UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the registrantx Filed by a party other than the registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Hatteras Financial Corp.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of filing fee (Check the appropriate box.):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined.): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number or the form or schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, schedule, or registration statement no.: |

110 Oakwood Drive, Suite 340

Winston Salem, North Carolina 27103

(336) 760-9331

March 27, 2009

Dear shareholder:

The board of directors and executive officers of Hatteras Financial Corp., a Maryland corporation, join me in extending to you a cordial invitation to attend the 2009 annual meeting of our shareholders. This meeting will be held on Wednesday, May 6, 2009, at 10:00 a.m., local time, at the Old Town Club, 2875 Old Town Club Road, Winston Salem, North Carolina 27106.

Pursuant to rules adopted by the Securities and Exchange Commission, we have provided access to our proxy materials over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials, or Notice, on or about March 27, 2009 to our shareholders of record on March 17, 2009. The Notice contains instructions for your use of this process, including how to access our proxy statement and annual report over the Internet, how to authorize your proxy to vote online and how to request a paper copy of the proxy statement and annual report.

If you are unable to attend the meeting in person, it is very important that your shares be represented and voted at the annual meeting. You may authorize your proxy to vote your shares over the Internet as described in the Notice. Alternatively, if you received a paper copy of the proxy card by mail, please complete, date, sign and promptly return the proxy card in the self-addressed stamped envelope provided. You may also vote by telephone as described in your proxy card. If you vote your shares over the Internet, by mail or by telephone prior to the annual meeting, you may nevertheless revoke your proxy and cast your vote personally at the meeting.

We look forward to seeing you on May 6, 2009.

|

| Sincerely, |

|

|

| Michael R. Hough |

| Chairman of the Board and Chief Executive Officer |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 6, 2009

To our shareholders:

You are cordially invited to attend the 2009 annual meeting of the shareholders of Hatteras Financial Corp., a Maryland corporation, which will be held at the Old Town Club, 2875 Old Town Club Road, Winston Salem, North Carolina 27106, on May 6, 2009 at 10:00 a.m., local time. At the meeting, shareholders will consider and vote on the following matters:

| | 1. | the election of six directors to hold office until our 2010 annual meeting of shareholders and until his or her successor has been duly elected and qualifies; and |

| | 2. | the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the 2009 fiscal year. |

In addition, shareholders will consider and vote on such other business as may properly come before the annual meeting, including any adjournments or postponements of the meeting.

If you own shares of our common stock as of the close of business on March 17, 2009, you can vote those shares by proxy or at the meeting.

Whether or not you plan to attend the meeting in person, please authorize your proxy to vote your shares over the Internet, as described in the Notice of Internet Availability of Proxy Materials, or Notice. Alternatively, if you received a paper copy of the proxy card by mail, please mark, sign, date and promptly return the proxy card in the self-addressed stamped envelope provided. You may also authorize your proxy to vote your shares by telephone as described in your proxy card. Shareholders who vote over the Internet, by mail or by telephone prior to the meeting may nevertheless attend the meeting, revoke their proxies and vote their shares in person.

|

| By order of the board of directors: |

|

|

| Kenneth A. Steele |

| Chief Financial Officer, Secretary and Treasurer |

|

| Winston Salem, North Carolina |

| March 27, 2009 |

2009 ANNUAL MEETING OF SHAREHOLDERS

OF

HATTERAS FINANCIAL CORP.

PROXY STATEMENT

QUESTIONS AND ANSWERS

| Q: | Why did I receive a Notice of Internet Availability of Proxy Materials? |

| A: | Our board of directors is soliciting proxies to be voted at our annual meeting. The annual meeting will be held at the Old Town Club, 2875 Old Town Club Road, Winston Salem, North Carolina 27106, on Wednesday, May 6, 2009, at 10:00 a.m., local time. Pursuant to the rules adopted by the Securities and Exchange Commission (“SEC”), we have provided access to our proxy materials over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials, which is referred to herein as the “Notice,” on or about March 27, 2009 to our shareholders of record on March 17, 2009. The Notice and this proxy statement summarize the information you need to know to vote by proxy or in person at the annual meeting. You do not need to attend the annual meeting in person in order to vote. |

| Q: | When was the Notice mailed? |

| A: | The Notice was mailed to shareholders beginning on or about March 27, 2009. |

| Q: | Who is entitled to vote? |

| A: | All shareholders of record as of the close of business on March 17, 2009, the record date, are entitled to vote at the annual meeting. |

| Q: | What is the quorum for the meeting? |

| A: | A quorum at the annual meeting will consist of a majority of the votes entitled to be cast by the holders of all shares of common stock outstanding. No business may be conducted at the meeting if a quorum is not present. As of the record date, 36,192,411 shares of common stock were issued and outstanding. If less than a majority of outstanding shares entitled to vote are represented at the annual meeting, the chairman of the meeting may adjourn the annual meeting to another date, time or place, not later than 120 days after the original record date of March 17, 2009. Notice need not be given of the new date, time or place if announced at the meeting before an adjournment is taken. |

| Q: | How many votes do I have? |

| A: | You are entitled to one vote for each whole share of common stock you held as of the record date. Our shareholders do not have the right to cumulate their votes for directors. |

| A: | Whether or not you plan to attend the annual meeting, we urge you to authorize your proxy to vote your shares over the Internet as described in the Notice. Alternatively, if you received a paper copy of the proxy card by mail please complete, date, sign and promptly return the proxy card in the self-addressed stamped envelope provided. You may also authorize your proxy to vote your shares by telephone as described in your proxy card. Authorizing your proxy over the Internet, by mailing a proxy card or by telephone will not limit your right to attend the annual meeting and vote your shares in person. Your proxy (one of the individuals named in your proxy card) will vote your shares per your instructions. If you fail to provide instructions on a proxy properly submitted via the Internet, mail or telephone, your proxy will vote, as |

1

recommended by the board of directors, to elect (FOR) the director nominees listed in “Proposal 1 – Election of Directors” and in favor of (FOR) “Proposal 2 – Ratification of Appointment of Independent Registered Public Accounting Firm.”

| Q: | How do I vote my shares that are held by my broker? |

| A: | If you have shares held by a broker, you may instruct your broker to vote your shares by following the instructions that the broker provides to you. Most brokers allow you to authorize your proxy by mail, telephone and on the Internet. |

| | • | | Proposal 1: the election of six directors to hold office until our 2010 annual meeting of shareholders and until his or her successor has been elected and qualifies; and |

| | • | | Proposal 2: the ratification of the appointment of Ernst & Young LLP to act as our independent registered public accounting firm for 2009. |

In addition, you will be voting on such other business as may properly come before the annual meeting, including any adjournments or postponements thereof.

| Q: | What vote is required to approve the proposals assuming that a quorum is present at the annual meeting? |

| | | | |

| A: | | Proposal 1: Election of Directors | | The election of the director nominees must be approved by a plurality of the votes cast. |

| | |

| | Proposal 2: Ratification of Independent Auditors | | Ratification of the appointment of auditors requires a majority of the votes cast. |

| Q: | How are abstentions and broker non-votes treated? |

| A: | A “broker non-vote” occurs when a bank, broker or other holder of record holding shares for a beneficial owner does not vote on a particular proposal because that holder does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner. Pursuant to Maryland law, abstentions and broker non-votes are counted as present for purposes of determining the presence of a quorum. For purposes of the election of directors and the vote on Proposal 2, abstentions will not be counted as votes cast and will have no effect on the result of the vote. |

Under the rules of the New York Stock Exchange, brokerage firms may have the discretionary authority to vote their customers’ shares on certain routine matters for which they do not receive voting instructions, including the uncontested election of directors and ratification of independent auditors. Therefore, brokerage firms may vote such shares to approve Proposals 1 and 2.

| Q: | Will there be any other items of business on the agenda? |

| A: | The board of directors does not know of any other matters that may be brought before the annual meeting nor does it foresee or have reason to believe that proxy holders will have to vote for substitute or alternate nominees for election to the board of directors. In the event that any other matter should come before the annual meeting or any nominee is not available for election, the persons named in the enclosed proxy will have discretionary authority to vote all proxies with respect to such matters in accordance with their discretion. |

2

| Q: | What happens if I submit my proxy without providing voting instructions on all proposals? |

| A: | Proxies properly submitted via the Internet, mail or telephone will be voted at the annual meeting in accordance with your directions. If the properly-submitted proxy does not provide voting instructions on a proposal,the proxy will be voted to elect (FOR) each of the director nominees listed in “Proposal 1 – Election of Directors”and in favor of (FOR) “Proposal 2 – Ratification of Appointment of Independent Registered Public Accounting Firm.” |

| Q: | Will anyone contact me regarding this vote? |

| A: | No arrangements or contracts have been made with any solicitors as of the date of this proxy statement, although we reserve the right to engage solicitors if we deem them necessary. Such solicitations may be made by mail, telephone, facsimile, e-mail or personal interviews. |

| Q: | Who has paid for this proxy solicitation? |

| A: | We have paid the entire expense of preparing, printing and mailing the Notice and, to the extent requested by our shareholders, the proxy materials and any additional materials furnished to shareholders. Proxies may be solicited by our directors or our officers or by employees of our manager personally or by telephone without additional compensation for such activities. We will also request persons, firms and corporations holding shares in their names or in the names of their nominees, which are beneficially owned by others, to send appropriate solicitation materials to such beneficial owners. We will reimburse such holders for their reasonable expenses. |

| Q: | May shareholders ask questions at the annual meeting? |

| A: | Yes. There will be time allotted at the end of the meeting when our representatives will answer questions from the floor. |

| Q: | What does it mean if I receive more than one Notice? |

| A: | It means that you have multiple accounts at the transfer agent or with stockbrokers. Please submit all of your proxies over the Internet, following the instructions provided in the Notice, by mail or by telephone to ensure that all of your shares are voted. |

| Q: | Can I change my vote after I have voted? |

| A: | Yes. Proxies properly submitted over the Internet, by mail or by telephone do not preclude a shareholder from voting in person at the meeting. A shareholder may revoke a proxy at any time prior to its exercise by filing with our corporate secretary a duly executed revocation of proxy, by properly submitting, either by Internet, mail or telephone, a proxy to our corporate secretary bearing a later date or by appearing at the meeting and voting in person. Attendance at the meeting will not by itself constitute revocation of a proxy. |

| Q: | Can I find additional information on the company’s website? |

| A: | Yes. Our website is located atwww.hatfin.com. Although the information contained on our website is not part of this proxy statement, you can view additional information on the website, such as our corporate governance guidelines, our code of business conduct and ethics, charters of our board committees and reports that we file with the SEC. A copy of our corporate governance guidelines, our code of business conduct and ethics and each of the charters of our board committees may be obtained free of charge by writing to Hatteras Financial Corp., 110 Oakwood Drive, Suite 340, Winston Salem, 27103, Attention: Corporate Secretary. |

3

PROPOSAL 1: ELECTION OF DIRECTORS

Our board of directors consists of six members with directors serving one-year terms and until their successors are duly elected and qualified. The term for each director expires at each annual meeting of shareholders.

At the 2009 annual meeting, all six directors will be elected to serve until the 2010 annual meeting and until their successors are duly elected and qualified. The board of directors has nominated our current directors, Michael R. Hough, Benjamin M. Hough, David W. Berson, Ira G. Kawaller, Jeffrey D. Miller and Thomas D. Wren, to serve as directors (the “Nominees”). The board of directors anticipates that each Nominee will serve, if elected, as a director. However, if anyone nominated by the board of directors is unable to accept election, the proxies will be voted for the election of such other person or persons as the board of directors may recommend.

The board of directors recommends a vote FOR each Nominee.

The Board of Directors and its Committees

Our manager, Atlantic Capital Advisors LLC, manages our day-to-day operations, subject to the supervision of our board of directors. Members of our board are kept informed of our business through discussions with our manager’s executive officers, by reviewing materials provided to them and by participating in meetings of the board and its committees.

Information Regarding the Nominees

The biographical descriptions below set forth certain information with respect to each Nominee for election as a director at the annual meeting. Each of our current directors has served on the board since our initial private offering, which was consummated in November 2007.

| | |

Michael R. Hough Chairman and Chief Executive Officer Age: 48 Shares beneficially owned: 75,363 Stock options beneficially owned: 24,300 | | Mr. Hough is the chief executive officer of our manager and has been our chief executive officer since September 2007. Mr. Hough is a co-founder and director of our manager and ACM. Since founding ACM in 1998, Mr. Hough has been responsible for managing all aspects of the operations and growth of ACM. From 1988 to 1997, Mr. Hough was a principal and founding member of First Winston Securities, Inc., a regional fixed-income broker-dealer where he was head of taxable trading and sales. From 1983 to 1987, Mr. Hough worked as a taxable trader in the fixed income department of Wachovia Bank N.A. He holds a B.A. degree in economics from Wake Forest University. Michael R. Hough and Benjamin M. Hough, our president, chief operating officer and director, are brothers. |

| |

Benjamin M. Hough President, Chief Operating Officer and Director Age: 44 Shares beneficially owned: 68,703 Stock options beneficially owned: 21,262 | | Mr. Hough is the president and chief operating officer of our manager and has been our president and chief operating officer since September 2007. Mr. Hough is a co-founder and has been a director of our manager and ACM since 2007 and 2001, respectively. From 1997 to 2001, he was the head of the BB&T Capital Markets office in Winston-Salem, NC where he was vice president of institutional fixed income sales and trading. From 1995 to 1997, Mr. Hough was the head of the First National Bank of Maryland office in Washington, DC where he served as vice president of fixed income sales. Prior to that, Mr. Hough was vice president of NationsBanc Capital Markets, previously American Security Bank, in institutional fixed income trading and sales. Mr. Hough holds a B.A. degree in economics from the University of North Carolina at Chapel Hill. Benjamin M. Hough and Michael R. Hough, our chairman and chief executive officer, are brothers. |

4

| | |

David W. Berson Director Age: 54 Shares beneficially owned: 4,071 Committees: • Compensation and Governance | | Dr. Berson has been a member of our board of directors since November 2007. Dr. Berson has served as senior vice president, chief economist and strategist at The PMI Group since October 2007. In that role he is responsible for all analyses and forecasts of the economy, housing and mortgage markets; leads the company’s annual strategic planning process; and manages the company’s risk analytics and pricing division. Prior to joining The PMI Group, Dr. Berson was vice president and chief economist at Fannie Mae. Prior to that, Dr. Berson was a senior economist at the U.S. League of Savings Institutions. In addition, Dr. Berson was the chief financial economist at Wharton Econometrics, a visiting scholar at the Federal Reserve Bank of Kansas City and an assistant professor of economics at Claremont McKenna College and Claremont Graduate School. His U.S. government experience includes staff economist at the Council of Economic Advisors and economic analyst at the Treasury Department. Dr. Berson holds a Ph.D. in economics and an M.P.P. in public policy from the University of Michigan and a B.A. in history and economics from Williams College. |

| |

Ira G. Kawaller Director Age: 59 Share beneficially owned: 5,771 Committees: •Audit •Compensation and Governance | | Dr. Kawaller has been a member of our board of directors since November 2007. Dr. Kawaller is president of Kawaller & Co., LLC, a financial consulting company that assists businesses in their use of derivative instruments for risk management purposes. In addition, Dr. Kawaller is also the managing partner of the Kawaller Fund, LP, which operates as a derivatives-only commodity pool. He has served as a member of the Financial Accounting Standards Board’s Derivatives Implementation Group and the Government Accounting Standards Board’s Derivative Instrument Task force on Derivatives and Hedging. Prior to founding Kawaller & Co., Dr. Kawaller was the vice president and director of the New York office of the Chicago Mercantile Exchange. Prior to that, he held positions at J. Aron & Company, AT&T, and the Board of Governors of the Federal Reserve System. Dr. Kawaller has held adjunct professorships at Columbia University and Polytechnic University. He received a Ph.D. in Economics from Purdue University. |

| |

Jeffrey D. Miller Director Age: 38 Shares beneficially owned: 4,071 Committees: •Audit •Compensation and Governance (Chair) | | Mr. Miller has been a member of our board of directors since November 2007. Since March 2007, Mr. Miller has served as vice president, general counsel and secretary of Highwoods Properties, Inc. Prior to joining Highwoods Properties, Inc., Mr. Miller was a partner with the law firm of DLA Piper LLP (US) where he concentrated his practice on securities, corporate governance and related strategic matters, and served as general outside counsel to a variety of publicly-traded real estate investment trusts. Prior to that, Mr. Miller was a partner with the law firm of Alston & Bird LLP. Mr. Miller holds a B.A. from Pennsylvania State University and a J.D. and M.B.A. from Wake Forest University. He is admitted to practice law in North Carolina. |

5

| | |

Thomas D. Wren Director Age: 57 Shares beneficially owned: 4,071 Committees: • Audit (Chair) | | Mr. Wren has been a member of our board of directors since November 2007. Mr. Wren is also a director and shareholder of ACM. Mr. Wren was the treasurer of MBNA America and served as director of funds management in the treasury division. As a group executive and treasurer, Mr. Wren oversaw the company’s investment and funding activities including liquidity management, investment portfolio management, structured finance, and all related capital market programs. He currently serves on the board of directors and the investment committees for both the Delaware Hospice and the Delaware Community Foundation. In addition, Mr. Wren serves on the board of directors and audit committees for Brandywine, Brandywine Blue and Brandywine Advisors, domestic mutual funds managed by Freiss Associates, LLC. Prior to joining MBNA America, Mr. Wren was chief investment and funding officer for Shawmut National Corporation. Prior to that, Mr. Wren worked for the Comptroller of the Currency, or OCC, for 18 years, which included managing the OCC’s London operation. |

Director Independence

Under the enhanced corporate governance standards of the New York Stock Exchange, or NYSE, at least a majority of our directors, and all of the members of our audit committee and compensation and governance committee, must meet the test of “independence.” The NYSE standards provide that to qualify as an “independent” director, in addition to satisfying certain bright-line criteria, the board of directors must affirmatively determine that a director has no material relationship with us (either directly or as a partner, shareholder or officer of an organization that has a relationship with the company). Our board of directors has affirmatively determined that each of Drs. Berson and Kawaller and Messrs. Miller and Wren satisfies the bright-line independence criteria of the NYSE and that none has a relationship with us that would interfere with such person’s ability to exercise independent judgment as a member of the board of directors. Therefore, we believe that all of these directors, who constitute a majority of our board of directors, are independent under the NYSE rules.

As required by the NYSE rules, the independent directors of our board regularly meet in executive session, without management present. Generally, these executive sessions follow after each meeting of the board and each committee meeting. In 2008, the independent directors of the board met in executive sessions without management present four times. The chairman of the compensation and governance committee presides over such independent, non-management sessions of the board.

We have implemented procedures for interested parties, including shareholders, who wish to communicate directly with our independent directors. We believe that providing a method for interested parties to communicate directly with our independent directors, rather than the full board of directors, would provide a more confidential, candid and efficient method of relaying any interested party’s concerns or comments. See “Communication with the Board of Directors, Independent Directors and the Audit Committee.”

Board Committees

Our board of directors has appointed an audit committee and a compensation and governance committee and has adopted a written charter for each of these committees. Each of these committees has three directors and is composed exclusively of independent directors, as required by and defined in the rules and listing qualifications of the NYSE and, with respect to the members of the audit committee, Rule 10A-3 promulgated pursuant to the Securities Exchange Act of 1934, as amended (the “Securities Exchange Act”).

Audit Committee

The audit committee is responsible for engaging independent public accountants, reviewing with the independent public accountants the plans and results of the audit engagement, approving professional services provided by the independent public accountants, reviewing the independence of the independent public accountants, considering the range of audit and non-audit fees and reviewing the adequacy of our internal accounting controls. Mr. Wren chairs our audit committee and serves as our “audit committee financial expert,” as that term is defined by the SEC. Dr. Kawaller and Mr. Miller are also members of the audit committee. Each

6

member of the audit committee is financially literate and able to read and understand fundamental financial statements. The board of directors has reviewed the audit committee members’ service on audit committees of other public companies and has determined that such simultaneous service, if any, does not impair the members’ ability to serve on our audit committee. The audit committee has the power to investigate any matter brought to its attention within the scope of its duties and to retain counsel for this purpose where appropriate.

In addition, the committee is responsible for reviewing any transactions that involve potential conflicts of interest, including any potential conflicts involving executive officers, directors and their immediate family members. Our written code of business conduct and ethics expressly prohibits the continuation of any conflict of interest by an employee, officer or director except under guidelines approved by the board of directors. Our code of business conduct and ethics requires any employee, officer or director to report any actual conflict of interest to our compliance officer. Under our code of business conduct and ethics, all contracts and transactions between our company and any director or officer (or any entity in which such director or officer is a director or has a material financial interest) must be reviewed and approved by a majority of disinterested directors. In addition, our corporate governance guidelines require that each member of our board of directors consult the chairman of the board in advance of accepting an invitation to serve on another company’s board if the director has concerns about whether serving as a director of another company might conflict with his or her duties to our company. In that situation, our corporate governance guidelines also suggest that the director inform the compensation and governance committee in writing of the director’s decision.

Because the facts and circumstances regarding potential conflicts are difficult to predict, the board of directors has not adopted a written policy for evaluating conflicts of interests. In the event a conflict of interest arises, the board of directors will review, among other things, the facts and circumstances of the conflict, our applicable corporate governance policies, the effects of any potential waivers of those policies, applicable state law, and the NYSE continued listing rules and regulations, and will consider the advice of counsel, before making any decisions regarding the conflict.

The audit committee held five meetings in 2008.

Compensation and Governance Committee

The compensation and governance committee evaluates the performance of our manager (including our executive officers, which are provided by our manager), reviews the compensation and fees payable to our manager under our management agreement, administers the issuance of any stock issued to our employees, our manager or employees of our manager that provide services to us under our 2007 Equity Incentive Plan, implements and oversees our corporate governance guidelines and code of business conduct and ethics, adopts policies with respect to conflicts of interest, monitors our compliance with corporate governance requirements of state and federal law and the rules and regulations of the NYSE, conducts director candidate searches, oversees and evaluates our board of directors and management, evaluates from time to time the appropriate size and composition of our board of directors and recommends, as appropriate, increases, decreases and changes in the composition of our board of directors and formally proposes the slate of directors to be elected at each annual meeting of our shareholders. Our compensation and governance committee may designate a sub-committee of at least one member to address specific issues on behalf of the committee. Mr. Miller chairs our compensation and governance committee. Drs. Berson and Kawaller are members of the compensation and governance committee.

The compensation and governance committee held four meetings in 2008.

Our board of directors may from time to time establish other committees to facilitate the management of our company.

Board Meetings

The board of directors held 13 meetings during 2008, and each director, other than Dr. Kawaller, attended at least 75% of the board meetings and each director’s respective committee meetings. Dr. Kawaller attended all regularly scheduled quarterly board meetings. The board of directors has not yet adopted a policy with respect to directors’ attendance at our annual meetings of shareholders. After reviewing the attendance of directors and shareholders at our initial annual meeting in 2009, the board expects to consider a policy with respect to directors’ attendance at future annual meetings.

7

Compensation and Governance Committee Interlocks and Insider Participation

None of the members of our compensation and governance committee is or has been employed by us. Three of our executive officers and two members of our board of directors, Messrs. Hough, Hough and Gibbs, currently serve as executive officers and members of the board of directors of ACM Financial Trust, a private mortgage real estate investment trust managed by our manager, Atlantic Capital Advisors LLC. None of our other executive officers currently serves, or in the past three years has served, as a member of the board of directors or compensation committee of another entity that has one or more executive officers serving on our board of directors or compensation and governance committee.

Director Compensation for 2008

In 2008, each member of our board of directors who was not an employee of our company received annual compensation for service as a director as follows:

| | • | | Each non-employee director received an annual fee of $30,000. |

| | • | | In addition, the chairman of our audit committee was paid an annual fee of $5,000, and the chairman of our compensation and governance committee received an annual fee of $2,500. |

| | • | | Each member of our board of directors was also reimbursed for reasonable out-of-pocket expenses associated with service on our behalf and with attendance at or participation in board meetings or committee meetings, including reasonable travel expenses. |

On January 27, 2009, the board of directors increased the annual fee paid to each non-employee director of our company to $40,000.

Non-employee directors also participate in our 2007 Equity Incentive Plan. We provide an initial grant of shares of restricted stock to each non-employee director upon his appointment to our board. Each initial grant will be for a number of shares of restricted stock having a fair market value as near to $10,000 as of the date of grant as possible without exceeding such value. Each of our current directors was appointed at the time of our initial private offering and received 500 shares of restricted stock in connection with our private offering in November 2007 and 2,000 shares of restricted stock in connection with our initial public offering in April 2008. We will also provide for an annual grant of shares of restricted stock to each non-employee director on January 31st of each year. Each annual grant will be for a number of shares of restricted stock having a fair market value as near to $40,000 as possible without exceeding such value. Notwithstanding the foregoing, a non-employee director receiving an initial restricted stock grant on, or within 90 days prior to, January 31st of any year will not receive an annual grant with respect to that year. Each initial and annual restricted stock grant will vest in equal installments over three years beginning on the first anniversary of the date of the grant, provided that the recipient remain a director of our company on the vesting date. In the event of change in control of our company, all outstanding shares of restricted stock granted under the plan to our non-employee directors will become fully vested.

The following table summarizes the compensation that we paid to our non-employee directors in 2008:

2008 Director Compensation Table

| | | | | | | | | |

Name | | Fees Earned

or Paid in

Cash | | Stock awards (1) | | Total |

David W. Berson(2) | | $ | 30,000 | | $ | 14,000 | | $ | 44,000 |

Ira G. Kawaller(3) | | | 30,000 | | | 14,000 | | | 44,000 |

Jeffrey D. Miller(2) | | | 32,500 | | | 14,000 | | | 46,500 |

Thomas D. Wren(2) | | | 35,000 | | | 14,000 | | | 49,000 |

(1) | All stock awards were granted pursuant to our 2007 Equity Incentive Plan. The dollar value is computed in accordance with FAS 123R and reflects the amount expensed in 2008. See Note 9 to our consolidated financial statements included in our Annual Report on Form 10-K for a discussion of our accounting of shares of restricted stock and the assumptions used. The grant date fair value of each award is $24.00 per share. |

(2) | The director owns 4,071 common shares in total as of March 27, 2009. |

(3) | Dr. Kawaller owns 5,771 common shares in total as of March 27, 2009. |

Our board of directors (or a duly formed committee thereof) may revise our non-employee directors’ compensation in its discretion.

8

Nomination of Directors

Before each annual meeting of shareholders, the compensation and governance committee considers the nomination of all directors whose terms expire at the next annual meeting of shareholders and also considers new candidates whenever there is a vacancy on the board or whenever a vacancy is anticipated due to a change in the size or composition of the board, a retirement of a director or for any other reasons. In addition to considering incumbent directors, the compensation and governance committee identifies director candidates based on recommendations from the directors and executive officers. The committee may in the future engage the services of third-party search firms to assist in identifying or evaluating director candidates. No such firm was engaged in 2008.

The compensation and governance committee evaluates annually the effectiveness of the board as a whole and of each individual director and identifies any areas in which the board would be better served by adding new members with different skills, backgrounds or areas of experience. The board of directors considers director candidates based on a number of factors including: whether the board member will be “independent,” as such term is defined by the NYSE listing standards; whether the candidate possesses the highest personal and professional ethics, integrity and values; and whether the candidate has an inquisitive and objective perspective, practical wisdom and mature judgment. Candidates are also evaluated on their understanding of our business and willingness to devote adequate time to carrying out their duties. The compensation and governance committee also monitors the mix of skills, experience and background to assure that the board has the necessary composition to effectively perform its oversight function.

Corporate Governance Matters

We have adopted a code of business conduct and ethics that applies to all our employees and each member of our board of directors and corporate governance guidelines. We anticipate that any waivers of our code of business conduct and ethics will be posted on our website. The following documents are available at our website atwww.hatfin.com in the “Governance Documents” area of the “Investor Relations” section:

| | • | | audit committee charter; |

| | • | | compensation and governance committee charter; |

| | • | | code of business conduct and ethics; |

| | • | | whistleblower policy; and |

| | • | | corporate governance guidelines. |

Each committee reviews its written charter annually. Copies of the documents listed above are available in print to any shareholder who requests them. Requests should be sent Hatteras Financial Corp., 110 Oakwood Drive, Suite 340, Winston Salem, North Carolina 27103, Attention: Corporate Secretary.

We have not adopted a policy with respect to shareholder-recommended director nominees. The compensation and governance committee continues to review potential policy choices and expects to recommend a specific policy related to shareholder-recommended director nominees to the board for adoption during 2009.

Communication with the Board of Directors, Independent Directors and the Audit Committee

Our board of directors may be contacted by any party via mail at the address listed below.

Board of Directors

Hatteras Financial Corp.

110 Oakwood Drive, Suite 340

Winston Salem, North Carolina 27103

9

We believe that providing a method for interested parties to communicate directly with our independent directors, rather than the full board, would provide a more confidential, candid and efficient method of relaying any interested party’s concerns or comments. As discussed above, the presiding director of independent, non-management sessions of the directors is the chairman of the compensation and governance committee. The independent directors can be contacted by any party via mail at the address listed below.

Independent Directors

Hatteras Financial Corp.

110 Oakwood Drive, Suite 340

Winston Salem, North Carolina 27103

The audit committee has adopted a process for anyone to send communications to the audit committee with concerns or complaints concerning our company’s regulatory compliance, accounting, audit or internal controls issues. The audit committee can be contacted by any party as described below:

1) via mail at the address listed below;

Chairman

Audit Committee

Hatteras Financial Corp.

110 Oakwood Drive, Suite 340

Winston Salem, North Carolina 27103; or

2) via the Internet atwww.hatfin.com.

Biographical Information Regarding Executive Officers Who Are Not Directors

Each of the executive officers identified below has served in his respective position since our inception.

| | |

Kenneth A. Steele Chief Financial Officer, Secretary and Treasurer Age: 45 Shares beneficially owned: 43,626 Stock options beneficially owned: 15,188 | | Mr. Steele is the chief financial officer, secretary and treasurer of our manager and has been our chief financial officer, treasurer and secretary since September 2007. Since September 2002, Mr. Steele has also been the chief financial officer, secretary and treasurer of ACM. Prior to joining ACM, Mr. Steele had been a senior manager with Dixon Odom PLLC, an accounting firm, where he specialized in real estate, financial institutions, and mergers and acquisitions since 1991. He was responsible for the firm’s real estate investment trust tax work and for public and private real estate investment partnerships. He also provided consulting services related to corporate finance, commercial and residential development, and equity investment. A certified public accountant, Mr. Steele earned a Masters of Accounting from the Kenan Flagler Business School at the University of North Carolina at Chapel Hill and a B.S. degree in Business Administration from the University of North Carolina at Chapel Hill. |

| |

William H. Gibbs, Jr. Executive Vice President and Co-Chief Investment Officer Age: 49 Shares beneficially owned: 40,279 Stock options beneficially owned: 12,150 | | Mr. Gibbs is the executive vice president and co-chief investment officer of our manager and has been our executive vice president and co-chief investment officer since September 2007. Mr. Gibbs is a co-founder and has been a director of our manager and ACM since 2007 and 2002, respectively. Prior to that, Mr. Gibbs was a senior vice president of BB&T Capital Markets from 1999 to 2002 and was responsible for the Baltimore-Washington region. From 1982 to 1999, Mr. Gibbs served as managing director of the First National Bank of Maryland capital markets group managing the financial institutions portfolio group. Mr. Gibbs has helped advise financial institutions with structuring and implementing their investment portfolios and the development of asset/liability management strategies. He holds a B.S. degree in economics and finance from Towson University. |

10

| | |

Frederick J. Boos, II Executive Vice President and Co-Chief Investment Officer Age: 55 Shares beneficially owned: 33,282 Stock options beneficially owned: 8,100 | | Mr. Boos is the executive vice president and co-chief investment officer of our manager and has been our executive vice president and co-chief investment officer since September 2007. Since March 2006, Mr. Boos has been the executive vice president and chief investment strategist of ACM. Prior to joining ACM, Mr. Boos had been an executive vice president and director of asset liability and capital management for MBNA America from 2003 to 2006. Mr. Boos has previously served as senior vice president and investment portfolio manager for multiple regional banks including Maryland National Bank, First National Bank of Maryland, Shawmut National Bank and American Security Bank. His prior bank treasury responsibilities include liquidity and risk management, capital management, economic capital planning, residential mortgage portfolio management as well as numerous bank ALCO Directorships. He holds a Masters of Business Administration from American University and a B.S. in finance from the University of Maryland, College Park. |

Executive Officer Compensation for 2008

We are managed by Atlantic Capital Advisors LLC pursuant to the management agreement between our manager and us. We do not have any employees whom we compensate directly with salaries or other cash compensation. Our executive officers are officers of, and hold an ownership interest in our manager, and are compensated by our manager, in part, for their services to us. See “Certain Relationships and Related Transactions” for a discussion of the fees paid to Atlantic Capital Advisors LLC. See “Security Ownership of Certain Beneficial Owners and Management” for a discussion of awards received by the executive officers of our manager pursuant to our 2007 Equity Incentive Plan in connection with our initial private offering on November 5, 2007.

Equity Compensation Plans

The following table provides information as of December 31, 2008 with respect to shares of common stock that may be issued under our existing equity compensation plans:

| | | | | | | |

Plan Category | | Number of Securities to

be Issued upon Exercise

of Outstanding Options | | Weighted Average

Exercise Price of

Outstanding Options | | Number of Securities

Remaining Available for

Future Issuance under

Equity Compensation

Plans(1) |

Equity Compensation Plans Approved by Shareholders(2) | | 81,000 | | $ | 20.00 | | 156,000 |

Equity Compensation Plans Not Approved by Shareholders | | — | | | — | | — |

(1) | Excluding securities reflected in the column entitled “Number of Securities to be Issued upon Exercise of Outstanding Options.” |

(2) | Consists of our 2007 Equity Incentive Plan under which the board of directors generally grants stock options and restricted stock, and has the ability to grant phantom stock and stock appreciation rights, to our employees, officers and directors and our manager, Atlantic Capital Advisors LLC. |

11

PROPOSAL 2: RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The audit committee of our board of directors has selected the accounting firm of Ernst & Young LLP to serve as our independent registered public accountants for the year ending December 31, 2009, subject to ratification of this appointment by our shareholders. Ernst & Young LLP has served as our independent registered public accountants since our initial private offering in November 2007 and is considered by our management to be well qualified.

Fee Disclosure

The following is a summary of the fees billed to our company by Ernst & Young LLP for professional services rendered for the year ended December 31, 2008 and the period from September 19, 2007 (date of inception) to December 31, 2007:

| | | | | | |

| | | Year Ended

December 31, 2008 | | Period from

September 19, 2007

(date of inception) to

December 31, 2007 |

Audit Fees | | $ | 500,500 | | $ | 161,386 |

Audit-Related Fees | | | — | | | — |

Tax Fees | | | 13,000 | | | — |

All Other Fees | | | — | | | — |

| | | | | | |

Total | | $ | 513,500 | | $ | 161,386 |

| | | | | | |

Audit Fees

“Audit Fees” consist of fees and related expenses billed for professional services rendered for the audit of the financial statements and services that are normally provided by Ernst & Young LLP in connection with statutory and regulatory filings or engagements. For example, audit fees included fees for professional services rendered in connection with quarterly and annual reports, and the issuance of consents by Ernst & Young LLP to be named in our registration statements and to the use of their audit report in the registration statements.

Audit-Related Fees and All Other Fees

“Audit-Related Fees” and “All Other Fees” consist of fees and related expenses for products and services other than services described under “Audit Fees” and “Tax Fees.” Ernst & Young LLP did not perform any such products or services for us during the year ended December 31, 2008 and the period from September 19, 2007 (date of inception) to December 31, 2007.

Tax Fees

“Tax Fees” consist of fees and related expenses billed for professional services for tax compliance, tax advice and tax planning. These services include assistance regarding federal and state tax compliance and tax planning and structuring.

Pre-Approval Policy

All audit, tax and other services provided to us were reviewed and pre-approved by the audit committee or a member of the audit committee designated by the full committee to pre-approve such services. The audit committee or designated member concluded that the provision of such services by Ernst & Young LLP was compatible with the maintenance of that firm’s independence in the conduct of its auditing functions.

A representative of Ernst & Young LLP will be present at the annual meeting, will be given the opportunity to make a statement if he or she so desires and will be available to respond to appropriate questions.

The board of directors recommends a vote FOR the ratification of the appointment of the independent registered public accountants.

12

AUDIT COMMITTEE REPORT

The audit committee oversees the company’s financial reporting process on behalf of the board of directors, in accordance with the audit committee charter. Management is responsible for the company’s financial statements and the financial reporting process, including the system of internal controls. The company’s independent registered public accounting firm, Ernst & Young LLP, is responsible for expressing an opinion on the conformity of the company’s audited financial statements with generally accepted accounting principles.

In fulfilling its oversight responsibilities, the audit committee reviewed with management and Ernst & Young LLP the audited financial statements included in the company’s Annual Report on Form 10-K for the year ended December 31, 2008, and discussed with management the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements. The audit committee also reviewed and discussed with management and Ernst & Young LLP the disclosures made in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Controls and Procedures” included in the Annual Report on Form 10-K for the year ended December 31, 2008.

In addition, the audit committee discussed and received the written disclosures and the letter from the independent registered public accountants required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and the audit committee discussed with the independent registered public accountants the auditors’ independence from management and us and the matters required to be discussed by Statement on Auditing Standards No. 61.

In reliance on the reviews and discussions referred to above, prior to the filing of the company’s Annual Report on Form 10-K for the year ended December 31, 2008 with the SEC, the audit committee recommended to the board of directors (and the board approved) that the audited financial statements be included in such Annual Report for filing with the SEC.

The members of the audit committee are not professionally engaged in the practice of auditing or accounting. Members of the audit committee rely, without independent verification, on the information provided to them and on the representations made by management and the independent registered public accountants. Accordingly, the audit committee’s oversight does not provide an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the audit committee’s considerations and discussions referred to above do not assure that the audit of the company’s financial statements has been carried out in accordance with generally accepted auditing standards, that the financial statements are presented in accordance with generally accepted accounting principles or that Ernst & Young LLP is in fact “independent.”

Submitted by the audit committee of the board of directors

Thomas D. Wren (Chairman)

Ira G. Kawaller

Jeffrey D. Miller

13

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table presents information regarding the beneficial ownership of our common stock as of March 24, 2009, with respect to:

| | • | | each of our executive officers; |

| | • | | each shareholder of our company that is known to us to be the beneficial owner of more than 5% of our common stock based upon filings made with the SEC; and |

| | • | | all directors and executive officers as a group. |

Unless otherwise indicated, the business address for each of the identified shareholders is 110 Oakwood Drive, Suite 340, Winston Salem, North Carolina 27103. Except as indicated in the footnotes below, none of the executive officers or directors has pledged his shares of common stock as collateral.

| | | | | | |

Name of Beneficial Owner | | Shares of Common

Stock(1) | | | Percent of Common

Stock(2) | |

Michael R. Hough(3) | | 99,663 | | | * | |

Benjamin M. Hough(4) | | 89,965 | | | * | |

Kenneth A. Steele(5) | | 58,814 | | | * | |

William H. Gibbs, Jr.(6) | | 52,429 | | | * | |

Frederick J. Boos, II(7) | | 41,382 | | | * | |

David W. Berson(8) | | 4,071 | | | * | |

Ira G. Kawaller(8) | | 5,771 | | | * | |

Jeffrey D. Miller(8) | | 4,071 | | | * | |

Thomas D. Wren(8) | | 4,071 | | | * | |

Legg Mason Capital Management, Inc./ LMM LLC (9) | | 2,674,218 | | | 7.4 | % |

Wells Fargo & Company(10) | | 1,916,071 | | | 5.3 | % |

Wells Capital Management Incorporated(11) | | 1,885,595 | | | 5.2 | % |

T. Rowe Price Associates, Inc.(12) | | 2,455,000 | | | 6.8 | % |

All directors and executive officers as a group | | 360,237 | | | * | |

| * | Represents ownership of less than 1.0%. |

(1) | In accordance with SEC rules, each listed person’s beneficial ownership includes: (1) all shares the investor actually owns beneficially or of record; (2) all shares over which the investor has or shares voting or dispositive control; and (3) all shares the investor has the right to acquire within 60 days (such as upon the exercise of options that are currently vested or which are scheduled to vest within 60 days). For purposes of this table, we have assumed the options granted in connection with our initial private offering in November 2007 will vest in the next 60 days. |

(2) | Based on 36,273,411 shares of our common stock outstanding as of March 24, 2009 on a fully diluted basis. |

(3) | The number of shares beneficially owned includes 16,200 shares of restricted stock issued pursuant to the 2007 Equity Incentive Plan on November 5, 2007, which vested on November 5, 2008, representing $353,970 in value based on $21.85 per share, the closing price on the NYSE on the vesting date. The number of shares beneficially owned also includes 32,400 shares of unvested restricted stock, or $861,840 in value based on $26.60 per share, the closing price on the NYSE for December 31, 2008, issued pursuant to the 2007 Equity Incentive Plan on November 5, 2007. These 32,400 shares of restricted stock will vest in two equal installments on November 5, 2009 and 2010. |

14

The number of shares beneficially owned includes options to purchase 24,300 shares of our common stock issued pursuant to the 2007 Equity Incentive Plan on November 5, 2007, of which 8,100 options vested on November 5, 2008, and are currently exercisable. The remaining options to purchase 16,200 shares of our common stock will vest in two equal installments on November 5, 2009 and 2010. The term of each option expires on November 5, 2017 and the exercise price of each option is $20.00, the offering price of our common stock in our initial private offering in November 2007.

(4) | The number of shares beneficially owned includes 14,175 shares of restricted stock issued pursuant to the 2007 Equity Incentive Plan on November 5, 2007, which vested on November 5, 2008, representing approximately $309,724 in value based on $21.85 per share, the closing price on the NYSE on the vesting date. The number of shares beneficially owned also includes 28,350 shares of unvested restricted stock, or $754,110 in value based on $26.60 per share, the closing price on the NYSE for December 31, 2008, issued pursuant to the 2007 Equity Incentive Plan on November 5, 2007. These 28,350 shares of restricted stock will vest in two equal installments on November 5, 2009 and 2010. |

The number of shares beneficially owned includes options to purchase 21,262 shares of our common stock issued pursuant to the 2007 Equity Incentive Plan on November 5, 2007, of which 7,087 options vested on November 5, 2008, and are currently exercisable. The remaining options to purchase 14,175 shares of our common stock will vest in two equal installments on November 5, 2009 and 2010. The term of each option expires on November 5, 2017 and the exercise price of each option is $20.00, the offering price of our common stock in our initial private offering in November 2007.

(5) | The number of shares beneficially owned includes 10,125 shares of restricted stock issued pursuant to the 2007 Equity Incentive Plan on November 5, 2007, which vested on November 5, 2008, representing approximately $221,231 in value based on $21.85 per share, the closing price on the NYSE on the vesting date. The number of shares beneficially owned also includes 20,250 shares of unvested restricted stock, or $538,650 in value based on $26.60 per share, the closing price on the NYSE for December 31, 2008, issued pursuant to the 2007 Equity Incentive Plan on November 5, 2007. These 20,250 shares of restricted stock will vest in two equal installments on November 5, 2009 and 2010. |

The number of shares beneficially owned includes options to purchase 15,188 shares of our common stock issued pursuant to the 2007 Equity Incentive Plan on November 5, 2007, of which 5,063 options vested on November 5, 2008, and are currently exercisable. The remaining options to purchase 10,125 shares of our common stock will vest in two equal installments on November 5, 2009 and 2010. The term of each option expires on November 5, 2017 and the exercise price of each option is $20.00, the offering price of our common stock in our initial private offering in November 2007.

(6) | The number of shares beneficially owned includes 8,100 shares of restricted stock issued pursuant to the 2007 Equity Incentive Plan on November 5, 2007, which vested on November 5, 2008, representing $176,985 in value based on $21.85 per share, the closing price on the NYSE on the vesting date. The number of shares beneficially owned also includes 16,200 shares of unvested restricted stock, or $430,920 in value based on $26.60 per share, the closing price on the NYSE for December 31, 2008, issued pursuant to the 2007 Equity Incentive Plan on November 5, 2007. These 16,200 shares of restricted stock will vest in two equal installments on November 5, 2009 and 2010. |

The number of shares beneficially owned includes options to purchase 12,150 shares of our common stock issued pursuant to the 2007 Equity Incentive Plan on November 5, 2007, of which 4,050 options vested on November 5, 2008, and are currently exercisable. The remaining options to purchase 8,100 shares of our common stock will vest in two equal installments on November 5, 2009 and 2010. The term of each option expires on November 5, 2017 and the exercise price of each option is $20.00, the offering price of our common stock in our initial private offering in November 2007.

(7) | The number of shares beneficially owned includes 5,400 shares of restricted stock issued pursuant to the 2007 Equity Incentive Plan on November 5, 2007, which vested on November 5, 2008, representing $117,990 in value based on $21.85 per share, the closing price on the NYSE on the vesting date. The number of shares beneficially owned also includes 10,800 shares of unvested restricted stock, or $287,280 in value based on $26.60 per share, the closing price on the NYSE for December 31, 2008, issued pursuant to the 2007 Equity Incentive Plan on November 5, 2007. These 10,800 shares of restricted stock will vest in two equal installments on November 5, 2009 and 2010. |

The number of shares beneficially owned includes options to purchase 8,100 shares of our common stock issued pursuant to the 2007 Equity Incentive Plan on November 5, 2007, of which 2,700 options vested on November 5, 2008, and are currently exercisable. The remaining options to purchase 5,400 shares of our common stock will vest in two equal installments on November 5, 2009 and 2010. The term of each option expires on November 5, 2017 and the exercise price of each option is $20.00, the offering price of our common stock in our initial private offering in November 2007.

(8) | The number of shares beneficially owned includes 3,904 shares of restricted stock issued pursuant to the 2007 Equity Incentive Plan. |

(9) | This information and the information in this footnote was obtained from a Schedule 13G/A filed with the SEC on February 17, 2009. Legg Mason Capital Management, Inc. and LMM LLC filed as a “group” pursuant to Rule 13d-1(b) of the Securities Exchange Act. The business address for this shareholder is 100 Light Street, Baltimore, Maryland 21202. Legg Mason Capital Management, Inc., in its capacity as investment advisor, may be deemed to beneficially own 2,174,218 shares of common stock which are held of record by clients of Legg Mason Capital Management, Inc. LMM LLC, in its capacity as investment advisor, may be deemed to beneficially own 500,000 shares of common stock which are held of record by clients of LMM LLC. Those clients have the right to receive, or the power to direct receipt of, dividends from, or the proceeds from the sale of, such securities. No such client is known to Legg Mason Capital Management, Inc. or LMM LLC to have such right or power with respect to more than five percent of the common stock. |

(10) | This information and the information in this footnote was obtained from a Schedule 13G filed with the SEC on January 29, 2009. The Schedule 13G reports the beneficial ownership of 1,916,071 shares of common stock. The business address for this shareholder is 420 Montgomery Street, San Francisco, California 94163. |

(11) | This information and the information in this footnote was obtained from a Schedule 13G filed with the SEC on January 29, 2009. The Schedule 13G reports the beneficial ownership of 1,885,595 shares of common stock. The business address for this shareholder is 525 Market Street, San Francisco, California 94105. |

(12) | This information and the information in this footnote was obtained from a Schedule 13G filed with the SEC on February 13, 2009. The business address for this shareholder is 100 E. Pratt Street, Baltimore, Maryland 21202. T. Rowe Price Associates, Inc., in its capacity as |

15

investment advisor, may be deemed to beneficially own 2,455,000 shares of common stock which are held of record by clients of T. Rowe Price Associates, Inc. Those clients have the right to receive, or the power to direct receipt of, dividends from, or the proceeds from the sale of, such securities. No such client is known to T. Rowe Price Associates, Inc. to have such right or power with respect to more than five percent of the common stock.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act requires our executive officers and directors, and persons who own more than 10% of a registered class of our equity securities (“10% Holders”), to file reports of ownership and changes in ownership with the SEC. Officers, directors and 10% Holders are required by SEC regulation to furnish our company with copies of all Section 16(a) forms that they file. To our knowledge, except for one late report filed by Benjamin M. Hough reporting the indirect beneficial ownership of 100 shares of common stock held by his spouse and acquired in connection with our initial private offering in November 2007 at the offering price, based solely on review of the copies of such reports furnished to us, or written representations from reporting persons that all reportable transactions were reported, we believe that during the fiscal year ended December 31, 2008 the executive officers, directors and 10% Holders timely filed all reports they were required to file under Section 16(a).

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

On November 5, 2007, we executed a management agreement with Atlantic Capital Advisors LLC, our manager, pursuant to which our manager provides for the day-to-day management of our operations. The management agreement requires our manager to manage our business affairs in conformity with the policies and the investment guidelines that are approved and monitored by our board of directors. All of our executive officers also serve as officers of our manager and of ACM Financial Trust, another real estate investment trust managed by our manager that has similar investment objectives to ours. Furthermore, two of our non-independent directors, Michael R. Hough and Benjamin M. Hough, also serve as directors of ACM. These officers and directors and own a controlling interest in our manager. We incurred approximately $6.2 million in management fees under the management agreement for the year ended December 31, 2008.

The initial term of the management agreement expires on November 5, 2010 and will be automatically renewed for a one-year term on such date and on each anniversary date thereafter unless terminated as described below. Our independent directors review our manager’s performance periodically and, following the initial term, the management agreement may be terminated upon the affirmative vote of at least two-thirds of our independent directors, or by a vote of the holders of a majority of our outstanding common stock, based upon (1) unsatisfactory performance that is materially detrimental to us or (2) a determination that the management fees payable to our manager are not fair, subject to our manager’s right to prevent such a termination pursuant to clause (2) by accepting a reduction of management fees agreed to by at least two-thirds of our independent directors and our manager. We must provide 180 days’ prior notice of any such termination and our manager will be paid a termination fee equal to three times the average annual management fee earned by the manager during the two years immediately preceding termination, calculated as of the end of the most recently completed fiscal quarter prior to the date of termination.

We may in the future become self-managed, and we may do so in a variety of ways, including by (1) effectively terminating the management agreement in connection with a transaction that results in us acquiring or otherwise assuming control of our manager, or (2) actually terminating the management agreement in connection with a transaction that results in us hiring substantially all of the management team of the manager. We refer to these two events as an Atlantic Capital Internalization. Although we are generally obligated to pay a termination fee to the manager if we elect to terminate the management agreement, other than for cause (as that term is defined in the agreement), prior to the completion of the initial term or during a renewal term, if an Atlantic Capital Internalization occurs within 36 months following the completion of our initial private offering in November 2007, then we will not be required to pay any fee in connection with terminating the management agreement or otherwise in connection with the transaction, other than assuming the liabilities of the manager related to our management and other than any consideration to compensate the manager for terminating or our acquiring any business of the manager other than its management of us. If an Atlantic Capital Internalization occurs after 36 months following the completion of our initial private offering in November 2007, then we will

16

negotiate the compensation to be paid to our manager in good faith, but in any case, such compensation shall not exceed two times the average annual management fee earned by the manager during the two years immediately preceding the transaction whereby we become self managed, other than assuming the liabilities of the manager related to our management and other than any consideration to compensate the manager for terminating or our acquiring any business of the manager other than its management of us.

We may also terminate the management agreement without payment of the termination fee with 30 days’ prior written notice for cause, which is defined as (1) our manager’s continued material breach of any provision of the management agreement following a period of 30 days after written notice thereof, (2) our manager���s engagement in any act of fraud, misappropriation of funds, or embezzlement against us, (3) our manager’s gross negligence, bad faith, willful misconduct or reckless disregard in the performance of its duties under the management agreement, (4) the commencement of any proceeding relating to our manager’s bankruptcy or insolvency that is not withdrawn within 60 days or in certain other instances where our manager becomes insolvent, (5) the dissolution of our manager (unless the directors have approved a successor under the management agreement) or (6) a change of control (as defined in the management agreement) of our manager. Cause does not include unsatisfactory performance, even if that performance is materially detrimental to our business. Our manager may terminate the management agreement, without payment of the termination fee, in the event we become regulated as an investment company under the Investment Company Act of 1940. Furthermore, our manager may decline to renew the management agreement by providing us with 180 days’ written notice. Our manager may also terminate the management agreement upon 60 days’ written notice if we default in the performance of any material term of the management agreement and the default continues for a period of 30 days after written notice to us, whereupon we would be required to pay our manager a termination fee in accordance with the terms of the management agreement.

In connection with our initial public offering in April 2008, our manager’s executive officers and one of our directors purchased an aggregate of 11,217 shares of common stock in the offering at the public offering price of $24.00 per share for an aggregate investment of $269,208. In connection with our second public offering in December 2008, our manager, our manager’s executive officers and one of our directors purchased an aggregate of 39,536 shares of common stock in the offering at the public offering price of $22.00 per share for an aggregate investment of $869,792.

SHAREHOLDER PROPOSALS

Shareholder proposals intended to be presented at the 2010 annual meeting of shareholders must be received by the corporate secretary of the company no later than November 27, 2009 in order to be considered for inclusion in our proxy statement relating to the 2010 meeting pursuant to Rule 14a-8 under the Exchange Act (“Rule 14a-8”).

Our bylaws currently provide that in order for a proposal of a shareholder to be presented at our 2010 annual meeting of shareholders, other than a shareholder proposal included in our proxy statement pursuant to Rule 14a-8, it must be received at our principal executive offices no earlier than the close of business on October 28, 2009 and on or before November 27, 2009. If the 2010 annual meeting of shareholders is scheduled to take place before April 6, 2010 or after June 5, 2010, then notice must be delivered no earlier than the close of business on the 150th day prior to the 2010 annual meeting of shareholders and not later than the close of business on the later of the 120th day prior to the 2010 annual meeting of shareholders or the tenth day following the day on which public announcement of the date of the 2010 annual meeting of shareholders is first made public by our company. Any such proposal should be mailed to: Hatteras Financial Corp., 110 Oakwood Drive, Suite 340, Winston Salem, North Carolina 27103, Attention: Corporate Secretary. A copy of the bylaws may be obtained from our corporate secretary by written request to the same address.

|

| By Order of the Board of Directors |

|

|

| Kenneth A. Steele |

| Chief Financial Officer, Secretary and Treasurer |

Winston Salem, North Carolina

March 27, 2009

17

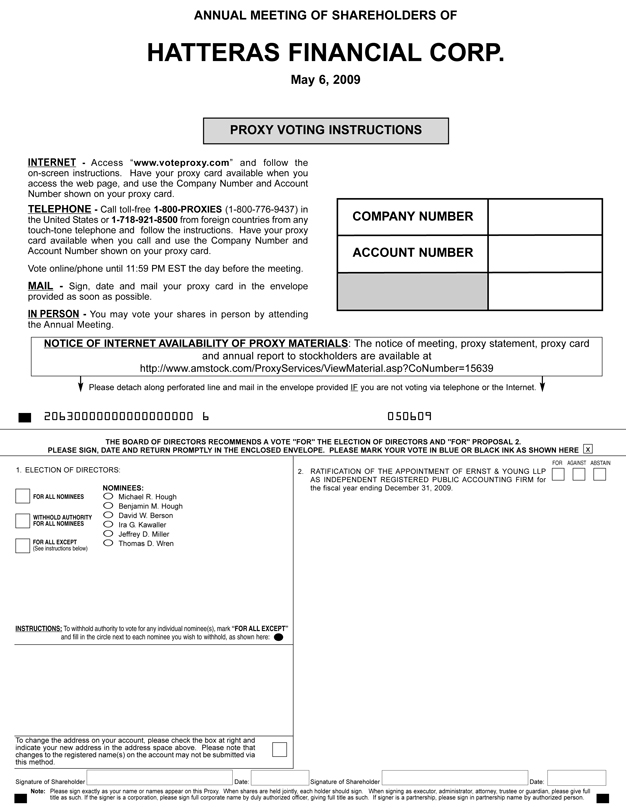

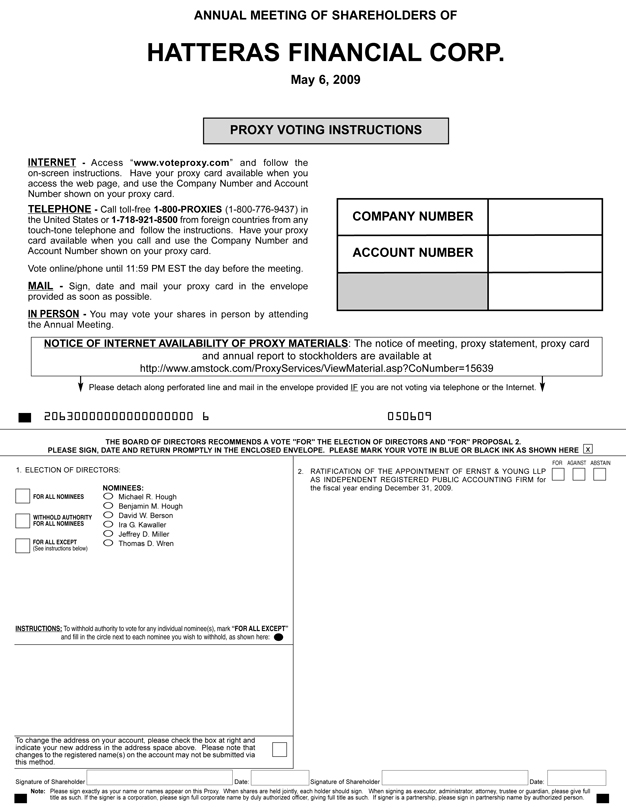

ANNUAL MEETING OF SHAREHOLDERS OF

HATTERAS FINANCIAL CORP.

May 6, 2009

PROXY VOTING INSTRUCTIONS

INTERNET – Access “www.voteproxy.com” and follow the on-screen instructions. Have your proxy card available when you access the web page, and use the Company Number and Account Number shown on your proxy card.

TELEPHONE – call toll-free 1-800-PROXIES (1-800-776-9437) in the United States or 1-718-921-8500 from foreign countries from any touch-tone telephone and follow the instructions. Have your proxy card available when you call and use the Company Number and Account Number shown on your proxy card.

Vote online/phone until 11:59 PM EST the day before the meeting.

MAIL – Sign, date and mail your proxy card in the envelope provided as soon as possible.

IN PERSON – you may vote your shares in person by attending the Annual Meeting.

COMPANY NUMBER ACCOUNT NUMBER

NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS: The notice of meeting, proxy statement, proxy card and annual report to stockholders are available at http://www.amstock.com/ProxyServices/ViewMaterial.asp?CoNumber=15639

Please detach along perforated line and mail in the envelop provided IF you are not voting via telephone or the Internet.

26300000000000000006 050609

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF DIRECTORS AND “FOR” PROPOSAL 2. PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HERE

1. ELECTION OF DIRECTORS:

FOR ALL NOMINEES

WITHHOLD AUTHORITY FOR ALL NOMINEES

FOR ALL EXCEPT (See instructions below)

NOMINEES:

Michael R. Hough

Benjamin M. Hough

David. W. Berson

Ira G. Kawaller

Jeffrey D. Miller

Thomas D. Wren

INSTRUCTIONS: to withhold authority to vote for any individual nominee(s), mark “FOR ALL EXCEPT” and fill in the circle next to each nominee you wish to withhold, as shown here:

To change the address on your account, please check the box at right and indicate your new address in the address space above. Please note that changes to the registered name(s) on the account may not be submitted via this method.

2. RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM for the fiscal year ending December 31, 2009. FOR AGAINST ABSTAIN

Signature of Shareholder Date: Signature of Shareholder Date:

Note: please sign exactly as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person.

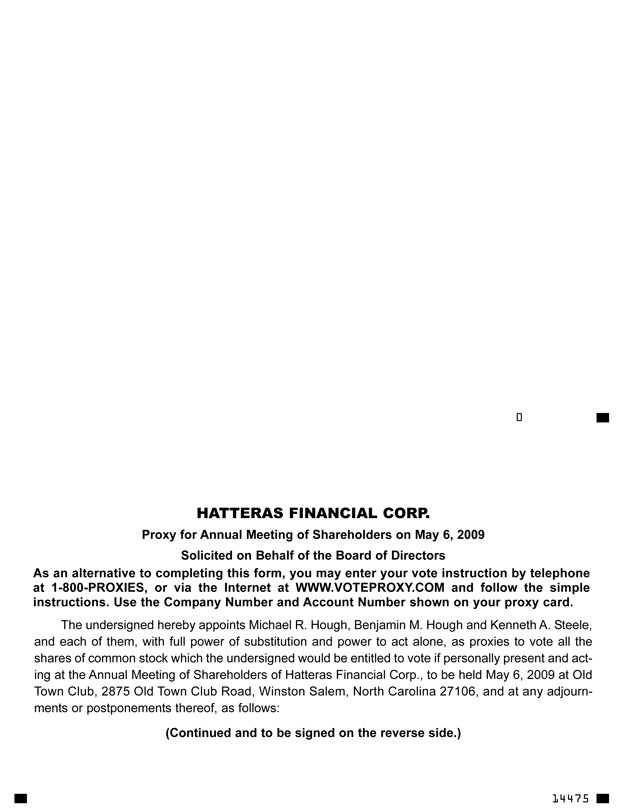

HATTERAS FINANCIAL CORP.

Proxy for Annual Meeting of Shareholders on May 6, 2009

Solicited on Behalf of the Board of Directors

As an alternative to completing this form, you may enter your vote instruction by telephone at 1-800-PROXIES, or via the Internet at WWW.VOTEPROXY.COM and follow the simple instructions. Use the Company Number and Account Number shown on your proxy card.

The undersigned hereby appoints Michael R. Hough, Benjamin M. Hough and Kenneth A. Steele, and each of them, with full power of substitution and power to act alone, as proxies to vote all the shares of common stock which the undersigned would be entitled to vote if personally present and acting at the Annual Meeting of Shareholders of Hatteras Financial Corp., to be held May 6, 2009 at Old Town Club, 2875 Old Town Club Road, Winston Salem, North Carolina 27106, and at any adjournments or postponements thereof, as follows:

(Continued and to be signed on the reverse side.)

14475