UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________________________________________________

FORM 6-K

___________________________________________________________

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

For the quarterly period ended March 31, 2022

Commission file number 1-33867

___________________________________________________________

TEEKAY TANKERS LTD.

(Exact name of Registrant as specified in its charter)

___________________________________________________________

4th Floor, Belvedere Building, 69 Pitts Bay Road, Hamilton, HM08, Bermuda

(Address of principal executive office)

___________________________________________________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ý Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1).

Yes ¨ No ý

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7).

Yes ¨ No ý

TEEKAY TANKERS LTD.

REPORT ON FORM 6-K FOR THE QUARTERLY PERIOD ENDED MARCH 31, 2022

INDEX

PART I – FINANCIAL INFORMATION

ITEM 1 – FINANCIAL STATEMENTS

TEEKAY TANKERS LTD. AND SUBSIDIARIES

UNAUDITED CONSOLIDATED STATEMENTS OF LOSS

(in thousands of U.S. Dollars, except share and per share amounts)

| | | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31, | | |

| | 2022 | | 2021 | | | | |

| | $ | | $ | | | | |

| | | | | | | | |

Voyage charter revenues (note 3) | | 164,751 | | 112,201 | | | | |

Time-charter revenues (note 3) | | 6,275 | | 28,285 | | | | |

| | | | | | | | |

Other revenues (note 3) | | 2,992 | | 2,263 | | | | |

| Total revenues | | 174,018 | | 142,749 | | | | |

| | | | | | | | |

| Voyage expenses | | (101,622) | | (69,045) | | | | |

Vessel operating expenses (notes 12b and 12c) | | (39,001) | | (43,048) | | | | |

| Time-charter hire expenses | | (5,550) | | (3,630) | | | | |

| Depreciation and amortization | | (25,080) | | (26,684) | | | | |

General and administrative expenses (note 12b) | | (10,120) | | (11,470) | | | | |

Write-down of assets (note 14) | | (421) | | (715) | | | | |

| | | | | | | |

| Loss from operations | | (7,776) | | (11,843) | | | | |

| | | | | | | | |

| Interest expense | | (8,162) | | (10,068) | | | | |

| Interest income | | 35 | | 30 | | | | |

Realized and unrealized gain on derivative instruments (note 7) | | 2,028 | | 703 | | | | |

| Equity loss | | (754) | | (359) | | | | |

Other (expense) income (note 8) | | (133) | | 743 | | | | |

| Net loss before income tax | | (14,762) | | (20,794) | | | | |

Income tax recovery (expense) (note 9) | | 820 | | (571) | | | | |

| Net loss | | (13,942) | | (21,365) | | | | |

| | | | | | | | |

| | | | | | | | |

Per common share amounts (note 13) | | | | | | | | |

| - Basic loss per share | | $ | (0.41) | | $ | (0.63) | | | | |

| - Diluted loss per share | | $ | (0.41) | | $ | (0.63) | | | | |

| | | | | | | | |

Weighted-average number of Class A and Class B common stock outstanding (note 13) | | | | | | | | |

| - Basic | | 33,911,545 | | 33,743,722 | | | | |

| - Diluted | | 33,911,545 | | 33,743,722 | | | | |

| | | | | | | | |

Related party transactions (note 12) | | | | | | | | |

The accompanying notes are an integral part of the unaudited consolidated financial statements.

TEEKAY TANKERS LTD. AND SUBSIDIARIES

UNAUDITED CONSOLIDATED BALANCE SHEETS

(in thousands of U.S. Dollars)

| | | | | | | | | | | | | | |

| | As at | | As at |

| | March 31, 2022 | | December 31, 2021 |

| | $ | | $ |

| ASSETS | | | | |

| Current | | | | |

| Cash and cash equivalents | | 18,366 | | 50,572 |

Restricted cash – current (note 15) | | 2,200 | | 2,221 |

| Accounts receivable | | 43,150 | | 41,085 |

| Bunker and lube oil inventory | | 62,731 | | 49,028 |

| Prepaid expenses | | 14,115 | | 10,223 |

Due from affiliates (note 12c) | | 3,673 | | 4,220 |

Current portion of derivative assets (note 7) | | 786 | | — |

Assets held for sale (note 14) | | 28,531 | | 43,543 |

| Accrued revenue | | 57,512 | | 44,503 |

| Total current assets | | 231,064 | | 245,395 |

Restricted cash – long-term (note 15) | | 3,135 | | 3,135 |

| Vessels and equipment | | | | |

At cost, less accumulated depreciation of $222.7 million (2021 - $271.9 million) (notes 5 and 14) | | 656,525 | | 925,249 |

Vessels related to finance leases, at cost, less accumulated depreciation of $186.6 million (2021 - $112.9 million) (note 6) | | 662,020 | | 411,749 |

Operating lease right-of-use assets (notes 6 and 14) | | 10,895 | | 14,257 |

| Total vessels and equipment | | 1,329,440 | | 1,351,255 |

| Investment in and advances to equity-accounted joint venture | | 12,200 | | 12,954 |

Derivative assets (note 7) | | 1,878 | | 668 |

| Other non-current assets | | 1,274 | | 1,422 |

| Intangible assets at cost, less accumulated amortization of $4.3 million (2021 - $4.2 million) | | 1,378 | | 1,494 |

| Goodwill | | 2,426 | | 2,426 |

| Total assets | | 1,582,795 | | 1,618,749 |

| LIABILITIES AND EQUITY | | | | |

| Current | | | | |

| Accounts payable | | 28,714 | | 34,832 |

Accrued liabilities (note 12c) | | 42,124 | | 32,583 |

Short-term debt (note 4) | | 28,000 | | 25,000 |

| Current portion of long-term debt (note 5) | | 11,058 | | 15,500 |

Current portion of derivative liabilities (note 7) | | — | | 122 |

Current obligations related to finance leases (note 6) | | 47,650 | | 27,032 |

Current portion of operating lease liabilities (note 6) | | 9,215 | | 9,389 |

Due to affiliates (note 12c) | | 16,226 | | 10,944 |

Other current liabilities (note 3) | | 828 | | 1,686 |

| Total current liabilities | | 183,815 | | 157,088 |

Long-term debt (note 5) | | 110,258 | | 304,791 |

Long-term obligations related to finance leases (note 6) | | 415,530 | | 267,449 |

Long-term operating lease liabilities (note 6) | | 2,746 | | 4,868 |

| | | | |

Other long-term liabilities (note 9) | | 45,541 | | 46,141 |

| Total liabilities | | 757,890 | | 780,337 |

Commitments and contingencies (notes 4, 5, 6 and 7) | | | | |

| Equity | | | | |

Common stock and additional paid-in capital (585.0 million shares authorized, 29.2 million Class A and 4.6 million Class B shares issued and outstanding as of March 31, 2022, and 585.0 million shares authorized, 29.2 million Class A and 4.6 million Class B shares issued and outstanding as at December 31, 2021) (note 11) | | 1,301,537 | | 1,301,102 |

| Accumulated deficit | | (476,632) | | (462,690) |

| Total equity | | 824,905 | | 838,412 |

| Total liabilities and equity | | 1,582,795 | | 1,618,749 |

Subsequent events (note 17)

The accompanying notes are an integral part of the unaudited consolidated financial statements.

TEEKAY TANKERS LTD. AND SUBSIDIARIES

UNAUDITED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands of U.S. Dollars)

| | | | | | | | | | | | | | |

| | Three Months Ended March 31, |

| | 2022 | | 2021 |

| | $ | | $ |

| Cash, cash equivalents and restricted cash (used for) provided by | | | | |

| OPERATING ACTIVITIES | | | | |

| Net loss | | (13,942) | | (21,365) |

| Non-cash items: | | | | |

| Depreciation and amortization | | 25,080 | | 26,684 |

Write-down of assets (note 14) | | 421 | | 715 |

Unrealized gain on derivative instruments (note 7) | | (2,118) | | (740) |

| Equity loss | | 754 | | 359 |

Income tax (recovery) expense (note 9) | | (820) | | 484 |

| Other | | 2,865 | | (500) |

| Change in operating assets and liabilities | | (24,771) | | (30,037) |

| Expenditures for dry docking | | (2,138) | | (3,045) |

| Net operating cash flow | | (14,669) | | (27,445) |

| | | | |

| FINANCING ACTIVITIES | | | | |

Proceeds from short-term debt (note 4) | | 23,000 | | 10,000 |

Prepayments of short-term debt (note 4) | | (20,000) | | — |

| | | | |

Scheduled repayments of long-term debt (note 5) | | (51,299) | | (2,808) |

Prepayments of long-term debt (note 5) | | (149,508) | | (15,000) |

Proceeds from financing related to sales and leaseback of vessels, net of issuance costs (note 6) | | 175,341 | | — |

Scheduled repayments of obligations related to finance leases (note 6) | | (6,718) | | (6,082) |

| | | |

| Other | | (305) | | (42) |

| Net financing cash flow | | (29,489) | | (13,932) |

| | | | |

| INVESTING ACTIVITIES | | | | |

Proceeds from sale of vessels (note 14) | | 16,002 | | 32,687 |

| Expenditures for vessels and equipment | | (4,071) | | (913) |

| | | | |

| Net investing cash flow | | 11,931 | | 31,774 |

| | | | |

| Decrease in cash, cash equivalents and restricted cash | | (32,227) | | (9,603) |

| Cash, cash equivalents and restricted cash, beginning of the period | | 55,928 | | 103,146 |

| Cash, cash equivalents and restricted cash, end of the period | | 23,701 | | 93,543 |

Supplemental cash flow information (note 15)

The accompanying notes are an integral part of the unaudited consolidated financial statements.

TEEKAY TANKERS LTD. AND SUBSIDIARIES

UNAUDITED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(in thousands of U.S. Dollars, except share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock and Additional Paid-in Capital | | | | |

| | | Thousands of Common Shares # | | Class A Common Shares $ | | Class B Common Shares $ | | Accumulated Deficit $ | | Total $ |

| Balance as at December 31, 2021 | | 33,789 | | 1,212,570 | | 88,532 | | (462,690) | | 838,412 |

| Net loss | | — | | — | | — | | (13,942) | | (13,942) |

Equity-based compensation (note 11) | | 16 | | 435 | | — | | — | | 435 |

| Balance as at March 31, 2022 | | 33,805 | | 1,213,005 | | 88,532 | | (476,632) | | 824,905 |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Common Stock and Additional Paid-in Capital | | | | |

| | | Thousands of Common Shares # | | Class A Common Shares $ | | Class B Common Shares $ | | Accumulated Deficit $ | | Total $ |

| Balance as at December 31, 2020 | | 33,738 | | 1,210,688 | | 88,532 | | (220,318) | | 1,078,902 |

| Net loss | | — | | — | | — | | (21,365) | | (21,365) |

Equity-based compensation (note 11) | | 17 | | 341 | | — | | — | | 341 |

| Balance as at March 31, 2021 | | 33,755 | | 1,211,029 | | 88,532 | | (241,683) | | 1,057,878 |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

The accompanying notes are an integral part of the unaudited consolidated financial statements.

TEEKAY TANKERS LTD. AND SUBSIDIARIES

NOTES TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(all tabular amounts stated in thousands of U.S. Dollars, other than share or per share data)

1.Basis of Presentation

The unaudited interim consolidated financial statements (or unaudited consolidated financial statements) have been prepared in accordance with United States generally accepted accounting principles (or GAAP). These unaudited consolidated financial statements include the accounts of Teekay Tankers Ltd., its wholly-owned subsidiaries, equity-accounted joint venture and any variable interest entities (or VIEs) of which it is the primary beneficiary (collectively, the Company). The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported in the unaudited consolidated financial statements and accompanying notes. Actual results could differ from those estimates.

Certain information and footnote disclosures required by GAAP for complete annual financial statements have been omitted and, therefore, these unaudited consolidated financial statements should be read in conjunction with the Company’s audited consolidated financial statements for the year ended December 31, 2021, filed on Form 20-F with the U.S. Securities and Exchange Commission (or the SEC) on April 6, 2022. In the opinion of management, these unaudited consolidated financial statements reflect all adjustments, consisting solely of a normal recurring nature, necessary to present fairly, in all material respects, the Company’s unaudited consolidated financial position, results of operations, cash flows and changes in total equity for the interim periods presented. The results of operations for the interim periods presented are not necessarily indicative of those for a full fiscal year. Intercompany balances and transactions have been eliminated upon consolidation.

2. Recent Accounting Pronouncements

In March 2020, the FASB issued Accounting Standards Update 2020-04, Reference Rate Reform (Topic 848) Facilitation of the Effects of Reference Rate Reform on Financial Reporting (or ASU 2020-04). ASU 2020-04 provides optional guidance for a limited period of time to ease potential accounting impacts associated with transitioning away from reference rates that are expected to be discontinued, such as the London Interbank Offered Rate (or LIBOR). The amendments in ASU 2020-04 apply only to contracts, hedging relationships, and other transactions that reference LIBOR or another reference rate expected to be discontinued. The Company adopted this update effective January 1, 2022. The Company does not expect any material impact from the adoption of ASU 2020-04.

3. Revenue

The Company’s primary source of revenue is from chartering its vessels (Aframax tankers, Suezmax tankers and Long Range 2 (or LR2) tankers) to its customers. The Company utilizes two primary forms of contracts, consisting of voyage charters and time charters.

The extent to which the Company employs its vessels on voyage charters versus time charters is dependent upon the Company’s chartering strategy and the availability of time charters. Spot market rates for voyage charters are volatile from period to period, whereas time charters provide a stable source of monthly revenue. The Company also provides ship-to-ship (or STS) support services, which include managing the process of transferring cargo between seagoing ships positioned alongside each other, either stationary or underway, as well as management services to third-party owners of vessels. For descriptions of these types of contracts, see Item 18 –Financial Statements: Note 3 in the Company’s audited consolidated financial statements filed with its Annual Report on Form 20-F for the year ended December 31, 2021.

The following table contains a breakdown of the Company's revenue by contract type for the three months ended March 31, 2022 and March 31, 2021. Subsequent to the April 30, 2020 sale of the Company's non-U.S. portion of its STS support services business, as well as its LNG terminal management business, the Company has one reportable segment. See Item 18 – Financial Statements: Notes 3 and 4 in the Company's audited consolidated financial statements filed with its Annual Report on Form 20-F for the year ended December 31, 2021. The Company’s lease income consists of the revenue from its voyage charters and time charters.

TEEKAY TANKERS LTD. AND SUBSIDIARIES

NOTES TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(all tabular amounts stated in thousands of U.S. Dollars, other than share or per share data)

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2022 | | 2021 | | | | |

| $ | | $ | | | | |

| Voyage charter revenues | | | | | | | |

| Suezmax | 84,196 | | 55,943 | | | | |

| Aframax | 29,804 | | 27,069 | | | | |

| LR2 | 25,491 | | 17,149 | | | | |

| Full service lightering | 25,260 | | 12,040 | | | | |

| Total | 164,751 | | 112,201 | | | | |

| | | | | | | |

| Time-charter revenues | | | | | | | |

| Suezmax | — | | 19,435 | | | | |

| Aframax | 6,275 | | 6,240 | | | | |

| LR2 | — | | 2,610 | | | | |

| Total | 6,275 | | 28,285 | | | | |

| | | | | | | |

| Other revenues | | | | | | | |

| Ship-to-ship support services | 1,842 | | 970 | | | | |

| Vessel management | 1,150 | | 1,293 | | | | |

| | | | | | | |

| Total | 2,992 | | 2,263 | | | | |

| | | | | | | |

| Total revenues | 174,018 | | 142,749 | | | | |

Charters-out

As at March 31, 2022, three (December 31, 2021 - three) of the Company’s vessels operated under fixed-rate time-charter contracts, all of which are scheduled to expire in 2022. As at March 31, 2022, the minimum scheduled future revenues to be received by the Company under these time charters were approximately $6.3 million (remainder of 2022) (December 31, 2021 - $11.3 million (2022)). The hire payments should not be construed to reflect a forecast of total charter hire revenue for any of the periods. Future hire payments do not include hire payments generated from new contracts entered into after March 31, 2022, from unexercised option periods of contracts that existed on March 31, 2022 or from variable consideration, if any, under contracts. In addition, future hire payments presented above have been reduced by estimated off-hire time for required periodic maintenance and do not reflect the impact of revenue sharing arrangements whereby time-charter revenues are shared with other revenue sharing arrangement participants. Actual amounts may vary given future events such as unplanned vessel maintenance.

Contract Liabilities

As at March 31, 2022, the Company had $nil (December 31, 2021 - $0.9 million) of advanced payments recognized as contract liabilities that are expected to be recognized as time-charter revenues in subsequent periods and which are included in other current liabilities on the Company's unaudited consolidated balance sheets.

TEEKAY TANKERS LTD. AND SUBSIDIARIES

NOTES TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(all tabular amounts stated in thousands of U.S. Dollars, other than share or per share data)

4. Short-Term Debt

As at March 31, 2022, Teekay Tankers Chartering Pte. Ltd. (or TTCL), a wholly-owned subsidiary of the Company, had a working capital loan facility (or the Working Capital Loan), which provided for aggregate borrowings up to $80.0 million. The amount available for drawdown is limited to a percentage of certain receivables and accrued revenue, which is assessed weekly. As at March 31, 2022, the next maturity date of the Working Capital Loan was in May 2022, and subsequently has been extended to November 2022. The Working Capital Loan maturity date is continually extended for further periods of six months thereafter unless and until the lender gives notice in writing that no further extensions shall occur. Proceeds of the Working Capital Loan are used to provide working capital in relation to certain vessels subject to the revenue sharing agreements (or RSAs). Interest payments are based on the Secured Overnight Financing Rate (or SOFR) plus a margin of 3.5%. The Working Capital Loan is collateralized by the assets of TTCL. The Working Capital Loan requires the Company to maintain its paid-in capital contribution under the RSAs and the retained distributions of the RSA counterparties in an amount equal to the greater of (a) an amount equal to the minimum average capital contributed by the RSA counterparties per vessel in respect of the RSA (including cash, bunkers or other working capital contributions and amounts accrued to the RSA counterparties but unpaid) and (b) a minimum capital contribution ranging from $20.0 million to $30.0 million based on the amount borrowed. As at March 31, 2022, $28.0 million (December 31, 2021 - $25.0 million) was owing under this facility, the aggregate available borrowings were $48.3 million (December 31, 2021 - $45.4 million) and the interest rate on the facility was 3.9% (December 31, 2021 - 3.6%). As at March 31, 2022, the Company was in compliance with all covenants in respect of this facility.

5. Long-Term Debt

| | | | | | | | | | | |

| As at | | As at |

| March 31, 2022 | | December 31, 2021 |

| $ | | $ |

| Revolving credit facility due through December 2024 | 73,167 | | 271,167 |

| Term loan due in August 2023 | 50,531 | | 53,339 |

| Total principal | 123,698 | | 324,506 |

| Less: unamortized discount and debt issuance costs | (2,382) | | (4,215) |

| Total debt | 121,316 | | 320,291 |

| Less: current portion | (11,058) | | (15,500) |

| Long-term portion | 110,258 | | 304,791 |

As at March 31, 2022, the Company had one revolving credit facility (or the 2020 Revolver), which, as at such date, provided for aggregate borrowings of up to $212.7 million (December 31, 2021 - $344.9 million), of which $139.5 million (December 31, 2021 - $73.7 million) was undrawn. Interest payments are based on LIBOR plus a margin of 2.40%. The total amount available under the 2020 Revolver decreases by $56.7 million (remainder of 2022), $43.6 million (2023) and $112.4 million (2024). The 2020 Revolver is collateralized by 21 of the Company's vessels, together with other related security.

As at March 31, 2022, the Company also had one term loan (or the 2020 Term Loan) outstanding, which totaled $50.5 million (December 31, 2021 - $53.3 million). Interest payments are based on LIBOR plus a margin of 2.25%. The term loan reduces in quarterly payments and has a balloon repayment due at maturity in 2023. The 2020 Term Loan is collateralized by four of the Company's vessels, together with other related security.

The 2020 Revolver and the 2020 Term Loan require the Company to maintain a minimum hull coverage ratio of 125% of the total outstanding drawn balance and 125% of the total outstanding principal balance, respectively, for the facility periods. Such requirements are assessed on a semi-annual basis with reference to vessel valuations compiled by two or more agreed upon third parties. Should the ratios drop below the required amounts, the lenders may request that the Company either prepay a portion of the applicable loan in the amount of the shortfall or provide additional collateral in the amount of the shortfall, at the Company's option. As at March 31, 2022, the hull coverage ratios were 635% and 202% for the 2020 Revolver and 2020 Term Loan, respectively. A decline in the tanker market could negatively affect these ratios. In addition, the Company is required to maintain a minimum liquidity (cash, cash equivalents and undrawn committed revolving credit lines with at least six months to maturity) of the greater of $35.0 million and at least 5% of the Company's total consolidated debt and obligations related to finance leases. As at March 31, 2022, the Company was in compliance with all covenants in respect of the 2020 Revolver and the 2020 Term Loan.

The weighted-average interest rate on the Company’s long-term debt as at March 31, 2022 was 2.8% (December 31, 2021 - 2.5%). This rate does not reflect the effect of the Company’s interest rate swap agreement (see note 7).

The aggregate annual long-term debt principal repayments required to be made by the Company under the 2020 Revolver and the 2020 Term Loan subsequent to March 31, 2022 are $8.4 million (remainder of 2022), $42.1 million (2023) and $73.2 million (2024).

TEEKAY TANKERS LTD. AND SUBSIDIARIES

NOTES TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(all tabular amounts stated in thousands of U.S. Dollars, other than share or per share data)

6. Operating Leases and Obligations Related to Finance Leases

Operating Leases

The Company charters-in vessels from other vessel owners on time-charter contracts, whereby the vessel owner provides use and technical operation of the vessel for the Company. A time charter-in contract is typically for a fixed period of time, although in certain cases the Company may have the option to extend the charter. The Company typically pays the owner a daily hire rate that is fixed over the duration of the charter. The Company is generally not required to pay the daily hire rate during periods the vessel is not able to operate.

As at March 31, 2022, minimum commitments to be incurred by the Company under time charter-in contracts were approximately $19.0 million (remainder of 2022), $18.2 million (2023), $6.8 million (2024), $6.8 million (2025), $6.8 million (2026) and $17.8 million (thereafter), including one Aframax tanker newbuilding expected to be delivered to the Company in the fourth quarter of 2022 to commence a seven-year time charter-in contract.

Obligations Related to Finance Leases

| | | | | | | | | | | |

| As at | | As at |

| March 31, 2022 | | December 31, 2021 |

| $ | | $ |

| Obligations related to finance leases | 466,409 | | 295,828 |

| Less: unamortized discount and debt issuance costs | (3,229) | | (1,347) |

| Total obligations related to finance leases | 463,180 | | 294,481 |

| Less: current portion | (47,650) | | (27,032) |

| Long-term obligations related to finance leases | 415,530 | | 267,449 |

As at March 31, 2022, the Company had sale-leaseback financing transactions with financial institutions relating to 22 of the Company's vessels, including eight vessels for which sale-leaseback financing transactions were completed in March 2022. In April 2022, the Company completed sale-leaseback financing transactions with a financial institution relating to five additional vessels (see note 17).

Under the sale-leaseback arrangements completed as of March 31, 2022, the Company transferred the vessels to subsidiaries of the financial institutions (collectively, the Lessors) and leased the vessels back from the Lessors on bareboat charters ranging from six to 12-year terms ending between 2028 and 2031. The Company is obligated to purchase four of the vessels upon maturity of their respective bareboat charters. The Company also has the option to purchase each of the 22 vessels, 10 of which can be purchased between now and the end of their respective lease terms, four of which can be purchased starting in September 2023 until the end of their respective lease terms, and the remaining eight of which can be purchased starting in March 2024 until the end of their respective lease terms.

The bareboat charters related to all 22 of these vessels require that the Company maintain a minimum liquidity (cash, cash equivalents and undrawn committed revolving credit lines with at least six months to maturity) of the greater of $35.0 million and at least 5.0% of the Company's consolidated debt and obligations related to finance leases.

Eighteen of the bareboat charters require the Company to maintain, for each vessel, a minimum hull coverage ratio of 100% of the total outstanding principal balance. As at March 31, 2022, these ratios ranged from 108% to 150% (December 31, 2021 - ranged from 106% to 134%). The four remaining bareboat charters require the Company to maintain, for each vessel, a minimum hull coverage ratio of 105% of the total outstanding principal balance. As at March 31, 2022, these ratios ranged from 145% to 153% (December 31, 2021 - ranged from 132% to 140%). For 10 of the bareboat charters, should any of these ratios drop below the required amount, the Lessor may request that the Company prepay additional charter hire. For the remaining 12 bareboat charters, should any of these ratios drop below the required amount, the Lessor may request that the Company either prepay additional charter hire in the amount of the shortfall or, in certain circumstances, make a payment to reduce the outstanding principal balance or provide additional collateral satisfactory to the relevant Lessor in the amount of the shortfall, in each case to restore compliance with the relevant ratio.

The requirements of the bareboat charters are assessed annually with reference to vessel valuations compiled by one or more agreed upon third parties. As at March 31, 2022, the Company was in compliance with all covenants in respect of its obligations related to finance leases.

During 2021, the Company completed the repurchase of eight vessels from one lessor. In April 2021, the Company was served with a claim from the counterparty of the bareboat charters relating to these vessels, for reimbursement of breakage costs in respect of interest rate swaps that were entered into by the counterparty at the time of the original transaction in connection with the counterparty's then-underlying financing. The Company filed a defense to this claim in June 2021, rejecting the claim that the Company is responsible for paying these breakage cost reimbursements under the terms of the bareboat charters. As of March 31, 2022, the amount of breakage costs being claimed was $7.3 million. No loss provision in respect of this claim has been made by the Company based on its assessment of the merits of the claim.

TEEKAY TANKERS LTD. AND SUBSIDIARIES

NOTES TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(all tabular amounts stated in thousands of U.S. Dollars, other than share or per share data)

The weighted-average interest rate on the Company’s obligations related to finance leases as at March 31, 2022 was 4.5% (December 31, 2021 - 4.8%).

As at March 31, 2022, the Company's total remaining commitments related to the financial liabilities of these vessels were approximately $563.1 million (December 31, 2021 - $364.6 million), including imputed interest of $96.7 million (December 31, 2021 - $68.8 million), repayable from 2022 through 2031, as indicated below:

| | | | | | | | |

| | Commitments |

| | March 31, 2022 |

| Year | | $ |

| Remainder of 2022 | | 51,608 |

| 2023 | | 67,514 |

| 2024 | | 66,290 |

| 2025 | | 64,896 |

| 2026 | | 63,587 |

| Thereafter | | 249,238 |

7. Derivative Instruments

Interest rate swap agreement

The Company uses derivative instruments in accordance with its overall risk management policies. The Company enters into interest rate swap agreements which exchange a receipt of floating interest for a payment of fixed interest to reduce the Company’s exposure to interest rate variability on its outstanding floating-rate debt. The Company has not designated, for accounting purposes, its interest rate swap as a cash flow hedge of its U.S. Dollar LIBOR-denominated borrowings.

In March 2020, the Company entered into an interest rate swap agreement which is scheduled to mature in December 2024. The following summarizes the Company's interest rate swap agreement as at March 31, 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest Rate | | Notional Amount | | Fair Value /Carrying Amount of Asset | | Remaining Term | | Fixed Swap Rate |

| Index | | $ | | $ | | (years) | | (%) (1) |

| LIBOR-Based Debt: | | | | | | | | | |

| U.S. Dollar-denominated interest rate swap agreement | LIBOR | | 50,000 | | 2,439 | | 2.8 | | 0.76 |

(1)Excludes the margin the Company pays on its variable-rate long-term debt, which, as of March 31, 2022, ranged from 2.25% to 2.40%.

The Company is potentially exposed to credit loss in the event of non-performance by the counterparty to the interest rate swap agreement in the event that the fair value results in an asset being recorded. In order to minimize counterparty risk, the Company only enters into interest rate swap agreements with counterparties that are rated A– or better by Standard & Poor’s or A3 or better by Moody’s at the time transactions are entered into.

Forward freight agreements

The Company uses forward freight agreements (or FFAs) in non-hedge-related transactions to increase or decrease its exposure to spot market rates, within defined limits. Net gains and losses from FFAs are recorded within realized and unrealized gain on derivative instruments in the Company's unaudited consolidated statements of loss.

TEEKAY TANKERS LTD. AND SUBSIDIARIES

NOTES TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(all tabular amounts stated in thousands of U.S. Dollars, other than share or per share data)

Tabular Disclosure

The following table presents the location and fair value amounts of derivative instruments, segregated by type of contract, on the Company’s unaudited consolidated balance sheets.

| | | | | | | | | | | | | | | | | | | | | |

| Current Portion of Derivative Assets | | Derivative Assets | | | | Current Portion of Derivative Liabilities | | |

| $ | | $ | | | | $ | | |

| As at March 31, 2022 | | | | | | | | | |

| Interest rate swap agreement | 561 | | 1,878 | | | | — | | |

| Forward freight agreements | 225 | | — | | | | — | | |

| 786 | | 1,878 | | | | — | | |

| | | | | | | | | |

| As at December 31, 2021 | | | | | | | | | |

| Interest rate swap agreement | — | | 668 | | | | (118) | | |

| Forward freight agreements | — | | — | | | | (4) | | |

| — | | 668 | | | | (122) | | |

Realized and unrealized (losses) gains relating to the interest rate swaps and FFAs are recognized in earnings and reported in realized and unrealized gain on derivative instruments in the Company’s unaudited consolidated statements of loss as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Three Months Ended |

| March 31, 2022 | | March 31, 2021 |

| Realized Losses | Unrealized Gains | Total | | Realized (Losses) Gains | Unrealized Gains (Losses) | Total |

| $ | $ | $ | | $ | $ | $ |

| Interest rate swap agreement | (67) | 1,889 | 1,822 | | (65) | 773 | 708 |

| Forward freight agreements | (23) | 229 | 206 | | 28 | (33) | (5) |

| (90) | 2,118 | 2,028 | | (37) | 740 | 703 |

8. Other (Expense) Income

The components of other (expense) income are as follows:

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2022 | | 2021 | | | | |

| $ | | $ | | | | |

| Foreign exchange (loss) gain | (154) | | 612 | | | | |

| Other income | 21 | | 131 | | | | |

| Total | (133) | | 743 | | | | |

TEEKAY TANKERS LTD. AND SUBSIDIARIES

NOTES TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(all tabular amounts stated in thousands of U.S. Dollars, other than share or per share data)

9. Income Tax Recovery (Expense)

The following table reflects changes in uncertain tax positions relating to freight tax liabilities, which are recorded in other long-term liabilities on the Company's unaudited consolidated balance sheets:

| | | | | | | | | | | |

| | Three Months Ended March 31, |

| 2022

$ | | 2021

$ |

| Balance of unrecognized tax benefits as at January 1 | 45,603 | | 49,124 |

| Increases for positions related to the current year | 426 | | 1,062 |

| Increases for positions related to prior years | 1,241 | | 1,293 |

| | | |

| | | |

| Decreases related to statute of limitations | (2,264) | | (2,065) |

| Foreign exchange loss (gain) | 138 | | (598) |

| Balance of unrecognized tax benefits as at March 31 | 45,144 | | 48,816 |

Included in the Company's current income tax recovery (expense) are provisions for uncertain tax positions relating to freight taxes. Positions relating to freight taxes can vary each year depending on the trading patterns of the Company's vessels.

The Company does not presently anticipate that its provisions for these uncertain tax positions will significantly increase in the next 12 months; however, this is dependent on the jurisdictions in which vessel trading activity occurs. The Company reviews its freight tax obligations on a regular basis and may update its assessment of its tax positions based on available information at that time. Such information may include legal advice as to applicability of freight taxes in relevant jurisdictions. Freight tax regulations are subject to change and interpretation; therefore, the amounts recorded by the Company may change accordingly.

10. Fair Value Measurements

For a description of how the Company estimates fair value and for a description of the fair value hierarchy levels, see Item 18 – Financial Statements: Note 12 to the Company’s audited consolidated financial statements filed with its Annual Report on Form 20-F for the year ended December 31, 2021.

The following table includes the estimated fair value, carrying value and categorization using the fair value hierarchy of those assets and liabilities that are measured at their estimated fair value on a recurring and non-recurring basis, as well as certain financial instruments that are not measured at fair value on a recurring basis.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | March 31, 2022 | | December 31, 2021 |

| | | Fair Value Hierarchy Level | | Carrying Amount Asset / (Liability) $ | | Fair Value Asset / (Liability) $ | | Carrying Amount Asset / (Liability) $ | | Fair Value Asset / (Liability) $ |

| Recurring: | | | | | | | | | | |

Cash, cash equivalents and restricted cash (note 15) | | Level 1 | | 23,701 | | 23,701 | | 55,928 | | 55,928 |

Derivative instruments (note 7) | | | | | | | | | | |

Interest rate swap agreement | | Level 2 | | 2,439 | | 2,439 | | 550 | | 550 |

| Freight forward agreements | | Level 2 | | 225 | | 225 | | (4) | | (4) |

| | | | | | | | | | |

| Non-recurring: | | | | | | | | | | |

Operating lease right-of-use assets (note 14) | | Level 2 | | 7,442 | | 7,442 | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Assets held for sale (note 14) | | Level 2 | | 13,844 | | 13,844 | | 40,854 | | 40,854 |

| Equity-accounted joint venture | | Level 2 | | | | | | 9,174 | | 9,174 |

| | | | | | | | | | |

| Other: | | | | | | | | | | |

Short-term debt (note 4) | | Level 2 | | (28,000) | | (28,000) | | (25,000) | | (25,000) |

| Advances to equity-accounted joint venture | | Level 2 | | 3,780 | | Note (1) | | 3,780 | | 3,780 |

Long-term debt, including current portion (note 5) | | Level 2 | | (121,316) | | (123,985) | | (320,291) | | (325,509) |

Obligations related to finance leases, including current portion (note 6) | | Level 2 | | (463,180) | | (471,100) | | (294,481) | | (306,386) |

| | | | | | | | | | |

(1)The advances to its equity-accounted joint venture, together with the Company’s investment in the equity-accounted joint venture, form the net aggregate carrying value of the Company’s interests in the equity-accounted joint venture in these unaudited consolidated financial statements. The fair values of the individual components of such aggregate interests as at March 31, 2022 were not determinable.

TEEKAY TANKERS LTD. AND SUBSIDIARIES

NOTES TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(all tabular amounts stated in thousands of U.S. Dollars, other than share or per share data)

11. Capital Stock and Equity-Based Compensation

The authorized capital stock of the Company at March 31, 2022 was 100.0 million shares of Preferred Stock (December 31, 2021 - 100.0 million shares), with a par value of $0.01 per share (December 31, 2021 - $0.01 per share), 485.0 million shares of Class A common stock (December 31, 2021 - 485.0 million shares), with a par value of $0.01 per share (December 31, 2021 - $0.01 per share), and 100.0 million shares of Class B common stock (December 31, 2021 - 100.0 million shares), with a par value of $0.01 per share (December 31, 2021 - $0.01 per share). A share of Class A common stock entitles the holder to one vote per share while a share of Class B common stock entitles the holder to five votes per share, subject to a 49% aggregate Class B common stock voting power maximum. As of March 31, 2022, the Company had 29.2 million shares of Class A common stock (December 31, 2021 – 29.2 million), 4.6 million shares of Class B common stock (December 31, 2021 – 4.6 million) and no shares of preferred stock (December 31, 2021 – nil) issued and outstanding.

During the three months ended March 31, 2022 and 2021, the Company recognized $0.7 million and $0.4 million, respectively, of expenses related to restricted stock units and stock options in general and administrative expenses. During the three months ended March 31, 2022, a total of 27.2 thousand restricted stock units (2021 - 24.0 thousand) with a market value of $0.3 million (2021 - $0.3 million) vested and 14.5 thousand shares (2021 - 17.3 thousand shares) of Class A common stock, net of withholding taxes, were concurrently issued to the grantees.

12. Related Party Transactions

Management Fee - Related and Other

a.The Company's operations are conducted in part by its subsidiaries, which receive services from Teekay Corporation's (or Teekay's) wholly-owned subsidiary, Teekay Services Ltd. (or the Manager, previously Teekay Shipping Ltd.) and its affiliates. The Manager provides various services under a long-term management agreement (the Management Agreement), as disclosed below. In October 2021, Teekay entered into an agreement to dispose to affiliates of Stonepeak of its general partner interest in its publicly listed subsidiary, Teekay LNG Partners L.P. (or Teekay LNG) (now known as Seapeak LLC), all of its common units in Teekay LNG, three subsidiaries which collectively contained the shore-based management operations of Teekay LNG, including Teekay Shipping Ltd., as well as certain of Teekay LNG's joint ventures. In November 2021, Teekay Services Ltd., a wholly-owned subsidiary of Teekay, assumed the role as Manager, in advance of the completion of the dispositions related to Teekay LNG, which closed in January 2022.

b.Amounts (paid) and received by the Company for related party transactions for the periods indicated below were as follows:

| | | | | | | | | | | | | | | |

| | Three Months Ended March 31, | | |

| | 2022 | | 2021 | | | | |

| $ | | $ | | | | |

Vessel operating expenses - technical management fee (i) | (252) | | (252) | | | | |

Strategic and administrative service fees (ii) | (7,414) | | (9,042) | | | | |

Secondment fees (iii) | — | | (87) | | | | |

Technical management fee recoveries (iv) | 173 | | 170 | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

(i)The cost of ship management services provided by a third party has been presented as vessel operating expenses on the Company's unaudited consolidated statements of loss. The Company paid such third party technical management fees to the Manager in relation to certain former Tanker Investments Ltd. vessels.

(ii)The Manager’s strategic and administrative service fees have been presented in general and administrative expenses, except for fees related to technical management services, which have been presented in vessel operating expenses on the Company’s unaudited consolidated statements of loss. The Company’s executive officers are employees of Teekay or subsidiaries thereof, and their compensation (other than any awards under the Company’s long-term incentive plan) is set and paid by Teekay or such other subsidiaries. The Company compensates Teekay for time spent by its executive officers on the Company’s management matters through the strategic portion of the management fee.

(iii)The Company pays secondment fees for services provided by some employees of Teekay. Secondment fees have been presented in general and administrative expenses, except for fees related to technical management services, which have been presented in vessel operating expenses on the Company's unaudited consolidated statements of loss.

(iv)The Company receives reimbursements from Teekay for the provision of technical management services. These reimbursements have been presented in general and administrative expenses on the Company's unaudited consolidated statements of loss.

c.The Manager and other subsidiaries of Teekay collect revenues and remit payments for expenses incurred by the Company’s vessels. Such amounts, which are presented on the Company’s unaudited consolidated balance sheets in "due from affiliates" or "due to affiliates," as applicable, are without interest or stated terms of repayment. In addition, $nil and $1.9 million were payable as crewing and manning costs as at March 31, 2022 and December 31, 2021, respectively, and such amounts are included in accrued liabilities on the Company's unaudited consolidated balance sheets. These crewing and manning costs were payable as reimbursement to the Manager once they were paid by the Manager to the vessels' crew.

TEEKAY TANKERS LTD. AND SUBSIDIARIES

NOTES TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(all tabular amounts stated in thousands of U.S. Dollars, other than share or per share data)

13. Loss Per Share

The net loss available for common shareholders and loss per common share are presented in the table below:

| | | | | | | | | | | | | | | |

| | Three Months Ended March 31, | | |

| | 2022 | | 2021 | | | | |

| $ | | $ | | | | |

| Net loss | (13,942) | | (21,365) | | | | |

| | | | | | | |

Weighted average number of common shares - basic (1) | 33,911,545 | | 33,743,722 | | | | |

| Dilutive effect of stock-based awards | — | | — | | | | |

| Weighted average number of common shares - diluted | 33,911,545 | | 33,743,722 | | | | |

| | | | | | | |

| Loss per common share: | | | | | | | |

| – Basic | (0.41) | | (0.63) | | | | |

| – Diluted | (0.41) | | (0.63) | | | | |

(1) Includes unissued common shares related to non-forfeitable stock-based compensation.

Stock-based awards that have an anti-dilutive effect on the calculation of diluted earnings per common share are excluded from this calculation. In the periods where a loss attributable to shareholders has been incurred, all stock-based awards are anti-dilutive. For the three months ended March 31, 2022 and 2021, 0.2 million and 0.2 million restricted stock units, respectively, had anti-dilutive effects on the calculation of diluted earnings per common share. For the three months ended March 31, 2022 and 2021, options to acquire 0.6 million and 0.6 million shares, respectively, of the Company’s Class A common stock had anti-dilutive effects on the calculation of diluted earnings per common share.

14. Write-down of Assets

During the three months ended March 31, 2022, the Company completed the sale of one Suezmax tanker for $15.5 million. This vessel was written-down to its agreed sales price less selling costs and classified as held for sale on the Company's consolidated balance sheet as at December 31, 2021.

During the three months ended March 31, 2022 and March 31, 2021, the Company recorded write-downs of $1.1 million and $0.7 million, respectively, on its operating lease right-of-use assets, which were written-down to their estimated fair values, based on prevailing charter rates for comparable periods, due to a reduction in these charter rates.

As at March 31, 2022 and December 31, 2021, the Company classified two Aframax tankers, including their bunker and lube oil inventory, as held for sale on the Company's unaudited consolidated balance sheets, and one of these vessels was written down to its estimated sales price, less estimated selling costs at December 31, 2021. During the three months ended March 31, 2022, the Company agreed to the sale of both vessels for a total price of $28.1 million, and the previous write-down of $0.6 million for one of these vessels was reversed. Both vessels were delivered to their new owners in April 2022 (see note 17).

During the three months ended March 31, 2021, the Company completed the sale of two Aframax tankers for a total price of $32.0 million.

15. Supplemental Cash Flow Information

Total cash, cash equivalents and restricted cash are as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| As at | | As at | | As at | | As at |

| March 31, 2022 | | December 31, 2021 | | March 31, 2021 | | December 31, 2020 |

| $ | | $ | | $ | | $ |

| Cash and cash equivalents | 18,366 | | 50,572 | | 87,595 | | 97,232 |

| Restricted cash – current | 2,200 | | 2,221 | | 2,813 | | 2,779 |

| Restricted cash – long-term | 3,135 | | 3,135 | | 3,135 | | 3,135 |

| | | | | | | |

| | | | | | | |

| 23,701 | | 55,928 | | 93,543 | | 103,146 |

The Company maintains restricted cash deposits relating to certain FFAs (see note 7), and as required by the Company's obligations related to certain finance leases (see note 6).

TEEKAY TANKERS LTD. AND SUBSIDIARIES

NOTES TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(all tabular amounts stated in thousands of U.S. Dollars, other than share or per share data)

16. Liquidity

Management is required to assess if the Company will have sufficient liquidity to continue as a going concern for the one-year period following the issuance of these unaudited consolidated financial statements. Based on the Company's liquidity as at the date these unaudited consolidated financial statements were issued, including the liquidity generated from the sale of two tankers in April 2022, the completion of the sale-leaseback of five vessels in April 2022 (see note 17), and from the expected cash flows from Company's operations over the following year, the Company estimates that it will have sufficient liquidity to meet its minimum liquidity requirements under its financial covenants and to continue as a going concern for at least a one-year period following the issuance of these unaudited consolidated financial statements.

17. Subsequent Events

In April 2022, the Company completed the sale of two Aframax tankers for a total price of $28.1 million. Both vessels and their related bunkers and lube oil inventory were classified as held for sale on the Company's unaudited consolidated balance sheets as at March 31, 2022 and December 31, 2021 (see note 14).

In April 2022, the Company completed a $114.0 million sale-leaseback financing transaction related to four LR2 product tankers and one Suezmax tanker. Pursuant to this arrangement, the Company transferred the vessels to subsidiaries of a financial institution and leased the vessels back on bareboat charters ranging from seven to eight-year terms. The Company is required to repurchase the vessels upon maturity of the bareboat charters and has the option to repurchase any of the vessels throughout the lease terms.

TEEKAY TANKERS LTD. AND SUBSIDIARIES

March 31, 2022

PART I - FINANCIAL INFORMATION

ITEM 2 – MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations should be read in conjunction with the unaudited consolidated financial statements and accompanying notes contained in "Item 1 – Financial Statements" of this Report on Form 6-K and with our audited consolidated financial statements contained in "Item 18 – Financial Statements" and "Management’s Discussion and Analysis of Financial Condition and Results of Operations" in "Item 5 – Operating and Financial Review and Prospects" of our Annual Report on Form 20-F for the year ended December 31, 2021.

OVERVIEW

Our business is to own and operate crude oil and product tankers, and we employ a chartering strategy that seeks to capture upside opportunities in the tanker spot market while using fixed-rate time charters and full service lightering (or FSL) contracts to reduce potential downside risks. Our mix of vessels trading in the spot market or subject to fixed-term time charters will change from time to time. In addition to our core business, we also provide ship-to-ship (or STS) support services, along with our tanker commercial management and technical management operations. As at March 31, 2022, our fleet consisted of 53 vessels, including five chartered-in vessels, and one 50%-owned Very Large Crude Carrier (or VLCC). The following table summarizes our fleet as at March 31, 2022:

| | | | | | | | | | | |

| Owned or Leased Vessels | Chartered-in Vessels | Total |

|

| Fixed-rate: | | | |

| | | |

| Aframax Tankers | 3 | — | 3 |

| | | |

| | | |

Total Fixed-Rate Fleet (1) | 3 | — | 3 |

| | | |

| Spot-rate: | | | |

| Suezmax Tankers | 25 | — | 25 |

Aframax Tankers (2)(3) | 10 | 2 | 12 |

LR2 Product Tankers (2) | 9 | 1 | 10 |

VLCC Tanker (4) | 1 | — | 1 |

Total Spot Fleet (5) | 45 | 3 | 48 |

| STS Support Vessels | — | 2 | 2 |

| Total Teekay Tankers Fleet | 48 | 5 | 53 |

(1)All charter-out contracts are scheduled to expire in 2022.

(2)Two Aframax tankers are currently time chartered-in for periods of 24 months expiring in 2023, each with an option to extend for one year. One Long Range 2 (or LR2) product tanker is currently time chartered-in for a period of 18 to 24 months expiring in 2023 with an option to extend for one year.

(3)Excludes one newbuilding Aframax tanker, which is expected to be delivered to us in late-2022 under a seven-year time charter-in contract with options to extend for up to three years.

(4)VLCC owned through a 50/50 joint venture (or High-Q joint venture). As at March 31, 2022, the VLCC was in dry dock.

(5)As at March 31, 2022, a total of 42 of our owned, leased and chartered-in vessels, as well as 11 vessels not in our fleet and owned by third parties, were subject to revenue sharing agreements (or RSAs).

ITEMS YOU SHOULD CONSIDER WHEN EVALUATING OUR RESULTS

There are a number of factors that should be considered when evaluating our historical financial performance and assessing our future prospects, and we use a variety of financial and operational terms and concepts when analyzing our results of operations. These items can be found in "Item 5 – Operating and Financial Review and Prospects" in our Annual Report on Form 20-F for the year ended December 31, 2021.

SIGNIFICANT DEVELOPMENTS IN 2022

Conflict in Ukraine

In late February 2022, the Russian Federation invaded Ukraine. This follows Russia’s involvement in divesting control by Ukraine of the Crimea region and certain parts of south-eastern Ukraine starting in 2014. In response to both events, the United States, several European Union nations, and other countries announced a series of sanctions and executive orders against citizens, entities, and activities connected to Russia and, with respect to the sanctions and orders announced in 2022, Belarus. The sanctions imposed following the 2022 invasion have been numerous and significant in scope. In addition, the United States and several other countries have announced prohibitions on the

importation of Russian oil or intentions to cut back on their reliance on Russian oil. Furthermore, several of the world’s largest oil and gas companies, pension and wealth funds and other asset managers have announced divestments of Russian holdings and assets, including those related to the crude oil and petroleum products industries. As a result of these measures, crude oil and petroleum product trading patterns are being significantly impacted as some countries are looking to reduce imports of Russian oil while Russia is having to find alternative markets for its oil exports. There is also a risk that Russian oil production and exports could decline as a result of sanctions should they be unable to find alternative markets for their oil. As at the date of this report, the conflict is ongoing and, as a result, additional sanctions and executive orders may be implemented that could further impact the trade of crude oil and petroleum products, as well as the supply of Russian oil to the global market and the demand for, and price of, oil and petroleum products.

Novel Coronavirus (COVID-19) Pandemic

The COVID-19 pandemic resulted in a significant decline in global demand for oil during 2020; although oil demand has partially recovered since 2020, new outbreaks may continue to have a negative impact on oil demand in the future. As our business is primarily the transportation of crude oil and refined petroleum products on behalf of our customers, any significant decrease in demand for the cargo we transport could adversely affect demand for our vessels and services.

For the three months ended March 31, 2022, we did not experience any material business interruptions as a result of the COVID-19 pandemic. Spot tanker rates have come under pressure since mid-May 2020 as a result of significantly reduced oil demand due to the COVID-19 pandemic and the subsequent decision by the OPEC+ group of oil producers to implement record oil supply cuts. Reduced oil production from other oil producing nations due to the impact of the COVID-19 pandemic, as well as the unwinding of floating storage and the delivery of newbuilding vessels to the world tanker fleet, has also contributed to the weakness in tanker rates. We continue to monitor the potential impact of the COVID-19 pandemic on us and our industry, including counterparty risk associated with our vessels under contract and the impact on potential vessel impairments. We have also introduced a number of measures to protect the health and safety of the crews on our vessels and our onshore staff.

Effects of the COVID-19 pandemic may include, among others: deterioration of worldwide, regional or national economic conditions and activity and of demand for oil, including due to a potential slowdown in oil demand due to a resurgence of COVID-19 cases and variants in many regions and the potential for continued or renewed restrictions and lockdowns; operational disruptions to us or our customers due to worker health risks and the effects of regulations, directives or practices implemented in response to the pandemic (such as travel restrictions for individuals and vessels and quarantining and physical distancing); potential delays in (a) the loading and discharging of cargo on or from our vessels, (b) vessel inspections and related certifications by class societies, customers or government agencies, (c) maintenance, modifications or repairs to, or dry docking of, our existing vessels due to worker health or other business disruptions, and (d) the timing of crew changes; reduced cash flow and financial condition, including potential liquidity constraints; potential reduced access to capital as a result of any credit tightening generally or due to declines in global financial markets; potential reduced ability to opportunistically sell any of our vessels on the second-hand market, either as a result of a lack of buyers or a general decline in the value of second-hand vessels; potential decreases in the market values of our vessels and any related impairment charges or breaches relating to vessel-to-loan financial covenants; and potential deterioration in the financial condition and prospects of our customers or business partners.

Given the dynamic nature of the pandemic, including the development of variants of the virus that cause COVID-19 and the levels of effectiveness and delivery of vaccines and other actions to contain or treat the virus, the duration of any potential business disruption and the related financial impact and effects on us and our suppliers, customers and industry, cannot be reasonably estimated at this time and could materially affect our business, results of operations and financial condition. Please read "Item 3 - Key Information - Risk Factors" in our Annual Report on Form 20-F for the year ended December 31, 2021 for additional information about the potential risks of the COVID-19 pandemic on our business.

Vessel Sales

During the first quarter of 2022, we agreed to sell one Suezmax tanker and two Aframax tankers for a total price of $43.6 million. The Suezmax tanker was delivered to its new owner in February 2022 and the Aframax tankers were delivered to their new owners in April 2022.

Sale-leaseback Financing Transactions

In March 2022, we completed a $177.3 million sale-leaseback financing transaction relating to eight Suezmax tankers. Each vessel is leased on a bareboat charter ranging from six to nine-year terms, with purchase options available commencing at the end of the second year.

In April 2022, we completed a $114.0 million sale-leaseback financing transaction relating to four LR2 products tankers and one Suezmax tanker. Each vessel is leased on a bareboat charter ranging from seven to eight-year terms, with purchase options available throughout the lease terms and a purchase obligation at the end of the leases.

RESULTS OF OPERATIONS

In accordance with GAAP, we report gross revenues in our unaudited consolidated statements of loss and include voyage expenses among our operating expenses. However, ship-owners base economic decisions regarding the deployment of their vessels upon anticipated "time-charter equivalent" (or TCE) rates, which represent net revenues (or loss from operations before vessel operating expenses, time-charter hire expenses, depreciation and amortization, general and administrative expenses and write-down of assets), which includes voyage expenses, divided by revenue days; in addition, industry analysts typically measure bulk shipping freight and hire rates in terms of TCE rates. This is

because under time charter-out contracts the customer usually pays the voyage expenses, while under voyage charters the ship-owner usually pays the voyage expenses, which typically are added to the hire rate at an approximate cost. Accordingly, the discussion of revenue below focuses on net revenues and TCE rates (both of which are non-GAAP financial measures) where applicable.

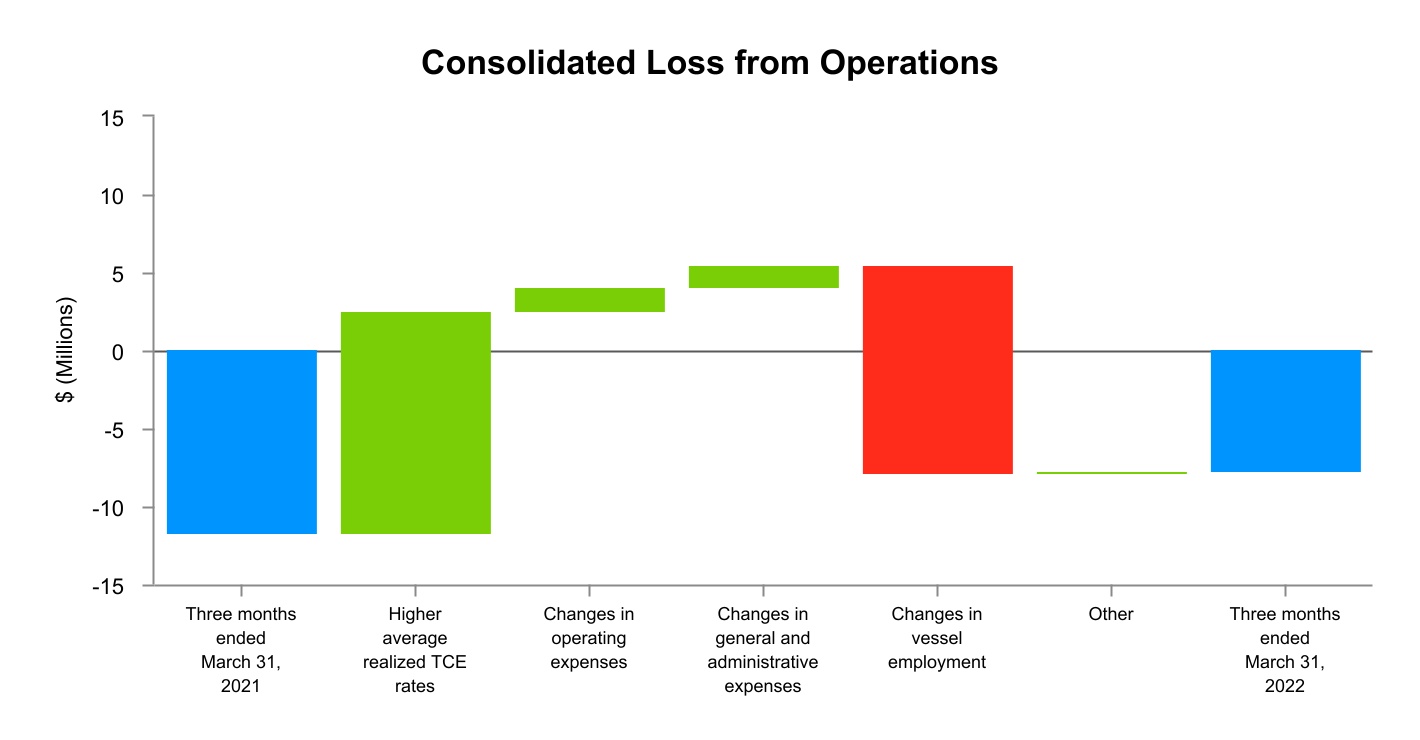

Summary

Our consolidated loss from operations was $7.8 million for the three months ended March 31, 2022, compared to a loss from operations of $11.8 million in the same period last year. The primary reasons for this decrease in loss are as follows:

•an increase of $14.2 million as a result of higher overall average realized spot TCE rates earned by our Suezmax tankers, Aframax tankers and LR2 product tankers in the first quarter of 2022, as well as higher earnings from our FSL dedicated vessels;

•an increase of $1.6 million due to a decrease in vessel operating expenses during the first quarter of 2022, primarily resulting from the timing of repair and maintenance activities; and

•an increase of $1.4 million due to a decrease in general and administrative expenses during the first quarter of 2022, primarily resulting from lower general corporate expenditures;

partially offset by:

•a net decrease of $13.3 million due to various vessels returning from time charter-out contracts during the first three quarters of 2021 and earning lower spot rates during the first quarter of 2022 compared to previous fixed rates, partially offset by one Aframax tanker commencing a time charter-out contract during the fourth quarter of 2021 and earning a higher fixed rate compared to the average spot rate in the first quarter of 2021.

Details of the changes to our results of operations for the three months ended March 31, 2022, compared to the three months ended March 31, 2021, are provided below.

Three Months Ended March 31, 2022 versus Three Months Ended March 31, 2021

We own and operate crude oil and product tankers that (i) are subject to long-term, fixed-rate time-charter contracts (which have an original term of one year or more), (ii) operate in the spot tanker market, or (iii) are subject to time charters that are priced on a spot market basis or are short-term, fixed-rate contracts (which have original terms of less than one year), including those employed on FSL contracts. In addition, we provide STS support services, along with our tanker commercial management and technical management services.

The following table presents our results for the three months ended March 31, 2022 and 2021, and includes a comparison of net revenues, a non-GAAP financial measure, for those periods to loss from operations, the most directly comparable GAAP financial measure:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| (in thousands of U.S. Dollars, except percentage changes) | 2022 | | 2021 | | % Change | | | | | | |

| Revenues | 174,018 | | 142,749 | | 21.9% | | | | | | |

| Less: Voyage expenses | (101,622) | | (69,045) | | 47.2% | | | | | | |

| Net revenues | 72,396 | | 73,704 | | (1.8)% | | | | | | |

| | | | | | | | | | | |

| Vessel operating expenses | (39,001) | | (43,048) | | (9.4)% | | | | | | |

| Time-charter hire expenses | (5,550) | | (3,630) | | 52.9% | | | | | | |

| Depreciation and amortization | (25,080) | | (26,684) | | (6.0)% | | | | | | |

| General and administrative expenses | (10,120) | | (11,470) | | (11.8)% | | | | | | |

| Write-down of assets | (421) | | (715) | | (41.1)% | | | | | | |

| | | | | | | | | | | |

| Loss from operations | (7,776) | | (11,843) | | (34.3)% | | | | | | |

| | | | | | | | | | | |

| Interest expense | (8,162) | | (10,068) | | (18.9)% | | | | | | |

| Interest income | 35 | | 30 | | 16.7% | | | | | | |

Realized and unrealized gain on derivative

instruments | 2,028 | | 703 | | 188.5% | | | | | | |

| Equity loss | (754) | | (359) | | 110.0% | | | | | | |

| Other (expense) income | (133) | | 743 | | (117.9)% | | | | | | |

| Net loss before income tax | (14,762) | | (20,794) | | (29.0)% | | | | | | |

| Income tax recovery (expense) | 820 | | (571) | | (243.6)% | | | | | | |

| Net loss | (13,942) | | (21,365) | | (34.7)% | | | | | | |

Net Revenues. Net revenues were $72.4 million for the three months ended March 31, 2022, compared to $73.7 million for the same period in the prior year.

The decrease for the three months ended March 31, 2022 compared to the same period in the prior year was primarily the result of:

•a net decrease of $13.3 million for the three months ended March 31, 2022 primarily due to various vessels returning from time charter-out contracts during the first three quarters of 2021 and earning lower spot rates during the first quarter of 2022 compared to previous fixed rates, partially offset by one Aframax tanker commencing on a time charter-out contract during the fourth quarter of 2021 and earning a higher fixed rate during the first quarter of 2022 compared to the average spot rate in the first quarter of 2021;

•a net decrease of $1.5 million for the three months ended March 31, 2022 primarily due to the sale of four Aframax tankers at various times during 2021 and the sale of one Suezmax tanker during the first quarter of 2022, as well as the redeliveries of one Aframax chartered-in tanker and one LR2 chartered-in tanker to their owners during the first quarter of 2021, partially offset by the addition of one LR2 chartered-in tanker and one Aframax chartered-in tanker that were delivered to us during the second half of 2021; and

•a decrease of $1.2 million for the three months ended March 31, 2022 due to more off-hire days and off-hire bunker expenses related to increased dry dockings and ballast water treatment system (or BWTS) installations during the first quarter of 2022 compared to the same period in the prior year;

partially offset by:

•an increase of $14.0 million for the three months ended March 31, 2022 due to higher overall average realized spot rates earned by our Suezmax tankers, Aframax tankers and LR2 product tankers during the first quarter of 2022; and

•an increase of $0.6 million for the three months ended March 31, 2022 due to higher STS support services revenues resulting from a higher number of operations compared to the same period in the prior year.

Vessel Operating Expenses. Vessel operating expenses were $39.0 million for the three months ended March 31, 2022 compared to $43.0 million for the same period in the prior year. The decrease was primarily due to a reduction of $2.8 million due to the sale of five tankers during 2021 and the first quarter of 2022, and a decrease of $2.4 million related to the timing of repair and planned maintenance activities and lower expenditures for ship management costs during the first quarter of 2022, partially offset by an increase of $1.2 million mainly due to higher expenditures for insurance, port expenses and crewing-related costs during the first quarter of 2022, as well as an increase in costs related to a higher volume of STS support services activities.

Time-charter Hire Expenses. Time-charter hire expenses were $5.6 million for the three months ended March 31, 2022 compared to $3.6 million for the same period in the prior year. A net increase of $1.9 million was primarily due to the deliveries to us of three chartered-in vessels during the second half of 2021, including two tankers and one lightering support vessel, partially offset by the redeliveries to their owners of four chartered-in vessels during 2021, including two tankers and two lightering support vessels.

Depreciation and Amortization. Depreciation and amortization was $25.1 million for the three months ended March 31, 2022, compared to $26.7 million for the same period in the prior year. The decrease was primarily due to a decrease of $2.1 million resulting from the impairments of seven tankers during the first half of 2021, a reduction of $2.1 million due to the sale of three tankers during the second half of 2021 and first quarter of 2022, as well as the classification of two tankers as held for sale since December 31, 2021, partially offset by a net increase of $2.6 million primarily due to depreciation related to capitalized expenditures associated with dry dockings and modifications to our vessels during 2021.

General and Administrative Expenses. General and administrative expenses were $10.1 million for the three months ended March 31, 2022, compared to $11.5 million for the same period in the prior year. The decrease was primarily due to lower administrative, strategic management, and other fees incurred under our management agreement with a subsidiary of Teekay Corporation (or Teekay) primarily due to organizational changes, as well as the timing of equity-based compensation and other general corporate expenditures.

Write-Down of Assets. The write-down of assets of $0.4 million for the three months ended March 31, 2022, was due to:

•the impairment recorded on two of our operating lease right-of-use assets resulting from a decline in short-term time-charter rates as of March 31, 2022, which resulted in a write-down of $1.1 million;

partially offset by:

•a gain of $0.6 million due to the reversal of the previous write-down of one Aframax tanker, which was recorded during the fourth quarter of 2021, to reflect the agreed sales price, which sale was completed in April 2022.

The write-down of assets of $0.7 million for the three months ended March 31, 2021, was due to the impairment recorded on one of our operating lease right-of-use assets resulting from a decline in short-term time-charter rates.

Interest Expense. Interest expense was $8.2 million for the three months ended March 31, 2022, compared to $10.1 million for the same period in the prior year. The decrease was primarily due to lower principal balances and interest rates associated with our finance lease obligations, mainly resulting from the completion of new sale-leaseback transactions for eight vessels, which were repurchased under their previous higher-cost sale-leaseback agreements during 2021, partially offset by the write-off of capitalized loan costs resulting from the sale-leaseback transaction completed for eight vessels in March 2022.

Realized and Unrealized Gain on Derivative Instruments. Realized and unrealized gain on derivative instruments was $2.0 million for the three months ended March 31, 2022, compared to $0.7 million for the same period in the prior year.

In March 2020, we entered into an interest rate swap with a notional amount of $50.0 million and a fixed rate of approximately 0.8%, which is scheduled to mature in December 2024. Primarily as a result of changes in the long-term forward London Interbank Offered Rate (or LIBOR) rates, we recognized an unrealized gain of $1.9 million for the three months ended March 31, 2022, compared to an unrealized gain of $0.8 million for the same period in the prior year under the interest rate swap agreement.

We use forward freight agreements (or FFAs) to increase or decrease our exposure to spot market rates, within defined limits. We recognized an unrealized gain of $0.2 million for the three months ended March 31, 2022, compared to an unrealized loss of $0.1 million for the same period in the prior year under the FFAs.

Other (Expense) Income. Other expense was $0.1 million for the three months ended March 31, 2022, compared to other income of $0.7 million for the same period in the prior year. The decrease in other income was primarily due to changes in foreign currency exchange rates related to our accrued tax and working capital balances.

Income Tax Recovery (Expense). Income tax recovery was $0.8 million for the three months ended March 31, 2022, compared to income tax expense of $0.6 million for the same period in the prior year. The fluctuation was primarily due to changes in vessel trading activities, as well as higher recoveries related to the expiry of the statute of limitations in one jurisdiction during the three months ended March 31, 2022. For additional information, please read "Item 1 – Financial Statements: Note 9 - Income Tax Recovery (Expense)" of this report.

Tanker Market

Crude tanker spot rates were relatively weak during the first two months of 2022 due to the impact of the Omicron COVID-19 variant on oil demand, lower than expected oil supply growth due to temporary production outages, and high crude oil prices which led to an increase in bunker costs. However, Russia’s invasion of Ukraine in late February led to a spike in crude tanker rates, particularly in the Aframax and Suezmax sectors, due to trade disruptions and the rerouting of cargos. Since then, the tanker market has exhibited significant rate volatility and stronger crude tanker spot rates.

Although the near-term outlook for the tanker market is uncertain, changing trade patterns due to the Russia-Ukraine conflict are resulting in an increase in tanker tonne-mile demand. During the past few weeks, there has been a decrease in Russian crude oil exports to Europe and a corresponding increase in Russian crude oil exports to Asia, particularly to India. This has been positive for tanker tonne-mile demand due

to longer voyage distances. Similarly, Europe is replacing Russian crude oil with imports from further afield, including the U.S. Gulf, West Africa, and the Middle East, which is also positive for tanker tonne-mile demand. Given the European Union's recent proposal to phase-out all Russian crude oil imports over the next six months, and refined products by the end of 2022, we expect that these altered trade patterns may persist for an extended period of time. In addition, the fleet of Russian-owned and operated ships, which comprises approximately 5% of the global Aframax fleet, is finding it more difficult to trade, which is further tightening available tanker fleet supply.

The outlook for the global economy and oil demand has worsened since the start of the year due to rising inflation, Russia’s invasion of Ukraine, and a resurgence of COVID-19 cases, particularly in China. In its April 2022 “World Economic Outlook” report, the International Monetary Fund (or IMF) reduced its GDP growth outlook from 4.4% to 3.6% and warned that risks are weighted to the downside. In addition, the International Energy Agency (or IEA) has downgraded its outlook for global oil demand growth from 3.2 million barrels per day (or mb/d) at the start of the year to 1.9 mb/d in its April 2022 report. A weakened outlook for the global economy and oil demand is a potential headwind for tanker rates in the coming months; however, these negative impacts may be offset by the increase in average voyage distances due to the Russia-Ukraine conflict and we expect rate volatility to persist in the near-term.

The outlook for tanker fleet supply continues to be very positive, with some of the best supply fundamentals seen in over two decades. As of April 2022, the tanker orderbook stood at only 6.4% of the existing fleet size, which is the lowest since Clarksons started tracking orderbook data in 1996. Rising newbuilding prices, which are currently the highest since 2009, and a lack of shipyard capacity continue to limit new tanker orders, with just 0.2 million deadweight (or mdwt) of new orders placed in the first quarter of 2022, the lowest since at least 1996. With most major shipyards at capacity through the middle of 2025, there is limited available capacity to order new tankers for delivery in the next three years. This, coupled with an aging global tanker fleet, should lay the foundation for very low fleet growth through 2025.

In summary, spot tanker rates have increased following Russia’s invasion of Ukraine and look to remain volatile in the coming weeks and months as the situation continues to unfold. Although the near-term outlook is uncertain, the longer-term outlook appears positive due to a small tanker orderbook, very low levels of tanker ordering, and an aging global tanker fleet, which together should lead to an extended period of very low tanker fleet growth.