Table of Contents

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-173250

PROSPECTUS

Realogy Corporation

Up to $1,143,706,000 11.00% Series A Convertible Senior Subordinated Notes due 2018

Up to $291,424,196 11.00% Series B Convertible Senior Subordinated Notes due 2018

Up to $675,111,000 11.00% Series C Convertible Senior Subordinated Notes due 2018

and

Domus Holdings Corp.

Class A Common Stock Issuable upon Conversion of the Notes

Realogy Corporation (“Realogy”) issued $2,110,241,196 aggregate principal amount of 11.00% Convertible Senior Subordinated Notes due 2018, consisting of (i) $1,143,706,000 aggregate principal amount of 11.00% Series A Convertible Senior Subordinated Notes due 2018 (the “Series A Convertible Notes”), (ii) $291,424,196 aggregate principal amount of 11.00% Series B Convertible Senior Subordinated Notes due 2018 (the “Series B Convertible Notes”) and (iii) $675,111,000 aggregate principal amount of 11.00% Series C Convertible Senior Subordinated Notes due 2018 (the “Series C Convertible Notes” and, together with the Series A Convertible Notes and the Series B Convertible Notes, the “notes”) on January 5, 2011 in connection with Realogy’s private debt exchange offers (the “Debt Exchange Offering”) as more fully described herein. The Series A Convertible Notes, Series B Convertible Notes and Series C Convertible Notes were issued under the same indenture (the “indenture”), dated as of January 5, 2011, by and among, Realogy, Domus Holdings Corp., Realogy’s indirect parent corporation (“Holdings”), the note guarantors party thereto (the “Note Guarantors”) and The Bank of New York Mellon Trust Company, N.A., as trustee (the “Trustee), and are treated as a single class for substantially all purposes under the indenture. This prospectus will be used by the selling securityholders named herein to resell their notes up to a total principal amount of $2,110,241,196 and the Class A Common Stock of Holdings, par value $0.01 per share (“Class A Common Stock”), issuable upon conversion of the notes. We are registering the offer and sale of the notes up to a total principal amount of $2,110,241,196 and the shares of Class A Common Stock issuable upon conversion of the notes to satisfy registration rights we have granted.

The Series A Convertible Notes bear interest at a rate of 11.00% per annum. The Series B Convertible Notes bear interest at a rate of 11.00% per annum. The Series C Convertible Notes bear interest at a rate of 11.00% per annum. Interest is payable semiannually to holders of record at the close of business on April 1 and October 1 immediately preceding the interest payment dates of April 15 and October 15 of each year.

The notes are guaranteed on an unsecured senior subordinated basis by each of Realogy’s U.S. direct or indirect restricted subsidiaries that is a guarantor under the 13.375% Senior Subordinated Notes (as defined below). Subject to certain exceptions, any subsidiary that in the future guarantees the 13.375% Senior Subordinated Notes will also guarantee the notes. Holdings also guarantees the notes on an unsecured junior subordinated basis.

The notes are convertible into Class A Common Stock at any time prior to April 15, 2018. Every $1,000 aggregate principal amount of Series A Convertible Notes or Series B Convertible Notes is convertible into 975.6098 shares of Class A Common Stock, which is equivalent to an initial conversion price of approximately $1.025 per share, and every $1,000 aggregate principal amount of Series C Convertible Notes is convertible into 926.7841 shares of Class A Common Stock, which is equivalent to an initial conversion price of approximately $1.079 per share, in each case subject to adjustments under certain conditions as set forth in the indenture.

Upon the occurrence of a Qualified Public Offering (as defined below), and at any time thereafter, Realogy may, at its option, redeem the notes, in whole or in part, at a redemption price, payable in cash, equal to 90% of the principal amount of the notes to be redeemed plus accrued and unpaid interest thereon to, but not including, the redemption date. If Realogy undergoes a Change of Control (as defined below), it must offer to repurchase the notes at 101% of the principal amount, plus accrued and unpaid interest and additional interest, if any, to the repurchase date.

We are not selling any notes or shares of Class A Common Stock pursuant to this prospectus and will not receive any proceeds from sales of the securities registered herein by the selling securityholders. The selling securityholders may sell all or a portion of their notes and the Class A Common Stock issuable upon conversion thereof from time to time in market transactions, in negotiated transactions or otherwise, and at prices and on terms that will be determined by the prevailing market price or at negotiated prices. For more information regarding the sales of the notes and Class A Common Stock issuable upon conversion of the notes by the selling securityholders pursuant to this prospectus, please read “Plan of Distribution.”

There is no public market for the notes or Class A Common Stock and we do not intend to apply for listing of the notes or the Class A Common Stock on any securities exchanges or for quotation of these securities through any automated quotation systems. Because there is no public market for our Class A Common Stock, the selling securityholders will sell their shares of our Class A Common Stock at a fixed price until shares of our Class A Common Stock are quoted on the OTC Bulletin Board or listed for trading or quoted on any other public market, and thereafter at prevailing market prices or privately negotiated prices. The offering price is between $1.00 to $2.00 per share of Class A Common Stock.

Investing in the notes and the Class A Common Stock issuable upon conversion of the notes involves risks. See “Risk Factors” beginning on page 21.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is June 16, 2011.

Table of Contents

| Page | ||||

| ii | ||||

| ii | ||||

| 1 | ||||

| 21 | ||||

| 51 | ||||

| 54 | ||||

| 55 | ||||

| 56 | ||||

| 57 | ||||

SELECTED HISTORICAL CONSOLIDATED AND COMBINED FINANCIAL STATEMENTS | 58 | |||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 61 | |||

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 111 | |||

MANAGEMENT’S REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING | 112 | |||

| 113 | ||||

| 134 | ||||

| 140 | ||||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 160 | |||

| 165 | ||||

| 170 | ||||

| 179 | ||||

| 192 | ||||

| 219 | ||||

| 221 | ||||

| 223 | ||||

| 225 | ||||

| 233 | ||||

| 235 | ||||

| 237 | ||||

| 271 | ||||

| 271 | ||||

| 272 | ||||

| F-1 | ||||

Except as otherwise indicated or unless the context otherwise requires, the terms “we,” “us,” “our,” “our company” and the “Company” refer to Domus Holdings Corp. and its consolidated subsidiaries, including Domus Intermediate Holdings Corp., a Delaware limited liability company (“Intermediate”) and Realogy Corporation, a Delaware corporation (“Realogy”). Holdings is not a party to the senior secured credit facility and certain references in this prospectus to our consolidated indebtedness exclude Holdings with respect to indebtedness under the senior secured credit facility. In addition, while Holdings is a guarantor of Realogy’s obligations under the Unsecured Notes (as defined below) and the First and a Half Lien Notes (as defined below), Holdings is not subject to the restrictive covenants in the agreements governing such indebtedness. Holdings, the indirect parent of Realogy, does not conduct any operations other than with respect to its indirect ownership of Realogy. Intermediate, the parent of Realogy, does not conduct any operations other than with respect to its ownership of Realogy.

You should rely only on the information contained in this prospectus or to which we have referred you. We have not, and the selling securityholders have not, authorized anyone to provide you with information that is different. This prospectus may only be used where it is legal to sell the securities being offered by this prospectus. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front cover of this prospectus.

i

Table of Contents

STATE SECURITIES LAWS CONSIDERATIONS

The securities represented hereby have not been registered under any state securities commission or regulatory authority and may be offered, sold or otherwise transferred only if so registered or in a manner exempt from registration under such state securities commission or regulatory authority. See “State Securities Laws Considerations.”

We own or have rights to use the trademarks, service marks and trade names that we use in conjunction with the operation of our business. Some of the more important trademarks that we own or have rights to use that appear in this prospectus include the CENTURY 21®, COLDWELL BANKER®, ERA®, THE CORCORAN GROUP®, COLDWELL BANKER COMMERCIAL®, SOTHEBY’S INTERNATIONAL REALTY® and BETTER HOMES AND GARDENS® marks, which are registered in the United States and/or registered or pending registration in other jurisdictions, as appropriate to the needs of our relevant business. Each trademark, trade name or service mark of any other company appearing in this prospectus is owned by such company.

MARKET AND INDUSTRY DATA AND FORECASTS

This prospectus includes data, forecasts and information obtained from independent trade associations, industry publications and surveys and other information available to us. Some data is also based on our good faith estimates, which are derived from management’s knowledge of the industry and independent sources. As noted in this prospectus, the National Association of Realtors (“NAR”), the Federal National Mortgage Association (“Fannie Mae”) and the Federal Home Loan Mortgage Corporation (“Freddie Mac”) were the primary sources for third-party industry data and forecasts. While data provided by NAR and Fannie Mae are two indicators of the direction of the residential housing market, we believe that homesale statistics will continue to vary between us and NAR and Fannie Mae because they use survey data in their historical reports and forecasting models whereas we use data based on actual reported results. In addition to the differences in calculation methodologies, there are geographical differences and concentrations in the markets in which we operate versus the national market. For instance, comparability is impaired due to NAR’s utilization of seasonally adjusted annualized rates whereas we report actual period over period changes and their use of median price for their forecasts compared to our average price. Historical NAR data is subject to periodic review and revision. NAR has recently issued a press release disclosing that it is engaged in a review of its sampling and methodology processes with respect to existing homesale data to ensure accuracy. NAR expects to conclude this analysis and publish any revisions in the summer of 2011. Any such changes could result in downward revisions of NAR’s historical national survey data but would have no impact on Realogy’s reported financial results or key business driver information.

Forecasts regarding rates of home ownership, median sales price, volume of homesales, and other metrics included in this prospectus to describe the housing industry are inherently uncertain or speculative in nature and actual results for any period may materially differ. Industry publications and surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but such information may not be accurate or complete. We have not independently verified any of the data from third-party sources nor have we ascertained the underlying economic assumptions relied upon therein. Statements as to our market position are based on market data currently available to us. While we believe that the industry data presented herein are derived from the most widely recognized sources for reporting U.S. residential housing market statistical data, we do not endorse or suggest reliance on this data alone.

We believe our internal research is reliable, even though such research has not been verified by any independent sources.

ii

Table of Contents

This summary highlights information contained elsewhere in this prospectus. You should read the entire prospectus carefully, including the section entitled “Risk Factors” and our financial statements and the related notes included elsewhere in this prospectus, before making an investment decision to purchase notes and shares of Class A Common Stock issuable upon conversion of the notes. All amounts in this prospectus are expressed in U.S. dollars and the financial statements have been prepared in accordance with generally accepted accounting principles in the Unites States (“GAAP”).

Our Company

Realogy is a wholly-owned subsidiary of Domus Intermediate Holding Corp., a Delaware corporation, which is wholly-owned by Holdings. Holdings, a Delaware corporation, does not conduct any operations other than with respect to its indirect ownership of Realogy.

We are one of the preeminent and most integrated providers of real estate and relocation services. We are the world’s largest real estate brokerage franchisor, the largest U.S. residential real estate brokerage firm, the largest U.S. provider and a leading global provider of outsourced employee relocation services and a provider of title and settlement services. Through our portfolio of leading brands and the broad range of services we offer, we have established our company as a leader in the residential real estate industry, with operations that are dispersed throughout the U.S. and in various locations worldwide. We derive the vast majority of our revenues from serving the needs of buyers and sellers of existing homes, rather than serving the needs of builders and developers of new homes. Realogy was incorporated on January 27, 2006 in the State of Delaware. Holdings was incorporated on December 14, 2006 in the State of Delaware.

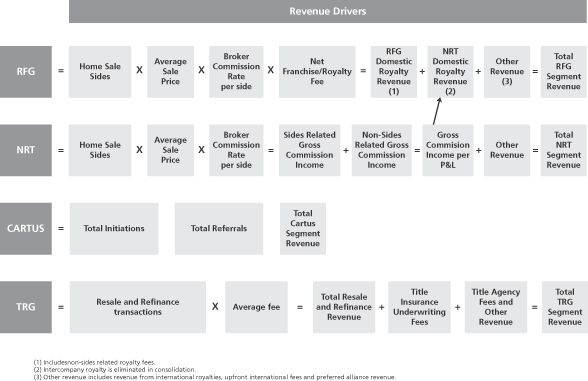

We report our operations in four segments: Real Estate Franchise Services, Company Owned Real Estate Brokerage Services, Relocation Services and Title and Settlement Services.

Segment Overview

Real Estate Franchise Services: Through our Real Estate Franchise Services segment, or RFG, we are a franchisor of some of the most recognized brands in the real estate industry. As of March 31, 2011, our franchise system had approximately 14,600 offices (which included approximately 740 of our company owned and operated brokerage offices) and 260,400 independent sales associates operating under our franchise and proprietary brands in the U.S. and 99 other countries and territories around the world (internationally, generally through master franchise agreements). In 2010, based on NAR’s historical survey data and our own results, we were involved, either through our franchise operations of our franchisees or our company owned brokerages, in approximately 23% of all existing homesale transaction volume (sides times average sales price) for domestic transactions involving a real estate brokerage firm. As of December 31, 2010, we had approximately 3,600 domestic franchisees, none of which individually represented more than 1% of our franchise royalties (other than our subsidiary, NRT LLC, or NRT, which operates our company owned brokerage business). We believe this reduces our exposure to any one franchisee. On average, our franchisee’s tenure with our brands is 18 years as of December 31, 2010. Our franchise revenues included $42 million and $206 million of royalties paid by our company owned brokerage operations, or approximately 36% and 37% of total franchise revenues, for the three months ended March 31, 2011 and the year ended December 31, 2010, respectively, which eliminates in consolidation. As of March 31, 2011, our real estate franchise brands were:

| • | Century 21®—One of the world’s largest residential real estate brokerage franchisors, with approximately 7,900 franchise offices and approximately 119,200 independent sales associates located in the U.S. and 70 other countries and territories; |

1

Table of Contents

| • | Coldwell Banker®—One of the largest residential real estate brokerage franchisors, with approximately 3,200 franchise and company owned offices and approximately 87,200 independent sales associates located in the U.S. and 48 other countries and territories; |

| • | ERA®—A residential real estate brokerage franchisor, with approximately 2,500 franchise and company owned offices and approximately 30,700 independent sales associates located in the U.S. and 41 other countries and territories; |

| • | Sotheby’s International Realty®—A luxury real estate brokerage brand. In February 2004, we acquired Sotheby’s company owned offices and the exclusive license for the rights to the Sotheby’s Realty and Sotheby’s International Realty® trademarks. Since that time, we have grown the brand from 15 company owned offices to approximately 560 franchise and company owned offices and approximately 12,000 independent sales associates located in the U.S. and 41 other countries and territories; |

| • | Better Homes and Gardens® Real Estate —We launched the Better Homes and Gardens® Real Estate brand in July 2008 under an exclusive long-term license from Meredith Corporation (“Meredith”) and have approximately 200 franchise offices and approximately 7,000 independent sales associates located in the U.S.; and |

| • | Coldwell Banker Commercial®—A commercial real estate brokerage franchisor. Our commercial franchise system has approximately 160 franchise offices and approximately 2,000 independent sales associates worldwide. The number of offices and independent sales associates in our commercial franchise system does not include our residential franchise and company owned brokerage offices and the independent sales associates who work out of those brokerage offices that also conduct commercial real estate brokerage business using the Coldwell Banker Commercial® trademarks. |

We derive substantially all of our real estate franchising revenues from royalty fees received under long-term franchise agreements with our franchisees (typically ten years in duration for domestic agreements). The royalty fee is based on a percentage of the franchisees’ sales commission earned from real estate transactions, which we refer to as gross commission income. Our franchisees pay us royalty fees for the right to operate under one of our trademarks and to utilize the benefits of the systems and tools provided by our real estate franchise operations. These royalty fees enable us to have recurring revenue streams. In exchange, we provide our franchisees with support that is designed to facilitate our franchisees in growing their business, attracting new independent sales associates and increasing their revenue and profitability. We support our franchisees with dedicated branding-related national marketing and servicing programs, technology, training and education. We believe that one of our strengths is the strong relationships that we have with our franchisees, as evidenced by our franchisee retention rate of 95% in 2010. Our retention rate represents the annual gross commission income as of December 31 of the previous year generated by our franchisees that remain in the franchise system on an annual basis, measured against the annual gross commission income of all franchisees as of December 31 of the previous year.

Company Owned Real Estate Brokerage Services: Through our subsidiary, NRT, we own and operate a full-service real estate brokerage business in more than 35 of the largest metropolitan areas of the U.S. Our company owned real estate brokerage business operates principally under our Coldwell Banker® brand as well as under the ERA® and Sotheby’s International Realty® franchised brands, and proprietary brands that we own, but do not currently franchise to third parties, such as The Corcoran Group®. In addition, under NRT, we operate a large independent REO residential asset manager, which focuses on bank-owned properties. At March 31, 2011, we had approximately 740 company owned brokerage offices, approximately 5,000 employees and approximately 43,000 independent sales associates working with these company owned offices. Acquisitions have been, and will continue to be, part of our strategy and a contributor to the growth of our company owned brokerage business.

2

Table of Contents

Our company owned real estate brokerage business derives revenues primarily from gross commission income received serving as the broker at the closing of real estate transactions. For the year ended December 31, 2010, our average homesale broker commission rate was 2.48% which represents the average commission rate earned on either the “buy” side or the “sell” side of a homesale transaction. Generally in U.S. homesale transactions, the broker for the home seller instructs the closing agent to pay a portion of the sales commission to the broker for the buyer and keeps the remaining portion of the homesale commission. In addition, as a full-service real estate brokerage company, in compliance with applicable laws and regulations, including the Real Estate Settlement Procedures Act (“RESPA”), we actively promote the services of our relocation and title and settlement services businesses, as well as the products offered by PHH Home Loans, LLC (“PHH Home Loans”), our home mortgage venture with PHH Corporation (“PHH”) that is the exclusive recommended provider of mortgages for our real estate brokerage and relocation service customers. All mortgage loans originated by PHH Home Loans are sold to PHH or other third party investors, and PHH Home Loans does not hold any mortgage loans for investment purposes or perform servicing functions for any loans it originates. Accordingly, our home mortgage venture structure insulates us from mortgage servicing risk. We own 49.9% of PHH Home Loans and PHH owns the remaining 50.1%. The Company is not the primary beneficiary and therefore our financial results only reflect our proportionate share of the venture’s results of operations which are recorded using the equity method.

Relocation Services: Through our subsidiary, Cartus Corporation (“Cartus”), we are a leading global provider of outsourced employee relocation services and the largest provider in the U.S. We offer a broad range of world-class employee relocation services designed to manage all aspects of an employee’s move to facilitate a smooth transition in what otherwise may be a difficult process for both the employee and the employer.

Our relocation services business primarily offers its clients employee relocation services such as homesale assistance, home finding and other destination services, expense processing, relocation policy counseling and other consulting services, arranging household moving services, visa and immigration support, intercultural and language training and group move management services. In addition to general residential housing trends, key drivers of our relocation services business are corporate spending and employment trends.

In January 2010, our relocation business acquired Primacy, a relocation and global assignment management services company headquartered in Memphis, Tennessee with international locations in Canada, Europe and Asia. The acquisition enabled Cartus to re-enter the U.S. government relocation business, increase its domestic operations, as well as expand the Company’s global relocation capabilities. Effective January 1, 2011, the Primacy business operates under the Cartus name.

In 2010, we assisted in over 148,000 relocations in over 160 countries for approximately 1,500 active clients, including over 60% of the Fortune 50 companies as well as affinity organizations. Cartus has offices in the U.S. as well as internationally in Swindon and Richmond, United Kingdom, Canada, Hong Kong, Singapore, China, Germany, France, Switzerland and The Netherlands.

Clients pay a fee for the services performed and we also receive commissions from third-party service providers, such as real estate brokers and household goods moving service providers. The majority of our clients pay interest on home equity advances and nearly all clients reimburse all other costs associated with our services, including, where required, repayment of home equity advances and reimbursement of losses on the sale of homes purchased. We believe we provide our relocation clients with exceptional service which leads to client retention. As of December 31, 2010, our top 25 relocation clients had an average tenure of 18 years with us. In addition, our relocation services business generates revenue for our other businesses because the clients of our relocation services business often utilize the services of our franchisees and company owned brokerage offices as well as our title and settlement services.

3

Table of Contents

Title and Settlement Services: In most real estate transactions, a buyer will choose, or will be required, to purchase title insurance that will protect the purchaser and/or the mortgage lender against loss or damage in the event that title is not transferred properly and to insure free and clear ownership of the property to the buyer. Our title and settlement services business, which we refer to as TRG, assists with the closing of a real estate transaction by providing full-service title and settlement (i.e., closing and escrow) services to customers, real estate companies, including our company owned real estate brokerage and relocation services businesses as well as a targeted channel of large financial institution clients including PHH. In addition to our own title settlement services, we also coordinate a nationwide network of attorneys, title agents and notaries to service financial institution clients on a national basis.

Our title and settlement services business earns revenues through fees charged in real estate transactions for rendering title and other settlement and non-settlement related services. We provide many of these services in connection with transactions in which our company owned real estate brokerage and relocation services businesses are participating. During 2010, approximately 39% of the customers of our company owned brokerage offices where we offer title coverage also utilized our title and settlement services. Fees for escrow and closing services are generally separate and distinct from premiums paid for title insurance and other real estate services. We also derive revenues by providing our title and settlement services to various financial institutions in the mortgage lending industry. Such revenues are primarily derived from providing our services to their customers who are refinancing their mortgage loans.

We also serve as an underwriter of title insurance policies in connection with residential and commercial real estate transactions. Our title insurance underwriter is licensed in 25 states and Washington, D.C. Our title underwriting operation generally earns revenues through the collection of premiums on policies that it issues.

The Refinancing Transactions

Debt Exchange Offering

On January 5, 2011, Realogy consummated private debt exchange offers exempt from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), for its outstanding 10.50% Senior Notes due 2014 (the “10.50% Senior Notes”), 11.00%/11.75% Senior Toggle Notes due 2014 (the “Senior Toggle Notes” and, together with the 10.50% Senior Notes, the “Existing Senior Notes”) and 12.375% Senior Subordinated Notes due 2015 (the “12.375% Senior Subordinated Notes” and, together with the Existing Senior Notes, the “Existing Notes”) pursuant to which Realogy issued the outstanding 11.50% Senior Notes due 2017 (the “11.50% Senior Notes”), the outstanding 12.00% Senior Notes due 2017 (the “12.00% Senior Notes” and, together with the 11.50% Senior Notes, the “Extended Maturity Senior Notes” and, together with the Existing Senior Notes, the “Senior Notes”), the outstanding 13.375% Senior Subordinated Notes due 2018 (the “13.375% Senior Subordinated Notes” and, together with the Extended Maturity Senior Notes, the “Extended Maturity Notes”) and the notes all as issued in the Debt Exchange Offering in exchange for the Existing Notes. The term “Senior Subordinated Notes” refers to the 12.375% Senior Subordinated Notes and the 13.375% Senior Subordinated Notes, collectively; and the term “Unsecured Notes” refers to the Senior Notes, the Senior Subordinated Notes and the notes, collectively.

Pursuant to the Debt Exchange Offering, approximately $2,110 million aggregate principal amount of Existing Notes were tendered for the notes, which are convertible at the holder’s option into Class A Common Stock and approximately $632 million aggregate principal amount were tendered for the Extended Maturity Notes. On January 5, 2011, Realogy issued:

| • | $492 million aggregate principal amount of 11.50% Senior Notes and $1,144 million aggregate principal amount of Series A Convertible Notes in exchange for $1,636 million aggregate principal amount of outstanding 10.50% Senior Notes; |

4

Table of Contents

| • | $130 million aggregate principal amount of 12.00% Senior Notes and $291 million aggregate principal amount of Series B Convertible Notes in exchange for $421 aggregate principal amount of outstanding Senior Toggle Notes; and |

| • | $10 million aggregate principal amount of 13.375% Senior Subordinated Notes and $675 million aggregate principal amount of Series C Convertible Notes in exchange for $685 million aggregate principal amount of outstanding 12.375% Senior Subordinated Notes. |

In addition, upon receipt of the requisite consents from the holders of the 10.50% Senior Notes and Senior Toggle Notes, Realogy amended the respective indentures governing the terms of such notes to remove substantially all of the restrictive covenants and certain other provisions previously contained in those indentures.

As a result of the Debt Exchange Offering, Realogy extended the maturity of approximately $2,742 million aggregate principal amount of the Unsecured Notes to 2017 and 2018, leaving approximately $303 million aggregate principal amount of Existing Notes that mature in 2014 and 2015. In addition, pursuant to the terms of the indenture, the notes are redeemable at Realogy’s option at a price equal to 90% of the principal amount thereof, plus accrued and unpaid interest to the date of redemption upon a Qualified Public Offering.

Amendment to Senior Secured Credit Facility

Effective February 3, 2011, Realogy entered into the first amendment to the senior secured credit facility (the “Senior Secured Credit Facility Amendment”) and an incremental assumption agreement, which resulted in the following:

| • | certain lenders extended the maturity of a significant portion of first lien term loans, revolving commitments and synthetic letter of credit commitments to October 10, 2016, April 10, 2016, and October 10, 2016, respectively, which extensions resulted in approximately $2,424 million aggregate principal amount of extended term loans, approximately $461 million aggregate principal amount of commitments in respect of extended revolving loans and approximately $171 million aggregate principal amount of extended synthetic letter of credit commitments; |

| • | certain lenders simultaneously converted approximately $98 million aggregate principal amount of revolving commitments in respect of extended revolving loans to extended term loans, thereby reducing the commitments under the revolving credit facility to $652 million; |

| • | the net proceeds of the $700 million aggregate principal amount of First and a Half Lien Notes (as defined below), together with cash on hand, were used to prepay $700 million of the outstanding extended term loans, thereby reducing the aggregate principal amount of extended term loans to $1,822 million; |

| • | the interest rate with respect to the extended term loans was increased by 1.25% from the rate applicable to the non-extended term loans; |

| • | the interest rate with respect to the extended revolving loans was increased by 1.0% from the rate applicable to the non-extended revolving loans; and |

| • | the fee with respect to the synthetic letter of credit facility was increased by 1.25% from the fee applicable to the non-extended synthetic letter of credit facility. |

The Senior Secured Credit Facility Amendment also provides for the following:

| • | allows for one or more future issuances of additional senior secured notes or unsecured notes or loans to prepay Realogy’s first lien term loans, to be secured on either apari passu basis with, or junior to, its first lien obligations under the senior secured credit facility; |

5

Table of Contents

| • | allows for one or more future issuances of additional senior secured or unsecured notes or loans to prepay Realogy’s second lien loans, to be secured on apari passu basis with, or junior to, its second lien loans under the senior secured credit facility; |

| • | allows for the incurrence of additional incremental term loans that are secured on a junior basis to the second lien loans in an aggregate amount not to exceed $350 million; and |

| • | provides that debt financing secured by a lien that is junior in priority to the first lien obligations under the senior secured credit facility (including, but not limited to, the First and a Half Lien Notes) will not, subject to certain exceptions, constitute senior secured debt for purposes of calculating the senior secured leverage ratio under the senior secured credit facility. |

The extended term loans do not require any scheduled amortization of principal. The non-extended term loan facility will continue to provide for quarterly amortization payments totaling 1% per annum of the principal amount of the non-extended first lien term loans. Approximately $635 million aggregate principal amount of the term loans under the senior secured credit facility were not extended in connection with the Senior Secured Credit Facility Amendment.

Issuance of First and a Half Lien Notes

On February 3, 2011, Realogy issued $700 million aggregate principal amount of 7.875% Senior Secured Notes due 2019 (the “First and a Half Lien Notes”) in a private offering exempt from the registration requirements of the Securities Act. The First and a Half Lien Notes are secured by substantially the same collateral as Realogy’s existing secured obligations under the senior secured credit facility, but the priority of the collateral liens securing the First and a Half Lien Notes is (i) junior to the collateral liens securing Realogy’s first lien obligations under the senior secured credit facility and (ii) senior to the collateral liens securing Realogy’s second lien obligations under the senior secured credit facility.

As discussed above, the net proceeds from the offering of the First and a Half Lien Notes, along with cash on hand, were used to prepay $700 million of certain of Realogy’s first lien term loans that were extended in connection with the Senior Secured Credit Facility Amendment. See “Description of Other Indebtedness” for further discussion of the First and a Half Lien Notes and Realogy’s other outstanding indebtedness.

As used in this prospectus, the term “Refinancing Transactions” refers to, collectively, (1) the Debt Exchange Offering, (2) the Senior Secured Credit Facility Amendment, and (3) the issuance of First and a Half Lien Notes.

* * * *

Our headquarters are located at One Campus Drive, Parsippany, New Jersey 07054 and our general telephone number is (973) 407 2000. We maintain an internet website athttp://www.realogy.com. Our internet website address is provided as an inactive textual reference. Our internet website and the information contained on that site, or connected to that site, are not incorporated by reference into this prospectus.

6

Table of Contents

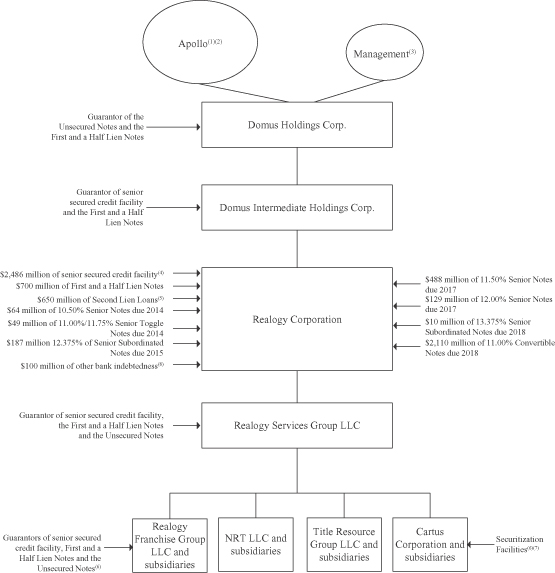

OUR OWNERSHIP AND DEBT STRUCTURE

The following diagram sets forth our ownership and debt structure as of March 31, 2011. The diagram does not display all of our subsidiaries.

| (1) | Consists of investment funds affiliated with Apollo (as defined below) and an investment fund of co-investors managed by Apollo that invested an aggregate of $1,978 million of equity in Holdings upon consummation of the Merger. |

| (2) | In connection with the Debt Exchange Offering, Apollo and Paulson & Co. Inc., on behalf of the several investment funds and accounts managed by it (together with such investment funds and accounts, “Paulson”), received Convertible Notes. On a fully diluted basis, assuming that all notes issued in the Debt Exchange Offering are converted into Class A Common Stock, Apollo and Paulson would own approximately 66.2% and 21.5%, respectively, of the outstanding common stock of Holdings (the |

7

Table of Contents

“Common Stock”) immediately following such conversion, and the remaining 12.2% of our outstanding Common Stock would be held by our directors, officers and employees (0.1%) and other holders of Convertible Notes. |

| (3) | Certain members of our management also contributed rollover equity of $23 million to finance a portion of the Merger. As of March 31, 2011, management owned 2,606,905 shares of Common Stock, options to purchase 15,989,500 shares of Common Stock and 105,000 shares of restricted stock of Holdings. On January 5, 2011, the Board of Directors of Realogy approved the Realogy Corporation Phantom Value Plan and made initial grants of Incentive Awards of approximately $21.8 million to our CEO, the other named executive officers and the CEO’s other three direct reports. These grants are subject to the terms and conditions of the Phantom Value Plan which is intended to provide certain participants, including the Company’s named executive officers, with an incentive to remain in the service of the Company, to increase their interest in the success of the Company and to receive compensation based upon the Company’s success. |

| (4) | As of March 31, 2011, the first priority obligations under the senior secured credit facility consisted of a $2,456 million term loan facility, $30 million of outstanding borrowings under a $652 million revolving credit facility, and $223 million of letters of credit outstanding under a $223 million synthetic letter of credit facility. As of March 31, 2011, borrowing availability under the revolving credit facility was approximately $517 million (after giving effect to $105 million of outstanding letters of credit). As of May 30, 2011, we had $325 million outstanding under the revolving credit facility. |

| (5) | Realogy has $650 million of second lien term loans under the incremental loan feature of the senior secured credit facility (the “Second Lien Loans”). |

| (6) | Guarantors include each wholly-owned subsidiary of Realogy other than subsidiaries that are (a) foreign subsidiaries, (b) securitization entities that are subsidiaries of Cartus Corporation, (c) insurance underwriters that are subsidiaries of Title Resource Group LLC and (d) qualified foreign corporation holding companies. |

| (7) | Certain subsidiaries of Cartus Corporation are borrowers under the Securitization Facilities. These special purpose entities were created for financing relocation receivables and advances, relocation properties held for sale and other related assets and issuing notes secured by such receivables and other assets. At March 31, 2011, $311 million of securitization obligations were outstanding under our Securitization Facilities which were collateralized by $390 million of securitization assets that are not available to pay our general obligations. |

| (8) | Other bank indebtedness consists of revolving credit facilities that are supported by letters of credit issued under the senior secured credit facility, of which $50 million is due in November 2011 and $50 million is due in January 2013. |

Our Equity Sponsor

On December 15, 2006, Realogy entered into an agreement and plan of merger (the “Merger”) with affiliates of Apollo. The Merger was consummated on April 10, 2007. As a result of the Merger, Realogy became an indirect wholly-owned subsidiary of Holdings and our principal stockholders are investment funds affiliated with, or co-investment vehicles managed by, Apollo Management VI, L.P. or one of its affiliates (together with Apollo Global Management, LLC and its subsidiaries, “Apollo”). Founded in 1990, Apollo is a leading global alternative asset manager with offices in New York, Los Angeles, London, Frankfurt, Luxembourg, Singapore, Hong Kong and Mumbai. As of March 31, 2011, Apollo had assets under management of $70 billion in its private equity, capital markets and real estate businesses. Companies owned or controlled by Apollo or its affiliates or in which Apollo or its affiliates have a significant equity investment include, among others, Affinion Group Holdings, Inc., AMC Entertainment, Inc., Berry Plastics Group, Inc., CEVA Group Plc, Metals USA Holdings Corp., Momentive Performance Materials LLC, NCL Corporation Ltd., Noranda Aluminum Holding Corporation, Rexnord Holdings, Inc. and Verso Paper Company.

8

Table of Contents

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL DATA

The following table presents our summary historical consolidated financial data and operating statistics. The consolidated statement of operations data for the years ended December 31, 2010, 2009 and 2008 and the consolidated balance sheet data as of December 31, 2010 and 2009 have been derived from our audited consolidated financial statements included in this prospectus. The consolidated balance sheet data as of December 31, 2008 has been derived from our consolidated and combined financial statements not included in this prospectus. The unaudited condensed consolidated statement of operations data and balance sheet data for the three months ended March 31, 2011 and 2010 have been derived from our unaudited historical condensed consolidated financial statements included in this prospectus. Results for interim periods are not indicative of results to be expected for any interim period or for a full year.

Holdings, the indirect parent of Realogy, does not conduct any operations other than with respect to its indirect ownership of Realogy. Intermediate, the parent of Realogy, does not conduct any operations other than with respect to its ownership of Realogy. Any expenses related to stock compensation issued by Holdings to the employees or directors of Realogy or franchise taxes incurred by Holdings are recorded in Realogy’s financial statements. As a result, there are no material differences between Holdings’ and Realogy’s financial statements for the three months ended March 31, 2011 and 2010 and the years ended December 31, 2010, 2009 and 2008 and no material differences between Intermediate’s and Realogy’s financial statements for the three months ended March 31, 2011 and 2010 and the years ended December 31, 2010, 2009 and 2008.

The summary historical consolidated financial data should be read in conjunction with the sections of this prospectus entitled “Capitalization,” and “Selected Historical Consolidated and Combined Financial Statements.”

| As of or For the Three Months Ended March 31, | As of or For the Year Ended December 31, | |||||||||||||||||||

| 2011 | 2010 | 2010 | 2009 | 2008 | ||||||||||||||||

Statement of Operations Data: | ||||||||||||||||||||

Net revenue | $ | 831 | $ | 819 | $ | 4,090 | $ | 3,932 | $ | 4,725 | ||||||||||

Total expenses | 1,067 | 1,011 | 4,084 | 4,266 | 6,988 | |||||||||||||||

Income (loss) before income taxes, equity in earnings and noncontrolling interests | (236 | ) | (192 | ) | 6 | (334 | ) | (2,263 | ) | |||||||||||

Income tax expense (benefit) | 1 | 6 | 133 | (50 | ) | (380 | ) | |||||||||||||

Equity in (earnings) losses of unconsolidated entities | — | (1 | ) | (30 | ) | (24 | ) | 28 | ||||||||||||

Net loss | (237 | ) | (197 | ) | (97 | ) | (260 | ) | (1,911 | ) | ||||||||||

Less: Net income attributable to noncontrolling interests | — | — | (2 | ) | (2 | ) | (1 | ) | ||||||||||||

Net loss attributable to Realogy and Holdings | $ | (237 | ) | $ | (197 | ) | $ | (99 | ) | $ | (262 | ) | $ | (1,912 | ) | |||||

9

Table of Contents

| As of or For the Three Months Ended March 31, | As of or For the Year Ended December 31, | |||||||||||||||||||

| 2011 | 2010 | 2010 | 2009 | 2008 | ||||||||||||||||

Other Data: | ||||||||||||||||||||

Interest expense, net (1) | $ | 179 | $ | 152 | $ | 604 | $ | 583 | $ | 624 | ||||||||||

Cash flows provided by (used in): | ||||||||||||||||||||

Operating activities | (87 | ) | 13 | (118 | ) | 341 | 109 | |||||||||||||

Investing activities | (19 | ) | (3 | ) | (70 | ) | (47 | ) | (23 | ) | ||||||||||

Financing activities | 6 | (58 | ) | 124 | (479 | ) | 199 | |||||||||||||

EBITDA (2) | (11 | ) | 11 | 835 | 465 | (1,449 | ) | |||||||||||||

EBITDA before restructuring and other items (2) | 25 | 22 | 534 | 427 | 411 | |||||||||||||||

Adjusted EBITDA—Senior secured credit facility covenant compliance (3) | 634 | 633 | 619 | 657 | ||||||||||||||||

Balance Sheet Data: | ||||||||||||||||||||

Cash and cash equivalents | $ | 93 | $ | 207 | $ | 192 | $ | 255 | $ | 437 | ||||||||||

Securitization assets (4) | 390 | 306 | 393 | 364 | 845 | |||||||||||||||

Total assets | 7,913 | 8,083 | 8,029 | 8,041 | 8,912 | |||||||||||||||

Securitization obligations | 311 | 239 | 331 | 305 | 703 | |||||||||||||||

Long-term debt, including short-term portion | 6,973 | 6,738 | 6,892 | 6,706 | 6,760 | |||||||||||||||

Equity (deficit) (5) | (1,297 | ) | (1,177 | ) | (1,072 | ) | (981 | ) | (740 | ) | ||||||||||

| (1) | Based upon our debt balances at December 31, 2010, after giving effect to the Refinancing Transactions, we estimate that our annual cash interest will increase by approximately $55 million assuming LIBOR rates as of December 31, 2010. |

| (2) | EBITDA is defined by us as net income (loss) before depreciation and amortization, interest (income) expense, net (other than relocation services interest for securitization assets and securitization obligations) and income taxes. EBITDA before restructuring and other items is defined by us as EBITDA adjusted for merger costs, restructuring costs, former parent legacy cost (benefit) items, net, impairment of intangible assets, goodwill and investments in unconsolidated entities, non-cash charges for PHH Home Loans impairment and gain or loss on the early extinguishment of debt. We present EBITDA and EBITDA before restructuring and other items because we believe EBITDA and EBITDA before restructuring and other items are useful supplemental measures in evaluating the performance of our operating businesses and provide greater transparency into our results of operations. The EBITDA and EBITDA before restructuring and other items measures are used by our management, including our chief operating decision maker, to perform such evaluation. EBITDA and EBITDA before restructuring and other items should not be considered in isolation or as a substitute for net income or other statement of operations data prepared in accordance with GAAP. |

We believe EBITDA facilitates company-to-company operating performance comparisons by backing out potential differences caused by variations in capital structures (affecting net interest expense), taxation, the age and book depreciation of facilities (affecting relative depreciation expense) and the amortization of intangibles, which may vary for different companies for reasons unrelated to operating performance. We believe EBITDA before restructuring and other items also facilitates company-to-company operating performance comparisons by backing out those items in EBITDA as well as certain historical cost (benefit) items which may vary for different companies for reasons unrelated to operating performance. We further believe that EBITDA is frequently used by securities analysts, investors and other interested parties in their evaluation of companies, many of which present an EBITDA measure when reporting their results.

10

Table of Contents

EBITDA and EBITDA before restructuring and other items have limitations as analytical tools, and you should not consider EBITDA and EBITDA before restructuring and other items either in isolation or as substitutes for analyzing our results as reported under GAAP. The limitations include the following:

| • | these measures do not reflect changes in, or cash requirement for, our working capital needs; |

| • | these measures do not reflect our interest expense (except for interest related to our securitization obligations), or the cash requirements necessary to service interest or principal payments on our debt; |

| • | these measures do not reflect our income tax expense or the cash requirements to pay our taxes; |

| • | these measures do not reflect historical cash expenditures or future requirements for capital expenditures or contractual commitments; |

| • | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often require replacement in the future, and these EBITDA measures do not reflect any cash requirements for such replacements; and |

| • | other companies in our industry may calculate these EBITDA measures differently so they may not be comparable. |

EBITDA and EBITDA before restructuring and other items are not necessarily comparable to other similarly titled financial measures of other companies due to the potential inconsistencies in the method of calculation

| (3) | Adjusted EBITDA—Senior Secured Credit Facility Covenant Compliance corresponds to the definition of “EBITDA,” calculated on a “pro forma basis,” used in the senior secured credit facility to calculate the senior secured leverage ratio. Adjusted EBITDA is calculated by adjusting EBITDA by the items described below. Adjusted EBITDA is presented to demonstrate Realogy’s compliance with the senior secured leverage ratio covenant in the senior secured credit facility. Adjusted EBITDA has limitations as an analytical tool and should not be considered in isolation or as a substitute for net income or other statement of operations data prepared in accordance with GAAP. |

In addition to the limitations described above with respect to EBITDA and EBITDA before restructuring and other items, Adjusted EBITDA includes pro forma cost savings, the pro forma effect of business optimization initiatives and the pro forma full year effect of acquisitions and new franchisees. These adjustments may not reflect the actual cost savings or pro forma effect recognized in future periods. We present Adjusted EBITDA for the trailing twelve month period.

11

Table of Contents

A reconciliation of net loss attributable to Realogy to EBITDA, EBITDA before restructuring and other items and Adjusted EBITDA for the twelve months ended March 31, 2011 and the years ended December 31, 2010, 2009 and 2008 as calculated in accordance with the senior secured credit facility and presented in certificates delivered to the lenders under the senior secured credit facility is set forth in the following table:

| For the Twelve Months Ended | ||||||||||||||||

| March 31, 2011 | December 31, 2010 | December 31, 2009 | December 31, 2008 | |||||||||||||

Net loss attributable to Realogy | $ | (139 | ) | $ | (99 | ) | $ | (262 | ) | $ | (1,912 | ) | ||||

Income tax expense (benefit) | 128 | 133 | (50 | ) | (380 | ) | ||||||||||

Income (loss) before income taxes | (11 | ) | 34 | (312 | ) | (2,292 | ) | |||||||||

Interest expense (income), net | 631 | 604 | 583 | 624 | ||||||||||||

Depreciation and amortization | 193 | 197 | 194 | 219 | ||||||||||||

EBITDA | 813 | 835 | 465 | (1,449 | ) | |||||||||||

Merger costs, restructuring costs and former parent legacy costs (benefit), net | (312 | )(a) | (301 | )(b) | 37 | 40 | ||||||||||

Impairment of intangible assets, goodwill and investments in unconsolidated entities | — | — | — | 1,789 | (c) | |||||||||||

Non-cash charges for PHH Home Loans impairment | — | — | — | 31 | ||||||||||||

Loss (gain) on the early extinguishment of debt | 36 | — | (75 | ) | — | |||||||||||

EBITDA before restructuring and other items | 537 | 534 | 427 | 411 | ||||||||||||

Pro forma cost savings | 17 | (d) | 20 | (e) | 33 | (f) | 65 | (g) | ||||||||

Pro forma effect of business optimization initiatives | 48 | (h) | 49 | (i) | 38 | (j) | 61 | (k) | ||||||||

Non-cash charges | (2 | )(l) | (4 | )(m) | 34 | (n) | 60 | (o) | ||||||||

Non-recurring fair value adjustments for purchase accounting (p) | 4 | 4 | 5 | 6 | ||||||||||||

Pro forma effect of acquisitions and new franchisees (q) | 13 | 13 | 5 | 14 | ||||||||||||

Apollo management fees (r) | 15 | 15 | 15 | 14 | ||||||||||||

| Proceeds from WEX contingent asset (s) | — | — | 55 | 12 | ||||||||||||

Incremental securitization interest costs (t) | 2 | 2 | 3 | 6 | ||||||||||||

Expenses incurred in debt modification activities (u) | — | — | 4 | 5 | ||||||||||||

Better Homes and Gardens Real Estate start up costs | — | — | 3 | |||||||||||||

Adjusted EBITDA—Senior secured credit facility covenant compliance | $ | 634 | $ | 633 | $ | 619 | $ | 657 | ||||||||

Total senior secured net debt (v) | $ | 2,427 | $ | 2,905 | $ | 2,886 | $ | 3,250 | ||||||||

Senior secured leverage ratio | 3.83x | 4.59x | 4.66x | 4.95x | ||||||||||||

| (a) | Consists of $18 million of restructuring costs and $1 million of merger costs offset by a net benefit of $331 million for former parent legacy items. |

| (b) | Consists of $21 million of restructuring costs and $1 million of merger costs offset by a benefit of $323 million of former parent legacy items. |

| (c) | Represents the non-cash adjustment for the impairment of goodwill, intangible assets and investments in unconsolidated entities. |

| (d) | Represents actual costs incurred that are not expected to recur in subsequent periods due to restructuring activities initiated during the twelve months ended March 31, 2011. From this restructuring, we expect to reduce our operating costs by approximately $17 million on a twelve-month run-rate basis and estimate that less than $1 million of such savings were realized from the time they were put in place. The adjustment shown represents the impact the savings would have had on the period from April 1, 2010 through the time they were put in place had those actions been effected on April 1, 2010. |

| (e) | Represents actual costs incurred that are not expected to recur in subsequent periods due to restructuring activities initiated during 2010. From this restructuring, we expect to reduce our operating costs by approximately $34 million on a twelve-month run-rate basis and estimate that $14 million of such savings were realized from the time they were put in place. The adjustment shown represents the |

12

Table of Contents

impact the savings would have had on the period from January 1, 2010 through the time they were put in place, had those actions been effected on January 1, 2010. |

| (f) | Represents actual costs incurred that were not expected to recur in subsequent periods due to restructuring activities initiated during 2009. From this restructuring, we expected to reduce our operating costs by approximately $103 million on a twelve-month run-rate basis and estimated that $70 million of such savings were realized from the time they were put in place. The adjustment shown represents the impact the savings would have had on the period from January 1, 2009 through the time they were put in place, had those actions been effected on January 1, 2009. |

| (g) | Represents actual costs incurred that were not expected to recur in subsequent periods due to restructuring activities initiated during 2008. From this restructuring, we expected to reduce our operating costs by approximately $96 million on a twelve month run-rate basis and estimated that $31 million of such savings were realized from the time they were put in place. The adjustment shown represents the impact the savings would have had on the period from January 1, 2008 through the time they were put in place, had those actions been effected on January 1, 2008. |

| (h) | Represents the twelve-month pro forma effect of business optimization initiatives that have been completed to reduce costs of $9 million related to our Relocation Services new business start-ups, integration costs and acquisition related non-cash adjustments, $5 million related to vendor renegotiations, $26 million for employee retention accruals and $8 million of other initiatives. The employee retention accruals reflect the employee retention plans that have been implemented in lieu of our customary bonus plan, due to the ongoing and prolonged downturn in the housing market in order to ensure the retention of executive officers and other key personnel, principally within our corporate services unit and the corporate offices of our four business units. |

| (i) | Represents the twelve-month pro forma effect of business optimization initiatives that have been completed to reduce costs, including $12 million related to our Relocation Services new business start-ups, integration costs and acquisition related non-cash adjustments, $6 million related to vendor renegotiations, $23 million for employee retention accruals and $8 million of other initiatives. The employee retention accruals reflect the employee retention plans that have been implemented in lieu of our customary bonus plan, due to the ongoing and prolonged downturn in the housing market in order to ensure the retention of executive officers and other key personnel, principally within our corporate services unit and the corporate offices of our four business units. |

| (j) | Represents the twelve-month pro forma effect of business optimization initiatives that have been completed to reduce costs, including $3 million for initiatives to improve the Company Owned Real Estate Brokerage profit margin, $2 million for initiatives to improve Relocation Services and Title and Settlement Services fees, $19 million for employee retention accruals, and $14 million related to other initiatives. The employee retention accruals reflect the employee retention plans that have been implemented in lieu of our customary bonus plan, due to the ongoing and prolonged downturn in the housing market in order to ensure the retention of executive officers and other key personnel, principally within our corporate services unit and the corporate offices of our four business units. |

| (k) | Represents the twelve month pro forma effect of business optimization initiatives that have been completed to reduce costs, including $4 million related to the exit of the government at-risk homesale business, $4 million related to the elimination of the 401(k) employer match, $7 million related to the renegotiation of NRT contracts, $6 million for employee retention accruals, $22 million for initiatives to improve the Company Owned Real Estate Brokerage profit margin and Relocation Services fees and $18 million related to other initiatives. The employee retention accruals reflect the employee retention plans that have been implemented in lieu of our customary bonus plan, due to the ongoing and prolonged downturn in the housing market in order to ensure the retention of executive officers and other key personnel, principally within our corporate services unit and the corporate offices of our four business units. |

13

Table of Contents

| (l) | Represents the elimination of non-cash expenses, including $6 million of stock-based compensation expense and $1 million of other non-cash items less $9 million for the change in the allowance for doubtful accounts and notes reserves from April 1, 2010 through March 31, 2011. |

| (m) | Represents the elimination of non-cash expenses, including $6 million of stock-based compensation expense, less $8 million for the change in the allowance for doubtful accounts and notes reserves from January 1, 2010 through December 31, 2010 and $2 million of other non-cash items. |

| (n) | Represents the elimination of non-cash expenses, including a $14 million write-down of a cost method investment acquired in 2006, $12 million for the change in the allowance for doubtful accounts and the reserves for development advance notes and promissory notes from January 1, 2009 through December 31, 2009, $7 million of stock-based compensation expense, and $1 million related to the unrealized net losses on foreign currency transactions and foreign currency forward contracts. |

| (o) | Represents the elimination of non-cash expenses including $22 million for the change in the allowance for doubtful accounts and $17 million related to the reserve for development advance notes and promissory notes from January 1, 2008 through December 31, 2008, $7 million of stock based compensation expense, $14 million related to net losses on foreign currency transactions and foreign currency forward contracts. |

| (p) | Reflects the adjustment for the negative impact of fair value adjustments for purchase accounting at the operating business segments primarily related to deferred rent. |

| (q) | Represents the estimated impact of acquisitions and new franchisees as if they had been acquired or signed as of the beginning of the twelve-month periods. We have made a number of assumptions in calculating such estimate and there can be no assurance that we would have generated the projected levels of EBITDA had we owned the acquired entities or entered into the franchise contracts as of the beginning of the twelve-month periods. |

| (r) | Represents elimination of annual management fees payable to Apollo for the twelve-month periods. |

| (s) | Wright Express Corporation (“WEX”) was divested by Cendant in February 2005 through an initial public offering (“IPO”). As a result of such IPO, the tax basis of WEX’s tangible and intangible assets increased to their fair market value which may reduce federal income tax that WEX might otherwise be obligated to pay in future periods. Under Article III of the Tax Receivable Agreement dated February 22, 2005 among WEX, Cendant and Cartus (the “TRA”), WEX was required to pay Cendant 85% of any tax savings related to the increase in fair value utilized for a period of time that we expect will be beyond the maturity of the notes. Cendant is required to pay 62.5% of these tax-savings payments received from WEX to Realogy. On June 26, 2009, Realogy entered into a Tax Receivable Prepayment Agreement with WEX, pursuant to which WEX simultaneously paid Realogy the sum of $51 million, less expenses of approximately $2 million, as prepayment in full of its remaining contingent obligations to Realogy under Article III of the TRA. |

| (t) | Reflects incremental borrowing costs incurred as a result of the securitization facilities refinancing for the twelve-month periods. |

| (u) | Represents the expenses incurred in connection with our unsuccessful debt modification activities in the third quarter of 2009 and 2008. |

| (v) | Represents senior secured net debt, which is equal to total borrowings which are secured by a first priority lien on our assets plus capital lease obligations less readily available cash. Pursuant to the terms of the senior secured credit facility, senior secured debt does not include First and a Half Lien Notes, Second Lien Loans, other bank indebtedness not secured by a first lien on our assets, securitization obligations or Unsecured Notes. The senior secured debt as of March 31, 2011 was $2,486 million plus $13 million of capital lease obligations less $72 million of readily available cash as of March 31, 2011. The senior secured debt as of December 31, 2010 was $3,059 million plus $12 million of capital lease obligations less $166 million of readily available cash as of December 31, 2010. The senior secured debt as of December 31, 2009 was $3,091 million plus $14 million of capital lease obligations less $219 million of readily available cash as of December 31, 2009. The senior secured |

14

Table of Contents

debt as of December 31, 2008 was $3,638 million plus $14 million of capital lease obligations less $402 million of readily available cash as of December 31, 2008. |

| (4) | Represents the portion of relocation receivables and advances, relocation properties held for sale and other related assets that collateralize our securitization obligations. |

| (5) | For the successor period, Equity (deficit) is comprised of the capital contribution of $2,001 million from affiliates of Apollo and co-investors offset by the net loss for the period. |

The following table represents key business drivers for the periods set forth below:

| Three Months Ended March 31, | Year Ended December 31, | |||||||||||||||||||

| 2011 | 2010 | 2010 | 2009 | 2008 | ||||||||||||||||

Operating Statistics: | ||||||||||||||||||||

Real Estate Franchise Services(1) | ||||||||||||||||||||

Closed homesale sides (2) | 184,643 | 193,340 | 922,341 | 983,516 | 995,622 | |||||||||||||||

Average homesale price (3) | $ | 193,710 | $ | 188,478 | $ | 198,076 | $ | 190,406 | $ | 214,271 | ||||||||||

Average homesale broker commission rate (4) | 2.54% | 2.55% | 2.54% | 2.55% | 2.52% | |||||||||||||||

Net effective royalty rate (5) | 4.87% | 5.04% | 5.00% | 5.10% | 5.12% | |||||||||||||||

Royalty per side (6) | $ | 251 | $ | 252 | $ | 262 | $ | 257 | $ | 287 | ||||||||||

Company Owned Real Estate Brokerage Services(7) | ||||||||||||||||||||

Closed homesale sides (2) | 51,200 | 52,532 | 255,287 | 273,817 | 275,090 | |||||||||||||||

Average homesale price (3) | $ | 414,164 | $ | 417,782 | $ | 435,500 | $ | 390,688 | $ | 479,301 | ||||||||||

Average homesale broker commission rate (4) | 2.50% | 2.48% | 2.48% | 2.51% | 2.48% | |||||||||||||||

Gross commission income per side (8) | $ | 11,188 | $ | 11,161 | $ | 11,571 | $ | 10,519 | $ | 12,612 | ||||||||||

Relocation Services | ||||||||||||||||||||

Initiations (9) | 35,108 | 32,429 | 148,304 | 114,684 | 136,089 | |||||||||||||||

Referrals (10) | 12,812 | 12,109 | 69,605 | 64,995 | 71,743 | |||||||||||||||

Title and Settlement Services | ||||||||||||||||||||

Purchase title and closing units (11) | 18,971 | 19,947 | 94,290 | 104,689 | 110,462 | |||||||||||||||

Refinance title and closing units (12) | 16,826 | 11,935 | 62,225 | 69,927 | 35,893 | |||||||||||||||

Average price per closing unit (13) | $ | 1,386 | $ | 1,353 | $ | 1,386 | $ | 1,317 | $ | 1,500 | ||||||||||

| (1) | These amounts include only those relating to third-party franchisees and do not include amounts relating to the Company Owned Real Estate Brokerage Services segment. |

| (2) | A closed homesale side represents either the “buy” side or the “sell” side of a homesale transaction. |

| (3) | Represents the average selling price of closed homesale transactions. |

| (4) | Represents the average commission rate earned on either the “buy” side or “sell” side of a homesale transaction. |

| (5) | Represents the average percentage of our franchisees’ commission revenue (excluding NRT) paid to the Real Estate Franchise Services segment as a royalty. The net effective royalty rate does not include the effect of non-standard incentives granted to some franchisees. |

| (6) | Represents net domestic royalties earned from our franchisees (excluding NRT) divided by the total number of our franchisees’ closed homesale sides. |

| (7) | Our real estate brokerage business has a significant concentration of offices and transactions in geographic regions where home prices are at the higher end of the U.S. real estate market, particularly the east and west coasts. The real estate franchise business has franchised offices that are more widely dispersed across the United States than our real estate brokerage operations. Accordingly, operating results and homesale statistics may differ between our brokerage and franchise businesses based upon geographic presence and the corresponding homesale activity in each geographic region. |

| (8) | Represents gross commission income divided by closed homesale sides. |

15

Table of Contents

| (9) | Represents the total number of transferees served by the relocation services business. The amounts presented include Primacy initiations of 7,712 for the three months ended March 31, 2011, 5,177 for the period January 21, 2010 through March 31, 2010 and 26,087 initiations for the year ended December 31, 2010 as a result of the acquisition of Primacy in January 2010. |

| (10) | Represents the number of referrals from which we earned revenue from real estate brokers. The amounts presented include Primacy referrals of 968 for the three months ended March 31, 2011, 716 for the period January 21, 2010 through March 31, 2010 and 4,997 referrals for the year ended December 31, 2010 as a result of the acquisition of Primacy in January 2010. |

| (11) | Represents the number of title and closing units processed as a result of home purchases. |

| (12) | Represents the number of title and closing units processed as a result of homeowners refinancing their home loans. |

| (13) | Represents the average fee we earn on purchase title and refinancing title units. |

16

Table of Contents

THE OFFERING

The summary below describes the principal terms of the notes and the Class A Common Stock issuable upon conversion of the notes and is not intended to be complete. It does not contain all the information that is important to you. For a more detailed description of the terms and conditions of these securities, please refer to the sections entitled “Description of the Notes” and “Description of the Common Stock.”

Issuer of the Notes | Realogy Corporation, a Delaware corporation. |

Issuer of the Class A Common Stock | Domus Holdings Corp., a Delaware corporation and the indirect parent of Realogy. |

Securities Offered by the Selling Stockholders | Up to $1,143,706,000 principal amount of 11.00% Series A Convertible Senior Subordinated Notes due 2018, up to $291,424,196 principal amount of 11.00% Series B Convertible Senior Subordinated Notes due 2018 and up to $675,111,000 principal amount of 11.00% Series C Convertible Senior Subordinated Notes due 2018, which were issued under the same indenture and are treated as a single class for substantially all purposes under the indenture, and Class A Common Stock issuable upon conversion of the notes. |

Maturity | April 15, 2018, if not earlier repurchased, redeemed or converted. Realogy will be obligated to pay the outstanding aggregate principal amount in cash on the maturity date of the notes. |

Interest | Cash interest on the Convertible Notes accrues at a rate of 11.00% per annum. |

| Realogy will pay interest on overdue principal, if any, from time to time on demand at a rate that is 2% per annum in excess of 11.00% to the extent lawful, and will pay interest on overdue installments of interest, if any, from time to time on demand at a rate that is 2% per annum in excess of 11.00% to the extent lawful. |

Interest Payment Dates | Interest on the notes is payable semi-annually in arrears on April 15 and October 15. |

Guarantees | The notes are guaranteed on an unsecured senior subordinated basis by each of Realogy’s U.S. direct or indirect restricted subsidiaries that is a guarantor under the 13.375% Senior Subordinated Notes. Subject to certain exceptions, any subsidiary that in the future guarantees the 13.375% Senior Subordinated Notes will also guarantee the notes. In addition, Holdings also guarantees the notes on an unsecured junior subordinated basis. Except in certain circumstances, each guarantee will be released upon the release of the guarantor from its guarantee under the 13.375% Senior Subordinated Notes. If Realogy fails to make payments on the notes, the guarantors, including Holdings, must make them instead. Each entity, other than Holdings, that guarantees Realogy’s obligations under the notes and the indenture is referred to in this prospectus as a “Note Guarantor.” |

17

Table of Contents

| As of and for the three months ended March 31, 2011, Realogy’s subsidiaries that are not Note Guarantors represented 7.1% of its total assets (2.2% of its total assets excluding assets of its non-guarantor securitization entities), 4.3% of its total liabilities (1.0% of its total liabilities excluding liabilities of its non-guarantor securitization entities), 7.3% of its net revenue (7.2% of its net revenue excluding net revenue of its non-guarantor securitization entities), 5.5% of its loss before income taxes, equity in earnings and noncontrolling interests (5.1% of its loss before income taxes, equity in earnings and noncontrolling interests excluding income before income taxes, equity in earnings and noncontrolling interests of its non-guarantor securitization entities) and 118.2% of its EBITDA (100% of its EBITDA excluding EBITDA of its non-guarantor securitization entities), in each case after intercompany eliminations. |

| As of and for the year ended December 31, 2010, Realogy’s subsidiaries that are not Note Guarantors represented 7.2% of its total assets (2.4% of its total assets excluding assets of its non-guarantor securitization entities), 4.6% of its total liabilities (1.0% of its total liabilities, excluding liabilities of its non-guarantor securitization entities), 5.1% of its net revenue (5.1% of its net revenue excluding net revenue of its non-guarantor securitization entities), 600% of its income before income taxes, equity in earnings and noncontrolling interests (850% of its income before income taxes, equity in earnings and noncontrolling interests excluding income before income taxes, equity in earnings and noncontrolling interests of its non-guarantor securitization entities) and 7.9% of its EBITDA (7.7% of its EBITDA excluding EBITDA of its non-guarantor securitization entities), in each case after intercompany eliminations. |

Ranking | The notes and the guarantees thereof are Realogy’s and the Note Guarantors’ unsecured senior subordinated obligations and: |

| • | are subordinated in right of payment to all of Realogy’s and the Note Guarantors’ existing and future senior debt, including the senior secured credit facility, the First and a Half Lien Notes, the Senior Notes, and the related guarantees; |

| • | are equal in right of payment with all of Realogy’s and the Note Guarantors’ existing and future senior subordinated debt, including the Senior Subordinated Notes; and |

| • | rank senior in right of payment to all of Realogy’s and the Note Guarantors’ existing and future debt that is by its terms subordinated to the notes. |

| The guarantee by Holdings is Holdings’ unsecured senior subordinated obligation, is equal in right of payment to all existing and future subordinated indebtedness of Holdings and is junior in right of payment to all existing and future senior indebtedness of Holdings. |

In addition, the guarantees of the notes are structurally subordinated to all of the existing and future liabilities and obligations (including |

18

Table of Contents

trade payables, but excluding intercompany liabilities) of each of Realogy’s subsidiaries that is not a Note Guarantor. |

| As of March 31, 2010: |

| • | Realogy and the Note Guarantors had approximately $3,836 million of senior secured indebtedness, including approximately $2,486 million of first lien indebtedness under the senior secured credit facility (without giving effect to $105 million of outstanding letters of credit under the senior secured credit facility and $517 million of undrawn availability under the revolving credit facility), $700 million under the First and a Half Lien Notes and $650 million of Second Lien Loans, all of which are effectively senior to the notes, to the extent of the value of the assets securing such debt; |

| • | Realogy and the Note Guarantors had approximately $4,666 million of senior indebtedness, including senior secured indebtedness, other bank indebtedness and the Senior Notes, all of which would have been senior to the notes; |

| • | Realogy and the Note Guarantors had approximately $2,307 million of senior subordinated indebtedness, including the notes; and |

| • | our non-Note Guarantor subsidiaries had approximately $400 million of total liabilities (approximately $311 million of which consisted of obligations under our securitization facilities), all of which are structurally senior to the notes. In addition, our securitization subsidiaries were permitted to incur approximately $253 million of additional secured relocation obligations under our securitization facilities, subject to maintaining sufficient relocation assets for collateralization, all of which are structurally senior to the notes. |

Optional Conversion | The notes are convertible at any time at the option of the holders thereof, in whole or in part, into shares of Class A Common Stock, at the conversion rates described below. |