[GRAPHIC OMITTED] Iridium

================================================================================

Iridium Business Overview & Update

June 2009

- --------------------------------------------------------------------------------

GHL Acquisition Corp.

slide01

|  |

================================================================================

Forward Looking Statements

- --------------------------------------------------------------------------------

This communication contains forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. The words "anticipates", "may",

"can", "believes", "expects", "projects",

"intends", "likely", "will", "to be" and other expressions that are predictions

of or indicate future events, trends or prospects and which do not relate to

historical matters identify forward-looking statements. These forward-looking

statements involve known and unknown risks, uncertainties and other factors

that may cause the actual results, performance or achievements of GHL

Acquisition Corp. ("GHQ") and/or Iridium Holdings LLC ("Iridium") to differ

materially from any future results, performance or achievements expressed or

implied by such forward-looking statements. All statements other than

statements of historical fact are statements that could be deemed

forward-looking statements. These risks and uncertainties include, but are not

limited to, uncertainties regarding the timing of the proposed transaction with

Iridium, whether the transaction will be approved by GHQ's stockholders,

whether the closing conditions will be satisfied (including receipt of

regulatory approvals), as well as industry and economic conditions,

competitive, legal, governmental and technological factors. There is no

assurance that GHQ's or Iridium's expectations will be realized. If one or more

of these risks or uncertainties materialize, or if our underlying assumptions

prove incorrect, actual results may vary materially from those expected,

estimated or projected. Readers are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date hereof.

Except for our ongoing obligations to disclose material information under the

Federal securities laws, we undertake no obligation to release publicly any

revisions to any forward-looking statements, to report events or to report the

occurrence of unanticipated events.

Iridium [GRAPHIC OMITTED] slide02

|  |

================================================================================

Additional Information and Where to Find It

- --------------------------------------------------------------------------------

This communication is being made with respect to a proposed acquisition and

related transactions involving GHQ and Iridium. In connection with these

proposed transactions,

GHQ has filed or intends to file with the Securities Exchange Commission

("SEC") a preliminary proxy statement and to mail a definitive proxy statement

and other relevant documents to GHQ's stockholders. The information contained

in this communication is not complete and may be changed. Before making any

voting or investment decisions, GHQ's stockholders and other interested persons

are urged to read GHQ's preliminary proxy statement, and any amendments

thereto, and the definitive proxy statement in connection with GHQ's

solicitation of proxies for the special meeting to be held to approve the

acquisition and any other relevant documents filed with the SEC because they

will contain important information about Iridium, GHQ and the proposed

transactions. The definitive proxy statement will be mailed to GHQ stockholders

as of a record date to be established for voting on the proposed acquisition.

Stockholders and other interested persons will also be able to obtain a copy of

the preliminary and definitive proxy statements once they are available,

without charge, at the SEC's web site at http://www.sec.gov or by directing a

request to: GHL Acquisition Corp., 300 Park Avenue, 23rd Floor, New York, New

York, telephone: (212) 372-4180.

Iridium [GRAPHIC OMITTED] slide03

|  |

================================================================================ Participants in the Solicitation - -------------------------------------------------------------------------------- GHQ and its directors and officers may be deemed to be participants in the solicitation of proxies to GHQ's stockholders in connection with the acquisition. A list of the names of those directors and officers and a description of their interests in GHQ is contained in GHQ's report on Form 10-K for the fiscal year ended December 31, 2008, which is filed with the SEC, and will also be contained in GHQ's proxy statement when it becomes available. GHQ's stockholders may obtain additional information about the direct and indirect interests of the participants in the acquisition, by security holdings or otherwise, by reading GHQ's proxy statement and other materials to be filed with the SEC as such information becomes available. Nothing in this communication should be construed as, or is intended to be, a solicitation for or an offer to provide investment advisory services. Iridium [GRAPHIC OMITTED] slide04 |  |

================================================================================

Iridium Going Public Through Merger with GHQ

- --------------------------------------------------------------------------------

Iridium will enter the public markets through a combination

with GHL Acquisition Corp. ("GHQ"), a special purpose

acquisition company that raised $400 million in its IPO in

2008

The Iridium/GHQ transaction leaves Iridium's current owners

with a meaningful ongoing stake in the combined company,

aligning incentives

[] Iridium and GHQ will combine via an acquisition of Iridium by GHQ

> GHQ will be renamed Iridium Communications Inc. and be NYSE-listed

> Acquisition yields meaningful tax benefits going forward

[] Iridium's current owners will receive the following consideration

> $77.1 million of cash

> 29.4 million shares (plus 1.95 million shares issued for Greenhill

convertible note)

> $25.5 million of cash (90 days post-closing) for facilitating tax

step-up

[ ] Greenhill and Iridium's current owners have agreed to meaningful share

lockups

> One-year lockup, except sales via underwritten secondary offerings

approved by Board of Directors after six months

> Transaction progressing according to plan

> Awaiting FCC approval

> Anticipated closing in the third quarter

Iridium [GRAPHIC OMITTED] slide05

|  |

================================================================================

Iridium: Positioned for Continued Strong Growth

- --------------------------------------------------------------------------------

The transaction allows Iridium to emerge as a public

company with no net debt, ready to fund continuing growth

[] High quality business f One of only two major players in the sector

(Inmarsat the other)

> Only provider with truly global service

> US Department of Defense serves as long-term anchor customer

> Valuable, global spectrum holdings

> Satellite operations outsourced to Boeing

[] Substantial scale

> Very high operating profit margin on service revenues

> ~4 - 5x increase in subscribers possible with existing infrastructure

[] Rapid growth (compound annual rates from 2002 - 2008):

> Subscriber growth of 32%

> Revenue growth of 29%

> Operational EBITDA growth(1) of 135% (2004 - 2008)

[] Attractive fully-distributed valuation

> 5.3x - 5.7x 2009 Operational EBITDA(2)

> Inmarsat trading at 9.5x consensus 2009 EBITDA

[] Valuation enhancement potential

> New products and applications

> Brand enhancement from net debt-free balance sheet and public company

status

(1) Operational EBITDA is a non-GAAP financial measure and excludes revenue

and expenses associated with next generation constellation deployment that

cannot be capitalized as well as non-recurring costs associated with

financing activities including the GHQ transaction. See page 20 for an

explanation of why Operational EBITDA is presented and a reconciliation to

the most directly comparable GAAP metric.

(2) Based on range of guidance provided by Iridium management. See page 18 for

calculations.

Iridium [GRAPHIC OMITTED] slide06

|  |

================================================================================

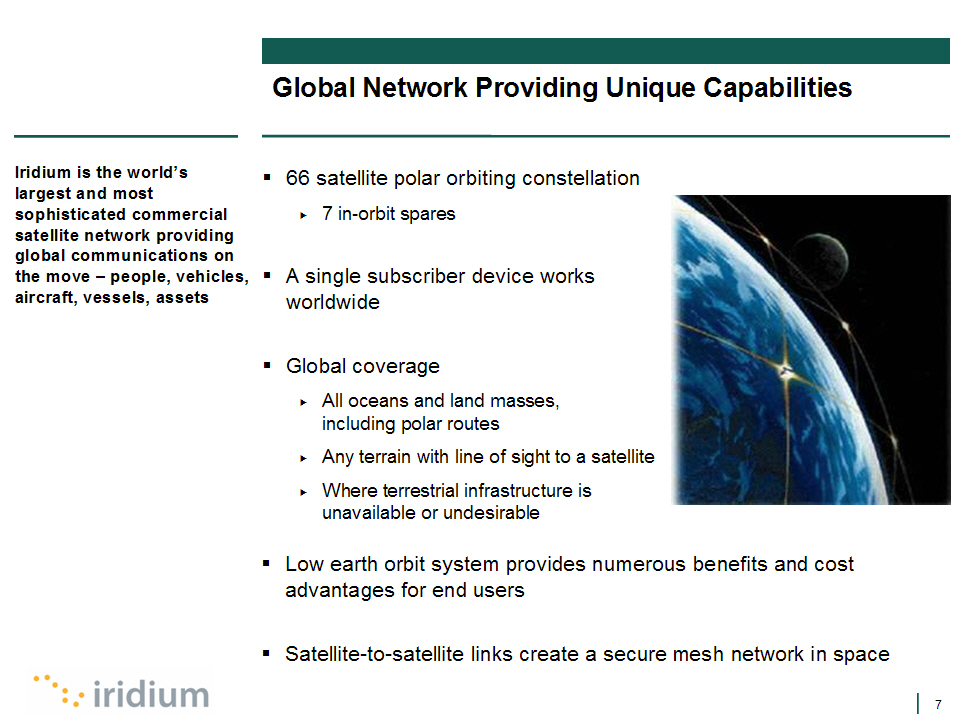

Global Network Providing Unique Capabilities

- --------------------------------------------------------------------------------

Iridium is the world's largest and most sophisticated

commercial satellite network providing global

communications on the move - people, vehicles, aircraft,

vessels, assets

[] 66 satellite polar orbiting constellation

> 7 in-orbit spares

[] A single subscriber device works worldwide

[] Global coverage

> All oceans and land masses, including polar routes

> Any terrain with line of sight to a satellite

> Where terrestrial infrastructure is unavailable or undesirable

[] Low earth orbit system provides numerous benefits and cost advantages for

end users

[] Satellite-to-satellite links create a secure mesh network in space

[GRAPHIC OMITTED]

Iridium [GRAPHIC OMITTED] slide07

|  |

===============================================================================

- --------------------------------------------------------------------------------

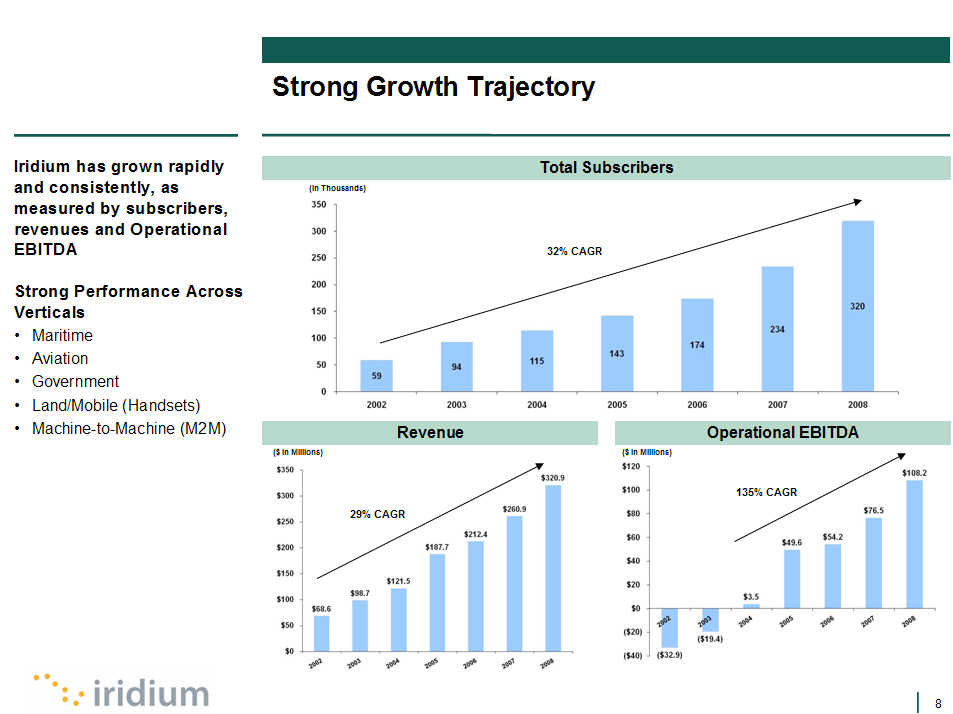

Iridium has grown rapidly and consistently, as measured by subscribers,

revenues and Operational EBITDA

Strong Performance Across

Verticals

o Maritime

o Aviation

o Government

o Land/Mobile (Handsets)

o Machine-to-Machine (M2M)

- --------------------------------------------------------------------------------

Total Subscribers

[GRAPHIC OMITTED]

- --------------------------------------------------------------------------------

- ------------------------------------- ---------------------------------------

Revenue Operational EBITDA

- ------------------------------------- ---------------------------------------

Iridium [GRAPHIC OMITTED] slide08

|  |

================================================================================

Strong Position in Growing Market

- --------------------------------------------------------------------------------

Mobile Satellite Services (MSS) is a

$1.3B market, with service revenues

growing at 10% and equipment growing

at 19% per year

In 2007 (the latest available data),

Iridium was the number one provider

of MSS to the US Government

- -------------------------------------- --------------------------------------

Total MSS Market Share 2001 - Total MSS Market Share 2008 -

$0.6 billion $1.3 billion

- -------------------------------------- --------------------------------------

[GRAPHIC OMITTED] [GRAPHIC OMITTED]

- --------------------------------------------------------------------------------

COVERAGE SERVICES 2008 REVs.

-------- -------- ----------

[GRAPHIC OMITTED] GEO - 3 + 8 legacy Voice, Broadband $635M

[GRAPHIC OMITTED] LEO - 66 + spares Voice, Low & High Data $321M

[GRAPHIC OMITTED] Regional GEO - 2 Voice, Broadband $127M

[GRAPHIC OMITTED] Regional LEO - 48 Voice, Low Data $86M

[GRAPHIC OMITTED] Global LEO - 24 Low Data $30M

Source: Industry sources, SEC filings

Iridium [GRAPHIC OMITTED] slide09

|  |

================================================================================

Iridium's Key Growth Strategies

- --------------------------------------------------------------------------------

Iridium's largely fixed cost business

model allows very high operating profit

of any incremental new service revenue

to fall to the bottom line

Iridium Partners (1)

[GRAPHIC OMITTED]

- --------------------------------------------------------------------------------

[] Continued Growth in Subscribers and Market Share

> Superior service offering and coverage advantage

> Network allows lower overall cost to end users

> Continue to take share from weaker competitors

> Continued low churn as more devices "built in" to VAR offerings

[] Continued Introduction of New Products

> 100+ VARs creating new applications and integrating Iridium into

their products

> New handsets and lower-priced data modems with lower build costs

> Expanding into high-speed data

> Recent introductions include new handset (9555) and OpenPort

> New services (such as Aero OpenPort, "push to talk" netted service

and iGPS)

[] Expanding Sales Coverage

> Expected entry into new geographic markets through licensing in

large, high-growth markets (e.g. China, Mexico, Russia, India)

> Continually adding new VARs, service providers, manufacturers and

developers

[] Exploiting Regulatory Mandates to Grow Current Markets

> Air transport safety

> Fishing compliance

> Vessel identification and tracking for security

> Long-haul trucking driver safety

(1) Includes Iridium's service providers, value added resellers and value

added manufacturers.

Iridium [GRAPHIC OMITTED] slide10

|  |

- --------------------------------------------------------------------------------

Strong Presence in Critical Applications

- --------------------------------------------------------------------------------

[GRAPHIC OMITTED] [GRAPHIC OMITTED] [GRAPHIC OMITTED]

- --------------------------------------------------------------------------------

Commercial Voice and Data Government

Q1 2009 Subscribers:219,085

2008Service Revenue:$122.0M

2008 Commercial Revenue Growth: 28%

- -------------------------------------------------------------------------------

[GRAPHIC OMITTED] [GRAPHIC OMITTED]

- --------------------------------------------------------------------------------

Maritime Aviation Land

Voice & data Voice & data Commercial voice

communications in communications in the sky subscribers

international waters; sky o Disaster

exclusive - Sea Area A4 o Emergency/rescue

o Crew calling o Flight following operations

o Fisheries mgmt o Cockpit o In-Network calling

o High Speed Data communications o Regional Pricing

o Long Range ID & Track o Air safety services o Quality Guarantee

- --------------------------------------------------------------------------------

Commercial Growth

Overall Traffic:(^12% Voice Traffic: ^7% Data Traffic: ^23%

- --------------------------------------------------------------------------------

Government Machine-to-Machine

Q1 2009 Subs: 31,163 Q1 2009 Subs: 77,613

`08Service Rev: $67.8M '08Service Rev: $11.2M

`08 Rev Growth: 17% '08 Rev Growth: 104%

- --------------------------------------------------------------------------------

Voice & data communications Low latency, global applications

in-theater o Hundreds of apps

o Fleet management

o Over-the-Horizon o Container tracking

o Netted o Oil and Gas telemetry

o Blue Force Tracking o Oceanographic data

o Unattended Sensors o Personal Locator Beacon

- --------------------------------------------------------------------------------

Note: Traffic growth reflects growth from 1Q08 to 1Q09

Iridium [GRAPHIC OMITTED] slide11

|  |

================================================================================

Defense Department Anchor Customer

- --------------------------------------------------------------------------------

Iridium continues to be an embedded

part of the DoD's communications

infrastructure, with many new

opportunities for growth

- ------------------------------------

Total Subscribers (3/31/09)

- ------------------------------------

[GRAPHIC OMITTED]

[] Unique high security network that complies with military standards

> 100% global coverage operated from single, government owned, Iridium

proprietary gateway

- Supported by Iridium operations and maintenance contract

> Significant investment by DoD in secure gateway and user equipment

[] DoD anchor contract for service through its own secure gateway since 2000

> In the second year of five year(1) contract signed in Q1 2008

> Serves all branches of DoD plus other international and government

users

> Fixed fee per user, bulk access for voice

> Increasing utilization of Iridium short burst data services; tiered

pricing

[] Increasingly wide range of DoD applications

> Source of R&D funds for new products and services

> Increasingly integrated into military platforms (e.g. aircraft,

vehicles, submarines, helicopters)

> New netted service provides deployable beyond line-of-sight tactical

radio capability

(1) As is customary for government contracts, Iridium's DoD contract is

structured with a one-year term and four one-year options to extend.

Iridium [GRAPHIC OMITTED] slide12

|  |

================================================================================

Iridium NEXT - Our Second Generation

- --------------------------------------------------------------------------------

Iridium expects to fund the

capital requirements (approximately

$2.7bn) primarily from internally

generated cash flows, proceeds from

the GHQ transaction and secondary

payload revenues

Selection of prime vendor expected

in mid 2009

- ------------------------------------

[GRAPHIC OMITTED]

[] Iridium has begun plans to replace current constellation

f Lockheed Martin and Thales Alenia in final stages of competing for a

prime contract

[] Initial launches to begin around 2014

[] Maintain unique attributes - 66 satellite LEO architecture,

inter-satellite links, global coverage, high availability

[] Backward compatible for existing customers - maintains ongoing growth in

existing cash flow base

[] Improved data speeds, subscriber technology, core technology improvements

(batteries, processors, solar cells)

[] Valuable platform for global interconnected secondary payloads

Iridium [GRAPHIC OMITTED] slide13

|  |

================================================================================

Opportunity to Share NEXT Infrastructure

- --------------------------------------------------------------------------------

Including secondary payloads on NEXT

could significantly defray overall

capital costs

[GRAPHIC OMITTED] [GRAPHIC OMITTED] [GRAPHIC OMITTED]

[] Significant interest from Government and industry in sharing NEXT global

networked communications infrastructure for space observation

[] Secondary payloads deployed on NEXT could revolutionize Earth sensing

> Unprecedented spatial and temporal coverage with 66 payloads

> Real-time data acquisition from on-board sensors

> Cost effective - likely < 20% the cost of dedicated satellites

[] Potential applications that could utilize NEXT secondary payload

capabilities include earth observation, communications, remote sensing,

space weather, climate change, space situational awareness

[] Customer funded technical feasibility studies underway

[GRAPHIC OMITTED] [GRAPHIC OMITTED] [GRAPHIC OMITTED] [GRAPHIC OMITTED]

Source: 2007 Futron study

Iridium [GRAPHIC OMITTED] slide14

|  |

================================================================================

Summary Historical Financial Statements

- --------------------------------------------------------------------------------

Despite difficult economic conditions,

Iridium anticipates full year 2009

Operational EBITDA of $120M - $130M; an

increase of 11% - 20% over 2008

($ in millions, subscriber data in thousands)

Years Ended December 31, 3 Months Ended Mar. 31(1)

2007 2008 2008 2009

Subscribers:

Commercial 202.5 288.6 218.3 296.7

U.S. Government 31.7 31.3 31.7 31.2

---------

Total Subscribers 234.2 319.9 250.0 327.9

% Growth - 37% - 31%

Revenues:

Commercial $101.2 $133.2 $29.0 $36.8

U.S. Government 57.9 67.8 14.1 18.5

Equipment 101.9 119.9 31.2 20.5

--------- ---------------------------------------------

Total Revenues $260.9 $320.9 $74.3 $75.8

% Growth - 23% - 2%

Operational EBITDA $76.5 $108.2 $26.3 $27.6

% Growth - 41% - 5%

% Margin 29% 34% 35% 36%

NEXT Costs 1.8 14.1 1.7 8.8

Non-Recurring

Transaction Expenses - 8.0 0.2 0.7

GAAP EBITDA $74.7 $86.2 $24.4 $18.0

% Growth - 15% - -26%

% Margin 29% 27% 33% 24%

(1) Unaudited.

Iridium [GRAPHIC OMITTED] slide15

|  |

================================================================================

Summary of Post-Transaction Iridium Balance Sheet

Assuming 30% Redemptions

- --------------------------------------------------------------------------------

Post-transaction, Iridium will have

a strong balance sheet with minimal

leverage

(All Values in Millions) 3/31/2009

Pro Forma

---------

Unrestricted Cash (1)(3) $153.2

Other Current Assets 83.3

Property & Equipment, Net 411.8

Other Long-Term Assets 23.6

Goodwill & Intangibles 130.4

---------

Total Assets $802.3

=========

Current Liabilities

$83.2

Motorola Payable 10.4

Debt (Short-Term & Long-Term) (2) 46.7

Other Liabilities 84.6

---------

Total Liabilities 224.9

Stockholders' Equity (2) 577.4

---------

Total Liabilities & Stockholders' Equity $802.3

=========

No

Net Cash (3) $96.1

Fully-Diluted Shares Outstanding (3)(4) 78.591

Future Potential Warrant Proceeds (5) $283.3

(1) Stated prior to payment of $25.5 million tax step-up payment, due 90-days

post-closing.

(2) Assumes conversion of Greenhill convertible note into equity.

(3) Assumes 30% of GHQ's existing public shareholders elect conversion for

$10.00 in cash per share. Motorola Payable is treated as debt for purposes

of this calculation.

(4) Based on treasury method for warrants outstanding and $10.00 share price.

(5) Based on cash exercise of 40.5 million warrants at $7.00 each.

Iridium [GRAPHIC OMITTED] slide16

|  |

================================================================================

Future Financing Plans & Options

- --------------------------------------------------------------------------------

GHQ transaction and NEXT procurement

strategy offer several flexible

financing options

[] Strong initial cash balance after GHQ transaction closing

[] Significant current and increasing future cash flow from operations

Project financing of NEXT secondary payloads

[] Potential government backed financing in support of NEXT suppliers

[] Considering flexible NEXT procurement approaches to stage investment

Iridium [GRAPHIC OMITTED] slide17

|  |

================================================================================

Valuation Comparison

- --------------------------------------------------------------------------------

Iridium's fully-distributed

valuation post-transaction

represents a 42% discount to

the EBITDA multiple of its

closest competitor, Inmarsat

Iridium's valuation is made

even more attractive by its

higher growth, lower leverage

and superior network coverage

(All Values in Millions,

Except Per Share Data) [GRAPHIC OMITTED] [GRAPHIC OMITTED]

Share Price $10.00 (1) $8.82(2)

x Fully Diluted Shares Outstanding 78.6 (3) 459.5

------------- --------

Equity Value $785.9 $4,054.0

Net Debt/(Cash) ($96.1)(3) $1,443.8

------------- --------

Enterprise Value $689.8 $5,497.8

2009E EBITDA $120.0-$130.0 (4) $578.4(5)

- --------------------------------------------------------------------------------

Enterprise Value / 2009E EBITDA 5.5x(6) 9.5x

- --------------------------------------------------------------------------------

Net Debt / 2009E EBITDA N/M 2.5x

Network Coverage Global No Polar Coverage

(1) Estimated conversion amount per share.

(2) Source: Bloomberg as of 6/12/09.

(3) Estimated pro forma as of 3/31/09 assuming 30% of GHQ's existing public

shareholders elect conversion for $10.00 in cash per share.

(4) Source: Operational EBITDA guidance from GHQ press release dated 4/28/09.

(5) Source: Bloomberg consensus estimates.

(6) Based on midpoint of 2009 EBITDA guidance.

Iridium [GRAPHIC OMITTED] slide18

|  |

================================================================================

Iridium: Positioned for Continued Strong Growth

- --------------------------------------------------------------------------------

The transaction allows Iridium to

emerge as a public company with

no net debt, ready to fund

continuing growth

[] High quality business

> One of only two major players in the sector (Inmarsat the other)

> Only provider with truly global service

> US Department of Defense serves as long-term anchor customer

> Valuable, global spectrum holdings

> Satellite operations outsourced to Boeing

[] Substantial scale

> Very high operating profit margin on service revenues

> ~4 - 5x increase in subscribers possible with existing infrastructure

[] Rapid growth (compound annual rates from 2002 - 2008):

> Subscriber growth of 32%

> Revenue growth of 29% f Operational EBITDA growth(1) of 135% (2004 -

2008)

[] Attractive fully-distributed valuation

> 5.3x - 5.7x 2009 Operational EBITDA(2)

> Inmarsat trading at 9.5x consensus 2009 EBITDA

[] Valuation enhancement potential

> New products and applications

> Brand enhancement from net debt-free balance sheet and public company

status

(1) Operational EBITDA is a non-GAAP financial measure and excludes revenue and

expenses associated with next generation constellation deployment that

cannot be capitalized as well as non-recurring costs associated with

financing activities including the GHQ transaction. See page 20 for an

explanation of why Operational EBITDA is presented and a reconciliation to

the most directly comparable GAAP metric. 19

(2) Based on range of guidance provided by Iridium management. See page 18 for

calculations.

Iridium [GRAPHIC OMITTED] slide19

|  |

=======================================================================================

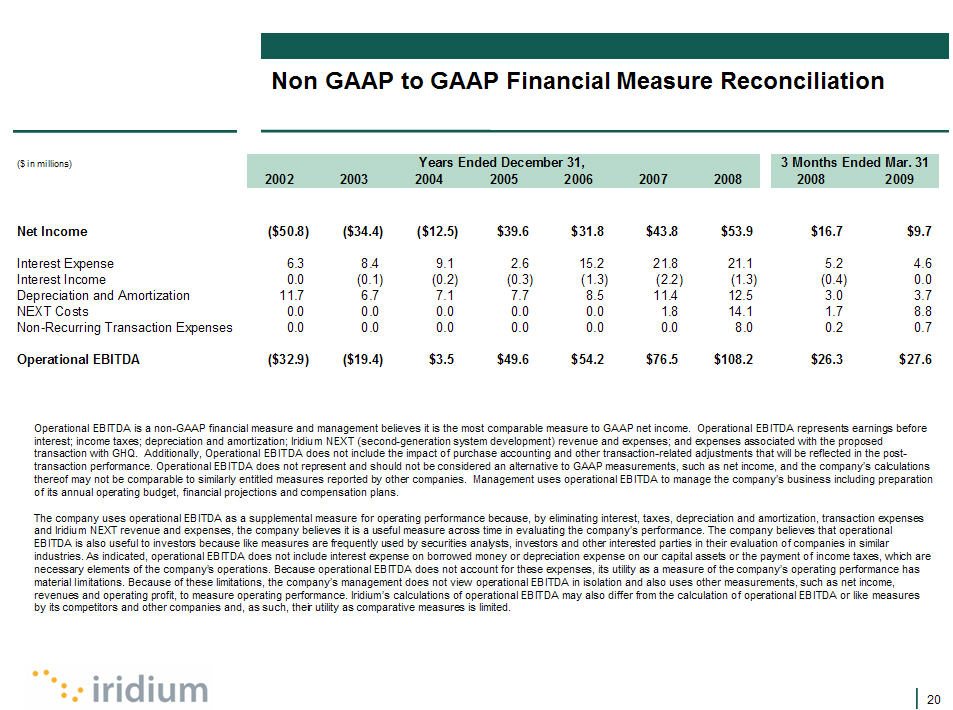

Non GAAP to GAAP Financial Measure Reconciliation

- ---------------------------------------------------------------------------------------

3 Months

($ in millions) Years Ended December 31, Ended Mar. 31

---------------------------------------------------- -------------

2002 2003 2004 2005 2006 2007 2008 2008 2009

Net Income ($50.8) ($34.4) ($12.5) $39.6 $31.8 $43.8 $53.9 $16.7 $9.7

Interest Expense 6.3 8.4 9.1 2.6 15.2 21.8 21.1 5.2 4.6

Interest Income 0.0 (0.1) (0.2) (0.3) (1.3) (2.2) (1.3) (0.4) 0.0

Depreciation

and Amortization 11.7 6.7 7.1 7.7 8.5 11.4 12.5 3.0 3.7

NEXT Costs 0.0 0.0 0.0 0.0 0.0 1.8 14.1 1.7 8.8

Non-Recurring

Transaction

Expenses 0.0 0.0 0.0 0.0 0.0 0.0 8.0 0.2 0.7

Operational

EBITDA ($32.9) ($19.4) $3.5 $49.6 $54.2 $76.5 $108.2 $26.3 $27.6

Operational EBITDA is a non-GAAP financial measure and management believes it

is the most comparable measure to GAAP net income. Operational EBITDA

represents earnings before interest; income taxes; depreciation and

amortization; Iridium NEXT (second-generation system development) revenue and

expenses; and expenses associated with the proposed transaction with GHQ.

Additionally, Operational EBITDA does not include the impact of purchase

accounting and other transaction-related adjustments that will be reflected in

the post- transaction performance. Operational EBITDA does not represent and

should not be considered an alternative to GAAP measurements, such as net

income, and the company's calculations thereof may not be comparable to

similarly entitled measures reported by other companies. Management uses

operational EBITDA to manage the company's business including preparation of

its annual operating budget, financial projections and compensation plans.

The company uses operational EBITDA as a supplemental measure for operating

performance because, by eliminating interest, taxes, depreciation and

amortization, transaction expenses and Iridium NEXT revenue and expenses, the

company believes it is a useful measure across time in evaluating the company's

performance. The company believes that operational EBITDA is also useful to

investors because like measures are frequently used by securities analysts,

investors and other interested parties in their evaluation of companies in

similar industries. As indicated, operational EBITDA does not include interest

expense on borrowed money or depreciation expense on our capital assets or the

payment of income taxes, which are necessary elements of the company's

operations. Because operational EBITDA does not account for these expenses, its

utility as a measure of the company's operating performance has material

limitations. Because of these limitations, the company's management does not

view operational EBITDA in isolation and also uses other measurements, such as

net income, revenues and operating profit, to measure operating performance.

Iridium's calculations of operational EBITDA may also differ from the

calculation of operational EBITDA or like measures by its competitors and other

companies and, as such, their utility as comparative measures is limited.

[GRAPHIC OMITTED]

Iridium [GRAPHIC OMITTED] slide20

|  |