3Q 2009 Preliminary Earnings Call

November 3, 2009

Exhibit 99.2

The preliminary financial results reflect management’s best estimate of the Company’s

net asbestos liability based upon information currently available. The preliminary results

do not reflect any potential adjustments from the favorable asbestos ruling on October

14, 2009 for the Company’s Warren Pumps subsidiary. The Company expects additional

information related to this matter to become available prior to filing its third quarter Form

10-Q with the SEC on or before November 16, 2009. Any adjustments that result from the

Company’s evaluation of this information will be reflected in the Company’s financial

statements included in its third quarter Form 10-Q.

Preliminary Results

1

The following information contains forward-looking statements, including forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking

statements include, but are not limited to, statements concerning Colfax's plans, objectives,

expectations and intentions and other statements that are not historical or current facts. Forward-

looking statements are based on Colfax's current expectations and involve risks and uncertainties that

could cause actual results to differ materially from those expressed or implied in such forward-looking

statements. Factors that could cause Colfax's results to differ materially from current expectations

include, but are not limited to factors detailed in Colfax's reports filed with the U.S. Securities and

Exchange Commission as well as its Annual Report on Form 10-K under the caption “Risk Factors”. In

addition, these statements are based on a number of assumptions that are subject to change. This

presentation speaks only as of this date. Colfax disclaims any duty to update the information herein.

Forward-Looking Statements

2

Adjusted net income of $10.0 million (23 cents per share) compared to $12.1 million (28

cents per share) in Q3 2008, including negative currency effects of 1 cent per share

Net sales of $128.5 million compared to $153.5 million in Q3 2008, a decrease of 16.2%

(organic decline of 12.0%)

Adjusted operating income of $16.5 million compared to $20.3 million in Q3 2008,

including negative currency effects of $0.8 million

Adjusted EBITDA of $20.2 million compared to $24.0 million in Q3 2008, including

negative currency effects of $1.0 million

Third quarter orders of $124.3 million compared to $173.8 in Q3 2008, a decrease of

28.5% (organic decline of 25.5%)

Backlog of $298.0 million

Q3 2009 Highlights

3

Lower results for Q3 2009 vs. Q3 2008 but held margin

Organic sales down 12% overall driven by general industrial; strong growth in global navy (up 79%)

and power generation (up 17%)

Gross profit margin up 40 bps to 35.9% and adjusted EBITDA margin held at 15.7%

Global business conditions still weak; seeing signs of improvement

Organic orders declined 26% - commercial marine (down 27%), oil & gas (down 49%), and

general industrial (down 33%)

Weakness in most general industrial submarkets including chemical, machinery

support and building products

Marine cancellations minimal ($0.5 million in Q3 2009)

Organic orders up 15% sequentially, backlog up slightly

Solid increases in commercial marine (up 25%), power generation (up 44%), global

navy (up 55%) and general industrial (up 15%)

Purchased PD-Technik, a provider of commercial marine products and services in

Hamburg, Germany – enhances aftermarket opportunities

Q3 2009 Highlights Continued

4

YTD 2009 Highlights

Adjusted net income of $28.9 million (67 cents per share) compared to $36.2 million

(82 cents per share) in 2008, including negative currency effects of 10 cents per share

Net sales of $394.1 million compared to $445.5 million in 2008, a decrease of 11.6%

(organic decline of 2.5%)

Adjusted operating income of $47.9 million compared to $62.2 million in 2008,

including negative currency effects of $6.4 million

Adjusted EBITDA of $58.5 million compared to $73.5 million in 2008, including

negative currency effects of $7.2 million

Orders of $349.2 million compared to $542.9 million in 2008, a decrease of 35.7%

(organic decline of 29.9%)

5

Continuing to rightsize to align capacity with demand

Major actions since the beginning of the year:

Reduced temporary, contract and full-time employees (approximately 230 associates)

Implemented furlough programs in Germany (approximately 628 associates, 100 full-time

equivalents)

Closed facility in Aberdeen, NC

Closing Sanford, NC facility by year end

Expect savings of about $16 million in 2009, including furlough-related savings

Expect restructuring expenses of about $14 million in 2009 for activities announced to

date

Additional restructuring anticipated in 4Q

Will remain agile and respond as conditions warrant

CBS activity continues in all areas

Profit Protection Plan Update

6

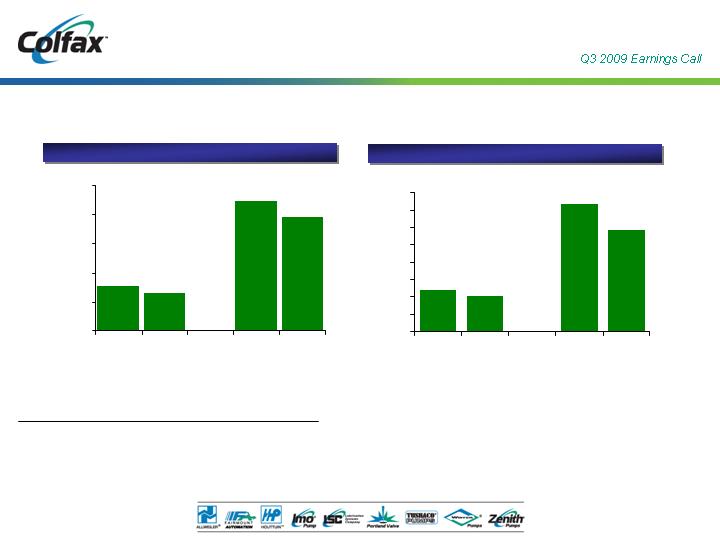

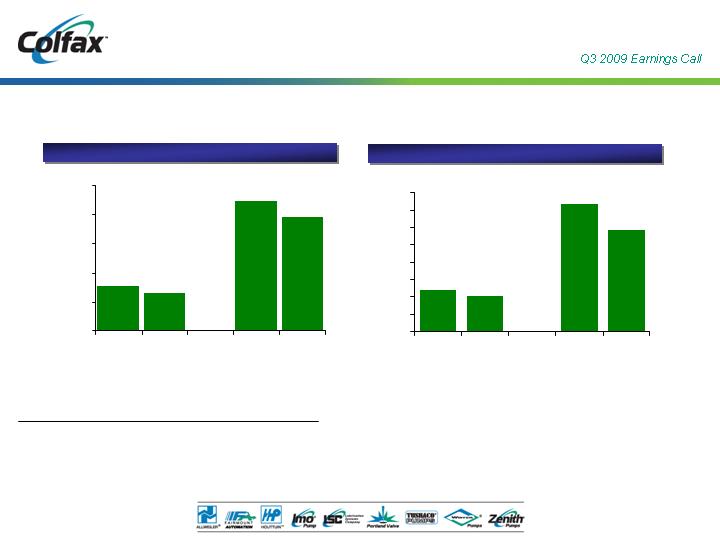

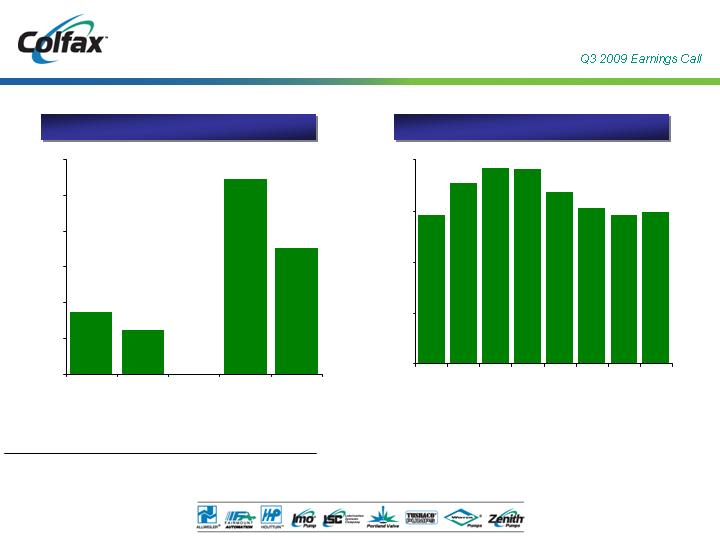

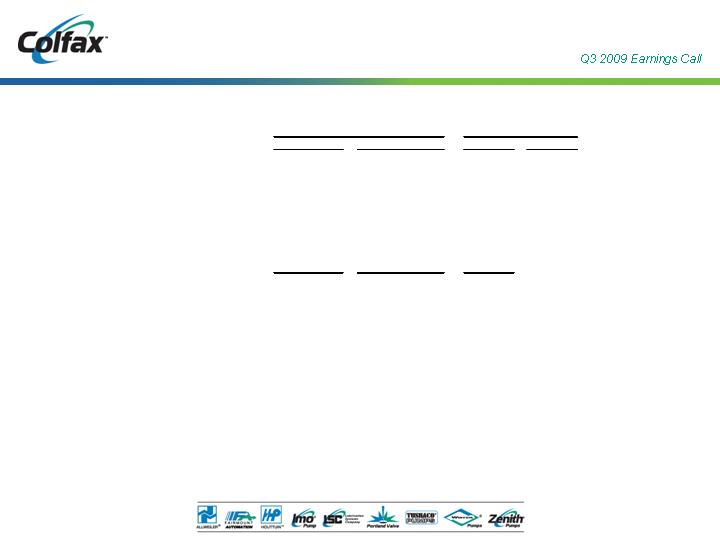

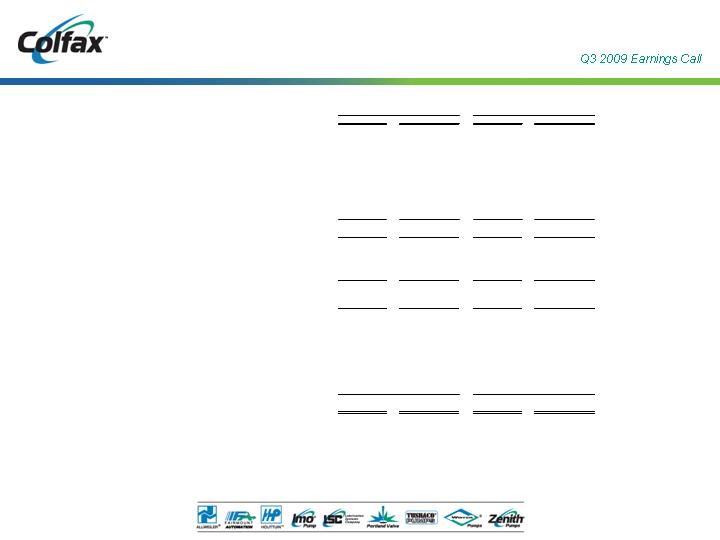

2009

YTD

2008

YTD

-

Q3 2009

Q3 2008

$500.0

$400.0

$300.0

$200.0

$100.0

$0.0

$394.1

$445.5

$128.5

$153.5

14.8%

16.5%

15.7%

15.7%

% Margin

0.1%

--

0.3%

--

Acquisitions

(16.2)%

(4.6)%

(12.0)%

(11.6)%

--

--

Total Growth (Decline)

(9.1)%

--

--

FX Translation

(2.5)%

--

--

Existing Businesses

Revenue and Adjusted EBITDA

(1) Refer to Appendix for Non-GAAP reconciliation.

__________________

Note: Dollars in millions.

Revenue

Adjusted EBITDA (1)

$24.0

$20.2

$73.5

$58.5

$0.0

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

$70.0

$80.0

Q3 2008

Q3 2009

-

YTD

2008

YTD

2009

7

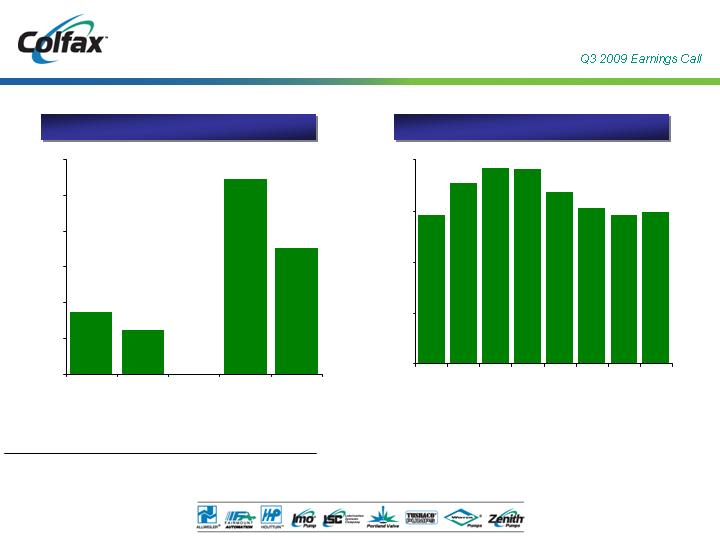

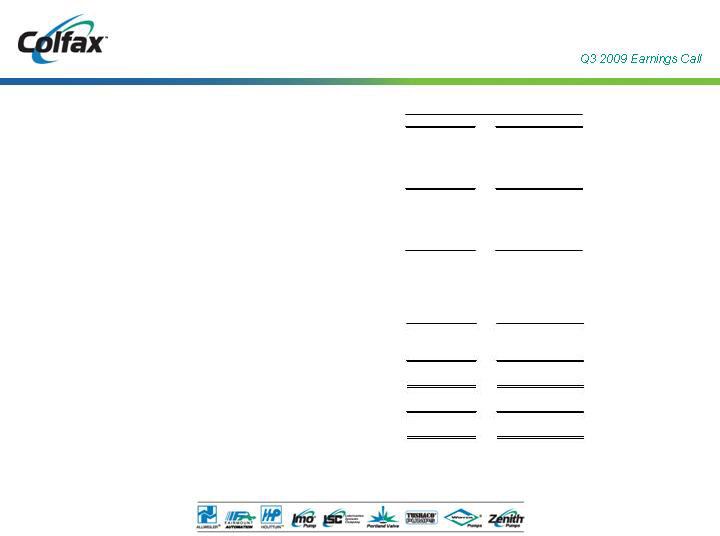

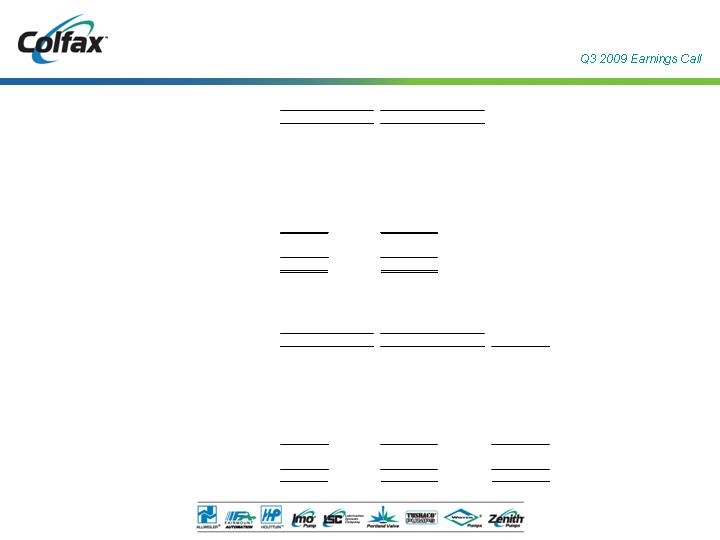

____________________

Note: Dollars in millions.

YTD 2009

YTD 2008

Q3 2009

Q3 2008

$600.0

$500.0

$400.0

$300.0

$200.0

$100.0

$0.0

$349.2

$542.9

$124.3

$173.8

Orders

Backlog

Orders and Backlog

0.1%

--

0.2%

--

Acquisitions

(35.7)%

--

(28.5)%

Total Growth

(5.8)%

--

(3.2)%

--

FX Translation

(29.9)%

--

(25.5)%

--

Existing

Businesses

$292.8

$353.6

$384.0

$383.1

$337.3

$305.6

$292.3

$298.0

$0.0

$100.0

$200.0

$300.0

$400.0

Q4

2007

Q1

2008

Q2

2008

Q3

2008

Q4

2008

Q1

2009

Q2

2009

Q3

2009

8

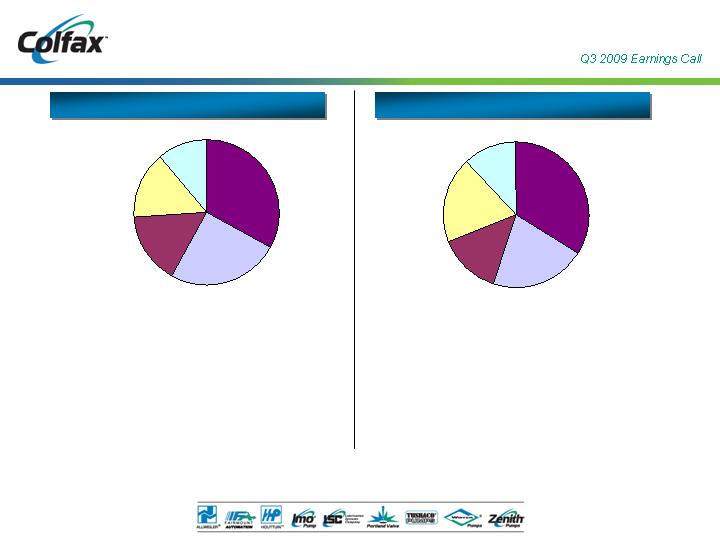

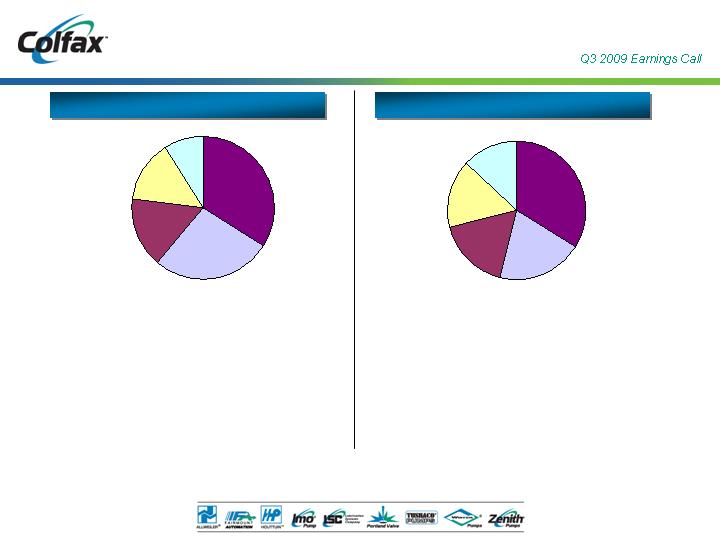

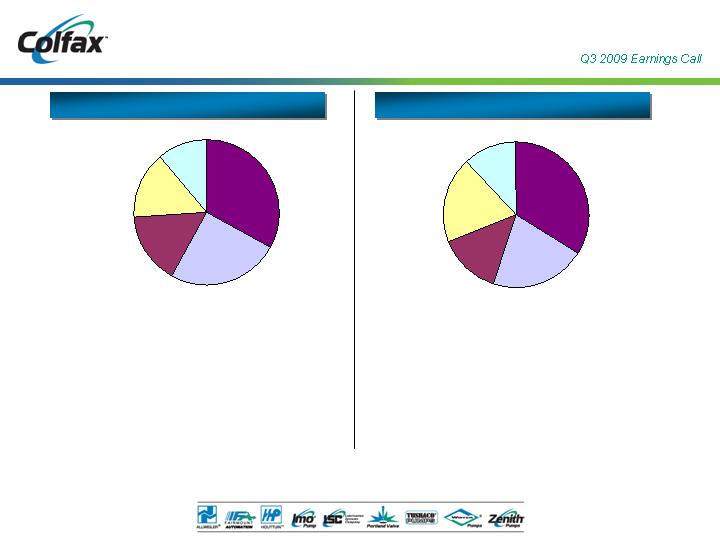

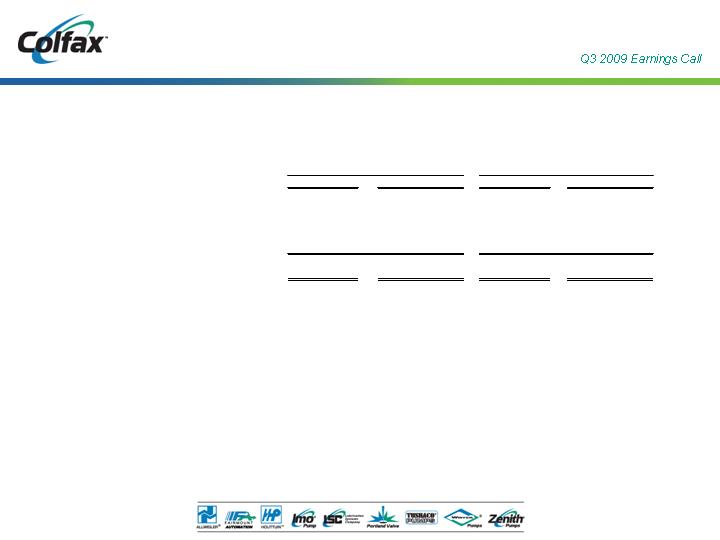

Q3 2009 Sales and Orders by End Market

(12)%

(16)%

Total

(34)%

(36)%

General Industrial

79%

78%

Global Navy

17%

12%

Power Generation

(8)%

(8)%

Oil & Gas

Commercial Marine

(9)%

(18)%

Organic Growth

Total Growth

25%

Marine

Commercial

11%

Global Navy

15%

Generation

Power

16%

Oil & Gas

33%

Industrial

General

Sales: $128.5 million

Orders: $124.3 million

(26)%

(29)%

Total

(33)%

(35)%

General Industrial

59%

55%

Global Navy

(7)%

(9)%

Power Generation

(49)%

(49)%

Oil & Gas

Commercial Marine

(27)%

(33)%

Organic Growth

Total Growth

General

Industrial

34%

Oil & Gas

14%

Power

Generation

19%

Global Navy

12%

Commercial

Marine

21%

9

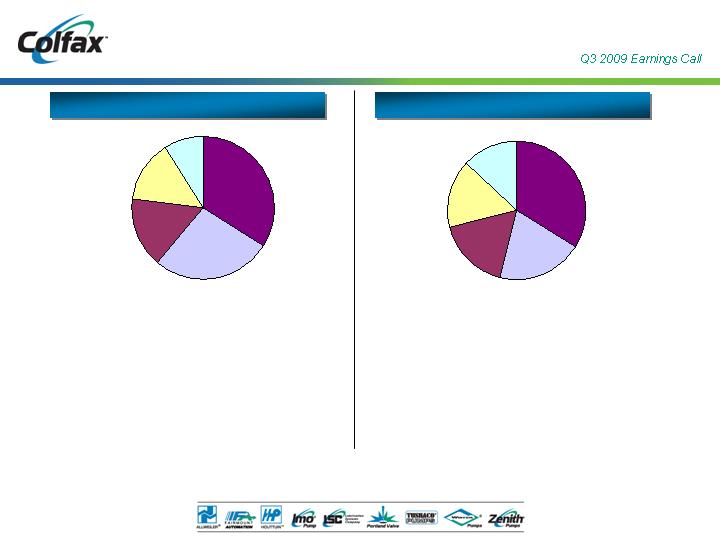

2009 YTD Sales and Orders by End Market

(30)%

(36)%

Total

(35)%

(41)%

General Industrial

32%

29%

Global Navy

(14)%

(20)%

Power Generation

(23)%

(27)%

Oil & Gas

Commercial Marine

(48)%

(56)%

Organic Growth

Total Growth

Orders: $349.2 million

Sales: $394.1 million

9%

Global Navy

14%

Generation

Power

16%

Oil & Gas

27%

Marine

Commercial

34%

Industrial

General

(3)%

(12)%

Total

(21)%

(28)%

General Industrial

46%

43%

Global Navy

-

(8)%

Power Generation

4%

-

Oil & Gas

Commercial Marine

13%

(4)%

Organic Growth

Total Growth

General

Industrial

34%

Commercial

Marine

20%

Oil & Gas

17%

Power

Generation

16%

Global Navy

13%

10

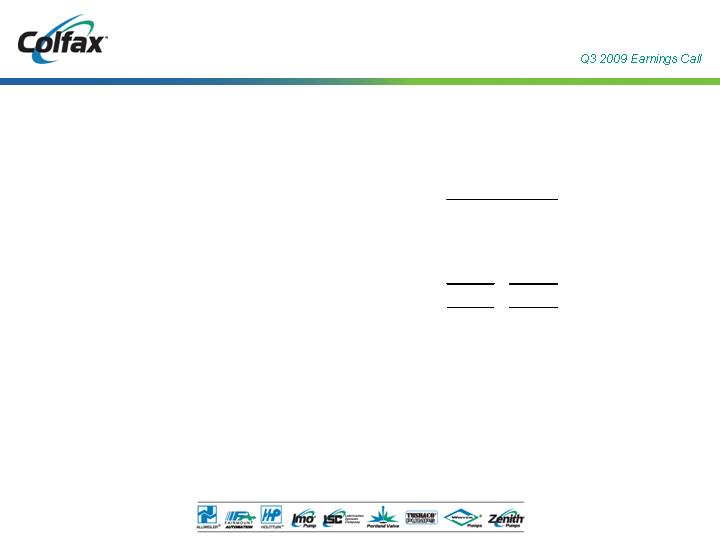

2009 Q3 vs. Q2 Sales and Orders by End Market

(4)%

(0)%

Total

(5)%

(2)%

General Industrial

39%

40%

Global Navy

(2)%

1%

Power Generation

(7)%

(6)%

Oil & Gas

Commercial Marine

(16)%

(8)%

Organic Growth

Total Growth

15%

20%

Total

15%

19%

General Industrial

55%

56%

Global Navy

44%

49%

Power Generation

(28)%

(27)%

Oil & Gas

Commercial Marine

25%

36%

Organic Growth

Total Growth

Sales

Orders

11

Strong balance sheet

Debt to adjusted EBITDA - approximately 1X

Debt of $93 million, principal payments of $9 million in 2010, matures in 2013

Cash = $51 million

$136 million available on revolver

Strong cash flow

Adjusted EBITDA (LTM) of $84 million

Strong Financial Condition

Note: As of 10/2/09

12

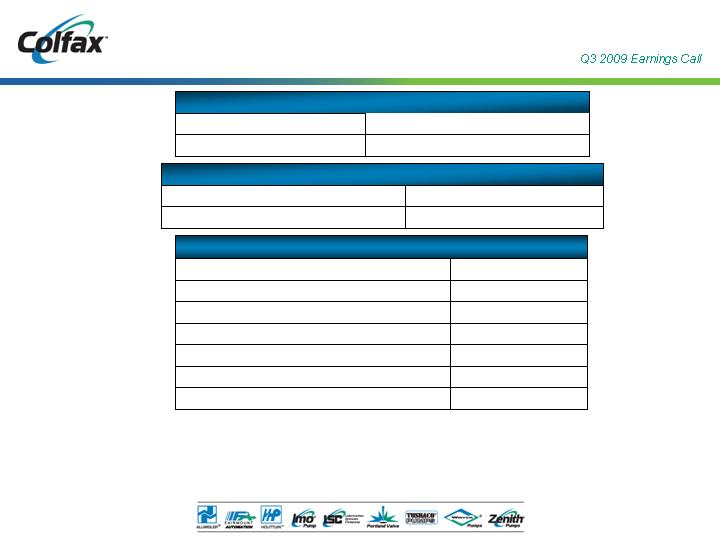

Refer to Appendix for Non-GAAP reconciliation.

__________________

Note: Dollars in millions.

Preliminary Income Statement Summary

Three Months Ended

Delta

October 2, 2009

September 26, 2008

$

%

Orders

$ 124.3

$ 173.8

$ (49.5)

(28.5)%

Sales

$ 128.5

$ 153.5

$ (24.9)

(16.2)%

Gross Profit

$ 46.2

$ 54.5

$ (8.3)

(15.2)%

% of Sales

35.9%

35.5%

Adjusted SG&A Expenses

$ 28.1

$ 32.7

$ (4.5)

(13.8)%

R&D Expense

1.5

1.5

0.0

3.0 %

Operating Expenses

$ 29.7

$ 34.1

$ (4.5)

(13.1)%

% of Sales

23.1%

22.2%

Adjusted Operating Income

$ 16.5

$ 20.3

$ (3.8)

(18.7)%

% of Sales

12.9%

13.3%

Adjusted EBITDA

$ 20.2

$ 24.0

$ (3.8)

(15.9)%

% of Sales

15.7%

15.7%

Adjusted Net Income

$ 10.0

$ 12.1

$ (2.1)

(17.6)%

% of Sales

7.8%

7.9%

Adjusted Net Income Per Share

$ 0.23

$ 0.28

$ (0.05)

(16.3)%

13

Preliminary Income Statement Summary

Refer to Appendix for Non-GAAP reconciliation.

__________________

Note: Dollars in millions.

Delta

October 2, 2009

September 26, 2008

$

%

Orders

$ 349.2

$ 542.9

$ (193.7)

(35.7)%

Sales

$ 394.1

$ 445.5

$ (51.5)

(11.6)%

Gross Profit

$ 138.8

$ 159.4

$ (20.6)

(12.9)%

% of Sales

35.2%

35.8%

Adjusted SG&A Expense

$ 86.2

$ 92.8

$ (6.6)

(7.1)%

R&D Expense

4.6

4.4

0.2

4.1 %

Operating Expenses

$ 90.9

$ 97.2

$ (6.4)

(6.6)%

% of Sales

23.1%

21.8%

Adjusted Operating Income

$ 47.9

$ 62.2

$ (14.3)

(23.0)%

% of Sales

12.2%

14.0%

Adusted EBITDA

$ 58.5

$ 73.5

$ (15.0)

(20.4)%

% of Sales

14.8%

16.5%

Adjusted Net Income

$ 28.9

$ 36.2

$ (7.3)

(20.2)%

% of Sales

7.3%

8.1%

Adjusted Net Income Per Share

$ 0.67

$ 0.82

$ (0.16)

(18.9)%

Nine Months Ended

14

____________________

Note: Dollars in millions.

Preliminary Statement of Cash Flows Summary

October 2, 2009

September 26, 2008

Net income (loss)

13.0

$

(11.0)

$

Non-cash expenses

14.0

9.5

Change in working capital and accrued liabilities

6.1

(26.3)

Other

0.9

(2.9)

Total Operating Activities

34.0

$

(30.7)

$

Capital expenditures

(7.8)

$

(13.3)

$

Acquisitions, net of cash acquired

(1.3)

-

Other

0.3

-

��

Total Investing Activities

(8.8)

$

(13.3)

$

Repayments of borrowings

(3.8)

$

(107.8)

$

Proceeds from IPO, net of offering costs

-

193.0

Dividends paid to preferred shareholders

-

(38.5)

Other

(0.4)

(3.4)

Total Financing Activities

(4.2)

$

43.3

$

Effect of exchange rates on cash

1.0

0.5

Increase (decrease) in cash

22.0

(0.2)

Cash, beginning of period

28.8

48.1

Cash, end of period

50.8

$

47.9

$

Nine Months Ended

15

2009 Outlook Summary

$525 million

To

$515 million

2009 Total

(10)%

To

(8)%

2009 Organic growth (1)

Revenue Range

$0.94

To

$0.88

2009 Adjusted net income per share (2)

$0.41

To

$0.35

2009 Net income per share

EPS Range

(1) Excludes impact of acquisitions and foreign exchange rate fluctuations

(2) Excludes impact of asbestos coverage litigation, asbestos liability and defense costs, and restructuring and other related charges

(See Appendix for Non-GAAP reconciliation)

$2.5 million

Incremental public company costs

43.3 million

Outstanding shares

$8 million

Interest expense

32%

Tax rate

$1.46

Euro

$7 million

Asbestos liability and defense costs

$12 million

Asbestos coverage litigation

Assumptions

NOTE: Guidance as of 11/3/09

16

Well Positioned for the Future

Leading Brand Names

Generating Aftermarket

Sales and Services

Experienced Management

Team in Place to Grow

Organically and Through

Strategic Acquisitions

Global Leader in Specialty

Fluid Handling Products

Proven Application

Expertise in Solving

Critical Customer Needs

Serving Fast

Growing Infrastructure

Driven End Markets

CBS-Driven Culture Focused

on Profitable Sales Growth

17

Appendix

18

Adjusted net income, adjusted net income per share, adjusted operating income and adjusted EBITDA exclude

asbestos liability and defense costs (income) and asbestos coverage litigation expenses, certain legacy legal

charges, certain due diligence costs, restructuring and other related charges as well as one time initial public

offering-related costs to the extent they impact the periods presented. Adjusted selling, general and

administrative expenses exclude certain legacy legal adjustments and certain due diligence costs. Adjusted net

income also reflects interest expense as if the initial public offering (IPO) had occurred at the beginning of 2007

and presents income taxes at an effective tax rate of 32% in 2009 and 34% in 2008. Adjusted net income per share

in 2008 assumes the 44,006,026 shares outstanding at the closing of the IPO to be outstanding since January 1,

2007. Projected adjusted net income per share excludes actual and estimated restructuring and other related

charges, asbestos coverage litigation expenses and asbestos liability and defense costs. Organic sales growth

(decline) and organic order growth (decline) exclude the impact of acquisitions and foreign exchange rate

fluctuations. These non-GAAP financial measures assist Colfax in comparing its operating performance on a

consistent basis because, among other things, they remove the impact of changes in our capital structure and

asset base, non-recurring items such as IPO-related costs, legacy asbestos issues (except in the case of EBITDA)

and items outside the control of its operating management team.

Sales and order information by end market are estimates. We periodically update our customer groupings in

order to refine these estimates. During 2009, reclassifications of previously reported amounts were made to

conform to current period presentation. No changes have been made to total sales or orders.

Disclaimer

19

____________________

Note: Dollars in thousands.

Non-GAAP Reconciliation

(Preliminary

1

and unaudited)

October 2, 2009

September 26, 2008

October 2, 2009

September 26, 2008

EBITDA

Net income (loss)

1,819

$

13,651

$

13,046

$

(10,950)

$

Interest expense

1,834

1,951

5,466

9,684

Provision (benefit) for income taxes

64

5,329

5,309

(3,772)

Depreciation and amortization

3,681

3,695

10,592

11,345

EBITDA

7,398

$

24,626

$

34,413

$

6,307

$

EBITDA margin

5.8%

16.0%

8.7%

1.4%

Adjusted EBITDA

Net income (loss)

1,819

$

13,651

$

13,046

$

(10,950)

$

Interest expense

1,834

1,951

5,466

9,684

Provision (benefit) for income taxes

64

5,329

5,309

(3,772)

Depreciation and amortization

3,681

3,695

10,592

11,345

Restructuring and other related charges

9,608

-

10,755

-

IPO-related costs

-

-

-

57,017

Legacy legal adjustment

-

-

-

4,131

Due diligence costs

-

582

-

582

Asbestos liability and defense costs (income)

1,377

(6,312)

4,504

(6,749)

Asbestos coverage litigation expense

1,845

5,148

8,838

12,257

Adjusted EBITDA

20,228

$

24,044

$

58,510

$

73,545

$

Adjusted EBITDA margin

15.7%

15.7%

14.8%

16.5%

1

Three Months Ended

Nine Months Ended

The preliminary financial results as of and for the three and nine months ending October

2

,

2009

reflect management’s best estimate of the Company’s net

asbestos liability based upon information currently available. The preliminary results do not reflect any potential adjustments from the favorable asbestos ruling

on October

14

,

2009

for the Company’s Warren Pumps subsidiary

.

The Company expects additional information related to this matter to become available

prior to filing its third quarter Form

10

-

Q with the SEC on or before November

16

,

2009

.

Any adjustments that result from the Company’s evaluation of this

information will be reflected in the Company’s financial statements included in its third quarter Form

10

-

Q

.

20

____________________

Note: Dollars in thousands, except per share amounts.

Non-GAAP Reconciliation

(Preliminary

1

and unaudited)

October 2, 2009

September 26, 2008

October 2, 2009

September 26, 2008

Adjusted Net Income and Adjusted Earnings per Share

Net income (loss)

1,819

$

13,651

$

13,046

$

(10,950)

$

Restructuring and other related charges

9,608

-

10,755

-

IPO-related costs

-

-

-

57,017

Legacy legal adjustment

-

-

-

4,131

Due diligence costs

-

582

-

582

Asbestos liability and defense costs (income)

1,377

(6,312)

4,504

(6,749)

Asbestos coverage litigation expense

1,845

5,148

8,838

12,257

Interest adjustment to effect IPO at beginning of period

-

-

-

2,302

Tax adjustment to effective rate of 32% and 34%, respectively

(4,644)

(926)

(8,276)

(22,410)

Adjusted net income

10,005

$

12,143

$

28,867

$

36,180

$

Adjusted net income margin

7.8%

7.9%

7.3%

8.1%

Weighted average shares outstanding - diluted

43,324,995

-

43,274,177

-

Shares outstanding at closing of IPO

-

44,006,026

-

44,006,026

Adjusted net income per share

0.23

$

0.28

$

0.67

$

0.82

$

Net income per share-basic

and diluted in accordance with GAAP

0.04

$

0.31

$

0.30

$

(0.43)

$

Adjusted Operating Income

Operating income (loss)

3,717

$

20,931

$

23,821

$

(5,038)

$

Restructuring and other related charges

9,608

-

10,755

-

IPO-related costs

-

-

-

57,017

Legacy legal adjustment

-

-

-

4,131

Due diligence costs

-

582

-

582

Asbestos liability and defense costs (income)

1,377

(6,312)

4,504

(6,749)

Asbestos coverage litigation expense

1,845

5,148

8,838

12,257

Adjusted operating income

16,547

$

20,349

$

47,918

$

62,200

$

Adjusted operating income margin

12.9%

13.3%

12.2%

14.0%

1

Three Months Ended

Nine Months Ended

The preliminary financial results as of and for the three and nine months ending October

2

,

2009

reflect management’s best estimate of the Company’s net asbestos

liability based upon information currently available. The preliminary results do not reflect any potential adjustments from the favorable asbestos ruling on October

14

,

2009

for the Company’s Warren Pumps subsidiary

.

The Company expects additional information related to this matter to become available prior to filing its third

quarter Form

10

-

Q with the SEC on or before November

16

,

2009

.

Any adjustments that result from the Company’s evaluation of this information will be reflected in

the Company’s financial statements included in its third quarter Form

10

-

Q

.

21

____________________

Note: Dollars in millions.

Sales & Order Growth

$

%

$

%

Three Months Ended September 26, 2008

153.5

$

173.8

$

Components of Change:

Existing Businesses

(18.4)

(12.0)%

(44.3)

(25.5)%

Acquisitions

0.5

0.3 %

0.4

0.2 %

Foreign Currency Translation

(7.1)

(4.6)%

(5.6)

(3.2)%

Total

(25.0)

(16.2)%

(49.5)

(28.5)%

Three Months Ended October 2, 2009

128.5

$

124.3

$

Backlog

at

$

%

$

%

Period

End

Nine Months Ended September 26, 2008

445.5

$

542.9

$

383.1

$

Components of Change:

Existing Businesses

(11.4)

(2.5)%

(162.6)

(29.9)%

(83.9)

(21.9)%

Acquisitions

0.5

0.1 %

0.4

0.1 %

0.5

0.1 %

Foreign Currency Translation

(40.5)

(9.1)%

(31.5)

(5.8)%

(1.7)

(0.4)%

Total

(51.4)

(11.6)%

(193.7)

(35.7)%

(85.1)

(22.2)%

Nine Months Ended October 2, 2009

394.1

$

349.2

$

298.0

$

Sales

Orders

Sales

Orders

22

____________________

Note: Dollars in thousands.

Non-GAAP Reconciliation

October 2, 2009

September 26, 2008

October 2, 2009

September 26, 2008

Adjusted SG&A Expense

Selling, general and administrative expenses

28,136

$

33,233

$

86,248

$

97,516

$

Legacy legal adjustment

-

-

-

4,131

Due diligence costs

-

582

-

582

Adjusted selling, general and administrative expenses

28,136

$

32,651

$

86,248

$

92,803

$

21.9%

21.3%

21.9%

20.8%

Three Months Ended

Nine Months Ended

23

Non-GAAP Reconciliation

Projected net income per share - fully diluted

$ 0.35

$ 0.41

Restructuring and other related charges incurred year-to-date

0.17

0.17

Estimated fourth quarter restructuring and other related charges2

0.06

0.06

Asbestos coverage litigation

0.19

0.19

Asbestos liability and defense costs

0.11

0.11

Projected adjusted net income per share - fully diluted

$ 0.88

$ 0.94

1

2

Represents estimated costs related to restructuring actions implemented through November 3, 2009.

EPS Range

Does not reflect any potential adjustments from the favorable asbestos ruling on October 14, 2009 fot the Company’s

Warren Pumps subsidiary. The Company expects additional information related to this matter to become available

prior to filing its third quarter Form 10-Q with the SEC on or before November 16, 2009. Any adjustments that result

from the Company’s evaluation of this information will be reflected in the Company’s financial statements included in

its third quarter Form 10-Q.

Colfax Corporation

Reconciliation of Projected 2009 Net Income Per Share1to Adjusted Net Income Per Share

Amounts in Dollars

(unaudited)

24