact with casino players. Dealers, for example, are encouraged to “High Five” winning players.

As of September 30, 2007, the casino houses 92 table games including 67 Blackjack tables, seven Craps tables, five Roulette tables, one Caribbean Stud Poker table, one Midi Baccarat table, one Mini-Baccarat table, one War table, two Three Card Poker tables, one Big 6 table, one Let-it-Ride table, one Rapid Roulette table, one No-Bust Blackjack table, two Bonus Texas Holdem tables and one Pai-Gow Poker table, 553 slot and video machines, an approximate 1,200 square-foot race and sports book, as well as the 2,000 square-foot Center Bar. Some of the casino’s gaming chips are themed to coincide with current concerts and the casino also offers patrons other attractions, such as cutting edge slot technology, proprietary slot graphics, distinctive slot signage, guitar-neck-shaped levers on certain slot machines and piano-like roulette tables complete with keyboards.

Retail

The resort’s retail operations consist of the Retail Store, a 3,600 square-foot retail shop. Visitors may purchase clothing and other accessories, including merchandise displaying the popular “Hard Rock Hotel” and “HRH” logos, from the Retail Store and from a sundry store located in the resort. Our retail operations offer a convenient and inexpensive outlet to market and advertise the “Hard Rock Hotel” trademark and attract other Las Vegas visitors to the resort. Our in-house design team is responsible for maintaining the consistency of the Resort’s image while creating new merchandise to expand and diversify the retail selection.

Body English

During May 2004, the Company opened Body English. Body English is an approximately 8,500 square-foot facility, with an 1,100 person capacity, featuring two rooms on two levels, including a sunken dance floor, three bars and lighting and sound equipment featuring popular and innovative DJs from all around the country to provide the proper entertainment to attract our target clientele.

Banquet Facility

Our 6,000 square-foot conference center and entertainment area has capacity for 390 persons. The banquet facility is located adjacent to the Beach Club area and can accommodate one large event/group and has the capability of being separated into three distinct 2,000 square-foot convention spaces.

9

The Joint

As a live music venue with a capacity for 2,050 persons, The Joint successfully draws audiences from Las Vegas visitors and from the local Las Vegas population. We believe that as a result of hosting concerts by famous musicians which in 2007 included, among others, legends such as Steve Winwood, Mary J. Blige, BB King, Willie Nelson, more recent phenomena such as AFI, Korn, Three Days Grace, Jimmy Eat World, and cutting edge groups such as the Kottonmouth Kings and Interpol, The Joint continues to be a premier venue in Las Vegas for live popular music. We also believe The Joint continues to be a favorite venue for musicians due to its intimacy and relatively small capacity. The resort has in the past year also hosted special events such as 944 magazine’s two-year anniversary party, televised mixed martial arts and boxing events, and Rolling Stone magazine’s 40th anniversary celebration. We believe The Joint’s concerts and the resort’s special events generate significant worldwide publicity and reinforce the resort’s marquee image and unique position in the Las Vegas marketplace and provide an added source of visitors for the hotel, casino, retail and food and beverage operations.

The Beach Club

The Beach Club features a 300-foot long, sand bottomed pool with a water slide, a water fall, a running stream and underwater rock music. The Beach Club also features beaches with white sand imported from Monterey, California, rock outcroppings and whirlpools. In addition, the Beach Club features swim-up blackjack, a Beach Club bar and grill, 37 Tahitian-style private cabanas, and a removable dance floor that extends from one of the beach areas, providing the perfect party space amid thousands of tons of imported sand. The private cabanas include water misters, a refrigerator, a safe, a television and (for an additional fee) an on-site massage service.

Food and Beverage

The resort offers its patrons a selection of high-quality food and beverages at multiple price points. The resort’s food and beverage operations include four restaurants (AJ’s Steakhouse, Pink Taco, Mr. Lucky’s, and Nobu), three bars in the casino (the Las Vegas Lounge, Sports Deluxe and Center Bar), three bars in The Joint, a bar at the Beach Club and catering service for corporate events, conventions, banquets and parties. AJ’s Steakhouse, with seating capacity for approximately 100 persons, is reminiscent of classic steakhouses that reigned in 1960’s Las Vegas, with an open kitchen, and serves prime Chicago stockyard beef. Pink Taco, with seating capacity of approximately 150 persons, is a stylish, authentic Mexican eatery with seasonal outside dining. Mr. Lucky’s, a 24-hour restaurant with seating capacity for approximately 200 persons, specializes in high-quality, moderately priced American cuisine. Nobu, with seating capacity of approximately 120 persons, is a ground breaking temple of Japanese cuisine with Latin American influences created by Master Chef Nobu Matsuhisa and owned and operated independently of the resort. In early January 2008, we expect to open Ago, an elegant Northern Italian trattoria, which also will have seating capacity for approximately 180 persons. In connection with closing Simon Bar and Kitchen, we entered into a separation and release agreement, effective October 29, 2007, pursuant to which we will pay the former operator approximately $400,000.

Both the 1,800 square-foot Las Vegas Lounge and the approximately 2,000 square-foot Center Bar have become popular with both Las Vegas tourists and local residents who are attracted to the resort’s entertainment and vibrant, energetic atmosphere. As a result, these bars frequently reach their service capacity on weekends, holidays and when special events and concerts are held in The Joint or at the Beach Club. In addition, The Joint and the Beach Club offer their customers a selection of menu items and beverages.

The Hard Rock Cafe

The resort also features a world famous Hard Rock Cafe, known as the Hard Rock Cafe, Las Vegas. Although not operated by the resort, we believe the Hard Rock Cafe Las Vegas adds another mid-priced restaurant venue to appeal to our clientele.

10

The Rock Spa

Our health club and spa facilities feature amenities such as treadmills, stair-masters, stationary bicycles, CYBEX machines, a variety of free weights, steam rooms, showers, massage, facial and other personal services. We believe the Rock Spa is a facility suitable for a first class destination resort.

Banquets and Corporate Events

The resort hosts a number of corporate events, conventions, banquets and private parties for up to 3,000 persons. Past clients include Callaway Golf, ESPN, HBO, VH1, Red Bull, PeopleSoft, Coors Brewing Co., Sketchers, Jack Daniels, Microsoft, Toyota, Sony, Goldman Sachs, Xerox, Wells Fargo and Sprint PCS. Depending upon the size of the event, customers can choose to host their corporate functions, conventions and banquets either indoors, at The Joint or in the Banquet facility, or outdoors, around the swimming pool at the Beach Club.

EXPANSION AND RENOVATION PROJECT

In March 2007, we announced a large-scale expansion project at the Hard Rock. The expansion is expected to include the addition of approximately 875 guest rooms, including an all-suite tower with upgraded amenities, approximately 60,000 square feet of meeting and convention space, and approximately 30,000 square feet of casino space. The project also includes an expansion of the hotel’s pool, several new food and beverage outlets, a new and larger “The Joint” live entertainment venue, a new spa and exercise facility and additional retail space. Renovations to the existing property began during 2007 and include upgrades to existing suites, restaurants and bars, retail shops, and common areas, and a new ultra lounge and poker room. These renovations are scheduled to be completed in 2008. We expect the expansion to be complete by late 2009.

MARKETING

Our marketing efforts are targeted at both the visitor market (tourists and business travelers) as well as local patrons. Our marketing department uses both traditional and innovative marketing strategies to promote the “Hard Rock Hotel” and “Hard Rock Casino” trademarks. We employ targeted marketing programs through the use of our proprietary database, which contains in excess of 400,000 names and addresses and in excess of 300,000 email addresses. The resort is aggressively marketed not only through domestic and international public relations activities, direct mail, internet blasts, print, radio and television advertising, but also through special arrangements with various members of the entertainment industry. The Hard Rock also hosts many well-publicized and often televised events such as the World Extreme Cage Fighting, Top Rank Boxing and various awards shows. We believe these types of events are held at the resort because its stylish and distinctive atmosphere is consistent with the theme of the events. The events, in turn, reinforce the resort’s image as a destination resort among its target clientele. The concerts in The Joint by popular artists, some of which have been televised, are another form of promotional activity that reinforces the resort’s image.

The casino marketing staff has developed the Rockstar Player’s Club program for visitors to the casino. The Rockstar Player’s Club player loyalty program utilizes a casino player tracking card. The program, which is available to all casino visitors, tracks each patron’s gaming record, and based upon the level of gaming activity, members may become eligible for discounted or complimentary services, invitations to special events and merchandise at the resort.

Management targets local residents through direct mail advertising as well as through hosting special events and parties specifically geared to the local population. In addition, management believes the off-Las Vegas Strip location and close proximity to a variety of restaurants and nightclubs attracts local residents to the resort.

11

TRADEMARKS

“Hard Rock Hotel” and “Hard Rock Casino” are registered trademarks owned by Hard Rock Cafe International (USA), Inc., which is controlled by the Seminole Tribe of Florida. We have obtained the exclusive, royalty-free and perpetual right to use and exploit these trademarks in connection with hotel/casino operations or casino operations in the State of Illinois and all states and possessions of the United States that are located west of the Mississippi River, including the entire state of Louisiana, but excluding Texas, except for the Greater Houston Area, the nations of Australia, Brazil, Israel and Venezuela, and the Greater Vancouver Area, British Columbia, Canada. In addition, we have obtained the right to sell licensed merchandise bearing the geographic location where it is sold in stores located in or contiguous to a Hard Rock Hotel/Casino or a Hard Rock Casino and licensed merchandise bearing the Interest address through the Internet.

LAS VEGAS MARKET

Las Vegas is one of the fastest growing and largest entertainment markets in the United States. During 2006, according to the Las Vegas Convention and Visitors Authority (the “LVCVA”), gaming revenues in Clark County reached $10.6 billion. In addition, according to the LVCVA:

| | • | | the number of visitors traveling to Las Vegas was approximately 38.9 million in 2006, representing a compound annual growth rate of approximately 4.6% since 1988’s 17.2 million visitors; |

| | • | | the aggregate expenditures by Las Vegas visitors was $36.7 billion in 2006 and $10.0 billion in 1988, representing a compound annual growth rate of 7.5%; and |

| | • | | the number of hotel and motel rooms in Las Vegas was 67,391 in 1989 and 133,205 in 2006, representing a compound annual growth rate of approximately 4.1%. |

We believe the addition of quality themed hotel casinos and resorts during recent years will continue to increase visitor traffic to Las Vegas and we will benefit in particular due to our unique niche and proximity to the Las Vegas Strip.

The following table sets forth certain statistical information for the Las Vegas market for the nine months ended September 30, 2007 and for the years 2002 through 2006, as reported by the LVCVA.

LAS VEGAS MARKET STATISTICS

| | | | | | | | | | | | | | | | | | |

| | | 2002 | | 2003 | | 2004 | | 2005 | | 2006 | | 2007(1) |

Visitor Volume (in thousands) | | | 35,072 | | | 35,540 | | | 37,389 | | | 38,566 | | | 38,915 | | | 29,607 |

Clark County Gaming Revenues (in millions) | | $ | 7,631 | | $ | 7,831 | | $ | 8,711 | | $ | 9,709 | | $ | 10,643 | | $ | 8,092 |

Hotel/Motel Rooms | | | 126,787 | | | 130,482 | | | 131,503 | | | 133,186 | | | 132,605 | | | 133,434 |

Airport Passenger Traffic (in thousands) | | | 35,009 | | | 36,266 | | | 41,442 | | | 44,267 | | | 46,193 | | | 36,039 |

Convention Attendance (in thousands) | | | 5,105 | | | 5,658 | | | 5,725 | | | 6,166 | | | 6,308 | | | 5,089 |

| (1) | Nine months ended September 30, 2007. |

COMPETITION

The resort, located less than one mile east of the Las Vegas Strip, competes with other high-quality Las Vegas resorts and other Las Vegas hotel casinos, including those located on the Las Vegas Strip, on the basis of overall atmosphere, range of amenities, price, location, entertainment offered, theme and size. Currently, there are over 25 upscale, luxury and mid-priced gaming properties located on or near the Las Vegas Strip, six additional upscale, luxury and mid-priced gaming properties in the downtown Las Vegas area and additional

12

gaming properties located in other areas of Las Vegas. Many of the competing properties, such as the Rio, Mandalay Bay, Paris, The Venetian, The Mirage, Treasure Island, Caesar’s Palace, Luxor, New York-New York, Bellagio, Planet Hollywood, the Palms, the MGM Grand and The Wynn Las Vegas have themes and/or attractions, which draw a significant number of visitors and directly compete with our operations. Some of these facilities are operated by companies that have more than one operating facility and may have greater name recognition and financial and marketing resources than we do and market to the same target demographic group. Furthermore, additional hotel casinos, containing a significant number of hotel rooms, are expected to open in Las Vegas within the coming years. There can be no assurance the Las Vegas market will continue to grow or hotel casino resorts will continue to be popular, and a decline or leveling off of the growth or popularity of such facilities would adversely affect our financial condition and results of operations.

We will also face competition from competing “Hard Rock” hotels and hotel casinos that may be established in jurisdictions other than Las Vegas. Although we have obtained the exclusive, royalty-free and perpetual right to use and exploit the “Hard Rock Hotel” and the “Hard Rock Casino” trademarks in connection with hotel/casino operations or casino operations in the State of Illinois and all states and possessions of the United States that are located west of the Mississippi River, including the entire state of Louisiana, but excluding Texas, except for the Greater Houston Area, the nations of Australia, Brazil, Israel and Venezuela, and the Greater Vancouver Area, British Columbia, Canada, Hard Rock Cafe International (USA), Inc., which is controlled by the Seminole Tribe of Florida, is the sole owner of the rights to the “Hard Rock Cafe,” the “Hard Rock Hotel” and the “Hard Rock Casino” trademarks. As a result, Hard Rock Cafe International (USA), Inc., or its licensee, can use and exploit the “Hard Rock” name and logo, other than in connection with hotel/casino operations or casino operations in our exclusive territory, including marketing “Hard Rock” merchandise anywhere in the world. For example, Hard Rock Cafe International (USA), Inc. has licensed the use of the “Hard Rock” name in connection with its Seminole Hard Rock Hotels in Hollywood and Tampa, Florida. There can be no assurance that our business and results of operations will not be adversely affected by the management or the enforcement of the “Hard Rock” brand name by parties outside of our control.

To a lesser extent, the resort competes with hotel casinos in the Mesquite, Laughlin, Reno and Lake Tahoe areas of Nevada, and in a growing number of other jurisdictions in which gaming is now permitted. The resort also competes with state-sponsored lotteries, on- and off-track wagering, card parlors, riverboat and Native American gaming ventures, and other forms of legalized gaming in the United States, as well as with gaming on cruise ships, Internet gaming ventures and international gaming operations. In 1998, California enacted The Tribal Government Gaming and Economic Self-Sufficiency Act (the “Tribal Act”). The Tribal Act provides a mechanism for federally recognized Native American tribes to conduct certain types of gaming on their land. The California electorate approved Proposition 1A on March 7, 2000. Proposition 1A gives all California Indian tribes the right to operate a limited number of certain kinds of gaming machines and other forms of casino wagering on California Indian reservations. Continued proliferation of gaming activities permitted by Proposition 1A may materially negatively affect Nevada gaming markets and our financial position and results of operations. Management is unable, however, to assess the magnitude of the specific impact on us. See “Risk Factors—Risks Related to Our Business—We face intense local competition which could impact our operations and adversely affect our business and results of operations.”

EMPLOYEES

As of September 30, 2007, we had 1,362 full-time employees and 629 on-call employees who are employed on an as-needed basis. None of our employees are members of unions; however, various unions have been aggressively soliciting new members in Las Vegas. We have been approached by unions on various occasions and cannot assure that one or more unions will not approach our employees. We consider our relations with our employees to be good and have never experienced an organized work stoppage, strike or labor dispute.

13

NEVADA GAMING REGULATION AND LICENSING

Introduction

The gaming industry is highly regulated. Gaming registrations, licenses and approvals, once obtained, can be suspended or revoked for a variety of reasons. We cannot assure you that we will obtain all required registrations, licenses and approvals on a timely basis or at all, or that, once obtained, the registrations, findings of suitability, licenses and approvals will not be suspended, conditioned, limited or revoked. The ownership and operation of casino gaming facilities in the State of Nevada are subject to the Nevada Gaming Control Act and the regulations made under such Act, as well as to various local ordinances. The Hard Rock is subject to the licensing and regulatory control of the Nevada Commission, the Nevada State Gaming Control Board (the“Nevada Board”), and the Clark County Liquor and Gaming Licensing Board (the“Clark County Board” and, together with the Nevada Commission and the Nevada Board, the“Nevada Gaming Authorities”).

Owner and Operator Licensing Requirements

In order for our indirect subsidiary, HRHH Gaming, LLC, to become the operator of the gaming-related activities at the Hard Rock, it is required to apply for approval from, and be licensed by, the Nevada Gaming Authorities as a nonrestricted licensee, which we refer to herein as a company licensee. If HRHH Gaming is granted gaming licenses, it will have to pay periodic fees and taxes. The gaming licenses will not be transferable. HRHH Gaming has filed all necessary applications with the Nevada Gaming Authorities. We cannot assure you that HRHH Gaming will be able to obtain all approvals and licenses from the Nevada Gaming Authorities on a timely basis or at all.

Company Registration Requirements

For HRHH Gaming to be licensed to operate the gaming-related activities at the Hard Rock, our Class A members are required to apply to, and be found suitable by, the Nevada Commission to own our voting securities, and we are required to be registered by the Nevada Commission as a “publicly traded corporation,” which we refer to herein as a registered company, for the purposes of the Nevada Gaming Control Act. The Company and its subsidiaries in the line of ownership of HRHH Gaming are also required to apply to, and be found suitable by the Nevada Commission to own the equity interests of their respective subsidiaries and to be registered by the Nevada Commission as intermediary companies. All of the required applications by the prospective registrants have been filed.

Once we have been registered by the Nevada Commission, we will be required to submit detailed financial and operating reports to the Nevada Commission and provide any other information that the Nevada Commission may require. Substantially all of our material loans, leases, sales of securities and similar financing transactions must be reported to, or approved by, the Nevada Commission.

Individual Licensing Requirements

No person may become a stockholder of, or receive any percentage of the profits of, a registered intermediary company or company licensee without first obtaining licenses and approvals from the Nevada Gaming Authorities. The Nevada Gaming Authorities may investigate any individual who has a material relationship to or material involvement with us to determine whether the individual is suitable or should be licensed as a business associate of a gaming licensee. We and our officers, directors and certain key employees are required to file applications with the Nevada Gaming Authorities and may be required to be licensed or found suitable by the Nevada Gaming Authorities. The Nevada Gaming Authorities may deny an application for licensing for any cause which they deem reasonable. A finding of suitability is comparable to licensing, and both require submission of detailed personal and financial information followed by a thorough investigation. An applicant for licensing or an applicant for a finding of suitability must pay or must cause to be paid all the costs of the investigation. Changes in licensed positions must be reported to the Nevada Gaming Authorities and, in

14

addition to their authority to deny an application for a finding of suitability or licensing, the Nevada Gaming Authorities have the jurisdiction to disapprove a change in a corporate position.

If the Nevada Gaming Authorities were to find an officer, director or key employee unsuitable for licensing or unsuitable to continue having a relationship with us, we would have to sever all relationships with that person. In addition, the Nevada Commission may require us to terminate the employment of any person who refuses to file appropriate applications. Determinations of suitability or questions pertaining to licensing are not subject to judicial review in Nevada.

Consequences of Violating Gaming Laws

If the Nevada Commission decides that we have violated the Nevada Gaming Control Act or any of its regulations, it could limit, condition, suspend or revoke our applications, or registrations and gaming license, once obtained. In addition, we and the persons involved could be subject to substantial fines for each separate violation of the Nevada Gaming Control Act, or of the regulations of the Nevada Commission, at the discretion of the Nevada Commission. Further, the Nevada Commission could appoint a supervisor to operate the gaming-related activities at the Hard Rock and, under specified circumstances, earnings generated during the supervisor’s appointment (except for the reasonable rental value of the premises) could be forfeited to the State of Nevada. Limitation, conditioning or suspension of any gaming licenses we may obtain and the appointment of a supervisor could, and revocation of any such gaming license would, have a significant negative effect on our gaming operations.

Requirements for Voting Security Holders

Regardless of the number of shares or other interests held, any beneficial holder of the voting securities of a registered company may be required to file an application, be investigated and have that person’s suitability as a beneficial holder of voting securities determined if the Nevada Commission has reason to believe that the ownership would otherwise be inconsistent with the declared policies of the State of Nevada. If the beneficial holder of such securities who must be found suitable is a corporation, partnership, limited partnership, limited liability company or trust, it must submit detailed business and financial information including a list of its beneficial owners. The applicant must pay all costs of the investigation incurred by the Nevada Gaming Authorities in conducting any investigation.

The Nevada Gaming Control Act requires any person who acquires more than 5% of the voting securities of a registered company to report the acquisition to the Nevada Commission. The Nevada Gaming Control Act requires beneficial owners of more than 10% of a registered company’s voting securities to apply to the Nevada Commission for a finding of suitability within 30 days after the Chairman of the Nevada Board mails the written notice requiring such filing. Under certain circumstances, an “institutional investor,” as defined in the Nevada Gaming Control Act, which acquires more than 10%, but not more than 15%, of the registered company’s voting securities may apply to the Nevada Commission for a waiver of a finding of suitability if the institutional investor holds the voting securities for investment purposes only. An institutional investor that has obtained a waiver may, in certain circumstances, own up to 19% of the voting securities of a registered company for a limited period of time and maintain the waiver. An institutional investor will not be deemed to hold voting securities for investment purposes unless the voting securities were acquired and are held in the ordinary course of business as an institutional investor and not for the purpose of causing, directly or indirectly, the election of a majority of the members of the board at directors of the registered company, a change in the corporate charter, bylaws, management, policies or operations of the registered company, or any of its gaming affiliates, or any other action which the Nevada Commission finds to be inconsistent with holding the registered company’s voting securities for investment purposes only. Activities which are not deemed to be inconsistent with holding voting securities for investment purposes only include:

| | • | | voting on all matters voted on by stockholders or interest holders; |

15

| | • | | making financial and other inquiries of management of the type normally made by securities analysts for informational purposes and not to cause a change in its management, policies or operations; and |

| | • | | other activities that the Nevada Commission may determine to be consistent with such investment intent. |

Consequences of Being Found Unsuitable

Any person who fails or refuses to apply for a finding of suitability or a license within 30 days after being ordered to do so by the Nevada Commission or by the Chairman of the Nevada Board, or who refuses or fails to pay the investigative costs incurred by the Nevada Gaming Authorities in connection with the investigation of its application, may be found unsuitable. The same restrictions apply to a record owner if the record owner, after request, fails to identify the beneficial owner. Any person found unsuitable and who holds, directly or indirectly, any beneficial ownership of any voting security or debt security of a registered company beyond the period of time as may be prescribed by the Nevada Gaming Commission may be guilty of a criminal offense. We will be subject to disciplinary action if, after we receive notice that a person is unsuitable to hold an equity interest or to have any other relationship with, we:

| | • | | pay that person any dividend or interest upon any voting securities; |

| | • | | allow that person to exercise, directly or indirectly, any voting right held by that person relating to our Company; |

| | • | | pay remuneration in any form to that person for services rendered or otherwise; or |

| | • | | fail to pursue all lawful efforts to require the unsuitable person to relinquish such person’s voting securities including, if necessary, the immediate purchase of the voting securities for cash at fair market value. |

Approval of Public Offerings

A registered company may not make a public offering of its securities without the prior approval of the Nevada Commission if it intends to use the proceeds from the offering to construct, acquire or finance gaming facilities in Nevada, or to retire or extend obligations incurred for those purposes or for similar transactions. Once we become a registered company, any approval that we might receive in the future relating to future offerings will not constitute a finding, recommendation or approval by any of the Nevada Board or the Nevada Commission as to the accuracy or adequacy of the offering memorandum or the investment merits of the securities. Any representation to the contrary is unlawful.

The regulations of the Nevada Commission also provide that any entity which is not an “affiliated company,” as that term is defined in the Nevada Gaming Control Act, or which is not otherwise subject to the provisions of the Nevada Gaming Control Act or regulations, such as our Company, that plans to make a public offering of securities intending to use such securities, or the proceeds from the sale thereof, for the construction or operation of gaming facilities in Nevada, or to retire or extend obligations incurred for such purposes, may apply to the Nevada Commission for prior approval of such offering. The Nevada Commission may find an applicant unsuitable based solely on the fact that it did not submit such an application, unless upon a written request for a ruling, referred to as a Ruling Request, the Nevada Board Chairman has ruled that it is not necessary to submit an application.

Approval of Changes in Control

Once we become a registered company, we must obtain prior approval of the Nevada Commission with respect to a change in control through:

16

| | • | | stock or asset acquisitions; |

| | • | | management or consulting agreements; or |

| | • | | any act or conduct by a person by which the person obtains control of us. |

Entities seeking to acquire control of a registered company must satisfy the Nevada Board and Nevada Commission with respect to a variety of stringent standards before assuming control of the registered company. The Nevada Commission may also require controlling stockholders, officers, directors and other persons having a material relationship or involvement with the entity proposing to acquire control to be investigated and licensed as part of the approval process relating to the transaction.

Approval of Defensive Tactics

The Nevada legislature has declared that some corporate acquisitions opposed by management, repurchases of voting securities and corporate defense tactics affecting Nevada gaming licenses or affecting registered companies that are affiliated with the operations permitted by Nevada gaming licenses may be harmful to stable and productive corporate gaming. The Nevada Commission has established a regulatory scheme to reduce the potentially adverse effects of these business practices upon Nevada’s gaming industry and to further Nevada’s policy to:

| | • | | assure the financial stability of corporate gaming operators and their affiliates; |

| | • | | preserve the beneficial aspects of conducting business in the corporate form; and |

| | • | | promote a neutral environment for the orderly governance of corporate affairs. |

Once we become a registered company, approvals may be required from the Nevada Commission before we can make exceptional repurchases of voting securities above their current market price and before a corporate acquisition opposed by management can be consummated. The Nevada Gaming Control Act also requires prior approval of a plan of recapitalization proposed by a registered company’s board of directors in response to a tender offer made directly to its stockholders for the purpose of acquiring control.

Fees and Taxes

License fees and taxes, computed in various ways depending on the type of gaming or activity involved, are payable to the State of Nevada and to the counties and cities in which the licensed subsidiaries respective operations are conducted. Depending upon the particular fee or tax involved, these fees and taxes are payable monthly, quarterly or annually and are based upon:

| | • | | a percentage of the gross revenue received; |

| | • | | the number of gaming devices operated; or |

| | • | | the number of table games operated. |

A live entertainment tax is also paid by gaming operations where entertainment is furnished in connection with admission fees, the selling or serving of food or refreshments or the selling of merchandise.

Foreign Gaming Investigations

Any person who is licensed, required to be licensed, registered, required to be registered, or is under common control with those persons (collectively, “licensees”), and who proposes to become involved in a gaming venture outside of Nevada, is required to deposit with the Nevada Board, and thereafter maintain, a revolving fund in the amount of $10,000 to pay the expenses of investigation of the Nevada Board of the licensee’s or registrant’s participation in such foreign gaming. The revolving fund is subject to increase or

17

decrease in the discretion of the Nevada Commission. Licensees and registrants are required to comply with the reporting requirements imposed by the Nevada Gaming Control Act. A licensee or registrant is also subject to disciplinary action by the Nevada Commission if it:

| | • | | knowingly violates any laws of the foreign jurisdiction pertaining to the foreign gaming operation; |

| | • | | fails to conduct the foreign gaming operation in accordance with the standards of honesty and integrity required of Nevada gaming operations; |

| | • | | engages in any activity or enters into any association that is unsuitable because it poses an unreasonable threat to the control of gaming in Nevada, reflects or tends to reflect, discredit or disrepute upon the State of Nevada or gaming in Nevada, or is contrary to the gaming policies of Nevada; |

| | • | | engages in activities or enters into associations that are harmful to the State of Nevada or its ability to collect gaming taxes and fees; or |

| | • | | employs, contracts with or associates with a person in the foreign operation who has been denied a license or finding of suitability in Nevada on the ground of unsuitability. |

License for Conduct of Gaming and Sale of Alcoholic Beverages

The conduct of gaming activities and the service and sale of alcoholic beverages at the Hard Rock are subject to licensing, control and regulation by the Clark County Board. In addition to approving the licensee, the Clark County Board has the authority to approve all persons owning or controlling the stock of any business entity controlling a gaming or liquor license. All licenses are revocable and are not transferable. The Clark County Board has full power to limit, condition, suspend or revoke any license. Any disciplinary action could, and revocation would, have a substantial negative impact upon the operations of the Hard Rock.

AGREEMENTS GOVERNING THE OPERATION OF THE HARD ROCK

Joint Venture Agreement

The DLJMB Parties and Morgans Parties have entered into an Amended and Restated Limited Liability Company Agreement (the “JV Agreement”), dated February 2, 2007, that governs their relationship with each other as our members.

Classes of Membership Interests. We have two classes of membership interests: Class A Membership Interests and Class B Membership Interests. Holders of Class A Membership Interests are entitled to vote on any matter to be voted upon by our members. Except as provided by law, the holders of Class B Membership Interests do not have any right to vote. As of September 30, 2007, DLJMB VoteCo and Morgans hold 67% and 33% of our Class A Membership Interests, respectively. As of September 30, 2007, DLJMB IV HRH, DLJMB Partners and Morgans LLC held approximately 49%, 18% and 33% of our Class B Membership Interests, respectively.

Initial Capital Contributions. On February 2, 2007, the DLJMB Parties contributed cash equity capital to us to provide a portion of the funds necessary to consummate the Acquisition, and the Morgans Parties were deemed to have contributed cash equity capital to us by virtue of the application of the escrow deposits under the Acquisition Agreements to the purchase price for the Acquisition and by virtue of the credit given to Morgans LLC for the expenses it incurred in connection with the Acquisition. DLJMB VoteCo and Morgans contributed (or were deemed to have contributed) a de minimus amount of capital for their Class A Membership Interests.

Additional Capital Contributions. The JV Agreement provides that DLJMB IV HRH will request that our members make additional capital contributions to us to fund the expansion of the Hard Rock pursuant to a budget approved by our board of directors. In the event of such a request, each of our members is entitled, and

18

may be required, to fund its pro rata portion of the capital contribution in accordance with its percentage interest. The JV Agreement provides that under certain circumstances a member may fund its portion of the expansion capital by posting (or causing an affiliate to post) a letter of credit in accordance with the terms of our CMBS facility. The Morgans Parties may elect not to participate in an expansion capital call, in which case, subject to the JV Agreement, the DLJMB Parties will fund the Morgans Parties’ share of the capital contribution, subject to a cap of $150 million on the DLJMB Parties’ aggregate capital contributions to us for the expansion project.

The JV Agreement also provides that in certain cases DLJMB IV HRH may request that our members make necessary capital contributions contemplated by the operating plans and budgets approved by our board of directors, or in the event of an unexpected shortfall in capital.

Percentage Interest Adjustments. In the event that the Morgans Parties elect not to participate in a capital contribution and the DLJMB Parties fund it (subject to the receipt of all approvals under applicable gaming regulations), each member’s percentage interest will be adjusted to reflect the disproportionate contribution according to formulas provided in the JV Agreement.

In the event any of our members fails to make a capital contribution when it is required to do so, then any other member that is not its affiliate may (a) make an additional capital contribution in cash or by posting a letter of credit to cover the shortfall, (b) loan us the shortfall amount or (c) if a Morgans Party has failed to make the capital contribution, DLJMB IV HRH may secure new financing or new equity for us to cover the shortfall. If a member makes a shortfall capital contribution or loan, then (following any applicable notice periods and right to remedy the shortfall, and subject to the receipt of all approvals under applicable gaming regulations) the percentage interest of the contributing member will be increased according to a formula that provides a 150% credit for the shortfall contribution, and the percentage interest of the member that failed to make the contribution will be adjusted downward by the same amount.

Distribution of Cash Available for Distribution. To the extent not prohibited by the terms of any financing agreement or applicable law, our board of directors may cause us to distribute cash available for distribution to our members. Under the JV Agreement, the DLJMB Parties receive a preferred return of capital in an amount based on a percentage of the fees paid by us to Morgans Management under the Management Agreement (described below). Cash available for distribution is then distributed among the members pro rata in proportion to their percentage interests (as adjusted to disregard the effect of any prior adjustments to the percentage interests made as a result of the posting of letters of credit). If at such time the DLJMB Parties have received a return of all of their capital contributions, then the cash available for distribution will be distributed to the Morgans Parties until they have received a return of all of their capital contributions. Thereafter, all remaining amounts will be distributed between the Morgans Parties and the DLJMB Parties pro rata in proportion to their percentage interests as of the date of such distribution.

Board of Directors. We are managed by our board of directors. Under the JV Agreement, each of DLJMB VoteCo and Morgans currently is entitled to designate three directors. The current members of the board that have been designated by DLJMB VoteCo are Steven Rattner, Neal Pomroy and Ryan Sprott and the three current members that have been designated by Morgans are Fred J. Kleisner, David T. Hamamoto and Richard Syzmanski.

The JV Agreement generally provides that, at meetings of the board, designees of each of DLJMB VoteCo and Morgans must be present so that each party has persons representing an equal number of votes in attendance. All decisions require the affirmative vote of a majority of the directors present at the meeting. The members of the board also may act by written consent if at least two directors designated by each party executes the consent. The authority of the board is subject to DLJMB VoteCo’s right in its sole discretion to cause us to take certain actions relating to financing our operations.

19

In the event that we terminate the Management Agreement for cause (including as a result of a failure by the manager under the Management Agreement to meet the EBITDA performance requirements set forth in the Management Agreement), the Morgans Parties cease to be our members or a “change of control” (as defined in the JV Agreement) of either of the Morgans Parties occurs, then DLJMB VoteCo will be entitled to expand the board to eight directors and appoint two new directors. Following the expansion of the board, certain actions relating to the scope of our business, amendments of the JV Agreement and other actions requiring board approval will require both Morgans LLC’s and DLJMB IV HRH’s consent.

The JV Agreement provides that certain decisions made on our behalf must be made by our board of directors, including, among other things, approval of our operating plan and budget, amendments to the development budget and plans for the expansion project for the Hard Rock, any decision to postpone or cancel the commencement of the expansion project and material construction work.

Officers. Our officers currently are Mr. Kleisner (President) and Mr. Szymanski (Secretary, Treasurer and Vice President). The board may vest the officers with certain powers to act on our behalf (i.e., to execute documents and take certain other actions).

Restrictions on Transfer. Our members generally are prohibited from transferring or encumbering our membership interests without the prior written consent of our Class A members. Transfers of interests by a Morgans Party or a DLJ Fund in any intermediate subsidiary that indirectly holds interests in our Company will be considered a transfer of such person’s indirect interest in our Company. The “DLJ Funds” include DLJMB Partners, DLJMB HRH Co-Investments, L.P., DLJ Offshore Partners IV, L.P., DLJ Merchant Banking Partners IV (Pacific), L.P. and MBP IV Plan Investors, L.P. and are all parties which indirectly hold interests in us. Exceptions to the transfer prohibition apply to (a) transfers to subsidiaries of a DLJ Fund or Morgans, (b) transfers of the equity interests of a Morgans Party or a DLJ Fund (including pursuant to a change in control of those entities), and (c) after the earlier of February 2, 2011 and the termination date of the Management Agreement, in accordance with the right of first offer in favor of the other members under the JV Agreement. If the DLJMB Parties propose to transfer more than 51.0% of the membership interests in us to a third party and the right of first offer is not exercised, the DLJMB Parties will be able to require the Morgans Parties to sell the same ratable share of their membership interests in us to the third party on the same terms and conditions. If this drag-along right is not exercised, then the Morgans Parties may exercise a tag-along right to sell their interests to the third-party transferee on the same terms and conditions as under the sale by the DLJMB Parties. Notwithstanding these exceptions, no transfer may be made unless certain general conditions are met, including that the transfer complies with applicable gaming regulations.