Exhibit (c) - (2)

|

Minneapolis New York Chicago San Francisco Palo Alto London Hong Kong PROJECT GLORIA Confidential Discussion Materials June 1, 2012 Since 1895. Member SIPC and NYSE. GUIDES FOR THE JOURNEY.® PiperJaffray® |

|

TABLE OF CONTENTS CONFIDENTIAL INFORMATION Section I Transaction Overview Section II GLORIA Overview Section III Valuation Summary Appendix A GLORIA Financial Summary This presentation has been delivered pursuant to, and is subject to the terms and conditions of, the engagement letter between Piper Jaffray & Co. (“Piper Jaffray”) and GLORIA dated March 6, 2012. GUIDES FOR THE JOURNEY.® PiperJaffray® 2 |

|

SECTION I Transaction Overview GUIDES FOR THE JOURNEY.® PiperJaffray® |

|

|

|

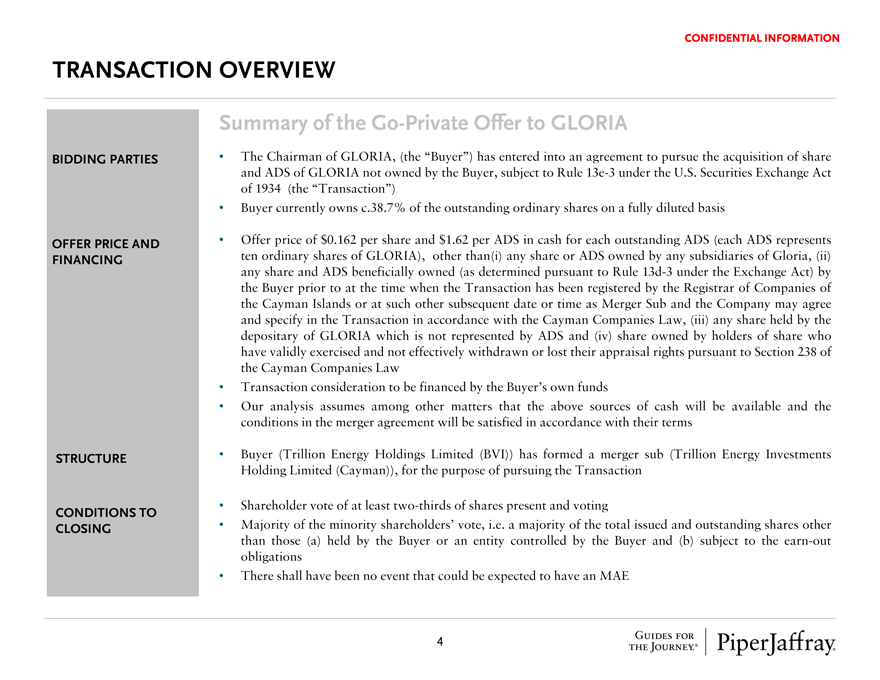

TRANSACTION OVERVIEW CONFIDENTIAL INFORMATION BIDDING PARTIES OFFER PRICE AND FINANCING STRUCTURE CONDITIONS TO CLOSING Summary of the Go-Private Offer to GLORIA The Chairman of GLORIA, (the “Buyer”) has entered into an agreement to pursue the acquisition of share and ADS of GLORIA not owned by the Buyer, subject to Rule 13e-3 under the U.S. Securities Exchange Act of 1934 (the “Transaction”) Buyer currently owns c.38.7% of the outstanding ordinary shares on a fully diluted basis Offer price of $0.162 per share and $1.62 per ADS in cash for each outstanding ADS (each ADS represents ten ordinary shares of GLORIA), other than(i) any share or ADS owned by any subsidiaries of Gloria, (ii) any share and ADS beneficially owned (as determined pursuant to Rule 13d-3 under the Exchange Act) by the Buyer prior to at the time when the Transaction has been registered by the Registrar of Companies of the Cayman Islands or at such other subsequent date or time as Merger Sub and the Company may agree and specify in the Transaction in accordance with the Cayman Companies Law, (iii) any share held by the depositary of GLORIA which is not represented by ADS and (iv) share owned by holders of share who have validly exercised and not effectively withdrawn or lost their appraisal rights pursuant to Section 238 of the Cayman Companies Law Transaction consideration to be financed by the Buyer’s own funds Our analysis assumes among other matters that the above sources of cash will be available and the conditions in the merger agreement will be satisfied in accordance with their terms Buyer (Trillion Energy Holdings Limited (BVI)) has formed a merger sub (Trillion Energy Investments Holding Limited (Cayman)), for the purpose of pursuing the Transaction Shareholder vote of at least two-thirds of shares present and voting Majority of the minority shareholders’ vote, i.e. a majority of the total issued and outstanding shares other than those (a) held by the Buyer or an entity controlled by the Buyer and (b) subject to the earn-out obligations There shall have been no event that could be expected to have an MAE GUIDES FOR THE JOURNEY.® PiperJaffray® 4 |

|

|

|

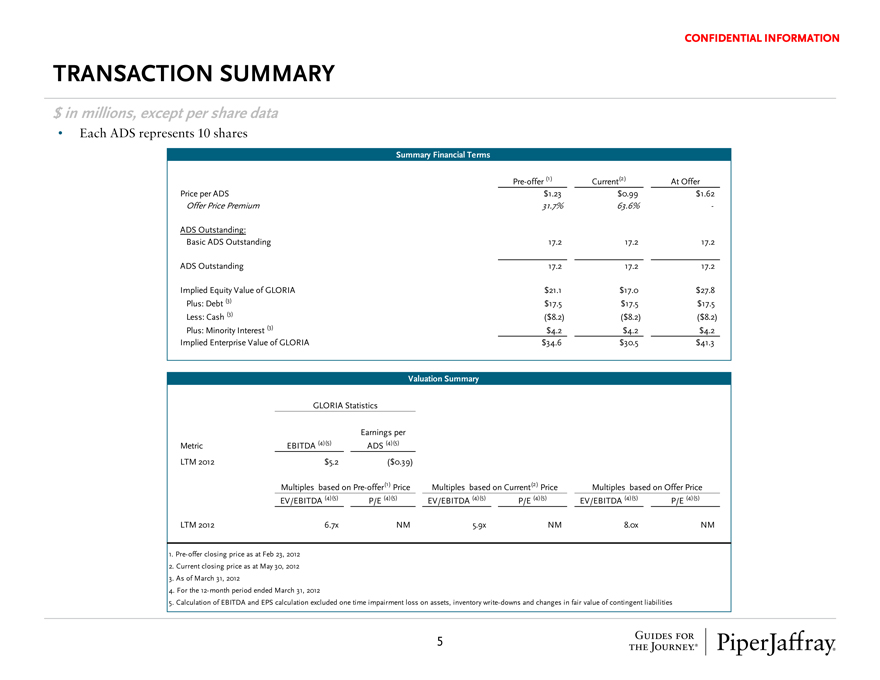

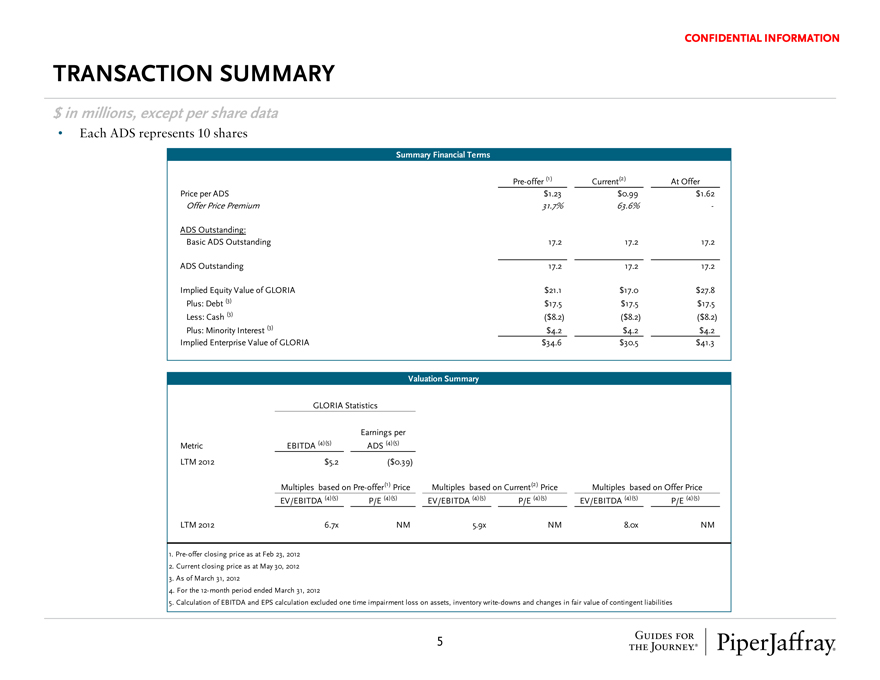

TRANSACTION SUMMARY CONFIDENTIAL INFORMATION $ in millions, except per share data Each ADS represents 10 shares Summary Financial Terms Pre-offer (1) Current (2) At Offer Price per ADS $1.23 $0.99 $1.62 Offer Price Premium 31.7% 63.6% - ADS Outstanding: Basic ADS Outstanding 17.2 17.2 17.2 ADS Outstanding 17.2 17.2 17.2 Implied Equity Value of GLORIA $21.1 $17.0 $27.8 Plus: Debt (3) $17.5 $17.5 $17.5 Less: Cash (3) ($8.2) ($8.2) ($8.2) Plus: Minority Interest (3) $4.2 $4.2 $4.2 Implied Enterprise Value of GLORIA $34.6 $30.5 $41.3 Valuation Summary GLORIA Statistics Earnings per ADS (4)(5) Metric EBITDA (4)(5) LTM 2012 $5.2 ($0.39) Multiples based on Pre-offer(1) Price Multiples based on Current(2) Price Multiples based on Offer Price EV/EBITDA (4)(5) P/E (4)(5) EV/EBITDA (4)(5) P/E (4)(5) EV/EBITDA (4)(5) P/E (4)(5) LTM 2012 6.7x NM 5.9x NM 8.0x NM 1. Pre-offer closing price as at Feb 23, 2012 2. Current closing price as at May 30, 2012 3. As of March 31, 2012 4. For the 12-month period ended March 31, 2012 5. Calculation of EBITDA and EPS calculation excluded one time impairment loss on assets, inventory write-downs and changes in fair value of contingent liabilities GUIDES FOR THE JOURNEY.® PiperJaffray® 5 |

SECTION II

GLORIA Overview

GUIDES FOR THE JOURNEY.®

PiperJaffray®

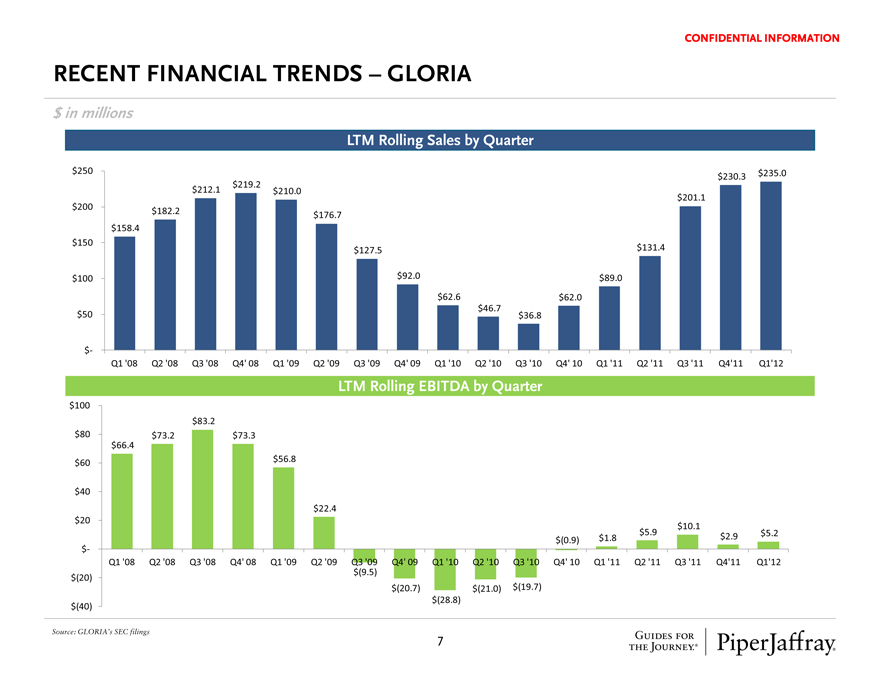

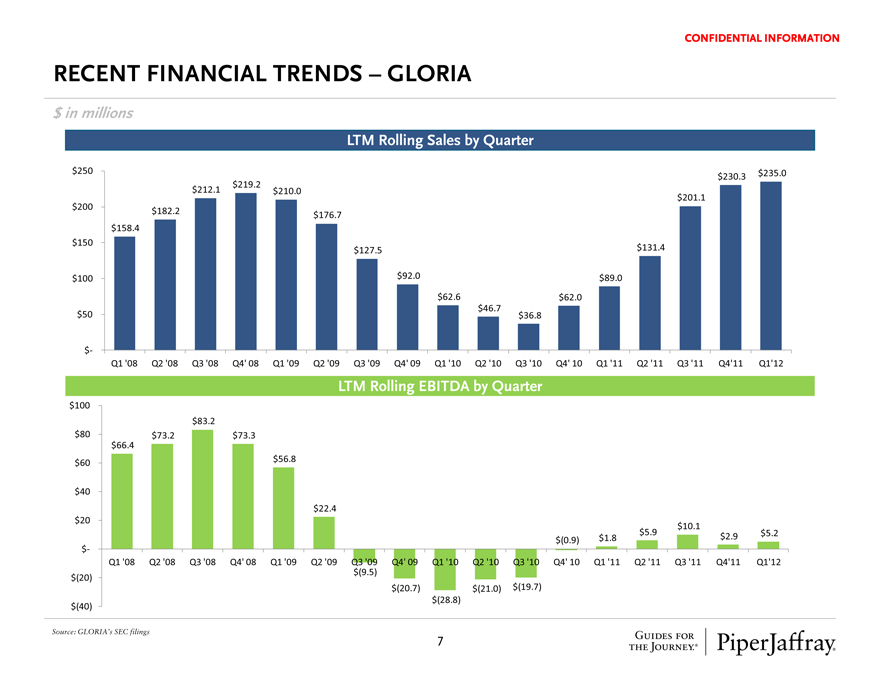

RECENT FINANCIAL TRENDS — GLORIA

CONFIDENTIAL INFORMATION

$ in millions

LTM Rolling Sales by Quarter

$250 $235.0 $219.2 $230.3 $212.1 $210.0 $201.1 $200 $182.2 $176.7 $158.4 $150 $127.5 $131.4

$100 $92.0 $89.0

$62.6 $62.0

$46.7

$50 $36.8

$-

Q1 ‘08 Q2 ‘08 Q3 ‘08 Q4‘ 08 Q1 ‘09 Q2 ‘09 Q3 ‘09 Q4‘ 09 Q1 ‘10 Q2 ‘10 Q3 ‘10 Q4‘ 10 Q1 ‘11 Q2 ‘11 Q3 ‘11 Q4‘11 Q1‘12

LTM Rolling EBITDA by Quarter

$100

$83.2

$80 $73.2 $73.3

$66.4

$56.8

$60

$40

$22.4

$20

$10.1

$5.9 $5.2

$1.8 $2.9

$(0.9)

$-

Q1 ‘08 Q2 ‘08 Q3 ‘08 Q4‘ 08 Q1 ‘09 Q2 ‘09 Q3 ‘09 Q4‘ 09 Q1 ‘10 Q2 ‘10 Q3 ‘10 Q4‘ 10 Q1 ‘11 Q2 ‘11 Q3 ‘11 Q4‘11 Q1‘12

$(9.5)

$(20)

$(20.7) $(21.0) $(19.7)

$(28.8)

$(40)

Source: GLORIA’s SEC filings

GUIDES FOR THE JOURNEY.®

PiperJaffray® 7

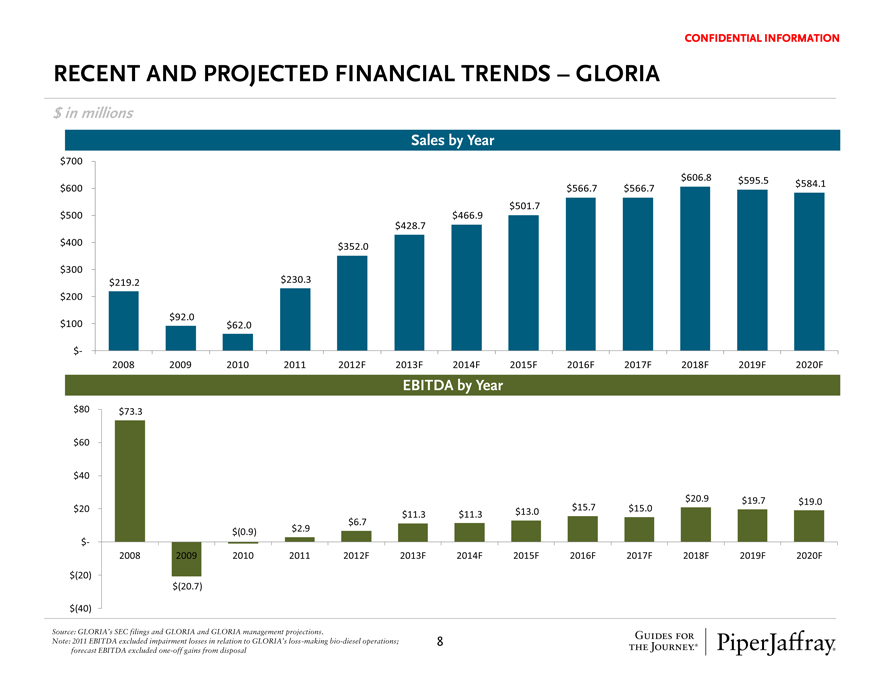

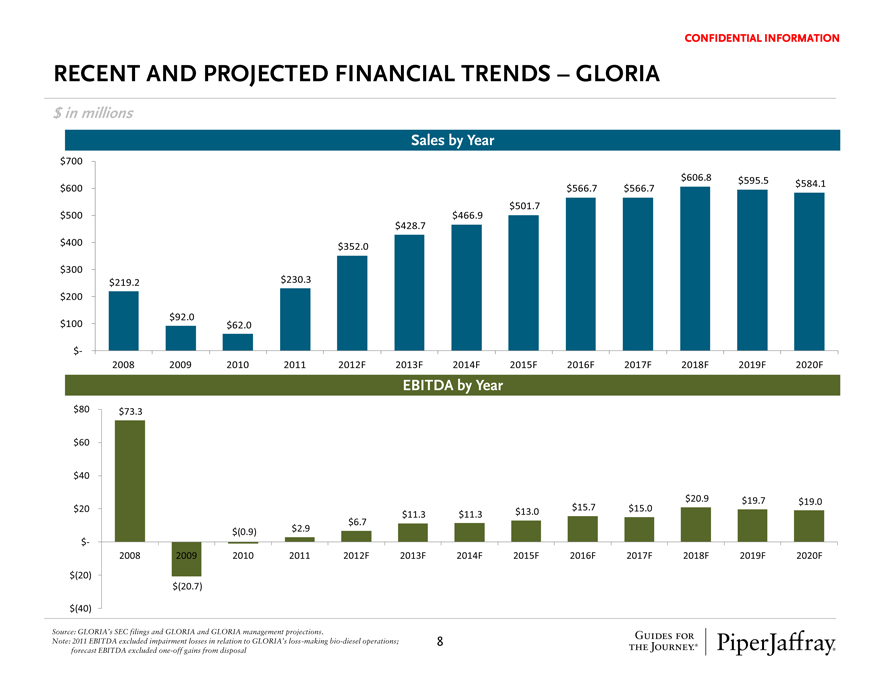

RECENT AND PROJECTED FINANCIAL TRENDS — GLORIA

CONFIDENTIAL INFORMATION

$ in millions

Sales by Year

$700

$606.8

$600 $566.7 $566.7 $595.5 $584.1

$501.7

$500 $466.9

$428.7

$400 $352.0

$300

$219.2 $230.3

$200

$92.0

$100 $62.0

$-

2008 2009 2010 2011 2012F 2013F 2014F 2015F 2016F 2017F 2018F 2019F 2020F

EBITDA by Year

$80 $73.3

$60

$40

$20.9 $19.7 $19.0

$20 $13.0 $15.7 $15.0

$11.3 $11.3

$6.7

$(0.9) $2.9

$-

2008 2009 2010 2011 2012F 2013F 2014F 2015F 2016F 2017F 2018F 2019F 2020F

$(20)

$(20.7)

$(40)

Source: GLORIA’s SEC filings and GLORIA and GLORIA management projections.

Note: 2011 EBITDA excluded impairment losses in relation to GLORIA’s loss-making bio-diesel operations; forecast EBITDA excluded one-off gains from disposal

GUIDES FOR THE JOURNEY.®

PiperJaffray® 8

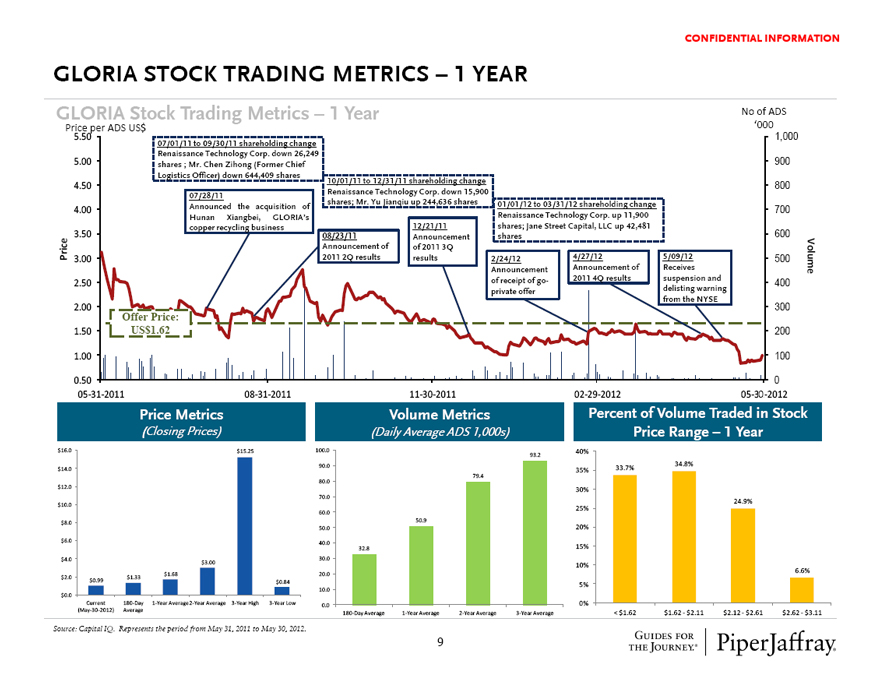

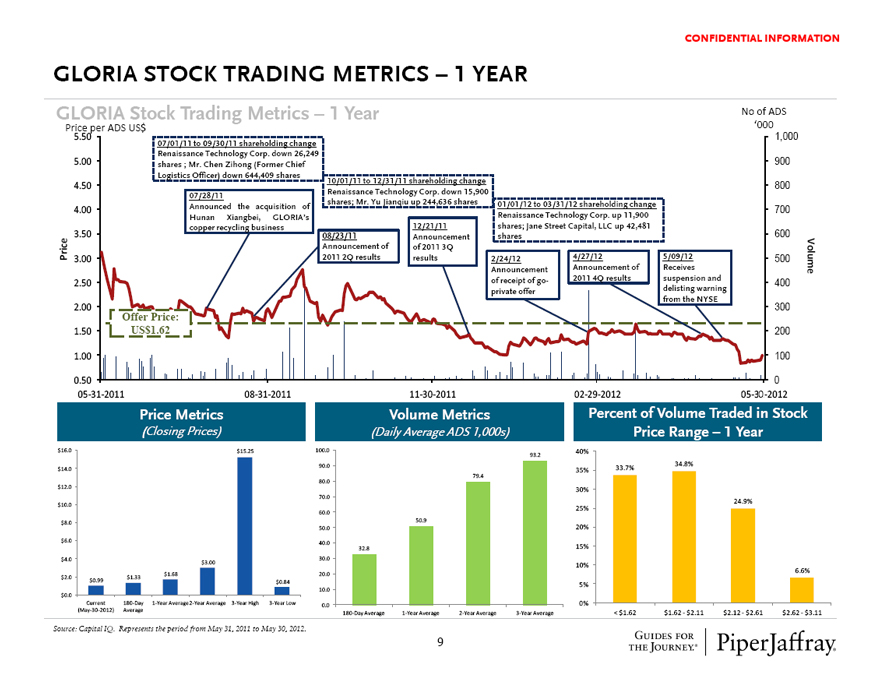

GLORIA STOCK TRADING METRICS — 1 YEAR

CONFIDENTIAL INFORMATION

GLORIA Stock Trading Metrics — 1 Year

Price per ADS US$

5.50 5.00 4.50 4.00

Price 3.50 3.00 2.50 2.00 1.50 1.00 0.50

05-31-2011 08-31-2011 11-30-2011 02-29-2012 05-30-2012

Offer Price: US$1.62

07/01/11 to 09/30/11 shareholding change Renaissance Technology Corp. down 26,249 shares ; Mr. Chen Zihong (Former Chief Logistics Officer) down 644,409 shares

07/28/11

Announced the acquisition of Hunan Xiangbei, GLORIA’s copper recycling business

10/01/11 to 12/31/11 shareholding change Renaissance Technology Corp. down 15,900 shares; Mr. Yu Jianqiu up 244,636 shares

08/23/11

Announcement of 2011 2Q results

12/21/11 Announcement of 2011 3Q results

01/01/12 to 03/31/12 shareholding change Renaissance Technology Corp. up 11,900 shares; Jane Street Capital, LLC up 42,481 shares 2/24/12

Announcement of receipt of go-private offer 4/27/12

Announcement of 2011 4Q results

5/09/12 Receives suspension and delisting warning from the NYSE

No of ADS

‘000 1,000 900 800 700 600 500 Volume 400 300 200 100 0

Price Metrics

(Closing Prices)

$16.0 $15.25 $14.0 $12.0 $10.0 $8.0 $6.0 $4.0 $3.00 $1.68 $2.0 $1.33 $0.99 $0.84

$0.0

Current 180-Day 1-Year Average2-Year Average 3-Year High 3-Year Low

(May-30-2012) Average

Volume Metrics

(Daily Average ADS 1,000s)

100.0 93.2 90.0 79.4 80.0 70.0 60.0 50.9 50.0 40.0 32.8 30.0 20.0 10.0 0.0

180-Day Average 1-Year Average 2-Year Average 3-Year Average

Percent of Volume Traded in Stock Price Range — 1 Year

40% 34.8% 35% 33.7% 30% 24.9% 25% 20% 15% 10% 6.6% 5% 0%

< $1.62 $1.62-$2.11 $2.12-$2.61 $2.62-$3.11

Source: Capital IQ. Represents the period from May 31, 2011 to May 30, 2012.

GUIDES FOR THE JOURNEY.®

PiperJaffray® 9

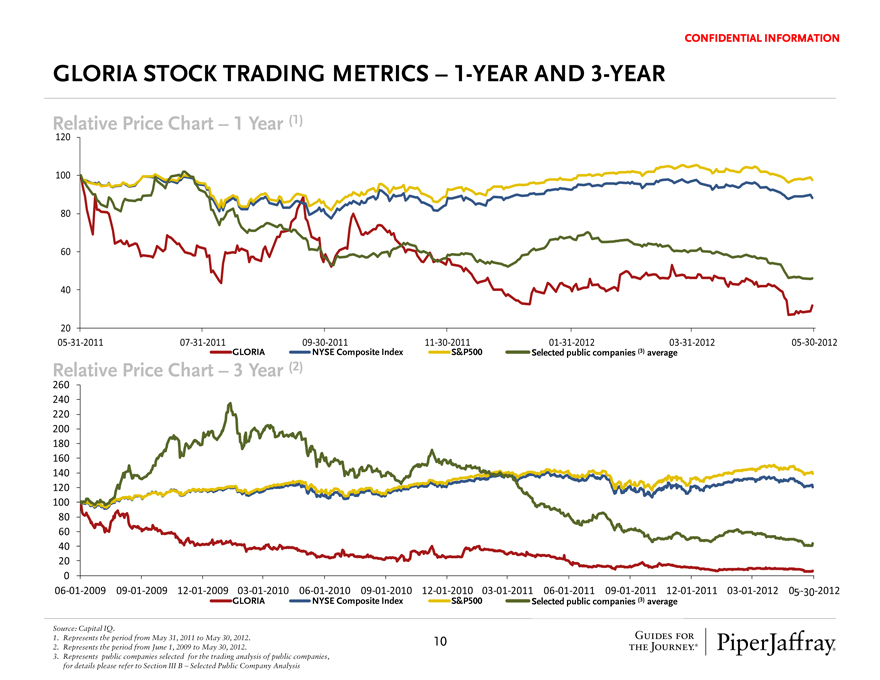

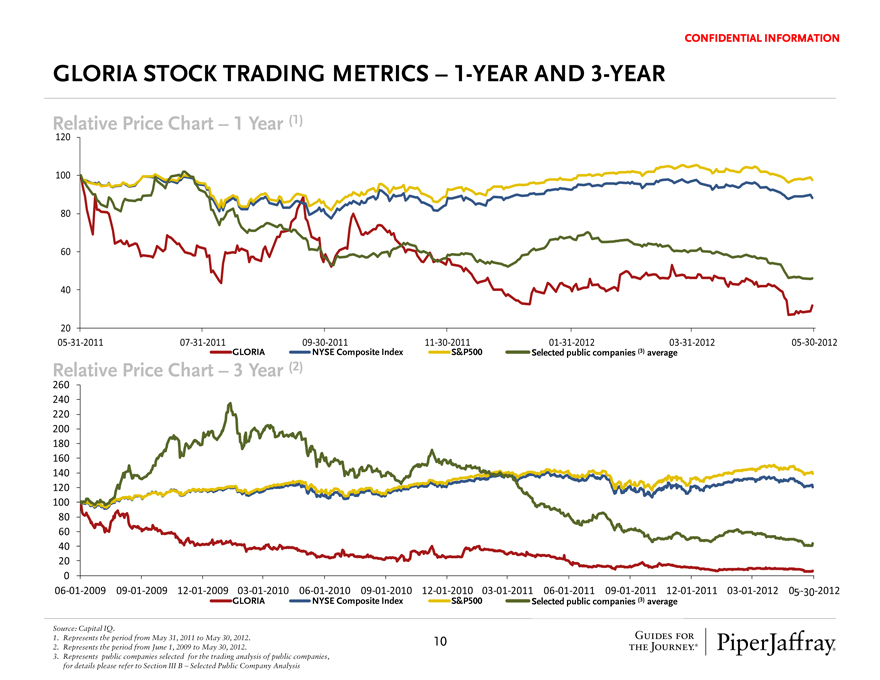

GLORIA STOCK TRADING METRICS — 1-YEAR AND 3-YEAR

CONFIDENTIAL INFORMATION

Relative Price Chart — 1 Year (1)

120

100 80

60

40

20 05-31-2011

07-31-2011 09-30-2011 11-30-2011 01-31-2012 3-31-2012 05-30-2012

GLORIA

NYSE Composite Index

S&P500

Selected public companies (3) average

Relative Price Chart — 3 Year (2)

260 240 220 200 180 160 140 120 100 80 60 40 20 0 06-01-2009

09-01-2009 12-01-2009 03-01-2010 06-01-2010 09-01-2010 12-01-2010 03-01-2011 06-01-2011 09-01-2011 12-01-2011 03-01-2012 05-30-2012

GLORIA

NYSE Composite Index

S&P500

Selected public companies (3) average

Source: Capital IQ.

1. Represents the period from May 31, 2011 to May 30, 2012.

2. Represents the period from June 1, 2009 to May 30, 2012.

3. Represents public companies selected for the trading analysis of public companies, for details please refer to Section III B — Selected Public Company Analysis

GUIDES FOR THE JOURNEY.®

PiperJaffray® 10

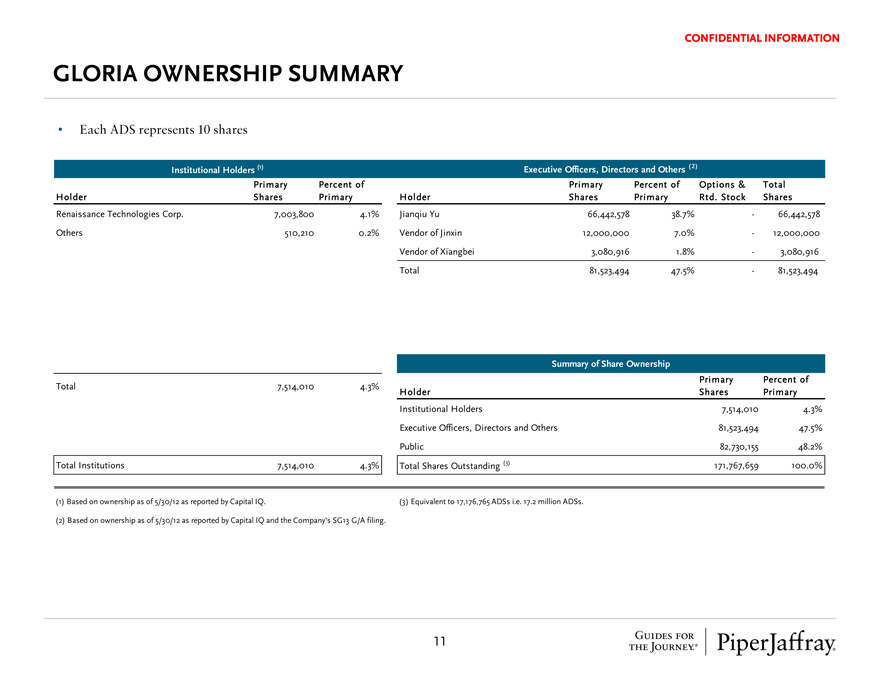

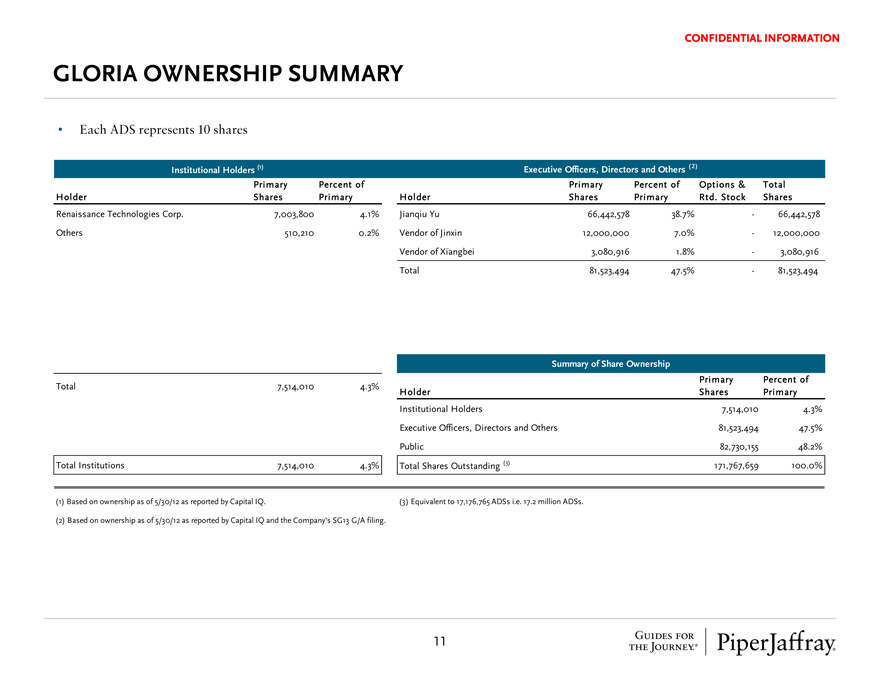

GLORIA OWNERSHIP SUMMARY

CONFIDENTIAL INFORMATION

‰ Each ADS represents 10 shares

Institutional Holders (1) Executive Officers, Directors and Others (2)

Primary Percent of Primary Percent of Options & Total

Holder Shares Primary Holder Shares Primary Rtd. Stock Shares

Renaissance Technologies Corp. 7,003,800 4.1% Jianqiu Yu 66,442,578 38.7%—66,442,578

Others 510,210 0.2% Vendor of Jinxin 12,000,000 7.0%—12,000,000

Vendor of Xiangbei 3,080,916 1.8%—3,080,916

Total 81,523,494 47.5%—81,523,494

Summary of Share Ownership

Primary Percent of

Total 7,514,010 4.3% Holder Shares Primary

Institutional Holders 7,514,010 4.3%

Executive Officers, Directors and Others 81,523,494 47.5%

Public 82,730,155 48.2%

Total Institutions 7,514,010 4.3% Total Shares Outstanding (3) 171,767,659 100.0%

(1) Based on ownership as of 5/30/12 as reported by Capital IQ. (3) Equivalent to 17,176,765 ADSs i.e. 17.2 million ADSs.

(2) Based on ownership as of 5/30/12 as reported by Capital IQ and the Company’s SG13 G/A filing.

GUIDES FOR THE JOURNEY.®

PiperJaffray® 11

SECTION III - A

Valuation Summary

GUIDES FOR THE JOURNEY.®

PiperJaffray®

CONFIDENTIAL INFORMATION

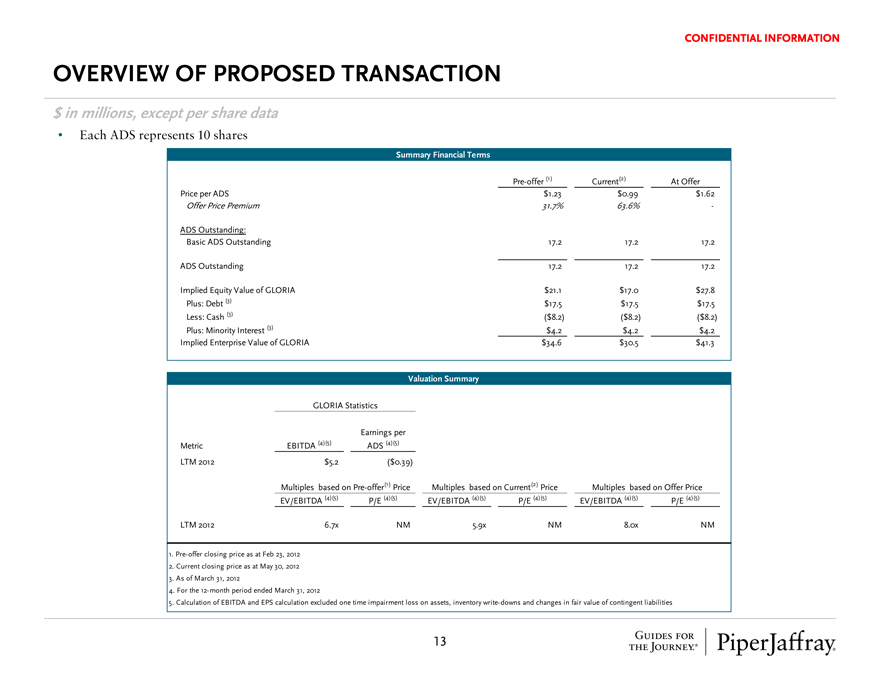

OVERVIEW OF PROPOSED TRANSACTION

$ in millions, except per share data

• Each ADS represents 10 shares

Summary Financial Terms

Pre-offer (1) Current(2) At Offer

Price per ADS $1.23 $0.99 $1.62

Offer Price Premium 31.7% 63.6% -

ADS Outstanding:

Basic ADS Outstanding 17.2 17.2 17.2

ADS Outstanding 17.2 17.2 17.2

Implied Equity Value of GLORIA $21.1 $17.0 $27.8

Plus: Debt (3) $17.5 $17.5 $17.5

Less: Cash (3) ($8.2) ($8.2) ($8.2)

Plus: Minority Interest (3) $4.2 $4.2 $4.2

Implied Enterprise Value of GLORIA $34.6 $30.5 $41.3

Valuation Summary

GLORIA Statistics

Metric EBITDA (4)(5) Earnings per ADS (4)(5)

LTM 2012 $5.2 ($0.39)

Multiples based on Pre-offer(1) Price Multiples based on Current(2) Price Multiples based on Offer Price

EV/EBITDA (4)(5) P/E (4)(5) EV/EBITDA (4)(5) P/E (4)(5) EV/EBITDA (4)(5) P/E (4)(5)

LTM 2012 6.7x NM 5.9x NM 8.0x NM

1. Pre-offer closing price as at Feb 23, 2012

2. Current closing price as at May 30, 2012

3. As of March 31, 2012

4. For the 12-month period ended March 31, 2012

5. Calculation of EBITDA and EPS calculation excluded one time impairment loss on assets, inventory write-downs and changes in fair value of contingent liabilities

GUIDES FOR THE JOURNEY.®

PiperJaffray®

13

CONFIDENTIAL INFORMATION

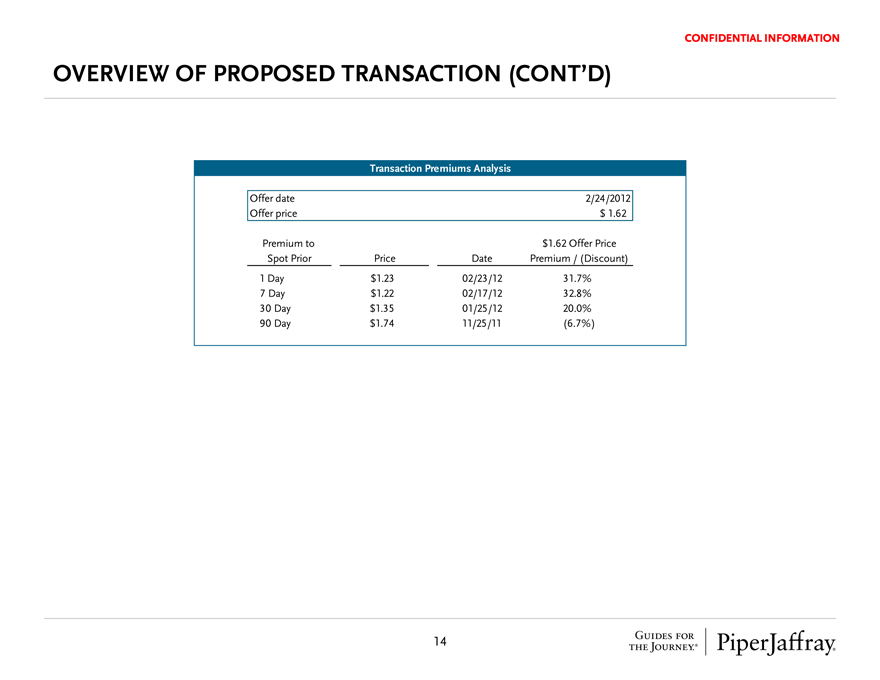

OVERVIEW OF PROPOSED TRANSACTION (CONT’D)

Transaction Premiums Analysis

Offer date 2/24/2012

Offer price $ 1.62

Premium to $1.62 Offer Price

Spot Prior Price Date Premium / (Discount)

1 Day $1.23 02/23/12 31.7%

7 Day $1.22 02/17/12 32.8%

30 Day $1.35 01/25/12 20.0%

90 Day $1.74 11/25/11 (6.7%)

GUIDES FOR THE JOURNEY.®

PiperJaffray®

14

CONFIDENTIAL INFORMATION

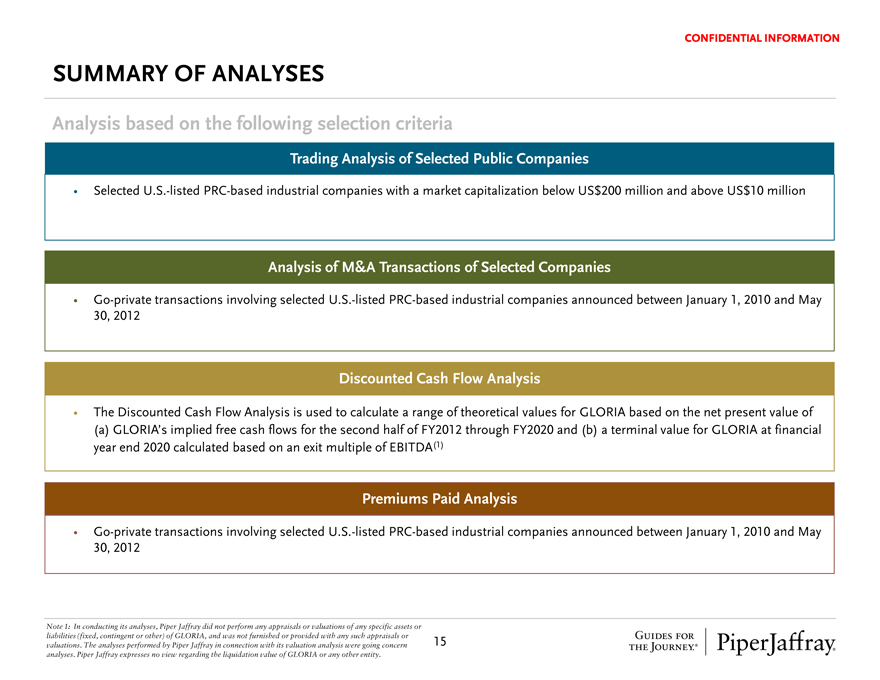

SUMMARY OF ANALYSES

Analysis based on the following selection criteria

Trading Analysis of Selected Public Companies

• Selected U.S.-listed PRC-based industrial companies with a market capitalization below US$200 million and above US$10 million

Analysis of M&A Transactions of Selected Companies

• Go-private transactions involving selected U.S.-listed PRC-based industrial companies announced between January 1, 2010 and May 30, 2012

Discounted Cash Flow Analysis

• The Discounted Cash Flow Analysis is used to calculate a range of theoretical values for GLORIA based on the net present value of (a) GLORIA’s implied free cash flows for the second half of FY2012 through FY2020 and (b) a terminal value for GLORIA at financial year end 2020 calculated based on an exit multiple of EBITDA(1)

Premiums Paid Analysis

• Go-private transactions involving selected U.S.-listed PRC-based industrial companies announced between January 1, 2010 and May 30, 2012

Note 1: In conducting its analyses, Piper Jaffray did not perform any appraisals or valuations of any specific assets or liabilities (fixed, contingent or other) of GLORIA, and was not furnished or provided with any such appraisals or valuations. The analyses performed by Piper Jaffray in connection with its valuation analysis were going concern analyses. Piper Jaffray expresses no view regarding the liquidation value of GLORIA or any other entity.

GUIDES FOR THE JOURNEY.®

PiperJaffray®

15

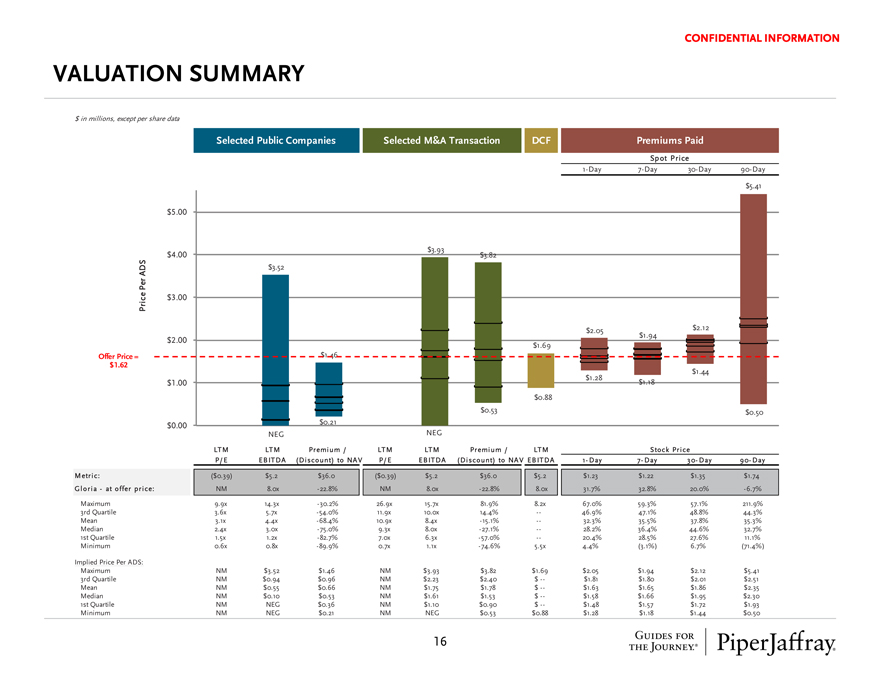

CONFIDENTIAL INFORMATION

VALUATION SUMMARY

$ in millions, except per share data

Selected Public Companies Selected M&A Transaction DCF Premiums Paid

Spot Price

1-Day 7-Day 30-Day 90-Day

$5.41 $5.00 $3.93

$4.00 $3.52 $3.82

Price Per ADS

$3.00

$2.05 $2.12

$2.00 $1.94

$1.69

Offer Price = $1.46

$1.62

$1.44

$1.28

$1.00 $1.18

$0.88

$0.53 $0.50

$0.00 $0.21

NEG NEG

LTM LTM Premium / LTM LTM Premium / LTM Stock Price

P/E EBITDA (Discount) to NAV P/E EBITDA (Discount) to NAV EBITDA 1-Day 7-Day 30-Day 90-Day

Metric: ($0.39) $5.2 $36.0 ($0.39) $5.2 $36.0 $5.2 $1.23 $1.22 $1.35 $1.74

Gloria - at offer price: NM 8.0x -22.8% NM 8.0x -22.8% 8.0x 31.7% 32.8% 20.0% -6.7%

Maximum 9.9x 14.3x -30.2% 26.9x 15.7x 81.9% 8.2x 67.0% 59.3% 57.1% 211.9%

3rd Quartile 3.6x 5.7x -54.0% 11.9x 10.0x 14.4% -- 46.9% 47.1% 48.8% 44.3%

Mean 3.1x 4.4x -68.4% 10.9x 8.4x -15.1% -- 32.3% 35.5% 37.8% 35.3%

Median 2.4x 3.0x -75.0% 9.3x 8.0x -27.1% -- 28.2% 36.4% 44.6% 32.7%

1st Quartile 1.5x 1.2x -82.7% 7.0x 6.3x -57.0% -- 20.4% 28.5% 27.6% 11.1%

Minimum 0.6x 0.8x -89.9% 0.7x 1.1x -74.6% 5.5x 4.4%(3.1%) 6.7%(71.4%)

Implied Price Per ADS:

Maximum NM $3.52 $1.46 NM $3.93 $3.82 $1.69 $2.05 $1.94 $2.12 $5.41

3rd Quartile NM $0.94 $0.96 NM $2.23 $2.40 $ -- $1.81 $1.80 $2.01 $2.51

Mean NM $0.55 $0.66 NM $1.75 $1.78 $ -- $1.63 $1.65 $1.86 $2.35

Median NM $0.10 $0.53 NM $1.61 $1.53 $ -- $1.58 $1.66 $1.95 $2.30

1st Quartile NM NEG $0.36 NM $1.10 $0.90 $ -- $1.48 $1.57 $1.72 $1.93

Minimum NM NEG $0.21 NM NEG $0.53 $0.88 $1.28 $1.18 $1.44 $0.50

GUIDES FOR THE JOURNEY.®

PiperJaffray®

16

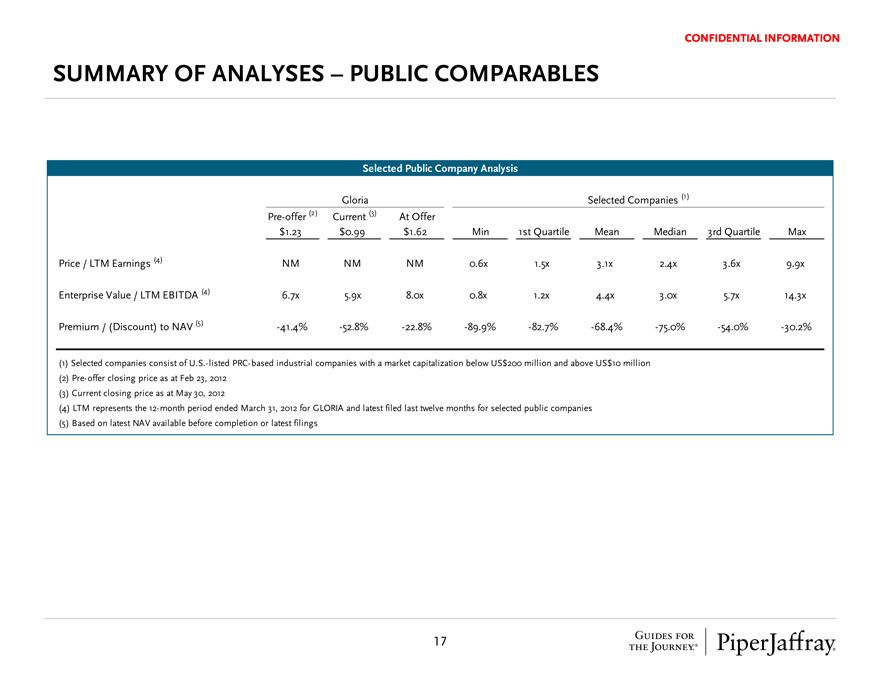

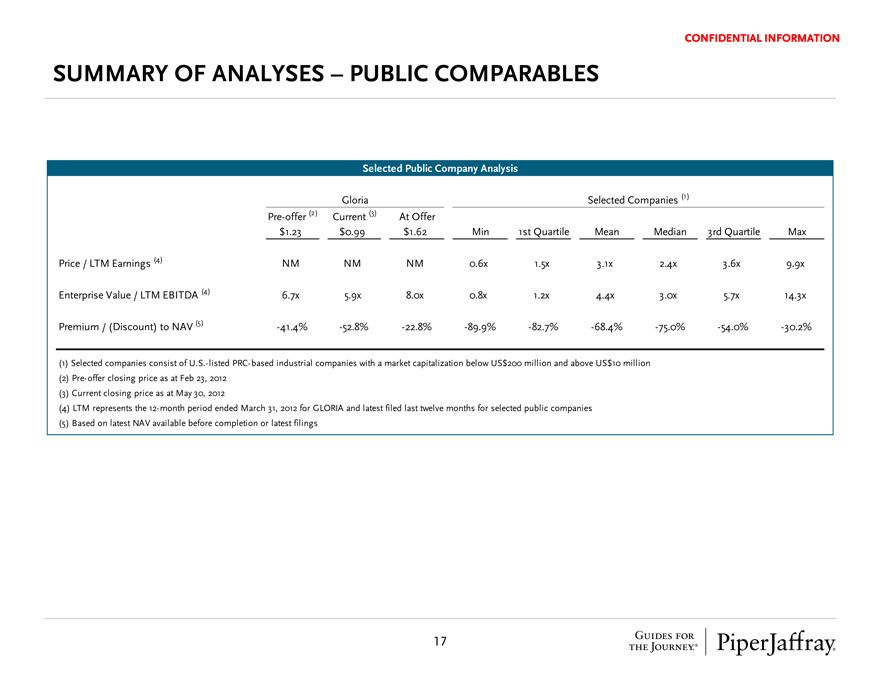

SUMMARY OF ANALYSES – PUBLIC COMPARABLES

CONFIDENTIAL INFORMATION

Selected Public Company Analysis

Gloria Selected Companies (1)

Pre-offer (2) $1.23 Current (3) $0.99 At Offer $1.62 Min 1st Quartile Mean Median 3rd Quartile Max

Price / LTM Earnings (4) NM NM NM 0.6x 1.5x 3.1x 2.4x 3.6x 9.9x

Enterprise Value / LTM EBITDA (4) 6.7x 5.9x 8.0x 0.8x 1.2x 4.4x 3.0x 5.7x 14.3x

Premium / (Discount) to NAV (5) -41.4% -52.8% -22.8% -89.9% -82.7% -68.4% -75.0% -54.0% -30.2%

(1) Selected companies consist of U.S.-listed PRC-based industrial companies with a market capitalization below US$200 million and above US$10 million

(2) Pre-offer closing price as at Feb 23, 2012

(3) Current closing price as at May 30, 2012

(4) LTM represents the 12-month period ended March 31, 2012 for GLORIA and latest filed last twelve months for selected public companies

(5) Based on latest NAV available before completion or latest filings

17 GUIDES FOR THE JOURNEY.® PiperJaffray®

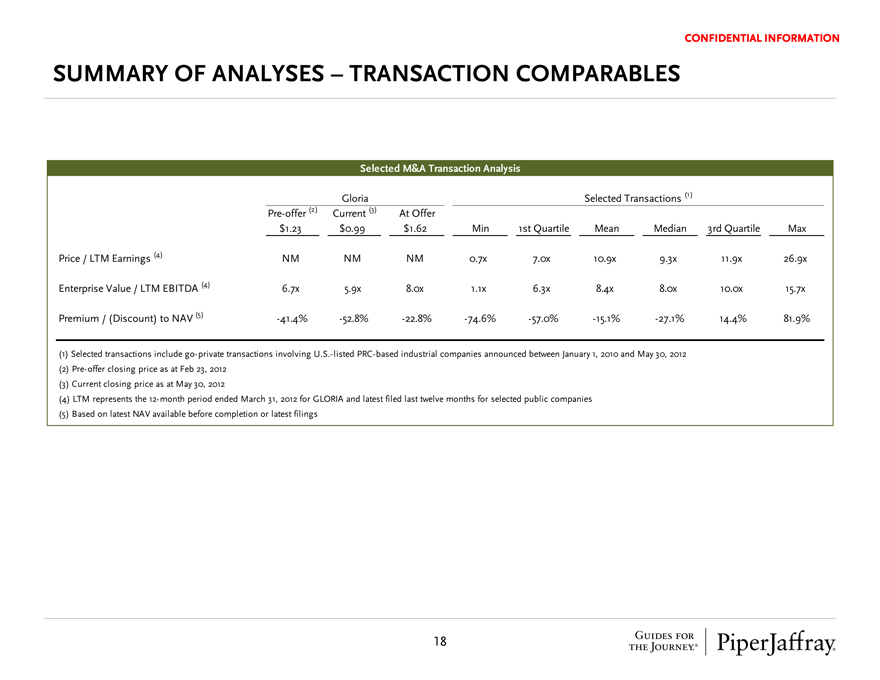

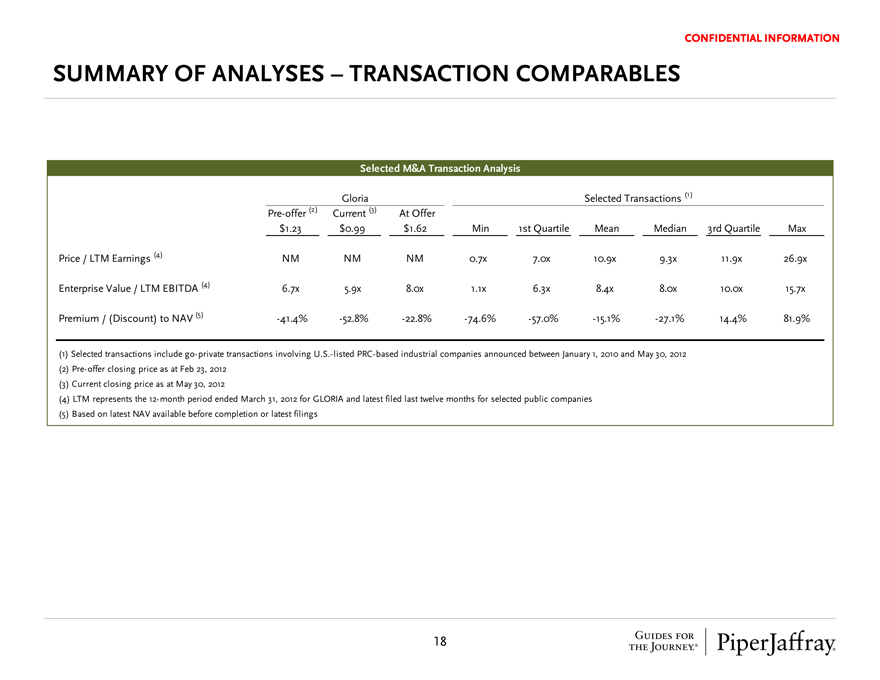

SUMMARY OF ANALYSES – TRANSACTION COMPARABLES

CONFIDENTIAL INFORMATION

Selected M&A Transaction Analysis

Gloria Selected Transactions (1)

Pre-offer (2) $1.23 Current (3) $0.99 At Offer $1.62 Min 1st Quartile Mean Median 3rd Quartile Max

Price / LTM Earnings (4) NM NM NM 0.7x 7.0x 10.9x 9.3x 11.9x 26.9x

Enterprise Value / LTM EBITDA (4) 6.7x 5.9x 8.0x 1.1x 6.3x 8.4x 8.0x 10.0x 15.7x

Premium / (Discount) to NAV (5) -41.4% -52.8% -22.8% -74.6% -57.0% -15.1% -27.1% 14.4% 81.9%

(1) Selected transactions include go-private transactions involving U.S.-listed PRC-based industrial companies announced between January 1, 2010 and May 30, 2012

(2) Pre-offer closing price as at Feb 23, 2012

(3) Current closing price as at May 30, 2012

(4) LTM represents the 12-month period ended March 31, 2012 for GLORIA and latest filed last twelve months for selected public companies

(5) Based on latest NAV available before completion or latest filings

18 GUIDES FOR THE JOURNEY.® PiperJaffray®

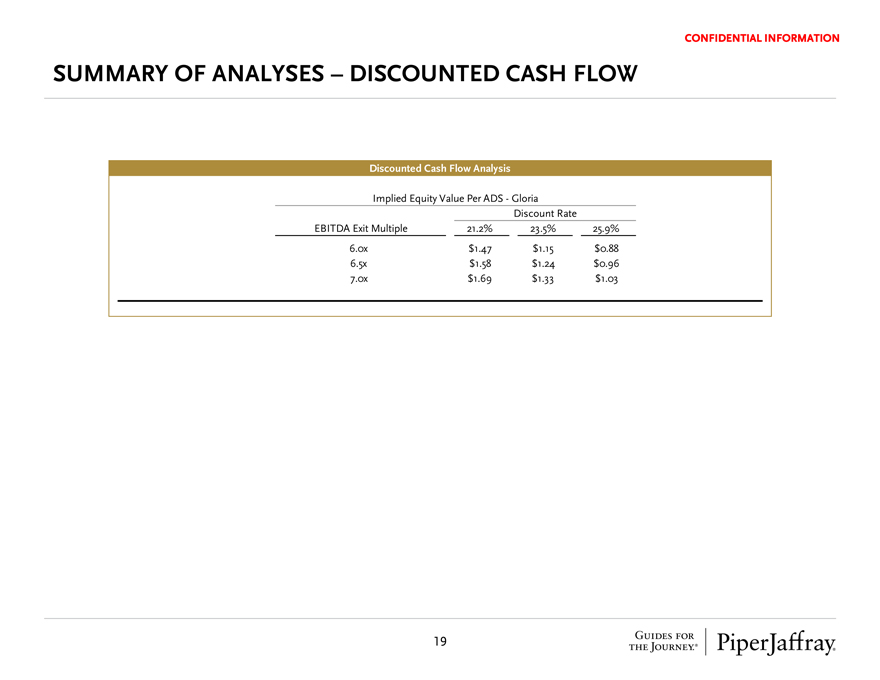

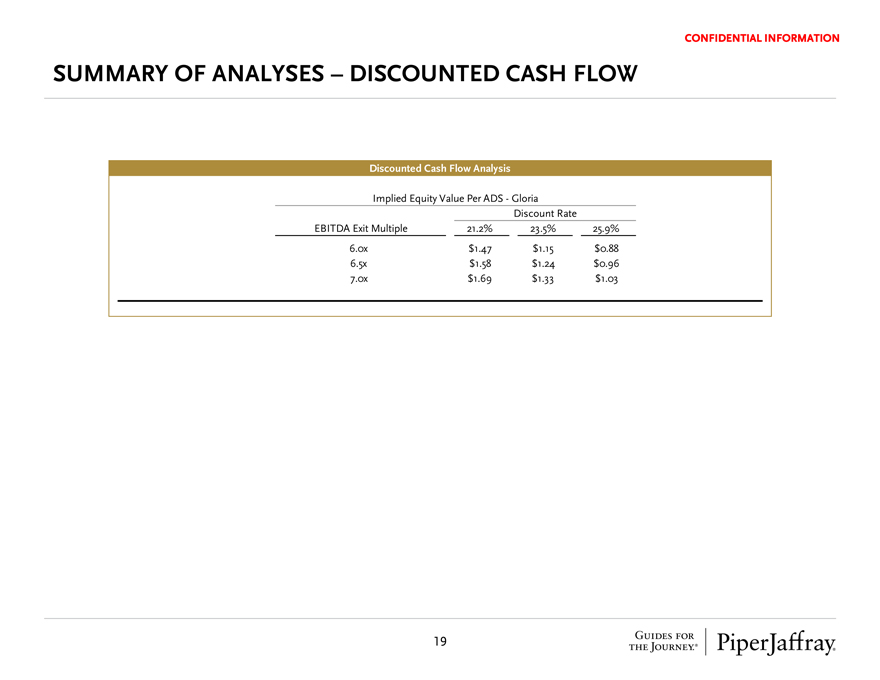

SUMMARY OF ANALYSES – DISCOUNTED CASH FLOW

CONFIDENTIAL INFORMATION

Discounted Cash Flow Analysis

Implied Equity Value Per ADS - Gloria

Discount Rate

EBITDA Exit Multiple 21.2% 23.5% 25.9%

6.0x $1.47 $1.15 $0.88

6.5x $1.58 $1.24 $0.96

7.0x $1.69 $1.33 $1.03

19 GUIDES FOR THE JOURNEY.® PiperJaffray®

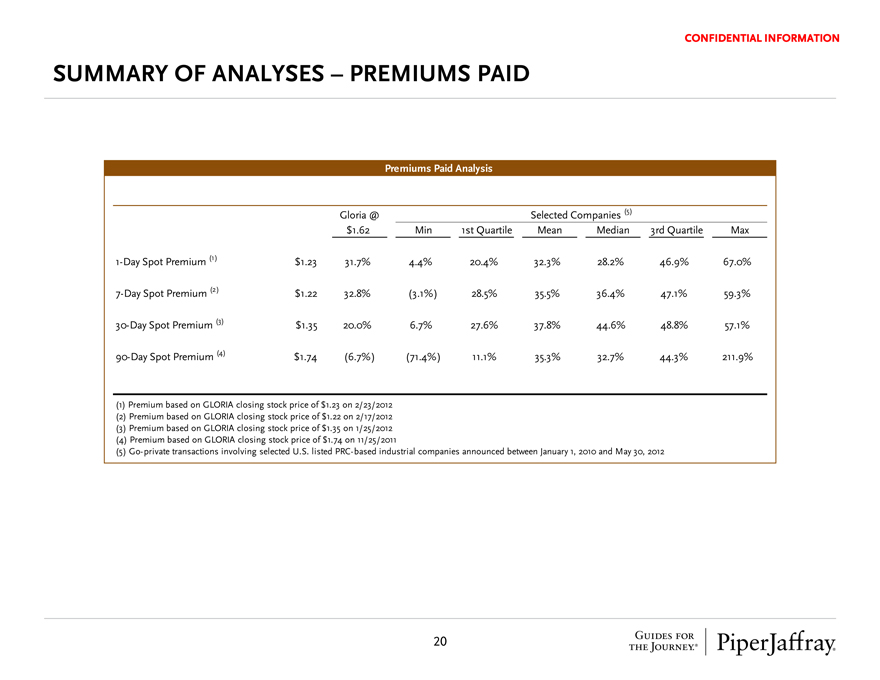

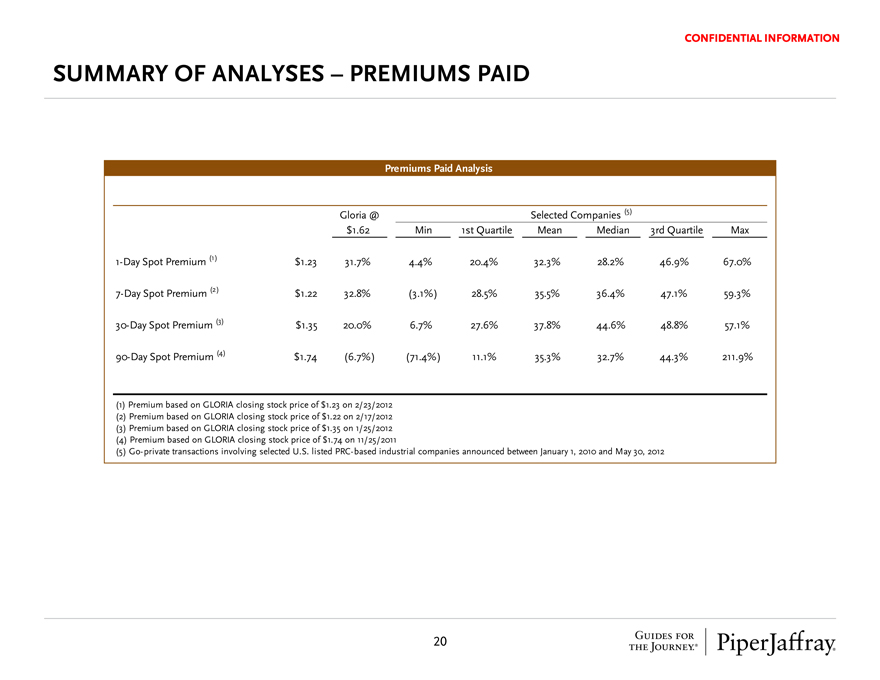

SUMMARY OF ANALYSES – PREMIUMS PAID

CONFIDENTIAL INFORMATION

Premiums Paid Analysis

Selected Companies (5)

Gloria @ $1.62 Min 1st Quartile Mean Median 3rd Quartile Max

1-Day Spot Premium (1) $1.23 31.7% 4.4% 20.4% 32.3% 28.2% 46.9% 67.0%

7-Day Spot Premium (2) $1.22 32.8% (3.1%) 28.5% 35.5% 36.4% 47.1% 59.3%

30-Day Spot Premium (3) $1.35 20.0% 6.7% 27.6% 37.8% 44.6% 48.8% 57.1%

90-Day Spot Premium (4) $1.74 (6.7%) (71.4%) 11.1% 35.3% 32.7% 44.3% 211.9%

(1) Premium based on GLORIA closing stock price of $1.23 on 2/23/2012

(2) Premium based on GLORIA closing stock price of $1.22 on 2/17/2012

(3) Premium based on GLORIA closing stock price of $1.35 on 1/25/2012

(4) Premium based on GLORIA closing stock price of $1.74 on 11/25/2011

(5) Go-private transactions involving selected U.S. listed PRC-based industrial companies announced between January 1, 2010 and May 30, 2012

20 GUIDES FOR THE JOURNEY.® PiperJaffray®

SECTION III - B

Selected Public Company Analysis

GUIDES FOR THE JOURNEY.® PiperJaffray®

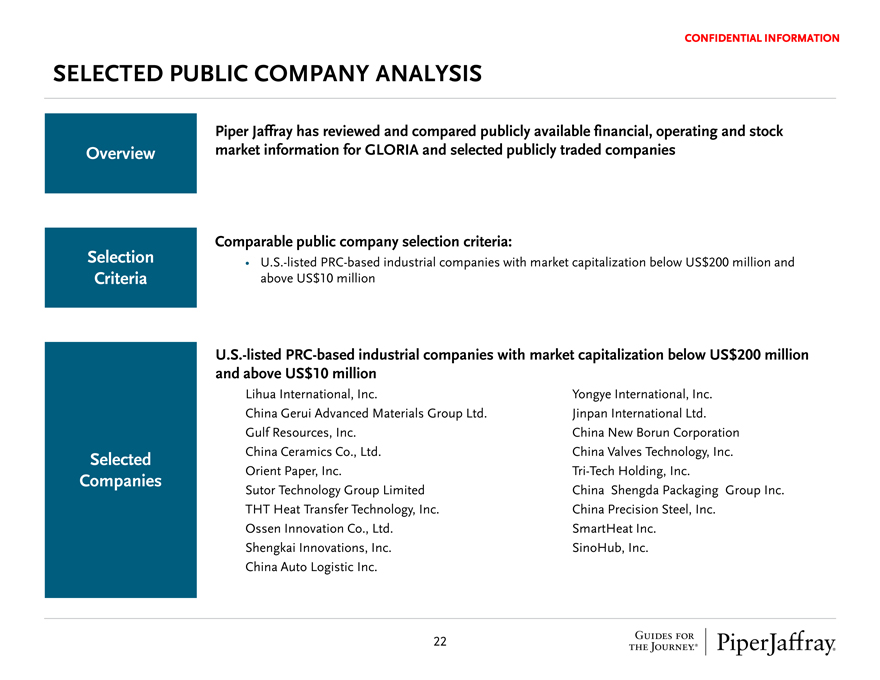

SELECTED PUBLIC COMPANY ANALYSIS

CONFIDENTIAL INFORMATION

Overview

Piper Jaffray has reviewed and compared publicly available financial, operating and stock market information for GLORIA and selected publicly traded companies

Selection Criteria

Comparable public company selection criteria:

• U.S.-listed PRC-based industrial companies with market capitalization below US$200 million and above US$10 million

Selected Companies

U.S.-listed PRC-based industrial companies with market capitalization below US$200 million and above US$10 million

Lihua International, Inc. Yongye International, Inc.

China Gerui Advanced Materials Group Ltd. Jinpan International Ltd.

Gulf Resources, Inc. China New Borun Corporation

China Ceramics Co., Ltd. China Valves Technology, Inc.

Orient Paper, Inc. Tri-Tech Holding, Inc.

Sutor Technology Group Limited China Shengda Packaging Group Inc.

THT Heat Transfer Technology, Inc. China Precision Steel, Inc.

Ossen Innovation Co., Ltd. SmartHeat Inc.

Shengkai Innovations, Inc. SinoHub, Inc.

China Auto Logistic Inc.

22 GUIDES FOR THE JOURNEY.® PiperJaffray®

\

CONFIDENTIAL INFORMATION

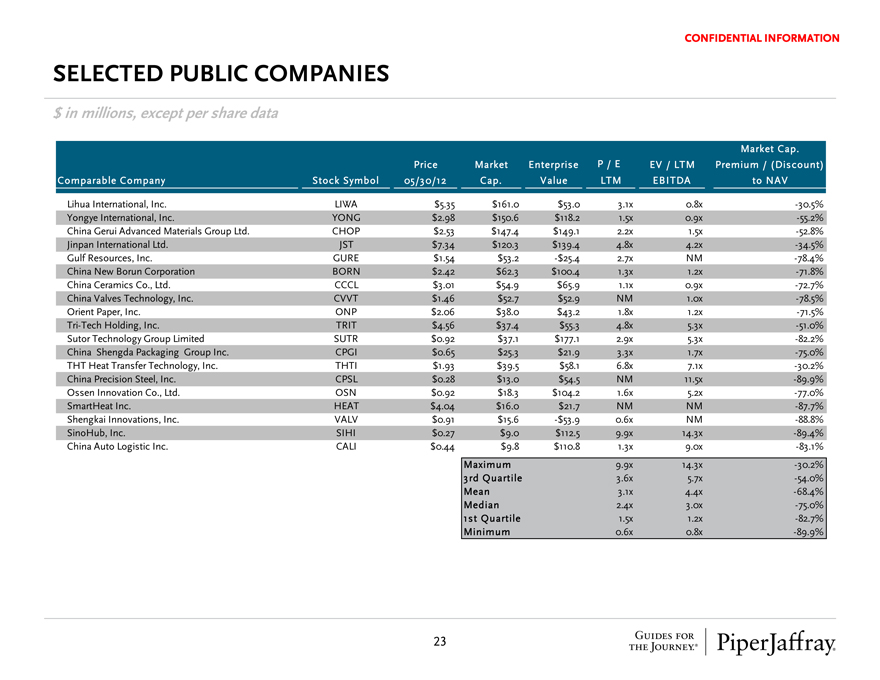

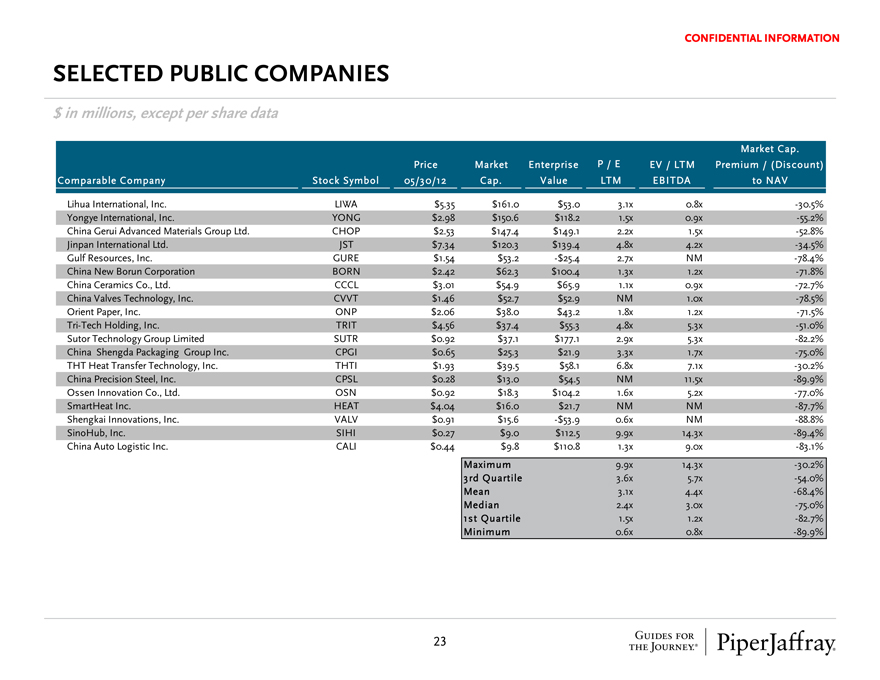

SELECTED PUBLIC COMPANIES

$ in millions, except per share data

Market Cap.

Price Market Enterprise P / E EV / LTM Premium / (Discount)

Comparable Company Stock Symbol 05/30/12 Cap. Value LTM EBITDA to NAV

Lihua International, Inc. LIWA $5.35 $161.0 $53.0 3.1x 0.8x -30.5%

Yongye International, Inc. YONG $2.98 $150.6 $118.2 1.5x 0.9x -55.2%

China Gerui Advanced Materials Group Ltd. CHOP $2.53 $147.4 $149.1 2.2x 1.5x -52.8%

Jinpan International Ltd. JST $7.34 $120.3 $139.4 4.8x 4.2x -34.5%

Gulf Resources, Inc. GURE $1.54 $53.2 -$25.4 2.7x NM -78.4%

China New Borun Corporation BORN $2.42 $62.3 $100.4 1.3x 1.2x -71.8%

China Ceramics Co., Ltd. CCCL $3.01 $54.9 $65.9 1.1x 0.9x -72.7%

China Valves Technology, Inc. CVVT $1.46 $52.7 $52.9 NM 1.0x -78.5%

Orient Paper, Inc. ONP $2.06 $38.0 $43.2 1.8x 1.2x -71.5%

Tri-Tech Holding, Inc. TRIT $4.56 $37.4 $55.3 4.8x 5.3x -51.0%

Sutor Technology Group Limited SUTR $0.92 $37.1 $177.1 2.9x 5.3x -82.2%

China Shengda Packaging Group Inc. CPGI $0.65 $25.3 $21.9 3.3x 1.7x -75.0%

THT Heat Transfer Technology, Inc. THTI $1.93 $39.5 $58.1 6.8x 7.1x -30.2%

China Precision Steel, Inc. CPSL $0.28 $13.0 $54.5 NM 11.5x -89.9%

Ossen Innovation Co., Ltd. OSN $0.92 $18.3 $104.2 1.6x 5.2x -77.0%

SmartHeat Inc. HEAT $4.04 $16.0 $21.7 NM NM -87.7%

Shengkai Innovations, Inc. VALV $0.91 $15.6 -$53.9 0.6x NM -88.8%

SinoHub, Inc. SIHI $0.27 $9.0 $112.5 9.9x 14.3x -89.4%

China Auto Logistic Inc. CALI $0.44 $9.8 $110.8 1.3x 9.0x -83.1%

Maximum 9.9x 14.3x -30.2%

3rd Quartile 3.6x 5.7x -54.0%

Mean 3.1x 4.4x -68.4%

Median 2.4x 3.0x -75.0%

1st Quartile 1.5x 1.2x -82.7%

Minimum 0.6x 0.8x -89.9%

23 GUIDES FOR THE JOURNEY.®

PiperJaffray®

SECTION III - C

Selected Precedent Transaction Analysis

GUIDES FOR THE JOURNEY.®

PiperJaffray®

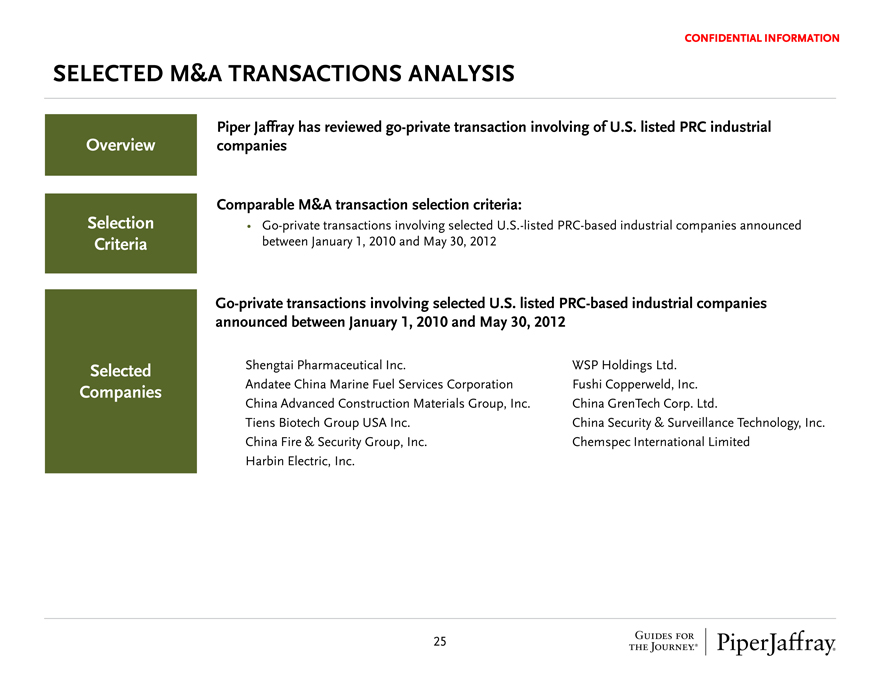

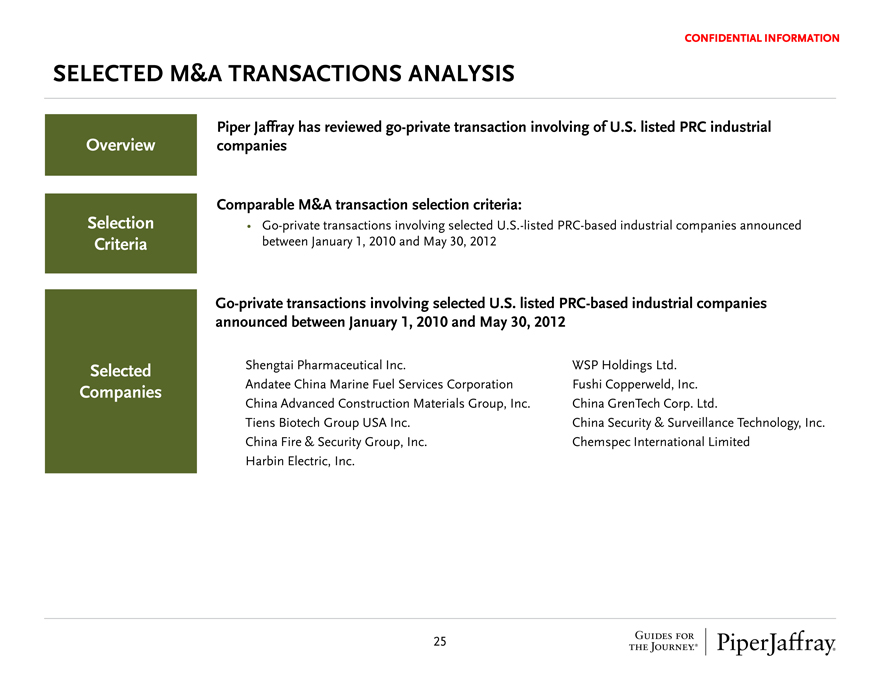

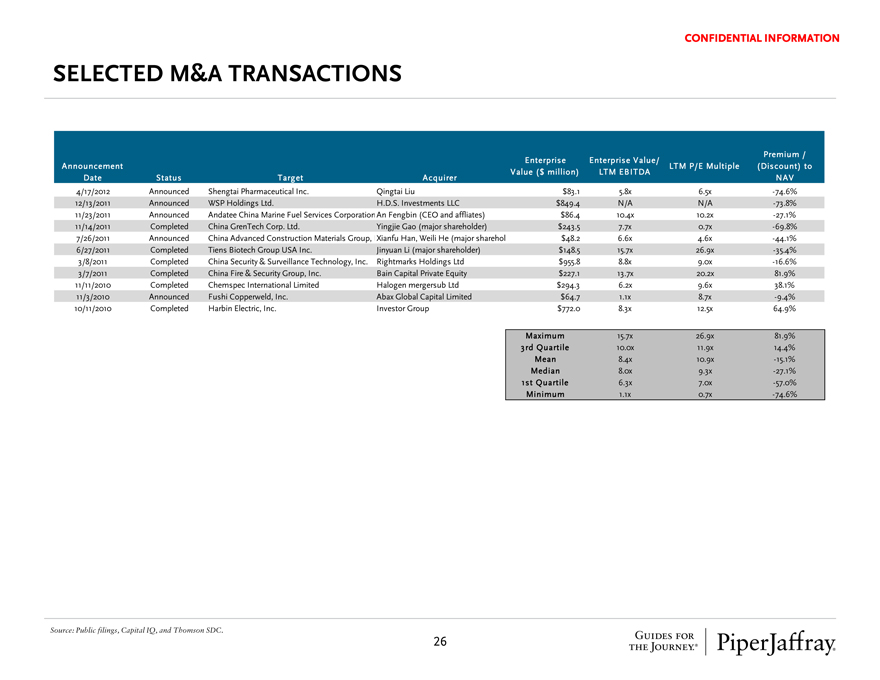

CONFIDENTIAL INFORMATION

SELECTED M&A TRANSACTIONS ANALYSIS

Overview

Piper Jaffray has reviewed go-private transaction involving of U.S. listed PRC industrial companies

Selection Criteria

Comparable M&A transaction selection criteria:

Go-private transactions involving selected U.S.-listed PRC-based industrial companies announced between January 1, 2010 and May 30, 2012

Selected Companies

Go-private transactions involving selected U.S. listed PRC-based industrial companies announced between January 1, 2010 and May 30, 2012

Shengtai Pharmaceutical Inc. WSP Holdings Ltd.

Andatee China Marine Fuel Services Corporation Fushi Copperweld, Inc.

China Advanced Construction Materials Group, Inc. China GrenTech Corp. Ltd.

Tiens Biotech Group USA Inc. China Security & Surveillance Technology, Inc.

China Fire & Security Group, Inc. Chemspec International Limited

Harbin Electric, Inc.

25 GUIDES FOR THE JOURNEY.®

PiperJaffray®

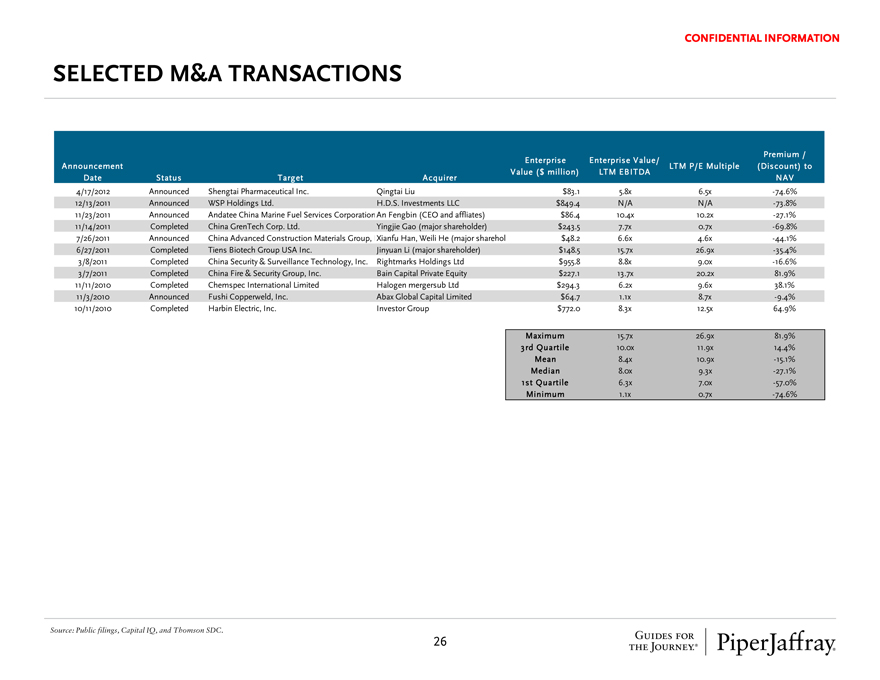

SELECTED M&A TRANSACTIONS

CONFIDENTIAL INFORMATION

Premium /

Enterprise Enterprise Value/

Announcement LTM P/E Multiple (Discount) to

Value ($ million) LTM EBITDA

Date Status Target Acquirer NAV

4/17/2012 Announced Shengtai Pharmaceutical Inc. Qingtai Liu $83.1 5.8x 6.5x -74.6%

12/13/2011 Announced WSP Holdings Ltd. H.D.S. Investments LLC $849.4 N/A N/A -73.8%

11/23/2011 Announced Andatee China Marine Fuel Services Corporation An Fengbin (CEO and affliates) $86.4 10.4x 10.2x -27.1%

11/14/2011 Completed China GrenTech Corp. Ltd. Yingjie Gao (major shareholder) $243.5 7.7x 0.7x -69.8%

7/26/2011 Announced China Advanced Construction Materials Group, Inc. Xianfu Han, Weili He (major shareholders) $48.2 6.6x 4.6x -44.1%

6/27/2011 Completed Tiens Biotech Group USA Inc. Jinyuan Li (major shareholder) $148.5 15.7x 26.9x -35.4%

3/8/2011 Completed China Security & Surveillance Technology, Inc. Rightmarks Holdings Ltd $955.8 8.8x 9.0x -16.6%

3/7/2011 Completed China Fire & Security Group, Inc. Bain Capital Private Equity $227.1 13.7x 20.2x 81.9%

11/11/2010 Completed Chemspec International Limited Halogen mergersub Ltd $294.3 6.2x 9.6x 38.1%

11/3/2010 Announced Fushi Copperweld, Inc. Abax Global Capital Limited $64.7 1.1x 8.7x -9.4%

10/11/2010 Completed Harbin Electric, Inc. Investor Group $772.0 8.3x 12.5x 64.9%

Maximum 15.7x 26.9x 81.9%

3rd Quartile 10.0x 11.9x 14.4%

Mean 8.4x 10.9x -15.1%

Median 8.0x 9.3x -27.1%

1st Quartile 6.3x 7.0x -57.0%

Minimum 1.1x 0.7x -74.6%

Source: Public filings, Capital IQ, and Thomson SDC.

GUIDES FOR THE JOURNEY.®

PiperJaffray®

26

SECTION III - D

Discounted Cash Flow Analysis

GUIDES FOR THE JOURNEY.®

PiperJaffray®

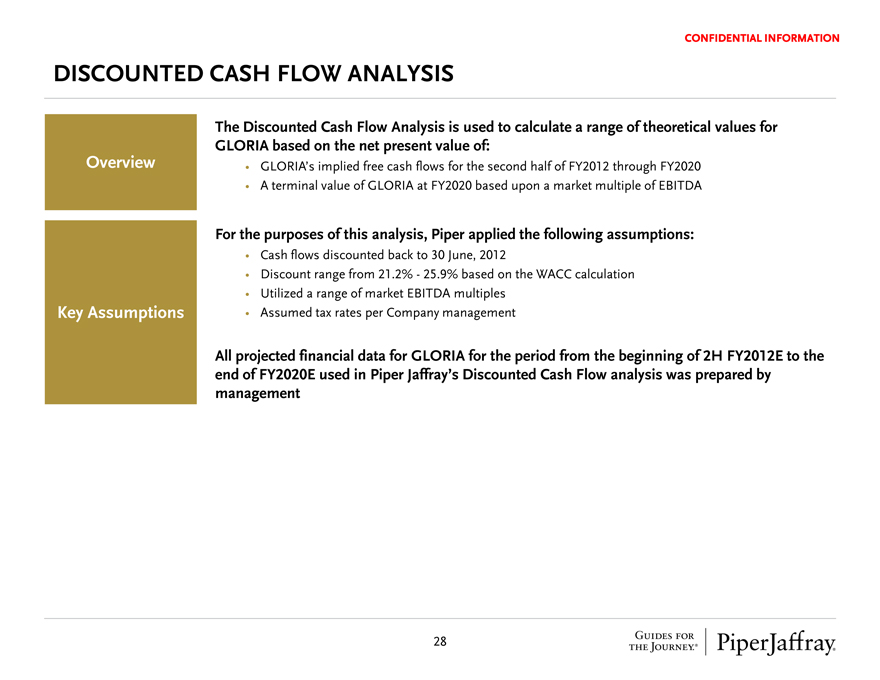

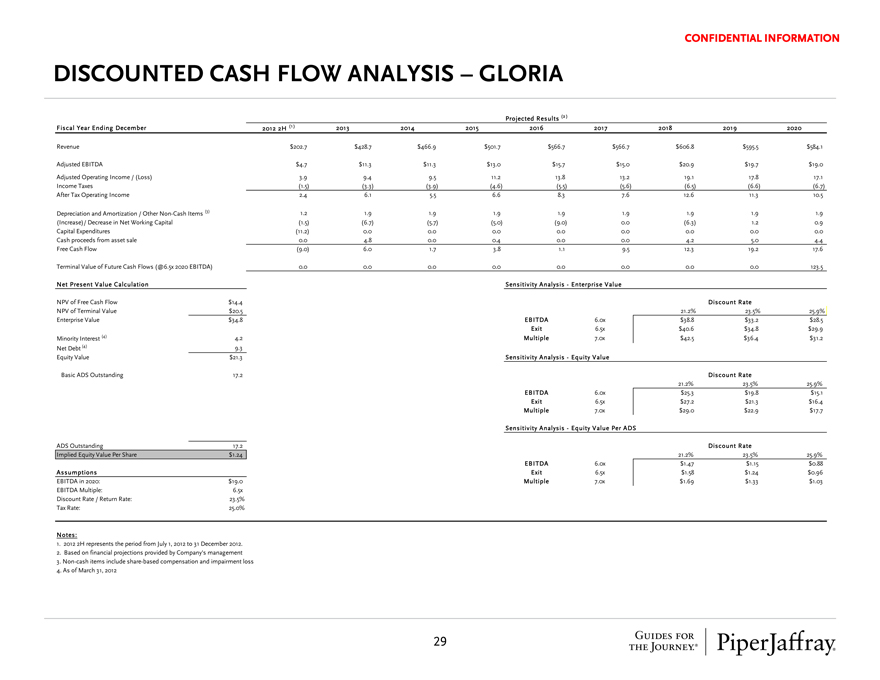

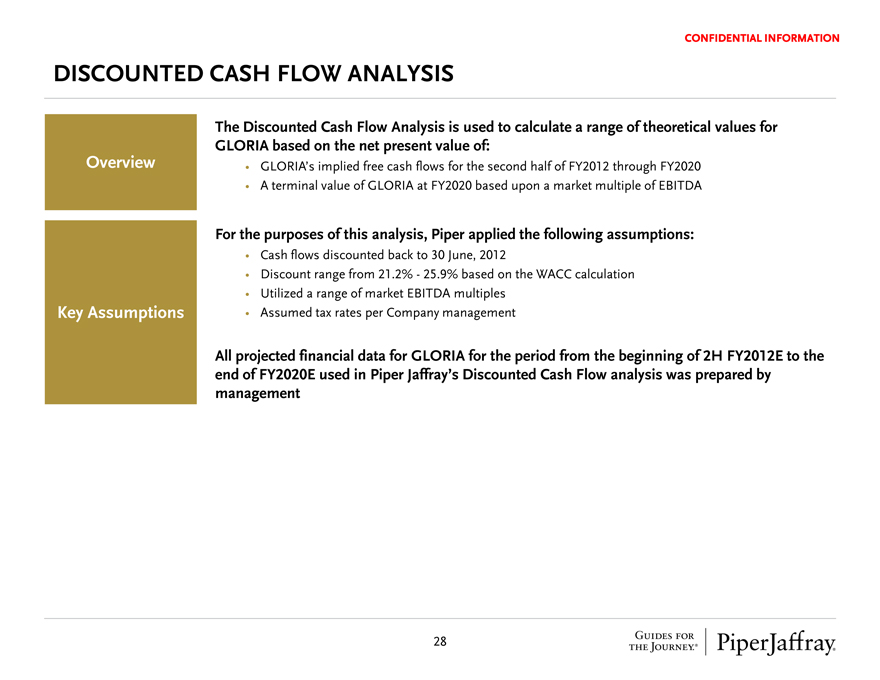

DISCOUNTED CASH FLOW ANALYSIS

CONFIDENTIAL INFORMATION

Overview

The Discounted Cash Flow Analysis is used to calculate a range of theoretical values for GLORIA based on the net present value of:

GLORIA’s implied free cash flows for the second half of FY2012 through FY2020

A terminal value of GLORIA at FY2020 based upon a market multiple of EBITDA

Key Assumptions

For the purposes of this analysis, Piper applied the following assumptions:

Cash flows discounted back to 30 June, 2012

Discount range from 21.2% - 25.9% based on the WACC calculation

Utilized a range of market EBITDA multiples

Assumed tax rates per Company management

All projected financial data for GLORIA for the period from the beginning of 2H FY2012E to the end of FY2020E used in Piper Jaffray’s Discounted Cash Flow analysis was prepared by management

GUIDES FOR THE JOURNEY.®

PiperJaffray®

28

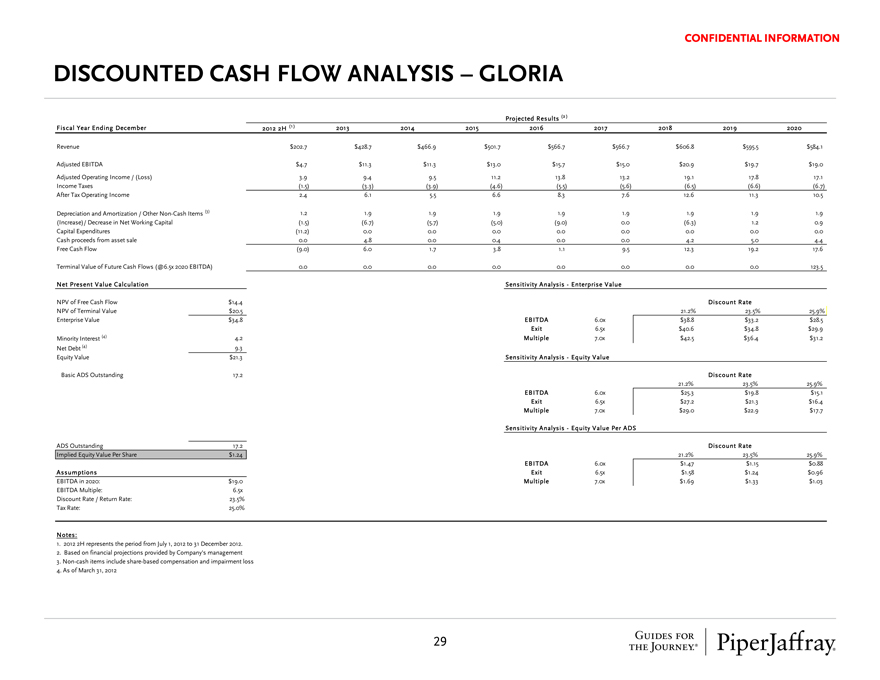

CONFIDENTIAL INFORMATION

DISCOUNTED CASH FLOW ANALYSIS – GLORIA

Projected Results (2)

Fiscal Year Ending December 2012 2H (1) 2013 2014 2015 2016 2017 2018 2019 2020

Revenue $202.7 $428.7 $466.9 $501.7 $566.7 $566.7 $606.8 $595.5 $584.1

Adjusted EBITDA $4.7 $11.3 $11.3 $13.0 $15.7 $15.0 $20.9 $19.7 $19.0

Adjusted Operating Income / (Loss) 3.9 9.4 9.5 11.2 13.8 13.2 19.1 17.8 17.1

Income Taxes (1.5) (3.3) (3.9) (4.6) (5.5) (5.6) (6.5) (6.6) (6.7)

After Tax Operating Income 2.4 6.1 5.5 6.6 8.3 7.6 12.6 11.3 10.5

Depreciation and Amortization / Other Non-Cash Items (3) 1.2 1.9 1.9 1.9 1.9 1.9 1.9 1.9 1.9

(Increase) / Decrease in Net Working Capital (1.5) (6.7) (5.7) (5.0) (9.0) 0.0 (6.3) 1.2 0.9

Capital Expenditures (11.2) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Cash proceeds from asset sale 0.0 4.8 0.0 0.4 0.0 0.0 4.2 5.0 4.4

Free Cash Flow (9.0) 6.0 1.7 3.8 1.1 9.5 12.3 19.2 17.6

Terminal Value of Future Cash Flows (@6.5x 2020 EBITDA) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 123.5

Net Present Value Calculation Sensitivity Analysis - Enterprise Value

Discount Rate NPV of Free Cash Flow $14.4

NPV of Terminal Value $20.5 21.2% 23.5% 25.9%

Enterprise Value $34.8 EBITDA 6.0x $38.8 $33.2 $28.5

Exit 6.5x $40.6 $34.8 $29.9

Minority Interest (4) 4.2 Multiple 7.0x $42.5 $36.4 $31.2

Net Debt (4) 9.3

Equity Value $21.3 Sensitivity Analysis - Equity Value

Basic ADS Outstanding 17.2 Discount Rate

21.2% 23.5% 25.9%

EBITDA 6.0x $25.3 $19.8 $15.1

Exit 6.5x $27.2 $21.3 $16.4

Multiple 7.0x $29.0 $22.9 $17.7

Sensitivity Analysis - Equity Value Per ADS

ADS Outstanding 17.2 Discount Rate

Implied Equity Value Per Share $1.24 21.2% 23.5% 25.9%

EBITDA 6.0x $1.47 $1.15 $0.88

Assumptions Exit 6.5x $1.58 $1.24 $0.96

EBITDA in 2020: $19.0 Multiple 7.0x $1.69 $1.33 $1.03

EBITDA Multiple: 6.5x

Discount Rate / Return Rate: 23.5%

Tax Rate: 25.0%

Notes:

1. 2012 2H represents the period from July 1, 2012 to 31 December 2012.

2. Based on financial projections provided by Company’s management

3. Non-cash items include share-based compensation and impairment loss

4. As of March 31, 2012

29 GUIDES FOR THE JOURNEY.® PiperJaffray®

SECTION III - E

Premium Paid Analysis

GUIDES FOR THE JOURNEY.® PiperJaffray®

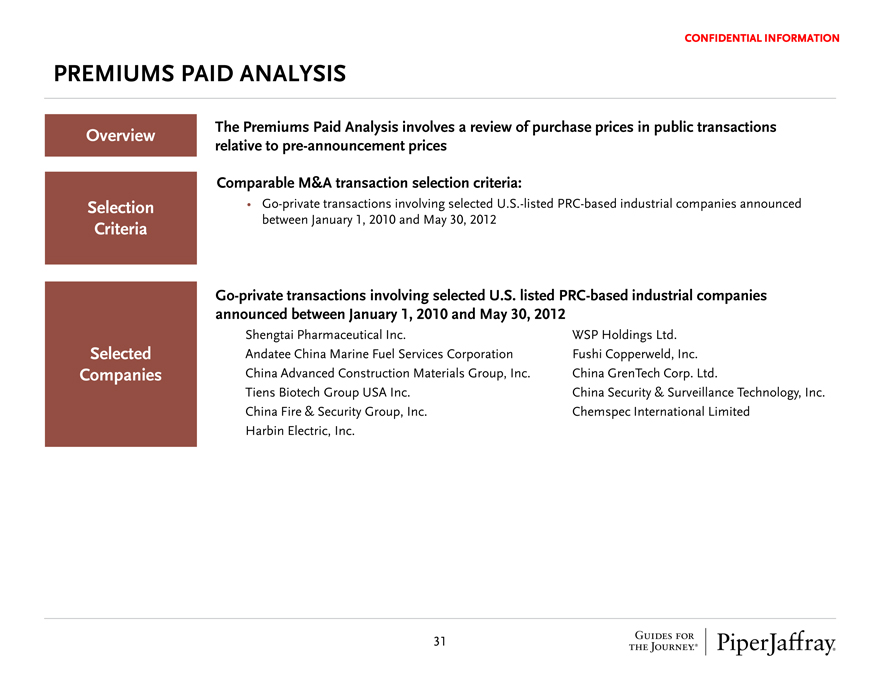

CONFIDENTIAL INFORMATION

PREMIUMS PAID ANALYSIS

Overview The Premiums Paid Analysis involves a review of purchase prices in public transactions relative to pre-announcement prices

Comparable M&A transaction selection criteria:

Selection Criteria Go-private transactions involving selected U.S.-listed PRC-based industrial companies announced between January 1, 2010 and May 30, 2012

Go-private transactions involving selected U.S. listed PRC-based industrial companies announced between January 1, 2010 and May 30, 2012

Selected Companies

Shengtai Pharmaceutical Inc. WSP Holdings Ltd.

Andatee China Marine Fuel Services Corporation Fushi Copperweld, Inc.

China Advanced Construction Materials Group, Inc. China GrenTech Corp. Ltd.

Tiens Biotech Group USA Inc. China Security & Surveillance Technology, Inc.

China Fire & Security Group, Inc. Chemspec International Limited

Harbin Electric, Inc.

31 GUIDES FOR THE JOURNEY.® PiperJaffray®

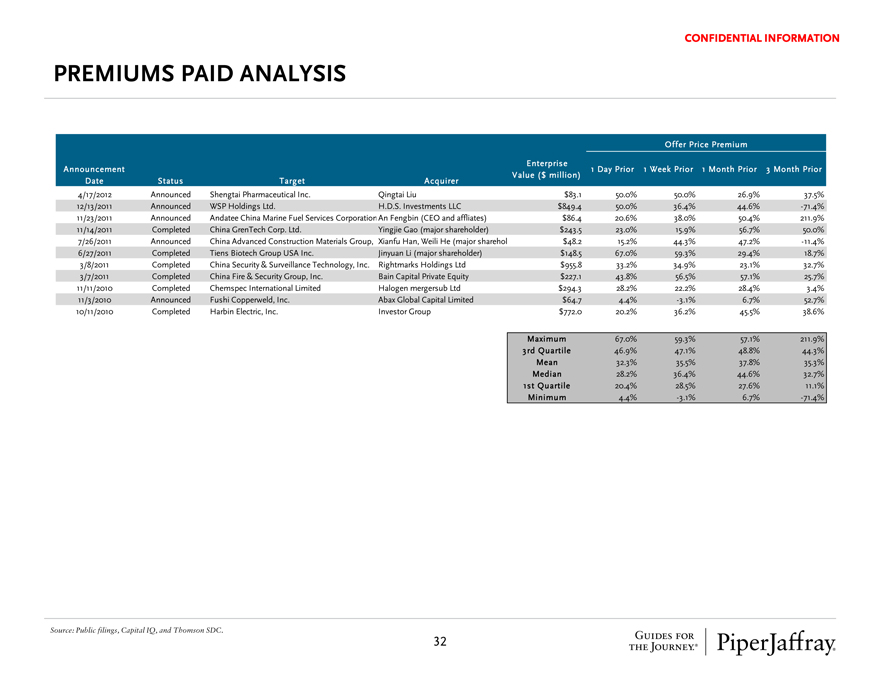

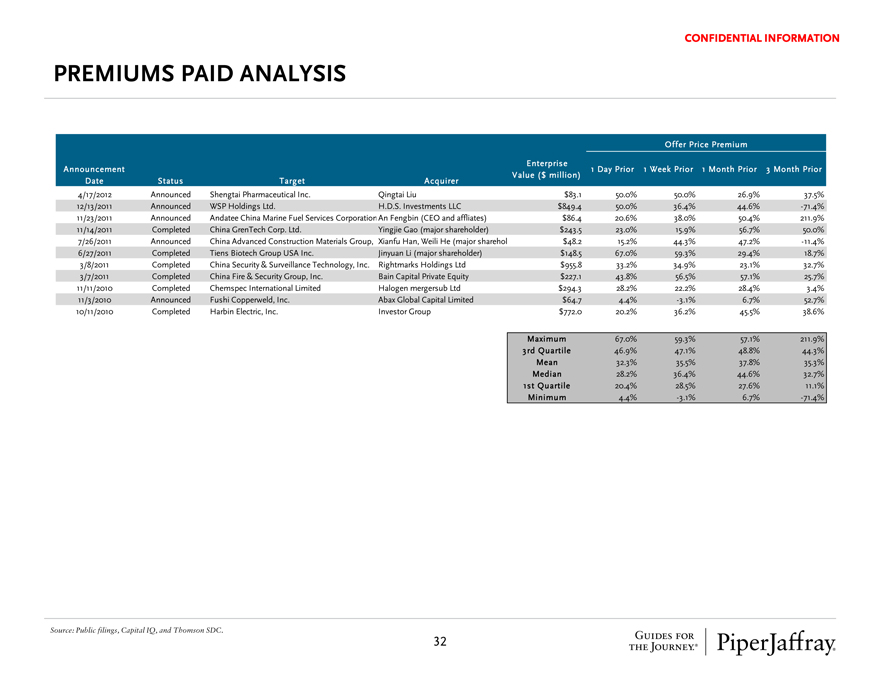

CONFIDENTIAL INFORMATION

PREMIUMS PAID ANALYSIS

Offer Price Premium

Announcement Date Status Target Acquirer Enterprise Value ($ million) 1 Day Prior 1 Week Prior 1 Month Prior 3 Month Prior

4/17/2012 Announced Shengtai Pharmaceutical Inc. Qingtai Liu $83.1 50.0% 50.0% 26.9% 37.5%

12/13/2011 Announced WSP Holdings Ltd. H.D.S. Investments LLC $849.4 50.0% 36.4% 44.6% -71.4%

11/23/2011 Announced Andatee China Marine Fuel Services CorporationAn Fengbin (CEO and affiliates) $86.4 20.6% 38.0% 50.4% 211.9%

11/14/2011 Completed China GrenTech Corp. Ltd. Yingjie Gao (major shareholder) $243.5 23.0% 15.9% 56.7% 50.0%

7/26/2011 Announced China Advanced Construction Materials Group, Inc. Xianfu Han, Weili He (major shareholders) $48.2 15.2% 44.3% 47.2% -11.4%

6/27/2011 Completed Tiens Biotech Group USA Inc. Jinyuan Li (major shareholder) $148.5 67.0% 59.3% 29.4% 18.7%

3/8/2011 Completed China Security & Surveillance Technology, Inc. Rightmarks Holdings Ltd $955.8 33.2% 34.9% 23.1% 32.7%

3/7/2011 Completed China Fire & Security Group, Inc. Bain Capital Private Equity $227.1 43.8% 56.5% 57.1% 25.7%

11/11/2010 Completed Chemspec International Limited Halogen mergersub Ltd $294.3 28.2% 22.2% 28.4% 3.4%

11/3/2010 Announced Fushi Copperweld, Inc. Abax Global Capital Limited $64.7 4.4% -3.1% 6.7% 52.7%

10/11/2010 Completed Harbin Electric, Inc. Investor Group $772.0 20.2% 36.2% 45.5% 38.6%

Maximum 67.0% 59.3% 57.1% 211.9%

3rd Quartile 46.9% 47.1% 48.8% 44.3%

Mean 32.3% 35.5% 37.8% 35.3%

Median 28.2% 36.4% 44.6% 32.7%

1st Quartile 20.4% 28.5% 27.6% 11.1%

Minimum 4.4% -3.1% 6.7% -71.4%

Source: Public filings, Capital IQ, and Thomson SDC.

32 GUIDES FOR THE JOURNEY.® PiperJaffray®

Appendix A

GLORIA Financial Summary

GUIDES FOR THE JOURNEY.® PiperJaffray®

CONFIDENTIAL INFORMATION

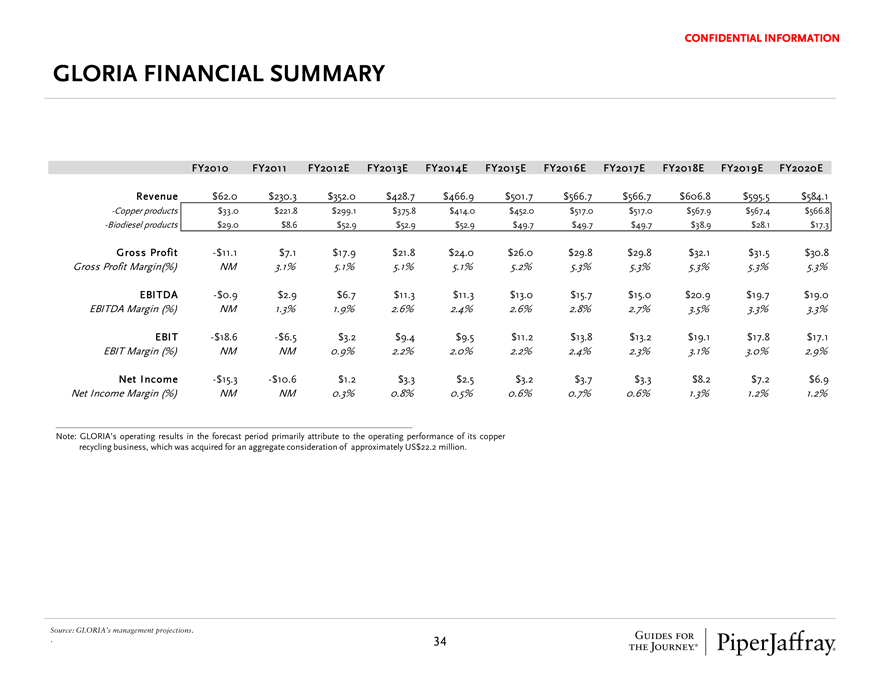

GLORIA FINANCIAL SUMMARY

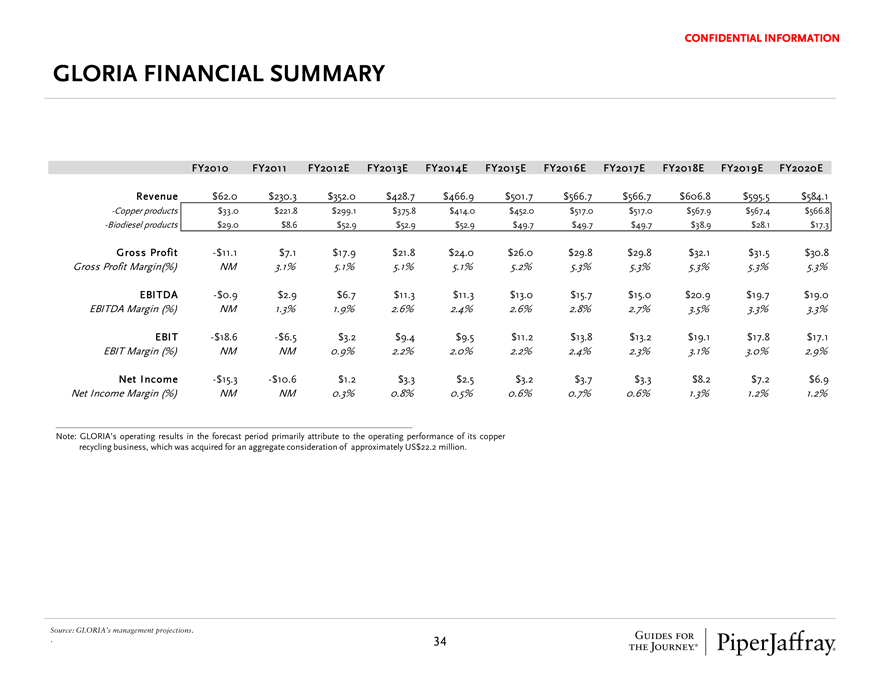

FY2010 FY2011 FY2012E FY2013E FY2014E FY2015E FY2016E FY2017E FY2018E FY2019E FY2020E

Revenue $62.0 $230.3 $352.0 $428.7 $466.9 $501.7 $566.7 $566.7 $606.8 $595.5 $584.1

-Copper products $33.0 $221.8 $299.1 $375.8 $414.0 $452.0 $517.0 $517.0 $567.9 $567.4 $566.8

-Biodiesel products $29.0 $8.6 $52.9 $52.9 $52.9 $49.7 $49.7 $49.7 $38.9 $28.1 $17.3

Gross Profit -$11.1 $7.1 $17.9 $21.8 $24.0 $26.0 $29.8 $29.8 $32.1 $31.5 $30.8

Gross Profit Margin(%) NM 3.1% 5.1% 5.1% 5.1% 5.2% 5.3% 5.3% 5.3% 5.3% 5.3%

EBITDA -$0.9 $2.9 $6.7 $11.3 $11.3 $13.0 $15.7 $15.0 $20.9 $19.7 $19.0

EBITDA Margin (%) NM 1.3% 1.9% 2.6% 2.4% 2.6% 2.8% 2.7% 3.5% 3.3% 3.3%

EBIT -$18.6 -$6.5 $3.2 $9.4 $9.5 $11.2 $13.8 $13.2 $19.1 $17.8 $17.1

EBIT Margin (%) NM NM 0.9% 2.2% 2.0% 2.2% 2.4% 2.3% 3.1% 3.0% 2.9%

Net Income -$15.3 -$10.6 $1.2 $3.3 $2.5 $3.2 $3.7 $3.3 $8.2 $7.2 $6.9

Net Income Margin (%) NM NM 0.3% 0.8% 0.5% 0.6% 0.7% 0.6% 1.3% 1.2% 1.2%

Note: GLORIA’s operating results in the forecast period primarily attribute to the operating performance of its copper recycling business, which was acquired for an aggregate consideration of approximately US$22.2 million.

Source: GLORIA’s management projections.

34 GUIDES FOR THE JOURNEY.® PiperJaffray®