B. Classification of Claims and Interests

i. Classification in General.

A Claim or Interest is placed in a particular Class for all purposes, including voting, confirmation, and distribution under the Plan and under sections 1122 and 1123(a)(1) of the Bankruptcy Code; provided, that a Claim or Interest is placed in a particular Class for the purpose of receiving distributions pursuant to the Plan only to the extent that such Claim or Interest is an Allowed Claim or Allowed Interest in that Class and such Claim or Interest has not been satisfied, released, or otherwise settled prior to the Effective Date.

ii. Summary of Classification.

The following table designates the Classes of Claims against, and Interests in, each of the Debtors and specifies which of those Classes are (a) Impaired or Unimpaired by the Plan, (b) entitled to vote to accept or reject the Plan in accordance with section 1126 of the Bankruptcy Code, and (c) deemed to reject the Plan. In accordance with section 1123(a)(1) of the Bankruptcy Code, Administrative Expense Claims, Fee Claims, and DIP Claims have not been classified and, thus, are excluded from the Classes of Claims and Interests set forth in this Section 3 of the Plan. All of the potential Classes for the Debtors are set forth herein. Certain of the Debtors may not have holders of Claims or Interests in a particular Class or Classes, and such Classes shall be treated as set forth in Section 3.4 of the Plan.

| Class | Designation | Treatment | Entitled to Vote |

| 1(a) | Priority Tax Claims against BSC | Unimpaired | No (Presumed to accept) |

| 1(b) | Priority Tax Claims against BGI | Unimpaired | No (Presumed to accept) |

| 1(c) | Priority Tax Claims against ABI | Unimpaired | No (Presumed to accept) |

| 1(d) | Priority Tax Claims against BSI | Unimpaired | No (Presumed to accept) |

| 1(e) | Priority Tax Claims against BST | Unimpaired | No (Presumed to accept) |

| 2(a) | Priority Non-Tax Claims against BSC | Unimpaired | No (Presumed to accept) |

| 2(b) | Priority Non-Tax Claims against BGI | Unimpaired | No (Presumed to accept) |

| 2(c) | Priority Non-Tax Claims against ABI | Unimpaired | No (Presumed to accept) |

| 2(d) | Priority Non-Tax Claims against BSI | Unimpaired | No (Presumed to accept) |

| 2(e) | Priority Non-Tax Claims against BST | Unimpaired | No (Presumed to accept) |

| 3(a) | Other Secured Claims against BSC | Unimpaired | No (Presumed to accept) |

| 3(b) | Other Secured Claims against BGI | Unimpaired | No (Presumed to accept) |

| 3(c) | Other Secured Claims against ABI | Unimpaired | No (Presumed to accept) |

| 3(d) | Other Secured Claims against BSI | Unimpaired | No (Presumed to accept) |

| 3(e) | Other Secured Claims against BST | Unimpaired | No (Presumed to accept) |

| 4(a) | General Unsecured Claims against BSC | Impaired | Yes |

| 4(b) | General Unsecured Claims against BGI | Impaired | Yes |

| 4(c) | General Unsecured Claims against ABI | Impaired | Yes |

| 4(d) | General Unsecured Claims against BSI | Impaired | Yes |

| 4(e) | General Unsecured Claims against BST | Impaired | Yes |

| 5(a) | Subordinated Securities Claims against BSC | Impaired | No (Deemed to reject) |

| 5(b) | Subordinated Securities Claims against BGI | Impaired | No (Deemed to reject) |

| 5(c) | Subordinated Securities Claims against ABI | Impaired | No (Deemed to reject) |

| 5(d) | Subordinated Securities Claims against BSI | Impaired | No (Deemed to reject) |

| 5(e) | Subordinated Securities Claims against BST | Impaired | No (Deemed to reject) |

| 6(a) | Intercompany Interests in BGI | Impaired | No (Deemed to reject) |

| 6(b) | Intercompany Interests in ABI | Impaired | No (Deemed to reject) |

| 6(c) | Intercompany Interests in BSI | Impaired | No (Deemed to reject) |

| 6(d) | Intercompany Interests in BST | Impaired | No (Deemed to reject) |

| 7(a) | Equity Interests in BSC | Impaired | No (Deemed to reject) |

iii. Special Provision Governing Unimpaired Claims.

Except as otherwise provided in the Plan, nothing under the Plan shall affect the rights of the Debtors or the Plan Administrator, as applicable, in respect of any Unimpaired Claims, including all rights in respect of legal and equitable defenses to, or setoffs or recoupments against, any such Unimpaired Claims.

iv. Elimination of Vacant Classes.

Any Class of Claims or Interests that, as of the commencement of the Confirmation Hearing, does not have at least one holder of a Claim or Interest that is Allowed in an amount greater than zero for voting purposes shall be considered vacant, deemed eliminated from the Plan for purposes of voting to accept or reject the Plan, and disregarded for purposes of determining whether the Plan satisfies section 1129(a)(8) of the Bankruptcy Code with respect to that Class.

v. Voting Classes; Presumed Acceptance by Non-Voting Classes.

If a Class contains Claims eligible to vote and no holders of Claims eligible to vote in such Class vote to accept or reject the Plan, the Debtors shall request the Bankruptcy Court at the Confirmation Hearing to deem the Plan accepted by the holders of such Claims in such Class.

vi. Confirmation Pursuant to Sections 1129(a)(10) and 1129(b) of the Bankruptcy Code.

The Debtors shall seek Confirmation of the Plan pursuant to section 1129(b) of the Bankruptcy Code with respect to any rejecting Class of Claims or Interests. The Debtors reserve the right to modify the Plan in accordance with Section 12 of the Plan to the extent, if any, that Confirmation pursuant to section 1129(b) of the Bankruptcy Code requires modification, including by modifying the treatment applicable to a Class of Claims or Interests to render such Class of Claims or Interests Unimpaired to the extent permitted by the Bankruptcy Code and the Bankruptcy Rules.

C. Treatment of Claims and Interests

i. Class 1(a) – Priority Tax Claims Against BSC.

(a) Classification: Class 1(a) consists of Priority Tax Claims against BSC.

(b) Treatment: Except to the extent that a holder of an Allowed Priority Tax Claim against BSC agrees to less favorable treatment, each holder of an Allowed Priority Tax Claim against BSC shall receive, in full and final satisfaction of such Allowed Priority Tax Claim against BSC, at the sole option of the Debtors or the Plan Administrator, as applicable, (a) Cash (from the Net Cash Proceeds (BSC)) in an amount equal to such Allowed Priority Tax Claim against BSC on, or as soon thereafter as is reasonably practicable, the later of (i) the Effective Date, to the extent such Claim is an Allowed Priority Tax Claim against BSC on the Effective Date; (ii) the first Business Day after the date that is forty-five (45) calendar days after the date such Priority Tax Claim becomes an Allowed Priority Tax Claim against BSC; and (iii) the date such Allowed Priority Tax Claim against BSC is due and payable in the ordinary course as such obligation becomes due; or (b) equal annual Cash payments (from the Net Cash Proceeds (BSC)) in an aggregate amount equal to the amount of such Allowed Priority Tax Claim against BSC, together with interest at the applicable rate under section 511 of the Bankruptcy Code, over a period not exceeding five (5) years from and after the Petition Date; provided, that the Debtors reserve the right to prepay all or a portion of any such amounts at any time under this option without penalty or premium.

(c) Voting: Class 1(a) is Unimpaired, and holders of Priority Tax Claims against BSC are conclusively presumed to have accepted the Plan pursuant to section 1126(f) of the Bankruptcy Code. Therefore, holders of Priority Tax Claims against BSC are not entitled to vote to accept or reject the Plan, and the votes of such holders will not be solicited with respect to such Priority Tax Claims against BSC.

ii. Class 1(b) – Priority Tax Claims Against BGI.

(a) Classification: Class 1(b) consists of Priority Tax Claims against BGI.

(b) Treatment: Except to the extent that a holder of an Allowed Priority Tax Claim against BGI agrees to less favorable treatment, each holder of an Allowed Priority Tax Claim against BGI shall receive, in full and final satisfaction of such Allowed Priority Tax Claim against BGI, at the sole option of the Debtors or the Plan Administrator, as applicable, (a) Cash (from the Net Cash Proceeds (BGI)) in an amount equal to such Allowed Priority Tax Claim against BGI on, or as soon thereafter as is reasonably practicable, the later of (i) the Effective Date, to the extent such Claim is an Allowed Priority Tax Claim against BGI on the Effective Date; (ii) the first Business Day after the date that is forty-five (45) calendar days after the date such Priority Tax Claim becomes an Allowed Priority Tax Claim against BGI; and (iii) the date such Allowed Priority Tax Claim against BGI is due and payable in the ordinary course as such obligation becomes due; or (b) equal annual Cash (from the Net Cash Proceeds (BGI)) payments in an aggregate amount equal to the amount of such Allowed Priority Tax Claim against BGI, together with interest at the applicable rate under section 511 of the Bankruptcy Code, over a period not exceeding five (5) years from and after the Petition Date; provided, that the Debtors reserve the right to prepay all or a portion of any such amounts at any time under this option without penalty or premium.

(c) Voting: Class 1(b) is Unimpaired, and holders of Priority Tax Claims against BGI are conclusively presumed to have accepted the Plan pursuant to section 1126(f) of the Bankruptcy Code. Therefore, holders of Priority Tax Claims against BGI are not entitled to vote to accept or reject the Plan, and the votes of such holders will not be solicited with respect to such Priority Tax Claims against BGI.

iii. Class 1(c) – Priority Tax Claims Against ABI.

(a) Classification: Class 1(c) consists of Priority Tax Claims against ABI.

(b) Treatment: Except to the extent that a holder of an Allowed Priority Tax Claim against ABI agrees to less favorable treatment, each holder of an Allowed Priority Tax Claim against ABI shall receive, in full and final satisfaction of such Allowed Priority Tax Claim against ABI, at the sole option of the Debtors or the Plan Administrator, as applicable, (a) Cash (from the Net Cash Proceeds (ABI)) in an amount equal to such Allowed Priority Tax Claim against ABI on, or as soon thereafter as is reasonably practicable, the later of (i) the Effective Date, to the extent such Claim is an Allowed Priority Tax Claim against ABI on the Effective Date; (ii) the first Business Day after the date that is forty-five (45) calendar days after the date such Priority Tax Claim becomes an Allowed Priority Tax Claim against ABI; and (iii) the date such Allowed Priority Tax Claim against ABI is due and payable in the ordinary course as such obligation becomes due; or (b) equal annual Cash payments (from the Net Cash Proceeds (ABI)) in an aggregate amount equal to the amount of such Allowed Priority Tax Claim against ABI, together with interest at the applicable rate under section 511 of the Bankruptcy Code, over a period not exceeding five (5) years from and after the Petition Date; provided, that the Debtors reserve the right to prepay all or a portion of any such amounts at any time under this option without penalty or premium.

(c) Voting: Class 1(c) is Unimpaired, and holders of Priority Tax Claims against ABI are conclusively presumed to have accepted the Plan pursuant to section 1126(f) of the Bankruptcy Code. Therefore, holders of Priority Tax Claims against ABI are not entitled to vote to accept or reject the Plan, and the votes of such holders will not be solicited with respect to such Priority Tax Claims against ABI.

iv. Class 1(d) – Priority Tax Claims Against BSI.

(a) Classification: Class 1(d) consists of Priority Tax Claims against BSI.

(b) Treatment: Except to the extent that a holder of an Allowed Priority Tax Claim against BSI agrees to less favorable treatment, each holder of an Allowed Priority Tax Claim against BSI shall receive, in full and final satisfaction of such Allowed Priority Tax Claim against BSI, at the sole option of the Debtors or the Plan Administrator, as applicable, (a) Cash (from the Net Cash Proceeds (BSI)) in an amount equal to such Allowed Priority Tax Claim against BSI on, or as soon thereafter as is reasonably practicable, the later of (i) the Effective Date, to the extent such Claim is an Allowed Priority Tax Claim against BSI on the Effective Date; (ii) the first Business Day after the date that is forty-five (45) calendar days after the date such Priority Tax Claim becomes an Allowed Priority Tax Claim against BSI; and (iii) the date such Allowed Priority Tax Claim against BSI is due and payable in the ordinary course as such obligation becomes due; or (b) equal annual Cash payments (from the Net Cash Proceeds (BSI)) in an aggregate amount equal to the amount of such Allowed Priority Tax Claim against BSI, together with interest at the applicable rate under section 511 of the Bankruptcy Code, over a period not exceeding five (5) years from and after the Petition Date; provided, that the Debtors reserve the right to prepay all or a portion of any such amounts at any time under this option without penalty or premium.

(c) Voting: Class 1(d) is Unimpaired, and holders of Priority Tax Claims against BSI are conclusively presumed to have accepted the Plan pursuant to section 1126(f) of the Bankruptcy Code. Therefore, holders of Priority Tax Claims against BSI are not entitled to vote to accept or reject the Plan, and the votes of such holders will not be solicited with respect to such Priority Tax Claims against BSI.

v. Class 1(e) – Priority Tax Claims Against BST.

(a) Classification: Class 1(e) consists of Priority Tax Claims against BST.

(b) Treatment: Except to the extent that a holder of an Allowed Priority Tax Claim against BST agrees to less favorable treatment, each holder of an Allowed Priority Tax Claim against BST shall receive, in full and final satisfaction of such Allowed Priority Tax Claim against BST, at the sole option of the Debtors or the Plan Administrator, as applicable, (a) Cash (from the Net Cash Proceeds (BST)) in an amount equal to such Allowed Priority Tax Claim against BST on, or as soon thereafter as is reasonably practicable, the later of (i) the Effective Date, to the extent such Claim is an Allowed Priority Tax Claim against BST on the Effective Date; (ii) the first Business Day after the date that is forty-five (45) calendar days after the date such Priority Tax Claim becomes an Allowed Priority Tax Claim against BST; and (iii) the date such Allowed Priority Tax Claim against BST is due and payable in the ordinary course as such obligation becomes due; or (b) equal annual Cash payments (from the Net Cash Proceeds (BST)) in an aggregate amount equal to the amount of such Allowed Priority Tax Claim against BST, together with interest at the applicable rate under section 511 of the Bankruptcy Code, over a period not exceeding five (5) years from and after the Petition Date; provided, that the Debtors reserve the right to prepay all or a portion of any such amounts at any time under this option without penalty or premium.

(c) Voting: Class 1(e) is Unimpaired, and holders of Priority Tax Claims against BST are conclusively presumed to have accepted the Plan pursuant to section 1126(f) of the Bankruptcy Code. Therefore, holders of Priority Tax Claims against BST are not entitled to vote to accept or reject the Plan, and the votes of such holders will not be solicited with respect to such Priority Tax Claims against BST.

vi. Class 2(a) – Priority Non-Tax Claims Against BSC.

(a) Classification: Class 2(a) consists of Priority Non-Tax Claims against BSC.

(b) Treatment: Except to the extent that a holder of an Allowed Priority Non-Tax Claim against BSC agrees to less favorable treatment, on or as soon as practicable after the Effective Date, each holder thereof shall be paid in full in Cash (from the Net Cash Proceeds (BSC)) or otherwise receive treatment consistent with the provisions of section 1129(a)(9) of the Bankruptcy Code.

(c) Voting: Class 2(a) is Unimpaired, and holders of Priority Non-Tax Claims against BSC are conclusively presumed to have accepted the Plan pursuant to section 1126(f) of the Bankruptcy Code. Therefore, holders of Priority Non-Tax Claims against BSC are not entitled to vote to accept or reject the Plan, and the votes of such holders will not be solicited with respect to such Priority Non-Tax Claims against BSC.

vii. Class 2(b) – Priority Non-Tax Claims Against BGI.

(a) Classification: Class 2(b) consists of Priority Non-Tax Claims against BGI.

(b) Treatment: Except to the extent that a holder of an Allowed Priority Non-Tax Claim against BGI agrees to less favorable treatment, on or as soon as practicable after the Effective Date, each holder thereof shall be paid in full in Cash (from the Net Cash Proceeds (BGI)) or otherwise receive treatment consistent with the provisions of section 1129(a)(9) of the Bankruptcy Code.

(c) Voting: Class 2(b) is Unimpaired, and holders of Priority Non-Tax Claims against BGI are conclusively presumed to have accepted the Plan pursuant to section 1126(f) of the Bankruptcy Code. Therefore, holders of Priority Non-Tax Claims against BGI are not entitled to vote to accept or reject the Plan, and the votes of such holders will not be solicited with respect to such Priority Non-Tax Claims against BGI.

viii. Class 2(c) – Priority Non-Tax Claims Against ABI.

(a) Classification: Class 2(c) consists of Priority Non-Tax Claims against ABI.

(b) Treatment: Except to the extent that a holder of an Allowed Priority Non-Tax Claim against ABI agrees to less favorable treatment, on or as soon as practicable after the Effective Date, each holder thereof shall be paid in full in Cash (from the Net Cash Proceeds (ABI)) or otherwise receive treatment consistent with the provisions of section 1129(a)(9) of the Bankruptcy Code.

(c) Voting: Class 2(c) is Unimpaired, and holders of Priority Non-Tax Claims against ABI are conclusively presumed to have accepted the Plan pursuant to section 1126(f) of the Bankruptcy Code. Therefore, holders of Priority Non-Tax Claims against ABI are not entitled to vote to accept or reject the Plan, and the votes of such holders will not be solicited with respect to such Priority Non-Tax Claims against ABI.

ix. Class 2(d) – Priority Non-Tax Claims Against BSI.

(a) Classification: Class 2(d) consists of Priority Non-Tax Claims against BSI.

(b) Treatment: Except to the extent that a holder of an Allowed Priority Non-Tax Claim against BSI agrees to less favorable treatment, on or as soon as practicable after the Effective Date, each holder thereof shall be paid in full in Cash (from the Net Cash Proceeds (BSI)) or otherwise receive treatment consistent with the provisions of section 1129(a)(9) of the Bankruptcy Code.

(c) Voting: Class 2(d) is Unimpaired, and holders of Priority Non-Tax Claims against BSI are conclusively presumed to have accepted the Plan pursuant to section 1126(f) of the Bankruptcy Code. Therefore, holders of Priority Non-Tax Claims against BSI are not entitled to vote to accept or reject the Plan, and the votes of such holders will not be solicited with respect to such Priority Non-Tax Claims against BSI.

x. Class 2(e) – Priority Non-Tax Claims Against BST.

(a) Classification: Class 2(e) consists of Priority Non-Tax Claims against BST.

(b) Treatment: Except to the extent that a holder of an Allowed Priority Non-Tax Claim against BST agrees to less favorable treatment, on or as soon as practicable after the Effective Date, each holder thereof shall be paid in full in Cash (from the Net Cash Proceeds (BST)) or otherwise receive treatment consistent with the provisions of section 1129(a)(9) of the Bankruptcy Code.

(c) Voting: Class 2(e) is Unimpaired, and holders of Priority Non-Tax Claims against BST are conclusively presumed to have accepted the Plan pursuant to section 1126(f) of the Bankruptcy Code. Therefore, holders of Priority Non-Tax Claims against BST are not entitled to vote to accept or reject the Plan, and the votes of such holders will not be solicited with respect to such Priority Non-Tax Claims against BST.

xi. Class 3(a) – Other Secured Claims Against BSC.

(a) Classification: Class 3(a) consists of Other Secured Claims against BSC. To the extent that Other Secured Claims against BSC are secured by different collateral or different interests in the same collateral, such Claims shall be treated as separate subclasses of Class 3(a).

(b) Treatment:

(i) Except to the extent that a holder of an Allowed Other Secured Claim against BSC agrees to different treatment, on the later of the Effective Date and the date that is thirty (30) days after the date such Other Secured Claim against BSC becomes an Allowed Claim, or as soon thereafter as is reasonably practicable, each holder of an Allowed Other Secured Claim against BSC will receive, on account of such Allowed Claim, at the sole option of the Debtors or the Plan Administrator, as applicable: (i) Cash (from the Net Cash Proceeds (BSC)) in an amount equal to the Allowed amount of such Claim; (ii) such other treatment sufficient to render such holder’s Allowed Other Secured Claim against BSC Unimpaired; or (iii) return of the applicable collateral in satisfaction of the Allowed amount of such Other Secured Claim against BSC.

(ii) Except as otherwise specifically provided in the Plan, upon the payment in full in Cash of an Other Secured Claim against BSC, any Lien securing an Other Secured Claim against BSC that is paid in full, in Cash, shall be deemed released, and the holder of such Other Secured Claim against BSC shall be authorized and directed to release any collateral or other property of the Debtors (including any Cash collateral) held by such holder and to take such actions as may be requested by the Plan Administrator, to evidence the release of such Lien, including the execution, delivery and filing or recording of such releases as may be requested by the Plan Administrator.

(c) Voting: Class 3(a) is Unimpaired, and holders of Other Secured Claims against BSC are conclusively presumed to have accepted the Plan pursuant to section 1126(f) of the Bankruptcy Code. Therefore, holders of Other Secured Claims against BSC are not entitled to vote to accept or reject the Plan, and the votes of such holders will not be solicited with respect to such Other Secured Claims against BSC.

xii. Class 3(b) – Other Secured Claims Against BGI.

(a) Classification: Class 3(b) consists of Other Secured Claims against BGI. To the extent that Other Secured Claims against BGI are secured by different collateral or different interests in the same collateral, such Claims shall be treated as separate subclasses of Class 3(b).

(b) Treatment:

(i) Except to the extent that a holder of an Allowed Other Secured Claim against BGI agrees to different treatment, on the later of the Effective Date and the date that is thirty (30) days after the date such Other Secured Claim against BGI becomes an Allowed Claim, or as soon thereafter as is reasonably practicable, each holder of an Allowed Other Secured Claim against BGI will receive, on account of such Allowed Claim, at the sole option of the Debtors or the Plan Administrator, as applicable: (i) Cash (from the Net Cash Proceeds (BGI)) in an amount equal to the Allowed amount of such Claim; (ii) such other treatment sufficient to render such holder’s Allowed Other Secured Claim against BGI Unimpaired; or (iii) return of the applicable collateral in satisfaction of the Allowed amount of such Other Secured Claim against BGI.

(ii) Except as otherwise specifically provided in the Plan, upon the payment in full in Cash of an Other Secured Claim against BGI, any Lien securing an Other Secured Claim against BGI that is paid in full, in Cash, shall be deemed released, and the holder of such Other Secured Claim against BGI shall be authorized and directed to release any collateral or other property of the Debtors (including any Cash collateral) held by such holder and to take such actions as may be requested by the Plan Administrator, to evidence the release of such Lien, including the execution, delivery and filing or recording of such releases as may be requested by the Plan Administrator.

(c) Voting: Class 3(b) is Unimpaired, and holders of Other Secured Claims against BGI are conclusively presumed to have accepted the Plan pursuant to section 1126(f) of the Bankruptcy Code. Therefore, holders of Other Secured Claims against BGI are not entitled to vote to accept or reject the Plan, and the votes of such holders will not be solicited with respect to such Other Secured Claims against BGI.

xiii. Class 3(c) – Other Secured Claims Against ABI.

(a) Classification: Class 3(c) consists of Other Secured Claims against ABI. To the extent that Other Secured Claims against ABI are secured by different collateral or different interests in the same collateral, such Claims shall be treated as separate subclasses of Class 3(c).

(b) Treatment:

(i) Except to the extent that a holder of an Allowed Other Secured Claim against ABI agrees to different treatment, on the later of the Effective Date and the date that is thirty (30) days after the date such Other Secured Claim against ABI becomes an Allowed Claim, or as soon thereafter as is reasonably practicable, each holder of an Allowed Other Secured Claim against ABI will receive, on account of such Allowed Claim, at the sole option of the Debtors or the Plan Administrator, as applicable: (i) Cash (from the Net Cash Proceeds (ABI)) in an amount equal to the Allowed amount of such Claim; (ii) such other treatment sufficient to render such holder’s Allowed Other Secured Claim against ABI Unimpaired; or (iii) return of the applicable collateral in satisfaction of the Allowed amount of such Other Secured Claim against ABI.

(ii) Except as otherwise specifically provided in the Plan, upon the payment in full in Cash of an Other Secured Claim against ABI, any Lien securing an Other Secured Claim against ABI that is paid in full, in Cash, shall be deemed released, and the holder of such Other Secured Claim against ABI shall be authorized and directed to release any collateral or other property of the Debtors (including any Cash collateral) held by such holder and to take such actions as may be requested by the Plan Administrator, to evidence the release of such Lien, including the execution, delivery and filing or recording of such releases as may be requested by the Plan Administrator.

(c) Voting: Class 3(c) is Unimpaired, and holders of Other Secured Claims against ABI are conclusively presumed to have accepted the Plan pursuant to section 1126(f) of the Bankruptcy Code. Therefore, holders of Other Secured Claims against ABI are not entitled to vote to accept or reject the Plan, and the votes of such holders will not be solicited with respect to such Other Secured Claims against ABI.

xiv. Class 3(d) – Other Secured Claims Against BSI.

(a) Classification: Class 3(d) consists of Other Secured Claims against BSI. To the extent that Other Secured Claims against BSI are secured by different collateral or different interests in the same collateral, such Claims shall be treated as separate subclasses of Class 3(d).

(b) Treatment:

(i) Except to the extent that a holder of an Allowed Other Secured Claim against BSI agrees to different treatment, on the later of the Effective Date and the date that is thirty (30) days after the date such Other Secured Claim against BSI becomes an Allowed Claim, or as soon thereafter as is reasonably practicable, each holder of an Allowed Other Secured Claim against BSI will receive, on account of such Allowed Claim, at the sole option of the Debtors or the Plan Administrator, as applicable: (i) Cash (from the Net Cash Proceeds (BSI)) in an amount equal to the Allowed amount of such Claim; (ii) such other treatment sufficient to render such holder’s Allowed Other Secured Claim against BSI Unimpaired; or (iii) return of the applicable collateral in satisfaction of the Allowed amount of such Other Secured Claim against BSI.

(ii) Except as otherwise specifically provided the Plan, upon the payment in full in Cash of an Other Secured Claim against BSI, any Lien securing an Other Secured Claim against BSI that is paid in full, in Cash, shall be deemed released, and the holder of such Other Secured Claim against BSI shall be authorized and directed to release any collateral or other property of the Debtors (including any Cash collateral) held by such holder and to take such actions as may be requested by the Plan Administrator, to evidence the release of such Lien, including the execution, delivery and filing or recording of such releases as may be requested by the Plan Administrator.

(c) Voting: Class 3(d) is Unimpaired, and holders of Other Secured Claims against BSI are conclusively presumed to have accepted the Plan pursuant to section 1126(f) of the Bankruptcy Code. Therefore, holders of Other Secured Claims against BSI are not entitled to vote to accept or reject the Plan, and the votes of such holders will not be solicited with respect to such Other Secured Claims against BSI.

xv. Class 3(e) – Other Secured Claims Against BST.

(a) Classification: Class 3(e) consists of Other Secured Claims against BST. To the extent that Other Secured Claims against BST are secured by different collateral or different interests in the same collateral, such Claims shall be treated as separate subclasses of Class 3(e).

(b) Treatment:

(i) Except to the extent that a holder of an Allowed Other Secured Claim against BST agrees to different treatment, on the later of the Effective Date and the date that is thirty (30) days after the date such Other Secured Claim against BST becomes an Allowed Claim, or as soon thereafter as is reasonably practicable, each holder of an Allowed Other Secured Claim against BST will receive, on account of such Allowed Claim, at the sole option of the Debtors or the Plan Administrator, as applicable: (i) Cash (from the Net Cash Proceeds (BST)) in an amount equal to the Allowed amount of such Claim; (ii) such other treatment sufficient to render such holder’s Allowed Other Secured Claim against BST Unimpaired; or (iii) return of the applicable collateral in satisfaction of the Allowed amount of such Other Secured Claim against BST.

(ii) Except as otherwise specifically provided in the Plan, upon the payment in full in Cash of an Other Secured Claim against BST, any Lien securing an Other Secured Claim against BST that is paid in full, in Cash, shall be deemed released, and the holder of such Other Secured Claim against BST shall be authorized and directed to release any collateral or other property of the Debtors (including any Cash collateral) held by such holder and to take such actions as may be requested by the Plan Administrator, to evidence the release of such Lien, including the execution, delivery and filing or recording of such releases as may be requested by the Plan Administrator.

(c) Voting: Class 3(e) is Unimpaired, and holders of Other Secured Claims against BST are conclusively presumed to have accepted the Plan pursuant to section 1126(f) of the Bankruptcy Code. Therefore, holders of Other Secured Claims against BST are not entitled to vote to accept or reject the Plan, and the votes of such holders will not be solicited with respect to such Other Secured Claims against BST.

xvi. Class 4(a) – General Unsecured Claims Against BSC.

(a) Classification: Class 4(a) consists of General Unsecured Claims against BSC.

(b) Treatment:

Except to the extent that a holder of an Allowed General Unsecured Claim against BSC agrees to less favorable treatment of such Claim, in full and final satisfaction, compromise, and settlement of and in exchange for such Allowed General Unsecured Claim against BSC, each holder thereof shall receive its Pro Rata share of the Net Cash Proceeds (BSC) after the Priority Tax Claims against BSC, Priority Non-Tax Claims against BSC and the Other Secured Claims against BSC are satisfied (or reserved for) in full in accordance with the Plan, until all Allowed General Unsecured Claims against BSC are satisfied in full in Cash;

provided, however, for purposes of determining the Pro Rata share under the Plan, the PBGC Subordination shall be enforced.

(c) Voting: Class 4(a) is Impaired, and the holders of General Unsecured Claims against BSC are entitled to vote to accept or reject the Plan.

xvii. Class 4(b) – General Unsecured Claims Against BGI.

(a) Classification: Class 4(b) consists of General Unsecured Claims against BGI.

(b) Treatment: Except to the extent that a holder of an Allowed General Unsecured Claim against BGI agrees to less favorable treatment of such Claim, in full and final satisfaction, compromise, and settlement of and in exchange for such Allowed General Unsecured Claim against BGI, each holder thereof shall receive its Pro Rata share of the Net Cash Proceeds (BGI) after the Priority Tax Claims against BGI, Priority Non-Tax Claims against BGI and the Other Secured Claims against BGI are satisfied (or reserved for) in full in accordance with the Plan, until all Allowed General Unsecured Claims against BGI are satisfied in full in Cash; provided, however, for purposes of determining the Pro Rata share under the Plan, the PBGC Subordination shall be enforced.

(c) Voting: Class 4(b) is Impaired, and the holders of General Unsecured Claims against BGI are entitled to vote to accept or reject the Plan.

xviii. Class 4(c) – General Unsecured Claims Against ABI.

(a) Classification: Class 4(c) consists of General Unsecured Claims against ABI.

(b) Treatment: Except to the extent that a holder of an Allowed General Unsecured Claim against ABI agrees to less favorable treatment of such Claim, in full and final satisfaction, compromise, and settlement of and in exchange for such Allowed General Unsecured Claim against ABI, each holder thereof shall receive its Pro Rata share of the Net Cash Proceeds (ABI) after the Priority Tax Claims against ABI, Priority Non-Tax Claims against ABI and the Other Secured Claims against ABI are satisfied (or reserved for) in full in accordance with the Plan, until all Allowed General Unsecured Claims against ABI are satisfied in full in Cash; provided, however, for purposes of determining the Pro Rata share under the Plan, the PBGC Subordination shall be enforced.

(c) Voting: Class 4(c) is Impaired, and the holders of General Unsecured Claims against ABI are entitled to vote to accept or reject the Plan.

xix. Class 4(d) – General Unsecured Claims Against BSI.

(a) Classification: Class 4(d) consists of General Unsecured Claims against BSI.

(b) Treatment: Except to the extent that a holder of an Allowed General Unsecured Claim against BSI agrees to less favorable treatment of such Claim, in full and final satisfaction, compromise, and settlement of and in exchange for such Allowed General Unsecured Claim against BSI, each holder thereof shall receive its Pro Rata share of the Net Cash Proceeds (BSI) after the Priority Tax Claims against BSI, Priority Non-Tax Claims against BSI and the Other Secured Claims against BSI are satisfied (or reserved for) in full in accordance with the Plan, until all Allowed General Unsecured Claims against BSI are satisfied in full in Cash; provided, however, for purposes of determining the Pro Rata share under the Plan, the PBGC Subordination shall be enforced.

(c) Voting: Class 4(d) is Impaired, and the holders of General Unsecured Claims against BSI are entitled to vote to accept or reject the Plan.

xx. Class 4(e) – General Unsecured Claims Against BST.

(a) Classification: Class 4(e) consists of General Unsecured Claims against BST.

(b) Treatment: Except to the extent that a holder of an Allowed General Unsecured Claim against BST agrees to less favorable treatment of such Claim, in full and final satisfaction, compromise, and settlement of and in exchange for such Allowed General Unsecured Claim against BST, each holder thereof shall receive its Pro Rata share of the Net Cash Proceeds (BST) after the Priority Tax Claims against BST, Priority Non-Tax Claims against BST and the Other Secured Claims against BST are satisfied (or reserved for) in full in accordance with the Plan, until all Allowed General Unsecured Claims against BST are satisfied in full in Cash; provided, however, for purposes of determining the Pro Rata share under the Plan, the PBGC Subordination shall be enforced.

(c) Voting: Class 4(e) is Impaired, and the holders of General Unsecured Claims against BST are entitled to vote to accept or reject the Plan.

xxi. Class 5(a) – Subordinated Securities Claims Against BSC.

(a) Classification: Class 5(a) consists of Subordinated Securities Claims against BSC.

(b) Treatment: On the Effective Date, all Subordinated Securities Claims against BSC shall be deemed cancelled without further action by or order of the Bankruptcy Court, and shall be of no further force and effect, whether surrendered for cancellation or otherwise. Holders of Subordinated Securities Claims against BSC shall not receive or retain any property under the Plan on account of such Subordinated Securities Claims against BSC; provided, however, that in the event that all other Allowed Claims against BSC have been satisfied in full in accordance with the Bankruptcy Code and the Plan, each holder of a Subordinated Securities Claim against BSC may receive its Pro Rata Share of any remaining assets in BSC.

(c) Voting: Class 5(a) is Impaired, and the holders of Subordinated Securities Claims against BSC are conclusively deemed to have rejected the Plan pursuant to section 1126(g) of the Bankruptcy Code. Therefore, holders of Subordinated Securities Claims against BSC are not entitled to vote to accept or reject the Plan, and the votes of such holders will not be solicited with respect to such Subordinated Securities Claims against BSC.

xxii. Class 5(b) – Subordinated Securities Claims Against BGI.

(a) Classification: Class 5(b) consists of Subordinated Securities Claims against BGI.

(b) Treatment: On the Effective Date, all Subordinated Securities Claims against BGI shall be deemed cancelled without further action by or order of the Bankruptcy Court, and shall be of no further force and effect, whether surrendered for cancellation or otherwise. Holders of Subordinated Securities Claims against BGI shall not receive or retain any property under the Plan on account of such Subordinated Securities Claims against BGI; provided, however, that in the event that all other Allowed Claims against BGI have been satisfied in full in accordance with the Bankruptcy Code and the Plan, each holder of a Subordinated Securities Claim against BGI may receive its Pro Rata Share of any remaining assets in BGI.

(c) Voting: Class 5(b) is Impaired, and the holders of Subordinated Securities Claims against BGI are conclusively deemed to have rejected the Plan pursuant to section 1126(g) of the Bankruptcy Code. Therefore, holders of Subordinated Securities Claims against BGI are not entitled to vote to accept or reject the Plan, and the votes of such holders will not be solicited with respect to such Subordinated Securities Claims against BGI.

xxiii. Class 5(c) – Subordinated Securities Claims Against ABI.

(a) Classification: Class 5(c) consists of Subordinated Securities Claims against ABI.

(b) Treatment: On the Effective Date, all Subordinated Securities Claims against ABI shall be deemed cancelled without further action by or order of the Bankruptcy Court, and shall be of no further force and effect, whether surrendered for cancellation or otherwise. Holders of Subordinated Securities Claims against ABI shall not receive or retain any property under the Plan on account of such Subordinated Securities Claims against ABI; provided, however, that in the event that all other Allowed Claims against ABI have been satisfied in full in accordance with the Bankruptcy Code and the Plan, each holder of a Subordinated Securities Claim against ABI may receive its Pro Rata Share of any remaining assets in ABI.

(c) Voting: Class 5(c) is Impaired, and the holders of Subordinated Securities Claims against ABI are conclusively deemed to have rejected the Plan pursuant to section 1126(g) of the Bankruptcy Code. Therefore, holders of Subordinated Securities Claims against ABI are not entitled to vote to accept or reject the Plan, and the votes of such holders will not be solicited with respect to such Subordinated Securities Claims against ABI.

xxiv. Class 5(d) – Subordinated Securities Claims Against BSI.

(a) Classification: Class 5(d) consists of Subordinated Securities Claims against BSI.

(b) Treatment: On the Effective Date, all Subordinated Securities Claims against BSI shall be deemed cancelled without further action by or order of the Bankruptcy Court, and shall be of no further force and effect, whether surrendered for cancellation or otherwise. Holders of Subordinated Securities Claims against BSI shall not receive or retain any property under the Plan on account of such Subordinated Securities Claims against BSI; provided, however, that in the event that all other Allowed Claims against BSI have been satisfied in full in accordance with the Bankruptcy Code and the Plan, each holder of a Subordinated Securities Claim against BSI may receive its Pro Rata Share of any remaining assets in BSI.

(c) Voting: Class 5(d) is Impaired, and the holders of Subordinated Securities Claims against BSI are conclusively deemed to have rejected the Plan pursuant to section 1126(g) of the Bankruptcy Code. Therefore, holders of Subordinated Securities Claims against BSI are not entitled to vote to accept or reject the Plan, and the votes of such holders will not be solicited with respect to such Subordinated Securities Claims against BSI.

xxv. Class 5(e) – Subordinated Securities Claims Against BST.

(a) Classification: Class 5(e) consists of Subordinated Securities Claims against BST.

(b) Treatment: On the Effective Date, all Subordinated Securities Claims against BST shall be deemed cancelled without further action by or order of the Bankruptcy Court, and shall be of no further force and effect, whether surrendered for cancellation or otherwise. Holders of Subordinated Securities Claims against BST shall not receive or retain any property under the Plan on account of such Subordinated Securities Claims against BST; provided, however, that in the event that all other Allowed Claims against BST have been satisfied in full in accordance with the Bankruptcy Code and the Plan, each holder of a Subordinated Securities Claim against BST may receive its Pro Rata Share of any remaining assets in BST.

(c) Voting: Class 5(e) is Impaired, and the holders of Subordinated Securities Claims against BST are conclusively deemed to have rejected the Plan pursuant to section 1126(g) of the Bankruptcy Code. Therefore, holders of Subordinated Securities Claims against BST are not entitled to vote to accept or reject the Plan, and the votes of such holders will not be solicited with respect to such Subordinated Securities Claims against BST.

xxvi. Class 6(a) – Intercompany Interests in BGI.

(a) Classification: Class 6(a) consists of Intercompany Interests in BGI.

(b) Treatment: All Intercompany Interests in BGI shall be cancelled if and when BGI is dissolved in accordance with Section 5.4(f) of the Plan. Each holder of an Intercompany Interest in BGI shall neither receive nor retain any property of the estate or direct interest in property of the estate of BGI on account of such Intercompany Interests thereafter; provided, however, that in the event that all Allowed Claims against BGI have been satisfied in full in accordance with the Bankruptcy Code and the Plan, each holder of an Intercompany Interest in BGI may receive its Pro Rata Share of any remaining assets in BGI.

(c) Voting: Class 6(a) is Impaired, and the holders of Intercompany Interests in BGI are conclusively deemed to have rejected the Plan pursuant to section 1126(g) of the Bankruptcy Code. Therefore, holders of Intercompany Interests in BSC are not entitled to vote to accept or reject the Plan, and the votes of such holders will not be solicited with respect to such Intercompany Interests.

xxvii. Class 6(b) – Intercompany Interests in ABI.

(a) Classification: Class 6(b) consists of Intercompany Interests in ABI.

(b) Treatment: All Intercompany Interests in ABI shall be cancelled if and when ABI is dissolved in accordance with Section 5.4(f) of the Plan. Each holder of an Intercompany Interest in ABI shall neither receive nor retain any property of the estate or direct interest in property of the estate of ABI on account of such Intercompany Interests thereafter; provided, however, that in the event that all Allowed Claims against BGI have been satisfied in full in accordance with the Bankruptcy Code and the Plan, each holder of an Intercompany Interest in ABI may receive its Pro Rata Share of any remaining assets in ABI.

(c) Voting: Class 6(b) is Impaired, and the holders of Intercompany Interests in ABI are conclusively deemed to have rejected the Plan pursuant to section 1126(g) of the Bankruptcy Code. Therefore, holders of Intercompany Interests in ABI are not entitled to vote to accept or reject the Plan, and the votes of such holders will not be solicited with respect to such Intercompany Interests.

xxviii. Class 6(c) – Intercompany Interests in BSI.

(a) Classification: Class 6(c) consists of Intercompany Interests in BSI.

(b) Treatment: All Intercompany Interests in BSI shall be cancelled if and when BSI is dissolved in accordance with Section 5.4(f) of the Plan. Each holder of an Intercompany Interest in BSI shall neither receive nor retain any property of the estate or direct interest in property of the estate of BSI on account of such Intercompany Interests thereafter; provided, however, that in the event that all Allowed Claims against BSI have been satisfied in full in accordance with the Bankruptcy Code and the Plan, each holder of an Intercompany Interest in BSI may receive its Pro Rata Share of any remaining assets in BSI.

(c) Voting: Class 6(c) is Impaired, and the holders of Intercompany Interests in BSI are conclusively deemed to have rejected the Plan pursuant to section 1126(g) of the Bankruptcy Code. Therefore, holders of Intercompany Interests in BSI are not entitled to vote to accept or reject the Plan, and the votes of such holders will not be solicited with respect to such Intercompany Interests.

xxix. Class 6(d) – Intercompany Interests in BST.

(a) Classification: Class 6(d) consists of Intercompany Interests in BST.

(b) Treatment: All Intercompany Interests in BST shall be cancelled if and when BST is dissolved in accordance with Section 5.4(f) of the Plan. Each holder of an Intercompany Interest in BST shall neither receive nor retain any property of the estate or direct interest in property of the estate of BST on account of such Intercompany Interests thereafter; provided, however, that in the event that all Allowed Claims against BST have been satisfied in full in accordance with the Bankruptcy Code and the Plan, each holder of an Intercompany Interest in BST may receive its Pro Rata Share of any remaining assets in BST.

(c) Voting: Class 6(d) is Impaired, and the holders of Intercompany Interests in BST are conclusively deemed to have rejected the Plan pursuant to section 1126(g) of the Bankruptcy Code. Therefore, holders of Intercompany Interests in BST are not entitled to vote to accept or reject the Plan, and the votes of such holders will not be solicited with respect to such Intercompany Interests.

xxx. Class 7(a) – Equity Interests in BSC.

(a) Classification: Class 7(a) consists of Equity Interests in BSC.

(b) Treatment: On the Effective Date, (i) all Equity Interests in BSC shall be cancelled and one share of BSC common stock (the “Single Share”) shall be issued to the Plan Administrator to hold in trust as custodian for the benefit of the former holders of Equity Interests in BSC consistent with their former relative priority and economic entitlements and the Single Share shall be recorded on the books and records maintained by the Plan Administrator without any necessity for any other or further actions to be taken by or on behalf of BSC; (ii) each former holder of Equity Interests in BSC (through their interest in the Single Share, as applicable) shall neither receive nor retain any property of the Estate or direct interest in property of the Estate on account of such Equity Interests in BSC; provided, that in the event that all Allowed Claims have been satisfied in full in accordance with the Bankruptcy Code and the Plan, each former holder of an Equity Interest in BSC may receive its share of any remaining assets of BSC consistent with such holder’s rights of payment and former relative priority and economic entitlements existing immediately prior to the Petition Date; (iii) unless otherwise determined by the Plan Administrator, on the date that BSC’s Chapter 11 Case is closed in accordance with Section 5.16 of the Plan, the Single Share issued on the Effective Date shall be deemed cancelled and of no further force and effect without any necessity for any other or further actions to be taken by or on behalf of BSC, provided that such cancellation does not adversely impact the Debtors’ Estates; and (iv) the continuing rights of the former holders of Equity Interests in BSC (including through their interest in Single Share or otherwise) shall be nontransferable except (A) by operation of law or (B) for administrative transfers where the ultimate beneficiary has not changed, subject to the Plan Administrator’s consent.

(c) Voting: Class 7(a) is Impaired, and the holders of Equity Interests in BSC are conclusively deemed to have rejected the Plan pursuant to section 1126(g) of the Bankruptcy Code. Therefore, holders of Equity Interests in BSC are not entitled to vote to accept or reject the Plan, and the votes of such holders will not be solicited with respect to such Equity Interests in BSC.

D. Means for Implementation

i. No Substantive Consolidation.

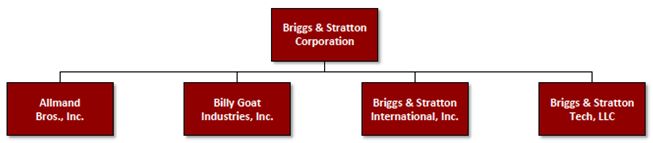

The Plan is being proposed as a joint plan of the Debtors for administrative purposes only and constitutes a separate chapter 11 plan of reorganization for each Debtor. The Plan is not premised upon the substantive consolidation of the Debtors with respect to the Classes of Claims or Interests set forth in the Plan.

ii. Sources of Consideration for Plan Distribution.

The Debtors, the Plan Administrator and the Wind-Down Estates, as applicable, shall fund Distributions under the Plan and the Plan Administrator Agreement with (i) the Sale Transaction Proceeds, and (ii) Cash on hand, including all Cash realized from the Debtors’ business and/or the Wind-Down operations.

The provisions of the Plan, including treatment provided for under the Plan for Allowed General Unsecured Claims, incorporate and reflect a compromise and settlement by and among the Debtors, the Creditors’ Committee, the PBGC, the DIP Lenders, the DIP Agent, and the Purchaser in accordance with the Global Settlement. Pursuant to section 1123(b)(3) of the Bankruptcy Code and Bankruptcy Rule 9019 and in consideration for the distributions and other benefits provided pursuant to the Plan, the provisions of the Plan and the Global Settlement shall constitute a good faith compromise of Claims, Interests, and controversies relating to the contractual, legal, and subordination rights that a holder of a General Unsecured Claim may have with respect to any such Claim or any distribution to be made on account of any such Claim. The entry of the Confirmation Order shall constitute the Bankruptcy Court’s approval of the compromise or settlement of all such Claims, Interests, and controversies, as well as a finding by the Bankruptcy Court that such compromises or settlements are in the best interests of the Debtors, their Estates, and holders of such Claims and Interests, and is fair, equitable, and reasonable.

(a) Appointment. The Confirmation Order shall provide for the appointment of a Plan Administrator. The Plan Administrator shall have all the powers, authority, and responsibilities specified in the Plan Administrator Agreement and as set forth in the Plan. The compensation for the Plan Administrator shall be as set forth in the Plan Administrator Agreement. The Plan Administrator’s retention shall commence on the Effective Date and shall continue until: (i) the Bankruptcy Court enters an order closing the Chapter 11 Cases; (ii) the Bankruptcy Court enters an order removing the Plan Administrator for cause; or (iii) the Plan Administrator’s resignation, removal, liquidation, dissolution, death, or incapacity, as applicable, and the appointment of a successor Plan Administrator in accordance with the Plan Administrator Agreement.

(b) Authority. The Plan Administrator shall have the authority and right on behalf of each of the Debtors, without the need for Bankruptcy Court approval (unless otherwise indicated), to carry out and implement all provisions of the Plan, including, without limitation, to:

(i) subject to Section 7 of the Plan, except to the extent Claims have been previously Allowed, control and effectuate the Claims reconciliation process in accordance with the terms of the Plan, including to object to, seek to subordinate, estimate, compromise or settle any and all Claims against the Debtors or the Wind-Down Estates;

(ii) subject to Section 6 of the Plan, make Distributions to holders of Allowed Claims in accordance with the Plan;

(iii) subject to Section 7.10 of the Plan, determine the amount of the individual SERPs Claims according to the individual actuarial calculations performed by Mercer;

(iv) exercise its reasonable business judgment to direct and control the Wind-Down under the Plan and in accordance with applicable law as necessary to maximize Distributions to holders of Allowed Claims;

(v) abandon any property that, in the Property Administrator’s judgment, is burdensome to the Wind-Down Estates;

(vi) prepare, file, and prosecute any necessary filings or pleadings with the Bankruptcy Court to carry out the duties of the Plan Administrator as described in the Plan;

(vii) other than any Causes of Action released by the Debtors pursuant to the Plan or otherwise, prosecute all Causes of Action on behalf of the Debtors, elect not to pursue any Causes of Action, and determine whether and when to compromise, settle, abandon, dismiss, or otherwise dispose of any such Causes of Action, as the Plan Administrator may determine is in the best interests of the Debtors and their Estates;

(viii) maintain the books and records and accounts of the Debtors and the Wind-Down Estates, as applicable;

(ix) retain professionals to assist in performing its duties under the Plan;

(x) incur and pay reasonable and necessary expenses in connection with the performance of duties under the Plan, including the reasonable fees and expenses of professionals retained by the Plan Administrator;

(xi) administer the tax obligations of each Debtor or Wind-Down Estate, as applicable, including (i) filing tax returns and paying tax obligations, (ii) requesting, if necessary, an expedited determination of any unpaid tax liability of each Debtor or Wind-Down Estate, as applicable, or their estate under Bankruptcy Code section 505(b), for all taxable periods of such Debtor ending after the Petition Date through the liquidation of such Debtor as determined under applicable tax laws, and (iii) representing the interest and account of each Debtor or Wind-Down Estate, or their estate under Bankruptcy Code section 505(b), before any taxing authority in all matters including, without limitation, any action, suit, proceeding or audit;

(xii) prepare and file any and all informational returns, reports, statements, returns or disclosures relating to the Debtors or the Wind-Down Estates, as applicable, that are required under the Plan, by any Governmental Unit or applicable law;

(xiii) determine whether to create a liquidating trust for the assets of a Debtor and which assets to transfer to such liquidating trust;

(xiv) pay statutory fees in accordance with Section 12.1 of the Plan;

(xv) take all actions that the Plan Administrator reasonably deems necessary to protect and increase the value of Debtors’ Assets and perform other duties and functions that are consistent with the implementation of the Plan;

(xvi) perform all duties and functions of the Disbursing Agent as set forth in the Plan; and

(xvii) close the Chapter 11 Cases.

(c) Boards of Directors and Officers. The officers and directors of the Debtors existing prior to the Effective Date shall be relieved of any and all duties with the respect to the Debtors as of the Effective Date without the need for them to resign or take any other action. The Plan Administrator shall serve as the initial director or manager, as applicable, and sole officer of each Wind-Down Estate after the Effective Date. The Plan Administrator shall elect such additional directors, managers and officers as the Plan Administrator deems necessary to implement the Plan and the actions contemplated in the Plan. The Plan Administrator shall also have the power to act by written consent to remove any director, manager, or officer of any Wind-Down Estate.

(d) Wind-Down.

(i) After the Effective Date, pursuant to the Plan, the Plan Administrator shall effectuate the Wind-Down in accordance with the Wind-Down Budget without any further approval by the Bankruptcy Court and free of any restrictions of the Bankruptcy Code or Bankruptcy Rules.

(ii) The Plan Administrator shall periodically review the Wind-Down Budget and make any necessary adjustments to the Wind-Down Budget to maintain sufficient funds to properly fund the Wind-Down; provided, that if the Plan Administrator concludes at any time that the Wind-Down Budget exceeds the amounts necessary to properly fund the Wind-Down, the Plan Administrator shall be authorized to move any excess amounts out of the Wind-Down Budget and consider them Net Cash Proceeds; provided, further, that if any Sale Transaction Proceeds or other funds are received by the Wind-Down Estates or the Plan Administrator, as applicable, after the Effective Date, the Plan Administrator shall allocate any portion of such proceeds for the Wind-Down Budget as it deems necessary to properly fund the Wind-Down and the rest of the proceeds shall be considered Net Cash Proceeds.

(iii) The Plan Administrator shall keep good records of: (a) the funds that are in the Wind-Down Budget, (b) Net Cash Proceeds for each Debtor, (c) any funds reserved for payment of Allowed Administrative Expense Claims, and (d) any funds reserved for Disputed Claims; provided, that the Plan Administrator shall not be required to keep Cash in separate accounts or reserves for such purposes.

(iv) The Wind-Down (as determined for federal income tax purposes) shall occur in an expeditious but orderly manner after the Effective Date.

(e) Indemnification. Each of the Wind-Down Estates shall indemnify and hold harmless the Plan Administrator solely in its capacity as the Plan Administrator and any professionals retained by the Plan Administrator for any losses incurred in such capacity, except to the extent such losses were the result of the Plan Administrator’s or its professionals’ bad faith, gross negligence, willful misconduct, or criminal conduct.

(f) Dissolution. After the Effective Date, the Plan Administrator shall, subject to applicable non-bankruptcy law and consistent with the implementation of the Plan and the Plan Administrator Agreement, merge, dissolve, liquidate, or take such other similar action with respect to each Debtor (including the cancellation of all Interests in a Wind-Down Estate) and complete the winding up of such Wind-Down Estate as expeditiously as practicable without the necessity for any other or further actions to be taken by or on behalf of such Wind-Down Estate or its shareholders or members, as applicable, or any payments to be made in connection therewith subject to the filing of a certificate of dissolution with the appropriate Governmental Unit; provided, however, that the foregoing does not limit the Plan Administrator’s ability to otherwise abandon an Interest in a Wind-Down Estate. The Plan Administrator may, to the extent required by applicable non-bankruptcy law, maintain a Wind-Down Estate as a corporate entity in good standing until such time as such Wind-Down Estate is dissolved or merged out of existence in accordance with the Plan.

v. Liquidating Trust.

In the event the Plan Administrator determines that the Wind-Down of a Debtor shall take the form of a liquidating trust, (1) the terms of the liquidating trust shall be set forth in a liquidating trust agreement, (2) the liquidating trust shall be structured to qualify as a “liquidating trust” within the meaning of Treasury Regulations section 301.7701-4(d) and in compliance with Revenue Procedure 94-45, 1994-2 C.B. 684, and, thus, as a “grantor trust” within the meaning of sections 671 through 679 of the Tax Code of which the holders of Claims who become the liquidating trust beneficiaries (as determined for U.S. federal income tax purposes) are the owners and grantors, consistent with the terms of the Plan, (3) the sole purpose of the liquidating trust shall be the liquidation and distribution of the assets transferred to the liquidating trust in accordance with Treasury Regulations section 301.7701-4(d), including the resolution of Claims, with no objective to continue or engage in the conduct of a trade or business, (4) all parties (including the Debtors, holders of Claims, the Creditors’ Committee, and the trustee of the liquidating trust) shall report consistently with such treatment (including the deemed receipt of the underlying assets, subject to applicable liabilities and obligations, by the holders of Allowed Claims, as applicable, followed by the deemed transfer of such assets to the liquidating trust), (5) all parties shall report consistently with the valuation of the assets transferred to the liquidating trust as determined by the trustee of the liquidating trust (or its designee), (6) the trustee of the liquidating trust shall be responsible for filing returns for the trust as a grantor trust pursuant to Treasury Regulations section 1.671-4(a), and (7) the trustee of the liquidating trust shall annually send to each holder of an interest in the liquidating trust a separate statement regarding the receipts and expenditures of the trust as relevant for U.S. federal income tax purposes.

Subject to definitive guidance from the Internal Revenue Service or a court of competent jurisdiction to the contrary (including the receipt by the trustee of the liquidating trust of a private letter ruling if the trustee so requests one, or the receipt of an adverse determination by the Internal Revenue Service upon audit if not contested by the trustee), the trustee of the liquidating trust may timely elect to (y) treat any portion of the liquidating trust allocable to Disputed Claims as a “disputed ownership fund” governed by Treasury Regulations section 1.468B-9 (and make any appropriate elections) and (z) to the extent permitted by applicable law, report consistently with the foregoing for state and local income tax purposes. If a “disputed ownership fund” election is made, (i) all parties (including the Debtors, holders of Claims, the Creditors’ Committee, and the trustee of the liquidating trust) shall report for U.S. federal, state, and local income tax purposes consistently with the foregoing, and (ii) any tax imposed on the liquidating trust with respect to assets allocable to Disputed Claims (including any earnings thereon and any gain recognized upon the actual or deemed disposition of such assets) will be payable out of such assets and, in the event of insufficient Cash to pay any such taxes, the trustee of the liquidating trust may sell all or part of such assets to pay the taxes. The trustee of the liquidating trust may request an expedited determination of taxes of the liquidating trust, including any reserve for Disputed Claims, under section 505(b) of the Bankruptcy Code for all tax returns filed for, or on behalf of, the liquidating trust for all taxable periods through the dissolution of the liquidating trust.

Upon the Effective Date, by virtue of entry of the Confirmation Order, all actions contemplated by the Plan (including any action to be undertaken by the Plan Administrator) shall be deemed authorized, approved, and, to the extent taken prior to the Effective Date, ratified without any requirement for further action by holders of Claims or Interests, the Debtors, or any other Entity or Person. All matters provided for in the Plan involving the corporate structure of the Debtors, and any corporate action required by the Debtors in connection therewith, shall be deemed to have occurred and shall be in effect as of the Effective Date, without any requirement of further action by the Debtors or the Estates.

vii. Withholding and Reporting Requirements.

(a) Withholding Rights. In connection with the Plan, any party issuing any instrument or making any distribution described in the Plan shall comply with all applicable withholding and reporting requirements imposed by any federal, state, or local taxing authority, and all distributions pursuant to the Plan and all related agreements shall be subject to any such withholding or reporting requirements. Any amounts withheld pursuant to the preceding sentence shall be deemed to have been distributed to and received by the applicable recipient for all purposes of the Plan. Notwithstanding the foregoing, each holder of an Allowed Claim or any other Person that receives a distribution pursuant to the Plan shall have responsibility for any taxes imposed by any Governmental Unit, including, without limitation, income, withholding, and other taxes, on account of such distribution. Any party issuing any instrument or making any distribution pursuant to the Plan has the right, but not the obligation, to not make a distribution until such holder has made arrangements satisfactory to such issuing or disbursing party for payment of any such tax obligations. Additionally, in the case of a non-Cash distribution that is subject to withholding, the distributing party has the right, but not the obligation, to withhold an appropriate portion of such distributed property and either (i) sell such withheld property to generate Cash necessary to pay over the withholding tax (or reimburse the distributing party for any advance payment of the withholding tax), or (ii) pay the withholding tax using its own funds and retain such withheld property.

(b) Forms. Any party entitled to receive any property as an issuance or distribution under the Plan shall, upon request, deliver to the Plan Administrator or the Wind-Down Estates, or such other Person designated by the Plan Administrator or the Wind-Down Estates, Form W-9 or, if the payee is a foreign Person, an applicable Form W-8, unless such Person is exempt under the Tax Code and so notifies the Plan Administrator. If such request is made by the Plan Administrator or the Wind-Down Estates, or such other Person designated by the Plan Administrator or the Wind-Down Estates, and the holder fails to comply within ninety (90) days after not less than two (2) requests have been made, the amount of such distribution shall irrevocably revert to the applicable Wind-Down Estate and any Claim in respect of such distribution shall be forever barred from assertion against any Debtor, the applicable Wind-Down Estate and their respective property.

viii. Exemption From Certain Transfer Taxes.

To the maximum extent provided by section 1146(a) of the Bankruptcy Code: (i) the issuance, distribution, transfer, or exchange of any debt, equity security, or other interest in the Debtors or the Wind-Down Estates, as applicable; or (ii) the making, delivery, or recording of any deed or other instrument of transfer under, in furtherance of, or in connection with, the Plan, including any deeds, bills of sale, assignments, or other instruments of transfer executed in connection with any transaction arising out of, contemplated by, or in any way related to the Plan, shall not be subject to any document recording tax, stamp tax, conveyance fee, intangibles or similar tax, mortgage tax, real estate transfer tax, mortgage recording tax, Uniform Commercial Code filing or recording fee, or other similar tax or governmental assessment, in each case to the extent permitted by applicable bankruptcy law, and the appropriate state or local government officials or agents shall forego collection of any such tax or governmental assessment and accept for filing and recordation any of the foregoing instruments or other documents without the payment of any such tax or governmental assessment.

ix. Effectuating Documents; Further Transactions.

(a) On or as soon as practicable after the Effective Date, the Plan Administrator shall take such actions as may be or become necessary or appropriate to effect any transaction described in, approved by, contemplated by, or necessary to effectuate the Plan, including (i) the execution and delivery of appropriate agreements or other documents of merger, consolidation, restructuring, financing, conversion, disposition, transfer, dissolution, transition services, or liquidation containing terms that are consistent with the terms of the Plan and that satisfy the applicable requirements of applicable law and any other terms to which the applicable Entities may determine; (ii) the execution and delivery of appropriate instruments of transfer, assignment, assumption, or delegation of any Asset, property, right, liability, debt, or obligation on terms consistent with the terms of the Plan and having other terms to which the applicable parties agree; (iii) the filing of appropriate certificates or articles of incorporation, reincorporation, merger, consolidation, conversion, or dissolution pursuant to applicable state law; (iv) the issuance of securities, all of which shall be authorized and approved in all respects, in each case, without further action being required under applicable law, regulation, order, or rule; (v) the execution, delivery, or filing of contracts, instruments, releases, and other agreements to effectuate and implement the Plan without the need for any approvals, authorizations, actions, or consents; and (vi) all other actions that the applicable Entities determine to be necessary or appropriate.

(b) Prior to the Effective Date, each officer, manager, or member of the board of directors of the Debtors, and on or after the Effective Date, each officer, manager, or member of the board of directors of the Wind-Down Estates and the Plan Administrator, as applicable, shall be authorized and directed to issue, execute, deliver, file, or record such contracts, securities, instruments, releases, indentures, and other agreements or documents and take such actions as may be necessary or appropriate to effectuate, implement, and further evidence the terms and conditions of the Plan in the name of, and on behalf of, the Wind-Down Estates, all of which shall be authorized and approved in all respects, in each case, without the need for any approvals, authorization, consents, or any further action required under applicable law, regulation, order, or rule (including, without limitation, any action by the stockholders or directors or managers of the Debtors, or the Wind-Down Estates) except for those expressly required pursuant to the Plan.

(c) The Debtors and the Plan Administrator shall be authorized to implement the Sale Transaction and the Plan in the manner most tax efficient to the Wind-Down Estates.

(d) All matters provided for in the Plan involving the corporate structure of the Debtors or the Wind-Down Estates, to the extent applicable, or any corporate or related action required by the Debtors or the Wind-Down Estates in connection herewith shall be deemed to have occurred and shall be in effect, without any requirement of further action by the stockholders, members, or directors or managers of the Debtors and with like effect as though such action had been taken unanimously by the stockholders, members, directors, managers, or officers, as applicable, of the Debtors or the Wind-Down Estates.

x. Preservation of Rights of Action.

Other than Causes of Action against an Entity that are waived, relinquished, exculpated, released, compromised, transferred or settled pursuant to the Plan, the Confirmation Order, the Sale Order, or by another order of the Bankruptcy Court, the Debtors reserve any and all Causes of Action. On and after the Effective Date, the Plan Administrator may pursue such Causes of Action in its sole discretion. No Entity may rely on the absence of a specific reference in the Plan or this Disclosure Statement to any Cause of Action against them as any indication that the Debtors, the Wind-Down Estates or the Plan Administrator, as applicable, will not pursue any and all available Causes of Action against them. No preclusion doctrine, including the doctrines of res judicata, collateral estoppel, issue preclusion, claim preclusion (judicial, equitable, or otherwise), or laches, shall apply to such Causes of Action upon, after, or as a consequence of the Confirmation or the Effective Date. Prior to the Effective Date, the Debtors, and on and after the Effective Date, the Plan Administrator or the Wind-Down Estates, as applicable, shall retain and shall have, including through its authorized agents or representatives, the exclusive right, authority, and discretion, subject to the Plan, to determine and to initiate, file, prosecute, enforce, abandon, settle, compromise, release, withdraw, or litigate to judgment any such Causes of Action and to decline to do any of the foregoing, as the Plan Administrator and the Wind-Down Estates may determine is in the best interest of the Debtors and their Estates, without the consent or approval of any third party or further notice to or action, order, or approval of the Bankruptcy Court. Notwithstanding anything contained in the Plan to the contrary, the settlement of any Claims and Causes of Action which are expressly to be settled by Confirmation of the Plan shall be resolved only by Confirmation and consummation of the Plan.

xi. Certificate of Incorporation and By-Laws.

As of the Effective Date, the certificate of incorporation and by-laws, or other organizational documents, as applicable, of the Debtors shall be amended to the extent necessary to carry out the provisions of the Plan. Such amended organizational documents (if any) shall be filed with the Bankruptcy Court as part of the Plan Supplement in advance of the Effective Date.

xii. Stock Trading Restrictions.

The restrictions imposed by the Final Order Establishing Notification Procedures and Approving Restrictions on Certain Transfers of Interests in and Claims Against the Debtors (ECF No. 535), as the same may be amended from time to time, shall remain effective and binding through the closing of the Chapter 11 Cases.

xiii. Cancellation of Existing Securities and Agreements

Except for the purpose of evidencing a right to a distribution under the Plan, and except as otherwise set forth in the Plan, all notes, instruments, other securities, and other evidence of debt issued shall be deemed cancelled, discharged, and of no force or effect and the obligations of the Debtors thereunder shall be deemed fully satisfied, released, and discharged.

xiv. Subordinated Claims.

The allowance, classification, and treatment of all Allowed Claims and Interests, and the respective distributions and treatments under the Plan, take into account and conform to the relative priority and rights of the Claims and Interests in each Class in connection with any contractual, legal, and equitable subordination rights relating thereto, whether arising under general principles of equitable subordination, sections 510(b)-(c) of the Bankruptcy Code, or otherwise. Pursuant to section 510 of the Bankruptcy Code, the Debtors reserve the right for the Wind-Down Estates and the Plan Administrator to seek to re-classify any Allowed Claim or Interest in accordance with any contractual, legal, or equitable subordination relating thereto.

xv. Nonconsensual Confirmation.

The Debtors intend to undertake to have the Bankruptcy Court confirm the Plan under section 1129(b) of the Bankruptcy Code as to any Classes that reject or are deemed to reject the Plan.

xvi. Closing of Chapter 11 Cases.

After an Estate has been fully administered, the Wind-Down Estates and Plan Administrator shall seek authority from the Bankruptcy Court to close the applicable Chapter 11 Case(s) in accordance with the Bankruptcy Code and Bankruptcy Rules.

xvii. Notice of Effective Date.

As soon as practicable, but not later than three (3) Business Days following the Effective Date, the Debtors or the Plan Administrator, as applicable, shall file a notice of the occurrence of the Effective Date with the Bankruptcy Court and serve the notice in accordance with the Bankruptcy Rules.

On the Effective Date, each of the Debtors shall maintain its current corporate form, which may be modified or changed at any time after the Effective Date by the Plan Administrator in accordance with the terms of the Plan and applicable law.

Notwithstanding the combination of the separate plans of reorganization for the Debtors set forth in the Plan for administrative purposes of economy and efficiency, the Plan constitutes a separate chapter 11 plan for each Debtor and

is not premised upon the substantive consolidation of the Debtors with respect to the Classes of Claims or Interests set forth in the Plan. Accordingly, if the Bankruptcy Court does not confirm the Plan with respect to one or more Debtors, it may still confirm the Plan with respect to any other Debtor that satisfies the confirmation requirements of section 1129 of the Bankruptcy Code.