Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |

Vantage Drilling Company

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than The Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials: | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Table of Contents

Vantage Drilling Company

NOTICE OF EXTRAORDINARY GENERAL MEETING

IN LIEU OF ANNUAL GENERAL MEETING

OF THE COMPANY

TO BE HELD ON SEPTEMBER 16, 2014

Notice is hereby given that the Extraordinary General Meeting in Lieu of Annual General Meeting (the “Meeting”) of Vantage Drilling Company, an exempted company incorporated with limited liability under the laws of the Cayman Islands (the “Company”), will be held at the Fairmont Waterfront, 900 Canada Place Way, Vancouver, British Columbia V6C 3L5, on Tuesday, September 16, 2014, at 9:00 a.m., Pacific Time for the following proposals:

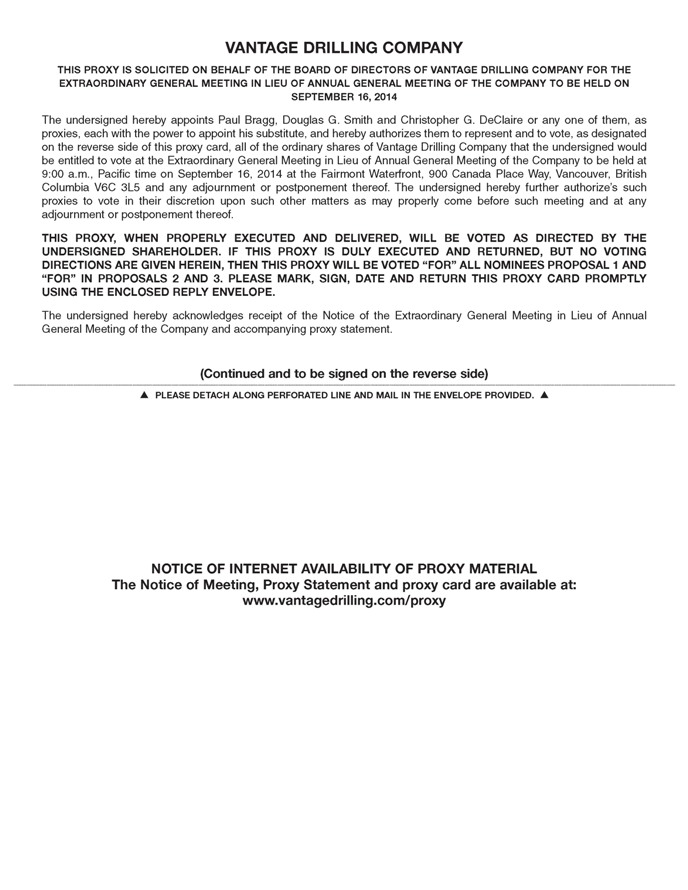

| (1) | To elect nine nominees to serve on the Company’s Board of Directors (the “Board of Directors”) to hold office until the expiration of their term or until their successors are duly elected and qualified; |

| (2) | To approve an ordinary resolution to ratify the appointment of UHY LLP to serve as the Company’s independent registered public accounting firm for the year ending December 31, 2014; |

| (3) | To approve, by a shareholder non-binding advisory vote, the compensation paid to the Company’s named executive officers, commonly referred to as a “Say on Pay” proposal; |

| (4) | To transact such other business as may properly come before the Meeting. |

Any shareholder entitled to attend and vote at the Meeting is entitled to appoint a proxy to attend and vote on such shareholder’s behalf. Such proxy need not be a holder of the Company’s ordinary shares. This proxy statement and a copy of our Annual Report are available on our web site atwww.vantagedrilling.com/proxy .

The Board of Directors has set July 18, 2014 as the record date for the Meeting. Only registered holders of the Company’s ordinary shares at the close of business on that date are entitled to receive notice of the Meeting and to attend and vote at the Meeting. All shareholders will be required to show proof that they held shares as of the record date in order to be admitted to the Meeting. If you are not a shareholder of record, but hold shares through a broker or nominee (in street name), you should provide proof of beneficial ownership on the record date for the Meeting, such as a recent account statement or a copy of the voting instruction card provided by your broker or nominee.

We hope you will be able to attend the meeting, but if you cannot do so, it is important that your shares be represented. The presence at the meeting, in person or by proxy of a majority of the ordinary shares outstanding on the record date shall constitute a quorum. It is important that your shares be voted at the Meeting. We urge you to read the proxy statement carefully, and to vote by telephone or Internet or by signing, dating, and returning the enclosed proxy card in the postage-paid envelope provided, whether or not you plan to attend the Meeting. Instructions are provided on the proxy card.

| By order of the Board of Directors, |

|

| Christopher G. DeClaire |

| Company Secretary |

July 23, 2014

Table of Contents

| 1 | ||||

| 3 | ||||

| 7 | ||||

| 12 | ||||

| 13 | ||||

INFORMATION REGARDING THE INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS FEES, SERVICES AND INDEPENDENCE | 14 | |||

| 15 | ||||

| 16 | ||||

| 37 | ||||

| 39 | ||||

i

Table of Contents

Vantage Drilling Company

PROXY STATEMENT

FOR THE EXTRAORDINARY GENERAL MEETING

IN LIEU OF ANNUAL GENERAL MEETING

OF THE COMPANY

TO BE HELD ON SEPTEMBER 16, 2014

The Board of Directors (the “Board of Directors”) of Vantage Drilling Company, an exempted company incorporated with limited liability under the laws of the Cayman Islands, is soliciting your proxy for use at the Extraordinary General Meeting in Lieu of Annual General Meeting to be held on Tuesday, September 16, 2014, at the Fairmont Waterfront,900 Canada Place Way, Vancouver, British Columbia V6C 3L5at 9:00 a.m., Pacific Time (the “Meeting”), and at any postponement or adjournment of the Meeting. This proxy statement provides information regarding the matters to be voted on at the Meeting, as well as other information that may be useful to you. This proxy statement and related materials are first being sent to our shareholders on or about July 23, 2014. Our registered office is located in the Cayman Islands at P.O. Box 309, Ugland House, Grand Cayman, KY1-1104, Cayman Islands. Our U.S. executive offices are located at 777 Post Oak Boulevard, Suite 800, Houston, Texas 77056, and our telephone number at this address is (281) 404-4700. Our website address iswww.vantagedrilling.com . Information contained on, or accessible through, our website is not a part of this proxy statement. References in this proxy statement to “we,” “our,” “us,” and the “company” are to Vantage Drilling Company.

Who Can Vote; Votes Per Share. Our ordinary shares, par value $0.001 per share, are our only outstanding class of voting securities. Registered holders of our ordinary shares at the close of business on July 18, 2014, the record date for the Meeting, will be entitled to notice of, and to vote at, the Meeting. As of the close of business on the record date, there were 306,200,417 ordinary shares issued and outstanding and held of record by 16 registered holders. Each ordinary share is entitled to one vote on each proposal contained herein.

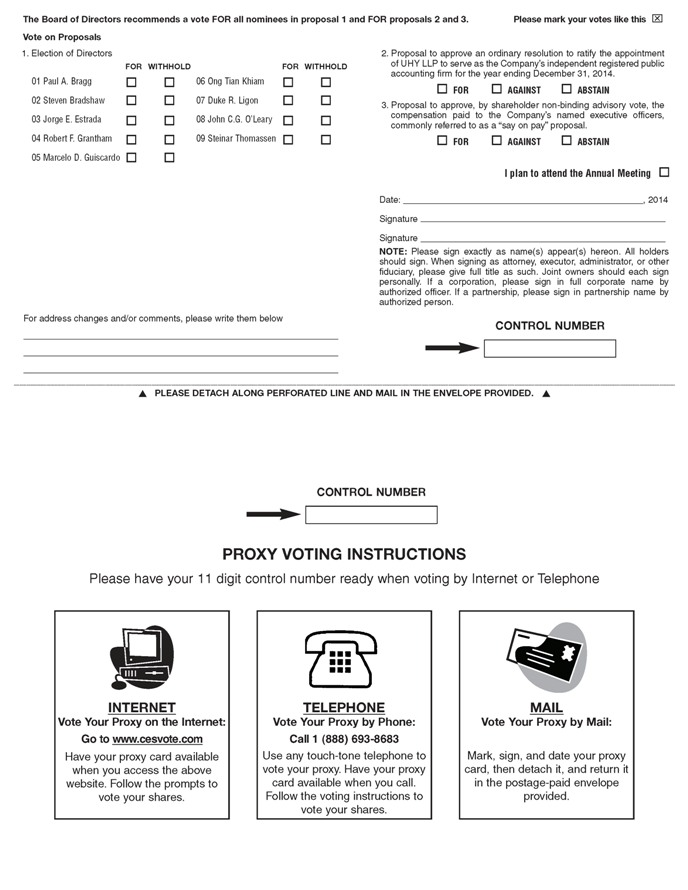

How to Vote; Submitting Your Proxy. You may vote by marking, signing, dating and returning the enclosed proxy card in the enclosed prepaid envelope. Alternatively you may vote by telephone, via the Internet, or in person by attending the Meeting. Only registered shareholders may vote in person at the Meeting. Instructions on how to vote by phone or via the Internet are set forth on the enclosed proxy card. If a proxy card is properly executed, the shares it represents will be voted at the Meeting in accordance with the instructions noted on the proxy. If no instructions are specified in the proxy card with respect to the matters to be acted upon, the shares represented by the proxy will be voted in accordance with the recommendations of the Board of Directors. The Board of Directors recommends that you vote your shares “ FOR ” the election of each nominee identified in Proposal 1 and “FOR” each of Proposals 2 and 3.

Accessing Proxy Materials over the Internet. Pursuant to rules promulgated by the Securities and Exchange Commission (the “SEC”), we are providing access to our proxy materials both by sending you this full set of proxy materials, including a proxy card, and by notifying you of the availability of our proxy materials on the Internet. This proxy statement and a copy of our Annual Report are available on our web site at www.vantagedrilling.com/proxy. Additionally, and in accordance with SEC rules, we maintain the proxy materials on our website in a manner that will not infringe on your anonymity if you access them.

Shares Registered in the Name of a Nominee. If your shares are held in the name of a broker, bank or other nominee (typically referred to as being held in “street name”), you will receive instructions from your broker, bank or other nominee that must be followed in order for your broker, bank or other nominee to vote your shares per your instructions. Many brokerage firms and banks have a process for their beneficial holders to provide

1

Table of Contents

instructions via the Internet or over the telephone. In the event you do not provide instructions on how to vote, your broker may have authority to vote your shares. A broker “non-vote” occurs when a broker or other nominee lacks discretionary power to vote and for which the broker or other nominee has not received specific voting instructions from the beneficial holder. Under the rules that govern brokers who are voting with respect to shares that are held in street name, brokers have the discretion to vote such shares on routine matters, but not on non-routine matters. Routine matters include ratification of the appointment of our independent registered public accounting firm, but not the election of directors, or the advisory vote on executive compensation. As such, brokers will have the authority to exercise discretion to vote shares only with respect to Proposal 2 because it involves a matter considered routine, but will not have the authority to exercise discretion to vote shares with respect to Proposals 1 or 3 because they involve non-routine matters.Your vote is especially important with respect to the election of directors. If your shares are held by a broker, your broker cannot vote your shares for the election of directors unless you provide voting instructions. Therefore,please instruct your broker regarding how to vote your shares on the election of directors promptly. If you hold shares through a broker, bank or other nominee and wish to be able to vote in person at the meeting, you must obtain a legal proxy from your broker, bank or other nominee and present it to the inspector of election with your ballot at the Meeting.

Revoking Your Proxy. If you hold shares registered directly in your name, you may revoke your proxy at any time before it is voted at the Meeting by sending a signed revocation thereof to Vantage Drilling Company, 777 Post Oak Boulevard, Suite 800, Houston, Texas 77056, Attention: Company Secretary, which we must receive by 11:59 p.m., Central Time, on September 15, 2014, by delivery of a valid, later-dated proxy or by voting by ballot at the Meeting. If you have voted via the Internet, you may change your vote by voting again via the Internet. Attendance at the Meeting alone will not revoke any proxy. However, please note that if you hold your shares in street name, you must contact your broker, bank or other nominee to change your vote or obtain a proxy to vote your shares if you want to cast your vote in person at the Meeting.

Proxy Solicitation. We will bear all costs and expenses of soliciting proxies from shareholders in connection with the matters to be voted on at the Meeting. We will request brokers, custodians, nominees, fiduciaries and other record holders to forward copies of our proxy and soliciting materials to beneficial owners and request authority for the exercise of proxies. In such cases, upon request, we will reimburse such holders for their reasonable out-of-pocket expenses incurred in connection with the solicitation. If you choose to access the proxy materials over the Internet, you are responsible for any Internet access charges you may incur. We have retained Alliance Advisors to assist in the solicitation of proxies at a fee of approximately $13,000, plus out-of-pocket expenses. No additional compensation will be paid to our directors, officers, or other employees for their services in soliciting proxies for the Meeting.

Quorum, Voting Requirements and Broker Non-Votes. In order to establish a quorum at the Meeting, pursuant to our Memorandum and Articles of Association (our “M&A”), there must be present, either in person or by proxy, the holders of a majority of the ordinary shares entitled to vote at the Meeting. For purposes of determining a quorum, broker “non-votes” are counted as present and entitled to vote. The nine nominees for election as directors who are included in Proposal 1 and who receive the most “FOR” votes cast by the shareholders will be elected as our directors. In respect of all other proposals, to be approved, any such proposal must receive the affirmative vote of a majority of the ordinary shares present or represented by proxy and voting on such proposal. “Broker non-votes” and abstentions will not affect the outcome of any such proposals. The result of the advisory vote on executive compensation are not binding on the Board of Directors.

Voting Procedures and Tabulation. We have appointed a representative of Alliance Advisors as the inspector of elections to act at the Meeting and to make a written report thereof. Prior to the Meeting, the inspector will sign an oath to perform his or her duties in an impartial manner and according to the best of his or her ability. The inspector will assist and advise the chairman of the Meeting in order to ascertain the number of ordinary shares outstanding and the voting power of each, determine the ordinary shares represented at the Meeting and the validity of proxies, ballots, and the poll voting procedure to be conducted at the Meeting, count all votes and ballots, and perform certain other duties. The determination of the chairman of the Meeting as to the validity of the qualification of any voter, the poll voting procedure, proxies and ballots will be final and binding.

2

Table of Contents

ELECTION OF DIRECTORS

Based upon the recommendation of the Nominating and Corporate Governance Committee, the Board of Directors has nominated the nine nominees identified and discussed in the paragraphs below for election at the Meeting. Each nominee has been previously elected by shareholders to the Board of Directors. Each nominee, if elected, will hold office until the next annual general meeting or until his office is vacated in accordance with the procedure in our M&A. Each of the nominees has agreed to serve if elected. We believe that all of the nominees possess the professional and personal qualifications necessary for board service, and have highlighted particularly noteworthy attributes for each nominee in the individual biographies below. If any one of them becomes unavailable to serve as a director, the Board of Directors may designate a substitute nominee. In that event, the persons named as proxies will vote for the substitute nominee designated by the Board of Directors. The Board of Directors does not presently contemplate that any of the nominees will become unavailable for election. See “Director Independence” for a discussion of the independence of the nominees.

The following table sets forth the names of the nominees proposed by the Board of Directors for election, their ages as of July 18, 2014 and certain other information with regard to each nominee.

Name | Age | Position | ||||

Paul A. Bragg | 58 | Chairman of the Board of Directors and Chief Executive Officer | ||||

Steven Bradshaw (1) | 65 | Director | ||||

Jorge E. Estrada (2), (3) | 66 | Director | ||||

Robert F. Grantham (1), (3) | 56 | Director | ||||

Marcelo D. Guiscardo (1) | 62 | Director | ||||

Ong Tian Khiam | 71 | Director | ||||

Duke R. Ligon (1), (2), (3) | 73 | Director | ||||

John C.G. O’Leary | 58 | Director | ||||

Steinar Thomassen (2), (3) | 68 | Lead Independent Director | ||||

| (1) | Member of our Compensation Committee as of December 31, 2013. |

| (2) | Member of our Audit Committee as of December 31, 2013. |

| (3) | Member of our Nominating and Corporate Governance Committee as of December 31, 2013. |

| Paul A. Bragg, 58, has served as our Chairman of the Board of Directors and Chief Executive Officer, and of our predecessor Vantage Energy Services, Inc. (“Vantage Energy”), since September 2006.Qualifications and Experience: Mr. Bragg has over 33 years of direct industry experience. Prior to joining us, Mr. Bragg was affiliated with Pride International, Inc. (“Pride”), which was one of the world’s largest international drilling and oilfield services companies prior to being acquired by Ensco plc. From 1999 through 2005, Mr. Bragg served as the Chief Executive Officer of Pride. From 1997 through 1999, Mr. Bragg served as Pride’s Chief Operating Officer, and from 1993 through 1997, Mr. Bragg served as the Vice President and Chief Financial Officer of Pride. As a result of his three decades in the offshore drilling industry, Mr. Bragg is experienced in the operational and marketing strategies that are key to our development and success. Additionally, Mr. Bragg has significant experience as the chief executive of a public company, with extensive knowledge of public and private financing and board functions.Education: Mr. Bragg graduated from the University of Texas at Austin in 1977 with a B.B.A. in Accounting.

Directorships for the past five years: None, other than our Board of Directors. |

3

Table of Contents

| Steven Bradshaw, 65, has served as one of our directors since April 2011. Qualifications and Experience: Mr. Bradshaw is currently a member of the Board of Directors and the Chairman of the Conflicts Committee of Blue Knight Energy Partners, LP, a publicly traded master limited partnership. From 2005 to 2009, Mr. Bradshaw was the Vice President of Administration and a new venture business advisor for Premium Drilling, Inc., an international offshore drilling contractor. From 1997 through 2001, and from 2004 through 2006, Mr. Bradshaw worked as a Managing Director for Global Logistics Solutions, a management and operations consulting group. From 2001 through 2003, Mr. Bradshaw served as the Executive Vice President of Skaugen Petrotrans, Inc., the United States subsidiary of I.M. Skaugen ASA, the world’s largest provider of ship-to-ship cargo transfer services. From 1989 to 1996, Mr. Bradshaw worked as the President of the Refined Products Division and an Executive Vice President of Marketing for the Kirby Corporation, a publicly traded transportation company. From 1986 through 1988, Mr. Bradshaw served as Vice President—Sales and a Market Development Manager for the Kirby Corporation. From 1975 through 1980, Mr. Bradshaw worked as a Terminals Manager for Midland Enterprises, Inc. Mr. Bradshaw served as a Lieutenant in the United States Navy from 1970 through 1973. Education: Mr. Bradshaw received a B.A. in Mathematics from the University of Missouri in 1970 and a M.B.A. from the Harvard Business School in 1975.

Directorships for the past five years: Blue Knight Energy Partners, LP (2009 to present) and Premium Drilling (Cayman) Limited (2006 to 2009). | |

| Jorge E. Estrada, 66, has served as one of our directors since 2008 and as a director of Vantage Energy since its inception.Qualifications and Experience: Mr. Estrada has over 38 years of direct industry experience. From July 1993 to January 2002, Mr. Estrada was employed as a consultant to Pride. From January 2002 to May 2005 he was employed by Pride in a business development capacity. Mr. Estrada is also the President and Chief Executive Officer of JEMPSA Media and Entertainment. Mr. Estrada has a strong technical background and extensive experience in the offshore drilling industry. Mr. Estrada’s extensive experience in the offshore drilling industry and wealth of technical knowledge provides him with unique insight into potential issues that could emerge with respect to our operational development. Additionally, Mr. Estrada has a business development background that is extremely valuable to us as we grow our business.Education: Mr. Estrada received a B.S. in Geophysics from Washington and Lee University, and was a PhD candidate at the Massachusetts Institute of Technology.

Directorships for the past five years: None, other than our Board of Directors. | |

| Robert F. Grantham, 56, has served as one of our directors since 2008. Qualifications and Experience: Mr. Grantham has over 26 years of industry experience. From 1982 to 2006 he held senior management positions with various maritime shipping companies, including serving as Chartering Broker for London based Andrew Low Son & Co. from 1982 to 1984, General Manager of Shipping Agency and Consulting Company Hong Kong & Eastern (Japan) Ltd. (HESCO) from 1984 to 1990, Senior Manager of Singapore based Seaconsortium Ltd. from 1991 through 1994, and as a director of its successor, the Ben Line Agency Group, from 1994 through 2006. In 2006, Mr. Grantham founded his own European based marine consulting company. Mr. Grantham’s numerous directorships and international oil and gas shipping experience have provided him with a strong background in international maritime issues that play a key role in our business. Further, Mr. Grantham’s extensive work on corporate governance matters through his directorships provides an experienced voice on the Board of Directors.

Directorships for the past five years: Bluewave Services, Ltd. (2006 to present) a shipping consultancy specializing in commercial operations of LNG vessels, The Medical Warehouse LTD (1999 to present) and TMT UK Ltd. (2006 to present). | |

4

Table of Contents

| Marcelo D. Guiscardo, 62, has served as one of our directors since 2008 and as a director of Vantage Energy since its inception. Qualifications and Experience: Mr. Guiscardo has 34 years of industry experience. He is currently president and founder of QME USA, LLC an Oilfield Equipment construction company in Houston, Texas. Since 2008, Mr. Guiscardo has been the president of GDM Business Development, an international consulting firm focused on the oil & gas industry where he currently serves as an advisor to energy industry clients. He served as President of Pioneer Natural Resources, Inc.’s Argentine subsidiary from January 2005 until May 2006. From March 2000 until January 2005, he was Vice President, E&P Services for Pride. From September 1999 until joining Pride, he was President of GDM Business Development. From November 1993 until September 1999, Mr. Guiscardo held two executive officer positions with, and was a director of, YPF Sociedad Anonima, an international integrated energy company. Mr. Guiscardo was YPF’s Vice President of Business Development in 1998 and 1999. Prior to that, he was YPF’s Vice President of Exploration and Production. From 1979 to 1993 he filled various positions for Exxon Company USA and Exxon International (now ExxonMobil) that culminated in having E&P responsibilities over the Middle East (Abu Dhabi, Egypt, Saudi Arabia and Yemen), France, Thailand and Cote d’Ivoire. Mr. Guiscardo has in-depth knowledge of the oil and gas industry as well as experience in strategic development that is key to our growth. Through his various management roles, he has developed extensive knowledge of compensation structures and financial matters. Education: Mr. Guiscardo graduated in May 1979 with a B.S. in Civil Engineering from Rutgers College of Engineering.

Directorships for the past five years: QM Equipment, S.A. (2008 to present) and Pampa Del Abra, S.A. (2010 to present). | |

| Ong Tian Khiam, 71, has served as one of our directors since 2009. Qualifications and Experience: Mr. Ong currently serves as the Chief Executive Officer of Valencia Drilling Corporation. From October 2009 through July 2010, Mr. Ong served as Chief Executive Officer of Mandarin Drilling Corporation. Additionally, since July 2007, Mr. Ong has served as Managing Director of OM Offshore Pte Ltd., a division of Otto Marine Pte Ltd., which invests in offshore drilling ventures. From November 1997 through July 2007, he served as Managing Director of PPL Shipyard Pte Ltd and Baker Marine Pte Ltd, a wholly-owned subsidiary of PPL, specializing in the construction of offshore drilling rigs and design of jackup drilling rigs. Through his experience, Mr. Ong has gained a variety of management and technical skills focusing on the design and production of offshore drilling equipment. Mr. Ong’s knowledge and skills with respect to the design and construction of offshore drilling vessels makes a valuable contribution to the Board of Directors as we continue to oversee the construction of vessels to be added to our fleet. Education: Mr. Ong graduated from the University of Singapore in 1969 with a Bachelor’s degree in Mechanical Engineering.

Directorships for the past five years: None, other than our Board of Directors. | |

| Duke R. Ligon, 73, has served as one of our directors since February 2011.Qualifications and Experience: Mr. Ligon is a lawyer and owns and manages Mekusukey Oil Company, LLC. From January 2007 to March 2010, Mr. Ligon worked as a Legal Strategic Advisor to Love’s Travel Shops & Country Stores, Inc. From February 1997 to January 2007, Mr. Ligon served as General Counsel and Senior Vice President of Devon Energy Corporation in addition to serving as a member of Devon’s Executive Management Committee. Prior to that, Mr. Ligon was a partner in the New York office of the law firm Mayer, Brown & Platt from 1995 to February 1997. From 1985 to 1995, Mr. Ligon worked | |

5

Table of Contents

as a Senior Vice President and Managing Director and the Head of Energy Merchant Banking for Bankers Trust Company in New York. Prior to that, Mr. Ligon worked for Corcoran, Hardesty, Whyte, Hemphill & Ligon P.C. as a partner in the law firm’s Washington D.C. office from 1982 through 1985. From 1975 to 1982, Mr. Ligon worked as a partner at Bracewell & Patterson and was a member of the firm’s Management Committee. Mr. Ligon worked as an Assistant Administrator in the Federal Energy Administration (the predecessor to the U.S. Department of Energy) from 1973 through 1975. In 1973, Mr. Ligon worked as a Director at the U.S. Department of the Interior and headed the Department’s Office of Oil and Gas. Prior to that, Mr. Ligon worked as the oil and gas advisor to U.S. Treasury Secretary John B. Connally in 1972. Before serving Secretary Connally, Mr. Ligon worked as an Assistant to the President of Continental Oil Company (Conoco) from 1971 through 1972. Prior to his experience with Continental Oil Company, Mr. Ligon served as a Captain in the United States Army from 1969 through 1971 and was awarded a Bronze Star for his service in the Republic of Vietnam. Through his experience in the energy industry and work with various law firms, Mr. Ligon provides insight into management matters and corporate strategy, including compensation and audit committee matters, that we believe is essential for a growing company.Education: Mr. Ligon received a B.A. from Westminster College in 1963 and a J.D. from the University of Texas School of Law in 1969.

Directorships for the past five years: SteelPath MLP Funds Trust (January 2010 to present), Pre-Paid Legal Services, Inc. (March 2007 to present), Blueknight Energy Partners, LLP (January 2009 to present), PostRock Energy (January 2006 to present) and Panhandle Oil & Gas (August 2007 to present). | ||

| John C.G. O’Leary, 58, has served as one of our directors since 2008 and as a director of Vantage Energy since its inception. Qualifications and Experience: Mr. O’Leary has over 31 years of industry experience. Mr. O’Leary is the CEO of Strand Energy, an independent consultancy firm with its head office in Dubai, UAE, providing advisory and brokerage services to clients in the upstream energy industry. Prior to forming Strand Energy, and from 2004 to 2006, Mr. O’Leary was a partner of Pareto Offshore ASA, a consultancy firm based in Oslo, Norway, providing consulting and brokerage services to customers in the upstream energy industry. Prior to commencing his work with Pareto Offshore in November 2004, Mr. O’Leary was President of Pride. He joined Pride in 1997 as Vice President of Worldwide Marketing. In addition to his experience in the oil and gas industry, which provides a view on the Board of Directors that encompasses the broader industry, Mr. O’Leary is experienced in finance and accounting matters and has extensive experience with financial statements. Education: Mr. O’Leary received an Honors B.E. in civil engineering from University College, Cork, Ireland in 1977. He holds two post-graduate degrees, one in Finance from Trinity College, Dublin and one in Petroleum Engineering from the French Petroleum Institute in Paris.

Directorships for the past five years: Technip (2008 to present) and Huisman-Itrec (2006 to present). | |

| Steinar Thomassen, 68, has served as one of our directors since 2008 and currently serves as Lead Independent Director. Qualifications and Experience: Mr. Thomassen has over 32 years of direct industry experience. Mr. Thomassen served as Manager of LNG Shipping for StatoilHydro ASA (formerly Statoil ASA) from August 2001 until his retirement in December 2007 and was responsible for the acquisition and construction supervision of three large LNG tankers. Previously, Mr. Thomassen served as Vice President of Industrial Shipping for Navion ASA from October 1997 to July 2001 and for Statoil ASA from September 1992 to September 1997 and was responsible for the chartering and | |

6

Table of Contents

operation of a fleet of LPG, chemical and product tankers. Previously, Mr. Thomassen served as Chief Financial Officer for Statoil North America Inc., from December 1989 to August 1992, and functioned as the head of administration, personnel, accounting and finance. From January 1986 until November 1989 he was employed by Statoil AS and served as Controller for the Statfjord E&P producing division. From May 1976 until December 1986, Mr. Thomassen was employed by Mobil Exploration Norway Inc., where he held various international positions, including Project Controller for the Statfjord Development, and served as Project Controller and Treasurer of the Yanbu Development Project in Saudi Arabia from January 1982 until December 1986. Mr. Thomassen’s experience in various positions with oil and gas companies provides international construction, marketing and general operational experience. Further, through his demonstrated skills as a chief financial officer, Mr. Thomassen provides the Board of Directors and the Audit Committee with valuable insight on finance matters, financial statements and audit matters. Education: Mr. Thomassen graduated from the Oslo School of Marketing in 1968.

Directorships for the past five years: None, other than our Board of Directors. |

Arrangement for Nomination of Directors

With respect to our current Board of Directors, each of Messrs. Ong, Grantham, Bradshaw, Ligon and Thomassen was originally nominated to serve on our Board by F3 Capital, but were reviewed and renominated for election in subsequent years by the Nominating & Corporate Governance Committee and the full Board of Directors. Each of Messrs. Grantham, Bradshaw, Ligon and Thomassen has been determined by the Board to be independent directors. Further, Mr. Thomassen has been designated as the Lead Independent Director of the Board of Directors.

Required Vote

Directors are elected by a plurality, and the nine nominees who receive the most “FOR” votes will be elected. Abstentions and broker non-votes will not affect the outcome of the election.

Board Recommendation

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE

“FOR” EACH NOMINEE TO THE BOARD OF DIRECTORS NAMED IN PROPOSAL 1.

INFORMATION CONCERNING OUR BOARD OF DIRECTORS

Communicating with the Board

Shareholders who wish to communicate to the Board of Directors should do so in writing to the following address:

[Name of Director(s) or Board of Directors]

Vantage Drilling Company

Attn: Investor Relations

777 Post Oak Boulevard, Suite 800

Houston, Texas 77056

All shareholder communications are logged and those not deemed frivolous, threatening or otherwise inappropriate are forwarded to the Chairman of the Nominating and Corporate Governance Committee for

7

Table of Contents

distribution or, if addressed to the Audit Committee or Compensation Committee, forwarded to the appropriate committee chairman. Such chairman will review the received communication with the Board of Directors, or the group addressed in the communication, for the purpose of determining an appropriate response. Any communication received may be shared with management.

Board Leadership Structure and Role in Risk Oversight

Board Leadership Structure

Our Board of Directors is committed to strong corporate governance and board independence. Our Board of Directors recognizes that having a shared Chief Executive Officer and Chairmanship can present an issue for some companies or some boards. The Nominating and Corporate Governance Committee and the Board of Directors continue to consider the issue of board leadership and do not believe there is any material corporate governance benefit to separating these positions at this time. Our Chairman of the Board does not have any enhanced rights as a director, but has the same voting authority as any other director. The role of Chairman principally consists of presiding at meetings of the Board of Directors and taking the initiative on establishing the proposed agenda for meetings of the Board of Directors, which is a role our senior management would play a significant part in regardless of which director serves as Chairman. Our Board of Directors continues to believe that the current structure is in the best interests of us and our shareholders and allows Paul A. Bragg, who serves as our Chairman and Chief Executive Officer, to focus on our strategy, business and operations.

The Board of Directors believes that there is no one best leadership structure model that is most effective in all circumstances. The Board of Directors retains the authority to separate the positions of Chairman and Chief Executive Officer in the future if such change is determined to be in our best interests and those of our shareholders. Thus, the Board of Directors remains flexible and committed to a strong corporate governance structure and board independence. The Board of Directors is committed to adopting corporate management and governance policies and strategies that promote our effective and ethical management. In this regard, the Board of Directors strongly believes that it should have maximum flexibility in deciding whether the offices of Chairman and Chief Executive Officer are combined or separate and, if separate, whether the Chairman should be an independent director or an employee.

Further, the Board of Directors believes that it is most important that an independent director serve as a focal point for the work of the independent directors. In 2009, as part of its commitment to strong corporate governance and independence, the Board of Directors established the position of Lead Independent Director. Mr. Thomassen currently serves as our Lead Independent Director. The Lead Independent Director is elected by our independent directors and ensures that (i) the Board of Directors operates independently of management and (ii) our directors and shareholders have an independent leadership contact. The Lead Independent Director is also responsible for:

| • | Presiding over meetings of the non-management and independent members of the Board of Directors; |

| • | Preparing the agenda of the Board of Directors in conjunction with the Chairman and Chief Executive Officer; |

| • | Serving as a point of contact between non-management and independent members of the Board of Directors and the Chairman and Chief Executive Officer to report or raise matters; |

| • | Calling executive sessions of the Board of Directors; and |

| • | Consulting with the Chairman of the Compensation Committee to provide performance feedback and compensation information to the Chairman and Chief Executive Officer. |

Board Assessment

As part of the Board of Directors’ annual assessment process, the Board of Directors evaluates our board and committee structure to ensure that it remains appropriate for us. Although the Board of Directors recognizes

8

Table of Contents

that there may be circumstances in the future that would lead to the separation of the roles of Chief Executive Officer and Chairman of the Board, the Board of Directors believes that the development of a formal policy is unnecessary at this time and may serve to limit flexibility to determine our ideal leadership structure.

Board of Directors’ Role in Risk Oversight

The Board of Directors is actively involved in our risk oversight. Although the Board of Directors as a whole has retained oversight over our risk assessment and risk management efforts, much of its oversight effort is conducted through its various committees. Each committee, generally through its chairman, then regularly reports back to the full Board of Directors on the conduct of the committee’s functions. The Board of Directors, as well as the individual committees, also regularly hear directly from our key officers and employees involved in risk assessment and risk management. Set forth below is a description of the role of the various committees, and the full Board of Directors, in risk oversight.

The Audit Committee assists the Board of Directors in risk oversight by reviewing and discussing with management, internal auditors and the independent auditors our significant financial and other exposures, and guidelines and policies relating to enterprise risk assessment and risk management, including our procedures for monitoring and controlling such risks. In addition to exercising oversight over key financial and business risks, the Audit Committee oversees, on behalf of the Board of Directors, financial reporting, tax, and accounting matters, as well as our internal controls over financial reporting. The Audit Committee also plays a key role in oversight of our compliance with legal and regulatory requirements.

The Compensation Committee oversees the compensation programs for our officers. As part of that process the Compensation Committee ensures that the performance goals and metrics used in our compensation plans and arrangements align the interest of executives with those of our shareholders and maximize our and our executives’ performance, without creating incentives for executives to take excessive or inappropriate risks.

The Nominating and Corporate Governance Committee has oversight over our governance policies and structures, management and director succession planning, as well as risks and efforts to manage our risks in those areas.

The full Board of Directors then regularly reviews the efforts of each of its committees and discusses the key strategic, financial, business, legal and other risks that we face, as well as our efforts to manage those risks.

We believe the current leadership structure of the Board of Directors supports the risk oversight functions described above by providing independent leadership at the committee level, with ultimate oversight by the full Board of Directors as led by our Chairman of the Board and Chief Executive Officer, as well as our Lead Independent Director.

Board Member Attendance at Meetings of Shareholders

Although we do not have a formal policy regarding attendance by members of the Board of Directors at meetings of our shareholders, we encourage directors to attend. Each of Messrs. Bragg, Bradshaw and Thomassen attended the Extraordinary General Meeting in lieu of Annual General Meeting held in March 2013.

Director Independence

There are no family relationships among any of our directors or executive officers. The Board of Directors has determined that the following members are independent as such term is defined under NYSE MKT rules and SEC regulations: Messrs. Bradshaw, Estrada, Grantham, Guiscardo, Ligon and Thomassen. Mr. Thomassen has been designated as the Lead Independent Director.

9

Table of Contents

Meeting Attendance and Board Committees

Meetings of the Board of Directors. During the year ended December 31, 2013, the Board of Directors held eight meetings. All directors attended at least 75% of the meetings of the Board of Directors and the committees on which they serve. We believe that attendance at meetings of the Board of Directors and its committees is only one criterion for judging the contribution of individual directors and that all directors have made substantial and valuable contributions.

Standing Committees. The Board of Directors also has three standing committees: the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee. Each of the committees has a separate chairperson and charter, and is comprised solely of independent directors. The Board of Directors may also create additional committees from time to time with responsibilities for strategic planning, financing, and such other responsibilities as the Board of Directors shall determine to be appropriate.

Audit Committee. At December 31, 2013, the Audit Committee consisted of Jorge E. Estrada, Duke R. Ligon and Steinar Thomassen. Mr. Thomassen serves as the Audit Committee Financial Expert and is the Chairman of the Audit Committee under the SEC rule implementing Section 404 of the Sarbanes-Oxley Act of 2002. The Audit Committee reviews and recommends to the Board of Directors internal accounting and financial controls and accounting principles and auditing practices to be employed in the preparation and review of our financial statements. In addition, the Audit Committee has authority to engage public accountants to audit our annual financial statements and determine the scope of the audit to be undertaken by such accountants. The Audit Committee is also charged with reviewing and approving all related party transactions. As of December 31, 2013, all of the members of the Audit Committee were independent as such term is defined under NYSE MKT rules and SEC regulations. The Audit Committee met six times during the year ended December 31, 2013.

Compensation Committee. At December 31, 2013, the Compensation Committee consisted of Marcelo D. Guiscardo, Steven Bradshaw, Robert Grantham and Duke R. Ligon. Marcelo D. Guiscardo serves as the Chairman of the Compensation Committee. The primary purpose of the Compensation Committee is to, among other things, discharge the responsibilities of directors relating to the compensation of our executives and to produce the report that the rules and regulations of the SEC require to be included in, or incorporated by reference into, our annual report and proxy statement. The Compensation Committee’s processes and procedures for determining executive compensation are described below in “Executive and Director Compensation—Compensation Committee Report.” As of December 31, 2013, all of the members of the Compensation Committee were independent as such term is defined under NYSE MKT rules and SEC regulations. The Compensation Committee met three times during the year ended December 31, 2013.

Nominating and Corporate Governance Committee. At December 31, 2013, the Nominating and Corporate Governance Committee consisted of Jorge E. Estrada, Robert F. Grantham, Duke Ligon, and Steinar Thomassen. The primary purpose of the Nominating and Corporate Governance Committee is to (1) identify individuals qualified to become members of the Board of Directors, (2) recommend candidates to the Board of Directors to either fill vacancies on the Board of Directors or to stand for election to the Board of Directors at the next annual general meeting of our shareholders, (3) select nominees for each committee of the Board of Directors, (4) develop and recommend to the Board of Directors appropriate corporate governance policies for the company, conduct a regular review of such policies and recommend to the Board of Directors any additions, amendments or changes thereto, and (5) perform such other functions as the Board of Directors may assign to the Nominating and Corporate Governance Committee from time to time. As of December 31, 2013, all of the members of the Nominating and Corporate Governance Committee were independent as such term is defined under NYSE MKT rules and SEC regulations. The Nominating and Corporate Governance Committee met three times during the year ended December 31, 2013.

Director Nominations Process

Nominating functions are handled by the Nominating and Corporate Governance Committee pursuant to its charter. Our M&A do not currently contain specific provisions that address the process by which a shareholder may nominate an individual to stand for election to the Board of Directors. We do not have a formal policy concerning

10

Table of Contents

shareholder recommendations for election of nominees to the Board of Directors. We have not received any recommendations from shareholders requesting that the Nominating and Corporate Governance Committee consider a candidate for inclusion among the Nominating and Corporate Governance Committee’s slate of nominees in our proxy statement, and we believe that no formal policy concerning shareholder recommendations is needed.

In evaluating director nominees, the Nominating and Corporate Governance Committee considers, among other things, the following factors:

| • | the appropriate size of the Board of Directors; |

| • | our needs with respect to the particular talents and experience of our directors; |

| • | experience at a policy-making level; |

| • | strategic thinking; |

| • | depth of understanding of our business and industry; |

| • | experience with accounting rules and practices; |

| • | a general understanding of marketing, financing and other disciplines relevant to the success of a publicly-traded company; |

| • | a general understanding of sound principles of corporate governance; and |

| • | the desire to balance the considerable benefit of continuity on the Board of Directors with the periodic injection of the fresh perspectives provided by new members. |

Although we have no formal policy with respect to diversity, the goal of the Nominating and Corporate Governance Committee is to assemble a Board of Directors that brings us a variety of perspectives and skills derived from high quality business and professional experience. Current members of the Nominating and Corporate Governance Committee and Board of Directors are also polled for suggestions as to individuals meeting such criteria. Research may also be performed to identify qualified individuals.

There are no stated minimum criteria for director nominees, though the Nominating and Corporate Governance Committee may consider such factors as it deems to be in the best interests of us and our shareholders. The Nominating and Corporate Governance Committee believes that, in accordance with the rules of the NYSE MKT, it is appropriate that a majority of the members of the Board of Directors meet the definition of “independent director” set forth in the rules of the NYSE MKT. The Nominating and Corporate Governance Committee also believes it appropriate for certain key members of our management to participate as members of the Board of Directors.

There have not been any material changes to the procedures by which shareholders may recommend nominees to the Board of Directors since our last shareholders meeting at which directors were elected.

Code of Ethics

We have adopted a Code of Business Conduct and Ethics that applies to all of our directors, officers and employees (the “Code of Conduct”). Our Code of Conduct is available atwww.vantagedrilling.com on the “Corporate Governance” page under the link “Vantage Code of Business Conduct and Ethics.” We intend to include on our website any amendments to, or waivers from, a provision of the Code of Conduct that applies to our principal executive officer, principal financial officer, or controller that relates to any element of the “code of ethics” definition contained in Item 406(b) of Regulation S-K.

Where to Find Corporate Governance Information

The charters for our Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee, and our Code of Conduct, are available on our website:www.vantagedrilling.com under “Corporate Governance.” Copies of these documents are also available in print form at no charge by sending a request to Investor Relations, Vantage Drilling Company, 777 Post Oak Boulevard, Suite 800, Houston, Texas 77056.

11

Table of Contents

TO APPROVE AN ORDINARY RESOLUTION TO RATIFY APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

UHY LLP, a U.S. based accounting firm (“UHY”), has served as our independent registered public accounting firm, and the independent registered public accounting firm of our predecessor, since our inception. The Audit Committee, in its capacity as a committee of the Board of Directors, has appointed UHY to audit our financial statements for the year ending December 31, 2014. Representatives of UHY plan to attend the Meeting and will be available to answer appropriate questions from shareholders. These representatives will be able to make a statement at the Meeting if they wish, although we do not expect them to do so.

Shareholder ratification of the appointment of UHY is not required by the rules of the NYSE MKT or the SEC or by our M&A. However, the Board of Directors is submitting the appointment of UHY to our shareholders for ratification as a matter of good corporate practice. If our shareholders fail to ratify the appointment, the Audit Committee will review its future selection of our independent registered public accounting firm. Even if the appointment of UHY is ratified, the Audit Committee may change to a different independent registered public accounting firm if it determines a change may be in the best interest of us and our shareholders.

Required Vote

The approval of the ratification of the appointment of UHY as our independent registered public accounting firm for the fiscal year ending December 31, 2014 requires the affirmative vote of a simple majority of the shareholders who, as being entitled to do so, vote in person or by proxy on this proposal at the Meeting.

Board Recommendation

THE BOARD OF DIRECTORS AND THE AUDIT COMMITTEE UNANIMOUSLY RECOMMEND A

VOTE “FOR” PROPOSAL 2.

12

Table of Contents

The Audit Committee reviews and recommends to the Board of Directors internal accounting and financial controls and accounting principles and auditing practices to be employed in the preparation and review of our financial statements. In addition, the Audit Committee has authority to engage public accountants to audit our annual financial statements and determine the scope of the audit to be undertaken by such accountants. The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the work of the independent registered public accounting firm for the purpose of preparing or issuing an audit report or performing other audit, review or attest services for us. The independent registered public accounting firm reports directly to the Audit Committee.

Management is responsible for the preparation, presentation, and integrity of our consolidated financial statements, accounting and financial reporting principles, internal control over financial reporting, and procedures designed to ensure compliance with accounting standards, applicable laws, and regulations. Management is also responsible for objectively reviewing and evaluating the adequacy, effectiveness, and quality of our system of internal control over financial reporting. Our independent registered public accounting firm is responsible for performing an independent audit of the consolidated financial statements and expressing an opinion on the conformity of those financial statements with accounting principles generally accepted in the United States. The Audit Committee’s responsibility is to monitor and oversee these processes and the engagement, independence and performance of our independent registered public accounting firm. The Audit Committee relies, without independent verification, on the information provided to it and on the representations made by management and the independent registered public accounting firm.

The Audit Committee met with our independent registered public accounting firm and discussed the overall scope and plans for their audit. The Audit Committee also discussed with the independent registered public accounting firm matters required to be discussed with audit committees under generally accepted auditing standards, including, among other things, matters related to the conduct of the audit of our consolidated financial statements and the matters required to be discussed by Audit Standard 16 as adopted by the Public Company Accounting Oversight Board.

UHY also provided to the Audit Committee the written disclosures and the letter required by Rule 3526 of the Public Company Accounting Oversight Board, and the Audit Committee discussed with the independent registered public accounting firm its independence. When considering UHY’s independence, the Audit Committee considered the non-audit services provided to us by the independent registered public accounting firm and concluded that such services are compatible with maintaining the firm’s independence.

The Audit Committee reviewed and discussed our audited consolidated financial statements for the year ended December 31, 2013 with management and UHY. Based on the Audit Committee’s review of the audited consolidated financial statements and the meetings and discussions with management and the independent registered public accounting firm, and subject to the limitations on the Audit Committee’s role and responsibilities referred to above and in the charter of the Audit Committee, the Audit Committee recommended to the Board of Directors that our audited consolidated financial statements be included in our annual report on Form 10-K for the year ended December 31, 2013 filed with the SEC.

By the Audit Committee of the Board of Directors,

Jorge E. Estrada

Duke R. Ligon

Steinar Thomassen

13

Table of Contents

INFORMATION REGARDING THE INDEPENDENT REGISTERED PUBLIC ACCOUNTANT’S

FEES, SERVICES AND INDEPENDENCE

Independent Registered Public Accountant Fees

For the years ended December 31, 2012 and 2013, UHY billed the approximate fees set forth below:

Fees | Year Ended December 31, 2012 | Year Ended December 31, 2013 | ||||||

Audit Fees (1) | $ | 628,250 | $ | 727,206 | ||||

Audit-Related Fees (2) | $ | 20,000 | — | |||||

Tax Fees | — | — | ||||||

All Other Fees | — | — | ||||||

Total Fees | $ | 648,250 | $ | 727,206 | ||||

| (1) | Audit Fees include fees billed for professional services rendered for the integrated audit of our annual consolidated financial statements and internal control over financial reporting, the review of the interim consolidated financial statements included in our quarterly reports, consents and comfort letters provided in connection with the filing of registration statements and debt offerings, and other related services that are normally provided in connection with statutory and regulatory filings. |

| (2) | Audit-related fees consist of fees billed for assurance and related services that are reasonably related to the performance of the audit or review of our consolidated financial statements and are not reported under “Audit Fees.” These services include accounting consultations and due diligence in connection with mergers and acquisitions, attestation services related to financial reporting that are not required by statute or regulation and consultations concerning financial accounting and reporting standards. |

Policy on Audit Committee Pre-Approval of Audit and Non-Audit Services of Independent Registered Public Accountant

The Audit Committee has adopted certain policies and procedures regarding permitted audit and non-audit services and the annual pre-approval of such services. Each year, the Audit Committee will ratify the types of audit and non-audit services of which management may wish to avail itself, subject to pre-approval of specific services. Each year, management and the independent registered public accounting firm will jointly submit a pre-approval request, which will list each known and/or anticipated audit and non-audit service for the upcoming calendar year and which will include associated budgeted fees. The Audit Committee will review the requests and approve a list of annual pre-approved non-audit services. Any additional interim requests for additional non-audit services that were not contained in the annual pre-approval request will be considered during quarterly Audit Committee meetings.

All services provided by UHY during the year ended December 31, 2013 were approved by the Audit Committee.

14

Table of Contents

TO APPROVE, BY A SHAREHOLDER NON-BINDING ADVISORY VOTE, THE COMPENSATION

PAID TO NAMED EXECUTIVE OFFICERS

As required under the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”), and in accordance with the recommendation by our Board of Directors and approval by our shareholders of an annual “Say on Pay” vote, the Board of Directors is submitting a “Say on Pay” proposal to shareholders for consideration. This proposal provides shareholders with the opportunity to cast an advisory vote on our executive compensation program. Our overall compensation program is intended to ensure that the compensation and incentive opportunities provided to our executives and employees remain competitive and provide the motivation to deliver the extra effort that leads to returning value to our shareholders. The primary objective of our executive compensation program is to provide competitive pay opportunities that are commensurate with our performance, that recognize individual initiative and achievements and that enable us to retain and attract qualified executive officers who are focused on our goals and long term success.

The Board of Directors invites you to review carefully the Compensation Discussion and Analysis beginning on page 16 and the tabular and other disclosures on executive compensation beginning on page 28. Based upon that review, the Board of Directors recommends that the shareholders approve, on an advisory basis, the compensation of our named executive officers, including the compensation practices and principles and their implementation, as discussed and disclosed in the Compensation Discussion and Analysis, the compensation tables, and any narrative executive compensation disclosure contained in this Proxy Statement.

While the vote does not bind the Board of Directors to any particular action, the Board of Directors values the input of our shareholders, and will take into account the outcome of this vote in considering future compensation arrangements.

2013 “Say-on-Pay” Vote

At our shareholders’ meeting held on March 18, 2013, holders of 146,215,368 ordinary shares, or approximately 59.7% of the shares that were voted either “for” or “against” the proposal, voted in favor of our executive compensation program. In addition to these shares, 1,037,398 ordinary shares abstained from the vote.

Required Vote

The “Say-on-Pay” vote is advisory, and therefore not binding on us, the Compensation Committee or the Board of Directors. However, the Compensation Committee and the Board of Directors value the opinions of our shareholders and, to the extent there is any significant vote against the executive compensation of our named executive officers, we will take into account our shareholders’ concerns and the Compensation Committee will evaluate whether any actions are necessary to address those concerns.

Board Recommendation

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” PROPOSAL 3.

15

Table of Contents

EXECUTIVE AND DIRECTOR COMPENSATION

Compensation Discussion and Analysis

Overview

The following discussion and analysis is intended to provide an explanation of our executive compensation program with respect to those individuals identified in the Summary Compensation Table below and referred to as our “named executive officers.” In 2013, we achieved a number of significant milestones, including the early commencement of operations on our third ultra-deepwater drillship, the Tungsten Explorer, and the completion of our planned refinancing of our high-yield debt. In addition, the company completed its fifth consecutive year of record income from operations with results for 2013 increasing by 75% over 2012. We accomplished these results while maintaining our culture of quality and safety, as exemplified by our total recordable incident rate of 0.56 and our lost time incident rate of 0.32 during the year. During 2013, we also added substantial backlog to our deepwater fleet, including approximately three years of firm backlog and two years of options for the Tungsten Explorer at leading edge dayrates. As a result, our deepwater fleet is fully contracted through 2015.

Compensation Philosophy and Objectives

Our executive compensation program reflects the philosophy that executive officers’ compensation should be closely aligned with the long-term interests of shareholders and strongly correlated with both company-wide and individual performance. Accordingly, our executive compensation program places an emphasis on equity-based incentives and performance based compensation. The key business metrics we consider in establishing targets and measuring the performance of our executive officers include:

| • | Safety performance; |

| • | Financial performance; |

| • | Customer satisfaction; and |

| • | Growth. |

The objectives of our executive compensation program are to attract, retain and motivate experienced high-quality professionals to meet the long-term interest of our shareholders and to reward outstanding performance. Many of our competitors are larger, more established offshore drilling companies with greater financial resources. In order to compete with other offshore drilling companies, it is essential that we offer compensation to our executive officers that is competitive with our peer group.

Consistent with our philosophy and objectives, we have designed a compensation program which we believe to be competitive with our peer group and have evaluated the mix of compensation between fixed (annual base salary) and performance-based compensation (typically annual cash incentive and long-term incentive plan awards). The Compensation Committee reviews each of the components of compensation and the metrics to evaluate the performance of our executives on an annual basis.

The components of our compensation program include:

| • | Annual Base Salary. The fixed cash component of our compensation program is used to attract and retain executives at levels intended to be competitive with the peer group. Currently base pay for our named executive officers ranges from 74% to 98% of market median for our peer group. |

| • | Annual Cash Incentive Awards. This component of our compensation program is an annual cash payment based on our performance relative to the metrics established by the Compensation Committee and the individual’s performance measured against his individual performance goals. |

| • | Time-vested Equity Awards. This component of our compensation program consists of time-vested restricted shares and/or options and is designed to encourage retention and align the executives’ interest with our shareholders. |

16

Table of Contents

| • | Performance-based Equity Awards. This component of compensation consists of performance-based restricted shares, options and/or cash and is designed to focus executives’ performance on our business and financial performance which should generate long-term shareholder value. |

| • | Other Benefits. This component of our compensation program consists primarily of a match for U.S. participants in a 401(k) plan, car allowances and subsidizing employees on assignments outside their home country including expatriate housing, schooling, home airfare and foreign taxes. |

Our Compensation Committee has adopted a Change of Control Policy (the “COC Policy”) in order to foster a stable and secure working environment whenever we are evaluating significant corporate transactions. The COC Policy generally provides for payments to be made and benefits to be provided to qualified individuals in the event we undergo a change of control and a qualified individual’s employment is terminated. See “Severance and Other Termination Payments” for more on the COC Policy.

In 2013, our Compensation Committee recommended, and our Board of Directors adopted, a Management Incentive Plan for purposes of enhancing the alignment of interests between our executive officers and shareholders. Under the Management Incentive Plan, our executive officers may earn cash payments periodically over the three year term of the plan based on the increase in trading value of our ordinary shares. See “2013 Compensation Program—Management Incentive Plan” for more on the Management Incentive Plan.

Compensation Committee

Our Compensation Committee is responsible for determining the compensation of our directors and executive officers as well as establishing our compensation philosophies. The Compensation Committee operates independently of management and annually seeks advice from advisors as it believes is appropriate. The Compensation Committee reviews our compensation program including the allocation of the respective components of compensation, guidelines for the long-term incentive plan, and the metrics for the annual incentive plan and the individual goals for the executive officers.

Benchmarking of Compensation and Compensation Consultant

The Compensation Committee believes that current practices of similarly-situated, publicly-held companies in the offshore drilling and oilfield services industries provide important information when making our compensation-related decisions. Accordingly, it regularly considers the cash and equity compensation practices of other publicly held companies that are of a similar size, or that directly compete with us in the offshore contract drilling industry, through the review of such companies’ public reports and through other resources. While benchmarking may not always be appropriate as a stand-alone tool for setting compensation due to the unique aspects of our business and objectives, the Compensation Committee believes that gathering this information is an important part of our compensation-related decision-making process.

Frost Consulting LLC (“Frost”) evaluated the overall compensation of our executive officers in 2011 and 2012, and recommended certain adjustments for purposes of 2013 executive compensation levels. In conjunction with the adoption of a new peer group in 2013, Frost evaluated the overall compensation of our executive officers and recommended modifications to executive compensation levels for 2014.

In performing its analysis and making recommendations, Frost reported to, and acted at the direction of, the Compensation Committee. The Compensation Committee did not adopt all of Frost’s recommendations, but utilized their work and its own judgment in making compensation decisions. Frost is not affiliated with any of our directors or officers, and Frost’s work has not raised any conflicts of interest. Our executive management did not engage Frost and did not direct or oversee Frost’s executive compensation analysis or recommendations.

Peer Group

2011-2013 Peer Group. For purposes of establishing and evaluating compensation levels during our start-up period, we utilized a peer group consisting solely of drilling companies that were in direct competition with us

17

Table of Contents

for the hiring the personnel necessary to manage our operations. In 2011, the Compensation Committee, together with Frost, reexamined the peer group used for purposes of evaluating the company’s overall executive compensation levels, and the group was expanded to take a more comprehensive view of compensation practices in energy or energy-related businesses that were more similar to us in size and performance. Following the evaluation, the Compensation Committee established a new peer group (the “2011 Peer Group”) composed of the following companies:

Atwood Oceanics, Inc. | Bristow Group, Inc. | |

Complete Production Services, Inc. | Ensco plc | |

Gulfmark Offshore, Inc. | Helmrich & Payne, Inc. | |

Hercules Offshore, Inc. | Oceaneering International, Inc. | |

Parker Drilling Co. | Pride International | |

Rowan Companies Inc. | Seadrill Ltd. | |

Songa Offshore SE | ||

In conjunction with its 2011 determination that at least 33% of annual equity awards for executives would be performance-based awards, the Compensation Committee evaluated the 2011 Peer Group and determined that in order to appropriately measure the overall performance of our shares as compared to our competitors, measured by total shareholder return, the 2011 Peer Group should be supplemented with larger companies in the offshore drilling and oilfield services industries. Based on recommendations from Frost, the Compensation Committee added the following companies to the peer group for purposes of evaluating the performance of our shares (the “Supplemental Peers”):

Noble Corp. | Diamond Offshore Drilling, Inc. | |

Nabors Industries Ltd. | Transocean Ltd. | |

Weatherford International Ltd. | Schlumberger Ltd. | |

For 2012, the 2011 Peer Group was modified slightly to remove Pride International, Inc. (following its acquisition by Ensco plc) and Complete Production Services, Inc. (following its acquisition by Superior Energy Services, Inc.).

As part of its review of our overall compensation programs in 2012, Frost examined the compensation programs for the 2011 Peer Group as well as the Supplemental Peers on the basis that the Supplemental Peers operate in several of the international jurisdictions where we operate, and are direct competitors for highly-skilled executives. Although not included in our benchmarks for compensation, the Compensation Committee considered the compensation practices of the Supplemental Peer Group in their evaluation of the overall compensation paid to executive officers.

18

Table of Contents

2014 Peer Group. In 2013, the Compensation Committee determined that in order to better reflect the company’s market capitalization, performance, and industry, the 2011 Peer Group and Supplemental Peers should be replaced with a new peer group for purposes of evaluating our overall compensation program and our performance-based equity awards (the “Definitive Peer Group”). The Compensation Committee worked with Frost to develop a peer group comprised of a balance of smaller oilfield services companies, together with a number of larger companies that are our direct competitors. The Definitive Peer Group includes:

Atwood Oceanics, Inc. | Cal Dive International, Inc. | |

Diamond Offshore Drilling | Ensco plc | |

Gulf Island Fabrication, Inc. | Gulfmark Offshore, Inc. | |

Hercules Offshore, Inc. | Hornbeck Offshore Services, Inc. | |

ION Geophysical, Inc. | Noble Corp. | |

Parker Drilling, Inc. | Rowan Companies | |

Transocean | Tesco Corp | |

For purposes of its 2013 evaluation of the overall compensation levels of our executive officers, Frost utilized the Definitive Peer Group for purposes of its analysis and recommended modifications to executive compensation practices for 2014.

Shareholder Vote on Executive Compensation

In evaluating executive officer compensation in 2013, the Compensation Committee also considered our shareholders’ approval of the compensation paid to our named executive officers as part of the company’s 2013 shareholders meeting.

Role of Executive Officers in Compensation Decisions

The compensation of our Chief Executive Officer and the other named executive officers was previously established pursuant to the terms of their respective employment agreements. Our Chief Executive Officer played a role in our executive compensation decisions for other officers in 2013 and made his compensation recommendations to the Compensation Committee. In forming his recommendations, the Chief Executive Officer considered the performance of the individuals evaluated, their tenure with us, their initial compensation package upon joining us and any subsequent modifications, internal pay equity matters and our performance. While the Compensation Committee considered the Chief Executive Officer’s recommendations, the final determination of each executive officer’s compensation as well as individual and company-wide performance was made by the Compensation Committee.

Elements of our Compensation Program

As described above, there are five primary components to our executive compensation—annual base salary, annual cash incentive awards, time-based equity awards, performance-based equity awards and, with respect to executives resident in foreign countries, expatriate executive perquisites. These are described in greater detail below.

Annual Base Salary. We attempt to set executive base salaries at levels comparable with those of executives in similar positions and with similar responsibilities at peer group companies. The Compensation Committee will review base salaries annually, subject to contractual obligations under the employment agreements with our executives. For 2011, our Compensation Committee, based on Frost’s comprehensive review, determined that Messrs. Bragg and Smith’s base salaries were below 90% of market median. Accordingly, the Compensation Committee adjusted the base salaries of Messrs. Bragg and Smith to meet this

19

Table of Contents

threshold. In 2012, our Compensation Committee again found that Messrs. Bragg and Smith’s salaries were below 90% of market median, however, no changes were made to their salaries for 2012 or 2013. Each of Messrs. Halkett, Munro and Thomson’s salaries either met or exceeded the 90% threshold and therefore were not adjusted. In mid-2011, we implemented a policy whereby any of our employees based in Singapore will have their salaries increased by 6% due to the increased costs of living in the region. As Messrs. Halkett, Munro and Thomson were each based in Singapore, they received a salary increase in accordance with this policy. No additional modifications were made to the base salaries received by our executive officers for 2012 or 2013.

Annual Cash Incentive Awards. All of our executive officers participate in our annual cash incentive plan. Under this plan, each executive officer is assigned a target and a maximum bonus expressed as a percentage of his annual base salary. The target bonus percentage and maximum bonus percentage for each of our named executive officers for 2013 is set forth below:

Name | Title | Target Award Percentage | Maximum Award Percentage | |||||||

Paul A. Bragg | Chief Executive Officer | 100 | % | 200 | % | |||||

Douglas G. Smith | Chief Financial Officer | 75 | % | 150 | % | |||||

Douglas W. Halkett | Chief Operating Officer | 80 | % | 160 | % | |||||

Donald Munro | Vice President—Operations | 70 | % | 140 | % | |||||

William L. Thomson | Vice President—Assets & Engineering | 70 | % | 140 | % | |||||

Target and maximum award percentages in the table above were established by our Compensation Committee in December 2012 and are identical to the target and maximum award percentage established for our executive officers for 2011 and 2012. As is typical among our peer group, target and maximum award percentages vary among the named executive officers based on the potential impact each position has on our financial performance. Target and maximum award levels were established at a level designed to approximate the median anticipated annual cash award opportunities for executives in comparable positions within our peer group.

The amount of the award actually earned by an executive is based on performance relative to pre-established departmental, strategic, safety, and financial goals and individual goals. Under this structure, each performance category has a threshold, target, and maximum percentage assigned to the level of performance in that category, and each category is assigned a weighted percentage that corresponds to an executive’s target award percentage. As a result, executives’ awards are determined by multiplying the level of performance for each category by the percentage of each executive’s award allocated to that category (threshold, target and maximum percentages were set at 60%, 100% and 200%, respectively, for 2013). For example, if an executive obtained the threshold level of strategic performance, and his strategic performance weighted allocation was set at 30%, he would receive 18% percent of his target award (60% threshold multiplied by 30% weighted allocation).

The following table indicates the percentage of each executive’s target award that could be earned, allocated by category:

Name | Strategic | Financial | Safety | Departmental | Individual | |||||||||||||||

Paul A. Bragg | 30 | % | 30 | % | 10 | % | N/A | 30 | % | |||||||||||