2019 Outlook March 12, 2019

Forward-Looking Statements, Non-GAAP Measures The following information may contain forward-looking statements, including forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Such forward-looking statements include, but are not limited to Colfax’s plans, objectives, expectations and intentions and other statements that are not historical or current fact, including those related to DJO. Forward-looking statements are based on Colfax’s current expectations and involve risks and uncertainties that could cause actual results to differ materially from those expressed or implied in such forward-looking statements. Factors that could cause Colfax’s results to differ materially from current expectations include, but are not limited to, the effects of the DJO transaction on Colfax and DJO operations and the factors detailed in Colfax’s reports filed with the U.S. Securities and Exchange Commission including its 2018 Annual Report on Form 10-K under the caption “Risk Factors.” In addition, these statements are based on a number of assumptions that are subject to change. This presentation speaks only as of the date hereof. Colfax disclaims any duty to update the information herein. Colfax has provided in this presentation financial information that has not been prepared in accordance with GAAP. These non-GAAP financial measures are adjusted net income, adjusted net income per share, adjusted EBITDA, adjusted EBITA, and core or organic sales growth (decline). Adjusted net income, adjusted net income per share, adjusted EBITDA and adjusted EBITA exclude restructuring charges and other related items, goodwill and intangible asset impairment charges, inventory step-up charges, and portfolio transformation costs, to the extent they impact the periods presented. Adjusted net income and adjusted net income per share also exclude the impact of acquisition- related amortization, pension settlement (gain) loss, and gain or loss on short term investments, to the extent they impact the periods presented. Core or organic sales growth (decline) excludes the impact of acquisitions and foreign exchange rate fluctuations. These non-GAAP financial measures assist Colfax management in comparing its operating performance over time because certain items may obscure underlying business trends and make comparisons of long- term performance difficult, as they are of a nature and/or size that occur with inconsistent frequency or relate to discrete restructuring plans that are fundamentally different from the ongoing productivity improvements of the Company. Colfax management also believes that presenting these measures allows investors to view its performance using the same measures that the Company uses in evaluating its financial and business performance and trends. 2

DJO Acquisition Completed ▪ Significant improvement in Colfax portfolio ▪ Higher margins, lower cyclicality ▪ Integration well underway, DJO team energized ▪ CBS training and resourcing launched pre-close ▪ Re-igniting longer-term growth potential of the business ▪ Increasing new product and workflow investments ▪ Building acquisition funnel ▪ Focus on completing transformation, converting to continuous improvement ▪ Steady margin improvement path Well-positioned for long-term value creation 3 Refer to Appendix for Non-GAAP reconciliation and footnotes.

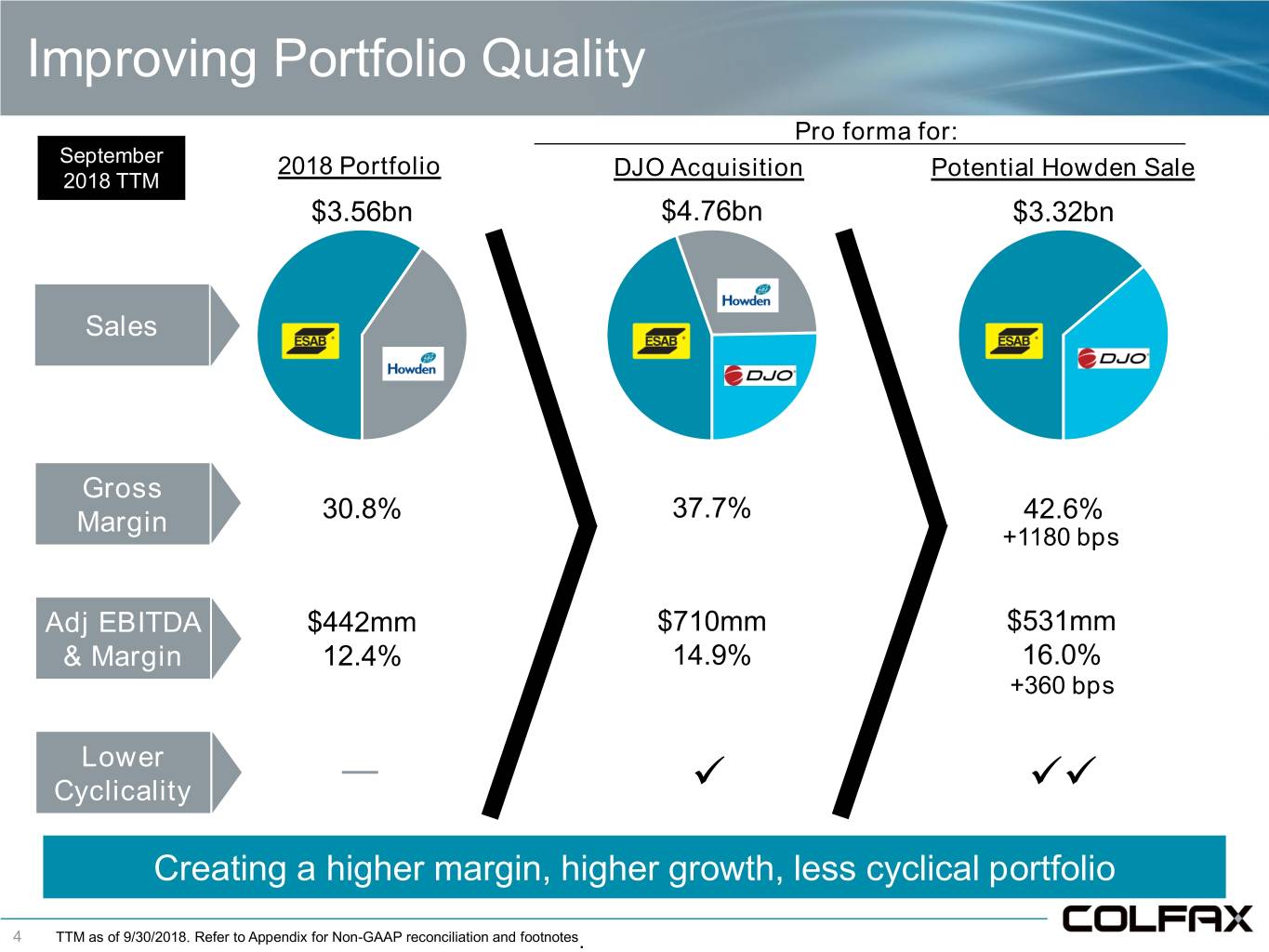

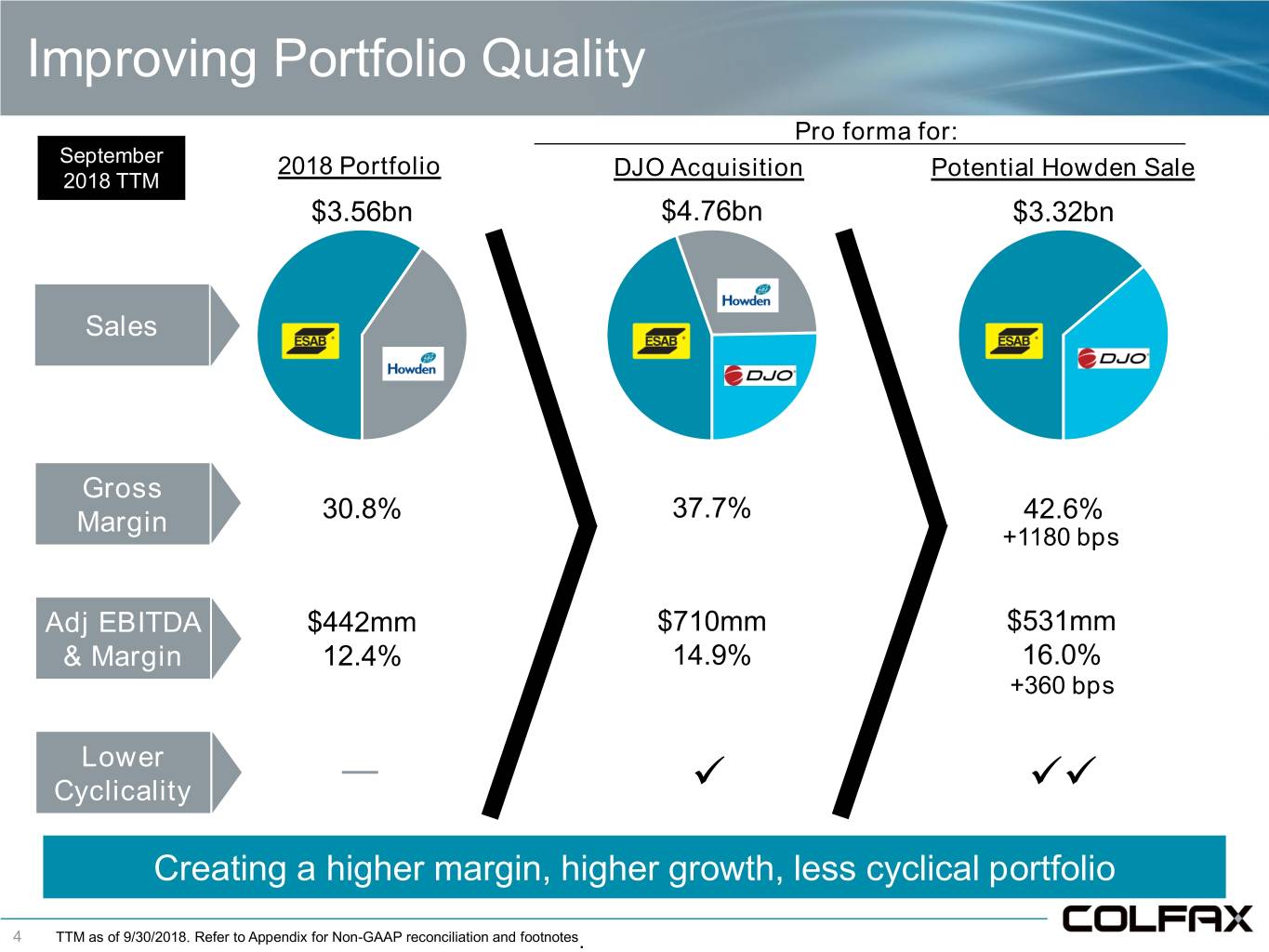

Improving Portfolio Quality Pro forma for: September 2018 Portfolio DJO Acquisition Potential Howden Sale 2018 TTM $3.56bn $4.76bn $3.32bn Sales Gross Margin 30.8% 37.7% 42.6% +1180 bps Adj EBITDA $442mm $710mm $531mm & Margin 12.4% 14.9% 16.0% +360 bps Lower ✓ ✓✓ Cyclicality Creating a higher margin, higher growth, less cyclical portfolio 4 TTM as of 9/30/2018. Refer to Appendix for Non-GAAP reconciliation and footnotes.

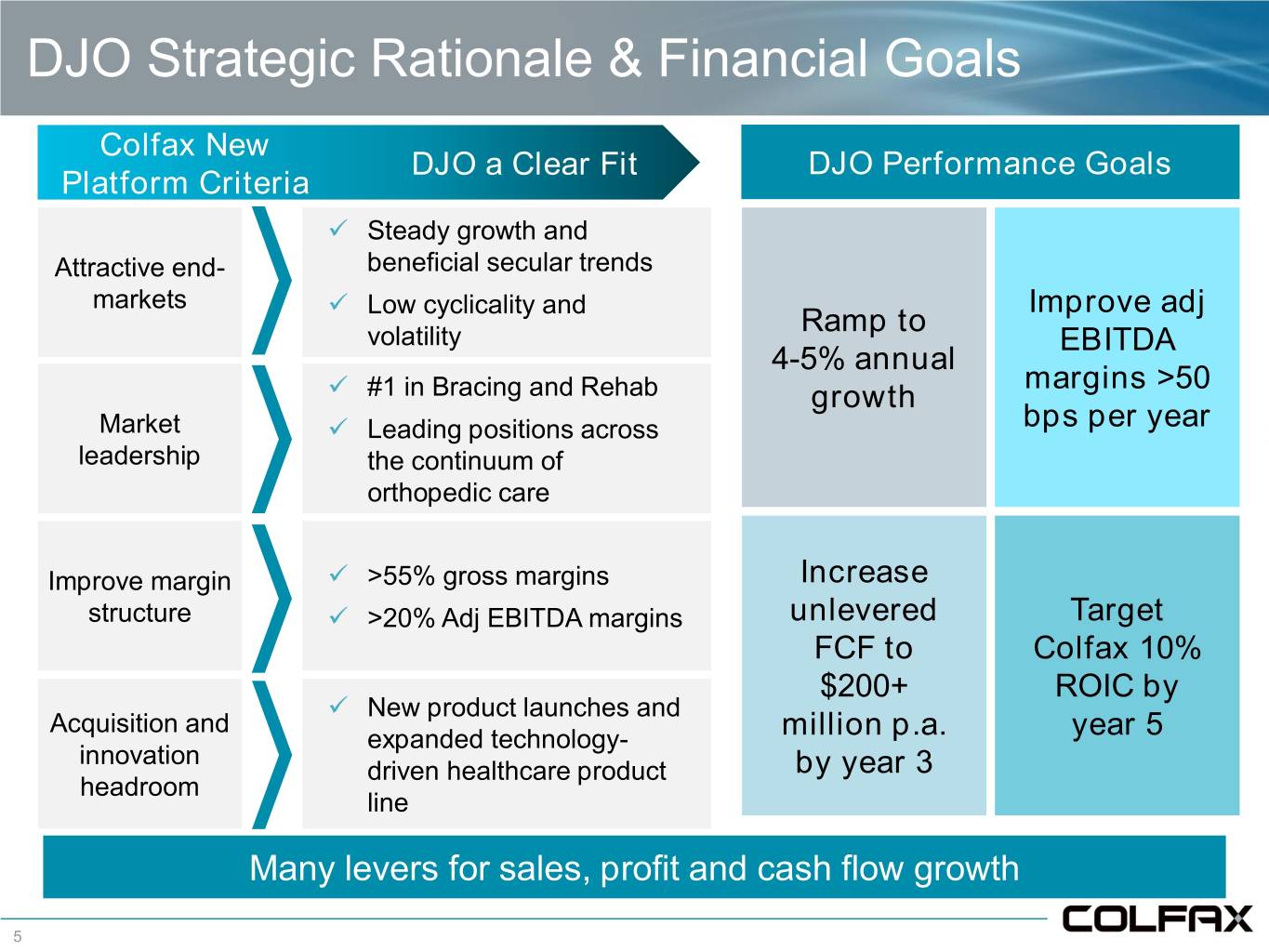

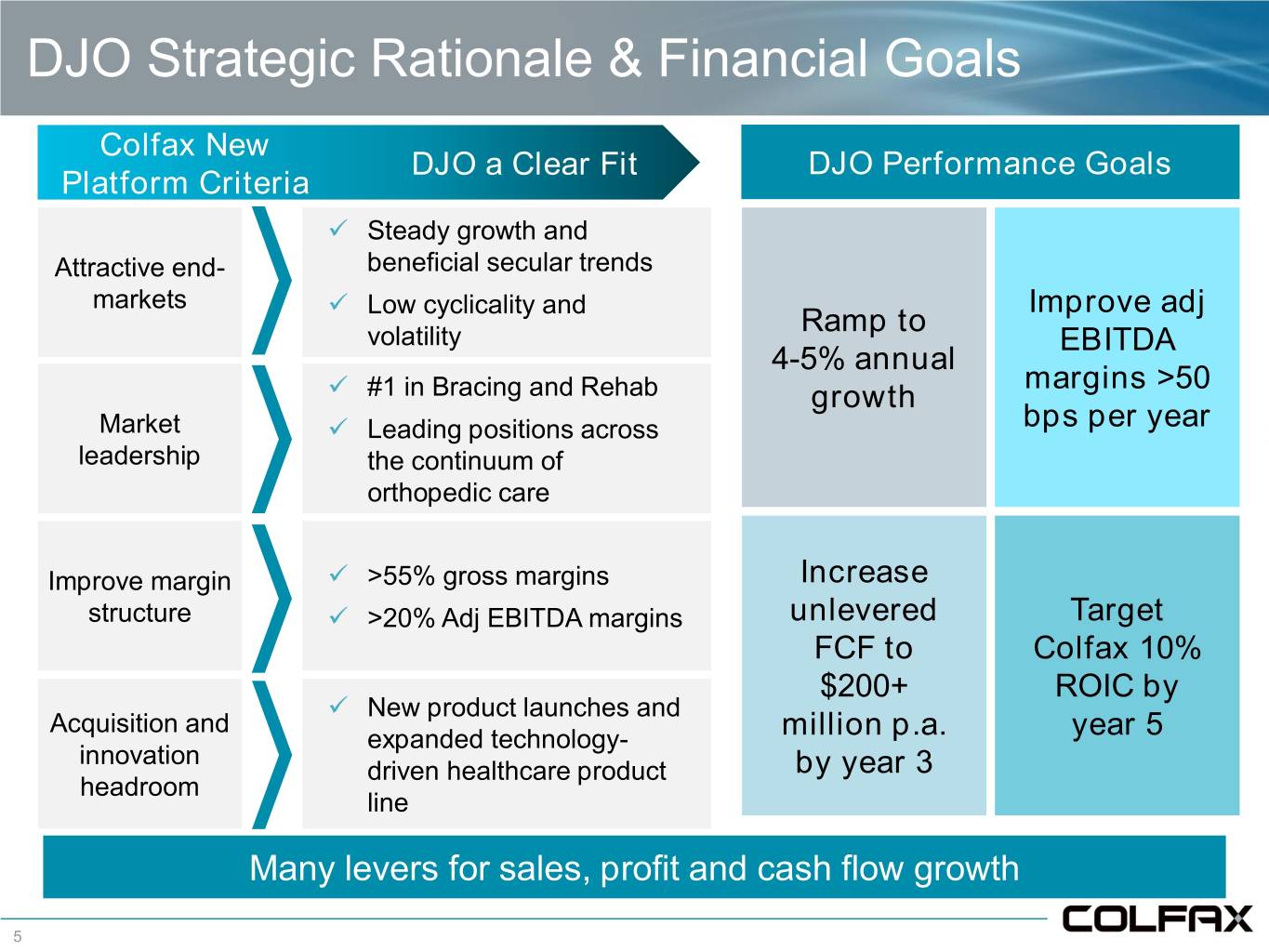

DJO Strategic Rationale & Financial Goals Colfax New DJO a Clear Fit DJO Performance Goals Platform Criteria ✓ Steady growth and Attractive end- beneficial secular trends markets ✓ Low cyclicality and Improve adj Ramp to volatility EBITDA 4-5% annual ✓ margins >50 #1 in Bracing and Rehab growth Market ✓ Leading positions across bps per year leadership the continuum of orthopedic care ✓ Improve margin >55% gross margins Increase structure ✓ >20% Adj EBITDA margins unlevered Target FCF to Colfax 10% $200+ ROIC by ✓ New product launches and Acquisition and expanded technology- million p.a. year 5 innovation driven healthcare product by year 3 headroom line Many levers for sales, profit and cash flow growth 5

Integration Update ▪ DJO team, led by Brady Shirley, energized to join Colfax ▪ Quickly connecting DJO into Colfax processes ▪ CBS training underway, cascading through business ▪ Working together to bring extra support to highest priorities ▪ Standard work 100-day review to lock-in longer-term value drivers Thoughtful focus and pacing 6

DJO 2019 Plan ▪ Improve to LSD growth ▪ Continue Reconstructive share gain ▪ Return Prevention & Rehabilitation to growth DJO 2019 ▪ Improve reimbursement process 12-Month ▪ Complete operational transformation Plan ▪ Stabilize Prevention & Rehabilitation supply chain ▪ 1-3% Drive procurement and value engineering Core growth ▪ Leverage enterprise efficiencies with Colfax ▪ Invest for future MSD growth $285-295m ▪ New product pipelines aEBITDA ▪ Reconstructive conversions ▪ Scalable infrastructure Build momentum, invest for the future 7

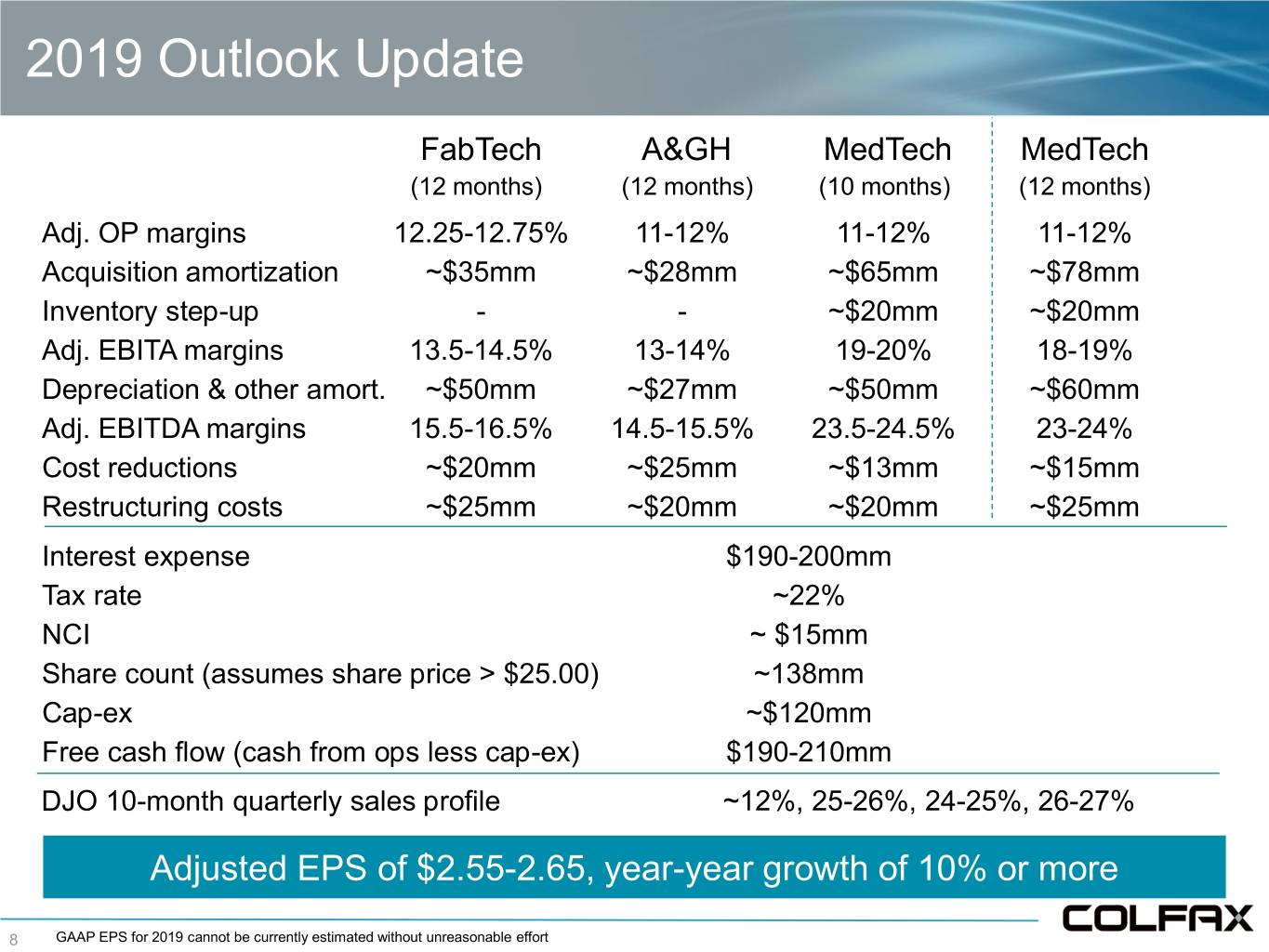

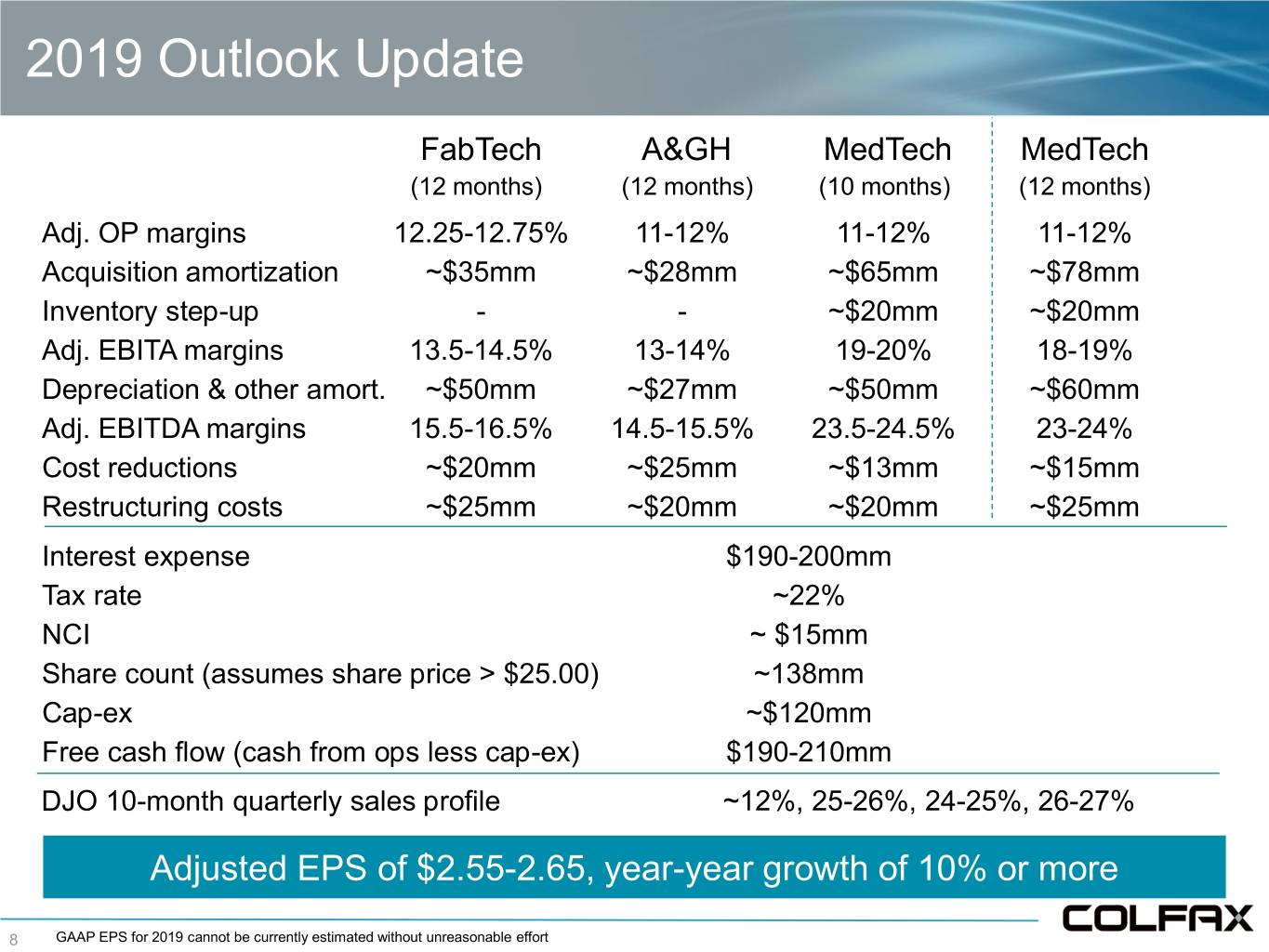

2019 Outlook Update FabTech A&GH MedTech MedTech (12 months) (12 months) (10 months) (12 months) Adj. OP margins 12.25-12.75% 11-12% 11-12% 11-12% Acquisition amortization ~$35mm ~$28mm ~$65mm ~$78mm Inventory step-up - - ~$20mm ~$20mm Adj. EBITA margins 13.5-14.5% 13-14% 19-20% 18-19% Depreciation & other amort. ~$50mm ~$27mm ~$50mm ~$60mm Adj. EBITDA margins 15.5-16.5% 14.5-15.5% 23.5-24.5% 23-24% Cost reductions ~$20mm ~$25mm ~$13mm ~$15mm Restructuring costs ~$25mm ~$20mm ~$20mm ~$25mm Interest expense $190-200mm Tax rate ~22% NCI ~ $15mm Share count (assumes share price > $25.00) ~138mm Cap-ex ~$120mm Free cash flow (cash from ops less cap-ex) $190-210mm DJO 10-month quarterly sales profile ~12%, 25-26%, 24-25%, 26-27% Adjusted EPS of $2.55-2.65, year-year growth of 10% or more 8 GAAP EPS for 2019 cannot be currently estimated without unreasonable effort

APPENDIX 9

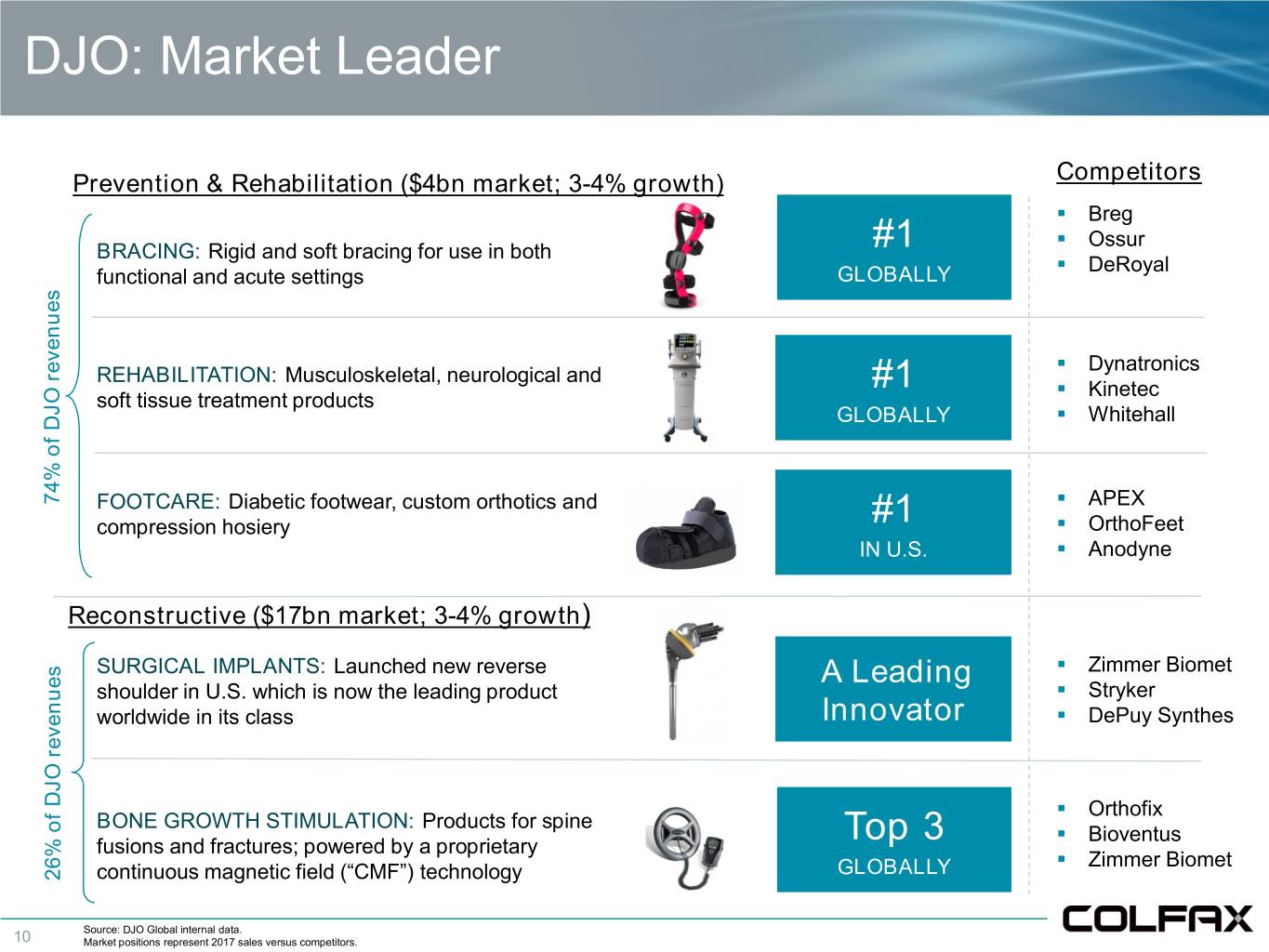

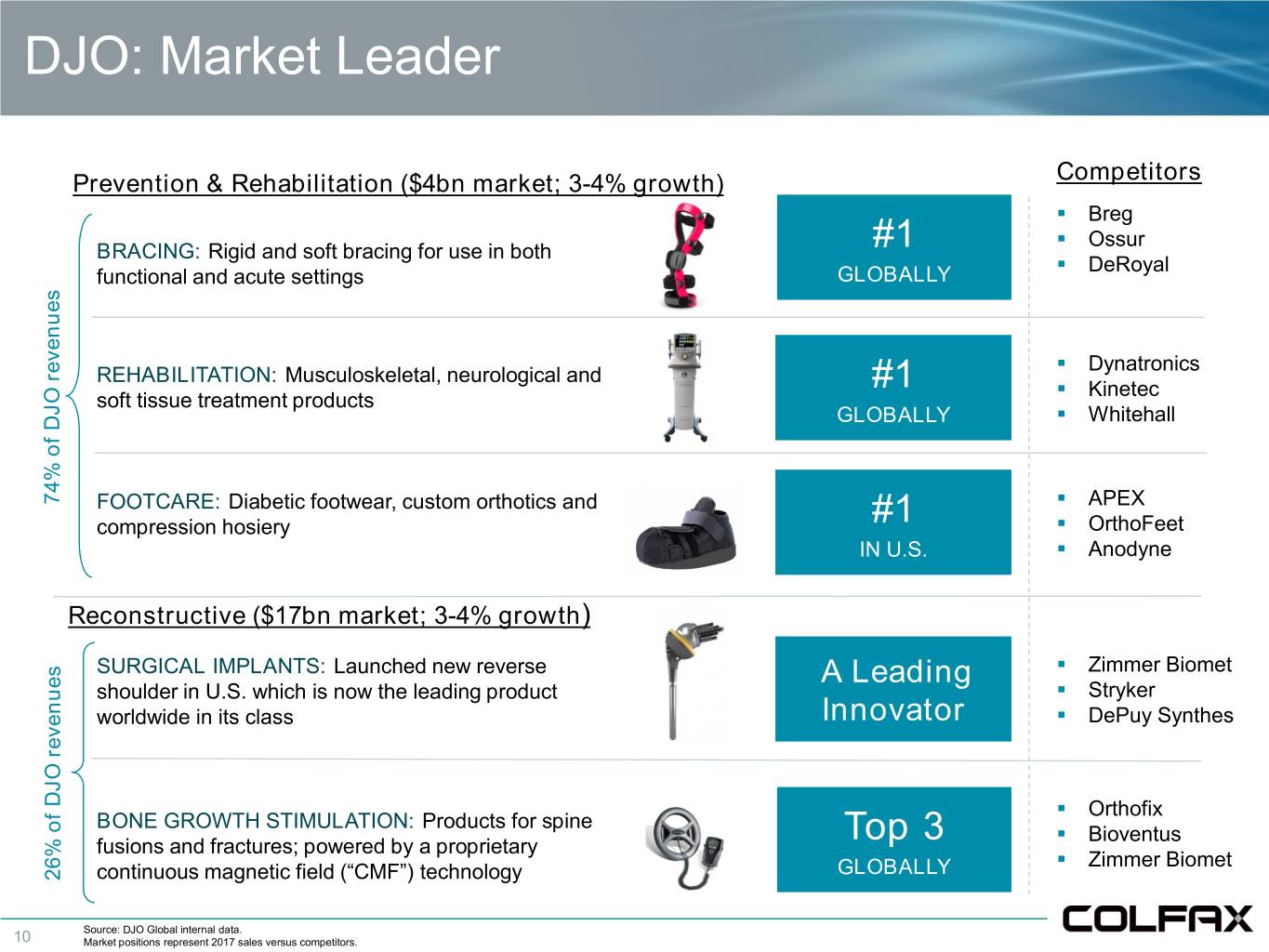

DJO: Market Leader Prevention & Rehabilitation ($4bn market; 3-4% growth) Competitors ▪ Breg ▪ Ossur BRACING: Rigid and soft bracing for use in both #1 ▪ DeRoyal functional and acute settings GLOBALLY ▪ Dynatronics REHABILITATION: Musculoskeletal, neurological and #1 ▪ Kinetec soft tissue treatment products GLOBALLY ▪ Whitehall ▪ 74% of of revenues DJO 74% FOOTCARE: Diabetic footwear, custom orthotics and APEX ▪ compression hosiery #1 OrthoFeet IN U.S. ▪ Anodyne Reconstructive ($17bn market; 3-4% growth) ▪ SURGICAL IMPLANTS: Launched new reverse A Leading Zimmer Biomet shoulder in U.S. which is now the leading product ▪ Stryker worldwide in its class Innovator ▪ DePuy Synthes ▪ Orthofix BONE GROWTH STIMULATION: Products for spine Top 3 ▪ Bioventus fusions and fractures; powered by a proprietary ▪ GLOBALLY Zimmer Biomet 26% of of revenues DJO 26% continuous magnetic field (“CMF”) technology Source: DJO Global internal data. 10 Market positions represent 2017 sales versus competitors.

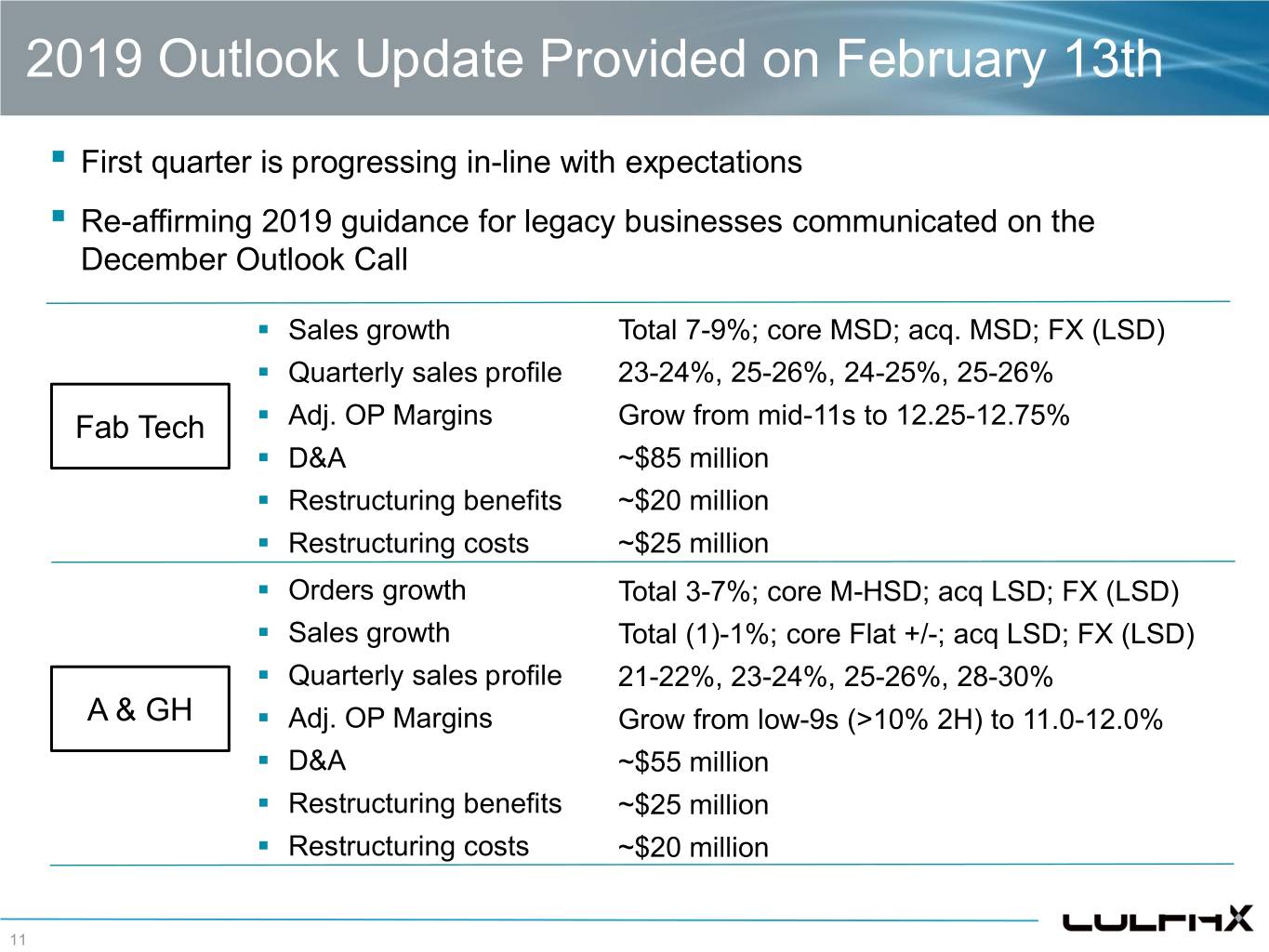

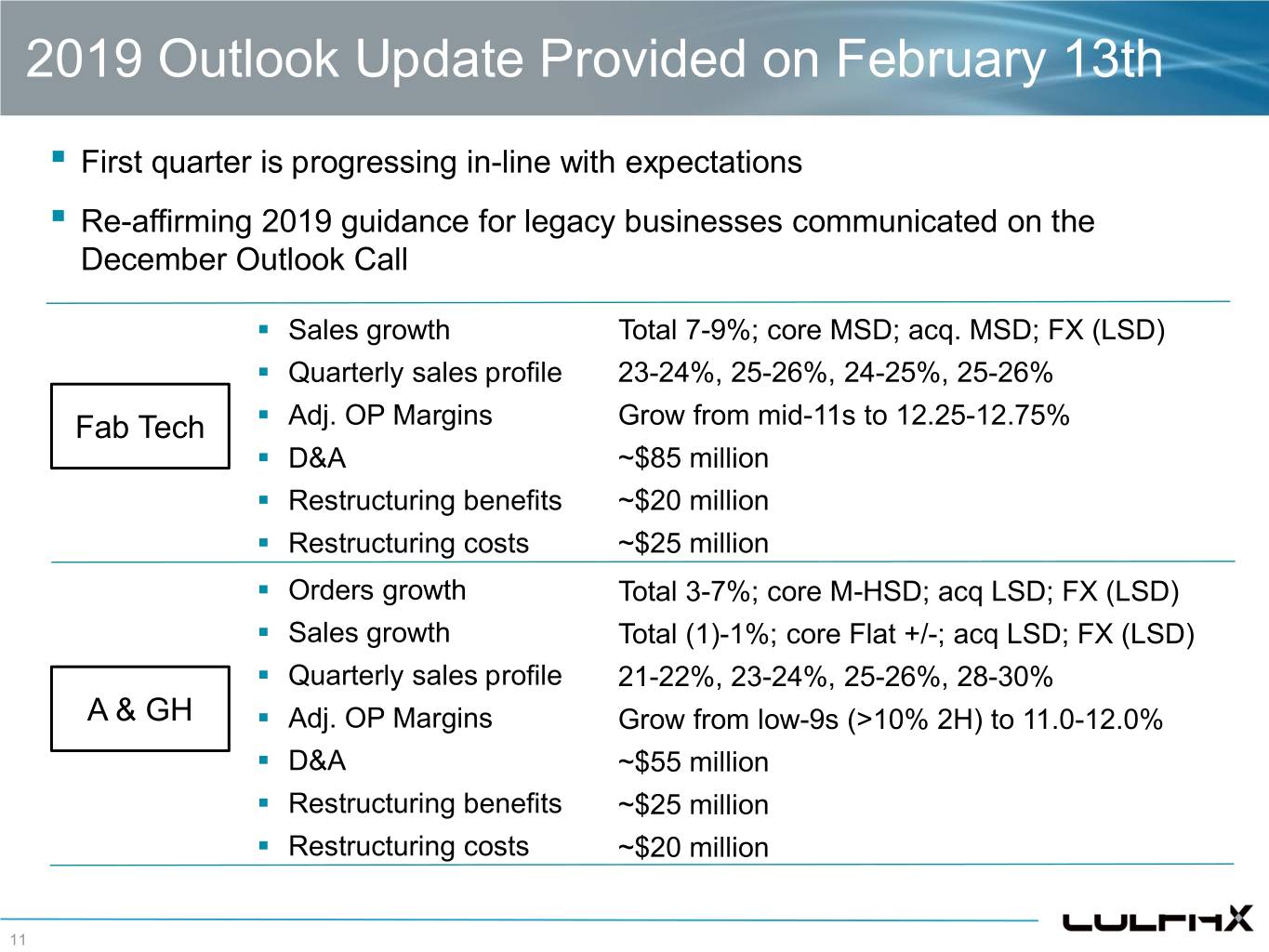

2019 Outlook Update Provided on February 13th ▪ First quarter is progressing in-line with expectations ▪ Re-affirming 2019 guidance for legacy businesses communicated on the December Outlook Call ▪ Sales growth Total 7-9%; core MSD; acq. MSD; FX (LSD) ▪ Quarterly sales profile 23-24%, 25-26%, 24-25%, 25-26% ▪ Fab Tech Adj. OP Margins Grow from mid-11s to 12.25-12.75% ▪ D&A ~$85 million ▪ Restructuring benefits ~$20 million ▪ Restructuring costs ~$25 million ▪ Orders growth Total 3-7%; core M-HSD; acq LSD; FX (LSD) ▪ Sales growth Total (1)-1%; core Flat +/-; acq LSD; FX (LSD) ▪ Quarterly sales profile 21-22%, 23-24%, 25-26%, 28-30% A & GH ▪ Adj. OP Margins Grow from low-9s (>10% 2H) to 11.0-12.0% ▪ D&A ~$55 million ▪ Restructuring benefits ~$25 million ▪ Restructuring costs ~$20 million 11

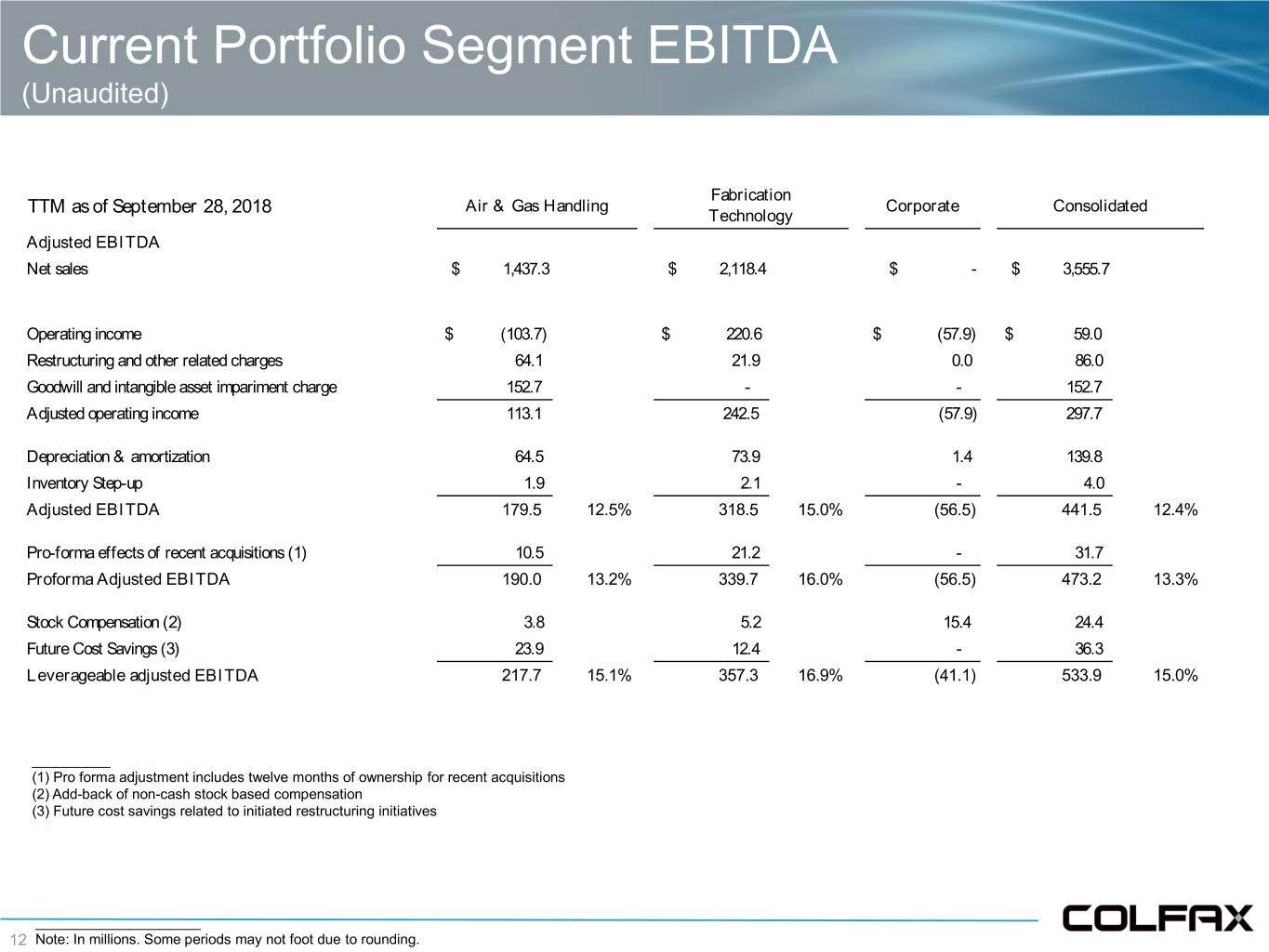

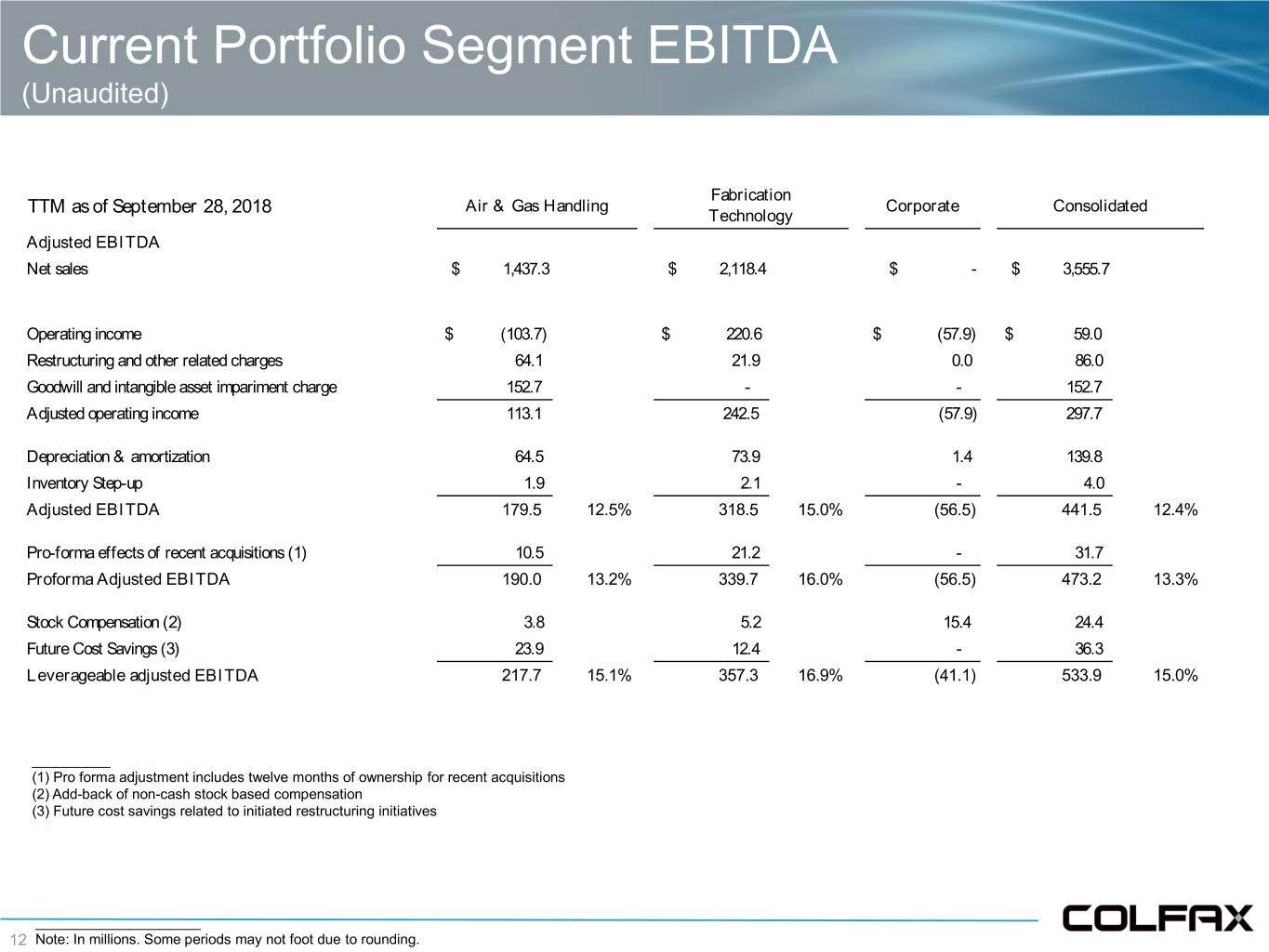

Current Portfolio Segment EBITDA (Unaudited) Fabrication TTM as of September 28, 2018 Air & Gas Handling Corporate Consolidated Technology Adjusted EBITDA Net sales $ 1,437.3 $ 2,118.4 $ - $ 3,555.7 Operating income $ (103.7) $ 220.6 $ (57.9) $ 59.0 Restructuring and other related charges 64.1 21.9 0.0 86.0 Goodwill and intangible asset impariment charge 152.7 - - 152.7 Adjusted operating income 113.1 242.5 (57.9) 297.7 Depreciation & amortization 64.5 73.9 1.4 139.8 Inventory Step-up 1.9 2.1 - 4.0 Adjusted EBITDA 179.5 12.5% 318.5 15.0% (56.5) 441.5 12.4% Pro-forma effects of recent acquisitions (1) 10.5 21.2 - 31.7 Proforma Adjusted EBITDA 190.0 13.2% 339.7 16.0% (56.5) 473.2 13.3% Stock Compensation (2) 3.8 5.2 15.4 24.4 Future Cost Savings (3) 23.9 12.4 - 36.3 Leverageable adjusted EBITDA 217.7 15.1% 357.3 16.9% (41.1) 533.9 15.0% __________ (1) Pro forma adjustment includes twelve months of ownership for recent acquisitions (2) Add-back of non-cash stock based compensation (3) Future cost savings related to initiated restructuring initiatives _____________________ 12 Note: In millions. Some periods may not foot due to rounding.

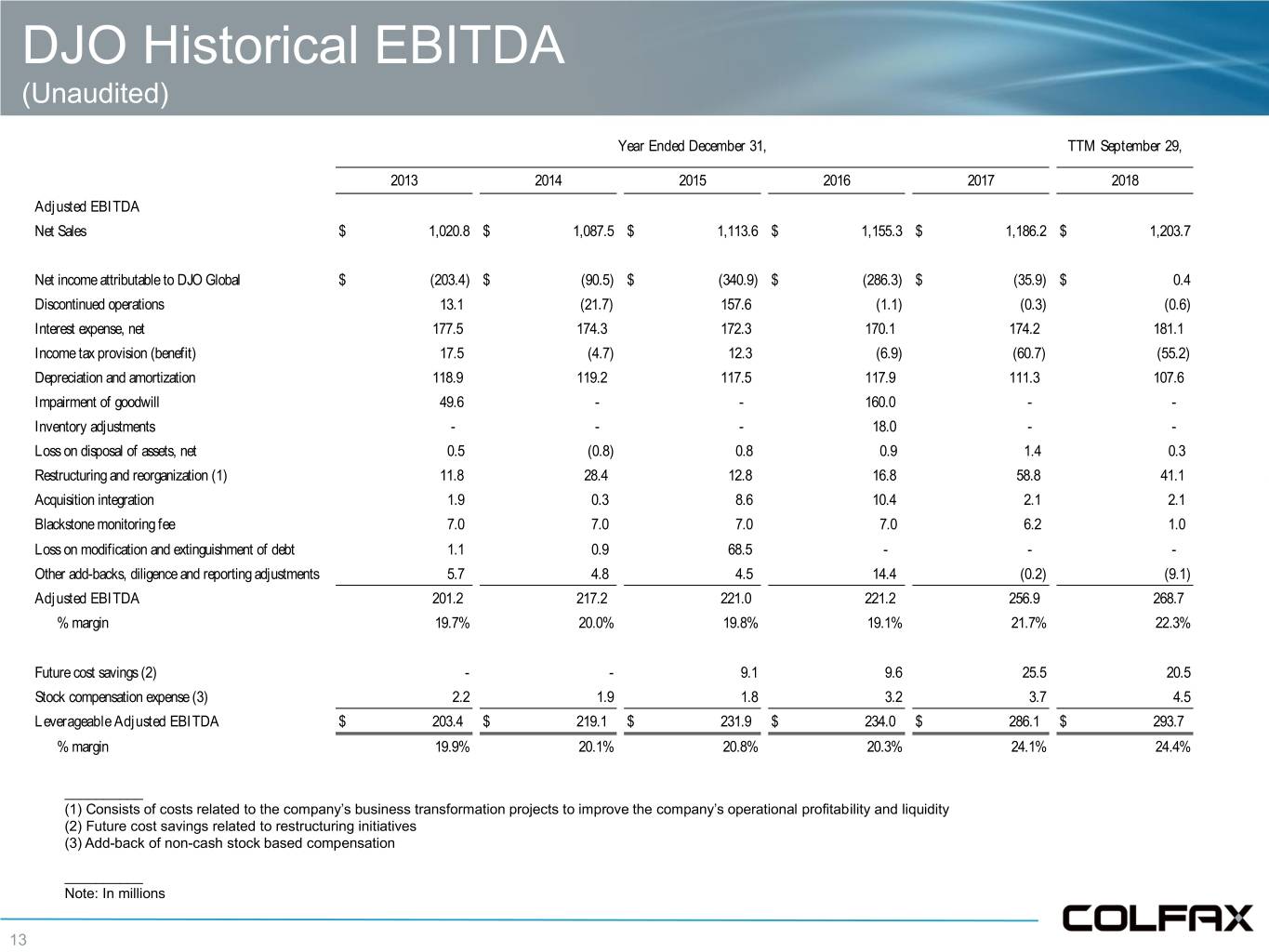

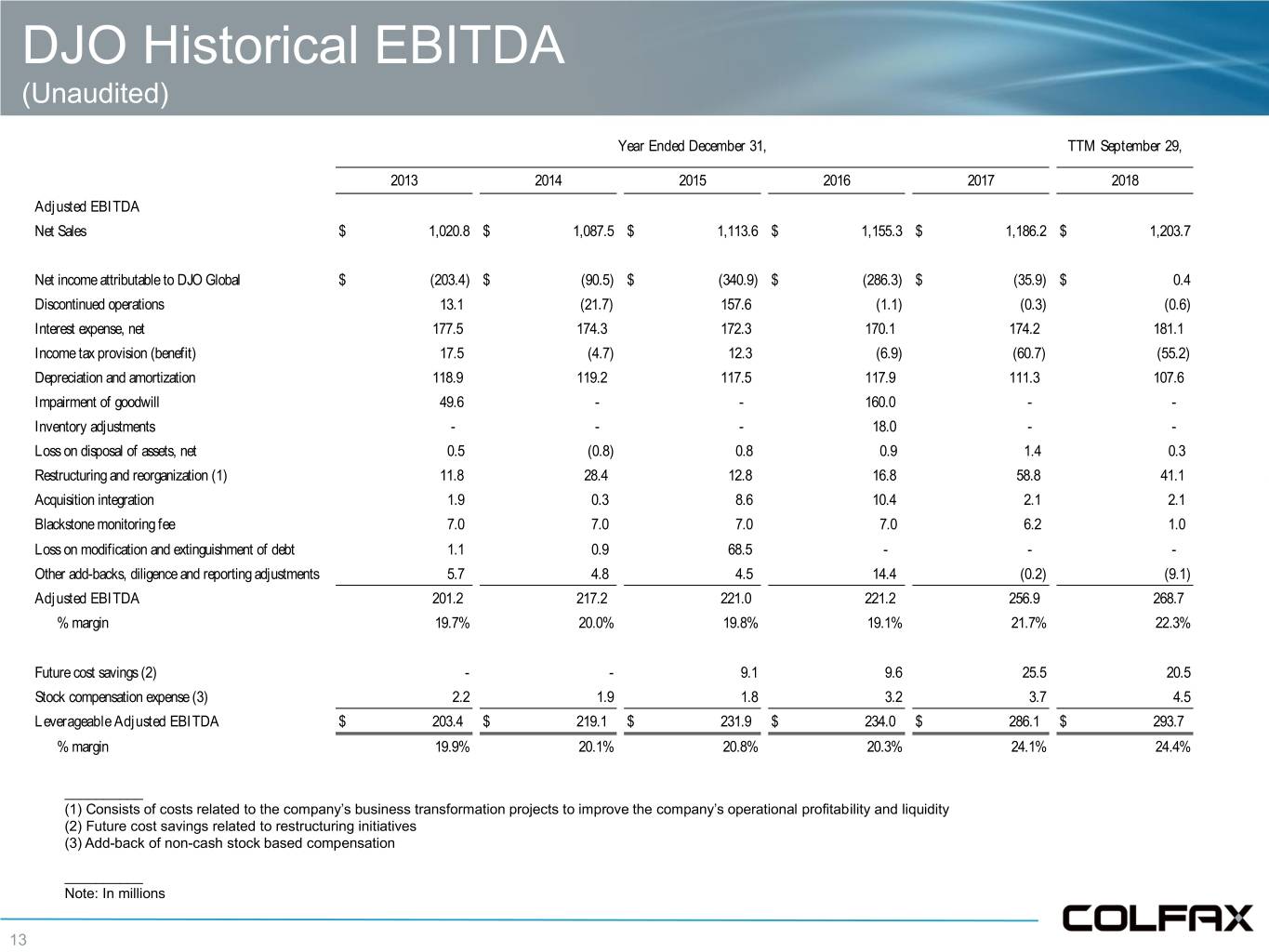

DJO Historical EBITDA (Unaudited) Year Ended December 31, TTM September 29, 2013 2014 2015 2016 2017 2018 Adjusted EBITDA Net Sales $ 1,020.8 $ 1,087.5 $ 1,113.6 $ 1,155.3 $ 1,186.2 $ 1,203.7 Net income attributable to DJO Global $ (203.4) $ (90.5) $ (340.9) $ (286.3) $ (35.9) $ 0.4 Discontinued operations 13.1 (21.7) 157.6 (1.1) (0.3) (0.6) Interest expense, net 177.5 174.3 172.3 170.1 174.2 181.1 Income tax provision (benefit) 17.5 (4.7) 12.3 (6.9) (60.7) (55.2) Depreciation and amortization 118.9 119.2 117.5 117.9 111.3 107.6 Impairment of goodwill 49.6 - - 160.0 - - Inventory adjustments - - - 18.0 - - Loss on disposal of assets, net 0.5 (0.8) 0.8 0.9 1.4 0.3 Restructuring and reorganization (1) 11.8 28.4 12.8 16.8 58.8 41.1 Acquisition integration 1.9 0.3 8.6 10.4 2.1 2.1 Blackstone monitoring fee 7.0 7.0 7.0 7.0 6.2 1.0 Loss on modification and extinguishment of debt 1.1 0.9 68.5 - - - Other add-backs, diligence and reporting adjustments 5.7 4.8 4.5 14.4 (0.2) (9.1) Adjusted EBITDA 201.2 217.2 221.0 221.2 256.9 268.7 % margin 19.7% 20.0% 19.8% 19.1% 21.7% 22.3% Future cost savings (2) - - 9.1 9.6 25.5 20.5 Stock compensation expense (3) 2.2 1.9 1.8 3.2 3.7 4.5 Leverageable Adjusted EBITDA $ 203.4 $ 219.1 $ 231.9 $ 234.0 $ 286.1 $ 293.7 % margin 19.9% 20.1% 20.8% 20.3% 24.1% 24.4% __________ (1) Consists of costs related to the company’s business transformation projects to improve the company’s operational profitability and liquidity (2) Future cost savings related to restructuring initiatives (3) Add-back of non-cash stock based compensation __________ Note: In millions 13

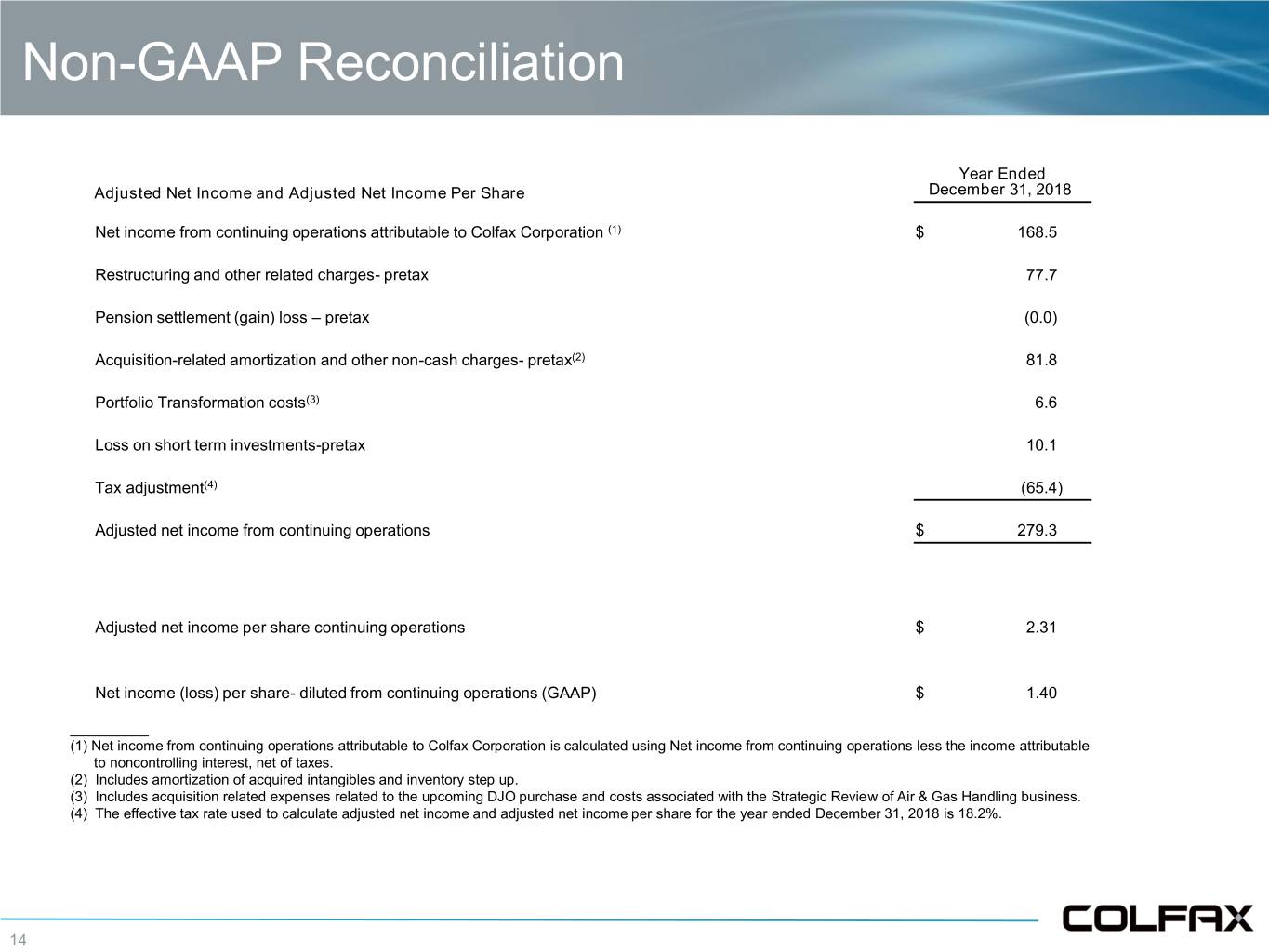

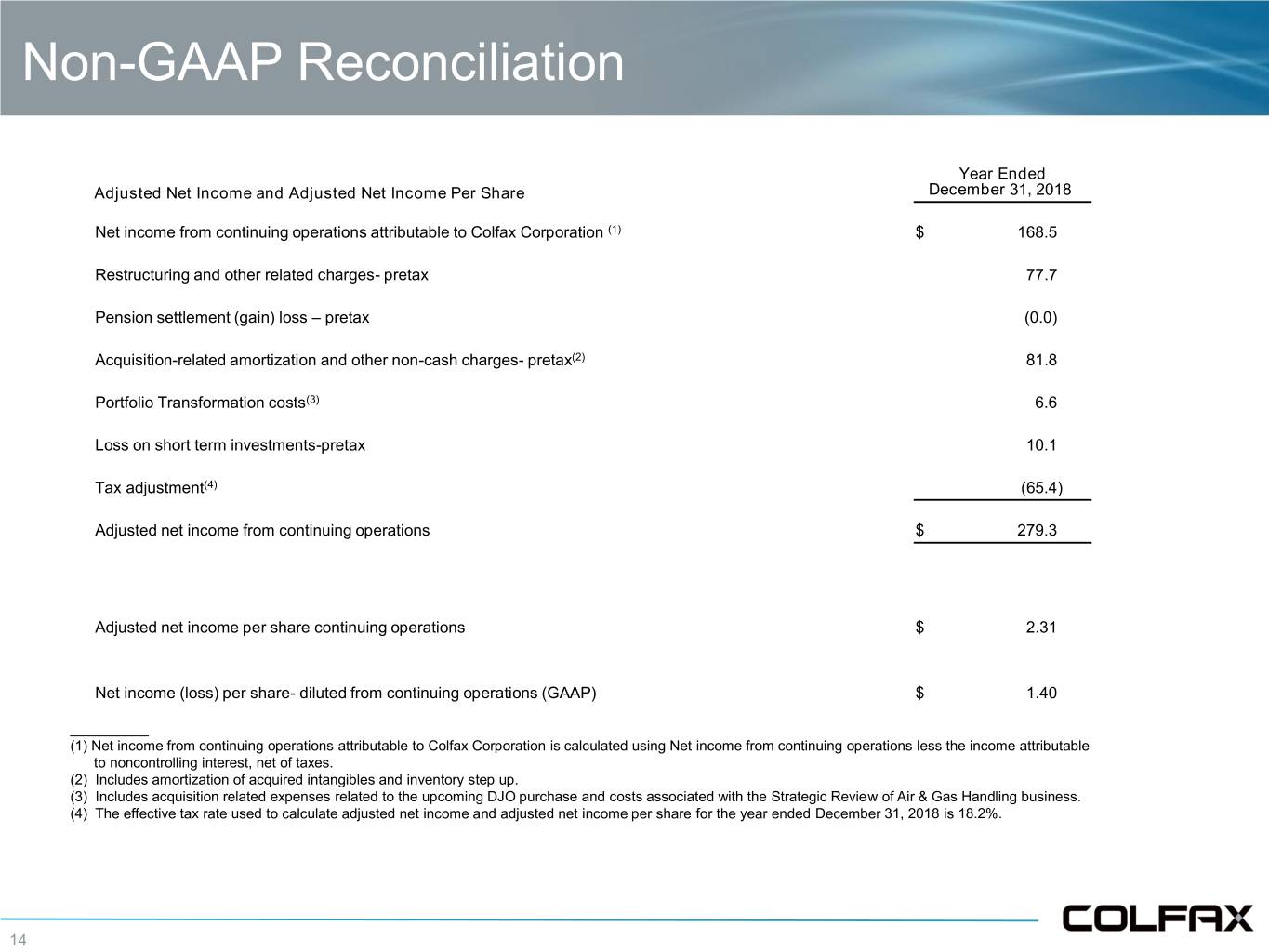

Non-GAAP Reconciliation Year Ended Adjusted Net Income and Adjusted Net Income Per Share December 31, 2018 Net income from continuing operations attributable to Colfax Corporation (1) $ 168.5 Restructuring and other related charges- pretax 77.7 Pension settlement (gain) loss – pretax (0.0) Acquisition-related amortization and other non-cash charges- pretax(2) 81.8 Portfolio Transformation costs(3) 6.6 Loss on short term investments-pretax 10.1 Tax adjustment(4) (65.4) Adjusted net income from continuing operations $ 279.3 Adjusted net income per share continuing operations $ 2.31 Net income (loss) per share- diluted from continuing operations (GAAP) $ 1.40 __________ (1) Net income from continuing operations attributable to Colfax Corporation is calculated using Net income from continuing operations less the income attributable to noncontrolling interest, net of taxes. (2) Includes amortization of acquired intangibles and inventory step up. (3) Includes acquisition related expenses related to the upcoming DJO purchase and costs associated with the Strategic Review of Air & Gas Handling business. (4) The effective tax rate used to calculate adjusted net income and adjusted net income per share for the year ended December 31, 2018 is 18.2%. 14

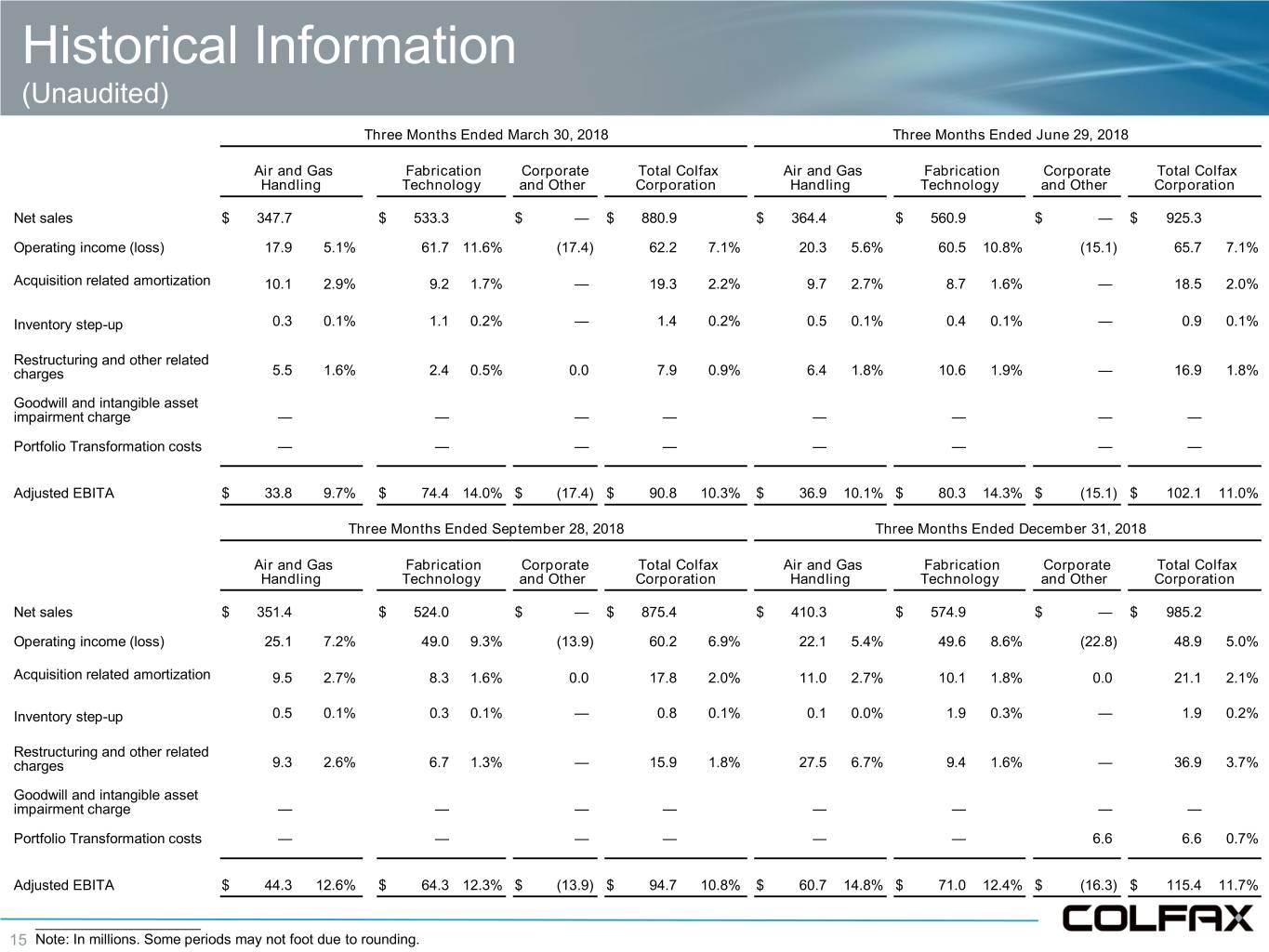

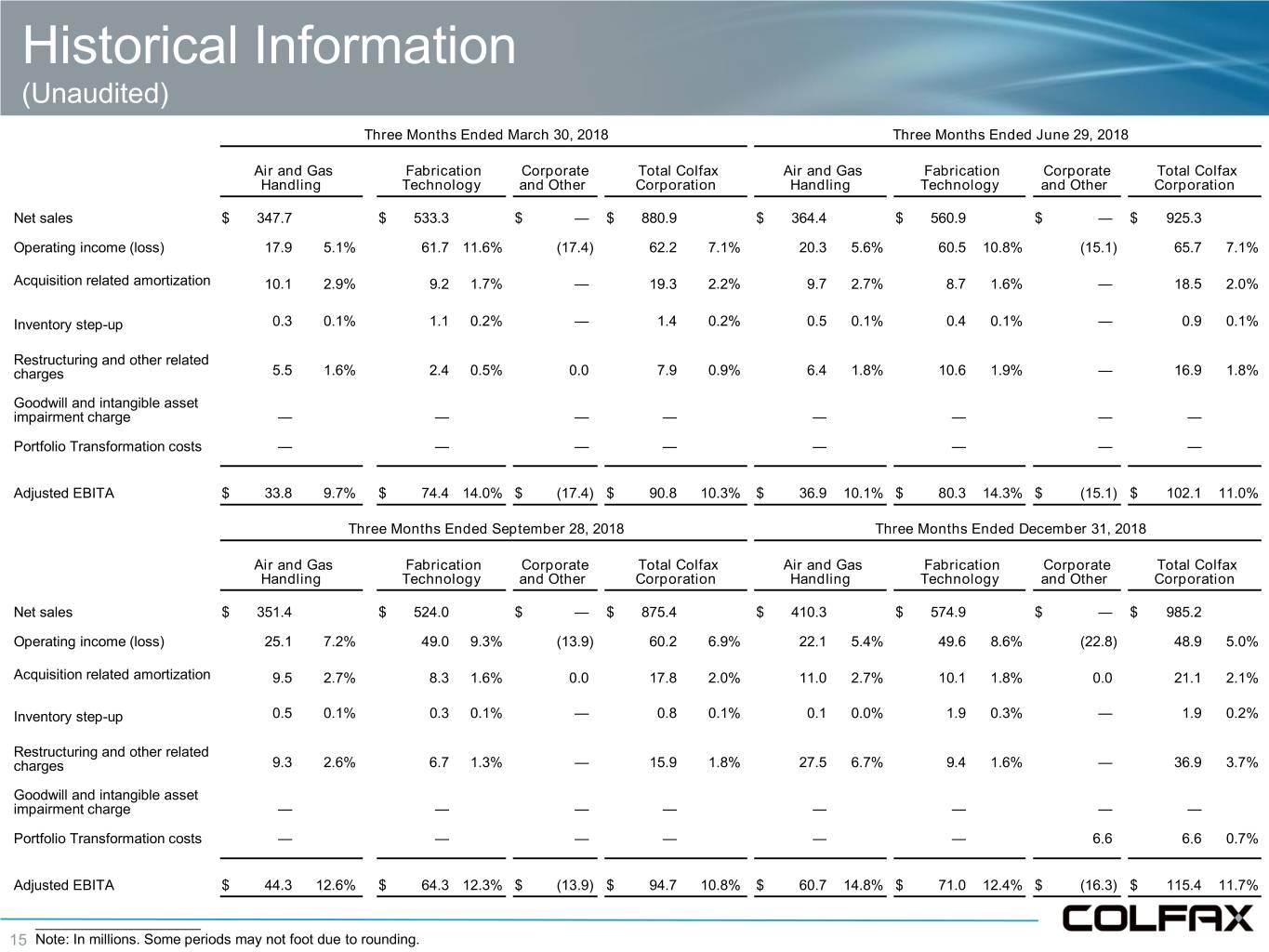

Historical Information (Unaudited) Three Months Ended March 30, 2018 Three Months Ended June 29, 2018 Air and Gas Fabrication Corporate Total Colfax Air and Gas Fabrication Corporate Total Colfax Handling Technology and Other Corporation Handling Technology and Other Corporation Net sales $ 347.7 $ 533.3 $ — $ 880.9 $ 364.4 $ 560.9 $ — $ 925.3 Operating income (loss) 17.9 5.1% 61.7 11.6% (17.4) 62.2 7.1% 20.3 5.6% 60.5 10.8% (15.1) 65.7 7.1% Acquisition related amortization 10.1 2.9% 9.2 1.7% — 19.3 2.2% 9.7 2.7% 8.7 1.6% — 18.5 2.0% Inventory step-up 0.3 0.1% 1.1 0.2% — 1.4 0.2% 0.5 0.1% 0.4 0.1% — 0.9 0.1% Restructuring and other related charges 5.5 1.6% 2.4 0.5% 0.0 7.9 0.9% 6.4 1.8% 10.6 1.9% — 16.9 1.8% Goodwill and intangible asset impairment charge — — — — — — — — Portfolio Transformation costs — — — — — — — — Adjusted EBITA $ 33.8 9.7% $ 74.4 14.0% $ (17.4) $ 90.8 10.3% $ 36.9 10.1% $ 80.3 14.3% $ (15.1) $ 102.1 11.0% Three Months Ended September 28, 2018 Three Months Ended December 31, 2018 Air and Gas Fabrication Corporate Total Colfax Air and Gas Fabrication Corporate Total Colfax Handling Technology and Other Corporation Handling Technology and Other Corporation Net sales $ 351.4 $ 524.0 $ — $ 875.4 $ 410.3 $ 574.9 $ — $ 985.2 Operating income (loss) 25.1 7.2% 49.0 9.3% (13.9) 60.2 6.9% 22.1 5.4% 49.6 8.6% (22.8) 48.9 5.0% Acquisition related amortization 9.5 2.7% 8.3 1.6% 0.0 17.8 2.0% 11.0 2.7% 10.1 1.8% 0.0 21.1 2.1% Inventory step-up 0.5 0.1% 0.3 0.1% — 0.8 0.1% 0.1 0.0% 1.9 0.3% — 1.9 0.2% Restructuring and other related charges 9.3 2.6% 6.7 1.3% — 15.9 1.8% 27.5 6.7% 9.4 1.6% — 36.9 3.7% Goodwill and intangible asset impairment charge — — — — — — — — Portfolio Transformation costs — — — — — — 6.6 6.6 0.7% Adjusted EBITA $ 44.3 12.6% $ 64.3 12.3% $ (13.9) $ 94.7 10.8% $ 60.7 14.8% $ 71.0 12.4% $ (16.3) $ 115.4 11.7% _____________________ 15 Note: In millions. Some periods may not foot due to rounding.

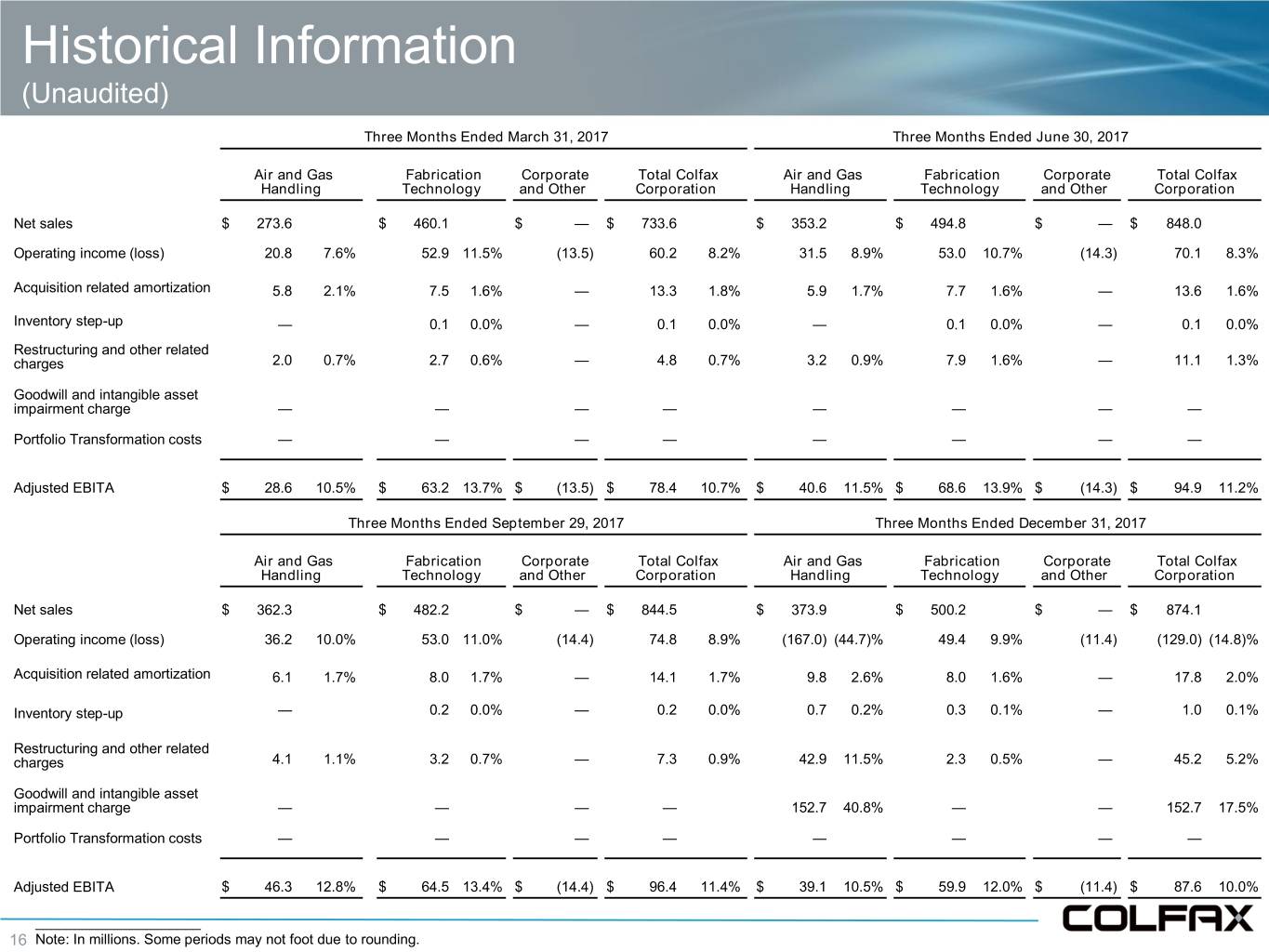

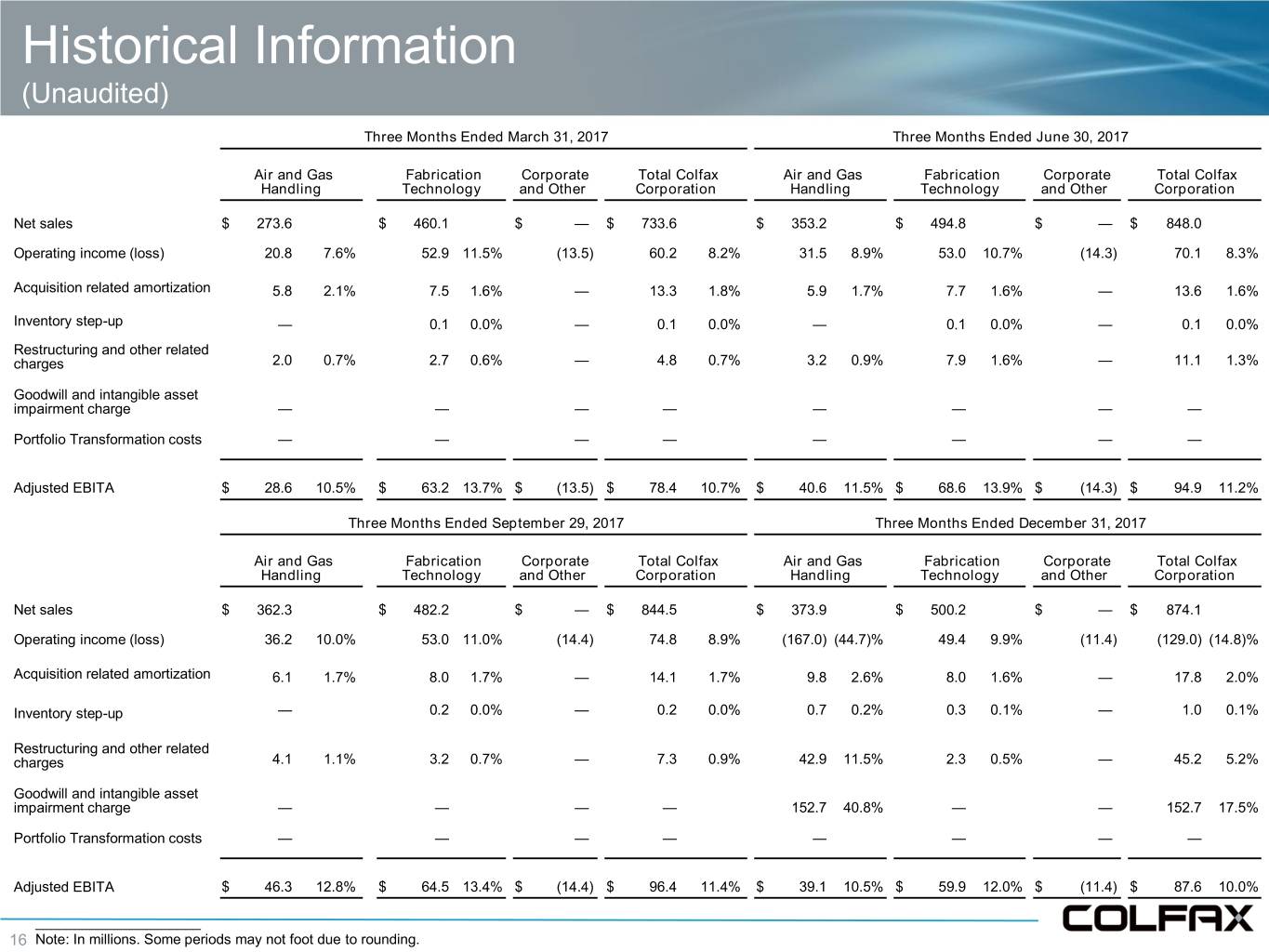

Historical Information (Unaudited) Three Months Ended March 31, 2017 Three Months Ended June 30, 2017 Air and Gas Fabrication Corporate Total Colfax Air and Gas Fabrication Corporate Total Colfax Handling Technology and Other Corporation Handling Technology and Other Corporation Net sales $ 273.6 $ 460.1 $ — $ 733.6 $ 353.2 $ 494.8 $ — $ 848.0 Operating income (loss) 20.8 7.6% 52.9 11.5% (13.5) 60.2 8.2% 31.5 8.9% 53.0 10.7% (14.3) 70.1 8.3% Acquisition related amortization 5.8 2.1% 7.5 1.6% — 13.3 1.8% 5.9 1.7% 7.7 1.6% — 13.6 1.6% Inventory step-up — 0.1 0.0% — 0.1 0.0% — 0.1 0.0% — 0.1 0.0% Restructuring and other related charges 2.0 0.7% 2.7 0.6% — 4.8 0.7% 3.2 0.9% 7.9 1.6% — 11.1 1.3% Goodwill and intangible asset impairment charge — — — — — — — — Portfolio Transformation costs — — — — — — — — Adjusted EBITA $ 28.6 10.5% $ 63.2 13.7% $ (13.5) $ 78.4 10.7% $ 40.6 11.5% $ 68.6 13.9% $ (14.3) $ 94.9 11.2% Three Months Ended September 29, 2017 Three Months Ended December 31, 2017 Air and Gas Fabrication Corporate Total Colfax Air and Gas Fabrication Corporate Total Colfax Handling Technology and Other Corporation Handling Technology and Other Corporation Net sales $ 362.3 $ 482.2 $ — $ 844.5 $ 373.9 $ 500.2 $ — $ 874.1 Operating income (loss) 36.2 10.0% 53.0 11.0% (14.4) 74.8 8.9% (167.0) (44.7)% 49.4 9.9% (11.4) (129.0) (14.8)% Acquisition related amortization 6.1 1.7% 8.0 1.7% — 14.1 1.7% 9.8 2.6% 8.0 1.6% — 17.8 2.0% Inventory step-up — 0.2 0.0% — 0.2 0.0% 0.7 0.2% 0.3 0.1% — 1.0 0.1% Restructuring and other related charges 4.1 1.1% 3.2 0.7% — 7.3 0.9% 42.9 11.5% 2.3 0.5% — 45.2 5.2% Goodwill and intangible asset impairment charge — — — — 152.7 40.8% — — 152.7 17.5% Portfolio Transformation costs — — — — — — — — Adjusted EBITA $ 46.3 12.8% $ 64.5 13.4% $ (14.4) $ 96.4 11.4% $ 39.1 10.5% $ 59.9 12.0% $ (11.4) $ 87.6 10.0% _____________________ 16 Note: In millions. Some periods may not foot due to rounding.