Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS

Filed Pursuant to Rule 424(b)(7)

Registration No. 333-197410

CALCULATION OF REGISTRATION FEE

| | | | | | | | |

| | | | | | | | |

| |

Title of each Class of Securities

to be Registered

| | Amount to be

Registered(1)

| | Proposed Maximum

Offering Price Per

Share

| | Proposed Maximum

Aggregate Offering

Price

| | Amount of

Registration Fee(2)

|

|---|

| |

Common Stock, $0.01 par value per share | | 2,512,899 | | $61.50 | | $154,543,289 | | $17,958 |

|

- (1)

- Includes 327,769 additional shares of our common stock that the underwriter has the option to purchase from the selling stockholders.

- (2)

- Calculated in accordance with Rules 456(b) and 457(r) under the Securities Act of 1933, as amended.

Table of Contents

PROSPECTUS SUPPLEMENT

(To Prospectus dated July 14, 2014)

2,185,130 Shares

Common Stock

The selling stockholders named in this prospectus supplement, certain of whom are directors, management or otherwise affiliated with directors of our company, are selling 2,185,130 shares of our common stock. We will not receive any proceeds from the sale of our common stock by the selling stockholders.

Our common stock is listed on the NASDAQ Global Select Market under the symbol "MFRM." On December 9, 2014, the last sale price of our common stock as reported on the NASDAQ Global Select Market was $62.65 per share.

Investing in our common stock involves risks. See "Risk Factors" beginning on page S-14 of this prospectus supplement and on page 2 of the accompanying prospectus, as well as in the documents incorporated by reference herein and therein, to read about factors you should consider before buying shares of our common stock.

| | | | | | | |

| | Per share | | Total | |

|---|

Public offering price | | $ | 61.50 | | $ | 134,385,495.00 | |

Underwriting discounts and commissions | | $ | 0.97 | | $ | 2,119,576.10 | |

Proceeds, before expenses, to the selling stockholders | | $ | 60.53 | | $ | 132,265,918.90 | |

We have agreed under certain circumstances to reimburse the underwriter for certain expenses incurred by them in connection with this offering. See "Underwriting."

The selling stockholders identified in this prospectus supplement have granted the underwriter a 30-day option to purchase up to an additional 327,769 shares of common stock on the same terms and conditions as set forth above. See the section of this prospectus supplement titled "Underwriting." We will not receive any of the proceeds from the sale of shares by these selling stockholders if the underwriter exercises its option to purchase additional shares of common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

The underwriter expects to deliver the shares against payment on or about December 16, 2014.

Barclays

Prospectus Supplement dated December 11, 2014

Table of Contents

TABLE OF CONTENTS

| | | | |

Prospectus Supplement

| |

|---|

| | Page | |

|---|

ABOUT THIS PROSPECTUS SUPPLEMENT | | | S-1 | |

PROSPECTUS SUPPLEMENT SUMMARY | | | S-2 | |

THE OFFERING | | | S-11 | |

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL INFORMATION | | | S-12 | |

RISK FACTORS | | | S-14 | |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS | | | S-17 | |

USE OF PROCEEDS | | | S-19 | |

DIVIDEND POLICY | | | S-20 | |

SELLING STOCKHOLDERS | | | S-21 | |

CERTAIN U.S. FEDERAL INCOME AND ESTATE TAX CONSIDERATIONS FOR NON-U.S. HOLDERS OF SHARES OF OUR COMMON STOCK | | | S-22 | |

UNDERWRITING | | | S-27 | |

LEGAL MATTERS | | | S-35 | |

EXPERTS | | | S-35 | |

WHERE YOU CAN FIND MORE INFORMATION | | | S-35 | |

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE | | | S-37 | |

Prospectus

|

|

|---|

| | Page | |

|---|

ABOUT THIS PROSPECTUS | | | 1 | |

RISK FACTORS | | | 2 | |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS | | | 2 | |

THE COMPANY | | | 4 | |

RATIOS OF EARNINGS TO FIXED CHARGES AND EARNINGS TO COMBINED FIXED CHARGES AND PREFERRED STOCK DIVIDENDS | | | 6 | |

USE OF PROCEEDS | | | 7 | |

DESCRIPTION OF SECURITIES | | | 8 | |

SELLING SECURITY HOLDERS | | | 14 | |

PLAN OF DISTRIBUTION | | | 15 | |

LEGAL MATTERS | | | 17 | |

EXPERTS | | | 17 | |

WHERE YOU CAN FIND MORE INFORMATION | | | 17 | |

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE | | | 18 | |

Neither we, the selling stockholders nor the underwriter (or any of our or their respective affiliates) have authorized anyone to provide any information or to make any representations other than that contained in this prospectus supplement, the accompanying prospectus or in any free writing prospectus prepared by or on behalf of us, or the information incorporated by reference herein or therein. Neither we, the selling stockholders nor the underwriter (or any of our or their respective affiliates) take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus supplement and the accompanying prospectus are an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein is current only as of the date of the applicable document.

S-i

Table of Contents

NOTE REGARDING TRADEMARKS AND SERVICE MARKS

We own or have rights to use the trademarks, service marks and trade names that we use in conjunction with the operation of our business. Some of the more important trademarks that we own or have rights to use that appear in this prospectus supplement, the accompanying prospectus and the information incorporated by reference herein and therein include "Mattress Firm®," "Comfort By Color®," "Mattress Firm Red Carpet Delivery Service®," "Hampton & Rhodes®," "YuMe®," "Mattress Firm SuperCenter®," "Happiness Guarantee™," "Replace Every 8®," "Save Money. Sleep Happy®," "Sleep Happy™," "Dream It's Possible™," "Side by side before you decide®," "Nobody Sells for Less, Nobody!®," "All the best brands...All the best prices!®," "Sleep Train®" and "Sleep Country®." Trademarks, trade names or service marks of other companies appearing in this prospectus supplement, the accompanying prospectus and the information incorporated by reference herein and therein are, to our knowledge, the property of their respective owners.

NOTE REGARDING MARKET AND INDUSTRY DATA

Industry and market data included in this prospectus supplement, the accompanying prospectus and the information incorporated by reference herein and therein were obtained from our own internal data, data from industry trade publications and groups (primarilyFurniture Today and the International Sleep Products Association, or "ISPA"), consumer research and marketing studies and, in some cases, are management estimates based on industry and other knowledge and experience in the markets in which we operate. Our estimates have been based on information obtained from our suppliers, customers, trade and business organizations and other contacts in the markets in which we operate. We believe these estimates and the third party information mentioned above to be accurate as of the date of this prospectus supplement.

S-ii

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

This document has two parts, this prospectus supplement and an accompanying prospectus dated July 14, 2014. The accompanying prospectus provides you with a general description of our common stock, which the selling stockholders are offering for sale pursuant to this prospectus supplement. This prospectus supplement, which describes certain matters relating to us and the specific terms of this offering of shares of our common stock, adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference herein and therein. To the extent the information contained in this prospectus supplement differs or varies from the information contained in the accompanying prospectus or documents incorporated by reference filed before the date of this prospectus supplement, the information in this prospectus supplement will supersede such information. Before purchasing any of our common stock, you should carefully read this prospectus supplement, the accompanying prospectus and any applicable free writing prospectus we file with the Securities and Exchange Commission, or "SEC," together with the additional information described under the headings "Where You Can Find More Information" and "Incorporation of Certain Information by Reference."

Unless the context otherwise requires, the terms "Mattress Firm," "our company," "the Company," "we," "us," "our" and the like refer to Mattress Firm Holding Corp. and its consolidated subsidiaries. Unless otherwise indicated, (i) the term "our stores" refers to our company-operated stores and our franchised stores and (ii) when used in relation to our company, the terms "market" and "markets" refer to the metropolitan statistical area or an aggregation of the metropolitan statistical areas in which we or our franchisees operate. You should assume that the information appearing in this prospectus supplement, the accompanying prospectus or any applicable free writing prospectus or any of the documents incorporated by reference herein or therein is accurate only as of the respective dates thereof. Our business, financial condition, results of operations and prospects may have changed since those dates.

We report on the basis of a 52- or 53-week fiscal year, which ends on the Tuesday closest to January 31. Each fiscal year is described by the period of the calendar year that comprises the majority of the fiscal year period. For example, the fiscal year ended January 28, 2014 is described as "fiscal 2013." Fiscal 2013 contained 52 weeks.

S-1

Table of Contents

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights important features of this offering and information contained elsewhere or incorporated by reference in this prospectus supplement and the accompanying prospectus. This summary does not contain all of the information that you should consider before investing in our common stock. You should read the entire prospectus supplement and the accompanying prospectus carefully, as well as the additional materials described under the captions "Where You Can Find More Information" and "Incorporation of Certain Information by Reference" in this prospectus supplement and the accompanying prospectus, including the Current Report on Form 8-K/A filed with the SEC on December 3, 2014, especially the risks of investing in our common stock discussed herein and therein under "Risk Factors" and "Cautionary Statement Regarding Forward-Looking Statements."

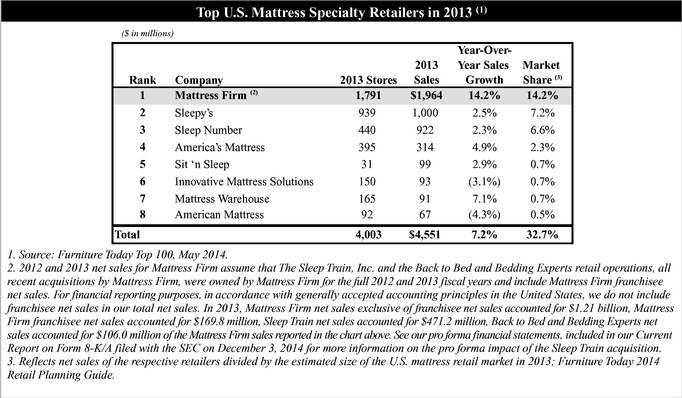

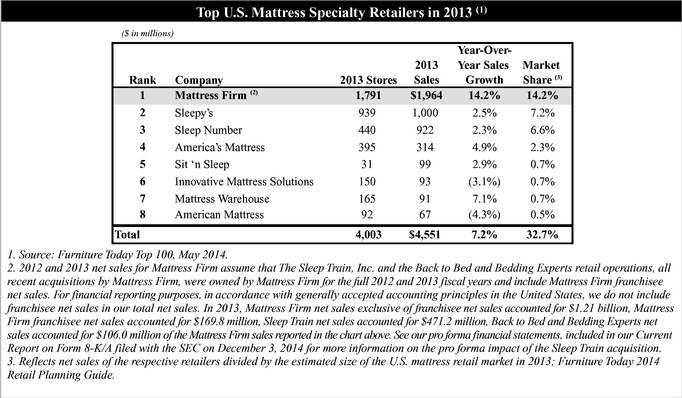

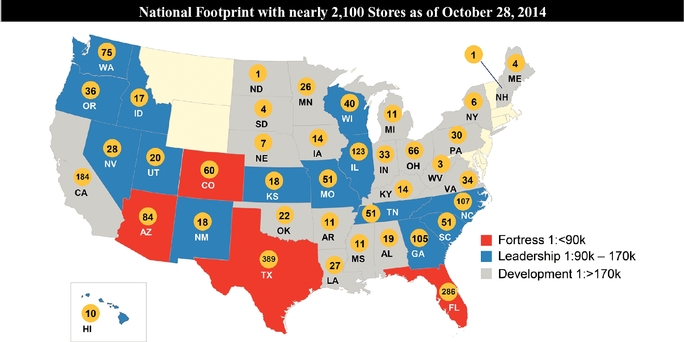

Our Company

We are a leading specialty retailer of mattresses and related products and accessories in the United States. As of October 28, 2014, we and our franchisees operated nearly 2,100 stores, primarily under theMattress Firm® andSleep Train / Sleep Country® brand names, in 76 markets across 40 states. We are the #1 U.S. mattress specialty retailer by store count, sales, year-over-year sales growth and market share according toFurniture Today Top 100, May 2014. We carry an extensive assortment of conventional and specialty mattresses and bedding related products across a wide range of price points. For the last twelve months ended October 28, 2014, total mattress sales represented 90.7% of our total net sales.

We believe that in our markets,Mattress Firm® is a highly recognized brand known for its broad selection, superior service and compelling value proposition. Based on our analysis of public store information, we believe that, within markets where we have operated for more than one year, more than 90% of our company-operated stores are located in markets in which we had the number one market share position as of October 28, 2014. Since our founding in 1986 in Houston, Texas, we have expanded our operations to emerge as the only border to border and coast to coast multi-brand specialty mattress

S-2

Table of Contents

retailer in the United States with net sales of approximately $1.7 billion in fiscal 2013, pro forma for the recent acquisition of The Sleep Train, Inc. ("Sleep Train"). See our pro forma financial statements, included in our Current Report on Form 8-K/A filed with the SEC on December 3, 2014. As adjusted to give further effect to $106.0 million in net sales in fiscal 2013 for Back to Bed and Bedding Experts (according toFurniture Today Top 100, May 2014, and assuming we had owned each of them for the full fiscal 2013) and $169.8 million in net sales for Mattress Firm franchisees in fiscal 2013, we and our franchisees would have had nearly $2 billion in net sales in fiscal 2013.

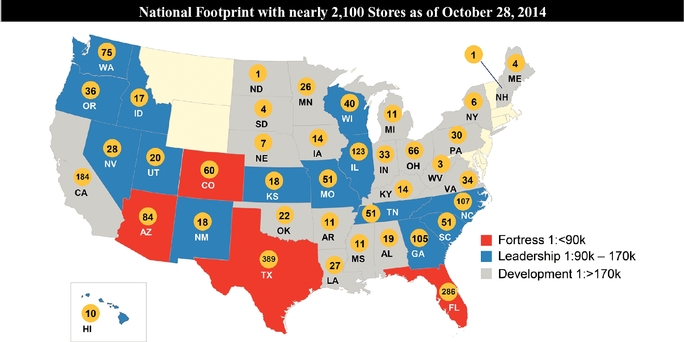

The chart below illustrates the locations and market per capita penetration of our and our franchisees' stores as of October 28, 2014 on a state-by-state basis. We identify states where we have one store per less than 90,000 residents as "Fortress" markets, states where we have one store per 90,000 through 170,000 residents as "Leadership" markets and states where we have one store per greater than 170,000 residents as "Development" markets. The chart below also illustrates our Fortress, Leadership and Development markets.

We believe our destination retail format provides our customers with a convenient, distinctive and enjoyable shopping experience. Our stores carry both a broad assortment of leading national mattress brands and our exclusive brands. With a wide range of styles, sizes, price points and unique features, we provide our customers with their choice of specialty and traditional mattresses from a variety of brands, including Tempur-Pedic (for which we are the largest retailer in the United States according to Tempur-Pedic's public SEC filings), Sealy, Serta, Simmons and Stearns & Foster. We focus on higher average unit price ("AUP") specialty mattresses that use premium support systems, such as latex and memory foam, rather than the steel innerspring coil systems found in traditional mattresses. According to ISPA, specialty mattresses have outgrown traditional mattresses since 2004, growing at a compound annual growth rate ("CAGR") of 9.2% vs. 2.1% for traditional mattresses. Specialty mattresses represented 44% of our 2013 net sales vs. 30% of overall U.S. wholesale mattress net sales in 2013.

We focus on driving profitability in each of the markets in which we operate through a strategy of penetrating a market with stores and leveraging fixed and discretionary costs, such as occupancy and advertising, as we gain sales volume and scale. We have a proven track record of growing our store base through organic new store openings and acquisitions. For example, since November 1, 2011 through October 28, 2014, we more than tripled our store count by adding 1,346 net new stores, which included 962 net stores added through strategic acquisitions.

S-3

Table of Contents

Our Industry

Overall Market

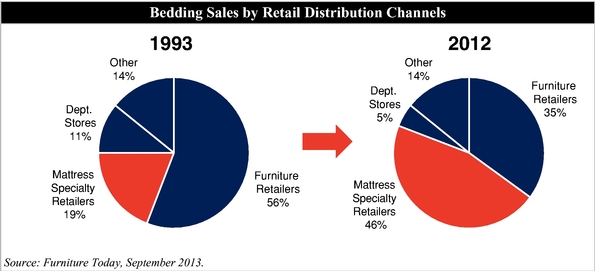

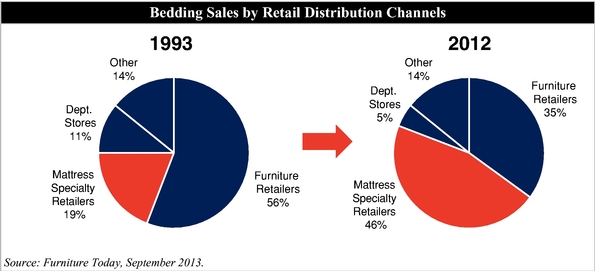

We operate in the large, fragmented and growing U.S. mattress retail market, in which retail sales were approximately $14 billion in 2013. The market is highly fragmented, with no single retailer holding more than an 8% market share in 2013 (other than Mattress Firm, whose market share exceeded 14% in 2013, assuming Sleep Train and Back to Bed had been owned by Mattress Firm for all of 2013). The top eight participants accounted for approximately one third of the total market in 2013. According toFurniture Today, in 2012, mattress specialty retailers had a market share of approximately 46%, which represented the largest share of the market, having more than doubled their percentage share over the past 15 years. According to the information released in October 2014 by ISPA, there is a 4.0% increase expected in the value of mattress shipments in 2014 and a 4.5% expected increase in 2015.

We believe that several trends support the positive outlook for long-term growth of the U.S. mattress retail market:

- •

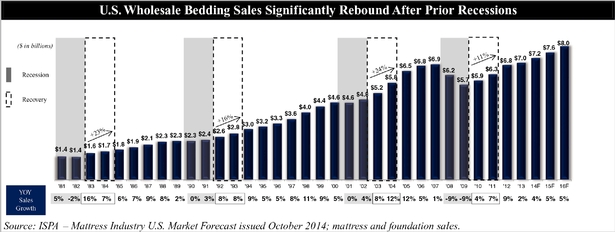

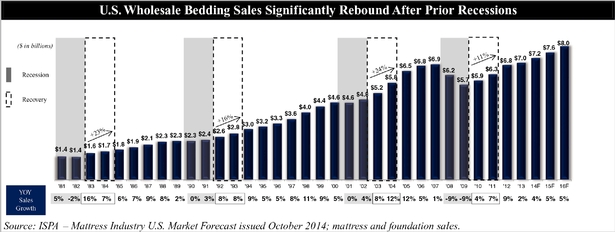

- Large industry with strong growth. The wholesale mattress industry is $7.0 billion in size and grew at a CAGR of 5.2% since 1980. We believe that the typically slow replacement nature of mattress purchases shields the industry over the longer term from much of the volatility experienced in the housing market. As shown in the chart below, mattress sales held steady in three of the four recessionary periods since 1980 and only suffered a decline in the "Great Recession" of 2008 and 2009. Moreover, periods of slower growth have historically been followed by faster growth periods due to pent-up consumer demand that builds from deferred purchases and aging mattresses. After the last four downturns, industry wholesale sales growth increased at rates of 23%, 16%, 24% and 11%, respectively, in the two years following the recessionary period.

- •

- Structural shift towards specialty mattress retailers. We believe the specialty sleep retail channel has gained significant market share at the expense of traditional furniture and department stores because specialty stores carry a wider product selection, have a more knowledgeable sales force and more dedicated floor space. As illustrated in the chart below, specialty sleep retailers have increased their market share from 19% of total retail sales in 1993 to 46% in 2012; over the same period, furniture retailers and department stores have lost market share, declining from 56% to 35%, and 11% to 5%, respectively. Despite the emergence of the mass channel over the last decade, we believe "big box" retailers have not captured significant share of the mattress market as they lack the knowledgeable sales force to sell the product, do not wish to carry a breadth of bulky SKUs and have shown little desire to enter the home delivery business.

S-4

Table of Contents

Further, the Internet channel has gained limited traction, as it is difficult to compare mattress SKUs across different retailers. The Internet remains primarily a research vehicle ("click-to-brick") given the tactile nature of the product.

- •

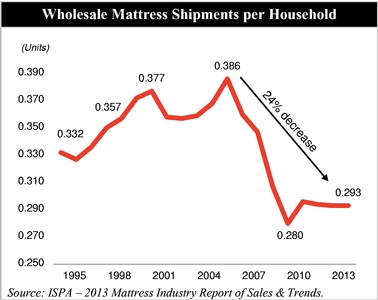

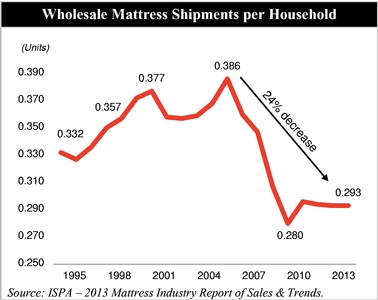

- Significant pent-up demand. Given that the primary driver in the industry is replacement sales and unit volume remains 20% to 24% below its peak in 2005, we believe that there is a large amount of pent-up demand that could provide meaningful upside. Unit growth has been atypical since the last recession as value-focused consumers continue to struggle and manufacturer advertising is below peak levels. Fifty percent of the units in the retail mattress industry are below $500, providing an opportunity for upside when the economy does materially improve for the value-conscious consumer.

- •

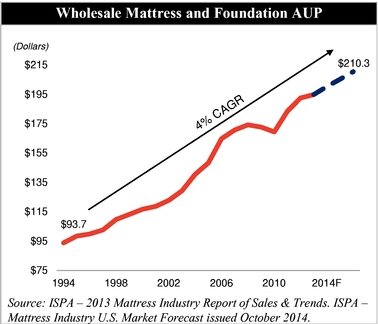

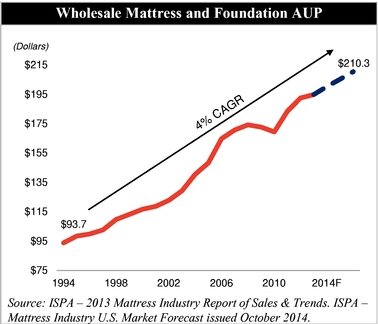

- Consistent increase in average unit price of wholesale shipments. According to ISPA, AUP has increased in 18 of the last 20 years (1994–2013). The industry-wide average prices at wholesale of mattresses and foundations continue to climb, having grown at a CAGR of 3.9% since 1994, based on data published by ISPA, aided by the increase in higher-priced specialty mattress products, technological benefits, manufacturer advertising and a shift towards queen and

S-5

Table of Contents

Overall, AUPs for a wholesale mattress and foundation increased by 1.2% in 2013 when compared with 2012, marking the third consecutive annual increase in unit prices since 2010. As shown in the chart below, industry-wide AUPs are projected to increase by 2.8% in 2014 and by 2.5% in 2015.

Our Competitive Strengths

Although the retail bedding industry in the United States is highly competitive, we believe the following competitive strengths differentiate us from our competitors and favorably position us to execute our growth strategy:

Leading specialty retailer. We believe our proven and effective operating model combines a broad merchandise selection, superior customer service by educated, extensively-trained associates, a compelling value proposition and highly visible and convenient store locations. The key attributes of theMattress Firm® experience include:

- •

- Extensive and differentiated product assortment. We offer a broad assortment of mattresses and related products and accessories, making us a preferred choice for our customers. The breadth of our merchandise offering includes a wide range of comfort choices, styles, sizes and price points. We focus our offering on the best known national brands, providing our customers the choice of both conventional and specialty mattresses. In addition, we also offer ourHampton & Rhodes® private label mattresses (to provide our customers with a broad range of value choices).

S-6

Table of Contents

- •

- Contemporary, easy-to-navigate store layout. Our stores feature a high-energy, casually elegant environment which utilizes a circular, race-track layout to guide the customer through the mattress selection process. Our stores also create a consultative environment, educating the customer on various comfort options before directing them towards the SleepRx® (premium specialty sleep gallery), Value Center (promotional) or Clearance Center (special buys and blemished) sections of our store. We implemented our proprietaryComfort By Color® merchandising approach that groups all of our mattresses into five distinct comfort categories, each represented by its own color, to help simplify the purchasing decision for customers. As our acquired stores adopted theComfort By Color® approach, we have observed favorable customer responses.

- •

- Compelling customer value proposition. Our compelling price and value proposition is a critical element of our merchandising strategy. With our low price guarantee, we promise to beat the lowest competitor-advertised price on a comparable product by 10% at any time up to 100 days after purchase and refund the customer the difference. OurHappiness GuaranteeTM policy enables our customers to return their mattress for a refund within 100 days of purchase if they are not fully satisfied with their product. Our consumer financing options, which are provided by third party financial institutions and are non-recourse to us, are also an important element of our service and value proposition. We believe that these services and guarantees build lasting trust and loyalty with our customers and lead to better ticket average, conversion rates and customer referrals.

- •

- Extensive Customer Service. Our educated, extensively-trained sales associates are required to participate in a comprehensive, on-going training program that we believe exceeds industry standards. We have implemented performance-monitoring programs to ensure that our sales associates are customer-focused and are effectively educating our customers on the various features and benefits of our products. As of October 28, 2014, over 97% of our sales associates were full-time employees, supporting our goal of hiring highly motivated, career-oriented individuals. Our sales associates receive a significant portion of their compensation in the form of commissions, which aligns their goals with those of our company. Another key element of our industry-leading customer service is ourMattress Firm Red Carpet Delivery Service®, through which we offer a three-hour guaranteed delivery window and same-day delivery, which we believe is distinctive in the industry.

- •

- Attractive, highly visible and convenient store locations. We have a dedicated and disciplined real estate team that helps us select store locations that are convenient to our target customers, are generally highly visible from the road and have high impact signage opportunities. A typicalMattress Firm® location is a freestanding or "end-cap" (corner) location in a high-traffic shopping center in a major retail trade area. We believe the quality of our real estate locations, combined with the distinctive and fresh feel of our stores, drives very attractive customer traffic and sales levels.

Attractive new store economic model. Mattress Firm has exceptional new store economics with average cash-on-cash returns in year one in excess of 100% and store payback in less than 12 months due to high inventory turns, strong purchasing leverage and low build-out costs. Given the national footprint of our vendors and the "showroom" nature of our stores, we are able to maintain limited inventory levels both at the store level and at our distribution centers. On average, our stores are fully "ramped" within the first year of opening.

Store 4-wall profitability is measured using store revenues, store product costs and all direct costs of operating our store. We expect our store 4-wall profitability to average approximately 23-27% of net sales inclusive of funds received from vendors upon the opening of a new store.

S-7

Table of Contents

Proven track record of driving profitability with Relative Market Share ("RMS") Model. We strive to grow our market-level profitability by increasing our Relative Market Share (defined as our market share relative to the market share of the top competitor in such market) in a given market primarily through the addition of strategically-located stores. Typically as we increase our RMS in a market, we are able to leverage fixed and discretionary costs such as occupancy and advertising. By doing so, we increase our "share of voice," as measured by per capita advertising spend, driving improved traffic, and higher customer conversion and comparable store net sales in the market. The RMS model also increases leverage over other market-level costs such as recruiting, training, warehouse, delivery, and overhead. We expect the RMS model to drive overall profitability as we continue to increase our store penetration across key markets, gain sales volume, grow brand presence and increase operational scale.

Scale benefits and strong market share position. We believe our scale and strong market share positions provide us with a number of competitive advantages, including:

- •

- Strong supplier relationships. Given our significant scale and the scope of our retail network, we believe we are a very important customer for the leading vendors in the industry. We believe that the strength of our supplier relationships enables us to source our merchandise in a more cost-effective manner than our mattress specialty retailer competitors, as well as receive higher vendor incentives and advertising support. Importantly, we believe that our significant scale gives us priority access to a wide range of styles and sub-brands and enables us to develop and source our proprietary brand cost-effectively.

- •

- Strong landlord relationships. We have developed strong relationships with real estate developers and landlords across the country due to our extensive store network and strong operating performance. We believe that our history and size position us favorably compared to our mattress specialty retailer competitors, as real estate companies prefer to lease to large, well-capitalized and established retailers.

Experienced and invested management team. Our experienced senior management team has extensive experience in the retail and mattress industries. Steve Stagner, our Chief Executive Officer, has over 20 years of experience in the mattress industry and originally was a top-performingMattress Firm® franchisee beforeMattress Firm® purchased his company in December 2004. Dale Carlsen, our President and Chief Strategy Officer, entered the industry in 1980 and founded Sleep Train in 1985. Co-Chief Operating Officer, Ken Murphy, joined Mattress Firm 15 years ago from Sealy and Rob Killgore, Co-Chief Operating Officer, joined Sleep Train in 1986. Each brings experience managing the operations of a large mattress retailer. Executive Vice President and Chief Financial Officer, Alex Weiss, is an experienced finance professional who joined Mattress Firm in September 2013.

We believe our management's breadth of experience in the industry has enabled us to anticipate and respond effectively to industry trends and competitive dynamics while driving superior customer service and cultivating long-standing relationships with our vendors. Following this offering, our directors and executive officers will beneficially own approximately 6.6% (or 6.5% if the underwriter exercises in full its option to purchase additional shares from the selling stockholders) of our equity.

Our Growth Strategies

We seek to enhance our position as the #1 specialty retailer of mattresses and related products and accessories and drive profitable sales growth. To achieve these objectives, we plan on executing the following key strategies:

Expand our company-operated store base. The highly fragmented U.S. retail mattress market provides us with a significant opportunity to expand our store base. From November 1, 2011 to October 28, 2014, we added 1,346 new company-operated stores, including 154 store openings in fiscal 2013, 163 store openings in the nine months ended October 28, 2014, and 962 stores through

S-8

Table of Contents

acquisitions. We plan to continue to expand our store base through a combination of new stores and acquisition opportunities in both existing and new markets. As of fiscal 2013, we achieved an average market penetration rate of oneMattress Firm® store per approximately 100,000 in population. In our most established and profitable markets, we have a higher penetration rate of oneMattress Firm® store per less than 60,000 in population. Based on our assessment of where we believe the market can be penetrated across the United States. We believe we can exceed 2,600 stores within the next three years and we believe we could operate at least 3,500 store locations in both new and existing markets over time. We believe that attractive opportunities in the real estate market will help us execute our expansion strategy.

- •

- Organic growth in new and existing markets. We continually research and survey the geographic landscape and have highlighted several markets with characteristics that we believe are attractive opportunities for market entry or further penetration and growth. We seek to strengthen our relative market share with the goal of achieving the number one position in each of our markets. From November 1, 2011 through October 28, 2014, we averaged approximately 128 store openings per year. Given our highly attractive new store economic model and our improving market level profitability as we continue to open stores, we believe we are well positioned to expand our presence and achieve economies of scale across regions.

- •

- Acquisition opportunities. Making strategic acquisitions is a core component of our growth strategy of increasing penetration in existing markets and entering new markets with high growth potential. Most recently, we acquired the Sleep Train brand portfolio, a leading specialty retailer on the West Coast with 314 retail stores. This acquisition allows our company to achieve immediate scale in West Coast markets and provides the company with a clear runway for growth in the highly populated and attractive West Coast region where we previously had a minimal presence. We have a strong track record over the last decade of supplementing our organic growth through acquisitions by acquiring retail mattress chains on an opportunistic basis and have completed more than 15 acquisitions since 2009. Given our established infrastructure and track record, we believe that we can efficiently acquire retailers, integrate them, implement our operating model and generate synergies.

Increase sales and profitability within our existing network of stores. We have achieved positive comparable-store net sales growth in 16 of the last 19 fiscal quarters. Our strategy is to continue to drive comparable-store net sales growth within our existing portfolio of stores by:

- •

- Increasing customer traffic. Consistent with our expectations, as we have increased our presence in a market and deployed additional marketing, we have seen an increase in customer traffic and sales and have been able to leverage fixed and discretionary costs. We will continue to undertake advertising and marketing initiatives that are aimed at efficiently and effectively improving our customer traffic.

- •

- Improving customer conversion. We will continue to focus on the training of our sales associates, who are our primary points of contact with our customers. In addition, we continually strive to improve our merchandising approach so that the customer shopping experience is optimized.

- •

- Increasing the average sales price of a transaction. Through effective sales techniques and the increasing demand for specialty mattresses, we expect the average price of a customer transaction to increase over time. We have strategically focused and built a strong market position in the specialty mattress category, which represented approximately 30% of bedding sales in the U.S. in 2012, but represented approximately 44% of our total net sales in fiscal 2013. As such, we believe that we are well positioned to capture increasing sales and profitability as the specialty mattresses continue to gain share.

S-9

Table of Contents

Sleep Train Acquisition

On October 20, 2014, we completed our acquisition of Sleep Train, a leading West Coast based bedding specialty retailer. Sleep Train and its subsidiaries operate over 314 specialty mattress retail stores located in California, Oregon, Washington, Idaho, Nevada and Hawaii. We believe that the acquisition of Sleep Train will meaningfully enhance Mattress Firm's position within the specialty retail bedding industry by creating the first border to border and coast to coast multi-brand mattress specialty retailer in the United States, with nearly 2,100 retail stores and net sales of approximately $1.7 billion in fiscal 2013, pro forma for the recent acquisition of Sleep Train. See our pro forma financial statements, included in our Current Report on Form 8-K/A filed with the SEC on December 3, 2014. As adjusted to give further effect to $106.0 million in net sales in fiscal 2013 for Back to Bed and Bedding Experts (according toFurniture Today Top 100, May 2014, and assuming we had owned each of them for the full fiscal 2013) and $169.8 million in net sales for Mattress Firm franchisees in fiscal 2013, we and our franchisees would have had nearly $2 billion in net sales in fiscal 2013.

We believe there is a compelling strategic rationale for the acquisition of Sleep Train:

- •

- Provides instant leadership position in the West Coast, including in key strategic markets

- •

- Fortifies Mattress Firm as the leading mattress specialty retailer in the United States

- •

- Generates significant synergistic opportunities

- •

- Provides a platform whereby we can implement our RMS model on the West Coast

- •

- Creates opportunity to begin leveraging national scale benefits

- •

- Adds high-volume, established locations with a strong and experienced leadership team

Corporate Information

Mattress Firm Holding Corp. was incorporated in Delaware on January 5, 2007 and commenced operations on January 18, 2007 through the acquisition of Mattress Holding Corp., or "Mattress Holding." Mattress Holding acquired the Mattress Firm® retail operations on October 18, 2002 and, together with its subsidiaries, owns substantially all of the assets and conducts the operations of our retail business. Mattress Firm commenced operations in 1986 through a predecessor entity.

Our principal executive offices are located at 5815 Gulf Freeway, Houston, TX 77023 and our telephone number at that address is (713) 923-1090. Our internet address iswww.mattressfirm.com. Please note that any references towww.mattressfirm.com in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein are inactive references only. Other than the documents specifically incorporated by reference herein, the information contained or referred to on, or otherwise accessible through, our website, is not incorporated by reference or otherwise part of this prospectus supplement.

S-10

Table of Contents

The Offering

| | |

Common stock offered by the selling stockholders | | 2,185,130 shares |

Selling stockholders | | The selling stockholders in this offering include (i) funds associated with J.W. Childs Associates, L.P., which collectively beneficially owned approximately 46.9% of our outstanding common stock as of November 30, 2014 and are affiliated with directors of our company; and (ii) certain directors and members of management or affiliates thereof. See "Selling Stockholders." |

Common stock subject to the underwriter's option | | 327,769 |

Common stock outstanding as of November 30, 2014(1) | | 35,017,602 shares |

Use of proceeds | | All of the shares of common stock being offered under this prospectus supplement are being sold by the selling stockholders. Accordingly, we will not receive any proceeds from the sale of shares by the selling stockholders. See "Use of Proceeds." |

NASDAQ Global Select Market symbol | | "MFRM" |

Risk factors | | You should read the "Risk Factors" sections in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein for a discussion of the factors to consider carefully before deciding to purchase any shares of our common stock. |

Certain U.S. federal income and estate tax considerations for non-U.S. holders of common stock | | For a discussion of certain U.S. federal income and estate tax considerations that may be relevant to certain Non-U.S. Holders (as defined therein), please read "Certain U.S. Federal Income and Estate Tax Considerations for Non-U.S. Holders of Shares of Our Common Stock" beginning on page S-22. |

- (1)

- The number of shares of our common stock outstanding as of November 30, 2014 excludes:

- •

- 1,006,274 shares of common stock issuable upon the exercise of options as of November 30, 2014, with exercise prices ranging from $19.00 to $57.05 per share and a weighted average exercise price of $23.50 per share;

- •

- 349,056 shares of restricted stock subject to future vesting requirements as of November 30, 2014; and

- •

- 2,321,252 additional shares of common stock reserved for future grants under our 2011 Omnibus Incentive Plan, or "Omnibus Plan," as of November 30, 2014.

S-11

Table of Contents

Summary Historical Consolidated Financial Information

The following table presents our summary historical consolidated financial and operating data for the periods and as of the dates indicated. You should read these tables along with our consolidated financial statements and related notes thereto included in our Annual Report on Form 10-K for the fiscal year ended January 28, 2014, as updated by our subsequent filings under the Exchange Act, including the section titled "Management's Discussion and Analysis of Financial Condition and Results of Operations" included in our quarterly report on Form 10-Q for the quarterly period ended October 28, 2014, incorporated by reference into this prospectus supplement and the accompanying prospectus. Historical results are not necessarily indicative of the results of operations expected for future periods. The consolidated financial and operations data for fiscal 2011, fiscal 2012 and fiscal 2013 are derived from our audited consolidated financial statements, which are included in our most recent Annual Report on Form 10-K, and are incorporated by reference herein. The consolidated financial and operations data for the thirty-nine weeks ended October 29, 2013 and October 28, 2014 are derived from our unaudited consolidated financial statements, which are included in our most recent Quarterly Report on Form 10-Q, and are incorporated by reference herein.

S-12

Table of Contents

| | | | | | | | | | | | | | | | |

| |

| |

| |

| | Thirty-Nine Weeks Ended | |

|---|

| | Fiscal Year | |

|---|

| | October 29,

2013 | | October 28,

2014 | |

|---|

| | 2011 | | 2012 | | 2013 | |

|---|

| |

| |

| |

| | (unaudited)

| |

|---|

| | (dollar amounts in thousands, except per share data)

| |

|---|

Statement of Operations: | | | | | | | | | | | | | | | | |

Net sales | | $ | 703,910 | | $ | 1,007,337 | | $ | 1,216,812 | | $ | 904,731 | | $ | 1,207,731 | |

Cost of sales | | | 428,018 | | | 614,572 | | | 751,487 | | | 553,878 | | | 740,522 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Gross profit from retail operations | | | 275,892 | | | 392,765 | | | 465,325 | | | 350,853 | | | 467,209 | |

Franchise fees and royalty income | | | 4,697 | | | 5,396 | | | 5,617 | | | 4,342 | | | 3,516 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | 280,589 | | | 398,161 | | | 470,942 | | | 355,195 | | | 470,725 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Sales and marketing expenses | | | 167,605 | | | 245,555 | | | 289,533 | | | 214,104 | | | 285,295 | |

General and administrative expenses | | | 51,684 | | | 73,640 | | | 82,964 | | | 60,143 | | | 110,358 | |

Intangible asset impairment change | | | — | | | 2,100 | | | — | | | — | | | — | |

Loss on store closings and impairment of store assets | | | 759 | | | 1,050 | | | 1,499 | | | 739 | | | 1,039 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Total operating expenses | | | 220,048 | | | 322,345 | | | 373,996 | | | 274,986 | | | 396,692 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Income from operations | | | 60,541 | | | 75,816 | | | 96,946 | | | 80,209 | | | 74,033 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Interest expense, net | | | 29,301 | | | 9,247 | | | 10,864 | | | 8,185 | | | 10,352 | |

Loss from debt extinguishment | | | 5,704 | | | — | | | — | | | — | | | 2,288 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | 35,005 | | | 9,247 | | | 10,864 | | | 8,185 | | | 12,640 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Income before income taxes | | | 25,536 | | | 66,569 | | | 86,082 | | | 72,024 | | | 61,393 | |

Income tax expense (benefit) | | | (8,815 | ) | | 26,698 | | | 33,158 | | | 27,756 | | | 23,762 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Net income | | $ | 34,351 | | $ | 39,871 | | $ | 52,924 | | $ | 44,268 | | $ | 37,631 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

Per Share Data: | | | | | | | | | | | | | | | | |

Basic net income per common share | | $ | 1.40 | | $ | 1.18 | | $ | 1.56 | | $ | 1.31 | | $ | 1.10 | |

Diluted net income per common share | | $ | 1.40 | | $ | 1.18 | | $ | 1.55 | | $ | 1.30 | | $ | 1.09 | |

As adjusted basic net income per common share | | $ | 1.40 | | $ | 1.49 | | $ | 1.67 | | $ | 1.37 | | $ | 1.64 | |

As adjusted diluted net income per common share | | $ | 1.40 | | $ | 1.49 | | $ | 1.66 | | $ | 1.36 | | $ | 1.62 | |

Basic weighted average shares outstanding | | | 24,586,274 | | | 33,770,779 | | | 33,870,461 | | | 33,848,032 | | | 34,149,531 | |

Diluted weighted average shares outstanding | | | 24,586,274 | | | 33,853,276 | | | 34,131,456 | | | 34,073,307 | | | 34,562,374 | |

S-13

Table of Contents

RISK FACTORS

An investment in our common stock involves substantial risk. See "Item 1A—Risk Factors" in our most recent Annual Report on Form 10-K and in any subsequent Quarterly Reports on Form 10-Q incorporated by reference into this prospectus supplement, including our most recent Quarterly Report on Form 10-Q, and the "Risk Factors" section in the accompanying prospectus, in addition to the other information contained in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein, for a discussion of the factors you should carefully consider before deciding to purchase shares of our common stock. These risks are those that we believe are the material risks that we face. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment in our common stock.

Risks Related to this Offering and Our Stock

Our stock price could be extremely volatile and, as a result, you may not be able to resell your shares at or above the price you paid for them.

Since our initial public offering in November 2011 through December 9, 2014, the price of our common stock, as reported by the NASDAQ Global Select Market, has ranged from a low of $21.03 on November 21, 2011 to a high of $71.82 on November 18, 2014. In addition, the stock market in general, and the market for stocks of some specialty retailers in particular, has been highly volatile in recent years. As a result, the market price of our common stock is likely to be similarly volatile, and investors in our common stock may experience a decrease, which could be substantial, in the value of their stock, including decreases unrelated to our operating performance or prospects, and could lose part or all of their investment. The price of our common stock could be subject to wide fluctuations in response to a number of factors, including those described elsewhere in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein and others such as:

- •

- variations in our operating performance and the performance of our competitors;

- •

- actual or anticipated fluctuations in our quarterly or annual operating results;

- •

- changes in our net sales, comparable-store sales or earnings estimates or recommendations by securities analysts;

- •

- publication of research reports by securities analysts about us or our competitors or our industry;

- •

- our failure or the failure of our competitors or vendors to meet analysts' projections or guidance that we or our competitors or vendors may give to the market;

- •

- additions and departures of key personnel;

- •

- strategic decisions by us or our competitors or vendors, such as acquisitions, divestitures, spin-offs, joint ventures, strategic investments or changes in business strategy;

- •

- the passage of legislation or other regulatory developments affecting us or our industry;

- •

- equity issuances by us, or share resales by our stockholders, or the perception that such issuances or resales may occur;

- •

- price and volume fluctuations in the overall stock market from time to time;

- •

- speculation in the press or investment community;

- •

- changes in accounting principles or actual or anticipated accounting problems;

- •

- terrorist acts, acts of war or periods of widespread civil unrest; and

- •

- changes in general market and economic conditions.

S-14

Table of Contents

As we are a specialty retailer in a single industry, we are especially vulnerable to these factors to the extent that they affect our industry or our products, or to a lesser extent our markets. Other retailers with more diversified product offerings may not be similarly at risk. For example, department stores that experience adverse developments regarding their bedding products may be better able to absorb the adverse effects. In the past, securities class action litigation has often been initiated against companies following periods of volatility in their stock price. This type of litigation could result in substantial costs and divert our management's attention and resources, and could also require us to make substantial payments to satisfy judgments or to settle litigation.

Because we have no current plans to pay cash dividends on our common stock for the foreseeable future, you may not receive any return on investment unless you sell your common stock for a price greater than that which you paid for it.

We may retain future earnings, if any, for future operations, expansion and debt repayment and have no current plans to pay any cash dividends for the foreseeable future. Any decision to declare and pay dividends in the future will be made at the discretion of our board of directors and will depend on, among other things, our results of operations, financial condition, cash requirements, contractual restrictions and other factors that our board of directors may deem relevant. In addition, our ability to pay dividends may be limited by covenants of any existing and future outstanding indebtedness we or our subsidiaries incur. As a result, you may not receive any return on an investment in our common stock unless you sell our common stock for a price greater than that which you paid for it.

We may fail to meet publicly announced financial guidance or other expectations about our business, which could cause our stock to decline in value.

We typically provide forward looking financial guidance when we announce our financial results from the prior quarter. We undertake no obligation to update such guidance at any time. There are a number of reasons why we might fail to meet financial guidance and other expectations about our business, including, but not limited to, factors described herein in other risk factors. If we fail to meet such financial guidance and other expectations, our stock could decline in value.

There may be sales of a substantial amount of our common stock after this offering by our current stockholders, and these sales could cause the price of our common stock to fall.

As of November 30, 2014, there were 35,017,602 shares of common stock outstanding. Following the completion of this offering, approximately 42.4% and 6.6% of our outstanding common stock (or 41.5% and 6.5% if the underwriter exercises in full its option to purchase additional shares from the selling stockholders) will be held by funds or individuals associated with J.W. Childs and our directors and executive officers, respectively.

We expect that the selling stockholders and certain of our executive officers will enter into a lock-up agreement with the underwriter, which regulates their sales of our common stock for a period of 60 days after the date of this prospectus supplement, subject to certain exceptions and automatic extensions in certain circumstances.

Sales of substantial amounts of our common stock in the public market after this offering, or the perception that such sales will occur, could adversely affect the market price of our common stock and make it difficult for us to raise funds through securities offerings in the future. The shares offered by this prospectus supplement will be eligible for immediate sale in the public market without restriction by persons other than our affiliates.

In addition, as of November 30, 2014, subject to certain exceptions and restrictions, holders of 16,423,288 shares of our common stock may require us to register their shares for resale under the federal securities laws in the future, and holders of 2,364,090 additional shares of our common stock

S-15

Table of Contents

would be entitled to have their shares included in any such registration statement, all subject to reduction upon the request of the underwriter of the offering, if any.

Provisions in our charter documents and Delaware law may deter takeover efforts that you feel would be beneficial to stockholder value.

Our certificate of incorporation and bylaws and Delaware law contain provisions which could make it harder for a third party to acquire us, even if doing so might be beneficial to our stockholders. These provisions include a classified board of directors and limitations on actions by our stockholders. In addition, our board of directors has the right to issue preferred stock without stockholder approval that could be used to dilute a potential hostile acquirer. Delaware law also imposes some restrictions on mergers and other business combinations between us and any holder of 15% or more of our outstanding common stock. As a result, you may lose your ability to sell your stock for a price in excess of the prevailing market price due to these protective measures and efforts by stockholders to change the direction or management of the company may be unsuccessful. See "Description of Securities" in the accompanying prospectus for additional information.

You may experience future dilution as a result of future securities issuances.

To the extent we issue securities in the future, including shares of our common stock or other securities convertible into or exchangeable for shares of our common stock, to raise capital, as consideration in future acquisitions or otherwise, our stockholders may experience substantial dilution. In addition, you may experience additional dilution upon (i) the exercise of any outstanding and future grants of options and warrants to purchase our common stock and (ii) future grants of restricted stock or other equity awards under our stock incentive plans, including our Omnibus Plan.

We cannot assure you that we will be able to sell shares or other securities in any other offering at a price per share that is equal to or greater than the price per share paid by investors in this offering. Furthermore, investors purchasing shares or other securities in the future could have rights, preferences or privileges senior to those of existing stockholders and you may experience dilution. Because our decision to issue additional equity or debt securities in any future offering will depend on market conditions and other factors beyond our control, we cannot predict or estimate the amount, timing or nature of our future issuances, if any.

S-16

Table of Contents

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein include statements that express our opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results and therefore are, or may be deemed to be, "forward-looking statements" within the meaning of Section 27A of the Securities Act. These forward-looking statements can generally be identified by the use of forward-looking terminology, including the terms "believes," "estimates," "anticipates," "expects," "feels," "seeks," "forecasts," "projects," "predicts," "intends," "potential," "continue," "plans," "may," "will," "should," "could" or "would" or, in each case, their negative or other variations or comparable terminology. These forward-looking statements include all matters that are not historical facts. They appear in a number of places throughout these documents and include statements regarding our intentions, beliefs or current expectations concerning, among other things, our results of operations, financial condition, liquidity, prospects, growth, strategies and the industry in which we operate.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. Although we base these forward-looking statements on assumptions that we believe are reasonable when made, we caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and industry developments may differ materially from statements made in or suggested by the forward-looking statements contained in this prospectus supplement. In addition, even if our results of operations, financial condition and liquidity and industry developments are consistent with the forward-looking statements contained in this prospectus supplement, those results or developments may not be indicative of results or developments in subsequent periods. Important factors that could cause actual results to differ materially from statements made or suggested by forward-looking statements include, but are not limited to, those referred to in the "Risk Factors" section of this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein, and the following:

- •

- a reduction in discretionary spending by consumers;

- •

- our ability to profitably open and operate new stores;

- •

- our intent to aggressively open additional stores in our existing markets;

- •

- our relationship with certain mattress manufacturers as our primary suppliers;

- •

- our dependence on a few key employees;

- •

- the possible impairment of our goodwill or other acquired intangible assets;

- •

- the effect of our planned growth and the integration of our acquisitions on our business infrastructure;

- •

- the impact of seasonality on our financial results and comparable-store sales;

- •

- fluctuations in our comparable-store sales from quarter to quarter;

- •

- our ability to raise adequate capital to support our expansion strategy;

- •

- our future expansion into new, unfamiliar markets;

- •

- our success in pursuing strategic acquisitions;

- •

- the effectiveness and efficiency of our advertising expenditures;

- •

- our success in keeping warranty claims and comfort exchange return rates within acceptable levels;

S-17

Table of Contents

- •

- our ability to deliver our products in a timely manner;

- •

- our status as a holding company with no business operations;

- •

- our ability to anticipate consumer trends;

- •

- heightened competition;

- •

- changes in applicable regulations;

- •

- risks related to our franchises, including our lack of control over their operations, their ability to finance and open new stores and our liabilities if they default on note or lease obligations;

- •

- risks related to our stock; and

- •

- other factors, including those discussed under the "Risk Factors" section of this prospectus supplement and in the accompanying prospectus, and in "Item 1A—Risk Factors" of Part I of our most recent Annual Report on Form 10-K and Part II of our most recent Quarterly Report on Form 10-Q, and elsewhere and in our other filings with the SEC.

In light of these risks and uncertainties, we caution you not to place undue reliance on these forward-looking statements. Any forward-looking statement that we make in this prospectus supplement, the accompanying prospectus or the documents incorporated by reference herein or therein speaks only as of the date of such statement, and we undertake no obligation to update any forward-looking statement or to publicly announce the results of any revision to any of those statements to reflect future events or developments, except as required by law. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless specifically expressed as such, and should only be viewed as historical data.

S-18

Table of Contents

USE OF PROCEEDS

We will not receive any proceeds from the sale of shares of our common stock by the selling stockholders.

The selling stockholders in this offering include (i) funds associated with J.W. Childs Associates L.P., which collectively beneficially owned approximately 46.9% of our outstanding common stock as of November 30, 2014 and are affiliated with directors of our company and (ii) certain directors and members of management or affiliates thereof. See "Selling Stockholders."

S-19

Table of Contents

DIVIDEND POLICY

We have not paid cash dividends since our acquisition by investment funds associated with J.W. Childs Associates, L.P. in fiscal 2006. We anticipate that we will retain future earnings, if any, to finance the continued development and expansion of our business. We do not anticipate paying cash dividends in the foreseeable future. Additionally, because we are a holding company, our ability to pay dividends is limited by the ability of our subsidiaries to pay dividends or make distributions to us, including restrictions under agreements governing our indebtedness outstanding from time to time. Any future determination with respect to the payment of dividends will be at the discretion of our board of directors and will be dependent upon, among other things, our financial condition, results of operations, capital requirements, the terms of our then existing indebtedness, general economic conditions and other factors considered relevant by our board of directors.

S-20

Table of Contents

SELLING STOCKHOLDERS

As of November 30, 2014, there were 35,017,602 shares of our common stock outstanding. The following table sets forth information regarding beneficial ownership, as of November 30, 2014, of outstanding shares of our common stock, par value $0.01 per share, by the selling stockholders.

Unless otherwise indicated below, the address for each selling stockholder is 5815 Gulf Freeway, Houston, Texas, 77023. Beneficial ownership has been determined in accordance with the applicable rules and regulations promulgated under the Securities Exchange Act of 1934, as amended, or the "Exchange Act." To our knowledge, except under applicable community property laws or as otherwise indicated, the persons named in the table have sole voting and sole investment control with respect to all shares shown as beneficially owned. The selling stockholders have granted the underwriter an option exercisable for 30 days after the date of this prospectus supplement, to purchase, from time to time, in whole or in part, up to an aggregate of 327,769 shares from the selling stockholders at the public offering price less underwriting discounts and commissions.

| | | | | | | | | | | | | | | | |

| | Common Stock

Beneficially Owned

Before Offering | | Common

Stock

Offered

Hereby

(no option

exercise) | | Common Stock

Beneficially Owned

After Offering

(no option

exercise) | |

|---|

Name of Selling Stockholder | | # | | % | | # | | # | | % | |

|---|

Investment funds associated with J.W. Childs(1) | | | 16,423,288 | | | 46.9 | % | | 1,953,096 | | | 14,470,192 | | | 41.3 | % |

John W. Childs 2013 Charitable Remainder Trust(2) | | | 421,452 | | | 1.2 | % | | 50,121 | | | 371,331 | | | 1.1 | % |

R. Stephen Stagner, Director and CEO(3) | | | 1,389,686 | | | 4.0 | % | | 173,913 | | | 1,215,773 | | | 3.5 | % |

Frederick C. Tinsey III, Director | | | 27,333 | | | * | | | 8,000 | | | 19,333 | | | * | |

- *

- Indicates beneficial ownership of less than 1%

- (1)

- As reflected on the Form 4/A filed with the Securities and Exchange Commission on January 7, 2014. Represents (i) 16,099,426 shares are indirectly owned by Winter Street Opportunity Fund, L.P. a Delaware limited partnership, whose general partner is J.W. Childs Advisors III, L.P., and (ii) 323,862 shares are indirectly owned by JWC Fund III Co-Invest, LLC, a Delaware limited liability company, whose managing member is J.W. Childs Associates, L.P. J.W. Childs Equity Partners III, L.P. and JWC Fund III Co-Invest, LLC hold their interest in the shares through JWC Mattress Holdings, LLC. J.W. Childs Associates, Inc. has voting and investment control of each of J.W. Childs Equity Partners III, L.P. and JWC Fund III Co-Invest, LLC and also manages JWC Mattress Holdings, LLC and, as a result, may be deemed to have indirect beneficial ownership of the securities held by JWC Mattress Holdings, LLC. Each of the J.W. Childs entities referenced above disclaims beneficial ownership of any securities other than the securities directly held by such entity. The business address for each of the J.W. Childs entities is 1000 Winter Street, Suite 4300, Waltham, MA 02451.

- (2)

- As reflected in on the Form 4/A filed by John W. Childs with the Securities and Exchange Commission on April 9, 2014. John W. Childs is a director of the Company and is the sole trustee of the John W. Childs 2013 Charitable Remainder Trust and retains voting rights over the trust. The address for the trust is 1000 Winter Street, Suite 4300, Watham, MA 02451.

- (3)

- Includes unexercised options to purchase an aggregate of 123,288 shares of the Company's common stock that vested on November 17, 2012, November 17, 2013, September 4, 2014 and November 17, 2014.

S-21

Table of Contents

CERTAIN U.S. FEDERAL INCOME AND ESTATE TAX CONSIDERATIONS FOR NON-U.S.

HOLDERS OF SHARES OF OUR COMMON STOCK

The following is a summary of certain U.S. federal income and estate tax considerations relating to the purchase, ownership and disposition of shares of our common stock by Non-U.S. Holders (defined below). This summary does not purport to be a complete analysis of all the potential tax considerations relevant to Non-U.S. Holders of shares of our common stock. This summary is based upon the Internal Revenue Code of 1986, as amended (the "Internal Revenue Code"), the Treasury regulations promulgated or proposed thereunder and administrative and judicial interpretations thereof, all as of the date hereof and all of which are subject to change at any time, possibly on a retroactive basis. There can be no assurance that the Internal Revenue Service ("IRS") will not challenge one or more of the tax consequences described herein, and we have not obtained, nor do we intend to obtain, a ruling from the IRS or an opinion of counsel with respect to the U.S. federal income or estate tax consequences to a Non-U.S. Holder of the purchase, ownership or disposition of shares of our common stock.

This summary assumes that shares of our common stock are held by a Non-U.S. Holder as "capital assets" within the meaning of Section 1221 of the Internal Revenue Code. This summary does not purport to deal with all aspects of U.S. federal income and estate taxation that might be relevant to particular Non-U.S. Holders in light of their particular investment circumstances or status, nor does it address specific tax considerations that may be relevant to particular persons who are subject to special treatment under U.S. federal income tax laws (including, for example, financial institutions, broker-dealers, insurance companies, partnerships or other pass-through entities, U.S. expatriates or former long-term residents of the United States, tax-exempt organizations, pension plans, "controlled foreign corporations," "passive foreign investment companies," corporations that accumulate earnings to avoid U.S. federal income tax, persons in special situations, such as those who have elected to mark securities to market or those who hold shares of our common stock as part of a straddle, hedge, conversion transaction, synthetic security or other integrated investment, persons that have a "functional currency" other than the U.S. dollar, or holders subject to the alternative minimum tax or the Medicare contribution tax). In addition, this summary does not address certain estate and any gift tax considerations or considerations arising under the tax laws of any state, local or non-U.S. jurisdiction.

For purposes of this summary, a "Non-U.S. Holder" means a beneficial owner of shares of our common stock that, for U.S. federal income tax purposes, is an individual, corporation, estate or trust other than:

- •

- an individual who is a citizen or resident of the United States;

- •

- a corporation, or any other organization taxable as a corporation for U.S. federal income tax purposes, that is created or organized in or under the laws of the United States, any state thereof or the District of Columbia;

- •

- an estate, the income of which is included in gross income for U.S. federal income tax purposes regardless of its source; or

- •

- a trust if (1) a U.S. court is able to exercise primary supervision over the trust's administration and one or more United States persons (as defined in the Internal Revenue Code) have the authority to control all of the trust's substantial decisions or (2) the trust has a valid election in effect under applicable U.S. Treasury regulations to be treated as a United States person.

If an entity that is classified as a partnership for U.S. federal income tax purposes holds shares of our common stock, the tax treatment of persons treated as its partners for U.S. federal income tax purposes will generally depend upon the status of the partner and the activities of the partnership. Partnerships and other entities that are classified as partnerships for U.S. federal income tax purposes

S-22

Table of Contents

(and persons who are partners of such partnerships or other entities) holding shares of our common stock are urged to consult their own tax advisors.

A modified definition of Non-U.S. Holder applies for U.S. federal estate tax purposes (as discussed below).

THIS SUMMARY IS FOR GENERAL INFORMATION ONLY AND IS NOT INTENDED TO BE TAX ADVICE. PROSPECTIVE INVESTORS ARE URGED TO CONSULT THEIR OWN TAX ADVISORS CONCERNING THE U.S. FEDERAL INCOME AND ESTATE TAXATION, STATE, LOCAL AND NON-U.S. TAXATION AND OTHER TAX CONSEQUENCES TO THEM OF THE PURCHASE, OWNERSHIP AND DISPOSITION OF SHARES OF OUR COMMON STOCK, AS WELL AS THE APPLICATION OF STATE, LOCAL AND NON-U.S. INCOME AND OTHER TAX LAWS.

Distributions on Shares of Our Common Stock

As discussed under "Dividend Policy" above, we do not currently anticipate paying cash dividends on shares of our common stock in the foreseeable future. In the event that we do make a distribution of cash or property with respect to shares of our common stock, any such distributions generally will constitute dividends for U.S. federal income tax purposes to the extent of our current or accumulated earnings and profits, as determined under U.S. federal income tax principles and will be subject to withholding as described in the next paragraph below. If a distribution exceeds our current or accumulated earnings and profits, the excess will be treated as a tax-free return of the Non-U.S. Holder's investment, up to such holder's adjusted tax basis in its shares of our common stock (determined on a share-by-share basis). Any remaining excess will be treated as capital gain, subject to the tax treatment described below in "Gain on Sale, Exchange or Other Taxable Disposition of Our Common Stock." Any distribution described in this paragraph would also be subject to the discussion below in "Additional Withholding and Information Reporting Requirements for Shares of Our Common Stock Held By or Through Foreign Entities."

Any dividends paid to a Non-U.S. Holder with respect to shares of our common stock generally will be subject to a 30% U.S. federal withholding tax unless such Non-U.S. Holder provides us or our agent, as the case may be, with an appropriate IRS Form W-8 prior to the payment of dividends, such as:

- •

- IRS Form W-8BEN or W-8BEN-E (or successor forms) certifying, under penalties of perjury, that such Non-U.S. Holder is entitled to a reduction in withholding under an applicable income tax treaty, or

- •

- IRS Form W-8ECI (or successor form) certifying, under penalties of perjury, that a dividend paid on shares of our common stock is not subject to withholding tax because it is effectively connected with the conduct of a trade or business in the United States of the Non-U.S. Holder (in which case such dividend generally will be subject to regular graduated U.S. federal income tax rates on a net income basis as described below).

The certification requirement described above also may require a Non-U.S. Holder that provides an IRS form or that claims treaty benefits to provide its U.S. taxpayer identification number.

Each Non-U.S. Holder is urged to consult its own tax advisor about the specific methods for satisfying these requirements. A claim for exemption will not be valid if the person receiving the applicable form has actual knowledge or reason to know that the statements on the form are false.

If dividends are effectively connected with the conduct of a trade or business in the United States of the Non-U.S. Holder (and, if required by an applicable income tax treaty, are attributable to a permanent establishment or fixed base maintained by such Non-U.S. Holder in the United States), the

S-23

Table of Contents

Non-U.S. Holder, although exempt from the withholding tax described above (provided that the certifications described above are satisfied), will generally be subject to U.S. federal income tax on such dividends on a net income basis in the same manner as if it were a resident of the United States. In addition, if such Non-U.S. Holder is taxable as a corporation for U.S. federal income tax purposes, such Non-U.S. Holder may be subject to an additional "branch profits tax" equal to 30% of its effectively connected earnings and profits for the taxable year, unless an applicable income tax treaty provides otherwise.

If a Non-U.S. Holder is eligible for a reduced rate of U.S. federal withholding tax pursuant to an applicable income tax treaty, such holder may obtain a refund or credit of any excess amount withheld by timely filing an appropriate claim for refund with the IRS.

Gain on Sale, Exchange or Other Taxable Disposition of Shares of Our Common Stock

Subject to the discussion below under "Additional Withholding and Information Reporting Requirements for Shares of Our Common Stock Held By or Through Foreign Entities," in general, a Non-U.S. Holder will not be subject to U.S. federal income tax or withholding tax on any gain realized upon such holder's sale, exchange or other taxable disposition of shares of our common stock unless (i) such Non-U.S. Holder is an individual who is present in the United States for 183 days or more in the taxable year of disposition, and certain other conditions are met, (ii) we are or have been a "United States real property holding corporation," as defined in the Internal Revenue Code (a "USRPHC"), at any time within the shorter of the five-year period preceding the disposition and the Non-U.S. Holder's holding period with respect to the applicable shares of our common stock (the "relevant period"), or (iii) such gain is effectively connected with the conduct by such Non-U.S. Holder of a trade or business in the United States (and, if required by an applicable income tax treaty, is attributable to a permanent establishment or fixed base maintained by such Non-U.S. Holder in the United States).

If the first exception applies, the Non-U.S. Holder generally will be subject to U.S. federal income tax at a rate of 30% (unless an applicable income tax treaty provides otherwise) on the amount by which such Non-U.S. Holder's capital gains allocable to U.S. sources exceed capital losses allocable to U.S. sources during the taxable year of the disposition.

With respect to the second exception above, although there can be no assurance, we believe we are not, and we do not currently anticipate becoming, a USRPHC. However, because the determination of whether we are a USRPHC depends on the fair market value of our U.S. real property relative to the fair market value of other business assets, there can be no assurance that we are not currently or will not become a USRPHC in the future. Generally, a corporation is a USRPHC only if the fair market value of its United States real property interests (as defined in the Internal Revenue Code) equals or exceeds 50% of the sum of the fair market value of its worldwide real property interests plus certain other assets used or held for use in a trade or business. Even if we are or become a USRPHC, a Non-U.S. Holder would not be subject to U.S. federal income tax on a sale, exchange or other taxable disposition of our common stock by reason of our status as a USRPHC so long as (i) our common stock continues to be regularly traded on an established securities market (within the meaning of Internal Revenue Code Section 897(c)(3)) during the calendar year in which such sale, exchange or other taxable disposition of our common stock occurs and (ii) such Non-U.S. Holder does not own and is not deemed to own (directly, indirectly or constructively) more than 5% of our common stock at any time during the relevant period. If we are a USRPHC and the requirements of (i) or (ii) are not met, gain on the disposition of shares of our common stock generally will be taxed in the same manner as gain that is effectively connected with the conduct of a U.S. trade or business, except that the "branch profits tax" will not apply.

S-24

Table of Contents

If the third exception applies, the Non-U.S. Holder generally will be subject to U.S. federal income tax on a net income basis with respect to such gain in the same manner as if such holder were a resident of the United States, unless otherwise provided in an applicable income tax treaty, and a Non-U.S. Holder that is a corporation for U.S. federal income tax purposes may also be subject to a "branch profits tax" with respect to such gain at a rate of 30%, unless an applicable income tax treaty provides otherwise.

Additional Withholding and Information Reporting Requirements for Shares of Our Common Stock Held By or Through Foreign Entities