Exhibit 99.1

NOTICE OF ANNUAL AND SPECIAL MEETING

OF SHAREHOLDERS AND

MANAGEMENT INFORMATION CIRCULAR

ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON NOVEMBER 9, 2017 |

September 29, 2017

NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the annual and special meeting (the “Meeting”) of the holders (the “Shareholders”) of common shares (“Common Shares”) of Student Transportation Inc. (the “Issuer”) will be held atThe Gallery, Toronto Stock Exchange Broadcast & Conference Centre, The Exchange Tower, 130 King Street West, Toronto, Ontario on Thursday, the 9th day of November, 2017, at the hour of 2:00 p.m. (Toronto time) for the following purposes:

| 1. | TO RECEIVE the financial statements of the Issuer for the fiscal year ended June 30, 2017, together with the report of the auditors thereon; |

| 2. | TO ELECT members of the board of directors of the Issuer; |

| 3. | TO APPOINT auditors and authorize the board of directors of the Issuer to fix the remuneration of the auditors; |

| 4. | TO CONSIDERand to pass an ordinary resolution, approving, ratifying and confirming certain amendments to the Issuer’s By-Law No. 1 to align the residency requirements of the board of directors with the current requirements of theBusiness Corporations Act (Ontario), as more particularly described in the accompanying management information circular; and |

| 5. | TO TRANSACT such further or other business as may properly come before the Meeting or any adjournment or adjournments thereof. |

The Issuer delivers its proxy materials to Shareholders using the “notice-and-access” system (“Notice and Access”), which involves the Issuer providing its proxy materials to Shareholders over the internet.We believe that this delivery process expedites Shareholders’ receipt of proxy materials and lowers the costs and reduces the environmental impact of the Meeting. Under Notice and Access, instead of receiving printed copies of the Meeting Materials, Shareholders receive a Notice and Access notification(the “Notice and Access Notification”) containing details of the Meeting date, location and purpose, as well as information on how they can access the Meeting Materials electronically and how to vote online.The Company will send the Notice and Access Notification on or about October 6, 2017 to the Shareholders of record as at September 28, 2017.Shareholders with existing instructions on their account to receive printed materials will receive a printed copy of the Meeting Materials. Other Shareholders wishing to receive a printed copy of the Meeting Materials should follow the instructions set out in the Notice and Access Notification.

The accompanying management information circular provides additional information relating to the matters to be dealt with at the Meeting and forms part of this notice.

DATED at Toronto, Ontario this 29th day of September, 2017.

| | BY ORDER OF THE BOARD OF DIRECTORS |

| | |

| | “Denis J. Gallagher” |

| | |

| | Chairman of the Board of Directors

Student Transportation Inc. |

TABLE OF CONTENTS

| PROXY SOLICITATION AND VOTING | 2 |

| Solicitation of Proxies | 2 |

| Appointment and Revocation of Proxies | 2 |

| Voting of Proxies | 3 |

| INFORMATION FOR BENEFICIAL HOLDERS OF SECURITIES | 3 |

| VOTING SECURITIES OF ISSUER AND PRINCIPAL HOLDERS THEREOF | 4 |

| MATTERS TO BE CONSIDERED AT THE MEETING | 4 |

| EXECUTIVE COMPENSATION | 7 |

| Compensation Discussion and Analysis | 7 |

| Objectives of the Issuer’s Compensation Program | 7 |

| Significant Elements of Executive Compensation | 7 |

| Setting Executive Compensation | 15 |

| Risks Associated with Compensation Policies and Practices | 21 |

| Hedging of Equity-Based Compensation or Securities of Issuer | 21 |

| Performance Graph | 21 |

| Summary Compensation Table | 22 |

| Employment Agreements with Named Executive Officers | 23 |

| Incentive Plan Awards | 29 |

| Outstanding Share-Based Awards | 29 |

| Value Vested or Earned During the Year | 29 |

| Termination and Change of Control Benefits | 29 |

| Description of Termination and Payment Terms. | 30 |

| Estimated Incremental Payments and Other Benefits upon Termination. | 31 |

| Other Conditions and Obligations regarding Payments | 32 |

| Director Compensation | 33 |

| Director Compensation Table | 33 |

| Director Compensation Arrangements | 34 |

| Deferred Share Unit Plan | 34 |

| Indebtedness of Directors and Officers | 34 |

| Payments to Directors as Consultants or Experts | 35 |

| AUDITOR’S FEES | 35 |

| INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS | 35 |

| DIRECTORS’ AND OFFICERS’ INSURANCE | 35 |

| STATEMENT OF CORPORATE GOVERNANCE PRACTICES | 35 |

| Determination of Compensation | 40 |

| OTHER BUSINESS | 42 |

| ADDITIONAL INFORMATION | 42 |

| APPROVAL OF DIRECTORS | 42 |

STUDENT TRANSPORTATION INC.

INFORMATION CIRCULAR

This information circular (the “Circular”) is furnished in connection with the solicitation of proxies by or on behalf of management of Student Transportation Inc. (the “Issuer”) for use at the annual and special meeting (the “Meeting”) of holders (the “Shareholders” or “Holders”) of common shares (“Common Shares”) of the Issuer to be held on the 9th day of November, 2017 at The Gallery, Toronto Stock Exchange Broadcast & Conference Centre, The Exchange Tower, 130 King Street West, Toronto, Ontario commencing at 2:00 p.m. (Toronto time), and at all postponements or adjournments thereof, for the purposes set forth in the accompanying Notice of Meeting.

PROXY SOLICITATION AND VOTING

Solicitation of Proxies

The solicitation of proxies for the Meeting will be made primarily by mail, but proxies may also be solicited personally, in writing or by telephone by employees of the Issuer, at nominal cost. The Issuer will bear the cost in respect of the solicitation of proxies for the Meeting and will bear the legal, printing and other costs associated with the preparation of this Circular.

The information contained herein is given as of the 29th day of September, 2017, except where otherwise noted.

Notice and Access

National Instrument 54-101 –Communications with Beneficial Owners of Securities of a Reporting Issuer (“NI 54-101”) and National Instrument 51-102 –Continuous Disclosure Obligations (“NI 51-102”) allow for the use of a “notice-and-access” regime (“Notice-and-Access”) for the delivery of proxy-related materials. The Issuer uses Notice-and-Access to distribute the Circular, the notice of meeting, the Issuers’ annual financial statements for Fiscal 2017, and management’s discussion & analysis accompanying the Fiscal 2017 annual financial statements, (collectively, the “Meeting Materials”) to Shareholders. Through Notice-and-Access, the Issuer will distribute its Meeting Materials to Shareholders over the internet, instead of mailing paper copies. The Issuer believes that the benefits of Notice-and-Access are as follows: (i) Shareholders will have more immediate access to the Meeting Materials; (ii) the Issuer will substantially reduce printing, postage and related material costs associated with the printing and mailing of the Meeting Materials; and (iii) the Issuer is promoting environmental responsibility by decreasing the large volume of paper documents generated in connection with the Meeting.

Under Notice and Access, the Issuer will (a) post the Meeting Materials on a website other than SEDAR and (b) send a notice to Shareholders that will include (i) basic information about the meeting and the matters to be voted on; (ii) instructions on how to obtain a paper copy of the Meeting Materials; and (iii) a plain-language explanation of how the notice and access system operates and how the Meeting Materials can be accessed online (the “Notice and Access Notification”).

On or about October 6, 2017, the Issuer will send to Shareholders a notice package containing the Notice and Access Notification and the relevant voting document (a form of proxy or voting instruction form).

The Issuer has determined that those beneficial Shareholders with existing instructions on their account to receive paper material will receive a paper copy of the Circular with the Notice.

Appointment and Revocation of Proxies

Together with this Circular, Shareholders will also be sent a form of proxy. The persons named in such proxy are officers of the Issuer.A Shareholder who wishes to appoint some other person to represent him or her at the Meeting may do so by crossing out the persons named in the enclosed proxy and inserting such person’s name in the blank space provided in the form of proxy or by completing another proper form of proxy. Such other person need not be a Shareholder of the Issuer. To be valid, proxies must be deposited at the offices of Computershare Investor Services Inc. (“Computershare”), 9th Floor, North Tower, 100 University Avenue, Toronto, Ontario, M5J 2Y1, so as not to arrive later than 2:00 p.m. (Toronto time) on November 7, 2017, or be deposited with the Chair of the Meeting prior to the commencement of the Meeting. If the Meeting is adjourned, proxies must be deposited 48 hours (excluding Saturdays, Sundays and holidays), before the time set for any reconvened meeting at which the proxy is to be used, or be deposited with the Chair of the Meeting.

The document appointing a proxy must be in writing and completed and signed by a Shareholder or his or her attorney authorized in writing or, if the Shareholder is a corporation, under its corporate seal or by an officer or attorney thereof duly authorized. Persons signing as officers, attorneys, executors, administrators, trustees, etc., should so indicate and provide satisfactory evidence of such authority.

A Shareholder that has given a proxy may revoke the proxy: (a) by completing and signing a proxy bearing a later date and depositing it as aforesaid; (b) by depositing an instrument in writing executed by the Shareholder or by his or her attorney authorized in writing: (i) at the registered office of the Issuer at any time up to and including the last business day preceding the day of the applicable Meeting, or any adjournment thereof, at which the proxy is to be used, or (ii) with the Chair of the Meeting prior to the commencement of such Meeting on the day of such Meeting or any adjournment thereof; or (c) in any other manner permitted by law.

Voting of Proxies

The persons named in the accompanying form of proxy will vote Common Shares in respect of which they are appointed, on any ballot that may be called for, in accordance with the instructions of the Shareholder as indicated on the proxy.In the absence of such specification, such Common Shares will be voted: (a) FOR the election, separately, of each of the eight nominees to the board of directors listed under the heading “Matters to be Considered at the Meeting - Election of Directors”; (b) FOR the appointment of Ernst & Young LLP as auditors of the Issuer and the fixing of the remuneration of the auditors; and (c) FOR the approval of an ordinary resolution (the “By-Law Amendment Resolution”) approving, ratifying and confirming certain amendments to the Issuer’s By-Law No. 1 to align the residency requirements of the board of directors with the current requirements of theBusiness Corporations Act (Ontario) (the “OBCA”), as more particularly described herein.

The persons appointed under the form of proxy are conferred with discretionary authority with respect to amendments to or variations of matters identified in the form of proxy and Notice of Meeting and with respect to other matters that may properly come before the Meeting. In the event that amendments or variations to matters identified in the Notice of Meeting are properly brought before the Meeting, it is the intention of the persons designated in the enclosed form of proxy to vote in accordance with their best judgment on such matters or business. At the time of printing this Circular, the directors of the Issuer (the “Directors”) know of no such amendments, variations or other matters.

INFORMATION FOR BENEFICIAL HOLDERS OF SECURITIES

Information set forth in this section is very important to persons who hold Common Shares otherwise than in their own names. Materials in connection with the Meeting are being sent to both registered and non-registered owners of the Common Shares. If you are a non-registered owner, and the Issuer or its agent has sent these materials directly to you, your name and address and information about your holdings of Common Shares have been obtained in accordance with applicable securities regulatory requirements from the intermediary holding on your behalf.

A non-registered securityholder of the Issuer (a “Beneficial Holder”) who beneficially owns Common Shares, but such Common Shares are registered in the name of an intermediary (such as a securities broker, financial institution, trustee, custodian or other nominee who holds securities on behalf of the Beneficial Holder or in the name of a clearing agency in which the intermediary is a participant), should note that only proxies or instructions deposited by securityholders whose names are on the records of the Issuer as the registered holders of Common Shares can be recognized and acted upon at the Meeting.

Common Shares that are listed in an account statement provided to a Beneficial Holder by a broker are registered in the name of CDS Clearing and Depository Services Inc. (“CDS”) or its nominee and not in the Beneficial Holder’s own name on the records of the Issuer.

Applicable regulatory policy in Canada requires brokers and other intermediaries to seek voting instructions from Beneficial Holders in advance of securityholders’ meetings. Every broker or other intermediary has its own mailing procedures and provides its own return instructions, which should be carefully followed by Beneficial Holders in order to ensure that their Common Shares are voted at the Meeting. Often, the form of proxy supplied to a Beneficial Holder by its broker is identical to that provided to registered securityholders. However, its purpose is limited to instructing the registered securityholder how to vote on behalf of the Beneficial Holder. Most brokers now delegate responsibility for obtaining instructions from clients to ADP Investor Communications (“ADP”). ADP typically prepares a machine-readable voting instruction form, mails those forms to the Beneficial Holders and asks Beneficial Holders to return the voting instruction forms to ADP. ADP then tabulates the results of all instructions received and provides appropriate instructions representing the voting of the securities to be represented at the Meeting. A Beneficial Holder receiving an ADP voting instruction form cannot use that voting instruction form to vote Common Shares directly at the Meeting. The voting instruction form must be returned to ADP well in advance of the Meeting in order to have the Common Shares voted.

Although Beneficial Holders may not be recognized directly at the Meeting for the purposes of voting Common Shares registered in the name of their broker or other intermediary, a Beneficial Holder may attend at the Meeting as proxyholder for the registered holder and vote their Common Shares in that capacity. Beneficial Holders who wish to attend the Meeting and indirectly vote their own Common Shares as proxyholder for the registered holder should enter their own names in the blank space on the form of proxy or voting instruction form provided to them and return the same to their broker or other intermediary (or the agent of such broker or other intermediary) in accordance with the instructions provided by such broker, intermediary or agent well in advance of the Meeting.

VOTING SECURITIES OF ISSUER AND PRINCIPAL HOLDERS THEREOF

The Issuer is authorized to issue an unlimited number of Common Shares. As of the date of this information circular, there were 94,881,876 Common Shares outstanding. At the Meeting, each Shareholder of record at the close of business on September 28, 2017, the record date established for the notice of the meeting (the “Record Date”), will be entitled to one vote for each Common Share held on all matters proposed to come before the Meeting.

To the knowledge of the Directors, as at the date hereof, no persons beneficially own or exercise control or direction over Common Shares carrying 10% or more of the votes attached to the issued and outstanding Common Shares. The Caisse de Dépôt et Placement du Québec holds 7,997,018 Common Shares, representing approximately 8.4% of the total Common Shares outstanding.

MATTERS TO BE CONSIDERED AT THE MEETING

The number of directors to be elected at the Meeting has been fixed at eight. The persons named in the enclosed form of proxy, if not expressly directed to the contrary in such form of proxy, intend to vote for the election, as directors, of the proposed nominees whose names are set out below. It is not contemplated that any of the proposed nominees will be unable to serve as a director but, if that should occur for any reason prior to the Meeting, the persons named in the enclosed form of proxy reserve the right to vote for another nominee at their discretion. Each Director elected will hold office until the next annual meeting or until his successor is elected or appointed.

On September 24, 2009, the board of directors reviewed and adopted a majority voting policy, which was amended by the board of directors on August 16, 2017. Under this policy, a director who is elected in an uncontested election with more votes withheld than cast in favour of his or her election will be required to tender his or her resignation to the Chairman of the board. The resignation will be effective when accepted by the board. The Compensation, Nominating and Governance Committee (the “CNG Committee”) of the Issuer and the board will consider the resignation and determine whether or not the resignation should be accepted. For more information on this policy, please see “Statement of Corporate Governance Practices, Item 6 – Nomination of Directors”.

The following table sets forth the names of, and certain information for, the eight persons proposed to be nominated for election as directors. Biographies for the directors, which include a summary of each director’s principal occupation and employment within the five preceding years and any cease-trade orders and bankruptcies, are set out at pages 35 to 38 of the Issuer’s annual information form dated September 28, 2017 (the “AIF”), which section is incorporated by reference herein. The AIF can be found under the Issuer’s profile at www.sedar.com. Upon request, the Issuer will provide a copy of the AIF free of charge to a securityholder of the Issuer.

Name & Place of Residence | | Principal Occupation | | Date Appointed

as a Director | | Ownership or

Control Over

Common Shares(1) | | DSU Units issued

under DSU Plan of

the Issuer(6) |

Denis Gallagher(4)

New Jersey, United States | | Chairman and Chief Executive Officer of the Issuer | | September 2004 | | 1,400,054 | | -- |

Irving Gerstein(2)(3)(9)

Ontario, Canada | | Corporate Director | | October 2004 | | 132,790 | | 24,227 |

George Rossi(3)(10)

Quebec, Canada | | Corporate Director | | October 2004 | | 7,100 | | 24,227 |

David Scopelliti(2)(3)(7)

Connecticut, United States | | Chief Executive Officer of Alcentra Capital Corporation, and Chief Investment Officer of Alcentra NY, LLC, a subsidiary of The Bank of New York Mellon Corporation | | October 2004 | | 19,656 | | 63,501 |

Barbara Basney(8)

Connecticut, United States | | VP, Global Brand Advertising and Media, Xerox Corp. | | November 2014 | | -- | | 16,796 |

Wendi Sturgis(5) New York, United States | | EVP, Enterprise Sales and Services, Yext, Inc. | | December 2013 | | 3,000 | | 18,699 |

Victor Wells(2)(3)(7)

Ontario, Canada | | Corporate Director | | September 2006 | | 7,400 | | 49,514 |

Kenneth Needler(2)

Ontario, Canada | | Corporate Director | | September 2004 | | 23,174 | | 24,227 |

Notes:

| (1) | All numbers and values in this table are stated as at June 30, 2017. The information as to Common Shares beneficially owned, directly or indirectly, including by associates or affiliates, not being within the knowledge of the Issuer, has been confirmed by the respective nominees individually. |

| (2) | Member of CNG Committee. |

| (3) | Member of the Audit Committee of the Issuer. |

| (4) | Chairman of the board of directors of the Issuer. |

| (5) | Chairperson of the Innovation and Technology Committee. |

| (6) | Commencing for the fiscal year ended June 30, 2016, each independent director earns annual DSU Units having a value of US$40,000. This resulted in each director receiving a grant of 6,842 DSU Units relating to their fiscal 2017 service. See “Executive Compensation – Director Compensation”. |

| (7) | Member of the Compensation Committee (the “Compensation Committee” and, together with the CNG Committee, the “Compensation Committees”) of the direct U.S. subsidiary of the Issuer, Student Transportation of America Holdings, Inc. (“STA Holdings”), which in turn owns 100% of the stock of the primary operating subsidiary of the Issuer, Student Transportation of America, Inc. (“STA”). |

| (8) | Member of the Innovation and Technology Committee. |

| (9) | Chairman of the CNG Committee of the Issuer. |

| (10) | Chairman of the Audit Committee of the Issuer. |

Director Equity Ownership Policy

The board of directors has adopted a mandatory Director Share Ownership Policy in order to further align the interests of the Issuer’s independent directors with the long-term interests of the Shareholders. The policy provides that all independent directors are required to acquire (and thereafter maintain ownership of) common share equity, which will include Notional Shares (as defined below) under the Issuer’s DSU Plan, with a fair market value equal to a minimum of US$150,000 within a period of three (3) years from the date of adoption of the policy or, in the case of new directors appointed after the adoption of the policy, three (3) years from the date of their respective appointments. For purposes of the policy, share ownership includes any shares owned, directly or indirectly, by a director or his or her immediate family members or held by such person or his or her immediate family members as part of a tax or estate plan, and DSUs issued under the DSU Plan. For purposes of determining compliance with the policy, the value of a share means an assumed per share value based on the average of the closing price of a Common Share on the last trading day of each of the previous four fiscal quarters, adjusted to United States dollars if necessary to match the US$150,000 requirement. The above policy was adopted in June 2015 and was re-approved in September 2017.

The Issuer’s DSU Plan was adopted in 2007. Amounts contributed to the DSU accounts, and accrued notional dividends earned thereon, are immediately vested and can be redeemed only once a director ceases serving on the board. In accordance with the Issuer’s director compensation structure, all of the directors receive 50% of their annual retainer in the form of DSUs in lieu of cash, unless a director elects a higher percentage. See “Compensation of Directors” below for further information about directors’ compensation.

| 2. | Appointment of Auditors |

It is proposed that the firm of Ernst & Young LLP be re-appointed as auditors of the Issuer, to hold office until the next annual meeting of the Shareholders or until their successor is appointed, and that the directors be authorized to fix the remuneration of the auditors.

Ernst & Young LLP has been the auditor of the Issuer since December 9, 2004.The persons named in the enclosed form of proxy, if not expressly directed to the contrary in such form of proxy, will vote such proxies in favour of a resolution to appoint Ernst & Young LLP as auditors of the Issuer and authorize the directors to fix their remuneration.

The annual report, the financial statements of the Issuer for the fiscal year ended June 30, 2017, and the Auditors’ Report thereon accompanying this Circular, will be placed before the Shareholders at the Meeting for their consideration. No formal action will be taken at the Meeting to approve the financial statements. If any Shareholder has questions regarding such financial statements, such questions may be brought forward at the Meeting.

| 4. | Special Business – Amendment to By-Law No. 1 |

On August 16, 2017, the board of directors approved certain amendments to the Issuer’s By-Law No. 1 (the “By-Law Amendment”) to update the director residency requirements to conform with the provisions of the OBCA and to reflect customary practices of other publicly-traded companies. The By-Law Amendment is reflected in Schedule “C” to this Circular.

By-Law No. 1 required that a majority of the directors of the Issuer be resident Canadians. At the time of the adoption of By-Law No. 1, this requirement was consistent with the requirements of the OBCA. However, since the adoption of By-Law No. 1, the OBCA has been amended to reduce the minimum number of directors of a corporation who must be resident Canadians to 25%, and a similarly modified residency requirement has been adopted by many Canadian public companies. In order to remain consistent with its governing statute and customary practices of other publicly-traded companies, and to provide the Issuer with maximum flexibility in the selection of qualified directors, the By-Law Amendment reduces the minimum number of directors of the Issuer who must be resident Canadians from a majority to 25%.

The By-Law Amendment also removes the requirement for a quorum of the directors, and each committee of the board of directors, to include a majority of directors who are resident Canadians as this is no longer required under the OBCA.

Pursuant to the provisions of the OBCA, the By-Law Amendment will cease to be effective unless ratified and confirmed by the Shareholders at the Meeting. At the Meeting, Shareholders will be asked to approve the By-Law Amendment Resolution, the full text of which is set forth in Schedule “B” to this Circular, approving, ratifying and confirming the By-Law Amendment. The By-Law Amendment Resolution must be passed by a majority of the votes cast on this matter by Shareholders present in person or by proxy at the Meeting.

The board of directors has approved the terms of the By-Law Amendment, and recommends that Shareholders vote FOR the approval of the By-Law Amendment Resolution.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Objectives of the Issuer’s Compensation Program

The Issuer’s executive compensation program is designed to achieve the following objectives:

| (a) | Recruitment and Retention of High Quality Experienced Personnel |

The Issuer operates in markets in which personnel with the requisite skills and relevant industry experience have become more difficult to identify each year and the Issuer generally operates in smaller markets than its larger competitors. Accordingly, the board and the Compensation Committees believe that providing competitive compensation enables the Issuer to recruit and retain qualified executives and other personnel. A competitive base salary is essential for this purpose. Also, the board and the Compensation Committees believe that providing opportunities to earn increased levels of compensation based on performance further encourages the retention of the Issuer’s executives, while at the same time creating incentives for management to both generate growth opportunities and protect and increase the value of the Issuer.

| (b) | Aligning Executives’ Interests with the Interests of the Issuer’s Shareholders |

By offering incentives that link a portion of the executives’ compensation to the Issuer’s performance, the board, and the Compensation Committees seek to balance both short-term and long-term interests of the Issuer’s Shareholders. This is accomplished by using a variety of performance-based measures and payout periods which are described in greater detail below under the heading “Significant Elements of Executive Compensation”.

| (c) | Reward Individual Results and Recognize Accomplishments |

In addition to incentives based on the Issuer’s performance, the board and the Compensation Committees believe it is important to reward the accomplishments of individuals which may not be solely reflected in objective financial performance measures. Accordingly, the Compensation Committees encourage that a portion of an executive’s bonus compensation be conditional on pre-established personal or qualitative goals for that individual. A discretionary bonus may be awarded to an executive for exceptional individual performance in unique circumstances. In relation to the Issuer’s unique business, qualitative goals may include, among other factors, financial management, effective assembly of a strong management organization, safety measures, cost management, or capital procurement and management. Other factors considered in respect of individual performance are discussed below under the heading “Factors Considered in Determining Compensation – Performance.”

Significant Elements of Executive Compensation

The board of directors and the Compensation Committees seek to achieve and balance the objectives of the Issuer’s compensation program through the use of some or all of the following elements of compensation:

When setting an executive’s base salary the Compensation Committees primarily consider the following:

| | (i) | Scope of responsibility; |

| | (ii) | Performance; |

| | (iii) | Skills and experience; and |

| | (iv) | Compensation paid by comparable companies. |

The Compensation Committees do not, however, use a specific formula in setting an executive’s base salary and may consider a variety of factors, including those described below under the heading “Setting Executive Compensation – Factors Considered in Determining Compensation”.

Base salary for the Issuer’s CEO is reviewed annually by the Compensation Committees, although at the present time it is circumscribed within his employment agreement. The base salaries of the other Named Executive Officers (as defined herein) are reviewed at least annually by the CEO, who consults at times with the Compensation Committees regarding changes. Additional information regarding base salaries paid to the Named Executive Officers during 2017 is set forth below under the headings “Compensation for Fiscal 2017 – Base Salary” and “Summary Compensation Table”.

| (b) | Short-Term Incentive Plan |

Annual Cash Bonus Incentive Plan

The Issuer has, in conjunction with entering into employment agreements with certain of its executives, adopted an annual cash bonus incentive plan (the “STIP”) in order to align the interests of the Issuer’s executives with the interests of the Issuer’s Shareholders over the short-term. Payments under STIP awards are determined based upon the Issuer achieving certain short-term strategic, financial and/or operational targets. The CEO’s STIP awards are determined annually by the Compensation Committees and the STIP awards for other Named Executive Officers are determined annually by the CEO.

For the 2017 fiscal year, the applicable performance measures utilized to determine awards to the CEO under the STIP were (i) year to year growth in school bus operations revenue (determined 10% of the potential bonus), (ii) an annual earnings before interest, taxes, depreciation and amortization and operating lease expense (“EBITDA”) margin test for school bus operations (determined 20% of the potential bonus), (iii) an annual Return On Assets test (determined 25% of the potential bonus), (iv) a payout ratio test based on the amount of the Company’s gross cash flow that was distributed by the Issuer in fiscal 2017 (determined 25% of the potential bonus), (v) a test based on annual growth in the Company’s EBITDA from fiscal year 2016 to fiscal year 2017, on a same-store sales basis, excluding acquisitions (determined 15% of the potential bonus) and (vi) the achievement of agreed qualitative performance goals set by the Compensation Committees at the start of each fiscal year (determined 5% of the potential bonus). Mr. Gallagher’s STIP is incorporated into his employment contract, and amendments thereto, and further details regarding the STIP are provided below under the heading “Employment Agreements with Named Executive Officers”.

For the 2017 fiscal year, the applicable performance measures utilized to determine a substantial amount of each of the awards under the STIP for the other Named Executive Officers were tied to the Issuer’s performance against its annual financial plan, with primary consideration given to the same five (5) key economic measures as set out above for the Company’s CEO, and other achievement targets as determined in the discretion of the Issuer’s CEO. The CEO may also consider other qualitative factors in arriving at the final STIP award to be granted to the other Named Executive Officers. The CEO liaises with the Compensation Committees contemporaneously with the finalization of these bonus awards.

STIP Awards Granted in Fiscal 2017

Information regarding the Named Executive Officers’ receipt of STIP awards made in fiscal 2017 and fiscal 2018 is set forth below under the headings “Compensation for Fiscal 2017 – Short-Term Incentive Plan”, “Final EIP Share Awards Granted in Fiscal Year 2017” and “Summary Compensation Table”.

| (c) | Long-Term Incentive Plan |

Performance Share Grant Plan

On September 30, 2016, the board of directors of the Issuer approved the adoption of a new performance share grant plan (the “PSG Plan”) of the Issuer. Prior to the implementation of the PSG Plan, the Issuer had in place an Equity Incentive Plan (the “EIP”), which provided for the issuance of certain shares (“EIP Shares”) of STA Holdings, a subsidiary of the Issuer, to employees and senior management. The EIP was used primarily for fulfilling the long-term incentive plan (the “LTIP”) of the Issuer and awards granted under the EIP were based largely on the achievement of certain pre-defined performance measures.

Following the completion of the 2016 fiscal year, all available shares under the EIP had been fully issued and the Issuer no longer had a long-term compensation plan with which to attract, retain and motivate existing and future employees, and align their interests with those of the Issuer and its Shareholders. Accordingly, while the board of directors and CNG Committee had determined that the EIP program had been highly successful in achieving the objectives described above, the PSG Plan was implemented by the Issuer to further these goals with the issuance of the same Common Shares held by the Issuer’s Shareholders. The PSG Plan was approved by Shareholders at the Issuer’s annual and special meeting of Shareholders held on November 8, 2016.

A summary of the key terms of the PSG Plan is set out below. The following information is intended as a brief description of the PSG Plan and is qualified in its entirety by the full text of the PSG Plan, a copy of which is available under the Issuer’s profile at www.sedar.com.

Purpose

The purpose of the PSG Plan is to: (a) align the interests of management and employees with those of the Shareholders; (b) assist in attracting, retaining and motivating key personnel of the Issuer by making a significant portion of their incentive compensation directly dependent upon achieving key strategic, financial and operational objectives that are critical to the ongoing growth and profitability of the Issuer; (c) optimize the performance of the Issuer through incentives which are consistent with the Issuer’s goals; and (d) provide management and employees with an incentive for excellence in individual performance.

Administration

The PSG Plan is administered by the members of the CNG Committee (or such other committee or persons as may be designated by the board of directors from time to time to administer the PSG Plan) (the “Administrators”), who have, subject to the terms of the PSG Plan, the sole and complete authority to make all determinations and to take all actions necessary or advisable for the implementation and administration of the PSG Plan. The Administrators have the authority to, among other things, (a) determine the aggregate number of PSG Units available for allocation in respect of each Performance Period (as defined herein); (b) determine the number of PSG Units to be allocated to each Designated Participant (as defined herein) and the allocation date thereof; (c) interpret and construe the provisions of the PSG Plan; (d) determine and establish the annual performance measures that shall apply to the vesting of the PSG Units allocated under the PSG Plan and evaluate and assess the extent to which such performance measures have been achieved in order for such PSG Units to become vested; and (e) adopt, amend and rescind administrative guidelines and other rules and regulations for implementing the PSG Plan.

Determination of Designated Participants

Officers and employees of the Issuer and its Related Entities (as defined in the PSG Plan) are eligible to participate in the PSG Plan (each, an “Eligible Person”). However, for each fiscal year of the Issuer (each, a “Performance Period”), the Administrators will determine the persons, from among the Eligible Persons, who will be allocated PSG Units in respect of such Performance Period (each, a “Designated Participant”). For certainty, in no event shall a non-executive director of the Issuer or any of its Related Entities be entitled to participate in the PSG Plan.

Allocation of PSG Units

At the beginning of each Performance Period, the Administrators shall allocate a number of PSG Units to each Designated Participant in respect of such Performance Period, the market value of which number of units shall not exceed the amount of such Designated Participant’s base salary (unless otherwise specified in such Designated Participant’s employment agreement). Each allocation of PSG Units will be communicated to a Designated Participant by way of delivery of a written agreement (an “Award Agreement”) executed and delivered at such time and in such format as determined in the discretion of the CNG Committee. The Designated Participant shall execute and return the Award Agreement to the Issuer within 30 days of receipt thereof. No certificates shall be issued with respect to PSG Units.

Determination of Performance Measures

At or prior to the time the Administrators allocate PSG Units to Designated Participants for a Performance Period, the board of directors shall, in its discretion, and upon the recommendation of the CNG Committee, determine the performance measures, standards, metrics, goals and/or objectives (which may include Issuer- and/or individual-related criteria) that will apply to each such allocation of PSG Units to Designated Participants for that Performance Period, and that will be used to determine the degree to which there will be vesting of such PSG Units into Common Shares. Performance measures in any Performance Period may include (without limitation) total shareholder return, payout ratio, return on assets, EBITDA margin or other financial measures, or qualitative personal performance goals.

The goals, performance measures, financial targets and award levels applicable to the Performance Period for the Issuer’s 2018 fiscal year have been determined by the board of directors (upon the recommendation of the CNG Committee) to be as follows, with each of the five tests or measures having a relative weighting as indicated:

| Measure | | Description | Fiscal 2018

Target |

Total

Shareholder

Return (10%) | · | Calculated using the simple average trading price of the Common Shares for the 30-day period ending on the last day of the 2017 fiscal year, as compared to the simple average trading price of the Common Shares for the 30-day period ending on the last day of the 2018 fiscal year, and then adding the effect of all dividends paid in the 2018 fiscal year | 8% |

| Payout Ratio | · | Based on the amount of the Issuer’s gross cash flow that is paid out in the form of distributions in the 2018 fiscal year | 68.6% |

| (20%) | · | This test will exclude extraordinary items (as determined by the board of directors) | |

Return on

Assets (“ROA”)

(30%) | · | An annual return on assets test for the operations | 5.2% |

EBITDA

Margin (25%) | · | Annual earnings before interest, taxes, depreciation and amortization and operating lease expense (“EBITDA”) margin test for the operations | 19.3% |

Qualitative

Goals (15%) | · | The achievement of certain agreed qualitative personal performance goals, set by the Compensation Committee or CEO (or his designate) near the start of each fiscal year, which generally will center around qualitative factors. Performance against this personal set of goals will be determined in the discretion of the board of directors. | TBD |

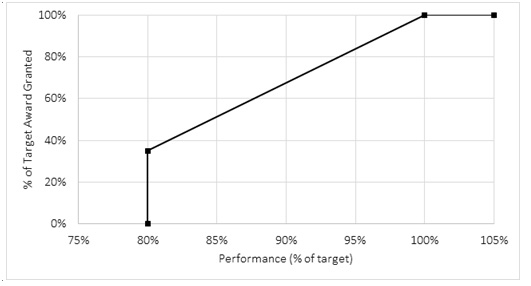

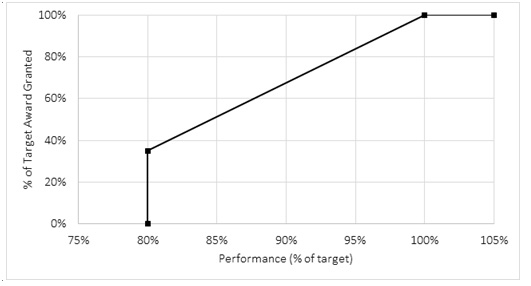

Achievement of 100% of “target performance”, or more, will result in 100% of the potential stock award being granted in shares.

Achievement of 80% of “target performance” will result in only 35% of the potential stock award being granted in shares. No stock award attributable to a measure will be granted if the results achieved for that measure are at less than 80% of “target performance”.

Achievement of a performance level between 80% and 100% of “target performance” for a measure will result in the actual amount of shares issued being a number between: (i) 35% of the potential stock award; and (ii) the maximum potential stock award, based upon linear interpolation between the two points. A chart demonstrating the granting of awards attributable to levels of partial achievement is set out below.

For the 2019 fiscal year Performance Period and each Performance Period thereafter, the goals, performance measures, financial targets and award levels shall be determined by the board of directors, in its sole discretion and upon the recommendation of the CNG Committee, and as such, may be different, and may have different weighting, than the goals, performance measures, financial targets and award levels set out above for the 2018 fiscal year.

Dividend Equivalents

Whenever cash dividends are paid on the Common Shares, a notional amount will be credited to a Designated Participant’s account for each PSG Unit recorded therein as of the record date equal to the cash dividend paid per Common Share. The notional amount credited to the Designated Participant’s account shall only be paid to the Designated Participant if the PSG Unit to which it relates has vested in accordance with the terms of the PSG Plan, and shall be paid in cash to such Designated Participant at the same time as when such PSG Unit is redeemed.

Limitations

The aggregate maximum number of Common Shares available for issuance under the PSG Plan is 3,000,000 Common Shares (subject to adjustment in the event of a stock dividend, stock split, combination or exchange of shares, merger, amalgamation, arrangement or other scheme of reorganization, spin-off or other distribution of the Issuer’s assets to shareholders (other than the payment of cash dividends in the ordinary course), or any other change in the capital of the Issuer affecting Common Shares), representing approximately 3.2% of the issued and outstanding Common Shares as of the date hereof. To the extent PSG Units are forfeited or cancelled before redemption, the Common Shares subject to such PSG Units will be added back to the number of Common Shares reserved for issuance under the PSG Plan and such Common Shares will again become available for PSG Unit grants under the PSG Plan.

The number of securities issuable to Insiders (as defined in the PSG Plan), at any time, under all security based compensation arrangements of the Issuer including, without limitation, this PSG Plan, shall not exceed 5% of the issued and outstanding Common Shares calculated on a non-diluted basis. The number of securities issued to Insiders, within any one-year period, under all security based compensation arrangements of the Issuer including, without limitation, this Plan, shall not exceed 5% of the issued and outstanding Common Shares calculated on a non-diluted basis.

Vesting of PSG Units

(i) Determination of Performance Percentage

On a date following the end of each Performance Period (the “Determination Date”), which shall be within 10 business days after the date on which the board of directors approves the Issuer’s annual financial statements for such Performance Period but not later than, assuming the Performance Period ends on or about the 30th day of June, the 7th day of September immediately following the end of such Performance Period), the Administrators shall determine, in their sole discretion, whether and to what extent each Designated Participant achieved the performance measures applicable to his or her PSG Units for such Performance Period. The Administrators will on the Determination Date assign a percentage for each allocation of PSG Units from 0 per cent to 100 per cent, which will reflect the level at which the Designated Participant attained the performance measures (the “Performance Percentage”). In no event shall the Performance Percentage be greater than 100 per cent, such that no Designated Participant will be entitled to vested PSG Units for a Performance Period in excess of the PSG Units allocated to such Designated Participant on the original allocation date for such Performance Period.

(ii) Vesting based on Performance Percentage

The number of PSG Units allocated to a Designated Participant for a Performance Period that will vest will be calculated by multiplying the aggregate number of such PSG Units by the applicable Performance Percentage. The resulting PSG Units will vest over a three-year period starting approximately from the original allocation date of such PSG Units (as to one-third of such PSG Units per year), with the first one-third of such PSG Units to vest on the applicable Determination Date.

(iii) Vesting on Death or Incapacity to Work

If a Designated Participant dies or is incapable of working as a result of physical or mental incapacity, all unvested PSG Units credited to such Designated Participant’s account will immediately vest on the date of termination of his or her employment.

(iv) Vesting on Termination without Cause or upon Resignation for Good Reason

If a Designated Participant is terminated without Cause (as defined in the PSG Plan) or resigns for Good Reason (as defined in the PSG Plan or the Designated Participant’s employment agreement, as applicable), the number of unvested PSG Units credited to such Designated Participant’s account that will vest will be calculated by multiplying, for each allocation of PSG Units, the aggregate number of such PSG Units by the applicable Performance Percentage. Apro rata portion of the resulting PSG Units will vest on the date of termination of such Designated Participant’s employment, based on the number of days that the Designated Participant was actively employed during the applicable Performance Period divided by the number of days comprising the applicable Performance Period.

For any PSG Units for which the applicable Performance Percentage has not been determined as of the date of such Designated Participant’s termination of employment, the Administrators will determine the proportional achievement of the performance measures and the corresponding Performance Percentage applicable to the allocation of PSG Units.

(v) Vesting on Termination for Cause or upon Resignation (other than for Good Reason)

If a Designated Participant is terminated for Cause or resigns (other than for Good Reason), all unvested PSG Units credited to such Designated Participant’s account will immediately expire as of the date of such Designated Participant’s termination of employment.

(vi) Vesting on Change of Control

If a Change of Control (as defined in the PSG Plan) occurs and the employment of a Designated Participant is terminated (other than for Cause or due to the resignation of such Designated Participant (other than for Good Reason)) within twelve (12) months following the occurrence of such Change of Control, the number of unvested PSG Units credited to such Designated Participant’s account that will vest will be calculated by multiplying, for each allocation of PSG Units, the aggregate number of such PSG Units by the applicable Performance Percentage. The resulting PSG Units shall vest on the date of termination of the Designated Participant’s employment.

For any PSG Units for which the applicable Performance Percentage has not been determined as of the date of such Designated Participant’s termination of employment, the Administrators will determine the proportional achievement of the performance measures and the corresponding Performance Percentage applicable to the allocation of PSG Units.

Redemption of PSG Units

PSG Units will be redeemed for Common Shares within 5 business days after the PSG Unit is fully vested. Each vested PSG Unit will be redeemed for one Common Share.

Clawback

In order to further align the interests of management and employees with those of the Shareholders, the PSG Plan includes a recoupment provision applicable to the PSG Units, notional amounts credited to a Designated Participant’s account in connection with the payment of dividends and any Common Shares and cash issued or issuable upon redemption of a PSG Unit, as well as any proceeds resulting from any sale or other disposition of Common Shares issued or issuable upon redemption of a PSG Unit (collectively, “PSG Compensation”). Under the PSG Plan, if, as a result of a restatement of the Issuer’s financial statements due to the Issuer’s material noncompliance with any financial reporting requirement under applicable securities laws, a Designated Participant received more PSG Compensation than the Designated Participant would have received absent the incorrect financial statements, the Issuer shall recover said excess PSG Compensation (defined as the excess of (i) the actual amount of PSG Compensation paid to the Designated Participant over (ii) the PSG Compensation that would have been paid based on the restated financial results during the three-year period preceding the date on which the Issuer is required to prepare such restatement). The PSG Plan also provides that if the Administrators make a determination, in their sole discretion, that a Designated Participant engaged in an act of embezzlement, fraud, breach of fiduciary duty or any other misconduct which constitutes just cause for dismissal during the Designated Participant’s employment, whether or not such misconduct contributes to an obligation to restate the Issuer’s financial statements, the Administrators may require reimbursement or forfeiture of all or part of the PSG Compensation received by the Designated Participant to the extent of the amount of damages suffered, or which would be a reasonable pre-estimate of the damages that would be suffered, by the Company as a result of the misconduct. The Administrators may use their judgment in determining the amount to be recovered.

Amendment

The Administrators may amend, suspend or terminate the PSG Plan at any time without shareholder approval, unless shareholder approval is required by law or by the rules, regulations and policies of the TSX, provided that, without the consent of a Designated Participant, such amendment, suspension or termination may not in any manner adversely affect the Designated Participant’s rights.

Subject to the terms of the PSG Plan, the Administrators may approve amendments relating to the PSG Plan, without obtaining shareholder approval, to the extent that such amendment:

| · | is of a typographical, grammatical, clerical or administrative nature or is required to comply with applicable regulatory requirements, including the rules of the TSX and NASDAQ, in place from time to time; |

| · | is an amendment to the PSG Plan respecting administration of the PSG Plan; |

| · | changes the terms and conditions on which PSG Units may be or have been allocated pursuant to the PSG Plan; |

| · | changes the termination provisions of a PSG Unit or the PSG Plan; or |

| · | is an amendment to the Plan of a “housekeeping nature”. |

Notwithstanding anything to the contrary contained herein, Shareholder approval will be required for the following:

| · | increasing the number of securities issuable under the PSG Plan, other than in accordance with the terms of the PSG Plan; |

| · | making a change to the class of Eligible Persons that would have the potential of broadening or increasing participation by Insiders or introducing participation by non-executive directors of the Issuer; |

| · | amending the vesting provisions under the heading “Vesting of PSG Units – Vesting on Change of Control” above such that the vesting of PSG Units thereunder would be triggered solely upon the occurrence of a Change of Control; |

| · | extending any term of an award under this PSG Plan beyond the original expiry date of the award benefiting an Insider; |

| · | amending the restriction on transferability of PSG Units; |

| · | permitting awards other than PSG Units to be made under the PSG Plan; and |

| · | amending the amendment provisions of the PSG Plan. |

Withholding Tax

In the event that the Issuer is required by any law or regulation of any taxing authority to withhold any taxes of any kind in connection with any payment or distribution to a Designated Participant under the PSG Plan, such Designated Participant may, prior to the redemption of vested PSG Units credited to his or her account, elect, in his or her discretion, to receive cash in lieu of Common Shares that would otherwise have been issued to such Designated Participant upon such redemption. The number of Common Shares waived in favour of receiving cash shall be that number of Common Shares having a Market Value (as defined in the PSG Plan) on the applicable vesting date equal to the amount of cash elected to be received by the Designated Participant in lieu of such Common Shares. For certainty, the number of Common Shares waived in favour of receiving cash will be added back to the number of Common Shares reserved for issuance under the PSG Plan and such Common Shares will again become available for PSG Unit grants under the PSG Plan.

Blackout Period

If a Designated Participant makes an election as described under the heading “Withholding Tax” above and the vesting date of the PSG Units for which the election has been made would occur during a Blackout Period (as defined in the PSG Plan), then, notwithstanding any other provision of the PSG Plan, the vested PSG Unit shall instead vest on the date which is 5 business days after the date on which the Blackout Period ends.

U.S. Participants

It is intended that the provisions of the PSG Plan shall be exempt from Section 409A of the U.S. Internal Revenue Code of 1986, as amended (“Section 409A”), under the exemption for short-term deferrals set forth in Treasury Regulation Section 1.409A-1(b)(4). In the event that the Administrators determine that any amounts payable under the PSG Plan will be taxable to a U.S. participant under Section 409A, the Issuer may, but shall not be required to, adopt such amendments to the PSG Plan and PSG Units and appropriate policies and procedures, including amendments and policies with retroactive effect, that the Administrators determine necessary or appropriate to preserve the intended tax treatment of the benefits provided by the PSG Plan and PSG Units thereunder; and/or take such other actions as the Administrators determine necessary or appropriate to avoid or limit the imposition of an additional tax under Section 409A.

No PSG Units nor any Common Shares issuable in respect of vested PSG Units shall be allocated or issued unless such allocation or issuance shall comply with all relevant provisions of law, including, without limitation, any applicable state securities laws, the United StatesSecurities Act of 1933, as amended, the rules and regulations thereunder and the requirements of any stock exchange or automated inter-dealer quotation system of a registered national securities association upon which such Common Shares may then be listed.

Transferability of PSG Units

A Designated Participant shall not be entitled to transfer, assign, charge, pledge or hypothecate, or otherwise alienate, whether by operation of law or otherwise, his or her PSG Unit account, any PSG Units or any rights the Designated Participant has under the PSG Plan, other than for normal estate settlement purposes.

Share Ownership Guidelines

The Issuer has implemented Share Ownership Guidelines (“SOG”), to encourage the long term holding of shares of the Issuer by certain senior officers and managers. The objective of the SOG is that the holdings of shares of the Issuer and PSG Units (on a combined basis per person) be no less than: (i) 150% times base salary for the Named Executive Officers; (ii) for the next five most critical officers, 100% of base salary; and (iii) for the other senior managers subject to the SOG rules, 50% of base salary. The guidelines provide for a phase-in period of five years such that the person must achieve at least one-fifth toward his or her goal each year. The CNG Committee is to review this policy every two years and propose recommended changes to the Board, as appropriate.

Final EIP Share Awards Granted in Fiscal Year 2017

After the conclusion of the 2016 fiscal year, 60 of the Issuer’s executives received EIP grants the benefits of which, because they were granted under the Issuer’s STIP program, were tied wholly or partially to hurdles designed to test the quantitative financial performance of the Issuer during the 2016 fiscal year. A total of 411,767 such performance-conditioned shares were granted, having an aggregate gross value upon grant of US$2,478,837.

The applicable performance measures utilized to determine a substantial amount of each of the performance-based EIP awards issued to the Named Executive Officers were tied to the Issuer’s performance against its annual financial plan, with primary consideration given to the following five (5) key economic measures: (i) year to year growth in school bus operations revenue, (ii) an annual EBITDA margin test for school bus operations, (iii) an annual return on assets test, (iv) a payout ratio test based on the amount of the Company’s gross cash flow that was distributed by the Issuer in fiscal 2016, and (v) a test based on annual growth in the Company’s EBITDA from fiscal year 2015 to fiscal year 2016, on a same-store sales basis, excluding acquisitions. In arriving at the amount of each of the performance-based EIP awards for executives who were not Named Executive Officers, the applicable performance measures were tied to the results of the respective executives’ function or geographic area of operation, in most cases, using a regional variation of the EBITDA margin and growth tests set out above.

In addition, after the conclusion of the 2016 fiscal year, 82 of the Issuer’s executives and staff received EIP grants under the LTIP, the benefits of which were specifically conditioned upon compliance with any applicable non-compete covenants they signed in favor of the Issuer. A total of 606,346 of such time-based shares were granted, having an aggregate gross value upon grant of US$3,319,000.

Based on the above-mentioned final EIP grants made after the conclusion of the 2016 fiscal year, 411,767 of the overall 1,018,113 EIP shares granted, or 40.4% of all the final shares granted, were conditioned primarily on meeting or exceeding hurdles designed to test the quantitative financial performance of the Issuer for the 2016 fiscal year. Net EIP shares issued in connection with the overall 1,018,113 EIP grants for the 2016 fiscal year were 655,646, after participant elections to satisfy estimated tax withholdings in the form of shares.

None of the awards of the final EIP shares described above have any relation to the performance of (or compliance with conditions by) the Issuer’s executives for the 2017 fiscal year and pertain solely to the performance of (or compliance with conditions by) the Issuer’s executives for the 2016 fiscal year.

On February 23, 2017, the Issuer issued 2,282,104 Common Shares in exchange for all of the outstanding EIP Shares (the “Share Exchange”). Following the completion of the Share Exchange, all of the outstanding EIP Shares were cancelled and the Issuer owns all of the outstanding equity securities of STA Holdings.

LTIP Awards Granted in Fiscal Year 2017

After considering the final grant of EIP shares in 2017 (as described above) and the other compensation paid to executives and employees for the 2017 fiscal year, the Compensation Committees determined that the executives and employees had been appropriately compensated for their performance in fiscal 2017 and elected to defer the initial grant of PSG Units under the PSG Plan until fiscal 2018.

The board of directors, the CNG Committee and the Compensation Committee have discretionary authority to award an annual cash bonus that is separate from the STIP in order to reward exceptional individual results and accomplishments in extraordinary situations. For persons other than the Named Executive Officers, the CEO has discretionary authority to award an annual cash bonus in order to reward exceptional individual results and accomplishments in these situations. No such discretionary extraordinary bonuses were paid to any of the Named Executive Officers in fiscal 2017. See “Compensation for Fiscal 2017 – Discretionary Bonus”.

Certain other benefits and perquisites are provided to the Issuer’s executives that may include, among other things, those described below under the heading “Employment Agreements with Named Executive Officers”. Additional information regarding the other benefits and perquisites paid to certain Named Executive Officers in 2017, as well as the terms of their respective employment agreements, is provided below under the headings “Summary Compensation Table” and “Employment Agreements with Named Executive Officers”.

Setting Executive Compensation

| (a) | Role of and Composition of the Compensation Committees |

The CNG Committee and the Compensation Committee are each composed entirely of directors who are “independent”, as defined under Multilateral Instrument 52-110 – Audit Committee (“MI 52-110”).

The CNG Committee is responsible to, among other things:

| · | Approve, determine and/or make recommendations to the board concerning the principal elements of executive compensation for the CEO; |

| · | Review the principal elements of executive compensation for the Named Executive Officers (other than the CEO), as such elements are recommended by the CEO; |

| · | Recommend to the board to whom participation in the LTIP should be made available and, if so, the terms of such participation; |

| · | Assess the need for and, if determined advisable, appoint any compensation consultant or advisor to the CNG Committee to assist in the evaluation of director, CEO or senior executive compensation; |

| · | Review and recommend to the board of directors, from time to time and at least bi-annually, the remuneration to be paid by the Issuer to directors; |

| · | Assess the performance of the CEO against objectives developed by the board of directors and report to the directors; |

| · | At least annually, review and approve corporate goals and objectives relevant to CEO compensation, evaluate the CEO’s performance in light of those goals and objectives and recommend to the board of directors, the CEO’s compensation levels based on this evaluation; and |

| · | Prepare and recommend to the board of directors for approval, all reporting of executive compensation as required by public disclosure requirements. |

As at June 30, 2017, the CNG Committee of the Issuer consisted of four directors of the Issuer: Mr. Gerstein (committee chairman), Mr. Needler, Mr. Wells and Mr. Scopelliti.

The Compensation Committee is a committee of STA Holdings formed by the board of STA Holdings, with approval of the board of the Issuer, and currently consists of two of the three directors of STA Holdings, Mr. Scopelliti (committee chairman) and Mr. Wells who are also members of the CNG Committee. The Compensation Committee reports to, and takes direction from, the CNG Committee and the entire board of the Issuer as to its activities. Additional information regarding the skills, experience and responsibilities of the Compensation Committee and its members is set forth below.

Each of the current CNG Committee members has direct experience that is relevant to his responsibilities in executive compensation with the Issuer:

The Honourable Irving R. Gerstein has been a director of the Issuer since 2004. Mr. Gerstein is a Member of the Order of Canada, a Member of the Order of Ontario and was appointed to the Senate of Canada in December 2008. Mr. Gerstein retired from the Senate of Canada in February 2016. He is a retired executive and is currently a director of Medical Facilities Corporation and Atlantic Power Corporation and previously served as a director of other public issuers, including Economic Investment Trust Limited, CTV Inc., Traders Group Limited, Guaranty Trust Company of Canada, Confederation Life Insurance Company and Scott’s Hospitality Inc., and as an officer and director of Peoples Jewellers Limited. Mr. Gerstein is an honorary director of Mount Sinai Hospital (Toronto), having previously served as Chairman of the Board, Chairman Emeritus and a director over a period of twenty-five years, and is currently a member of its Research Committee. Mr. Gerstein received his BSc. in Economics from the University of Pennsylvania (Wharton School of Finance and Commerce). In his career, Mr. Gerstein has gained extensive experience and dealings in executive management employment terms and senior compensation issues. Notably, as President of Peoples Jewellers Limited, he gained exposure to negotiating and setting the terms and conditions of employment contracts and bonus plans for an executive team operating a large international retail enterprise, as well as being involved in human resources issues such as acquisition integration and manpower restructuring. His current directorships with Medical Facilities Corporation and Atlantic Power Corporation have provided additional exposure to the terms and conditions of employment arrived at with the executive teams of those public companies, as well as exposure to recent compensation trends.

Mr. Scopelliti has over 25 years of experience as an institutional alternative assets investor. Currently, he is Chief Executive Officer and a member of the Board of Directors of Alcentra Capital Corporation (NASDAQ: “ABDC”) and Managing Director and Chief Investment Officer of Alcentra NY, LLC, a subsidiary of The Bank of New York Mellon Corporation. Previously, he was a Principal of GarMark Partners, a private debt and equity firm in Stamford, Connecticut. Prior to that, he was a Managing Director at PCG Asset Management, advising multi-billion dollar public and corporate pension fund clients on alternative investments. Prior to that, he was Head of Private Equity for the State of Connecticut Pension Plan where he restructured and rebuilt its $4.0 billion Private Investment Fund. He was also elected as Vice Chairman of the Institutional Limited Partners Association (ILPA), a global organization that serves institutional investors, and has served as a mentor for the Robert Toigo Foundation. Prior to that, he was the Managing Director with CIBC World Markets in New York and, prior to that, was the head of ING’s New York Merchant Banking Group, focusing on mezzanine and private equity capital in support of buyouts and growth financing. Mr. Scopelliti also served Heller Financial as a Portfolio Manager. Mr. Scopelliti holds a Bachelors of Business Administration in Finance from Pace University in New York and holds NASD Series 7 & 63 securities licences.

Mr. Needler started his career in the passenger transportation industry in 1972, with a company that was subsequently acquired by Laidlaw, Inc. Mr. Needler was named President and Chief Operating Officer of STA in July 1999, and served as such until June 30, 2005, after being appointed to the Board of Directors of STA in 1998. Between 1972 and 1990, Mr. Needler served in a number of management capacities at Laidlaw, Inc. including Division Manager (from 1974 to 1976), Regional Vice President (from 1976 to 1980) and President of the Canadian school bus operations (from 1980 to 1984). In 1984, Mr. Needler was appointed to the Board of Directors of Laidlaw, Inc. where he served as a Member of the Audit Committee and then as President of the Passenger Services Group. Mr. Needler has served on various bus association boards in both the motorcoach and school bus industries. He has also served as a director on his local hospital board as well as on the board of a Mutual Insurance Company located in Ontario. Mr. Needler dealt with numerous executive management employment terms and senior compensation issues for years in his career as an officer and director at Laidlaw. He negotiated bonus plans and other terms and conditions of employment for the regional executive teams operating that company, as well as dealing with a host of human resources issues, including labour practices, acquisition integration and consequential corporate restructuring. Mr. Needler's other directorships have provided additional exposure to employment contracts typically arrived at with management teams of hospitals and insurance companies.

Mr. Wells is a director and served on the Compensation Committee of MagIndustries Inc and GT Canada Medical Properties Inc. He is currently chair of the Audit Committee of Contagious Gaming Inc. and Pasinex Resources Limited of which he is also the Chairman. He was formerly a director and chair of the Audit Committee of Unique Broadband Systems Inc. (2012 to 2015), GT Canada Medical Properties Inc. (2010 to 2012), MagIndustries Inc. (2006 to 2011) and Northstar Healthcare Inc. (2007 to 2010). He was also formerly a director and member of the Audit Committee of TriNorth Capital Inc., a TSX-V listed company, from 2009 to 2010, and a Trustee of Canada Cartage Diversified Income Fund and chaired its Audit Committee. Mr. Wells was Vice President, Finance and Chief Financial Officer of Chemtrade Logistics Income Fund from its initial public offering in July 2001 until 2006. From 1998 to 2001, Mr. Wells was Vice President, Finance and Chief Financial Officer of Tahera Diamond Corporation, a diamond mining company listed on the TSX. During the time that Mr. Wells was a CFO, he worked with human resource management to develop performance measures and the related compensation targets. Mr. Wells is a member of Financial Executives International, a past Chapter President and Director. Mr. Wells is immediate past Chairman of the Canadian Financial Executives Research Foundation (2010 to 2016) and was formerly the Chairman of the Committee on Corporate Reporting (2006 to 2008) and was a member of the Accounting Standards Board from 1991 to 1995. Mr. Wells obtained his Chartered Accountant designation with Ernst & Young in Toronto, and was elected a Fellow of the Chartered Professional Accountants of British Columbia in 1990 and a Fellow of the Chartered Professional Accountants of Ontario in 2006. Mr. Wells obtained his Institute of Corporate Directors designation in 2007 and is a member of the Institute of Corporate Directors.

The above skills and experience possessed by the CNG Committee members has enabled the committee to make decisions on the suitability of the Issuer’s compensation policies and practices.

In connection with renewing the CEO’s employment agreement in 2014, the Compensation Committee sought the assistance of the compensation consulting firm of Hugessen Consulting to establish a benchmark for CEO compensation. Hugessen Consulting was retained in November of 2013 and commenced work that month. The mandate of Hugessen Consulting consisted of reviewing the current employment agreement and compensation of the Issuer’s CEO and assisting the board of directors in establishing a benchmark for CEO compensation. This included a detailed review of compensation of CEOs at a peer group of 17 similar companies, by size and industry.

In connection with the review of the Company’s then-existing EIP and the PSG Plan, the Company again sought the assistance of Hugessen Consulting. Hugessen Consulting was retained on June 10, 2016. In particular, Hugessen Consulting was asked to review the then-existing EIP, assist with the design and preparation of the PSG Plan and provide advice to the Issuer in determining the appropriate number of Common Shares to be reserved for issuance under the PSG Plan. In connection therewith, Hugessen Consulting reviewed the equity compensation plans of a peer group of 11 companies, as well as historic and prospective rates of overhang, dilution and run rate under the then-existing EIP and PSG Plan, as applicable.

In connection with renewing the CEO’s employment agreement in FY2017, the Compensation Committee again sought the assistance of Hugessen Consulting to comment on the components of the CEO’s compensation and various other terms of his proposed renewed agreement.

The table below sets forth the aggregate fees billed by each consultant or advisor, or any of its affiliates, in each of the two most recently completed financial years, for services related to determining compensation for any of the Issuer’s directors and executive officers. For a detailed description of the mandate of these consultants and dates on which they were retained, see “Factors Considered in Determining Compensation”.

| Fiscal Year | | Amount | | Consultant/Advisor |

| | | | | |

| 2016 | | Cdn. $27,669 | | Hugessen Consulting |

| 2017 | | Cdn. $117,280 | | Hugessen Consulting |

No other fees were billed for other services provided by the above-named consultant or any of its affiliates in the periods described above.

| (b) | Factors Considered in Determining Compensation |

In reviewing the principal elements of executive compensation for the CEO and the other Named Executive Officers, the Compensation Committees determine the total potential amount of compensation that could be awarded for a particular year, by considering, among other things, the factors set forth below. However, the Compensation Committees do not apply a mathematical formula in considering these factors and the weight to be assigned to each factor may vary from year to year. Information regarding how the Compensation Committees allocate total potential compensation among the elements of the Issuer’s compensation program is set forth below under the heading “Allocating Total Compensation Among the Elements of the Issuer’s Compensation Program”. The Compensation Committees consider the following factors in determining total compensation of Named Executive Officers:

| · | Scope of Responsibility. The Compensation Committees attempt to ensure that compensation is at a level commensurate with the scope of the executive’s responsibility. In general, the greater the scope of an executive’s responsibility, the greater the total compensation that will be awarded to the executive. A Named Executive Officer will be compensated for performing additional duties that are outside the purview of that executive’s normal duties. |

| · | Performance. The board and the Compensation Committees believe that key factors in determining the amount of an executive’s compensation are the Issuer’s financial and operational performance and the executive’s individual performance. The board’s assessment of the Issuer’s performance is primarily focused on objective factors. For example, awards under the STIP are generally based on quantitative factors, such as achievement of the Issuer’s financial plan, or incremental growth in revenue and/or earnings. Other objective measures of the Issuer’s performance may include profitability, safety, or other operational measures. Conversely, portions of compensation tied to individual performance are primarily assessed based on subjective measures of performance. For example, a portion of the CEO’s bonus is based on subjective assessments of that executive’s leadership qualities, individual initiatives, team-building efforts, capital raising efforts and contribution to the Issuer’s overall performance. Additional information regarding the relationship between the historical performance of the Issuer’s Common Shares and the Issuer’s compensation to executives is set forth below under the heading “Performance Graph”. |

| · | Skills and Experience. One of the objectives of the Issuer’s compensation program is to attract and retain highly qualified and experienced executives. In general, the greater the level of skill and experience of an executive, the greater the total compensation that will be awarded to that executive. |