Exhibit 99.2

Q4 2022 Conference Call February 15, 2023 Atomera Incorporated 1

Safe Harbor This presentation contains forward - looking statements concerning Atomera Incorporated (““Atomera,” the “Company,” “we,” “us,” and “our”). The words “believe,” “may,” “will,” “potentially,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “woul d,” “project,” “plan,” “expect” and similar expressions that convey uncertainty of future events or outcomes are intended to identify forwar d - looking statements. These forward - looking statements are subject to a number of risks, uncertainties and assumptions, including those disclosed in the section "Risk Factors" included in our Annual Report on Form 10 - K filed with the SEC on February 15, 2023 (the “Annual Report ”) . In light of these risks, uncertainties and assumptions, the forward - looking events and circumstances discussed in this presentation may not occur and actual results could differ materially and adversely from those anticipated or implied in our forward - looking statements. You should not rely upon forward - looking statements as predictions of future events. Although we believe that the expectations reflected in our forward - looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances described in the forward - looking statements will be achieved or occur. This presentation contains only basic information concerning Atomera. The Company’s filings with the Securities Exchange Commission, including the Annual Report, include more information about factors that could affect the Company’s operating and financial results. We assume no obligation to update information contained in this presentation. Although this presentation m ay remain available on the Company's website or elsewhere, its continued availability does not indicate that we are reaffirming or confirming any of the information contained herein. Atomera Incorporated 2

3 Strong, Growing and Defensible Patent Portfolio High Leverage IP Licensing Business Model Top Tier Management Team Transistor enhancement technology for the $550B semiconductor market Mears Silicon Technology (MST®) Quantum Engineered Materials

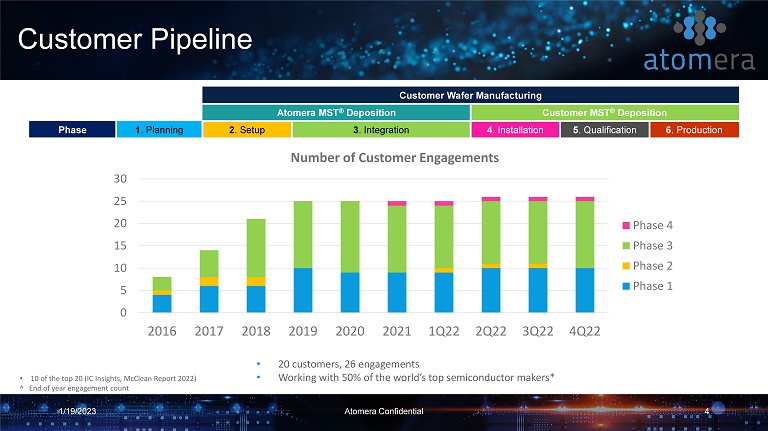

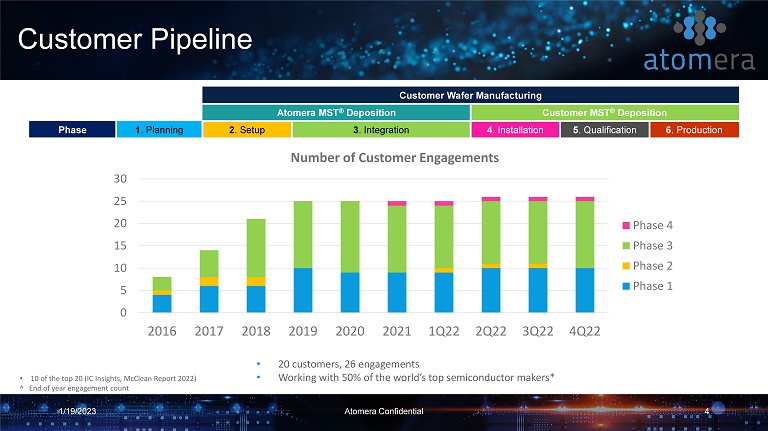

Customer Pipeline 4 • 20 customers, 26 engagements • Working with 50% of the world’s top semiconductor makers* • 10 of the top 20 (IC Insights, McClean Report 2022) ^ End of year engagement count Atomera Confidential 0 5 10 15 20 25 30 2016 2017 2018 2019 2020 2021 1Q22 2Q22 3Q22 4Q22 Number of Customer Engagements Phase 4 Phase 3 Phase 2 Phase 1 v Customer Wafer Manufacturing Atomera MST ® Deposition Customer MST ® Deposition Phase 1 . Planning 2 . Setup 3 . Integration 4 . Installation 5 . Qualification 6 . Production 1/19/2023

MST: Solving GAA Transistor Challenges ► Blocks source/drain dopant diffusion ► Provides enhanced punch - through stop layer between source and drain Atomera Incorporated 5 ► Lowers contact resistance ► Reduces HKMG stack height ► Improves carrier mobility, gate leakage Transistor Architectural Evolution

MST technology focus areas 6 MST for Advanced Nodes MST for RF - SOI MST - SP Atomera Incorporated

Strong and Growing IP Portfolio Atomera Incorporated 7 Core MST Method and Device MST Enabled Devices/Architecture Next - Gen Architectures using MST Discoverable These distinctive layers are visible on products using MST Extensive know - how Extends life and value of patents 107 Foreign Patents 127 US Patents 76 Foreign 29 US 105 Pending 339 Patents Granted and Pending

Financial Review Atomera Incorporated 8 Income Statement ($ in thousands, except per-share data) 12/31/2022 12/31/2021 12/31/2022 9/30/2022 12/31/2021 REVENUE 382$ 400$ 5$ 2$ -$ Gross Profit 301 400 5 2 - OPERATING EXPENSES Research & Development 10,038 8,779 2,523 2,743 2,249 General and Administration 6,441 6,164 1,559 1,567 1,508 Selling and Marketing 1,348 986 329 347 316 TOTAL OPERATING EXPENSES 17,827 15,929 4,411 4,657 4,073 OPERATING LOSS (17,526) (15,529) (4,406) (4,655) (4,073) Other Income (Expense) 85 (119) 134 53 (74) Provision for income tax - (66) - - (18) NET LOSS (17,441)$ (15,714)$ (4,272)$ (4,602)$ (4,165)$ Net Loss Per Share (0.75)$ (0.70)$ (0.18)$ (0.20)$ (0.18)$ Weighted average shares outstanding 23,157 22,492 23,538 23,294 22,751 ADJUSTED EBITDA (NON-GAAP) (14,082)$ (12,489)$ (3,494)$ (3,747)$ (3,359)$ ADJUSTED EBITDA PER SHARE (0.61)$ (0.56)$ (0.15)$ (0.16)$ (0.15)$ Balance Sheet Information Cash 21,184$ 28,699$ 21,184$ 23,287$ 28,699$ Debt - - - - - Year Ended Three Months Ended

We collaborate with customers to improve their products, through integration of MST, so that both companies benefit financially Mission Statement Atomera Incorporated 9

Thank You Atomera Incorporated 10