Table of Contents

As filed with the Securities and Exchange Commission on December 18, 2007

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

REALOGY CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 6531 | 20-4381990 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

One Campus Drive

Parsippany, NJ 07054

(973) 407-2000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

GUARANTORS LISTED ON SCHEDULE A HERETO

Seth Truwit, Esq.

Realogy Corporation

One Campus Drive

Parsippany, NJ 07054

(973) 407-2000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a copy to:

Rosa A. Testani, Esq.

Akin Gump Strauss Hauer & Feld LLP

590 Madison Avenue

New York, NY 10022

Telephone: (212) 872-1000

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

CALCULATION OF REGISTRATION FEE

Title of each class of securities to be registered | Amount to be registered | Proposed maximum per unit | Proposed maximum offering price | Amount of registration fee | ||||

10.50% Senior Notes due 2014 | $1,700,000,000 | 100%(1) | $1,700,000,000(2) | $52,190.00 | ||||

Guarantees of 10.50% Senior Notes due 2014 | (3) | |||||||

11.00%/11.75% Senior Toggle Notes due 2014(4) | $ 650,000,000 | 100%(1) | $ 650,000,000(2) | $19,955.00 | ||||

Guarantees of 11.00%/11.75% Senior Toggle Notes due 2014 | (3) | |||||||

12.375% Senior Subordinated Notes due 2015 | $ 875,000,000 | 100%(1) | $ 875,000,000(2) | $26,862.50 | ||||

Guarantees of 12.375% Senior Subordinated Notes due 2015 | (3) | |||||||

| (1) | The proposed maximum offering price per note is based on the book value of the notes as of December 18, 2007, in the absence of a public market for the notes, in accordance with Rule 457(f)(2) promulgated under the Securities Act of 1933, as amended. |

| (2) | Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(o) under the Securities Act. |

| (3) | Pursuant to Rule 457(n), no additional registration fee is payable with respect to the guarantees. |

| (4) | Represents $550,000,000 principal amount at original issuance plus $100,000,000 principal amount of the 11.00%/11.75% Senior Toggle Notes due 2014 which may be issued, at the option of Realogy Corporation, in lieu of cash interest payments thereon. Such additional principal amount constitutes Realogy Corporation’s reasonable good faith estimate of the amount of such notes which may be paid as interest in lieu of cash. Determined in accordance with Section 6(b) of the Securities Act of 1933 at a rate equal to $30.70 per $1,000,000 of the proposed maximum aggregate offering price. |

The registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

SCHEDULE A

The address for each of the guarantors listed below is One Campus Drive, Parsippany, NJ. The primary standard industrial classification code number for each of the guarantors listed below is 6531. The guarantors, the states or jurisdictions of incorporation or organization for each guarantor and the I.R.S. employer identification number for each guarantor is listed below.

Exact name of registrant as specified in its charter | State or other | I.R.S. employer identification no. | ||

Associates Investments | California | 33-0872539 | ||

Associates Realty Network | California | 33-0623648 | ||

Associates Realty, Inc. | California | 33-0872539 | ||

Burrow Escrow Services, Inc. | California | 33-0876967 | ||

C21 TM LLC | California | 20-5791224 | ||

CB TM LLC | California | 94-1629734 | ||

Coldwell Banker Real Estate LLC | California | 95-3656885 | ||

Coldwell Banker Residential Brokerage Company | California | 95-3140237 | ||

Coldwell Banker Residential Real Estate LLC | California | 95-3522685 | ||

Coldwell Banker Residential Referral Network | California | 33-0196250 | ||

Equity Title Company | California | 95-3415676 | ||

ERA TM LLC | California | 77-0385159 | ||

Fred Sands School of Real Estate | California | 95-4505682 | ||

Guardian Title Company | California | 95-2951502 | ||

Mid-Exchange LLC | California | 95-3559451 | ||

National Coordination Alliance LLC | California | 33-0477770 | ||

Realogy Operations LLC | California | 95-2699378 | ||

Summit Escrow | California | 33-0627936 | ||

Valley of California, Inc. | California | 94-1615655 | ||

West Coast Escrow Closing Co. | California | 20-1291098 | ||

West Coast Escrow Company | California | 95-4037858 | ||

Colorado Commercial, LLC | Colorado | 84-1539312 | ||

Guardian Title Agency, LLC | Colorado | 84-1300104 | ||

NRT Colorado LLC | Colorado | 84-1474328 | ||

Referral Network, LLC | Colorado | 84-1541495 | ||

Bob Tendler Real Estate, Inc. | Connecticut | 06-1093804 | ||

Hillshire House, Incorporated | Connecticut | 06-1003316 | ||

Real Estate Referral, Inc. | Connecticut | 06-1324555 | ||

The Four Star Corp. | Connecticut | 06-1372496 | ||

William Orange Realty, Inc. | Connecticut | 06-1370720 | ||

Advantage Title & Insurance, LLC | Delaware | 20-3392747 | ||

Associated Client Referral LLC | Delaware | 26-0376602 | ||

2

Table of Contents

Exact name of registrant as specified in its charter | State or other | I.R.S. employer identification no. | ||

Better Homes and Gardens Real Estate LLC | Delaware | 26-1439164 | ||

Better Homes and Gardens Real Estate Licensee LLC | Delaware | 26-1483161 | ||

Burgdorff LLC | Delaware | 26-0376660 | ||

Burgdorff Referral Associates LLC | Delaware | 26-0376767 | ||

Career Development Center, LLC | Delaware | 20-5782611 | ||

Cartus Corporation | Delaware | 94-1717274 | ||

Cartus Partner Corporation | Delaware | 26-1545145 | ||

CDRE TM LLC | Delaware | 20-5122543 | ||

Century 21 Real Estate LLC | Delaware | 95-3414846 | ||

CGRN, Inc. | Delaware | 22-3652986 | ||

Coldwell Banker LLC | Delaware | 33-0320545 | ||

Coldwell Banker Real Estate Services LLC | Delaware | 26-0376845 | ||

Equity Title Messenger Service Holding LLC | Delaware | 14-1871488 | ||

ERA Franchise Systems LLC | Delaware | 22-3419810 | ||

FedState Strategic Consulting, Incorporated | Delaware | 20-4789547 | ||

First California Escrow Corporation | Delaware | 20-2923040 | ||

Franchise Settlement Services LLC | Delaware | 20-0922030 | ||

FSA Membership Services, LLC | Delaware | 20-1003239 | ||

Grand Title, LLC | Delaware | 20-4789492 | ||

Guardian Holding Company | Delaware | 20-0597637 | ||

Gulf South Settlement Services, LLC | Delaware | 20-2668391 | ||

Hickory Title, LLC | Delaware | 20-3916961 | ||

Jack Gaughen LLC | Delaware | 26-0376973 | ||

Keystone Closing Services LLC | Delaware | 23-2930568 | ||

Legend Title LLC | Delaware | 20-3458751 | ||

Lincoln Settlement Services, LLC | Delaware | 20-3458710 | ||

Mid-State Escrow Corporation | Delaware | 20-4455380 | ||

NRT Arizona Commercial LLC | Delaware | 20-3697457 | ||

NRT Arizona Exito LLC | Delaware | 20-4206916 | ||

NRT Arizona LLC | Delaware | 20-3392792 | ||

NRT Arizona Referral LLC | Delaware | 20-3697479 | ||

NRT Columbus LLC | Delaware | 31-1794070 | ||

NRT Commercial LLC | Delaware | 52-2173782 | ||

NRT Commercial Utah LLC | Delaware | 87-0679989 | ||

NRT Hawaii Referral, LLC | Delaware | 20-3574360 | ||

NRT LLC | Delaware | 33-0769705 | ||

NRT Mid-Atlantic LLC | Delaware | 26-0393458 | ||

3

Table of Contents

Exact name of registrant as specified in its charter | State or other | I.R.S. employer identification no. | ||

NRT Missouri LLC | Delaware | 64-0965388 | ||

NRT Missouri Referral Network LLC | Delaware | 26-0393293 | ||

NRT New York LLC | Delaware | 13-4199334 | ||

NRT Pittsburgh LLC | Delaware | 26-0393427 | ||

NRT Relocation LLC | Delaware | 20-0011685 | ||

NRT Settlement Services of Missouri LLC | Delaware | 26-0006000 | ||

NRT Settlement Services of Texas LLC | Delaware | 52-2299482 | ||

NRT Sunshine Inc. | Delaware | 51-0455827 | ||

NRT The Condo Store LLC | Delaware | 20-0442165 | ||

NRT Utah LLC | Delaware | 87-0679991 | ||

Oncor International LLC | Delaware | 20-5470167 | ||

Pacific Access Holding Company, LLC | Delaware | 20-4960602 | ||

Patriot Settlement Services, LLC | Delaware | 20-0890440 | ||

Real Estate Referral LLC | Delaware | 26-0393629 | ||

Real Estate Referrals LLC | Delaware | 26-0393668 | ||

Real Estate Services LLC | Delaware | 22-3770721 | ||

Real Estate Services of Pennsylvania LLC | Delaware | 26-0393574 | ||

Realogy Franchise Group LLC | Delaware | 20-4206821 | ||

Realogy Global Services LLC | Delaware | 22-3528294 | ||

Realogy Licensing LLC | Delaware | 22-3544606 | ||

Realogy Services Group LLC | Delaware | 20-1572338 | ||

Realogy Services Venture Partner LLC | Delaware | 20-2054650 | ||

Rocky Mountain Settlement Services, LLC | Delaware | 20-3392708 | ||

Scranton Abstract, LLC | Delaware | 20-3093094 | ||

Secured Land Transfers LLC | Delaware | 26-0184940 | ||

Shelter Title LLC | Delaware | 20-4046806 | ||

Sotheby’s International Realty Referral Company, LLC | Delaware | 20-4568253 | ||

Sotheby’s International Realty Affiliates LLC | Delaware | 20-1077136 | ||

Sotheby’s International Realty Licensee LLC | Delaware | 20-1077287 | ||

TBR Settlement Services, LLC | Delaware | 20-3917025 | ||

Texas American Dissolution, Inc. | Delaware | 20-5255880 | ||

Title Resource Group Affiliates Holdings LLC | Delaware | 20-0597595 | ||

Title Resource Group Holdings LLC | Delaware | 22-3868607 | ||

Title Resource Group LLC | Delaware | 22-3680144 | ||

Title Resource Group Services LLC | Delaware | 22-3788990 | ||

Title Resources Incorporated | Delaware | 76-0594000 | ||

TRG Services, Escrow, Inc. | Delaware | 26-1512603 | ||

4

Table of Contents

Exact name of registrant as specified in its charter | State or other | I.R.S. employer identification no. | ||

Florida’s Preferred School of Real Estate, Inc. | Florida | 59-3533697 | ||

Referral Associates of Florida LLC | Florida | 13-3084484 | ||

Referral Network LLC | Florida | 59-2541359 | ||

St. Joe Real Estate Services, Inc. | Florida | 59-3517835 | ||

St. Joe Title Services LLC | Florida | 59-3508965 | ||

Coldwell Banker Commercial Pacific Properties LLC | Hawaii | 99-0335507 | ||

Coldwell Banker Pacific Properties LLC | Hawaii | 99-0323981 | ||

Pacific Properties Referrals, Inc. | Hawaii | 68-0547844 | ||

Dewolfe Realty Affiliates | Maine | 01-0527530 | ||

NRT Mid-Atlantic Title Services, LLC | Maryland | 52-1851057 | ||

The Miller Group, Inc. | Maryland | 52-1712893 | ||

Cotton Real Estate, Inc. | Massachusetts | 04-3031581 | ||

DeWolfe Relocation Services, Inc. | Massachusetts | 04-2860192 | ||

NRT Insurance Agency, Inc. | Massachusetts | 04-3332208 | ||

Referral Associates of New England LLC | Massachusetts | 04-3079542 | ||

The DeWolfe Companies, Inc. | Massachusetts | 04-2895334 | ||

The DeWolfe Company, Inc. | Massachusetts | 04-2531532 | ||

Trust of New England, Inc. | Massachusetts | 04-2844593 | ||

Sotheby’s International Realty, Inc. | Michigan | 38-2556952 | ||

Burnet Realty LLC | Minnesota | 41-1660781 | ||

Burnet Title LLC | Minnesota | 41-1926464 | ||

Burnet Title Holding LLC | Minnesota | 41-1840763 | ||

Home Referral Network LLC | Minnesota | 41-1685091 | ||

ERA General Agency Corporation | Missouri | 48-0824690 | ||

NRT Missouri Referral Network, Inc. | Missouri | 43-1250765 | ||

NRT Missouri, Inc. | Missouri | 43-0963580 | ||

Pacesetter Nevada, Inc. | Nevada | 91-1764224 | ||

Market Street Settlement Group LLC | New Hampshire | 02-0505642 | ||

Burgdorff Referral Associates, Inc. | New Jersey | 22-2708373 | ||

Coldwell Banker Real Estate Services, Inc. | New Jersey | 95-4302860 | ||

Douglas and Jean Burgdorff, Inc. | New Jersey | 22-1685738 | ||

ERA General Agency of New Jersey, Inc. | New Jersey | 22-3549853 | ||

Batjac Real Estate Corp. | New York | 13-3099108 | ||

Cook-Pony Farm Real Estate, Inc. | New York | 11-2638015 | ||

Corcoran Group - Brooklyn Landmark, LLC | New York | 11-3431404 | ||

The Corcoran Group Eastside, Inc. | New York | 13-3055291 | ||

The Sunshine Group, Ltd. | New York | 13-3329821 | ||

5

Table of Contents

Exact name of registrant as specified in its charter | State or other | I.R.S. employer identification no. | ||

Burnet Title of Ohio, LLC | Ohio | 41-1700407 | ||

NRT Commercial Ohio Incorporated | Ohio | 20-1574589 | ||

APEX Real Estate Information Services, LLC | Pennsylvania | 25-1848377 | ||

APEX Real Estate Information Services, LLP | Pennsylvania | 25-1810204 | ||

Coldwell Banker Residential Referral Network, Inc. | Pennsylvania | 25-1485174 | ||

J.W. Riker - Northern R.I., Inc. | Rhode Island | 05-0402949 | ||

Alpha Referral Network LLC | Texas | 33-0443969 | ||

American Title Company of Houston | Texas | 75-2477592 | ||

ATCOH Holding Company | Texas | 76-0452401 | ||

NRT Texas LLC | Texas | 75-2412614 | ||

NRT Texas Real Estate Services LLC | Texas | 75-2705077 | ||

Processing Solutions LLC | Texas | 76-0006215 | ||

Referral Network Inc. | Texas | 33-0443969 | ||

South Land Title Co., Inc. | Texas | 76-0443701 | ||

South-Land Title of Montgomery County, Inc. | Texas | 76-0674528 | ||

TAW Holding Inc. | Texas | 76-0593996 | ||

Texas American Title Company | Texas | 74-1909700 | ||

Texas American Title Company of Austin | Texas | 74-2771227 | ||

Burnet Realty, Inc. | Wisconsin | 33-0938368 | ||

Coldwell Banker Residential Real Estate Services of Wisconsin, Inc. | Wisconsin | 39-1499016 | ||

6

Table of Contents

The information in this prospectus is not complete and may be changed. We may not complete the Exchange Offer and issue these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell securities and it is not soliciting an offer to buy these securities in any state where the offer is not permitted.

Subject to completion, dated December 18, 2007

PROSPECTUS

Realogy Corporation

Offer to Exchange

$1,700,000,000 aggregate principal amount of 10.50% Senior Notes due 2014, which have been registered under the Securities Act of 1933,

for $1,700,000,000 aggregate principal amount of outstanding 10.50% Senior Notes due 2014.

$550,000,000 aggregate principal amount of 11.00%/11.75% Senior Toggle Notes due 2014, which have been

registered under the Securities Act of 1933,

for $550,000,000 aggregate principal amount of outstanding 11.00%/11.75% Senior Toggle Notes.

$875,000,000 aggregate principal amount of 12.375% Senior Subordinated Notes due 2015, which have been registered under the Securities Act of 1933,

for $875,000,000 aggregate principal amount of outstanding 12.375% Senior Subordinated Notes.

The Exchange Offer:

| • | We will exchange all old notes that are validly tendered and not validly withdrawn for an equal principal amount of exchange notes that have been registered. |

| • | You may withdraw tenders of old notes at any time prior to the expiration of this exchange offer. |

| • | This exchange offer expires at 5:00 p.m., New York City time, on , 2008, unless we extend the offer. |

The Exchange Notes:

| • | The terms of the exchange notes to be issued in this exchange offer are substantially identical to the old notes, except that the exchange notes will be freely tradable by persons who are not affiliated with us. |

| • | No public market currently exists for the old notes. We do not intend to list the exchange notes on any securities exchange and, therefore, no active public market is anticipated. |

| • | The exchange notes, like the old notes, will be guaranteed on a senior basis, in the case of the exchange senior notes and the exchange senior toggle notes, and on a senior subordinated basis, in the case of the exchange senior subordinated notes, by each of our existing and future U.S. subsidiaries that is a guarantor under our senior secured credit facility or that guarantees certain other indebtedness in the future, subject to certain exceptions. |

| • | The exchange notes, like the old notes, will be effectively subordinated to all of our secured debt, to the extent of the value of the assets securing such debt, and to all liabilities of our non-guarantor subsidiaries. The exchange senior notes and exchange senior toggle notes, like the old senior notes and old senior toggle notes, will rank equally with all of our existing and future unsecured senior debt and will rank senior to all of our existing and future senior subordinated and subordinated debt. The exchange senior subordinated notes, like the old senior subordinated notes, will be subordinated to all of our existing and future senior debt, will rank equally with all of our future senior subordinated debt and will rank senior to all of our future subordinated debt. |

| • | Like the old notes, if we fail to make payments on the exchange notes, our subsidiary guarantors must make them instead. |

| • | Each broker-dealer that receives exchange notes pursuant to this exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of the exchange notes. |

| • | If the broker-dealer acquired the old notes as a result of market-making or other trading activities, such broker-dealer may use this prospectus for the exchange offer, as supplemented or amended, in connection with its resales of the exchange notes. |

You should carefully consider therisk factors beginning on page 23 of this prospectus before participating in the exchange offer.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2008.

Table of Contents

| ii | ||

| ii | ||

| ii | ||

| 1 | ||

| 23 | ||

| 50 | ||

| 52 | ||

| 54 | ||

| 64 | ||

| 66 | ||

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED AND COMBINED FINANCIAL STATEMENTS | 68 | |

SELECTED HISTORICAL CONSOLIDATED AND COMBINED FINANCIAL STATEMENTS | 76 | |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 79 | |

| 115 | ||

| 147 | ||

| 166 | ||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 174 | |

| 176 | ||

| 182 | ||

| 254 | ||

| 256 | ||

| 259 | ||

| 260 | ||

| 262 | ||

| 263 | ||

| 263 | ||

| F-1 |

You should rely only on the information contained in this document. We have not authorized anyone to give you any information or to make any representations about us or the transactions we discuss in this prospectus other than those contained in this prospectus. If you are given any information or representations about these matters that is not discussed in this prospectus, you must not rely on that information. This prospectus is not an offer to sell or a solicitation of an offer to buy securities anywhere or to anyone where or to whom we are not permitted to offer or sell securities under applicable law. The delivery of this prospectus does not, under any circumstances, mean that there has not been a change in our affairs since the date of this prospectus. Subject to our obligation to amend or supplement this prospectus as required by law and the rules of the Securities and Exchange Commission, or the SEC, the information contained in this prospectus is correct only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of these securities.

Until , 2008 (90 days after the date of this prospectus), all dealers effecting transactions in the exchange notes, whether or not participating in the exchange offer, may be required to deliver a prospectus.

i

Table of Contents

WHERE YOU CAN FIND MORE INFORMATION

We will be required to file annual and quarterly reports and other information with the SEC after the registration statement described below is declared effective by the SEC. You may read and copy any reports, statements and other information that we file with the SEC at the SEC’s public reference room located at 100 F Street, N.E. Room 1580, Washington, D.C. 20549. You may request copies of the documents, upon payment of a duplicating fee, by writing the Public Reference Section of the SEC. Please call 1-800-SEC-0330 for further information on the public reference rooms. Our filings will also be available to the public from commercial document retrieval services and at the web site maintained by the SEC at http://www.sec.gov.

We have filed a registration statement on Form S-4 to register with the SEC the exchange notes and guarantees thereof to be issued in exchange for the old notes and guarantees thereof. This prospectus is part of that registration statement. As allowed by the SEC’s rules, this prospectus does not contain all of the information you can find in the registration statement or the exhibits to the registration statement. You should note that where we summarize in the prospectus the material terms of any contract, agreement or other document filed as an exhibit to the registration statement, the summary information provided in the prospectus is less complete than the actual contract, agreement or document. You should refer to the exhibits filed to the registration statement for copies of the actual contract, agreement or document.

We own or have rights to use the trademarks, service marks and trade names that we use in conjunction with the operation of our business. Some of the more important trademarks that we own, we have rights to use or we have prospective rights to use that appear in this prospectus include the BETTER HOMES AND GARDENS®, CENTURY 21®, COLDWELL BANKER®, ERA®, THE CORCORAN GROUP®, COLDWELL BANKER COMMERCIAL® and SOTHEBY’S INTERNATIONAL REALTY® marks, which are registered in the United States and/or registered or pending registration in other jurisdictions, as appropriate to the needs of our relevant business. Each trademark, trade name or service mark of any other company appearing in this prospectus is owned by such company.

MARKET AND INDUSTRY DATA AND FORECASTS

This prospectus includes industry and trade association data, forecasts and information that we have prepared based, in part, upon data, forecasts and information obtained from independent trade associations, industry publications and surveys and other information available to us. Some data is also based on our good faith estimates, which are derived from management’s knowledge of the industry and independent sources. As noted in this prospectus, the National Association of Realtors (“NAR”), the Federal National Mortgage Association (“FNMA”) and Freddie Mac were the primary sources for third-party industry data and forecasts. Forecasts regarding rates of home ownership, median sales price, volume of homesales, and other metrics included in this prospectus to describe the housing industry are inherently speculative in nature and actual results for any period may materially differ. Industry publications and surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of included information. We have not independently verified any of the data from third-party sources nor have we ascertained the underlying economic assumptions relied upon therein. Statements as to our market position are based on market data currently available to us. While we are not aware of any misstatements regarding our industry data presented herein, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this prospectus. Similarly, we believe our internal research is reliable, even though such research has not been verified by any independent sources.

ii

Table of Contents

The following is a summary of the more detailed information appearing elsewhere in this prospectus. It does not contain all of the information that may be important to you. You should read this prospectus in its entirety, including the “Risk Factors” section, and the documents we have referred you to, before participating in the exchange offer.

Except as otherwise indicated or unless the context otherwise requires, the terms “Realogy Corporation,” “Realogy,” “we,” “us,” “our,” “our company” and the “Company” refer to Realogy Corporation and its consolidated subsidiaries. “Cendant Corporation” and “Cendant” refer to Cendant Corporation, which changed its name to Avis Budget Group, Inc. in August 2006, and its consolidated subsidiaries, particularly in the context of its business and operations prior to, and in connection with, our separation from Cendant and “Avis Budget” and “Avis Budget Group, Inc.” refer to the business and operations of Cendant following our separation from Cendant.

On April 10, 2007, we completed the private offering of the old notes. In this prospectus, the term “old notes” refers to the 10.50% Senior Notes due 2014, the 11.00%/11.75% Senior Toggle Notes due 2014 and the 12.375% Senior Subordinated Notes due 2015, all issued in the private offering. The term “exchange notes” refers to the 10.50% Senior Notes due 2014, the 11.00%/11.75% Senior Toggle Notes due 2014 and the 12.375% Senior Subordinated Notes due 2015, all as registered under the Securities Act of 1933, as amended (the “Securities Act”). The term “notes” refers to both the old notes and the exchange notes.

Financial information and other data identified in this prospectus as “pro forma” give effect to the Separation (as defined in “Unaudited Pro Forma Condensed Consolidated Financial Statements”), the offering of the 2006 Senior Notes, and the Transactions (as defined in “Summary—The Transactions”), as if they had occurred on January 1, 2006. Financial information in this prospectus for the nine months ended September 30, 2007 is presented on a pro forma combined basis and represents the addition of the period January 1 through April 9, 2007 (the “Predecessor Period” or “Predecessor,” as context requires) and April 10 through September 30, 2007 (the “Successor Period” or “Successor,” as context requires). See “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

OUR COMPANY

We are one of the preeminent and most integrated providers of real estate and relocation services. We operate in four segments: Real Estate Franchise Services, Company-Owned Real Estate Brokerage Services, Relocation Services and Title and Settlement Services. Through our portfolio of leading brands and the broad range of services we offer, we have established our company as a leader in the residential real estate industry, with operations that are dispersed throughout the U.S. and in various locations worldwide. We are the world’s largest real estate brokerage franchisor, the largest U.S. residential real estate brokerage firm, the largest U.S. provider and a leading global provider of outsourced employee relocation services and a provider of title and settlement services. We derive the vast majority of our revenues from serving the needs of buyers and sellers of existing homes, rather than serving the needs of builders and developers of new homes. For the nine months ended September 30, 2007, on a pro forma combined basis, we had revenues, net income (loss) and Adjusted EBITDA (as defined in note (7) in “—Summary Historical Unaudited and Pro Forma Financial Data”) of $4,785 million, $(34) million and $702 million, respectively. For the year ended December 31, 2006 on a historical basis, we had revenues and net income of $6,492 million and $365 million, respectively. For the year ended December 31, 2006 on a pro forma combined basis, we had revenues, net income (loss) and Adjusted EBITDA of $6,484 million, $(46) million and $931 million, respectively.

SEGMENT OVERVIEW

Real Estate Franchise Services: We are a franchisor of five of the most recognized brands in the real estate industry. As of September 30, 2007, we had approximately 16,000 offices (which included approximately 1,000

1

Table of Contents

of our company-owned and operated brokerage offices) and 314,000 sales associates operating under our franchise brands in the U.S. and 86 other countries and territories around the world (internationally, generally through master franchise agreements). During 2006, we estimate that brokers operating under one of our franchised brands (including those of our company-owned brokerage operations) represented the buyer and/or the seller in approximately one out of every four single family domestic homesale transactions that involved a broker and we believe our franchisees and company-owned brokerage operations received approximately 23% of all brokerage commissions paid in such transactions. We believe that the geographic diversity of our franchisees reduces our risk of exposure to local or regional changes in the real estate market. In addition, as of December 31, 2006 we had approximately 5,000 franchisees, none of which individually represented more than 1% of our franchise royalties (other than our subsidiary, NRT, which operates our company-owned brokerage operations). We believe this reduces our exposure to any one franchisee. Our franchise revenues in 2006 and for the nine months ended September 30, 2007 included $327 million and $239 million, respectively, of royalties paid by our company-owned brokerage operations, or approximately 37% and 36%, respectively, of total franchise revenues, which eliminate in consolidation. As of September 30, 2007, our real estate franchise brands were:

• | Century 21®—One of the world’s largest residential real estate brokerage franchisors, with approximately 8,400 franchise offices and approximately 143,000 sales associates located in the U.S. and 56 other countries and territories; |

• | Coldwell Banker®—One of the world’s leading brands for the sale of million dollar-plus homes and one of the largest residential real estate brokerage franchisors, with approximately 3,800 franchise and company-owned offices and approximately 120,000 sales associates located in the U.S. and 44 other countries and territories; |

• | ERA®—A leading residential real estate brokerage franchisor, with approximately 2,950 franchise and company-owned offices and approximately 38,000 sales associates located in the U.S. and 47 other countries and territories; |

• | Sotheby’s International Realty®—A luxury real estate brokerage brand. In February 2004, we acquired from Sotheby’s Holdings, Inc. its company-owned offices and the exclusive license for the rights to the Sotheby’s Realty and Sotheby’s International Realty® trademarks. Since that time, we have grown the brand from 15 company-owned offices to 455 franchise and company-owned offices and approximately 8,600 sales associates located in the U.S. and 27 other countries and territories; and |

• | Coldwell Banker Commercial®—A leading commercial real estate brokerage franchisor. Our commercial franchise system has approximately 200 franchise offices and approximately 2,200 sales associates worldwide. The number of offices and sales associates in our commercial franchise system does not include our residential franchise and company-owned brokerage offices and the sales associates who work out of those brokerage offices that also conduct commercial real estate brokerage business using the Coldwell Banker Commercial® trademarks. |

In addition, on October 8, 2007, we announced that we entered into a long-term agreement to license the Better Homes and Gardens® Real Estate brand from Meredith Corporation (“Meredith”). We intend to build a new international residential real estate franchise company using the Better Homes and Gardens® Real Estate brand name. The licensing agreement between us and Meredith becomes fully operational on July 1, 2008 and is for a 50-year term, with a renewal term for another 50 years at our option. Meredith will receive ongoing license fees, subject to minimum payment requirements, based upon the royalties we earn from franchising the Better Homes and Gardens Real Estate brand.

We derive substantially all of our real estate franchising revenues from royalty fees received under long-term franchise agreements with our franchisees (typically ten years in duration for domestic agreements). The royalty fee is based on a percentage of the franchisees’ sales commission earned from real estate transactions,

2

Table of Contents

which we refer to as gross commission income. Our franchisees pay us royalty fees for the right to operate under one of our trademarks and to enjoy the benefits of the systems and tools provided by our real estate franchise operations. These royalty fees enable us to enjoy recurring revenue streams and high operating margins. In exchange, we provide our franchisees with world-class branding service and support that is designed to facilitate our franchisees in growing their business, attracting new sales associates and increasing their revenue and profitability. We support our franchisees with dedicated branding-related national marketing and servicing programs, technology, training and education. We believe that one of our strengths is the strong relationships that we have with our franchisees, as evidenced by our 98% retention rate of franchisees over the last four years. Our retention rate represents the annual gross commission income generated by our franchisees that is kept in the franchise system on an annual basis, measured against the annual gross commission income as of December 31 of the previous year.

Company-Owned Real Estate Brokerage Services: Through our subsidiary, NRT, we own and operate a full-service real estate brokerage business in more than 35 of the largest metropolitan areas of the U.S. Our company-owned real estate brokerage business operates principally under our Coldwell Banker® brand as well as under the ERA® and Sotheby’s International Realty® franchised brands, and proprietary brands that we own, but do not currently franchise to third parties, such as The Corcoran Group®. At September 30, 2007, we had approximately 1,000 company-owned brokerage offices, approximately 8,000 employees and approximately 58,000 independent contractor sales associates working with these company-owned offices. Acquisitions have been, and will continue to be, part of our strategy and a contributor to the growth of our company-owned brokerage business. We believe that the geographic diversity of our company-owned brokerage business could mitigate some of the impact of local or regional changes in the real estate market.

Our company-owned real estate brokerage business derives revenues primarily from gross commission income received at the closing of real estate transactions. Sales commissions usually range from 5% to 6% of the home’s sale price. In transactions in which we act as a broker for solely the buyer or the seller, the seller’s broker typically instructs the closing agent to pay a portion of the sales commission to the broker for the buyer. In addition, as a full-service real estate brokerage company, in compliance with applicable laws and regulations, including RESPA, we actively promote the services of our relocation and title and settlement services businesses, as well as the products offered by PHH Home Loans, LLC (“PHH Home Loans”), our home mortgage venture with PHH Corporation that is the exclusive recommended provider of mortgages for our real estate brokerage and relocation service customers. All mortgage loans originated by PHH Home Loans are sold to PHH Corporation or other third party investors, and PHH Home Loans does not hold any mortgage loans for investment purposes or perform servicing functions for any loans it originates. Accordingly, our home mortgage venture structure insulates us from mortgage servicing risk. We own 49.9% of PHH Home Loans and PHH Corporation owns the remaining 50.1%. As a result, our financial results only reflect our proportionate share of the venture’s results of operations which are recorded using the equity method.

Relocation Services: Through our subsidiary, Cartus Corporation (“Cartus”), we offer a broad range of world-class employee relocation services designed to manage all aspects of an employee’s move to facilitate a smooth transition in what otherwise may be a difficult process for both the employee and the employer. In 2006, we assisted in over 130,000 relocations in over 150 countries for over 1,100 active clients, including nearly two-thirds of the Fortune 50, as well as government agencies and affinity organizations, such as the United Services Automobile Association (USAA). Our relocation services business operates through five global service centers on three continents. Our relocation services business is a leading global provider of outsourced employee relocation services with the number one market share in the U.S. In addition to general residential housing trends, key drivers of our relocation services business are corporate and government spending and employment trends.

Our relocation services business primarily offers its clients employee relocation services such as homesale assistance, home finding and other destination services, expense processing, relocation policy counseling and other consulting services, arranging household moving services, visa and immigration support, intercultural and

3

Table of Contents

language training and group move management services. Clients pay a fee for the services performed and we also receive commissions from third-party service providers, such as real estate brokers and household goods moving service providers. The majority of our clients pay interest on home equity advances and reimburse all costs associated with our services, including, where required, repayment of home equity advances and reimbursement of losses on the sale of homes purchased. We believe we provide our relocation clients with exceptional service which leads to client retention. As of September 30, 2007, our top 25 relocation clients had an average tenure of 16 years with us. In addition, our relocation services business generates revenue for our other businesses because the clients of our relocation services business often utilize the services of our franchisees and company-owned brokerage offices as well as our title and settlement services.

Title and Settlement Services: In most real estate transactions, a buyer will choose, or will be required, to purchase title insurance that will protect the purchaser and/or the mortgage lender against loss or damage in the event that title is not transferred properly. Our title and settlement services business, which we refer to as Title Resource Group (“TRG”), assists with the closing of a real estate transaction by providing full-service title and settlement (i.e., closing and escrow) services to real estate companies and financial institutions. Our title and settlement services business was formed in 2002 in conjunction with Cendant’s acquisition of 100% of NRT to take advantage of the nationwide geographic presence of our company-owned brokerage and relocation services businesses.

Our title and settlement services business earns revenues through fees charged in real estate transactions for rendering title and other settlement and non-settlement related services. We provide many of these services in connection with transactions in which our company-owned real estate brokerage and relocation services businesses are participating. The majority of our title and settlement service operations are conveniently located in or around our company-owned brokerage locations, and during 2006, approximately 47% of the customers of our company-owned brokerage offices where we offer title coverage also utilized our title and settlement services. Fees for escrow and closing services are generally separate and distinct from premiums paid for title insurance and other real estate services. In some situations we serve as an underwriter of title insurance policies in connection with residential and commercial real estate transactions. Our title underwriting operation generally earns revenues through the collection of premiums on policies that it issues.

THE TRANSACTIONS

On April 10, 2007, Domus Holdings Corp., a Delaware corporation (“Holdings”) and an affiliate of Apollo Management, L.P. (“Apollo”), completed the acquisition of all of the outstanding equity of Realogy in a merger transaction for approximately $8,750 million (the “Merger”). In connection with the Merger, Holdings established a direct, wholly owned subsidiary, Domus Intermediate Holdings Corp. (“Intermediate”) to own all of the outstanding shares of Realogy.

The Merger was financed by borrowings under our senior secured credit facility, the issuance of the old notes, an Equity Investment (which is defined below) and cash on hand. See “—Use of Proceeds.” Two investment funds affiliated with Apollo and an investment fund of co-investors managed by Apollo, as well as members of the Company’s management who purchased Holdings common stock with cash or through rollover equity, contributed $2,001 million (the “Equity Investment”) to Realogy to complete the Merger. In addition, we refinanced the credit facilities governing our relocation securitization programs (the “Securitization Facilities Refinancings,” and the credit facilities as refinanced, the “Securitization Facilities”).

As used in this prospectus, the term “Transactions” refers to, collectively, (1) the Merger, (2) the offering of the old notes, (3) the initial borrowings under our senior secured credit facility, including our synthetic letter of credit facility, (4) the Equity Investment, and (5) the Securitization Facilities Refinancing. For a more complete

4

Table of Contents

description of the Transactions, see “The Merger,” “Certain Relationships and Related Party Transactions” and “Description of Other Indebtedness.”

* * * *

Our headquarters are located at One Campus Drive, Parsippany, New Jersey 07054 and our general telephone number is (973) 407-2000. We maintain an Internet site at http://www.realogy.com. Our website address is provided as an inactive textual reference. Our website and the information contained on that site, or connected to that site, are not incorporated by reference into this prospectus.

5

Table of Contents

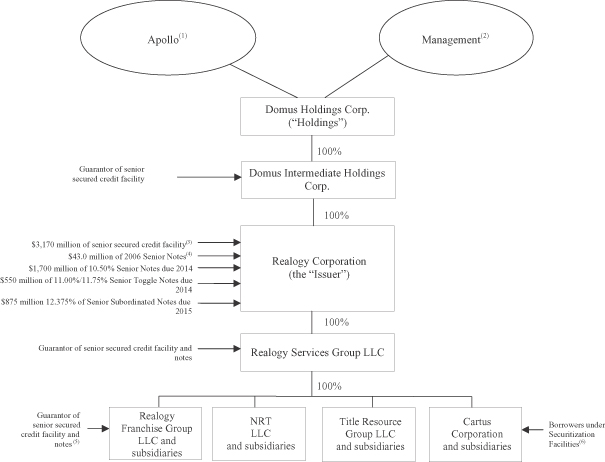

OUR OWNERSHIP AND DEBT STRUCTURE

The following diagram sets forth our ownership and debt structure as of September 30, 2007. The diagram does not display all of our subsidiaries.

(1) | Consists of two investment funds affiliated with Apollo and an investment fund of co-investors managed by Apollo that invested an aggregate of $1,978 million of equity in Holdings upon consummation of the Merger. |

(2) | Certain members of management also contributed rollover equity of $23 million to finance a portion of the Merger. In addition, in conjunction with the closing of the Transactions on April 10, 2007, Holdings granted approximately 11.2 million of stock options in three separate tranches to officers and key employees and approximately 0.4 million of restricted shares to senior officers. |

(3) | Consists of a $1,950 million term loan facility, a $750 million revolving credit facility and a $525 million synthetic letter of credit facility. In addition, at the closing date of the Transactions, we had a $1,220 million delayed draw term loan facility, which could only be used, and has been subsequently used, to refinance the 2006 Senior Notes. |

(4) | At issuance in October 2006, consisted of (a) $250 million aggregate principal amount of the Floating Rate Senior Notes due 2009, (b) $450 million aggregate principal amount of the 6.15% Senior Notes due 2011 and (c) $500 million aggregate principal amount of the 6.50% Senior Notes due 2016 (collectively, the “2006 Senior Notes”). At September 30, 2007, there was outstanding $43 million aggregate principal |

6

Table of Contents

amount of 2006 Senior Notes. Subsequent to September 30, 2007, we repurchased the remainder of the 2006 Senior Notes in privately negotiated transactions and there are no 2006 Senior Notes outstanding. |

(5) | Guarantors included each wholly-owned subsidiary of Realogy Corporation other than subsidiaries that are (a) foreign subsidiaries, (b) securitization entities that are subsidiaries of Cartus Corporation, (c) insurance underwriters that are subsidiaries of Title Resource Group LLC and (d) qualified foreign corporation holding companies. |

(6) | The borrowers under the Securitization Facilities consist of certain special purpose entities created by Cartus Corporation for financing relocation receivables and advances, relocation properties held for sale and other related assets and issuing notes secured by such receivables and other assets. Two separate special purpose entities in the U.S. issued revolving notes in the maximum amount of $850 million and $175 million, respectively, and one special purpose entity in the UK may borrow up to approximately $205 million (based on current exchange rates). |

OUR EQUITY SPONSOR

Apollo Investment Fund VI, L.P., our principal equity sponsor, is an affiliate of Apollo Management, L.P. Apollo Management, L.P., founded in 1990, is a leader in private equity, debt and capital markets investing and has more than 16 years of experience investing across the capital structure of leveraged companies. Apollo Management, L.P. employs more than 175 professionals and has offices in New York, Los Angeles, London, Frankfort, Paris and Singapore. Since its inception, Apollo Management, L.P. and affiliates have managed more than $41 billion of capital, across a wide variety of industries, both domestically and internationally. Apollo Investment Fund VI, L.P., an investment fund, has, along with related co-investing partnerships, total committed capital of approximately $12 billion. Companies owned or controlled by Apollo Management, L.P. and affiliates or in which Apollo Management, L.P. and affiliates have a significant equity investment include, among others, Affinion Group, Inc., Berry Plastics Group, CEVA Group Plc, Countrywide plc, Hexion Specialty Chemicals, Inc., Hughes Communications, Inc., Intelsat, Metals USA Holdings Corp., Momentive Performance Materials Inc., Noranda Aluminum, Rexnord Corporation and Verso Paper Company.

Our subsidiary, NRT, was formed by our former parent Cendant and Apollo Management, L.P. in 1997 in order to acquire National Realty Trust, the largest residential real estate brokerage operator in the U.S. Following an acquisition growth strategy which drove revenue growth from approximately $1 billion in 1997 to approximately $3 billion in 2001, Cendant exercised its option to purchase Apollo’s equity investment in April 2002.

7

Table of Contents

SUMMARY HISTORICAL AND UNAUDITED PRO FORMA FINANCIAL DATA

The following table presents our summary historical consolidated and combined financial data and our summary unaudited pro forma condensed consolidated financial data and operating statistics. The consolidated and combined statement of operations data for each of the years in the three-year period ended December 31, 2006 and the consolidated and combined balance sheet data as of December 31, 2006 and 2005 have been derived from our audited consolidated and combined financial statements included elsewhere in this prospectus. The consolidated and combined statement of operations data for the years ended December 31, 2003 and 2002 and the combined balance sheet data as of December 31, 2004, 2003 and 2002 have been derived from our combined financial statements not included elsewhere in this prospectus.

Although Realogy continued as the same legal entity after the Merger, the condensed consolidated and combined financial statements for 2007 are presented for two periods: January 1 through April 9, 2007 (the “Predecessor Period” or “Predecessor,” as context requires) and April 10 through September 30, 2007 (the “Successor Period” or “Successor,” as context requires), which relate to the period preceding the Merger and the period succeeding the Merger, respectively. The results of the Successor are not comparable to the results of the Predecessor due to the difference in the basis of presentation of purchase accounting as compared to historical cost. The condensed consolidated statements of operations data for the nine months ended September 30, 2006 and the period January 1, 2007 to April 9, 2007 are derived from the unaudited financial statements of the Predecessor included elsewhere in this prospectus, and the condensed consolidated balance sheet as of September 30, 2006 are derived from the unaudited financial statements of the Predecessor not included elsewhere in this prospectus, and, in each case, in the opinion of management, include all adjustments (consisting only of normal recurring accruals) necessary for a fair presentation of the financial position and results of operations as of the dates and for the periods indicated. The summary historical consolidated statements of operations data for the period April 10 to September 30, 2007 and the condensed consolidated balance sheet as of September 30, 2007 are derived from the unaudited financial statements of the Successor included elsewhere in this prospectus and, in the opinion of management, include all adjustments (consisting only of normal recurring accruals) necessary for a fair presentation of the financial position and results of operations as of the dates and for the periods indicated. The results for periods of less than a full year are not necessarily indicative of the results to be expected for any interim period or for a full year.

The following unaudited pro forma condensed consolidated and combined statement of operations data for the year ended December 31, 2006 has been derived from our historical consolidated and combined financial statements included elsewhere in this prospectus, has been prepared to give effect to (i) the Separation, (ii) the offering of the 2006 Senior Notes and (iii) the Transactions, and assumes that these events occurred on January 1, 2006. The following unaudited pro forma combined condensed consolidated and combined statement of operations data for the nine months ended September 30, 2007 has been derived from our historical consolidated and combined financial statements included elsewhere in this prospectus, has been prepared to give effect to the Transactions, and assumes that the Transactions occurred on January 1, 2006.

The pro forma adjustments are based upon available information and assumptions that we believe are reasonable; however, these adjustments are subject to change. The unaudited pro forma condensed consolidated and combined financial data are for informational purposes only and do not purport to represent what our results of operations or financial position would have been if the Separation, the offering of the 2006 Senior Notes and the Transactions had occurred as of the date indicated or what such results will be for future periods. Because the data in this table are only summary and do not provide all of the data contained in our unaudited pro forma condensed consolidated financial statements, the information should be read in conjunction with “Unaudited Pro Forma Condensed Consolidated and Combined Financial Statements.” The summary historical consolidated and combined financial data and summary unaudited pro forma condensed consolidated and combined financial data should also be read in conjunction with “Use of Proceeds,” “Capitalization,” “Selected Historical Consolidated and Combined Financial Statement,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our audited and unaudited consolidated and combined financial statements included elsewhere in this prospectus.

8

Table of Contents

(In millions, except ratios | Pro Forma | Historical | ||||||||||||||||||||||||||||||||||||||||

| Successor | Predecessor | |||||||||||||||||||||||||||||||||||||||||

| For the Nine Months Ended September 30, 2007 | For the Year Ended December 31, 2006 | As of or for the | For the Period from January 1, 2007 through April 9, 2007 | As of or for the Nine Months Ended September 30, 2006 | As of or For the Year Ended December 31 | |||||||||||||||||||||||||||||||||||||

| 2006 | 2005 | 2004 | 2003 | 2002 | ||||||||||||||||||||||||||||||||||||||

Statement of operations data: | ||||||||||||||||||||||||||||||||||||||||||

Revenues: | ||||||||||||||||||||||||||||||||||||||||||

Gross commission income | $ | 3,637 | $ | 4,965 | $ | 2,533 | $ | 1,104 | $ | 3,899 | $ | 4,965 | $ | 5,666 | $ | 5,197 | ||||||||||||||||||||||||||

Service revenue | 653 | 854 | 426 | 216 | 643 | 854 | 764 | 707 | ||||||||||||||||||||||||||||||||||

Franchise fees | 336 | 472 | 230 | 106 | 365 | 472 | 538 | 477 | ||||||||||||||||||||||||||||||||||

Other | 159 | 193 | 94 | 67 | 151 | 201 | 171 | 168 | ||||||||||||||||||||||||||||||||||

Net revenues | 4,785 | 6,484 | 3,283 | 1,493 | 5,058 | 6,492 | 7,139 | 6,549 | $ | 5,532 | $ | 4,117 | ||||||||||||||||||||||||||||||

Expenses: | ||||||||||||||||||||||||||||||||||||||||||

Commission and other agent-related costs | 2,410 | 3,335 | 1,684 | 726 | 2,615 | 3,335 | 3,838 | 3,494 | ||||||||||||||||||||||||||||||||||

Operating | 1,352 | 1,799 | 869 | 489 | 1,359 | 1,799 | 1,642 | 1,498 | ||||||||||||||||||||||||||||||||||

Marketing | 209 | 291 | 125 | 84 | 222 | 291 | 282 | 265 | ||||||||||||||||||||||||||||||||||

General and administrative | 209 | 253 | 128 | 123 | 152 | 218 | 204 | 177 | ||||||||||||||||||||||||||||||||||

Former parent legacy costs (benefit), net(1) | (17 | ) | (38 | ) | 2 | (19 | ) | 3 | (38 | ) | — | — | ||||||||||||||||||||||||||||||

Separation costs(2) | — | — | 2 | 2 | 65 | 66 | — | — | ||||||||||||||||||||||||||||||||||

Restructuring costs(3) | 7 | 46 | 6 | 1 | 26 | 46 | 6 | — | ||||||||||||||||||||||||||||||||||

Merger costs | — | — | 22 | 80 | — | — | — | — | ||||||||||||||||||||||||||||||||||

Depreciation and amortization(4) | 166 | 230 | 448 | 37 | 107 | 142 | 136 | 120 | ||||||||||||||||||||||||||||||||||

Interest expense(5) | 506 | 654 | 326 | 43 | 27 | 57 | 5 | 4 | ||||||||||||||||||||||||||||||||||

Interest income | (12 | ) | (16 | ) | (6 | ) | (6 | ) | (22 | ) | (28 | ) | (12 | ) | (10 | ) | ||||||||||||||||||||||||||

Total expenses | 4,830 | 6,554 | 3,606 | 1,560 | 4,554 | 5,888 | 6,101 | 5,548 | 4,672 | 3,574 | ||||||||||||||||||||||||||||||||

Income (loss) before income taxes and minority interest | (45 | ) | (70 | ) | (323 | ) | (67 | ) | 504 | 604 | 1,038 | 1,001 | 860 | 543 | ||||||||||||||||||||||||||||

Provision for income taxes | (12 | ) | (26 | ) | (120 | ) | (23 | ) | 205 | 237 | 408 | 379 | 285 | 186 | ||||||||||||||||||||||||||||

Minority interest, net of tax(6) | 1 | 2 | 1 | — | 1 | 2 | 3 | 4 | 6 | 9 | ||||||||||||||||||||||||||||||||

Net income (loss) | $ | (34 | ) | $ | (46 | ) | $ | (204 | ) | $ | (44 | ) | $ | 298 | $ | 365 | $ | 627 | $ | 618 | $ | 569 | $ | 348 | ||||||||||||||||||

Other financial data: | ||||||||||||||||||||||||||||||||||||||||||

Cash flow provided by operating activities | $ | 207 | $ | 107 | $ | 201 | $ | 245 | $ | 617 | $ | 703 | ||||||||||||||||||||||||||||||

Cash flow used in investing activities | (6,798 | ) | (40 | ) | (260 | ) | (310 | ) | (423 | ) | (271 | ) | ||||||||||||||||||||||||||||||

Cash flow provided by (used in) | $ | 6,338 | $ | 62 | $ | 1,302 | $ | 427 | $ | (216 | ) | $ | (405 | ) | ||||||||||||||||||||||||||||

EBITDA(7) | $ | 615 | $ | 798 | 445 | 7 | 616 | 775 | 1,167 | 1,115 | ||||||||||||||||||||||||||||||||

Adjusted EBITDA(7) | $ | 702 | $ | 931 | ||||||||||||||||||||||||||||||||||||||

Capital expenditures | $ | 41 | $ | 31 | $ | 88 | $ | 130 | $ | 131 | $ | 87 | ||||||||||||||||||||||||||||||

Ratio of earnings to fixed charges(8) | — | — | — | — | 5.4 | x | 4.4 | x | 11.9 | x | 14.7 | x | 15.5 | x | 13.9 | x | ||||||||||||||||||||||||||

Balance sheet data: | ||||||||||||||||||||||||||||||||||||||||||

Total assets(9) | $ | 12,346 | $ | 7,478 | $ | 6,668 | $ | 5,439 | $ | 5,015 | $ | 4,769 | $ | 4,051 | ||||||||||||||||||||||||||||

Long-term debt (including current portion)(10) | 6,256 | 1,825 | 1,800 | — | — | — | — | |||||||||||||||||||||||||||||||||||

Stockholders’ equity(11) | 1,798 | 3,210 | 2,483 | 3,567 | 3,552 | 2,973 | 2,405 | |||||||||||||||||||||||||||||||||||

9

Table of Contents

| For the Nine Months Ended September 30, 2007 | For the Nine Months Ended September 30, 2006 |

As of or For the Year Ended December 31 | ||||||||||||||||||||||||||

| 2006 | 2005 | 2004 | 2003 | 2002 | ||||||||||||||||||||||||

Segment operating statistics: | ||||||||||||||||||||||||||||

Real estate franchise services | ||||||||||||||||||||||||||||

Closed homesale sides-franchisees(12)(13) | 966,390 | 1,176,920 | 1,515,542 | 1,848,000 | 1,814,165 | 1,686,434 | 1,571,535 | |||||||||||||||||||||

Average homesale price (13)(14) | $ | 232,340 | $ | 231,127 | $ | 231,664 | $ | 224,486 | $ | 197,547 | $ | 175,347 | $ | 169,727 | ||||||||||||||

Average homesale brokerage commission rate(13)(15) | 2.49 | % | 2.47 | % | 2.47 | % | 2.51 | % | 2.56 | % | 2.62 | % | 2.65 | % | ||||||||||||||

Net effective royalty rate(13)(16) | 5.03 | % | 4.86 | % | 4.87 | % | 4.69 | % | 4.69 | % | 4.77 | % | 5.04 | % | ||||||||||||||

Royalty per side(17) | $ | 300 | $ | 284 | $ | 286 | $ | 271 | $ | 247 | $ | 228 | $ | 216 | ||||||||||||||

Company owned real estate brokerage services(18) | ||||||||||||||||||||||||||||

Closed homesale sides(12) | 261,204 | 307,476 | 390,222 | 468,248 | 488,658 | 476,627 | 347,896 | |||||||||||||||||||||

Average homesale price(14) | $ | 538,538 | $ | 491,256 | $ | 492,669 | $ | 470,538 | $ | 407,757 | $ | 341,050 | $ | 314,704 | ||||||||||||||

Average homesale brokerage commission rate(15) | 2.47 | % | 2.48 | % | 2.48 | % | 2.49 | % | 2.53 | % | 2.58 | % | 2.63 | % | ||||||||||||||

Gross commission income per side(19) | $ | 13,870 | $ | 12,647 | $ | 12,691 | $ | 12,100 | $ | 10,635 | $ | 9,036 | $ | 8,535 | ||||||||||||||

Relocation Services | ||||||||||||||||||||||||||||

Initiations(20) | 106,462 | 103,608 | 130,764 | 121,717 | 115,516 | 111,184 | 112,140 | |||||||||||||||||||||

Referrals(21) | 63,586 | 67,237 | 84,893 | 91,787 | 89,416 | 82,942 | 83,317 | |||||||||||||||||||||

Title and Settlement Services | ||||||||||||||||||||||||||||

Purchasing title and closing units(22) | 111,173 | 125,385 | 161,031 | 148,316 | 144,699 | 143,827 | 101,252 | |||||||||||||||||||||

Refinance title and closing units(23) | 28,555 | 30,557 | 40,996 | 51,903 | 55,909 | 117,674 | 60,450 | |||||||||||||||||||||

Average price per closing unit(24) | $ | 1,476 | $ | 1,406 | $ | 1,405 | $ | 1,384 | $ | 1,262 | $ | 1,033 | $ | 1,096 | ||||||||||||||

| (1) | Represents benefits of $38 million for the year ended December 31, 2006 related to (i) the realization of certain Cendant contingent assets ($3 million) and (ii) the adjustment of certain Cendant contingent liabilities ($47 million), offset by (iii) legal and other professional expenses ($12 million) primarily related to the administration of the Cendant contingent assets and liabilities. For the nine months ended September 30, 2007, the benefit of $17 million is primarily due to the sale of certain former parent legacy assets. |

| (2) | Represents costs incurred during 2006 in connection with our separation from Cendant relating to the non-cash charges for the accelerated vesting of certain Cendant equity awards and the conversion of Cendant equity awards into Realogy equity awards and legal, accounting and other advisory fees. |

| (3) | Represents charges recorded in 2006 to implement strategic initiatives targeted principally at reducing costs, enhancing organizational efficiency and consolidating and rationalizing existing processes and facilities. The 2006 charges represented facility consolidation expenses, employee separation costs and asset impairment charges. In 2005, restructuring costs represented restructuring activities initiated as a result of the PHH spin-off. |

| (4) | Each of 2006, 2005 and 2004 includes $14 million, $23 million and $16 million, respectively, of amortization of pendings and listings intangible assets of acquired brokerages, which are amortized over the estimated closing period of the underlying contracts and homes listed for sale, which is generally four to five months. The periods April 10 through September 30, 2007, January 1 through April 9, 2007 and the nine months ended September 30, 2006 include $342 million, less than $1 million and $12 million, respectively, of amortization of pendings and listings. |

| (5) | Interest expense does not include interest relating to our relocation securitization programs, which is recorded as a reduction of other revenues, as related borrowings are utilized to fund relocation receivables and advances and properties held for sale within our relocation business where interest is generally earned on such assets. |

| (6) | Represents the portion of consolidated entities not owned by Realogy in our title and settlement services segment. |

| (7) | EBITDA is defined as net income before depreciation and amortization, interest (income) expense, net (other than relocation services interest for securitization assets and securitization obligations), income taxes and minority interest, each of which is presented in our audited consolidated and combined statements of operations included elsewhere in this prospectus. Adjusted EBITDA is calculated by adjusting EBITDA by the items described below. We believe EBITDA and Adjusted EBITDA are useful as supplemental measures in evaluating the performance of our operating businesses and provides greater transparency into our consolidated and combined results of operations. EBITDA and Adjusted EBITDA are measures used by our management, including our chief operating decision maker, to perform such evaluation, and are factors in measuring compliance with debt covenants relating to certain of our borrowing arrangements. EBITDA and Adjusted EBITDA should not be considered in isolation or as a substitute for net income or other statement of operations data prepared in accordance with U.S. generally accepted accounting principles. Our presentation of EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures used by other companies. A reconciliation of EBITDA and Adjusted EBITDA to net income is included in the table below. |

We believe EBITDA and Adjusted EBITDA facilitate company-to-company operating performance comparisons by backing out potential differences caused by variations in capital structures (affecting net interest expense), taxation and the age and book depreciation |

10

Table of Contents

of facilities (affecting relative depreciation expense), which may vary for different companies for reasons unrelated to operating performance. We further believe that EBITDA is frequently used by securities analysts, investors and other interested parties in their evaluation of companies, many of which present an EBITDA measure when reporting their results. EBITDA and Adjusted EBITDA are not necessarily comparable to other similarly titled financial measures of other companies due to the potential inconsistencies in the method of calculation. In addition, Adjusted EBITDA as presented in this table corresponds to the definition of EBITDA used in the senior secured credit facility and the indentures governing the notes to test the permissibility of certain types of transactions, including debt incurrence. For a description of the senior secured credit facility and the indentures governing the notes, see “Description of Other Indebtedness” and “Description of Notes.” |

| EBITDA and Adjusted EBITDA have limitations as analytical tools, and you should not consider them either in isolation or as substitutes for analyzing our results as reported under GAAP. Some of these limitations are: |

| • | EBITDA and Adjusted EBITDA do not reflect changes in, or cash requirement for, our working capital needs; |

| • | EBITDA and Adjusted EBITDA do not reflect our interest expense (except for interest related to our securitization obligations), or the cash requirements necessary to service interest or principal payments, on our debt; |

| • | EBITDA and Adjusted EBITDA do not reflect our income tax expense or the cash requirements to pay our taxes; |

| • | EBITDA and Adjusted EBITDA do not reflect historical cash expenditures or future requirements for capital expenditures or contractual commitments; |

| • | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and EBITDA and Adjusted EBITDA do not reflect any cash requirements for such replacements; and |

| • | other companies in our industry may calculate EBITDA and Adjusted EBITDA differently so they may not be comparable. |

A reconciliation of pro forma net income to EBITDA and Adjusted EBITDA is set forth in the following table:

(In millions) | Pro Forma | Historical | |||||||||||||||||||||||||

| For the Nine Months Ended September 30, 2007 | For the Year Ended December 31, 2006 | For the Period from April 10, 2007 through September 30, 2007 | For the Period from January 1, 2007 through April 9, 2007 | For the Year Ended December 31, | |||||||||||||||||||||||

| 2006 | 2005 | 2004 | |||||||||||||||||||||||||

Net income (loss) | $ | (34 | ) | $ | (46 | ) | $ | (204 | ) | $ | (44 | ) | $ | 365 | $ | 627 | $ | 618 | |||||||||

Minority interest, net of tax | 1 | 2 | 1 | — | 2 | 3 | 4 | ||||||||||||||||||||

Provision for income taxes | (12 | ) | (26 | ) | (120 | ) | (23 | ) | 237 | 408 | 379 | ||||||||||||||||

Income (loss) before income taxes and minority interest | (45 | ) | (70 | ) | (323 | ) | (67 | ) | 604 | 1,038 | 1,001 | ||||||||||||||||

Interest expense (income), net | 494 | 638 | 320 | 37 | 29 | (7 | ) | (6 | ) | ||||||||||||||||||

Depreciation and amortization | 166 | 230 | 448 | 37 | 142 | 136 | 120 | ||||||||||||||||||||

EBITDA | 615 | 798 | $ | 445 | $ | 7 | $ | 775 | $ | 1,167 | $ | 1,115 | |||||||||||||||

Former parent legacy costs (benefit), net, separation costs, restructuring costs and merger costs(a) | (10 | ) | 8 | ||||||||||||||||||||||||

Integration and conversion costs(b) | 1 | 3 | |||||||||||||||||||||||||

Non-cash charges(c) | 19 | 27 | |||||||||||||||||||||||||

Pro forma proceeds from contingent assets(d) | 10 | 13 | |||||||||||||||||||||||||

Pro forma cost savings(e) | 47 | 46 | |||||||||||||||||||||||||

Non-cash rent expense(f) | — | 4 | |||||||||||||||||||||||||

Sponsor fees(g) | 11 | 15 | |||||||||||||||||||||||||

Purchase accounting impacts to EBITDA(h) | — | (1 | ) | ||||||||||||||||||||||||

Pro forma effect of NRT acquisitions and RFG acquisitions/new franchisees(i) | 9 | 18 | |||||||||||||||||||||||||

Adjusted EBITDA | $ | 702 | $ | 931 | |||||||||||||||||||||||

| (a) | On a pro forma basis for the nine months ended September 30, 2007, consists of $7 million of restructuring costs offset by a benefit of $17 million for former parent legacy matters. On a historical basis for the nine months ended September 30, 2007, consists of $102 million of merger costs, $45 million of separation benefits, $7 million of restructuring costs, and $4 million of separation costs offset by a benefit of $17 million of former parent legacy costs. On a pro forma basis for the year ended December 31, 2006, |

11

Table of Contents

consists of $46 million of restructuring costs offset by a benefit of $38 million for former parent legacy matters. On a historical basis for the year ended December 31, 2006, consists of $66 million of separation costs and $46 million of restructuring costs offset by a benefit of $38 million for former parent legacy matters. |

| (b) | Represents the elimination of integration and conversion costs related to NRT acquisitions. |

| (c) | Represents the elimination of non-cash stock based compensation expense and the non-cash charge in the allowance for doubtful accounts. Such amount excludes accelerated stock compensation costs incurred in connection with the Separation and the Merger and related costs of converting certain Cendant awards to those of Realogy. These costs are included in separation costs and merger costs and are eliminated in the unaudited pro forma condensed consolidated statement of operations. |

| (d) | Wright Express Corporation (“WEX”) was divested by Cendant in February 2005 through an initial public offering (“IPO”). As a result of such IPO, the tax basis of WEX’s tangible and intangible assets increased to their fair market value which may reduce federal income tax that WEX might otherwise be obligated to pay in future periods. WEX is required to pay Cendant 85% of any tax savings related to the increase in fair value utilized for a period of time that we expect will be beyond the maturity of the notes. Cendant is required to pay 62.5% of these tax savings payments received from WEX to us. The 2006 adjustment represents the full year effect of these projected tax savings payments that we expect to receive under this arrangement and the adjustment for the nine months ended September 30, 2007 represents nine months of the annualized net projected tax savings. |

| (e) | For the year ended December 31, 2006, represents actual costs incurred during 2006 that are not expected to recur in subsequent periods due to restructuring activities initiated during the year ended December 31, 2006. From this and other restructuring, we expect to reduce our operating costs by approximately $81 million annually on a run-rate basis and estimate that $42 million of such savings were realized in 2006. In addition the 2006 adjustment reflects a reduction of $7 million of certain costs associated with having listed publicly-traded equity. See “Note 12—Separation and Restructuring Costs” in the audited consolidated and combined financial statement included elsewhere in this prospectus. Additional restructuring activities were initiated in 2007 primarily late in the third quarter and early fourth quarter. From these 2007 restructuring activities, we expect to reduce our operating costs by approximately $60 million annually on a run-rate basis. The adjustment for the nine months ended September 30, 2007 represents nine months of the annualized projected cost savings and a $2 million reduction in certain costs associated with having listed publicly-traded equity. |

| (f) | Represents the elimination of estimated non-cash rent expense. |

| (g) | Represents the elimination of annual management fees to Apollo. |

| (h) | Represents the elimination of lower pension expense due to the effects of purchase accounting. |

| (i) | Represents the 2006 full year estimated impact of acquisitions made by NRT ($6 million) and RFG new franchise contracts ($12 million) as if they have been acquired or signed, respectively, on January 1, 2006. Represents the nine month 2007 estimated impact of acquisitions made by RFG acquisitions/new franchisees as if they had been acquired or signed, respectively, on January 1, 2007. We have made a number of assumptions in calculating such estimate and there can be no assurance that we would have generated the projected levels of EBITDA had we owned the acquired entities or entered into the franchise contracts on January 1. |

| (8) | For purposes of computing the ratio of earnings to fixed charges, earnings consist of income before income taxes and minority interests plus fixed charges and distributed income of equity investees. Fixed charges consist of interest expense on all indebtedness, including amortization of deferred financing costs, and the portion of rental expense that management believes is representative of the interest factor. In addition, interest expense includes interest incurred related to our securitization obligations. Interest related to these securitization obligations are recorded within net revenues on the consolidated and combined statements of operations as the related borrowings are utilized to fund advances within our relocation business where interest is earned on such advances. The interest related to these securitization obligations was $29 million for the period from April 10 through September 30, 2007, $13 million for the period from January 1 through April 9, 2007 and $42 million, $25 million, $9 million, $3 million and $3 million for the years ended December 31, 2006, 2005, 2004, 2003 and 2002, respectively. Our earnings were insufficient to cover fixed charges by approximately $325 million for the period from April 10 to September 30, 2007, and $67 million for the period from January 1 to April 9, 2007. Additionally, on a pro forma basis after giving effect to the Transactions, earnings would have been insufficient to cover fixed charges and there would have been a deficiency of $47 million for the nine months ended September 30, 2007 and $79 million for the year ended December 31, 2006. |

| (9) | Total assets includes relocation receivables and advances, relocation properties held for sale and other related assets that collateralize (or are available to collateralize) our relocation securitization programs. The assets collateralizing (or available to collateralize) our relocation securitization programs are reflected on our balance sheet as relocation receivables and advances and relocation properties held for sale, net, which we refer to collectively as “securitization assets.” Obligations under our relocation receivables programs are reflected in our balance sheet as current liabilities under the line item “securitization obligations.” See “Note 9—Long and Short Term Debt” in our audited consolidated and combined financial statements included elsewhere in this prospectus. |

12

Table of Contents

| (10) | Long-term debt does not include obligations under our relocation receivable programs, which are reflected in our balance sheet as liabilities under the line item “securitization obligations.” Our securitization obligations arise under three programs in which a bankruptcy remote special purpose entity borrows from one or more commercial paper conduits and uses the proceeds to purchase relocation receivables and related assets originated by Cartus Corporation and certain of its subsidiaries. A performance guaranty is provided by Realogy. As of December 31, 2006, our balance sheet reflected $1,190 million of securitization assets collateralizing the smaller $893 million of securitization obligations. See “Note 9—Long and Short Term Debt” in our audited consolidated and combined financial statements included elsewhere in this prospectus. Pro forma total debt does include an additional $8 million over the principal amount outstanding due to the estimated step up in the fair value of the 2006 Senior Notes. Securitization obligations and the write up to fair value of the 2006 Senior Notes will each be excluded from the definition of Indebtedness in the indentures relating to the notes. |