UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ý |

Filed by a Party other than the Registrant o |

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to §240.14a-12 |

BRIGGS & STRATTON CORPORATION |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

ý | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | |

| | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

BRIGGS & STRATTON CORPORATION

12301 WEST WIRTH STREET

WAUWATOSA, WISCONSIN 53222

Notice of Annual Meeting of Shareholders

The Annual Meeting of Shareholders of BRIGGS & STRATTON CORPORATION, a Wisconsin corporation, will be held at the Langham Hotel, 250 Franklin Street, Boston, Massachusetts on Wednesday, October 19, 2005, at 9:00 a.m. Eastern Daylight Time, for the following purposes:

(1) To elect three directors to serve for three-year terms expiring in 2008;

(2) To ratify the selection of PricewaterhouseCoopers LLP as the company’s independent auditors; and

(3) To take action on any other matters brought before the meeting appropriate for consideration by the shareholders of a Wisconsin corporation at an annual meeting.

By order of the Board of Directors.

Wauwatosa, Wisconsin

September 21, 2005

| ROBERT F. HEATH, Secretary |

Your vote is important to ensure that a majority of the stock is represented. You may vote using the Internet, by telephone, or by returning the enclosed proxy card in the envelope provided. Instructions for voting via the Internet or by telephone are included on your proxy card.

The Langham Hotel is located in downtown Boston.

Proxy Statement

* * * * *

GENERAL INFORMATION

This proxy statement relates to the solicitation of proxies by the Board of Directors of Briggs & Stratton Corporation (“Briggs & Stratton” or the “company”) to be used at the Annual Meeting of Shareholders and any adjournments. The meeting will be held on October 19, 2005 at the Langham Hotel, 250 Franklin Street, Boston, Massachusetts. Briggs & Stratton’s principal executive offices are located at 12301 West Wirth Street, Wauwatosa, Wisconsin 53222. This proxy statement and the form of proxy will be mailed to shareholders on or about September 21, 2005.

Who Can Vote?

Shareholders of record at the close of business on August 17, 2005 are entitled to notice of and to vote at the meeting. On August 17, 2005, Briggs & Stratton had outstanding 51,845,825 shares of $.01 par value common stock entitled to one vote per share.

How Do I Vote?

You may vote in person or by properly appointed proxy. You may cast your vote by returning your signed and dated proxy card, or by voting electronically. You have the option to vote by proxy via the Internet or toll-free touch-tone telephone.

Instructions to vote electronically are listed on your proxy card or on the information forwarded by your bank or broker. These procedures are designed to authenticate your identity as a shareholder and to allow you to confirm that your instructions have been properly recorded. If you vote over the Internet, you may incur costs that you will be responsible for such as telephone and Internet access charges. The Internet and telephone voting facilities will close at 5:00 p.m. Eastern Daylight Time on October 18, 2005.

You may revoke your proxy by voting in person at the meeting, by written notice to the Secretary, or by executing and delivering a later-dated proxy via the Internet, or by telephone or by mail, prior to the closing of the polls. Attendance at the meeting does not in itself constitute revocation of a proxy. All shares entitled to vote and represented by properly completed proxies timely received and not revoked will be voted as you direct. If no direction is given, the proxies will be voted as the Board of Directors recommends.

How Are Votes Counted?

A majority of the votes entitled to be cast on each matter, represented either in person or by proxy, will constitute a quorum with respect to the matter. If a quorum exists, the affirmative vote of a majority of the votes represented at the meeting is required for the election of directors and to ratify the selection of independent auditors. A vote withheld from the election of directors or an abstention with respect to the ratification of the selection of auditors will count toward the quorum requirement and will have the effect of a vote against the director nominee or ratification of auditors. The Board of Directors has appointed Innisfree M&A Incorporated as Inspectors of Election to count the votes and ballots.

Who Pays For This Proxy Solicitation?

Briggs & Stratton pays for the cost of solicitation of proxies. Solicitation is made primarily by mail. Some solicitation may be made by regular Briggs & Stratton employees, without additional compensation, by telephone, facsimile, or other means of communication, or in person. In addition, Briggs & Stratton has retained Innisfree M&A Incorporated to assist in its proxy solicitation efforts, at a fee anticipated not to exceed $10,000 plus reasonable out-of-pocket expenses.

1

What If Other Matters Come Up At The Annual Meeting?

The matters described in this proxy statement are the only matters we know will be voted on at the annual meeting. If other matters are properly presented at the meeting, the proxy holders will vote your shares as they see fit.

ITEM 1: ELECTION OF DIRECTORS

The Board of Directors of Briggs & Stratton is divided into three classes. The term of office of each class ends in successive years. Three directors are to be elected to serve for a term of three years expiring in 2008. Six directors will continue to serve for the terms designated in the following table. All directors are elected subject to the Bylaw restriction that they may not serve beyond the annual meeting following attainment of age 72.

The proxies received in response to this solicitation will be voted for the election of the nominees named below. If any nominee is unable to serve, the proxies may be voted for a substitute nominee selected by the Board of Directors.

GENERAL INFORMATION ABOUT THE NOMINEES AND DIRECTORS

Name, Age, Principal Occupation for Past Five Years and Directorships | | Year First

Became a

Director |

| | |

Nominees for Election at the Annual Meeting (Class of 2008): | | |

| | |

[GRAPHIC APPEARS HERE] | | JAY H. BAKER, 71 (1) (2) Retired. President of Kohl’s Corporation, an operator of family oriented, specialty department stores, until 2000. Director of Kohl’s Corporation. | | 1999 |

| | | | |

[GRAPHIC APPEARS HERE] | | MICHAEL E. BATTEN, 65 (1) (3) Chairman and Chief Executive Officer of Twin Disc, Incorporated, manufacturer of power transmission equipment. Director of Twin Disc, Incorporated, Sensient Technologies Corporation and Walker Forge, Inc. | | 1984 |

| | | | |

[GRAPHIC APPEARS HERE] | | BRIAN C. WALKER, 43 (2) (4) President and Chief Executive Officer, Herman Miller, Inc., a global provider of office furniture and services. President and Chief Operating Officer from 2003-2004, and President of Herman Miller, N.A. from 1999-2003; previously Chief Financial Officer. Director of Herman Miller, Inc. | | 2002 |

Footnotes (1), (2), (3) and (4) are on page 3.

2

Name, Age, Principal Occupation for Past Five Years and Directorships | | Year First

Became a

Director |

| | |

Incumbent Directors (Class of 2007): | | |

| | |

[GRAPHIC APPEARS HERE] | | WILLIAM F. ACHTMEYER, 50 (1) (2) Chairman, Managing Partner, President and Chief Executive Officer of The Parthenon Group LLC, a leading strategic advisory and principal investment firm. | | 2003 |

| | | | |

[GRAPHIC APPEARS HERE] | | DAVID L. BURNER, 66 (2) (3) Retired Chairman of Goodrich Corporation, an aircraft systems and services company. Chairman and Chief Executive Officer from 1997-2003. Director of Progress Energy, Inc., Milacron Inc., Lance, Inc. and Engelhard Corporation. | | 2000 |

| | | | |

[GRAPHIC APPEARS HERE] | | MARY K. BUSH, 57 (4) President of Bush International, a consulting firm that provides advice to companies on financial strategies and business development and to governments on financial market matters. Director of Brady Corporation and MGIC Investment Corporation, and trustee of the Pioneer Family of Mutual Funds. | | 2004 |

Incumbent Directors (Class of 2006): | | |

| | |

[GRAPHIC APPEARS HERE] | | ROBERT J. O’TOOLE, 64 (3) (4) Chairman of the Board and Chief Executive Officer, A.O. Smith Corporation, a diversified manufacturer whose major products include electric motors and water heaters. Director of Factory Mutual Insurance Co., Marshall & Ilsley Corporation and A.O. Smith Corporation. | | 1997 |

| | | | |

[GRAPHIC APPEARS HERE] | | JOHN S. SHIELY, 53 (3) Chairman (2003), President and Chief Executive Officer of Briggs & Stratton since July 1, 2001; previously President and Chief Operating Officer. Director of Marshall & Ilsley Corporation, Quad/Graphics, Inc., Cleveland Rock & Roll, Inc. (corporate board of the Rock & Roll Hall of Fame and Museum) and the Outdoor Power Equipment Institute. (5) | | 1994 |

| | | | |

[GRAPHIC APPEARS HERE] | | CHARLES I. STORY, 51 (1) (4) President and Chief Executive Officer, INROADS, Inc., an international non-profit training and development organization which prepares talented minorities for careers in business and engineering. Director of INROADS, Inc. and ChoicePoint Inc. Advisory Director of AmSouth Bank. | | 1994 |

Committee Membership: (1) Nominating & Governance, (2) Compensation, (3) Executive, (4) Audit. (5) Mr. Shiely’s brother Vincent R. Shiely is Vice President & President – Home Power Products Group of Briggs & Stratton.

3

CORPORATE GOVERNANCE

The Board of Directors is responsible for providing oversight of the affairs of the company for the benefit of shareholders. The Board has adopted corporate governance guidelines and has approved a code of business conduct and ethics applicable to all directors, officers and employees. Charters of the Audit, Compensation, Nominating and Governance Committees; Corporate Governance Guidelines and code of business conduct and ethics contained in the Briggs & Stratton Business Integrity Manual are available in the shareholder relations section of the company’s website (www.briggsandstratton.com) and are available in print to any shareholder upon request to the Secretary.

Director Selection Procedures. The Nominating & Governance Committee selects director nominees in accordance with the following procedures:

• Review the qualifications of existing Board members

• Determine qualifications desired in new director(s)

• Solicit suggestions from the Chief Executive Officer and directors on potential candidates

• Consider candidates recommended by security holders

• Retain search consultant as needed to identify candidates

• Evaluate qualifications of all candidates recommended for consideration

• Contact preferred candidate(s) to assess their interest

• Interview preferred candidate(s) to assess their qualifications

• Recommend candidate(s) for consideration by the Board

The Committee will consider recommendations from shareholders concerning the nomination of directors. Recommendations should be submitted in writing to the Secretary of the company and state the shareholder’s name and address, the name and address of the candidate, and the qualifications of and other detailed background information regarding the candidate. Recommendations must be received not later than 120 calendar days preceding the date of release of the prior year’s proxy statement. The company has not received any shareholder recommendations of director candidates with regard to the election of directors covered by this proxy statement or otherwise. The direct nomination of a director by shareholders must be made in accordance with the advance written notice requirements of the company’s Bylaws. A copy of the Bylaws may be obtained from the company’s Secretary. For consideration at the 2006 annual meeting, direct nominations must be received by the Secretary no earlier than July 13, 2006 and no later than August 7, 2006.

Director Selection Criteria. The Nominating & Governance Committee recommends nominees for director whose background, knowledge, experience, expertise and perspective will complement the qualifications of other directors and strengthen the Board. Nominees must meet the following minimum criteria:

• A strong commitment to integrity

• Common sense and good judgment

• Relevant professional or business knowledge

• A record of accomplishment in prior positions

• The time and interest to attend and participate in Board meetings

Director Independence. A majority of directors must meet the criteria for independence established by the Board in accordance with the rules of the New York Stock Exchange (the “NYSE”). A director will not qualify as independent unless the Board determines that the director has no material relationship with the company, either directly or as a partner, shareholder or officer of an organization that has a relationship with

4

the company. On the recommendation of the Nominating & Governance Committee, the Board has adopted the following categorical standards to form the basis for the Board’s independence determinations.

• The Board makes determinations of director independence based on all relevant facts and circumstances concerning a director’s relationships with the company, including commercial, banking, consulting, charitable and family relationships. The Board shall not consider a director to be independent if the director has a relationship with the company that prevents independence under the NYSE rules.

• The following commercial and charitable relationships will be considered to be immaterial relationships that do not impair a director’s independence: (1) the director or an immediate family member is an officer, employee, partner or significant owner of a company or organization that makes payments to, or receives payments from, Briggs & Stratton for property or services in an amount which, in any single fiscal year, is less than the greater of $500,000 or 1% of such other company’s consolidated gross revenues, and (2) the director is an officer, director or trustee of a charitable organization which receives contributions from Briggs & Stratton and the Briggs & Stratton Corporation Foundation, Inc. that aggregate less than the greater of $500,000 or 1% of such organization’s consolidated gross revenues in any single fiscal year out of the preceding three fiscal years.

In August 2005, the Nominating & Governance Committee and the Board evaluated the relationships between each director and the company and determined that Messrs. Achtmeyer, Baker, Batten, Burner, O’Toole, Story and Walker and Ms. Bush meet the company’s categorial standards and are independent. The Committee and the Board also determined that Messrs. O’Toole, Story and Walker and Ms. Bush meet the requirements established by the U.S. Securities and Exchange Commission and the NYSE for independence of audit committee members.

Board Meetings. The Board has regularly-scheduled quarterly meetings, and non-management directors of the Board meet alone in executive session twice a year. Mr. Shiely as Chairman of the Board presides at the regularly-scheduled Board meetings, and Mr. Batten as Chairman of the Nominating & Governance Committee presides at the executive sessions. In fiscal year 2005, the Board held six meetings and two executive sessions.

Meeting Attendance. Directors are expected to attend the annual meeting of shareholders and all regularly-scheduled Board meetings. In fiscal year 2005, each director attended the October 2004 annual meeting of shareholders, all Board meetings during his or her service on the Board, and all regularly-scheduled meetings of the committees on which he or she served. With respect to specially-scheduled committee telephonic meetings, Ms. Bush did not attend three such meetings due to practical issues regarding notification which have now been rectified, and therefore attended 70% of the total number of Board and committee meetings during her first year as a director.

Board Committees. The Board has established four committees to assist it in fulfilling its responsibilities. Each committee member is nominated by the Nominating & Governance Committee and appointed by the Board.

Audit Committee. The Audit Committee is composed of Messrs. O’Toole (chair), Story and Walker and Ms. Bush. Each member of the Committee has been determined by the Board to be independent under the rules of the SEC and NYSE, and the Board has determined that Messrs. O’Toole and Walker and Ms. Bush satisfy the requirements for an audit committee financial expert under SEC rules.

The Audit Committee’s primary duties and responsibilities are to (1) monitor the integrity of the company’s financial statements and review with the independent accountants the audited financial statements and their report, (2) retain independent public accountants to audit the company’s books and accounts, (3) oversee the independence and performance of the company’s internal and external

5

auditors, (4) review and approve non-audit services performed by the independent public accountants, (5) review the accountants’ recommendations on accounting policies and internal controls, (6) review internal accounting and auditing procedures, and (7) monitor the company’s compliance with legal and regulatory requirements. The Committee may delegate pre-approval authority concerning audit and non-audit services to the chair of the Committee, which if exercised shall be reported to the Committee at its next scheduled meeting. The Audit Committee held eight meetings during fiscal year 2005.

Compensation Committee. The Compensation Committee is composed of Messrs. Burner (chair), Achtmeyer, Baker and Walker. Each member has been determined by the Board to be independent under the rules of the NYSE.

The Compensation Committee (1) reviews and approves corporate goals and objectives relevant to CEO compensation, evaluates the CEO’s performance and sets the CEO’s compensation, (2) reviews the compensation and benefits provided to executive officers and makes recommendations to the Board as to salary levels and benefits, (3) reviews and recommends to the Board the adoption or amendment of compensation and benefit plans and programs maintained for the executive officers and other key employees, (4) administers the company’s incentive compensation plans for senior executives, (5) reviews the company’s management succession plan, and (6) prepares an annual report on executive compensation for inclusion in the proxy statement. The Compensation Committee held four meetings during fiscal year 2005.

Nominating & Governance Committee. The Nominating & Governance Committee is composed of Messrs. Batten (chair), Achtmeyer, Baker and Story. Each member has been determined by the Board to be independent under the rules of the NYSE.

The Nominating & Governance Committee (1) proposes to the Board a slate of nominees for election by the shareholders at the annual meeting and recommends prospective director candidates in the event of the resignation, death or retirement of directors or change in Board composition requirements, (2) reviews candidates recommended by shareholders for election to the Board, (3) develops plans regarding the size and composition of both the Board and Committees, and (4) monitors and makes recommendations to the Board concerning corporate governance matters. The Committee held four meetings during fiscal year 2005.

Executive Committee. The Executive Committee is composed of Messrs. Batten, Burner, O’Toole and Shiely. The Committee is authorized to exercise the authority of the Board in the management of the business and the affairs of the company between meetings of the Board, except as provided in the Bylaws. The Executive Committee held two meetings during fiscal year 2005.

Director Compensation. Each nonemployee director receives an annual retainer fee of $40,000 payable in cash, an annual award of 400 shares of Briggs & Stratton common stock not subject to any vesting requirements and premium-priced options to buy 4,000 shares of Briggs & Stratton common stock, a fee of $1,500 for each Board or Committee meeting attended, and a fee of $250 for participating in any written consent resolution. The stock options have an exercise price equal to 110% of the fair market value of the company’s stock on the grant date, become exercisable three years after the grant date and expire five years after the grant date, except that the Board has authority to accelerate the exercise date in the event of the director’s death or retirement. In the aggregate, nonemployee directors received options to purchase 32,000 shares for fiscal year 2005. The Chairs of the Audit, Compensation and Nominating & Governance Committees receive an additional annual retainer fee of $5,000.

Under the Deferred Compensation Plan for Directors, nonemployee directors may elect to defer receipt of all or a portion of their directors’ compensation until any date but no later than the year in which the director attains the age of 73 years. Participants may elect to have cash deferred amounts (1) credited with interest quarterly at 80% of the prevailing prime rate, or (2) converted into common share units based on the deferral date closing price of Briggs & Stratton’s common stock. Shares of Briggs & Stratton common stock that are deferred will be credited to a common stock account. Any balance in either the

6

common share unit account or the common stock account will be credited with an amount equivalent to any dividend paid on Briggs & Stratton’s common stock, which will be converted into additional common share units. Common share units may be distributed in cash or stock at the election of the directors. The balance in the common stock account will be distributed in shares of Briggs & Stratton common stock. All other distributions will be paid in cash. Nonemployee directors are also provided with $150,000 of coverage under Briggs & Stratton’s Business Travel Accident Plan while on corporate business.

Nonemployee directors are encouraged to use company products to enhance their understanding and appreciation of the company’s business. Directors may purchase at retail up to $10,000 annually of company products and products powered by the company’s engines and motors. The company reimburses directors for the purchase price of these products and also pays directors the applicable tax liability associated with the reimbursement. The amount of the reimbursement and tax payment is included in the directors’ taxable income. In fiscal year 2005, Mr. Batten received $2,660, Mr. Burner received $11,663, Ms. Bush received $13,400, Mr. Story received $404 and Mr. Walker received $8,229 to cover the purchase of products and the associated tax liability.

Communication with Directors. The Board has established a process for security holders to communicate with the Board, its non-management directors as a group or its presiding director. Such communications should be addressed to the Secretary of the company, who will forward the communication directly to the presiding director.

7

SECURITY OWNERSHIP OF DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth the beneficial ownership of shares of common stock of Briggs & Stratton by each director, nominee and the executive officers named in the Summary Compensation Table (the “named executive officers”), and by all directors and executive officers as a group, as of August 17, 2005. As of August 17, 2005, there are no shareholders who own in excess of five percent (5%) of the company’s common stock.

| | | | | | Nature of Beneficial Ownership | |

| | Total No. | | | | Sole | | Shared | | Sole | |

| | of Shares | | Percent | | Voting and | | Voting and | | Voting | |

| | Beneficially | | of | | Investment | | Investment | | Power | |

Directors and Executive Officers | | Owned | | Class | | Power | | Power | | Only | |

William F. Achtmeyer | | 1,216 | | * | | 1,216 | | 0 | | 0 | |

Jay H. Baker | | 12,400 | (a) | * | | 8,600 | | 3,800 | | 0 | |

Michael E. Batten | | 10,650 | (a) | * | | 10,650 | | 0 | | 0 | |

James E. Brenn | | 337,985 | (a)(b)(f) | * | | 146,445 | | 185,540 | | 6,000 | (e) |

David L. Burner | | 11,813 | (c) | * | | 11,813 | | 0 | | 0 | |

Mary K. Bush | | 800 | | * | | 800 | | 0 | | 0 | |

Paul M. Neylon | | 111,048 | (a) | * | | 101,497 | | 0 | | 9,551 | (e) |

Robert J. O’Toole | | 10,800 | (a) | * | | 10,800 | | 0 | | 0 | |

Stephen H. Rugg | | 89,720 | (a) | * | | 89,720 | | 0 | | 0 | |

Thomas R. Savage | | 112,176 | (a) | * | | 102,514 | | 0 | | 9,662 | (e) |

John S. Shiely | | 978,111 | (a)(d)(f) | 1.8 | | 390,111 | | 588,000 | | 0 | |

Charles I. Story | | 4,790 | (a) | * | | 2,790 | | 2,000 | | 0 | |

Todd J. Teske | | 232,497 | (a)(b) | * | | 62,342 | | 160,000 | | 10,155 | (e) |

Brian C. Walker | | 1,600 | | * | | 1,600 | | 0 | | 0 | |

All directors and executive officers as a group (23 persons including the above named persons) | | 2,246,241 | (a)(b)(c)(d)(e)(f) | 4.2 | | | | | | | |

*Less than 1%.

(a) | | Includes shares issuable pursuant to stock options exercisable within 60 days for Mr. Baker (6,000 shares), Mr. Batten (6,000 shares), Mr. Brenn (137,926 shares), Mr. Neylon (71,540 shares), Mr. O’Toole (6,000 shares), Mr. Rugg (85,720 shares), Mr. Savage (96,460 shares), Mr. Shiely (282,460 shares), Mr. Teske (58,380 shares), and all directors and executive officers as a group (1,035,134 shares). |

| | |

(b) | | Includes 160,000 shares in the Briggs & Stratton Retirement Plan. Mr. Brenn and Mr. Teske share beneficial ownership of these shares through joint voting and investment power. |

| | |

(c) | | Includes common share units acquired through deferral of director fees under the Deferred Compensation Plan for the following Director: Mr. Burner – 9,413. |

| | |

(d) | | Includes 588,000 shares in the Briggs & Stratton Corporation Foundation, Inc. Mr. Shiely shares beneficial ownership through joint voting and investment power. |

| | |

(e) | | Certain executive officers hold shares of restricted stock (included in table above) over which the holders have sole voting but no investment power as indicated: Mr. Brenn (6,000 shares), Mr. Neylon (9,551 shares), Mr. Savage (9,662 shares), Mr. Teske (10,155 shares), and all directors and executive officers as a group (46,706 shares). |

| | |

(f) | | Certain named executive officers and executive officers also hold deferred shares of the company common stock under the company’s Incentive Compensation Plan as indicated: Mr. Brenn (3,621 shares), Mr. Shiely (14,744 shares), and all directors and executive officers as a group (24,905 shares). Deferred shares are intended to reflect the performance of company common stock and are payable in common stock, but these shares have no voting rights and are not included in the number of shares reflected in the “Total No. of Shares Beneficially Owned” column in the table above. The company listed them in this footnote because they represent an additional economic interest of the named executive officers and executive officers tied to the performance of company common stock. |

This beneficial ownership information is based on information furnished by the directors and executive officers. Beneficial ownership is determined in accordance with Rule 13d-3 under the Exchange Act for

8

purposes of this Proxy Statement. It is not necessarily to be construed as beneficial ownership for other purposes.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires the directors and certain officers of Briggs & Stratton to file reports of their ownership of Briggs & Stratton common stock and of changes in such ownership with the U.S. Securities and Exchange Commission. Based on the information provided by the reporting persons, all applicable reporting requirements for fiscal 2005 were accomplished in a timely manner, except that due to an administrative oversight a Form 4 was filed late with the SEC covering an award of stock options to Mr. Shiely.

ITEM 2: RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS

The Audit Committee of the Board of Directors has selected the public accounting firm of PricewaterhouseCoopers LLP as the company’s independent auditors for the current fiscal year ending July 2, 2006. The Committee has directed that management submit the selection of independent auditors for ratification by the shareholders at the annual meeting.

Shareholder ratification of the selection of PricewaterhouseCoopers LLP as the company’s independent auditors is not required by the Bylaws or otherwise. However, the Committee and Board are submitting the selection of PricewaterhouseCoopers LLP for ratification because they value the shareholders’ views on the company’s independent auditors. If the shareholders fail to ratify the selection, the Audit Committee will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee may direct the appointment of a different independent accounting firm at any time during the year if the Committee determines that such a change would be in the best interests of the company and its shareholders.

The Audit Committee and Board recommend a vote FOR this proposal.

AUDIT COMMITTEE REPORT

The Audit Committee of the Board of Directors consists of four nonemployee directors. The Committee acts under a written Audit Committee Charter adopted by the Board of Directors, which is available on the company’s website. The Board has determined that Messrs. O’Toole and Walker and Ms. Bush are audit committee financial experts, and all committee members are independent under the rules of the U.S. Securities and Exchange Commission and NYSE.

Management has the primary responsibility for the financial statements, the reporting process and assurance for the adequacy of controls. Briggs & Stratton’s independent auditors are responsible for expressing an opinion on the conformity of Briggs & Stratton’s audited financial statements to accounting principles generally accepted in the U.S. and expressing an opinion on management’s assessment as to whether the company has maintained effective internal control over financial reporting and those controls are effective. The Audit Committee is responsible for monitoring and overseeing these processes on behalf of the Board of Directors.

In this context, the Audit Committee has reviewed and discussed Briggs & Stratton’s audited financial statements with management and PricewaterhouseCoopers LLP, the Company’s independent auditors. The Audit Committee has discussed with the independent auditors the matters related to the conduct of the audit required to be discussed by Statement on Auditing Standards No. 61, as amended. The Audit Committee also discussed with the independent auditors the quality and adequacy of the company’s internal controls, especially those related to financial reporting.

In addition, the Audit Committee has received from PricewaterhouseCoopers LLP the written disclosures of all relationships between Briggs & Stratton and PricewaterhouseCoopers LLP that may

9

bear on independence and the letter required by Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees” and has discussed with that firm its independence.

The Audit Committee also has discussed with the company’s internal auditors their evaluation of the company’s internal accounting controls and the overall quality of the company’s financial reporting.

In reliance on these reviews and discussions, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the company’s Annual Report on Form 10-K for the fiscal year ended July 3, 2005 for filing with the SEC.

Submitted by the Audit Committee of the Board of Directors.

| Robert J. O’Toole, Chairman |

| Mary K. Bush |

| Charles I. Story |

| Brian C. Walker |

INDEPENDENT AUDITORS’ FEES

Briggs & Stratton retained PricewaterhouseCoopers LLP to provide audit services for fiscal year 2005 and Deloitte & Touche LLP to provide such services for fiscal year 2004. The firms billed the following fees for the respective periods:

| | 2005 | | 2004 | |

Audit Fees | | $ | 653,050 | | $ | 306,430 | |

Audit-Related Fees | | 0 | | 93,100 | |

Tax Fees | | 97,633 | | 162,684 | |

All Other Fees | | 45,491 | | 0 | |

Total Fees | | $ | 796,174 | | $ | 562,214 | |

Audit-Related Fees include fees related to Sarbanes-Oxley readiness reviews and benefit plan audits. Tax Fees include fees for tax compliance reviews and the preparation of tax returns. All Other Fees include consulting services related to human resource matters and business planning. The Audit Committee has considered whether the independent auditors’ provision of services other than audit services is compatible with maintaining auditor independence.

CHANGE IN AUDITORS

On August 3, 2004, the Audit Committee dismissed Deloitte & Touche LLP as the company’s independent public accountants and appointed PricewaterhouseCoopers LLP as the company’s new independent accountants. Shareholders ratified the selection of PricewaterhouseCoopers LLC at the October 2004 annual meeting.

Deloitte & Touche LLP’s report on the company’s consolidated financial statements for the two fiscal years immediately prior to its replacement did not contain any adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles. Since the beginning of fiscal year 2003 and through the date of dismissal of Deloitte & Touche LLP, there were no disagreements between the company and Deloitte & Touche LLP on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to Deloitte & Touche LLP’s satisfaction, would have caused them to make reference to the subject matter of the disagreement in connection with their reports. Since the beginning of fiscal year 2003 and through the date of dismissal of Deloitte & Touche LLP, none of the reportable events described in Item 304(a)(1)(v) of Regulation S-K occurred, and the company did not consult with

10

PricewaterhouseCoopers LLP regarding any of the matters or events set forth in Item 304(a)(2)(i) and (ii) of Regulation S-K.

A representative of PricewaterhouseCoopers LLP will be present at the October annual meeting of shareholders. The representative will have the opportunity to make a statement and respond to appropriate questions.

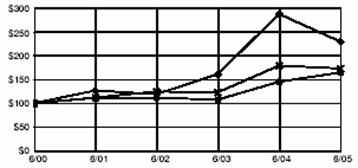

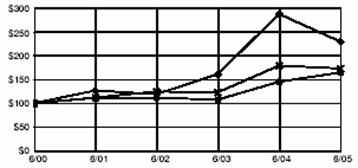

PERFORMANCE GRAPH

The chart below is a comparison of the cumulative return over the last five fiscal years had $100 been invested at the close of business on June 30, 2000 in each of Briggs & Stratton common stock, the Standard & Poor’s (S&P) Smallcap 600 Index and the S&P Machinery Index.

FIVE YEAR CUMULATIVE TOTAL RETURN COMPARISON*

Briggs & Stratton versus Published Indices

| | | | 6/00 | | 6/01 | | 6/02 | | 6/03 | | 6/04 | | 6/05 | |

| | Briggs & Stratton | | 100.00 | | 126.73 | | 118.98 | | 161.61 | | 288.42 | | 230.16 | |

| | S&P Smallcap 600 | | 100.00 | | 111.12 | | 111.42 | | 107.43 | | 145.30 | | 164.85 | |

| | S&P Machinery (diversified) | | 100.00 | | 111.72 | | 124.61 | | 122.88 | | 179.41 | | 173.28 | |

| * | Total return calculation is based on compounded monthly returns with reinvested dividends. |

COMPENSATION COMMITTEE

REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee of the Board of Directors consists of four directors, each of whom has been determined by the Board to be independent under the rules of the NYSE. The Committee reviews and approves corporate goals and objectives relevant to CEO compensation, evaluates the CEO’s performance and sets the CEO’s compensation in consultation with the full Board, and reviews the compensation and benefits provided to executive officers and makes recommendations to the Board as to their salary levels and benefits.

The objectives of the Committee in establishing compensation arrangements for senior management are to (1) attract and retain key executives who are important to the continued success of Briggs & Stratton and its operating units, and (2) provide strong financial incentives, at reasonable cost to the shareholders, for senior management to enhance the value of the shareholders’ investment. These compensation arrangements include cash compensation, stock awards and other benefits such as deferred compensation and supplemental retirement benefits.

The primary components of Briggs & Stratton’s executive compensation program are base salaries, cash bonuses, and long-term incentives comprising premium-priced stock options, restricted stock and deferred stock. Bonuses and long-term incentives are determined based on the company’s financial performance as measured by economic value added. In addition, bonuses are subject to a ceiling and floor, the sizes of stock option awards are based on the amounts of target bonuses, and the sizes of restricted and deferred stock awards are based on the amounts of actual bonuses.

11

The Committee believes that the company’s pay levels are appropriately targeted to attract and retain key executives, the bonus and long-term incentive programs provide very strong incentives for management to increase shareholder value, and total compensation is both cost-effective in promoting increases in shareholder value and reasonable under the circumstances.

Base Salaries

The annual salaries for all officers are determined based on level of responsibility and individual performance. The Committee reviews these salaries in August of each year, establishes a base salary for the CEO, and recommends to the Board base salaries for other officers. It is the Committee’s objective that officers generally be compensated between the 50th and 75th percentile of salaries paid by comparable companies. In reviewing base salaries in August 2004, the Committee considered compensation survey data provided by its outside consultant Hewitt Associates LLC. The data, initially prepared in March 2003 and updated in 2004 to account for market tends in compensation, was derived from a Comparator Group of companies in the same general sales dollar size range and broad industry sector as Briggs & Stratton. This group is not the same group of companies included in the S&P Machinery Index. The Committee determined that the salary levels set would achieve the Committee’s objectives. As a result of this process, Mr. Shiely, as Chief Executive Officer, received a base salary of $779,166 in fiscal year 2005.

Annual Cash Bonuses

Briggs & Stratton maintains an Economic Value Added (“EVA”) Incentive Compensation Plan (the “EVA Plan”). The purpose of the EVA Plan is to provide cash bonuses to key employees, including all executive officers, in a form relating financial reward to an increase in the value of Briggs & Stratton to its shareholders.

In general, EVA is net operating profit after taxes, less a capital charge. The capital charge, which is intended to represent the return expected by the providers of the firm’s capital, is the weighted average cost of (1) equity capital based on a 10-year Treasury Bond yield plus the product of a historical equity risk premium and the business risk index for Briggs & Stratton, and (2) debt capital equal to the actual after-tax cost to the company of its debt. As stated in the Incentive Compensation Plan approved by shareholders, EVA improvement is the financial performance measure most closely correlated with increases in shareholder value.

Under the EVA Plan, the annual Target Incentive Award for an executive is expressed as a percentage of base salary that ranges from 20% to 100% of base salary, with Mr. Shiely’s individual Target Incentive Award set at 100% of his base salary. The percentage used for each executive is determined by reference to the bonus opportunities customarily provided by other companies to executives having similar responsibilities. The Accrued Bonus calculated for a participant at the end of a fiscal year is equal to 30% of the Company Performance calculation (Base Salary x Target Incentive Award x Company Performance Factor) plus 70% of the Individual Performance calculation (Base Salary x Target Incentive Award x Individual Performance Factor), with no more than 15% of the Accrued Bonus attributable to Non-Quantifiable Individual Performance Factors. The EVA Plan also establishes a cap on the Accrued Bonus of each executive of three times the dollar amount of his or her Target Incentive Award, subject to the $3 million limit approved by shareholders in October 2004, and a floor (which is relevant for Bonus Bank purposes as discussed below) of negative one times the dollar amount of the executive’s Target Incentive Award.

The Company Performance Factor is measured by comparing the company’s Actual EVA for a fiscal year to the Target EVA for the same year. Target EVA for a fiscal year is the average of the Target EVA for the prior year and Actual EVA for the prior year. This methodology has been used consistently since 1992 to determine each year’s Target EVA. The Compensation Committee believes the methodology is appropriate for use in determining executive compensation because it is objective and predictable, it

EVA® is a registered trademark of Stern Stewart & Co.

12

adjusts the Target EVA each year based on actual financial results, and it requires that Actual EVA improve in order for the Target Incentive Award to be paid. The Individual Performance Factor for each executive, which is approved by the Committee, is the weighted average of one or more quantifiable or non-quantifiable factors called Supporting Performance Factors. Supporting Performance Factors are measured by an achievement percentage continuum that generally ranges from 50% to 150% of the individual goal to be achieved and are enumerated from 0.5 to 1.5 based on this range. If approved by the Committee, Supporting Performance Factors do not have a ceiling if they are the same as the Company Performance Factor or if they are based on the EVA of a division of the company. For fiscal year 2005, the company’s Target EVA was $34.99 million, the Company Performance Factor was 0.40, and the Individual Performance Factor for each executive named in the Summary Compensation Table was the Company Performance Factor or the EVA of a division of the company. As a result, the Accrued Bonus for each executive was less than the dollar amount of his or her Target Incentive Award.

The EVA Plan uses a Bonus Bank to ensure that extraordinary EVA performance is sustained before extraordinary bonus awards are paid out. The Bonus Bank applies to senior executives designated by the Committee under the EVA Plan, which for fiscal year 2005 included all of the company’s executive officers. An executive’s Bonus Bank account is considered at risk, given that in any year the Accrued Bonus for the executive is negative, the negative bonus amount is subtracted from the executive’s outstanding Bonus Bank balance, and that extraordinary EVA performance must be sustained for several years to ensure full payout of the Accrued Bonus. The EVA Plan also provides that any Accrued Bonus in excess of 100% of the Target Incentive Award shall be added to the senior executive’s outstanding Bonus Bank balance rather than being paid to the executive on a current basis. On termination of employment due to death, disability or retirement, the available balance in the Bonus Bank will be paid to the terminating executive or his designated beneficiary or estate. Executives who voluntarily leave to accept employment elsewhere or who are terminated for cause will forfeit any positive available balance. An executive is not expected to repay negative balances upon termination or retirement. Each executive had a positive Bonus Bank balance during fiscal year 2005.

In August 2005 the Committee approved cash bonuses under the EVA Plan for each senior executive equal to the executive’s Accrued Bonus for the year plus 33% of his or her Bonus Bank balance. Mr. Shiely’s bonus was $520,461.

Long-Term Incentives

In October 2004 shareholders approved a revised and restated Incentive Compensation Plan (“ICP”). The ICP authorizes the Committee to grant to officers and other key employees stock incentive awards in the form of one or any combination of the following: stock options, stock appreciation rights, deferred stock and restricted stock. Stock options granted under the ICP are premium-priced stock options (“PSOs”), because they must have an exercise price that is 110% of the price of the company’s stock on the grant date.

The Compensation Committee awards PSOs, restricted stock and deferred stock to senior executives under a written program that is designed to tie the interests of all senior executives to the long-term consolidated financial results of the company (the “Executive Program”). The Executive Program is structured such that each year an executive is awarded PSOs having a value equal to the dollar amount of the executive’s Target Incentive Award under the EVA Plan for the most recently completed fiscal year, and also is awarded restricted and/or deferred stock having a value equal to the amount of the executive’s actual cash bonus for the most recently completed fiscal year. The Executive Program also caps aggregate awards to all executives for an EVA Plan year at 730,000 PSOs and 500,000 shares of restricted and deferred stock, with any forced reduction in such awards carried forward for grant in future years. These provisions are intended to reduce the volatility of incentive compensation from year to year, increase stock ownership by senior executives, and relate restricted and deferred stock awards to the company’s financial performance.

PSOs include Incentive stock options (“ISOs”) as defined under and subject to Section 422 of the Internal Revenue Code and Non-Qualified Stock Options. PSOs are exercisable three years after date of

13

grant and expire upon the optionee’s termination of employment for cause, one year following termination of employment due to death, three years following termination due to retirement or disability, or three months after termination of employment for any other reason. However, in no event may any PSO continue longer than its maximum term set by the Compensation Committee at the time of grant. ISOs retain their status only if exercised within three months following termination of employment.

The number of PSOs awarded for fiscal year 2005 was determined by dividing the dollar amount of each executive’s Target Incentive Award by the Black-Scholes value of a share of the company’s common stock based on its fair market value on the date of the grant. The exercise price of the PSOs granted for fiscal year 2005 is $38.83, which is 110% of the fair market value of the company’s common stock on the grant date of August 16, 2005. The material assumptions and adjustments used in calculating Black-Scholes values are discussed below under the table relating to stock options.

The Committee also awarded restricted and deferred stock to each executive based on the amount of the bonus paid to the executive in August 2005. The number of restricted and deferred shares for each executive was calculated by dividing the executive’s bonus by the fair market value of the company’s common stock on the date of grant of August 16, 2005. Restricted and deferred stock vests five years after their grant date. The vesting date will not be accelerated by early or regular retirement, except in extraordinary circumstances approved by the Committee. If an executive resigns his or her employment prior to the vesting date, the restricted or deferred stock will be forfeited. Cash dividends are paid on restricted stock during the vesting period. Holders of deferred stock awards are credited with additional shares of deferred stock in lieu of cash dividends.

In August 2005 the Committee awarded PSOs, restricted stock and deferred stock to 16 senior executives. The award made to Mr. Shiely, which included 105,721 PSOs and 14,744 shares of deferred stock, was determined in the manner described above.

Tax Deductibility Considerations

Section 162(m) of the Internal Revenue Code limits tax deductions for executive compensation to $1million, unless certain conditions are met. The ICP, the EVA Plan and the Executive Plan are designed generally to ensure full tax deductibility of compensation paid under these plans, and it has been the policy of the Compensation Committee and Board to take reasonable steps to maintain the corporate tax deductibility of compensation paid to executive officers. For fiscal year 2005, the full amount of

Mr. Shiely’s base salary and annual cash bonus was tax deductible because the salary was below the $1million threshold and the bonus was based on the company’s performance during the year.

Submitted by the Compensation Committee of the Board of Directors.

| David L. Burner, Chairman |

| William F. Achtmeyer |

| Jay H. Baker |

| Brian C. Walker |

14

EXECUTIVE COMPENSATION

Compensation Summary

The table includes information for each of the last three fiscal years concerning the compensation paid by Briggs & Stratton to its Chief Executive Officer, the four other most highly compensated executive officers, and one retired officer (the “named executive officers”).

Summary Compensation Table

| | | | | | | | | | Long-Term Compensation | | | |

| | | | | | | | | | Awards | | Payouts | | | |

| | | | | | | | Restricted/ | | Securities | | | | | |

| | | | Annual | | Deferred | | Underlying | | | | All Other | |

Name and | | Fiscal | | Compensation (1) | | Stock | | Options/ | | LTIP | | Compensa- | |

Principal Position | | Year | | Salary ($) | | Bonus ($) | | Awards ($)(2) | | SARs (#)(3) | | Payouts ($)(4) | | tion ($)(5) | |

| | | | | | | | | | | | | | | |

J.S. Shiely | | 2005 | | $ | 779,166 | | $ | 520,461 | | $ | 515,450 | | 105,721 | | $ | 208,794 | | $ | 69,639 | |

Chairman, President and | | 2004 | | 737,768 | | 1,233,843 | | 0 | | 348,560 | | 311,633 | | 63,073 | |

Chief Executive Officer | | 2003 | | 695,490 | | 682,431 | | 0 | | 242,240 | | 0 | | 45,113 | |

| | | | | | | | | | | | | | | |

S.H. Rugg (6) | | 2005 | | 280,239 | | 222,862 | | 0 | | 0 | | 155,605 | | 98,098 | |

Former Senior Vice President | | 2004 | | 302,404 | | 303,444 | | 0 | | 85,720 | | 76,641 | | 20,936 | |

–Sales & Service | | 2003 | | 276,280 | | 192,669 | | 0 | | 68,380 | | 0 | | 15,749 | |

| | | | | | | | | | | | | | | |

T.R. Savage | | 2005 | | 321,846 | | 129,253 | | 128,024 | | 26,202 | | 52,010 | | 42,904 | |

Senior Vice President – | | 2004 | | 306,292 | | 296,277 | | 170,940 | | 83,700 | | 77,627 | | 18,870 | |

Administration | | 2003 | | 290,600 | | 130,770 | | 0 | | 46,420 | | 0 | | 12,883 | |

| | | | | | | | | | | | | | | |

J.E. Brenn | | 2005 | | 318,262 | | 127,813 | | 126,590 | | 25,910 | | 51,430 | | 36,977 | |

Senior Vice President and | | 2004 | | 302,878 | | 293,892 | | 170,940 | | 83,020 | | 76,761 | | 18,381 | |

Chief Financial Officer | | 2003 | | 287,640 | | 129,438 | | 0 | | 45,940 | | 0 | | 12,749 | |

| | | | | | | | | | | | | | | |

P.M. Neylon (7) | | 2005 | | 279,370 | | 125,341 | | 124,143 | | 22,744 | | 48,654 | | 42,014 | |

Senior Vice President & | | 2004 | | 264,208 | | 270,773 | | 170,940 | | 76,500 | | 72,617 | | 16,668 | |

President – Engine Power | | 2003 | | 245,190 | | 181,293 | | 0 | | 69,420 | | 14,299 | | 13,704 | |

Products Group | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

T.J. Teske (7) | | 2005 | | 248,904 | | 146,665 | | 145,259 | | 20,264 | | 18,977 | | 20,424 | |

Executive Vice President | | 2004 | | 227,426 | | 196,793 | | 170,940 | | 55,600 | | 28,324 | | 6,478 | |

& Chief Operating Officer | | 2003 | | 213,860 | | 64,158 | | 0 | | 22,780 | | 0 | | 7,035 | |

| | | | | | | | | | | | | | | | | | | | |

(1) | | Annual salary includes amounts earned in fiscal year, whether or not deferred. Annual bonus is the executive’s Total Bonus Payout, which includes any payments from the bonus bank, and any amounts the executive has elected to defer. |

| | |

(2) | | Restricted stock awards were granted on August 16, 2005 for fiscal 2005 to Messrs. Savage, Neylon and Teske in the amounts of 3,662 shares, 3,551 shares, and 4,155 shares respectively, and deferred stock awards were granted to Messrs. Shiely and Brenn in the amounts of 14,744 shares and 3,621 shares, respectively. All such awards are subject to forfeiture until vested. The dollar values shown in the table for these shares are based on the closing market price of company common stock on the grant date. The restricted and deferred stock awards will vest five years after the date of grant. |

| | |

| | The aggregate restricted stock holdings at the end of fiscal year 2005 for the named executive officers were as follows (based on a closing price of $35.18 on July 1, 2005): Mr. Savage – 6,000 shares valued at $211,080, Mr. Brenn – 6,000 shares valued at $211,080, Mr. Neylon – 6,000 shares valued at $211,080 and Mr. Teske – 6,000 shares valued at $211,080. |

| | |

| | Cash dividends are paid on a quarterly basis on restricted stock. An amount equivalent to any paid dividends is converted into additional common share units for the deferred stocks. |

| | |

(3) | | No SARs are outstanding. Option awards reported for fiscal 2005 were granted August 16, 2005. Option awards for 2003 and 2004 reflect a 2 for 1 stock split on October 29, 2004. |

| | |

(4) | | Figures reflect the portion of the EVA Plan bonus bank balances paid with respect to each fiscal year. These amounts are also included under the annual bonus column. |

| | |

(5) | | Amounts are reported in the year earned rather than, as shown in the Summary Compensation Table for prior years, in the year paid. All other compensation for fiscal 2005 for Messrs. Shiely, Rugg, Savage, Brenn, Neylon |

15

| | and Teske, respectively, includes: (i) matching contributions to the Briggs & Stratton’s Savings and Investment Plan for each named executive officer of $7,000, $4,686, $6,946, $6,965, $6,953 and $6,923; (ii) matching contributions to Briggs & Stratton’s Key Employee Savings and Investment Plan for each named executive officer of $32,839, $9,712, $7,383, $3,398, $5,991 and $5,116; (iii) reimbursement of professional consultant fees for each named officer of $0, $4,000, $1,775, $0, $1,420 and $0; (iv) consulting fees to Mr. Rugg in the amount of $50,000 pursuant to his consulting agreement; and (v) an executive life insurance premium for each named executive officer of $29,800, $29,700, $26,800, $26,614, $27,650 and $8,385. There were no premiums paid in 2004 and 2003. |

| | |

(6) | | Mr. Rugg retired on May 15, 2005. In connection with his retirement, in addition to the retirement benefits to which he is entitled, Mr. Rugg will receive the payments pursuant to the consulting agreement described under “Employment and Compensation Agreements” in this proxy statement. Additionally, exercise dates for all of his outstanding stock options were accelerated to May 16, 2005. |

| | |

(7) | | Titles shown in the table above for Messrs. Neylon and Teske are effective September 1, 2005. Mr. Neylon previously was Senior Vice President – Engine Products Group and Mr. Teske previously held the position of Senior Vice President & President – Briggs & Stratton Power Products Group, LLC. In addition, with respect to Mr. Neylon, the annual bonus and long term compensation reported for fiscal year 2004 has been reduced by $1,570 compared to the amounts reported in last year’s Summary Compensation Table because of a downward adjustment in the calculation of Division EVA. |

Stock Options

The Incentive Compensation Plan approved by shareholders in October 2004 provides for the granting of stock options with respect to Briggs & Stratton common stock. Option awards reported for fiscal 2005 were granted effective August 16, 2005. These options become exercisable August 16, 2008. Option awards are intended to qualify as incentive stock options to the extent permitted under the Internal Revenue Code of 1986, as amended. Any options not meeting the requirements for incentive stock options will be treated as non-qualified stock options.

Option/SAR Grants For Last Fiscal Year

| | Number of | | % of Total | | | | | | | |

| | Securities | | Options/SARs | | | | | | | |

| | Underlying | | Granted to | | Exercise or Base | | | | Grant Date | |

| | Options/SARs | | Employees in | | Price | | Expiration | | Present | |

Name | | Granted (#) | | Fiscal Year | | ($/ Sh) | | Date | | Value ($) | |

J.S. Shiely | | 105,721 | | 32.7 | % | $ | 38.83 | | 8/16/2010 | | $ | 779,164 | |

S.H. Rugg | | 0 | | 0.0 | | 0 | | N/A | | 0 | |

T.R. Savage | | 26,202 | | 8.1 | | | 38.83 | | 8/16/2010 | | 193,109 | |

J.E. Brenn | | 25,910 | | 8.0 | | | 38.83 | | 8/16/2010 | | 190,957 | |

P.M. Neylon | | 22,744 | | 7.0 | | | 38.83 | | 8/16/2010 | | 167,623 | |

T.J. Teske | | 20,264 | | 6.3 | | | 38.83 | | 8/16/2010 | | 149,346 | |

| | | | | | | | | | | | | |

The option price is 110% of the price of the company’s common stock on the date the stock option is awarded to an executive, and is payable in cash or by use of common stock already owned by the optionee. The Compensation Committee, in its sole discretion, may elect to cash out all or any portion of the stock options by paying a per share amount equal to the excess of the fair market value at exercise over the option exercise price. Such payment may be in cash or common stock. Finally, the Committee may elect to substitute stock appreciation rights for any or all outstanding stock options at any time. Stock options are not transferable except by will or the laws of descent or distribution.

The estimated grant date present value reflected in the Option/SAR table is determined using the Black-Scholes model. The material assumptions and adjustments incorporated in the Black-Scholes model in estimating the value of the options reflected in the table include the following:

• An exercise price on the option of $38.83.

• Fair market value of the common stock on the date of grant of $35.30.

• An option term of 5 years.

• An interest rate of 4.27 percent that represents the interest rate on a U.S. Treasury security on the date of grant with a maturity date corresponding to that of the option term.

16

• A monthly stock price volatility of 25.14% (utilizing 36 months of historical month-end stock prices).

• Cumulative dividends of $0.68 (1.93% yield) paid with respect to a share of common stock in the year prior to the date of grant.

The ultimate values of the options will depend on the future market price of Briggs & Stratton common stock, which cannot be forecast with reasonable accuracy. The actual value, if any, an optionee will realize upon exercise of an option will depend on the excess of the market value of Briggs & Stratton common stock over the exercise price on the date the option is exercised.

If there is a “change in control” of Briggs & Stratton, as defined in the Incentive Compensation Plan, any outstanding stock options which are not then exercisable will become fully exercisable and vested. Upon a change in control, optionees may elect to surrender all or any part of their stock options and receive a per share amount in cash equal to the excess of the “change in control price” over the exercise price of the stock option. If an optionee’s employment is terminated at or following a change in control (other than by death, disability, or retirement), the exercise periods of an optionee’s stock options will be extended to the earlier of six months and one day from the date of employment termination or the options’ respective expiration dates. No SARs were granted.

Aggregated Option/SAR Exercises In Last Fiscal Year

And FY-End Option/SAR Values*

| | | | | | Number of Securities | | Value of | |

| | | | | | Underlying Unexercised | | Unexercised In-the-Money | |

| | | | | | Options/SARs | | Options/SARs | |

| | Shares Acquired | | Value | | at Fiscal Year End (#) | | at Fiscal Year End ($) | |

Name | | on Exercise (#) | | Realized ($) | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable | |

J.S. Shiely | | 151,500 | | $ | 802,923 | | 202,540 | | 776,441 | | $ | 2,307,236 | | $ | 2,094,071 | |

S.H. Rugg | | 117,140 | | 971,833 | | 154,100 | | 0 | | 324,121 | | 0 | |

T.R. Savage | | 38,340 | | 60,276 | | 76,480 | | 176,302 | | 864,363 | | 456,494 | |

J.E. Brenn | | 39,954 | | 116,034 | | 118,006 | | 174,790 | | 1,364,991 | | 453,509 | |

P.M. Neylon | | 75,180 | | 387,744 | | 49,420 | | 190,784 | | 532,995 | | 590,841 | |

T.J. Teske | | 13,660 | | 7,704 | | 48,640 | | 108,384 | | 563,724 | | 223,250 | |

| | | | | | | | | | | | | | | | |

* No SARs are outstanding. Options at fiscal year end include options granted August 16, 2005 for fiscal 2005.

Equity Compensation Plan Information

The following table gives aggregate information under all equity compensation plans of Briggs & Stratton as of July 3, 2005.

| | | | | | Number of securities | |

| | | | Weighted average | | remaining available for | |

| | Number of securities to | | exercise price of | | future issuance under | |

| | be issued upon exercise | | outstanding | | equity compensation plans | |

| | of outstanding options, | | options, warrants | | (excluding securities | |

Plan Category | | warrants and rights | | and rights | | reflected in 1st column) | |

Equity compensation plans approved by security holders | | 3,107,168 | (1) | $ | 30.50 | | 7,985,000 | (2) |

Equity compensation plans not approved by security holders | | — | | N/A | | — | |

Total | | 3,107,168 | | $ | 30.50 | | 7,985,000 | |

(1) Represents options, restricted stock and deferred stock granted under Briggs & Stratton’s Stock Incentive Plan and Incentive Compensation Plan. Of this amount, 3,092,168 were awarded under the Briggs & Stratton Stock Incentive Plan, which terminated effective October 29, 2004. The remaining 15,000 awards were granted under the Briggs & Stratton Incentive Compensation Plan, which was approved by shareholders, effective October 29, 2004.

(2) Represents securities available for future issuance under the Briggs & Stratton Incentive Compensation Plan. Under the Briggs & Stratton Stock Incentive Plan, no securities remain available for future issuance.

17

Long-Term Incentive Compensation

The EVA Plan requires that Accrued Bonuses that senior executives have earned in excess of 100% of their Target Incentive Awards be banked rather than be paid to them currently. In any year an executive’s Accrued Bonus is negative, the negative bonus amount reduces the executive’s outstanding Bonus Bank balance. At the start of fiscal year 2005 there were no negative bank balances. In August 2005 one-third of each executive’s Bonus Bank balance was paid out to the participant since his or her Accrued Bonus did not exceed 100% of the Target Incentive Award, except that Mr. Rugg received 100% of his Bonus Bank balance due to his retirement.

Long-Term Incentive Plans – Awards in Last Fiscal Year

| | | | Estimated Future Payouts (Paybacks) Under Non-Stock | |

| | | | Price-Based Plans | |

| | Amounts Banked | | | | Target and | |

Name | | (Forfeited ($) | | Minimum ($) | | Maximum ($) | |

J.S. Shiely | | $ | 0 | | $ | 0 | | $ | 423,916 | |

S.H. Rugg | | 0 | | 0 | | 0 | |

T.R. Savage | | 0 | | 0 | | 105,596 | |

J.E. Brenn | | 0 | | 0 | | 104,419 | |

P.M. Neylon | | 0 | | 0 | | 98,782 | |

T.J. Teske | | 0 | | 0 | | 38,529 | |

| | | | | | | | | | |

Retirement Plan

The following table shows total estimated annual benefits from funded and unfunded sources generally payable to executive officers upon normal retirement at age 65 at specified compensation and years of service classifications. These are calculated on a single-life basis and adjusted for the projected Social Security offset:

| | | | | | | |

Average Annual Compensation | | | | Annual Pension Payable for Life | | | |

in Highest 5 of Last 10 | | | | After Specified Years of Credited Service | | | |

Calendar Years of Service | | 10 Years | | 20 Years | | 30 Years | | 40 Years | |

$ | 200,000 | | $ | 38,000 | | $ | 77,000 | | $ | 115,000 | | $ | 140,000 | * |

400,000 | | 80,000 | | 161,000 | | 241,000 | | 280,000 | * |

600,000 | | 122,000 | | 245,000 | | 367,000 | | 420,000 | * |

800,000 | | 164,000 | | 329,000 | | 493,000 | | 560,000 | * |

1,000,000 | | 206,000 | | 413,000 | | 619,000 | | 700,000 | * |

1,200,000 | | 248,000 | | 497,000 | | 745,000 | | 840,000 | * |

1,400,000 | | 290,000 | | 581,000 | | 871,000 | | 980,000 | * |

1,600,000 | | 332,000 | | 665,000 | | 997,000 | | 1,120,000 | * |

1,800,000 | | 374,000 | | 749,000 | | 1,123,000 | | 1,260,000 | * |

| | | | | | | | | | | | | | |

* Figures reduced to reflect the maximum limitation of 70% of compensation.

Briggs & Stratton maintains a defined benefit retirement plan (the “Retirement Plan”) covering all executive officers and substantially all other employees of its affiliates, except for employees of Simplicity Manufacturing, Inc. Under the Retirement Plan non-bargaining unit employees located in Wisconsin and other regional plant locations receive an annual pension payable on a monthly basis at retirement equal to 1.6% of the employee’s average of the highest five years’ compensation of the last ten calendar years of service prior to retirement multiplied by the number of years of credited service. This amount is offset by 50% of Social Security. The Social Security offset is prorated if years of credited service are less than 30.

Executive officers also participate in an unfunded program that supplements benefits under the Retirement Plan. Under this program executive officers are provided with additional increments of 0.50 of 1% of compensation per year of credited service over that presently payable under the Retirement Plan to non-bargaining unit employees. In no event will a pension paid under the above described plans to a non-bargaining unit employee exceed 70% of the employee’s average monthly compensation. The Board of Directors amended the supplemented program in August 2003 to provide Mr. Shiely with up to five additional years of credited service based on his tenure as CEO.

18

A trust has been established for deposit of the aggregate present value of the benefits described above for executive officers upon the occurrence of a change in control of Briggs & Stratton. The trust would not be considered funding the benefits for tax purposes.

The table above does not reflect limitations imposed by the Internal Revenue Code of 1986, as amended, on pensions paid under federal income tax qualified plans. However, an executive officer covered by Briggs & Stratton’s unfunded program will receive the full pension that the officer would be entitled in the absence of such limitations. Compensation, for purposes of the table, includes the compensation shown in the Summary Compensation Table under the headings “Salary,” “Bonus” and “LTIP Payouts.” The years of credited service under the Retirement Plan for the individuals named in the Summary Compensation Table are: Mr. Shiely–19; Mr. Rugg–32; Mr. Savage–13; Mr. Brenn–27; Mr. Neylon–32; and Mr. Teske–9.

Employment and Compensation Agreements

Each executive officer of Briggs & Stratton, including the officers named in the Summary Compensation Table, is party to a two-year employment agreement. The agreements automatically extend for an additional year upon each anniversary date unless either party gives a 30-day notice prior to the anniversary date that the agreement will not be renewed. Under the agreement, the officer agrees to perform the duties currently being performed in addition to other duties that may be assigned from time to time. Briggs & Stratton agrees to pay the officer a salary of not less than that of the previous year and to provide fringe benefits that are provided to all other salaried employees of Briggs & Stratton in comparable positions. In the event of a termination other than for cause, the officer’s salary and fringe benefits (but not bonus or long-term incentive compensation) are continued for the remaining term of the agreement.

The Board of Directors has authorized the Chairman of the Board to offer to all executive officers change in control employment agreements. These ensure the employee’s continued employment following a “change in control” on a basis equivalent to the employee’s employment immediately prior to such change in terms of position, duties, compensation and benefits, as well as specified payments upon termination following a change in control. Briggs & Stratton currently has such agreements with all of its executive officers. These agreements become effective only upon a defined change in control of Briggs & Stratton, or if the employee’s employment is terminated upon or in anticipation of such a change in control and automatically supersede any existing employment agreement. Under the agreements, if during the employment term (three years from the change in control) the employee is terminated other than for cause or if the employee voluntarily terminates his employment for good reason or during a 30-day window period one year after a change in control, the employee is entitled to specified severance benefits, including a lump sum payment of three times the sum of the employee’s annual salary and bonus and a “gross-up” payment that will, in general, effectively reimburse the employee for any amounts paid under federal excise taxes.

The company entered into a consulting agreement with Mr. Rugg that took effect when he retired from the company on May 15, 2005. Under the agreement, Mr. Rugg will provide consulting services to the company through May 15, 2007 and will receive as compensation $25,000 per month during the first year of the agreement and $16,667 per month during the second year, plus reasonable travel and living expenses related to performing these services. The agreement prohibits Mr. Rugg from competing with the company during the period of his consultancy and for two years thereafter.

19

ANNUAL REPORT TO THE SECURITIES AND EXCHANGE

COMMISSION ON FORM 10-K

Briggs & Stratton is required to file an annual report on Form 10-K with the Securities and Exchange Commission. A copy of Form 10-K for the fiscal year ended July 3, 2005 accompanies this Proxy Statement. Requests for additional copies should be directed to Carole Ford, Shareholder Relations, Briggs & Stratton Corporation, P.O. Box 702, Milwaukee, Wisconsin 53201.

SHAREHOLDER PROPOSALS

Proposals that shareholders intend to present at the 2006 annual meeting must be received at Briggs & Stratton’s principal executive offices no earlier than July 13, 2006 and no later than August 7, 2006, in order to be presented at the meeting and must be in accordance with the requirements of the Bylaws of Briggs & Stratton. Shareholder proposals must be received by May 24, 2006 to be considered for inclusion in the proxy material for that meeting under the SEC’s proxy rules.

| BY ORDER OF THE BOARD OF DIRECTORS |

| BRIGGS & STRATTON CORPORATION |

| |

| Robert F. Heath, Secretary |

Wauwatosa, Wisconsin

September 21, 2005

20

BRIGGS & STRATTON CORPORATION

P.O. Box 702, Milwaukee, WI 53201-0702

PROXY SOLICITATED ON BEHALF OF THE BOARD OF DIRECTORS

(SEE REVERSE SIDE)

BRIGGS & STRATTON CORPORATION ANNUAL MEETING

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR ELECTION OF DIRECTORS

AND PROPOSAL 2.

(1) | Election of Three Directors: Nominees – Jay H. Baker, Michael E. Batten, Brian C. Walker |

| o | VOTE FOR all nominees listed above* | | o | VOTE WITHHELD from all nominees listed above |

| *To withhold authority to vote for any nominee, write the nominee’s name on the space below. |

| |

| |

(2) | Ratification of PricewaterhouseCoopers LLP as the company’s independent auditor. |

| o | FOR | o | AGAINST | | o | ABSTAIN |

| | | | | | | |

(3) | In the discretion of the appointed proxies on any other matters properly brought to a shareholder vote at the meeting, all as |

| set forth in the Notice and Proxy Statement. |

| |

| You are acknowledging receipt of the Notice and Proxy Statement by submitting your vote. |

| | | | | | | | | | |

o | PLAN TO ATTEND THE MEETING. | Date | | , 2005 |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Signature(s) in Box | |

| | Please sign exactly as your name appears, giving your full title if signing as attorney or fiduciary. If shares are held jointly, each joint owner should sign. If a corporation, please sign in full corporate name by duly authorized officer. If a partnership, please sign in partnership name by authorized person. | |

| | | | | |

| | BRIGGS & STRATTON CORPORATION | | |

| PROXY/VOTING INSTRUCTIONS FOR ANNUAL MEETING | | PROXY |

| OF SHAREHOLDERS - OCTOBER 19, 2005 | | |

| | | | |

| | THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS | | |

The undersigned appoints each of JOHN S. SHIELY and ROBERT F. HEATH, with power of substitution, attorneys and proxies, to vote all shares votable by the undersigned at the shareholders’ annual meeting of Briggs & Stratton Corporation and at any adjournments. The meeting will be held in Boston, Massachusetts on October 19, 2005 at 9:00 a.m. Eastern Daylight Time. My voting directions are on the reverse side of this proxy. I revoke any proxy previously given.

This proxy, when properly executed, will be voted in the manner directed. If no direction is made, the proxy will be voted by the proxies named “FOR” proposals 1 and 2 and in their discretion on any other matters properly brought to a shareholder vote at the meeting.

If the undersigned holds Briggs & Stratton shares in Briggs & Stratton Corporation’s 401(k) Plans or Dividend Reinvestment Plan, this proxy constitutes voting instructions for any shares so held.

(Continued and to be Signed on Reverse Side)

21