Exhibit 99.1

Iridum® everywhere

2015 Analyst Day

Iridium Communications Inc. March 12, 2015

RELIABLE CRITICAL LIFELINES

Welcome & Agenda

Steve E. Kunszabo, Exec. Director Investor Relations March 12, 2015

IRIDIUM EVERYWHERE

RELIABLE CRITICAL LIFELINES

Forward-Looking Statements

Safe Harbor Statement

This presentation contains statements about future events and expectations known as “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Company has based these statements on its current expectations and the information currently available to it.

Forward-looking statements in this presentation include statements regarding the health of the existing constellation; expected growth in revenue, subscribers, Operational EBITDA, Operational EBITDA margin, free cash flow and market size and dynamics; expected cash taxes; future capital expenditure requirements; the funds for, development of and transition to the Iridium NEXT constellation; timing of drawdown of the COFACE credit facility; features of the Iridium NEXT system and future products; expected Iridium NEXT project costs and deployment schedule; prospects for the U.S. Government, legacy telephony, maritime (including GMDSS), aviation and M2M businesses including new products and services; the market for, capabilities and timing of availability of Iridium CertusSM broadband; peak net leverage and future deleveraging; the deployment, capabilities and benefits of, and the market for, the AireonSM system; Aireon’s, the Harris and hosted payload’s financial impact on Iridium and the capabilities and cost of, and market for, the Iridium PRIMESM program. Other forward-looking statements can be identified by the words “anticipates,” “may,” “can,” “believes,” “expects,” “projects,” “intends,” “likely,” “will,” “to be” and other expressions that are predictions of or indicate future events, trends or prospects. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of Iridium to differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to, uncertainties regarding expected Operational EBITDA and Operational EBITDA margins, growth in subscribers and revenue, overall Iridium NEXT development and costs, the company’s ability to continue to borrow under the Iridium NEXT financing, potential delays in the Iridium NEXT deployment, levels of demand for mobile satellite services (MSS), the development of and market for the Aireon and Harris hosted payloads, the development and demand for new products and services, including Iridium Certus broadband and Iridium PRIME, and the company’s ability to maintain the health, capacity and content of its satellite constellation, as well as general industry and economic conditions, and competitive, legal, governmental and technological factors. Other factors that could cause actual results to differ materially from those indicated by the forward-looking statements include those factors listed under the caption “Risk Factors” in the Company’s Form 10-K for the year ended December 31, 2014, filed with the Securities and Exchange Commission (“the SEC”) on February 26, 2015, as well as other filings Iridium makes with the SEC from time to time. There is no assurance that Iridium’s expectations will be realized. If one or more of these risks or uncertainties materialize, or if Iridium’s underlying assumptions prove incorrect, actual results may vary materially from those expected, estimated or projected.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof unless otherwise indicated. The Company undertakes no obligation to release publicly any revisions to any forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise.

IRIDIUM EVERYWHERE

Non-GAAP Financial Measures

Reporting Entity

For comparison purposes, the Company has presented the operating results of Iridium Holdings LLC and Iridium Communications Inc. on a combined basis for the year ended December 31, 2009 along with the Iridium Holdings LLC operating results for prior years. The combined 2009 presentation is a simple mathematical addition of the pre-acquisition results of operations of Iridium Holdings LLC for the period from January 1, 2009 to September 29, 2009 and the post-acquisition results of operations of Iridium Communications Inc. for the three months ended December 31, 2009. Please note that this presentation is different from the “combined” presentation that the Company includes in the ‘Management’s Discussion and Analysis’ section of the Company’s Form 10-K filed on March 4, 2014, which combined the pre-acquisition results of operations of Iridium Holdings LLC for the period from January 1, 2009 to September 29, 2009 with the full-year 2009 results of operations of Iridium Communications Inc., both pre- and post-acquisition. Iridium Communications Inc. had no material operating activities from the date of formation of GHL Acquisition Corp. until the acquisition. There are no other adjustments made in the combined presentation. This presentation is intended to facilitate the evaluation and understanding of the financial performance of the Iridium business on a year-to-year basis. Management believes this presentation is useful in providing the users of the Company’s financial information with an understanding of the Company’s results of operations because there were no material changes to the operations or customer relationships of Iridium as a result of the acquisition of Iridium Holdings LLC by GHL Acquisition Corp.

Non-GAAP Financial Measures

In addition to disclosing financial results that are determined in accordance with U.S. GAAP, the Company discloses Operational EBITDA, which is a non-GAAP financial measure, as a supplemental measure to help investors evaluate its fundamental operational performance. Operational EBITDA, or OEBITDA, represents earnings before interest, income taxes, depreciation and amortization, Iridium NEXT revenue and expenses (for periods prior to the deployment of Iridium NEXT only), loss from investment in Aireon (which was previously included with Iridium NEXT revenue and expenses), stock-based compensation expenses, transaction expenses associated with the acquisition, the impact of purchase accounting adjustments, and changes in the fair value of warrants. The Company also presents Operational EBITDA expressed as a percentage of GAAP revenue, or Operational EBITDA margin. Operational EBITDA, along with its related measure, Operational EBIDTA margin, does not represent, and should not be considered, an alternative to GAAP measures such as net income, and the Company’s calculations thereof may not be comparable to similarly entitled measures reported by other companies. A reconciliation of

Operational EBITDA to net income, its comparable GAAP financial measure, is in the attached appendix. By eliminating interest, income taxes, depreciation and amortization, Iridium NEXT revenue and expenses (for periods prior to the deployment of Iridium NEXT only), loss from investment in Aireon (which was previously included with Iridium NEXT revenue and expenses), stock-based compensation expenses, transaction expenses associated with the acquisition, the impact of purchase accounting adjustments and changes in the fair value of warrants, the Company believes the result is a useful measure across time in evaluating its fundamental core operating performance. Management also uses Operational EBITDA to manage the business, including in preparing its annual operating budget, debt covenant compliance, financial projections and compensation plans. The Company believes that Operational EBITDA is also useful to investors because similar measures are frequently used by securities analysts, investors and other interested parties in their evaluation of companies in similar industries. As indicated, Operational EBITDA does not include interest expense on borrowed money or the payment of income taxes or depreciation expense on the Company’s capital assets, which are necessary elements of the Company’s operations. It also excludes expenses in connection with the development, deployment and financing of Iridium NEXT and loss from investment in Aireon. Since Operational EBITDA does not account for these and other expenses, its utility as a measure of the Company’s operating performance has material limitations. Due to these limitations, management does not view Operational EBITDA in isolation and also uses other measurements, such as net income, revenue and operating profit, to measure operating performance.

IRIDIUM EVERYWHERE

Agenda

Welcome & Agenda Steve Kunszabo Exec. Director, Investor Relations

Corporate Strategy Matt Desch Chief Executive Officer

Commercial Business Bryan Hartin EVP, Sales & Marketing Government Business Scott Scheimreif EVP, Government Programs Iridium NEXT & Operations Scott Smith Chief Operating Officer

Aireon Alan Khalili CFO, Aireon LLC Vincent Capezzuto CTO, Aireon LLC

Financial Overview Tom Fitzpatrick Chief Financial Officer

Corporate Strategy Overview

Matthew J. Desch, Chief Executive Officer March 12, 2015

Iridium Everwhere

Reliable ciritical lifelines

Iridium Communications—A Bright Future

Iriduium everywhere

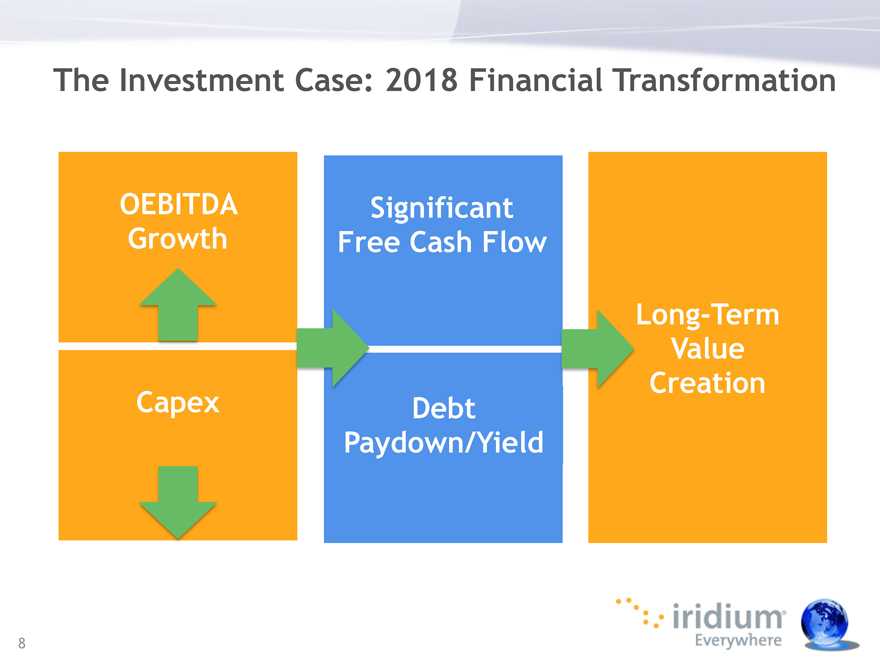

The Investment Case: 2018 Financial Transformation

OEBITDA Significant

Growth Free Cash Flow Long-Term Value Creation Capex Debt Paydown/Yield

8

Iriduium everywhere

Iridium Communications Overview

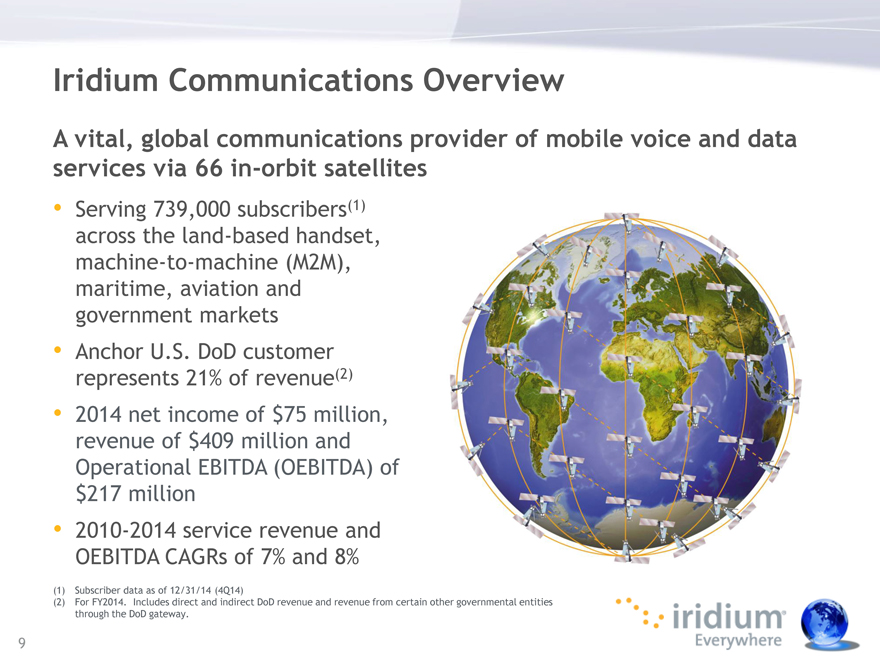

A vital, global communications provider of mobile voice and data services via 66 in-orbit satellites

Serving 739,000 subscribers(1) across the land-based handset, machine-to-machine (M2M), maritime, aviation and government markets

Anchor U.S. DoD customer represents 21% of revenue(2)

2014 net income of $75 million, revenue of $409 million and Operational EBITDA (OEBITDA) of $217 million

2010-2014 service revenue and OEBITDA CAGRs of 7% and 8%

(1) Subscriber data as of 12/31/14 (4Q14)

(2) For FY2014. Includes direct and indirect DoD revenue and revenue from certain other governmental entities through the DoD gateway.

9

Iriduium everywhere

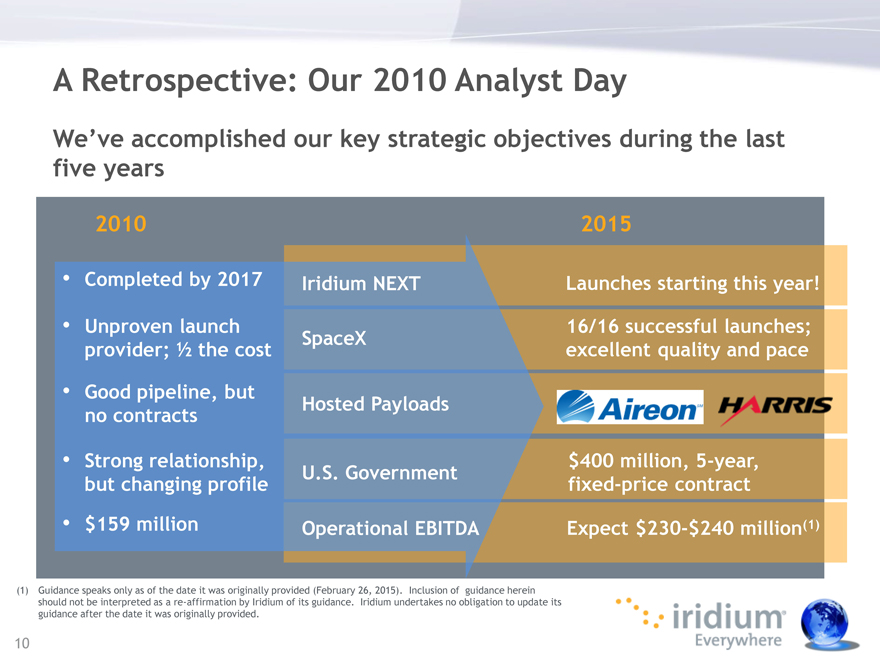

A Retrospective: Our 2010 Analyst Day

We’ve accomplished our key strategic objectives during the last five years

2010 2015

Completed by 2017 Iridium NEXT Launches starting this year!

Unproven launch 16/16 successful launches; SpaceX provider; 1/2 the cost excellent quality and pace

Good pipeline, but

Hosted Payloads no contracts

Strong relationship, $400 million, 5-year, U.S. Government but changing profile fixed-price contract

$159 million Operational EBITDA Expect $230-$240 million(1)

(1) Guidance speaks only as of the date it was originally provided (February 26, 2015). Inclusion of guidance herein should not be interpreted as a re-affirmation by Iridium of its guidance. Iridium undertakes no obligation to update its guidance after the date it was originally provided.

10

Aireon harris iridium everywhere

Iridium NEXT Is Almost Here!

Next-generation constellation will support our success for many years

Retains unique LEO architecture with 66 new operational satellites, 6 in-orbit spares and 9 ground spares

Scheduled to be fully deployed in 2017 using SpaceX Falcon 9 rockets – first planned launch in October 2015

Satellites under construction at Orbital Sciences factory in Arizona

Major hardware has been qualified and platform software is being tested

Ground infrastructure complete!

11

Iridium everywhere

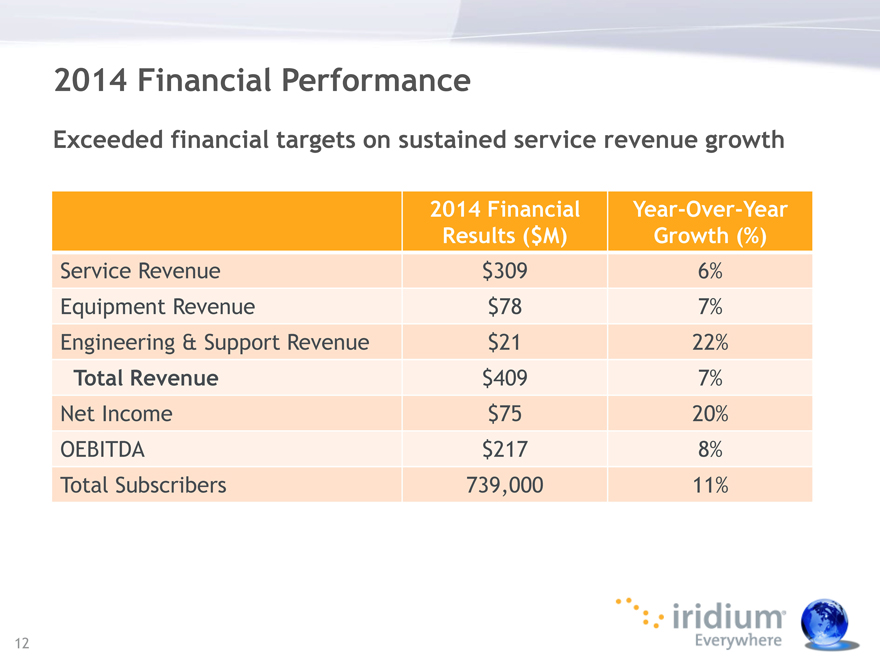

2014 Financial Performance

Exceeded financial targets on sustained service revenue growth

2014 Financial Year-Over-Year Results ($M) Growth (%)

Service Revenue $309 6% Equipment Revenue $78 7% Engineering & Support Revenue $21 22% Total Revenue $409 7%

Net Income $75 20% OEBITDA $217 8% Total Subscribers 739,000 11%

12

Iridium everywhere

Five growth pillars as we look ahead to 2018

u.s. government aireon & harris New products m2m maritime & aviation (broadband)

strong foundation iridium everywhere

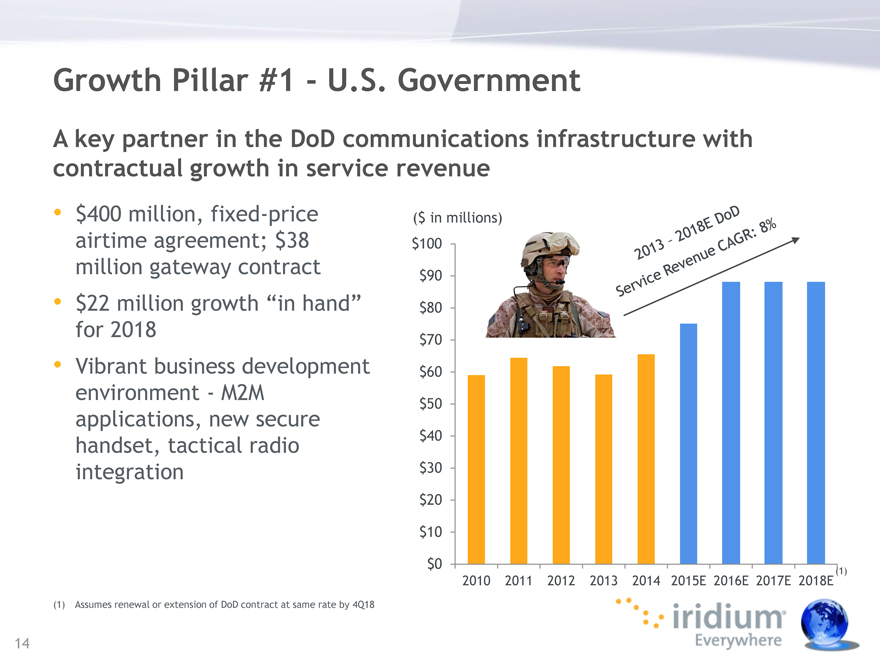

Growth Pillar #1—U.S. Government

A key partner in the DoD communications infrastructure with contractual growth in service revenue

$400 million, fixed-price ($ in millions) airtime agreement; $38 $100 million gateway contract $90

$22 million growth “in hand” $80 for 2018

$70

Vibrant business development $60 environment—M2M

$50

applications, new secure $40 handset, tactical radio integration $30

$20 $10

$0

(1)

2010 2011 2012 2013 2014 2015E 2016E 2017E 2018E

(1) Assumes renewal or extension of DoD contract at same rate by 4Q18

14

Iridium everywhere

Growth Pillar #2—Aireon

Aireon is ideally positioned to be the provider of space-based, real-time aircraft surveillance and control for $1 billion annual market opportunity in 2018

The only viable solution over oceans and remote areas

High operating leverage financial model

Ownership of proprietary data provides potential

upside Addressing tens of millions of currently unmonitored flight hours yields $1 billion annual market opportunity

Fuel savings ($6B-$8B in initial target areas over 12 years)

More efficient flight routing and management

Reduced emissions and environmental impact

15

Iridium everywhere

Growth Pillar #3 – New Products

Connects smartphones and tablets One handset offers traditional anywhere in the world voice and PTT capabilities

A low-cost personal communications Target customers include public device and service offering safety, military, utilities, resources

Over 7,000 units shipped since and mining launch; potential upside to commercial voice ARPU

Iridium go!®—2014 personal communications push-to-talk – 2015 changing the way we connect

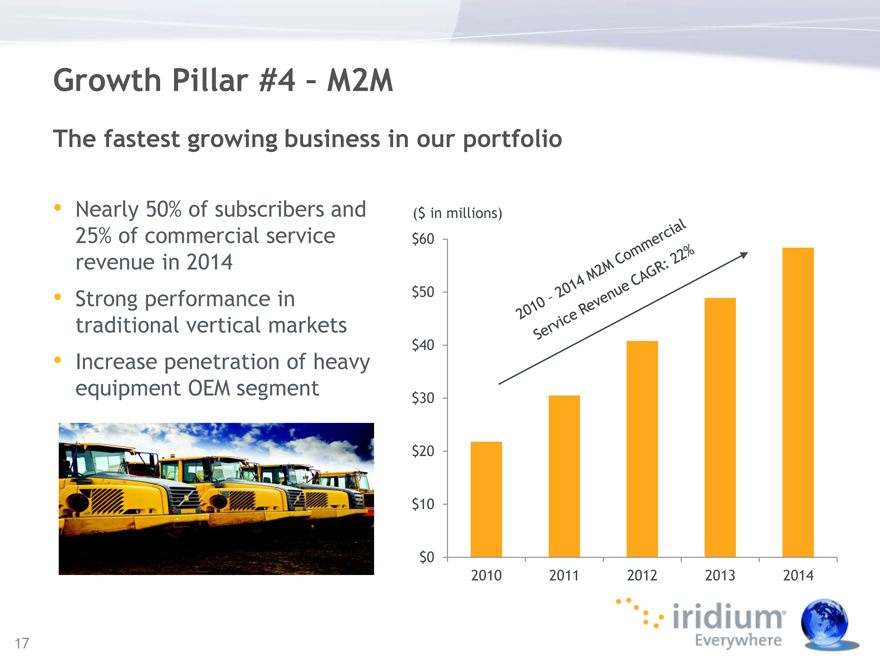

Growth pillar #4 – m2m the faster growing business in our portfolio nearly 50% of subscribers and 25% of commercial service revenue in 2014 strong performance in traditional vertical markets increase penetration of heavy equipment oem segment

($ in millions) $60 $50 $40 $30 $20 $10 $0 2010 2011 2012 2013 2014 2010 – 2014 m2m commercial service revenue cagr; 22%

Iridium everywhere

Growth Pillar # 5 – Iridium CertusSM Broadband

A new engine of growth

New, faster user terminals to take advantage of Iridium NEXT’s enhanced capabilities

Design, development and production in collaboration with world-class manufacturers using our core technology

New products begin rolling out in 2016/2017

Cobham rockwell Collins communications icg thales iridium everywhere

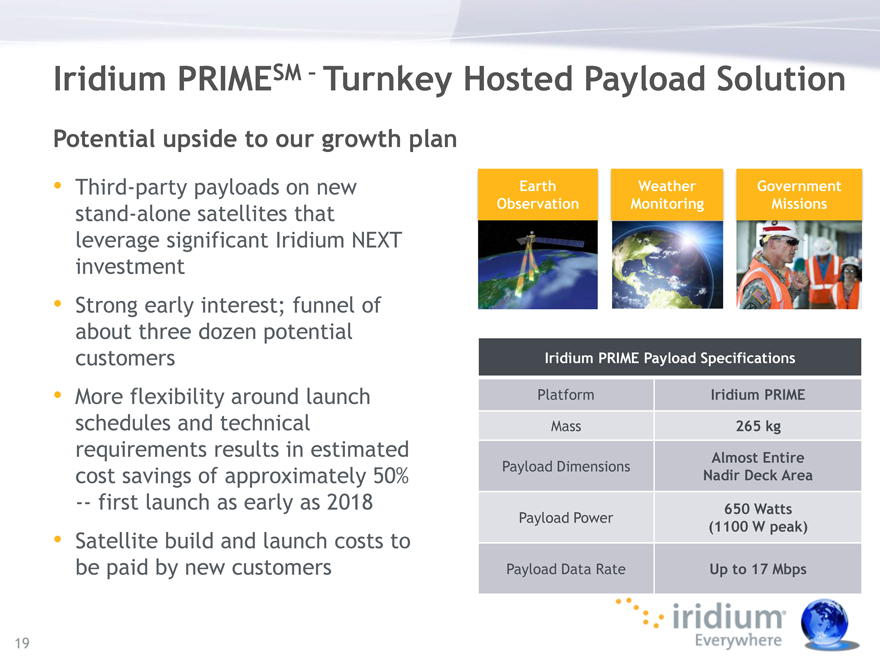

Iridium PRIMESM – Turnkey Hosted Payload Solution

Potential upside to our growth plan

Third-party payloads on new Earth Weather Government

stand-alone satellites that Observation Monitoring Missions

leverage significant Iridium NEXT investment

Strong early interest; funnel of about three dozen potential

customers Iridium PRIME Payload Specifications

More flexibility around launch Platform Iridium PRIME schedules and technical Mass 265 kg requirements results in estimated Almost Entire

Payload Dimensions

cost savings of approximately 50% Nadir Deck Area — first launch as early as 2018 Payload Power 650 Watts

(1100 W peak)

Satellite build and launch costs to be paid by new customers Payload Data Rate Up to 17 Mbps

Iridium everywhere

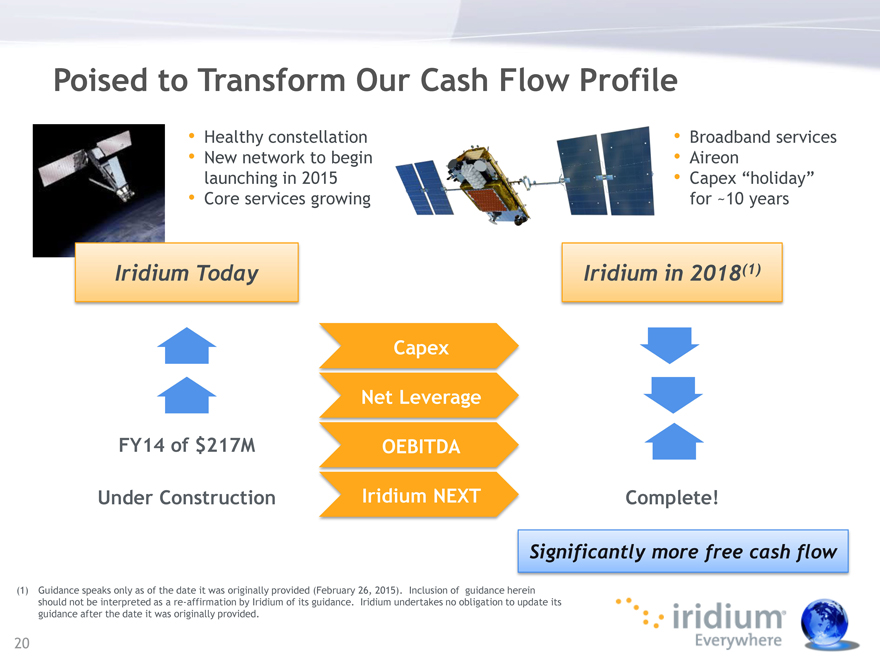

Poised to Transform Our Cash Flow Profile

Healthy constellation Broadband services

New network to begin Aireon launching in 2015 Capex “holiday”

Core services growing for ~10 years

Iridium Today Iridium in 2018(1)

Capex Net Leverage FY14 of $217M OEBITDA

Under Construction Iridium NEXT Complete!

Significantly more free cash flow

(1) Guidance speaks only as of the date it was originally provided (February 26, 2015). Inclusion of guidance herein should not be interpreted as a re-affirmation by Iridium of its guidance. Iridium undertakes no obligation to update its guidance after the date it was originally provided.

20

Iridium everywhere

Who we are still works!

Attractive and growing MSS market Favorable competitive dynamics – high barriers to entry Network leadership and advantages Established track record of growth Significant operating leverage Poised to transform cash flow profile

21 iridium everywhere

Commercial Business Overview

Bryan J. Hartin, EVP Sales & Marketing March 12, 2015

Iridium everywhere reliable critical lifelines

Why Iridium?

66 LEO cross-linked satellites provide global coverage

Wholesale distribution channel with worldwide reach

Robust product portfolio across key markets

Innovative partner ecosystem develops and distributes unique, value-added solutions across our lines of business

New growth pillar with Iridium CertusSM broadband

23 iridium everywhere

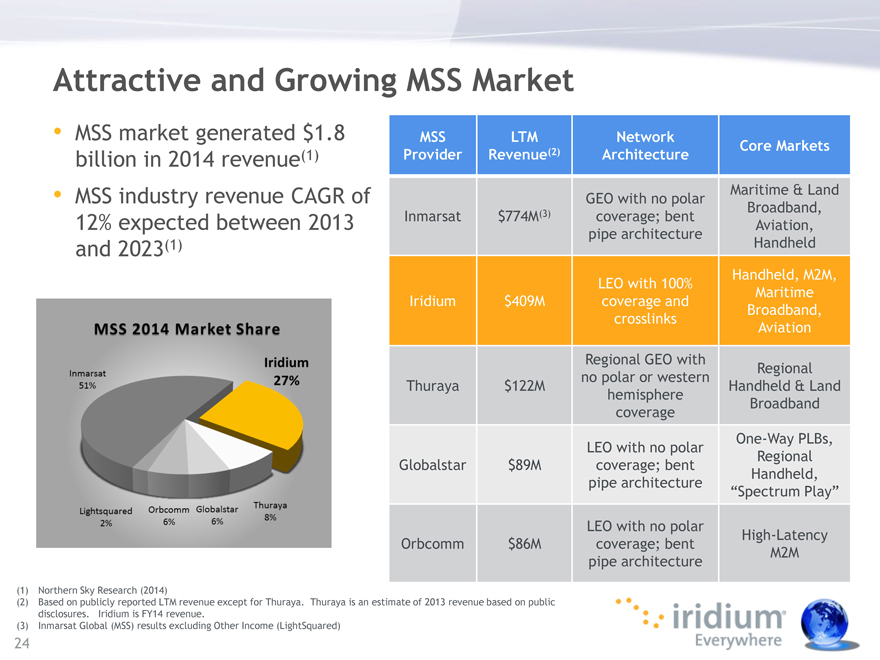

Attractive and Growing MSS Market

MSS market generated $1.8 MSS LTM Network

(2) Core Markets billion in 2014 revenue(1) Provider Revenue Architecture

MSS industry revenue CAGR of Maritime & Land

GEO with no polar

(3) Broadband, 12% expected between 2013 Inmarsat $774M coverage; bent Aviation, pipe architecture and 2023(1) Handheld Handheld, M2M, LEO with 100% Maritime Iridium $409M coverage and Broadband, crosslinks Aviation

Regional GEO with

Regional no polar or western Thuraya $122M Handheld & Land hemisphere Broadband coverage One-Way PLBs, LEO with no polar Regional Globalstar $89M coverage; bent Handheld, pipe architecture

“Spectrum Play”

LEO with no polar

High-Latency Orbcomm $86M coverage; bent M2M pipe architecture

(1) Northern Sky Research (2014)

(2) Based on publicly reported LTM revenue except for Thuraya. Thuraya is an estimate of 2013 revenue based on public disclosures. Iridium is FY14 revenue.

(3) Inmarsat Global (MSS) results excluding Other Income (LightSquared)

24

Iridium everywhere Mss 2014 market share inmarsat 51% iridium 27% lightsquared orbcomm globalstar thraya

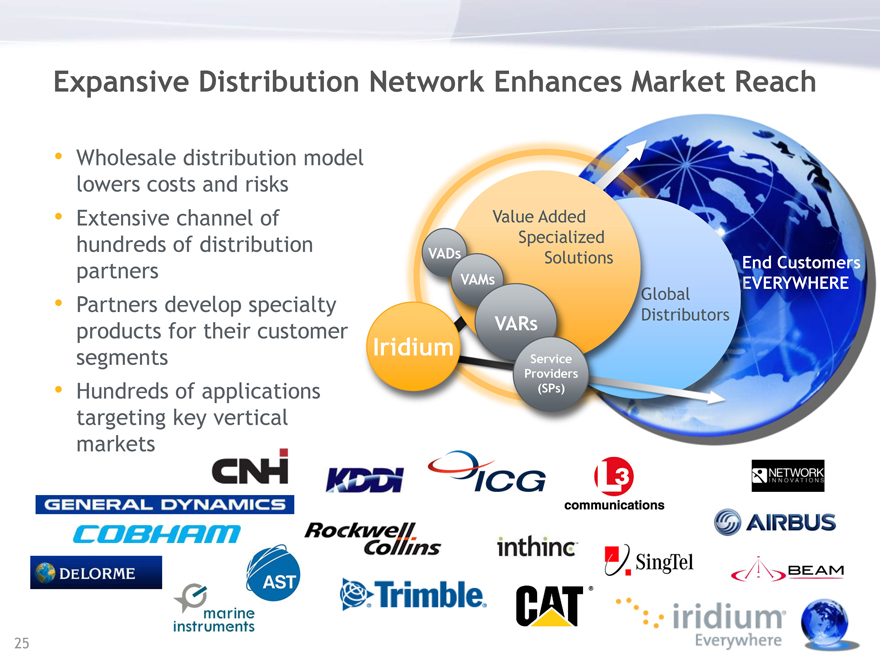

Expansive Distribution Network Enhances Market Reach

Wholesale distribution model lowers costs and risks

Extensive channel of Value Added hundreds of distribution Specialized

VADs Solutions partners nd Customers VAMs VERYWHERE

Partners develop specialty obal

VARs ibutors

products for their customer

Iridium

segments Service

Providers

Hundreds of applications (SPs) targeting key vertical markets

25

Spanning Segments and Communications Needs

Iridium Produc Service Lines

Circuit-Switched Handsets Voice & Data

Voice and Data

Push-To-Talk Transceivers

SBD Modules M2M Chipsets Iridium Burst® Iridium Pilot® Broadband

26

Product Portfolio Summary

Satellite L-Band Transceiver Short-Burst Iridium OpenPort® Phone Voice/Data Modem Data Transceiver Broadband Service

® Iridium Pilot, 9555, Iridium Extreme , Products ® 9522B, 9523 9602, 9603 Live TV, Iridium Pilot Land Iridium GO!

Station

Annual

40,000 – 60,000 20,000 – 40,000 100,000 – 140,000 1,500 – 1,800

Unit Sales

Stable, highly M2M is new growth Fastest growing Value player with renewed Market defensible engine (e.g. Caterpillar) Iridium service growth Dynamics Iridium #1 Foundation for broadband

27

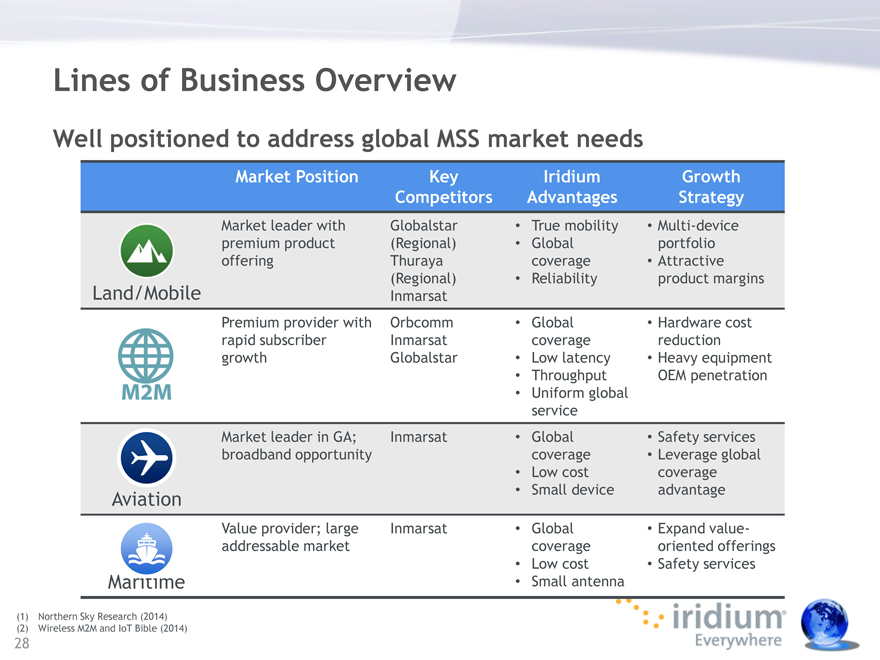

Lines of Business Overview

Well positioned to address global MSS market needs

Market Position Key Iridium Growth

Competitors Advantages Strategy

Market leader with Globalstar • True mobility • Multi-device premium product (Regional) • Global portfolio offering Thuraya coverage • Attractive (Regional) • Reliability product margins

Land/Mobile Inmarsat

Premium provider with Orbcomm • Global • Hardware cost rapid subscriber Inmarsat coverage reduction growth Globalstar • Low latency • Heavy equipment

Throughput OEM penetration

Uniform global service

Market leader in GA; Inmarsat • Global • Safety services broadband opportunity coverage • Leverage global

Low cost coverage Aviation Small device advantage Value provider; large Inmarsat Global Expand value-addressable market coverage oriented offerings

Low cost Safety services Maritime Small antenna

(1) Northern Sky Research (2014) (2) Wireless M2M and IoT Bible (2014)

28

Land/Mobile Profile

Strategic Positioning

Premium product and service

Unmatched performance advantage

Voice evolving to data services – data services >50% of total service revenue

Revenue and margin driver

Significant portion of installed customer base

Growth Strategy Development Opportunities

Multi-device portfolio Iridium GO!® – strong early shipments and high ARPU

Profitable hardware structure

Commercial Push-To-Talk Location-aware and emergency services

$1.9 billion Land/Mobile market opportunity

Enable smartphones and tablets in 2020 (Source: Northern Sky Research)

29

Land-Mobile New Products

Global satellite connectivity for smartphones and tablets

Enables custom applications

Over 7,000 units shipped since launch

Potential ARPU upside compared to traditional handsets

One handset offers traditional voice and PTT capabilities

Numerous SPs have signed resale agreements

Key customer use cases include military, enterprise and public service/first responders

30

M2M Profile

Strategic Positioning

Significant network advantage (coverage, uniform service, latency and throughput)

Cost competitive hardware

Strong and diverse reseller base

The Internet Of Things; fastest growing market

Growth Strategy Development Opportunities

Grow existing partner base Expanding addressable market with key heavy equipment OEM wins (Caterpillar, CNH)

Reduce hardware cost

Oil/Gas, Utilities, Automotive, Enterprise

Increase heavy equipment OEM

Trucking penetration

Enterprise applications

31

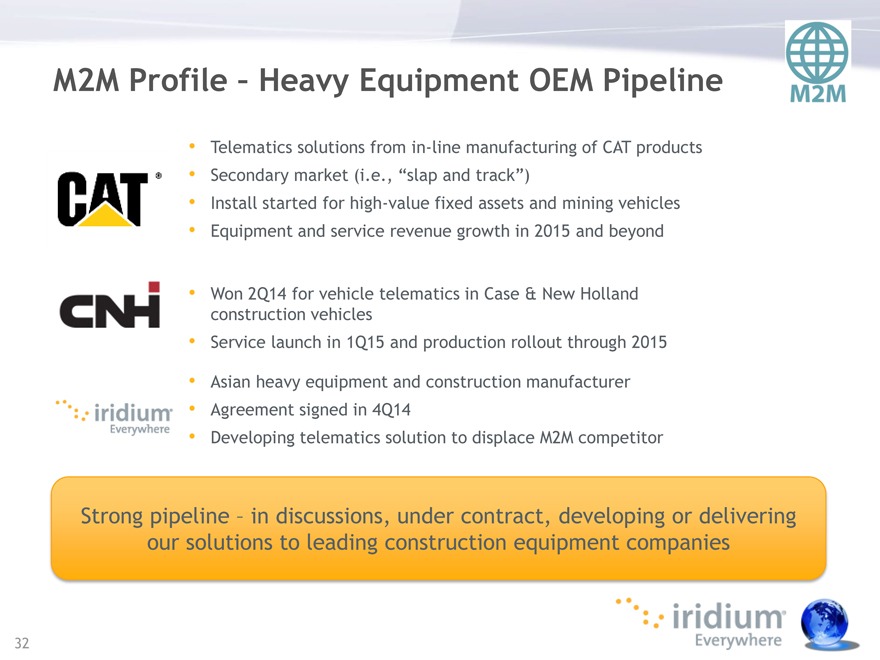

M2M Profile – Heavy Equipment OEM Pipeline

Telematics solutions from in-line manufacturing of CAT products

Secondary market (i.e., “slap and track”)

Install started for high-value fixed assets and mining vehicles

Equipment and service revenue growth in 2015 and beyond

Won 2Q14 for vehicle telematics in Case & New Holland construction vehicles

Service launch in 1Q15 and production rollout through 2015

Asian heavy equipment and construction manufacturer

Agreement signed in 4Q14

Developing telematics solution to displace M2M competitor

Strong pipeline – in discussions, under contract, developing or delivering our solutions to leading construction equipment companies

32

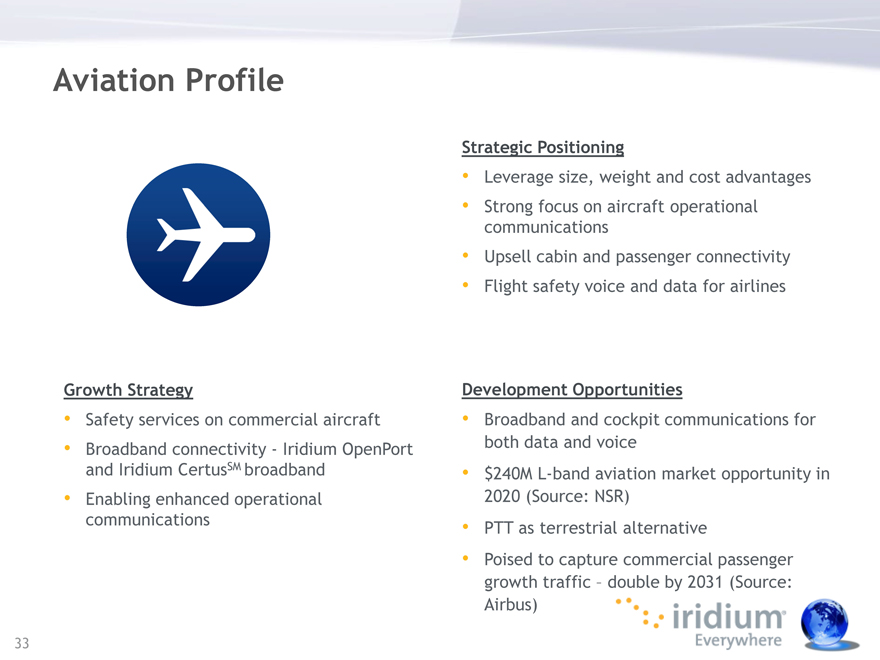

Aviation Profile

Strategic Positioning

Leverage size, weight and cost advantages

Strong focus on aircraft operational communications

Upsell cabin and passenger connectivity

Flight safety voice and data for airlines

Growth Strategy Development Opportunities

Safety services on commercial aircraft Broadband and cockpit communications for

Broadband connectivity—Iridium OpenPort both data and voice and Iridium CertusSM broadband $240M L-band aviation market opportunity in

Enabling enhanced operational 2020 (Source: NSR) communications

PTT as terrestrial alternative

Poised to capture commercial passenger growth traffic – double by 2031 (Source: Airbus)

33

Aviation Profile – New Opportunities

Changing Landscape

Competitor service retirement – loss of trust with partners and customers

Growth of OEM programs is supplanting key competitors

Iridium starting to be viewed as the de facto “cockpit” communications solution

New Opportunities

Broadband market opportunity – Iridium CertusSM

Rotorcraft – seeking solutions beyond aircraft tracking

UAV – increasing market presence across government and consumer segments

34

Maritime Profile

Strategic Positioning

Value provider in price-sensitive market

L-band competes in mid-low data speeds

Reliable, complementary VSAT backup

Oceanic and polar coverage

Strong subscriber and service revenue growth, high ARPU

Growth Strategy Development Opportunities

#1 solution in 128kbps and below GMDSS

Fleet penetration Broadband services

Crew calling $1.3 billion maritime market opportunity in 2020 (Source: Northern Sky Research)

35

Maritime Profile – New Opportunities

GMDSS – Maritime Safety Services

Addressable market of 60,000 vessels

Coordinating approval process with U.S. Coast Guard

Application being reviewed in 2015; recommendation for approval expected in

2016

GMDSS enhances relevance for operational communications

Iridium CertusSM Broadband

A new hardware and service paradigm

2016/2017 availability

36

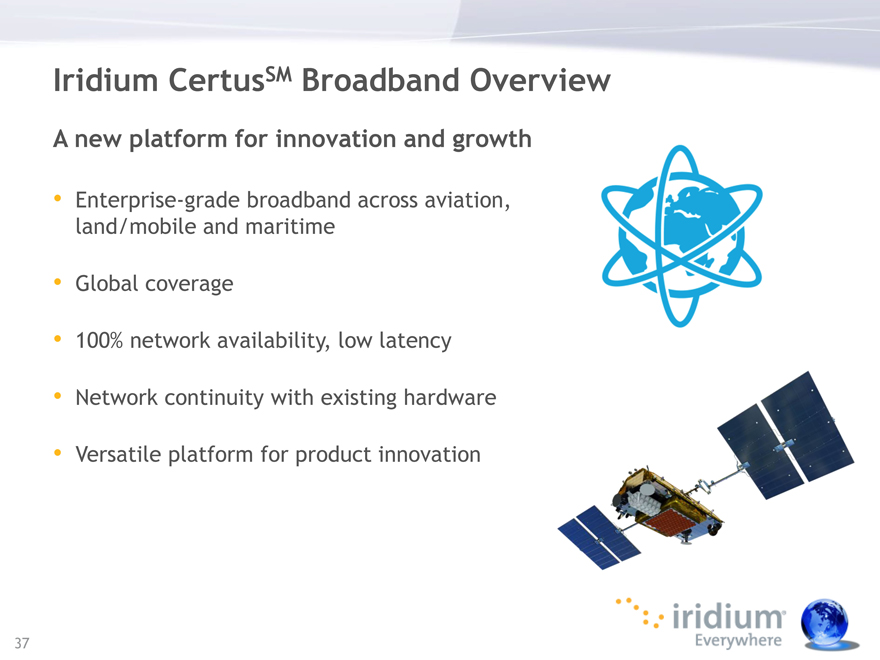

Iridium CertusSM Broadband Overview

A new platform for innovation and growth

Enterprise-grade broadband across aviation, land/mobile and maritime

Global coverage

100% network availability, low latency

Network continuity with existing hardware

Versatile platform for product innovation

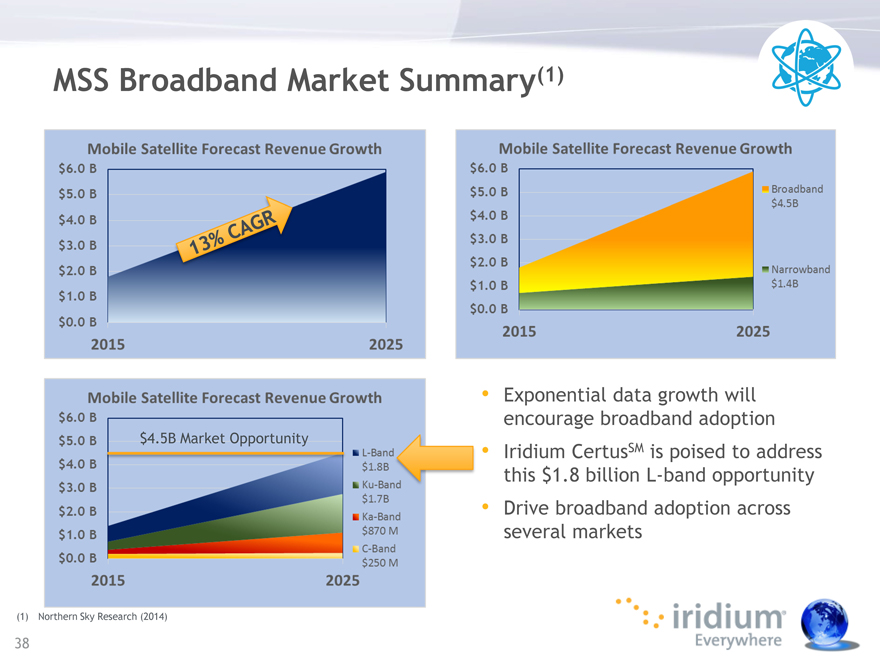

MSS Broadband Market Summary(1)

Exponential data growth will encourage broadband adoption

$4.5B Market Opportunity

Iridium CertusSM is poised to address this $1.8 billion L-band opportunity

Drive broadband adoption across several markets

(1) Northern Sky Research (2014)

38

Capturing The Broadband Opportunity Across Market Segments

Aviation Broadband – Delivering vital communications to the cockpit and cabin

Maritime Broadband – Enabling global communications for ship’s business and crew

Global Safety Services – Ensuring communications anytime, everywhere

39

What Our Partners Are Saying…

“Innovative communications solutions…to a diverse customer base in Aero and Maritime markets…”

“…will enhance flight deck connectivity to meet the growing needs of our customers…”

“The increased data speeds, lower weight and power savings provide a strong growth potential.”

“…a game-changer for the industry, offering unparalleled global broadband coverage…”

“…a game-changer; it will make in-flight broadband connectivity truly global with scalable solutions that will make virtually any application effective anywhere on the planet…”

40

Iridium CertusSM Strategy

What we seek to accomplish

Deliver a global platform for enterprise-grade, versatile product solutions

Innovation by external partners

Penetrate new markets

Growth engine for 2018 and beyond

What we will deliver

Provide core technology

Common tools and technology

Our world-class partners will

Design, develop, and distribute the next-generation of Iridium-enabled products

Make a significant financial and operational investment

41

Delivering Innovative Solutions & Growth

…through the strengths of our existing business…

Wholesale distribution Robust product Strong positioning in key network portfolio satellite markets

…and a new technology platform

Iridium CertusSM

42

Commercial Business Q&A Panel

Matt Desch Chief Executive Officer Bryan Hartin EVP, Sales & Marketing

Morning Break and Product Marketing Display

Government Business Overview

Scott T. Scheimreif, EVP Government Programs March 12, 2015

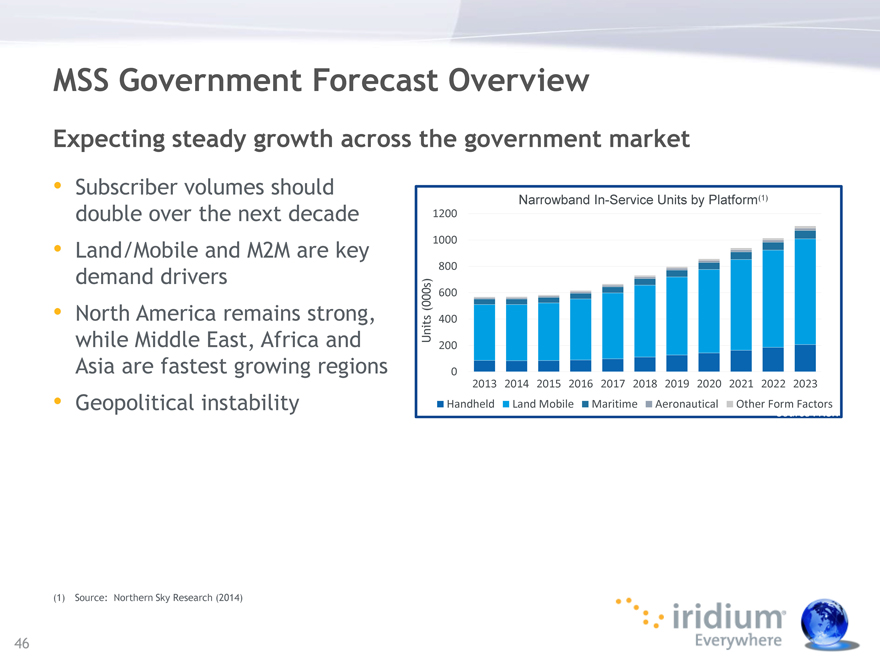

MSS Government Forecast Overview

Expecting steady growth across the government market

Subscriber volumes should

Narrowband In-Service Units by Platform(1)

double over the next decade 1200

Land/Mobile and M2M are key 1000

800

demand drivers

(000s) 600

North America remains strong,

Units 400

while Middle East, Africa and 200 Asia are fastest growing regions 0

2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

Geopolitical instability Handheld Land Mobile Maritime Aeronautical Other Form Source Factors : NSR

(1) Source: Northern Sky Research (2014)

46

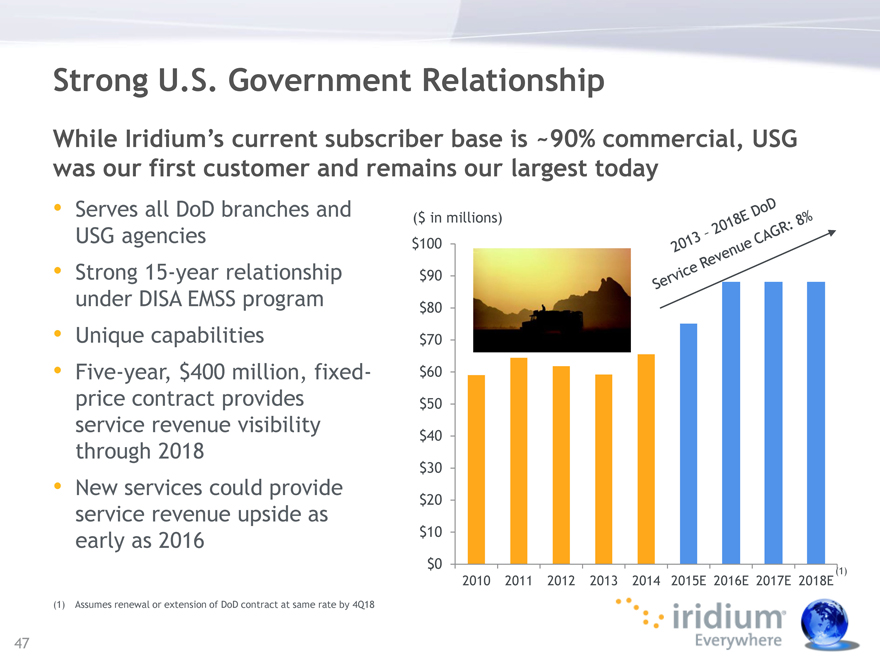

Strong U.S. Government Relationship

While Iridium’s current subscriber base is ~90% commercial, USG was our first customer and remains our largest today

Serves all DoD branches and ($ in millions) USG agencies $100

Strong 15-year relationship $90 under DISA EMSS program $80

Unique capabilities $70

Five-year, $400 million, fixed- $60 price contract provides $50 service revenue visibility

$40 $30 $20 $10

$0

(1)

2010 2011 2012 2013 2014 2015E 2016E 2017E 2018E

by 4Q18

New USG policy and guidance on Iridium® is clear – Use It!

Existing $400 million service revenue contract is solid through 2018 “Dod users are encouraged to take advantage of this cost-saving opportunity and maximize use” Terry halvorsen, Dod cio (acting) – January 2015 “Maximum utilization of unlimited services under the new contract is encouraged” disa advisory message – October 2013 “there are no additional costs for increasing subscriptions and/or usage starting fy204, individual navy commands will no longer pay for iridium airtime” naval message – june 2014 “all customers have access to unlimted airtime on an unlimited number of devies, and are encouraged to utilize this capability” – disa dwcf fy15 rates existing $400 million service revenue contract is solid through 2018

Delivering a Win/Win Across the Market

Leveraging our airtime services contract – industry and USG are reaping the benefits

VALIDATED FUNDED PRODUCTION/

USER NEED DEVELOPMENT OPERATIONS SUSTAINMENT REQUIREMENT PROGRAM DEPLOYMENT

Partner Funded IR&D

USG – Funded Development, Competition, Acquisition

Iridium Investment

New contract fosters innovation across industry and government

Incentivizes industry to invest in Iridium-based capabilities as government has committed to use Iridium network

Minimizes need for limited USG R&D funding

Lowers risk and schedule for government programs targeting Iridium technology

Promotes a joint investment model to rapidly field solutions

49

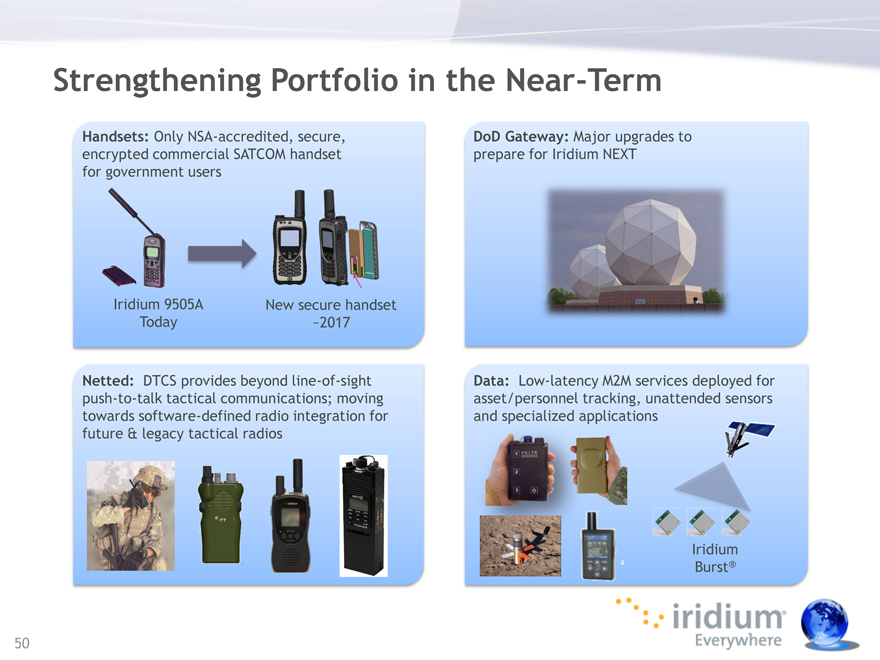

Strengthening Portfolio in the Near-Term

Handsets: Only NSA-accredited, secure, DoD Gateway: Major upgrades to encrypted commercial SATCOM handset prepare for Iridium NEXT for government users

Iridium 9505A New secure handset Today ~2017

Netted: DTCS provides beyond line-of-sight Data: Low-latency M2M services deployed for push-to-talk tactical communications; moving asset/personnel tracking, unattended sensors towards software-defined radio integration for and specialized applications future & legacy tactical radios

Iridium Burst®

50

Future Services and Enhanced Capabilities

Increasing our overall value to the USG; could provide service revenue upside as early as 2016

Iridium CertusSM broadband meets demand for greater bandwidth

Integration of software-defined radios

Satelles – secure time and location services through strategic partner; augments and validates GPS signal in challenged environments

51

The Future

Unique value proposition not likely to be challenged

Viewed as a mission-critical partner in support of DoD communications

DoD investments in dedicated gateway on schedule for Iridium NEXT

Adoption and utilization is strongly endorsed

Current airtime services contract is unprecedented; provides foundation for innovation and cost savings

Increasing demand for bandwidth and unique applications met by our partner solutions and expanding service portfolio

Iridium NEXT provides platform for enhanced capabilities and incremental service revenue

We’ve already begun preliminary discussions for the next contract in 2018

52

Network Leadership & Iridium NEXT

S. Scott Smith, Chief Operating Officer March 12, 2015

Reliable critical lifelines iridium everywhere

Current Constellation—Continued Confidence

Current network is healthy and performing well

High availability and robust service quality for customers

Flexible and resilient network architecture

One spare still available

“Iridium Everywhere” – 100% Global Coverage

55

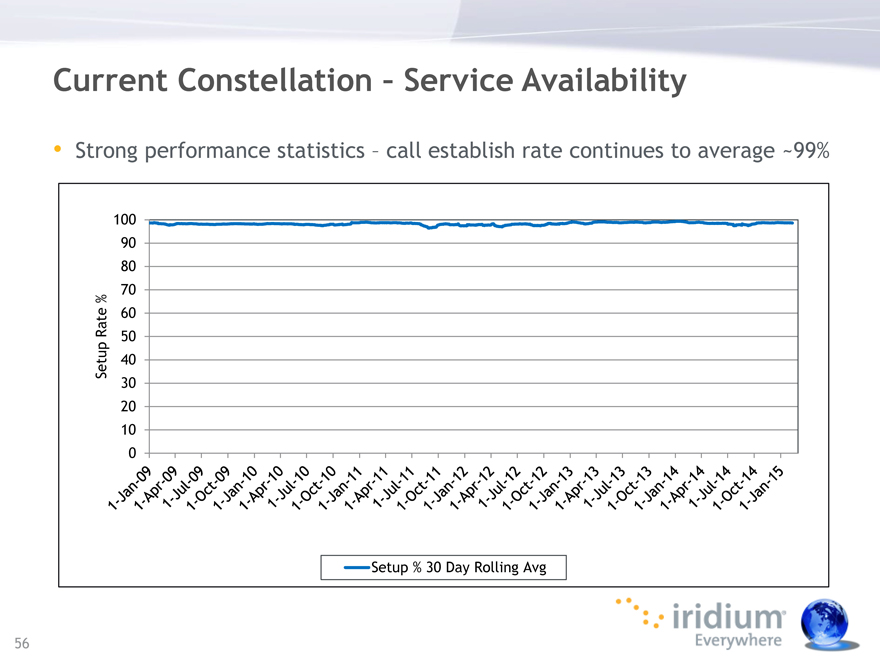

Current Constellation – Service Availability

Strong performance statistics – call establish rate continues to average ~99%

100 90 80

% 70 Rate 60 50 Setup 40 30 20 10 0

Setup % 30 Day Rolling Avg

Iridium® Network Traffic Routing

57

All Systems Go For Iridium NEXT

Less than one year to launch!

$1.7 billion spent through 2014

Ground infrastructure upgrades complete

Iridium NEXT satellite and system testing ongoing

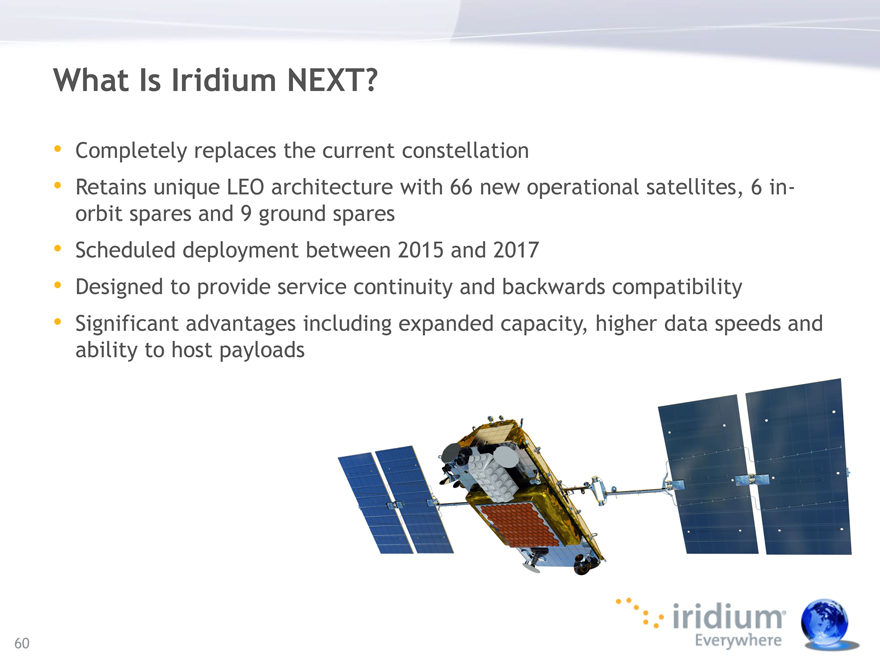

What Is Iridium NEXT?

59

What Is Iridium NEXT?

Completely replaces the current constellation

Retains unique LEO architecture with 66 new operational satellites, 6 in-orbit spares and 9 ground spares

Scheduled deployment between 2015 and 2017

Designed to provide service continuity and backwards compatibility

Significant advantages including expanded capacity, higher data speeds and ability to host payloads

Technology Evolution to Iridium NEXT

No greater priority than ensuring a smooth transition to Iridium NEXT

Implementing a continuous and methodical evolution from the current system to Iridium NEXT

Incremental one-for-one replacement of satellites

Designed for backwards compatibility to all subscriber devices and solutions

Legacy services will be supported by the next-generation architecture

61

Service Evolution To Iridium NEXT

Expanded and enhanced product portfolio supports ongoing growth

Superior processing power from new satellites – higher quality voice, expanded capacity, higher data speeds

Chipsets for devices available soon

Iridium CertusSM broadband

Ground systems upgrade complete for higher data speeds

62

Brought to you by… Iridium NEXT Management

Highly qualified team—“It’s in our blood”

We know what it takes to successfully manufacture, test, deploy and operate a satellite constellation

35 Iridium employees with over 540 years experience are directly managing Iridium NEXT subcontractors

Design and production plan benefits from extensive flight operations and technical resolution expertise

Access to all engineering design details, review of over 500 documents

Independent oversight by Summit

Space Corporation on behalf of COFACE lenders

Detailed quarterly technical reports

Review of Iridium NEXT documents, analysis and models

Access to industry knowledge and experts

A World Class Development Team is in Place

64

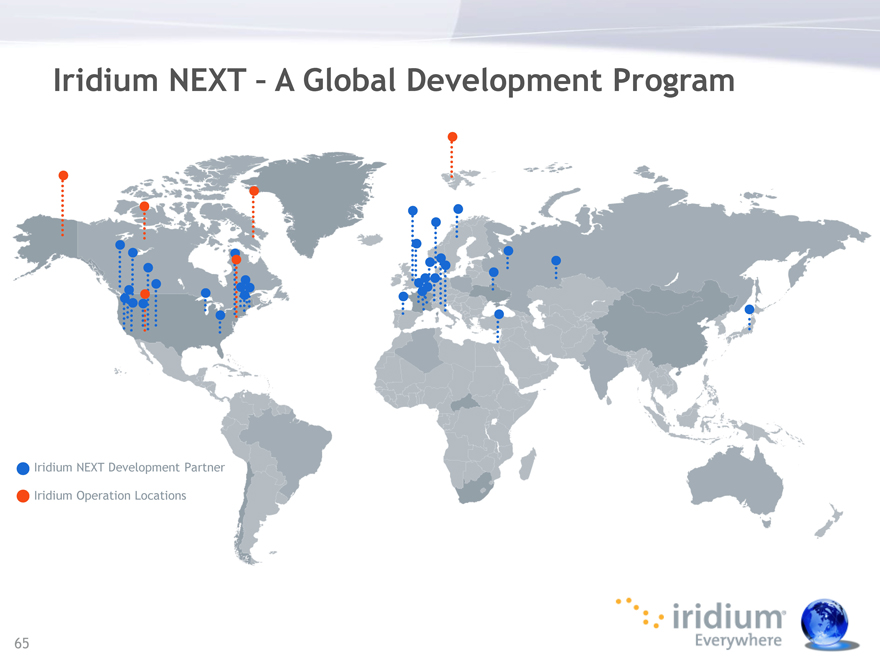

Iridium NEXT – A Global Development Program

Iridium NEXT Development Partner

Iridium Operation Locations

65

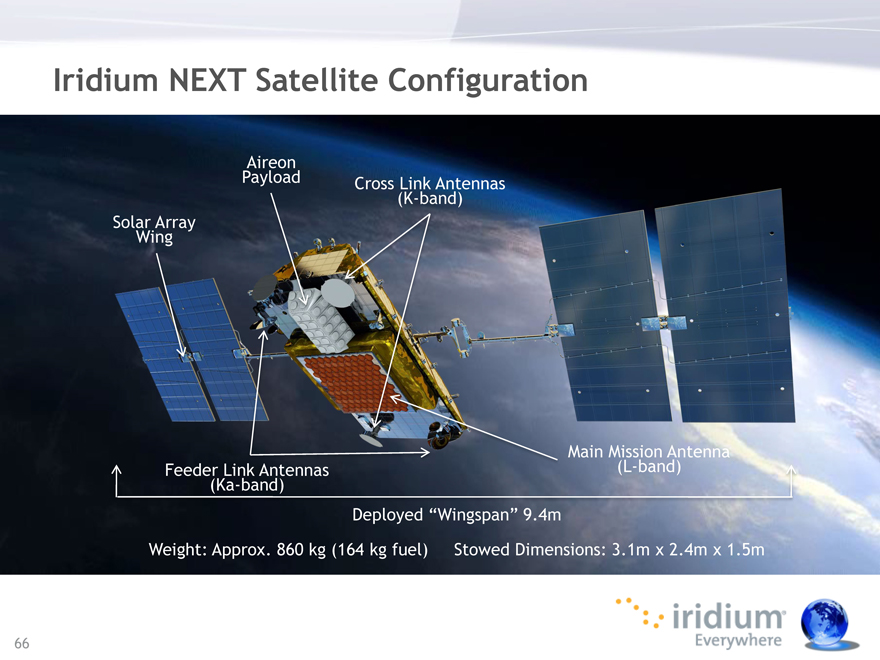

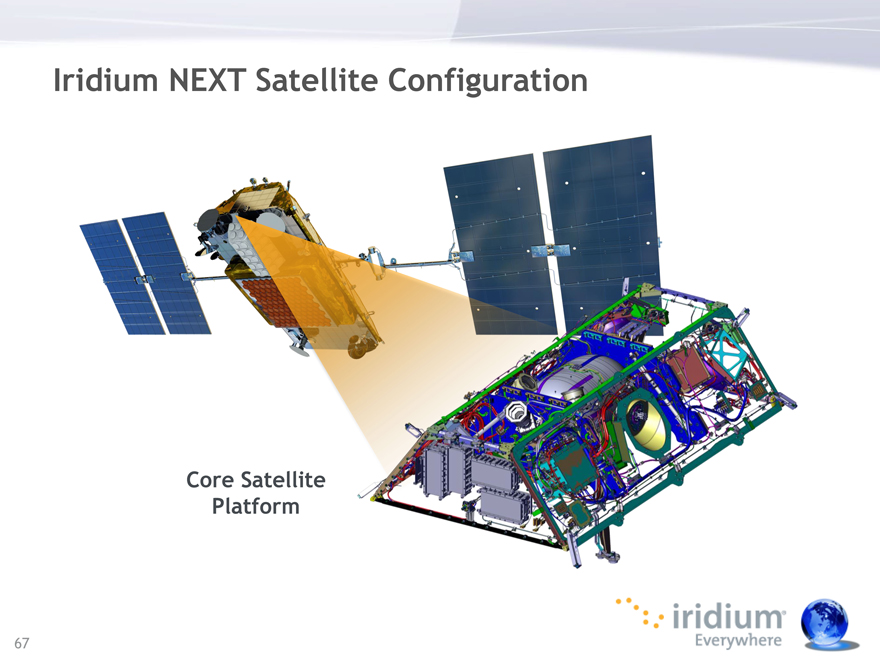

Iridium NEXT Satellite Configuration

Aireon

Payload Cross Link Antennas (K-band) Solar Array Wing

Main Mission Antenna Feeder Link Antennas (L-band) (Ka-band)

Deployed “Wingspan” 9.4m

Weight: Approx. 860 kg (164 kg fuel) Stowed Dimensions: 3.1m x 2.4m x 1.5m

66

Iridium NEXT Satellite Configuration

Core Satellite Platform

Iridium NEXT Satellite Simulator

Iridium NEXT Payload Hardware Qualification

Satellite Factory Clean Room—Orbital Sciences, Gilbert, AZ

Flight Model 2 Communications Payload Flight Model 2 Spacecraft Bus During During Assembly Assembly

69

First Solar Array Deployment

70

Satellite Factory – Final Assembly, Integration & Test

71

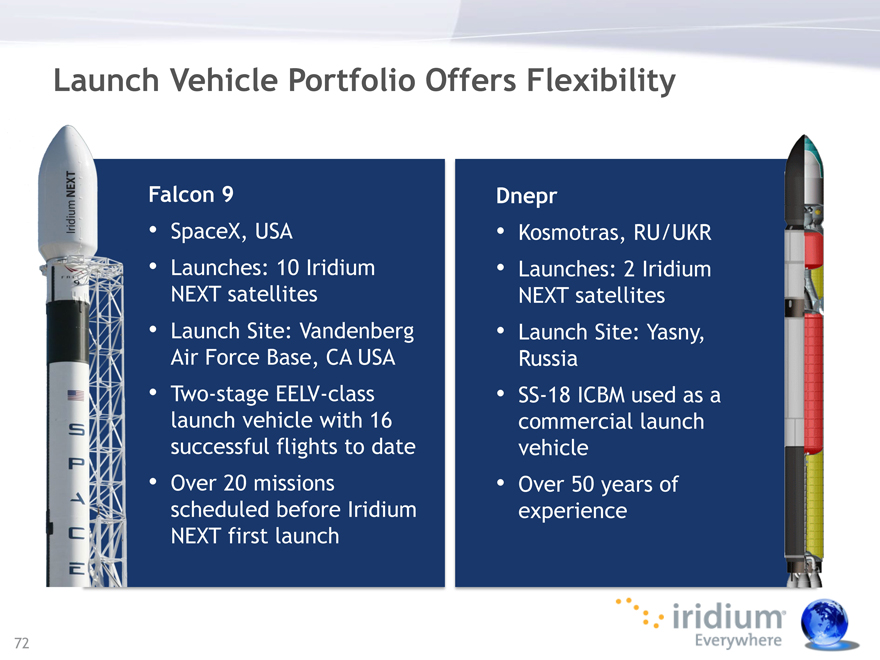

Launch Vehicle Portfolio Offers Flexibility

Falcon 9 Dnepr

SpaceX, USA Kosmotras, RU/UKR

Launches: 10 Iridium Launches: 2 Iridium NEXT satellites NEXT satellites

Launch Site: Vandenberg Launch Site: Yasny, Air Force Base, CA USA Russia

Two-stage EELV-class SS-18 ICBM used as a launch vehicle with 16 commercial launch successful flights to date vehicle

Over 20 missions Over 50 years of scheduled before Iridium experience NEXT first launch

72

Launch Vehicle Portfolio Offers Flexibility

Launches: 10 Iridium NEXT satellites • Launches: 2 Iridium NEXT satellites

73

New SpaceX Facility (VAFB)

VAFB SLC-4E Launch

Kosmotras (Dnepr) Facilities

Cluster-21 Launch

Yasny Launch Base Yuzhnoye Facility

Recent Dnepr Launch

Animation Showing an Example Launch Deployment Scenario

Iridium NEXT Hosted Payloads

Iridium NEXT design provides opportunity to host third-party payloads

Payload customer shares infrastructure of the Iridium NEXT satellite and global networked communications architecture

Aireon selected as the primary payload (global aviation monitoring)

Other “auxiliary components” operate in conjunction with Aireon payload

Iridium NEXT Hosted Payload Specifications

Harris Hosted

Weight >65 kg

Payload

Platform

Payload Dimensions 30 x 40 x 70 cm

68 W average (200 W

Payload Power peak)

<1 Mbps, Orbit Payload Data Rate average ~100Kbps

78

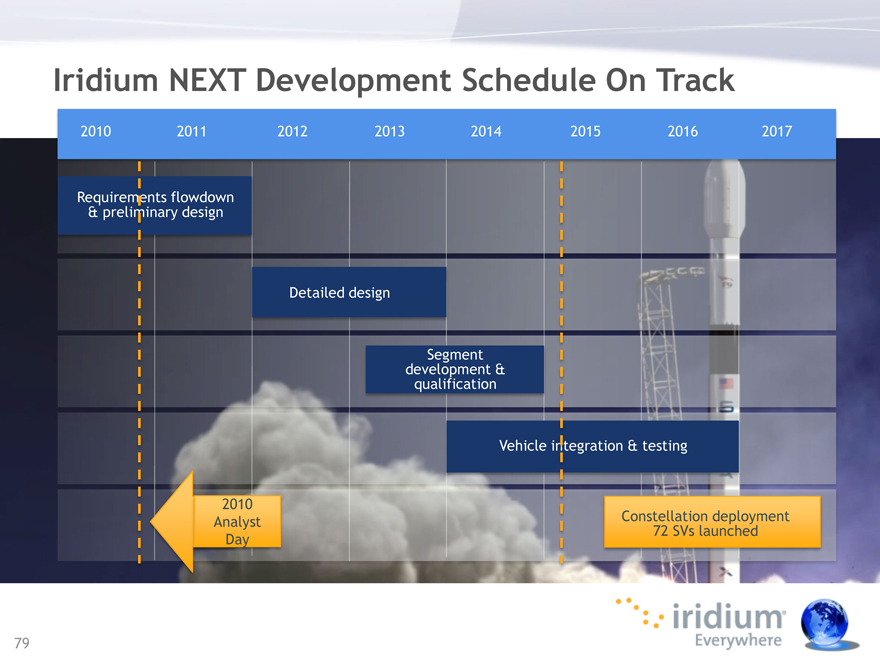

Iridium NEXT Development Schedule On Track

2010 2011 2012 2013 2014 2015 2016 2017

Require nts flowdown & preli nary design

Detailed design

Segment development & qualification

Vehicle i egration & testing

2010

Analyst Constellation deployment

72 SVs launched Day

79

Iridium NEXT—Coming Soon To A Planet Near You!

Less than one year and countin

80

Aireon Overview

Alan Khalili, CFO

Vincent Capezzuto, CTO March 12, 2015

aireonsm

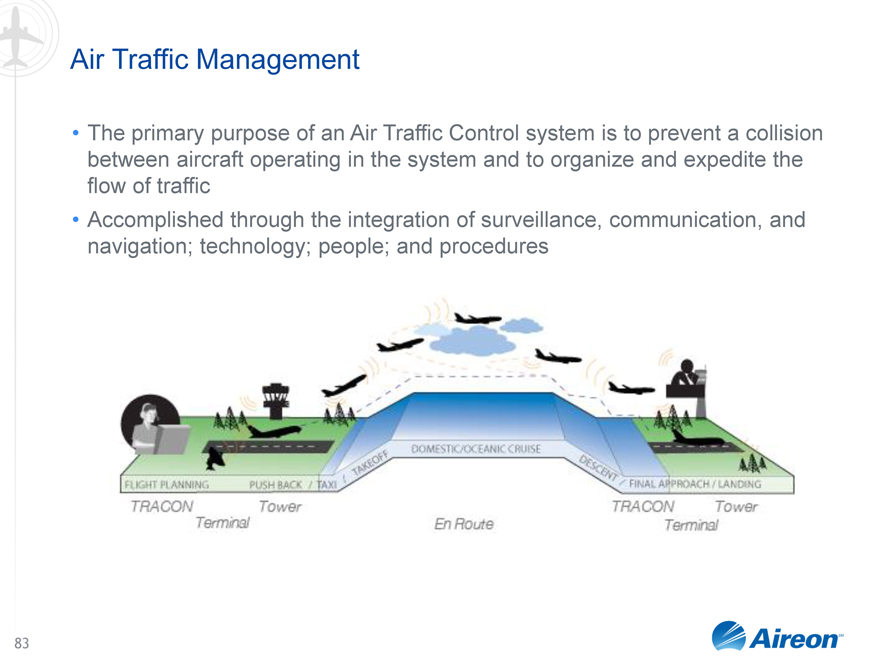

Air Traffic Management

The primary purpose of an Air Traffic Control system is to prevent a collision between aircraft operating in the system and to organize and expedite the flow of traffic

Accomplished through the integration of surveillance, communication, and navigation; technology; people; and procedures

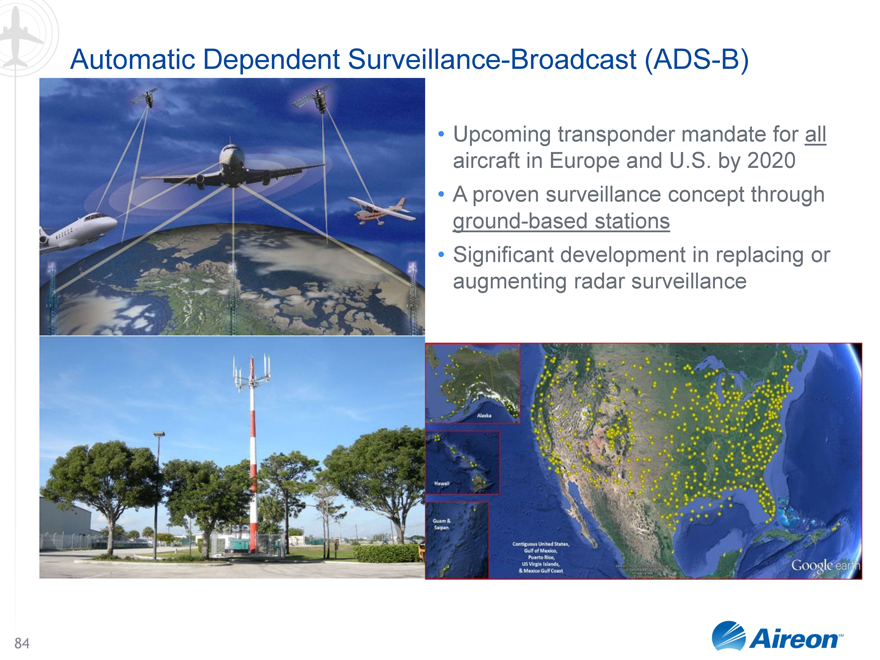

Automatic Dependent Surveillance-Broadcast (ADS-B)

Upcoming transponder mandate for all aircraft in Europe and U.S. by 2020

A proven surveillance concept through ground-based stations

Significant development in replacing or augmenting radar surveillance

84

Aireon Brings ADS-B to the Entire World

Augments current ADS-B terrestrial-based systems with oceanic and remote airspace coverage

Delivers true pole-to-pole global coverage, with real-time delivery of surveillance data to Air Navigation Service Providers (ANSPs)

No additional aircraft equipage required

Benefits of Space-Based ADS-B

Benefits include:

Reduced Air Navigation Service Provider (ANSP) costs, including infrastructure savings

Enhanced safety

Reduced airline: operations costs, fuel consumption (global oceanic is estimated at $500 million in fuel savings/year) and travel time

Reduced environmental impact

86

Best-in-Class Team

87

Aireon Aircraft Locating and Emergency Response Tracking

(ALERT)

MH370 highlighted a global need for more accurate surveillance of aircraft, especially in remote and oceanic areas

Aireon will provide a global emergency tracking service to ANSPs and Search

& Rescue authorities to provide the aviation community with the ability to query the location and last flight track of any ADS-B equipped aircraft

Aireon ALERT will be provided as a free public service, without any new equipment or investment from the airlines or ANSPs

The Aireon ALERT service will be provided through a 24/7 call center to make data available soon after communication is lost with an aircraft

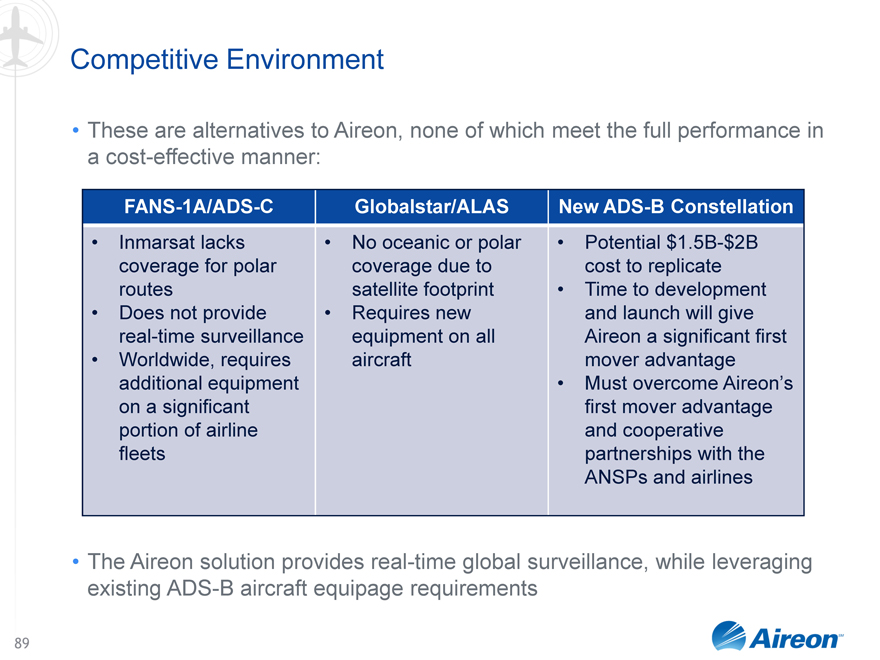

Competitive Environment

These are alternatives to Aireon, none of which meet the full performance in a cost-effective manner:

FANS-1A/ADS-C Globalstar/ALAS New ADS-B Constellation

Inmarsat lacks No oceanic or polar Potential $1.5B-$2B coverage for polar coverage due to cost to replicate routes satellite footprint Time to development

Does not provide Requires new and launch will give real-time surveillance equipment on all Aireon a significant first

Worldwide, requires aircraft mover advantage additional equipment Must overcome Aireon’s on a significant first mover advantage portion of airline and cooperative fleets partnerships with the ANSPs and airlines

The Aireon solution provides real-time global surveillance, while leveraging existing ADS-B aircraft equipage requirements

Investors, Customers and Innovators

90

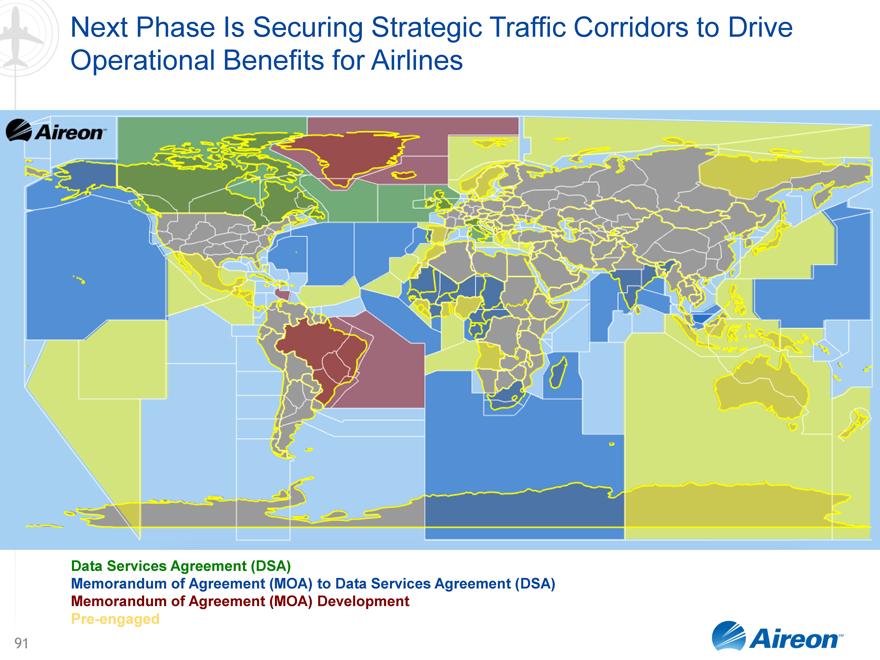

Next Phase Is Securing Strategic Traffic Corridors to Drive Operational Benefits for Airlines

Data Services Agreement (DSA)

Memorandum of Agreement (MOA) to Data Services Agreement (DSA) Memorandum of Agreement (MOA) Development Pre-engaged

91

Aireon – A Global Solution

Built upon the same standards developed by governments worldwide

Performance is unmatched by other alternatives

Can uniquely create benefits in excess of $500 million/year from fuel savings alone

On track to provide services by 2017

Strategically built a management team and investor base

ANSPs are increasingly appreciating these advantages

The FAA is no exception—we believe its proposed fiscal 2016 budget indicates its interest in gearing up for operational readiness

NATS UK, NAV CANADA and FAA contracts alone will support hosting fee payments to Iridium between mid-2016 and early 2017

Government Business, Iridium NEXT and Aireon Q&A Panel

Scott Scheimreif EVP, Government Programs Scott Smith Chief Operating Officer Alan Khalili CFO, Aireon LLC

Vincent Capezzuto CTO, Aireon LLC

Financial Overview

Thomas J. Fitzpatrick, CFO & CAO March 12, 2015

Iridium® everywhere reliable critical lifelines

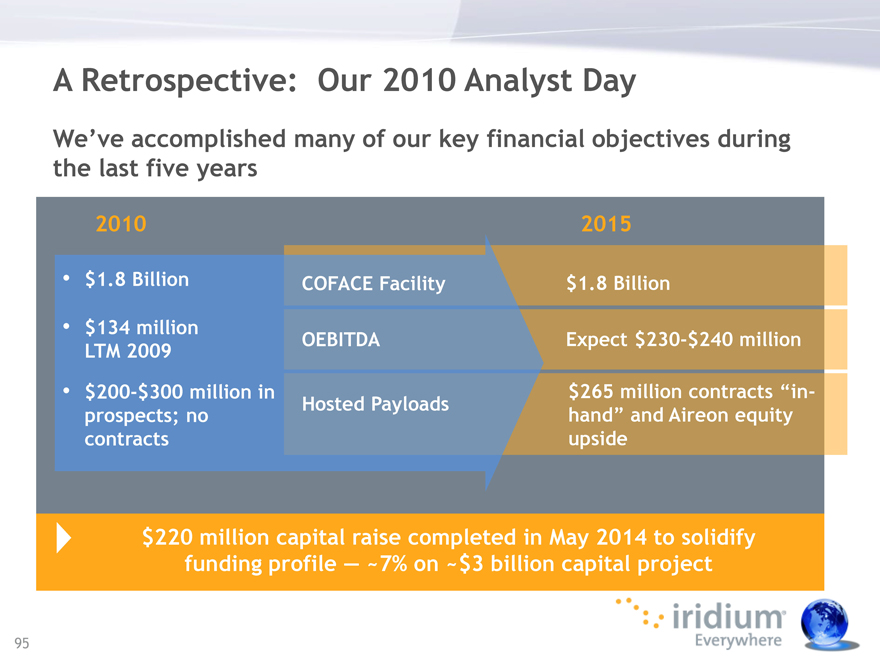

A Retrospective: Our 2010 Analyst Day

We’ve accomplished many of our key financial objectives during the last five years

2010 2015

$1.8 Billion COFACE Facility $1.8 Billion

$134 million

OEBITDA Expect $230-$240 million LTM 2009

$200-$300 million in $265 million contracts “in-

Hosted Payloads prospects; no hand” and Aireon equity contracts upside

$220 million capital raise completed in May 2014 to solidify funding profile — ~7% on ~$3 billion capital project

95

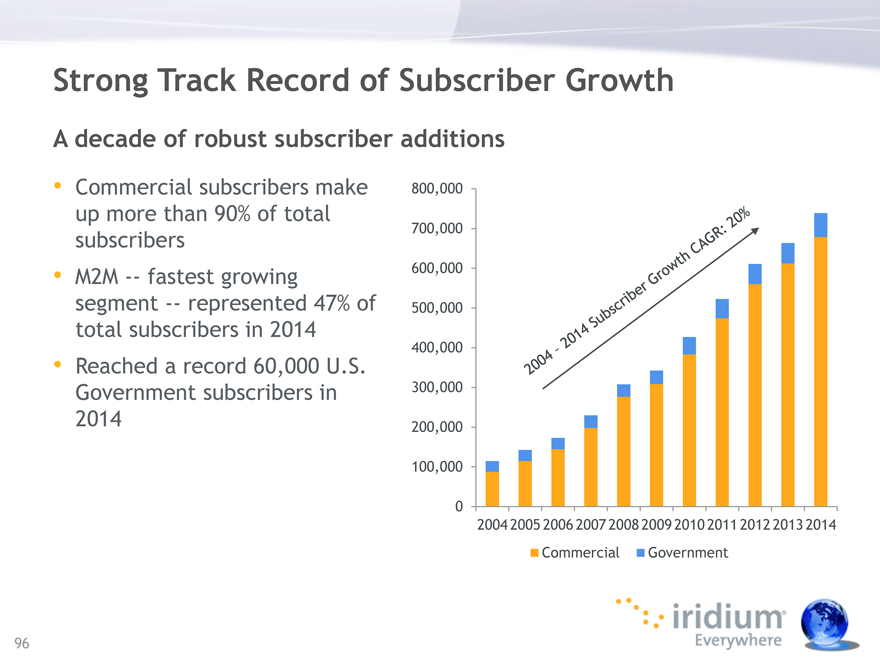

Strong Track Record of Subscriber Growth

A decade of robust subscriber additions

Commercial subscribers make 800,000 up more than 90% of total

700,000

subscribers

M2M — fastest growing 600,000 segment — represented 47% of 500,000 total subscribers in 2014 Reached a 60,000 U.S. 400,000 record Government subscribers in 300,000

2014 200,000 100,000

0

2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Commercial Government

2014 – 2015 subscriber growth cagr: 20%

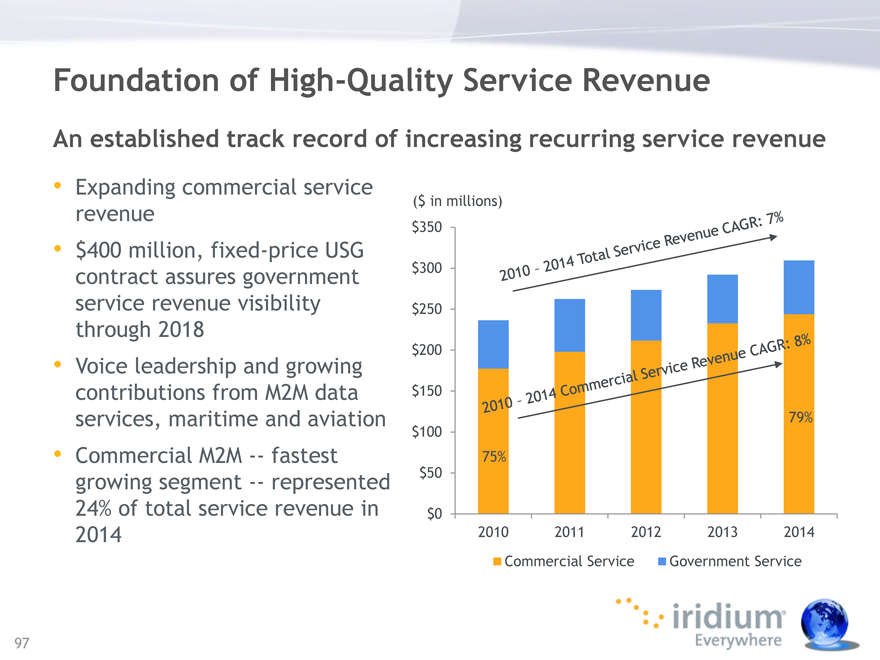

Foundation of High-Quality Service Revenue

An established track record of increasing recurring service revenue

Expanding commercial service

($ in millions)

revenue

$350

$400 million, fixed-price USG contract assures government $300 service revenue visibility $250 through 2018

$200

Voice leadership and growing contributions from M2M data $150 services, maritime and aviation 79%

$100

Commercial M2M — fastest 75% growing segment — represented $50 24% of total service revenue in $0

2014 2010 2011 2012 2013 2014 Commercial Service Government Service

97 2010 – 2014 total service revenue cagr: 7% 2010 – 2014 commercial service revenue cagr: 8%

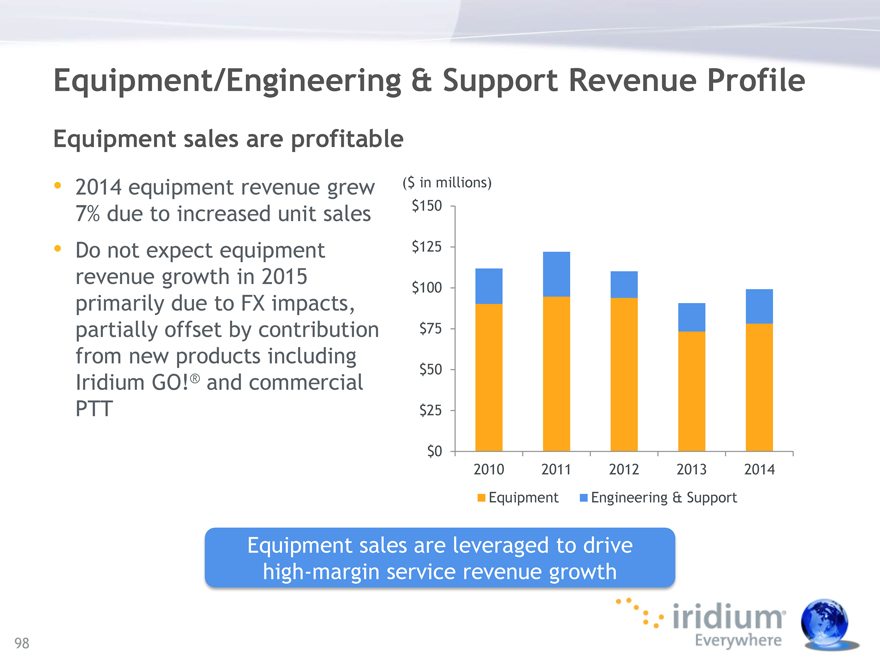

Equipment/Engineering & Support Revenue Profile

Equipment sales are profitable

2014 equipment revenue grew ($ in millions) 7% due to increased unit sales $150

Do not expect equipment $125 revenue growth in 2015

$100

primarily due to FX impacts, partially offset by contribution $75 from new products including

$50

Iridium GO!® and commercial

PTT $25

$0

2010 2011 2012 2013 2014 Equipment Engineering & Support

Equipment sales are leveraged to drive high-margin service revenue growth

98

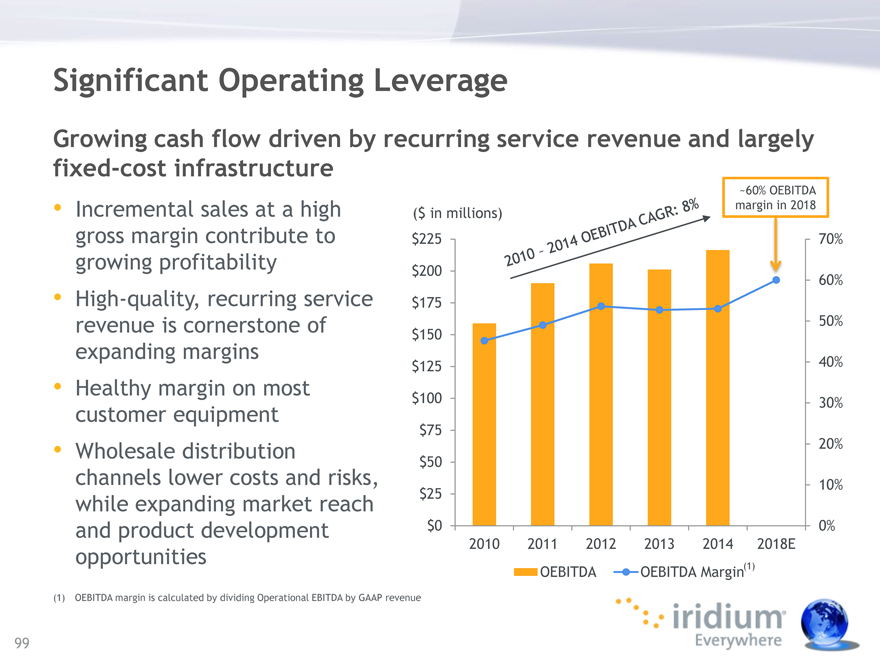

Significant Operating Leverage

Growing cash flow driven by recurring service revenue and largely fixed-cost infrastructure

~60% OEBITDA

Incremental sales at a high margin in 2018

($ in millions)

gross margin contribute to $225 70% growing profitability $200 High-quality, 60% • recurring service $175 revenue is cornerstone of $150 50% expanding margins

$125 40%

Healthy margin on most

$100 30%

customer equipment $75

Wholesale distribution 20%

$50

channels lower costs and risks, $25 10% while expanding market reach and product development $0 0%

2010 2011 2012 2013 2014 2018E

opportunities

OEBITDA OEBITDA Margin(1)

(1) OEBITDA margin is calculated by dividing Operational EBITDA by GAAP revenue

99 2010 – 2014 oebitda cagr: 8%

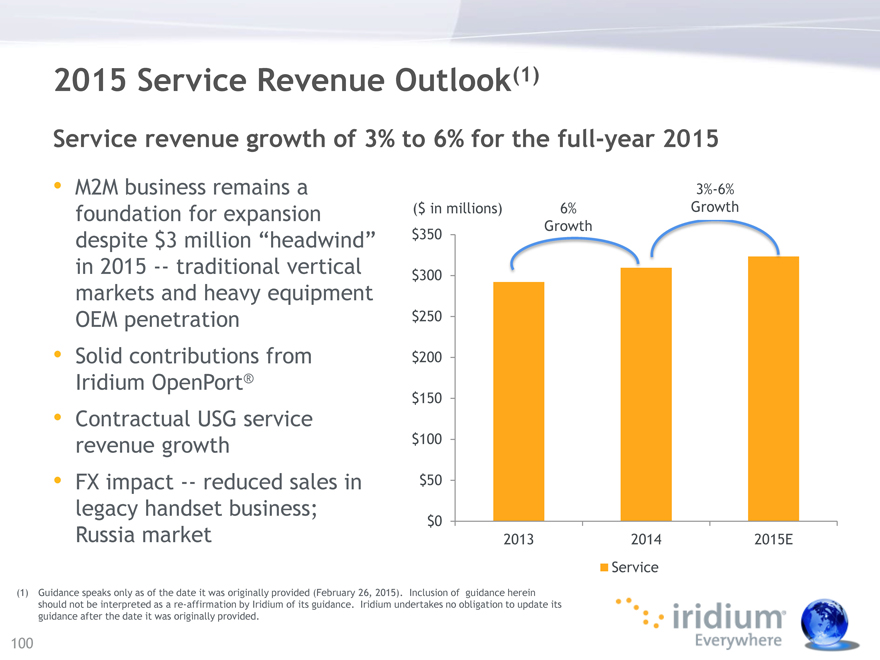

2015 Service Revenue Outlook(1)

Service revenue growth of 3% to 6% for the full-year 2015

M2M business remains a 3%-6% foundation for expansion ($ in millions) 6% Growth

Growth

despite $3 million “headwind” $350 in 2015 — traditional vertical $300 markets and heavy equipment OEM penetration $250

Solid contributions from $200 Iridium OpenPort®

$150

Contractual USG service revenue growth $100

FX impact — reduced sales in $50 legacy handset business;

$0

Russia market 2013 2014 2015E

Service

(1) Guidance speaks only as of the date it was originally provided (February 26, 2015). Inclusion of guidance herein should not be interpreted as a re-affirmation by Iridium of its guidance. Iridium undertakes no obligation to update its guidance after the date it was originally provided.

100

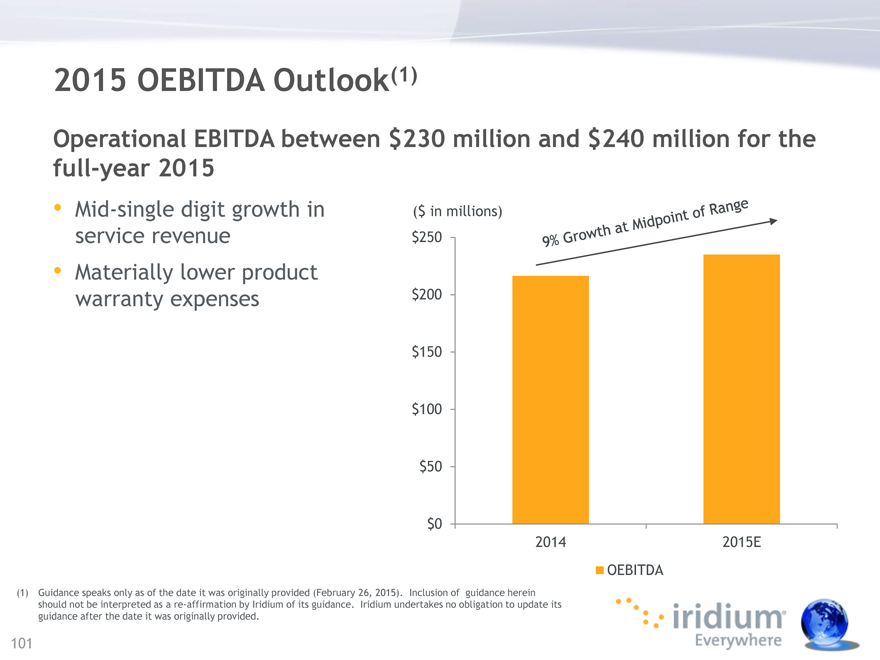

2015 OEBITDA Outlook(1)

Operational EBITDA between $230 million and $240 million for the full-year 2015

Mid-single digit growth in ($ in millions) service revenue $250

Materially lower product warranty expenses $200

$150 $100

$50

$0

2014 2015E OEBITDA

(1) Guidance speaks only as of the date it was originally provided (February 26, 2015). Inclusion of guidance herein should not be interpreted as a re-affirmation by Iridium of its guidance. Iridium undertakes no obligation to update its guidance after the date it was originally provided.

101

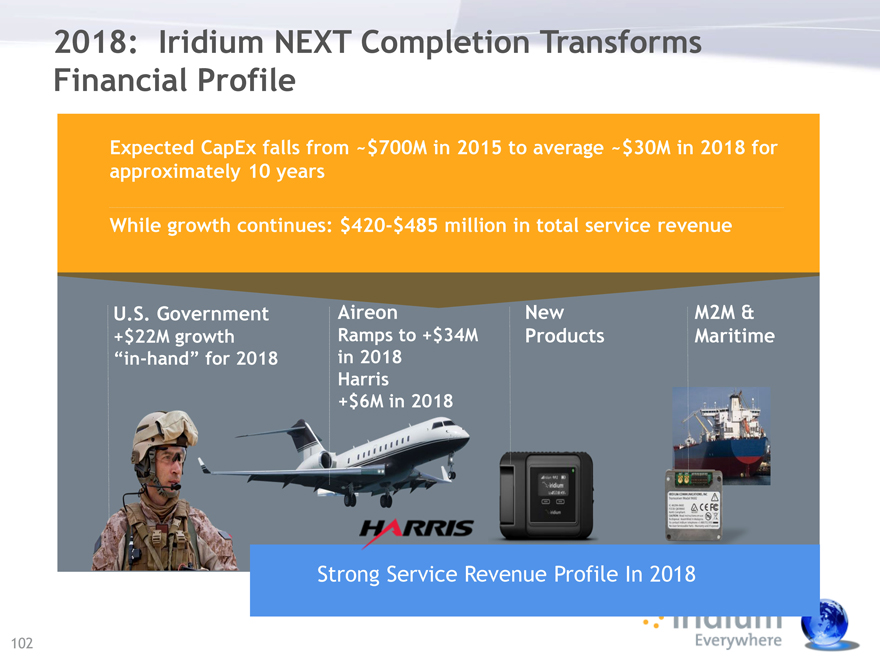

2018: Iridium NEXT Completion Transforms Financial Profile

Expected CapEx falls from ~$700M in 2015 to average ~$30M in 2018 for approximately 10 years

While growth continues: $420-$485 million in total service revenue

U.S. Government Aireon New M2M &

+$22M growth Ramps to +$34M Products Maritime

“in-hand” for 2018 in 2018

Harris

+$6M in 2018

Strong Service Revenue Profile In 2018

Iridium CertusSM Broadband – A New Growth Pillar

Significantly expands addressable market and service revenue profile

Mobile satellite services industry expected to grow from $2 billion in 2015 to over $5 billion in 2025(1) — broadband is a big piece

New, faster user terminals take advantage of Iridium NEXT’s enhanced capabilities

Design, development and production in collaboration with world-class partners using our core technology modules

(1) Source: Northern Sky Research

103

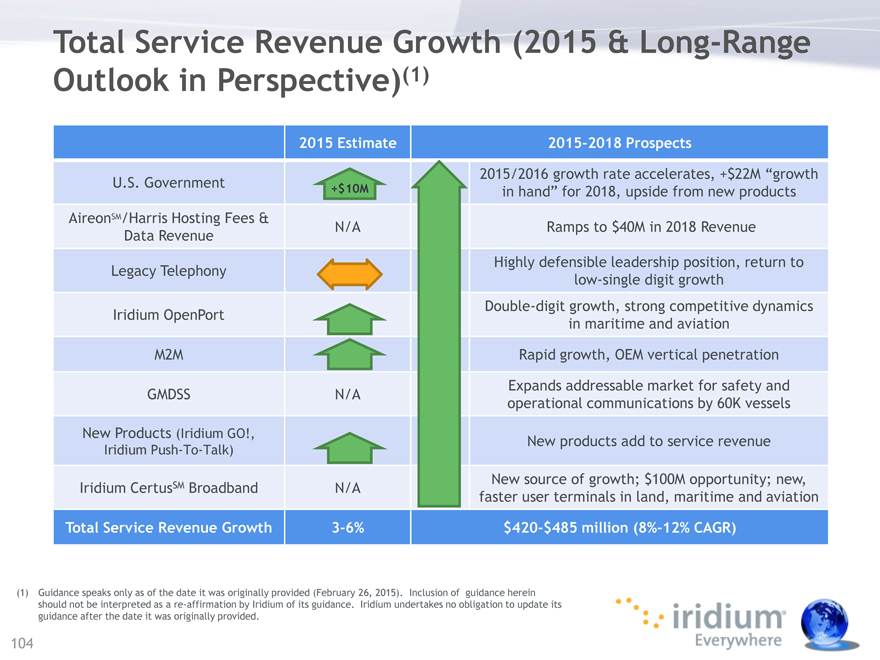

Total Service Revenue Growth (2015 & Long-Range Outlook in Perspective)(1)

2015 Estimate 2015-2018 Prospects

2015/2016 growth rate accelerates, +$22M “growth U.S. Government +$10M in hand” for 2018, upside from new products

AireonSM/Harris Hosting Fees &

N/A Ramps to $40M in 2018 Revenue Data Revenue

Highly defensible leadership position, return to Legacy Telephony low-single digit growth Double-digit growth, strong competitive dynamics Iridium OpenPort in maritime and aviation M2M Rapid growth, OEM vertical penetration Expands addressable market for safety and GMDSS N/A operational communications by 60K vessels

New Products (Iridium GO!,

New products add to service revenue

Iridium Push-To-Talk)

SM New source of growth; $100M opportunity; new, Iridium Certus Broadband N/A faster user terminals in land, maritime and aviation

Total Service Revenue Growth 3-6% $420-$485 million (8%-12% CAGR)

(1) Guidance speaks only as of the date it was originally provided (February 26, 2015). Inclusion of guidance herein should not be interpreted as a re-affirmation by Iridium of its guidance. Iridium undertakes no obligation to update its guidance after the date it was originally provided.

104

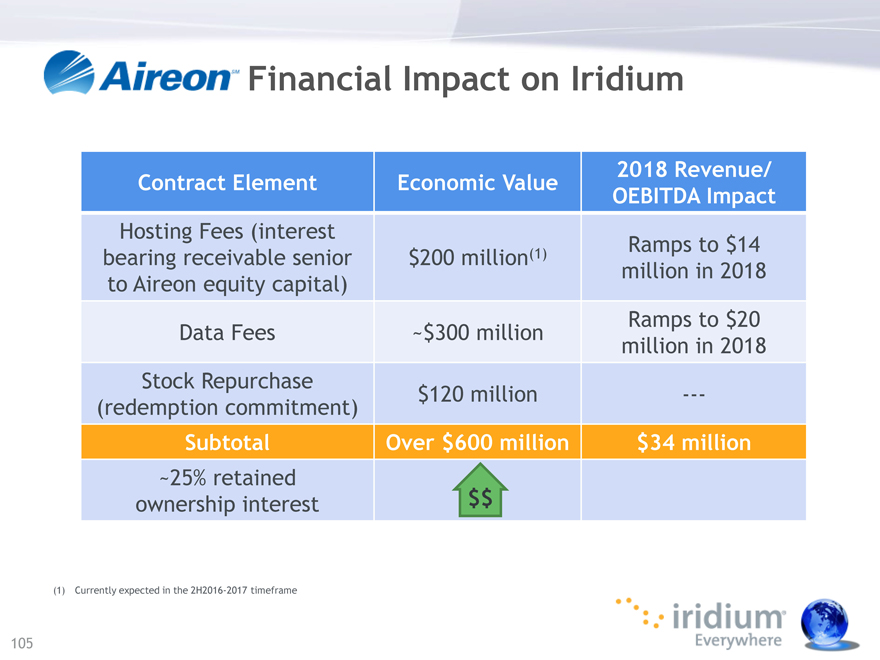

Financial Impact on Iridium

2018 Revenue/ Contract Element Economic Value OEBITDA Impact

Hosting Fees (interest

(1) Ramps to $14 bearing receivable senior $200 million million in 2018 to Aireon equity capital) Ramps to $20 Data Fees ~$300 million million in 2018 Stock Repurchase $120 million —- (redemption commitment)

Subtotal Over $600 million $34 million

~25% retained $$ ownership interest

(1) | | Currently expected in the 2H2016-2017 timeframe |

105

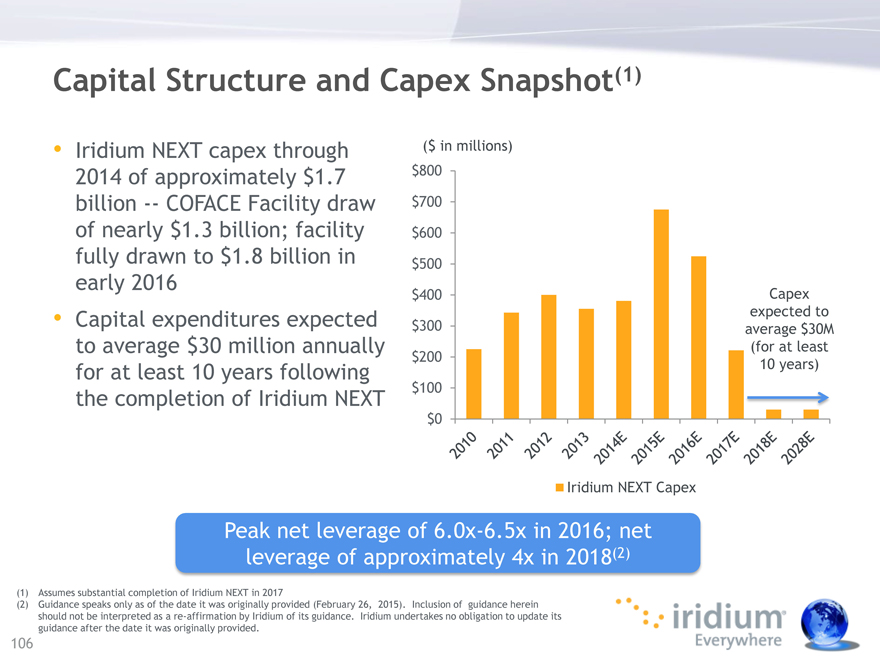

Capital Structure and Capex Snapshot(1)

Iridium NEXT capex through ($ in millions) 2014 of approximately $1.7 $800 billion — COFACE Facility draw $700 of nearly $1.3 billion; facility $600 fully drawn to $1.8 billion in $500 early 2016

$400 Capex

Capital expenditures expected expected to

$300 average $30M

to average $30 million annually (for at least

$200

for at least 10 years following 10 years) the completion of Iridium NEXT $100

$0

Iridium NEXT Capex

Peak net leverage of 6.0x-6.5x in 2016; net leverage of approximately 4x in 2018(2)

(1) Assumes substantial completion of Iridium NEXT in 2017

(2) Guidance speaks only as of the date it was originally provided (February 26, 2015). Inclusion of guidance herein should not be interpreted as a re-affirmation by Iridium of its guidance. Iridium undertakes no obligation to update its guidance after the date it was originally provided.

106

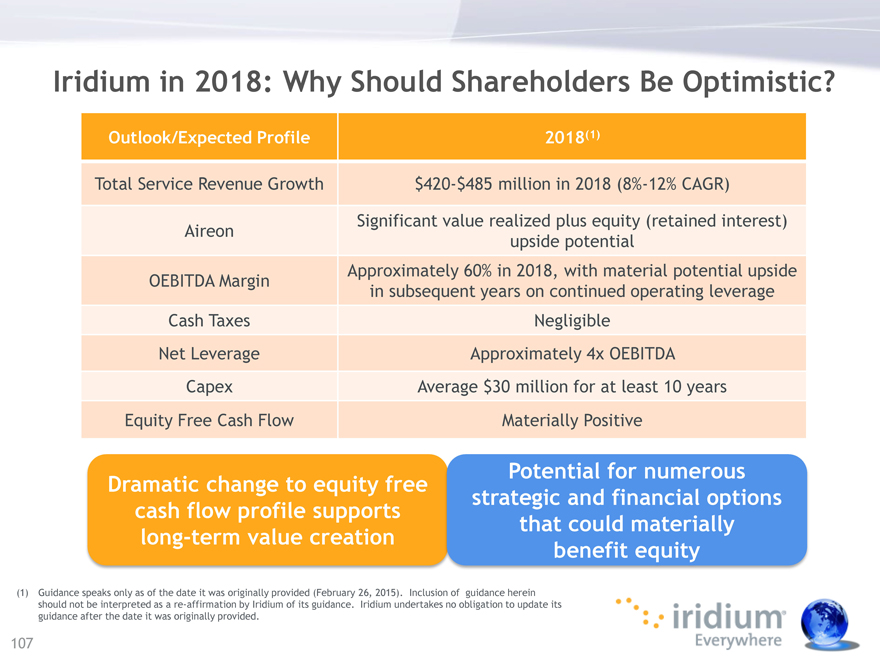

Iridium in 2018: Why Should Shareholders Be Optimistic?

Outlook/Expected Profile 2018(1)

Total Service Revenue Growth $420-$485 million in 2018 (8%-12% CAGR)

Significant value realized plus equity (retained interest) Aireon upside potential Approximately 60% in 2018, with material potential upside OEBITDA Margin in subsequent years on continued operating leverage Cash Taxes Negligible Net Leverage Approximately 4x OEBITDA

Capex Average $30 million for at least 10 years

Equity Free Cash Flow Materially Positive

Potential for numerous Dramatic change to equity free strategic and financial options cash flow profile supports that could materially long-term value creation benefit equity

(1) Guidance speaks only as of the date it was originally provided (February 26, 2015). Inclusion of guidance herein should not be interpreted as a re-affirmation by Iridium of its guidance. Iridium undertakes no obligation to update its guidance after the date it was originally provided.

107

Closing Remarks/Final Q&A Panel

Matt Desch Chief Executive Officer Tom Fitzpatrick Chief Financial Officer

Lunch and Facilities Tour

Appendix

Non-GAAP Financial Measures

Iridium Communications Inc. Non-GAAP Reconciliation $ in Thousands

For the Year Ended December 31,

2010 2011 2012 2013 2014 Q4 2014

Net income $ 19,941 $ 41,035 $ 64,631 $ 62,517 $ 74,989 $ 23,039

Interest expense 23 42 114 583 954 162

Interest income (660) (1,242) (1,186) (2,859) (4,594) (1,178) Income taxes 14,671 24,546 30,387 47,948 41,463 8,636 Depreciation and amortization 90,667 97,646 81,110 74,980 72,769 13,154 EBITDA 124,642 162,027 175,056 183,169 185,581 43,813 Iridium Next expenses, net 17,697 22,284 23,042 8,064 18,064 4,759

Loss from investment in Aireon — — 826 3,332 4,296 — Share-based compensation 4,875 5,895 7,332 6,715 9,559 3,461 Transaction expenses — — — — — —

Purchase accounting adjustments 11,666 163 (502) (194) (1,000) (250) Operational EBITDA $ 158,880 $ 190,369 $ 205,754 $ 201,086 $ 216,500 $ 51,783

2015 Analyst Day

Iridium Communications Inc. March 12, 2015

Iridium everywhere reliable critical lifelines