Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-269296

The information in this preliminary pricing supplement is not complete and may be changed. This preliminary pricing supplement is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| |

| Subject to Completion. Dated January 21, 2025. GS Finance Corp. $ Autocallable Basket-Linked Notes due guaranteed by The Goldman Sachs Group, Inc. |

The notes do not bear interest. The amount that you will be paid on your notes is based on the performance of an equally weighted basket comprised of the common stock of NVIDIA Corporation, the Class A common stock of Palantir Technologies Inc., the common stock of Broadcom Inc., the common stock of Micron Technology, Inc. and the Energy Select Sector SPDR® Fund (the basket underliers). Each basket underlier has an initial weighting of 20% and an initial weighted value of 20. The notes will mature on the stated maturity date (expected to be February 14, 2030), unless they are automatically called on any call observation date commencing on February 9, 2026.

The return on your notes is linked, in part, to the performance of the Energy Select Sector SPDR® Fund (ETF), and not to that of the index on which the ETF is based.

The initial basket level is 100 and the closing level of the basket on any call observation date and on the determination date (expected to be February 7, 2030), as applicable, will equal the sum of the products, as calculated for each basket underlier, of: (i) its closing level on the applicable call observation date or determination date, as applicable, divided by its initial level (set on the trade date, expected to be February 7, 2025, and will be an intra-day level or the closing level of such basket underlier on the trade date) multiplied by (ii) its initial weighted value.

Your notes will be automatically called on a call observation date if the closing level of the basket on such date is greater than or equal to the initial basket level, resulting in a payment on the corresponding call payment date for each $1,000 face amount of your notes equal to (i) $1,000 plus (ii) the product of $1,000 times the applicable call premium amount. The call observation dates, the call payment dates and the applicable call premium amount for each call payment date are specified on page PS-5 of this pricing supplement.

If your notes are not automatically called on any call observation date, we will calculate the basket return, which is the percentage increase or decrease in the closing level of the basket on the determination date (the final basket level) from the initial basket level. At maturity, for each $1,000 face amount of your notes, you will receive an amount in cash equal to:

•if the basket return is positive (the final basket level is greater than the initial basket level), the sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) the basket return;

•if the basket return is zero or negative but not below -50% (the final basket level is equal to or less than the initial basket level but not by more than 50%), $1,000; or

•if the basket return is negative and is below -50% (the final basket level is less than the initial basket level by more than 50%), the sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) the basket return. You will receive less than 50% of the face amount of your notes.

Declines in one basket underlier may offset increases in the other basket underliers.

You should read the disclosure herein to better understand the terms and risks of your investment, including the credit risk of GS Finance Corp. and The Goldman Sachs Group, Inc. See page PS-21.

The estimated value of your notes at the time the terms of your notes are set on the trade date is expected to be between $885 and $925 per $1,000 face amount. For a discussion of the estimated value and the price at which Goldman Sachs & Co. LLC would initially buy or sell your notes, if it makes a market in the notes, see the following page.

| | | |

Original issue date: | expected to be February 12, 2025 | Original issue price: | 100% of the face amount* |

Underwriting discount: | % of the face amount* | Net proceeds to the issuer: | % of the face amount |

* The original issue price will be % for certain investors; see “Supplemental Plan of Distribution; Conflicts of Interest” on page PS-40 for additional information regarding the fees comprising the underwriting discount.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense. The notes are not bank deposits and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency, nor are they obligations of, or guaranteed by, a bank.

Goldman Sachs & Co. LLC

Pricing Supplement No. dated , 2025.

The issue price, underwriting discount and net proceeds listed above relate to the notes we sell initially. We may decide to sell additional notes after the date of this pricing supplement, at issue prices and with underwriting discounts and net proceeds that differ from the amounts set forth above. The return (whether positive or negative) on your investment in notes will depend in part on the issue price you pay for such notes.

GS Finance Corp. may use this prospectus in the initial sale of the notes. In addition, Goldman Sachs & Co. LLC or any other affiliate of GS Finance Corp. may use this prospectus in a market-making transaction in a note after its initial sale. Unless GS Finance Corp. or its agent informs the purchaser otherwise in the confirmation of sale, this prospectus is being used in a market-making transaction.

|

Estimated Value of Your Notes The estimated value of your notes at the time the terms of your notes are set on the trade date (as determined by reference to pricing models used by Goldman Sachs & Co. LLC (GS&Co.) and taking into account our credit spreads) is expected to be between $885 and $925 per $1,000 face amount, which is less than the original issue price. The value of your notes at any time will reflect many factors and cannot be predicted; however, the price (not including GS&Co.’s customary bid and ask spreads) at which GS&Co. would initially buy or sell notes (if it makes a market, which it is not obligated to do) and the value that GS&Co. will initially use for account statements and otherwise is equal to approximately the estimated value of your notes at the time of pricing, plus an additional amount (initially equal to $ per $1,000 face amount). Prior to , the price (not including GS&Co.’s customary bid and ask spreads) at which GS&Co. would buy or sell your notes (if it makes a market, which it is not obligated to do) will equal approximately the sum of (a) the then-current estimated value of your notes (as determined by reference to GS&Co.’s pricing models) plus (b) any remaining additional amount (the additional amount will decline to zero on a straight-line basis from the time of pricing through ). On and after , the price (not including GS&Co.’s customary bid and ask spreads) at which GS&Co. would buy or sell your notes (if it makes a market) will equal approximately the then-current estimated value of your notes determined by reference to such pricing models. |

|

About Your Prospectus The notes are part of the Medium-Term Notes, Series F program of GS Finance Corp. and are fully and unconditionally guaranteed by The Goldman Sachs Group, Inc. This prospectus includes this pricing supplement and the accompanying documents listed below. This pricing supplement constitutes a supplement to the documents listed below, does not set forth all of the terms of your notes and therefore should be read in conjunction with such documents: The information in this pricing supplement supersedes any conflicting information in the documents listed above. In addition, some of the terms or features described in the listed documents may not apply to your notes. We refer to the notes we are offering by this pricing supplement as the “offered notes” or the “notes”. Each of the offered notes has the terms described below. Please note that in this pricing supplement, references to “GS Finance Corp.”, “we”, “our” and “us” mean only GS Finance Corp. and do not include its subsidiaries or affiliates, references to “The Goldman Sachs Group, Inc.”, our parent company, mean only The Goldman Sachs Group, Inc. and do not include its subsidiaries or affiliates and references to “Goldman Sachs” mean The Goldman Sachs Group, Inc. together with its consolidated subsidiaries and affiliates, including us. The notes will be issued under the senior debt indenture, dated as of October 10, 2008, as supplemented by the First Supplemental Indenture, dated as of February 20, 2015, each among us, as issuer, The Goldman Sachs Group, Inc., as guarantor, and The Bank of New York Mellon, as trustee. This indenture, as so supplemented and as further supplemented thereafter, is referred to as the “GSFC 2008 indenture” in the accompanying prospectus supplement. The notes will be issued in book-entry form and represented by master note no. 3, dated March 22, 2021. |

Terms AND CONDITIONS

CUSIP / ISIN: 40058GKN0 / US40058GKN06

Company (Issuer): GS Finance Corp.

Guarantor: The Goldman Sachs Group, Inc.

Basket underliers (each individually, a basket underlier):

•the common stock of NVIDIA Corporation (current Bloomberg ticker: “NVDA UW”), as it may be replaced or adjusted from time to time as provided herein;

•the Class A common stock of Palantir Technologies Inc. (current Bloomberg ticker: “PLTR UW”), as it may be replaced or adjusted from time to time as provided herein;

•the common stock of Broadcom Inc. (current Bloomberg ticker: “AVGO UW”), as it may be replaced or adjusted from time to time as provided herein;

•the common stock of Micron Technology, Inc. (current Bloomberg ticker: “MU UW”), as it may be replaced or adjusted from time to time as provided herein; and

•the Energy Select Sector SPDR® Fund (current Bloomberg symbol: “XLE UP Equity”), or any successor basket underlier, as it may be modified, replaced or adjusted from time to time as provided herein

Basket index stocks (each individually, a basket stock): the common stock of NVIDIA Corporation, the Class A common stock of Palantir Technologies Inc., the common stock of Broadcom Inc. and the common stock of Micron Technology, Inc., as each may be replaced or adjusted from time to time as provided herein

Basket fund: the Energy Select Sector SPDR® Fund, or any successor basket underlier, as it may be modified, replaced or adjusted from time to time as provided herein

Underlying index for the basket fund: the index tracked by such basket fund

Face amount: $ in the aggregate on the original issue date; the aggregate face amount may be increased if the company, at its sole option, decides to sell an additional amount on a date subsequent to the trade date.

Authorized denominations: $1,000 or any integral multiple of $1,000 in excess thereof

Principal amount: Subject to redemption by the company as provided under “— Company’s redemption right (automatic call feature)” below, on the stated maturity date the company will pay, for each $1,000 of the outstanding face amount, an amount, if any, in cash equal to the cash settlement amount.

Cash settlement amount:

•if the final basket level is greater than the initial basket level, the sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) the upside participation rate times (c) the basket return;

●if the final basket level is equal to or less than the initial basket level but greater than or equal to the trigger buffer level, $1,000; or

●if the final basket level is less than the trigger buffer level, the sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) the basket return

Company’s redemption right (automatic call feature): if a redemption event occurs, then the outstanding face amount will be automatically redeemed in whole and the company will pay an amount in cash on the following call payment date, for each $1,000 of the outstanding face amount, equal to the sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) the applicable call premium amount specified under “—Call observation dates” below

Redemption event: a redemption event will occur if, as measured on any call observation date, the closing level of the basket is greater than or equal to the initial basket level

Initial basket level: 100

Closing level of the basket: on any call observation date or the determination date, the sum of, for each of the basket underliers: the product of (i) the quotient of (a) the closing level of such basket underlier on such date divided by (b) the initial basket underlier level of such basket underlier times (ii) the initial weighted value of such

basket underlier, except in the limited circumstances described under “— Consequences of a market disruption event or a non-trading day” below

Final basket level: the closing level of the basket on the determination date, except in the limited circumstances described under “— Consequences of a market disruption event or a non-trading day” below

Upside participation rate: 100%

Basket return: the quotient of (i) the final basket level minus the initial basket level divided by (ii) the initial basket level, expressed as a percentage

Trigger buffer level: 50% of the initial basket level

Initial weighted value: for each basket underlier, its initial weight in the basket set forth below multiplied by the initial basket level, all as set forth below:

| | |

Basket Underlier | Initial Weight in the Basket | Initial Weighted Value |

the common stock of NVIDIA Corporation | 20% | 20 |

the Class A common stock of Palantir Technologies Inc. | 20% | 20 |

the common stock of Broadcom Inc. | 20% | 20 |

the common stock of Micron Technology, Inc. | 20% | 20 |

Energy Select Sector SPDR® Fund | 20% | 20 |

Initial basket underlier level (in each case, set on the trade date and will be an intra-day level or the closing level of such basket underlier on the trade date):

•with respect to the common stock of NVIDIA Corporation, ;

•with respect to the Class A common stock of Palantir Technologies Inc., ;

•with respect to the common stock of Broadcom Inc., ;

•with respect to the common stock of Micron Technology, Inc., ; and

•with respect to the Energy Select Sector SPDR® Fund, .

Call premium amount: with respect to any call payment date, the applicable call premium amount specified in the table set forth under “— Call observation dates” below; as shown in such table, the call premium amount increases the longer the notes are outstanding

Trade date: expected to be February 7, 2025

Original issue date (set on the trade date): expected to be February 12, 2025

Determination date (set on the trade date): expected to be February 7, 2030, unless the calculation agent determines that a market disruption event with respect to a basket underlier occurs or is continuing on such day or such day is not a trading day with respect to a basket underlier. In that event, the determination date will be the first following trading day on which the calculation agent determines that, on or subsequent to such originally scheduled determination date, each basket underlier has had at least one trading day on which no market disruption event has occurred or is continuing and the closing level of each of the basket underliers will be determined on or prior to the postponed determination date as set forth under “— Consequences of a market disruption event or a non-trading day” below. (In such case, the determination date may differ from the dates on which the levels of one or more basket underliers are determined for the purpose of the calculations to be performed on the determination date.) In no event, however, will the determination date be postponed to a date later than the originally scheduled stated maturity date or, if the originally scheduled stated maturity date is not a business day, later than the first business day after the originally scheduled stated maturity date. On such last possible determination date, if a market disruption event occurs or is continuing with respect to a basket underlier that has not yet had such a trading day on which no market disruption event has occurred or is continuing or if such last possible day is not a trading day with respect to such basket underlier, that day will nevertheless be the determination date.

Stated maturity date (set on the trade date): expected to be February 14, 2030, unless that day is not a business day, in which case the stated maturity date will be postponed to the next following business day. The stated maturity date will also be postponed if the determination date is postponed as described under “—

Determination date” above. In such a case, the stated maturity date will be postponed by the same number of business day(s) from but excluding the originally scheduled determination date to and including the actual determination date.

Call observation dates (set on the trade date): expected to be the dates specified as such in the table below, unless the calculation agent determines that a market disruption event with respect to a basket underlier occurs or is continuing on such day or such day is not a trading day with respect to a basket underlier. In that event, such call observation date will be the first following trading day on which the calculation agent determines that, on or subsequent to such originally scheduled call observation date, each basket underlier has had at least one trading day on which no market disruption event has occurred or is continuing and the closing level of each of the basket underliers will be determined on or prior to the postponed call observation date as set forth under “— Consequences of a market disruption event or a non-trading day” below. (In such case, the call observation date may differ from the dates on which the levels of one or more basket underliers are determined for the purpose of the calculations to be performed on the call observation date.) In no event, however, will the call observation date be postponed to a date later than the originally scheduled corresponding call payment date or, if the originally scheduled corresponding call payment date is not a business day, later than the first business day after such originally scheduled call payment date. On such last possible call observation date applicable to the relevant call payment date, if a market disruption event occurs or is continuing with respect to a basket underlier that has not yet had such a trading day on which no market disruption event has occurred or is continuing or if such last possible day is not a trading day with respect to such basket underlier, that day will nevertheless be the call observation date.

| | |

Call Observation Dates | Call Payment Dates | Call Premium Amount |

February 9, 2026 | February 17, 2026 | 10% |

February 8, 2027 | February 16, 2027 | 20% |

February 7, 2028 | February 14, 2028 | 30% |

February 7, 2029 | February 14, 2029 | 40% |

Call payment dates (set on the trade date): expected to be the dates specified as such in the table set forth under “—Call observation dates” above, or, if such day is not a business day, the next succeeding business day. If a call observation date is postponed as described under “— Call observation dates” above, the related call payment date will be postponed by the same number of business day(s) from but excluding the applicable originally scheduled call observation date to and including the actual call observation date.

Closing level: with respect to a basket underlier, on any trading day, the closing sale price or last reported sale price, regular way, for such basket underlier, on a per-share or other unit basis:

•on the principal national securities exchange on which such basket underlier is listed for trading on that day, or

•if such basket underlier is not listed on any national securities exchange on that day, on any other U.S. national market system that is the primary market for the trading of such basket underlier.

If such basket underlier is not listed or traded as described above, then the closing level for such basket underlier on any day will be the average, as determined by the calculation agent, of the bid prices for such basket underlier obtained from as many dealers in such basket underlier selected by the calculation agent as will make those bid prices available to the calculation agent. The number of dealers need not exceed three and may include the calculation agent or any of its or the company’s affiliates.

The closing level of a basket underlier is subject to adjustment as described under “— Anti-dilution adjustments for a basket index stock” and “— Anti-dilution adjustments for the basket fund”, as applicable, below.

Trading day: (i) with respect to a basket index stock, a day on which the principal securities market for such basket index stock is open for trading, and (ii) with respect to the basket fund, a day on which (a) the exchange on which such basket fund has its primary listing is open for trading and (b) the price of one share of such basket fund is quoted by the exchange on which such basket fund has its primary listing

Successor basket underlier: with respect to the basket fund, any substitute basket underlier approved by the calculation agent as a successor as provided under “— Discontinuance or modification of an underlier that is a basket fund” below

Basket fund investment advisor: with respect to the basket fund, at any time, the person or entity, including any successor investment advisor or trustee, as applicable, that serves as an investment advisor or trustee to such basket underlier as then in effect

Basket underlier stocks: with respect to the basket fund, at any time, the stocks that comprise such basket underlier as then in effect, after giving effect to any additions, deletions or substitutions

Basket index stock issuer: with respect to a basket index stock, the issuer of such basket underlier as then in effect

Market disruption event: (i) With respect to a basket underlier on any given trading day, any of the following will be a market disruption event:

•a suspension, absence or material limitation of trading in such basket underlier on its primary market for more than two consecutive hours of trading or during the one-half hour before the close of trading in that market, as determined by the calculation agent in its sole discretion,

•a suspension, absence or material limitation of trading in option or futures contracts relating to such basket underlier in the primary market for those contracts for more than two consecutive hours of trading or during the one-half hour before the close of trading in that market, as determined by the calculation agent in its sole discretion, or

•such basket underlier does not trade on what was the primary market for such basket underlier, as determined by the calculation agent in its sole discretion,

and, in the case of any of these events, the calculation agent determines in its sole discretion that such event could materially interfere with the ability of the company or any of its affiliates or a similarly situated person to unwind all or a material portion of a hedge that could be effected with respect to this note.

The following events will not be market disruption events:

•a limitation on the hours or numbers of days of trading, but only if the limitation results from an announced change in the regular business hours of the relevant market, and

•a decision to permanently discontinue trading in option or futures contracts relating to such basket underlier.

For this purpose, an “absence of trading” in the primary securities market on which shares of such basket underlier are traded, or on which option or futures contracts, if available, relating to such basket underlier are traded, will not include any time when that market is itself closed for trading under ordinary circumstances. In contrast, a suspension or limitation of trading in shares of such basket underlier or in option or futures contracts, if available, relating to such basket underlier in the primary market for such basket underlier or those contracts, by reason of:

•a price change exceeding limits set by that market,

•an imbalance of orders relating to the shares of such basket underlier or those contracts, or

•a disparity in bid and ask quotes relating to the shares of such basket underlier or those contracts,

will constitute a suspension or material limitation of trading in shares of such basket underlier or those contracts in that market.

(ii) A market disruption event with respect to one basket underlier will not, by itself, constitute a market disruption event for any unaffected basket underlier.

Consequences of a market disruption event or a non-trading day: If a market disruption event with respect to any basket underlier occurs or is continuing on a day that would otherwise be a call observation date or the determination date, or such day is not a trading day, then the call observation date or the determination date, as applicable, will be postponed as described under “— Call observation dates” or “— Determination date” above. As a result of any of the foregoing, the call payment date or stated maturity date for your notes may also be

postponed, as described under “— Call payment dates” or “ — Stated maturity date” above. If any call observation date or the determination date is postponed due to a market disruption event or non-trading day with respect to one or more of the basket underliers, the closing level of the basket for any postponed call observation date or the postponed determination date, as applicable, will be calculated based on (i) the closing level of each of the basket underliers that is not affected by the market disruption event or non-trading day, if any, on originally scheduled call observation date or the originally scheduled determination date, (ii) the closing level of each of the basket underliers that is affected by the market disruption event or non-trading day on the first trading day following the originally scheduled call observation date or originally scheduled determination date on which no market disruption event exists for that basket underlier, and (iii) the calculation agent’s assessment, in its sole discretion, of the closing level of each basket underlier on the last possible postponed call observation date or determination date, with respect to each basket underlier as to which a market disruption event or non-trading day continues through the last possible postponed call observation date or determination date. As a result, this could result in the closing level of differing basket underliers being determined on different calendar dates. For the avoidance of doubt, once the closing level for one or more basket underliers is determined for the call observation date or determination date, the occurrence of a later market disruption event or non-trading day will not alter such calculation.

Discontinuance or modification of a basket underlier that is a basket fund: If, with respect to the basket fund, such basket fund is delisted from the exchange on which the basket fund has its primary listing and the basket fund investment advisor or anyone else publishes a substitute basket underlier that the calculation agent determines is comparable to the basket fund and approves as a successor basket underlier, or if the calculation agent designates a substitute basket underlier, then the calculation agent will determine the amount payable on the call payment date or the stated maturity date by reference to such successor basket underlier.

If the calculation agent determines that the basket fund is delisted or withdrawn from the exchange on which the basket fund has its primary listing and there is no successor basket underlier, the calculation agent will determine the amount payable on the applicable call payment date or on the stated maturity date, as applicable, by a computation methodology that the calculation agent determines will as closely as reasonably possible replicate the basket fund.

If the calculation agent determines that the basket fund, the basket underlier stocks comprising such basket fund or the method of calculating such basket fund is changed at any time in any respect — including any split or reverse split of the basket fund, a material change in the investment objective of the basket fund and any addition, deletion or substitution and any reweighting or rebalancing of the basket underlier stocks and whether the change is made by the basket fund investment advisor under its existing policies or following a modification of those policies, is due to the publication of a successor basket underlier, is due to events affecting one or more of the basket underlier stocks or their issuers or is due to any other reason — then the calculation agent will be permitted (but not required) to make such adjustments in the basket fund or the method of its calculation as it believes are appropriate to ensure that the level of the basket fund used to determine the amount payable on a call payment date or the stated maturity date, as applicable, is equitable.

(ii) All determinations and adjustments to be made by the calculation agent with respect to a basket underlier may be made by the calculation agent in its sole discretion. The calculation agent is not obligated to make any such adjustments.

Anti-dilution adjustments for a basket index stock: The calculation agent will adjust the reference amount of a basket index stock in respect of each event for which adjustment is required under any of the six subsections beginning with “Stock splits” below (and not in respect of any other event). (If more than one such event occurs, the calculation agent shall adjust the reference amount as so provided for each such event, sequentially, in the order in which such events occur, and on a cumulative basis.) Having adjusted the reference amount for any and all such events as so provided, the calculation agent shall determine a closing level for the reference amount as so adjusted on the call observation date or the determination date, as applicable. (If the reference amount is adjusted pursuant to “Reorganization events” below so as to consist of distribution property, then the closing level on any call observation date or the determination date, as applicable, shall equal the sum of the respective closing levels or other values for all such distribution property on such call observation date or the determination date, as provided in “Reorganization events” below.) Having determined the closing level on any call observation date or the determination date, as applicable, the calculation agent shall use such prices to determine the

occurrence of a redemption event, or calculate the cash settlement amount. The calculation agent shall make all adjustments no later than the applicable call observation date or the determination date, as applicable.

Notwithstanding any other provision in this note, if an event for which adjustment is required under any of the six subsections beginning with “Stock splits” below occurs, the calculation agent may make the adjustment and any related determinations and calculations in a manner that differs from that specified in this note as necessary to achieve an equitable result. Upon written request by the holder to the calculation agent, the calculation agent will provide the holder with such information about these adjustments as such agent determines is appropriate.

Stock splits. A stock split is an increase in the number of a corporation’s outstanding shares of stock without any change in its stockholders’ equity. Each outstanding share will be worth less as a result of a stock split. If a basket index stock is subject to a stock split, then at the opening of business on the first day on which such basket index stock trades without the right to receive the stock split, the calculation agent will adjust the reference amount to equal the sum of the reference amount in effect immediately prior to such adjustment plus the product of (i) the number of new shares issued in the stock split with respect to one share of such basket index stock times (ii) the reference amount in effect immediately prior to such adjustment. The reference amount will not be adjusted, however, unless such first day occurs after the trade date and on or before the applicable call observation date or the determination date, as applicable.

Reverse stock splits. A reverse stock split is a decrease in the number of a corporation’s outstanding shares of stock without any change in its stockholders’ equity. Each outstanding share will be worth more as a result of a reverse stock split. If a basket index stock is subject to a reverse stock split, then once the reverse stock split becomes effective, the calculation agent will adjust the reference amount to equal the product of the reference amount in effect immediately prior to such adjustment and the quotient of (i) the number of shares of such basket index stock outstanding immediately after the reverse stock split becomes effective divided by (ii) the number of shares of such basket index stock outstanding immediately before the reverse stock split becomes effective. The reference amount will not be adjusted, however, unless the reverse stock split becomes effective after the trade date and on or before the applicable call observation date or the determination date, as applicable.

Stock dividends. In a stock dividend, a corporation issues additional shares of its stock to all holders of its outstanding shares of its stock in proportion to the shares they own. Each outstanding share will be worth less as a result of a stock dividend. If a basket index stock is subject to a stock dividend that is given ratably to all holders of such basket index stock, then at the opening of business on the ex-dividend date, the calculation agent will adjust the reference amount to equal the reference amount in effect immediately prior to such adjustment plus the product of (i) the number of shares issued in the stock dividend with respect to one share of such basket index stock times (ii) the reference amount in effect immediately prior to such adjustment. The reference amount will not be adjusted, however, unless such ex-dividend date occurs after the trade date and on or before the applicable call observation date or the determination date, as applicable.

Other dividends and distributions. There will be no adjustments to the reference amount to reflect dividends or other distributions paid with respect to a basket index stock other than:

•stock dividends as provided in “Stock dividends” above,

•issuances of transferable rights or warrants as provided in “Transferable rights and warrants” below,

•dividends or other distributions constituting spin-off events as provided in “Reorganization events” below, or

•extraordinary dividends described below.

A dividend or other distribution with respect to a basket index stock will be deemed to be an “extraordinary dividend” if its per share value of such dividend or other distribution exceeds the per share value of the immediately preceding dividend or distribution with respect to such basket index stock, if any, that is not an extraordinary dividend by an amount equal to at least 10% of the closing level of such basket index stock on the trading day immediately preceding the ex-dividend date for such extraordinary dividend.

If an extraordinary dividend occurs with respect to a basket index stock, the calculation agent will adjust the reference amount to equal the product of (a) the reference amount in effect immediately prior to such adjustment and (b) a fraction, the numerator of which is the closing level of such basket index stock on the trading day immediately preceding the ex-dividend date and the denominator of which is the amount by which such closing level exceeds the extraordinary dividend amount.

The “extraordinary dividend amount” with respect to an extraordinary dividend for a basket index stock will equal:

•in the case of an extraordinary dividend that is paid in lieu of a regular quarterly dividend, the amount per share of such extraordinary dividend minus the amount per share of the immediately preceding dividend or distribution with respect to such basket index stock, if any, that is not an extraordinary dividend or

•in the case of an extraordinary dividend that is not paid in lieu of a regular quarterly dividend, the amount per share of such extraordinary dividend.

To the extent an extraordinary dividend is not paid in cash, the value of the non-cash component will be determined by the calculation agent. A distribution on a basket index stock that constitutes a stock dividend, an issuance of transferable rights or warrants or a spin-off event and also constitutes an extraordinary dividend will result only in an adjustment to the reference amount pursuant to “Stock dividends” above, “Transferable rights and warrants” below or “Reorganization events” below, as applicable. The reference amount will not be adjusted pursuant to this subsection unless the ex-dividend date for the extraordinary dividend occurs after the trade date and on or before the applicable call observation date or the determination date, as applicable.

Transferable rights and warrants. With respect to a basket index stock, if the basket index stock issuer issues transferable rights or warrants to all holders of the basket index stock to subscribe for or purchase the basket index stock at an exercise price per share less than the closing level of the basket index stock on the trading day immediately before the ex-dividend date for such issuance, then the calculation agent will adjust the reference amount by multiplying the reference amount in effect immediately prior to such adjustment by a fraction:

•the numerator of which is the number of shares of basket index stock outstanding at the close of business on the day before such ex-dividend date plus the number of additional shares of basket index stock offered for subscription or purchase under such transferable rights or warrants, and

•the denominator of which is the number of shares of basket index stock outstanding at the close of business on the day before such ex-dividend date plus the number of additional shares of basket index stock that the aggregate offering price of the total number of shares of basket index stock so offered for subscription or purchase would purchase at the closing level of the basket index stock on the trading day immediately before such ex-dividend date, with such number of additional shares being determined by multiplying the total number of shares so offered by the exercise price of such transferable rights or warrants and dividing the resulting product by the closing level of the basket index stock on the trading day immediately before such ex-dividend date.

The reference amount will not be adjusted, however, unless such ex-dividend date occurs after the trade date and on or before the applicable call observation date or the determination date, as applicable.

Reorganization events. With respect to a basket index stock, if:

•any reclassification or other change of a basket index stock occurs,

•the basket index stock issuer has been subject to a merger, consolidation, amalgamation, binding share exchange or other business combination and is not the surviving entity or it does survive but all the shares of basket index stock are reclassified or changed,

•the basket index stock has been subject to a takeover, tender offer, exchange offer, solicitation proposal or other event by another person to purchase or otherwise obtain all of the outstanding shares of the basket index stock, such that all of the outstanding shares of the basket index stock (other than shares of the basket index stock owned or controlled by such other person) are transferred, or irrevocably committed to be transferred, to another person,

•the basket index stock issuer or any subsidiary of the basket index stock issuer has been subject to a merger, consolidation, amalgamation or binding share exchange in which the basket index stock issuer is the surviving entity and all the outstanding shares of the basket index stock (other than shares of the basket index stock owned or controlled by such other person) immediately prior to such event collectively represent less than 50% of the outstanding shares of the basket index stock immediately following such event,

•the basket index stock issuer sells or otherwise transfers its property and assets as an entirety or substantially as an entirety to another entity

•the basket index stock issuer issues to all holders of basket index stock equity securities of an issuer other than the basket index stock issuer (other than in a transaction described in any of the bullet points above) (a “spin-off event”),

•the basket index stock issuer is liquidated, dissolved or wound up or is subject to a proceeding under any applicable bankruptcy, insolvency or other similar law, or

•any other corporate or similar events that affect or could potentially affect market prices of, or shareholders’ rights in, the basket index stock or distribution property, which will be substantiated by an official characterization by either the Options Clearing Corporation with respect to options contracts on the basket index stock or by the primary securities exchange on which the basket index stock or listed options on the basket index stock are traded, and will ultimately be determined by the calculation agent in its sole discretion (any such event in this bullet point or any of the bullet points above in this subsection, a “reorganization event”),

then the calculation agent will adjust the reference amount so that the reference amount consists of the respective amounts of each type of distribution property deemed, for the purposes of this note, to be distributed in such reorganization event in respect of the reference amount as in effect immediately prior to such adjustment, taken together.

Notwithstanding the foregoing, however, the calculation agent will not make any adjustment for a reorganization event unless the event becomes effective — or, if the event is a spin-off event, unless the ex-dividend date for the spin-off event occurs — after the trade date and on or before the applicable call observation date or the determination date, as applicable.

The calculation agent will determine the value of each component type of distribution property, using the closing level on the relevant day for any such type consisting of securities and such other method as it determines to be appropriate, in its sole discretion, for any other type. If a holder of a basket index stock may elect to receive different types or combinations of types of distribution property in the reorganization event, the distribution property will be deemed to include the types and amounts thereof distributed to a holder that makes no election, as determined by the calculation agent in its sole discretion. If a reorganization event occurs and as a result the reference amount is adjusted to consist of distribution property, the calculation agent will make further adjustments for subsequent events that affect such distribution property or any component type thereof, to the same extent that it would make adjustments if a basket index stock were outstanding and were affected by the same kinds of events. The closing level on a call observation date or the determination date will be the total value, as determined by the calculation agent at the close of trading hours of a basket index stock on such call observation date or the determination date, as applicable, of all components of the reference amount, with each component having been adjusted on a sequential and cumulative basis for all relevant events affecting it.

The calculation agent may, in its sole discretion, modify the adjustments described in “Reorganization events” as necessary to ensure an equitable result.

If at any time the reference amount consists of distribution property, as determined by the calculation agent, then all references in this note to a “basket index stock” shall thereupon be deemed to mean such distribution property and all references in this note to a “share of basket index stock” shall thereupon be deemed to mean a comparable unit of each type of property comprising such distribution property, as determined by the calculation agent.

Minimum adjustments. Notwithstanding the foregoing, no adjustment will be required in respect of any event specified in “Stock splits”, “Reverse stock splits”, “Stock dividends”, “Other dividends and distributions” and “Transferable rights and warrants” above unless such adjustment would result in a change of at least 0.1% in the closing level of such basket index stock. The closing level of a basket index stock resulting from any adjustment shall be rounded up or down, as appropriate, to the nearest ten-thousandth, with five hundred-thousandths being rounded upward — e.g., 0.12344 will be rounded down to 0.1234 and 0.12345 will be rounded up to 0.1235.

Distribution property: cash, securities and/or other property distributed in any reorganization event in respect of the relevant reference amount and, in the case of a spin-off event, includes such reference amount

Ex-dividend date: for any dividend or other distribution with respect to a basket index stock, the first day on which the basket index stock trades without the right to receive such dividend or other distribution

Reference amount: with respect to a basket index stock, initially, one share of such basket index stock which shall be adjusted, as to the amount(s) and/or type(s) of property comprising the same, by the calculation agent as provided under “Anti-dilution adjustments for a basket index stock” above

Anti-dilution adjustments for the basket fund: the calculation agent will have discretion to adjust the closing level of the basket fund if certain events occur (including those described above under “— Discontinuance or modification of a basket underlier that is a basket fund”). In the event that any event other than a delisting or withdrawal from the relevant exchange occurs, the calculation agent shall determine whether and to what extent an adjustment should be made to the level of such basket underlier or any other term. The calculation agent shall have no obligation to make an adjustment for any such event.

Calculation agent: Goldman Sachs & Co. LLC (“GS&Co.”)

Tax characterization: The holder, on behalf of itself and any other person having a beneficial interest in this note, hereby agrees with the company (in the absence of a change in law, an administrative determination or a judicial ruling to the contrary) to characterize this note for all U.S. federal income tax purposes as a pre-paid derivative contract in respect of the basket underliers.

Overdue principal rate: the effective Federal Funds rate

HYPOTHETICAL EXAMPLES

Payment Examples

The following examples are provided for purposes of illustration only. They should not be taken as an indication or prediction of future investment results and merely are intended to illustrate the impact that the various hypothetical closing levels of the basket on a call observation date and the various hypothetical basket closing levels or hypothetical closing levels of the basket underliers, as applicable, on the determination date could have on the amount of cash payable on a call payment date or on the stated maturity date, as the case may be, assuming all other variables remain constant.

The examples below are based on a range of basket levels and closing levels of the basket underliers that are entirely hypothetical; no one can predict what the level of the basket will be on any day throughout the life of your notes, and no one can predict what the closing level of the basket will be on a call observation date or on the determination date. The basket underliers have been highly volatile in the past — meaning that the levels of the basket underliers have changed considerably in relatively short periods — and their performances cannot be predicted for any future period.

The information in the following examples reflects hypothetical rates of return on the offered notes assuming that they are purchased on the original issue date at the face amount and held to a call payment date or the stated maturity date, as the case may be. If you sell your notes in a secondary market prior to a call payment date or the stated maturity date, as the case may be, your return will depend upon the market value of your notes at the time of sale, which may be affected by a number of factors that are not reflected in the examples below, such as interest rates, the volatility of the basket underliers, the creditworthiness of GS Finance Corp., as issuer, and the creditworthiness of The Goldman Sachs Group, Inc., as guarantor. In addition, the estimated value of your notes at the time the terms of your notes are set on the trade date (as determined by reference to pricing models used by GS&Co.) is less than the original issue price of your notes. For more information on the estimated value of your notes, see “Additional Risk Factors Specific to Your Notes — The Estimated Value of Your Notes At the Time the Terms of Your Notes Are Set On the Trade Date (as Determined By Reference to Pricing Models Used By GS&Co.) Is Less Than the Original Issue Price Of Your Notes” on page PS-21 of this pricing supplement. The information in the examples also reflects the key terms and assumptions in the box below.

| |

Key Terms and Assumptions |

Face amount | $1,000 |

Initial basket level | 100 |

Upside participation rate | 100% |

Trigger buffer level | 50% of the initial basket level |

Call premium amount | the applicable call premium amount for each call payment date is specified on page S-5 of this pricing supplement |

The notes are not automatically called, unless otherwise indicated below Neither a market disruption event nor a non-trading day occurs with respect to any basket underlier on any originally scheduled call observation date or the originally scheduled determination date |

No change in or affecting any basket underlier, any basket underlier stock, any policy of the applicable basket fund investment advisor or any method by which the applicable underlying index sponsor calculates its underlying index |

Notes purchased on original issue date at the face amount and held to a call payment date or the stated maturity date |

Moreover, we have not yet set the initial levels of the basket underliers that will serve as the baselines for determining the basket return and the amount, if any, that we will pay on your notes, if any, on a call payment date or at maturity. We will not do so until the trade date. As a result, the actual initial levels of the basket underliers may differ substantially from their levels prior to the trade date.

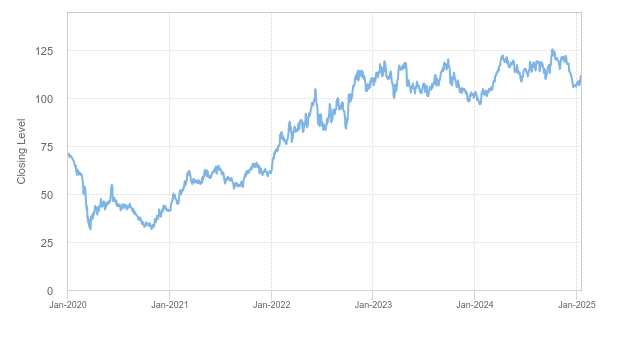

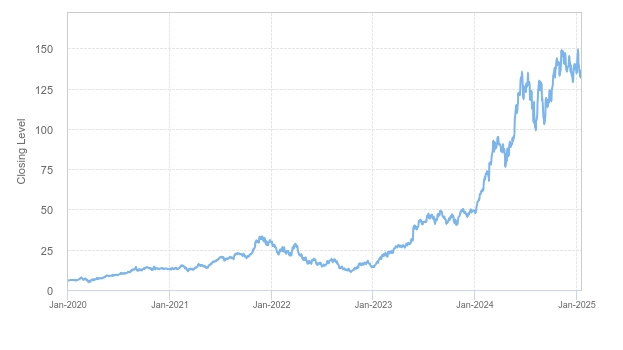

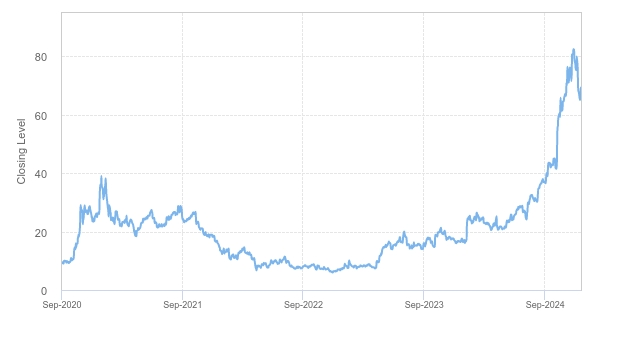

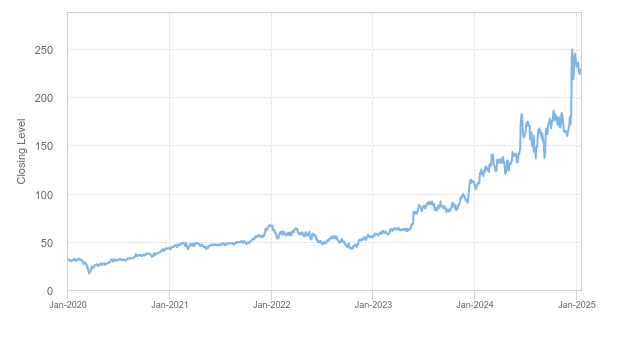

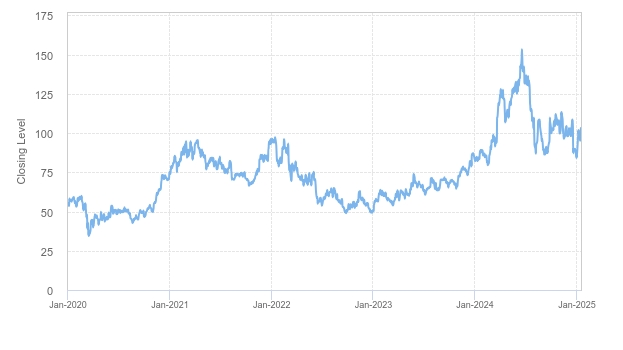

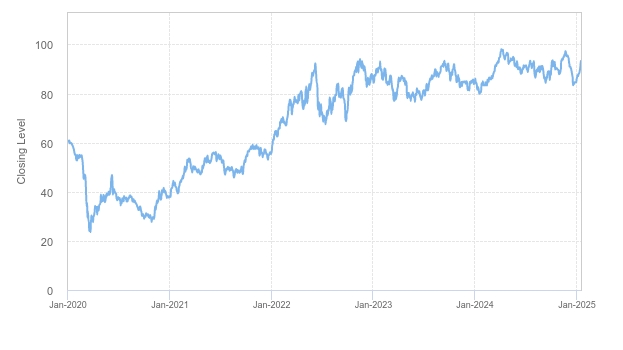

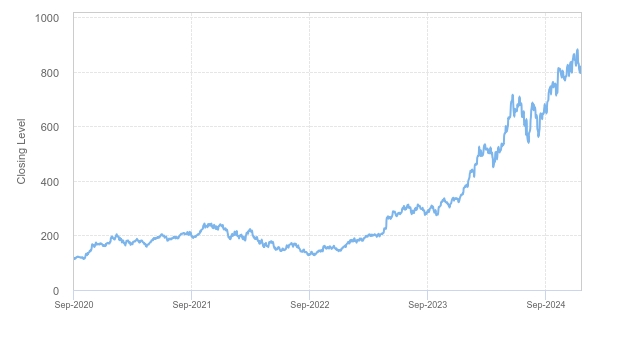

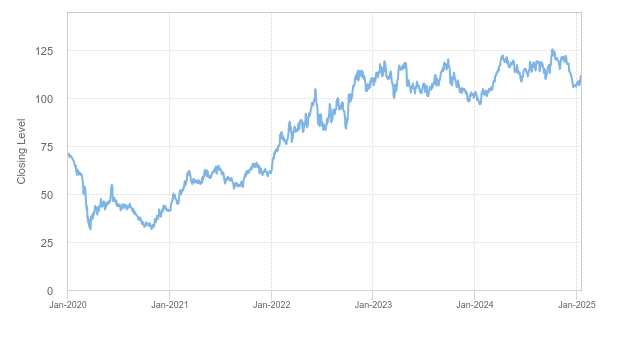

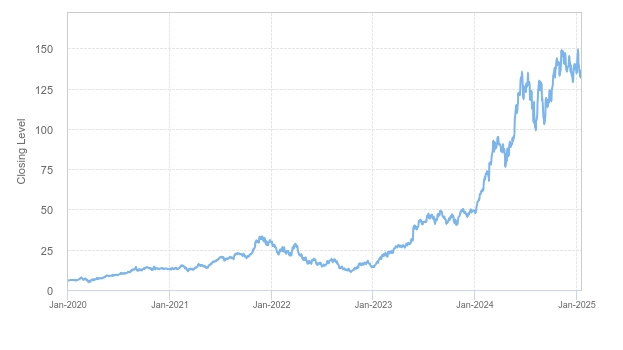

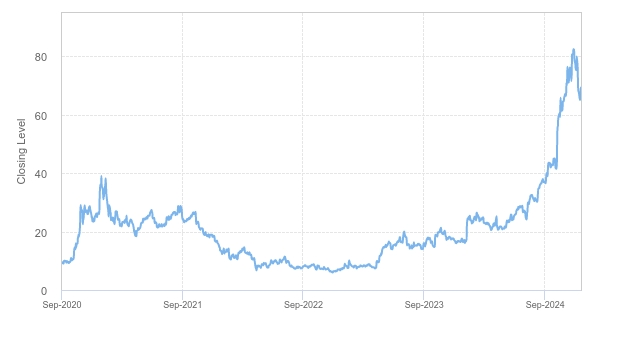

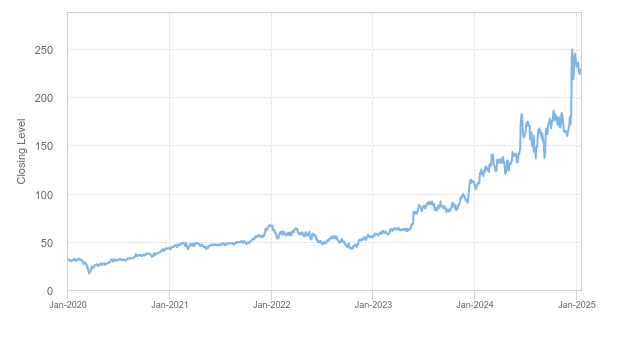

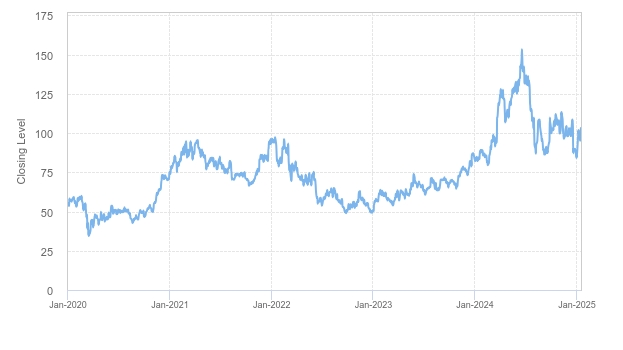

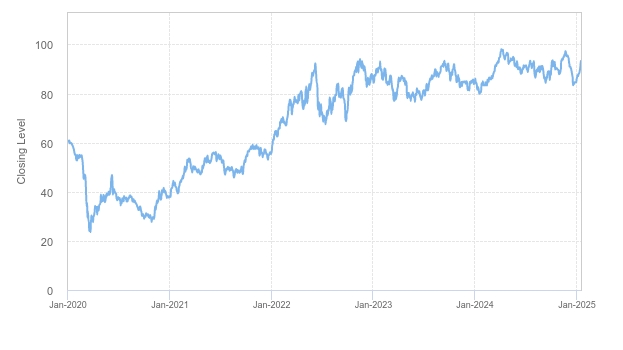

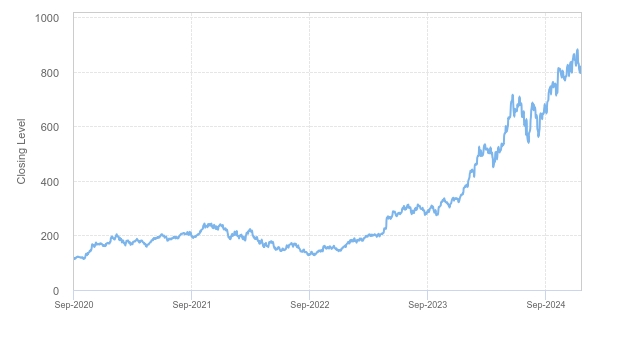

For these reasons, the actual performance of the basket over the life of your notes, as well as the amount payable on a call payment date or at maturity, if any, may bear little relation to the hypothetical examples shown below or to the historical levels of each basket underlier shown elsewhere in this pricing supplement. For information about the historical levels of each basket underlier during recent periods, see “The Basket and the Basket Underliers — Historical Closing Levels of the Basket Underliers” below. Before investing in the offered notes, you should consult publicly available information to determine the levels of the basket underliers between the date of this pricing supplement and the date of your purchase of the offered notes.

Also, the hypothetical examples shown below do not take into account the effects of applicable taxes. Because of the U.S. tax treatment applicable to your notes, tax liabilities could affect the after-tax rate of return on your notes to a comparatively greater extent than the after-tax return on the basket underliers.

Hypothetical Payment on a Call Payment Date

The examples below show the hypothetical payments that we would pay on a call payment date with respect to each $1,000 face amount of the notes if the closing level of the basket is greater than or equal to the initial basket level on the applicable call observation date. While there are four potential call payment dates with respect to your notes, the examples below only illustrate the amount you will receive, if any, on the first and second call payment date.

If your notes are automatically called on the first call observation date (i.e., on the first call observation date the closing level of the basket is greater than or equal to the initial basket level), the amount in cash that we would deliver for each $1,000 face amount of your notes on the applicable call payment date would be the sum of $1,000 plus the product of the applicable call premium amount times $1,000. If, for example, the closing level of the basket on the first call observation date were determined to be 120% of the initial basket level, your notes would be automatically called and the amount in cash that we would deliver on your notes on the corresponding call payment date would be 110% of the face amount of your notes or $1,100 for each $1,000 of the face amount of your notes.

If, for example, the notes are not automatically called on the first call observation date and are automatically called on the second call observation date (i.e., on the first call observation date the closing level of the basket is less than the initial basket level and on the second call observation date the closing level of the basket is greater than or equal to the initial basket level), the amount in cash that we would deliver for each $1,000 face amount of your notes on the applicable call payment date would be the sum of $1,000 plus the product of the applicable call premium amount times $1,000. If, for example, the closing level of the basket on the second call observation date were determined to be 140% of the initial basket level, your notes would be automatically called and the amount in cash that we would deliver on your notes on the corresponding call payment date would be 120% of the face amount of your notes or $1,200 for each $1,000 of the face amount of your notes.

Hypothetical Payment at Maturity

If the notes are not automatically called on any call observation date (i.e., on each of the call observation dates the closing level of the basket is less than the initial basket level), the amount in cash we would deliver for each $1,000 face amount of your notes on the stated maturity date will depend on the performance of the basket on the determination date, as shown in the table below. The table below assumes that the notes have not been automatically called on any call observation date and reflects hypothetical cash settlement amounts that you could receive on the stated maturity date. The levels in the left column of the table below represent hypothetical final basket levels and are expressed as percentages of the initial basket level. The amounts in the right column represent the hypothetical cash settlement amounts, based on the corresponding hypothetical final basket level, and are expressed as percentages of the face amount of a note (rounded to the nearest one-thousandth of a percent). Thus, a hypothetical cash settlement amount of 100.000% means that the value of the cash payment that we would deliver for each $1,000 of the outstanding face amount of the offered notes on the stated maturity date would equal 100.000% of the face amount of a note, based on the corresponding hypothetical final basket level and the assumptions noted above.

| |

The Notes Have Not Been Automatically Called |

Hypothetical Final Basket Level (as Percentage of Initial Basket Level) | Hypothetical Cash Settlement Amount (as Percentage of Face Amount) |

200.000% | 200.000% |

175.000% | 175.000% |

150.000% | 150.000% |

125.000% | 125.000% |

100.000% | 100.000% |

80.000% | 100.000% |

70.000% | 100.000% |

50.000% | 100.000% |

49.999% | 49.999% |

35.000% | 35.000% |

25.000% | 25.000% |

0.000% | 0.000% |

If, for example, the notes have not been automatically called on a call observation date and the final basket level were determined to be 25.000% of the initial basket level, the cash settlement amount that we would deliver on your notes at maturity would be 25.000% of the face amount of your notes, as shown in the table above. As a result, if you purchased your notes on the original issue date at the face amount and held them to the stated maturity date, you would lose 75.000% of your investment (if you purchased your notes at a premium to face amount you would lose a correspondingly higher percentage of your investment).

The following examples illustrate the hypothetical cash settlement amount at maturity for each note based on hypothetical final levels of the basket underliers, calculated based on the key terms and assumptions above. The percentages in Column A represent hypothetical final levels for each basket underlier, in each case expressed as a percentage of its initial level. The amounts in Column B represent the applicable initial weighted value for each basket underlier, and the amounts in Column C represent the products of the percentages in Column A times the corresponding amounts in Column B. The final basket level for each example is shown beneath each example, and will equal the sum of the products shown in Column C. The basket return for each example is shown beneath the final basket level for such example, and will equal the quotient of (i) the final basket level for such example minus the initial basket level divided by (ii) the initial basket level, expressed as a percentage. The values below have been rounded for ease of analysis.

Example 1: The final basket level is greater than the initial basket level.

| | | |

| Column A | Column B | Column C |

Basket Underlier | Hypothetical Final Level (as Percentage of Initial Level) | Initial Weighted Value | Column A x Column B |

the common stock of NVIDIA Corporation | 150% | 20 | 30.00 |

the Class A common stock of Palantir Technologies Inc. | 150% | 20 | 30.00 |

the common stock of Broadcom Inc. | 150% | 20 | 30.00 |

the common stock of Micron Technology, Inc. | 150% | 20 | 30.00 |

Energy Select Sector SPDR® Fund | 150% | 20 | 30.00 |

| | Final Basket Level: | 150.00 |

| | Basket Return: | 50.00% |

In this example, all of the hypothetical final levels for the basket underliers are greater than the applicable initial levels, which results in the hypothetical final basket level being greater than the initial basket level of 100. Since the hypothetical final basket level was determined to be 150.00, the hypothetical cash settlement amount for each $1,000 face amount of your notes will equal:

Cash settlement amount = $1,000 + ($1,000 × 100% × 50.00%) = $1,500

Example 2: The final basket level is less than the initial basket level, but greater than the trigger buffer level. The cash settlement amount equals the $1,000 face amount.

| | | |

| Column A | Column B | Column C |

Basket Underlier | Hypothetical Final Level (as Percentage of Initial Level) | Initial Weighted Value | Column A x Column B |

the common stock of NVIDIA Corporation | 95% | 20 | 19.00 |

the Class A common stock of Palantir Technologies Inc. | 95% | 20 | 19.00 |

the common stock of Broadcom Inc. | 95% | 20 | 19.00 |

the common stock of Micron Technology, Inc. | 95% | 20 | 19.00 |

Energy Select Sector SPDR® Fund | 95% | 20 | 19.00 |

| | Final Basket Level: | 95.00 |

| | Basket Return: | -5.00% |

In this example, all of the hypothetical final levels for the basket underliers are less than the applicable initial levels, which results in the hypothetical final basket level being less than the initial basket level of 100. Since the hypothetical final basket level of 95 is greater than the trigger buffer level of 50% of the initial basket level but less than the initial basket level of 100, the hypothetical cash settlement amount for each $1,000 face amount of your notes will equal the face amount of the note, or $1,000.

Example 3: The final basket level is less than the trigger buffer level. The cash settlement amount is less than the $1,000 face amount.

| | | |

| Column A | Column B | Column C |

Basket Underlier | Hypothetical Final Level (as Percentage of Initial Level) | Initial Weighted Value | Column A x Column B |

the common stock of NVIDIA Corporation | 10% | 20 | 2.00 |

the Class A common stock of Palantir Technologies Inc. | 10% | 20 | 2.00 |

the common stock of Broadcom Inc. | 10% | 20 | 2.00 |

the common stock of Micron Technology, Inc. | 100% | 20 | 20.00 |

Energy Select Sector SPDR® Fund | 110% | 20 | 22.00 |

| | Final Basket Level: | 48.00 |

| | Basket Return: | -52.00% |

In this example, the hypothetical final levels of the common stock of NVIDIA Corporation, the Class A common stock of Palantir Technologies Inc. and the common stock of Broadcom Inc. are less than their initial levels, while the hypothetical final level of the common stock of Micron Technology, Inc. is equal to its initial level and the hypothetical final level of the Energy Select Sector SPDR® Fund is greater than its initial level.

In this example, the large decline in the common stock of NVIDIA Corporation, the Class A common stock of Palantir Technologies Inc. and the common stock of Broadcom Inc. results in the hypothetical final basket level being less than the trigger buffer level of 50% of the initial basket level even though the common stock of Micron Technology, Inc. remained flat and the Energy Select Sector SPDR® Fund increased.

Since the hypothetical final basket level of 48.00 is less than the trigger buffer level of 50% of the initial basket level, the hypothetical cash settlement amount for each $1,000 face amount of your notes will equal:

Cash settlement amount = $1,000 + ($1,000 × -52.00%) = $480

Example 4: The final basket level is less than the trigger buffer level. The cash settlement amount is less than the $1,000 face amount.

| | | |

| Column A | Column B | Column C |

Basket Underlier | Hypothetical Final Level (as Percentage of Initial Level) | Initial Weighted Value | Column A x Column B |

the common stock of NVIDIA Corporation | 40% | 20 | 8.00 |

the Class A common stock of Palantir Technologies Inc. | 40% | 20 | 8.00 |

the common stock of Broadcom Inc. | 40% | 20 | 8.00 |

the common stock of Micron Technology, Inc. | 40% | 20 | 8.00 |

Energy Select Sector SPDR® Fund | 40% | 20 | 8.00 |

| | Final Basket Level: | 40.00 |

| | Basket Return: | -60.00% |

In this example, the hypothetical final levels for all of the basket underliers are less than the applicable initial levels, which results in the hypothetical final basket level being less than the initial basket level of 100. Since the hypothetical final basket level of 40.00 is less than the trigger buffer level of 50% of the initial basket level, the hypothetical cash settlement amount for each $1,000 face amount of your notes will equal:

Cash settlement amount = $1,000 + ($1,000 × -60%)) = $400.00

The amounts shown above are entirely hypothetical; they are based on market prices for the basket underlier stocks that may not be achieved on a call observation date or the determination date, as the case may be, and on assumptions that may prove to be erroneous. The actual market value of your notes on the stated maturity date or at any other time, including any time you may wish to sell your notes, may bear little relation to the hypothetical amounts shown above, and these amounts should not be viewed as an indication of the financial return on an investment in the offered notes. The hypothetical amounts on notes held to the stated maturity date in the

examples above assume you purchased your notes at their face amount and have not been adjusted to reflect the actual issue price you pay for your notes. The return on your investment (whether positive or negative) in your notes will be affected by the amount you pay for your notes. If you purchase your notes for a price other than the face amount, the return on your investment will differ from, and may be significantly lower than, the hypothetical returns suggested by the above examples. Please read “Additional Risk Factors Specific to Your Notes — The Market Value of Your Notes May Be Influenced by Many Unpredictable Factors” on page PS-23.

Payments on the notes are economically equivalent to the amounts that would be paid on a combination of other instruments. For example, payments on the notes are economically equivalent to a combination of an interest-bearing bond bought by the holder and one or more options entered into between the holder and us (with one or more implicit option premiums paid over time). The discussion in this paragraph does not modify or affect the terms of the notes or the U.S. federal income tax treatment of the notes, as described elsewhere in this pricing supplement.

We cannot predict the actual closing level of the basket on a call observation date or the determination date or what the market value of your notes will be on any particular trading day, nor can we predict the relationship between the level of each basket underlier and the market value of your notes at any time prior to the stated maturity date. The actual amount that you will receive on a call payment date or at maturity and the rate of return on the offered notes will depend on whether the notes are automatically called and the actual initial level of each basket underlier, which we will set on the trade date, and the actual basket return determined by the calculation agent as described above. Moreover, the assumptions on which the hypothetical returns are based may turn out to be inaccurate. Consequently, the amount of cash to be paid in respect of your notes, if any, on the call payment date or the stated maturity date may be very different from the hypothetical cash settlement amounts shown in the examples above.

Anti-dilution Adjustment Examples for a Basket Index Stock

The calculation agent will adjust the closing level of a basket index stock on a call observation date or the determination date, as applicable, only if an event described under one of the six subsections beginning with “Stock splits” under “Terms and Conditions — Anti-dilution adjustments for a basket index stock” occurs and only if the relevant event occurs during the period described under the applicable subsection. The adjustments described under “Terms and Conditions — Anti-dilution adjustments for a basket index stock” do not cover all events that could affect the closing level of a basket index stock on a call observation date or the determination date, as applicable, such as an issuer tender or exchange offer for such basket index stock at a premium to its market price or a tender or exchange offer made by a third party for less than all outstanding shares of such basket index stock. We describe the risks relating to dilution under “Additional Risk Factors Specific to the Notes — You Have Limited Anti-dilution Protection” on page S-9 of the accompanying general terms supplement no. 8,999.

How Adjustments Will Be Made

In this pricing supplement, we refer to anti-dilution adjustment of the closing level of a basket index stock on a call observation date or the determination date, as applicable. With respect to a basket index stock, if an event requiring anti-dilution adjustment occurs, the calculation agent will make the adjustment by taking the following steps:

Step One. The calculation agent will adjust the reference amount. This term refers to the amount of the basket index stock or other property that must be used to determine the closing level of the basket index stock on the call observation date or the determination date, as applicable. For example, if no adjustment described under “Terms and Conditions — Anti-dilution adjustments for a basket index stock” is required at a time, the reference amount for that time will be one share of the basket index stock. In that case, the closing level of the basket index stock on a call observation date or the determination date, as applicable, will be the closing level of one share of the basket index stock on the applicable call observation date or the determination date. We describe how the closing level will be determined under “Terms and Conditions — Closing level” above.

If an adjustment described under “Terms and Conditions — Anti-dilution adjustments for a basket index stock” is required because one of the dilution events described in the first five subsections beginning with “Stock splits” under “Terms and Conditions — Anti-dilution adjustments for a basket index stock” — these involve stock splits, reverse stock splits, stock dividends, other dividends and distributions and issuances of transferable rights and warrants — occurs, then the adjusted reference amount at that time might instead be, for example, two shares of the basket index stock or a half share of the basket index stock, depending on the event. In that example, the closing level of the basket index stock on a call observation date or the determination date, as applicable, would be the price (determined as specified under “Terms and Conditions — Closing level” above) at the close of trading on the applicable call observation date or the determination date of two shares of the basket index stock or a half share of the basket index stock, as applicable.

If an adjustment described under “Terms and Conditions — Anti-dilution adjustments for a basket index stock” is required at a time because one of the reorganization events described under “Terms and Conditions — Reorganization events” — these involve events in which cash, securities or other property is distributed in respect of the basket index stock — occurs, then the reference amount at that time will be adjusted to be as follows, assuming there has been no prior or subsequent anti-dilution adjustment: the amount of each type of the property distributed in the reorganization event in respect of one share of the basket index stock, plus one share of the basket index stock if the basket index stock remains outstanding. In that event, the closing level of the basket index stock on a call observation date or the determination date, as applicable, would be the value of the adjusted reference amount at the close of trading on such call observation date or the determination date.

The manner in which the calculation agent adjusts the reference amount in step one will depend on the type of dilution event requiring adjustment. These events and the nature of the required adjustments are described in the six subsections beginning with “Stock splits” under “Terms and Conditions — Anti-dilution adjustments for a basket index stock”.

Step Two. Having adjusted the reference amount in step one, the calculation agent will determine the closing level of the basket index stock on a call observation date or the determination date, as applicable, in the following manner.

If the adjusted reference amount at the applicable time consists entirely of shares of the basket index stock, the basket index stock level will be the closing level (determined as described under “Terms and Conditions — Closing level” above) of the adjusted reference amount on the applicable date.

On the other hand, if the adjusted reference amount at the applicable time includes any property other than shares of the basket index stock, the closing level of the basket index stock on a call observation date or the determination date, as applicable, will be the value of the adjusted reference amount as determined by the calculation agent in the manner described under “— Adjustments for Reorganization Events” below at the applicable time.

Step Three. Having determined the closing level of the basket index stock on a call observation date or the determination date, as applicable, in step two, the calculation agent will use such level to determine the occurrence of a redemption event or to calculate the cash settlement amount.

If more than one event requiring adjustment as described under “Terms and Conditions — Anti-dilution adjustments for a basket index stock” occurs, the calculation agent will first adjust the reference amount as described in step one above for each event, sequentially, in the order in which the events occur, and on a cumulative basis. Thus, having adjusted the reference amount for the first event, the calculation agent will repeat step one for the second event, applying the required adjustment to the reference amount as already adjusted for the first event, and so on for each event. Having adjusted the reference amount for all events, the calculation agent will then take the remaining applicable steps in the process described above, determining the closing level of the basket index stock on a call observation date or the determination date, as applicable, using the reference amount as sequentially and cumulatively adjusted for all the relevant events. The calculation agent will make all required determinations and adjustments no later than the applicable call observation date or the determination date, as applicable.

The calculation agent will adjust the reference amount for each reorganization event described under “Terms and Conditions — Reorganization events” above. For any other dilution event described above, however, the calculation agent will not be required to adjust the reference amount unless the adjustment would result in a change of at least 0.1% in the basket index stock level that would apply without the adjustment. The closing level of the basket index stock on a call observation date or the determination date, as applicable, resulting from any adjustment will be rounded up or down, as appropriate, to the nearest ten-thousandth, with five hundred-thousandths being rounded upward — e.g., 0.12344 will be rounded down to 0.1234 and 0.12345 will be rounded up to 0.1235.

If an event requiring anti-dilution adjustment occurs, the calculation agent will make the adjustment with a view to offsetting, to the extent practical, any change in the economic position of the holder, GS Finance Corp., as issuer, and The Goldman Sachs Group, Inc., as guarantor, relative to your notes, that results solely from that event. The calculation agent may, in its sole discretion, modify the anti-dilution adjustments as necessary to ensure an equitable result.

The calculation agent will make all determinations with respect to anti-dilution adjustments, including any determination as to whether an event requiring adjustment has occurred, as to the nature of the adjustment required and how it will be made or as to the value of any property distributed in a reorganization event, and will do so in its sole discretion. In the absence of manifest error, those determinations will be conclusive for all purposes and will be binding on you and us, without any liability on the part of the calculation agent. The calculation agent will provide information about the adjustments it makes upon written request by the holder.

In this pricing supplement, when we say that the calculation agent will adjust the reference amount for one or more dilution events, we mean that the calculation agent will take all the applicable steps described above with respect to those events.

The six subsections beginning with “Stock splits” under “Terms and Conditions — Anti-dilution adjustments for a basket index stock” describe the dilution events for which the reference amount is to be adjusted. Each subsection describes the manner in which the calculation agent will adjust the reference amount — the first step in the adjustment process described above — for the relevant event.

Adjustments for Reorganization Events

If a reorganization event occurs, then the calculation agent will adjust the reference amount so that it consists of the amount of each type of distribution property described under “Terms and Conditions — Anti-dilution

adjustments for a basket index stock — Reorganization events” above distributed in respect of one share of a basket index stock — or in respect of whatever the prior reference amount may be — in the reorganization event, taken together. For purposes of the three-step adjustment process described under “— How Adjustments Will Be Made” above, the distribution property so distributed will be the adjusted reference amount described in step one, the value of that property at the close of trading hours for a basket index stock on the applicable date will be the basket index stock level described in step two, and the calculation agent will determine the occurrence of a redemption event or will calculate the cash settlement amount as described in step three. As described under “— How Adjustments Will Be Made” above, the calculation agent may, in its sole discretion, modify the adjustments described in this paragraph as necessary to ensure an equitable result.