Exhibit 99.1

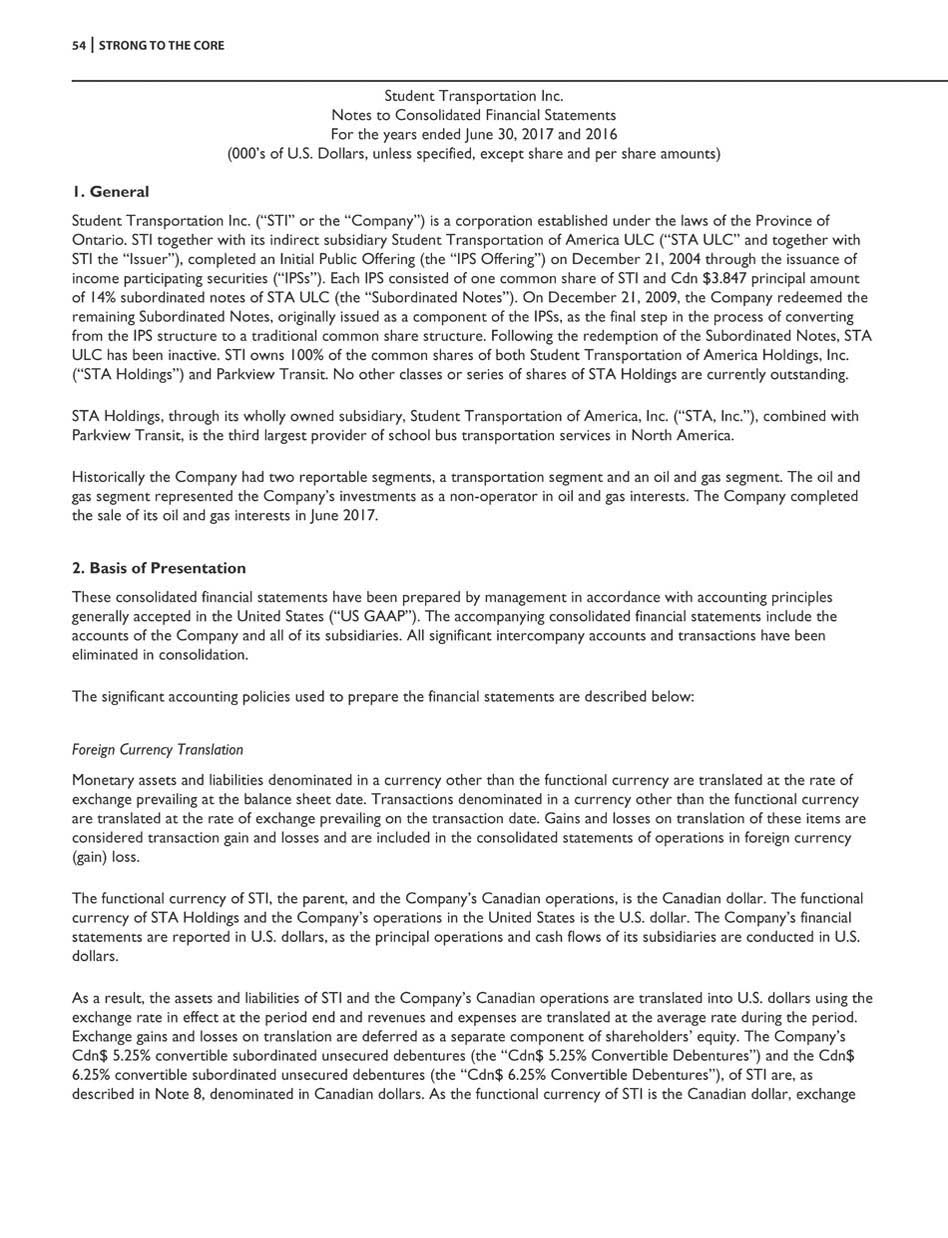

2017 ANNUAL REPORT STRONG TO THE CORE

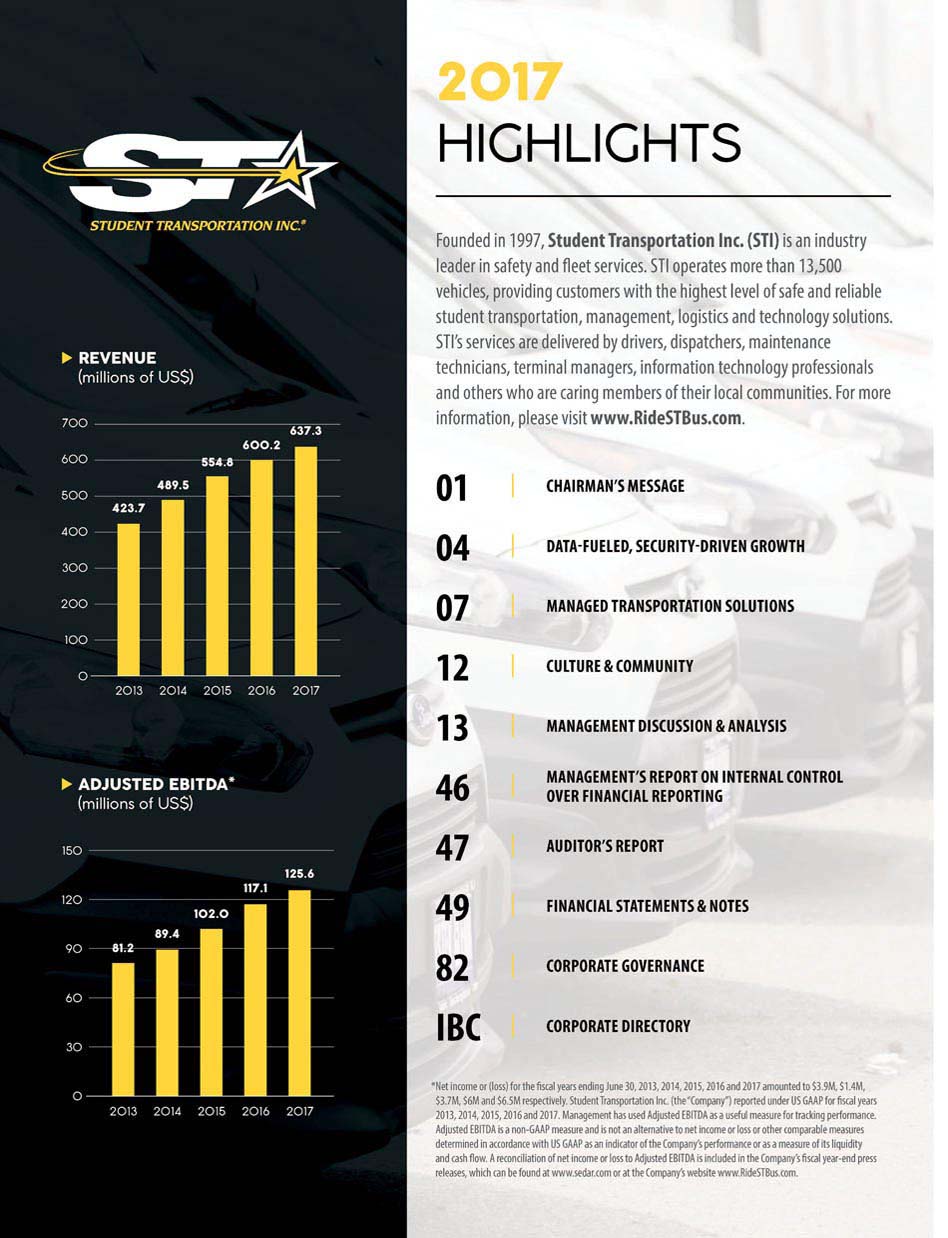

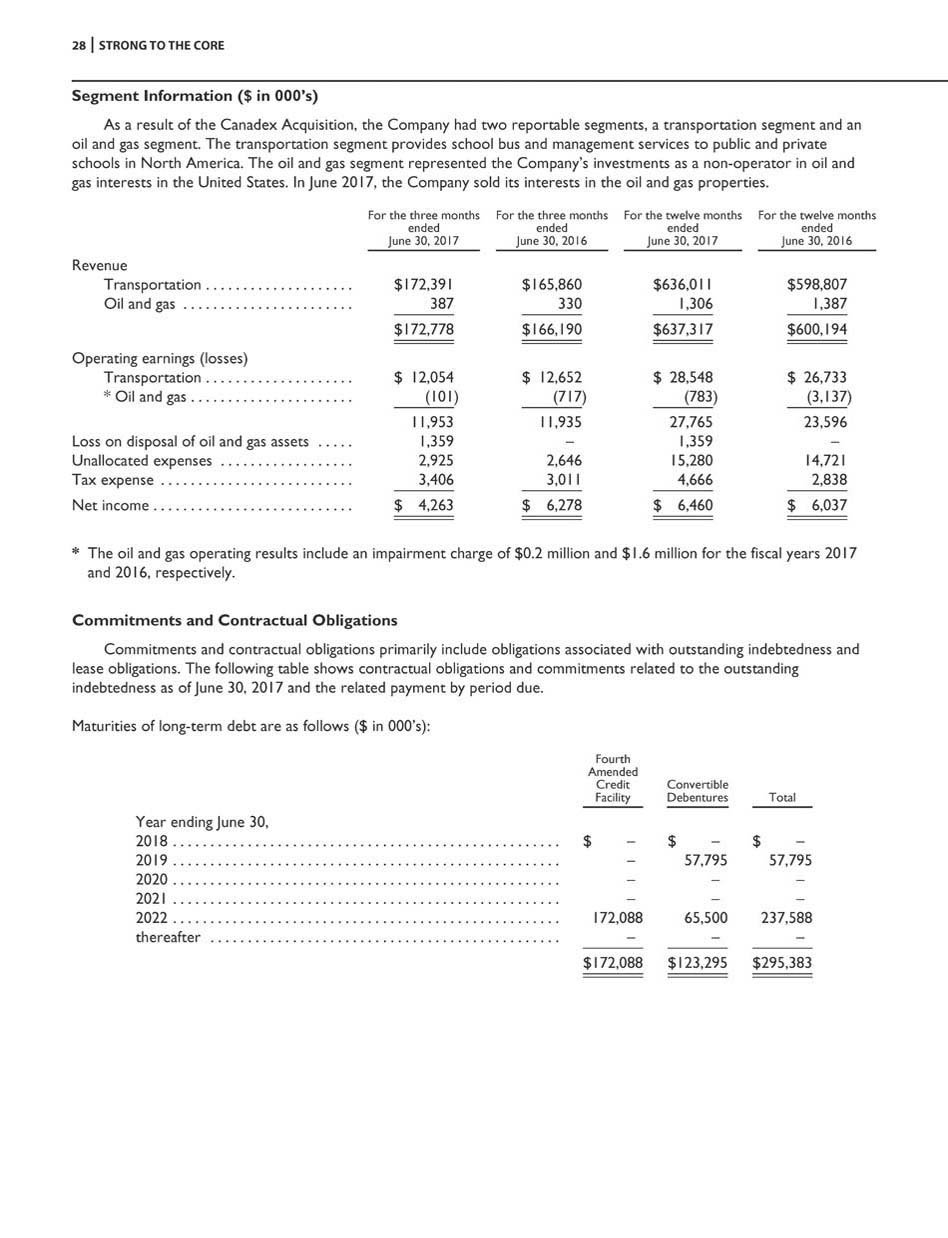

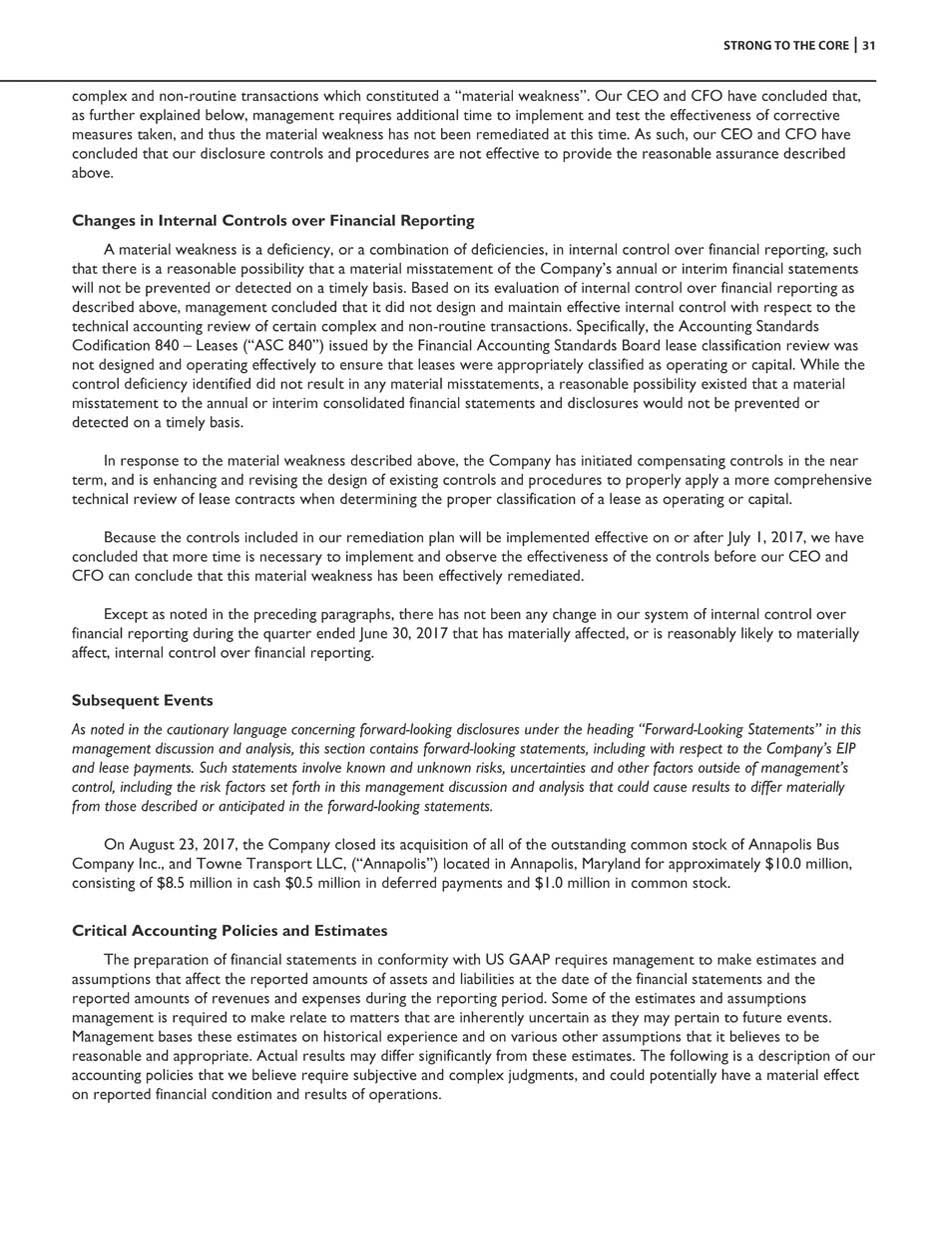

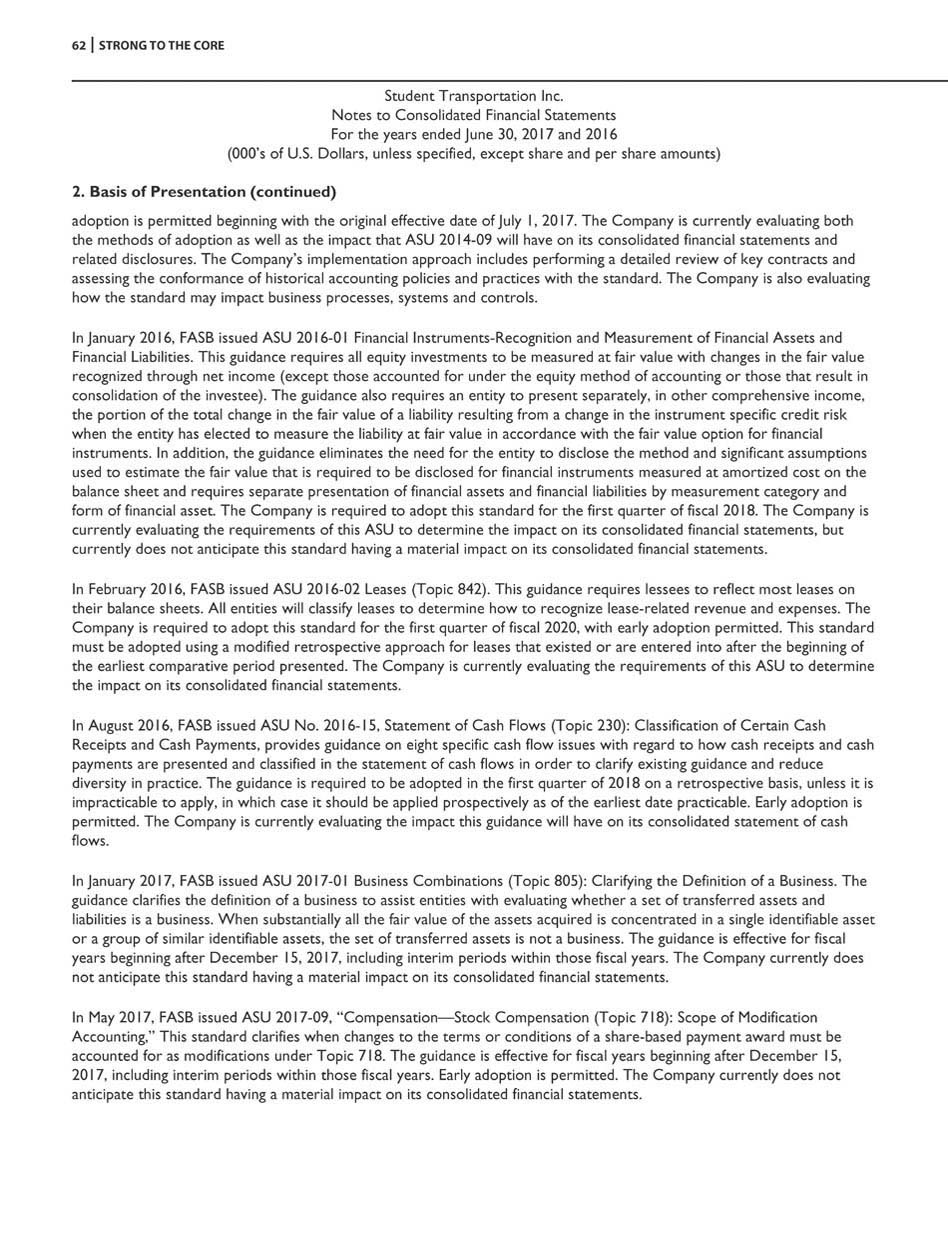

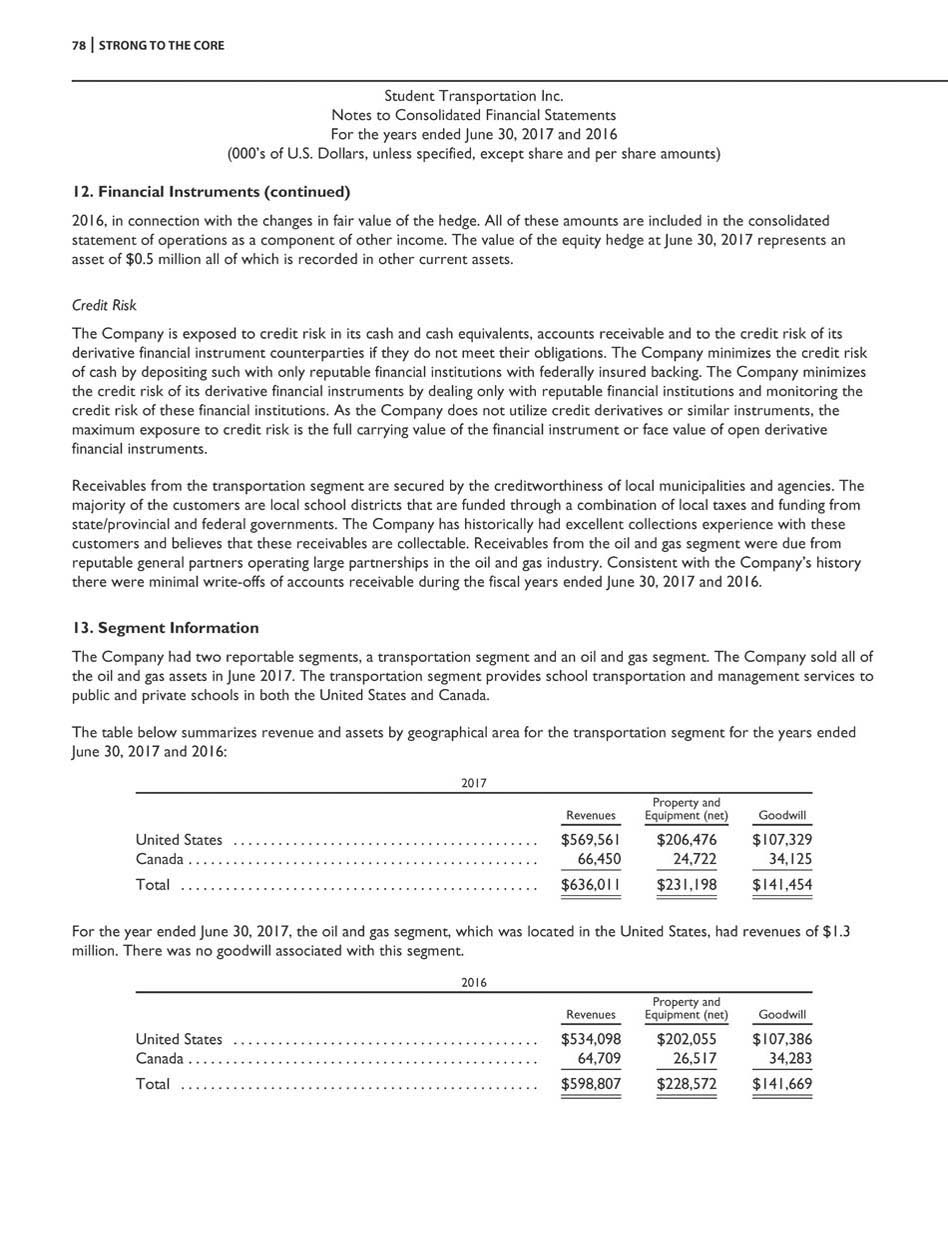

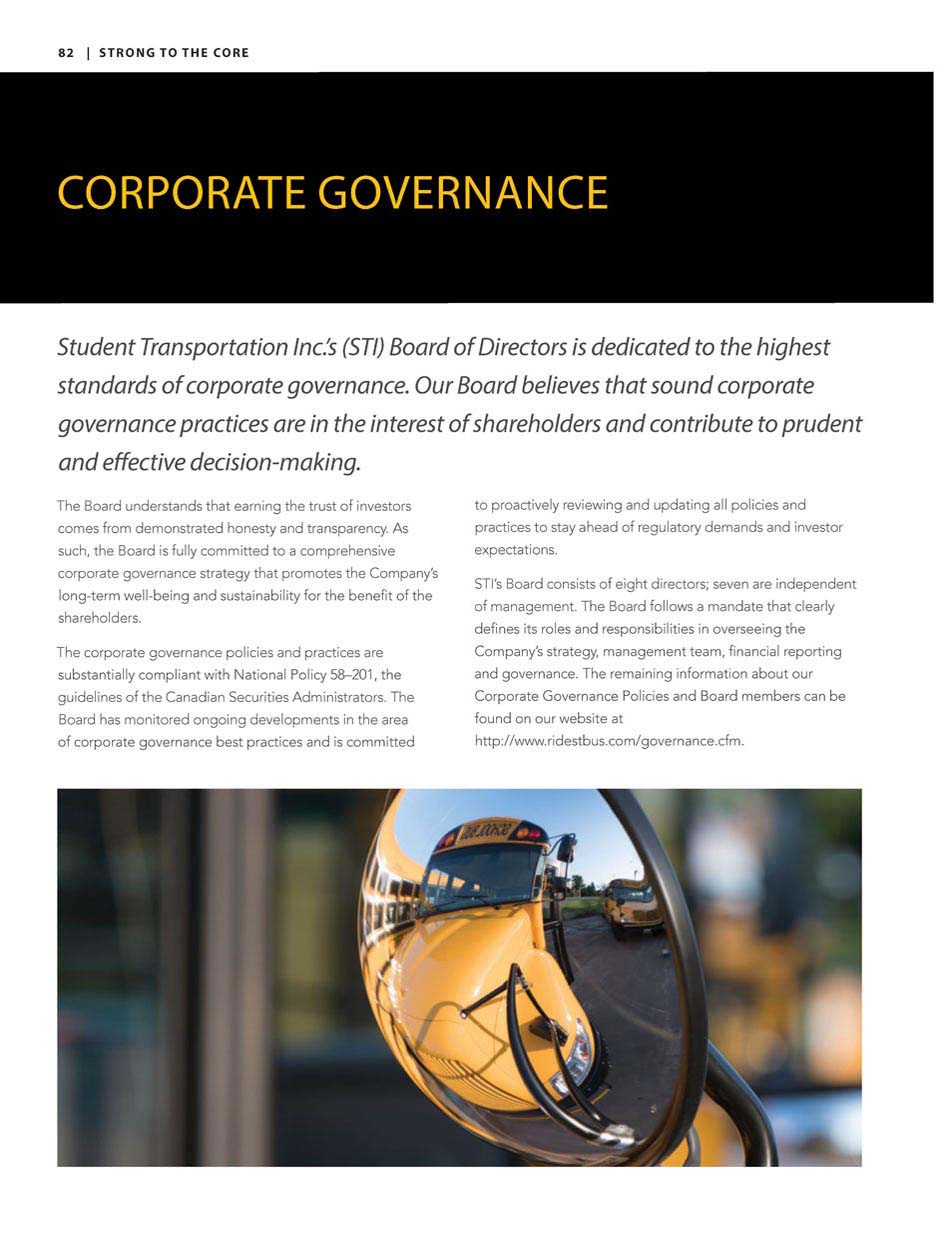

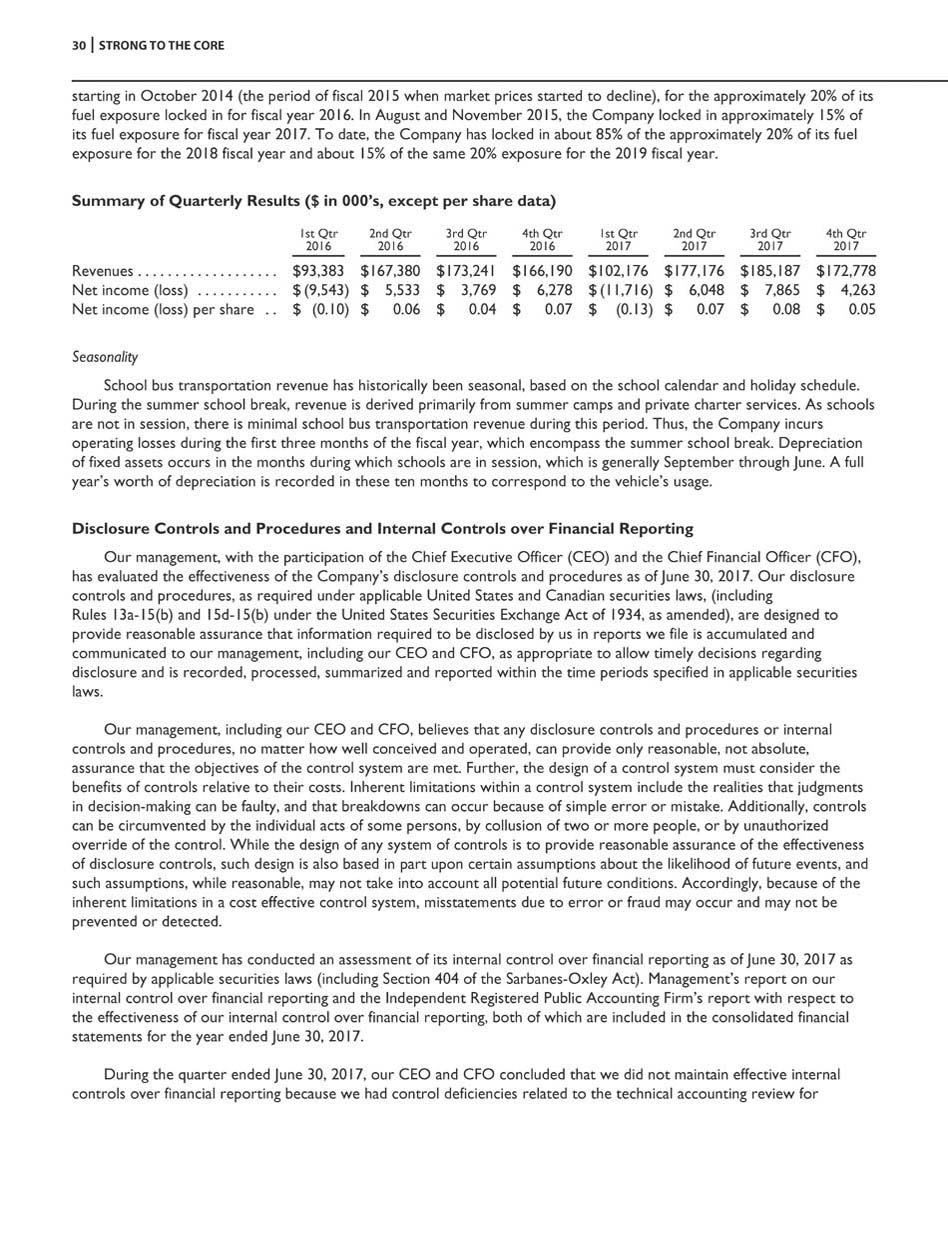

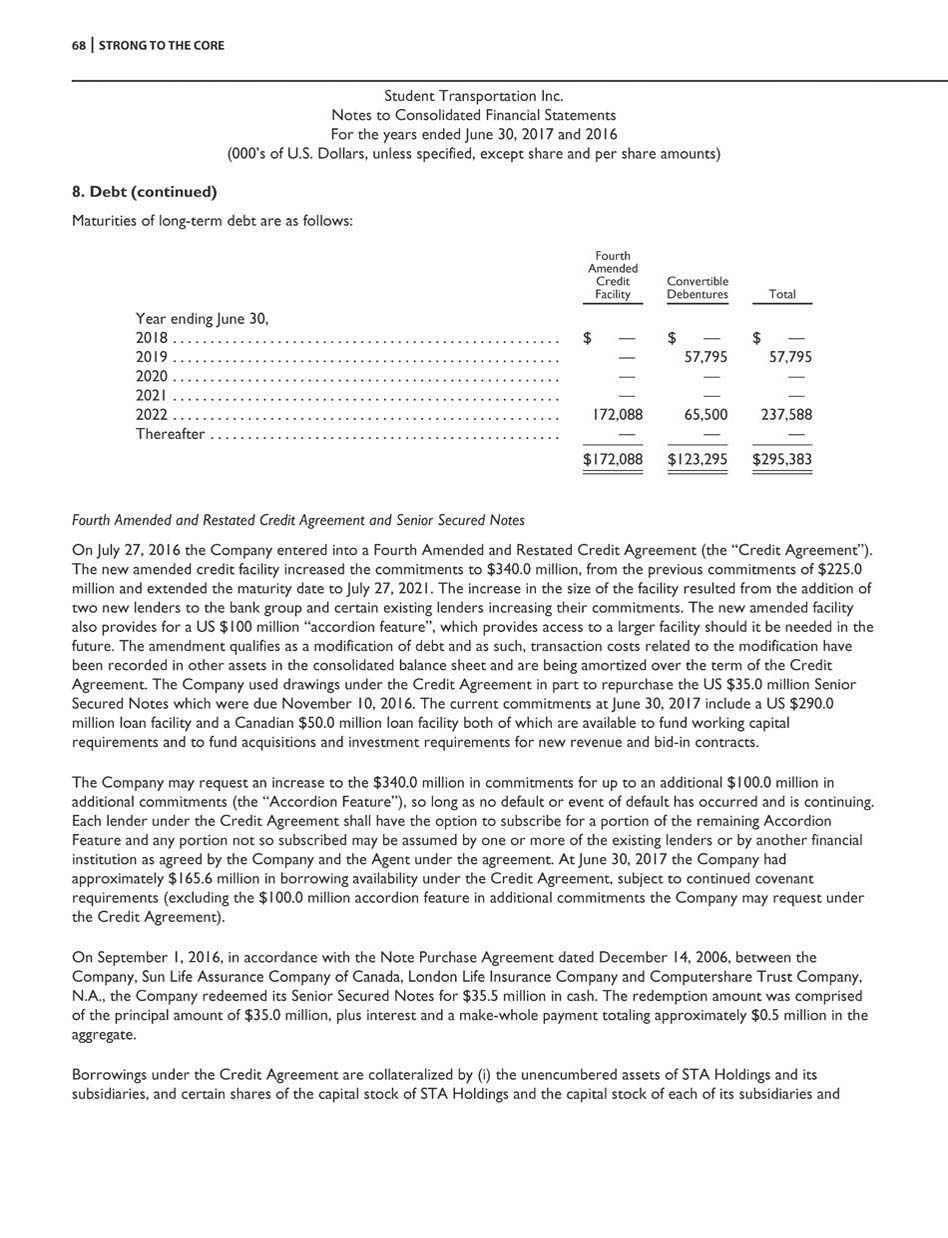

REVENUE (millions of US$) 700 600 500 400 300 200 100 0 2013 2014 2015 2016 2017 423.7 489.5 554.8 600.2 637.3 2017 HIGHLIGHTS *Net income or (loss) for the fiscal years ending June 30, 2013, 2014, 2015, 2016 and 2017 amounted to $3.9M, $1.4M, $3.7M, $6M and $6.5M respectively. Student Transportation Inc. (the“Company”) reported under US GAAP for fiscal years 2013, 2014, 2015, 2016 and 2017. Management has used Adjusted EBITDA as a useful measure for tracking performance. Adjusted EBITDA is a non - GAAP measure and is not an alternative to net income or loss or other comparable measures determined in accordance with US GAAP as an indicator of the Company’s performance or as a measure of its liquidity and cash flow. A reconciliation of net income or loss to Adjusted EBITDA is included in the Company’s fiscal year - end press releases, which can be found at www.sedar.com or at the Company’s website www.RideSTBus.com. Founded in 1997, Student Transportation Inc. (STI) is an industry leader in safety and fleet services. STI operates more than 13,500 vehicles, providing customers with the highest level of safe and reliable student transportation, management, logistics and technology solutions. STI’s services are delivered by drivers, dispatchers, maintenance technicians, terminal managers, information technology professionals and others who are caring members of their local communities. For more information, please visit www.RideSTBus.com . CHAIRMAN’S MESSAGE DATA - FUELED, SECURITY - DRIVEN GROWTH MANAGED TRANSPORTATION SOLUTIONS CULTURE & COMMUNITY MANAGEMENT DISCUSSION & ANALYSIS MANAGEMENT’S REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING AUDITOR’S REPORT FINANCIAL STATEMENTS & NOTES CORPORATE GOVERNANCE CORPORATE DIRECTORY 01 04 07 12 13 46 47 49 82 IBC 30 60 90 0 2013 2014 2015 2016 2017 81.2 ADJUSTED EBITDA * (millions of US$) 150 125.6 117.1 120 102.0 89.4

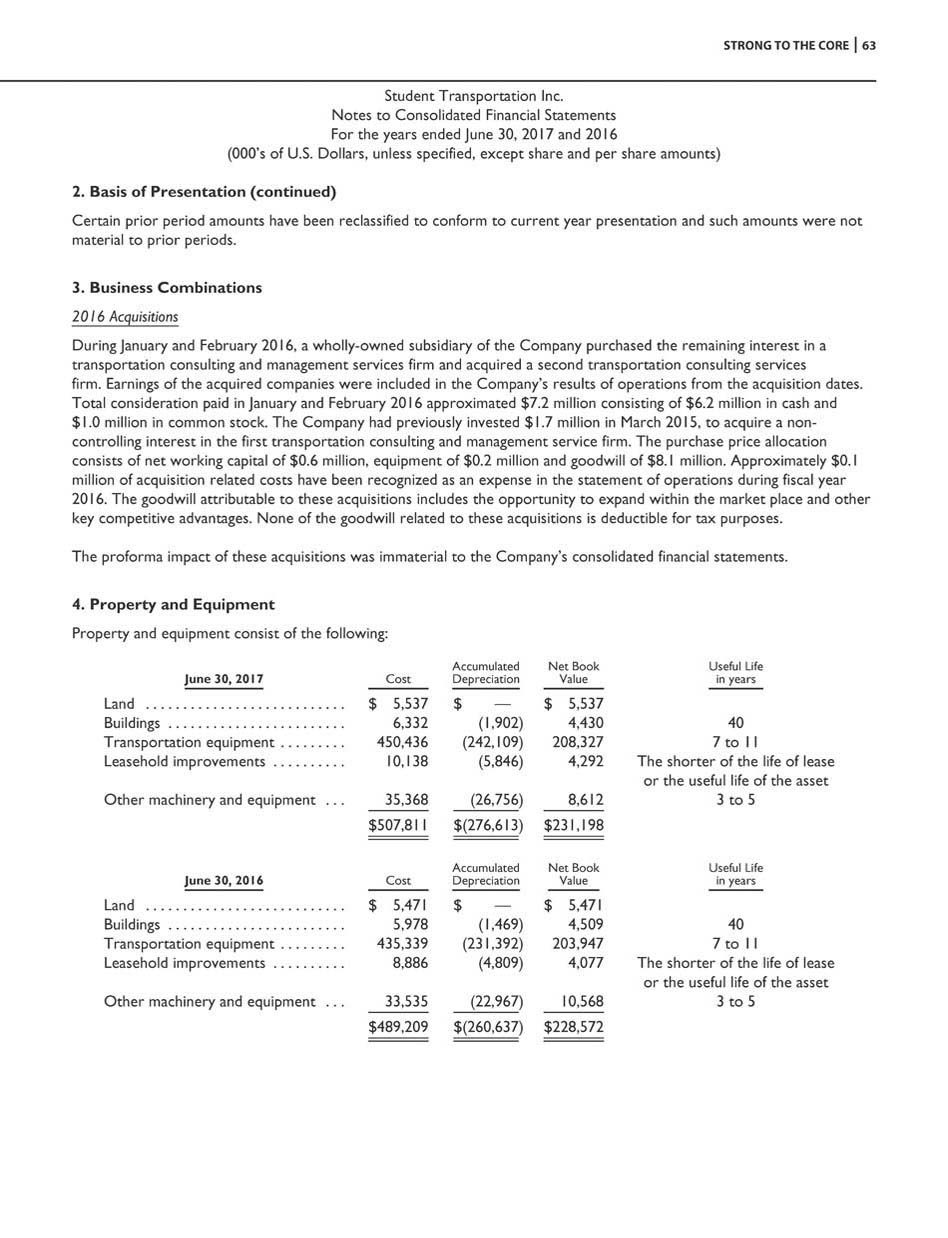

STRONG TO THE CORE | 1 Message from the Chairman & CEO BUILDING ON THE PAST, TRANSFORMING THE FUTURE safety - first mindset that are crucial to our success. There are many challenges facing the school transportation industry these days, including driver shortages, budget constraints, aging public fleets and widespread routing nefficiencies. This year, the industrywide driver shortage increasingly impacted parents and school districts across North America, as contractors and transportation directors struggled to fill driver seats with well - trained, certified professionals. This tightening of the labor pool for school bus drivers created some shortages in several of our markets, as well. Twenty years ago, I started this great company from my kitchen table with support from family, friends and others who believed in my dream of building a business to last with people who care and love what they do . Today we have a nationwide footprint of 175 operations and facilities across North America, core competencies in safety and fleet services, and a dedication to community service and family culture that are the foundation of our business . In fiscal 2017 , we transported over 1 . 25 million students daily to school in 22 states and two Canadian provinces with more than 13 , 500 vehicles and 15 , 000 tremendous employees . We are industry leaders not by size, but by design ; I am pleased with where we are today and where we are headed in the future . This past July we paid our 150 th consecutive monthly dividend and we will continue to create value for our shareholders despite market conditions . We increased revenue by 6.2 percent in fiscal 2017, and remained disciplined in our approach to growth. We have taken time over the last two years to develop new strategies, rebuild our infrastructure, add new people and apply new technologies. The opportunities for growth in our core yellow school bus business are tremendous. This year, we expanded our partnership with Florida’s Duval County Public Schools with a new revenue contract that doubles the size of our fleet from 250 to 500 vehicles, making them our largest customer in fiscal 2018. We also were awarded new contracts in seven states and negotiated higher prices on many existing contracts up for renewal. We did have to make some tough decisions to end a few relationships where we felt we needed price increases to raise driver salaries. Others were prepared to provide service at lower prices, but in my 42 years in this business, I’ve seen that school districts eventually come back to us when service sn’t what it should be. We are fortunate to have the most experienced and best senior management team in the industry. They continue to inspire our workforce, and nurture the family culture and

2 | STRONG TO THE CORE “By using technology to better manage our operations, we will maximize the benefits and mitigate risks to position us for sustained growth in the years to come. The focus of our new School Transportation Group will help pave the way for stronger organic growth, while creating new opportunities to expand our footprint through strategic acquisitions. “ – Denis J. Gallagher By using technology to better manage our operations, we will maximize the benefits and mitigate risks to position us for sustained growth in the years to come. The focus of our new School Transportation Group will help pave the way for stronger organic growth, while creating new opportunities to expand our footprint through strategic acquisitions. In addition to cost reduction and efficiencies, operational tailwinds in fiscal 2017 included low fuel prices and more “customer paid fuel” agreements in our contracts, which makes fuel “risk off.” I am most proud of our contract renewal rate, which remains at approximately 95 percent over our 20 - year history. It’s a tribute to our frontline operations teams – drivers, monitors, mechanics, managers and others – who are directly responsible for our stellar reputation for service and safety. Leveraging Core Competencies In our new Managed Services Group (MSG) we’re leveraging our strong record for effective fleet management to open new consulting and management opportunities. We’re applying new technologies for school district customers in operational analysis, routing and scheduling, and deploying our industry - leading SafeStop app, which lets parents know where the bus is and when it is coming. SafeStop is now a key offering in new contracts and we continue to launch new SafeStop partnerships inside and outside the school transportation industry. Recently, we signed an agreement that makes SafeStop the official School Bus Tracking App for one of the industry’s leading providers of GPS services. In addition, we’re providing SafeStop to nearly a dozen other GPS companies, as well as many schools and contractors, solidifying its position as the most complete and universal school bus tracking app on the market. After several failed attempts by others to replicate what we built, school officials and parents appreciate the expertise needed to successfully operate a service like this, and we expect to Our corporate, regional and local operating teams worked together to improve driver retention and address recruiting in new and innovative ways. We’re also leveraging our advanced technology to create more efficient routing to reduce the number of vehicles a school district needs to transport students and thus, the number of drivers needed. Our newly formed School Transportation Group (STG) was created to focus on our core contracted school bus operations, and will build and improve upon our current efforts to develop and recruit new drivers and maintenance technicians, while maintaining our high retention rate of those already here. We will continue to develop new technologies to reduce costs and improve safety. Severe weather created a headwind for us in fiscal 2017, hitting a few of our markets hard. Some schools were off as many as 12 days, well above the norm. Floods, tornados and ice storms across the U.S. and Canada resulted in lost revenue when several state and local governments opted not to have students make up lost days at the end of the school year. Since the added costs for wages, fuel and snow removal had already been incurred and expensed, those revenues were not recovered. Lowering Maintenance and Operating Costs It costs less to run a good operation than a bad one, and our fleet management team has done a great job in lowering our maintenance and operating costs. They now gather data on everything from mileage to driver behavior and engine diagnostics, and have implemented an innovative purchasing system to further drive down costs. This process took more than a year to perfect, but the systems are in place and the results are beginning to show. Our fleet management team is working closely with our local operators who use real - time data to streamline routes, reduce the number of vehicles needed and help drivers operate their buses more efficiently.

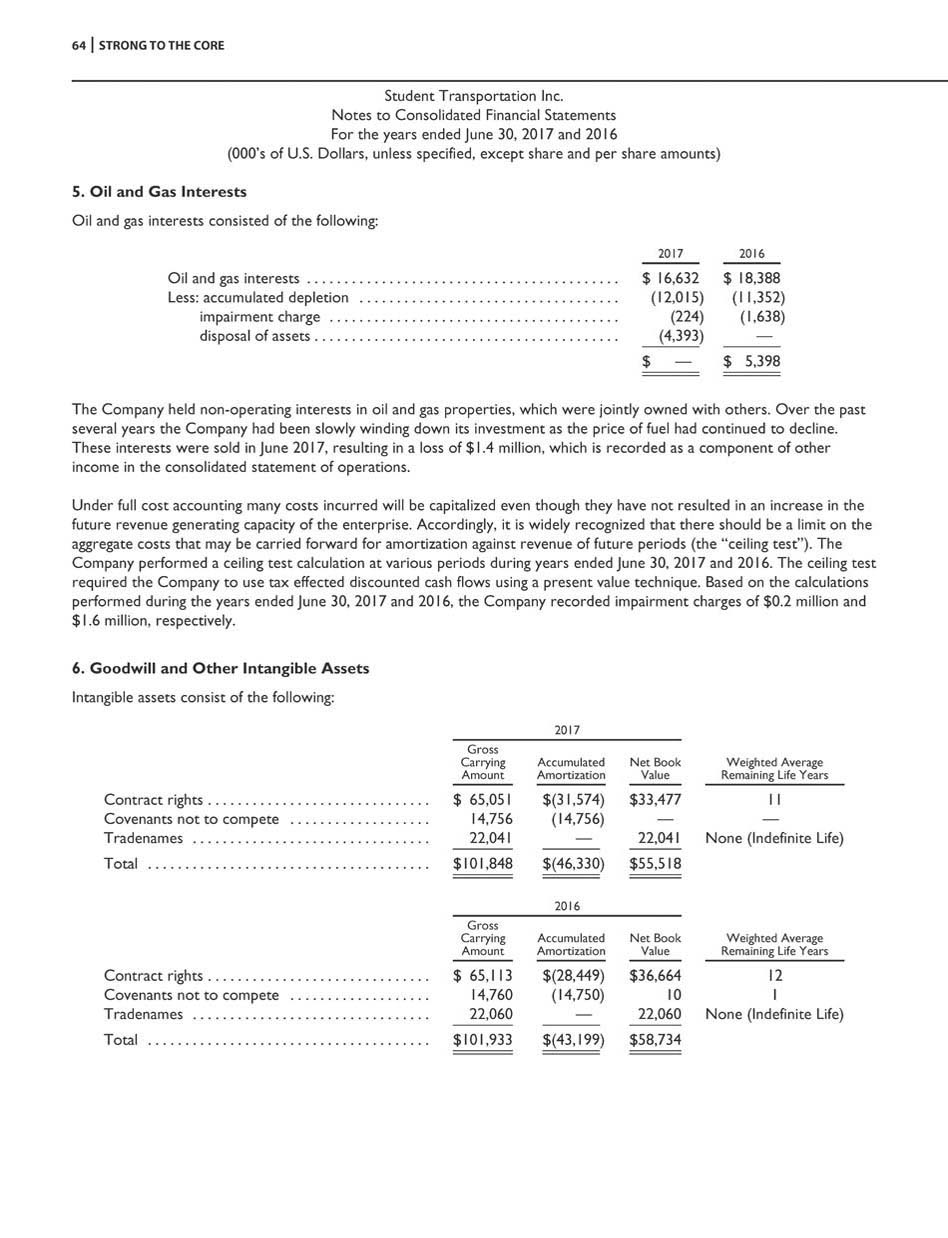

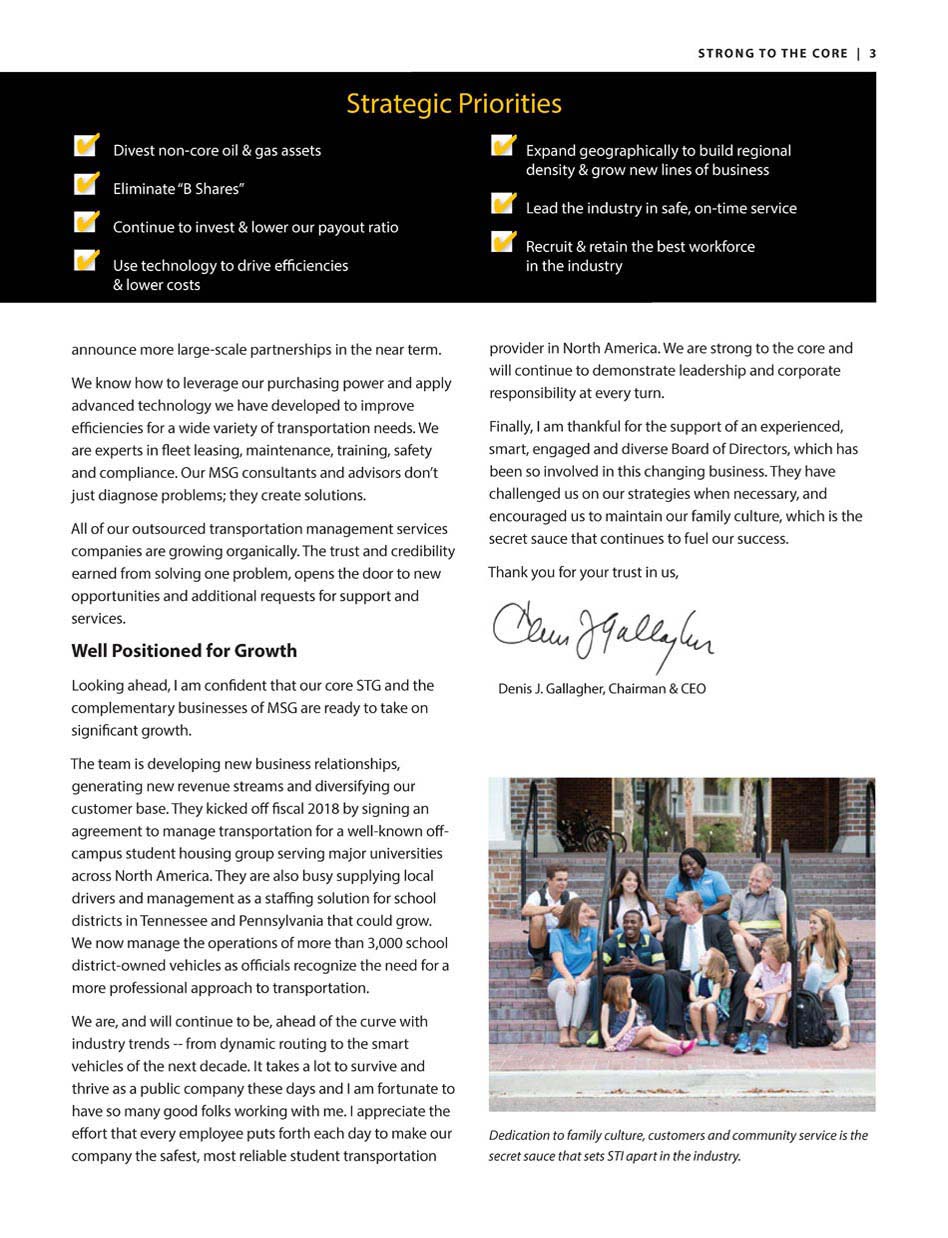

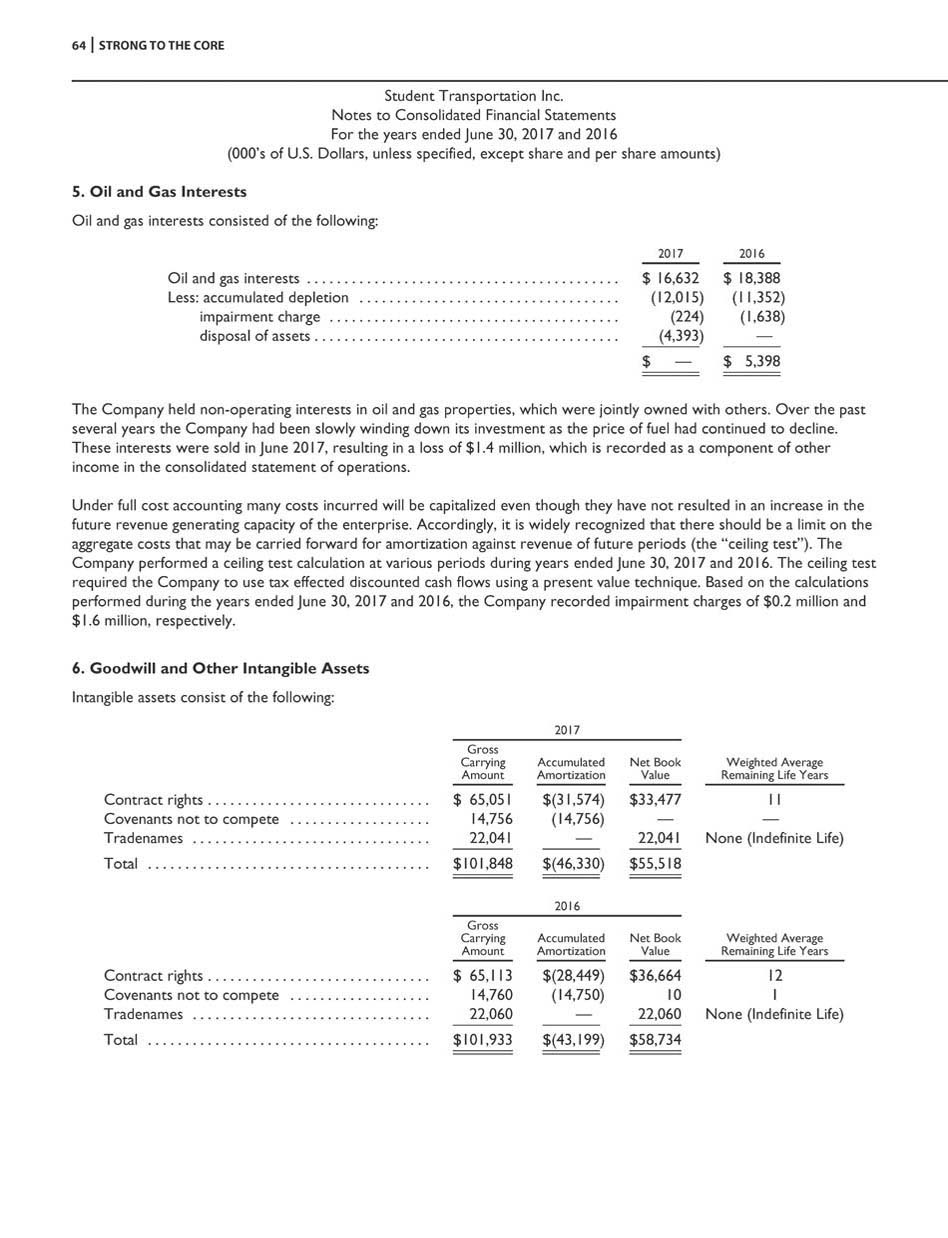

STRONG TO THE CORE | 3 Strategic Priorities Expand geographically to build regional density & grow new lines of business Lead the industry in safe, on - time service Recruit & retain the best workforce in the industry announce more large - scale partnerships in the near term. We know how to leverage our purchasing power and apply advanced technology we have developed to improve efficiencies for a wide variety of transportation needs. We are experts in fleet leasing, maintenance, training, safety and compliance. Our MSG consultants and advisors don’t just diagnose problems; they create solutions. All of our outsourced transportation management services companies are growing organically. The trust and credibility earned from solving one problem, opens the door to new opportunities and additional requests for support and services Well Positioned for Growth Looking ahead, I am confident that our core STG and the complementary businesses of MSG are ready to take on significant growth. The team is developing new business relationships, generating new revenue streams and diversifying our customer base. They kicked off fiscal 2018 by signing an agreement to manage transportation for a well - known off - campus student housing group serving major universities across North America. They are also busy supplying local drivers and management as a staffing solution for school districts in Tennessee and Pennsylvania that could grow. We now manage the operations of more than 3 , 000 school district - owned vehicles as officials recognize the need for a more professional approach to transportation . We are, and will continue to be, ahead of the curve with industry trends -- from dynamic routing to the smart vehicles of the next decade. It takes a lot to survive and thrive as a public company these days and I am fortunate to have so many good folks working with me. I appreciate the effort that every employee puts forth each day to make our company the safest, most reliable student transportation provider in North America. We are strong to the core and will continue to demonstrate leadership and corporate responsibility at every turn. Finally, I am thankful for the support of an experienced, smart, engaged and diverse Board of Directors, which has been so involved in this changing business. They have challenged us on our strategies when necessary, and encouraged us to maintain our family culture, which is the secret sauce that continues to fuel our success. Thank you for your trust in us, Denis J. Gallagher, Chairman & CEO Divest non - core oil & gas assets Eliminate “B Shares” Continue to invest & lower our payout ratio Use technology to drive efficiencies & lower costs Dedication to family culture, customers and community service is the secret sauce that sets STI apart in the industry.

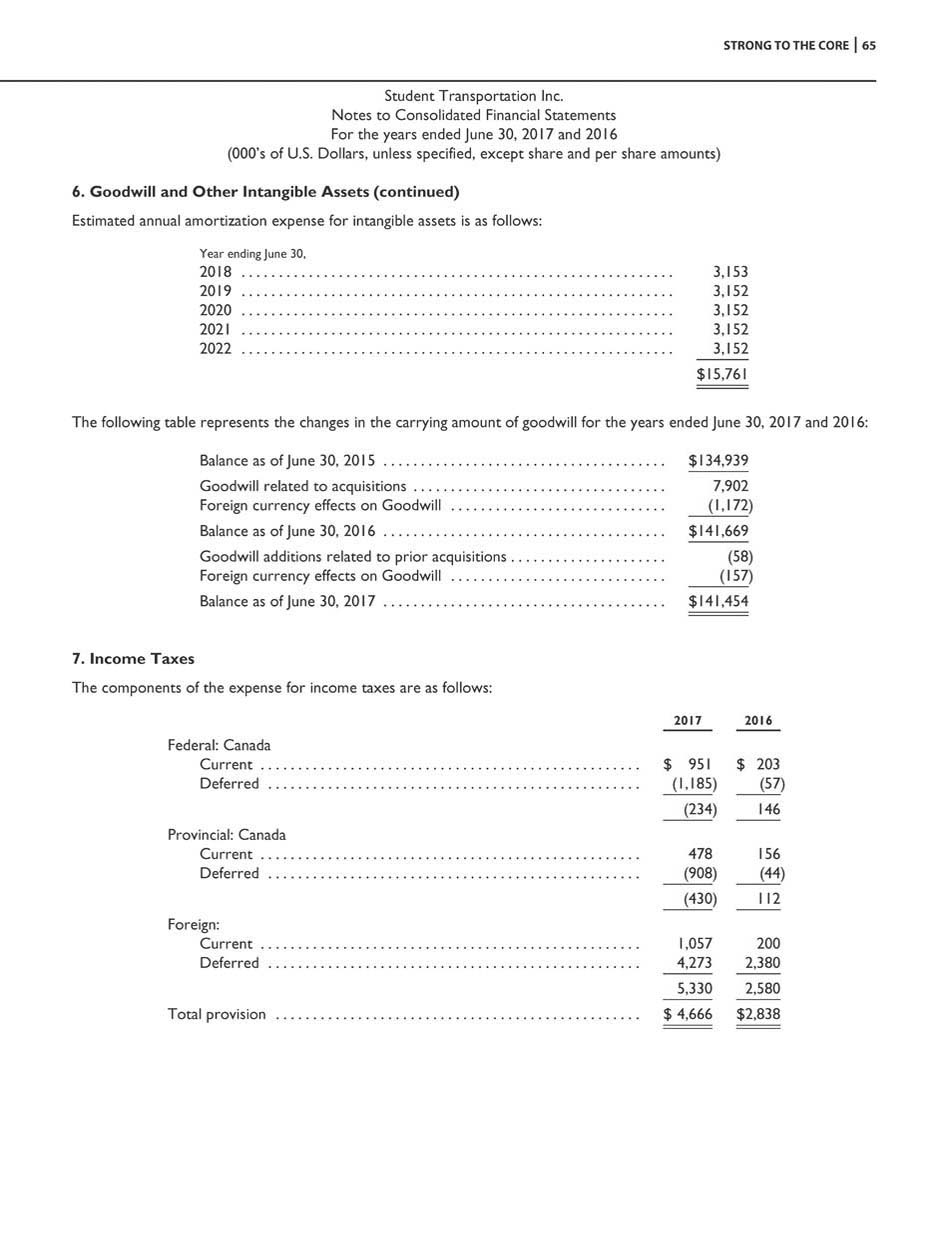

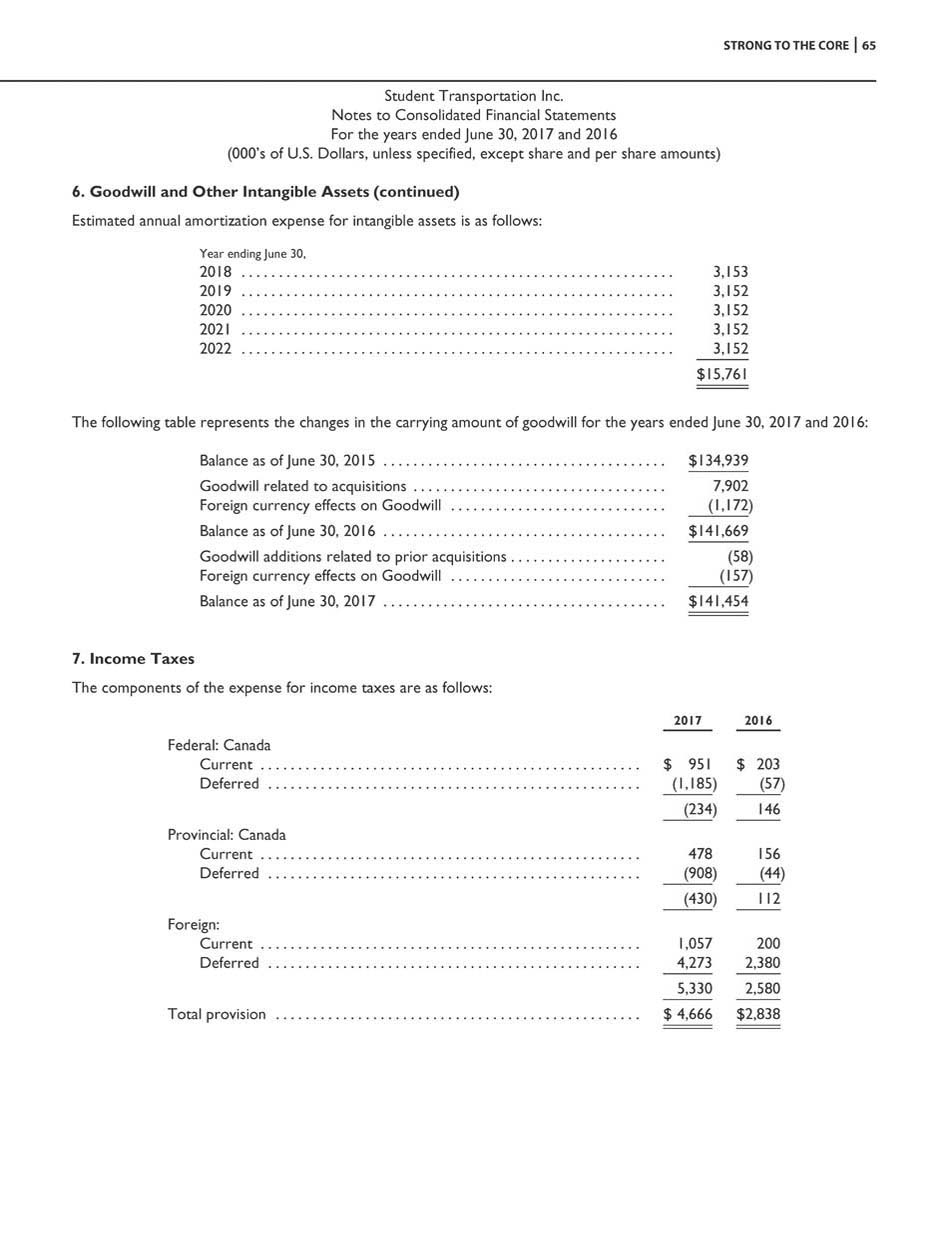

4 | STRONG TO THE CORE L e a d In dustry v i t y an d M n t a al school bus operations tea ms faced some formid ab ge s in fisc al 2 01 7, e t r the indus ry’s high e s a f e, bu ke pt the ir ye s o customers and th e i o c i b le r v t s r mi c l tu re and c ea p r a ch s ar , u e t o se Dr iv s ho r t ag e w er th No n d ry i ue hi t o e m l o y e r e t n t i o an d e cr u i n g el p d ti g s h or ta g e s a o s he aj or t y of ur o e on N d te ch no lo gi s i n fle et m ag e en al s hel e d dr v er s ho rt a as w e de li ve e d re s u de ts i th pa rt neri ng w it h cu st r s to e nh a ce as util z at io , we re d ced r fle t b t e ffi ie e t s i in n 17 01 s o ol e de it e rv in g cu co t ra s fo th e nt ct w t h o r exi i n g us t m in a p o he d l w th t e v e ic le . B y ie d i m p 0 hi c i rk t s a d , i c di g k n i ll e, fis c 20 1 Th i i n i n g k e y ne 10 - y r l id a At t he m ti w e e d e d nven r i e n ha e b c in t gra t o r da il y o r at n l er e c ts it h e pr cur em en t pro ra ms An a yt i s n c ea s g r bi i y t ke inf orme d, d t dr v n b u in e s de c i si o s. O r p ocur ment t a m ha in t od ed Dat W a e u i n g a d Busi ne ss Intelli e e o nc e p s t o distill large volumes of dat fro o r var o s nfor tion s ystems, an d provide the righ in s gh t o th ri gh t people to drive positive change in the organization. t , o og y we’ve in c e sa fety, security and man ag le d d o icles b eh a y , 6 5 p e nt More v is ib le t o st om s, qu ly p ar of our ng oi g ro gr a t o e of o ur v ehicles e equipp ed with G i n d w h adv n ed d gital re co rding sy st ems, two - r ad io s, s d front bumper crossing arms and Child Check - Mate systems, this technology i c eas es safety and gi local mana gement and custo mer transp orta tion officia ls u nparalle led visibi lity i nt o driver behav o oppo rt unities fo r more e fficient rou ti ng . We continue to take advantage of the low c ost of f el, and expanded ou r fleet f a ternative - fueled e icles to nearly 2,200 th is y ea r. W e nego ti at ed p e gallo fuel prices in t lo w pric f the 201 7/20 18 ch ool y a In ad it ion, we are will xt d th t nd li lo tes for most $ 2 r a ng e i n 201 7 an d h a v e l c ke d e v e n ing to a monthly ro ll in agree e th f fis cal 20 1 . – Patrick Vaugha n, President – School Transportation Gro up DATA - FUELED, SECURITY - DRIVEN GROWTH

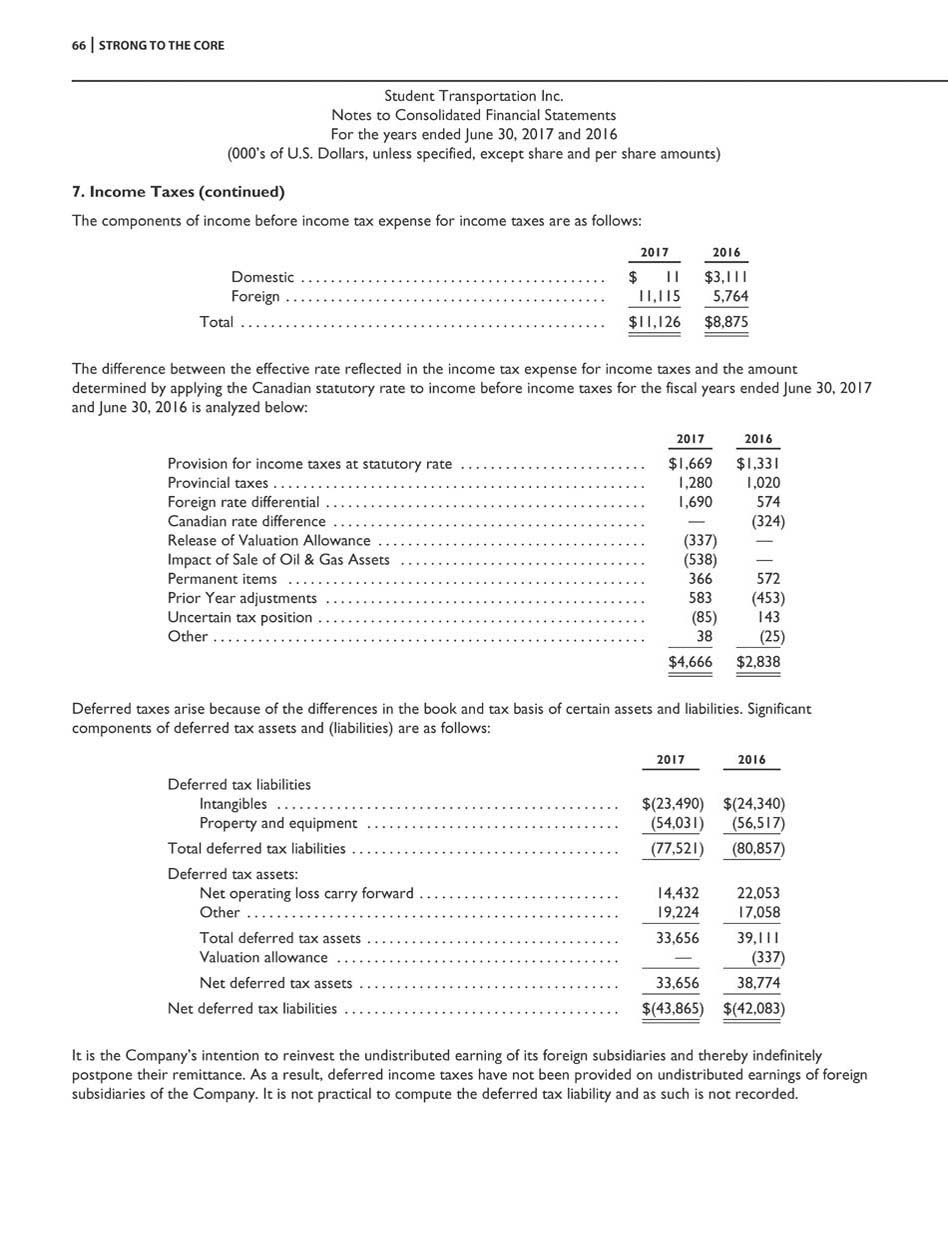

ST T C O E 5 Left: Miss Vonner Pruitt, Driver/Trainer, Jacksonville, FL Right: (l - r) Logistics & Procurement team members Michael Marra, Brianna Valerio and Thomas Yessman. “It makes you feel good when you advance . We have fun here ; we joke around, but we get our job done . We keep the shop clean and know we’re doing our part to keep kids safe.” – Belinda “Billie” Waugh Hi hly Sk , D i W f rc B e in d a “B il li e” W au gh i th e fir st f male m chan c S I ’s W e t Regio a nd G and J n ction’s Employee o t e Y ea r. O ver h 16 ye rs of s e rvice sh e ha s a ed f m driv t o st recen tl y, she w s pr o is beg nni g t he jo t n ci an and lot l ea d. o te d to ful l - time m ec h a i c y t o ob t a in h r CDE Sc h o l u e ch ni ci an C tifi o e ti B tion lo al Oper at i o Mana ge r Sh a n derson sai d, y 23 f a g e ent p ri ce , I ha ad th h o e d g ch d ed c at d o al n iv du al wit h h nt g i ty s e l f i i li ” at d B il lie sa o t h w om en t h i n g er f a in g a si mi lar c path ? “I’d say g tr it u a fun jo b A nd v a be gi nn in g echanic, it’s a gre at l earning ex peri n ce . There’s always roo m for advancement if you w an t it, and you ca n transfer ne a ly any w er e i t he c nt ry w i h th is c om pan y Th ey re always g oin to e d ch e ki ds have to g o to choo l; hi s is a g ood jo b to h av e. ” – Be linda “B illi e” W g h, Mechan ic Junction , CO

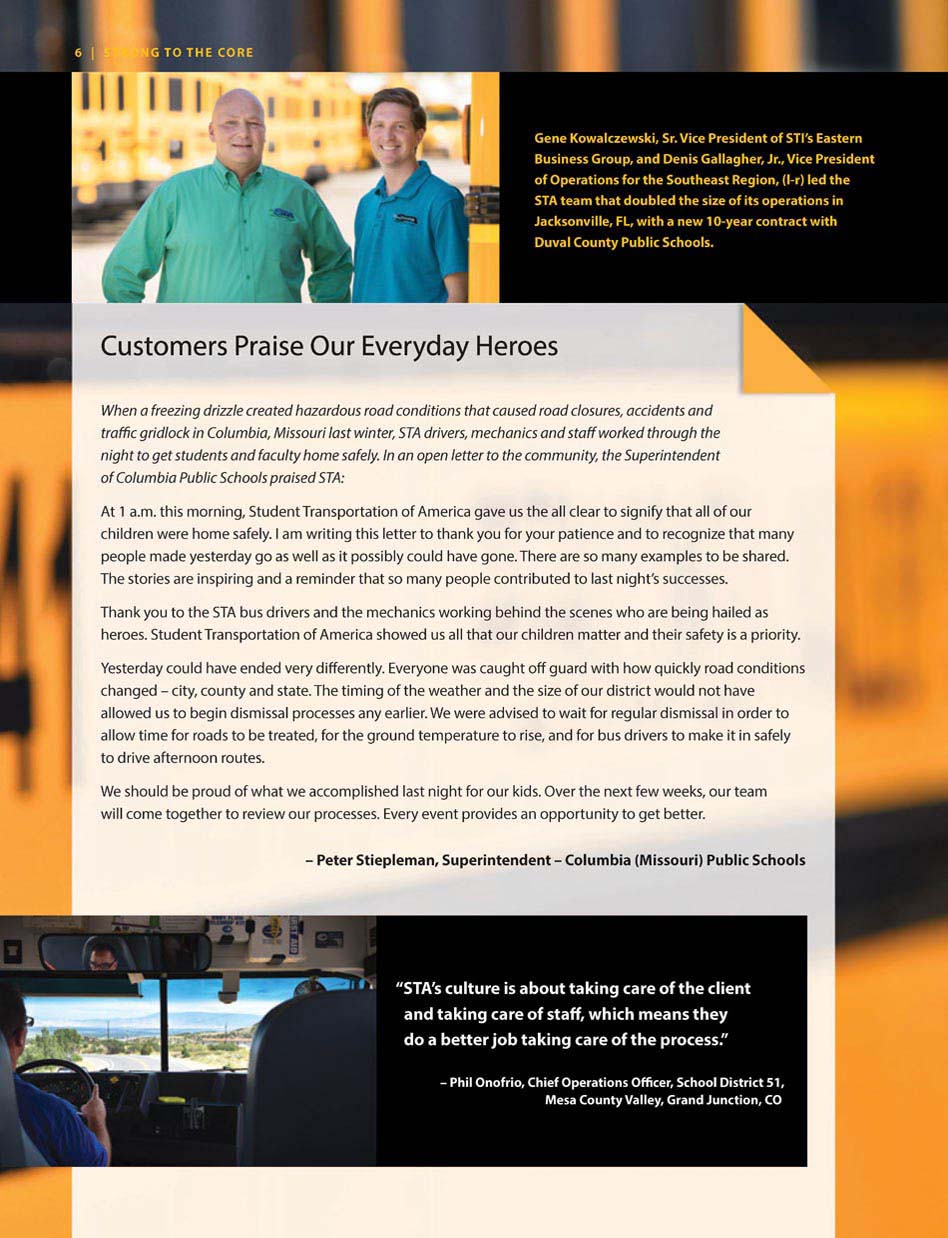

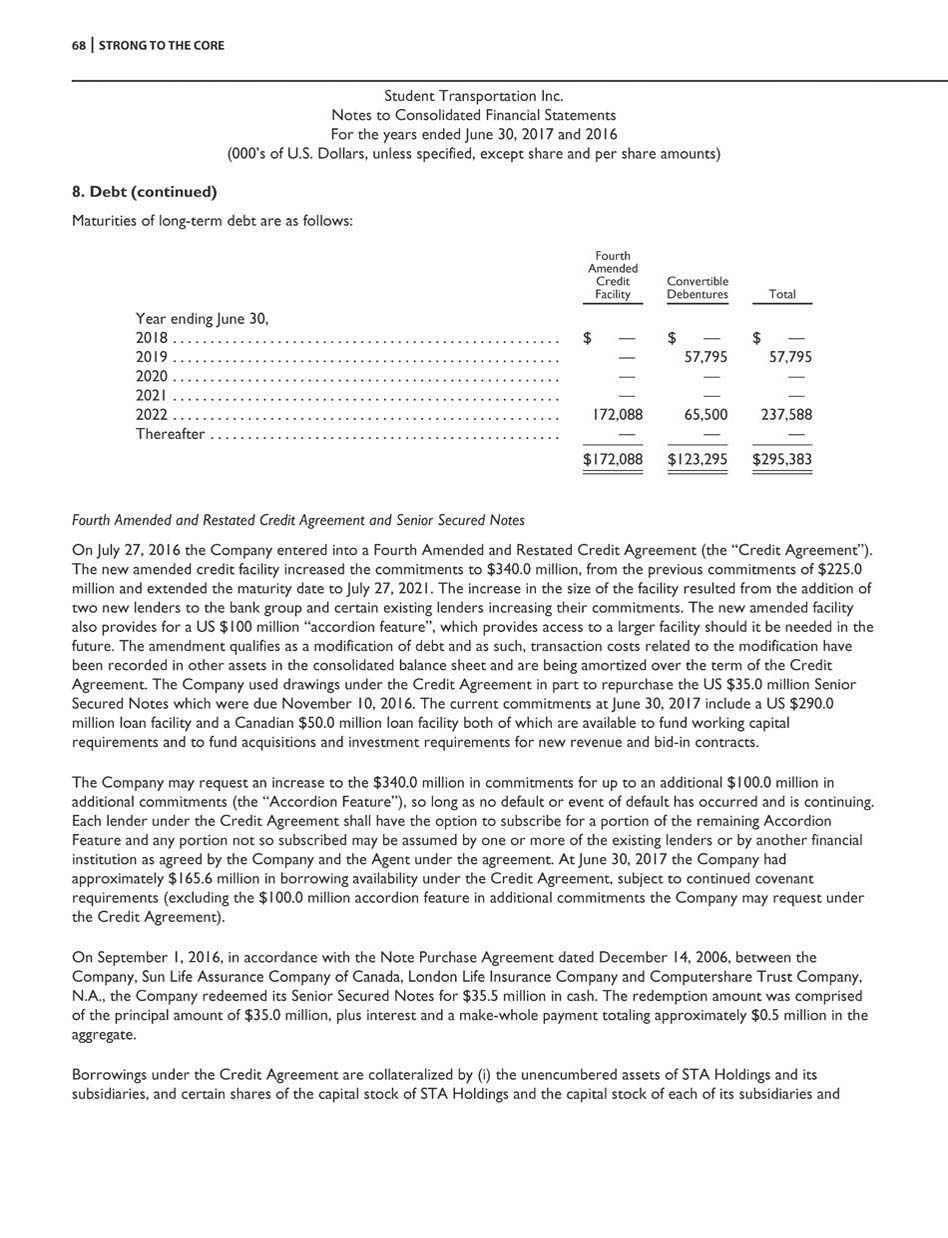

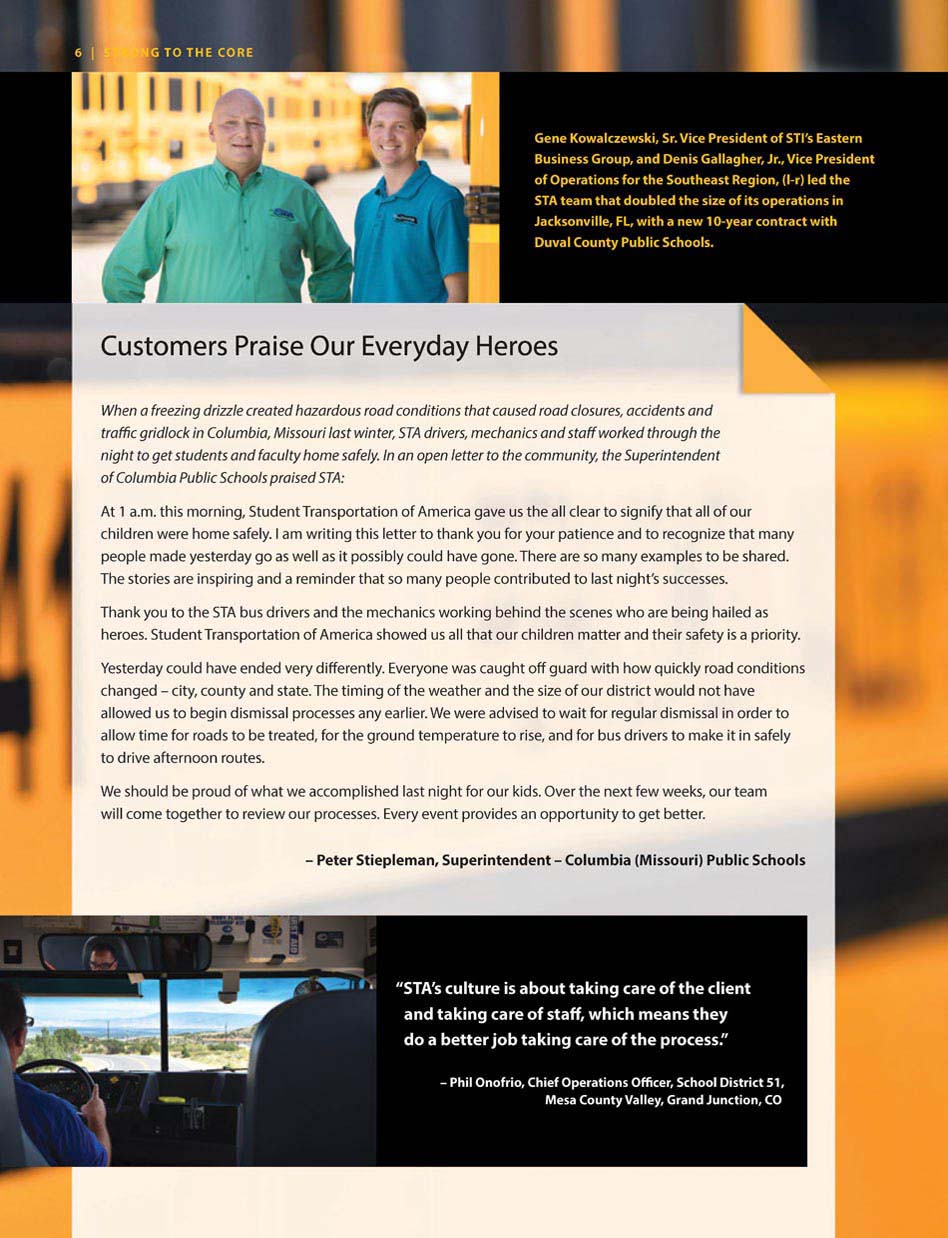

6 | STRONG TO THE CORE “STA’s culture is about taking care of the client and taking care of staff, which means they do a better job taking care of the process.” – Phil Onofrio, Chief Operations Officer, School District 51, Mesa County Valley, Grand Junction, CO When a freezin g drizzle crea ted hazardous ro ad condi tions that cause d road closures, accidents an traffic gridlock in Columbia, Missouri last wi nter, STA dr iver s, mechani cs and staff worked through t he night to get stu dents and fac lty h om saf l In an ope n le tt er to the co mmunity, the Superintende of Columbia P c S h o ols raise STA: At 1 a.m. th s morning, Student Tra sp rtati of Am c a gav s t e all clea r to s i gn fy tha t a l of o r child r en w e r e ho m e sa f el y . I a m wr i t in g t h s e t e r t o t h nk y u r y pa ti e c e a n d t o e n i z e th a t a n y people made yes erday go s well s it possi ly coul d have one. T he re a re o ma ny exa m p le s to b e sh r ed. The stories are in pi ing nd a rem nder hat s man y p eop l c on tr ib ut ed to last nig ht’s cce se . Thank you to the STA bus drivers and the mec hanics w r ki n g beh i d th sc nes who a e being hailed a s heroes. Stude t T sportation of America show ed us a ll t at ou r ch e n tt and t he ir saf ety is a p ior i y. Yesterday c uld ha ended e y di eren y. E ver yo as caugh t off gua rd with how qu ick y ro ad co d tio changed – i ty nty and s ate. Th tim ng f the w ather and the size of our dist r ct ould no hav e allowe d u be gin dismissal proce ses any ea l ier. W w re adv is e to wait for r eg u r ism ss a r de r to all o w tim e f d s t o b e t r e a t e d , f or th e g r u n d t empe r a u r e t i e a d f o r bu s driv er s t o ake i t a f e ly to dri ve aft r o r tes. We sho ul d be proud f wh t we accomplishe d last ni ght for ou r kids. Over the next few weeks, our tea will c ome tog er to ev ew proce e . Ev er y ev ent provides an opportunity to be e r. – Peter St ieplem u per nt en umbi a (Missouri) Public School Gene Kowalczewski, Sr. Vice President of STI’s Eastern Business Group, and Denis Gallagher, Jr., Vice President of Operations for the Southeast Region, (l - r) led the STA team that doubled the size of its operations in Jacksonville, FL, with a new 10 - year contract with Duval County Public Schools.

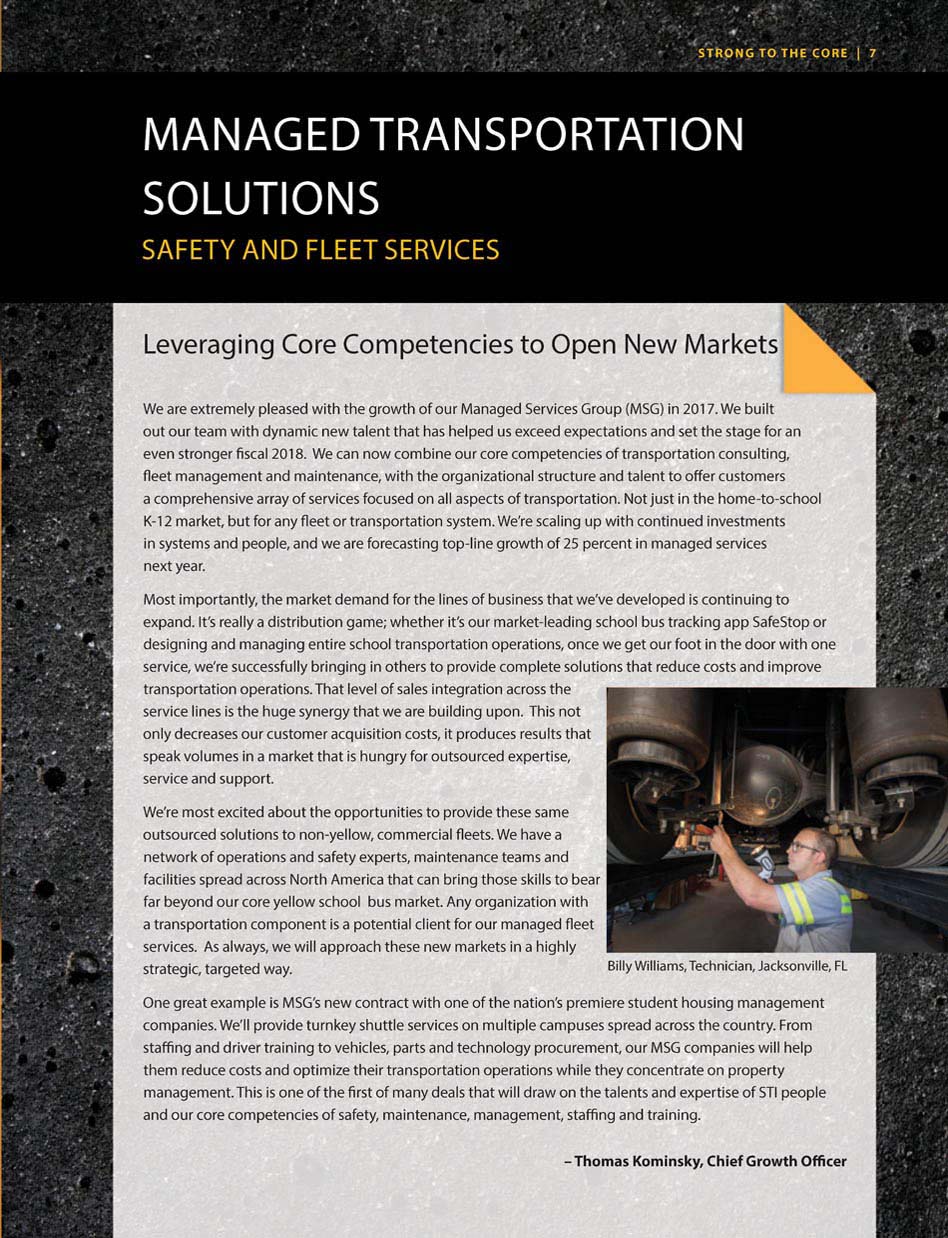

SAFETY & FLEET MAINTENANCE CONSULTING STRONG TO THE CORE | 7 Billy Williams Tech ni cia Jack onvil le FL MANAGED TRANSPORTATION SOLUTIONS SAFETY AND FLEET SERVICES L verag ng Co e Co m p ete es t o O p e n N e w Ma r ke t s We are e xt re me ly p le as ed w th th e gr ow th of our Manage d Se rv ice G o up (MS G) in 2017 We b ui t ou t ou r te am w th dy na mi c new tale nt t ha t ha s he lp ed u s ex ceed e xp ectatio s a d set the st ag e fo r an v en stron ge fis cal 2018 We ca n no w co mbin e ou co e c ompe te cie of tr n por ation c ns u ting fle et m n agem ent an d mainte n nc e, with th e or ganizational struc tu e and talen t to o ffer cu stom er s compre he ns ive ar ay of s e vi ce s focu se d on a ll a spects o f tra sp o tati on No t just n the home - to - school K - 12 m arke t, b ut f or any flee t o t ra ns port ation sy st em We’re sc al in g up wit h co nt in ue d invest me nt n s ys tems and p eo pl e, nd we a e fo eca st ing top - li ne g o wt h of 25 perce t in m a ag ed serv ces next y ear. Mo st i mpor ta nt ly th e ma rk et d em a d fo r the li ne s of b u ines s th at w e’ ve d evel pe s continui ng to x pand It s reall y a di st ibu ti on g ame; w he th er t’ s ou r ma rket - l ea ding sc o bu s tr ac king app SafeSto p or de s gn g a d m a ging e nt r e sc ho ol t a nspo rtat io op er at ns on ce we ge t our fo ot in the do or w ith one se rvice, we’ re succe ss full y br ingi ng i n others t o provid e comp le te solutions that e du ce c ts a nd mp ove tr an sp orta tio o pe ra tion s. That level of al es ntegra tion a cr os s th e servic e line s s the huge synerg y th at w e ar e bu i d ng pon Th is not only d e e ases our c usto me r a qu is it io costs, it pr od uc es ul ts tha t sp ea k vo lu me n a m ar ke t that is hu ng ry f out so urced e pe t is e, se rv ic e an d s pp r t. We ’re most e xcited about the o pp or tu ni ti es t o pr ov id e these same ou ts ou rc ed ol utio ns t o non - yellow c mmer ci a flee ts We h av e a netw or k of pe a ti on and safe ty e xp erts ma in te na c e te ams nd faci lities pr ea d acros N or th A me r ca t ha t ca n br ing th os e skills t o e ar far beyond o ur c or e yell ow school b us m ar ket. A ny organizatio with tran sp ortati on com po ne nt s a pote nt ial c ient f or ou man ag ed fl ee t s rvices . As alwa ys , we w ill ap proach t he se n ew m rke ts i n a highly st a te gic, tar ge te d wa y. On gr ea t example is M SG s n ew contract w th o ne of the na ti on ’s prem er e st uden t ho using ma na ge me nt companie s. We’ll p ro v de tu nk ey shuttle s er vi ce s on m ulti ple ca mp us es prea d acro s t he country . Fr om staffing a nd dri ve r tr a ning t o ve hi cles parts and te ch no logy p ro cu reme nt ou MSG mp an ie s w l he p them reduce cost s an d opti mi ze t heir t a nspo rt at io n op r atio ns w hile t hey conce tr ate p ope rt y a nagement Th is s one of the firs t of many de a s th at w i l dr aw on the ta le nts and ex pertis e of STI people an d our co e com pete ncie s of s af et y, a nt en an c manage me nt staffing a nd t r n in g. Thomas Kominsky, Chief G o wth Offi ce

STR D e Sa f e ty, Se c u r i t y & I mpr ove d Pe r for m a SafeStop is on a roll, m ore t h a n d o lin o the th ir d year in a ro w. By th e en d of fiscal 2 0 7, over 20,000 parents an d guar d ha d re gi 3, 500 ve hicles and adding to that us u f r t e p p, w hi ch i s no w tr acki m ore th an n a ddit io o b e g prime c nica t n s an d sa fe ty t ool f or pa r ent s , Sa f eS t o p i s p r o v ing it s w o r t a n p o r i n r o f es a d m in creasi ngly rely on its data and analytics to b uild m o e co st - ff v r an sp i on st m o s w ho Sa fe St op nd o d a p s nt cti on able insights t o Analytics platform is help in g transportation sta ffs turn th im prove routing, s afety and perf ormance. By the start of fiscal 2018 , more than 97 percent o f our custom ers ha d re tu the prior scho ol ye ar, an d we ’d launched new SafeStop service s fo r school dis tricts, contra ctor s an d shuttle systems in Ma in e, C onne cticut , New Jersey, South Carolina, Alab am a, Tex as, Co lo ra do , Il li no is, Indiana, W is co ns in , Missouri, Oregon and Manit ob a, Canada . High sales vity at the sta rt of the school year should broa en ou ba n furthe SafeStop continues to deepen our relationships with current customers, and open doors for other lines of MSG we i w scho o d t cts contracts with transpor t d bey ond o u r current o e As children he a b k to sch o , and paren s a d rid s ac ss th e n t i n t s k , “ Wh e r e ’ t h s? ” t s o s t ro id thh t an Pa ric k Ga la her Di rect r f S e Saf e S top Our industry - leading SafeStop app is making life easier for parents and opening doors to new customers for all STI business units. · K - 12 municipal & private fleets · Fleets owned & operated by school districts · Commercia l fl eets · Enterprise fleets · Muni, state & federal fleets MSG M · K - 12 municipal & private fleets · College & univ. shuttle · Local, county & state gov’t S T G Training Management & Sta ffi ng Consulting Fleet Operations & Maintenance S a f e ty Core Competencies · College & univ. shuttle · Direct - to - parent transport

OR New fleet maintenance technologies are changing the way our technicians work. New diagnostic tools, data collection devices and time - saving vehicle inspection tools are streamlining maintenance. The results are improved technician productivity and vehicle health. (l) Earl Jackson, Lead Technician, Jacksonville, FL Left: Jason Haywood, Field Trip Coordinator, Jacksonville, FL Right: Our SafeStop Analytics platform is helping transportation staffs turn thousands of data points into actionable insights to improve routing, safety and performance. W h Da ta a nd analy ti e at ed eve ry th in g we did i n 20 17 . It wil l lead t o a fu ndam enta l tr an sfor mation o f o ur b si n p r c ti c e s , an d m ak e ou r op eratio ns e v e n sa f e r an d mo r e effic ient i n 20 1 8 n d b e y d. In the short - t r m, the high - po we red inte grat ed syste s operatio ns are p viding n ew m an age s and gre d ibili ty i n r h ad quar te rs and field er yt hi ng from payr oll an d w e i s increasingly c on nect ed via afety nsp t . O fl e o f ude nt c in g, a nd p t d tom er a pp s. pu rc ha si ng t o pr e - tr ip v eh GP S, W i - Fi, vi de a m Lo ok n a ead, e e n - boa ch ngi ng ablets and pre dict iv e ds of our ride rs o ke s i - autono mo us vehicles, artificial i nt el ligence, ehicl e di agn os ics that will al lo w us to customiz e ou r services to the th e s. Trends in ho me schooling, sp ecial needs educatio n, ap ng th e tradit ional defin ition of the schoo l day and we’re prepar in g c ha te r a n d priv at e schoo to the se evolving need . We ’r e al so e xploring technologies li ke d ynam ic routing tha t ha ve the potential to mi ti ga te the issue of driver shortages and improv as se t utilizat ion, as we ll as electric vehicles that can cut costs benefit t he environment. The op po rtunitie s to i mprove o ur perations, our c om munities a nd our ustomers’ quality of life through more relevant co nn ec tions be tw ee n etwor ks, systems and de vi e re unprecedented. Our technology team will continue to work diligentl y to o ptimiz e the se ns ors, software and systems of today, while keeping our eyes on the future a nd our m in ds open to the next big thing in mobility. – Keith Engelbert, Chief Tec hn o og y Offi ce

10 | STRON G T O THE CORE S T A t e mem be rs and th r families in Co egeville, PA Members of STA’s Griswold, CT, terminal organized a holiday toy drive to benefit patients at Connecticut Children’s Medical Center in Hartford. They began at the Griswold High School Homecoming game and stuffed a bus with toys and money donated by community members during the month - long effort. Cu t ure M a tters Comm unit y service ru ns deep at STI. It has bee n a gu id in g li gh t for our founder, our company an d our employ ee s throughout our 20 - year h istory. We started our first charitable org anizatio n, the STA Education Foundation, in 2003. O ve r the next 13 years we a wa rded hundreds of sc holarships t o de serv in g high s ch ool st udents at schools we s er ve, as well as to fami ly me mbers of our emp loye es. The Foundation strengthene d its fu nd rais ing muscle in 2012 when CEO Denis Ga ll ag her partne re d with NAS CA R driv er Denny Hamlin and Hootie & the Blowfish m usician Mark B ryan to create a celebrity music an d go lf event in Charleston, SC. In its first 5 years, Denis, Denny & Mark’s Pro - Am Jam ra is ed nea rl y $ 1 million to support three charitable organizat io ns tha t work to cr eate bet ter opportun ities for chil dren . By 2016, the STI Car es Foundation wa s crea ted to broaden our outreach , ma ke a greater i mp a t on the commu niti we ser ve a nd , more i mp ortant ly , h elp r e mp lo ye es i n thei r ti ee d. T he se fol ks g iv so h of thems el ve s ever y ay and, he n ha rd t im es a ect them, are th e e fo th – Dougla a ll a g e , President, Ca re s Fo undation

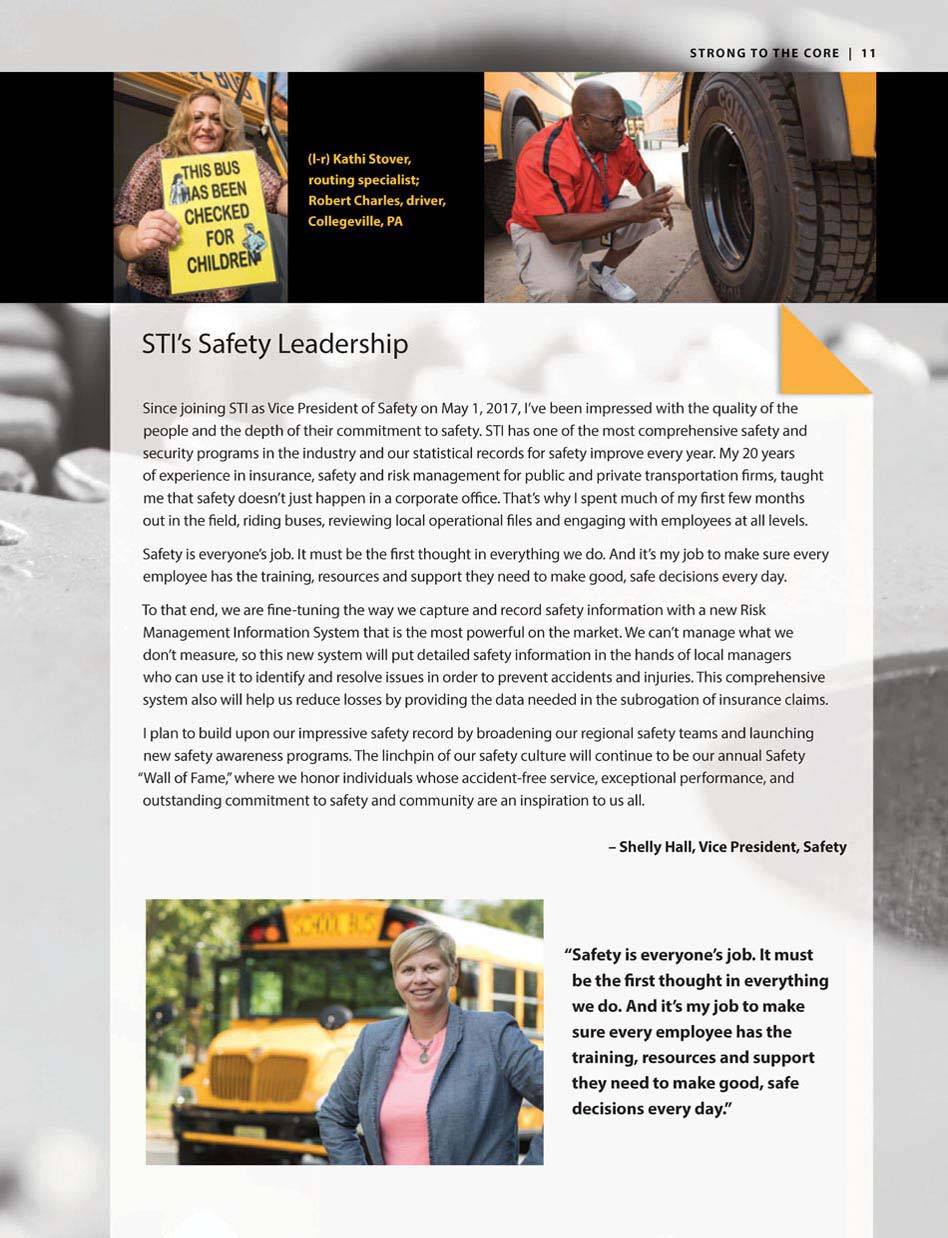

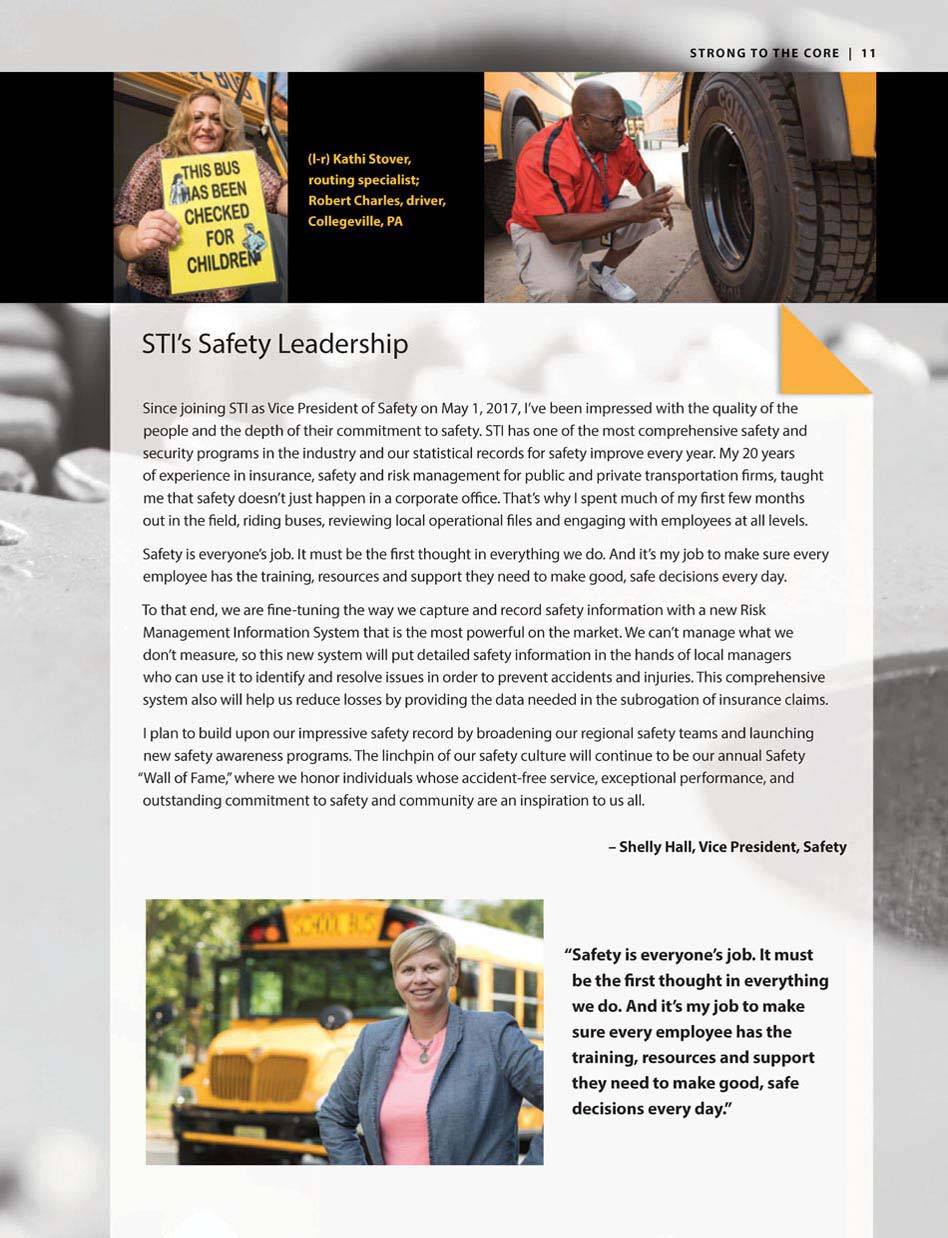

E (l - r) Kathi Stover, routing specialist; Robert Charles, driver, Collegeville, PA Safety is everyone’s job. It must be the first thought in everything we do. And it’s my job to make sure every employee has the training, resources and support th ey need to make good, safe decisions every day.” STI S a f y Le d e rs h Since i in STI as Vi e Pr esident of Sa y on M ay 1, 2017, I’ve been impresse d with the quality of the pe p le and the d ep o f th ei r commitment t o safety. STI has one of t he mos t co mprehe ns iv e safety and ri ty p ro grams in the industry and our statistical records fo r safe ty imp rove e very yea r. M y 20 years of experience in insurance, safety and risk management for public and pr iv ate tran sp ortation firms, tau gh t me that safety doesn’t just happen in a corporate office. That’s why I spent much of my first few months out in the field, riding buses, reviewing local operational files and engaging with employees at all levels. Safety is everyone’s job. It must be the first thought in everything we do. A nd i t’ s my job to ma ke s ur e every employee has the training, resources and support they need t o make good, safe decisions ever y da y. To that end, we are fine - tuning the way we capture and record safet y in form at ion with a n ew R is k Management Information System that is the most powerful on the marke t. We ca n’ t ma na ge w hat we don’t me asure, so this new system wi ll put detailed safety information in th e hands of l oc al managers who can use it to identify and resolve issues in order to prevent accidents and injuries. This comprehensi ve system also will help us reduce losses by providing the data needed in the subrogation of insura nc e clai m . I plan to build upon our impressive safety record by broadening our regional safety team s n d aun hing new safety awareness programs. The linchpin of our safety culture will continue to be ou r nnual Saf t “Wall of Fame,” where we honor individuals whose accident - free service, exceptional pe rf rmance, and outstanding commitment to safety and community are an inspiration to us all. – Shelly Hall, Vic e Pr e ide t, Saf ty

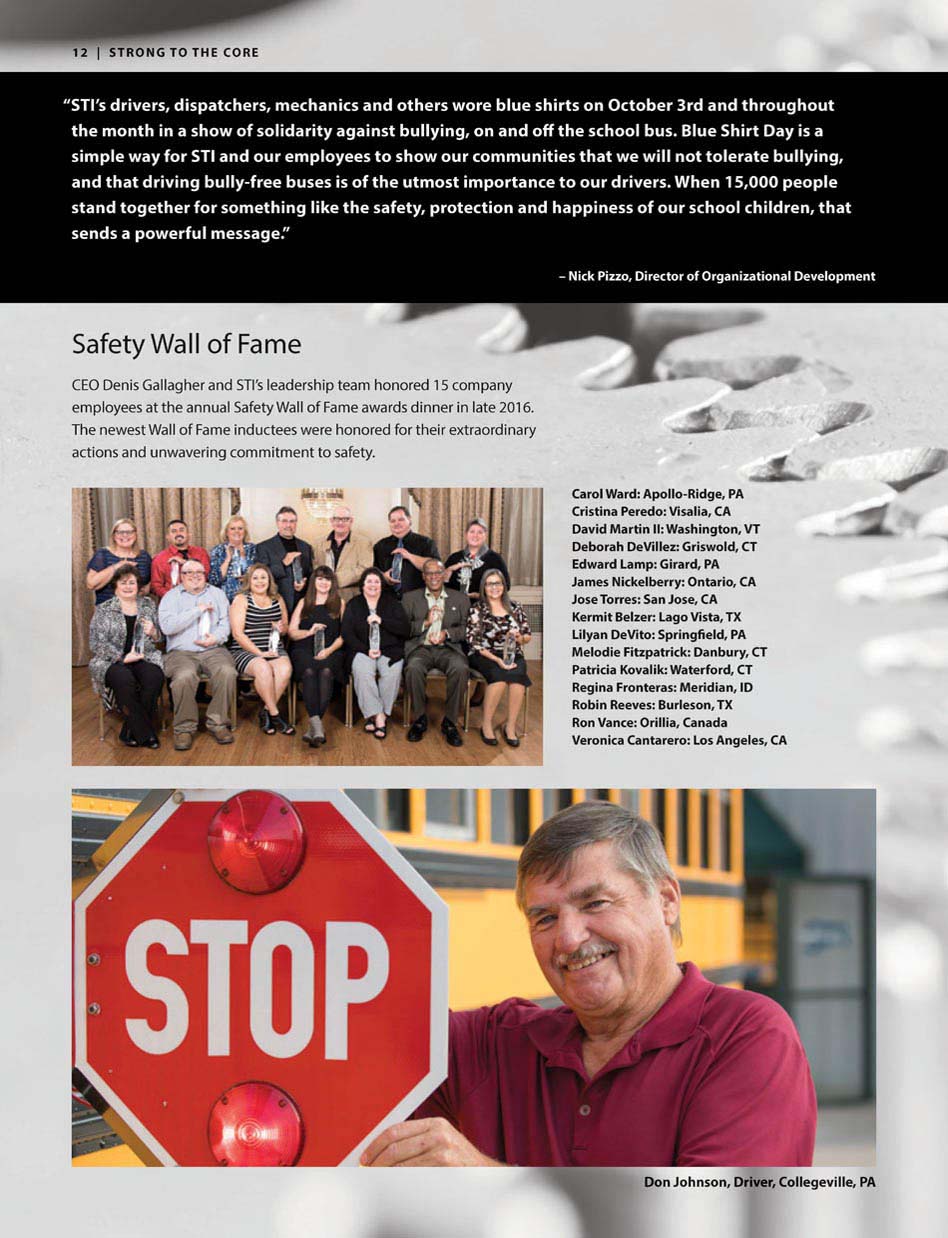

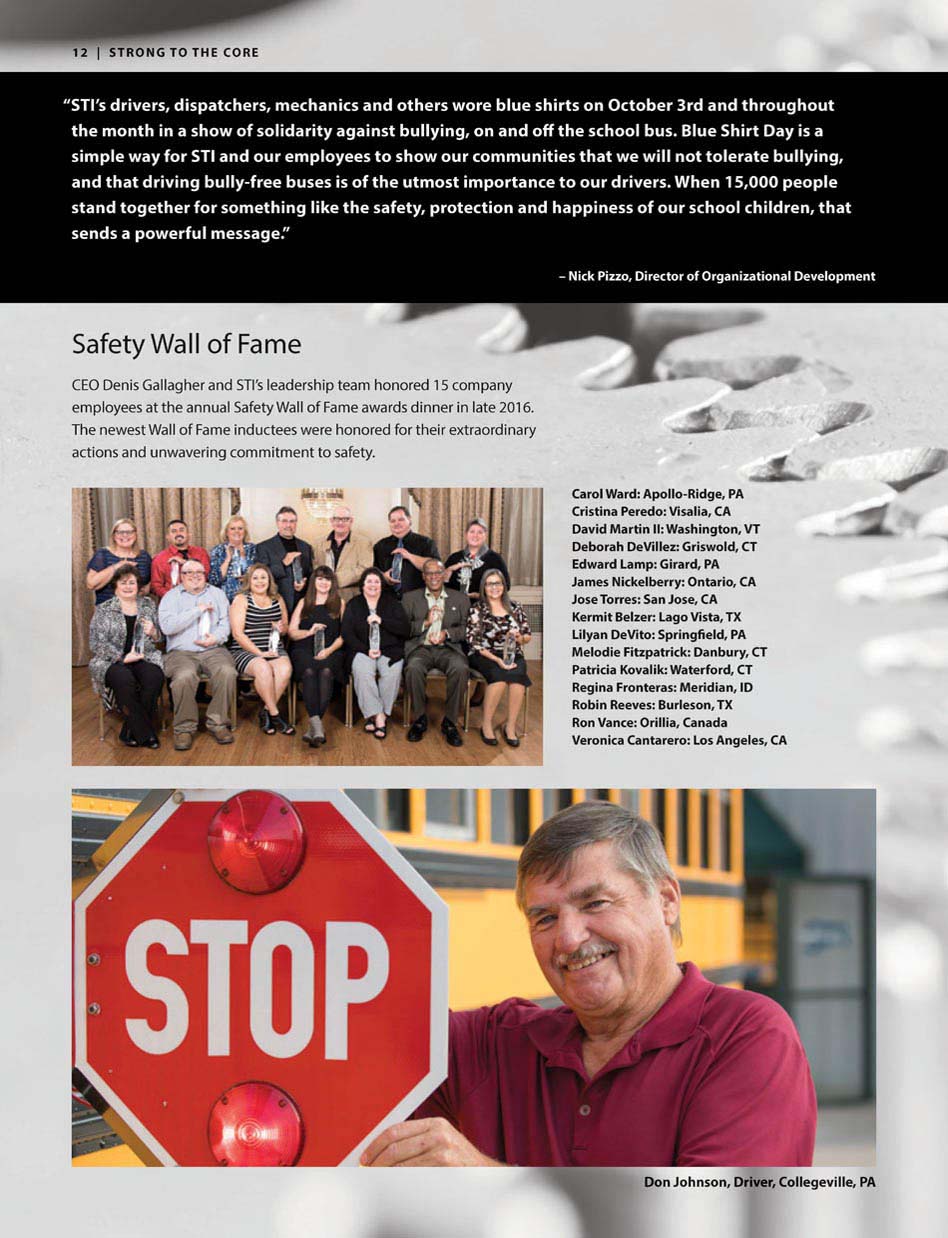

O R E “STI’s drivers, dispatchers, mechanics and others wore blue shirts on October 3rd and throughout the month in a show of solidarity against bullying, on and off the school bus. Blue Shirt Day is a simple way for STI and our employees to show our communities that we will not tolerate bullying, and that driving bully - free buses is of the utmost importance to our drivers. When 15,000 people stand together for something like the safety, protection and happiness of our school children, that sends a powerful message.” – Nick Pizzo, Director of Organizational Development S fety W f a EO D is Ga lag he nd S I’s le ad er ship t ea m honored 5 company plo ye t nnua l Safe ty W all of Fame awards dinner in la 2016 Th n t Wal of Fa me nductees w re ho or ed for their e xt r o din ry t n w ver ng c om mi tm ent o af ty. Ca o W d ol lo - R dge , PA Cr in Peredo: V s a CA Da v d M ar t i n I: Washingt n, VT De bor h D eV llez : Griswold C Edw rd L am : Girard, PA Jame s Nic kelberr : O n o C A Jose or res: Sa n J ose, CA Kermit Belz : La o ista, T X Lilyan DeV ito Spr ngfield, PA M e odie itzpat ick: Dan bu ry, CT P atr a Ko ate rfor d, CT Regina Fr nteras : Me ridian , ID Ro b n Reeves : Burl eson TX ance: Orillia Ca na da Veronica Cantarero: Los An geles, C A o n r , o l g e i ll , P A

STRONG TO THE CORE 13 STUDENT TRANSPORTATION INC. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS The following Management’s Discussion and Analysis of the Financial Condition and Results of Operations of Student Transportation Inc., is supplemental to, and should be read in conjunction with, the financial statements and footnotes for the period ended June 30, 2017. These financial statements can be found on SEDAR at www.sedar.com . As an SEC issuer (as defined under applicable Canadian securities laws), Student Transportation Inc.’s financial statements are prepared in accordance with United States generally accepted accounting principles (“US GAAP”). The information in this Management’s Discussion and Analysis of the Financial Condition and Results of Operations is effective September 20, 2017. Additional information about, and the Annual Information Form filed by, Student Transportation Inc., is also available on SEDAR at www.sedar.com. All references to “ $ ” or “US $ ” are to U . S . dollars and all references to “Cdn $ ” are to Canadian dollars . All references to the Company are to either Student Transportation Inc . or to STI and its subsidiaries, as the context requires . Unless the context requires otherwise, references to years are to the Company’s fiscal year ended June 30 . Forward - Looking Statements Certain statements in this Management’s Discussion and Analysis (“MD&A”), including without limitation in the sections of this MD&A entitled “Results of Operations”, “Liquidity and Capital Resources”, “Commitments and Contractual Obligations” and “Quantitative and Qualitative Disclosures About Market Risk” are “forward - looking statements” within the meaning of applicable securities laws, which reflect the expectations of management regarding the Company’s revenues, expense levels, seasonality, liquidity, profitability of new business acquired or secured through bids, borrowing availability, ability to renew or refinance various loan facilities as they become due, ability to execute the Company’s growth strategy and cash distributions, as well as their future growth, results of operations, performance and business prospects and opportunities. Forward - looking statements generally can be identified by the use of forward - looking terminology such as “may”, “will”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “should”, “plans” or “continue” or similar expressions, and negative forms thereof, suggesting future outcomes or events. These forward - looking statements reflect the Company’s current expectations regarding future events and operating performance and speak only as of the date of this Management Discussion and Analysis. Actual results may vary from the forward - looking statements. Specifically, forward - looking statements involve significant risks and uncertainties, should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether or not or the times at or by which such performance or results will be achieved. A number of factors could cause actual results to differ materially from the results discussed in the forward - looking statements, including, but not limited to, the factors referred to and incorporated by reference under the heading “Risk Factors” such as an inability to control the Company’s operating expenses, significant capital expenditures, the Company’s ability to retain or renew its customer contracts, find suitable business for acquisition and identify conversion opportunities and win bid contracts on profitable terms, the Company’s consolidated indebtedness and restrictive covenants related thereto, the Company’s ability to make payments on its convertible debentures, the Company’s acquisition strategy, increased industry competition and consolidation, reliance on certain key personnel, the possibility that a greater number of employees will join unions, rising insurance costs, a lack of insurance coverage for certain losses, new governmental laws and regulations, environmental requirements, seasonality of the industry in which the Company operates, any inability to maintain letters of credit and performance bonds, the termination of certain of the Company’s contracts for reasons beyond management’s control, the Company’s status as a public company and foreign private issuer for U.S Federal Securities Law purposes, increased disclosure requirements now that we are no longer an emerging growth company status for U.S. federal securities law purposes, reduced spending by school districts and governmental agencies, terrorism attacks, man - made or natural disasters, cyber terrorism and data security breeches and risks related to the Company’s capital structure. Material factors and assumptions that were relied upon in making the forward - looking statements include contract and customer retention, current and future expense levels, availability of quality acquisition, bid and conversion opportunities, current borrowing availability and financial ratios, as well as current and historical results of operations and performance. Although the forward - looking statements contained in this Management Discussion and Analysis are based upon what the Company believes to be

14 STRONG TO THE CORE reasonable assumptions, investors cannot be assured that actual results will be consistent with these forward - looking statements, and the differences may be material. These forward - looking statements are made as of the date of this Management Discussion and Analysis and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as specifically required by applicable law. General Student Transportation Inc. (“STI” or the “Company”) is a corporation established under the laws of the Province of Ontario. Following the completion of the Share Exchange (see Equity Incentive Plan - Class B Shares), STI owns 100% of the outstanding common shares of Student Transportation of America Holdings, Inc. (“STA Holdings”) and 100% of the outstanding shares of Parkview Transit. No other classes or series of shares of STA Holdings are currently outstanding. STA Holdings, through its wholly owned subsidiary, Student Transportation of America, Inc. (“STA, Inc.”), combined with Parkview Transit, is the third largest provider of school bus transportation services in North America. STI’s common stock and convertible debentures are listed and trade on the Toronto Stock Exchange. Since September 2011, STI’s common stock has also listed and traded on the NASDAQ Global Select Market. Upon the approval of the Company’s Form 40 - F registration statement by the U.S. Security and Exchange Commission in September 2011, the Company became a “foreign private issuers’ under applicable U.S. federal securities laws. Convertible Debentures On June 7, 2011, the Company issued US$ 6.25% convertible subordinated unsecured debentures (the “US$ 6.25% Convertible Debentures”) due June 30, 2018, at a price of US $1,000 per debenture, for total gross proceeds of $60.0 million. On September 19, 2016, the Company redeemed the US$ 6.25% Convertible Debentures in their entirety, (see “Liquidity and Capital Resources - Convertible Debentures”). On November 12, 2013, the Company closed its offering of Cdn$ 6.25% convertible subordinated unsecured debentures due June 30, 2019 (the “Cdn$ 6.25% Convertible Debentures”), at a price of Cdn $1,000 per debenture, for total gross proceeds of $71.4 million (Cdn $75.0 million). On August 16, 2016, the Company closed its offering of Cdn$ 5.25% convertible subordinated unsecured debentures due September 30, 2021 (the “Cdn$ 5.25% Convertible Debentures”), at a price of Cdn $1,000 per debenture, for total gross proceeds of $65.8 million (Cdn $85.0 million). The US$ 6.25% Convertible Debentures, the Cdn$ 6.25% Convertible Debentures and the Cdn$ 5.25% Convertible Debentures are collectively referred to as the “Convertible Debentures”. The net proceeds from the issuances of the Convertible Debentures were used to repay indebtedness under the senior credit facilities, which provided additional borrowing capacity, and for general corporate purposes. During the first quarter of fiscal year 2017, approximately $0.1 million of the Company’s US$ 6.25% Convertible Debentures were converted into 6,736 shares of common stock. The remaining US$ 6.25% Convertible Debentures were repaid on September 19, 2016, (see “Liquidity and Capital Resource - Convertible Debentures”). Each outstanding Convertible Debenture is convertible into common shares of the Company at the option of the holder at any time prior to the close of business on the earlier of the business day immediately preceding the maturity date or, if called for redemption, on the business day immediately preceding the date fixed for redemption, at a conversion price of US $9.50 per common share (the “US$ 6.25% Convertible Debenture Conversion Price”) which was equivalent to 105.2632 common shares for each US $1,000 principal amount of US$ 6.25% Convertible Debentures, at a conversion price of Cdn $9.05 per common share (the “Cdn$ 6.25% Convertible Debenture Conversion Price”) which is equivalent to 110.4972 common shares for each Cdn $1,000 principal amount of Cdn$ 6.25% Convertible Debentures and at a conversion price of Cdn $9.35 per common share (the “Cdn$ 5.25% Convertible Debenture Conversion Price”) which is equivalent to 106.9519 common shares for each Cdn $1,000 principal amount of Cdn$ 5.25% Convertible Debentures.

STRONG TO THE CORE 15 The US$ 6.25% Convertible Debentures were not redeemable prior to June 30, 2014. The Company had the right, at its option, to redeem the US$ 6.25% Convertible Debentures in whole or in part, from time to time, after July 1, 2014, but prior to June 30, 2016, on at least 30 days’ prior notice at a redemption price equal to par plus accrued and unpaid interest, provided that the weighted average trading price of the common shares on a recognized exchange for the 20 consecutive trading days ending five trading days prior to the date on which the redemption notice is given is at least 125% of the US$ 6.25% Convertible Debenture Conversion Price. After June 30, 2016 and prior to maturity, the Company had the right, at its option, to redeem the US$ 6.25% Convertible Debentures in whole or in part, from time to time, on at least 30 days prior notice at a redemption price equal to par plus accrued and unpaid interest. On September 19, 2016 the Company redeemed the remaining US$ 6.25% Convertible Debentures in their entirety, (see “Liquidity and Capital Resource - Convertible Debentures”). The Cdn$ 6.25% Convertible Debentures are not redeemable prior to June 30, 2017. The Company will have the right, at its option, to redeem the Cdn$ 6.25% Convertible Debentures in whole or in part, from time to time, on or after June 30, 2017 but prior to June 30, 2018, on at least 30 days prior notice at a redemption price equal to par plus accrued and unpaid interest, provided that the weighted average trading price of the common shares on a recognized exchange for the 20 consecutive trading days ending five trading days prior to the date on which the redemption notice is given is at least 125% of the Cdn$ 6.25% Convertible Debenture Conversion Price. After June 30, 2018 and prior to maturity the Company will have the right, at its option to redeem the Cdn$ 6.25% Convertible Debentures in whole or in part, from time to time, on at least 30 days prior notice at a redemption price equal to par plus accrued and unpaid interest. The Cdn$ 5.25% Convertible Debentures are not redeemable prior to September 30, 2019. The Company will have the right, at its option, to redeem the Cdn$ 5.25% Convertible Debentures in whole or in part, from time to time, on or after September 30, 2019 but prior to September 30, 2020, on at least 30 days prior notice at a redemption price equal to par plus accrued and unpaid interest, provided that the weighted average trading price of the common shares on a recognized exchange for the 20 consecutive trading days ending five trading days prior to the date on which the redemption notice is given is at least 125% of the Cdn$ 5.25% Convertible Debenture Conversion Price. After September 30, 2019 and prior to maturity the Company will have the right, at its option to redeem the Cdn$ 5.25% Convertible Debentures in whole or in part, from time to time, on at least 30 days prior notice at a redemption price equal to par plus accrued and unpaid interest. The Company may at its option, subject to applicable regulatory approval, elect to satisfy its obligation to pay the outstanding principal amount of the Convertible Debentures in whole by issuing and delivering common shares for each Cdn $1,000 principal amount of the Cdn$ 6.25% Convertible Debentures and the Cdn$ 5.25% Convertible Debentures. The amount of common shares delivered is obtained by dividing each principal amount of Convertible Debentures by 95% of the current market price of the common shares on the date set for redemption or the maturity date. The Company may elect, subject to applicable regulatory approval, to issue and deliver common stock of the Company to the indenture trustee under the Convertible Debenture indentures, to sell in the open market, to satisfy the Company’s obligation to pay interest on the Convertible Debentures on each interest payment date. The Convertible Debenture holders will receive a cash payment in satisfaction of the interest obligation equal to the interest payable from the sale of such common shares. The Company must commence, within 30 days of a Change of Control (as defined in the Convertible Debentures indentures), an offer to purchase all of the Convertible Debentures then outstanding at a purchase price equal to 101% of the principal amount of the Convertible Debentures, plus accrued and unpaid interest thereon. STI Common Shares The Company renewed its normal course issuer bid (“NCIB”) on May 19, 2017. Pursuant to the notice, the Company is permitted to acquire up to a maximum amount of Common Shares equal to 9,225,542 Common Shares in the twelve month period commencing May 24, 2017 and ending on May 23, 2018, subject to the Company’s senior debt agreement requirements. The Company did not repurchase any shares during the fiscal year ended June 30, 2017. During the 2016 fiscal year, the Company purchased and cancelled 575,226 common shares having a value of $2.3 million, pursuant to the NCIB that was in effect at the time.

16 STRONG TO THE CORE On April 11, 2016, pursuant to a block trade, the Company acquired and cancelled the remaining 5.0 million shares held by SNCF - Participations (“SNCF - P”), formerly the Company’s largest shareholder, for approximately $23.5 million. SNCF - P had originally invested in the Company in 2008, and had sold 4.0 million shares in August 2015. In April 2016, SNCF - P also sold an additional 6.4 million shares through a combination of a private transaction and a separate sale to a bank syndicate. The disposal of shares by SNCF - P was part of their previously announced strategy to divest a group of transportation and logistics companies considered as “non - core assets” in their investment portfolio. In September 2016, the Company issued 6,736 shares of stock having an approximate value of $0.1 million in connection with conversions of the Company’s US$ 6.25% Convertible Debentures, which were recorded as a non - cash financing activity. The remaining outstanding US$ 6.25% Convertible Debentures were redeemed on September 19, 2016 (see “Liquidity and Capital Resources - Convertible Debentures”). During the 2016 fiscal year, the Company issued a total of 309 , 161 shares having an approximate value of $ 1 . 0 million in connection with the acquisition of the two transportation consulting and management services firms (see “Liquidity and Capital Resources”) . On February 23 , 2017 , the Company issued 2 , 282 , 104 shares of stock having an approximate value of $ 12 . 8 million (net of fees of $ 0 . 1 million) in connection with the redemption of the Class B Series Three common shares, which have been recorded as a non - cash financing activity (see “Equity Incentive Plan - Class B Shares”) . Dividend Reinvestment Plan The Company established a dividend reinvestment plan (the “Plan”) in May 2009 to enable eligible shareholders of the Company to reinvest dividends on their common shares to acquire additional common shares of the Company. The common shares issued under the Plan are issued directly from the treasury of STI at a price based on the volume weighted average of the Canadian dollar closing price of the common shares for the 5 trading days immediately preceding the relevant dividend date, less a 3% discount and converted into U.S. dollars at the daily Bank of Canada noon exchange rate posted on the last trading day of such 5 trading day period. Pursuant to the Plan, the Company issued 439,388 common shares during the twelve months ended June 30, 2017 which represent non - cash dividends having a value of $2.4 million. The Plan can be amended, suspended or terminated at any time, but such action would have no retroactive effect that would prejudice the interests of any participants. Equity Incentive Plan – Class B Shares The shareholders of the Company approved the adoption of the STA Holdings Equity Incentive Plan (“EIP”) by STA Holdings in December 2005. The shareholders also approved the initial allotment of Class B common shares available for issuance under the EIP in December 2005, with subsequent approvals of additional allotments in November 2008 and November 2012. Following the Share Exchange described below, the EIP was terminated. On November 8, 2016, the Company’s shareholders approved two special business items at the Company’s 2016 Annual and Special Meeting of shareholders. The first item related to the approval of a new performance share grant plan of the Company (the “New PSG Plan”). The New PSG Plan will replace the EIP originally set up at the STA Holdings level. Under the New PSG Plan, participants will be eligible to receive performance share grant units from the Company (“PSG Units”) that are redeemable for common shares of the Company. The vesting of PSG Units will be based entirely upon the achievement of multiple pre - defined performance measures and, except in certain prescribed circumstances the PSG Units will vest over a three - year period. The first grant of PSG Units is expected to occur in the 2018 fiscal year. The second item related to the approval for the issuance of up to 2.7 million common shares by the Company to the holders of Class B Series Three common shares of STA Holdings in exchange for all issued and outstanding Class B Series Three common shares (the “Share Exchange”). The Share Exchange was expected to happen on or before February 28, 2017. On February 23, 2017, the Company issued 2,282,104 STI common shares in exchange for all of the outstanding Class B Series Three common shares. Following the Share Exchange, all of the outstanding Class B Series Three common shares were cancelled, and the Company owns 100% of the equity securities of STA Holdings.

STRONG TO THE CORE 17 The holders of the Class B Series Three common shares were entitled to receive dividends, as and when declared by the board of directors of STA Holdings, approximately equivalent to the dividends received by the holders of STI common shares. Pursuant to the liquidity provisions of the EIP, the holders of Class B Series Three common shares had an option to “put” up to one third of the shares awarded each year back to the Company, starting one year immediately following the grant. The Class B common shares granted were fully vested at the grant date. These shares were classified as a liability and re - measured at fair value at the end of each reporting period. Changes in fair value and dividends on the Class B common shares were recorded as a component of other expense (income), net in the consolidated statement of operations. Before the shares were exchanged on February 23, 2017, the Company recorded an expense of $1.1 million and $1.4 million for the twelve months ended June 30, 2017 and 2016, respectively, associated with the change in fair value on the Class B common shares. The Company recorded $0.6 million and $0.9 million in dividend payments on the Class B common shares for the twelve months ended June 30, 2017 and 2016, which were recorded as a component of other income, net in the consolidated statement of operations. The Company entered into an equity hedge in April 2016 with a major Canadian bank to partially mitigate changes in the liability associated with the Class B shares outstanding pursuant to the Company’s EIP plan. The Company is in the process of unwinding the equity hedge as the Class B shares are no longer outstanding. Approximately 8% of the shares initiated in connection with the hedge remain outstanding as at June 30, 2017. The equity hedge was not designated as a hedge for accounting purposes, therefore the changes in fair value of the equity hedge are recorded in the consolidated statement of operations., The Company recorded a gain of $2.0 million for the twelve months ended June 30, 2017 which consisted of both realized gains on the partial liquidation of the hedge as well as changes in the fair market value of the remaining hedge, which is included in the consolidated statement of operations as a component of other income. The value of the equity hedge at June 30, 2017 represents an asset of $0.5 million all of which is recorded in other current assets. During the twelve months ended June 30, 2017, STA Holdings granted 1,018,114 Class B Series Three common shares pursuant to the EIP. The Company recognized $5.8 million in non - cash stock - based compensation expense related to these grants during the twelve months ended June 30, 2017. In connection with these grants, 362,468 shares were withheld at the election of the participants to satisfy income tax withholdings. Pursuant to the liquidity provision of the EIP plan, 430,313 Class B Series Three common shares were “put” back to the Company, having a fair value of $2.4 million during the twelve months ended June 30, 2017. On February 23, 2017 the Company exchanged all of the remaining Class B Series Three common shares, having an approximate value of $12.8 million (of which $9.3 million was recorded in other current liabilities immediately prior to the exchange) into STI common shares. This exchange was recorded as a non - cash financing activity. During the twelve months ended June 30, 2016, STA Holdings granted 1,023,008 Class B Series Three common shares pursuant to the EIP. The Company recognized $4.0 million in non - cash stock - based compensation expense related to these grants during the twelve months ended June 30, 2016. In connection with these grants, 417,536 shares were withheld at the election of the participants to satisfy income tax withholdings. Pursuant to the liquidity provision of the EIP plan, 139,912 Class B Series Three common shares were “put” back to the Company, having a fair value of $0.7 million during the twelve months ended June 30, 2016. The total number of Class B Series Three common shares outstanding as at June 30, 2016 was 2,056,771. The fair value of the Class B Series Three common shares outstanding at June 30, 2016 represented a liability of $10.5 million, of which $7.7 million was recorded in other current liabilities and represents the current value of those shares eligible to be put in the next twelve months pursuant to the EIP plan. The remaining balance was recorded in Class B Series Three common share liability.

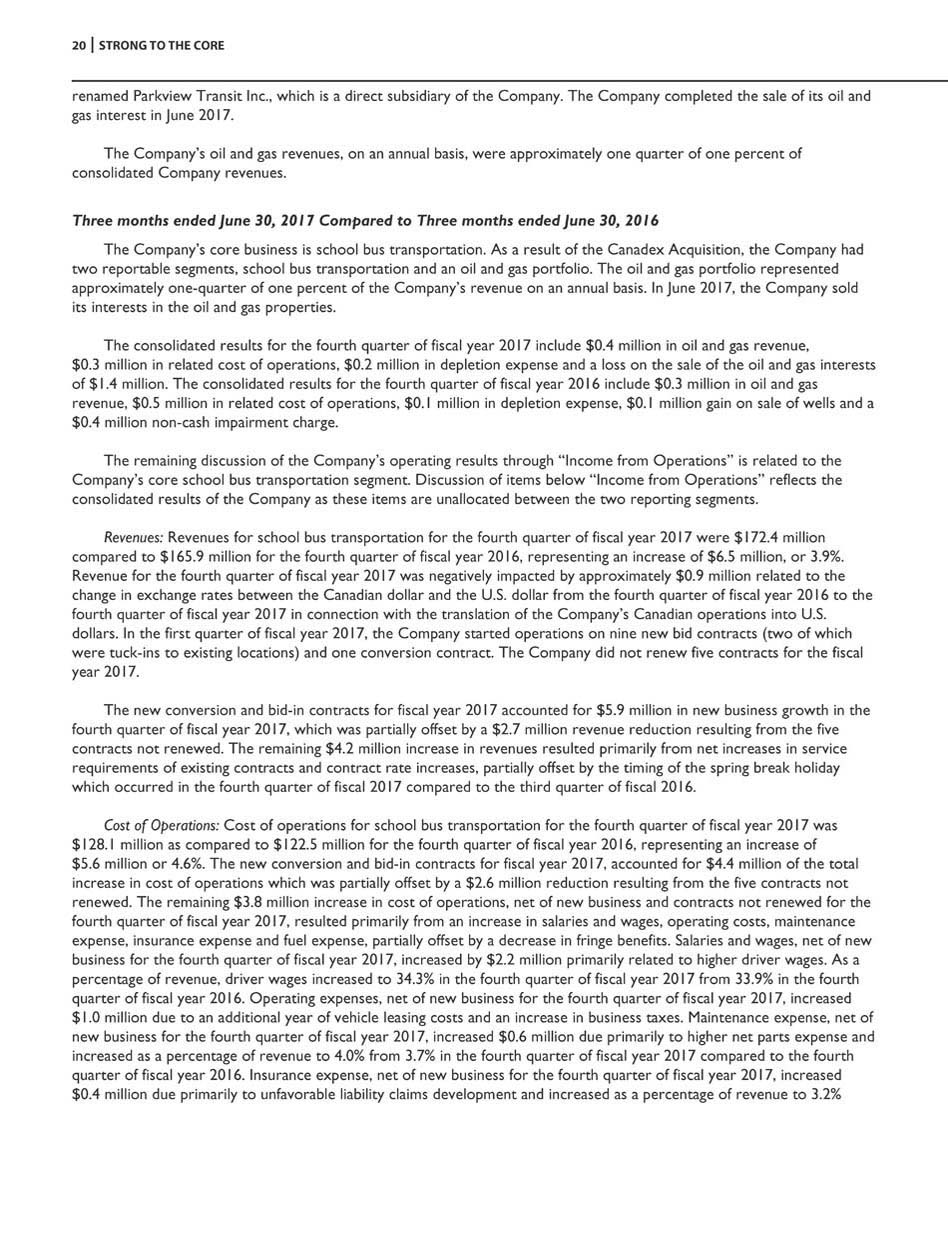

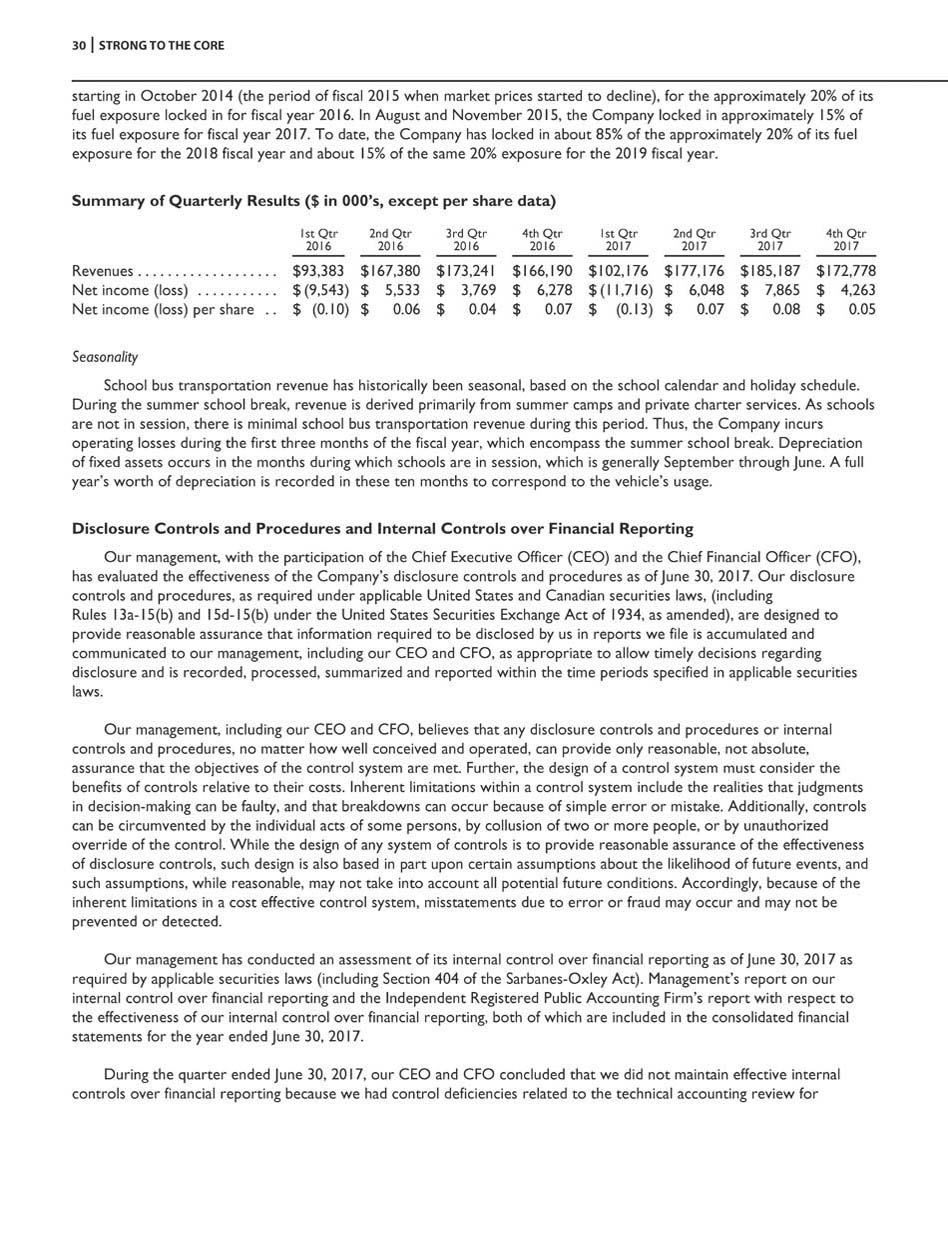

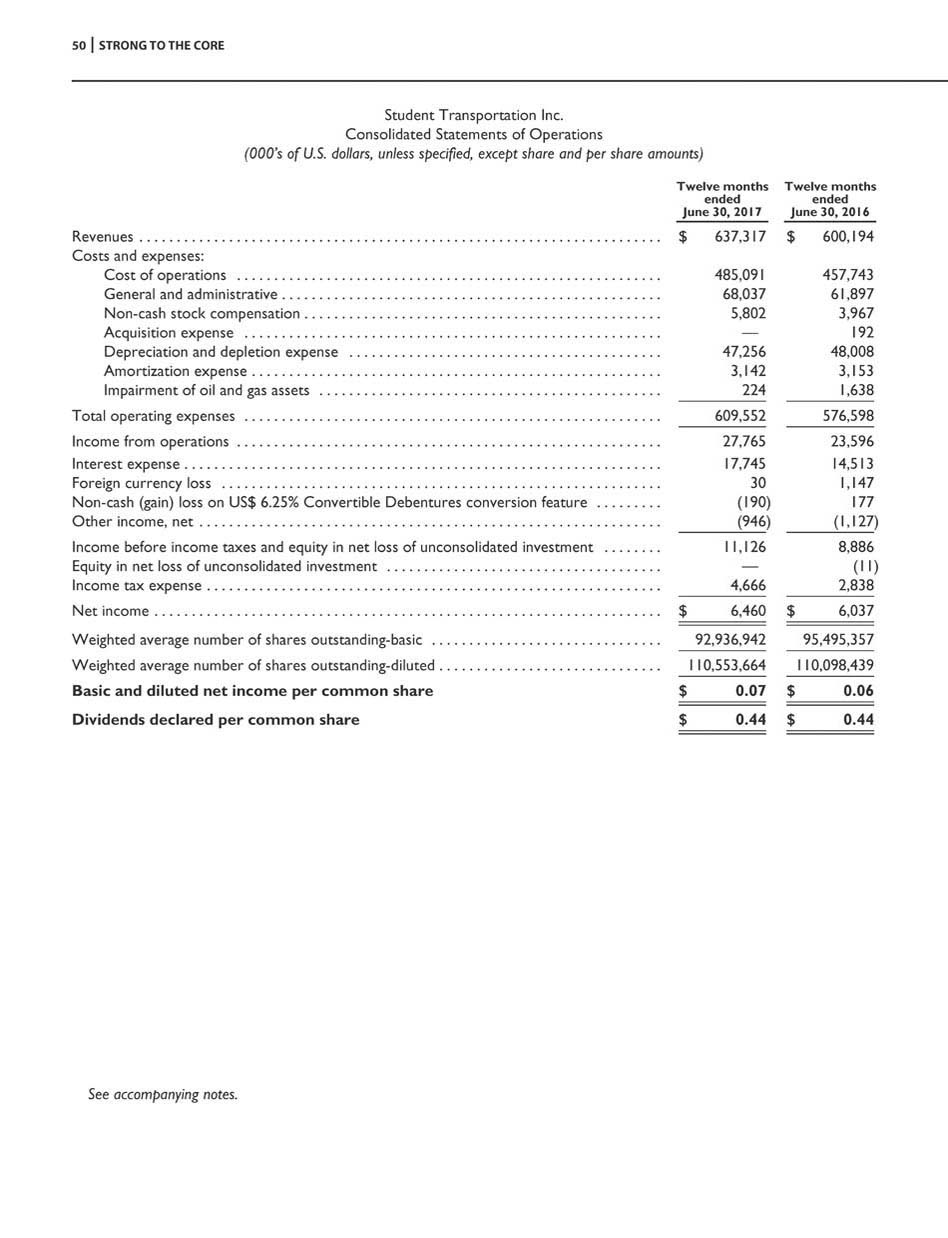

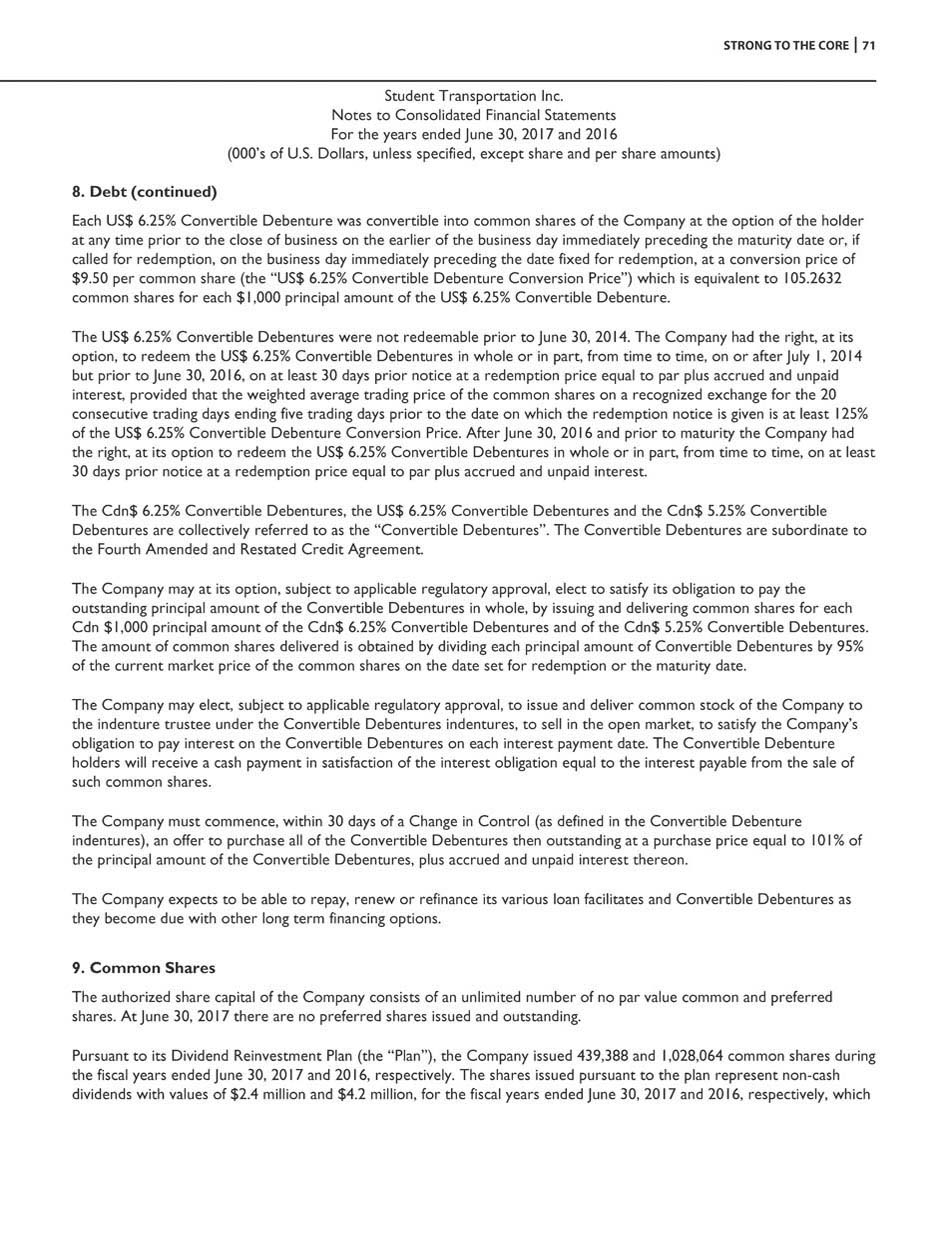

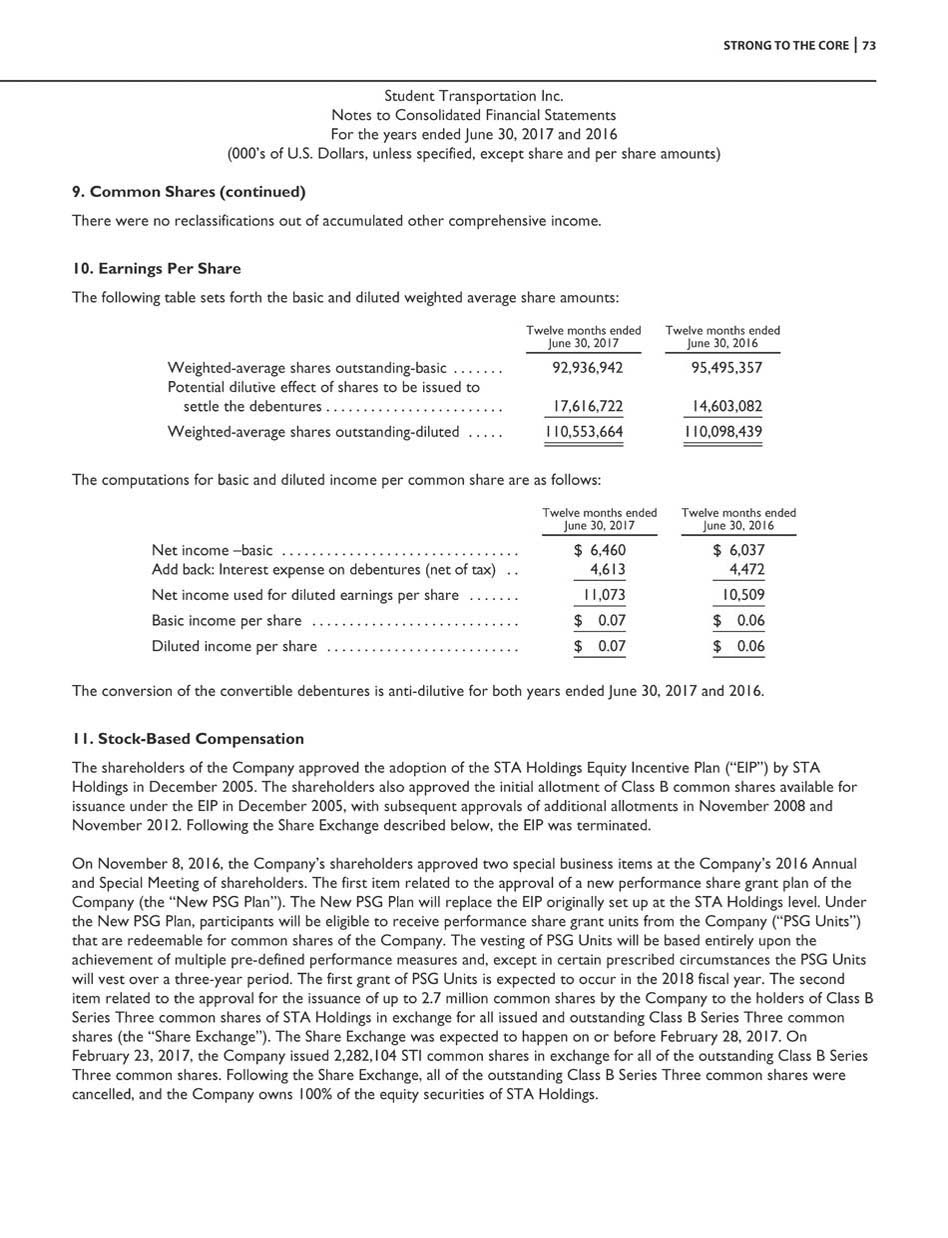

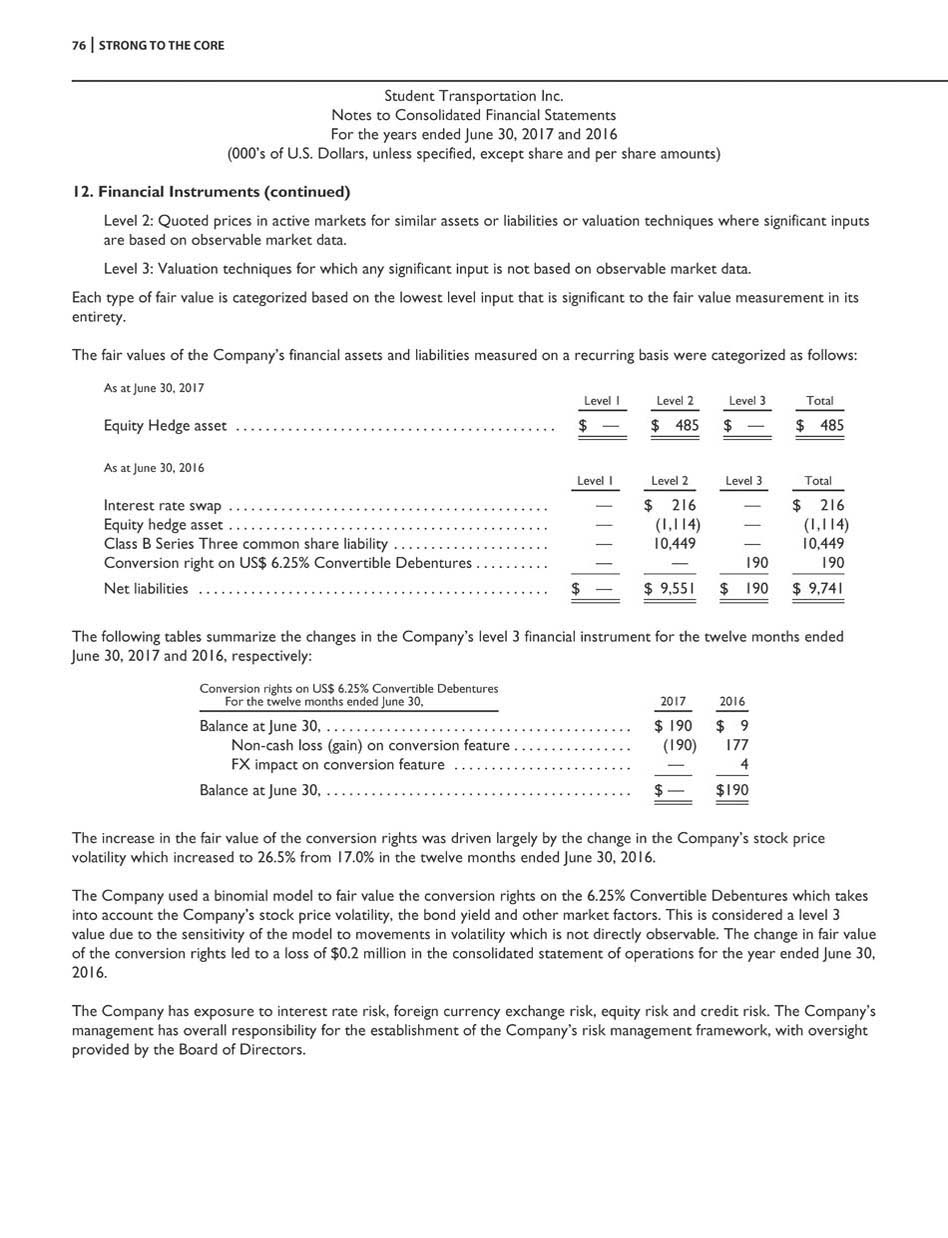

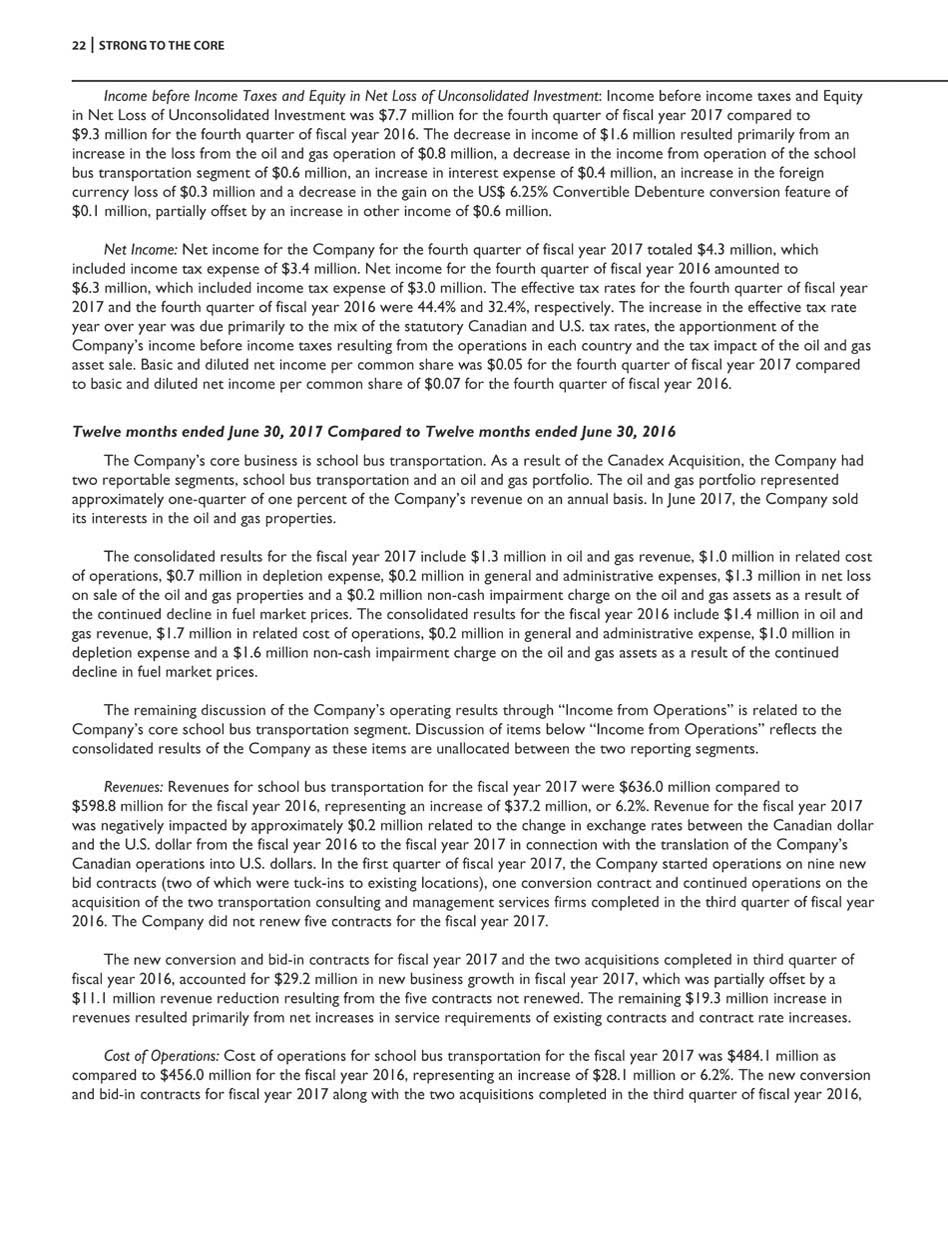

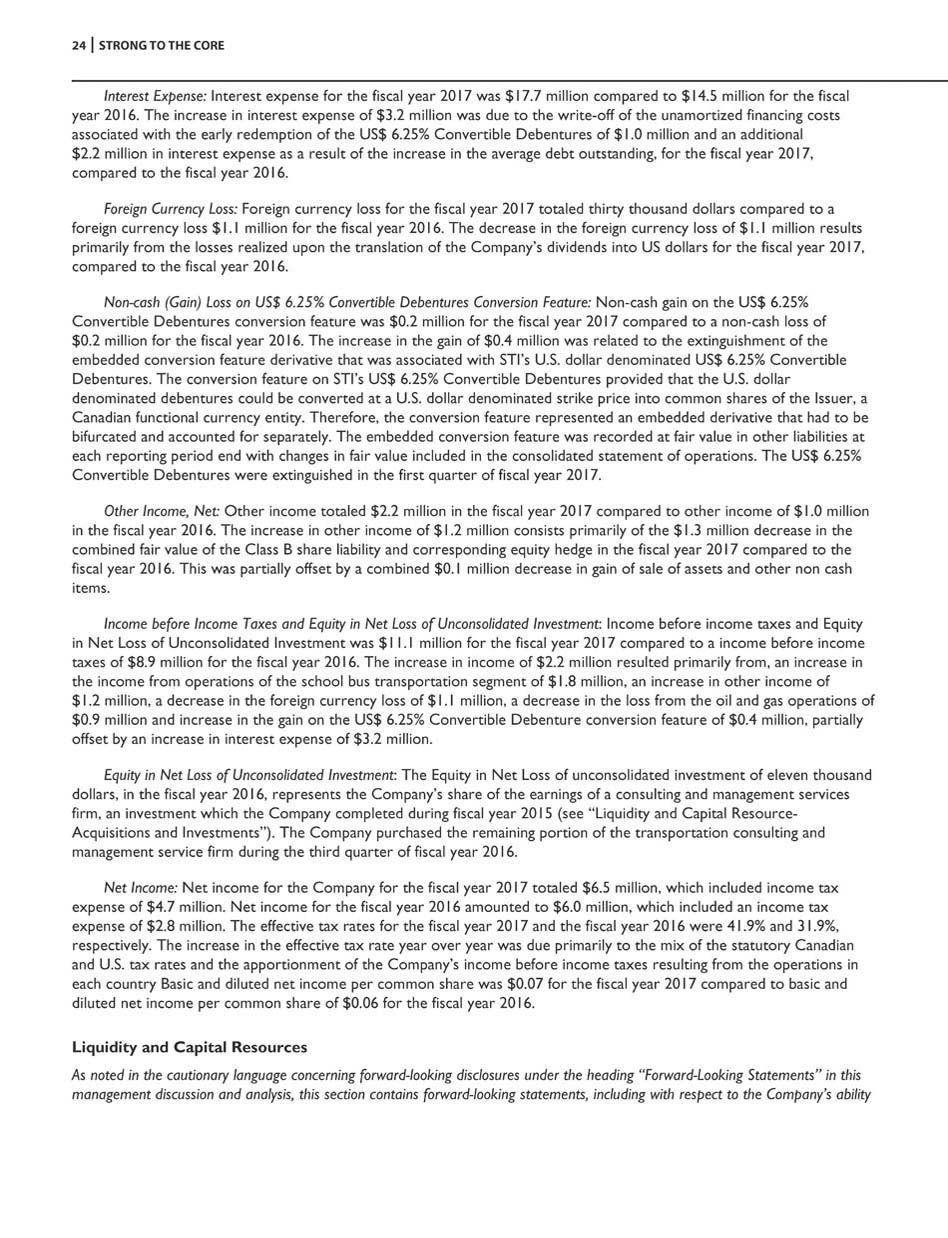

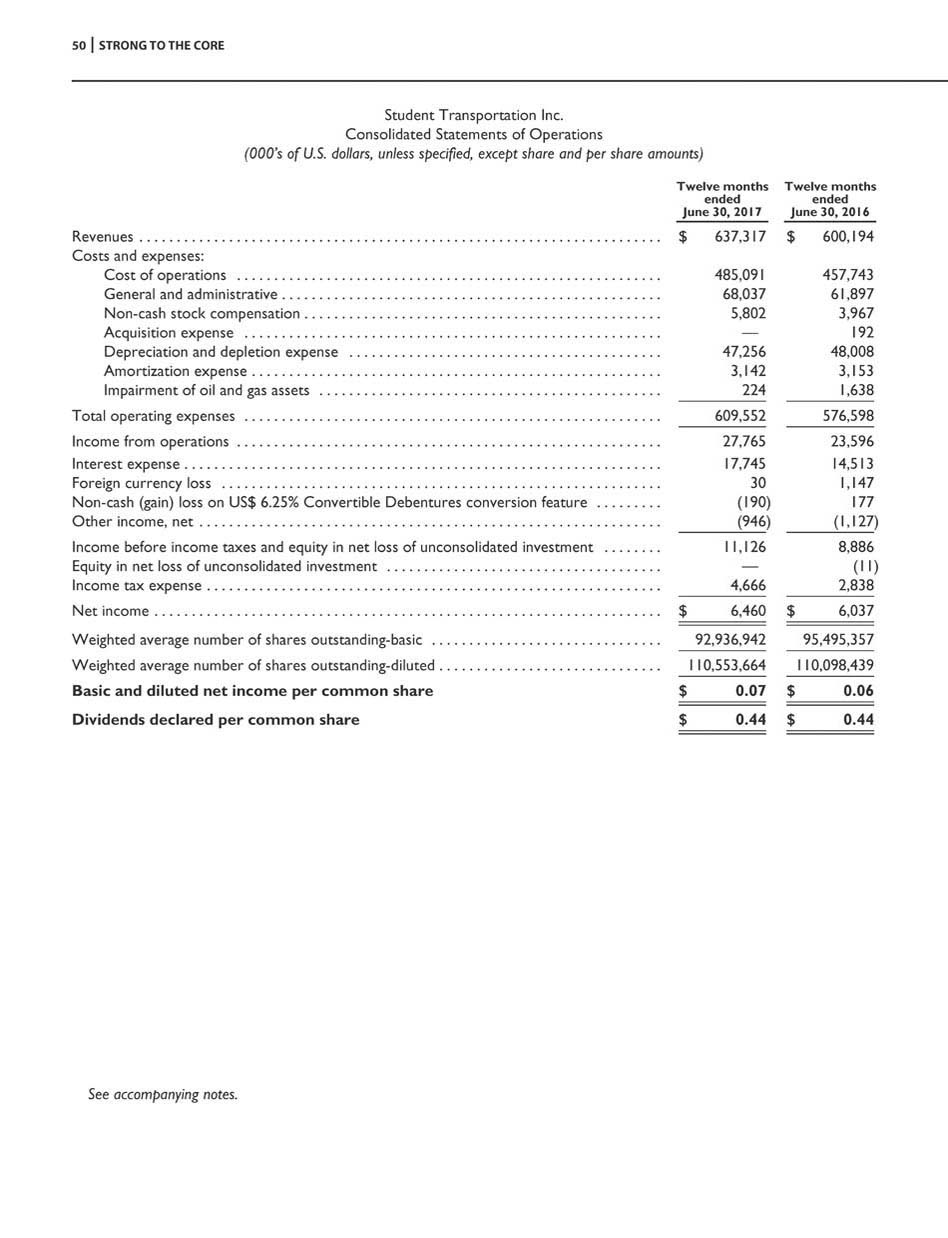

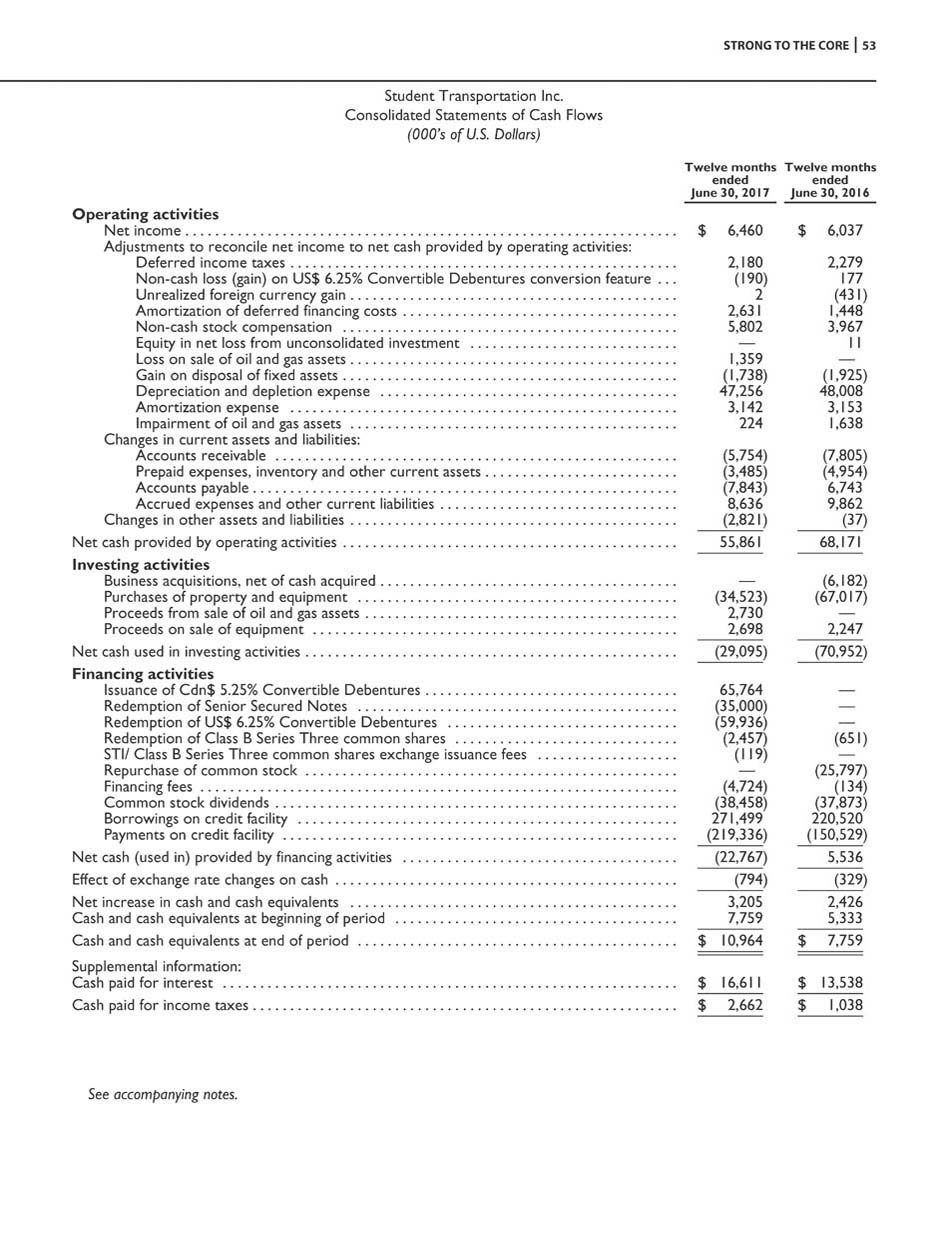

18 STRONG TO THE CORE Results of Operations ($ in 000’s, except per share data) As noted in the cautionary language concerning forward - looking disclosures under the heading “Forward - Looking Statements” in this management discussion and analysis, this section contains forward - looking statements, including with respect to the Company’s seasonality, fuel prices, currency and leasing alternatives. Such statements involve known and unknown risks, uncertainties and other factors outside of management’s control, including the risk factors set forth in this management discussion and analysis that could cause results to differ materially from those described or anticipated in the forward - looking statements. Three Months Ended June 30 Twelve Months Ended June 30 2017 2016 2017 2016 Revenues ............................................. $172,778 $166,190 $637,317 $600,194 Costs and expenses Cost of operations ................................. 128,443 122,971 485,091 457,743 General and administrative .......................... 17,508 15,772 68,037 61,897 Non - cash stock compensation ....................... – – 5,802 3,967 Acquisition expense ................................ – – – 192 Depreciation and depletion expense .................. 14,092 14,281 47,256 48,008 Amortization expense .............................. 782 793 3,142 3,153 Impairment of oil and gas assets ...................... – 438 224 1,638 Total operating expenses ................................ 160,825 154,255 609,552 576,598 Income from operations ................................ 11,953 11,935 27,765 23,596 Interest expense ....................................... 4,145 3,692 17,745 14,513 Foreign currency loss (gain) .............................. 121 (140) 30 1,147 Non - cash (gain) loss on US$ 6.25% Convertible Debentures conversion feature ................................... – (109) (190) 177 Other expense (income) net ............................. 18 (797) (946) (1,127) Income before income taxes and equity in net loss of unconsolidated investment ............................ 7,669 9,289 11,126 8,886 Equity in net loss of unconsolidated investment ............. – – – (11) Income tax expense .................................... 3,406 3,011 4,666 2,838 Net income ........................................... $ 4,263 $ 6,278 $ 6,460 $ 6,037 Basic and diluted net income per common share ............ $ 0.05 $ 0.07 $ 0.07 $ 0.06 Seasonality The Company’s operations are seasonal and follow the school calendars of the public and private schools it serves. During the summer school break, revenue is derived primarily from summer camps and private charter services. Since schools are not in session, there is minimal school bus transportation revenue. Thus, the Company incurs operating losses during the first three months of the fiscal year, which encompass the summer school break. Depreciation of fixed assets occurs in the months during which schools are in session, which is generally September through June. A full year’s worth of depreciation is recorded in these ten months to correspond with the vehicles’ usage. In addition, the Company purchases a majority of its replacement capital expenditures, along with investment capital spending for new bids and contracts awarded for the upcoming school year in the same time period. These purchases have historically been funded by borrowings on the Company’s senior credit facility and through operating lease financings. Market Fuel Price Exposure The Company is exposed to changes in the market price of fuel on our school transportation contracts in the ordinary course of business. The Company continues to have fuel mitigation features in approximately 60% of its school transportation revenue contracts that provide some measure of protection against market fuel price increases, ranging from the outright purchase of fuel by school districts to fuel reimbursements associated with fuel price caps / collars and

STRONG TO THE CORE 19 fuel escalators. So while the Company is still exposed to some price risk under some of these fuel mitigation features when market fuel prices increase, it also benefits to some extent with a decline in market fuel prices as well. In addition to the contract mitigation features related to fuel in the revenue contracts, over the last several years the Company has also endeavored to lock in an approximate 20% of its fuel exposure by entering into fixed price contracts with its fuel vendors on an annual basis, with the final approximate 20% of fuel exposure at risk and fully subject to market price fluctuations. The Company locked in the 20% of fuel exposure for fiscal 2016 in the October through December 2014 timeframe, when the price of fuel was approximately $60 per barrel. In the August and November 2015 timeframe the Company locked in approximately 15% of fuel exposure for the 2017 fiscal year when the price of fuel was approximately $45 per barrel. To date, the Company has locked in about 85% of the approximate 20% of its fuel exposure for the 2018 fiscal year and about 15% of the same 20% exposure for the 2019 fiscal year. Foreign Currency Translation Impacts on Financial Reporting The Company’s financial statements are reported in U.S. dollars, as the principal operations and cash flows of its subsidiaries are conducted in U.S. dollars. The results of the Company’s Canadian operations (revenues and expenses) are translated into U.S. dollars using the average exchange rate during the period. The average Canadian dollar / U.S. dollar exchange rates for the twelvemonths ended June 30, 2017 and 2016 were 1.3267 and 1.3258, respectively. Managed and Leased Fleet Business The Company’s school transportation services have historically included managed services contracts. These transportation services are structured as management services contracts under which the Company manages the transportation for the school district and the school district continues to own the school bus fleet. In addition, since the fiscal year 2007 the Company has financed a portion of its growth and replacement school vehicles through operating leases. Such managed services contracts and leased vehicles require lower up front capital investment (as the school district maintains ownership of the managed fleet and the lessor maintains ownership of the leased fleet) and thus results in lower annual depreciation expense on an ongoing basis. Currently, leased and managed buses account for approximately 33% and 5%, respectively, of the Company’s fleet. The Company intends to review leasing alternatives on an annual basis based on the economics of the lease financing. During the fiscal year ended June 30, 2016, the Company entered into additional operating leases with ten major financial institutions to lease approximately $58.3 million in replacement school vehicles and $22.0 million in growth school vehicles for the 2015 - 2016 school year. The term of these leases is six years at effective fixed rates in the range of 2.6% to 4.2%. Annual lease payments on these additional leases will approximate $11.3 million per year for the term of the leases. During the fiscal year ended June 30, 2017, the Company entered into additional operating leases with nine major financial institutions to lease approximately $39.8 million in replacement school vehicles and $10.5 million in growth school vehicles for the 2016 - 2017 school year. The term of these leases is six years at effective fixed rates in the range of 1.9% to 4.4%. Annual lease payments on these additional leases will approximate $6.9 million per year for the term of the leases. Oil and Gas Interests In January 2008, the Company closed the acquisition (the “Canadex Acquisition”) of all of the outstanding stock of Canadex Resources Limited (“Canadex”). Canadex was a transportation and energy company consisting of two separate business segments. The transportation segment represented school bus operations in Ontario, while the energy division held non - operating positions in oil and gas investments in the United States. The interests in oil and gas properties were held through Canadex’s wholly owned subsidiary, Canadex Resources Inc. (“CRI”). CRI invested as a non - operator in properties for the exploration and upstream production of crude oil, natural gas and condensates. It held junior participations in approximately 500 wells primarily in Texas and Oklahoma, with a few located in Louisiana and Kansas in the United States. CRI’s co - invested with a range of operators to provide flexibility to exploit a variety of exploration and development opportunities. The financial statements reflected the Company’s proportionate interest in the oil and gas activities as a non - operator. Canadex, through a series of amalgamations subsequent to the Canadex Acquisition, was

20 STRONG TO THE CORE renamed Parkview Transit Inc., which is a direct subsidiary of the Company. The Company completed the sale of its oil and gas interest in June 2017. The Company’s oil and gas revenues, on an annual basis, were approximately one quarter of one percent of consolidated Company revenues. Three months ended June 30, 2017 Compared to Three months ended June 30, 2016 The Company’s core business is school bus transportation. As a result of the Canadex Acquisition, the Company had two reportable segments, school bus transportation and an oil and gas portfolio. The oil and gas portfolio represented approximately one - quarter of one percent of the Company’s revenue on an annual basis. In June 2017, the Company sold its interests in the oil and gas properties. The consolidated results for the fourth quarter of fiscal year 2017 include $0.4 million in oil and gas revenue, $0.3 million in related cost of operations, $0.2 million in depletion expense and a loss on the sale of the oil and gas interests of $1.4 million. The consolidated results for the fourth quarter of fiscal year 2016 include $0.3 million in oil and gas revenue, $0.5 million in related cost of operations, $0.1 million in depletion expense, $0.1 million gain on sale of wells and a $0.4 million non - cash impairment charge. The remaining discussion of the Company’s operating results through “Income from Operations” is related to the Company’s core school bus transportation segment . Discussion of items below “Income from Operations” reflects the consolidated results of the Company as these items are unallocated between the two reporting segments . Revenues: Revenues for school bus transportation for the fourth quarter of fiscal year 2017 were $172.4 million compared to $165.9 million for the fourth quarter of fiscal year 2016, representing an increase of $6.5 million, or 3.9%. Revenue for the fourth quarter of fiscal year 2017 was negatively impacted by approximately $0.9 million related to the change in exchange rates between the Canadian dollar and the U.S. dollar from the fourth quarter of fiscal year 2016 to the fourth quarter of fiscal year 2017 in connection with the translation of the Company’s Canadian operations into U.S. dollars. In the first quarter of fiscal year 2017, the Company started operations on nine new bid contracts (two of which were tuck - ins to existing locations) and one conversion contract. The Company did not renew five contracts for the fiscal year 2017. The new conversion and bid - in contracts for fiscal year 2017 accounted for $5.9 million in new business growth in the fourth quarter of fiscal year 2017, which was partially offset by a $2.7 million revenue reduction resulting from the five contracts not renewed. The remaining $4.2 million increase in revenues resulted primarily from net increases in service requirements of existing contracts and contract rate increases, partially offset by the timing of the spring break holiday which occurred in the fourth quarter of fiscal 2017 compared to the third quarter of fiscal 2016. Cost of Operations: Cost of operations for school bus transportation for the fourth quarter of fiscal year 2017 was $128.1 million as compared to $122.5 million for the fourth quarter of fiscal year 2016, representing an increase of $5.6 million or 4.6%. The new conversion and bid - in contracts for fiscal year 2017, accounted for $4.4 million of the total increase in cost of operations which was partially offset by a $2.6 million reduction resulting from the five contracts not renewed. The remaining $3.8 million increase in cost of operations, net of new business and contracts not renewed for the fourth quarter of fiscal year 2017, resulted primarily from an increase in salaries and wages, operating costs, maintenance expense, insurance expense and fuel expense, partially offset by a decrease in fringe benefits. Salaries and wages, net of new business for the fourth quarter of fiscal year 2017, increased by $2.2 million primarily related to higher driver wages. As a percentage of revenue, driver wages increased to 34.3% in the fourth quarter of fiscal year 2017 from 33.9% in the fourth quarter of fiscal year 2016. Operating expenses, net of new business for the fourth quarter of fiscal year 2017, increased $1.0 million due to an additional year of vehicle leasing costs and an increase in business taxes. Maintenance expense, net of new business for the fourth quarter of fiscal year 2017, increased $0.6 million due primarily to higher net parts expense and increased as a percentage of revenue to 4.0% from 3.7% in the fourth quarter of fiscal year 2017 compared to the fourth quarter of fiscal year 2016. Insurance expense, net of new business for the fourth quarter of fiscal year 2017, increased $0.4 million due primarily to unfavorable liability claims development and increased as a percentage of revenue to 3.2%

STRONG TO THE CORE 21 from 3.1% in the fourth quarter of fiscal year 2017 compared to the fourth quarter of fiscal year 2016. Fuel expense, net of new business for the fourth quarter of fiscal year 2017, increased $0.1 million, primarily related to the expiration of the alternative fuel tax credit on December 31, 2016. As a percentage of revenue, fuel decreased to 5.1% in the fourth quarter of fiscal year 2017 from 5.2% in the fourth quarter of fiscal 2016. Fringe benefits net of new business for the fourth quarter of fiscal year 2017 decreased $0.5 million due primarily to favorable claims experience in workers compensation, partially offset by higher employment taxes associated with higher rates and the wage increases noted above. As a percentage of revenue, fringe benefits decreased to 8.6% in the fourth quarter of fiscal year 2017 from 9.0% in the fourth quarter of fiscal year 2016. General and Administrative Expense: General and administrative expense for school bus transportation for the fourth quarter of fiscal year 2017 was $17.5 million compared to $15.7 million for the fourth quarter of fiscal year 2016, an increase of $1.8 million or 11.5%. As a percentage of revenue, total general and administrative expense increased to 10.2% of revenue in the fourth quarter of fiscal year 2017 from 9.5% in the fourth quarter of fiscal year 2016. The increase in general and administrative expenses is due to higher professional fees related to human resource systems implementation, additional accounting and consulting fees associated with the Company’s first year 404 SOX compliance and higher administrative compensation. Depreciation Expense: Depreciation expense for school bus transportation was $13.9 million for the fourth quarter of fiscal year 2017 as compared to $14.2 million for the fourth quarter of fiscal year 2016. As a percentage of revenue, depreciation expense decreased to 8.1% for the fourth quarter of fiscal year 2017 from 8.6% for the fourth quarter of fiscal year 2016. Amortization Expense: Amortization expense for school bus transportation was $0.8 million for both the fourth quarter of fiscal year 2017 and the fourth quarter of fiscal year 2016. As a percentage of revenue, amortization expense was 0.5% for both the fourth quarter of fiscal year 2017 and the fourth quarter of fiscal year 2016. Income from Operations: Income from operations for school bus transportation was $12.1 million for the fourth quarter of fiscal year 2017 compared to $12.7 million for the fourth quarter of fiscal year 2016. The decrease in income from operations of $0.6 million resulted from the operating line items discussed above and reflects a negative impact of $0.1 million in exchange rates between the Canadian dollar and the US dollar from the fourth quarter of fiscal 2016 compares to the fourth quarter of fiscal 2017 in connection with the translation of the Company’s Canadian operations into US dollars. Interest Expense: Interest expense for the fourth quarter of fiscal year 2017 was $4.1 million compared to $3.7 million for the fourth quarter of fiscal year 2016. The increase in interest expense of $0.4 million was due to the increase in the average debt outstanding, for the fourth quarter of fiscal year 2017, compared to the fourth quarter of fiscal year 2016. Foreign Currency Loss (Gain): Foreign currency loss for the fourth quarter of fiscal year 2017 totaled $0.1 million compared to a foreign currency gain $0.2 million for the fourth quarter of fiscal year 2016. The increase in the foreign currency loss of $0.3 million results primarily from the losses realized upon the translation of the Company’s dividends into US dollars for the fourth quarter of fiscal year 2017, compared to the fourth quarter of fiscal year 2016. Non - cash Gain on US$ 6.25% Convertible Debentures Conversion Feature: Non - cash gain on the US$ 6.25% Convertible Debentures conversion feature was $0.1 million for the fourth quarter of fiscal year 2016. The gain of $0.1 million was related to the change in fair value of the embedded conversion feature derivative associated with STI’s issuance of the U.S. dollar denominated US$ 6.25% Convertible Debentures. The US$ 6.25% Convertible Debentures were extinguished in the first quarter of fiscal year 2017. Other Income, Net: Other income totaled $1.3 million in the fourth quarter of fiscal year 2017 compared to other income of $0.7 million in the fourth quarter of fiscal year 2016. The increase in other income of $0.6 million consists primarily of a $1.6 million increase in unrealized foreign gain and higher gain on asset sales partially offset by $1.0 million decrease in the combined fair value of the Class B share liability and corresponding equity hedge in fourth quarter of fiscal year 2017 compared to the fourth quarter of fiscal year 2016.

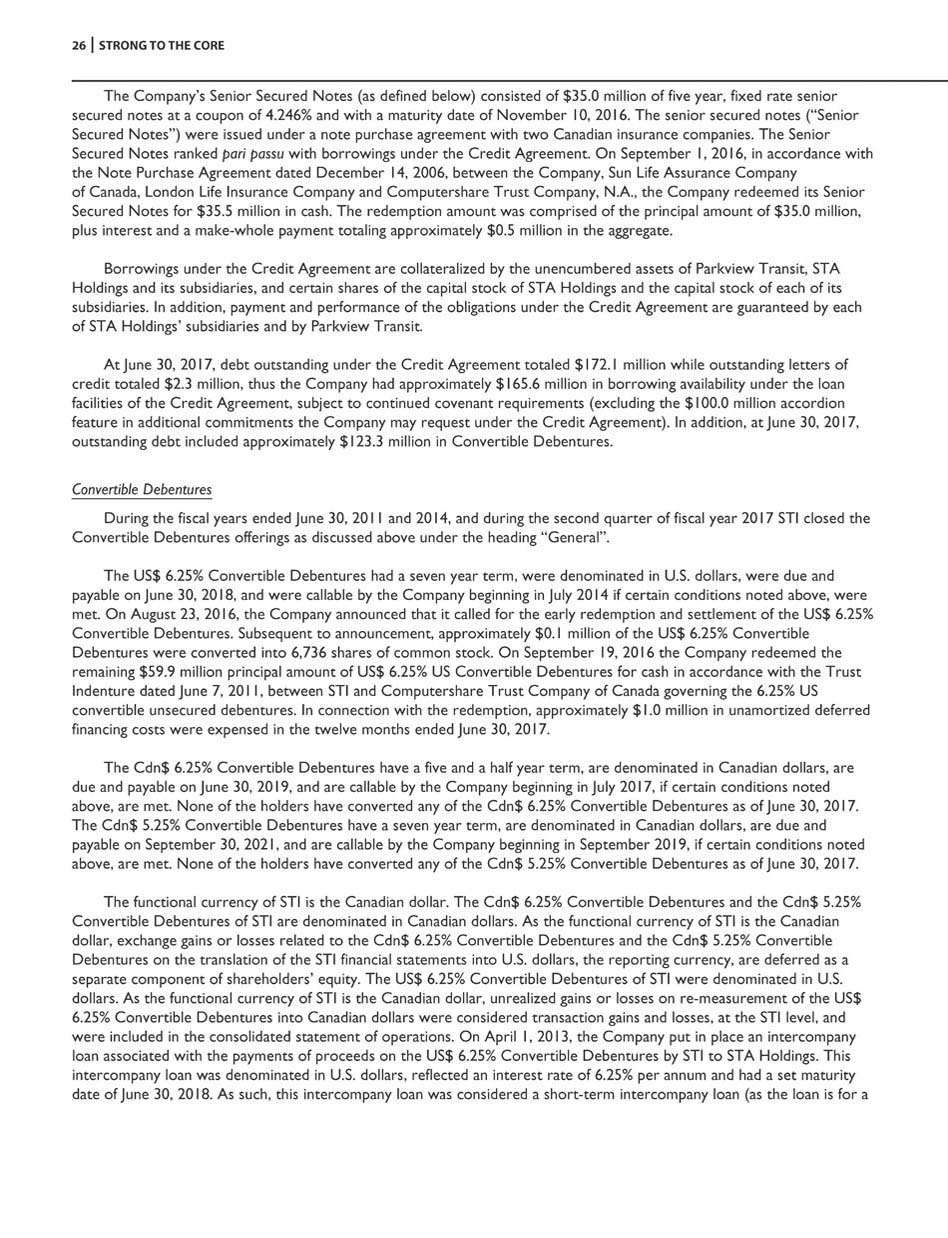

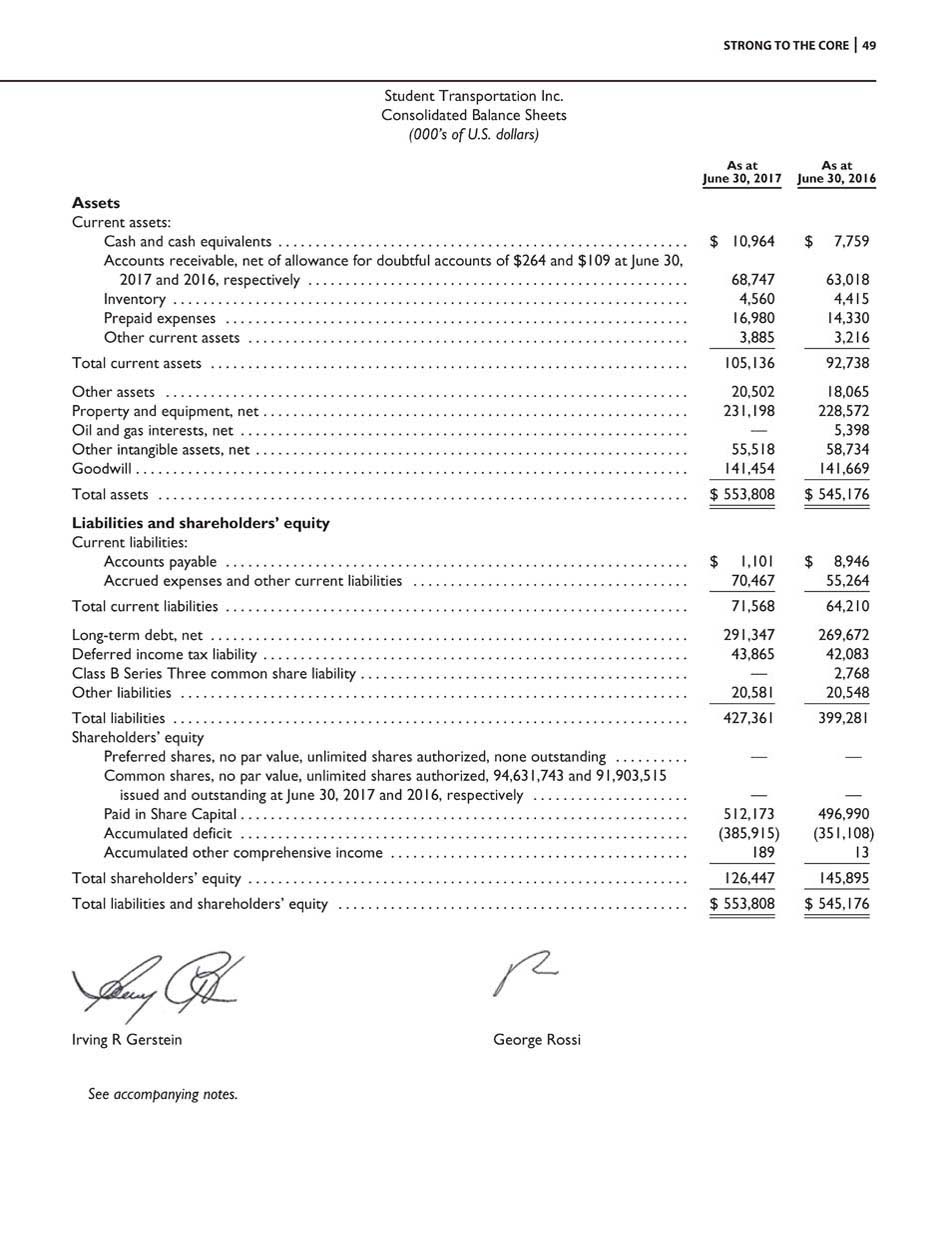

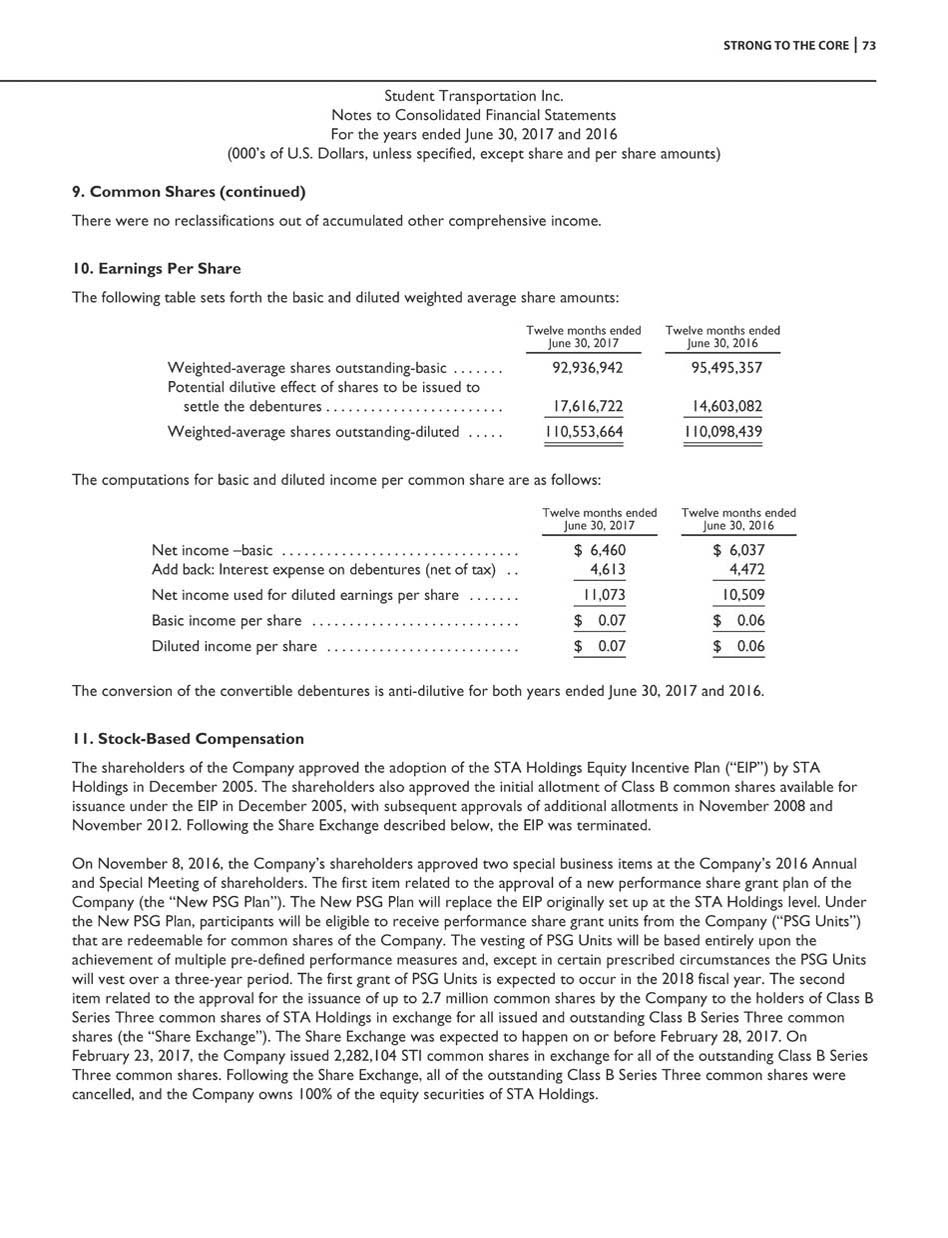

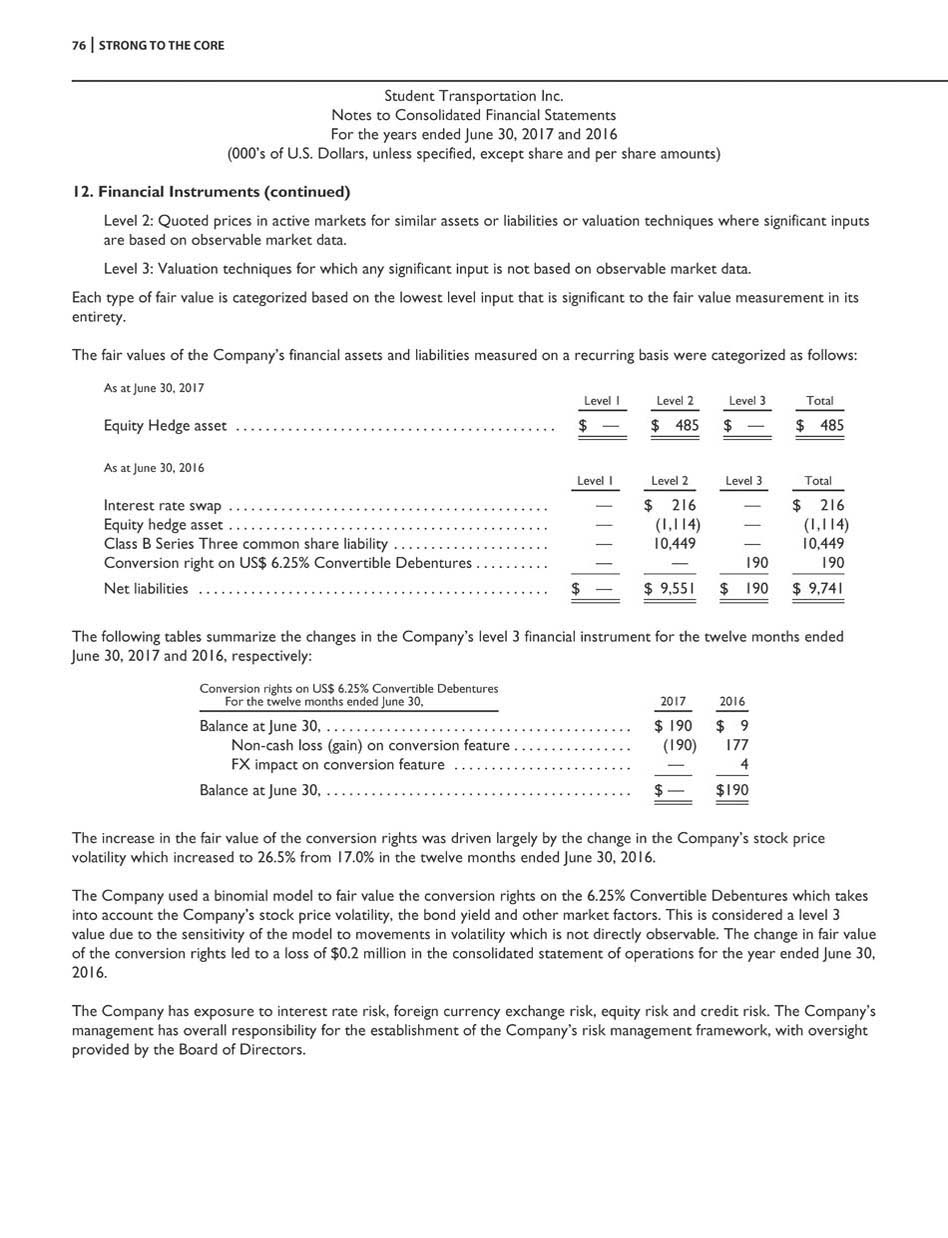

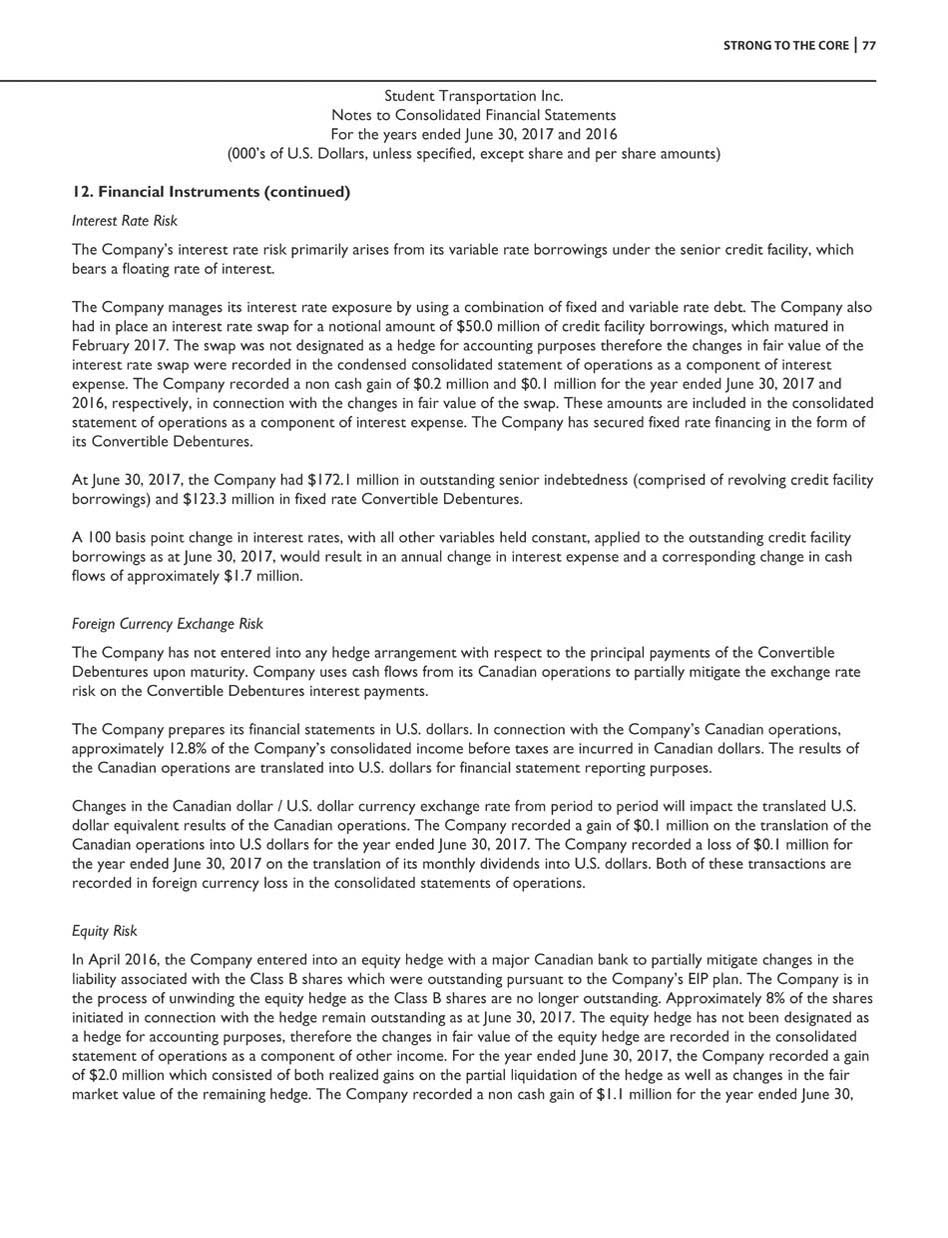

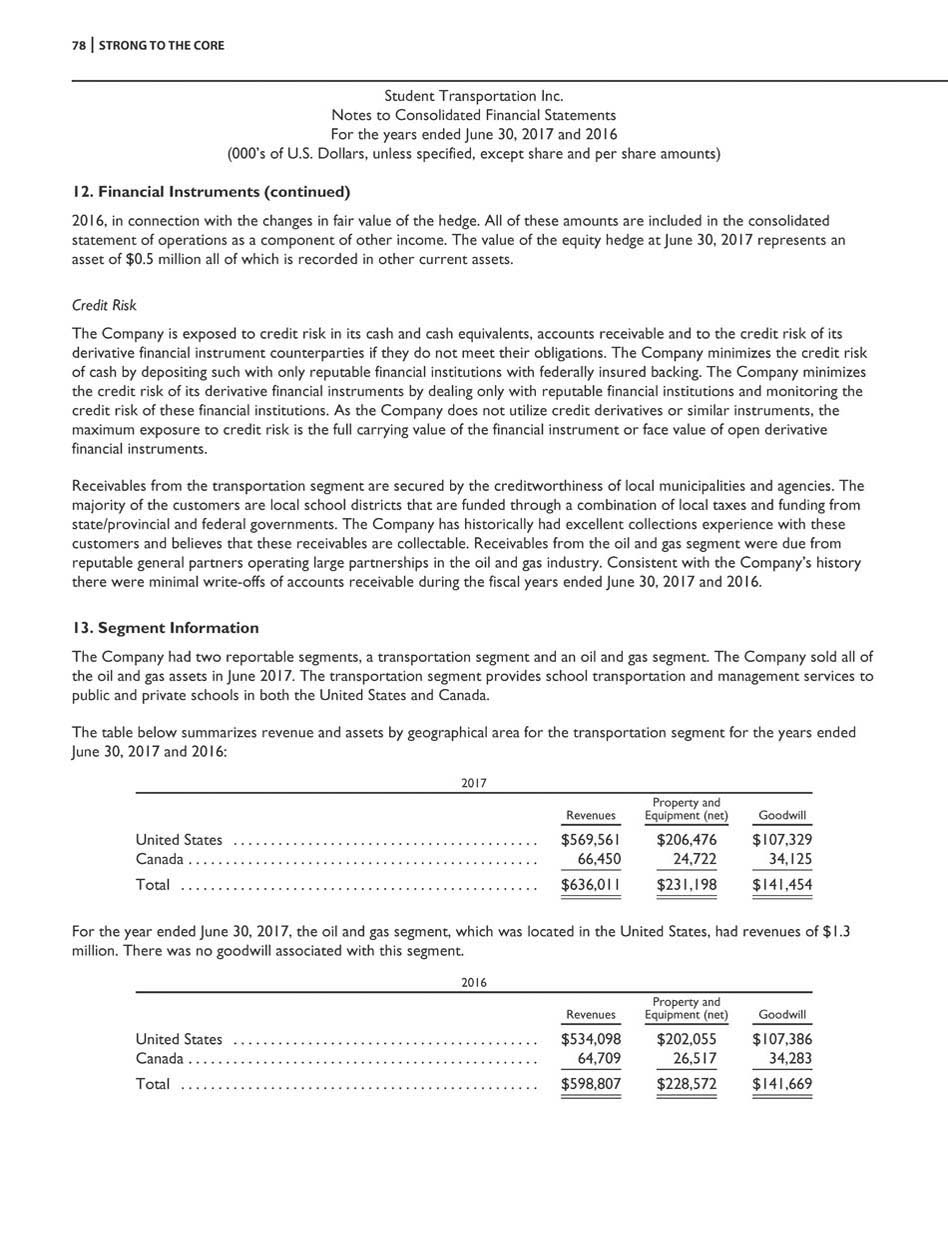

22 STRONG TO THE CORE Income before Income Taxes and Equity in Net Loss of Unconsolidated Investment : Income before income taxes and Equity in Net Loss of Unconsolidated Investment was $7.7 million for the fourth quarter of fiscal year 2017 compared to $9.3 million for the fourth quarter of fiscal year 2016. The decrease in income of $1.6 million resulted primarily from an increase in the loss from the oil and gas operation of $0.8 million, a decrease in the income from operation of the school bus transportation segment of $0.6 million, an increase in interest expense of $0.4 million, an increase in the foreign currency loss of $0.3 million and a decrease in the gain on the US$ 6.25% Convertible Debenture conversion feature of $0.1 million, partially offset by an increase in other income of $0.6 million. Net Income: Net income for the Company for the fourth quarter of fiscal year 2017 totaled $4.3 million, which included income tax expense of $3.4 million. Net income for the fourth quarter of fiscal year 2016 amounted to $6.3 million, which included income tax expense of $3.0 million. The effective tax rates for the fourth quarter of fiscal year 2017 and the fourth quarter of fiscal year 2016 were 44.4% and 32.4%, respectively. The increase in the effective tax rate year over year was due primarily to the mix of the statutory Canadian and U.S. tax rates, the apportionment of the Company’s income before income taxes resulting from the operations in each country and the tax impact of the oil and gas asset sale. Basic and diluted net income per common share was $0.05 for the fourth quarter of fiscal year 2017 compared to basic and diluted net income per common share of $0.07 for the fourth quarter of fiscal year 2016. Twelve months ended June 30, 2017 Compared to Twelve months ended June 30, 2016 The Company’s core business is school bus transportation. As a result of the Canadex Acquisition, the Company had two reportable segments, school bus transportation and an oil and gas portfolio. The oil and gas portfolio represented approximately one - quarter of one percent of the Company’s revenue on an annual basis. In June 2017, the Company sold its interests in the oil and gas properties. The consolidated results for the fiscal year 2017 include $1.3 million in oil and gas revenue, $1.0 million in related cost of operations, $0.7 million in depletion expense, $0.2 million in general and administrative expenses, $1.3 million in net loss on sale of the oil and gas properties and a $0.2 million non - cash impairment charge on the oil and gas assets as a result of the continued decline in fuel market prices. The consolidated results for the fiscal year 2016 include $1.4 million in oil and gas revenue, $1.7 million in related cost of operations, $0.2 million in general and administrative expense, $1.0 million in depletion expense and a $1.6 million non - cash impairment charge on the oil and gas assets as a result of the continued decline in fuel market prices. The remaining discussion of the Company’s operating results through “Income from Operations” is related to the Company’s core school bus transportation segment . Discussion of items below “Income from Operations” reflects the consolidated results of the Company as these items are unallocated between the two reporting segments . Revenues: Revenues for school bus transportation for the fiscal year 2017 were $636.0 million compared to $598.8 million for the fiscal year 2016, representing an increase of $37.2 million, or 6.2%. Revenue for the fiscal year 2017 was negatively impacted by approximately $0.2 million related to the change in exchange rates between the Canadian dollar and the U.S. dollar from the fiscal year 2016 to the fiscal year 2017 in connection with the translation of the Company’s Canadian operations into U.S. dollars. In the first quarter of fiscal year 2017, the Company started operations on nine new bid contracts (two of which were tuck - ins to existing locations), one conversion contract and continued operations on the acquisition of the two transportation consulting and management services firms completed in the third quarter of fiscal year 2016. The Company did not renew five contracts for the fiscal year 2017. The new conversion and bid - in contracts for fiscal year 2017 and the two acquisitions completed in third quarter of fiscal year 2016, accounted for $29.2 million in new business growth in fiscal year 2017, which was partially offset by a $11.1 million revenue reduction resulting from the five contracts not renewed. The remaining $19.3 million increase in revenues resulted primarily from net increases in service requirements of existing contracts and contract rate increases. Cost of Operations: Cost of operations for school bus transportation for the fiscal year 2017 was $484.1 million as compared to $456.0 million for the fiscal year 2016, representing an increase of $28.1 million or 6.2%. The new conversion and bid - in contracts for fiscal year 2017 along with the two acquisitions completed in the third quarter of fiscal year 2016,