|

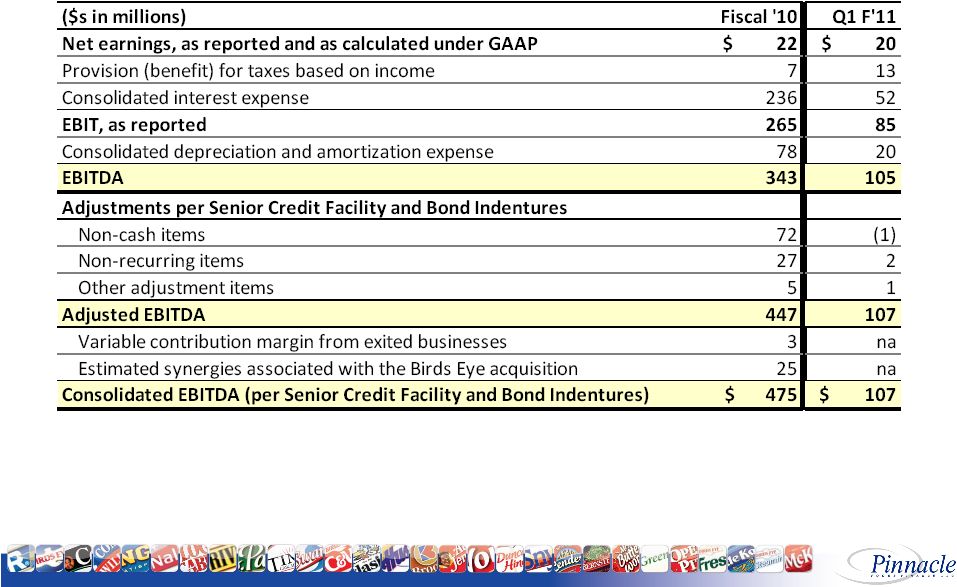

2 Forward-Looking Statements and GAAP Reconciliation Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by which, such performance or results will be achieved or whether such performance or results will ever be achieved. Forward-looking information is based on information available at the time and management’s good faith belief with respect to future events, and is subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the statements. Forward-looking statements speak only as of the date the statements are made. Pinnacle Foods Finance LLC (“Pinnacle Foods,” “Pinnacle” or the “Company”) assumes no obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information except to the extent required by applicable securities laws. If the Company does update one or more forward-looking statements, no inference should be drawn that the Company will make additional updates with respect thereto or with respect to other forward-looking statements. SEC rules regulate the use of “non-GAAP financial measures” in public disclosures, such as “Free Cash Flow”, “EBITDA” “Adjusted EBITDA” and “Consolidated EBITDA”, that are derived on the basis of methodologies other than in accordance with generally accepted accounting principles, or “GAAP.” These rules govern the manner in which non-GAAP financial measures may be publicly presented and prohibit in all filings with the SEC, among other things: • exclusion of charges or liabilities that require, or will require, cash settlement or would have required cash settlement, absent an ability to settle in another manner, from a non-GAAP financial measure; and • adjustment of a non-GAAP financial measure to eliminate or smooth items identified as non-recurring, infrequent or unusual, when the nature of the charge or gain is such that it has occurred in the past two years or is reasonably likely to recur within the next two years. We have included non-GAAP financial measures in this presentation, including Free Cash Flow, EBITDA, Adjusted EBITDA and Consolidated EBITDA, that may not comply with the SEC rules governing the presentation of non-GAAP financial measures. In addition, the Company’s measurements of Consolidated EBITDA are based on definitions of EBITDA included in certain of the Company’s debt agreements and, as a result, may not be comparable to those of other companies. Also, Free Cash Flow may not be comparable to similarly titled amounts presented by other companies. |