Exhibit 99.1 Welcome!Exhibit 99.1 Welcome!

Forward-Looking Statements Safe Harbor Statement This presentation contains statements about future events and expectations known as “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Iridium Communications Inc. (“Iridium” or the “Company”) has based these statements on its current expectations and the information currently available to it. Forward-looking statements in this presentation include statements regarding expected equipment revenue, service revenue, Operational EBITDA, Operational EBITDA margin, capital expenditure, free cash flow, cash taxes and leverage levels; expected Iridium® NEXT capabilities and benefits; expected growth in the MSS industry; contracted U.S. government revenues; the market for and capabilities of new products and services, such as Iridium CertusSM broadband; the capabilities and benefits of and the market for the AireonSM system; and the Aireon and Harris hosted payload’s financial impact on Iridium. Other forward-looking statements can be identified by the words anticipates, may, can, believes, expects, projects, intends, likely, will, to be and other expressions that are predictions of or indicate future events, trends or prospects. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of Iridium to differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to, uncertainties regarding expected Operational EBITDA, growth in subscribers and revenue, levels of demand for mobile satellite services (MSS), the development of and market for the Aireon and Harris hosted payloads, the ability of Aireon to raise funds to pay its hosting fees, the development and demand for new products and services, including Iridium Certus broadband, and the Company’s ability to maintain the health, capacity and content of its satellite constellation, as well as general industry and economic conditions, and competitive, legal, governmental and technological factors. Other factors that could cause actual results to differ materially from those indicated by the forward-looking statements include those factors listed under the caption Risk Factors“ in the Company’s Form 10-K for the year ended December 31, 2018, filed with the SEC on February 28, 2019, as well as other filings Iridium makes with the SEC from time to time. There is no assurance that Iridium's expectations will be realized. If one or more of these risks or uncertainties materialize, or if Iridium's underlying assumptions prove incorrect, actual results may vary materially from those expected, estimated or projected. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof unless otherwise indicated. The Company undertakes no obligation to release publicly any revisions to any forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise.Forward-Looking Statements Safe Harbor Statement This presentation contains statements about future events and expectations known as “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Iridium Communications Inc. (“Iridium” or the “Company”) has based these statements on its current expectations and the information currently available to it. Forward-looking statements in this presentation include statements regarding expected equipment revenue, service revenue, Operational EBITDA, Operational EBITDA margin, capital expenditure, free cash flow, cash taxes and leverage levels; expected Iridium® NEXT capabilities and benefits; expected growth in the MSS industry; contracted U.S. government revenues; the market for and capabilities of new products and services, such as Iridium CertusSM broadband; the capabilities and benefits of and the market for the AireonSM system; and the Aireon and Harris hosted payload’s financial impact on Iridium. Other forward-looking statements can be identified by the words anticipates, may, can, believes, expects, projects, intends, likely, will, to be and other expressions that are predictions of or indicate future events, trends or prospects. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of Iridium to differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to, uncertainties regarding expected Operational EBITDA, growth in subscribers and revenue, levels of demand for mobile satellite services (MSS), the development of and market for the Aireon and Harris hosted payloads, the ability of Aireon to raise funds to pay its hosting fees, the development and demand for new products and services, including Iridium Certus broadband, and the Company’s ability to maintain the health, capacity and content of its satellite constellation, as well as general industry and economic conditions, and competitive, legal, governmental and technological factors. Other factors that could cause actual results to differ materially from those indicated by the forward-looking statements include those factors listed under the caption Risk Factors“ in the Company’s Form 10-K for the year ended December 31, 2018, filed with the SEC on February 28, 2019, as well as other filings Iridium makes with the SEC from time to time. There is no assurance that Iridium's expectations will be realized. If one or more of these risks or uncertainties materialize, or if Iridium's underlying assumptions prove incorrect, actual results may vary materially from those expected, estimated or projected. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof unless otherwise indicated. The Company undertakes no obligation to release publicly any revisions to any forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise.

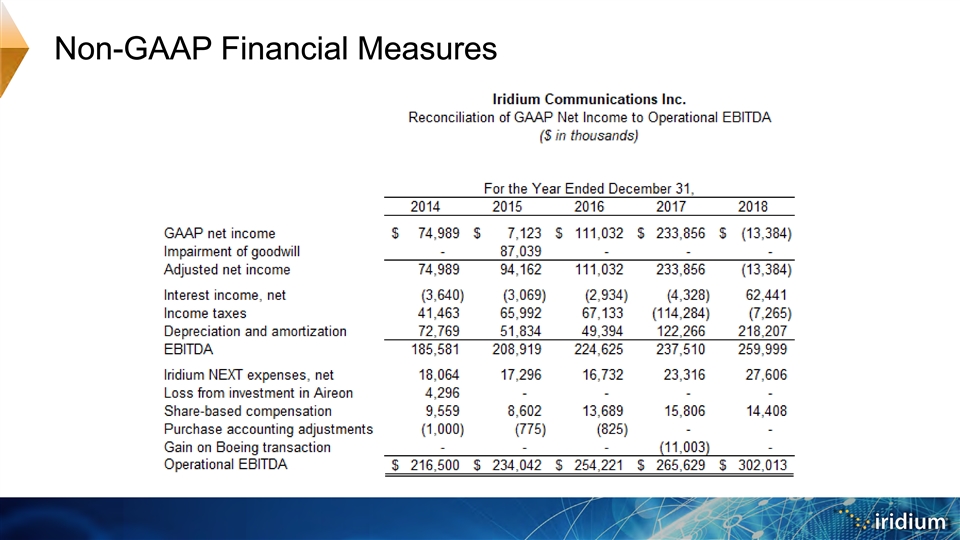

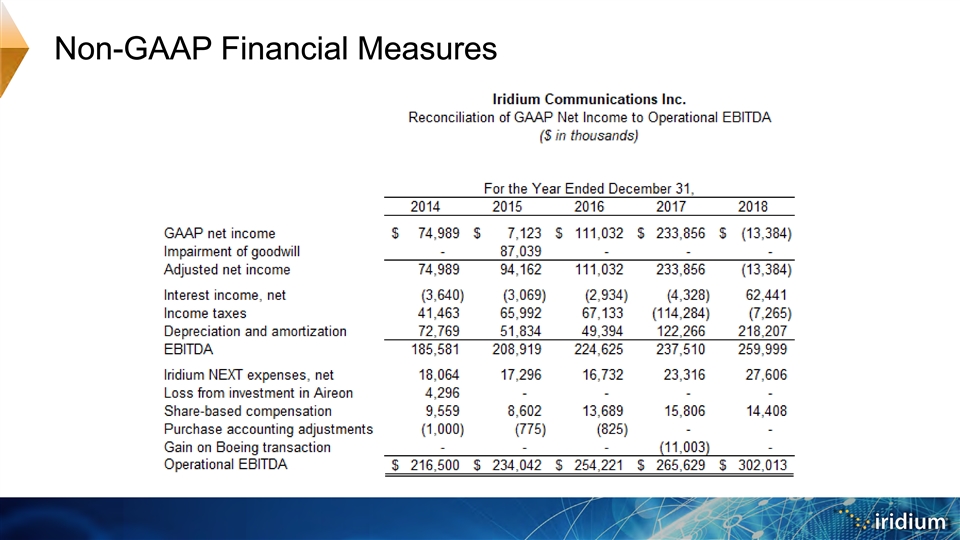

Non-GAAP Financial Measures Non-GAAP Financial Measures In addition to disclosing financial results that are determined in accordance with U.S. GAAP, the Company provides Operational EBITDA and Operational EBITDA margin, which are non-GAAP financial measures, as supplemental measures to help investors evaluate the Company’s fundamental operational performance. Operational EBITDA represents earnings before interest, income taxes, depreciation and amortization, Iridium NEXT revenue and expenses (for periods prior to the deployment of Iridium NEXT only), loss from investment in Aireon, share-based compensation expenses, the impact of purchase accounting, and non-cash gain from the Boeing transaction. Iridium NEXT revenue and expenses were excluded from Operational EBITDA through 2017. Beginning in 2018, Iridium NEXT revenues and recurring Iridium NEXT expenses (recurring Iridium NEXT expenses are not part of the approximately $3 billion construction cost of Iridium NEXT (the “Construction Costs”)) were no longer excluded in calculating Operational EBITDA. U.S. GAAP requires that certain of the Construction Costs be expensed. These certain Construction Costs, which beginning in 2018 principally consisted of in-orbit insurance, will continue to be excluded from the calculation of Operational EBITDA through the first quarter of 2020. The Company also presents Operational EBITDA expressed as a percentage of GAAP revenue, or Operational EBITDA margin. Operational EBITDA, along with its related measure, Operational EBITDA margin, does not represent, and should not be considered, an alternative to U.S. GAAP measurements such as net income or loss, and the Company’s calculations thereof may not be comparable to similarly titled measures reported by other companies. A reconciliation of consolidated GAAP net income to Operational EBITDA is in the attached appendix. By eliminating interest, income taxes, depreciation and amortization, Iridium NEXT revenue and expenses (for periods prior to the deployment of Iridium NEXT only), loss from investment in Aireon, share-based compensation expenses, the impact of purchase accounting, and non-cash gain from the Boeing transaction, the Company believes the result is a useful measure across time in evaluating its fundamental core operating performance. Management also uses Operational EBITDA to manage the business, including in preparing its annual operating budget, debt covenant compliance, financial projections and compensation plans. The Company believes that Operational EBITDA is also useful to investors because similar measures are frequently used by securities analysts, investors and other interested parties in their evaluation of companies in similar industries. However, there is no standardized measurement of Operational EBITDA, and Operational EBITDA as the Company presents it may not be comparable with similarly titled non-GAAP financial measures used by other companies. As indicated, Operational EBITDA does not include interest expense on borrowed money, the payment of income taxes, amortization of the Company’s definite-lived intangibles assets, or depreciation expense on the Company’s capital assets, which are necessary elements of the Company’s operations. It also excludes expenses in connection with the development, deployment and financing of Iridium NEXT and the loss from investment in Aireon. Since Operational EBITDA does not account for these and other expenses, its utility as a measure of the Company’s operating performance has material limitations. Due to these limitations, the Company’s management does not view Operational EBITDA in isolation, but also uses other measurements, such as net income, revenues and operating profit, to measure operating performance.Non-GAAP Financial Measures Non-GAAP Financial Measures In addition to disclosing financial results that are determined in accordance with U.S. GAAP, the Company provides Operational EBITDA and Operational EBITDA margin, which are non-GAAP financial measures, as supplemental measures to help investors evaluate the Company’s fundamental operational performance. Operational EBITDA represents earnings before interest, income taxes, depreciation and amortization, Iridium NEXT revenue and expenses (for periods prior to the deployment of Iridium NEXT only), loss from investment in Aireon, share-based compensation expenses, the impact of purchase accounting, and non-cash gain from the Boeing transaction. Iridium NEXT revenue and expenses were excluded from Operational EBITDA through 2017. Beginning in 2018, Iridium NEXT revenues and recurring Iridium NEXT expenses (recurring Iridium NEXT expenses are not part of the approximately $3 billion construction cost of Iridium NEXT (the “Construction Costs”)) were no longer excluded in calculating Operational EBITDA. U.S. GAAP requires that certain of the Construction Costs be expensed. These certain Construction Costs, which beginning in 2018 principally consisted of in-orbit insurance, will continue to be excluded from the calculation of Operational EBITDA through the first quarter of 2020. The Company also presents Operational EBITDA expressed as a percentage of GAAP revenue, or Operational EBITDA margin. Operational EBITDA, along with its related measure, Operational EBITDA margin, does not represent, and should not be considered, an alternative to U.S. GAAP measurements such as net income or loss, and the Company’s calculations thereof may not be comparable to similarly titled measures reported by other companies. A reconciliation of consolidated GAAP net income to Operational EBITDA is in the attached appendix. By eliminating interest, income taxes, depreciation and amortization, Iridium NEXT revenue and expenses (for periods prior to the deployment of Iridium NEXT only), loss from investment in Aireon, share-based compensation expenses, the impact of purchase accounting, and non-cash gain from the Boeing transaction, the Company believes the result is a useful measure across time in evaluating its fundamental core operating performance. Management also uses Operational EBITDA to manage the business, including in preparing its annual operating budget, debt covenant compliance, financial projections and compensation plans. The Company believes that Operational EBITDA is also useful to investors because similar measures are frequently used by securities analysts, investors and other interested parties in their evaluation of companies in similar industries. However, there is no standardized measurement of Operational EBITDA, and Operational EBITDA as the Company presents it may not be comparable with similarly titled non-GAAP financial measures used by other companies. As indicated, Operational EBITDA does not include interest expense on borrowed money, the payment of income taxes, amortization of the Company’s definite-lived intangibles assets, or depreciation expense on the Company’s capital assets, which are necessary elements of the Company’s operations. It also excludes expenses in connection with the development, deployment and financing of Iridium NEXT and the loss from investment in Aireon. Since Operational EBITDA does not account for these and other expenses, its utility as a measure of the Company’s operating performance has material limitations. Due to these limitations, the Company’s management does not view Operational EBITDA in isolation, but also uses other measurements, such as net income, revenues and operating profit, to measure operating performance.

Non-GAAP Financial MeasuresNon-GAAP Financial Measures

AGENDA Welcome | Ken Levy Corporate Strategy Overview | Matt Desch Iridium Operations | Suzi McBride Commercial Business | Bryan Hartin U.S. Government Business | Scott Scheimreif Q&A Satelles | Michael O’Connor Aireon | Don Thoma Financial & Operational Overview | Tom Fitzpatrick Q&AAGENDA Welcome | Ken Levy Corporate Strategy Overview | Matt Desch Iridium Operations | Suzi McBride Commercial Business | Bryan Hartin U.S. Government Business | Scott Scheimreif Q&A Satelles | Michael O’Connor Aireon | Don Thoma Financial & Operational Overview | Tom Fitzpatrick Q&A

Matt Desch Chief Executive OfficerMatt Desch Chief Executive Officer

Welcome! A lot has transpired since our last Investor Day in 2015… 7Welcome! A lot has transpired since our last Investor Day in 2015… 7

The Iridium Leadership Team Bringing Experience & Continuity Thomas J. Fitzpatrick Matthew J. Desch Suzi McBride Chief Financial Officer & Chief Executive Officer Chief Operations Officer Chief Administrative Officer Don Thoma Chief Executive Officer Aireon Thomas D. Hickey Bryan J. Hartin Scott T. Scheimreif Chief Legal Officer & Executive Vice President, Executive Vice President, Secretary Sales & Marketing U.S. Government Programs 8The Iridium Leadership Team Bringing Experience & Continuity Thomas J. Fitzpatrick Matthew J. Desch Suzi McBride Chief Financial Officer & Chief Executive Officer Chief Operations Officer Chief Administrative Officer Don Thoma Chief Executive Officer Aireon Thomas D. Hickey Bryan J. Hartin Scott T. Scheimreif Chief Legal Officer & Executive Vice President, Executive Vice President, Secretary Sales & Marketing U.S. Government Programs 8

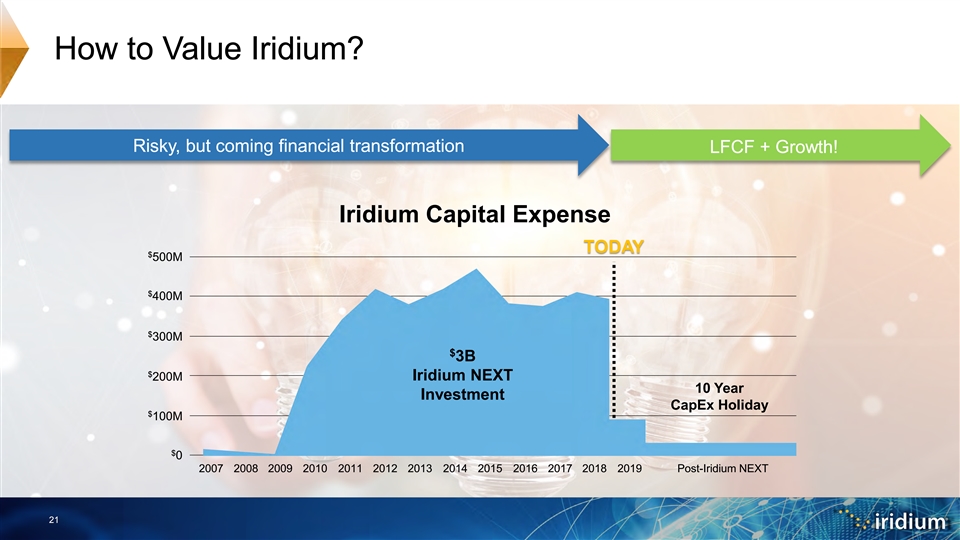

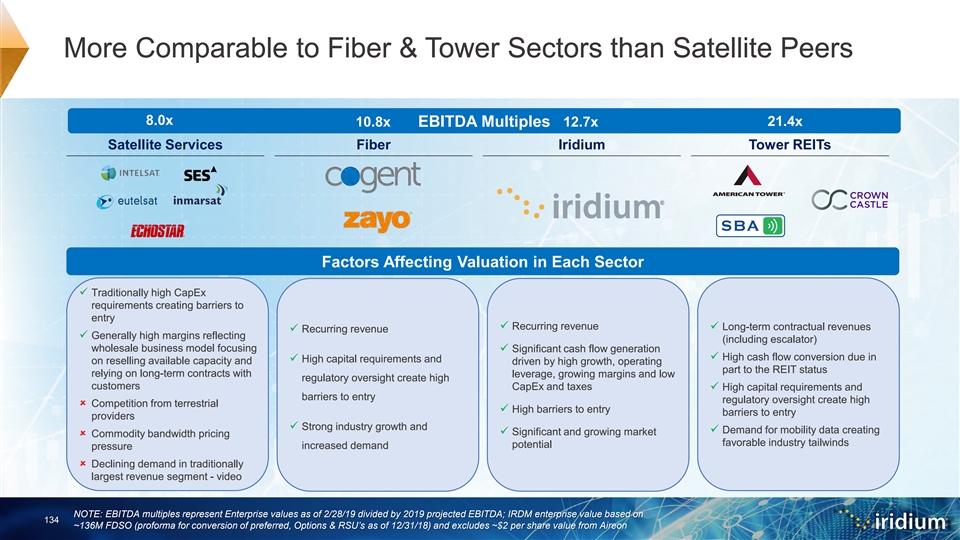

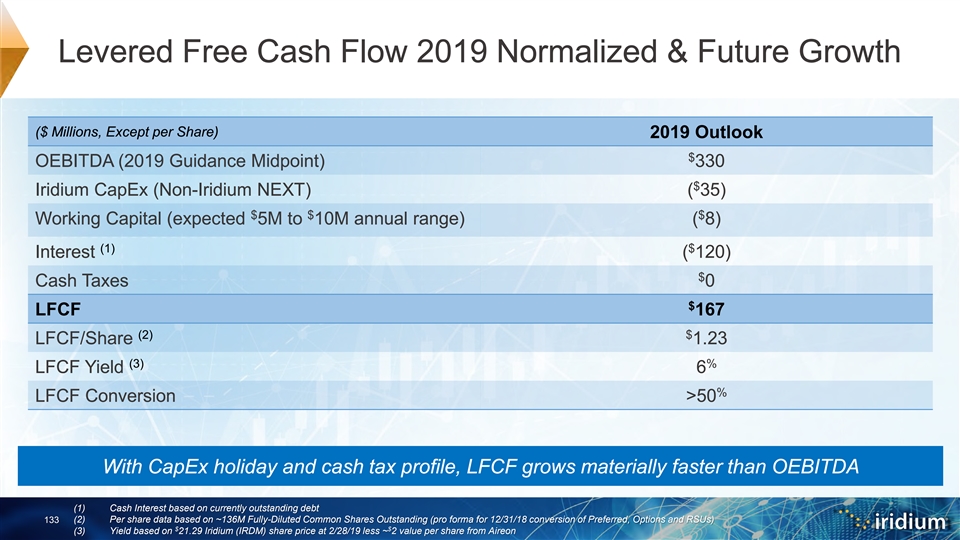

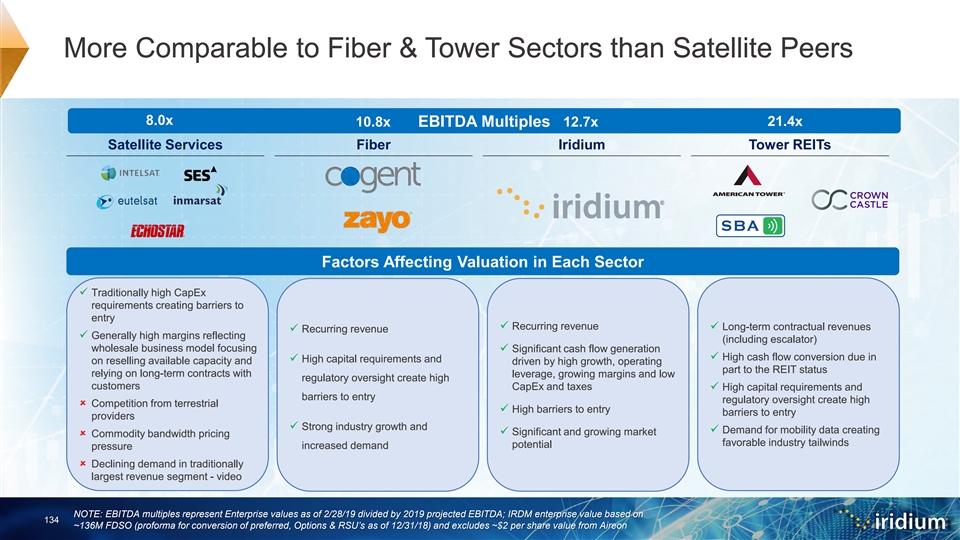

Executive Summary Powerful New Network Ready to Exploit $ Our 3B, multi-year project is complete! Growth Vectors Even Stronger IoT, Broadband, Government, Hosted Payloads, and more… Financial Transformation Has Begun! Valuation Considerations Levered Free Cash Flow (LFCF) AND growth company, not just another “satellite company” 9Executive Summary Powerful New Network Ready to Exploit $ Our 3B, multi-year project is complete! Growth Vectors Even Stronger IoT, Broadband, Government, Hosted Payloads, and more… Financial Transformation Has Begun! Valuation Considerations Levered Free Cash Flow (LFCF) AND growth company, not just another “satellite company” 9

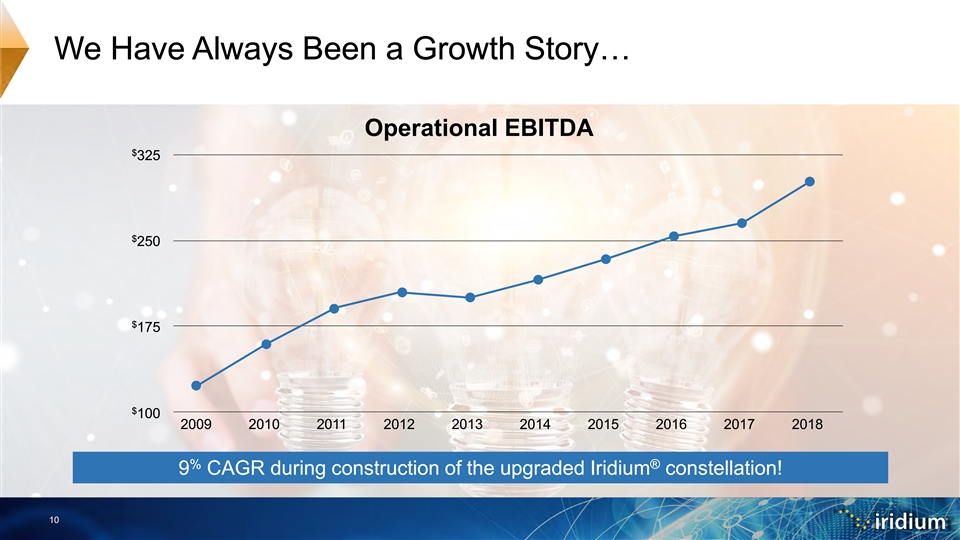

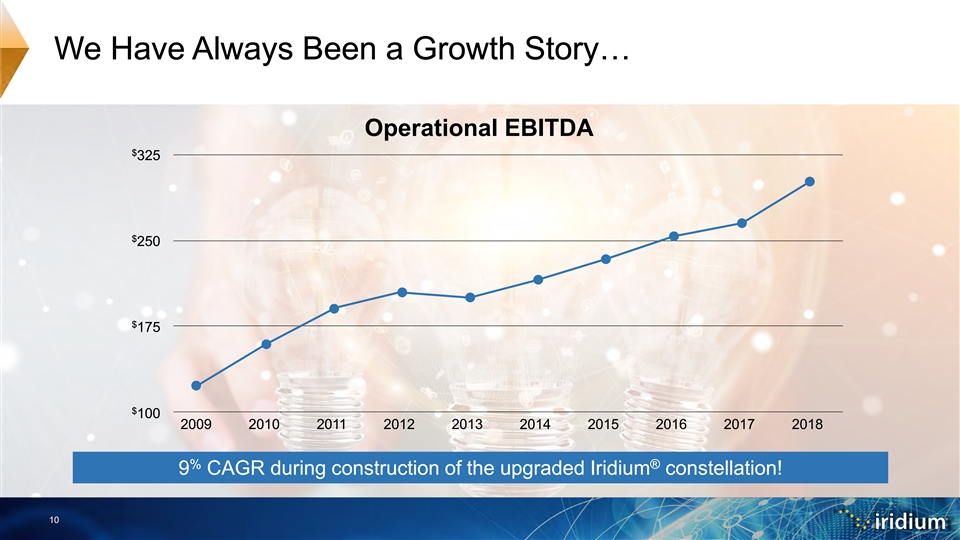

We Have Always Been a Growth Story… Operational EBITDA $ 325 $ 250 $ 175 $ 100 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 % ® 9 CAGR during construction of the upgraded Iridium constellation! 10We Have Always Been a Growth Story… Operational EBITDA $ 325 $ 250 $ 175 $ 100 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 % ® 9 CAGR during construction of the upgraded Iridium constellation! 10

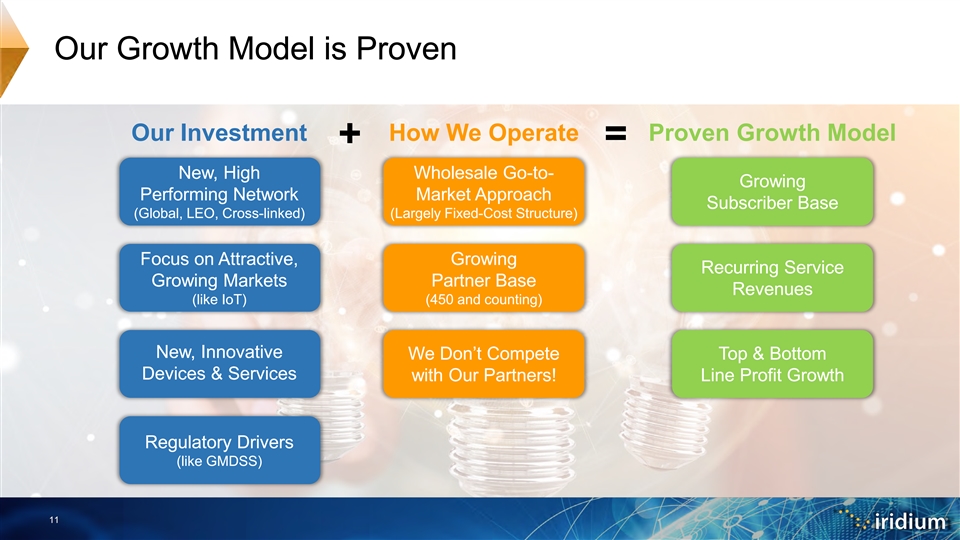

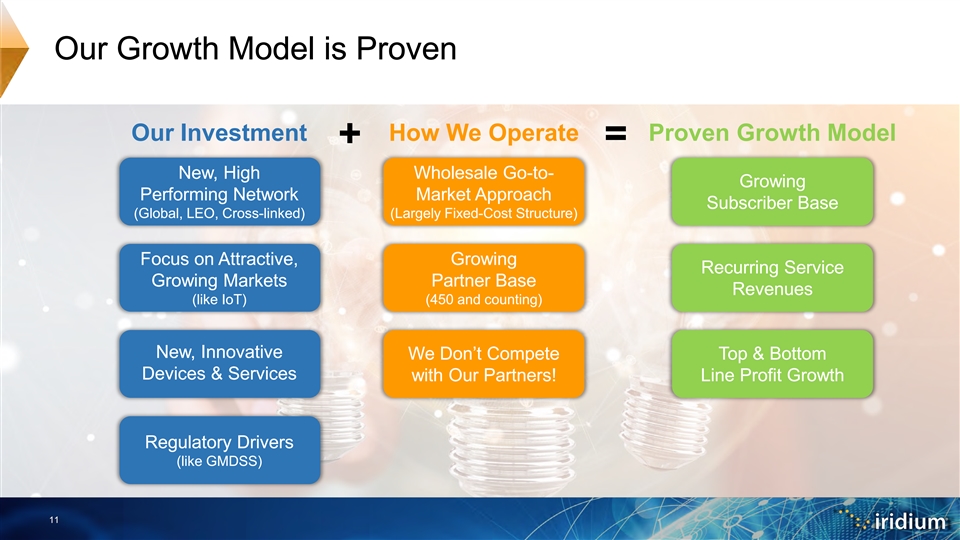

Our Growth Model is Proven Our Investment How We Operate Proven Growth Model + = New, High Wholesale Go-to- Growing Performing Network Market Approach Subscriber Base (Global, LEO, Cross-linked) (Largely Fixed-Cost Structure) Focus on Attractive, Growing Recurring Service Growing Markets Partner Base Revenues (like IoT) (450 and counting) New, Innovative We Don’t Compete Top & Bottom Devices & Services with Our Partners! Line Profit Growth Regulatory Drivers (like GMDSS) 11Our Growth Model is Proven Our Investment How We Operate Proven Growth Model + = New, High Wholesale Go-to- Growing Performing Network Market Approach Subscriber Base (Global, LEO, Cross-linked) (Largely Fixed-Cost Structure) Focus on Attractive, Growing Recurring Service Growing Markets Partner Base Revenues (like IoT) (450 and counting) New, Innovative We Don’t Compete Top & Bottom Devices & Services with Our Partners! Line Profit Growth Regulatory Drivers (like GMDSS) 11

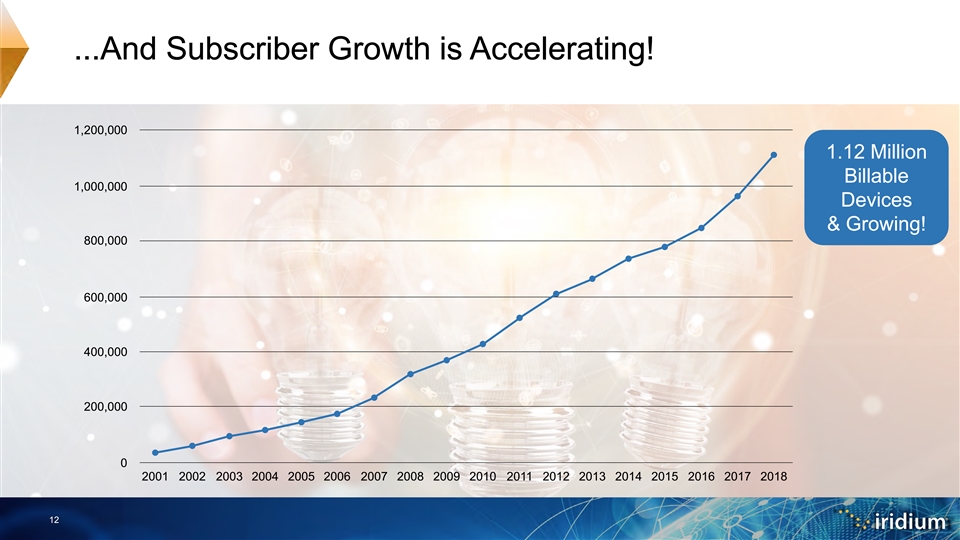

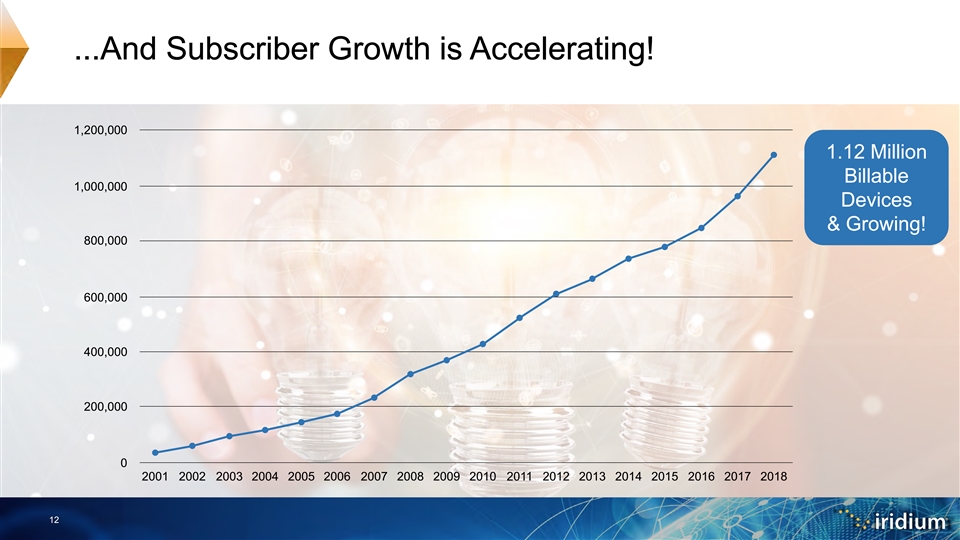

...And Subscriber Growth is Accelerating! 1,200,000 1.12 Million Billable 1,000,000 Devices & Growing! 800,000 600,000 400,000 200,000 0 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 12...And Subscriber Growth is Accelerating! 1,200,000 1.12 Million Billable 1,000,000 Devices & Growing! 800,000 600,000 400,000 200,000 0 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 12

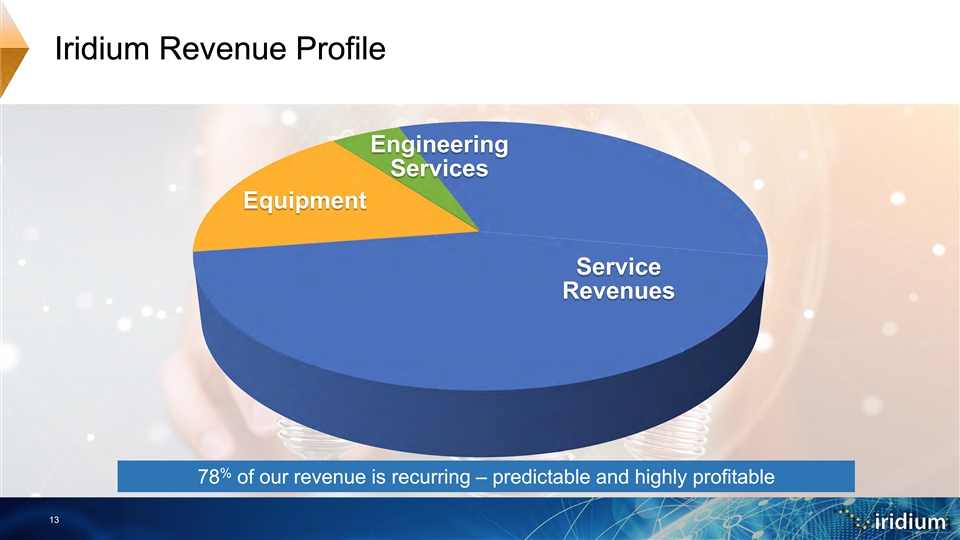

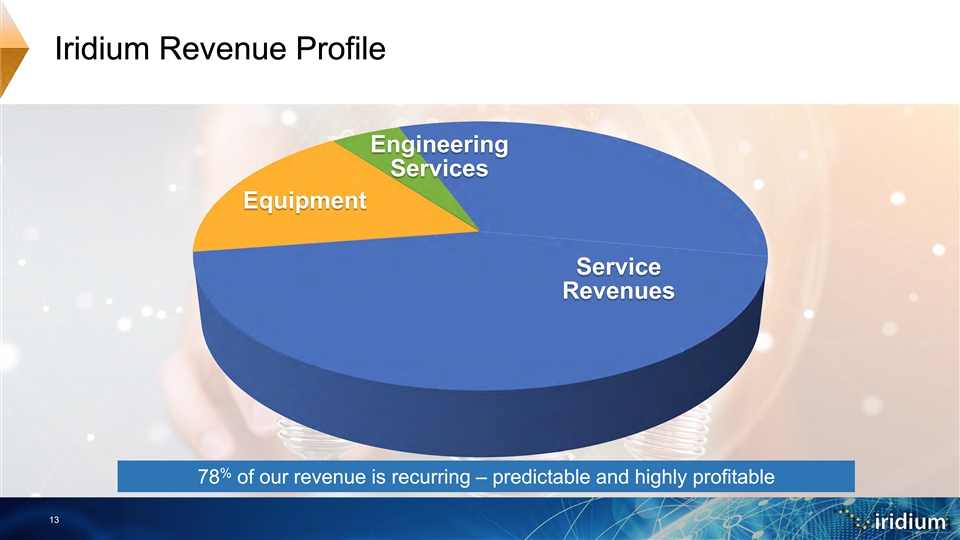

Iridium Revenue Profile Engineering Services Equipment Service Revenues % 78 of our revenue is recurring – predictable and highly profitable 13Iridium Revenue Profile Engineering Services Equipment Service Revenues % 78 of our revenue is recurring – predictable and highly profitable 13

Upgraded Iridium Constellation Creates Opportunities NEW EXPANDED Specialty Broadband IoT Services • Maritime / GMDSS • Satellite Time & Location SM • Aviation / GADSS • Iridium Certus Narrowband • Land Mobile / On-the-Move • Government / Secure Voice / PTT Potential Hosted Payloads U.S. Government • Aireon & Harris 14Upgraded Iridium Constellation Creates Opportunities NEW EXPANDED Specialty Broadband IoT Services • Maritime / GMDSS • Satellite Time & Location SM • Aviation / GADSS • Iridium Certus Narrowband • Land Mobile / On-the-Move • Government / Secure Voice / PTT Potential Hosted Payloads U.S. Government • Aireon & Harris 14

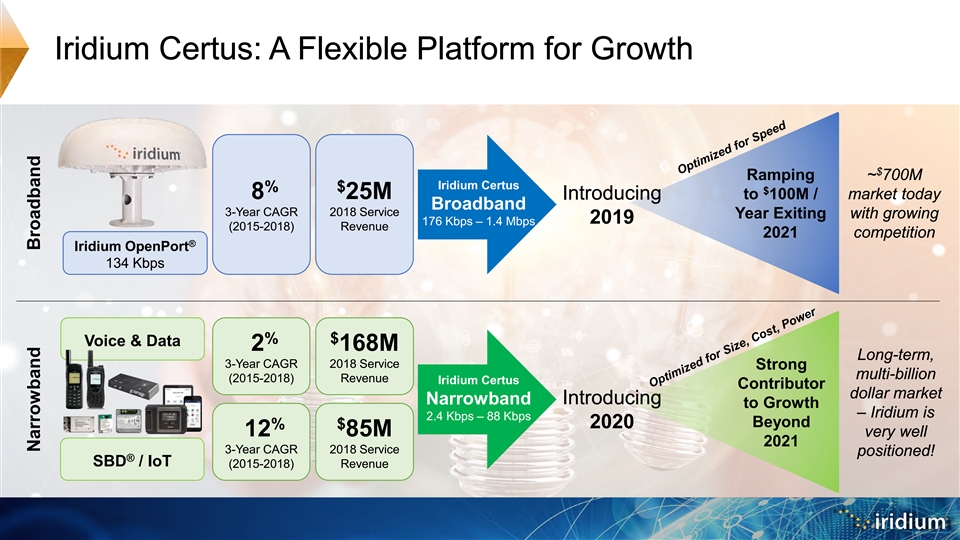

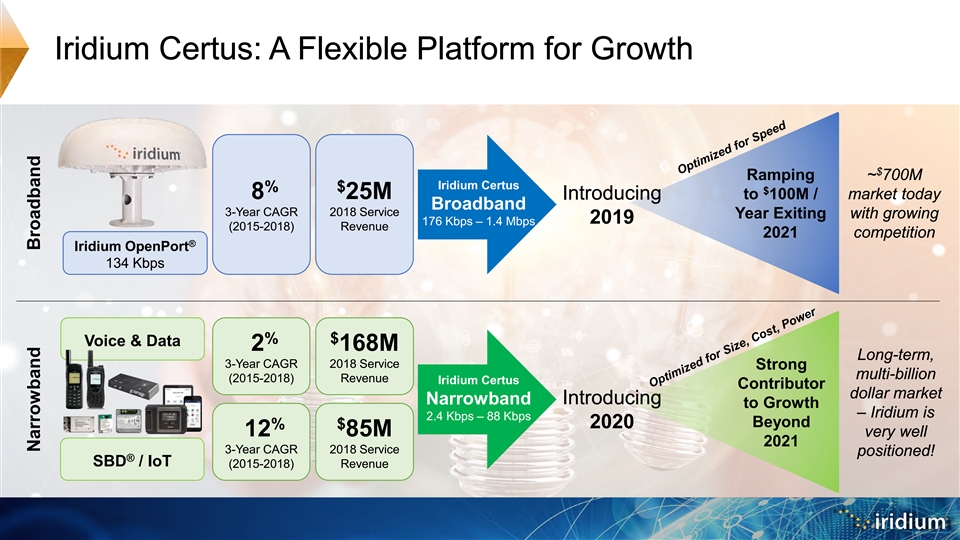

Iridium Certus: A Flexible Platform for Growth Iridium Certus % $ 8 25M Introducing Broadband 3-Year CAGR 2018 Service 2019 176 Kbps – 1.4 Mbps (2015-2018) Revenue ® Iridium OpenPort 134 Kbps % $ Voice & Data 2 168M 3-Year CAGR 2018 Service (2015-2018) Revenue Iridium Certus Introducing Narrowband 2.4 Kbps – 88 Kbps 2020 % $ 12 85M 3-Year CAGR 2018 Service ® SBD / IoT (2015-2018) Revenue Narrowband BroadbandIridium Certus: A Flexible Platform for Growth Iridium Certus % $ 8 25M Introducing Broadband 3-Year CAGR 2018 Service 2019 176 Kbps – 1.4 Mbps (2015-2018) Revenue ® Iridium OpenPort 134 Kbps % $ Voice & Data 2 168M 3-Year CAGR 2018 Service (2015-2018) Revenue Iridium Certus Introducing Narrowband 2.4 Kbps – 88 Kbps 2020 % $ 12 85M 3-Year CAGR 2018 Service ® SBD / IoT (2015-2018) Revenue Narrowband Broadband

Iridium Certus: A Flexible Platform for Growth $ Ramping ~ 700M Iridium Certus % $ $ 8 25M to 100M / market today Introducing Broadband 3-Year CAGR 2018 Service Year Exiting with growing 2019 176 Kbps – 1.4 Mbps (2015-2018) Revenue 2021 competition ® Iridium OpenPort 134 Kbps % $ Voice & Data 2 168M Long-term, 3-Year CAGR 2018 Service Strong multi-billion (2015-2018) Revenue Iridium Certus Contributor dollar market Introducing Narrowband to Growth – Iridium is 2.4 Kbps – 88 Kbps Beyond 2020 % $ 12 85M very well 2021 3-Year CAGR 2018 Service positioned! ® SBD / IoT (2015-2018) Revenue Narrowband BroadbandIridium Certus: A Flexible Platform for Growth $ Ramping ~ 700M Iridium Certus % $ $ 8 25M to 100M / market today Introducing Broadband 3-Year CAGR 2018 Service Year Exiting with growing 2019 176 Kbps – 1.4 Mbps (2015-2018) Revenue 2021 competition ® Iridium OpenPort 134 Kbps % $ Voice & Data 2 168M Long-term, 3-Year CAGR 2018 Service Strong multi-billion (2015-2018) Revenue Iridium Certus Contributor dollar market Introducing Narrowband to Growth – Iridium is 2.4 Kbps – 88 Kbps Beyond 2020 % $ 12 85M very well 2021 3-Year CAGR 2018 Service positioned! ® SBD / IoT (2015-2018) Revenue Narrowband Broadband

The Story of Iridium How to think about IridiumThe Story of Iridium How to think about Iridium

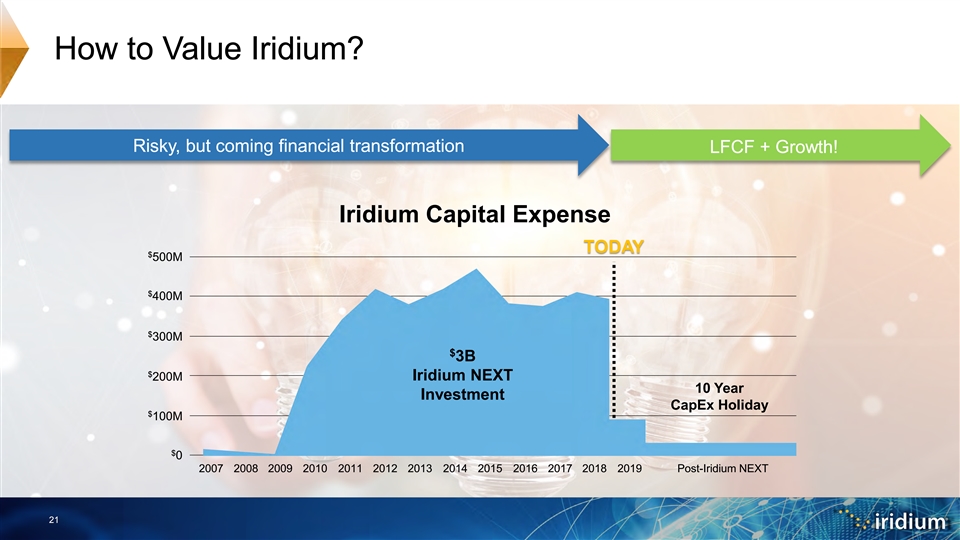

How to Value Iridium? Risky, but coming financial transformation LFCF + Growth! Iridium Capital Expense TODAY $ 500M $ 400M $ 300M $ 3B $ 200M Iridium NEXT 10 Year Investment CapEx Holiday $ 100M $ 0 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Post-Iridium NEXT 21How to Value Iridium? Risky, but coming financial transformation LFCF + Growth! Iridium Capital Expense TODAY $ 500M $ 400M $ 300M $ 3B $ 200M Iridium NEXT 10 Year Investment CapEx Holiday $ 100M $ 0 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Post-Iridium NEXT 21

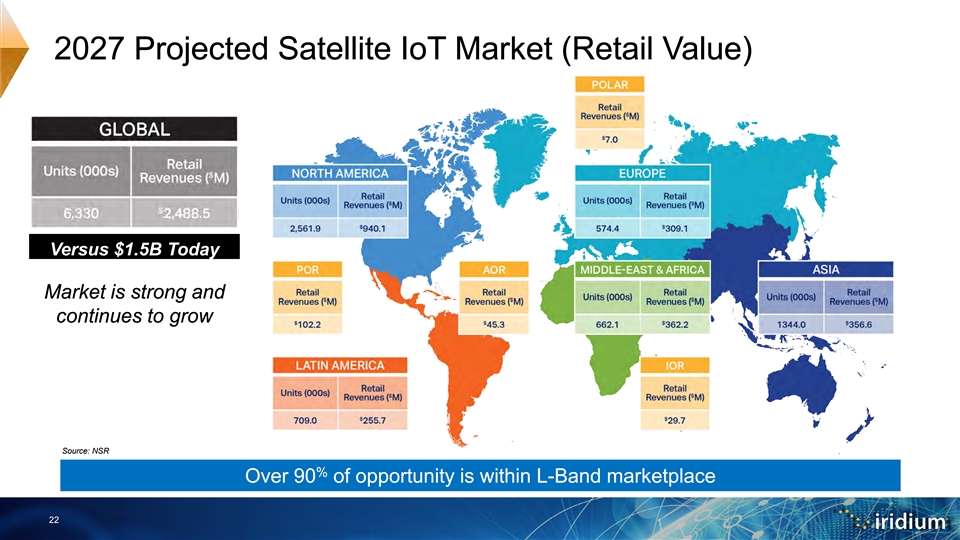

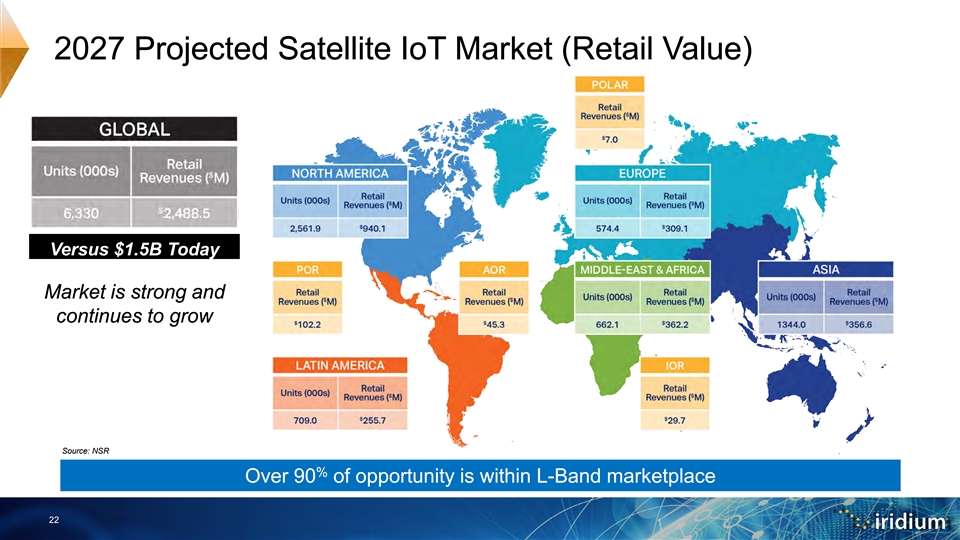

2027 Projected Satellite IoT Market (Retail Value) Versus $1.5B Today Market is strong and continues to grow Source: NSR % Over 90 of opportunity is within L-Band marketplace 222027 Projected Satellite IoT Market (Retail Value) Versus $1.5B Today Market is strong and continues to grow Source: NSR % Over 90 of opportunity is within L-Band marketplace 22

Coverage “Plateau” Fueling Satellite Growth Source: Gigaom Source: NSR Broad base of applications fueling growth and this should continue to diversify 23Coverage “Plateau” Fueling Satellite Growth Source: Gigaom Source: NSR Broad base of applications fueling growth and this should continue to diversify 23

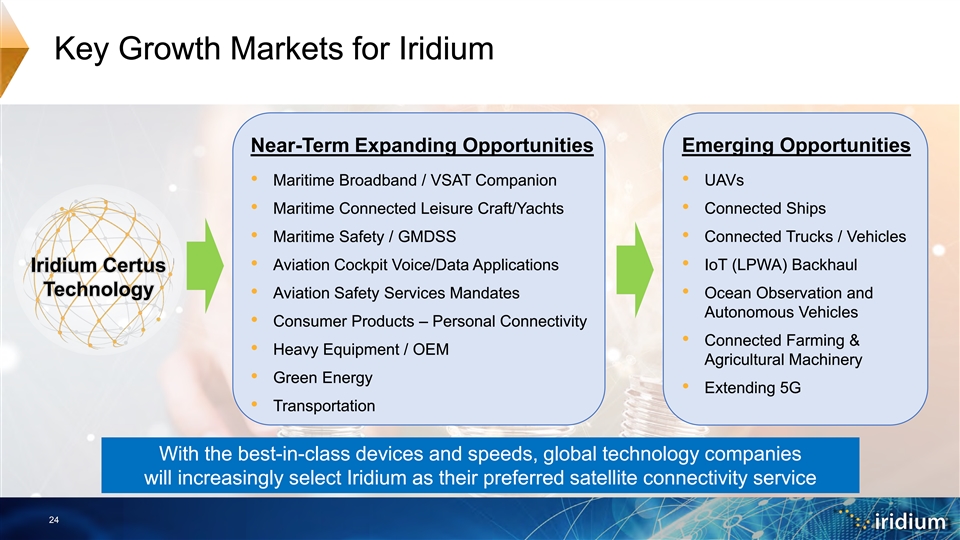

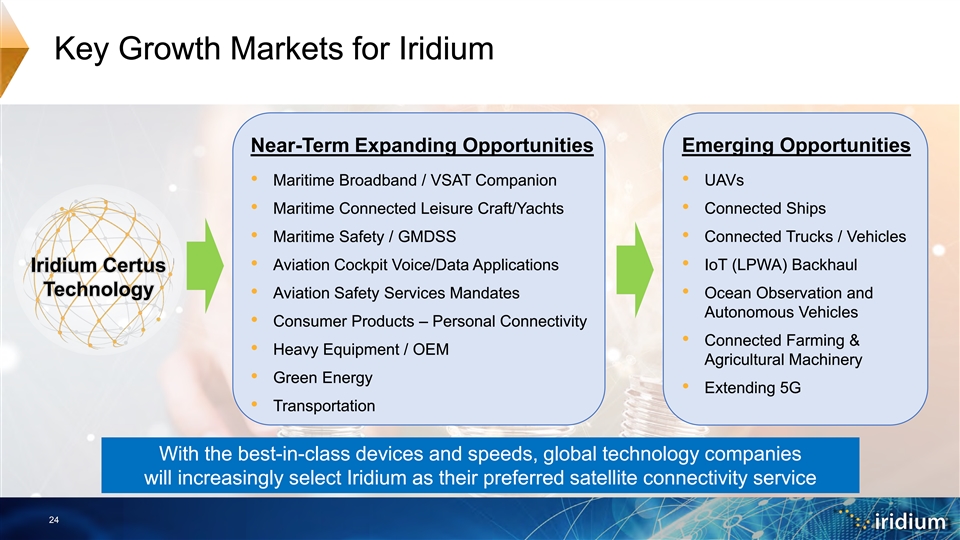

Key Growth Markets for Iridium Near-Term Expanding Opportunities Emerging Opportunities • Maritime Broadband / VSAT Companion • UAVs • Maritime Connected Leisure Craft/Yachts • Connected Ships • Maritime Safety / GMDSS • Connected Trucks / Vehicles • Aviation Cockpit Voice/Data Applications • IoT (LPWA) Backhaul Iridium Certus Technology • Ocean Observation and • Aviation Safety Services Mandates Autonomous Vehicles • Consumer Products – Personal Connectivity • Connected Farming & • Heavy Equipment / OEM Agricultural Machinery • Green Energy • Extending 5G • Transportation With the best-in-class devices and speeds, global technology companies will increasingly select Iridium as their preferred satellite connectivity service 24Key Growth Markets for Iridium Near-Term Expanding Opportunities Emerging Opportunities • Maritime Broadband / VSAT Companion • UAVs • Maritime Connected Leisure Craft/Yachts • Connected Ships • Maritime Safety / GMDSS • Connected Trucks / Vehicles • Aviation Cockpit Voice/Data Applications • IoT (LPWA) Backhaul Iridium Certus Technology • Ocean Observation and • Aviation Safety Services Mandates Autonomous Vehicles • Consumer Products – Personal Connectivity • Connected Farming & • Heavy Equipment / OEM Agricultural Machinery • Green Energy • Extending 5G • Transportation With the best-in-class devices and speeds, global technology companies will increasingly select Iridium as their preferred satellite connectivity service 24

The Next 20 Years Will Be Equally Exciting! 25The Next 20 Years Will Be Equally Exciting! 25

Suzi McBride Chief Operations OfficerSuzi McBride Chief Operations Officer

A Diverse & Wide-Ranging Organization 28A Diverse & Wide-Ranging Organization 28

® World-Class Iridium Network and Operations IMPROVED NEW SERVICE SERVICE & OUR 2019 FOCUS IRIDIUM CAPABILITIES QUALITY ARE AT IS GROWTH! NETWORK & PRODUCTS ALL-TIME HIGH 29® World-Class Iridium Network and Operations IMPROVED NEW SERVICE SERVICE & OUR 2019 FOCUS IRIDIUM CAPABILITIES QUALITY ARE AT IS GROWTH! NETWORK & PRODUCTS ALL-TIME HIGH 29

How Our Network Works Iridium Satellites Iridium Satellites Public & Private Networks Hosted Payload Services USG Commercial Gateway Gateway SM Iridium Iridium Certus Satellite Time USG Services Services & Location Services 30How Our Network Works Iridium Satellites Iridium Satellites Public & Private Networks Hosted Payload Services USG Commercial Gateway Gateway SM Iridium Iridium Certus Satellite Time USG Services Services & Location Services 30

The Only Truly Global Network Plot of Iridium Service Usage (Origination Points): February 7, 2019 – February 13, 2019 ® SBD Data Transmission Iridium Voice Call ® Iridium OpenPort Data Traffic Iridium Certus Session 31The Only Truly Global Network Plot of Iridium Service Usage (Origination Points): February 7, 2019 – February 13, 2019 ® SBD Data Transmission Iridium Voice Call ® Iridium OpenPort Data Traffic Iridium Certus Session 31

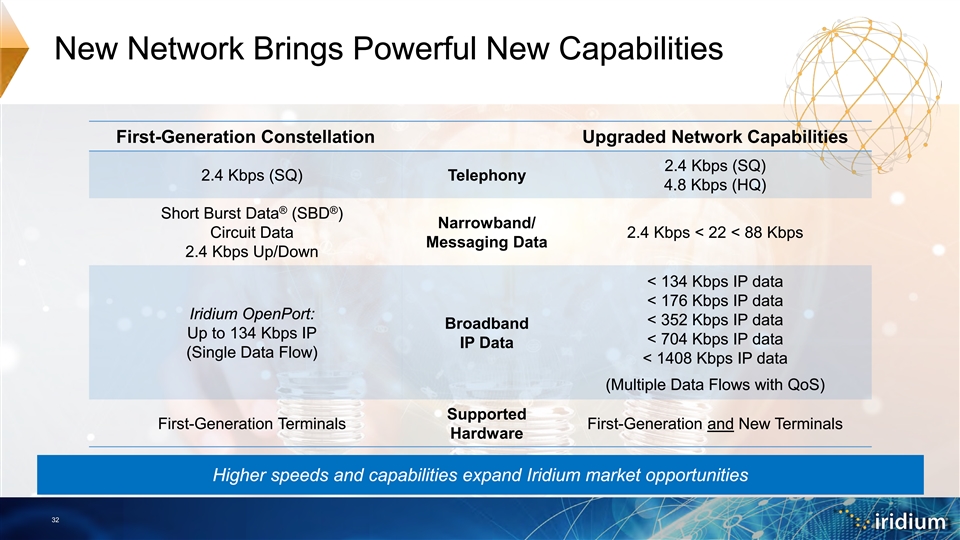

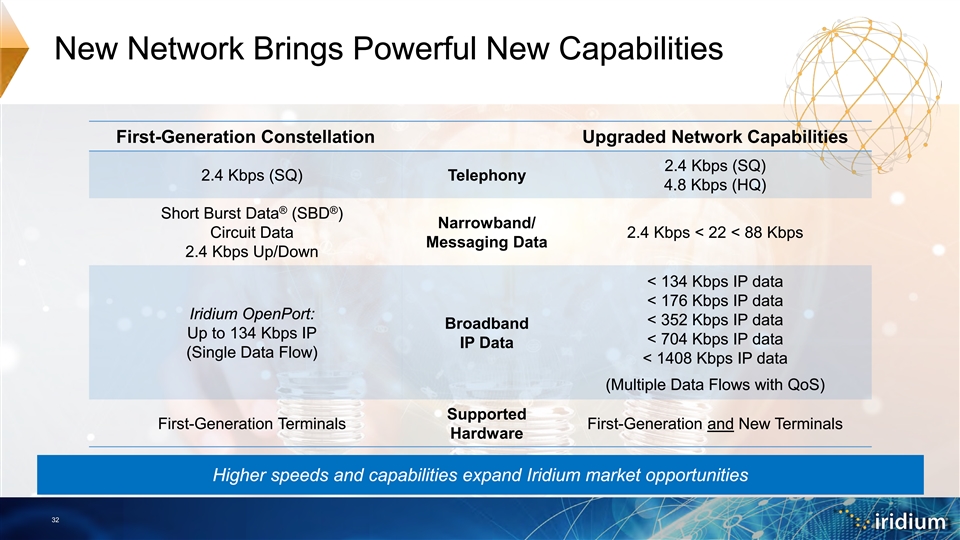

New Network Brings Powerful New Capabilities First-Generation Constellation Upgraded Network Capabilities 2.4 Kbps (SQ) 2.4 Kbps (SQ) Telephony 4.8 Kbps (HQ) ® ® Short Burst Data (SBD ) Narrowband/ Circuit Data 2.4 Kbps < 22 < 88 Kbps Messaging Data 2.4 Kbps Up/Down < 134 Kbps IP data < 176 Kbps IP data Iridium OpenPort: < 352 Kbps IP data Broadband Up to 134 Kbps IP < 704 Kbps IP data IP Data (Single Data Flow) < 1408 Kbps IP data (Multiple Data Flows with QoS) Supported First-Generation Terminals First-Generation and New Terminals Hardware Higher speeds and capabilities expand Iridium market opportunities 32New Network Brings Powerful New Capabilities First-Generation Constellation Upgraded Network Capabilities 2.4 Kbps (SQ) 2.4 Kbps (SQ) Telephony 4.8 Kbps (HQ) ® ® Short Burst Data (SBD ) Narrowband/ Circuit Data 2.4 Kbps < 22 < 88 Kbps Messaging Data 2.4 Kbps Up/Down < 134 Kbps IP data < 176 Kbps IP data Iridium OpenPort: < 352 Kbps IP data Broadband Up to 134 Kbps IP < 704 Kbps IP data IP Data (Single Data Flow) < 1408 Kbps IP data (Multiple Data Flows with QoS) Supported First-Generation Terminals First-Generation and New Terminals Hardware Higher speeds and capabilities expand Iridium market opportunities 32

New Satellites Offer Improved Performance First-Generation Satellites New Satellites 5-7 Years Design Life 12.5 Years 1100 Connections 1900+ Multiple User Waveforms - 1990s Fixed Technology & Waveforms Computers Reprogrammable Payload Processor Up to 6 Mbps Crosslinks Up to 17 Mbps Up to 3 Mbps Feeder-Links Up to 30 Mbps 640 kg Mass 840 kg 600 Watt Average Power 1300 Watt Average 60 A-hr Battery 126 A-hr 33New Satellites Offer Improved Performance First-Generation Satellites New Satellites 5-7 Years Design Life 12.5 Years 1100 Connections 1900+ Multiple User Waveforms - 1990s Fixed Technology & Waveforms Computers Reprogrammable Payload Processor Up to 6 Mbps Crosslinks Up to 17 Mbps Up to 3 Mbps Feeder-Links Up to 30 Mbps 640 kg Mass 840 kg 600 Watt Average Power 1300 Watt Average 60 A-hr Battery 126 A-hr 33

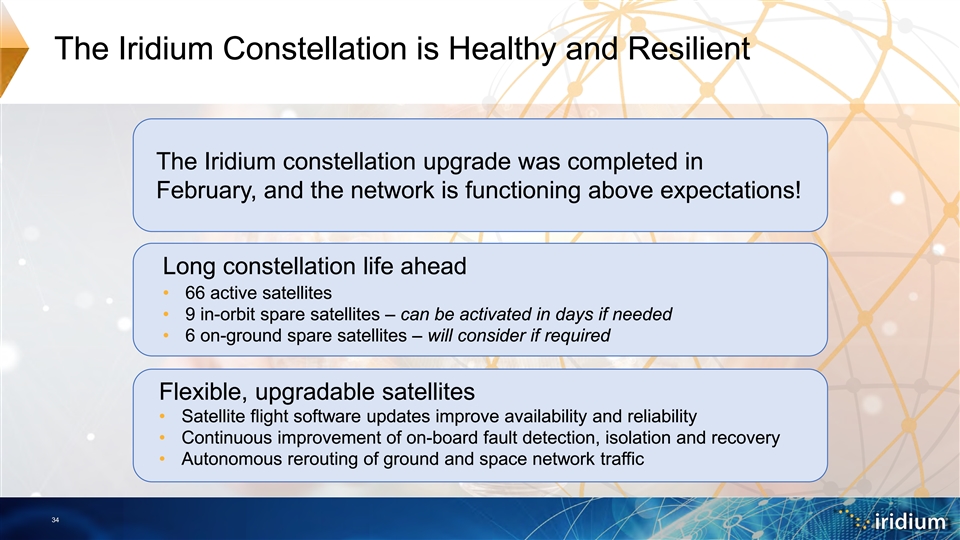

The Iridium Constellation is Healthy and Resilient The Iridium constellation upgrade was completed in February, and the network is functioning above expectations! Long constellation life ahead • 66 active satellites • 9 in-orbit spare satellites – can be activated in days if needed • 6 on-ground spare satellites – will consider if required Flexible, upgradable satellites • Satellite flight software updates improve availability and reliability • Continuous improvement of on-board fault detection, isolation and recovery • Autonomous rerouting of ground and space network traffic 34The Iridium Constellation is Healthy and Resilient The Iridium constellation upgrade was completed in February, and the network is functioning above expectations! Long constellation life ahead • 66 active satellites • 9 in-orbit spare satellites – can be activated in days if needed • 6 on-ground spare satellites – will consider if required Flexible, upgradable satellites • Satellite flight software updates improve availability and reliability • Continuous improvement of on-board fault detection, isolation and recovery • Autonomous rerouting of ground and space network traffic 34

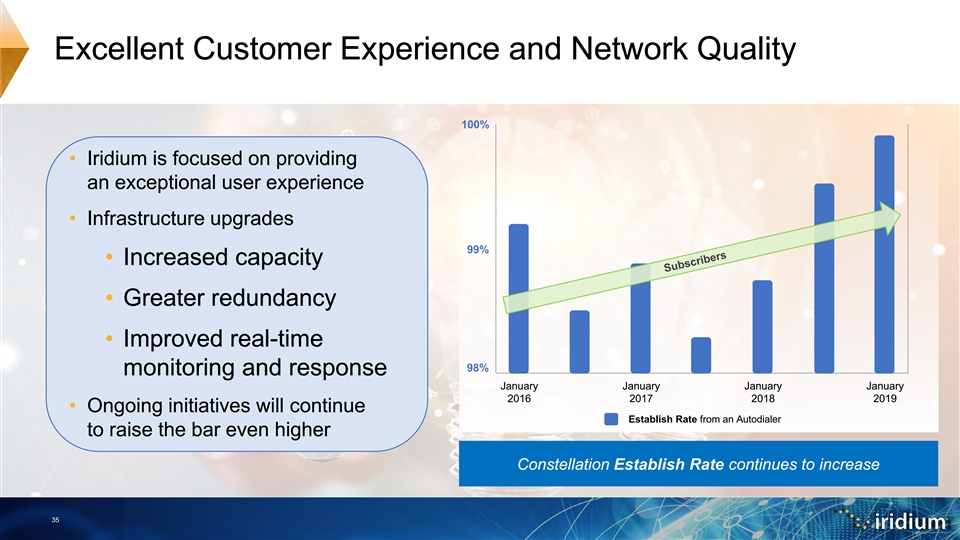

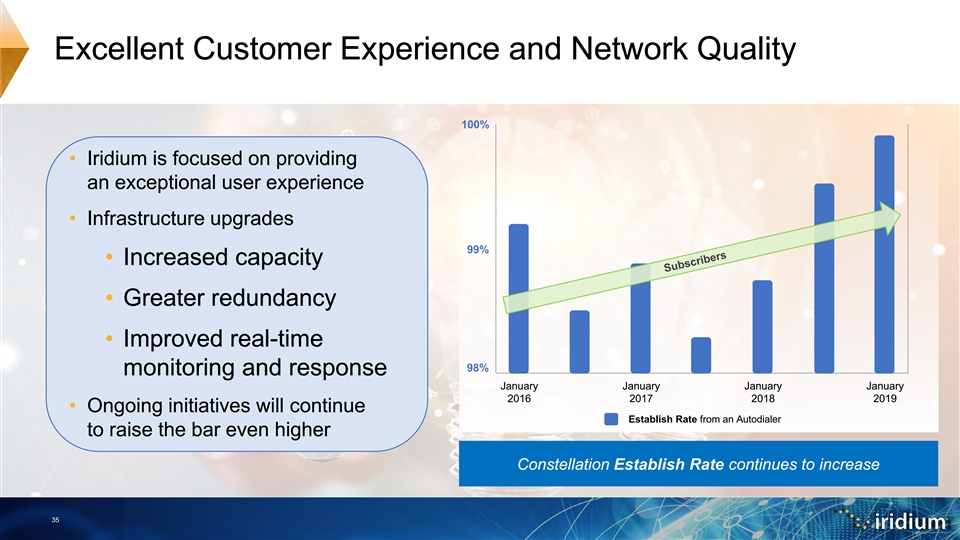

Excellent Customer Experience and Network Quality 100% • Iridium is focused on providing an exceptional user experience • Infrastructure upgrades 99% • Increased capacity • Greater redundancy • Improved real-time 98% monitoring and response January January January January 2016 2017 2018 2019 • Ongoing initiatives will continue Establish Rate from an Autodialer to raise the bar even higher Constellation Establish Rate continues to increase 35Excellent Customer Experience and Network Quality 100% • Iridium is focused on providing an exceptional user experience • Infrastructure upgrades 99% • Increased capacity • Greater redundancy • Improved real-time 98% monitoring and response January January January January 2016 2017 2018 2019 • Ongoing initiatives will continue Establish Rate from an Autodialer to raise the bar even higher Constellation Establish Rate continues to increase 35

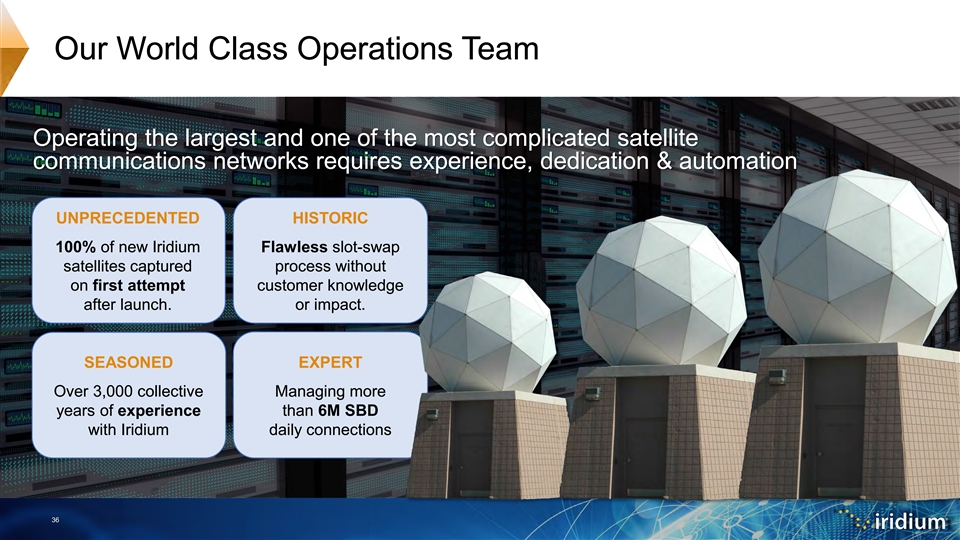

Our World Class Operations Team Operating the largest and one of the most complicated satellite communications networks requires experience, dedication & automation UNPRECEDENTED HISTORIC 100% of new Iridium Flawless slot-swap satellites captured process without on first attempt customer knowledge after launch. or impact. SEASONED EXPERT Over 3,000 collective Managing more years of experience than 6M SBD with Iridium daily connections 36Our World Class Operations Team Operating the largest and one of the most complicated satellite communications networks requires experience, dedication & automation UNPRECEDENTED HISTORIC 100% of new Iridium Flawless slot-swap satellites captured process without on first attempt customer knowledge after launch. or impact. SEASONED EXPERT Over 3,000 collective Managing more years of experience than 6M SBD with Iridium daily connections 36

The Iridium Network is Secure! • Latest security technology guards against intrusion and denial-of-service attacks • Feeder-links protected from rogue uplinks • Gateway infrastructure investments help manage incoming traffic • Ongoing external security audits • Encryption of critical commands using NSA-approved devices 37The Iridium Network is Secure! • Latest security technology guards against intrusion and denial-of-service attacks • Feeder-links protected from rogue uplinks • Gateway infrastructure investments help manage incoming traffic • Ongoing external security audits • Encryption of critical commands using NSA-approved devices 37

Thought Leader in Space Sustainability All first-generation satellites will be de-boosted in 2019 - and most will have re-entered by year-end 38Thought Leader in Space Sustainability All first-generation satellites will be de-boosted in 2019 - and most will have re-entered by year-end 38

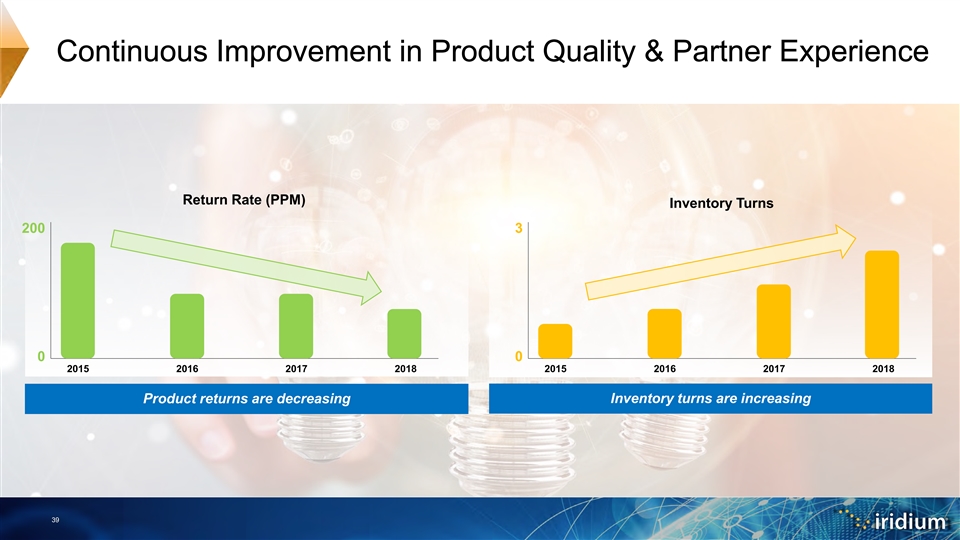

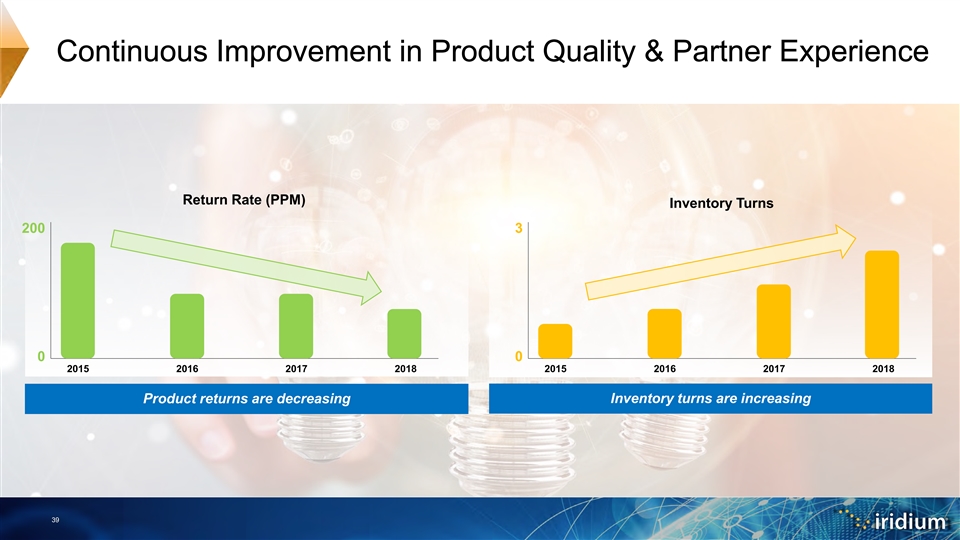

Continuous Improvement in Product Quality & Partner Experience Return Rate (PPM) Inventory Turns 200 3 0 0 2015 2016 2017 2018 2015 2016 2017 2018 Product returns are decreasing Inventory turns are increasing 39Continuous Improvement in Product Quality & Partner Experience Return Rate (PPM) Inventory Turns 200 3 0 0 2015 2016 2017 2018 2015 2016 2017 2018 Product returns are decreasing Inventory turns are increasing 39

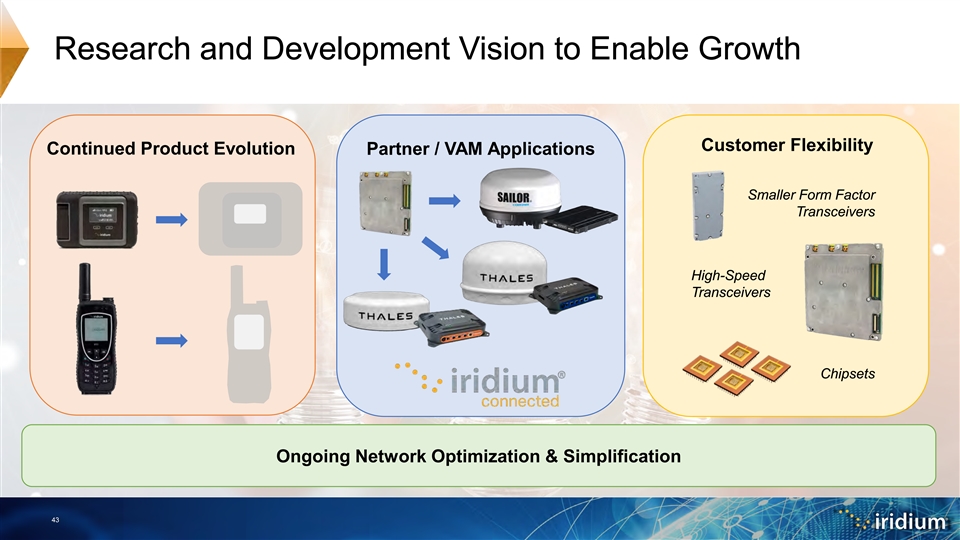

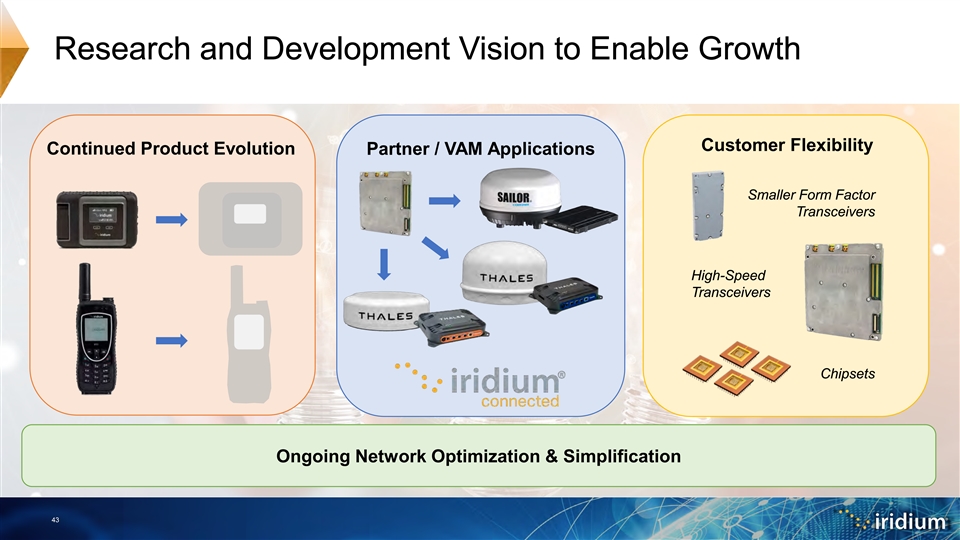

Exploiting Our New Network New Products Three Core Components of Research & Development Iridium Certus Services Network & Operational Improvements 42Exploiting Our New Network New Products Three Core Components of Research & Development Iridium Certus Services Network & Operational Improvements 42

Research and Development Vision to Enable Growth Customer Flexibility Continued Product Evolution Partner / VAM Applications Smaller Form Factor Transceivers High-Speed Transceivers Chipsets Ongoing Network Optimization & Simplification 43Research and Development Vision to Enable Growth Customer Flexibility Continued Product Evolution Partner / VAM Applications Smaller Form Factor Transceivers High-Speed Transceivers Chipsets Ongoing Network Optimization & Simplification 43

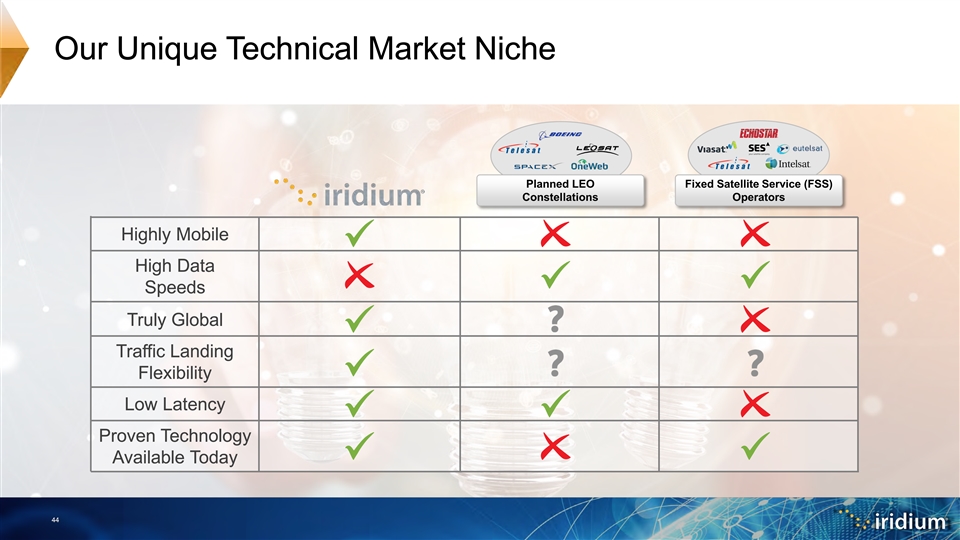

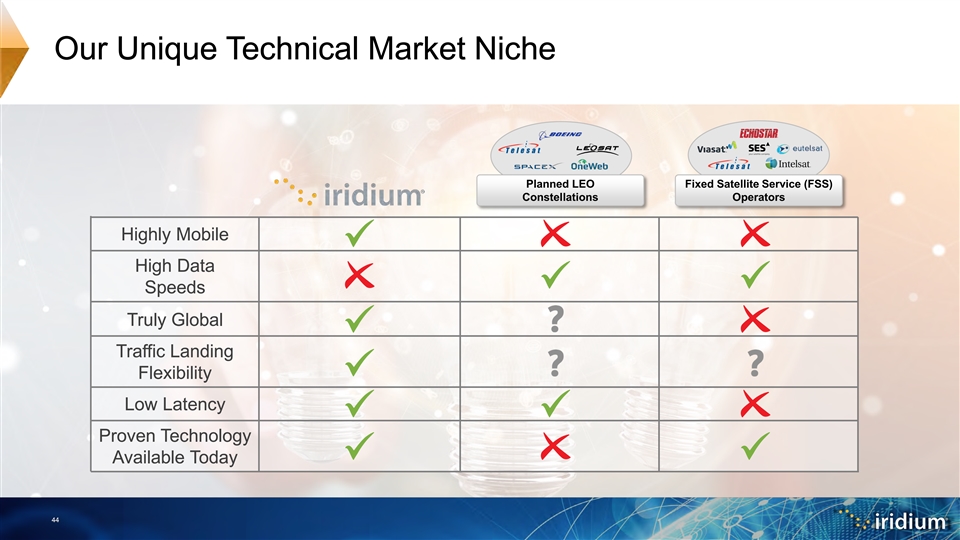

Our Unique Technical Market Niche Planned LEO Fixed Satellite Service (FSS) Constellations Operators Highly Mobile High Data Speeds Truly Global Traffic Landing Flexibility Low Latency Proven Technology Available Today 44Our Unique Technical Market Niche Planned LEO Fixed Satellite Service (FSS) Constellations Operators Highly Mobile High Data Speeds Truly Global Traffic Landing Flexibility Low Latency Proven Technology Available Today 44

Our Unique Technical Market Niche Planned LEO Fixed Satellite Service (FSS) Constellations Operators Highly Mobile High Data Speeds Truly Global Traffic Landing Flexibility Low Latency Low Bandwidth/ Proven Technology Highly Mobile/ High Bandwidth/ Available Today High Availability Low Latency/ Fixed High-Speed Markets Global Markets Broadcast Markets 45Our Unique Technical Market Niche Planned LEO Fixed Satellite Service (FSS) Constellations Operators Highly Mobile High Data Speeds Truly Global Traffic Landing Flexibility Low Latency Low Bandwidth/ Proven Technology Highly Mobile/ High Bandwidth/ Available Today High Availability Low Latency/ Fixed High-Speed Markets Global Markets Broadcast Markets 45

2019 Focus Areas New Products & Services • Iridium Certus platform evolution • New narrowband transceivers (Iridium Certus 9770) • Global Maritime Distress and Safety System (GMDSS) Continued Quality Improvement • New U.S. manufacturing site • Improved customer support • Faster gateway recoveries • Increased satellite operations automation Hemispheric Diversity • Adding southern hemisphere ground site for geographic diversity will help manage constellation congestion as Iridium network traffic grows 462019 Focus Areas New Products & Services • Iridium Certus platform evolution • New narrowband transceivers (Iridium Certus 9770) • Global Maritime Distress and Safety System (GMDSS) Continued Quality Improvement • New U.S. manufacturing site • Improved customer support • Faster gateway recoveries • Increased satellite operations automation Hemispheric Diversity • Adding southern hemisphere ground site for geographic diversity will help manage constellation congestion as Iridium network traffic grows 46

Bryan Hartin Executive Vice President, Sales & MarketingBryan Hartin Executive Vice President, Sales & Marketing

2013 2019 Iridium’s business has transformed over the past 6 years… 492013 2019 Iridium’s business has transformed over the past 6 years… 49

Key Fundamentals for Growth Introduce finished Maintain wholesale Enable partner product ® Iridium products approach growth with modules as required and transceivers Iridium has a strong business model and product portfolio as a basis for future growth 50Key Fundamentals for Growth Introduce finished Maintain wholesale Enable partner product ® Iridium products approach growth with modules as required and transceivers Iridium has a strong business model and product portfolio as a basis for future growth 50

What We Sell PRODUCTS SERVICES CIRCUIT SWITCH HANDSETS VOICE & DATA ® IRIDIUM VOICE & DATA PUSH-TO-TALK TRANSCEIVERS ® SBD IoT / SHORT ® TRANSCEIVERS BURST DATA CUSTOM IoT CHIPSETS SOLUTIONS BROADBAND ® IRIDIUM PILOT SERVICES 51What We Sell PRODUCTS SERVICES CIRCUIT SWITCH HANDSETS VOICE & DATA ® IRIDIUM VOICE & DATA PUSH-TO-TALK TRANSCEIVERS ® SBD IoT / SHORT ® TRANSCEIVERS BURST DATA CUSTOM IoT CHIPSETS SOLUTIONS BROADBAND ® IRIDIUM PILOT SERVICES 51

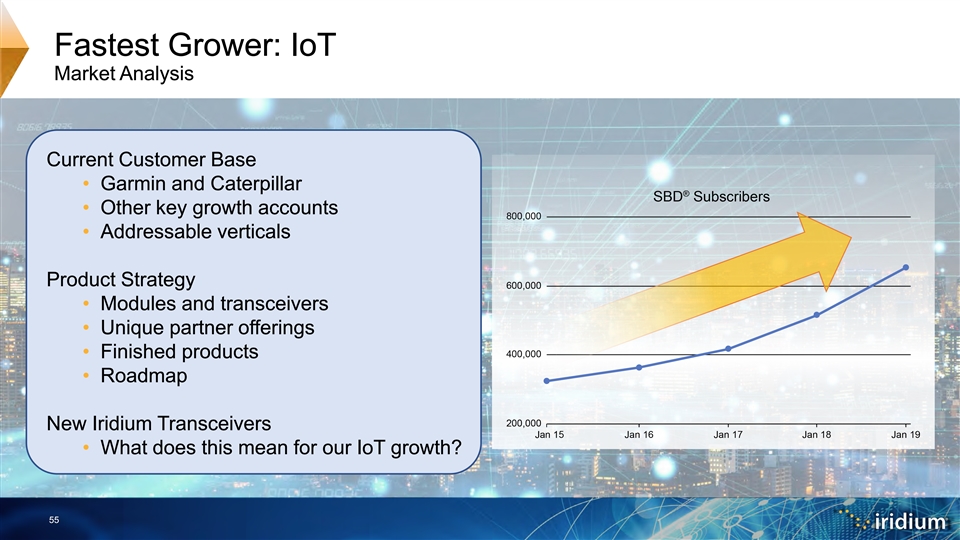

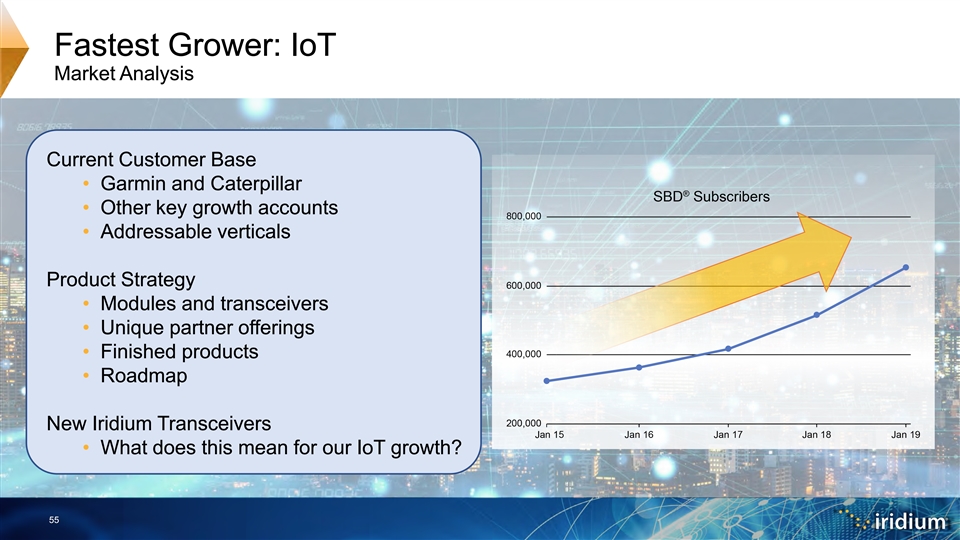

Here and Now: Iridium is a Growth Company Key drivers of success are based on our position in each of our target growth markets All markets have growth opportunities in Maritime IoT 2019 and beyond! Existing customer base Innovative partner plus new products and solutions continue to drive services drive our future Land Mobile subscribers and revenue Recurring revenue and ® • Solid Iridium OpenPort • Garmin and Caterpillar a sticky customer base customer base have been growth drivers is our foundation for Iridium as a whole • Broadband offering SM • Struggling handheld with Iridium Certus 350/700 • Strong position with Aviation competitors provides market opening heavy equipment OEMs Iridium owns the cockpit is key lever for growth • GMDSS recognition enables • Premium products ® • Business aviation cabin new opportunity (i.e. Iridium Extreme • Small form-factor, expansion and Iridium Extreme PTT) low-latency, and low-cost are key differentiators • Leader in safety services • Recreational explorer ® market leader (Iridium GO! ) • UAVs 52Here and Now: Iridium is a Growth Company Key drivers of success are based on our position in each of our target growth markets All markets have growth opportunities in Maritime IoT 2019 and beyond! Existing customer base Innovative partner plus new products and solutions continue to drive services drive our future Land Mobile subscribers and revenue Recurring revenue and ® • Solid Iridium OpenPort • Garmin and Caterpillar a sticky customer base customer base have been growth drivers is our foundation for Iridium as a whole • Broadband offering SM • Struggling handheld with Iridium Certus 350/700 • Strong position with Aviation competitors provides market opening heavy equipment OEMs Iridium owns the cockpit is key lever for growth • GMDSS recognition enables • Premium products ® • Business aviation cabin new opportunity (i.e. Iridium Extreme • Small form-factor, expansion and Iridium Extreme PTT) low-latency, and low-cost are key differentiators • Leader in safety services • Recreational explorer ® market leader (Iridium GO! ) • UAVs 52

Hitting the Growth Gear • Upgraded Network • World-Class Technology and Distribution Partners • Attractive Market Opportunities • Regulatory Drivers (GMDSS, AMSRS, GADSS) • Iridium Certus Products and Services • World-Class Marketing with Global Reach • Surgical Direct to Stimulate Demand / “Feet on the Street” Iridium growth machine is running hot across all verticals 53Hitting the Growth Gear • Upgraded Network • World-Class Technology and Distribution Partners • Attractive Market Opportunities • Regulatory Drivers (GMDSS, AMSRS, GADSS) • Iridium Certus Products and Services • World-Class Marketing with Global Reach • Surgical Direct to Stimulate Demand / “Feet on the Street” Iridium growth machine is running hot across all verticals 53

Tim Last | VP & GM, Iridium IoT Business 54Tim Last | VP & GM, Iridium IoT Business 54

Fastest Grower: IoT Market Analysis Current Customer Base • Garmin and Caterpillar • Other key growth accounts • Addressable verticals Product Strategy • Modules and transceivers • Unique partner offerings • Finished products • Roadmap New Iridium Transceivers • What does this mean for our IoT growth? 55Fastest Grower: IoT Market Analysis Current Customer Base • Garmin and Caterpillar • Other key growth accounts • Addressable verticals Product Strategy • Modules and transceivers • Unique partner offerings • Finished products • Roadmap New Iridium Transceivers • What does this mean for our IoT growth? 55

IoT Strategy 56IoT Strategy 56

Top 3 IoT Priorities 57Top 3 IoT Priorities 57

5858

Partnership 59Partnership 59

Wholesale Business StrategyWholesale Business Strategy

Wholesale Business Strategy Partners represent: • Face to the customer • Solution and service experts • Market and geography experts Iridium delivers: • Reliable network, products, services • Wholesale distribution program • Resources to stimulate demand Iridium does NOT compete with its partners 61Wholesale Business Strategy Partners represent: • Face to the customer • Solution and service experts • Market and geography experts Iridium delivers: • Reliable network, products, services • Wholesale distribution program • Resources to stimulate demand Iridium does NOT compete with its partners 61

Partner Growth: Expertise & Value Growth Targets: 400+ • Global heavy equipment OEMs • Railways • UAVs • Foreign MODs • Airframes • Cloud partners • Autonomous ships 2012 2019 Iridium partners provide the “secret sauce” for our growth 62 Selling PartnersPartner Growth: Expertise & Value Growth Targets: 400+ • Global heavy equipment OEMs • Railways • UAVs • Foreign MODs • Airframes • Cloud partners • Autonomous ships 2012 2019 Iridium partners provide the “secret sauce” for our growth 62 Selling Partners

63 63

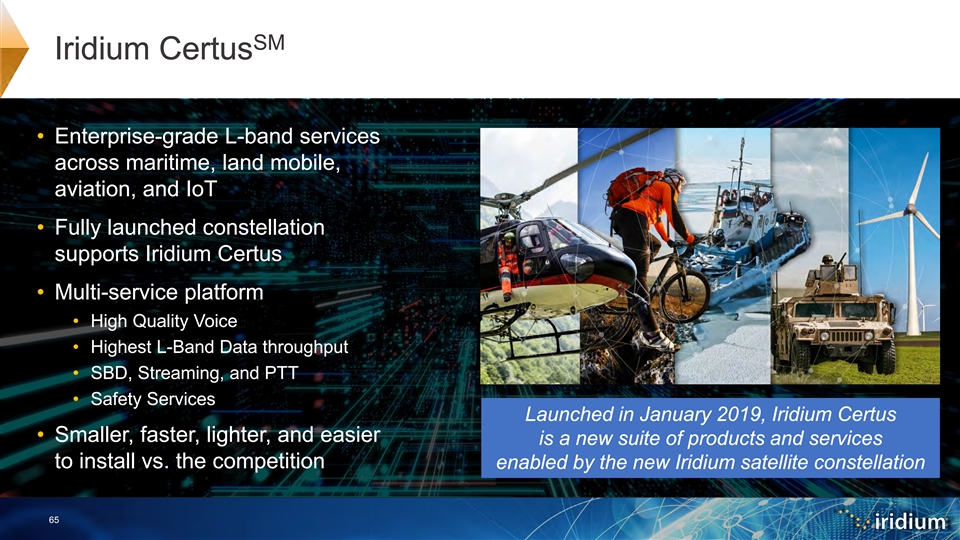

SM Iridium Certus • Enterprise-grade L-band services across maritime, land mobile, aviation, and IoT • Fully launched constellation supports Iridium Certus • Multi-service platform • High Quality Voice • Highest L-Band Data throughput • SBD, Streaming, and PTT • Safety Services Launched in January 2019, Iridium Certus • Smaller, faster, lighter, and easier is a new suite of products and services to install vs. the competition enabled by the new Iridium satellite constellation 65SM Iridium Certus • Enterprise-grade L-band services across maritime, land mobile, aviation, and IoT • Fully launched constellation supports Iridium Certus • Multi-service platform • High Quality Voice • Highest L-Band Data throughput • SBD, Streaming, and PTT • Safety Services Launched in January 2019, Iridium Certus • Smaller, faster, lighter, and easier is a new suite of products and services to install vs. the competition enabled by the new Iridium satellite constellation 65

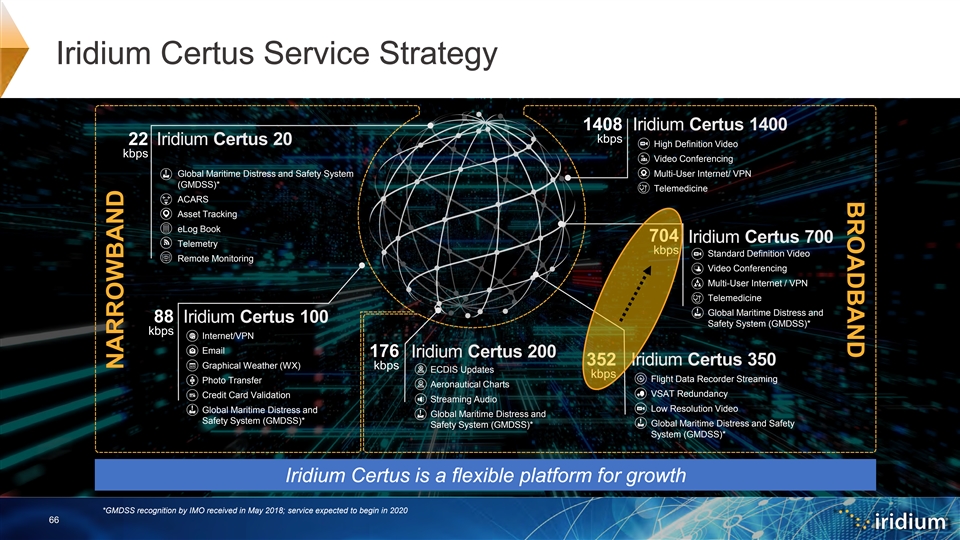

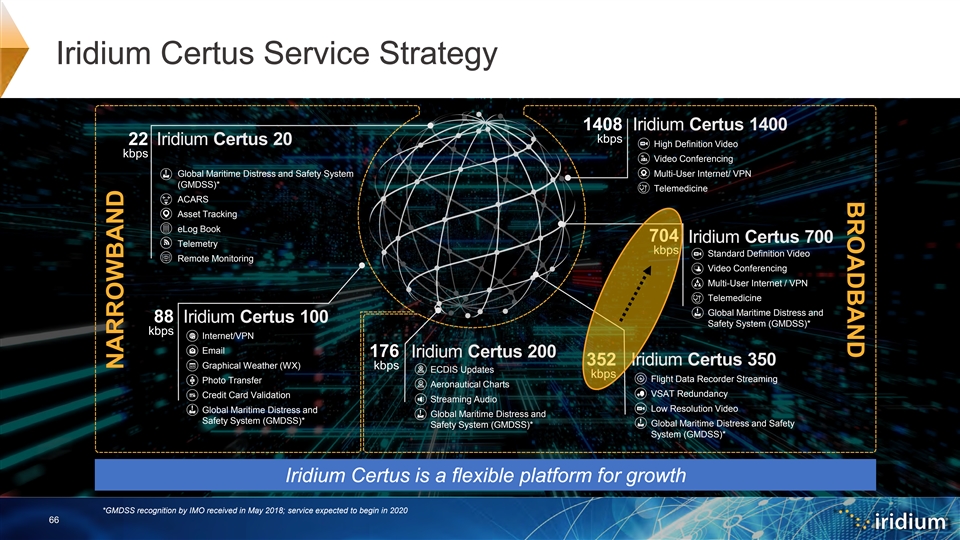

BROADBAND Iridium Certus Service Strategy 1408 Iridium Certus 1400 kbps 22 Iridium Certus 20 High Definition Video kbps Video Conferencing Global Maritime Distress and Safety System Multi-User Internet/ VPN (GMDSS)* Telemedicine ACARS Asset Tracking eLog Book 704 Iridium Certus 700 Telemetry kbps Standard Definition Video Remote Monitoring Video Conferencing Multi-User Internet / VPN Telemedicine Global Maritime Distress and 88 Iridium Certus 100 Safety System (GMDSS)* kbps Internet/VPN Email 176 Iridium Certus 200 352 Iridium Certus 350 Graphical Weather (WX) kbps ECDIS Updates kbps Flight Data Recorder Streaming Photo Transfer Aeronautical Charts VSAT Redundancy Credit Card Validation Streaming Audio Low Resolution Video Global Maritime Distress and Global Maritime Distress and Safety System (GMDSS)* Global Maritime Distress and Safety Safety System (GMDSS)* System (GMDSS)* Iridium Certus is a flexible platform for growth *GMDSS recognition by IMO received in May 2018; service expected to begin in 2020 66 NARROWBANDBROADBAND Iridium Certus Service Strategy 1408 Iridium Certus 1400 kbps 22 Iridium Certus 20 High Definition Video kbps Video Conferencing Global Maritime Distress and Safety System Multi-User Internet/ VPN (GMDSS)* Telemedicine ACARS Asset Tracking eLog Book 704 Iridium Certus 700 Telemetry kbps Standard Definition Video Remote Monitoring Video Conferencing Multi-User Internet / VPN Telemedicine Global Maritime Distress and 88 Iridium Certus 100 Safety System (GMDSS)* kbps Internet/VPN Email 176 Iridium Certus 200 352 Iridium Certus 350 Graphical Weather (WX) kbps ECDIS Updates kbps Flight Data Recorder Streaming Photo Transfer Aeronautical Charts VSAT Redundancy Credit Card Validation Streaming Audio Low Resolution Video Global Maritime Distress and Global Maritime Distress and Safety System (GMDSS)* Global Maritime Distress and Safety Safety System (GMDSS)* System (GMDSS)* Iridium Certus is a flexible platform for growth *GMDSS recognition by IMO received in May 2018; service expected to begin in 2020 66 NARROWBAND

Iridium Certus Initial Product Strategy High Quality Robust ✓ ✓ VesseLINK SAILOR 4300 Powerful World Class ✓✓ MissionLINK Recognized Affordable ✓✓ Brand Safety Easy Install FlytLINK ✓✓ Supported Lighter ✓ ✓ Iridium VAMs have developed superior product offerings based on Iridium’s new, advanced satellite network 67Iridium Certus Initial Product Strategy High Quality Robust ✓ ✓ VesseLINK SAILOR 4300 Powerful World Class ✓✓ MissionLINK Recognized Affordable ✓✓ Brand Safety Easy Install FlytLINK ✓✓ Supported Lighter ✓ ✓ Iridium VAMs have developed superior product offerings based on Iridium’s new, advanced satellite network 67

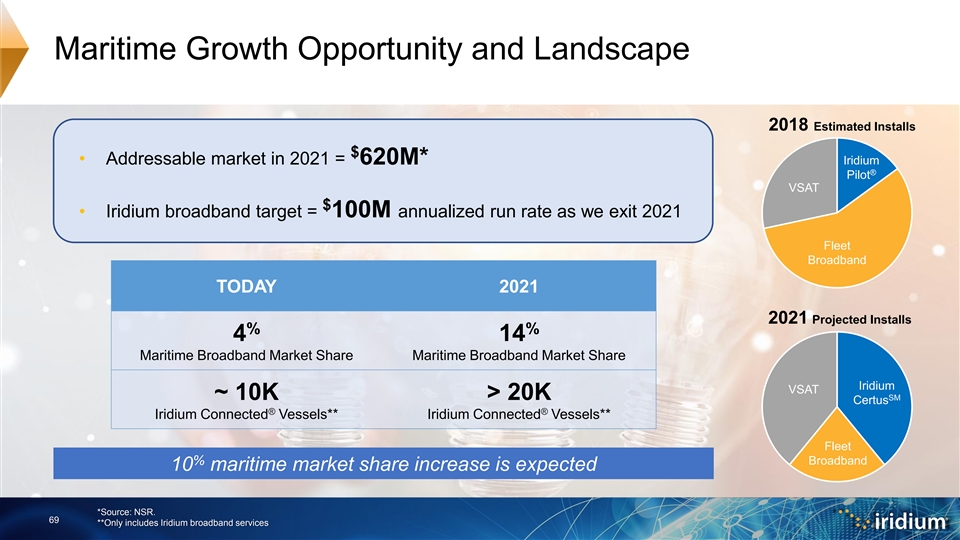

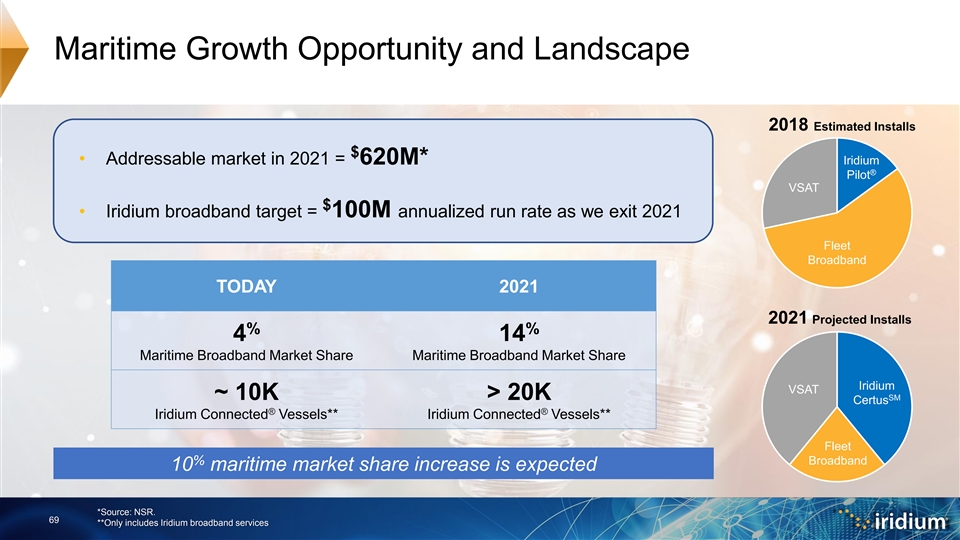

Maritime is our Biggest Growth Opportunity $ • Maritime is the key focus and majority of 100M target • Superior speed compared to Inmarsat FleetBroadband • Iridium GMDSS recognition will accelerate adoption* • Inmarsat fatigue and pricing abuse • Iridium Certus provides real choice $ Iridium Certus maritime solutions = path to 100M annual Iridium broadband revenue *Iridium GMDSS service expected in early 2020. 68Maritime is our Biggest Growth Opportunity $ • Maritime is the key focus and majority of 100M target • Superior speed compared to Inmarsat FleetBroadband • Iridium GMDSS recognition will accelerate adoption* • Inmarsat fatigue and pricing abuse • Iridium Certus provides real choice $ Iridium Certus maritime solutions = path to 100M annual Iridium broadband revenue *Iridium GMDSS service expected in early 2020. 68

Ma Maritim ritime Growth e Growth Oppo Opportun rtunity ity and Landscape 2018 Estimated Installs $ • Addressable market in 2021 = 620M* Iridium ® Pilot VSAT $ • Iridium broadband target = 100M annualized run rate as we exit 2021 Fleet Broadband TODAY 2021 2021 Projected Installs % % 4 14 Maritime Broadband Market Share Maritime Broadband Market Share Iridium VSAT ~ 10K > 20K SM Certus ® ® Iridium Connected Vessels** Iridium Connected Vessels** Fleet % Broadband 10 maritime market share increase is expected *Source: NSR. 69 **Only includes Iridium broadband servicesMa Maritim ritime Growth e Growth Oppo Opportun rtunity ity and Landscape 2018 Estimated Installs $ • Addressable market in 2021 = 620M* Iridium ® Pilot VSAT $ • Iridium broadband target = 100M annualized run rate as we exit 2021 Fleet Broadband TODAY 2021 2021 Projected Installs % % 4 14 Maritime Broadband Market Share Maritime Broadband Market Share Iridium VSAT ~ 10K > 20K SM Certus ® ® Iridium Connected Vessels** Iridium Connected Vessels** Fleet % Broadband 10 maritime market share increase is expected *Source: NSR. 69 **Only includes Iridium broadband services

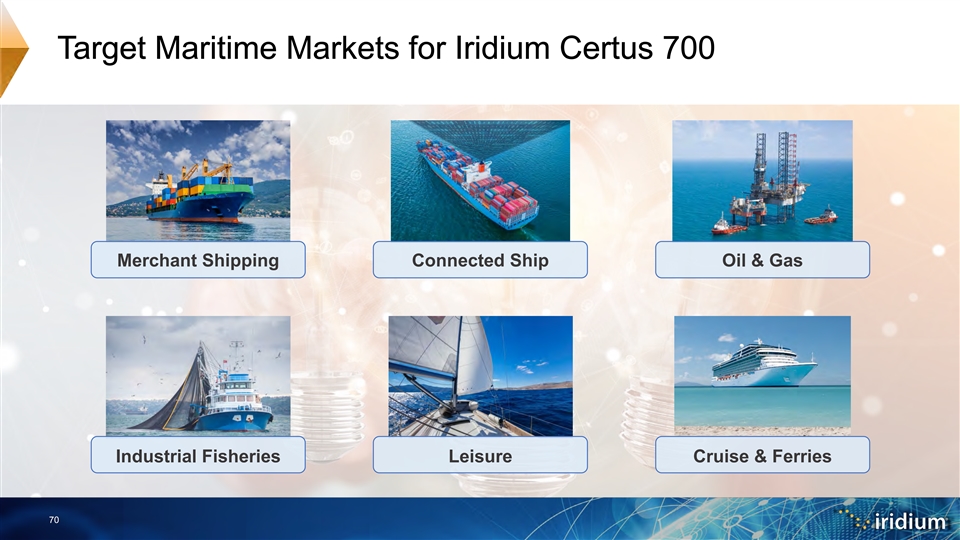

Target Maritime Markets for Iridium Certus 700 Merchant Shipping Connected Ship Oil & Gas Industrial Fisheries Leisure Cruise & Ferries 70Target Maritime Markets for Iridium Certus 700 Merchant Shipping Connected Ship Oil & Gas Industrial Fisheries Leisure Cruise & Ferries 70

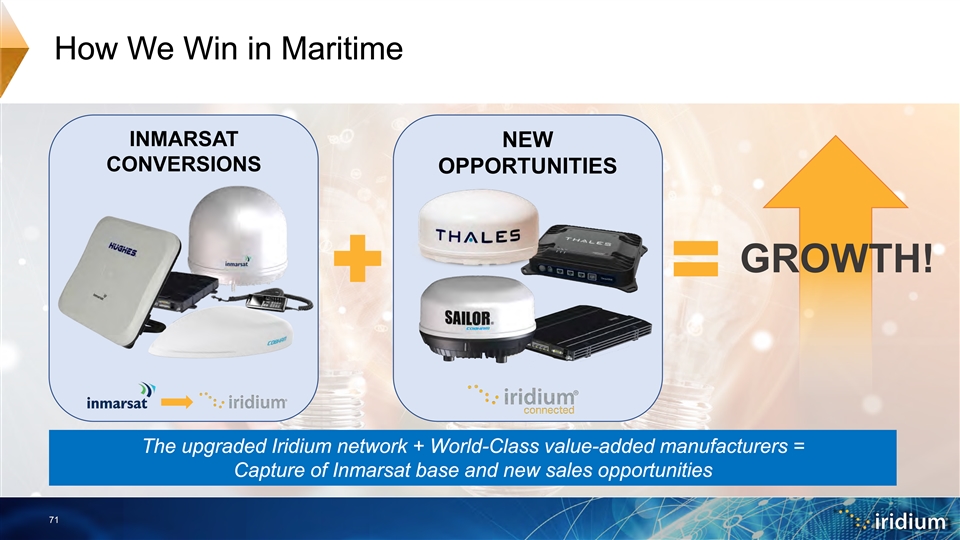

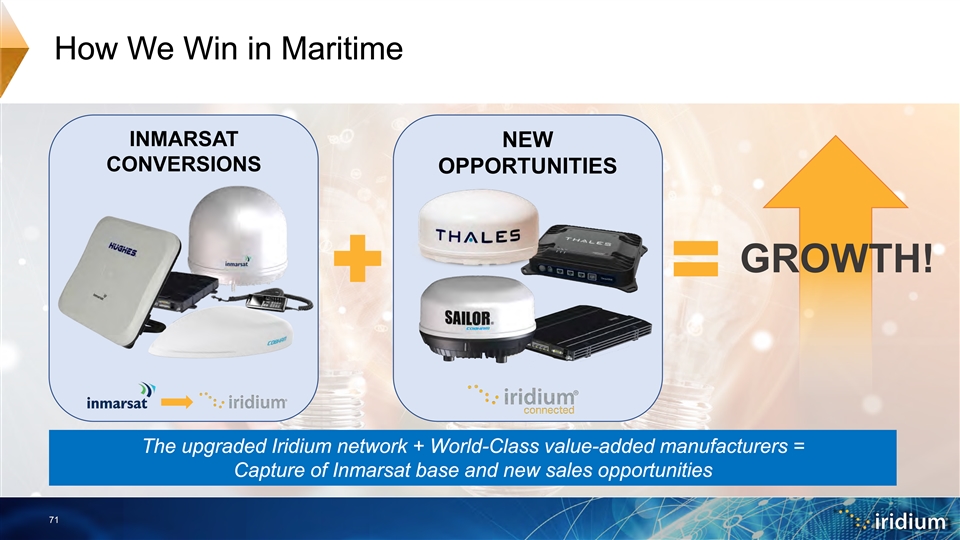

How We Win in Maritime INMARSAT NEW CONVERSIONS OPPORTUNITIES GROWTH! The upgraded Iridium network + World-Class value-added manufacturers = Capture of Inmarsat base and new sales opportunities 71How We Win in Maritime INMARSAT NEW CONVERSIONS OPPORTUNITIES GROWTH! The upgraded Iridium network + World-Class value-added manufacturers = Capture of Inmarsat base and new sales opportunities 71

Iridium Certus for Primary L-Band Communications Iridium Certus is ideal for high-speed requirements on vessels, delivering: • Optimal benefits of L-Band and Low-Earth Orbit in a high speed solution • Standardized packaging and speeds • Clear and upfront pricing, no small print Iridium Certus is a straightforward turnkey solution in an increasingly confusing market 72Iridium Certus for Primary L-Band Communications Iridium Certus is ideal for high-speed requirements on vessels, delivering: • Optimal benefits of L-Band and Low-Earth Orbit in a high speed solution • Standardized packaging and speeds • Clear and upfront pricing, no small print Iridium Certus is a straightforward turnkey solution in an increasingly confusing market 72

Iridium Certus for VSAT Companion Use When paired with traditional VSAT, Iridium Certus delivers an ideal hybrid solution combining the benefits of: • Low-Earth Orbit with Geostationary Orbit • L-Band with Ku-Band Iridium Certus maritime solutions expected to be the de facto standard for VSAT companions 73Iridium Certus for VSAT Companion Use When paired with traditional VSAT, Iridium Certus delivers an ideal hybrid solution combining the benefits of: • Low-Earth Orbit with Geostationary Orbit • L-Band with Ku-Band Iridium Certus maritime solutions expected to be the de facto standard for VSAT companions 73

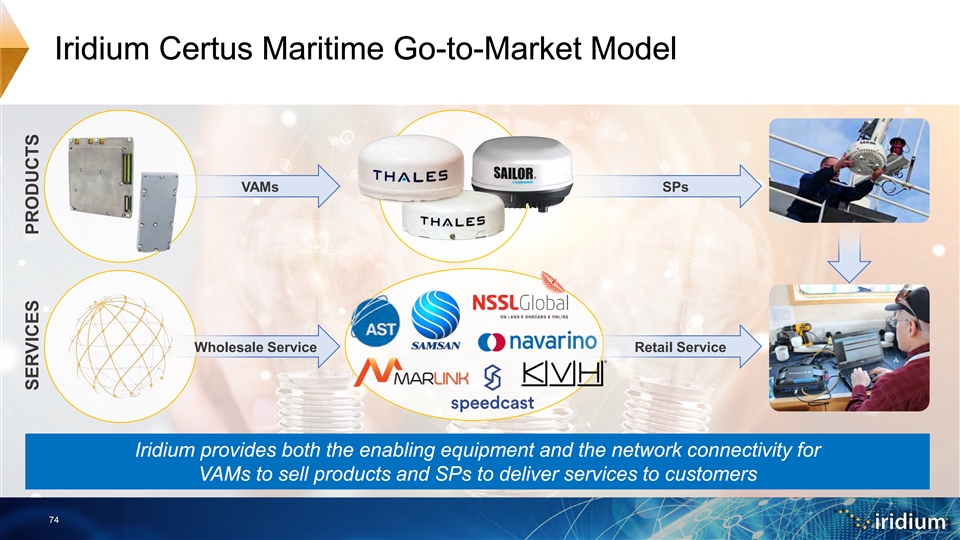

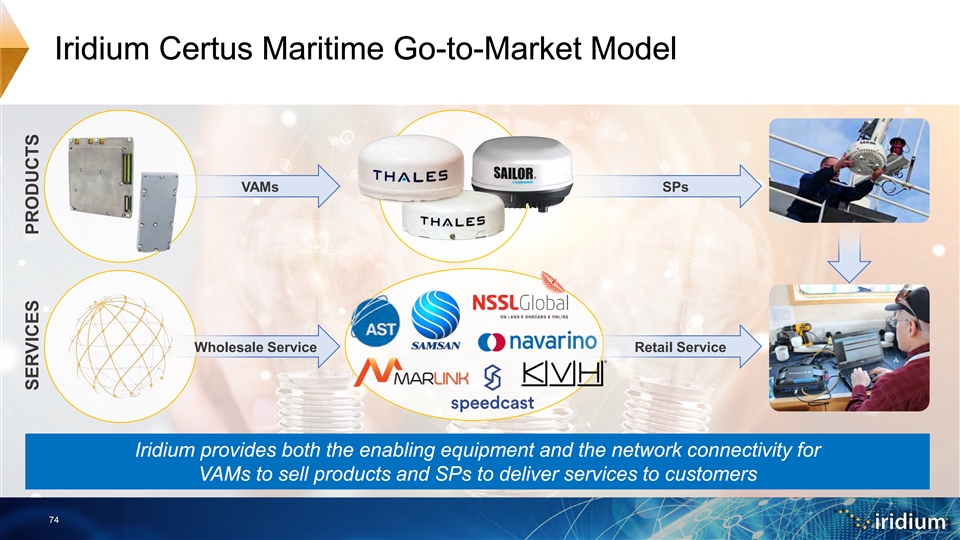

Iridium Certus Maritime Go-to-Market Model VAMs SPs Wholesale Service Retail Service Iridium provides both the enabling equipment and the network connectivity for VAMs to sell products and SPs to deliver services to customers 74 SERVICES PRODUCTSIridium Certus Maritime Go-to-Market Model VAMs SPs Wholesale Service Retail Service Iridium provides both the enabling equipment and the network connectivity for VAMs to sell products and SPs to deliver services to customers 74 SERVICES PRODUCTS

ü Smaller ü Faster ü Lighter ü Less Expensive FleetBroadband 500 SAILOR 4300 75ü Smaller ü Faster ü Lighter ü Less Expensive FleetBroadband 500 SAILOR 4300 75

Competitor Terminal Installations Terminal Installation 76Competitor Terminal Installations Terminal Installation 76

Iridium Certus is Easy to Install = Simple Upgrade 77Iridium Certus is Easy to Install = Simple Upgrade 77

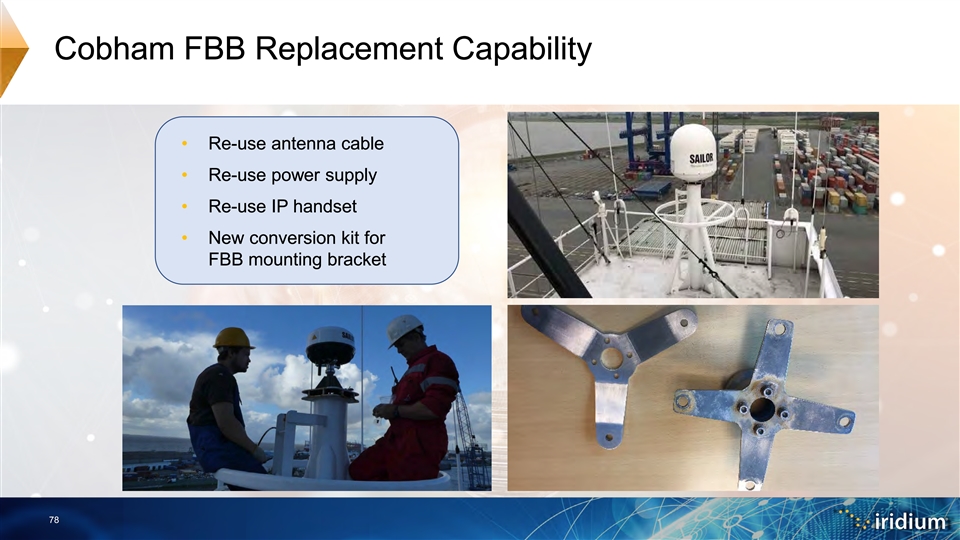

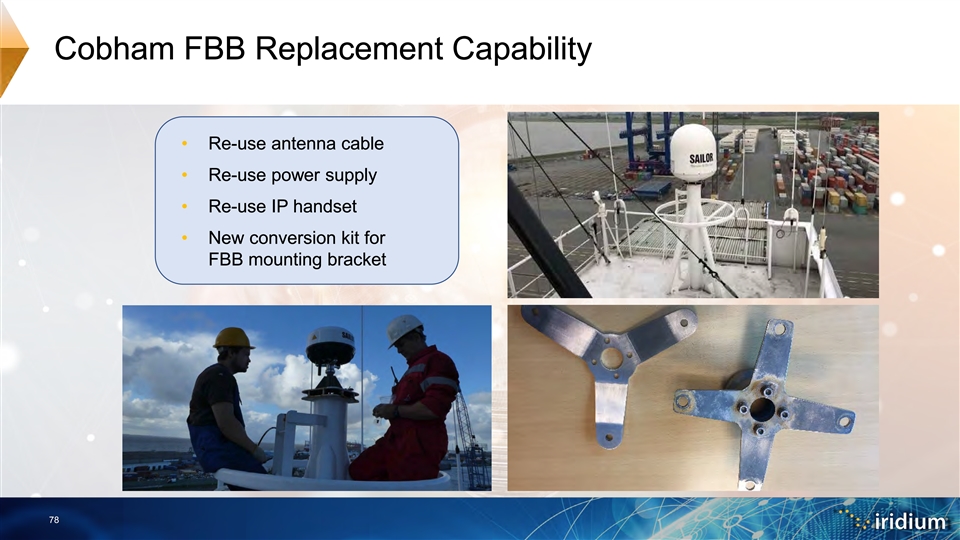

Cobham FBB Replacement Capability • Re-use antenna cable • Re-use power supply • Re-use IP handset • New conversion kit for FBB mounting bracket 78Cobham FBB Replacement Capability • Re-use antenna cable • Re-use power supply • Re-use IP handset • New conversion kit for FBB mounting bracket 78

Why Iridium: Global Polar Coverage is Critical “Because of the high latitude of the route, the boats could not use regular communication measures such as satellite phones or long-wave radio. They can only rely on Iridium.” -- Global Times Article, February 2018 Han Guomin, CEO of Cosco Shipping Specialized Carriers Limited, meets with the crew of Tianle in 2016. 79Why Iridium: Global Polar Coverage is Critical “Because of the high latitude of the route, the boats could not use regular communication measures such as satellite phones or long-wave radio. They can only rely on Iridium.” -- Global Times Article, February 2018 Han Guomin, CEO of Cosco Shipping Specialized Carriers Limited, meets with the crew of Tianle in 2016. 79

Why Iridium: Competitive Edge “We like the [Iridium] Certus product. It’s a great addition, and I think they are going to do well with it. There’s no doubt it is a big advancement over the [Iridium] OpenPort service. They have all new satellites and new hardware. In addition to the coverage and technological advantages of the service over Inmarsat FleetBroadband, I think ship owners are going to remember the multiple price increases on FleetBroadband imposed upon them when they were struggling financially, just a few short years ago.” -- Satellite Mobility World, February 2019 Martin Kits van Heyningen, CEO KVH Industries, Inc. 80Why Iridium: Competitive Edge “We like the [Iridium] Certus product. It’s a great addition, and I think they are going to do well with it. There’s no doubt it is a big advancement over the [Iridium] OpenPort service. They have all new satellites and new hardware. In addition to the coverage and technological advantages of the service over Inmarsat FleetBroadband, I think ship owners are going to remember the multiple price increases on FleetBroadband imposed upon them when they were struggling financially, just a few short years ago.” -- Satellite Mobility World, February 2019 Martin Kits van Heyningen, CEO KVH Industries, Inc. 80

Other Key Partner Quotes “Our long-term, non-exclusive “Iridium Certus will alliances and commercial greatly complement our “Iridium's signature full global collaborations with Satellite Speedcast Atlas™ managed coverage, coupled with the Operators ensure we can services portfolio delivering enhanced capacity and speed of deliver future-proof solutions, reliable communications to end Iridium Certus, has created a and we look forward to users anywhere on the planet. real buzz in the marketplace... continuing our work with Iridium We look forward to continuing We're excited to bring this new in order to bring the benefits of working with Iridium for many service to our diverse maritime its next generation network to years to come.” customer base.” our global customer base.” Tim Bailey, Graeme Gordon, Executive Vice President, Products, Marketing, Global Commercial Director, Satcom Global Ghani Behloul, and Business Development, Speedcast Chief Marketing Officer, Marlink 81Other Key Partner Quotes “Our long-term, non-exclusive “Iridium Certus will alliances and commercial greatly complement our “Iridium's signature full global collaborations with Satellite Speedcast Atlas™ managed coverage, coupled with the Operators ensure we can services portfolio delivering enhanced capacity and speed of deliver future-proof solutions, reliable communications to end Iridium Certus, has created a and we look forward to users anywhere on the planet. real buzz in the marketplace... continuing our work with Iridium We look forward to continuing We're excited to bring this new in order to bring the benefits of working with Iridium for many service to our diverse maritime its next generation network to years to come.” customer base.” our global customer base.” Tim Bailey, Graeme Gordon, Executive Vice President, Products, Marketing, Global Commercial Director, Satcom Global Ghani Behloul, and Business Development, Speedcast Chief Marketing Officer, Marlink 81

$ The Road to Initial 100M in Broadband Revenue ü Lower initial hardware cost ü Less expensive service plans ü Better customer value ü New and reliable network with higher speeds than competitors ü Lower total cost of ownership ü Enhanced margin for service providers Our superior offering positions us to win the satellite broadband marketplace 82$ The Road to Initial 100M in Broadband Revenue ü Lower initial hardware cost ü Less expensive service plans ü Better customer value ü New and reliable network with higher speeds than competitors ü Lower total cost of ownership ü Enhanced margin for service providers Our superior offering positions us to win the satellite broadband marketplace 82

Iridium Certus Growth Opportunity Beyond 2021 Iridium Certus Broadband Iridium Certus Narrowband P E RF O RM ANCE 83 P RI CEIridium Certus Growth Opportunity Beyond 2021 Iridium Certus Broadband Iridium Certus Narrowband P E RF O RM ANCE 83 P RI CE

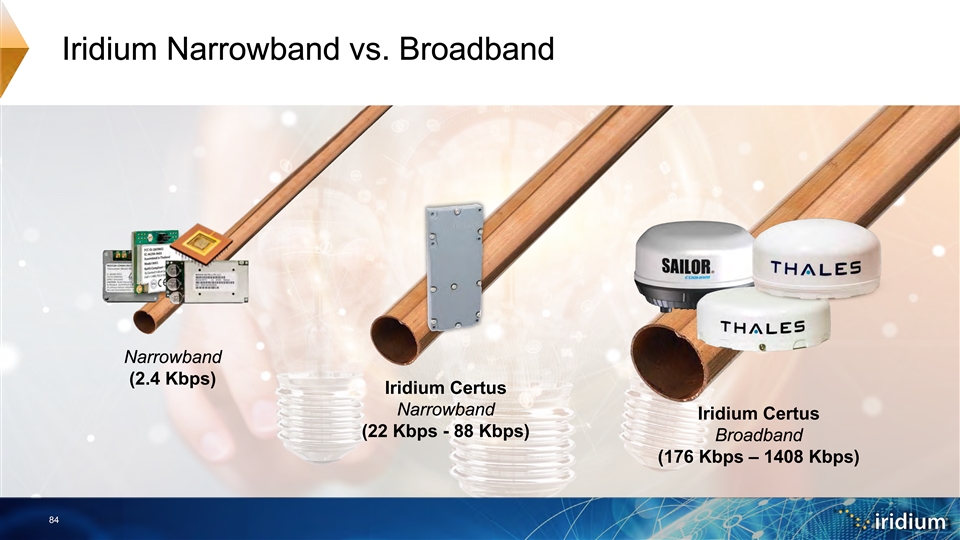

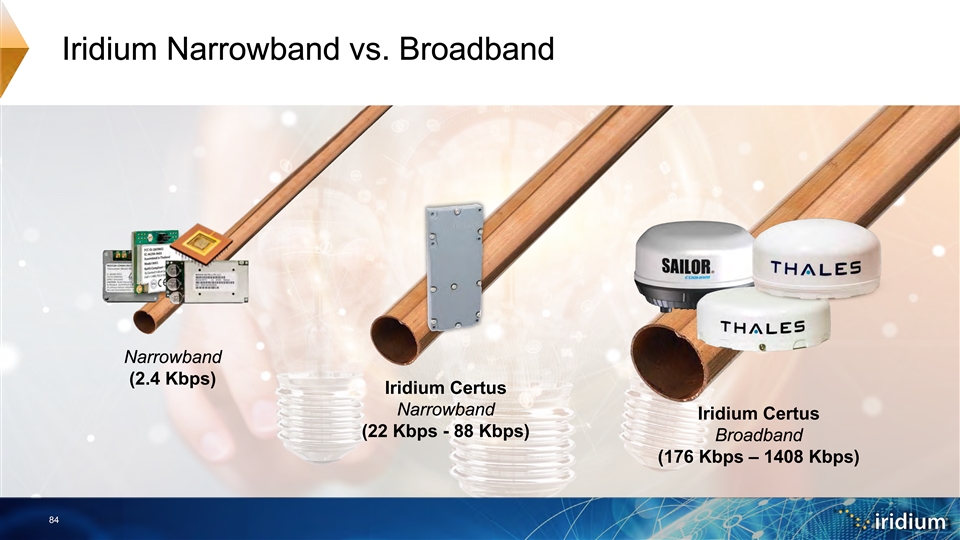

Iridium Narrowband vs. Broadband Narrowband (2.4 Kbps) Iridium Certus Narrowband Iridium Certus (22 Kbps - 88 Kbps) Broadband (176 Kbps – 1408 Kbps) 84Iridium Narrowband vs. Broadband Narrowband (2.4 Kbps) Iridium Certus Narrowband Iridium Certus (22 Kbps - 88 Kbps) Broadband (176 Kbps – 1408 Kbps) 84

Iridium Certus 9770 is in the Sweet Spot for Growth • Initial product fills a service gap in 22/88 • Enables partners to innovate • Decreases time to revenue 85Iridium Certus 9770 is in the Sweet Spot for Growth • Initial product fills a service gap in 22/88 • Enables partners to innovate • Decreases time to revenue 85

Iridium Certus Growth OpportunitiesIridium Certus Growth Opportunities

Connected Hotspots for Smartphones and Tablets Integration of Iridium Certus 9770 into a second-generation Iridium GO! expands the market by improving user experience st nd 1 Generation 2 Generation App Experience App Experience Custom-Developed Apps Standard Apps Applications Circuit-Switched Data IP Data Time to Connect 30 Seconds 2 Seconds Time to Start Send/Receive Data 45 Seconds 5 Seconds Upload Speed 2.4 kbps 22 kbps Time to Send 10k Email 1 minute 10 seconds Download Speed 2.4 kbps 88 kbps Time to Download 50k Webpage 3 minutes 10 seconds Native Email Custom Email App Low-Res Videos and Pictures Example Applications Custom Weather App Chat Apps Custom Weather App Compressed Web Browsing App Iridium Certus 9770 based Iridium GO! improves user experience and generates growth 87Connected Hotspots for Smartphones and Tablets Integration of Iridium Certus 9770 into a second-generation Iridium GO! expands the market by improving user experience st nd 1 Generation 2 Generation App Experience App Experience Custom-Developed Apps Standard Apps Applications Circuit-Switched Data IP Data Time to Connect 30 Seconds 2 Seconds Time to Start Send/Receive Data 45 Seconds 5 Seconds Upload Speed 2.4 kbps 22 kbps Time to Send 10k Email 1 minute 10 seconds Download Speed 2.4 kbps 88 kbps Time to Download 50k Webpage 3 minutes 10 seconds Native Email Custom Email App Low-Res Videos and Pictures Example Applications Custom Weather App Chat Apps Custom Weather App Compressed Web Browsing App Iridium Certus 9770 based Iridium GO! improves user experience and generates growth 87

Monitoring and Safety for Maritime The Connected Ship GMDSS Vessel Monitoring System (VMS) 88Monitoring and Safety for Maritime The Connected Ship GMDSS Vessel Monitoring System (VMS) 88

UAVs and Connected Cars Supports increased data requirements 89UAVs and Connected Cars Supports increased data requirements 89

Scientific Research and Exploration Supports increased data requirements 90Scientific Research and Exploration Supports increased data requirements 90

Pipeline Monitoring Supports increased data requirements 91Pipeline Monitoring Supports increased data requirements 91

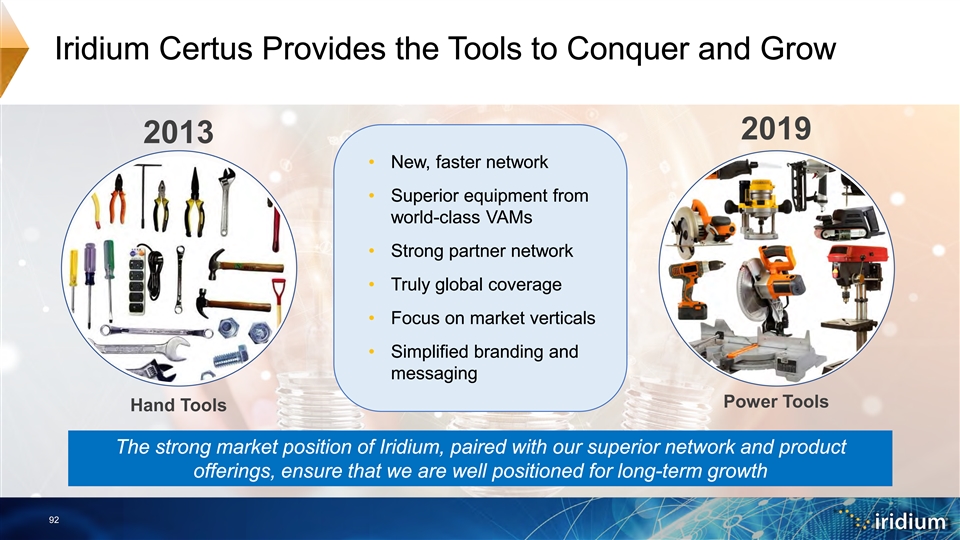

Iridium Certus Provides the Tools to Conquer and Grow 2019 2013 • New, faster network • Superior equipment from world-class VAMs • Strong partner network • Truly global coverage • Focus on market verticals • Simplified branding and messaging Power Tools Hand Tools The strong market position of Iridium, paired with our superior network and product offerings, ensure that we are well positioned for long-term growth 92Iridium Certus Provides the Tools to Conquer and Grow 2019 2013 • New, faster network • Superior equipment from world-class VAMs • Strong partner network • Truly global coverage • Focus on market verticals • Simplified branding and messaging Power Tools Hand Tools The strong market position of Iridium, paired with our superior network and product offerings, ensure that we are well positioned for long-term growth 92

Iridium = GROWTH! $ Iridium Certus = 100M broadband revenue exit rate in 2021 Iridium Certus narrowband fueling more growth beyond 2021 We’ve got this! 93Iridium = GROWTH! $ Iridium Certus = 100M broadband revenue exit rate in 2021 Iridium Certus narrowband fueling more growth beyond 2021 We’ve got this! 93

Scott Scheimreif Executive Vice President, U.S. Government ProgramsScott Scheimreif Executive Vice President, U.S. Government Programs

Iridium and the U.S. Government (USG) • Successful 20-year partnership with the USG • Leverages our unique network • A platform for innovation • An expanding government partner ecosystem • Continued growth and adoption Delivering mission-critical capabilities to the USG for 20 years! 96Iridium and the U.S. Government (USG) • Successful 20-year partnership with the USG • Leverages our unique network • A platform for innovation • An expanding government partner ecosystem • Continued growth and adoption Delivering mission-critical capabilities to the USG for 20 years! 96

Our History with the U.S. Government • Significant investment in government private network in 1990s $ • Our first sole-source award was in December 2000 for 36M • Launched new services through USG investments ® • 2002: Short Burst Data • 2009: Distributed Tactical Communication System (DTCS) ® • 2012: Iridium Burst • Significant growth throughout program life • Innovative contract award in 2013 th • In negotiations for our 5 consecutive sole-source contract The U.S. Government remains our single largest customer 97Our History with the U.S. Government • Significant investment in government private network in 1990s $ • Our first sole-source award was in December 2000 for 36M • Launched new services through USG investments ® • 2002: Short Burst Data • 2009: Distributed Tactical Communication System (DTCS) ® • 2012: Iridium Burst • Significant growth throughout program life • Innovative contract award in 2013 th • In negotiations for our 5 consecutive sole-source contract The U.S. Government remains our single largest customer 97

Historical Growth Under Enhanced Mobile Satellite Services 113K EMSS Subscriber Growth (2000 – 2018) Iridium Burst DTCS 43K ® SBD 3K 2010 2011 2012 2013 2014 2015 2016 2017 2018 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 Variable Rate Contract Fixed Priced Contract Steady growth and a proven track record of success under the EMSS program 98Historical Growth Under Enhanced Mobile Satellite Services 113K EMSS Subscriber Growth (2000 – 2018) Iridium Burst DTCS 43K ® SBD 3K 2010 2011 2012 2013 2014 2015 2016 2017 2018 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 Variable Rate Contract Fixed Priced Contract Steady growth and a proven track record of success under the EMSS program 98

Key Differentiator: Our Network • Crosslinked LEO constellation • Dedicated USG gateway • Truly global coverage • Highly mobile applications • Independence from foreign infrastructure • Operational security Our truly global, Low-Earth Orbit (LEO) network provides critical operational benefits 99Key Differentiator: Our Network • Crosslinked LEO constellation • Dedicated USG gateway • Truly global coverage • Highly mobile applications • Independence from foreign infrastructure • Operational security Our truly global, Low-Earth Orbit (LEO) network provides critical operational benefits 99

Innovations & Investments • Dismounted tactical communications • NSA accredited secure communications • Gateway enhancements • Emerging products and services • Improved situational awareness Our network provides a unique platform for innovation, enabling mission success 100Innovations & Investments • Dismounted tactical communications • NSA accredited secure communications • Gateway enhancements • Emerging products and services • Improved situational awareness Our network provides a unique platform for innovation, enabling mission success 100

Market Expansion • Iridium USG partners 101Market Expansion • Iridium USG partners 101

Market Expansion • Experimentation and trials 102Market Expansion • Experimentation and trials 102

Market Expansion • Commercial SATCOM transition 103Market Expansion • Commercial SATCOM transition 103

Market Expansion • Future of space in the USG We are well positioned to continue the success well into the future 104Market Expansion • Future of space in the USG We are well positioned to continue the success well into the future 104

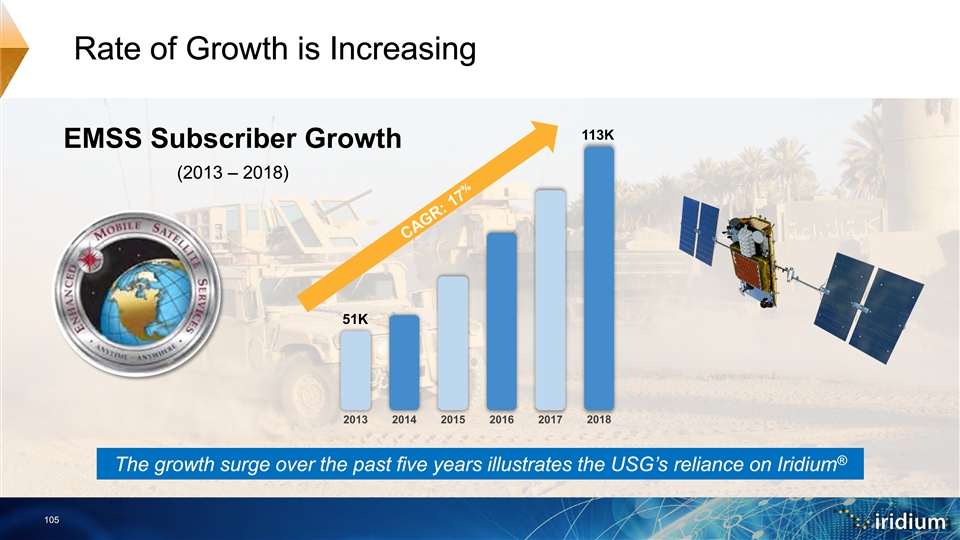

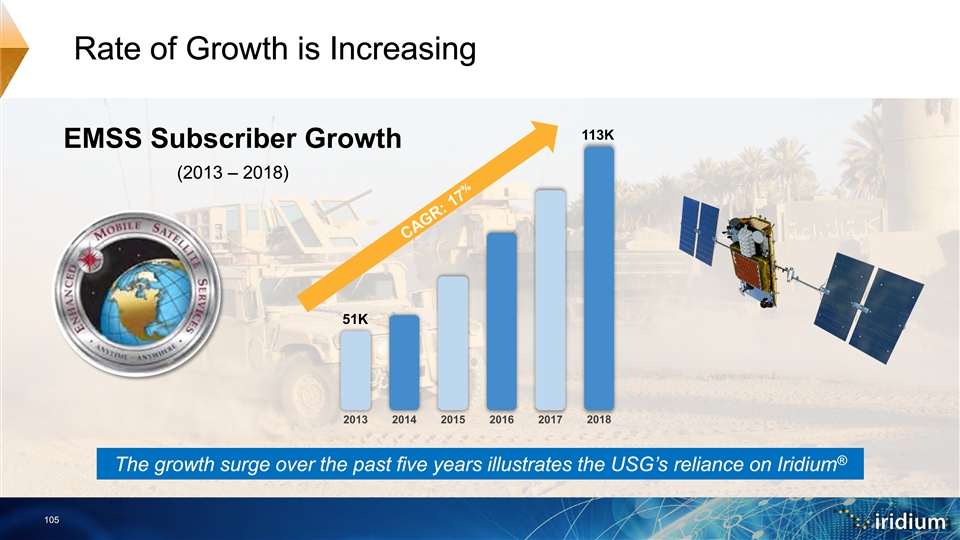

Rate of Growth is Increasing 113K EMSS Subscriber Growth (2013 – 2018) 51K 2013 2014 2015 2016 2017 2018 ® The growth surge over the past five years illustrates the USG’s reliance on Iridium 105Rate of Growth is Increasing 113K EMSS Subscriber Growth (2013 – 2018) 51K 2013 2014 2015 2016 2017 2018 ® The growth surge over the past five years illustrates the USG’s reliance on Iridium 105

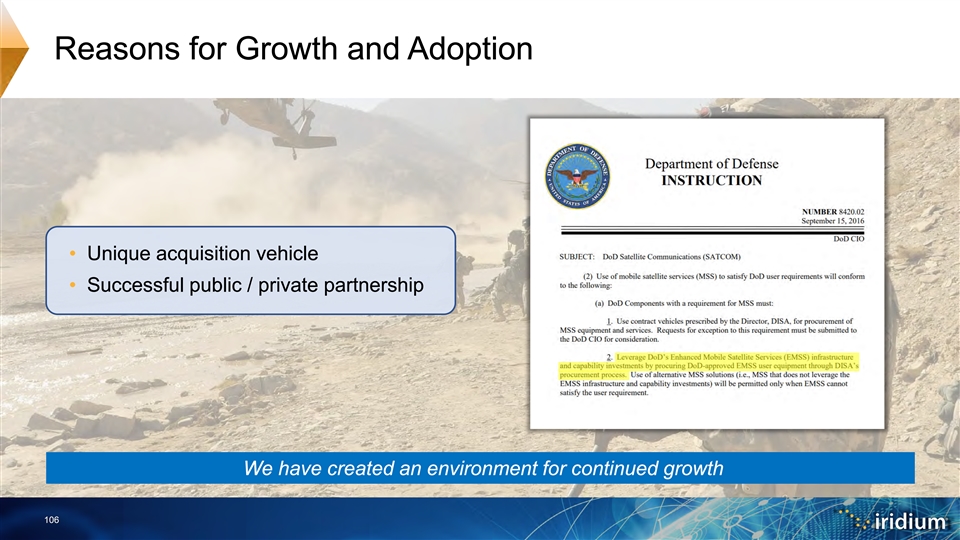

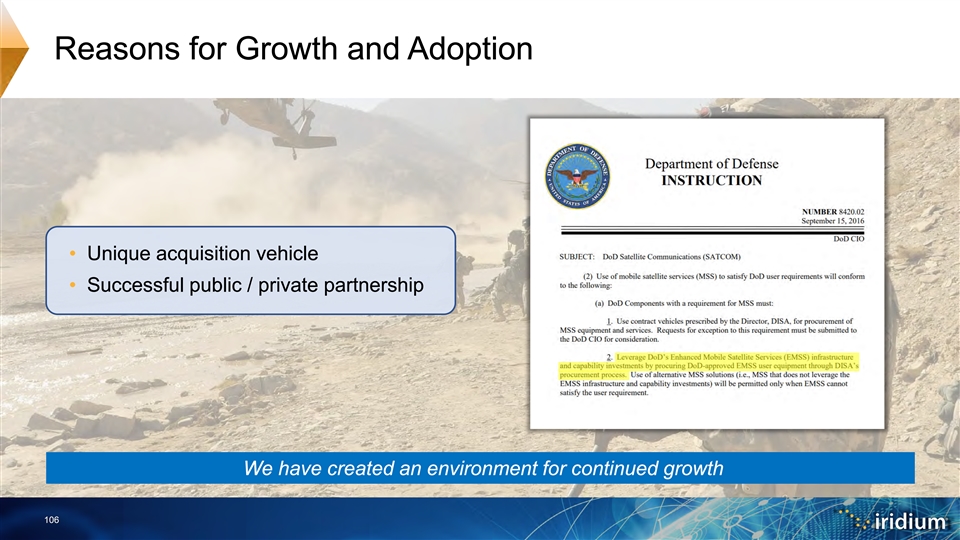

Reasons for Growth and Adoption • Unique acquisition vehicle • Successful public / private partnership We have created an environment for continued growth 106Reasons for Growth and Adoption • Unique acquisition vehicle • Successful public / private partnership We have created an environment for continued growth 106

Reasons for Growth and Adoption • Amazing new network • Attractive competitive environment We have created an environment for continued growth 107Reasons for Growth and Adoption • Amazing new network • Attractive competitive environment We have created an environment for continued growth 107

Reasons for Growth and Adoption • Expanded industrial partner base We have created an environment for continued growth 108Reasons for Growth and Adoption • Expanded industrial partner base We have created an environment for continued growth 108

Supporting the USG Over the Years • Mobile, secure communications • Humanitarian assistance and disaster response • Resilient and reliable connectivity • Polar communications • Real-time situational awareness • Command and control Increased adoption is driven by our long-term relationship with USG 109Supporting the USG Over the Years • Mobile, secure communications • Humanitarian assistance and disaster response • Resilient and reliable connectivity • Polar communications • Real-time situational awareness • Command and control Increased adoption is driven by our long-term relationship with USG 109

SM Enabling Growth through Iridium Certus Secure Truly global Communications-on-the-move (COTM) Proven industry partners Iridium Certus is taking off in the USG market 110SM Enabling Growth through Iridium Certus Secure Truly global Communications-on-the-move (COTM) Proven industry partners Iridium Certus is taking off in the USG market 110

Enabling Growth through Satellite Time & Location (STL) • Alternative Position, Navigation and Timing (PNT) • Resilient and diverse • Addresses a critical capability gap We continue to identify new applications that leverage our unique network 111Enabling Growth through Satellite Time & Location (STL) • Alternative Position, Navigation and Timing (PNT) • Resilient and diverse • Addresses a critical capability gap We continue to identify new applications that leverage our unique network 111

Looking to the Next 20 Years • In negotiations for our next service contract • Builds on success of last five years • Provides a vehicle for future innovation • Integration of Iridium across major programs • Excited and motivated partner base Expecting a win-win outcome for our future services contract! 112Looking to the Next 20 Years • In negotiations for our next service contract • Builds on success of last five years • Provides a vehicle for future innovation • Integration of Iridium across major programs • Excited and motivated partner base Expecting a win-win outcome for our future services contract! 112

The Future of Iridium in the USG has Never Been Brighter! • The USG remains our single largest customer • EMSS contract negotiations continue • We fully anticipate that our 20-year partnership with the USG will continue well into the future • Our USG partners remain motivated to integrate Iridium into applications • The USG’s growth and adoption of Iridium is at record highs as they pursue new ways to $ leverage our new 3B network 113The Future of Iridium in the USG has Never Been Brighter! • The USG remains our single largest customer • EMSS contract negotiations continue • We fully anticipate that our 20-year partnership with the USG will continue well into the future • Our USG partners remain motivated to integrate Iridium into applications • The USG’s growth and adoption of Iridium is at record highs as they pursue new ways to $ leverage our new 3B network 113

Tom Fitzpatrick Chief Financial OfficerTom Fitzpatrick Chief Financial Officer

Iridium ProspectsIridium Prospects

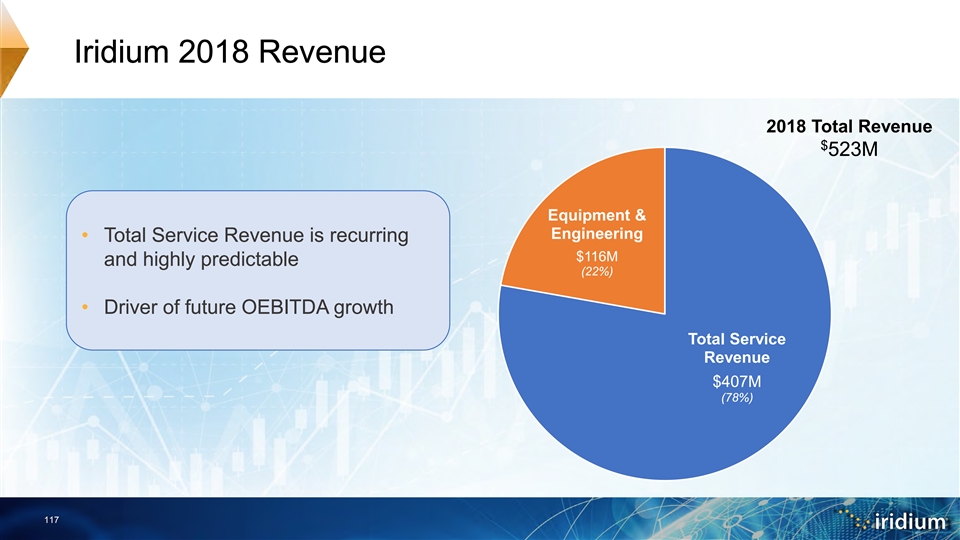

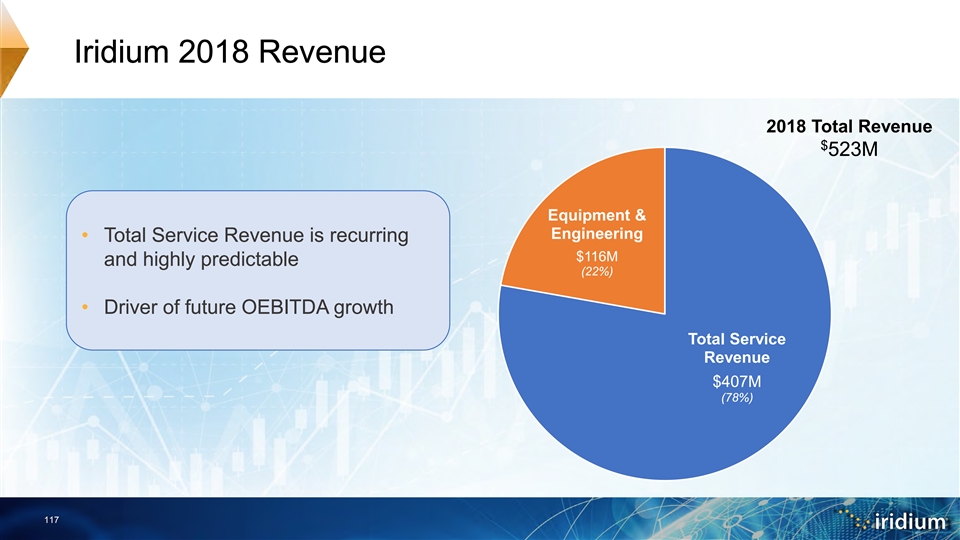

Iridium 2018 Revenue 2018 Total Revenue $ 523M Equipment & Engineering • Total Service Revenue is recurring $116M and highly predictable (22%) • Driver of future OEBITDA growth Total Service Revenue $407M (78%) 117Iridium 2018 Revenue 2018 Total Revenue $ 523M Equipment & Engineering • Total Service Revenue is recurring $116M and highly predictable (22%) • Driver of future OEBITDA growth Total Service Revenue $407M (78%) 117

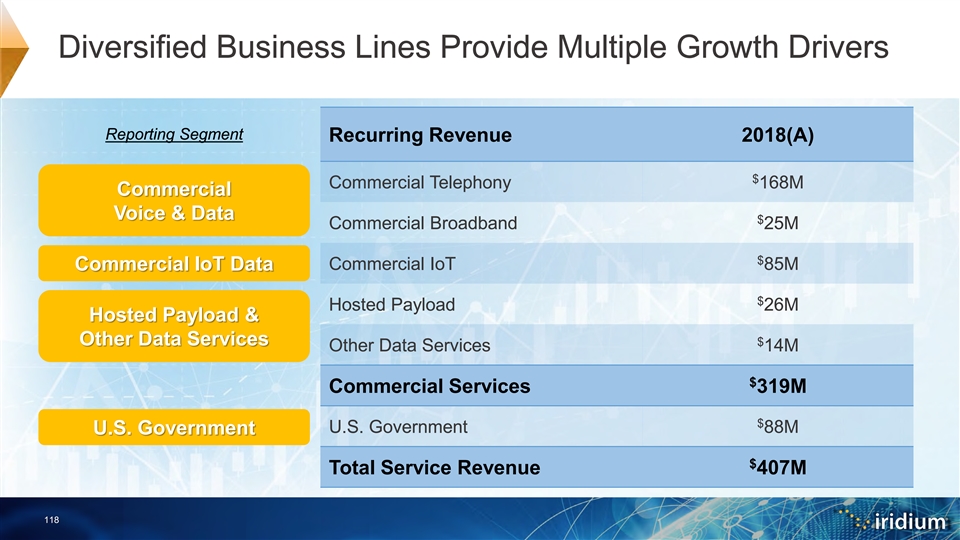

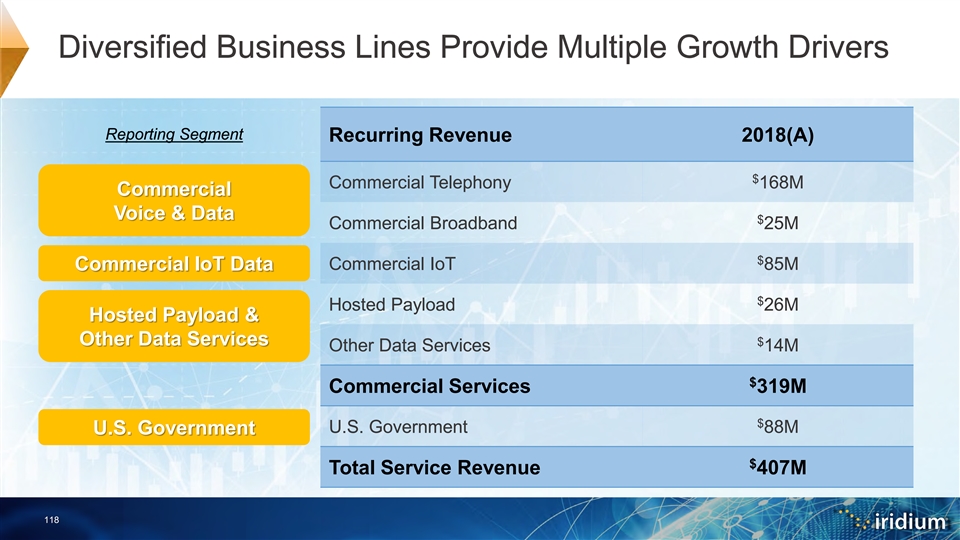

Diversified Business Lines Provide Multiple Growth Drivers Reporting Segment Recurring Revenue 2018(A) $ Commercial Telephony 168M Commercial Voice & Data $ Commercial Broadband 25M $ Commercial IoT 85M Commercial IoT Data $ Hosted Payload 26M Hosted Payload & Other Data Services $ Other Data Services 14M $ Commercial Services 319M $ U.S. Government 88M U.S. Government $ Total Service Revenue 407M 118Diversified Business Lines Provide Multiple Growth Drivers Reporting Segment Recurring Revenue 2018(A) $ Commercial Telephony 168M Commercial Voice & Data $ Commercial Broadband 25M $ Commercial IoT 85M Commercial IoT Data $ Hosted Payload 26M Hosted Payload & Other Data Services $ Other Data Services 14M $ Commercial Services 319M $ U.S. Government 88M U.S. Government $ Total Service Revenue 407M 118

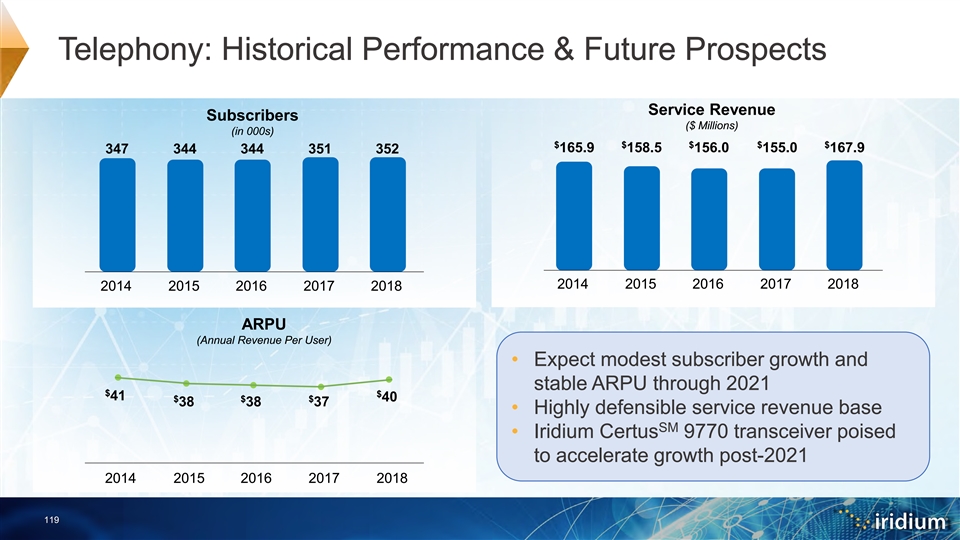

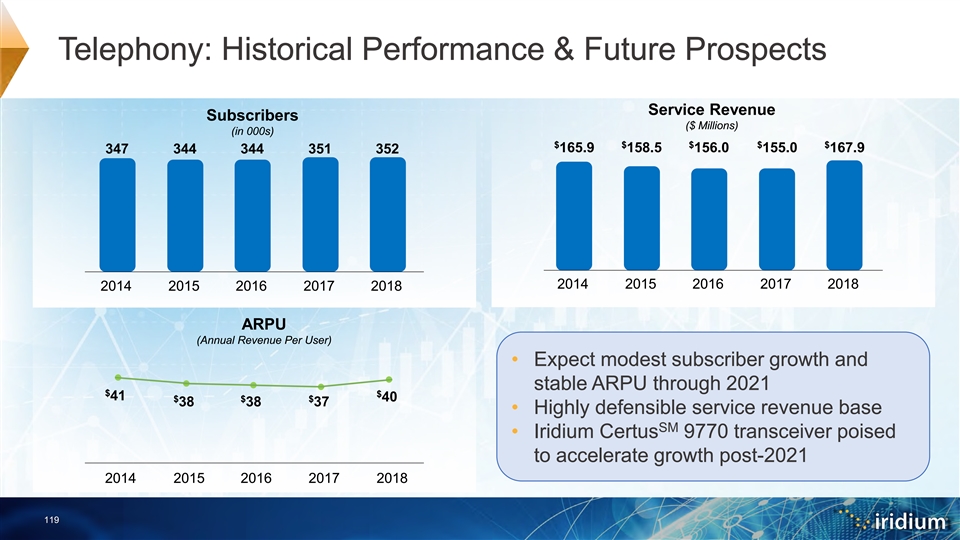

Telephony: Historical Performance & Future Prospects Service Revenue Subscribers ($ Millions) (in 000s) $ $ $ $ $ 165.9 158.5 156.0 155.0 167.9 347 344 344 351 352 2014 2015 2016 2017 2018 2014 2015 2016 2017 2018 ARPU (Annual Revenue Per User) • Expect modest subscriber growth and stable ARPU through 2021 $ $ 41 $ $ $ 40 38 38 37 • Highly defensible service revenue base SM • Iridium Certus 9770 transceiver poised to accelerate growth post-2021 2014 2015 2016 2017 2018 119Telephony: Historical Performance & Future Prospects Service Revenue Subscribers ($ Millions) (in 000s) $ $ $ $ $ 165.9 158.5 156.0 155.0 167.9 347 344 344 351 352 2014 2015 2016 2017 2018 2014 2015 2016 2017 2018 ARPU (Annual Revenue Per User) • Expect modest subscriber growth and stable ARPU through 2021 $ $ 41 $ $ $ 40 38 38 37 • Highly defensible service revenue base SM • Iridium Certus 9770 transceiver poised to accelerate growth post-2021 2014 2015 2016 2017 2018 119

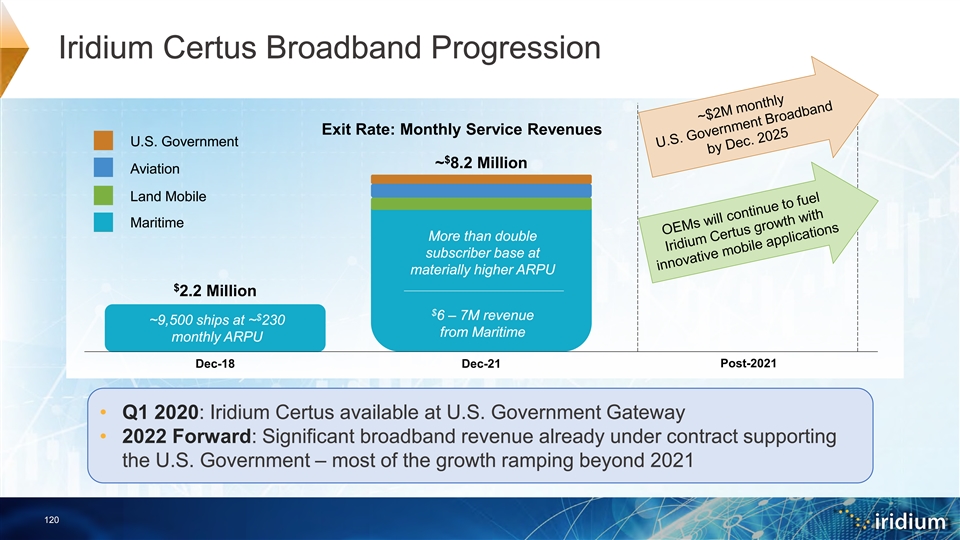

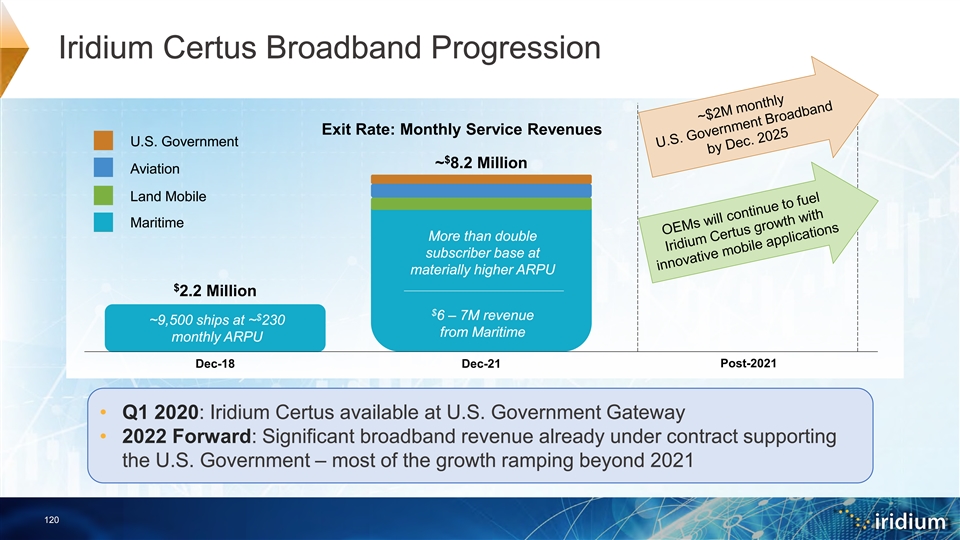

Iridium Certus Broadband Progression Exit Rate: Monthly Service Revenues U.S. Government $ ~ 8.2 Million Aviation Land Mobile Maritime More than double subscriber base at materially higher ARPU $ 2.2 Million $ 6 – 7M revenue $ ~9,500 ships at ~ 230 from Maritime monthly ARPU Post-2021 Dec-18 Dec-21 • Q1 2020: Iridium Certus available at U.S. Government Gateway • 2022 Forward: Significant broadband revenue already under contract supporting the U.S. Government – most of the growth ramping beyond 2021 120Iridium Certus Broadband Progression Exit Rate: Monthly Service Revenues U.S. Government $ ~ 8.2 Million Aviation Land Mobile Maritime More than double subscriber base at materially higher ARPU $ 2.2 Million $ 6 – 7M revenue $ ~9,500 ships at ~ 230 from Maritime monthly ARPU Post-2021 Dec-18 Dec-21 • Q1 2020: Iridium Certus available at U.S. Government Gateway • 2022 Forward: Significant broadband revenue already under contract supporting the U.S. Government – most of the growth ramping beyond 2021 120

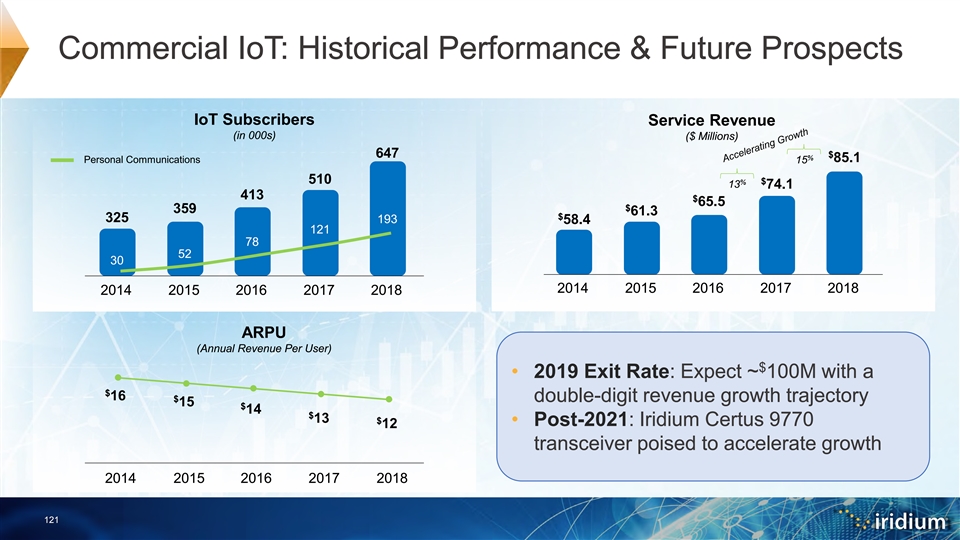

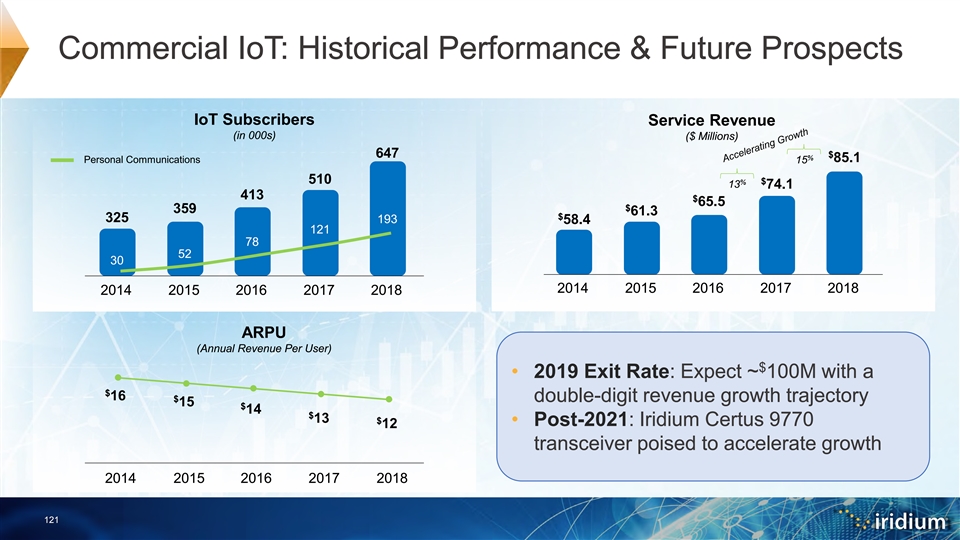

Commercial IoT: Historical Performance & Future Prospects IoT Subscribers Service Revenue (in 000s) ($ Millions) 647 $ % 85.1 Personal Communications 15 510 % $ 13 74.1 413 $ 65.5 $ 359 61.3 $ 325 193 58.4 121 78 52 30 2014 2015 2016 2017 2018 2014 2015 2016 2017 2018 ARPU (Annual Revenue Per User) $ • 2019 Exit Rate: Expect ~ 100M with a $ 16 $ double-digit revenue growth trajectory 15 $ 14 $ 13 $ • Post-2021: Iridium Certus 9770 12 transceiver poised to accelerate growth 2014 2015 2016 2017 2018 121Commercial IoT: Historical Performance & Future Prospects IoT Subscribers Service Revenue (in 000s) ($ Millions) 647 $ % 85.1 Personal Communications 15 510 % $ 13 74.1 413 $ 65.5 $ 359 61.3 $ 325 193 58.4 121 78 52 30 2014 2015 2016 2017 2018 2014 2015 2016 2017 2018 ARPU (Annual Revenue Per User) $ • 2019 Exit Rate: Expect ~ 100M with a $ 16 $ double-digit revenue growth trajectory 15 $ 14 $ 13 $ • Post-2021: Iridium Certus 9770 12 transceiver poised to accelerate growth 2014 2015 2016 2017 2018 121

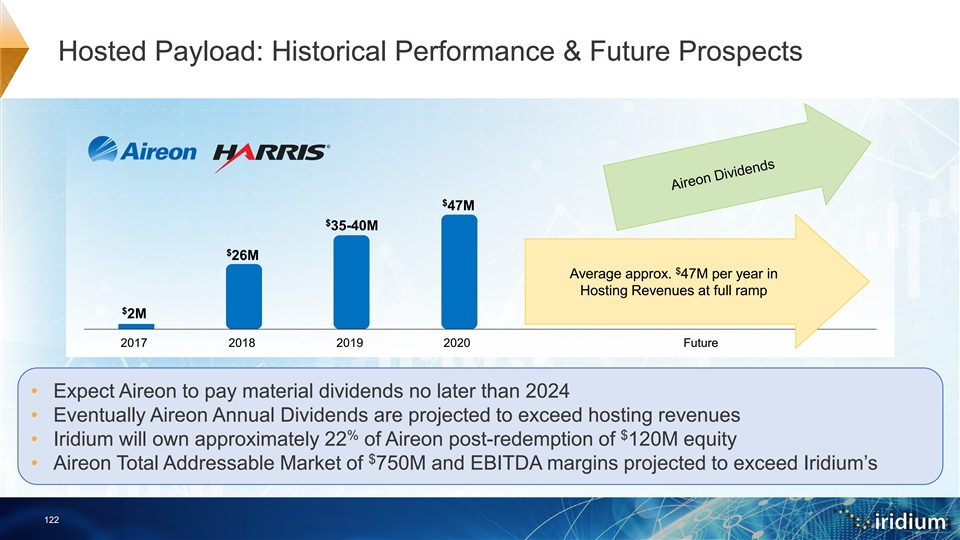

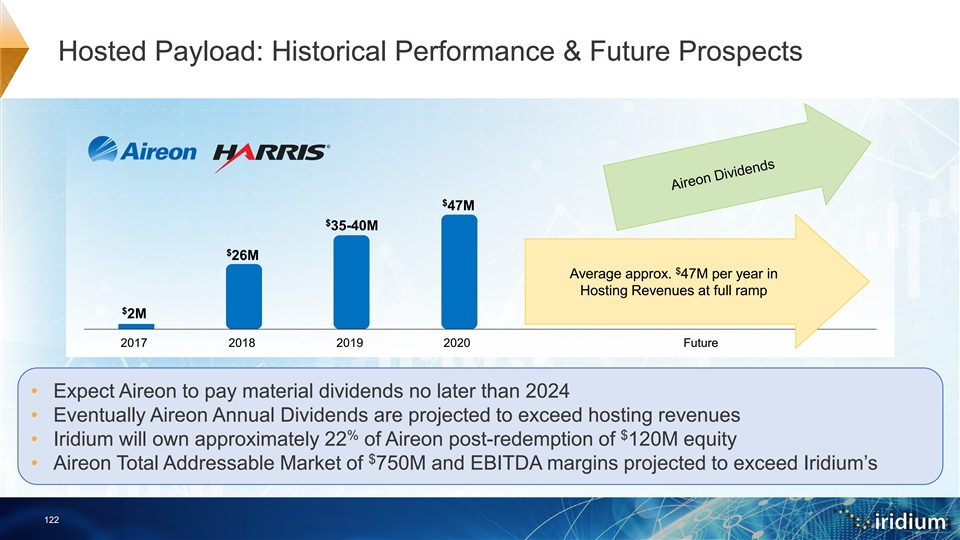

Hosted Payload: Historical Performance & Future Prospects $ 47M $ 35-40M $ 26M $ Average approx. 47M per year in Hosting Revenues at full ramp $ 2M 2017 2018 2019 2020 Future • Expect Aireon to pay material dividends no later than 2024 • Eventually Aireon Annual Dividends are projected to exceed hosting revenues % $ • Iridium will own approximately 22 of Aireon post-redemption of 120M equity $ • Aireon Total Addressable Market of 750M and EBITDA margins projected to exceed Iridium’s 122Hosted Payload: Historical Performance & Future Prospects $ 47M $ 35-40M $ 26M $ Average approx. 47M per year in Hosting Revenues at full ramp $ 2M 2017 2018 2019 2020 Future • Expect Aireon to pay material dividends no later than 2024 • Eventually Aireon Annual Dividends are projected to exceed hosting revenues % $ • Iridium will own approximately 22 of Aireon post-redemption of 120M equity $ • Aireon Total Addressable Market of 750M and EBITDA margins projected to exceed Iridium’s 122

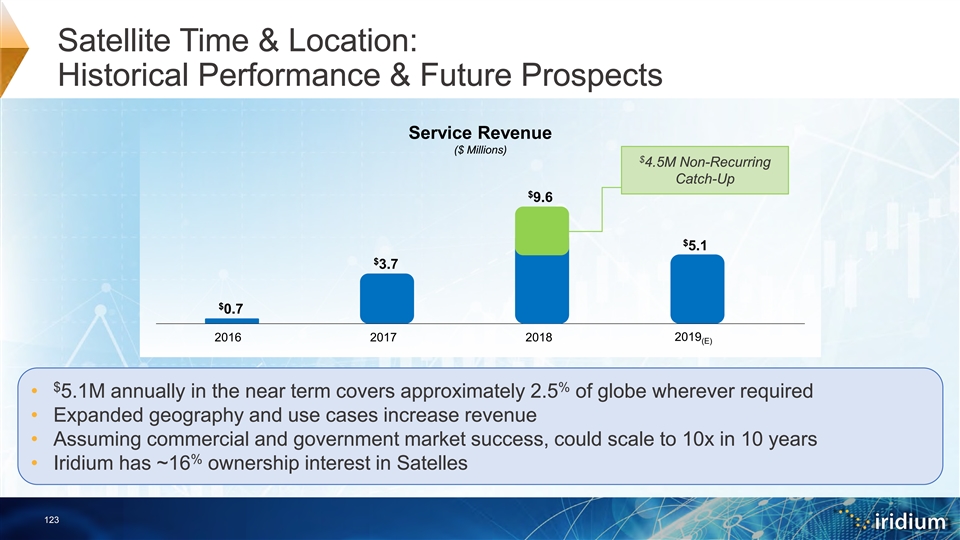

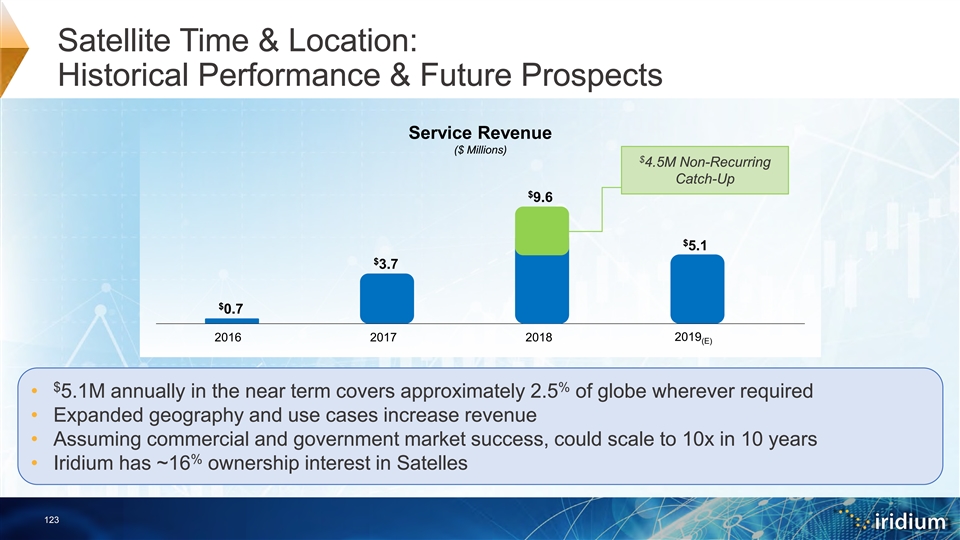

Satellite Time & Location: Historical Performance & Future Prospects Service Revenue ($ Millions) $ 4.5M Non-Recurring Catch-Up $ 9.6 $ 5.1 $ 3.7 $ 0.7 2019 2016 2017 2018 (E) $ % • 5.1M annually in the near term covers approximately 2.5 of globe wherever required • Expanded geography and use cases increase revenue • Assuming commercial and government market success, could scale to 10x in 10 years % • Iridium has ~16 ownership interest in Satelles 123Satellite Time & Location: Historical Performance & Future Prospects Service Revenue ($ Millions) $ 4.5M Non-Recurring Catch-Up $ 9.6 $ 5.1 $ 3.7 $ 0.7 2019 2016 2017 2018 (E) $ % • 5.1M annually in the near term covers approximately 2.5 of globe wherever required • Expanded geography and use cases increase revenue • Assuming commercial and government market success, could scale to 10x in 10 years % • Iridium has ~16 ownership interest in Satelles 123

Diversified Business Lines Provide Multiple Growth Drivers Y/Y Recurring Revenue 2018(A) 2019(E) Revenue Characteristics Change ® Highly defensible base + PTT & Iridium GO! growth – expect low single digit $ % Commercial Telephony 168M + 8 growth (plus Iridium Certus 9770 22/88 opens new capabilities post-2021) $ Significant Iridium Certus growth fuels expected 100M annual $ % Commercial Broadband 25M + 11 exit rate in 2021; Significant growth continues thereafter Y/Y double-digit subscriber growth; Iridium Certus 9770 partner ecosystem $ % Commercial IoT 85M + 15 potential and volume to open new horizons post-2021 $ Contractual revenue from new satellites ~ 47M at full ramp; $ $ Hosted Payload 26M 35-40M $ Aireon data fee ramps to ~ 23M/year in 2H-2019 $ % Other Data Services 14M + 86 Primarily Satellite Timing & Location (STL) + licensing revenue $ % Commercial Services 319M + 22 Long-standing customer with fixed-price contract renewal expected $ % U.S. Government 88M 0 in April 2019; expect long-term contract and increased revenues $ % $ Total Service Revenue 407M + 16 ~ 440M 124 Commercial Voice & DataDiversified Business Lines Provide Multiple Growth Drivers Y/Y Recurring Revenue 2018(A) 2019(E) Revenue Characteristics Change ® Highly defensible base + PTT & Iridium GO! growth – expect low single digit $ % Commercial Telephony 168M + 8 growth (plus Iridium Certus 9770 22/88 opens new capabilities post-2021) $ Significant Iridium Certus growth fuels expected 100M annual $ % Commercial Broadband 25M + 11 exit rate in 2021; Significant growth continues thereafter Y/Y double-digit subscriber growth; Iridium Certus 9770 partner ecosystem $ % Commercial IoT 85M + 15 potential and volume to open new horizons post-2021 $ Contractual revenue from new satellites ~ 47M at full ramp; $ $ Hosted Payload 26M 35-40M $ Aireon data fee ramps to ~ 23M/year in 2H-2019 $ % Other Data Services 14M + 86 Primarily Satellite Timing & Location (STL) + licensing revenue $ % Commercial Services 319M + 22 Long-standing customer with fixed-price contract renewal expected $ % U.S. Government 88M 0 in April 2019; expect long-term contract and increased revenues $ % $ Total Service Revenue 407M + 16 ~ 440M 124 Commercial Voice & Data

Handset Shipments (in 000s) 52 Equipment Revenue 42 39 37 2015 2016 2017 2018 ($ Millions) $ 97.8 2019 $ $ expected to 78.2 77.1 $ $ 74.2 73.6 be down from 2018 with low growth thereafter 2014 2015 2016 2017 2018 2019 • Handsets: Expect reduced shipments in 2019, then relatively flat thereafter • IoT: Expect growth, though a higher mix of lower-priced chipsets may temper equipment revenue, while increasing device adoption and accelerating subscription growth 125Handset Shipments (in 000s) 52 Equipment Revenue 42 39 37 2015 2016 2017 2018 ($ Millions) $ 97.8 2019 $ $ expected to 78.2 77.1 $ $ 74.2 73.6 be down from 2018 with low growth thereafter 2014 2015 2016 2017 2018 2019 • Handsets: Expect reduced shipments in 2019, then relatively flat thereafter • IoT: Expect growth, though a higher mix of lower-priced chipsets may temper equipment revenue, while increasing device adoption and accelerating subscription growth 125

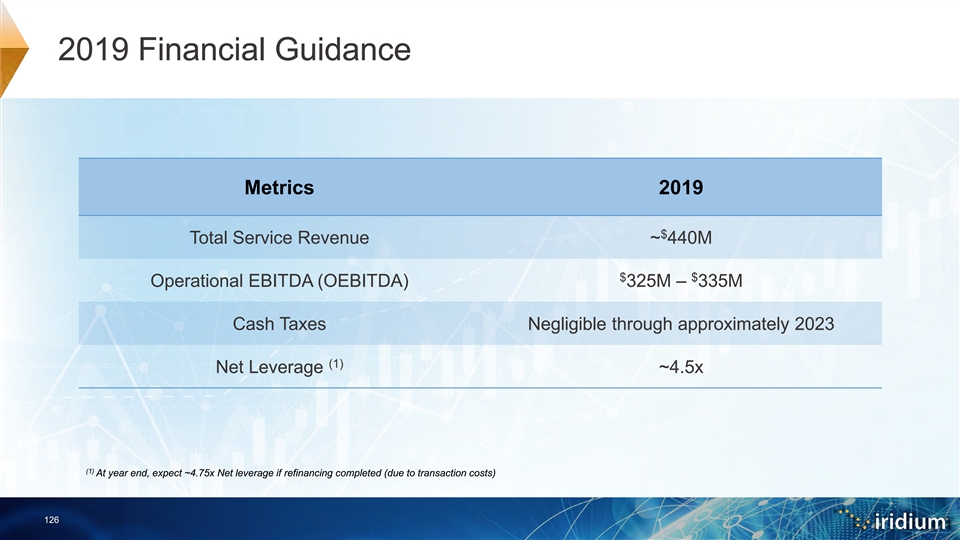

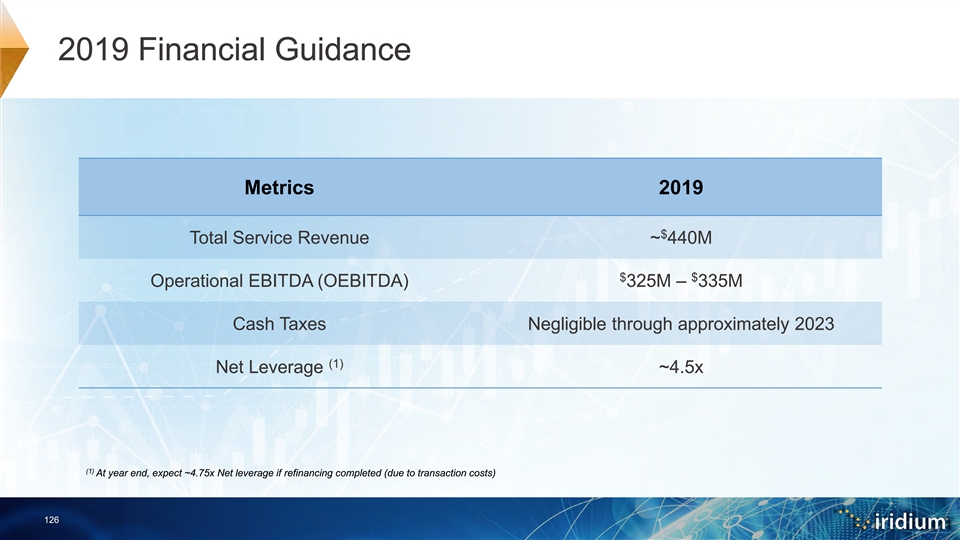

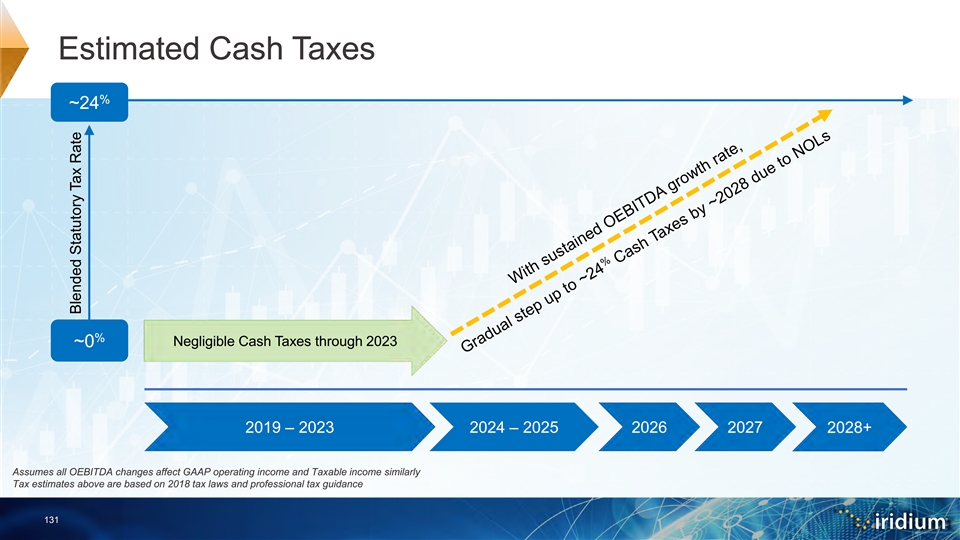

2019 Financial Guidance Metrics 2019 $ Total Service Revenue ~ 440M $ $ Operational EBITDA (OEBITDA) 325M – 335M Cash Taxes Negligible through approximately 2023 (1) Net Leverage ~4.5x (1) At year end, expect ~4.75x Net leverage if refinancing completed (due to transaction costs) 1262019 Financial Guidance Metrics 2019 $ Total Service Revenue ~ 440M $ $ Operational EBITDA (OEBITDA) 325M – 335M Cash Taxes Negligible through approximately 2023 (1) Net Leverage ~4.5x (1) At year end, expect ~4.75x Net leverage if refinancing completed (due to transaction costs) 126

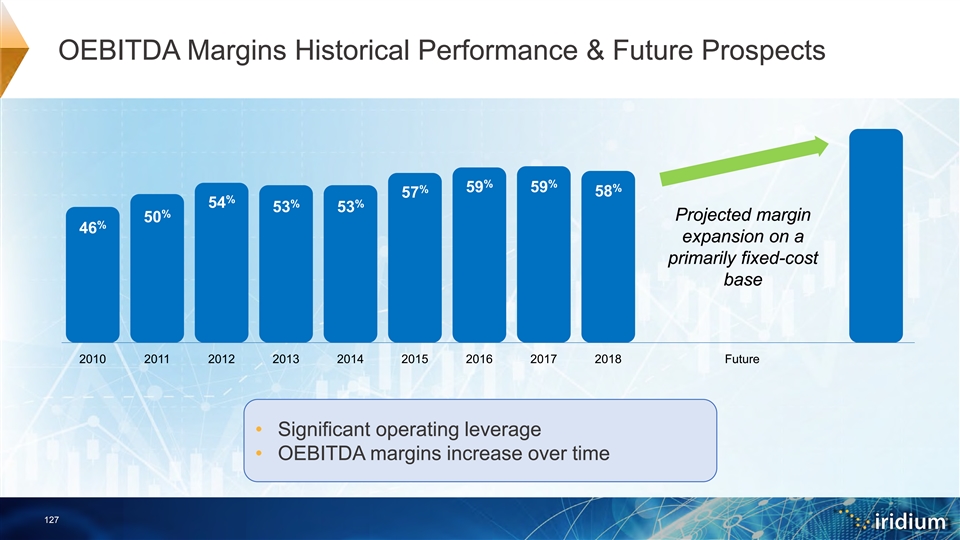

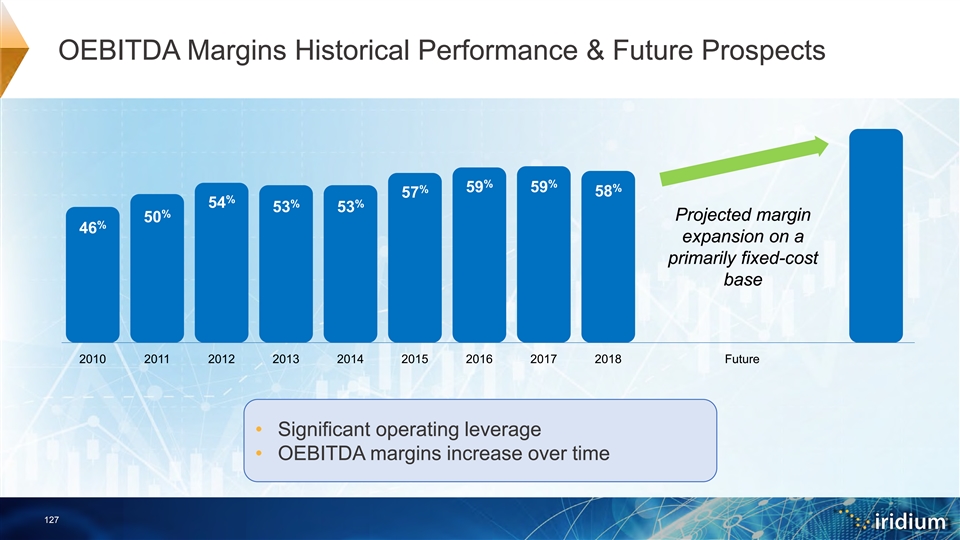

OEBITDA Margins Historical Performance & Future Prospects % % 59 59 % % 58 57 % % % 54 53 53 % Projected margin 50 % 46 expansion on a primarily fixed-cost base 2010 2011 2012 2013 2014 2015 2016 2017 2018 Future • Significant operating leverage • OEBITDA margins increase over time 127OEBITDA Margins Historical Performance & Future Prospects % % 59 59 % % 58 57 % % % 54 53 53 % Projected margin 50 % 46 expansion on a primarily fixed-cost base 2010 2011 2012 2013 2014 2015 2016 2017 2018 Future • Significant operating leverage • OEBITDA margins increase over time 127

Iridium Capital Structure EvolutionIridium Capital Structure Evolution

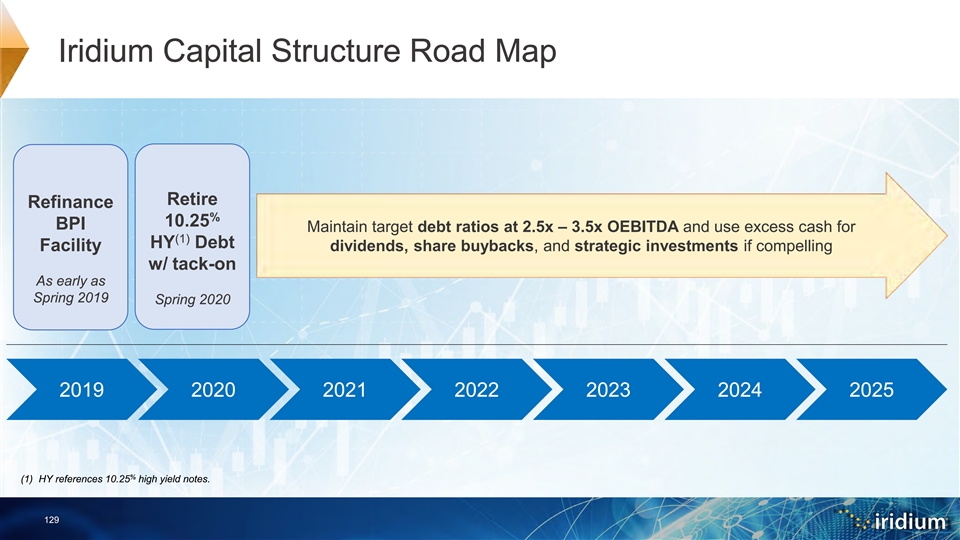

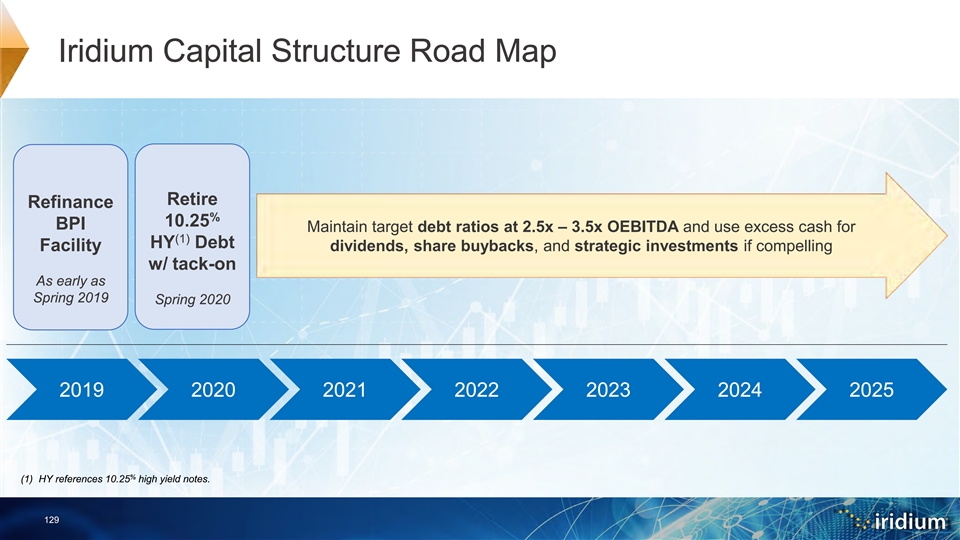

Iridium Capital Structure Road Map Retire Refinance % 10.25 BPI Maintain target debt ratios at 2.5x – 3.5x OEBITDA and use excess cash for (1) HY Debt Facility dividends, share buybacks, and strategic investments if compelling w/ tack-on As early as Spring 2019 Spring 2020 2019 2020 2021 2022 2023 2024 2025 % (1) HY references 10.25 high yield notes. 129Iridium Capital Structure Road Map Retire Refinance % 10.25 BPI Maintain target debt ratios at 2.5x – 3.5x OEBITDA and use excess cash for (1) HY Debt Facility dividends, share buybacks, and strategic investments if compelling w/ tack-on As early as Spring 2019 Spring 2020 2019 2020 2021 2022 2023 2024 2025 % (1) HY references 10.25 high yield notes. 129