April 10, 2013 |  |

VIA EDGAR Roger Schwall Assistant Director United States Securities & Exchange Commission Division of Corporate Finance 100 F. Street, N.E.

Washington, D.C. 20549 | |

Jeffrey P. Berg direct dial: 310.442.8850 jberg@bakerlaw.com |

| | Re: | Cellteck, Inc. |

| | | Amendment No. 2 to Current Report on Form 8-K |

| | | Filed March 11, 2013 |

| | | File No. 000-53246 |

Dear Mr. Schwall:

On behalf of Cellteck, Inc. (the “Company”), this letter responds to the April 3, 2013 letter from the staff (the “Staff”) of the Securities and Exchange Commission (the “SEC”) with respect to the above-referenced filing.

During a conference call on April 8, 2013, the Staff indicated to us that it would not be necessary at this time to file an Amendment No. 3 to the above-referenced filing. Instead, the Staff indicated that the Company could send this letter to the SEC with only the revised pages of: (1) the interim unaudited financial statements of Eos Petro, Inc. for the nine month period ended September 30, 2012 and audited financial statements of Eos Petro, Inc. for the year ended December 31, 2011 (the “Financial Statements”), previously filed as Exhibit 99.1 to the above-referenced filing; and (2) the Works Unit Reserve Evaluation dated February 19, 2013 (the “Reserve Report”), previously filed as Exhibit 99.3 to the above-referenced filing, which needed to be amended in order to respond to the Staff’s comments. The Staff’s comments are set forth below in bold, followed by the Company’s response to each comment. The revised pages of the Financial Statements and Reserve Report are attached as exhibits to this letter.

The Company acknowledges that, during the April 8, 2013 conference call, the Staff indicated that it would not consider clearing the comments set forth in the Staff’s April 3, 2013 letter until the Staff had reviewed the Company’s Annual Report on Form 10-K for the year ended December 31, 2012.

Roger Schwall, Assistant Director

United States Securities & Exchange Commission

April 10, 2013

Page 2

Simultaneously with the submission of this letter, and in response to a telephonic comment from the Staff on April 3, 2013, the Company is also filing via EDGAR a separate letter, signed by an officer of the Company, in which the Company acknowledges that, in responding to the comments set forth in the Staff’s April 3, 2013 letter:

| · | The Company is responsible for the adequacy and accuracy of the disclosure in the filings; |

| · | Staff comments or changes to disclosure in response to Staff comments do not foreclose the SEC from taking any action with respect to the filings; and |

| · | The Company may not assert Staff comments as a defense in any proceeding initiated by the SEC or any person under the federal securities laws of the United States. |

Capitalized terms not otherwise defined herein have the same meanings given to them as in the above-referenced filing.

Amendment No. 2 to Current Report on Form 8-K Filed March 11, 2013

Exhibit 99.1 – Financial Statements of Eos Petro, Inc. and Subsidiaries

Note 13 – Supplemental Information Relating to Oil and Gas Producing Activities (unaudited), page F-35

Standardized Measure of Discounted Future Cash Flows, page F-35

| 1. | Please revise your estimated quantities table to reflect the net proved developed and net proved undeveloped reserved, as outlined in your February 19, 2013 reserve report, not the gross reserves that are now disclosed. |

In response to the Staff’s comment, attached to this letter asExhibit A are revised pages F-35 and F-36 of the Financial Statements. The estimated quantities tables now reflect net proved developed and net proved undeveloped reserves.

| 2. | Please revise the components in your standardized measure of oil and gas to agree to your February 19, 2013 reserve report, as appropriate. For example, we note that your reserve report states that future gross revenue is $6,076,430 and discounted FNI is $2,752,830, but your disclosure quantifies these amounts as $15,535,762 and $5,154,481. Please also make corresponding changes to the changes in standardized measure schedule so that the schedule is correct. |

Roger Schwall, Assistant Director

United States Securities & Exchange Commission

April 10, 2013

Page 3

In response to the Staff’s comment, please see page F-36 of the Financial Statements attached to this letter asExhibit A, which has been revised to match the reserve report’s future gross revenue of $6,076,430. However, please note that the discounted FNI on page F-36 still does not match the reserve report’s discounted FNI of $2,752,830. As was disclosed in the Reserve Report, the Reserve Report’s discounted FNI did not take into account state or federal income taxes. The discounted FNI on page F-36 deducts $1,189,199 in future income taxes. The Company is advised that it is normal and customary in the industry for reserve reports to not deduct state or federal income taxes from FNI calculations. The attached page F-36 also deducts the same $2,000,500 in future production and development costs as was deducted in the Reserve Report.

Changes corresponding with the above were also made to the standardized measure schedule in the Financial Statements on page F-36.

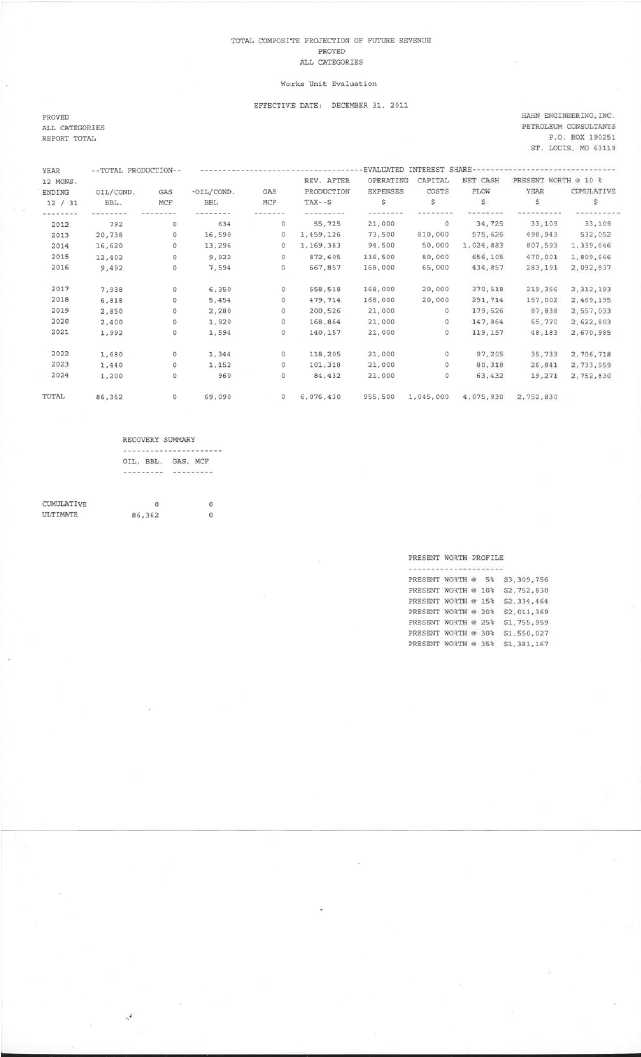

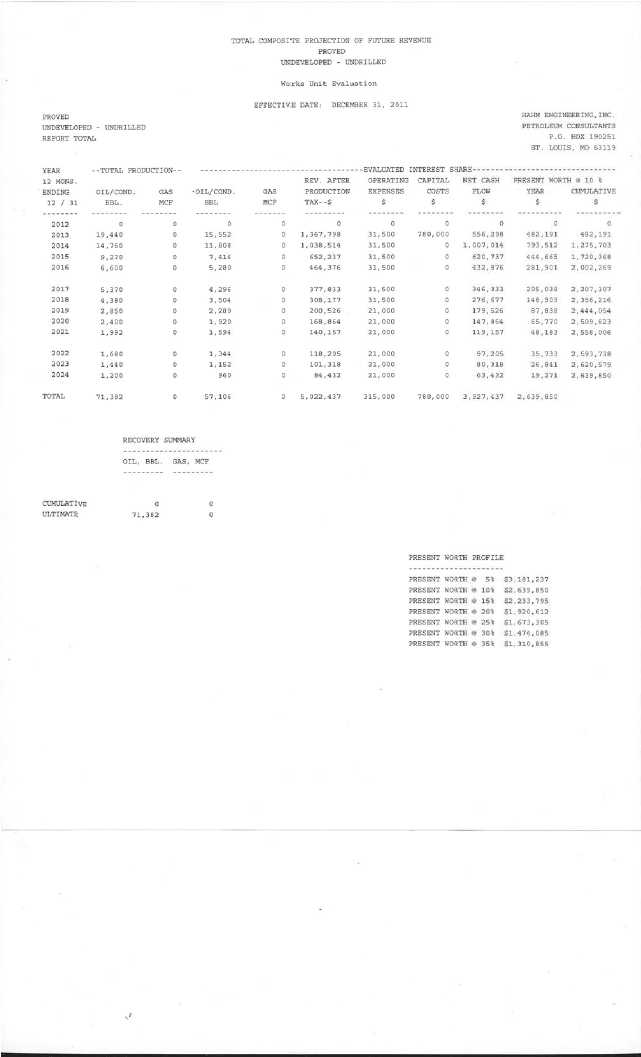

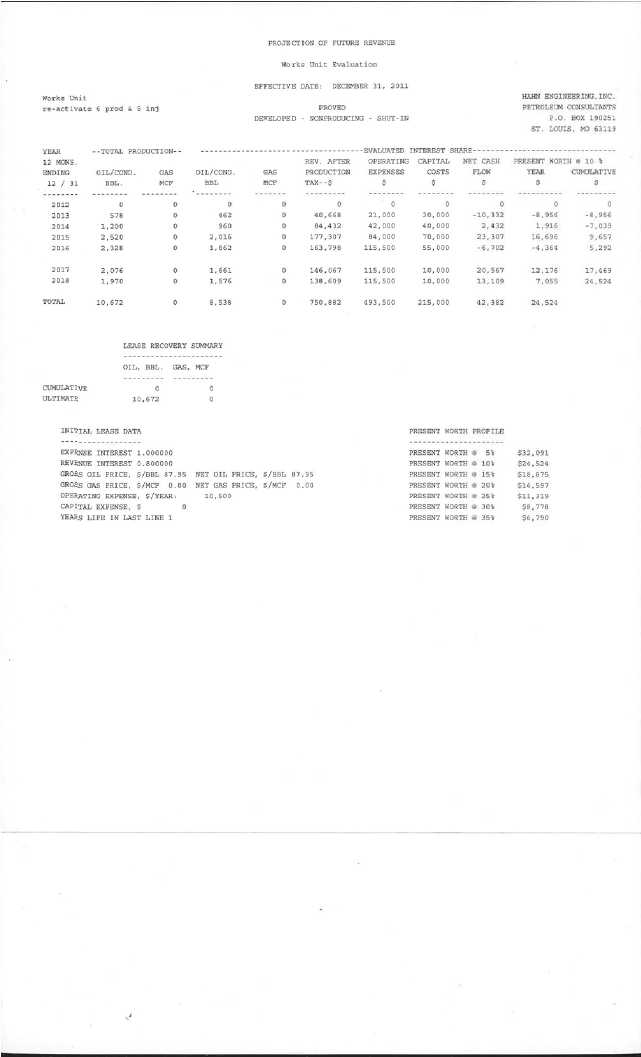

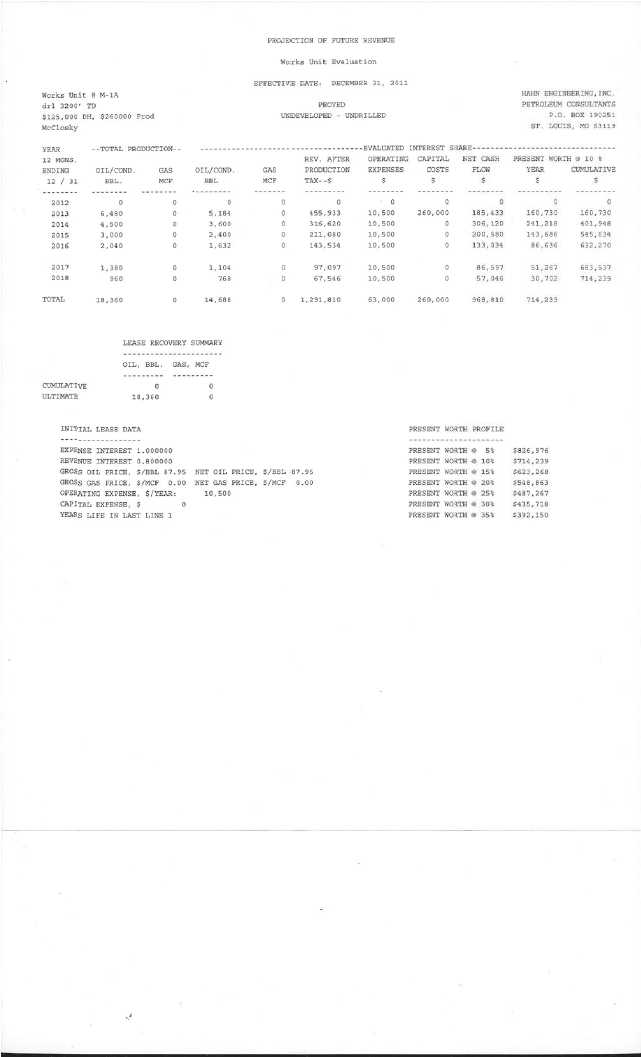

Exhibit 99.3 – Hahn Engineering, Inc. Reserve Report

| 3. | The reserves report filed as Exhibit 99.3 to your Form 8-K/A appears to include income data in the individual cash flow calculation tables which does not reflect the revisions in the crude oil benchmark price or capital costs relating to abandonment that were made in responding to prior comments. Therefore, these schedules are inconsistent with the corresponding income data on pages 1 and 2 of the amended reserves report. Please obtain and file a revised reserves report which includes corrections to the supplemental tables to be consistent with the information presented elsewhere in the report. |

On April 5, 2013, Joseph Hahn, the petroleum engineer who prepared the Reserve Report, and Jessica Wade, an attorney at Baker & Hostetler LLP, spoke to John Hodgin, Staff petroleum engineer, to discuss the above-referenced comment on the Reserve Report. The three of them determined that, when income data in the Reserve Report was amended to respond previous Staff comments, the corresponding schedules of supplemental tables to the Reserve Report were not similarly amended.

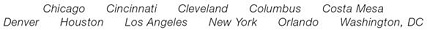

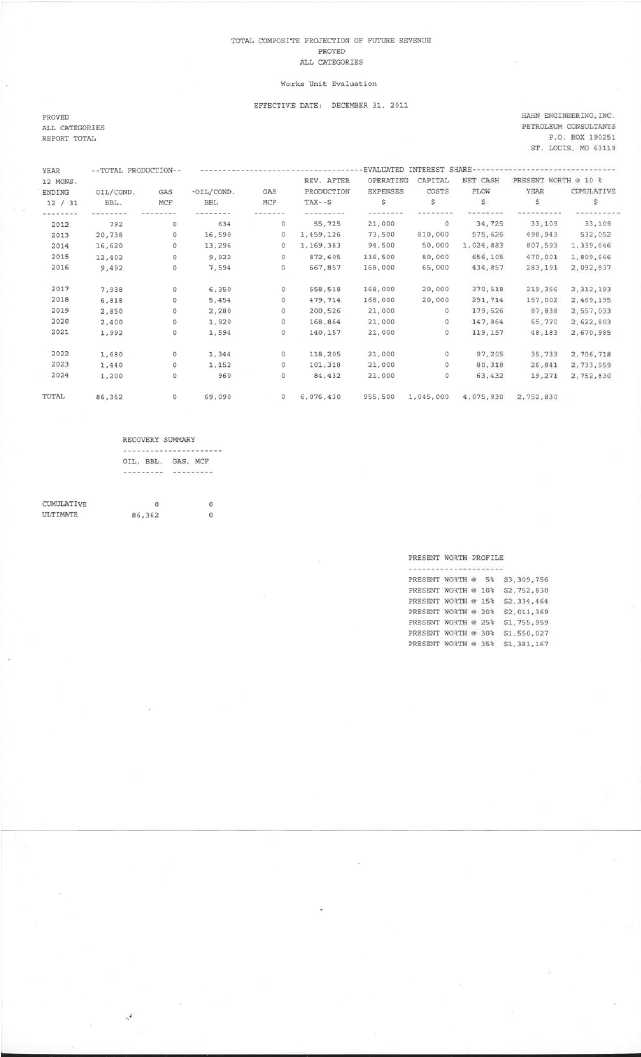

To respond to the Staff’s comment, the following amended supplemental cashflow tables are attached asExhibit B to this letter:

| 1. | Page 1 – TotalProved Reserves Summary; |

| 2. | Page 2 – TotalProved Developed Producing Reserves Summary; |

Roger Schwall, Assistant Director

United States Securities & Exchange Commission

April 10, 2013

Page 4

| 3. | Page 3 –Total Proved Developed Non-Producing Reserves Summary; |

| 4. | Page 4 –Total Proved Undeveloped Undrilled Reserves Summary; |

| 5. | Page 5 -Individual Cashflow of Current Producing Wells; |

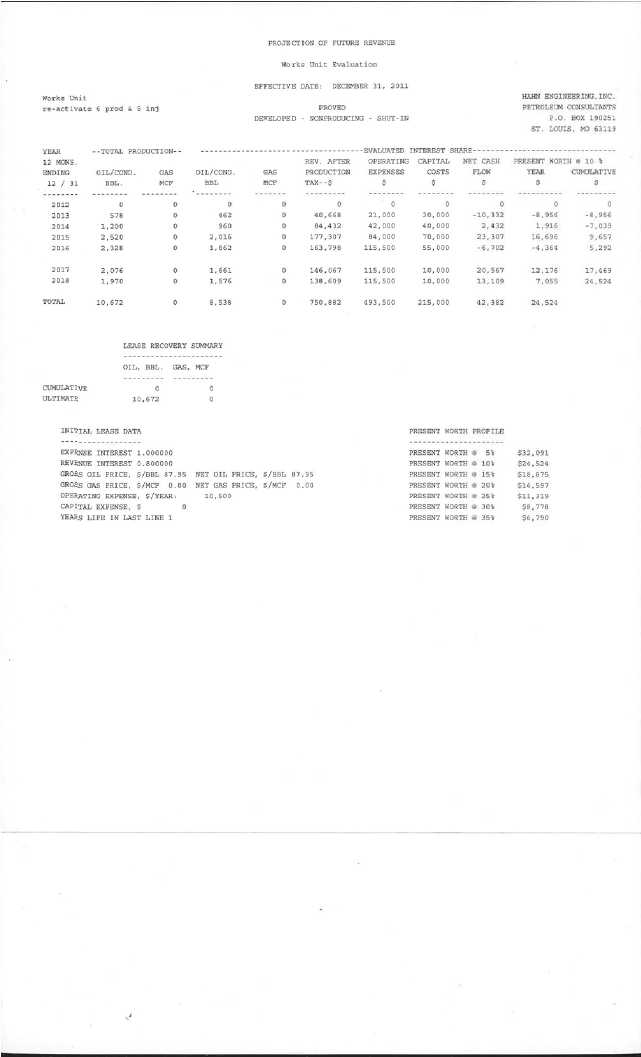

| 6. | Page 6 –Individual Cashflow of Reactivating Currently Shut-in Wells; |

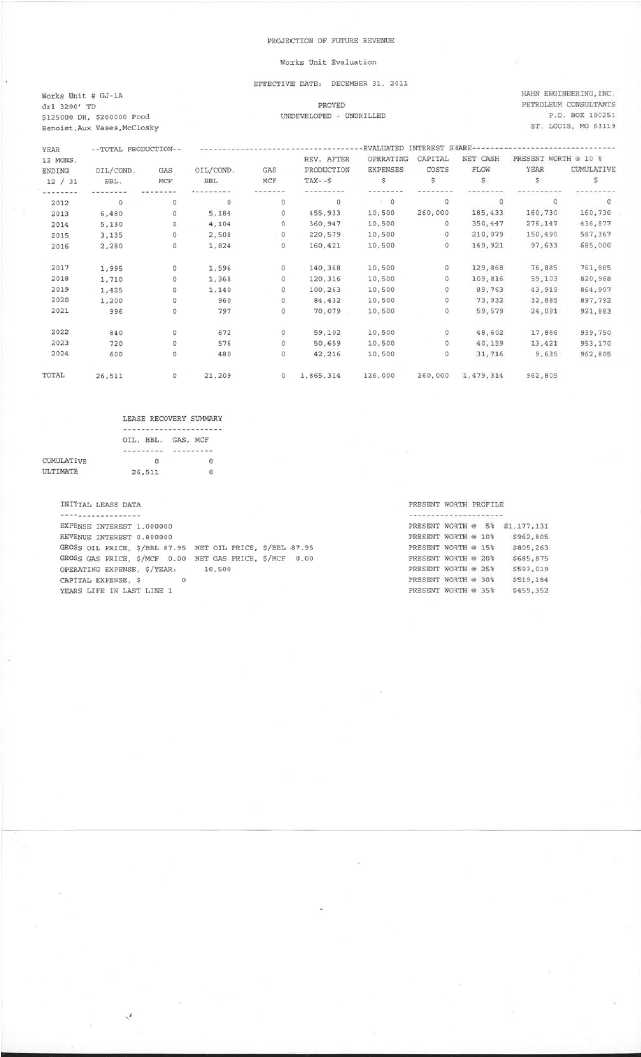

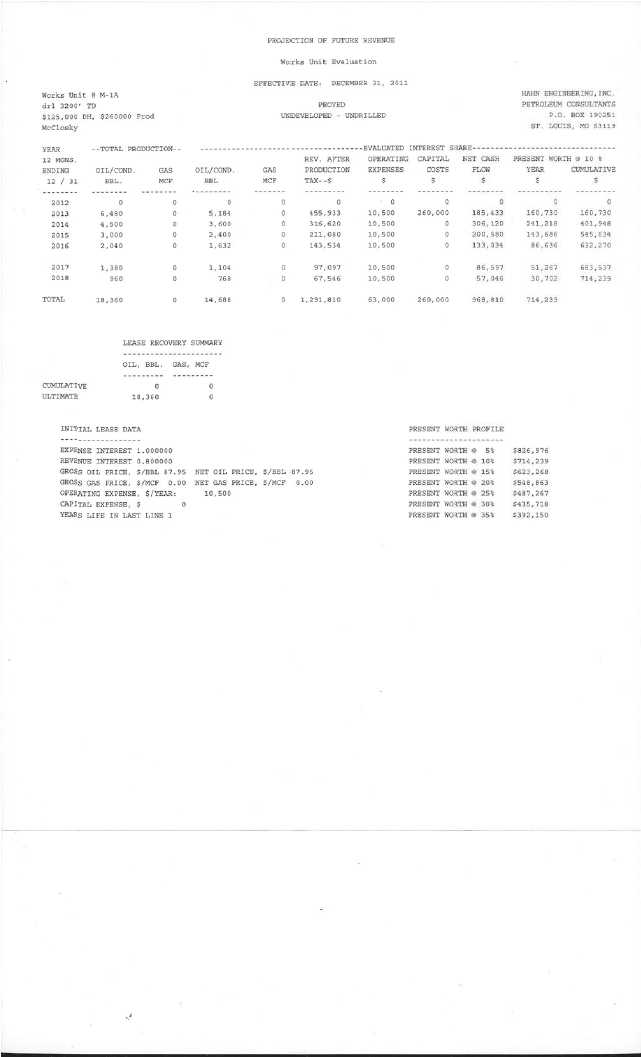

| 7. | Page 7 –Individual Cashflow of M#1A Undrilled Location; |

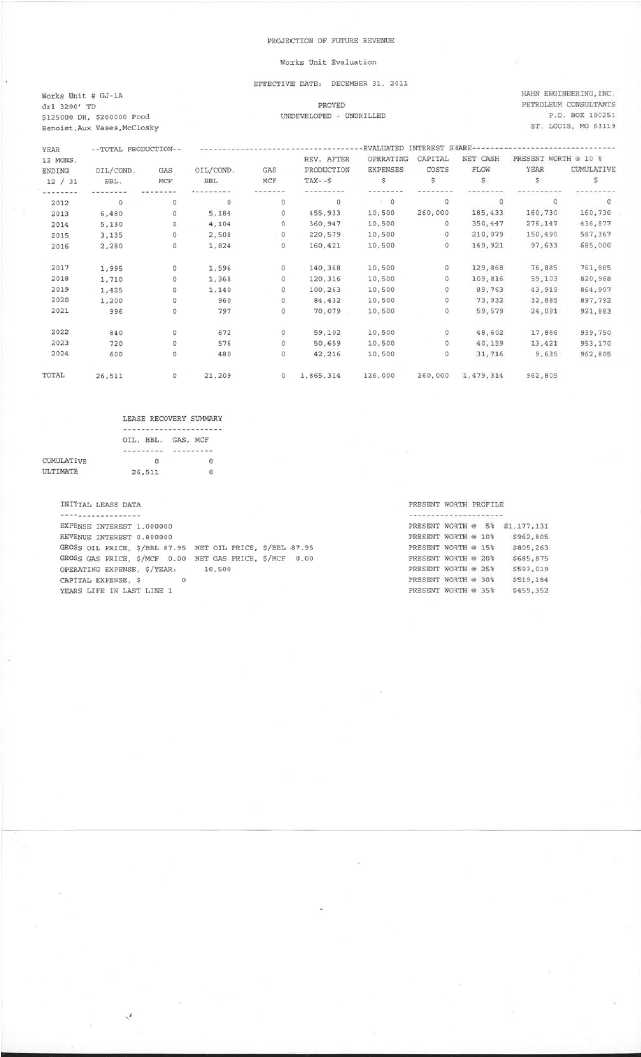

| 8. | Page 8 –Individual Cashflow of GJ#1A Undrilled Location; |

| 9. | Page 9 –Individual Cashflow of GJ#4A Undrilled Location (PUD); and |

| 10. | Page 10 -Production Graph With Projected BOPM for PDP, PDNP, Total Proved (PDP+PDNP+PUD). |

Closing Comments

The Company hopes that these responses fully address your inquiries. Please contact us if you have any further questions at the address and phone number in our letterhead.

| | Sincerely, |

| | |

| | |

| | |

| | /s/ Jeffrey P. Berg |

| | |

| | Jeffrey P. Berg |

| | of BAKER & HOSTETLER LLP |

| | |

EXHIBIT A

EOS Petro, Inc. and Subsidiaries

(A Development Stage Company)

Notes to Consolidated Financial Statements

For the Period from May 2, 2011 (Inception) to December 31, 2011,

For the Period from May 2, 2011 (Inception) to September 30, 2012 (Unaudited),

And For the Nine Months Ended September 30, 2012 and 2011 (Unaudited)

NOTE 13 - SUPPLEMENTAL INFORMATION RELATING TO OIL AND GAS PRODUCING ACTIVITIES (UNAUDITED)

Estimated Quantities of Proved Reserves. Hahn Engineering, Inc., an independent engineering firm, prepared the estimates of the proved reserves, future production, and income attributable to the leasehold interests as of December 31, 2011. Estimates of Proved Reserves as of December 31, 2011 were prepared by management using the report of Hahn Engineering, Inc. The estimated proved net recoverable reserves presented below include only those quantities that were expected to be commercially recoverable at prices and costs in effect at the balance sheet dates under the then existing regulatory practices and with conventional equipment and operating methods. Proved Developed Reserves represent only those reserves estimated to be recovered through existing wells. Proved Undeveloped Reserves include those reserves that may be recovered from new wells on undrilled acreage or from existing wells on which a relatively major expenditure for recompletion or secondary recovery operations is required. All of the Company’s Proved Reserves are located onshore in the continental United States of America.

Discounted future cash flow estimates like those shown below are not intended to represent estimates of the fair value of oil and gas properties. Estimates of fair value should also consider unproved reserves, anticipated future oil and gas prices, interest rates, changes in development and production costs and risks associated with future production. Because of these and other considerations, any estimate of fair value is subjective and imprecise.

The following table sets forth estimates of the proved oil and gas reserves (net of royalty interests) for the Company and changes therein, for the periods indicated.

| Estimated Quantities of Proved Reserves |

| | | Oil | |

| | | (bbls) | |

| December 31, 2011 | | | |

| Purchases of reserves in place | | | 69,232 | |

| Production | | | (142 | ) |

| Net change | | | (69,090 | ) |

| | | | | |

Standardized Measure of Discounted Future Net Cash Flows. The Standardized Measure related to proved oil and gas reserves is summarized below. Future cash inflows were computed by applying a twelve month average of the first day of the month prices to estimated future production, less estimated future expenditures (based on year end costs) to be incurred in developing and producing the proved reserves, less estimated future income tax expense. Future income tax expenses are calculated by applying appropriate year-end tax rates to future pretax net cash flows, less the tax basis of properties involved. Future net cash flows are discounted at a rate of 10% annually to derive the standardized measure of discounted future net cash flows. This calculation procedure does not necessarily result in an estimate of the fair market value or the present value of the Company.

EOS Petro, Inc. and Subsidiaries

(A Development Stage Company)

Notes to Consolidated Financial Statements

For the Period from May 2, 2011 (Inception) to December 31, 2011,

For the Period from May 2, 2011 (Inception) to September 30, 2012 (Unaudited),

And For the Nine Months Ended September 30, 2012 and 2011 (Unaudited)

| Estimated Quantities of Proved Reserves |

| | | Oil | |

| | | (bbls) | |

| Proved developed reserves December 31, 2011 | | | 11,984 | |

| | | | | |

| Proved undeveloped reserves December 31, 2011 | | | 57,106 | |

| | | | | |

| Standardized Measure of Oil and Gas |

| December 31, 2011 | | | |

| Future cash inflows | | $ | 6,076,430 | |

| Future production and development costs | | | (2,000,500 | ) |

| Future income taxes | | | (1,189,199 | ) |

| Future net cash flows | | | 2,886,731 | |

| Discount of future net cash flows at 10% per annum | | | (937,071 | ) |

| Standardized measure of discounted future net cash flows | | $ | 1,949,660 | |

The following table sets forth the changes in standardized measure of discounted future net cash flows relating to proved oil and gas reserves for the periods indicated.

| Changes in Standardized Measure |

| | | | |

| Period ended December 31, 2011 | | | |

| Beginning of the year | | $ | - | |

| Sales of oil and gas produced, net of production costs | | | 44,443 | |

| Purchases of minerals in place | | | 1,905,217 | |

| Net change | | $ | 1,949,660 | |

EXHIBIT B