Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-253421

| GS Finance Corp. $1,100,000 Basket Commodity-Linked Notes due 2025 guaranteed by The Goldman Sachs Group, Inc. |

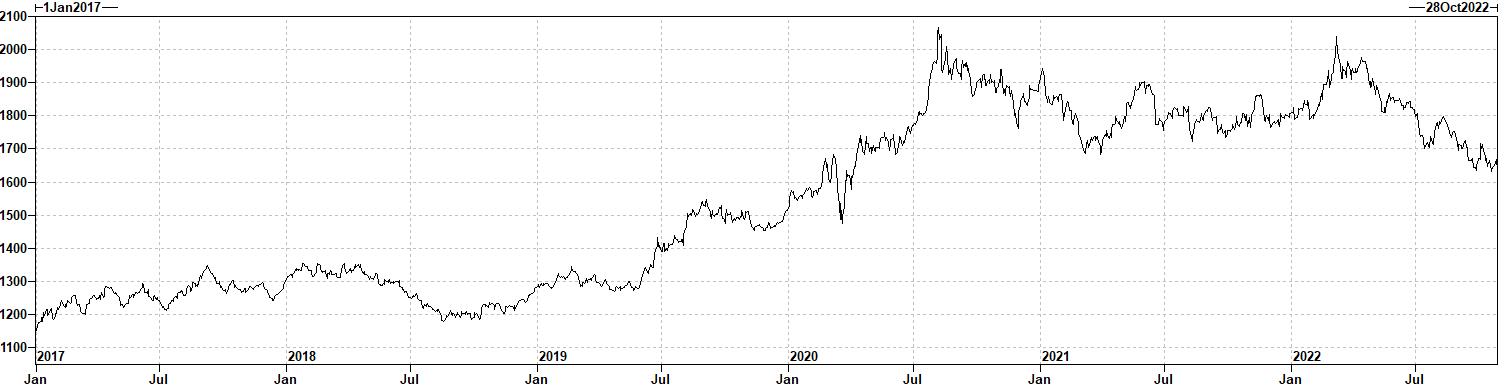

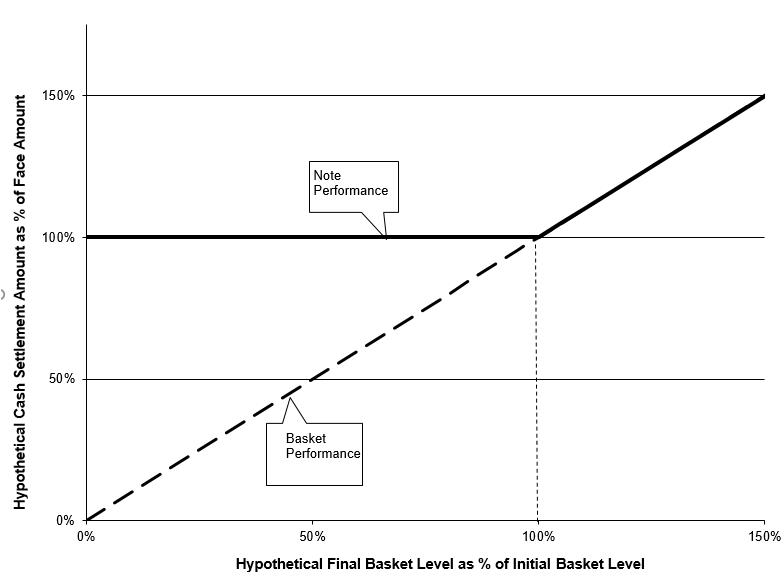

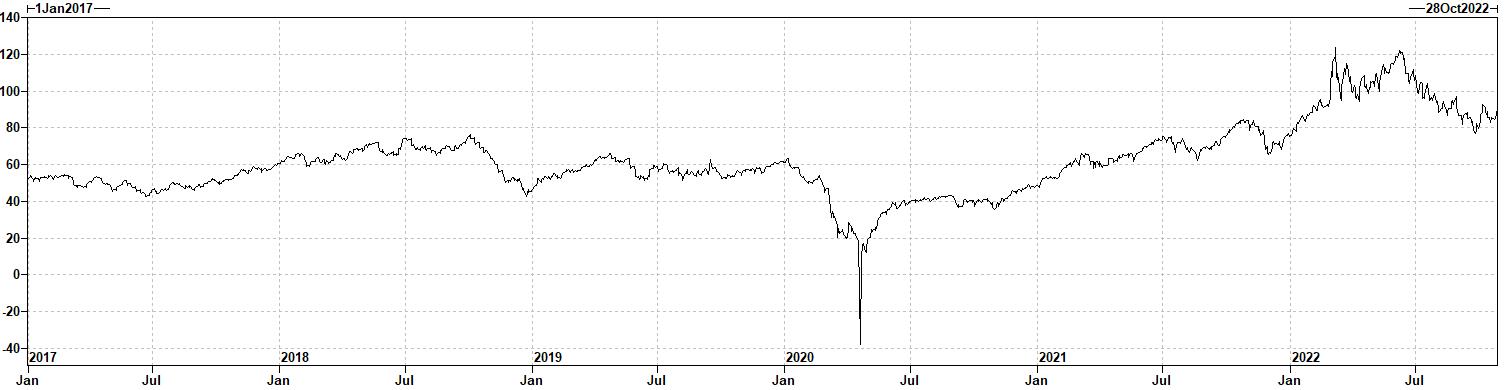

The notes do not bear interest. The amount that you will be paid on your notes on the stated maturity date (May 1, 2025) is based on the performance of an unequally weighted basket comprised of (i) the settlement price of the first or second nearby West Texas Intermediate (WTI) light sweet crude oil futures contract (25% weighting), (ii) the settlement price of the first or second nearby ICE Brent Crude futures contract (25% weighting), (iii) the London Metal Exchange (LME) official price, in U.S. dollars, per metric tonne of Grade A Copper (12.5% weighting), (iv) the LME official price, in U.S. dollars, per metric tonne of Special High Grade Zinc (12.5% weighting), (v) the LME official price, in U.S. dollars, per metric tonne of High-Grade Primary Aluminum (12.5% weighting) and (vi) the official U.S. dollar LBMA Gold Price PM (expressed in U.S. dollars per troy ounce) (12.5% weighting), each of which we refer to as a “basket commodity”, as measured from the trade date (October 28, 2022) to and including the determination date (April 28, 2025). The initial basket level is 100 and the final basket level will equal the sum of the products, as calculated for each basket commodity, of: (i) its final basket commodity price divided by (ii) its initial basket commodity price multiplied by (iii) the applicable initial weighted value for each basket commodity.

If the final basket level on the determination date is greater than the initial basket level, then the return on the notes will be positive and equal the basket return (the percentage increase or decrease in the final basket level from the initial basket level).

If the final basket level is equal to or less than the initial basket level, you will receive the face amount of your notes at maturity.

At maturity, for each $1,000 face amount of your notes you will receive an amount in cash equal to:

●if the final basket level is greater than the initial basket level, the sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) the basket return; or |

●if the final basket level is equal to or less than the initial basket level, $1,000. |

Declines in one basket commodity may offset increases in the other basket indices. Due to the unequal weighting of each basket commodity, the performances of the basket commodities with greater weights will have a significantly larger impact on the return on your notes than the performances of the basket commodities with lesser weights.

You should read the disclosure herein to better understand the terms and risks of your investment, including the credit risk of GS Finance Corp. and The Goldman Sachs Group, Inc. See page PS-10.

The estimated value of your notes at the time the terms of your notes are set on the trade date is equal to approximately $972.75 per $1,000 face amount. For a discussion of the estimated value and the price at which Goldman Sachs & Co. LLC would initially buy or sell your notes, if it makes a market in the notes, see the following page.

Original issue date: | November 2, 2022 | Original issue price: | 100% of the face amount |

Underwriting discount: | 0.75% of the face amount* | Net proceeds to the issuer: | 99.25% of the face amount |

*See “Supplemental Plan of Distribution; Conflicts of Interest” on page PS-5 for additional information regarding the fees comprising the underwriting discount.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense. The notes are not bank deposits and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency, nor are they obligations of, or guaranteed by, a bank.

Goldman Sachs & Co. LLC

Pricing Supplement No. 8,088 dated October 28, 2022.

The issue price, underwriting discount and net proceeds listed above relate to the notes we sell initially. We may decide to sell additional notes after the date of this pricing supplement, at issue prices and with underwriting discounts and net proceeds that differ from the amounts set forth above. The return (whether positive or negative) on your investment in notes will depend in part on the issue price you pay for such notes.

GS Finance Corp. may use this prospectus in the initial sale of the notes. In addition, Goldman Sachs & Co. LLC or any other affiliate of GS Finance Corp. may use this prospectus in a market-making transaction in a note after its initial sale. Unless GS Finance Corp. or its agent informs the purchaser otherwise in the confirmation of sale, this prospectus is being used in a market-making transaction.

Estimated Value of Your Notes The estimated value of your notes at the time the terms of your notes are set on the trade date (as determined by reference to pricing models used by Goldman Sachs & Co. LLC (GS&Co.) and taking into account our credit spreads) is equal to approximately $972.75 per $1,000 face amount, which is less than the original issue price. The value of your notes at any time will reflect many factors and cannot be predicted; however, the price (not including GS&Co.’s customary bid and ask spreads) at which GS&Co. would initially buy or sell notes (if it makes a market, which it is not obligated to do) and the value that GS&Co. will initially use for account statements and otherwise is equal to approximately the estimated value of your notes at the time of pricing, plus an additional amount (initially equal to $27.25 per $1,000 face amount). Prior to February 10, 2023, the price (not including GS&Co.’s customary bid and ask spreads) at which GS&Co. would buy or sell your notes (if it makes a market, which it is not obligated to do) will equal approximately the sum of (a) the then-current estimated value of your notes (as determined by reference to GS&Co.’s pricing models) plus (b) any remaining additional amount (the additional amount will decline to zero on a straight-line basis from the time of pricing through February 9, 2023). On and after February 10, 2023, the price (not including GS&Co.’s customary bid and ask spreads) at which GS&Co. would buy or sell your notes (if it makes a market) will equal approximately the then-current estimated value of your notes determined by reference to such pricing models. |

About Your Prospectus The notes are part of the Medium-Term Notes, Series F program of GS Finance Corp. and are fully and unconditionally guaranteed by The Goldman Sachs Group, Inc. This prospectus includes this pricing supplement and the accompanying documents listed below. This pricing supplement constitutes a supplement to the documents listed below and should be read in conjunction with such documents: •Commodity terms supplement no. 2,014 dated March 22, 2021 •Prospectus supplement dated March 22, 2021 •Prospectus dated March 22, 2021 The information in this pricing supplement supersedes any conflicting information in the documents listed above. In addition, some of the terms or features described in the listed documents may not apply to your notes. Please note that, for purposes of this pricing supplement, references in the commodity terms supplement no. 2,014 to “underlier(s)”, “underlier commodity” and “closing level” shall be deemed to refer to “basket commodity(s)”, “underlying commodity” and “closing price”, respectively. |

PS-2

SUMMARY INFORMATION

We refer to the notes we are offering by this pricing supplement as the “offered notes” or the “notes”. Each of the offered notes has the terms described below. Please note that in this pricing supplement, references to “GS Finance Corp.”, “we”, “our” and “us” mean only GS Finance Corp. and do not include its subsidiaries or affiliates, references to “The Goldman Sachs Group, Inc.”, our parent company, mean only The Goldman Sachs Group, Inc. and do not include its subsidiaries or affiliates and references to “Goldman Sachs” mean The Goldman Sachs Group, Inc. together with its consolidated subsidiaries and affiliates, including us. Also, references to the “accompanying prospectus” mean the accompanying prospectus, dated March 22, 2021, references to the “accompanying prospectus supplement” mean the accompanying prospectus supplement, dated March 22, 2021, for Medium-Term Notes, Series F, and references to the “accompanying commodity terms supplement no. 2,014” mean the accompanying commodity terms supplement no. 2,014, dated March 22, 2021, in each case of GS Finance Corp. and The Goldman Sachs Group, Inc. The notes will be issued under the senior debt indenture, dated as of October 10, 2008, as supplemented by the First Supplemental Indenture, dated as of February 20, 2015, each among us, as issuer, The Goldman Sachs Group, Inc., as guarantor, and The Bank of New York Mellon, as trustee. This indenture, as so supplemented and as further supplemented thereafter, is referred to as the “GSFC 2008 indenture” in the accompanying prospectus supplement.

Key Terms

Issuer: GS Finance Corp.

Guarantor: The Goldman Sachs Group, Inc.

Basket: an unequally weighted basket comprised of six basket commodities

Basket commodities (each individually, a basket commodity): the 6 basket commodities listed below; for each basket commodity, its current Bloomberg symbol, initial weight in the basket, initial weighted value and initial basket commodity price are set forth below:

Basket Commodity | Bloomberg Symbol | Initial Weight in the Basket | Initial Weighted Value | Initial Basket Commodity Price |

the relevant nearby West Texas Intermediate (WTI) light sweet crude oil futures contract as traded on the New York Mercantile Exchange (NYMEX) (WTI crude oil futures contract)* | CL1 <Cmdty>** | 25% | 25 | $87.90 |

the relevant nearby relevant ICE Brent Crude futures contract as traded on ICE Futures Europe (Brent Crude futures contract)* | CO1 <Cmdty>** | 25% | 25 | $95.77 |

the London Metal Exchange (“LME”) official price, in U.S. dollars, per metric tonne for Grade A Copper, as determined by the LME (copper price) | LOCADY <Cmdty> | 12.5% | 12.5 | $7,663.50 |

the LME official price, in U.S. dollars, per metric tonne for Special High Grade Zinc as determined by the LME (zinc price) | LOZSDY <Cmdty> | 12.5% | 12.5 | $2,914.00 |

the LME official price, in U.S. dollars, per metric tonne for High-Grade Primary Aluminum as determined by the LME (aluminum price) | LOAHDY <Cmdty> | 12.5% | 12.5 | $2,226.00 |

the official U.S. dollar LBMA Gold Price PM (expressed in U.S. dollars per troy ounce) calculated and administered by ICE Benchmark Administration (“IBA”) and published by the London Bullion Market Association (“LBMA”) (gold price) | GOLDLNPM <Cmdty> | 12.5% | 12.5 | $1,648.05 |

* The basket commodity closing price for such basket commodity will be the closing price of the first nearby futures contract of such basket commodity, subject to adjustment as described under “—Basket commodity closing price” below.

** Bloomberg ticker symbols are being provided for reference purposes only.

Specified currency: U.S. dollars (“$”)

PS-3

Face amount: each note will have a face amount of $1,000; $1,100,000 in the aggregate for all the offered notes; the aggregate face amount of the offered notes may be increased if the issuer, at its sole option, decides to sell an additional amount of the offered notes on a date subsequent to the date of this pricing supplement

Denominations: $1,000 and integral multiples of $1,000 in excess thereof

Cash settlement amount: on the stated maturity date, for each $1,000 face amount of your notes you will receive an amount in cash equal to:

•if the final basket level is greater than the initial basket level, the sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) the upside participation rate times (c) the basket return; or |

•if the final basket level is equal to or less than the initial basket level, $1,000. |

Purchase at amount other than face amount: the amount we will pay you at the stated maturity date for your notes will not be adjusted based on the issue price you pay for your notes, so if you acquire notes at a premium (or discount) to face amount and hold them to the stated maturity date, it could affect your investment in a number of ways. The return on your investment in such notes will be lower (or higher) than it would have been had you purchased the notes at face amount. See “Additional Risk Factors Specific to Your Notes — If You Purchase Your Notes at a Premium to Face Amount, the Return on Your Investment Will Be Lower Than the Return on Notes Purchased at Face Amount and the Impact of Certain Key Terms of the Notes Will be Negatively Affected”

Trade date: October 28, 2022

Original issue date (settlement date): November 2, 2022

Initial basket level: 100

Final basket level: the basket closing level on the determination date

Basket closing level: on any day, the sum of, for each of the basket commodities: the product of (i) the quotient of (a) the closing price of such basket commodity on such day divided by (b) the initial basket commodity price of such basket commodity times (ii) the initial weighted value of such basket commodity

Basket return: the quotient of (i) the final basket level minus the initial underlying basket level divided by (ii) the initial basket level, expressed as a percentage

Basket commodity closing price: In the case of each basket commodity, the closing price of such basket commodity; provided that, with respect to the WTI crude oil futures contract or the Brent Crude futures contract (each, a “basket commodity futures contract”), its basket commodity closing price will be the closing price of the first nearby futures contract of such basket commodity futures contract on the determination date as determined by the calculation agent unless the determination date falls on or after the last trading day during which trading may take place for the first nearby futures contract of such basket commodity futures contract, as determined by the calculation agent, in which case its basket commodity closing price will be the closing price of the second nearby futures contract of such basket commodity futures contract on such date as determined by the calculation agent, subject to the provisions as described under “Supplemental Terms of the Notes — Consequences of a Non-Trading Day or a Market Disruption Event” on page S-23 of the accompanying commodity terms supplement no. 2,014. The second nearby futures contract for a basket commodity futures contract will not be referenced due to any circumstance other than the calculation agent determining that the determination date has fallen on or after the last trading day during which trading may take place for the first nearby futures contract of such basket commodity futures contract.

Upside participation rate: 100%

Stated maturity date: May 1, 2025, subject to adjustment as described under “Supplemental Terms of the Notes — Stated Maturity Date” on page S-20 of the accompanying commodity terms supplement no. 2,014

Determination date: April 28, 2025, subject to adjustment as described under “Supplemental Terms of the Notes — Determination Date” on page S-21 of the accompanying commodity terms supplement no. 2,014

No interest: the notes do not bear interest

No redemption: the notes will not be subject to redemption right or price dependent redemption right

No listing: the notes will not be listed on any securities exchange or interdealer market quotation system

PS-4

Closing price: as described under “Supplemental Terms of the Notes — Special Calculation Provisions — Closing Level” on page S-31 of the accompanying commodity terms supplement no. 2,014

Business day: as described under “Supplemental Terms of the Notes — Special Calculation Provisions — Business Day” on page S-30 of the accompanying commodity terms supplement no. 2,014

Trading day: as described under “Supplemental Terms of the Notes — Special Calculation Provisions — Trading Day” on page S-30 of the accompanying commodity terms supplement no. 2,014

Use of proceeds and hedging: as described under “Use of Proceeds” and “Hedging” on page S-61 of the accompanying commodity terms supplement no. 2,014

ERISA: as described under “Employee Retirement Income Security Act” on page S-63 of the accompanying commodity terms supplement no. 2,014

Supplemental plan of distribution; conflicts of interest: as described under ““Supplemental Plan of Distribution” on page S-63 of the accompanying commodity terms supplement no. 2,014 and “Plan of Distribution — Conflicts of Interest” on page 129 of the accompanying prospectus; GS Finance Corp. estimates that its share of the total offering expenses, excluding underwriting discounts and commissions, will be approximately $20,000.

GS Finance Corp. will sell to GS&Co., and GS&Co. will purchase from GS Finance Corp., the aggregate face amount of the offered notes specified on the front cover of this pricing supplement. GS&Co. proposes initially to offer the notes to the public at the original issue price set forth on the cover page of this pricing supplement, and to certain securities dealers at such price less a concession not in excess of 0.25% of the face amount. In addition to the concession, GS&Co. will pay a fee of 0.5% of the face amount to CAIS Capital LLC in connection with its marketing efforts related to the offered notes. GS&Co. is an affiliate of GS Finance Corp. and The Goldman Sachs Group, Inc. and, as such, will have a “conflict of interest” in this offering of notes within the meaning of Financial Industry Regulatory Authority, Inc. (FINRA) Rule 5121. Consequently, this offering of notes will be conducted in compliance with the provisions of FINRA Rule 5121. GS&Co. will not be permitted to sell notes in this offering to an account over which it exercises discretionary authority without the prior specific written approval of the account holder. We have been advised that GS&Co. will also pay a fee in connection with the distribution of the notes to SIMON Markets LLC, a broker-dealer in which an affiliate of GS Finance Corp. holds an indirect minority equity interest.

We will deliver the notes against payment therefor in New York, New York on November 2, 2022. Under Rule 15c6-1 of the Securities Exchange Act of 1934, trades in the secondary market generally are required to settle in two business days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade notes on any date prior to two business days before delivery will be required to specify alternative settlement arrangements to prevent a failed settlement.

We have been advised by GS&Co. that it intends to make a market in the notes. However, neither GS&Co. nor any of our other affiliates that makes a market is obligated to do so and any of them may stop doing so at any time without notice. No assurance can be given as to the liquidity or trading market for the notes.

Calculation agent: GS&Co.

CUSIP no.: 40057NR41

ISIN no.: US40057NR413

FDIC: the notes are not bank deposits and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency, nor are they obligations of, or guaranteed by, a bank

PS-5

HYPOTHETICAL EXAMPLES

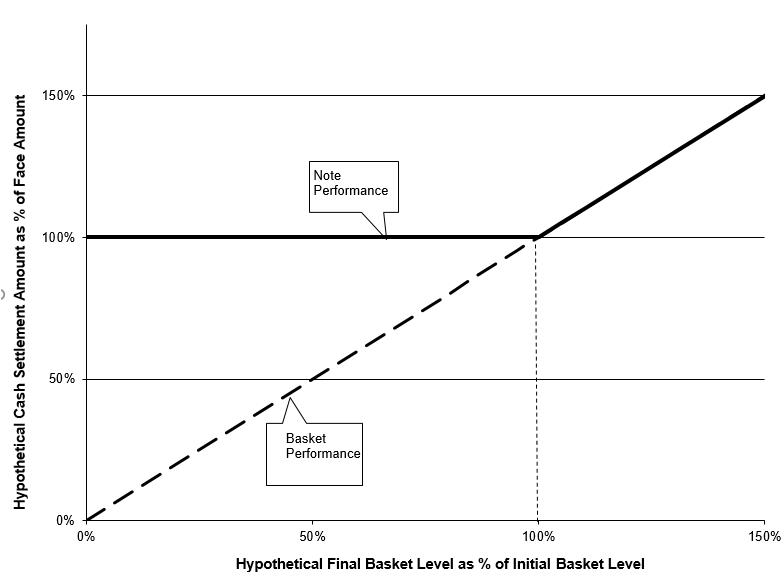

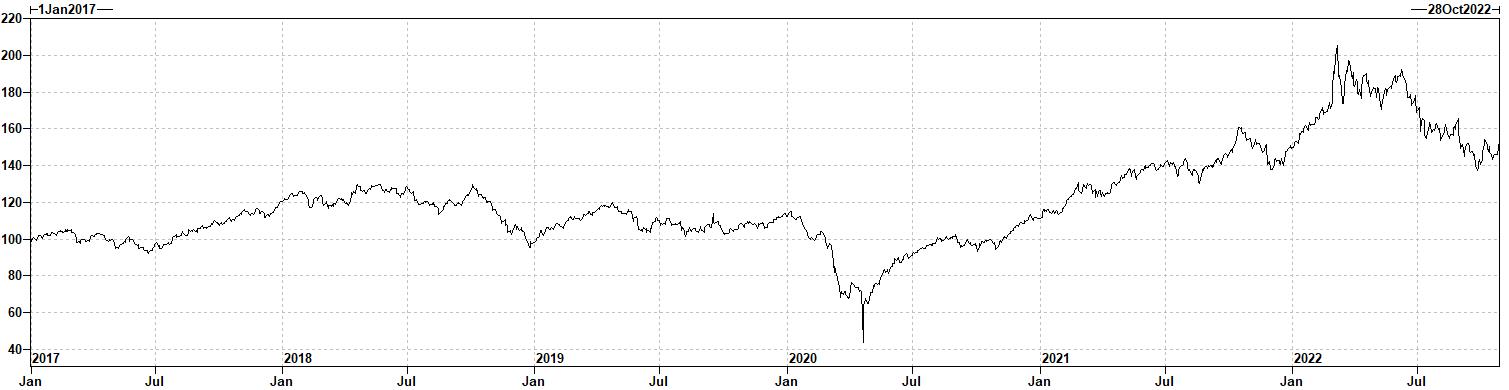

The following examples are provided for purposes of illustration only. They should not be taken as an indication or prediction of future investment results and are intended merely to illustrate the impact that the various hypothetical final basket levels or hypothetical closing prices of the basket commodities, as applicable, on the determination date could have on the cash settlement amount at maturity assuming all other variables remain constant.

The examples below are based on a range of final basket levels and closing prices of the basket commodities that are entirely hypothetical; no one can predict what the level of the basket will be on any day throughout the life of your notes, and no one can predict what the final basket level will be on the determination date. The basket commodities have been highly volatile in the past — meaning that the prices of the basket commodities have changed considerably in relatively short periods — and their performance cannot be predicted for any future period.

The information in the following examples reflects hypothetical rates of return on the offered notes assuming that they are purchased on the original issue date at the face amount and held to the stated maturity date. If you sell your notes in a secondary market prior to the stated maturity date, your return will depend upon the market value of your notes at the time of sale, which may be affected by a number of factors that are not reflected in the examples below, such as interest rates, the volatility of the basket commodities, the creditworthiness of GS Finance Corp., as issuer, and the creditworthiness of The Goldman Sachs Group, Inc., as guarantor. In addition, the estimated value of your notes at the time the terms of your notes are set on the trade date (as determined by reference to pricing models used by GS&Co.) is less than the original issue price of your notes. For more information on the estimated value of your notes, see “Additional Risk Factors Specific to Your Notes — The Estimated Value of Your Notes At the Time the Terms of Your Notes Are Set On the Trade Date (as Determined By Reference to Pricing Models Used By GS&Co.) Is Less Than the Original Issue Price Of Your Notes” on page PS-10 of this pricing supplement. The information in the examples also reflects the key terms and assumptions in the box below.

Key Terms and Assumptions |

Face amount | $1,000 |

Upside participation rate | 100% |

Neither a market disruption event nor a non-trading day occurs with respect to any basket commodity on the originally scheduled determination date Notes purchased on original issue date at the face amount and held to the stated maturity date |

For these reasons, the actual performance of the basket over the life of your notes, as well as the amount payable at maturity may bear little relation to the hypothetical examples shown below or to the historical prices of each basket commodity shown elsewhere in this pricing supplement. For information about the historical prices of the basket commodity during recent periods, see “The Basket and the Basket Commodities — Historical Closing Prices of the Basket Commodities” below. Before investing in the offered notes, you should consult publicly available information to determine the prices of the basket commodities between the date of this pricing supplement and the date of your purchase of the offered notes.

Also, the hypothetical examples shown below do not take into account the effects of applicable taxes. Because of the U.S. tax treatment applicable to your notes, tax liabilities could affect the after-tax rate of return on your notes to a comparatively greater extent than the after-tax return on the basket commodities.

The prices in the left column of the table below represent hypothetical final basket levels and are expressed as percentages of the initial basket level. The amounts in the right column represent the hypothetical cash settlement amounts, based on the corresponding hypothetical final basket level, and are expressed as percentages of the face amount of a note (rounded to the nearest one-thousandth of a percent). Thus, a hypothetical cash settlement amount of 100.000% means that the value of the cash payment that we would deliver for each $1,000 of the outstanding face amount of the offered notes on the stated maturity date would equal 100.000% of the face amount of a note, based on the corresponding hypothetical final basket level and the assumptions noted above.

PS-6

| Hypothetical Final Basket Level (as Percentage of Initial Basket Level) | Hypothetical Cash Settlement Amount (as Percentage of Face Amount) |

| 150.000% | 150.000% |

| 140.000% | 140.000% |

| 130.000% | 130.000% |

| 120.000% | 120.000% |

| 110.000% | 110.000% |

| 105.000% | 105.000% |

| 100.000% | 100.000% |

| 98.000% | 100.000% |

| 95.000% | 100.000% |

| 75.000% | 100.000% |

| 50.000% | 100.000% |

| 25.000% | 100.000% |

| 0.000% | 100.000% |

If, for example, the final basket level were determined to be 25.000% of the initial basket level, the cash settlement amount that we would deliver on your notes at maturity would be 100.000% of the face amount of your notes, as shown in the table above. As a result, if you purchased your notes on the original issue date at the face amount and held them to the stated maturity date, you would receive no return on your investment

The following chart also shows a graphical illustration of the hypothetical cash settlement amounts (expressed as a percentage of the face amount of your notes) that we would pay on your notes on the stated maturity date, if the final basket level were any of the hypothetical levels shown on the horizontal axis. The chart shows that any hypothetical final basket level of less than 100.000% (the section left of the 100.000% marker on the horizontal axis) would result in a hypothetical cash settlement amount of 100.000% of the face amount of your notes.

The following examples illustrate the hypothetical cash settlement amount at maturity for each note based on hypothetical final prices of the basket commodities, calculated based on the key terms and assumptions above. The percentages in Column A represent hypothetical final prices for each basket commodity, in each

PS-7

case expressed as a percentage of its initial price. The amounts in Column B represent the applicable initial weighted value for each basket commodity, and the amounts in Column C represent the products of the percentages in Column A times the corresponding amounts in Column B. The final basket level for each example is shown beneath each example, and equals the sum of the products shown in Column C. The basket return for each example is shown beneath the final basket level for such example, and equals the quotient of (i) the final basket level for such example minus the initial basket level divided by (ii) the initial basket level, expressed as a percentage. The values below have been rounded for ease of analysis.

Example 1: The final basket level is greater than the initial basket level.

| Column A | Column B | Column C |

| | | |

Basket Commodity | Hypothetical Final Price (as Percentage of Initial Price) | Initial Weighted Value | Column A x Column B |

WTI crude oil futures contract | 120.00% | 25.00 | 30.00 |

Brent Crude futures contract | 120.00% | 25.00 | 30.00 |

Copper price | 120.00% | 12.50 | 15.00 |

Zinc price | 120.00% | 12.50 | 15.00 |

Aluminum price | 120.00% | 12.50 | 15.00 |

Gold price | 120.00% | 12.50 | 15.00 |

| | | |

| | Final Basket Level: | 120.00 |

| | Basket Return: | 20.00% |

In this example, all of the hypothetical final prices for the basket commodities are greater than the applicable initial prices, which results in the hypothetical final basket level being greater than the initial basket level of 100.00. Since the hypothetical final basket level was determined to be 120.00, the hypothetical cash settlement amount for each $1,000 face amount of your notes will equal:

Cash settlement amount = $1,000 + ($1,000 × 100.00%× 20.00%) = $1,200.00

Example 2: The final basket level is less than the initial basket level. The cash settlement amount equals the $1,000 face amount.

| Column A | Column B | Column C |

| | | |

Basket Commodity | Hypothetical Final Price (as Percentage of Initial Price) | Initial Weighted Value | Column A x Column B |

WTI crude oil futures contract | 60.00% | 25.00 | 15.00 |

Brent Crude futures contract | 60.00% | 25.00 | 15.00 |

Copper price | 100.00% | 12.50 | 12.50 |

Zinc price | 100.00% | 12.50 | 12.50 |

Aluminum price | 120.00% | 12.50 | 15.00 |

Gold price | 120.00% | 12.50 | 15.00 |

| | | |

| | Final Basket Level: | 85.00 |

| | Basket Return: | -15.00% |

In this example, the hypothetical final prices of the WTI crude oil futures contract and the Brent Crude futures contract are less than their applicable initial prices, while the hypothetical final prices of the copper price and the zinc price are equal to their applicable initial prices and the hypothetical final prices of the aluminum price and the gold price are greater than their applicable initial prices.

Because the basket is unequally weighted, increases in the lower weighted basket commodities will be offset by decreases in the more heavily weighted basket commodities. In this example, the large decline in the WTI crude oil futures contract and the Brent Crude futures contract results in the hypothetical final basket level

PS-8

being less than 100 even though the copper price and the zinc price remained flat and the aluminum price and the gold price increased.

Since the hypothetical final basket level is less than the initial basket level, the hypothetical cash settlement amount for each $1,000 face amount of your notes will equal the face amount of the notes, or $1,000.

The cash settlement amounts shown above are entirely hypothetical; they are based on prices of the basket commodities that may not be achieved on the determination date and on assumptions that may prove to be erroneous. The actual market value of your notes on the stated maturity date or at any other time, including any time you may wish to sell your notes, may bear little relation to the hypothetical cash settlement amounts shown above, and these amounts should not be viewed as an indication of the financial return on an investment in the offered notes. The hypothetical cash settlement amounts on notes held to the stated maturity date in the examples above assume you purchased your notes at their face amount and have not been adjusted to reflect the actual issue price you pay for your notes. The return on your investment (whether positive or negative) in your notes will be affected by the amount you pay for your notes. If you purchase your notes for a price other than the face amount, the return on your investment will differ from, and may be significantly lower than, the hypothetical returns suggested by the above examples. Please read “Additional Risk Factors Specific to Your Notes — The Market Value of Your Notes May Be Influenced by Many Unpredictable Factors” on page PS-11.

Payments on the notes are economically equivalent to the amounts that would be paid on a combination of other instruments. For example, payments on the notes are economically equivalent to a combination of a bond bought by the holder and one or more options entered into between the holder and us. Therefore, the terms of the notes may be impacted by the various factors mentioned on page PS-11 in the section “Additional Risk Factors Specific to Your Notes — The Market Value of Your Notes May Be Influenced by Many Unpredictable Factors”. The discussion in this paragraph does not modify or affect the terms of the notes or the U.S. federal income tax treatment of the notes, as described elsewhere in this pricing supplement.

We cannot predict the actual final basket level or what the market value of your notes will be on any particular trading day, nor can we predict the relationship between the prices of each basket commodity and the market value of your notes at any time prior to the stated maturity date. The actual amount that you will receive at maturity and the rate of return on the offered notes will depend on the actual basket return determined by the calculation agent as described above. Moreover, the assumptions on which the hypothetical returns are based may turn out to be inaccurate. Consequently, the amount of cash to be paid in respect of your notes on the stated maturity date may be very different from the information reflected in the examples above. |

PS-9

ADDITIONAL RISK FACTORS SPECIFIC TO YOUR NOTES

An investment in your notes is subject to the risks described below, as well as the risks and considerations described in the accompanying prospectus, in the accompanying prospectus supplement and under “Additional Risk Factors Specific to the Notes” in the accompanying commodity terms supplement no. 2,014. You should carefully review these risks and considerations as well as the terms of the notes described herein and in the accompanying prospectus, the accompanying prospectus supplement and the accompanying commodity terms supplement no. 2,014. Your notes are a riskier investment than ordinary debt securities. You should carefully consider whether the offered notes are appropriate given your particular circumstances. |

Risks Related to Structure, Valuation and Secondary Market Sales

The Estimated Value of Your Notes At the Time the Terms of Your Notes Are Set On the Trade Date (as Determined By Reference to Pricing Models Used By GS&Co.) Is Less Than the Original Issue Price Of Your Notes

The original issue price for your notes exceeds the estimated value of your notes as of the time the terms of your notes are set on the trade date, as determined by reference to GS&Co.’s pricing models and taking into account our credit spreads. Such estimated value on the trade date is set forth above under “Estimated Value of Your Notes”; after the trade date, the estimated value as determined by reference to these models will be affected by changes in market conditions, the creditworthiness of GS Finance Corp., as issuer, the creditworthiness of The Goldman Sachs Group, Inc., as guarantor, and other relevant factors. The price at which GS&Co. would initially buy or sell your notes (if GS&Co. makes a market, which it is not obligated to do), and the value that GS&Co. will initially use for account statements and otherwise, also exceeds the estimated value of your notes as determined by reference to these models. As agreed by GS&Co. and the distribution participants, this excess (i.e., the additional amount described under “Estimated Value of Your Notes”) will decline to zero on a straight line basis over the period from the date hereof through the applicable date set forth above under “Estimated Value of Your Notes”. Thereafter, if GS&Co. buys or sells your notes it will do so at prices that reflect the estimated value determined by reference to such pricing models at that time. The price at which GS&Co. will buy or sell your notes at any time also will reflect its then current bid and ask spread for similar sized trades of structured notes.

In estimating the value of your notes as of the time the terms of your notes are set on the trade date, as disclosed above under “Estimated Value of Your Notes”, GS&Co.’s pricing models consider certain variables, including principally our credit spreads, interest rates (forecasted, current and historical rates), volatility, price-sensitivity analysis and the time to maturity of the notes. These pricing models are proprietary and rely in part on certain assumptions about future events, which may prove to be incorrect. As a result, the actual value you would receive if you sold your notes in the secondary market, if any, to others may differ, perhaps materially, from the estimated value of your notes determined by reference to our models due to, among other things, any differences in pricing models or assumptions used by others. See “— The Market Value of Your Notes May Be Influenced by Many Unpredictable Factors” below.

The difference between the estimated value of your notes as of the time the terms of your notes are set on the trade date and the original issue price is a result of certain factors, including principally the underwriting discount and commissions, the expenses incurred in creating, documenting and marketing the notes, and an estimate of the difference between the amounts we pay to GS&Co. and the amounts GS&Co. pays to us in connection with your notes. We pay to GS&Co. amounts based on what we would pay to holders of a non-structured note with a similar maturity. In return for such payment, GS&Co. pays to us the amounts we owe under your notes.

In addition to the factors discussed above, the value and quoted price of your notes at any time will reflect many factors and cannot be predicted. If GS&Co. makes a market in the notes, the price quoted by GS&Co. would reflect any changes in market conditions and other relevant factors, including any deterioration in our creditworthiness or perceived creditworthiness or the creditworthiness or perceived creditworthiness of The Goldman Sachs Group, Inc. These changes may adversely affect the value of your notes, including the price you may receive for your notes in any market making transaction. To the extent that GS&Co. makes a market in the notes, the quoted price will reflect the estimated value determined by reference to GS&Co.’s pricing models at that time, plus or minus its then current bid and ask spread for similar sized trades of structured notes (and subject to the declining excess amount described above).

PS-10

Furthermore, if you sell your notes, you will likely be charged a commission for secondary market transactions, or the price will likely reflect a dealer discount. This commission or discount will further reduce the proceeds you would receive for your notes in a secondary market sale.

There is no assurance that GS&Co. or any other party will be willing to purchase your notes at any price and, in this regard, GS&Co. is not obligated to make a market in the notes. See “Additional Risk Factors Specific to the Notes — Your Notes May Not Have an Active Trading Market” on page S-7 of the accompanying commodity terms supplement no. 2,014.

The Notes Are Subject to the Credit Risk of the Issuer and the Guarantor

Although the return on the notes will be based on the performance of the basket commodities, the payment of any amount due on the notes is subject to the credit risk of GS Finance Corp., as issuer of the notes, and the credit risk of The Goldman Sachs Group, Inc., as guarantor of the notes. The notes are our unsecured obligations. Investors are dependent on our ability to pay all amounts due on the notes, and therefore investors are subject to our credit risk and to changes in the market’s view of our creditworthiness. Similarly, investors are dependent on the ability of The Goldman Sachs Group, Inc., as guarantor of the notes, to pay all amounts due on the notes, and therefore are also subject to its credit risk and to changes in the market’s view of its creditworthiness. See “Description of the Notes We May Offer — Information About Our Medium-Term Notes, Series F Program — How the Notes Rank Against Other Debt” on page S-5 of the accompanying prospectus supplement and “Description of Debt Securities We May Offer— Guarantee by The Goldman Sachs Group, Inc.” on page 67 of the accompanying prospectus.

The Cash Settlement Amount on Your Notes Is Not Linked to the Closing Prices of the Basket Commodities at Any Time Other than the Determination Date

The final basket level will be based on the closing prices of the basket commodities on the determination date (subject to adjustment as described elsewhere in this pricing supplement). Therefore, if the closing prices of the basket commodities dropped precipitously on the determination date, the cash settlement amount for your notes may be significantly less than it would have been had the cash settlement amount been linked to the closing prices of the basket commodities prior to such drop in the prices of the basket commodities. Although the actual prices of the basket commodities on the stated maturity date or at other times during the life of your notes may be higher than the closing prices of the basket commodities on the determination date, you will not benefit from the closing prices of the basket commodities at any time other than on the determination date.

Your Notes Do Not Bear Interest

You will not receive any interest payments on your notes. As a result, even if the cash settlement amount payable for each of your notes on the stated maturity date exceeds the face amount of your notes, the overall return you earn on your notes may be less than you would have earned by investing in a non-indexed debt security of comparable maturity that bears interest at a prevailing market rate.

The Lower Performance of One Basket Commodity May Offset an Increase in the Other Basket Commodities

Declines in the price of one basket commodity may offset increases in the prices of the other basket commodities. As a result, any return on the basket— and thus on your notes — may be reduced or eliminated, which will have the effect of reducing the amount payable in respect of your notes at maturity. In addition, because the basket commodities are not equally weighted, increases in the lower weighted basket commodities may be offset by even small decreases in the more heavily weighted basket commodities.

The Market Value of Your Notes May Be Influenced by Many Unpredictable Factors

When we refer to the market value of your notes, we mean the value that you could receive for your notes if you chose and are able to sell them in the open market before the stated maturity date. A number of factors, many of which are beyond our control and impact the value of bonds and options generally, will influence the market value of your notes, including:

● | the prices of the basket commodities; |

● | the volatility — i.e., the frequency and magnitude of changes — in the prices of the basket commodities; |

● | economic, financial, regulatory, political, military, public health and other events that affect the commodity markets generally and the market segments of which the basket commodities are a part, and which may affect the closing prices of the basket commodities; |

● | interest rates and yield rates in the market; |

PS-11

● | the time remaining until your notes mature; and |

● | our creditworthiness and the creditworthiness of The Goldman Sachs Group, Inc., whether actual or perceived, including actual or anticipated upgrades or downgrades in our credit ratings or the credit ratings of The Goldman Sachs Group, Inc. or changes in other credit measures. |

Without limiting the foregoing, the market value of your notes may be negatively impacted by increasing interest rates. Such adverse impact of increasing interest rates could be significantly enhanced in notes with longer-dated maturities, the market values of which are generally more sensitive to increasing interest rates.

These factors will influence the price you will receive if you sell your notes before maturity, including the price you may receive for your notes in any market-making transaction. If you sell your notes before maturity, you may receive less than the face amount of your notes.

You cannot predict the future prices of the basket commodities based on their historical fluctuations. The actual prices of the basket commodities over the life of the notes may bear little or no relation to their historical closing prices or to the hypothetical examples shown elsewhere in this pricing supplement.

If the Values of the Basket Commodities Change, the Market Value of Your Notes May Not Change in the Same Manner

The price of your notes may move quite differently than the performance of the basket commodities. Changes in the value of one or more of the basket commodities may not result in a comparable change in the market value of your notes. Even if the value of one or more of the basket commodities increases above its initial basket commodity price during some portion of the life of the notes, the market value of your notes may not reflect this amount. We discuss some of the reasons for this disparity under “— The Market Value of Your Notes May Be Influenced by Many Unpredictable Factors” above.

You Will Not Have Any Rights Against the Publishers of the Prices of the Basket Commodities

You will have no rights against the publishers of the prices of the basket commodities, even though the amount you receive at maturity, if any, will depend on the performance of the basket commodities from the trade date to the determination date. The publishers of the prices of the basket commodities are not in any way involved in this offering and have no obligations relating to the notes or to the holders of the notes. You will not own or have any beneficial or other legal interest in, and will not be entitled to any rights with respect to, WTI crude oil, Brent Crude oil, copper, zinc, aluminum or gold or options, swaps or futures based upon the prices of the basket commodities.

You Have No Rights with Respect to the Basket Commodities, or the Commodities Underlying the Basket Commodities, or Rights to Receive the Basket Commodities or the Commodities Underlying the Basket Commodities

Investing in your notes will not make you a holder of the basket commodities or the commodities underlying the basket commodities. Neither you nor any other holder or owner of your notes will have any rights with respect to the basket commodities or the commodities underlying the basket commodities. Any amounts payable on your notes will be made in cash, and you will have no right to receive the basket commodities, or the commodity underlying the basket commodities.

We May Sell an Additional Aggregate Face Amount of the Notes at a Different Issue Price

At our sole option, we may decide to sell an additional aggregate face amount of the notes subsequent to the date of this pricing supplement. The issue price of the notes in the subsequent sale may differ substantially (higher or lower) from the original issue price you paid as provided on the cover of this pricing supplement.

If You Purchase Your Notes at a Premium to Face Amount, the Return on Your Investment Will Be Lower Than the Return on Notes Purchased at Face Amount and the Impact of Certain Key Terms of the Notes Will Be Negatively Affected

The cash settlement amount you will be paid for your notes on the stated maturity date will not be adjusted based on the issue price you pay for the notes. If you purchase notes at a price that differs from the face amount of the notes, then the return on your investment in such notes held to the stated maturity date will differ from, and may be substantially less than, the return on notes purchased at face amount. If you purchase your notes at a premium to face amount and hold them to the stated maturity date the return on your investment in the notes will be lower than it would have been had you purchased the notes at face amount or a discount to face amount.

PS-12

Additional Risks Related to the Basket Commodities

There Are Risks Associated with an Investment Linked to the Prices of Commodities Generally

The market prices of commodities can be highly volatile. Unlike fixed-income and equity investments, commodity market prices are not related to the value of a future income or earnings stream, and may be subject to rapid fluctuations based on numerous factors, some of which are described below under “—The Basket Commodities May Continue to Be Volatile and Each Basket Commodity May Be Affected by Factors Specific to Its Market, Which May Have an Adverse Effect on the Market Value of Your Notes”. In addition, many commodities are highly cyclical. These factors may have a larger impact on commodity prices and commodity-linked instruments than on instruments linked to traditional fixed-income and equity securities and may create additional investment risks that cause the value of the securities to be more volatile than the values of traditional securities. These and other factors may affect the performance of the basket commodities, and thus the value of your notes, in unpredictable or unanticipated ways.

Commodity Prices as Well as the Basket Commodities May Change Unpredictably, Affecting the Value of Your Notes in Unforeseeable Ways

Commodity prices as well as the basket commodities are affected by a variety of factors, including weather, governmental programs and policies, national and international political, military, terrorist and economic events, changes in interest and exchange rates, regulations in the relevant producer countries and in the commodities and securities markets, hedging, investment and trading activities by market participants, price limitations, position limits and trading halts on the exchange on which the basket commodities trade and trading activities in commodities and related contracts. These factors may affect the prices of the basket commodities and the value of your notes in varying ways, and different factors may cause the value of the basket commodities to move in inconsistent directions and at inconsistent rates.

The Basket Commodities May Continue to Be Volatile and Each Basket Commodity May Be Affected by Factors Specific to Its Market, Which May Have an Adverse Effect on the Market Value of Your Notes

Investments, such as the notes, linked to the prices of commodities, such as the basket commodities, are subject to sharp fluctuations in the prices of commodities over short periods of time for a variety of factors, including the principal factors set out below:

• | WTI crude oil. Demand for refined petroleum products by consumers, as well as by the agricultural, manufacturing and transportation industries, affects the price of crude oil. Crude oil’s end-use as a refined product is often as transport fuel, industrial fuel and in-home heating fuel. Potential for substitution in most areas exists, although considerations including relative cost often limit substitution levels. Because the precursors of demand for petroleum products are linked to economic activity, demand will tend to reflect economic conditions. Demand is also influenced by government regulations, such as environmental or consumption policies. In addition to general economic activity and demand, prices for crude oil are affected by political events, labor activity, developments in production technology such as fracking and, in particular, direct government intervention (such as embargos) or supply disruptions in major oil producing regions of the world. Such events tend to affect oil prices worldwide, regardless of the location of the event. Supply for crude oil may increase or decrease depending on many factors. These include production decisions by the Organization of the Petroleum Exporting Countries and other crude oil producers. In the event of sudden disruptions in the supplies of oil, such as those caused by war, weather and natural events, accidents, damage to pipelines (including by oil theft), acts of terrorism or cyberattacks, prices of oil futures contracts could become extremely volatile and unpredictable. Also, sudden and dramatic changes in the futures market may occur, for example, upon a cessation of hostilities that may exist in countries producing oil, the introduction of new or previously withheld supplies into the market or the introduction of substitute products or commodities. WTI crude oil is also subject to the risk that it has demonstrated a lack of correlation with world crude oil prices due to structural differences between the U.S. market for crude oil and the international market for crude oil. As a result, the price of WTI crude oil may be more volatile than world crude oil prices generally. |

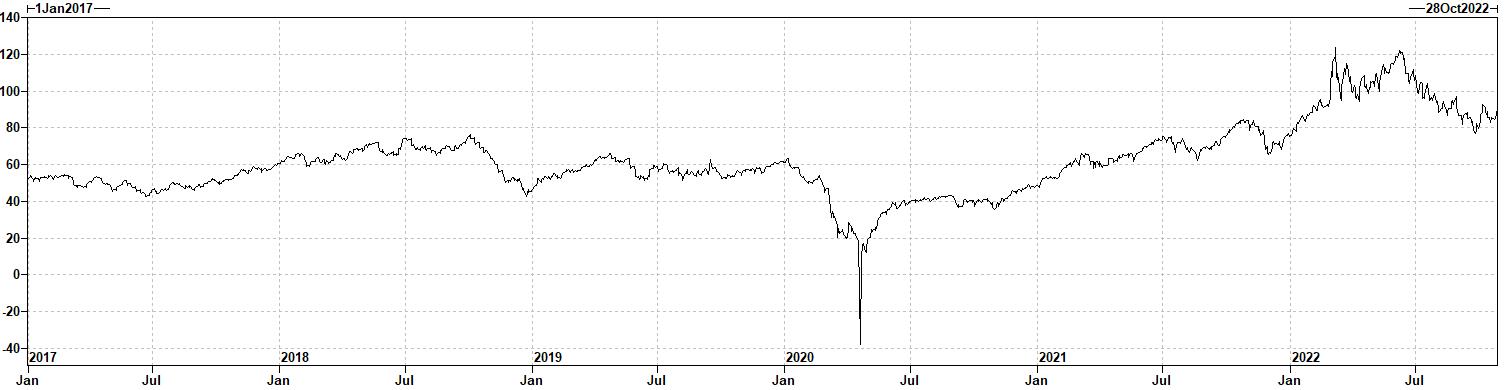

In addition, the prices of WTI crude oil futures contracts may be near zero, zero or negative, which can occur rapidly and unexpectedly. For example, in April 2020, a collapse of demand for fuel contributed to an oversupply of crude oil that rapidly filled most available oil storage facilities. Storage shortages meant that market participants that had contracted to buy and take delivery of crude oil were at risk of default under the terms of the May 2020 NYMEX WTI crude oil futures contract. The scarcity of storage resulted

PS-13

in some market participants selling their futures contracts at a negative price (effectively paying another market participant to accept delivery of the crude oil referenced by the relevant contracts). As a result, for the first time in history, crude oil futures contracts traded below zero. On April 20, 2020, the last trading day before expiration of the May 2020 WTI crude oil futures contract, prices of that contract fell to negative $37.63. See “The Basket and the Basket Commodities”.

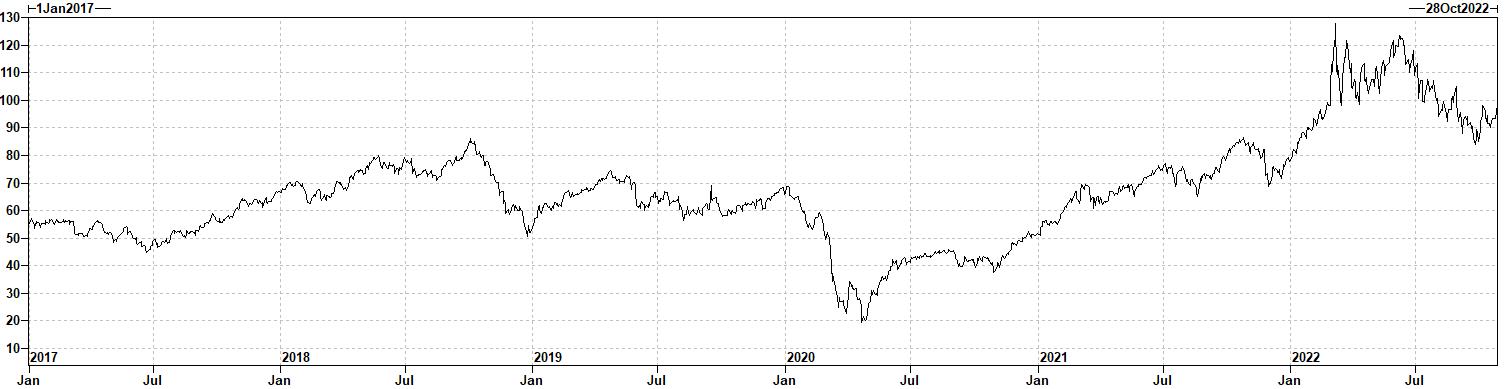

• | Brent crude oil. Demand for refined petroleum products by consumers, as well as by the agricultural, manufacturing and transportation industries, affects the price of crude oil. Crude oil’s end-use as a refined product is often as transport fuel, industrial fuel and in-home heating fuel. Potential for substitution in most areas exists, although considerations including relative cost often limit substitution levels. Because the precursors of demand for petroleum products are linked to economic activity, demand will tend to reflect economic conditions. Demand is also influenced by government regulations, such as environmental or consumption policies. In addition to general economic activity and demand, prices for crude oil are affected by political events, labor activity, developments in production technology such as fracking and, in particular, direct government intervention (such as embargos) or supply disruptions in major oil producing regions of the world. Such events tend to affect oil prices worldwide, regardless of the location of the event. Supply for crude oil may increase or decrease depending on many factors. These include production decisions by the Organization of the Petroleum Exporting Countries and other crude oil producers. In the event of sudden disruptions in the supplies of oil, such as those caused by war, weather and natural events, accidents, damage to pipelines (including by oil theft), acts of terrorism or cyberattacks, prices of oil futures contracts could become extremely volatile and unpredictable. Also, sudden and dramatic changes in the futures market may occur, for example, upon a cessation of hostilities that may exist in countries producing oil, the introduction of new or previously withheld supplies into the market or the introduction of substitute products or commodities. The price of Brent crude oil futures has experienced very severe price fluctuations over the recent past and there can be no assurance that this extreme price volatility will not continue in the future. See “The Basket and the Basket Commodities”. |

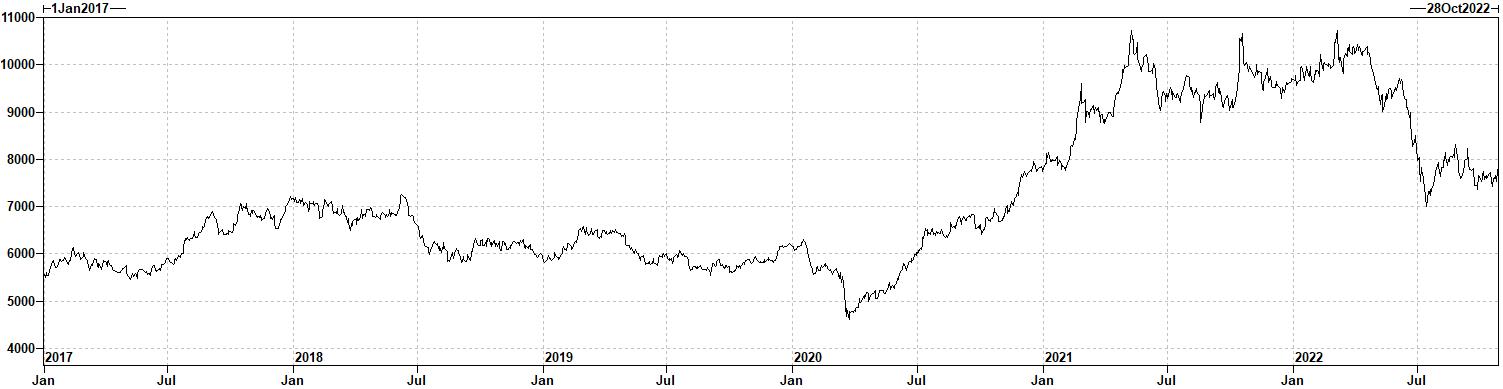

• | Copper. Demand for copper is significantly influenced by the level of global industrial economic activity. Industrial sectors which are particularly important to demand for copper include the electrical and construction sectors. In recent years demand has been supported by strong consumption from newly industrializing countries due to their copper-intensive economic growth and infrastructure development. An additional, but highly volatile, component of demand is adjustments to inventory in response to changes in economic activity and/or pricing levels. There are substitutes for copper in various applications. Their availability and price will also affect demand for copper. The main sources of copper are mines in Latin America and Eastern Europe and copper is refined mainly in Latin America, Australia and Asia. The supply of copper is also affected by current and previous price levels, which will influence investment decisions in new smelters, and the cost and availability of transportation from a copper-producing country or region to a copper-consuming country or region. In previous years, copper supply has been affected by technical issues at mines, strikes, financial problems and terrorist activity. Copper price may also be affected by changes in expectations regarding the availability and cost of copper, which is influenced by such factors as: (i) changes in technology used in the extraction and processing of copper ore and the recovery and recycling of copper from above ground stock; (ii) changes in law and regulation relating to that extraction, processing, recovery and recycling, including environmental and health and safety laws and regulations; (iii) changes in current reserves, including proven and probable reserves; and (iv) changes in estimates for long term copper prices, which may affect the economic viability of the extraction of reserves. It is not possible to predict the aggregate effect of all or any combination of these factors. See “The Basket and the Basket Commodities”. |

• | Zinc. Demand for zinc is significantly influenced by the level of global industrial economic activity. The galvanized steel industrial sector is particularly important to demand for zinc given that the use of zinc in the manufacture of galvanized steel accounts for a significant percentage of worldwide zinc demand. The galvanized steel sector is in turn heavily dependent on the automobile and construction sectors. Growth in the production of galvanized steel will drive zinc demand. An additional, but highly volatile, component of demand is adjustments to inventory in response to changes in economic activity and/or pricing levels. The supply of zinc concentrate (the raw material) is dominated by Australia, North America and Latin America. The supply of zinc is also affected by current and previous price levels, which will influence investment decisions in new mines and smelters. |

PS-14

• | Aluminum: The price of aluminum is primarily affected by the global demand for and supply of aluminum, but is also influenced significantly from time to time by speculative actions and by currency exchange rates. Demand for aluminum is significantly influenced by the level of global industrial economic activity, particularly in large industrial countries such as the United States and China. Changes in demand from these countries due to economic downturns or for other reasons may have an outsized negative impact on aluminum prices. Industrial sectors which are particularly important to demand for aluminum include the automobile, packaging and construction sectors. Demand for aluminum in each of these industries may change significantly in response to changes in global and local economic conditions. An additional, but highly volatile, component of demand is adjustments to inventory in response to changes in economic activity and/or pricing levels. Disruptions in supply chains, from mining to storage, to smelting and refining, may cause rapid and unexpected fluctuations in the price of aluminum. Such disruptions may be caused by, among other things, shutdowns precipitated by national responses to pandemics. There are substitutes for aluminum, including man-made and synthetic substitutes, in various applications. Their availability and price will also affect demand for aluminum. The supply of aluminum is widely spread around the world, and the principal factor dictating the smelting of such aluminum is the ready availability of inexpensive power. Substantial increases in energy prices, which may be caused by a variety of factors, including geopolitical conflict, may make it less profitable to smelt aluminum, thereby decreasing the supply of processed aluminum. This may lead to an increase in aluminum prices, but it may also make it more economical to rely on substitutes for aluminum, leading to a decrease in demand for aluminum and therefore to a decrease in aluminum prices. The supply of aluminum is also affected by current and previous price levels, which will influence investment decisions in new smelters. Other factors influencing supply include droughts, transportation problems, shortages of power and raw materials, and the costs of regulatory compliance, including compliance with environmental regulations. |

• | Gold. The price of gold to which the return on the notes is linked, in part, is the afternoon London gold price per troy ounce of gold for delivery in London through a member of the LBMA authorized to effect such delivery. The market for gold bullion is global, and gold prices are subject to volatile price movements over short periods of time. Specific factors affecting the price of gold include economic factors, including, among other things, the structure of and confidence in the global monetary system, expectations of the future rate of inflation, the relative strength of, and confidence in, the U.S. dollar (the currency in which the price of gold is generally quoted), interest rates and gold borrowing and lending rates, and global or regional economic, financial, political, regulatory, judicial or other events, as well as wars and political and civil upheavals. Gold prices may also be affected by industry factors such as industrial and jewelry demand, lending, sales and purchases of gold by the official sector, including central banks and other governmental agencies and multilateral institutions that hold gold, sales of gold recycled from jewelry, as opposed to newly produced gold, in particular as the result of financial crises, levels of gold production and production costs in major gold producing nations such as China, the United States and Australia, non-concurrent trading hours of gold markets and short-term changes in supply and demand because of trading activities in the gold market. It is not possible to predict the aggregate effect of all or any combination of these factors. Gold prices may also be affected by the degree to which consumers, governments, corporate and financial institutions hold physical gold as a safe haven asset (hoarding) which may be caused by a banking crisis/recovery, a rapid change in the value of other assets (both financial and physical) or changes in the level of geopolitical tension. The price of gold may be, and has recently been, extremely volatile, and we can give you no assurance that the volatility will lessen. See “The Basket and the Basket Commodities”. |

Additionally, recently, prior to and since Russia’s further invasion of Ukraine, the price of oil, including the prices of WTI crude oil futures contracts and Brent crude oil futures contracts, has been volatile and increased significantly. This conflict has led to disruptions in the supply of oil and fertilizer and caused fluctuations in the prices of oil, and changing geopolitical conditions and political events in Europe, the Middle East and elsewhere are likely to cause continued volatility in the prices of such commodity. In addition, on March 8, 2022, the U.S. Government issued an executive order banning the import of Russian oil to the United States. The U.S. Congress has also passed legislation to ban imports of Russian oil. These actions, and similar governmental, regulatory or legislative actions in the United States or in other jurisdictions, including, without limitation, sanctions-related actions by the U.S. or foreign governments, could cause prices of oil futures contracts to become even more volatile and unpredictable. Any of these developments could adversely affect the price of WTI crude oil futures and Brent crude oil futures, and, therefore, the value of the notes and the cash settlement amount.

PS-15

There Are Specific Risks Associated with WTI Crude Oil and Brent Crude Oil and the WTI Crude Oil Futures Contract and the Brent Crude Futures Contract

Oil prices are currently experiencing high volatility and have also been highly volatile in the past.

Oil prices are affected by numerous factors, including oil supply and demand, the level of global industrial activity, the driving habits of consumers, political events and policies, regulations, weather, fiscal, monetary and exchange control programs, and, especially, direct government intervention such as embargoes, and supply disruptions in major producing or consuming regions such as the Middle East, the United States, Latin America, Russia, Ukraine and Nigeria. The outcome of meetings of the Organization of Petroleum Exporting Countries also can affect liquidity and world oil supply and, consequently, the value of the basket commodities. Market expectations about these events and trading activity also may cause oil prices to fluctuate unpredictably. If the volatility of crude oil increases or decreases, the volatility of the basket commodities may also increase or decrease, and the market value of, and amount payable on, your notes may be adversely affected.

Furthermore, a significant proportion of world oil production capacity is controlled by a small number of producers. These producers have, in certain periods, implemented curtailments of or increases in output and trade. These efforts at supply control could adversely affect the closing prices of the basket commodities and the market value of, and amount payable on, your notes. Additionally, actions taken by consuming nations, such as the releases of oil reserves, may occur in a way that is not predictable and could adversely affect the price of crude oil, the closing prices of the basket commodities and the market value of, and amount payable on, your notes.

Also, the production and pricing of substitute products for crude oil, such as shale oil, as well as development of new substitute products for crude oil, could adversely affect the closing prices of the basket commodities and the market value of, and amount payable on, your notes. Increases in the price of crude oil may drive increased production of substitute products, such as shale oil, which may cause the price of crude oil to decline.

Your Notes Are Linked, in Part, to the Futures Contracts on WTI Crude Oil and Brent Crude Not to the Spot Prices of the Respective Physical Commodities

The return on your notes will be related, in part, to the performance of the futures contracts on WTI crude oil and brent crude and not the spot prices of the respective physical commodities. The price of a commodity futures contract reflects the expected value of the commodity upon delivery in the future, whereas the spot price of a physical commodity reflects the immediate delivery value of the commodity. A variety of factors can lead to a disparity between the expected future price of a commodity and the spot price at a given point in time, such as the cost of storing, transporting or handling the commodity for the term of the commodity futures contract, interest charges incurred to finance the purchase of the commodity and expectations concerning supply and demand for the commodity. The price movement of a commodity futures contract is typically correlated with the movements of the spot price of the reference physical commodity, but the correlation is generally imperfect and price moves in the spot market may not be reflected in the futures market (and vice versa). Accordingly, your notes may underperform a similar investment that more directly reflects the return on the physical commodity.

If the First Nearby Futures Contract is Used to Calculate the Closing Price of a Basket Commodity Futures Contract, Such Closing Price May Be More Volatile Than if Another Nearby Futures Contract Had Been Used

The settlement price that will be used to calculate the closing price of a basket commodity futures contract on the determination date will be the price of the first nearby futures contract of such basket commodity futures contract, unless the determination date falls on or after the last trading day during which trading may take place for the first nearby futures contract of such basket commodity futures contract, in which case the second nearby futures contract of such basket commodity futures contract will be used.

The price of a commodity futures contract is typically at its most volatile as the futures contract approaches maturity. In the event the first nearby futures contract is used to determine the closing price of the basket commodity futures contracts on the determination date, the closing price of each such basket commodity futures contract may therefore be more volatile than if another nearby futures contract with a longer maturity had been used.

PS-16

If the Second Nearby Futures Contract For a Basket Commodity Futures Contract is Used on the Determination Date, Any Downward Trend In Its Underlying Commodity May Be Amplified Relative to the First Nearby Futures Contract Of Such Basket Commodity Futures Contract

As we describe elsewhere in this pricing supplement, the settlement price that will be used to calculate the closing price of the a basket commodity futures contract on the determination date will be the price of the first nearby futures contract of such basket commodity futures contract, unless the determination date falls on or after the last trading day during which trading may take place for the first nearby futures contract of such basket commodity futures contract, in which case the second nearby futures contract of such basket commodity futures contract will be used.

As a commodity futures contract nears maturity, the price of such commodity futures contract tends to approximate the spot price for its underlying commodity. However, the price of a commodity futures contract with a longer maturity may reflect longer-term trends in its underlying commodity or market expectations regarding the future price of its underlying commodity. In the event that the second nearby future contracts for a basket commodity futures contract is used to determine the closing price of such basket commodity futures contract on the determination date, the closing price of such basket commodity futures contract may therefore be lower than if the first nearby futures contract of such basket commodity futures contract had been used.

The LME May Change the Rules of any of its Markets at Any Time

A number of markets including the LME and financial benchmarks have come under increasing pressure regarding price discovery, transparency of pricing, integrity and governance. The LME conducted an internal audit in 2014 and concluded at that time that the ring (the LME’s open-outcry trading) met the International Organization of Securities Commissions published principles for financial benchmarks, which include recommendations for changes to benchmark governance, quality and accountability mechanisms (the “IOSCO Principles”). The LME indicated that it would continue to conduct internal and external audits and it would continue to make changes as necessary. The LME also noted that the ring would need enhancements to keep pace with the changing marketplace and LME’s other trading venues (including its electronic venues). LME has since announced and then cancelled plans to close the ring and move entirely to electronic trading. If the LME changes the rules of the ring, including, among other things, by changing the methods pursuant to which the price of the basket commodity is determined, or makes any other changes that may result from the implementation of IOSCO Principles or otherwise (including the implementation of electronic trading mechanisms in lieu of the ring), such changes may result in a sudden or prolonged increase or decrease or heightened volatility in the price of the basket commodity. Any such effects on the price of the basket commodity may adversely affect the value of, and cash settlement amount on, your notes. Further, uncertainty as to the extent and manner in which the LME will continue to adopt changes and whether it will continue to support the ring and the timing of such changes may adversely affect the trading market for your notes. See “Supplemental Terms of the Notes - Discontinuance or Modification of an Underlier” on page S-27 of the accompanying commodity terms supplement no. 2,014.

Potential Discrepancies, or Future Changes, in the Calculation of the Gold Price Could Have an Adverse Effect on an Investment in the Notes

ICE Benchmark Administration (IBA) is the administrator for the gold price, and IBA provides the auction platform, methodology as well as overall independent administration and governance for the gold price. As the administrator of the gold price, IBA operates an electronic and tradeable auction process. The price formation is in U.S. dollars only and prices are set twice daily at 10:30 a.m. and 3:00 p.m. (London time). Within the process, aggregated gold bids and offers are updated in real-time with the imbalance calculated and the price updated every 30 seconds until the buy and sell orders are matched. If the gold price varies materially from the price of gold determined by other mechanisms, the value of an investment in the notes could be adversely impacted. The calculation of the gold price is not an exact process, but is based upon a procedure of matching orders from participants in the auction process and their customers to sell gold with orders from participants in the auction process and their customers to buy gold at particular prices. The gold price does not therefore purport to reflect each buyer or seller of gold in the market, nor does it purport to set a definitive price for gold at which all orders for sale or purchase will take place on that particular day or time. All orders placed into the auction process by the participants will be executed on the basis of the price determined pursuant to the gold price auction process. Any future developments or changes in the determination of the gold price, to the extent they have a material impact on the gold price, could adversely affect an investment in the notes.

PS-17

An Investment in the Notes is Subject to Risks Associated with the London Bullion Market Association and the London Bullion Market

Gold is traded on the London bullion market, which is the market in London on which the members of the LBMA quote prices.

Investments in commodities that are traded on non-U.S. markets involve risks associated with the markets in those countries, including risks of volatility and governmental intervention in those markets.

The LBMA is a self-regulatory organization of bullion market participants. Although the LBMA sets out good practices for participants in the bullion market, the LBMA itself is not a regulated entity. If the LBMA should cease operations, if bullion trading should become subject to a value added tax or other tax or any other form of regulation currently not in place, or if the LBMA should change any rule or bylaw or take emergency action under its rules, the market for gold, and consequently the closing gold fixing price, as well as the value of the notes, may be affected. The London bullion market is a principals’ market which operates in a manner more closely analogous to an over-the-counter physical commodity market than a regulated futures market, and certain features of U.S. futures contracts are not present in the context of London bullion market trading. For example, there are no daily price limits on the London bullion market which would otherwise restrict fluctuations in the prices of London bullion market contracts. In a declining market, it is possible that prices may continue to decline without limitation within a trading day or over a period of trading days.

Risks Related to Tax

Certain Considerations for Insurance Companies and Employee Benefit Plans

Any insurance company or fiduciary of a pension plan or other employee benefit plan that is subject to the prohibited transaction rules of the Employee Retirement Income Security Act of 1974, as amended, which we call “ERISA”, or the Internal Revenue Code of 1986, as amended, including an IRA or a Keogh plan (or a governmental plan to which similar prohibitions apply), and that is considering purchasing the offered notes with the assets of the insurance company or the assets of such a plan, should consult with its counsel regarding whether the purchase or holding of the offered notes could become a “prohibited transaction” under ERISA, the Internal Revenue Code or any substantially similar prohibition in light of the representations a purchaser or holder in any of the above categories is deemed to make by purchasing and holding the offered notes. This is discussed in more detail under “Employee Retirement Income Security Act” below.

Your Notes Will Be Treated as Debt Instruments Subject to Special Rules Governing Contingent Payment Debt Instruments for U.S. Federal Income Tax Purposes

The notes will be treated as debt instruments subject to special rules governing contingent payment debt instruments for U.S. federal income tax purposes. If you are a U.S. individual or taxable entity, you generally will be required to pay taxes on ordinary income from the notes over their term based on the comparable yield for the notes, even though you will not receive any payments from us until maturity. This comparable yield is determined solely to calculate the amount on which you will be taxed prior to maturity and is neither a prediction nor a guarantee of what the actual yield will be. In addition, any gain you may recognize on the sale, exchange or maturity of the notes will be taxed as ordinary interest income. If you are a secondary purchaser of the notes, the tax consequences to you may be different. Please see “Supplemental Discussion of U.S. Federal Income Tax Consequences” below for a more detailed discussion. Please also consult your tax advisor concerning the U.S. federal income tax and any other applicable tax consequences to you of owning your notes in your particular circumstances.

Foreign Account Tax Compliance Act (FATCA) Withholding May Apply to Payments on Your Notes, Including as a Result of the Failure of the Bank or Broker Through Which You Hold the Notes to Provide Information to Tax Authorities

Please see the discussion under “United States Taxation — Taxation of Debt Securities — Foreign Account Tax Compliance Act (FATCA) Withholding” in the accompanying prospectus for a description of the applicability of FATCA to payments made on your notes.

PS-18

THE BASKET AND THE BASKET COMMODITIES

THE BASKET

The basket is comprised of six basket commodities with the following initial weights within the basket: the WTI crude oil futures contract (25% weighting), the Brent Crude futures contract (25% weighting), the copper price (12.5% weighting), the zinc price (12.5% weighting), the aluminum price (12.5% weighting) and the gold price (12.5% weighting).

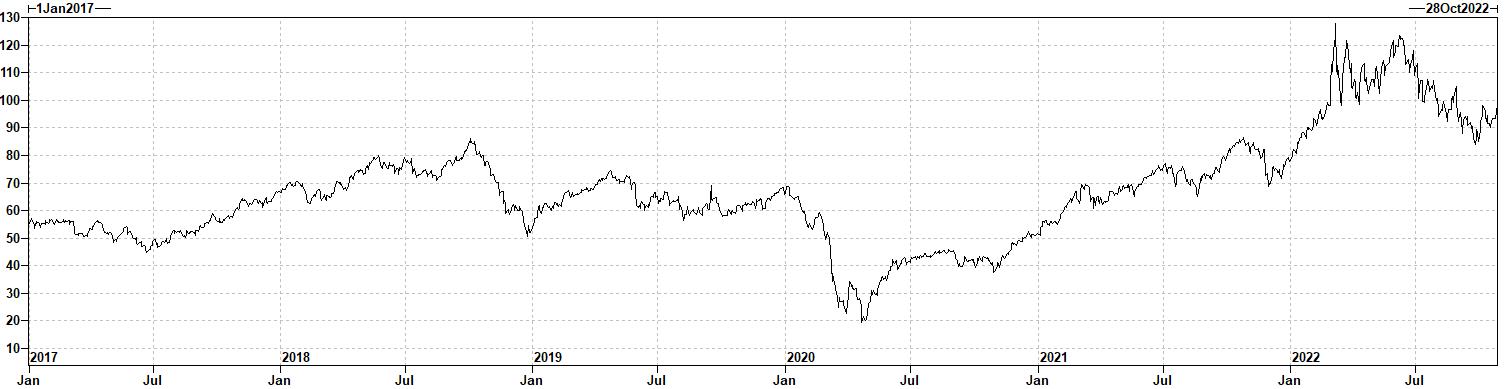

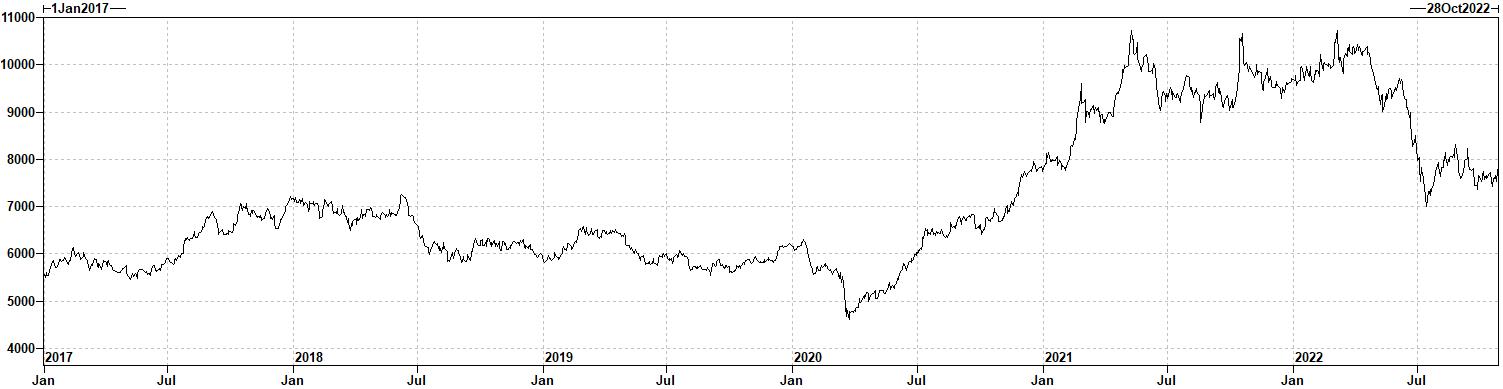

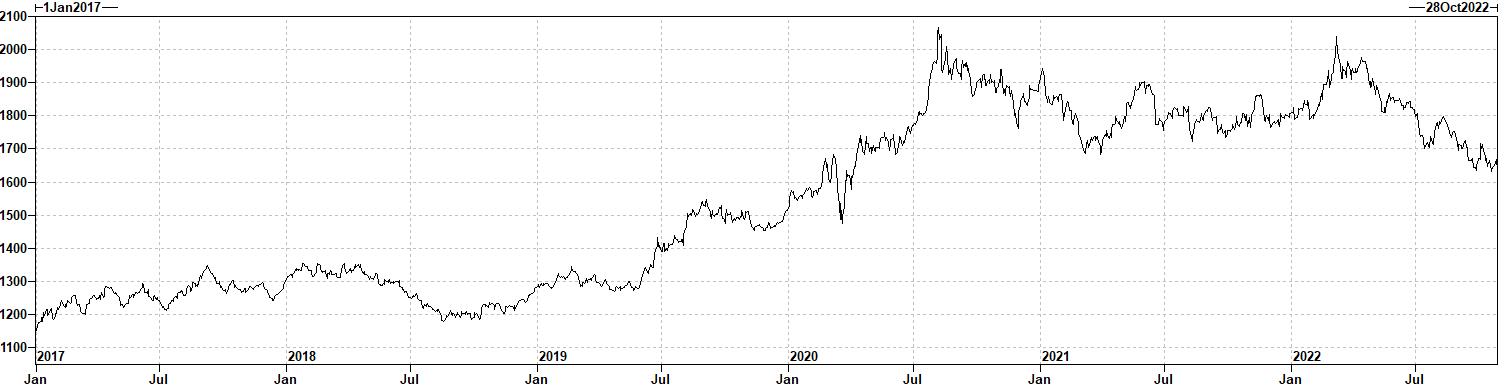

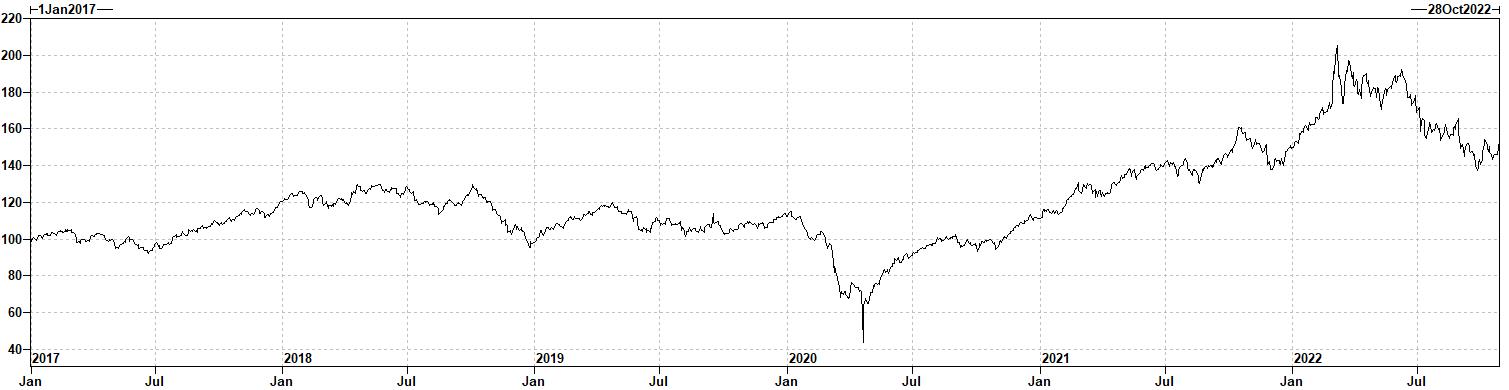

WTI Crude Oil Futures Contract