Hahn Engineering, Inc.

Petroleum Consultants

P. O. Box 190251

St. Louis, MO 63119

(314) 968-3656

FAX (314) 968-3656

December 19, 2012

Eos Petro, Inc.

Attn: Mr. Nickolas Konstant

2049 Century Park East, Suite 3670

Los Angeles, CA 90067

Re: Works Unit Reserve Evaluation

Gentlemen:

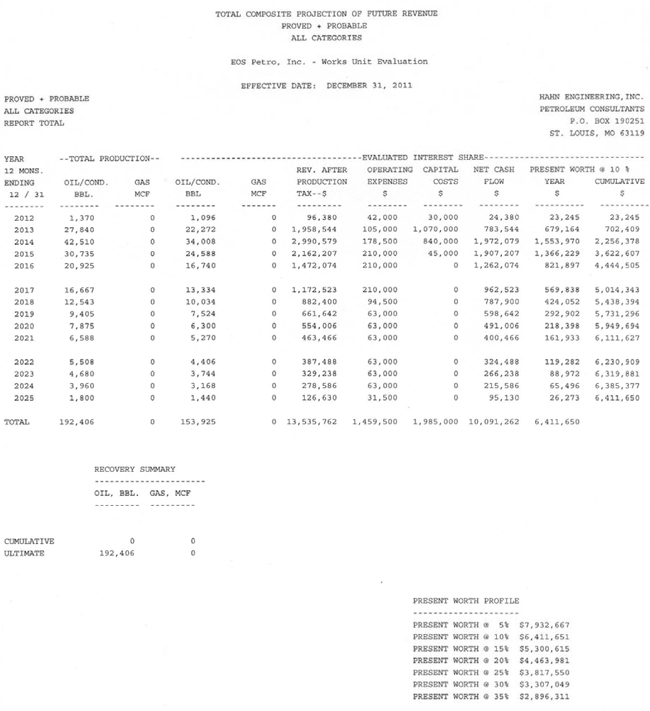

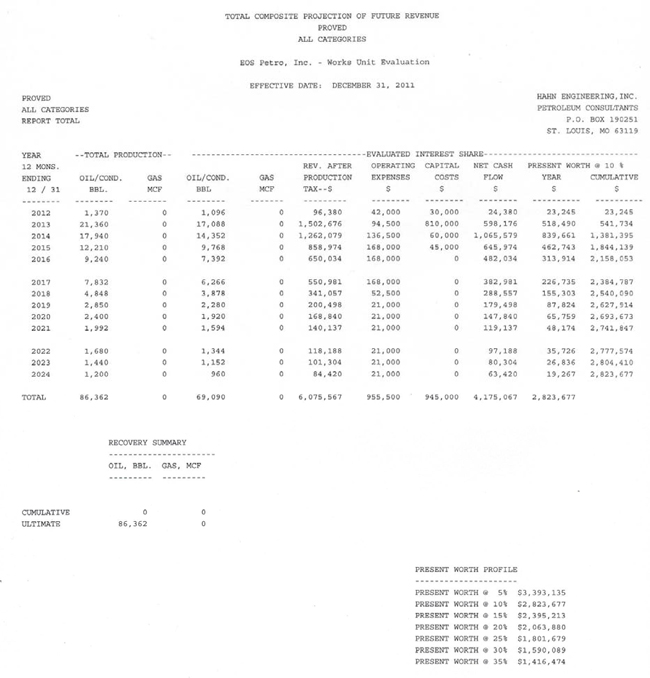

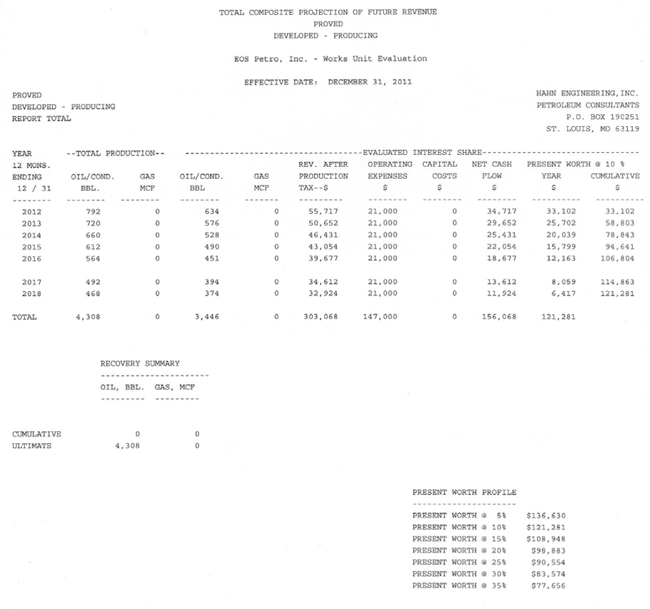

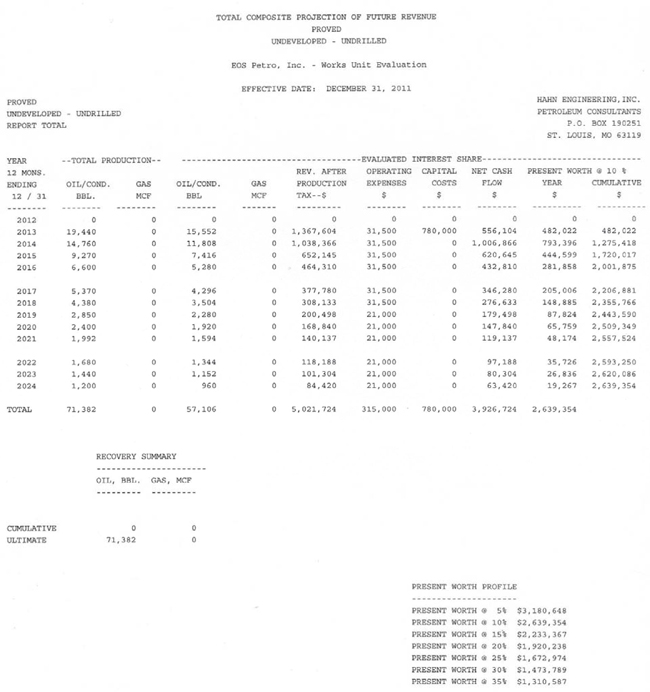

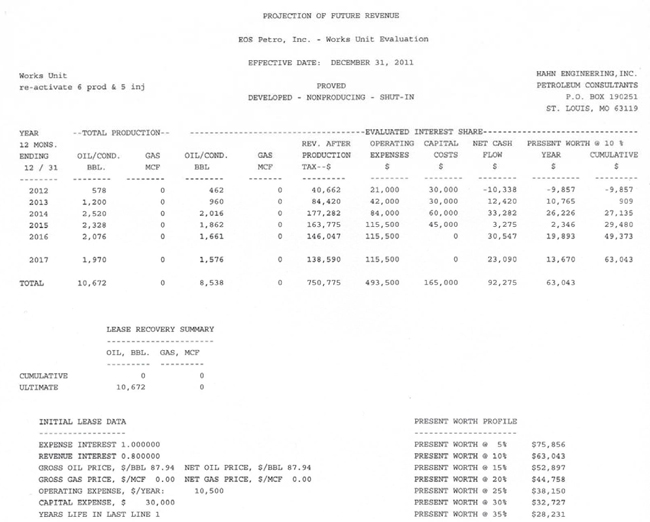

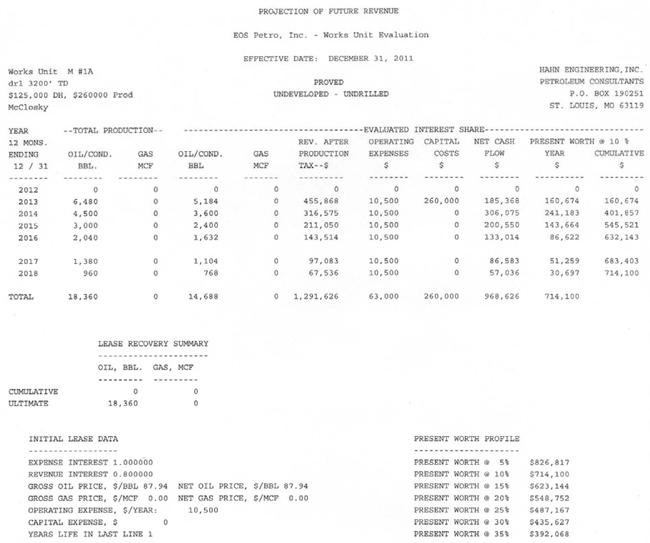

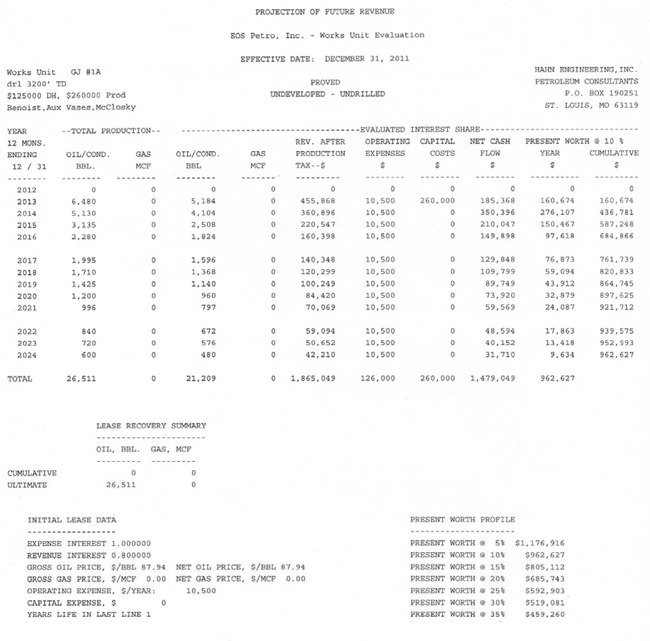

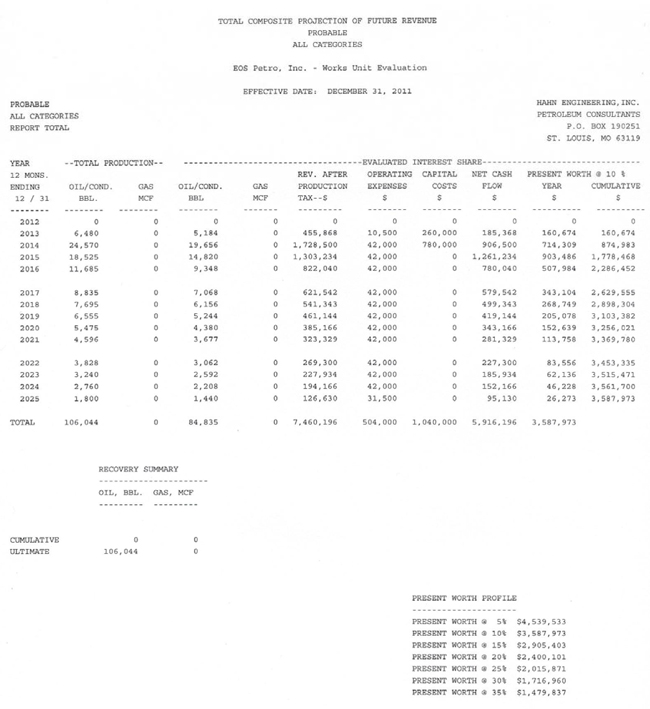

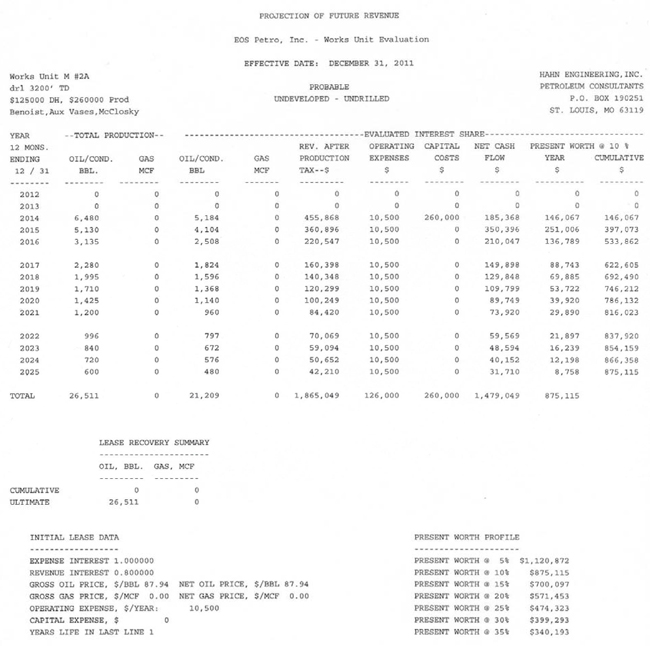

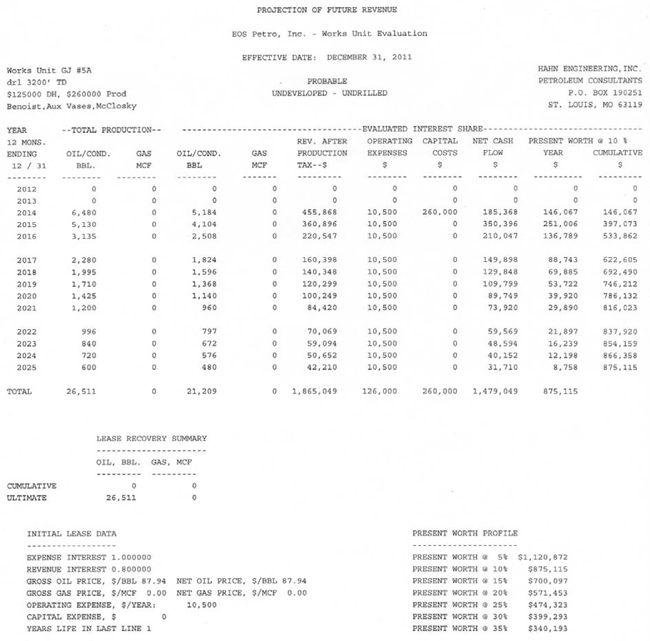

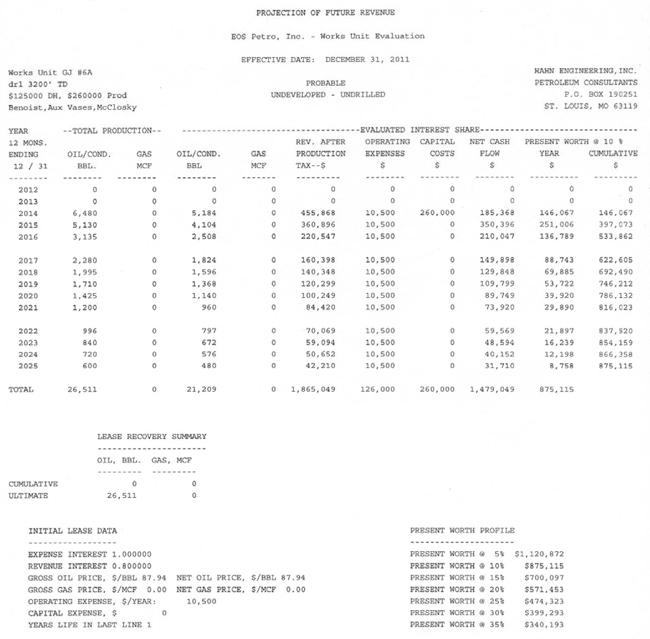

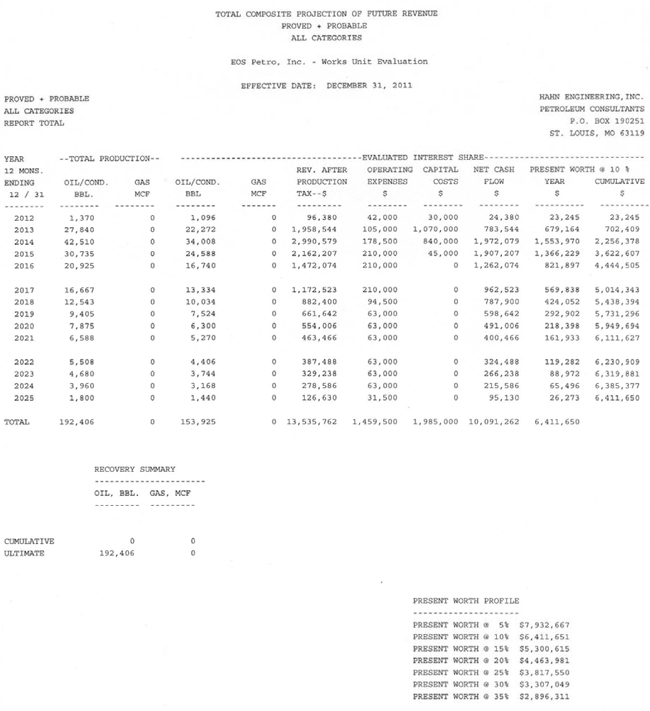

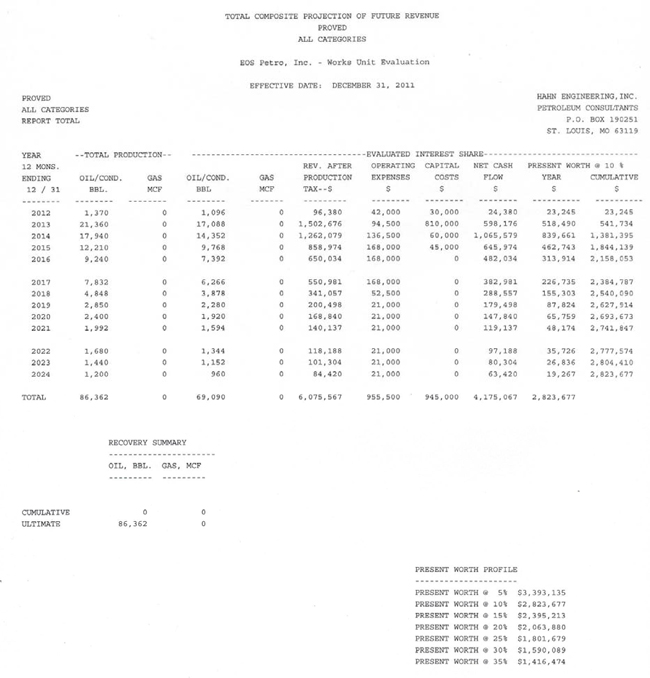

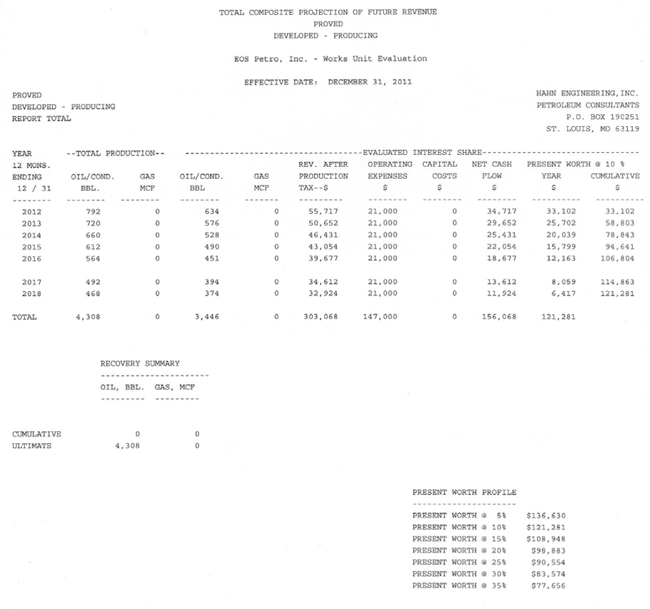

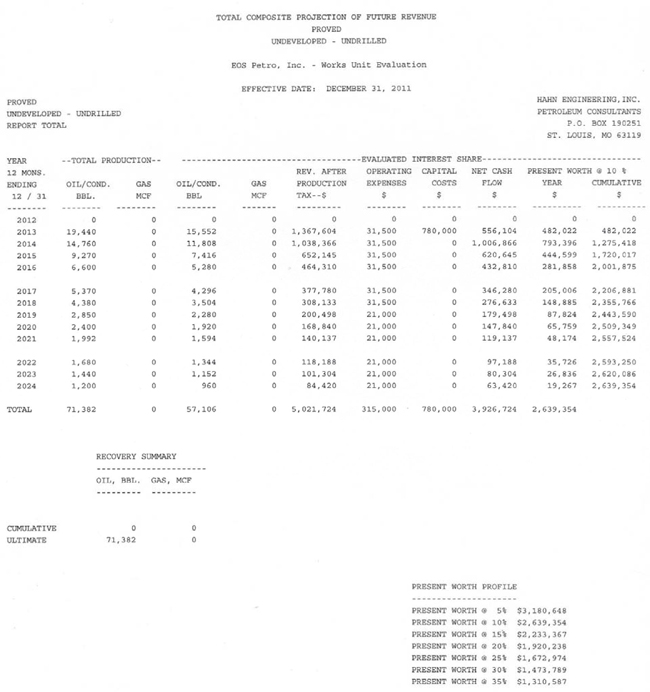

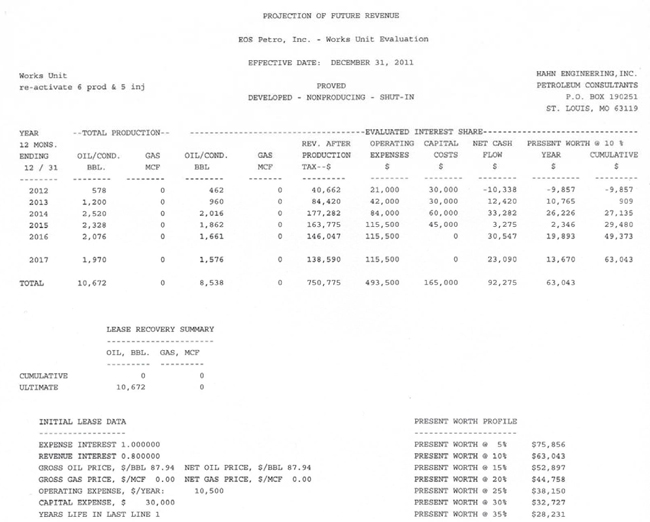

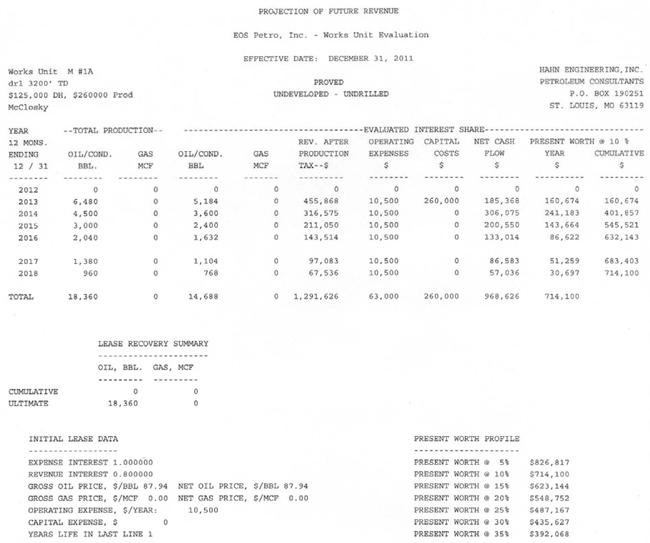

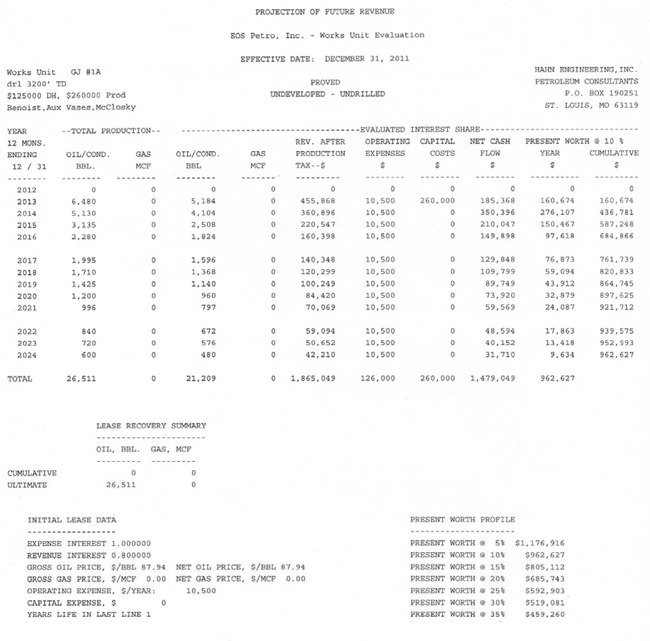

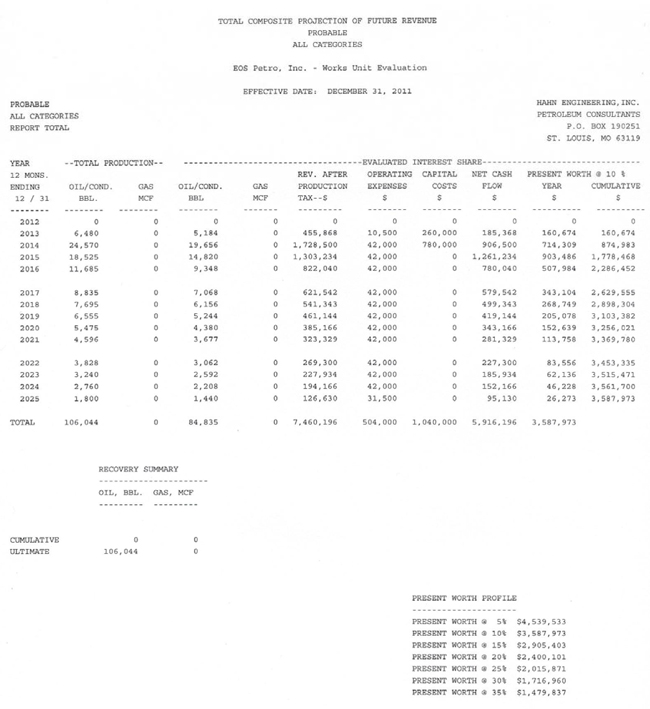

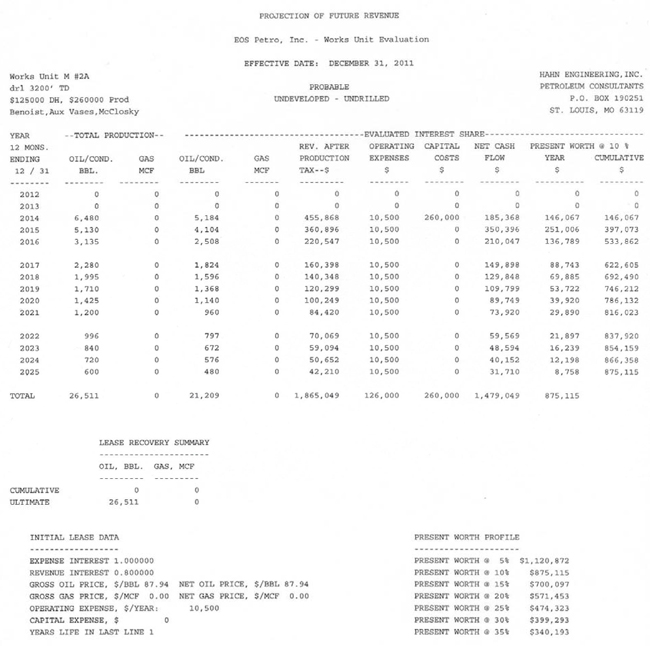

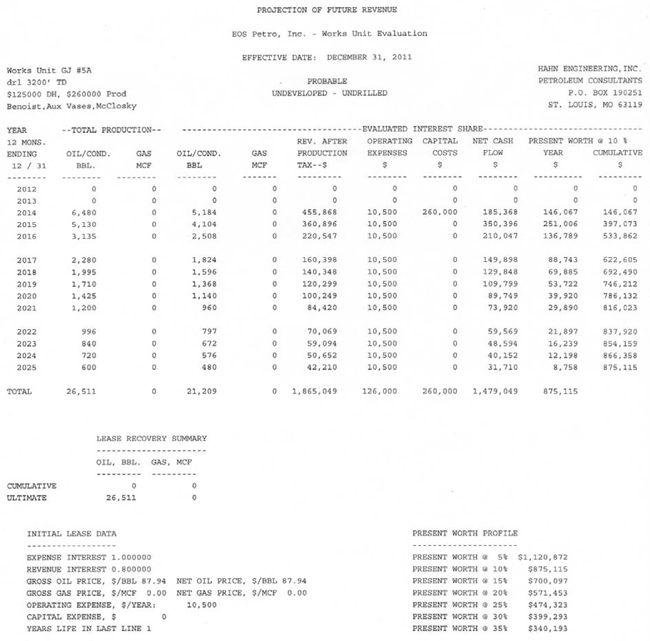

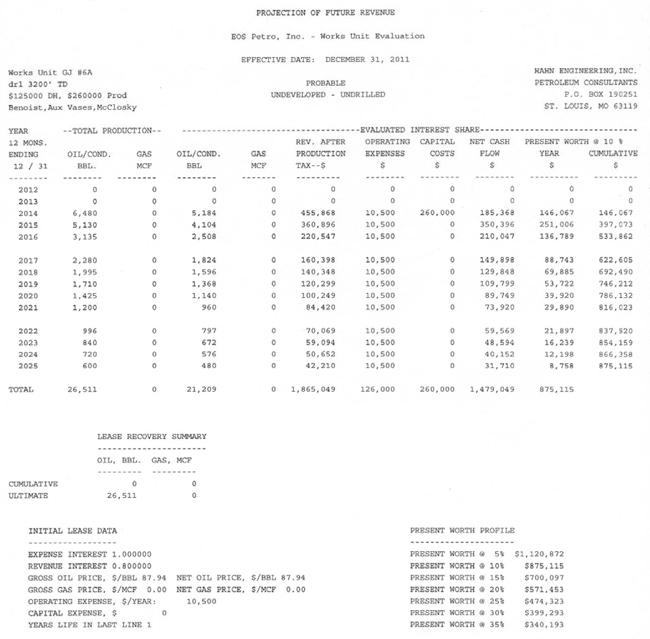

At your request, Hahn Engineering, Inc. has prepared an estimate of the reserves, future production and income attributable to a certain working interest in the Works Unit owned and operated by Eos Petro, Inc. in the Albion Consolidated Field, Edwards County, Illinois, as of December 31, 2011. The income data was estimated using a constant oil price based on SEC guidelines.

It should be noted that due to a combination of economic and political forces, there is significant uncertainty regarding the forecasting of future hydrocarbon prices. Crude oil prices were based on an average of the 1st day of the month posted price for each of the prior twelve months and held constant thereafter as required by the SEC regulations. The recoverable reserves and the income attributable thereto have a direct relationship to the hydrocarbon prices actually received; therefore, volumes of reserves actually recovered and amounts of income actually received may differ significantly from the estimated quantities presented in this report. A summary of the results, as of December 31, 2011, is shown below.

Estimated Reserve and Income of Certain Leasehold Interests

Eos Petro, Inc. as of December 31, 2011

| | | Proved | | | | | | | | | Total | |

| | | Proved Developed | | | Undeveloped | | | Total | | | Total | | | Proved & | |

| | | Producing | | | Non-Producing | | | Undrilled | | | Proved | | | Probable | | | Probable | |

| Gross Reserves | | | | | | | | | | | | | | | | | | | | | | | | |

| Oil - Barrels | | | 4,308 | | | | 10,672 | | | | 71,382 | | | | 86,362 | | | | 106,044 | | | | 192,406 | |

| Net Reserve | | | | | | | | | | | | | | | | | | | | | | | | |

| Oil – Barrels | | | 3,446 | | | | 8,538 | | | | 57,106 | | | | 69,090 | | | | 84,835 | | | | 153,925 | |

| Income Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Future Gross Revenue | | $ | 303,068 | | | $ | 750,775 | | | $ | 5,021,724 | | | $ | 6,075,567 | | | $ | 7,460,196 | | | $ | 13,535,762 | |

| Deductions | | $ | 147,000 | | | $ | 658,500 | | | $ | 1,095,000 | | | $ | 1,900,500 | | | $ | 1,544,000 | | | $ | 3,444,500 | |

| Future Net Income (FNI) | | $ | 156,068 | | | $ | 92,275 | | | $ | 3,926,724 | | | $ | 4,175,067 | | | $ | 5,916,196 | | | $ | 10,091,262 | |

| Discounted FNI @ 10 % | | $ | 121,281 | | | $ | 63,043 | | | $ | 2,639,354 | | | $ | 2,823,677 | | | $ | 3,587,973 | | | $ | 6,411,650 | |

Liquid hydrocarbons are expressed in standard 42 gallon barrels. All gas volumes, if any, is sales gas expressed in millions of cubic feet (MMCF) at the official temperature and pressure bases of the areas in which the gas reserves are located.

The deductions are comprised of the normal direct and indirect costs of operating the wells, i.e. pumper’s expense, electricity, propane, chemical inhibitor, supplies, insurance and normal well repair expense. There is no severance tax in the State of Illinois. The future net income is before the deduction of state and federal income taxes and general administrative overhead, and has not been adjusted for outstanding loans that may exist nor does it include any adjustment for cash on hand or gas production imbalances that may exist. Liquid hydrocarbon reserves account for approximately 100% of the total future gross revenue from the proved developed producing reserves.

The discounted future net income shown above was calculated using a discount rate of 10 percent per annum compounded semi-annually. Future net income was calculated at six other discount rates. These results are shown on each estimated projection of future production and income presented for all reserve categories in this report and in summary form below.

Discounted Future Net Income

as of December 31, 2011

| | | Proved | | | | | | | | | Total | |

| Discount | | Proved Developed | | | Undeveloped | | | Total | | | Total | | | Proved & | |

| Factor | | Producing | | | Non-Producing | | | Undrilled | | | Proved | | | Probable | | | Probable | |

| | | | | | | | | | | | | | | | | | | |

| 5 | | $ | 136,630 | | | $ | 75,856 | | | $ | 3,180,648 | | | $ | 3,393,135 | | | $ | 4,539,533 | | | $ | 7,932,667 | |

| 15 | | $ | 108,948 | | | $ | 52,897 | | | $ | 2,233,367 | | | $ | 2,395,213 | | | $ | 2,905,403 | | | $ | 5,300,615 | |

| 20 | | $ | 98,883 | | | $ | 44,758 | | | $ | 1,920,238 | | | $ | 2,063,880 | | | $ | 2,400,101 | | | $ | 4,463,981 | |

| 25 | | $ | 90,554 | | | $ | 38,150 | | | $ | 1,672,974 | | | $ | 1,801,679 | | | $ | 2,015,871 | | | $ | 3,817,550 | |

| 30 | | $ | 83,574 | | | $ | 32,727 | | | $ | 1,473,789 | | | $ | 1,590,089 | | | $ | 1,716,960 | | | $ | 3,307,049 | |

| 35 | | $ | 77,656 | | | $ | 28,231 | | | $ | 1,310,587 | | | $ | 1,416,474 | | | $ | 1,479,837 | | | $ | 2,896,311 | |

The results shown above are presented for your information and should not be construed as our estimate of fair market value.

Reserves Included in this Report

The proved reserves included herein conform to the definition as set forth in the SEC regulation Part 210.4-10(a).

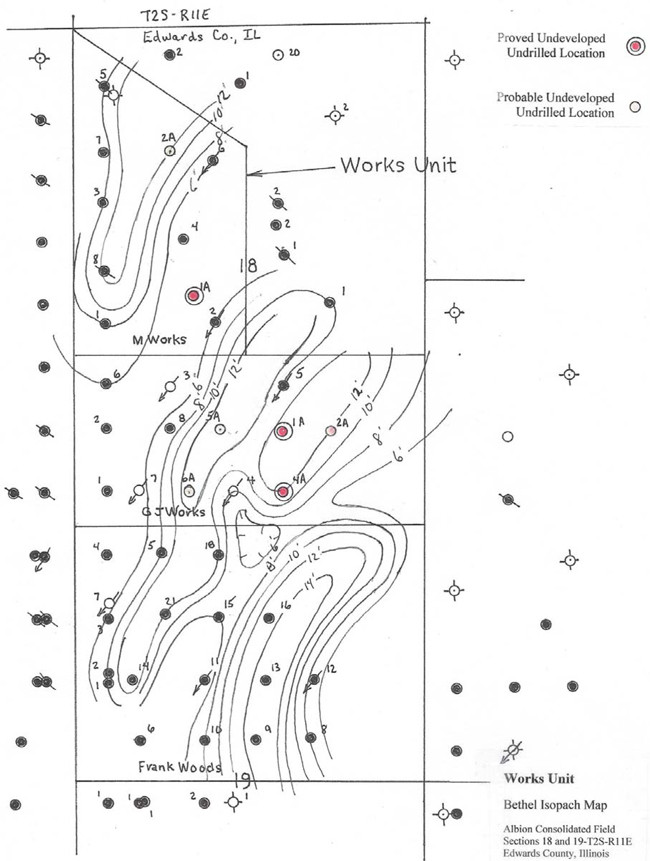

Estimates of Reserves

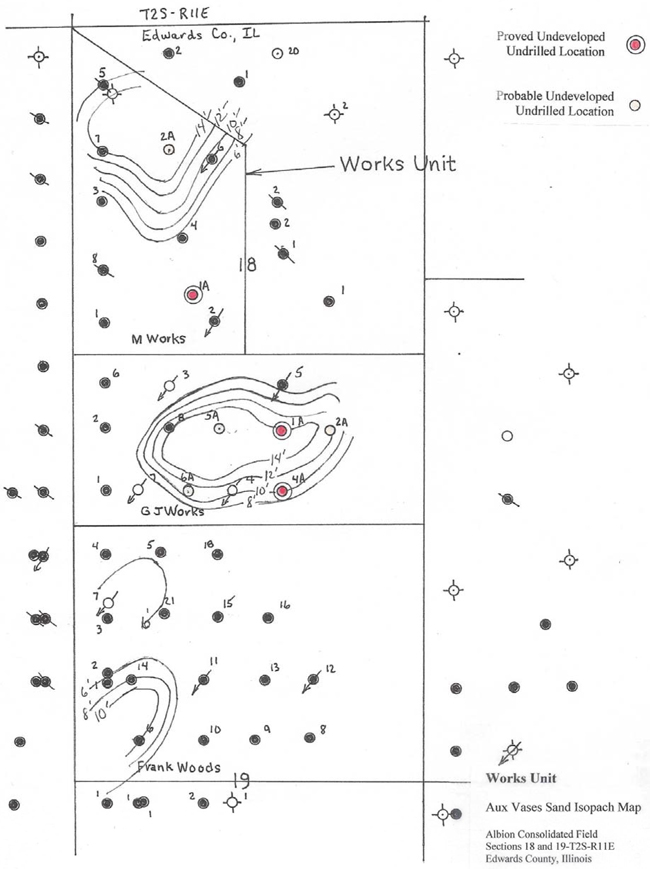

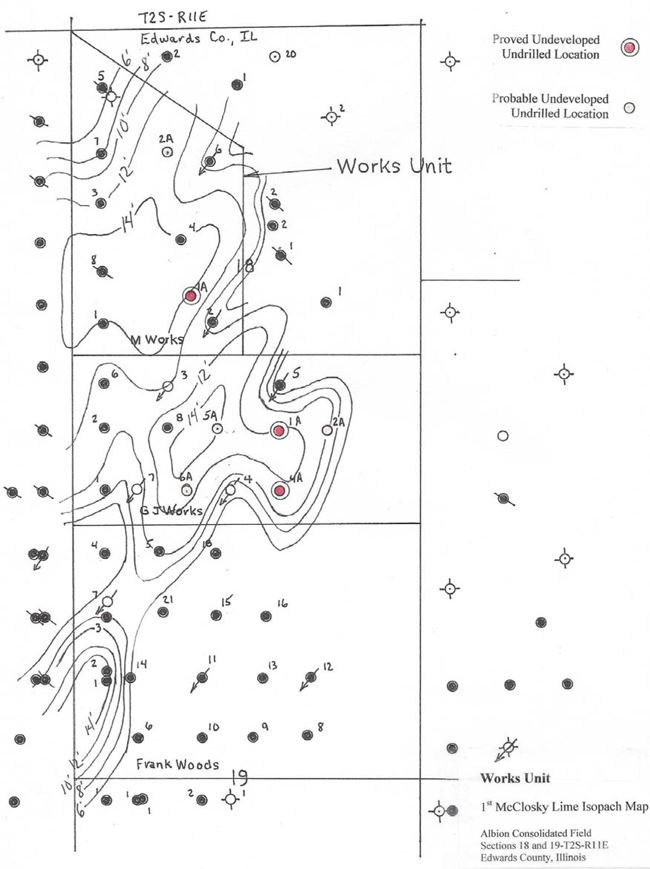

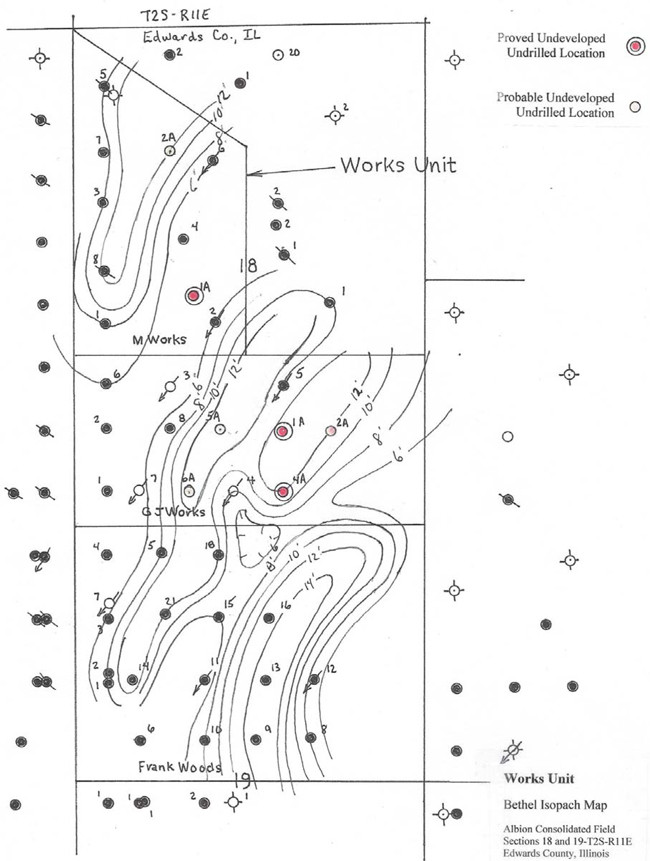

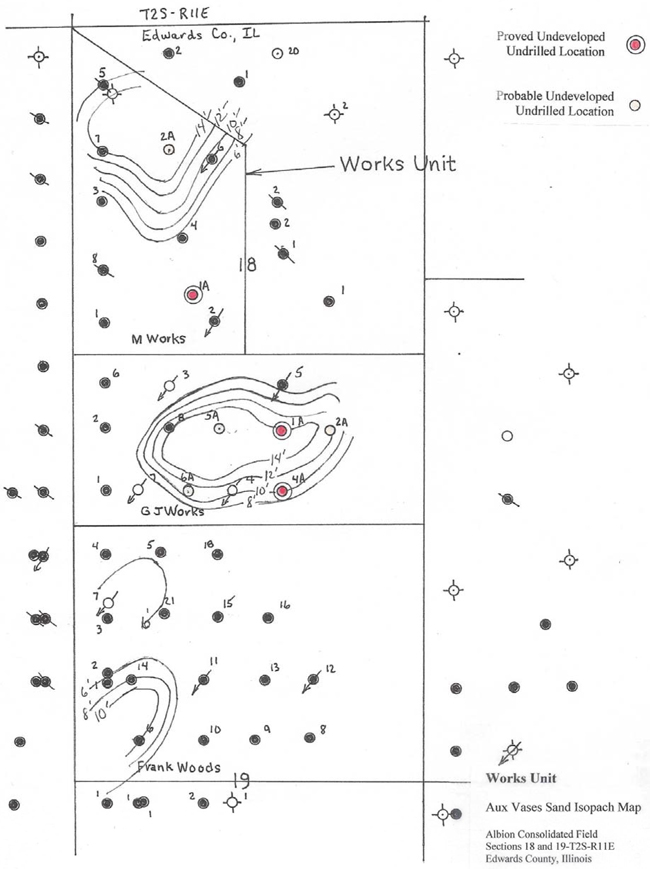

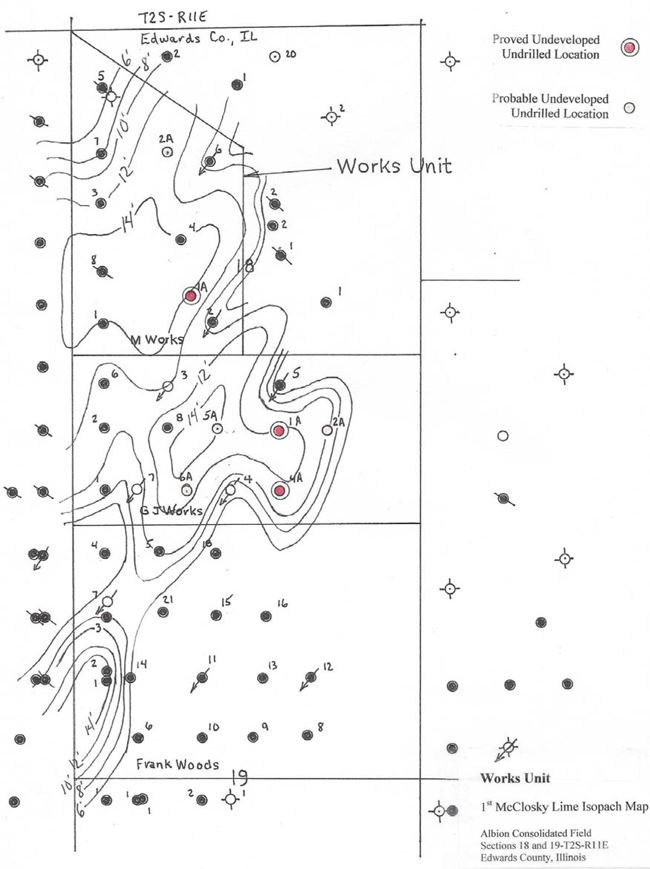

In general, the proved developed producing reserves included herein were estimated by the performance method. The reserves estimated by the performance method utilized extrapolations of various historical oil sales data in those cases where such data were definitive. The proved developed non-producing reserves were based on well test data taken prior to 2008 when the Works Unit was shut-in due to the death of the owner/operator at that time. The proved undeveloped undrilled reserves were based on recoveries from similar zone production from the Unit with a reasonable certainty that they will be recovered. The probable undeveloped undrilled reserves were based on recoveries from similar zone production from the Unit with less certainty that they will be recovered. Isopach maps of the primary producing zones with marked proved and probable well locations are attached. Structure maps of overlying marker zones are also attached.

The reserves included in this report are estimates only and should not be construed as being exact quantities. They may or may not be actually recovered, and if recovered, the revenues therefrom and the actual costs related thereto could be more or less than the estimated amounts. Moreover, estimates of reserves may increase or decrease as a result of future operations.

Future Production Rates

Initial production rates are based on the current producing rates for those wells now on production. The historical oil sales graph plotted monthly since 1998 is attached. Projections of estimated future oil production, as marked, are also shown on the graph. Historical oil production data was available from 1980 through October 2012.

Hydrocarbon Prices

Oil prices were based on the average posted crude oil price for the 1st day of each of the twelve months for the calendar year 2011, or $87.9375 per barrel and held constant thereafter per SEC guidelines. There is no severance tax in the State of Illinois.

Operating Expenses

Operating expenses for the Works Unit in this report were based on both similar well operating expenses incurred by the operator at other similar wells. These estimated expenses would include pumper’s expense, electricity, propane, chemical inhibitor, supplies, insurance and normal well repair expense. The operating expenses were held constant for economic life of each lease. No deduction was made for indirect costs such as loan repayments, interest expense and exploration and development prepayments that are not charged directly to the leases or wells.

General

The estimates of reserves presented herein are based upon a detailed study of the properties in which Eos Petro, Inc owns a working interest. No consideration was given in this report to potential environmental liabilities which may or may not exist nor were any costs included for potential liability to plug and abandon wells, or restore and clean up damages, if any, caused by past operating practices. Eos Petro, Inc. has supplied to Hahn Engineering, Inc. their pertinent accounts, records and other data for this investigation. Historical information and data from a prior operator, Superior Oil Company, was also utilized. The ownership interests, expenses and other factual data furnished were accepted as presented. The historical oil sales data for each lease was obtained from IHS Energy/Petroleum Information and generally available through October 2012.

Hahn Engineering, Inc. does not have any interest in the subject properties and neither the employment to perform this study nor the compensation is contingent on our estimates of reserves and future income for the subject properties. Hahn Engineering, Inc. does not guarantee the reserve estimates or the net cash flow projections. This report was prepared for the exclusive use of Eos Petro, Inc. Thank you for this opportunity to be of service.

Yours truly,

HAHN ENGINEERING, INC.

| /s/ Joseph K. Hahn | |

| Joseph K. Hahn, P.E. | |

EOS Petro, Inc.

As of December 31, 2011

| Reserves Category: | | | |

| | | Net | |

| | | Reserves | |

| | | Bbls. Oil | |

| USA Proved | | | | |

| Developed | | | 11,984 | |

| Undeveloped | | | 57,106 | |

| | | | | |

| Total Proved | | | 69,090 | |

| | | | | |

| USA Probable | | | | |

| Developed | | | 0 | |

| Undeveloped | | | 84,835 | |

| | | | | |

| Total Probable | | | 84,835 | |

| | | | | |

| Total USA Proved and Probable | | | 153,925 | |