Exhibit 99.2

Q3 2018 Conference Call November 1, 2018

2 Safe Harbor This presentation contains forward - looking statements concerning Atomera Incorporated (““Atomera,” the “Company,” “we,” “us,” and “our”). The words “believe,” “may,” “will,” “potentially,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “would,” “project,” “plan,” “expect” and similar expressions that convey uncertainty of future events or outcomes are intended to identify forward - looking statements. These forward - looking statements are subject to a number of risks, uncertainties and assumptions, including those described in the “Risk Factors” section of our Prospectus Supplement filed pursuant to Rule 424(b)(5) with the SEC on October 11, 2018 (the “Prospectus Supplement”). In light of these risks, uncertainties and assumptions, the forward - looking events and circumstances discussed in this presentation may not occur and actual results could differ materially and adversely from those anticipated or implied in our forward - looking statements. You should not rely upon forward - looking statements as predictions of future events. Although we believe that the expectations reflected in our forward - looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances described in the forward - looking statements will be achieved or occur. This presentation contains only basic information concerning Atomera. The Company’s filings with the Securities Exchange Commission, including the Prospectus Supplement, include more information about factors that could affect the Company’s operating and financial results. We assume no obligation to update information contained in this presentation. Although this presentation may remain available on the Company's website or elsewhere, its continued availability does not indicate that we are reaffirming or confirming any of the information contained herein.

Technology at the Atomic Level 3 Company Overview Strong, Growing and Defensible Patent Portfolio High Leverage IP Licensing Business Model Top Tier Management Team Transistor enhancement technology for the $400B semiconductor market

4 ST Micro & AKM Commercial Licenses • Atomera Licenses MST to Asahi Kasei Microdevices (AKM) – Sept 25, 2018 • Japanese manufacturer of high end ICs for consumer, automotive and industrial • Division of Asahi Kasei Chemical Group • Long time partner of Atomera • First commercial licensee of Atomera’s MST technology • Integration License • Atomera Licenses MST to STMicroelectronics – October 2, 2018 • One of the world’s largest semiconductor companies • 2017 revenue: $8.3B • Leading IDM making solutions for Smart Driving, Internet of Things • Working with MST for less than two years • Integration License

5 Equity capital raise Successfully closed $12.5 public stock offering on October 15, 2018 Net proceeds $11.5M after underwriting fees and expenses 2,625,000 shares sold, now have 15.0M shares outstanding Underwriters and advisors Roth Capital: sole book running manager National Securities: co - manager Loop Capital: financial advisor Use of proceeds Engineering headcount additions for increased customer support Additional EPI tools and metrology testing

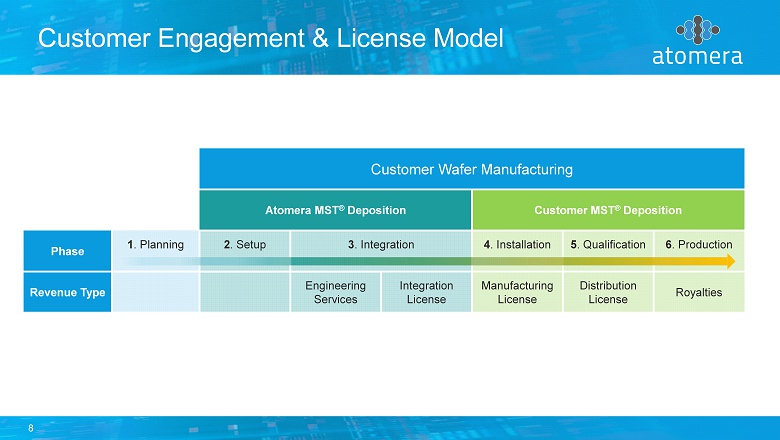

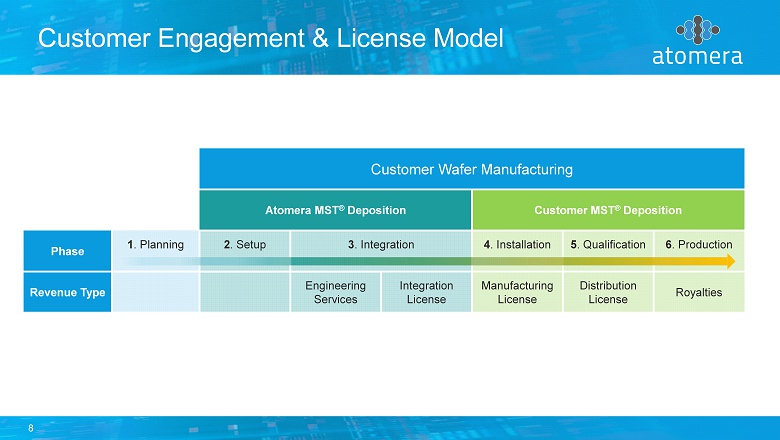

6 Customer Engagement Model v Customer Wafer Manufacturing Atomera MST ® Deposition Customer MST ® Deposition Phase 1 . Planning 2 . Setup 3 . Integration 4 . Installation 5 . Qualification 6 . Production

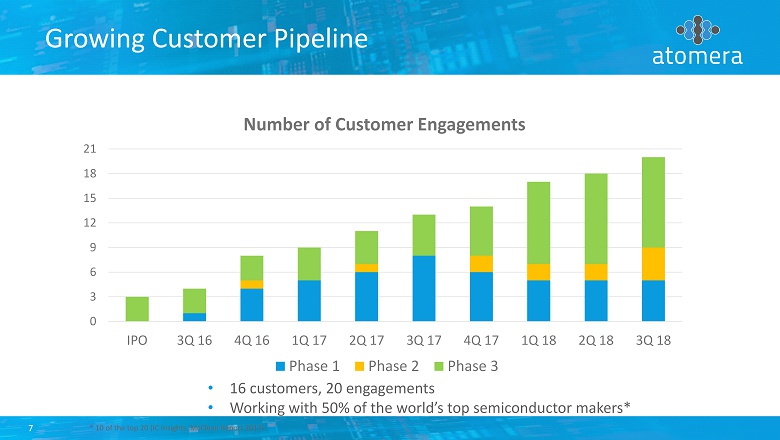

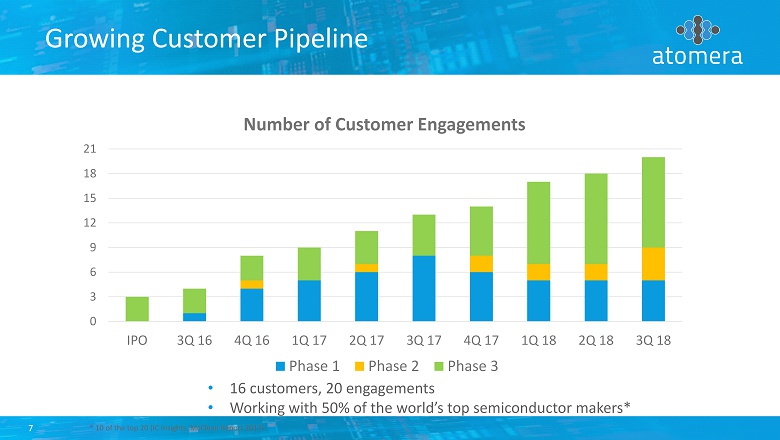

7 Growing Customer Pipeline • 16 customers, 20 engagements • Working with 50% of the world’s top semiconductor makers* 0 3 6 9 12 15 18 21 IPO 3Q 16 4Q 16 1Q 17 2Q 17 3Q 17 4Q 17 1Q 18 2Q 18 3Q 18 Number of Customer Engagements Phase 1 Phase 2 Phase 3 * 10 of the top 20 (IC Insights, McClean Report 2017)

8 Customer Engagement & License Model v Customer Wafer Manufacturing Atomera MST ® Deposition Customer MST ® Deposition Phase 1 . Planning 2 . Setup 3 . Integration 4 . Installation 5 . Qualification 6 . Production Revenue Type Engineering Services Integration License Manufacturing License Distribution License Royalties

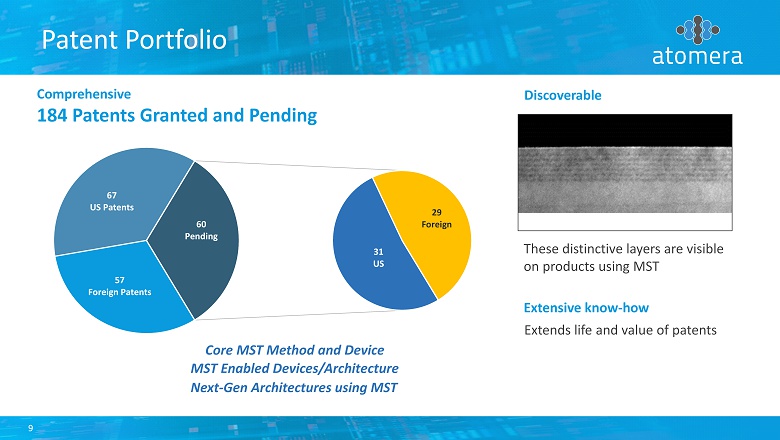

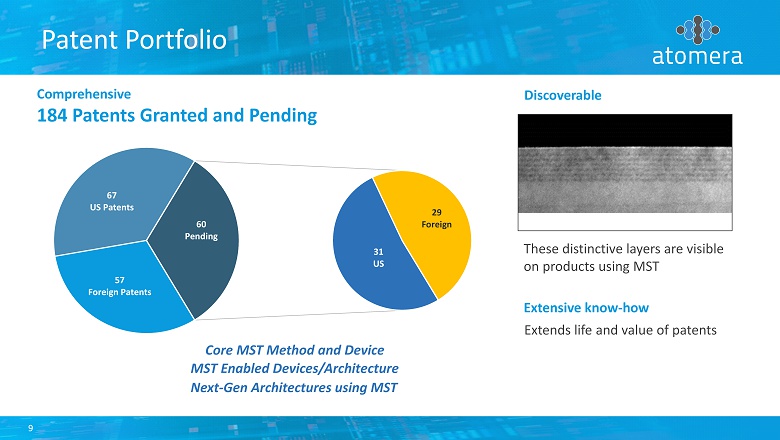

9 Patent Portfolio 57 Foreign Patents 67 US Patents 31 US 29 Foreign 60 Pending These distinctive layers are visible on products using MST Extends life and value of patents Comprehensive 184 Patents Granted and Pending Discoverable Core MST Method and Device MST Enabled Devices/Architecture Next - Gen Architectures using MST Extensive know - how

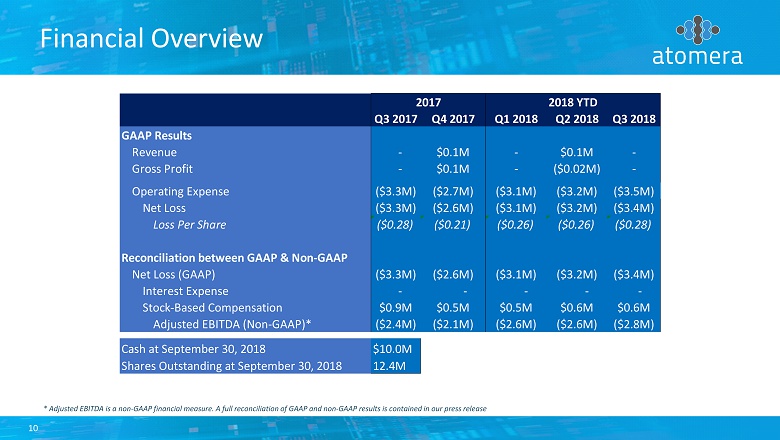

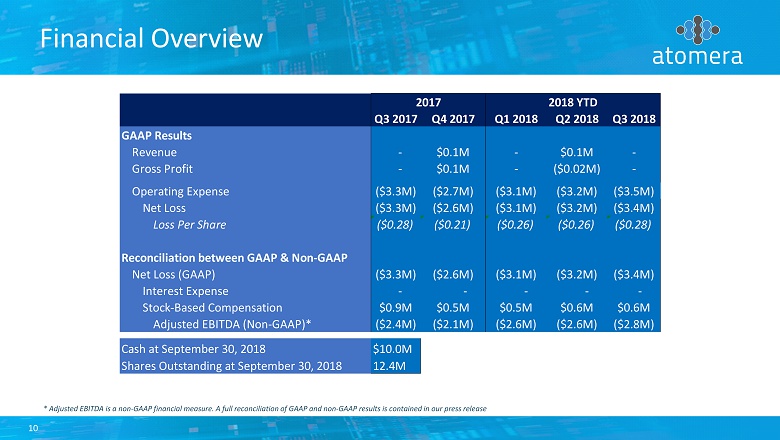

10 Financial Overview * Adjusted EBITDA is a non - GAAP financial measure. A full reconciliation of GAAP and non - GAAP results is contained in our press release Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 GAAP Results Revenue - $0.1M - $0.1M - Gross Profit - $0.1M - ($0.02M) - Operating Expense ($3.3M) ($2.7M) ($3.1M) ($3.2M) ($3.5M) Net Loss ($3.3M) ($2.6M) ($3.1M) ($3.2M) ($3.4M) Loss Per Share ($0.28) ($0.21) ($0.26) ($0.26) ($0.28) Reconciliation between GAAP & Non-GAAP Net Loss (GAAP) ($3.3M) ($2.6M) ($3.1M) ($3.2M) ($3.4M) Interest Expense - - - - - Stock-Based Compensation $0.9M $0.5M $0.5M $0.6M $0.6M Adjusted EBITDA (Non-GAAP)* ($2.4M) ($2.1M) ($2.6M) ($2.6M) ($2.8M) Cash at September 30, 2018 $10.0M Shares Outstanding at September 30, 2018 12.4M 2017 2018 YTD

11 Summary Signed first two customer licenses with AKM and STMicroelectronics Completed financing, strengthening our balance sheet 20 total engagements with 16 different customers Strengthened patent and know - how portfolio Entered company’s commercialization phase

Thank You 12