Exhibit 99.2 Advancing strategy through LimaCorporate acquisition September 25, 2023

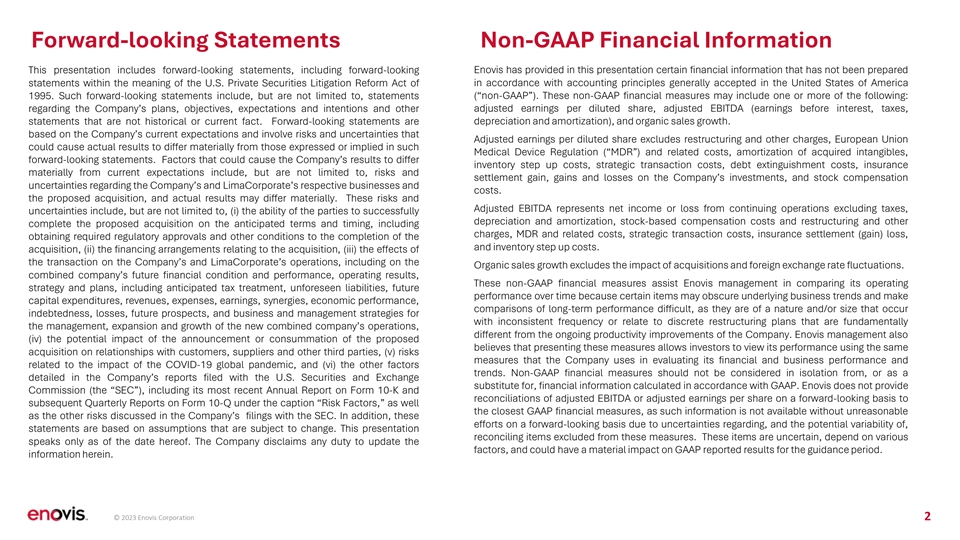

Forward-looking Statements Non-GAAP Financial Information This presentation includes forward-looking statements, including forward-looking Enovis has provided in this presentation certain financial information that has not been prepared statements within the meaning of the U.S. Private Securities Litigation Reform Act of in accordance with accounting principles generally accepted in the United States of America (“non-GAAP”). These non-GAAP financial measures may include one or more of the following: 1995. Such forward-looking statements include, but are not limited to, statements regarding the Company’s plans, objectives, expectations and intentions and other adjusted earnings per diluted share, adjusted EBITDA (earnings before interest, taxes, statements that are not historical or current fact. Forward-looking statements are depreciation and amortization), and organic sales growth. based on the Company’s current expectations and involve risks and uncertainties that Adjusted earnings per diluted share excludes restructuring and other charges, European Union could cause actual results to differ materially from those expressed or implied in such Medical Device Regulation (“MDR”) and related costs, amortization of acquired intangibles, forward-looking statements. Factors that could cause the Company’s results to differ inventory step up costs, strategic transaction costs, debt extinguishment costs, insurance materially from current expectations include, but are not limited to, risks and settlement gain, gains and losses on the Company’s investments, and stock compensation uncertainties regarding the Company’s and LimaCorporate’s respective businesses and costs. the proposed acquisition, and actual results may differ materially. These risks and Adjusted EBITDA represents net income or loss from continuing operations excluding taxes, uncertainties include, but are not limited to, (i) the ability of the parties to successfully depreciation and amortization, stock-based compensation costs and restructuring and other complete the proposed acquisition on the anticipated terms and timing, including charges, MDR and related costs, strategic transaction costs, insurance settlement (gain) loss, obtaining required regulatory approvals and other conditions to the completion of the and inventory step up costs. acquisition, (ii) the financing arrangements relating to the acquisition, (iii) the effects of the transaction on the Company’s and LimaCorporate’s operations, including on the Organic sales growth excludes the impact of acquisitions and foreign exchange rate fluctuations. combined company’s future financial condition and performance, operating results, These non-GAAP financial measures assist Enovis management in comparing its operating strategy and plans, including anticipated tax treatment, unforeseen liabilities, future performance over time because certain items may obscure underlying business trends and make capital expenditures, revenues, expenses, earnings, synergies, economic performance, comparisons of long-term performance difficult, as they are of a nature and/or size that occur indebtedness, losses, future prospects, and business and management strategies for with inconsistent frequency or relate to discrete restructuring plans that are fundamentally the management, expansion and growth of the new combined company’s operations, different from the ongoing productivity improvements of the Company. Enovis management also (iv) the potential impact of the announcement or consummation of the proposed believes that presenting these measures allows investors to view its performance using the same acquisition on relationships with customers, suppliers and other third parties, (v) risks measures that the Company uses in evaluating its financial and business performance and related to the impact of the COVID-19 global pandemic, and (vi) the other factors trends. Non-GAAP financial measures should not be considered in isolation from, or as a detailed in the Company’s reports filed with the U.S. Securities and Exchange substitute for, financial information calculated in accordance with GAAP. Enovis does not provide Commission (the “SEC”), including its most recent Annual Report on Form 10-K and reconciliations of adjusted EBITDA or adjusted earnings per share on a forward-looking basis to subsequent Quarterly Reports on Form 10-Q under the caption “Risk Factors,” as well the closest GAAP financial measures, as such information is not available without unreasonable as the other risks discussed in the Company’s filings with the SEC. In addition, these efforts on a forward-looking basis due to uncertainties regarding, and the potential variability of, statements are based on assumptions that are subject to change. This presentation reconciling items excluded from these measures. These items are uncertain, depend on various speaks only as of the date hereof. The Company disclaims any duty to update the factors, and could have a material impact on GAAP reported results for the guidance period. information herein. © 2023 Enovis Corporation 2

Extending Enovis’ Leadership Position in Attractive Global Reconstructive Market • Definitive agreement to acquire LimaCorporate, a European orthopedics leader with robust product offerings and capabilities for €800m; transaction to close in early 2024 • Creates a ~$1B global reconstructive business, with ~50% in the large and fast-growing extremities segment and provides complementary International footprint • Strengthens our R&D pipeline and adds manufacturing scale and emerging competencies in 3D printing and patient matched/custom implant solutions • Accelerates progress against our key strategic goals: HSD growth, continued margin expansion and global scale • Strong financial profile and shareholder value creation opportunities from cross-selling and >$40m of annual cost synergies expected by year 3 Compounding value creation from growth and margin acceleration © 2023 Enovis Corporation 3

LimaCorporate Business Overview REVENUE GEOGRAPHIC MIX ▪ HSD growth history, ROW Fixation & Other 2 DD CAGR since 2021 APAC Knee US ▪ Accretive profitability, >20% Extremities 3 adjusted EBITDA margins ~$0.3B 1 TTM ▪ Strong innovation engine and Europe leading 3D printing capabilities Hip▪ Highly automated production 2022A facilities in Italy with dedicated SMR Shoulder innovation center and ability to scale Attractive Geographic Footprint Complementary product & geographic mix with additive capabilities and attractive financial profile 1: Trailing twelve month ending 6/30/2023; 2: 2023 YTD; 3: Adjusted for IFRS to US GAAP differences © 2023 Enovis Corporation 4

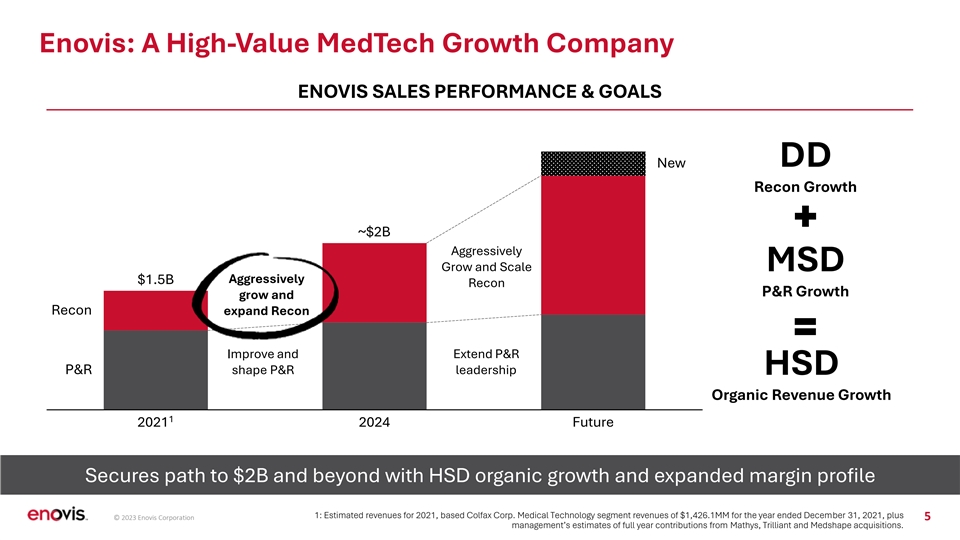

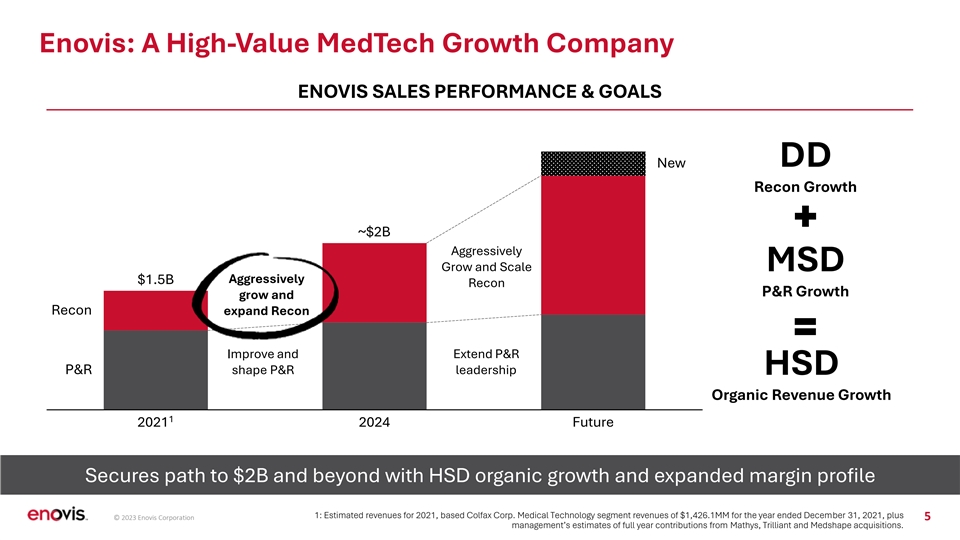

Enovis: A High-Value MedTech Growth Company ENOVIS SALES PERFORMANCE & GOALS DD New Recon Growth ~$2B Aggressively Grow and Scale MSD Aggressively $1.5B Recon P&R Growth grow and Recon expand Recon Improve and Extend P&R P&R shape P&R leadership HSD Organic Revenue Growth 1 2021 2024 Future Secures path to $2B and beyond with HSD organic growth and expanded margin profile 1: Estimated revenues for 2021, based Colfax Corp. Medical Technology segment revenues of $1,426.1MM for the year ended December 31, 2021, plus © 2023 Enovis Corporation 5 management’s estimates of full year contributions from Mathys, Trilliant and Medshape acquisitions.

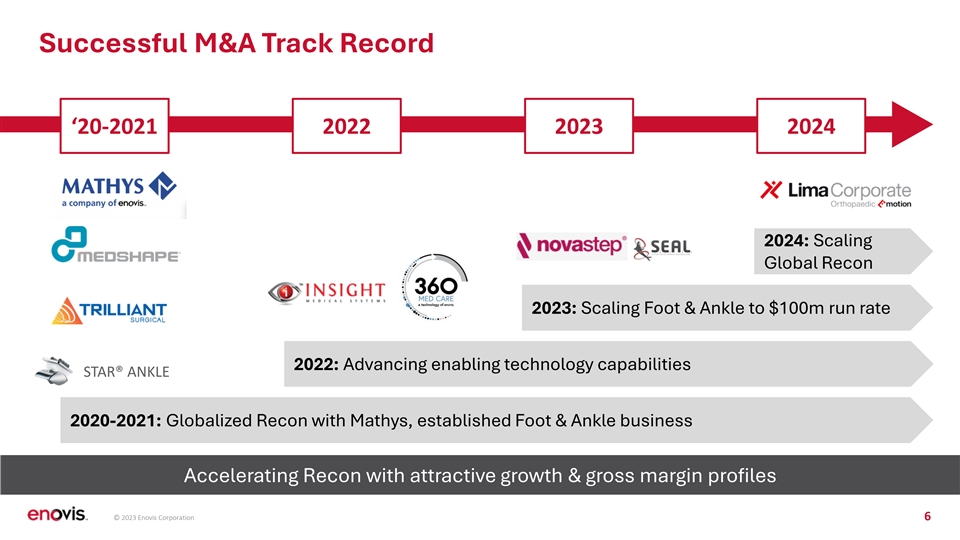

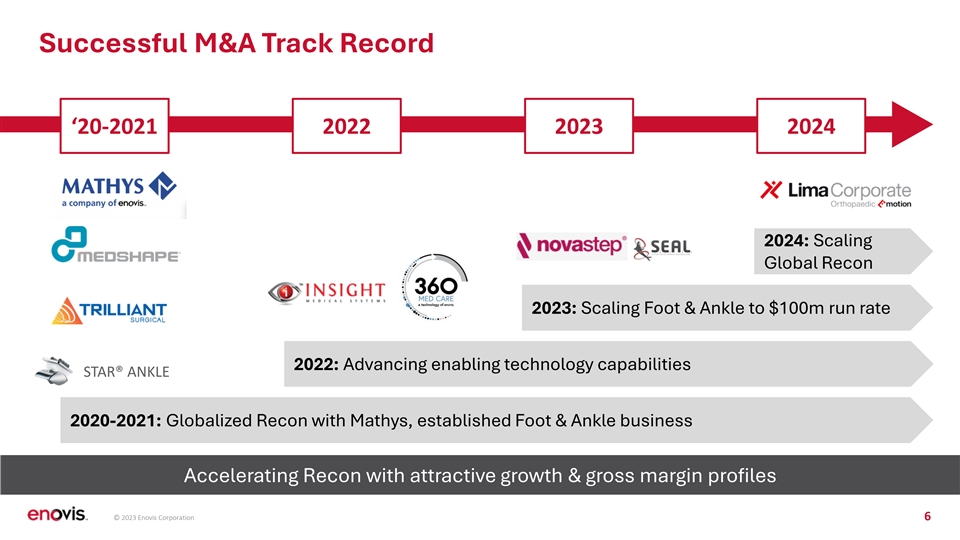

Successful M&A Track Record ‘20-2021 2022 2023 2024 2024: Scaling Global Recon 2023: Scaling Foot & Ankle to $100m run rate 2022: Advancing enabling technology capabilities STAR® ANKLE 2020-2021: Globalized Recon with Mathys, established Foot & Ankle business Accelerating Recon with attractive growth & gross margin profiles © 2023 Enovis Corporation 6

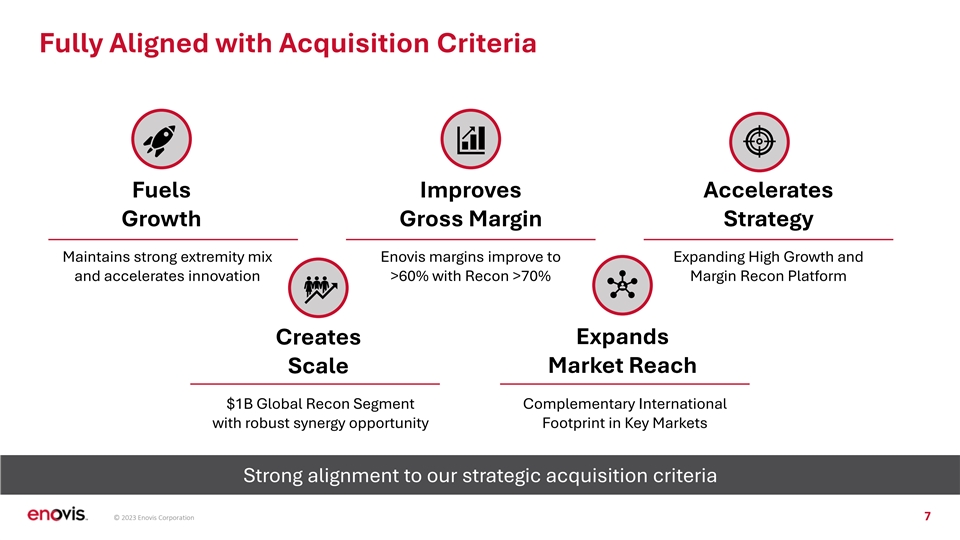

Fully Aligned with Acquisition Criteria Fuels Improves Accelerates Growth Gross Margin Strategy Maintains strong extremity mix Enovis margins improve to Expanding High Growth and and accelerates innovation >60% with Recon >70% Margin Recon Platform Expands Creates Scale Market Reach $1B Global Recon Segment Complementary International with robust synergy opportunity Footprint in Key Markets Strong alignment to our strategic acquisition criteria © 2023 Enovis Corporation 7

Combination Accelerates Global Recon Scale & Expands Margins REVENUE GEOGRAPHIC MIX ADJUSTED EBITDA MARGIN ~$2B $1.7B 47% +~120bps Recon 37% Int’l 32% Int’l 40% US P&R US 2023 2023 2023 2023 2023 2023 1 Enovis Combined 1 1 Enovis Combined Enovis Combined Creates >$1B high-growth global Recon player and accelerates trajectory of margin expansion 1: Latest ENOV guidance plus estimated LimaCorporate 2023 full year financials adjusted for IFRS to US GAAP differences; Excludes any expected synergies © 2023 Enovis Corporation 8

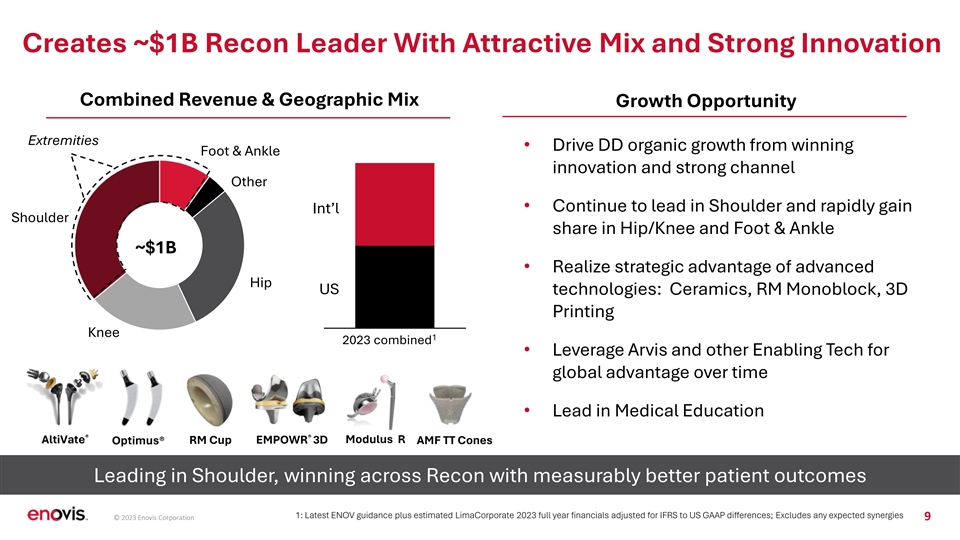

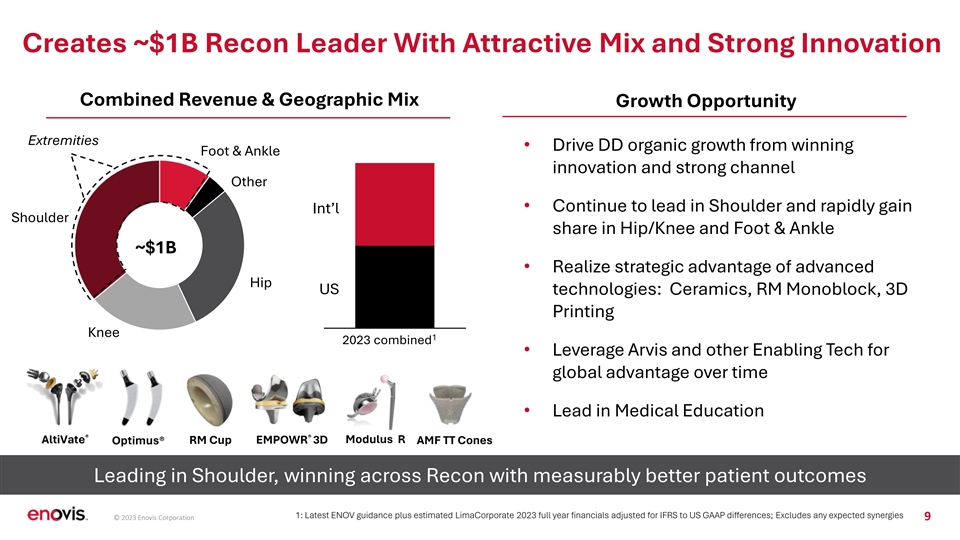

Creates ~$1B Recon Leader With Attractive Mix and Strong Innovation Combined Revenue & Geographic Mix Growth Opportunity Extremities • Drive DD organic growth from winning Foot & Ankle innovation and strong channel Other • Continue to lead in Shoulder and rapidly gain Int’l Shoulder share in Hip/Knee and Foot & Ankle ~$1B • Realize strategic advantage of advanced Hip US technologies: Ceramics, RM Monoblock, 3D Printing Knee 1 2023 combined • Leverage Arvis and other Enabling Tech for global advantage over time • Lead in Medical Education ® ® AltiVate RM Cup EMPOWR 3D Modulus R AMF TT Cones Optimus® Leading in Shoulder, winning across Recon with measurably better patient outcomes 1: Latest ENOV guidance plus estimated LimaCorporate 2023 full year financials adjusted for IFRS to US GAAP differences; Excludes any expected synergies © 2023 Enovis Corporation 9

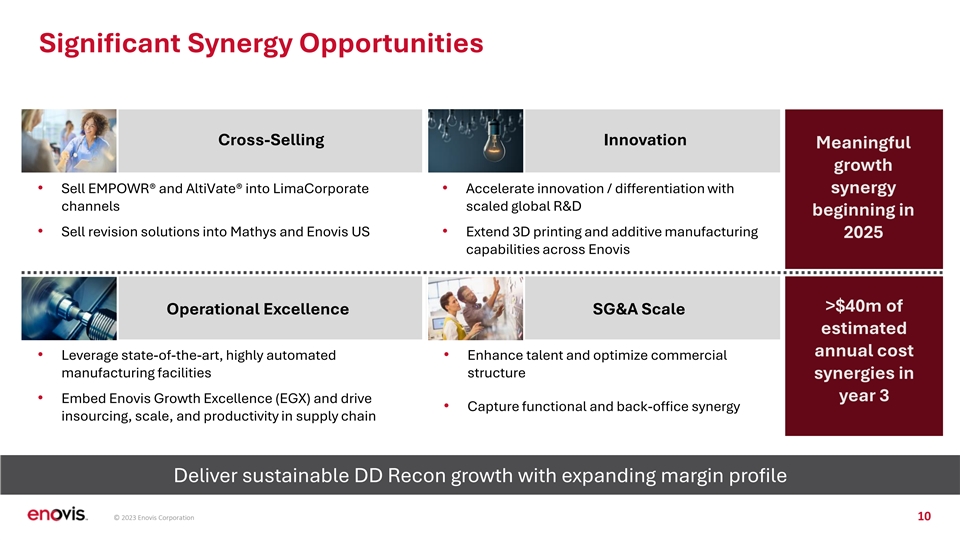

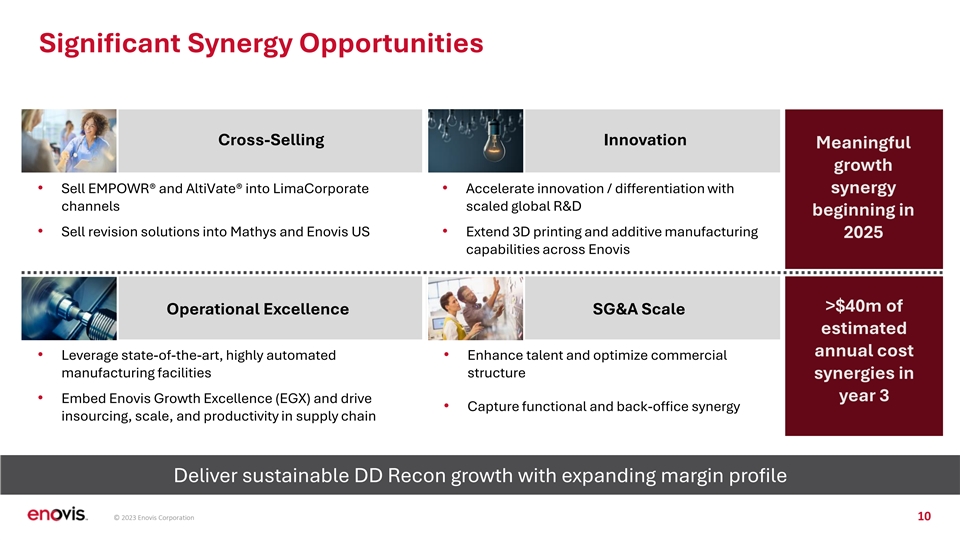

Significant Synergy Opportunities Cross-Selling Innovation Meaningful growth • Sell EMPOWR® and AltiVate® into LimaCorporate • Accelerate innovation / differentiation with synergy channels scaled global R&D beginning in • Sell revision solutions into Mathys and Enovis US • Extend 3D printing and additive manufacturing 2025 capabilities across Enovis >$40m of Operational Excellence SG&A Scale estimated annual cost • Leverage state-of-the-art, highly automated • Enhance talent and optimize commercial manufacturing facilities structure synergies in year 3 • Embed Enovis Growth Excellence (EGX) and drive • Capture functional and back-office synergy insourcing, scale, and productivity in supply chain Deliver sustainable DD Recon growth with expanding margin profile © 2023 Enovis Corporation 10

Acquisition Accelerates Enovis Growth Strategy Accelerates Maintains Recon progress against mix & improves strategic goals growth profile Attractive value Strengthens R&D creation and Operational opportunity Capabilities Driving scale across an enhanced Recon platform © 2023 Enovis Corporation 11

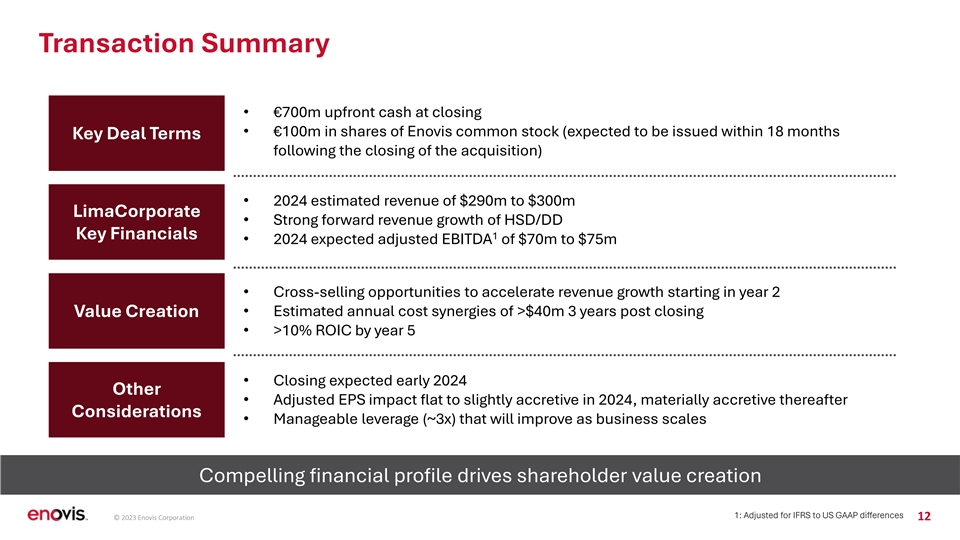

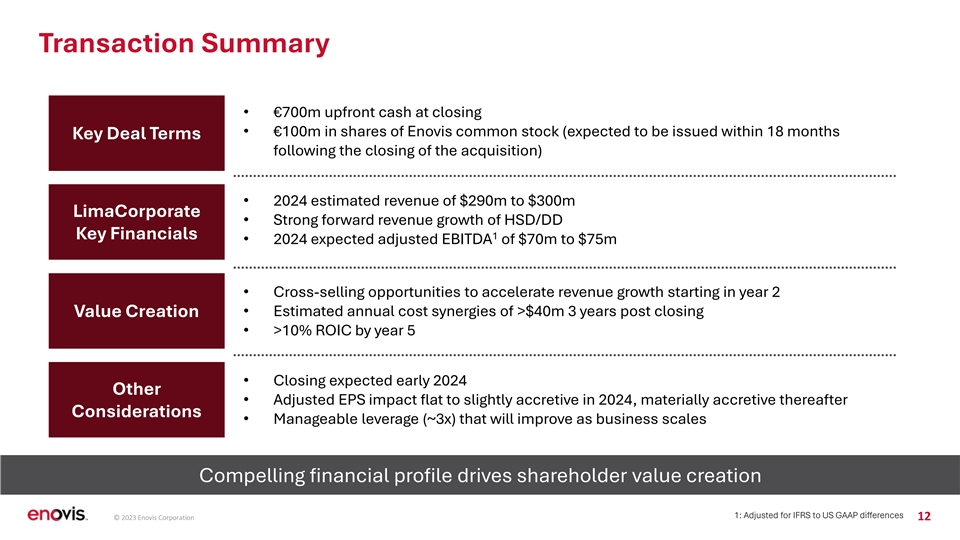

Transaction Summary • €700m upfront cash at closing • €100m in shares of Enovis common stock (expected to be issued within 18 months Key Deal Terms following the closing of the acquisition) • 2024 estimated revenue of $290m to $300m LimaCorporate • Strong forward revenue growth of HSD/DD Key Financials 1 • 2024 expected adjusted EBITDA of $70m to $75m • Cross-selling opportunities to accelerate revenue growth starting in year 2 • Estimated annual cost synergies of >$40m 3 years post closing Value Creation • >10% ROIC by year 5 • Closing expected early 2024 Other • Adjusted EPS impact flat to slightly accretive in 2024, materially accretive thereafter Considerations • Manageable leverage (~3x) that will improve as business scales Compelling financial profile drives shareholder value creation 1: Adjusted for IFRS to US GAAP differences © 2023 Enovis Corporation 12

Extending Enovis’ Leadership Position in Attractive Global Reconstructive Market • Definitive agreement to acquire LimaCorporate, a European orthopedics leader with robust product offerings and capabilities for €800m; transaction to close in early 2024 • Creates a ~$1B global reconstructive business, with ~50% in the large and fast-growing extremities segment and provides complementary International footprint • Strengthens our R&D pipeline and adds manufacturing scale and emerging competencies in 3D printing and patient matched/custom implant solutions • Accelerates progress against our key strategic goals: HSD growth, continued margin expansion and global scale • Strong financial profile and shareholder value creation opportunities from cross-selling and >$40m of annual cost synergies expected by year 3 Compounding value creation from growth and margin acceleration © 2023 Enovis Corporation 13