Exhibit 99.1

[GRAPHIC OMITTED] Overview of Improved Transaction Economics July 2009 GHL Acquisition Corp. slide01 |  |

[GRAPHIC OMITTED]

Forward Looking Statements

- --------------------------------------------------------------------------------

This communication contains forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. The words "anticipates", "may",

"can", "believes", "expects", "projects",

"intends", "likely", "will", "to be" and other expressions that are predictions

of or indicate future events, trends or prospects and which do not relate to

historical matters identify forward-looking statements. These forward-looking

statements involve known and unknown risks, uncertainties and other factors

that may cause the actual results, performance or achievements of GHL

Acquisition Corp. ("GHQ") and/or Iridium Holdings LLC ("Iridium") to differ

materially from any future results, performance or achievements expressed or

implied by such forward-looking statements. All statements other than

statements of historical fact are statements that could be deemed

forward-looking statements. These risks and uncertainties include, but are not

limited to, uncertainties regarding the timing of the proposed transaction with

Iridium, whether the transaction will be approved by GHQ's stockholders,

whether the closing conditions will be satisfied (including receipt of

regulatory approvals), as well as industry and economic conditions,

competitive, legal, governmental and technological factors. There is no

assurance that GHQ's or Iridium's expectations will be realized. If one or more

of these risks or uncertainties materialize, or if our underlying assumptions

prove incorrect, actual results may vary materially from those expected,

estimated or projected. Readers are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date hereof.

Except for our ongoing obligations to disclose material information under the

Federal securities laws, we undertake no obligation to release publicly any

revisions to any forward-looking statements, to report events or to report the

occurrence of unanticipated events.

2

[GRAPHIC OMITTED]

slide02

|  |

[GRAPHIC OMITTED]

Additional Information and Where to Find It

- --------------------------------------------------------------------------------

This communication is being made with respect to a proposed acquisition and

related transactions involving GHQ and Iridium. In connection with these

proposed transactions,

GHQ has filed with the Securities Exchange Commission ("SEC") a preliminary

proxy statement and intends to mail a definitive proxy statement and other

relevant documents to GHQ's stockholders. The information contained in this

communication is not complete and may be changed. Before making any voting or

investment decisions, GHQ's stockholders and other interested persons are urged

to read GHQ's preliminary proxy statement, and any amendments thereto, and the

definitive proxy statement in connection with GHQ's solicitation of proxies for

the special meeting to be held to approve the acquisition and any other

relevant documents filed with the SEC because they will contain important

information about Iridium, GHQ and the proposed transactions. The definitive

proxy statement will be mailed to GHQ stockholders as of a record date to be

established for voting on the proposed acquisition. Stockholders and other

interested persons will also be able to obtain a copy of the preliminary and

definitive proxy statements once they are available, without charge, at the

SEC's web site at http://www.sec.gov or by directing a request to: GHL

Acquisition

Corp., 300 Park Avenue, 23rd Floor, New York, New York,

telephone: (212) 372-4180.

3

[GRAPHIC OMITTED]

slide03

|  |

[GRAPHIC OMITTED]

Participants in the Solicitation

- --------------------------------------------------------------------------------

GHQ and its directors and officers may be deemed to be participants in the

solicitation of proxies to GHQ's stockholders in connection with the

acquisition. A list of the names of those directors and officers and a

description of their interests in GHQ is contained in GHQ's report on Form 10-K

for the fiscal year ended December 31, 2008, which is filed with the SEC, and

will also be contained in GHQ's proxy statement when it becomes available.

GHQ's stockholders may obtain additional information about the direct and

indirect interests of the participants in the acquisition, by security holdings

or otherwise, by reading GHQ's proxy statement and other materials to be filed

with the SEC as such information becomes available.

Nothing in this communication should be construed as, or is intended to be, a

solicitation for or an offer to provide investment advisory services.

4

[GRAPHIC OMITTED]

slide04

|  |

Steps Taken in Preparation for Merger

Vote

Improving Transaction Economics and

Facilitating Stockholder Approval

- -------------------------------------- ----------------------------------------

GHQ and Iridium have in recent months [] Transaction Price Reduction

taken a number of steps which both Announced in Late-April

facilitate the closing of the proposed

merger and increase the attractiveness > 15% reduction in consideration to

of the pro- forma company valuation be paid to existing Iridium holders

Today's warrant restructuring > Strong equity market performance

announcement further improves the since then (S&P 500 up 15%; Inmarsat

economics of the merger for GHQ up 13%)

stockholders

[] Elimination of ~3.7 Million GHQ

Warrants Held by Bank of America

> Will be repurchased upon merger

closing for $0.50 each

[] GHQ Warrant Restructuring Announced

Today

> Meaningfully reduces warrant

overhang on GHQ shares post-closing

> Reduces pro-forma,

fully-distributed EBITDA multiple

> ~14.4 million warrants will have

their strike price raised and

expiration date extended and ~12.4

million additional warrants will be

exchanged for GHQ shares and cash

5

[GRAPHIC OMITTED]

slide05

|  |

Details of Warrant Restructuring

- -------------------------------------- ----------------------------------------

As a result of the warrant [] In total, ~30.5 million GHQ warrant

restructuring, GHQ will have will be repurchased or restructured

dramatically fewer in-the-money upon closing of the acquisition of

warrants outstanding upon closing of Iridium

the Iridium merger, which is

expected to improve share trading > Represents ~69% of the 44.1 million

dynamics and enhance the pro-forma warrants that would otherwise have

valuation for stockholders been outstanding following the

acquisition

> Reduces pro-forma, fully-

distributed EBITDA multiple and

diminishes warrant overhang on GHQ

shares

> Repurchases conducted at

meaningful discount to intrinsic

value assuming Iridium closing;

restructurings significantly raise

strike prices to out-of-the-money

levels

[] Repurchase of ~3.7 million warrants

held by Bank of America (previously

announced)

> Purchase price of $0.50 each or

~$1.8 million in aggregate

[] Restructuring of ~14.4 million

warrants held by various holders

> Strike price increased to 15%

above share offering price in a

future GHQ common equity offering

(subject to a maximum strike price

of $11.50)

> Expiration date extended by two

years to February 2015

> Includes all of the 4.0 million

remaining private placement warrant

held by Greenhill and 0.4 million

warrants held by executives of GHL

Acquisition

[] Repurchase of ~12.4 million warrant

held by various holders

> Aggregate purchase price of ~$3.1

million of cash and ~$12.4 million

of GHQ common stock with the number

of shares based on the offering

price in a future GHQ common equity

offering (subject to minimum of

one-tenth of a share per warrant)

[] Greenhill will own the following

securities post-closing of the

acquisition of Iridium

> ~6.9 million GHQ common shares,

which it received for founding GHQ

and making an $8 million initial

equity investment

> ~1.9 million GHQ common shares,

resulting from conversion of its

$22.9 million convertible note

investment in Iridium

> 4.0 million GHQ warrants with an

out-of-the-money strike price as

described above

6

[GRAPHIC OMITTED]

slide06

|  |

Summary of Post-Transaction Iridium

Balance Sheet

Including Effects of Warrant

Restructuring; Assuming 30%

Redemptions

- -------------------------------------- ----------------------------------------

Post-merger, Iridium will have a (All Values in Millions) 1/2009

strong balance sheet with minimal Proo Forma

leverage Unrestricted Cash (1)(3) $150.1

Other Current Assets 83.3

Property & Equipment, Net 411.8

Other Long-Term Assets 23.6

Goodwill & Intangibles 130.4

------

------

Total Assets $799.2

------

Current Liabilities (1)

------

$83.2

Motorola Payable 10.4

Debt (Short-Term & Long-Term) (2) 46.7

Other Liabilities 84.6

------

Total Liabilities 224.9

Stockholders' Equity (2) 574.3

------

------

Total Liabilities & Stockholders'

Equity $799.2

------

Notes:

------

Net Cash (3) $93.0

Fully-Diluted Shares

Outstanding (3)(4) 71.791

Future Potential Warrant

Proceeds (5) $260.8

Source: GHQ Schedule 14A filed 6/8/09,

adjusted for warrant restructuring and

other items below.

(1) Stated prior to payment of $25.5

million tax step-up payment, due

90-days post-closing.

(2) Assumes conversion of Greenhill

convertible note into equity.

(3) Assumes 30% of GHQ's existing

public stockholders elect conversion

for $10.00 in cash per share. Motorola

Payable is treated as debt for purposes

of this calculation.

(4)Based on treasury method for

warrants outstanding and $10.00 share

price.

(5)Based on cash exercise of 13.7

million warrants at $7.00 each and 14.4

million warrants at $11.50 each.

[GRAPHIC OMITTED]

slide07

|  |

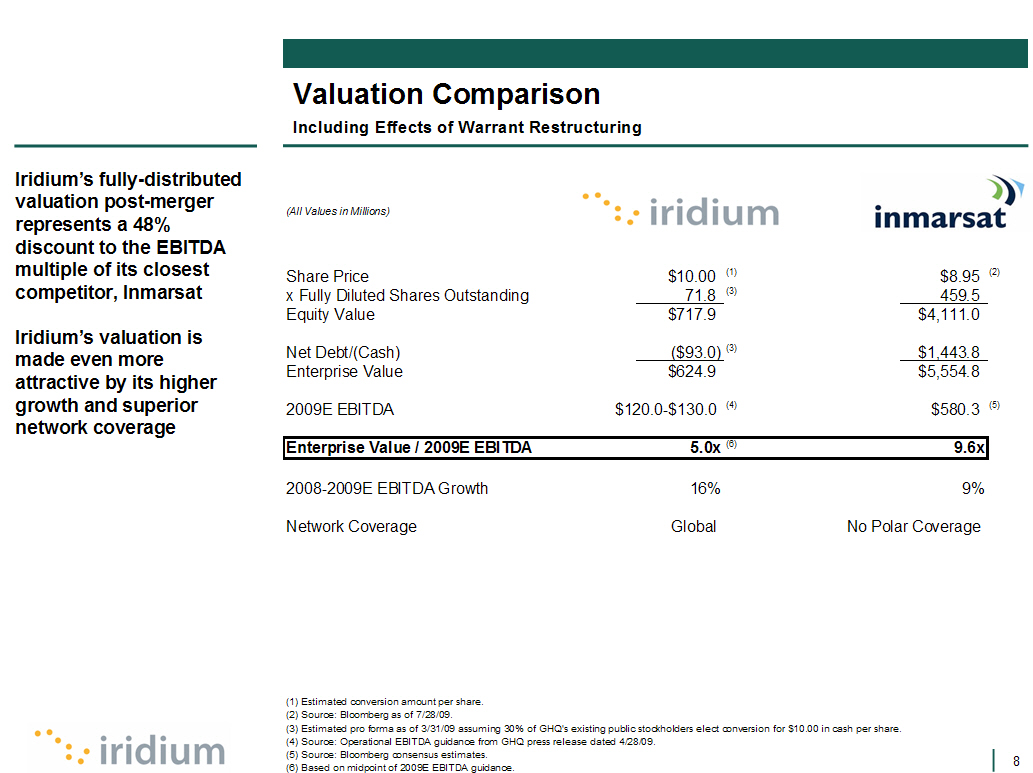

Valuation Comparison

Including Effects of Warrant

Restructuring

- -------------------------------------- ---------------------------------------

Iridium's fully-distributed valuation

post-merger represents a 48% discount

to the EBITDA multiple of its closest

competitor, Inmarsat

Iridium's valuation is made even more

attractive by its higher growth and

superior network coverage

(All Values in Millions)

Share Price $10.00 (1) $8.95(2)

x Fully Diluted Shares Outstanding 71.8 (3) 459.5

------------- ----------

Equity Value $717.9 $4,111.0

Net Debt/(Cash) ($93.0) (3) $1,443.8

------------- ----------

Enterprise Value $624.9 $5,554.8

2009E EBITDA $120.0-$130.0 (4) $580.3(5)

- ----------------------------------------------------------------------------

Enterprise Value / 2009E EBITDA 5.0x (6) 9.6x

- ----------------------------------------------------------------------------

- ----------------------------------------------------------------------------

2008-2009E EBITDA Growth 16% 9%

Network Coverage Global No Polar Coverage

(1) Estimated conversion amount per share.

(2) Source: Bloomberg as of 7/28/09.

(3) Estimated pro forma as of 3/31/09 assuming 30% of GHQ's existing public

stockholders elect conversion for $10.00 in cash per share.

(4) Source: Operational EBITDA guidance from GHQ press release dated 4/28/09.

(5) Source: Bloomberg consensus estimates.

(6) Based on midpoint of 2009E EBITDA guidance.

8

[GRAPHIC OMITTED]

slide08

|  |

Anticipated Timetable to Closing

- -------------------------------------- ---------------------------------------

[] Expecting Iridium to Announce Q2 Results During Week of August 10th

[] Anticipating September GHQ Stockholder Vote on Acquisition of Iridium

[] No Further Amendments to Economics or Other Terms Planned

[] Completion Subject to FCC Approval and GHQ Stockholder Approval [GRAPHIC

[GRAPHIC OMITTED]

slide09

|  |