UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| |

[X] | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED MARCH 31, 2009 |

[_] | TRANSITION REPORT UNDER SECTION13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM __________ TO __________ |

BRAZOS INTERNATIONAL EXPLORATION, INC.

(exact name of registrant as specified in charter)

NEVADA

000-53336

01-0884561_______

State or other jurisdiction

Commission File No.

IRS Employer Identification No.

Incorporation or organization

2818 Hamilton Parkway

Brooklyn, New York 11218

(Address of principal executive offices)

Registrant’s telephone number (347)834-7118

With Copies To:

Joseph Emas, Esq.

1224 Washington Avenue

Miami Beach, FL 33139

Tel:(305) 531-1174 Fax:(305) 531-1274

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act: None

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [_]

Check if there is no disclosure of delinquent filers in response to Item 405 of Regulation S-B contained in this form, and no disclosure will be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [ X ]

State issuer’s revenues for its most recent fiscal year: $0.00

The aggregate market value of the voting and non-voting common equity held by non-affiliates, computed by reference to the average bid and asked price of such common equity, as of March 31, 2009 is $51,000.

As of March 31, 2009, the issuer had 5,100,000 outstanding shares of Common Stock.

Transitional Small Business Disclosure Format (check one): Yes [X] No [ ]

BRAZOS INTERNATIONAL EXPLORATION, INC.

FORM 10-K

For the Fiscal Year Ended March 31, 2009

TALE OF CONTENTS

| | |

Part I | | Pg |

Item 1. | Business | 3 |

Item 1A. | Risk Factors | 10 |

Item 2 | Properties | 14 |

Item 3 | Legal Proceedings | 14 |

Item 4 | Submission of Matters to a Vote of Security Holders | 14 |

Part II | | |

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 15 |

Item 6 | Selected Financial Data | 16 |

Item 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 16 |

Item 7A | Quantitative and Qualitative Disclosure About Market Risk | 19 |

Item 8 | Financial Statements and Supplementary Data | 19 |

Item 9 | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 19 |

Item 9A | Controls & Procedures | 19 |

Item 9B | Other Information | 20 |

Part III | | |

Item 10 | Directors, Executive Officers and Corporate Governance | 20 |

Item 11 | Executive Compensation | 21 |

Item 12 | Security Ownership of Certain Beneficial Owners and Management | 21 |

Item 13 | Certain Relationships and Related Transactions and Director Independence | 22 |

Item 14 | Principal Accounting Fees and Services | 22 |

Part IV | | |

Item 15 | Exhibits, Financial Statement Schedules | 23 |

Part I

FORWARD-LOOKING INFORMATION

This Annual Report of Brazos International Exploration, Inc on Form 10-K contains forward-looking statements, particularly those identified with the words, "anticipates," "believes," "expects," "plans," “intends”, “objectives” and similar expressions. These statements reflect management's best judgment based on factors known at the time of such statements. The reader may find discussions containing such forward-looking statements in the material set forth under "Legal Proceedings" and "Management's Discussion and Analysis and Plan of Operations," generally, and specifically therein under the captions "Liquidity and Capital Resources" as well as elsewhere in this Annual Report on Form 10-K. Actual events or results may differ materially from those discussed herein.

ITEM 1: DESCRIPTION OF BUSINESS

We were incorporated in the State of Nevada on January 11, 2007. Our principal offices are located at 2818 Fort Hamilton Parkway, Brooklyn, NY 11218.

We intend to be in the business of mineral property exploration. To date, we have not conducted any exploration on our 16 mineral claims in the Laurentides Region near Mont Laurier, Quebec, as filed for record with Quebec Resources Naturelles et Faune:

We own a 100% interest in the mining claims comprising the Lac Dube claims, located approximately 200 km northwest and 65-70 km northeast of Montreal and Mont-Laurier, respectively. The property, which consists of 16 contiguous mining claims (940.04 ha), is situated in the Franchere Township (NTS Map 31J/15) in southwestern Quebec. The property is easily accessible by provincial highways, paved and all-weather gravel roads from major centers of Quebec (Montreal) and Quebec (Ottawa).

We purchased these claims from Mr. Michael Carr of Calgary, Alberta for a cash payment of $ 6,500 and 500,000 shares of our common stock at a price of $0.001 per share ($500) for a total price of $7,000.

Our objective is to conduct mineral exploration activities on the Lac Dube claims in order to assess whether it possesses economic reserves of precious and/or base metals, especially uranium. We have not yet identified any economic mineralization on the property. Our proposed exploration programs are designed to search for an economic mineral deposit.

Employees

We currently have no full-time employees including our CEO and Principal Accounting Officer.

Research & Development

For year ended March 31, 2009, we spent nothing for research and development, as compared to $5,000 during the year ended October 31, 2007.

3

The Gold/Silver/Uranium Market

Prices of base metals (copper, lead, zinc, etc.) are at historic highs. Gold, silver and platinum are at their highest prices in years. Uranium is currently over $95.00 per pound. Mining prospects that a few years ago would be rejected are now economically feasible. Exploration for minerals all over the world has opened new areas for investigation.

We intend to commence operations as an exploration stage mineral exploration company. As such, there is no assurance that a commercially viable mineral deposit exists on our sole mineral property interest, the Lac Dube claims. Further exploration will be required before a final evaluation as to the economic and legal feasibility of the Lac Dube claims is determined.

We will be engaged in the acquisition, and exploration of mineral properties with a view to exploiting any mineral deposits we discover that demonstrate economic feasibility. We acquired a 100% undivided right, title and interest in and to several mineral claims located in the Laurentides Region near Mont Laurier, Quebec, as filed for record with Quebec Resources Naturelles et Faune:

In order to acquire the claims, we paid $6,500 cash and 500,000 shares of our common stock to Mr. Michael Carr, the vendor of the property in an arm’s length transaction.

Our plan of operation is to determine whether the Lac Dube claims contain reserves of Uranium, gold and/or silver that are economically recoverable. The recoverability of amounts from the property will be dependent upon the discovery of sufficient reserves, confirmation of necessary financing to satisfy the expenditure requirements under the property agreement and to complete the development of the property and upon future profitable production or proceeds for the sale thereof.

Even if we complete our proposed exploration programs on the Lac Dube claims and they are successful in identifying a mineral deposit, we will have to spend substantial funds on further drilling and engineering studies before we will know if we have a commercially viable mineral deposit.

Labor and Other Supplies

We contract all labor for the development of Mineral claims acreage in a multi-phase program as recommended by our professional consultants.

Commodity Price Volatility

While gold has hit near-record levels and silver prices have kept pace proportionately, these prices are subject to two-fold influences: supply and demand and commodity speculators. One factor that seems to indicate continued strong prices is the downturn in our economy and the weakness of the US dollar. A segment of the investment community has turned to gold, particularly, as a hedge against the effect of these two situations. Demand for Uranium remains high world-wide.

Seasonality

The exploration for both base and precious minerals depends on access to areas where operations are to be conducted. Seasonal weather variations, including freeze-up and break-up affect access in certain circumstances. These factors influence the timing of our business plan and

4

Governmental Regulation

Canada

Mineral exploration in Canada is subject to extensive controls and regulations imposed by various levels of government. We do not expect that any of these controls or regulations will affect our operations in a manner materially different than they would affect other exploration companies of similar size.

In addition to federal regulation, each province has legislation and regulations which govern claim tenure, environmental protection and other matters.

United States

Our operations could be subject to various types of regulation at the federal, state and local levels should be decide to do exploration in the US. Such regulation includes requiring permits for the development of the property should preliminary exploration so indicate.

Our business is affected by numerous laws and regulations, including energy, environmental, conservation, tax and other laws and regulations relating to the mining industry. We plan to develop internal procedures and policies to ensure that our operations are conducted in full and substantial environmental regulatory compliance.

Failure to comply with any laws and regulations may result in the assessment of administrative, civil and criminal penalties, the imposition of injunctive relief or both. Moreover, changes in any of these laws and regulations could have a material adverse effect on business. In view of the many uncertainties with respect to current and future laws and regulations, including their applicability to us, we cannot predict the overall effect of such laws and regulations on our future operations.

We believe that our operations comply in all material respects with applicable laws and regulations and that the existence and enforcement of such laws and regulations have no more restrictive an effect on our operations than on other similar companies in the mineral exploration industry. We do not anticipate any material capital expenditures to comply with federal and state environmental requirements.

Environmental Regulation

Canada

All phases of the mining industry are governed by environmental regulation under Canadian federal and provincial laws, rules and regulations, which restrict and prohibit the release or emission and regulate the storage and transportation of various substances produced or utilized in association with exploration efforts. In addition, applicable environmental laws require that trenching and drilling sites be abandoned and reclaimed, to the satisfaction of provincial authorities, in order to remediate these sites to near natural conditions. Also, environmental laws may impose upon “responsible persons” remediation obligations on property designated as a site to be reclaimed. Compliance with such legislation can require significant expenditures. A breach of environmental laws may result in the imposition of fines and penalties and suspension of production, in addition to the costs of abandonment and reclamation.

5

United States

Operations on properties in which we may have an interest are subject to extensive federal, state and local environmental laws that regulate the discharge or disposal of materials or substances into the environment and otherwise are intended to protect the environment. Numerous governmental agencies issue rules and regulations to implement and enforce such laws, which are often difficult and costly to comply with and which carry substantial administrative, civil and criminal penalties and in some cases injunctive relief for failure to comply.

Some laws, rules and regulations relating to the protection of the environment may, in certain circumstances, impose “strict liability” for environmental contamination. These laws render a person or company liable for environmental and natural resource damages and cleanup costs. and, in the case of oil spills in certain states, consequential damages without regard to negligence or fault.

We have established guidelines and management systems to ensure compliance with environmental laws, rules and regulations. The existence of these controls cannot, however, guarantee total compliance with environmental laws, rules and regulations. We believe that the operator of the properties in which we may have an interest will be in substantial compliance with applicable laws, rules and regulations. chase. The occurrence of a significant event not fully insured or indemnified against could have a material adverse effect on our financial condition and operations. Compliance with environmental requirements, including financial assurance requirements and the costs associated with the remediation of any significant disturbance of the terrain could have a material adverse effect on our capital expenditures, earnings or competitive position.

Risk Factors

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information in this prospectus before investing in our common stock. If any of the following risks occur, our business, operating results and financial condition could be seriously harmed. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

IF WE DO NOT OBTAIN ADDITIONAL FINANCING, OUR BUSINESS WILL FAIL.

Our current operating funds are less than necessary to complete all intended exploration of the Lac Dube claims, and therefore we will need to obtain additional financing in order to complete our business plan. As of March 31, 2008 we had cash in the amount of $10,383. We currently do not have any operations and we have no income.

Our business plan calls for significant expenses in connection with the exploration of the Lac Dube claims. We do not currently have sufficient funds to conduct initial exploration on the property and require additional financing in order to determine whether the property contains economic mineralization. We will also require additional financing if the costs of the exploration of the Lac Dube claims are greater than anticipated.

We will require additional financing to sustain our business operations if we are not successful in earning revenues once exploration is complete. We do not currently have any arrangements for financing and we can provide no assurance to investors that we will be able to find such financing if required. Obtaining additional financing would be subject to a number of factors, including the market prices for base and precious metals and uranium, investor acceptance of our property and general market conditions. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us.

6

The most likely source of future funds presently available to us is through the sale of equity capital. Any sale of share capital will result in dilution to existing shareholders. The only other anticipated alternative for the financing of further exploration would be our sale of a partial interest in the Lac Dube claims to a third party in exchange for cash or exploration expenditures, which is not presently contemplated.

BECAUSE WE HAVE NOT COMMENCED BUSINESS OPERATIONS, WE FACE A HIGH RISK OF BUSINESS FAILURE.

Although we are preparing to commence exploration on the Lac Dube claims in the fall of 2008, we have not yet commenced exploration on the property. Accordingly, we have no way to evaluate the likelihood that our business will be successful. We were incorporated on January 11, 2007 and have been involved primarily in organizational activities and the acquisition of our mineral property. We have not earned any revenues as of the date of this prospectus. Potential investors should be aware of the difficulties

normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates.

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from development of the Lac Dube claims and the production of minerals from the claims, we will not be able to earn profits or continue operations.

There is limited history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

BECAUSE OF THE SPECULATIVE NATURE OF EXPLORATION OF MINING PROPERTIES, THERE IS A SUBSTANTIAL RISK THAT OUR BUSINESS WILL FAIL.

The search for valuable minerals as a business is extremely risky. We can provide investors with no assurance that our mineral claims contain economic mineralization or reserves of Uranium. Exploration for minerals is a speculative venture necessarily involving substantial risk. Our exploration of the Lac Dube claims may not result in the discovery of commercial quantities of copper, silver or gold. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we would be unable to complete our business plan.

BECAUSE OF THE INHERENT DANGERS INVOLVED IN MINERAL EXPLORATION, THERE IS A RISK THAT WE MAY INCUR LIABILITY OR DAMAGES AS WE CONDUCT OUR BUSINESS.

7

The search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. The payment of such liabilities may have a material adverse effect on our financial position.

EVEN IF WE DISCOVER RESERVES OF URANIUM ON THE LAC DUBE CLAIMS, WE MAY NOT BE ABLE TO SUCCESSFULLY DEVELOP THE LAC DUBE CLAIMS.

The Lac Dube claims do not contain any confirmed bodies of mineralization. If our exploration programs are successful in establishing minerals of commercial tonnage and grade, we will require additional funds in order to further develop the property. At this time, we cannot assure investors that we will be able to obtain such financing.

WE NEED TO CONTINUE AS A GOING CONCERN IF OUR BUSINESS IS TO SUCCEED.

Our independent accountant’s report to our audited financial statements for the period ended March 31, 2008, indicates that there are a number of factors that raise substantial doubt about our ability to continue as a going concern. Such factors identified in the report are our accumulated deficit since inception, our failure to attain profitable operations and our dependence upon obtaining adequate financing to pay our liabilities. If we are not able to continue as a going concern, it is likely investors will lose their investments.

IF WE BECOME SUBJECT TO BURDENSOME GOVERNMENT REGULATION OR OTHER LEGAL UNCERTAINTIES, OUR BUSINESS WILL BE NEGATIVELY AFFECTED.

There are several governmental regulations that materially restrict mineral property exploration and development. Under British Columbia mining law, to engage in certain types of exploration will require work permits, the posting of bonds, and the performance of remediation work for any physical disturbance to the land. While these current laws do not affect our current exploration plans, if we proceed to commence drilling operations on the Lac Dube claims, we will incur modest regulatory compliance costs.

In addition, the legal and regulatory environment that pertains to the exploration of ore is uncertain and may change. Uncertainty and new regulations could increase our costs of doing business and prevent us from exploring for ore deposits. The growth of demand for ore may also be significantly slowed. This could delay growth in potential demand for and limit our ability to generate revenues. In addition to new laws and regulations being adopted, existing laws may be applied to mining that have not as yet been applied. These new laws may increase our cost of doing business with the result that our financial condition and operating results may be harmed.

BECAUSE MANAGEMENT HAS NO TECHNICAL EXPERIENCE IN MINERAL EXPLORATION, OUR BUSINESS HAS A HIGHER RISK OF FAILURE.

Our directors do not have any technical training in the field of geology. As a result, we may not be able to recognize and take advantage of potential acquisition and exploration opportunities in the sector without the aid of qualified geological consultants. As well, with no direct training or experience, our management may not be fully aware of the specific requirements related to working in this industry. Their decisions and choices may not be well thought out and our operations and ultimate financial success may suffer irreparable harm as a result.

BECAUSE OUR DIRECTORS HAVE OTHER BUSINESS INTERESTS, HE MAY NOT BE ABLE OR WILLING TO DEVOTE A SUFFICIENT AMOUNT OF TIME TO OUR BUSINESS OPERATIONS, CAUSING OUR BUSINESS TO FAIL.

Our president, Mr. Keating intends to devote 10 hours per week to our business affairs. It is possible that the demands on Mr. Keating from other obligations could increase with the result that he would no longer be able to devote sufficient time to the management of our business. In addition, Mr. Keating may not possess sufficient time for our business if the demands of managing our business increased substantially beyond current levels.

Risks Relating to Our Common Stock:

If A Market For Our Common Stock Does Not Develop, Shareholders May Be Unable To Sell Their Shares.

There is currently no market for our common stock and we can provide no assurance that a market will develop. We currently plan to apply for listing of our common stock on the over the counter bulletin board upon the effectiveness of the registration statement, of which this prospectus forms a part. However, we can provide investors with no assurance that our shares will be traded on the bulletin board or, if traded, that a public market will materialize. If no market is ever developed for our shares, it will be difficult for shareholders to sell their stock. In such a case, shareholders may find that they are unable to achieve benefits from their investment.

If We Fail to Remain Current in Our Reporting Requirements, We Could be Removed From the OTC Bulletin Board Which Would Limit the Ability of Broker-Dealers to Sell Our Securities and the Ability of Stockholders to Sell Their Securities in the Secondary Market.

Companies trading on the OTC Bulletin Board, such as us, must be reporting issuers under Section 12 of the Securities Exchange Act of 1934, as amended, and must be current in their reports under Section 13, in order to maintain price quotation privileges on the OTC Bulletin Board. If we fail to remain current on our reporting requirements, we could be removed from the OTC Bulletin Board. As a result, the market liquidity for our securities could be severely adversely affected by limiting the ability of broker-dealers to sell our securities and the ability of stockholders to sell their securities in the secondary market.

Authorization of preferred stock.

Our Certificate of Incorporation authorizes the issuance of up to 5,000,000 shares of preferred stock with designations, rights and preferences determined from time to time by its Board of Directors. Accordingly, our Board of Directors is empowered, without stockholder approval, to issue preferred stock with dividend, liquidation, conversion, voting, or other rights which could adversely affect the voting power or other rights of the holders of the common stock. In the event of issuance, the preferred stock could be utilized, under certain circumstances, as a method of discouraging, delaying or preventing a change in control of the Company. Although we have no present intention to issue any shares of our authorized preferred stock, there can be no assurance that the Company will not do so in the future.

9

The Shares are an illiquid investment and transferability of the Shares is subject to significant restriction

There are substantial restrictions on the transfer of the Shares. Therefore, the purchase of the Shares must be considered a long-term investment acceptable only for prospective investors who are willing and can afford to accept and bear the substantial risk of the investment for an indefinite period of time. There is not a public market for the resale of the Shares. A prospective investor, therefore, may not be able to liquidate

its investment, even in the event of an emergency, and Shares may not be acceptable as collateral for a loan.

Our Common Stock is Subject to the "Penny Stock" Rules of the SEC and the Trading Market in Our Securities is Limited, Which Makes Transactions in Our Stock Cumbersome and May Reduce the Value of an Investment in Our Stock.

The Securities and Exchange Commission has adopted Rule 15g-9 which establishes the definition of a "penny stock," for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require:

| | |

| · | that a broker or dealer approve a person's account for transactions in penny stocks; and |

| · | the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. |

In order to approve a person's account for transactions in penny stocks, the broker or dealer must:

| | |

| · | obtain financial information and investment experience objectives of the person; and |

| · | make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. |

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the Commission relating to the penny stock market, which, in highlight form:

| | |

| · | sets forth the basis on which the broker or dealer made the suitability determination; and |

| · | that the broker or dealer received a signed, written agreement from the investor prior to the transaction. |

Generally, brokers may be less willing to execute transactions in securities subject to the "penny stock" rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

10

ITEM 2: PROPERTIES.

We maintain our principal office at 2818 Hamilton Parkway, Brooklyn, New York 11218. Our telephone number is (347)834-7118. These facilities are provided at no charge as a temporary office and mailing address by a officer and director.

We own a 100% interest in the mining claims comprising the Lac Dube claims, located approximately 200 km northwest and 65-70 km northeast of Montreal and Mont-Laurier, respectively. The property, which consists of 16 contiguous mining claims (940.04 ha), is situated in the Franchere Township (NTS Map 31J/15) in southwestern Quebec.

We purchased these claims from Mr. Michael Carr of Calgary, Alberta for a cash payment of $ 6,500 and 500,000 shares of our common stock at a price of $0.001 per share ($500) for a total price of $7,000.

ITEM 3: LEGAL PROCEEDINGS

From time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. However, litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business. We are currently not aware of any such legal proceedings or claims that we believe will have, individually or in the aggregate, a material adverse affect on our business, financial condition or operating results.

ITEM 4: SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

None.

PART II

ITEM 5: MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

OTC Bulletin Board Considerations

The Company’s common stock is currently traded on the Over the Counter Bulletin Board (“OTCBB”). To be quoted on the OTCBB, a market maker must file an application on our behalf in order to make a market for our common stock. Trading of our common stock is limited.

52 Week Low $0.25 High: $1.35

Holders

As of March 31, 2009, the approximate number of stockholders of record of the Common Stock of the Company was 38.

Dividends

We have not declared any dividends.

Equity Compensation Plan Information

We do not have any equity compensation plan as of the date of this report.

11

Recent sales of unregistered securities

On January 11, 2007 we issued 600,000 shares of our common stock to Mr. David Keating and in November, 2007, 500,000 shares of our common stock to Mr. Mathew Elsner. Mr. Keating is our president and Chief Executive Officer, our Treasurer and Principal Accounting Officer and director and Mr. Elsner is our Secretary and Director. Mr. Keating and Mr. Elsner acquired these shares at a deemed price of $0.001 per share for total amount $1,100.00 for the time, effort and expense of organizing the company. These shares were issued pursuant to Section 4(2) and Regulations S of Rule 506 of the Securities Act of 1933 (the "Securities Act") and are restricted shares as defined in the Securities Act.

We completed an offering of 3,500,000 shares of our common stock at a price of $0.01 per share to the following 35 purchasers in November, 2007.

We issued 500,000 shares of our common stock to Mr. Michael Carr at a price of $0.01 on March 19, 2007 as partial payment for our Lac Dube claims.

Item 6: Selected Financial Data

Not applicable.

Item 7: Management’s Discussion And Analysis Of Financial Condition And Results Of Operations

The following information should be read in conjunction with the consolidated financial statements and the notes thereto contained elsewhere in this report. The Private Securities Litigation Reform Act of 1995 provides a "safe harbor" for forward-looking statements. Information in this Item 7, "Management's Discussion and Analysis or Plan of Operation," and elsewhere in this 10-K that does not consist of historical facts, are "forward-looking statements." Statements accompanied or qualified by, or containing words such as "may," "will," "should," "believes," "expects," "intends," "plans," "projects," "estimates," "predicts," "potential," "outlook," "forecast," "anticipates," "presume," and "assume" constitute forward-looking statements, and as such, are not a guarantee of future perform ance. The statements involve factors, risks and uncertainties including those discussed in the “Risk Factors” section contained elsewhere in this report, the impact or occurrence of which can cause actual results to differ materially from the expected results described in such statements. Risks and uncertainties can include, among others, fluctuations in general business cycles and changing economic conditions; changing product demand and industry capacity; increased competition and pricing pressures; advances in technology that can reduce the demand for the Company's products, as well as other factors, many or all of which may be beyond the Company's control. Consequently, investors should not place undue reliance on forward-looking statements as predictive of future results. The Company disclaims any obligation to update the forward-looking statements in this report.

Overview

Prices of base metals (copper, lead, zinc, etc.) are at historic highs. Gold, silver and platinum are at their highest prices in years. Uranium is currently over $95.00 per pound. Mining prospects that a few years ago would be rejected are now economically feasible. Exploration for minerals all over the world has opened new areas for investigation.

12

We intend to commence operations as an exploration stage mineral exploration company. As such, there is no assurance that a commercially viable mineral deposit exists on our sole mineral property interest, the Lac Dube claims. Further exploration will be required before a final evaluation as to the economic and legal feasibility of the Lac Dube claims is determined.

We will be engaged in the acquisition, and exploration of mineral properties with a view to exploiting any mineral deposits we discover that demonstrate economic feasibility. We acquired a 100% undivided right, title and interest in and to several mineral claims located in the Laurentides Region near Mont Laurier, Quebec, as filed for record with Quebec Resources Naturelles et Faune:

In order to acquire the claims, we paid $6,500 cash and 500,000 shares of our common stock to Mr. Michael Carr, the vendor of the property in an arm’s length transaction.

Our plan of operation is to determine whether the Lac Dube claims contain reserves of Uranium, gold and/or silver that are economically recoverable. The recoverability of amounts from the property will be dependent upon the discovery of sufficient reserves, confirmation of necessary financing to satisfy the expenditure requirements under the property agreement and to complete the development of the property and upon future profitable production or proceeds for the sale thereof.

Even if we complete our proposed exploration programs on the Lac Dube claims and they are successful in identifying a mineral deposit, we will have to spend substantial funds on further drilling and engineering studies before we will know if we have a commercially viable mineral deposit.

Lac Dube Claims Purchase Agreement

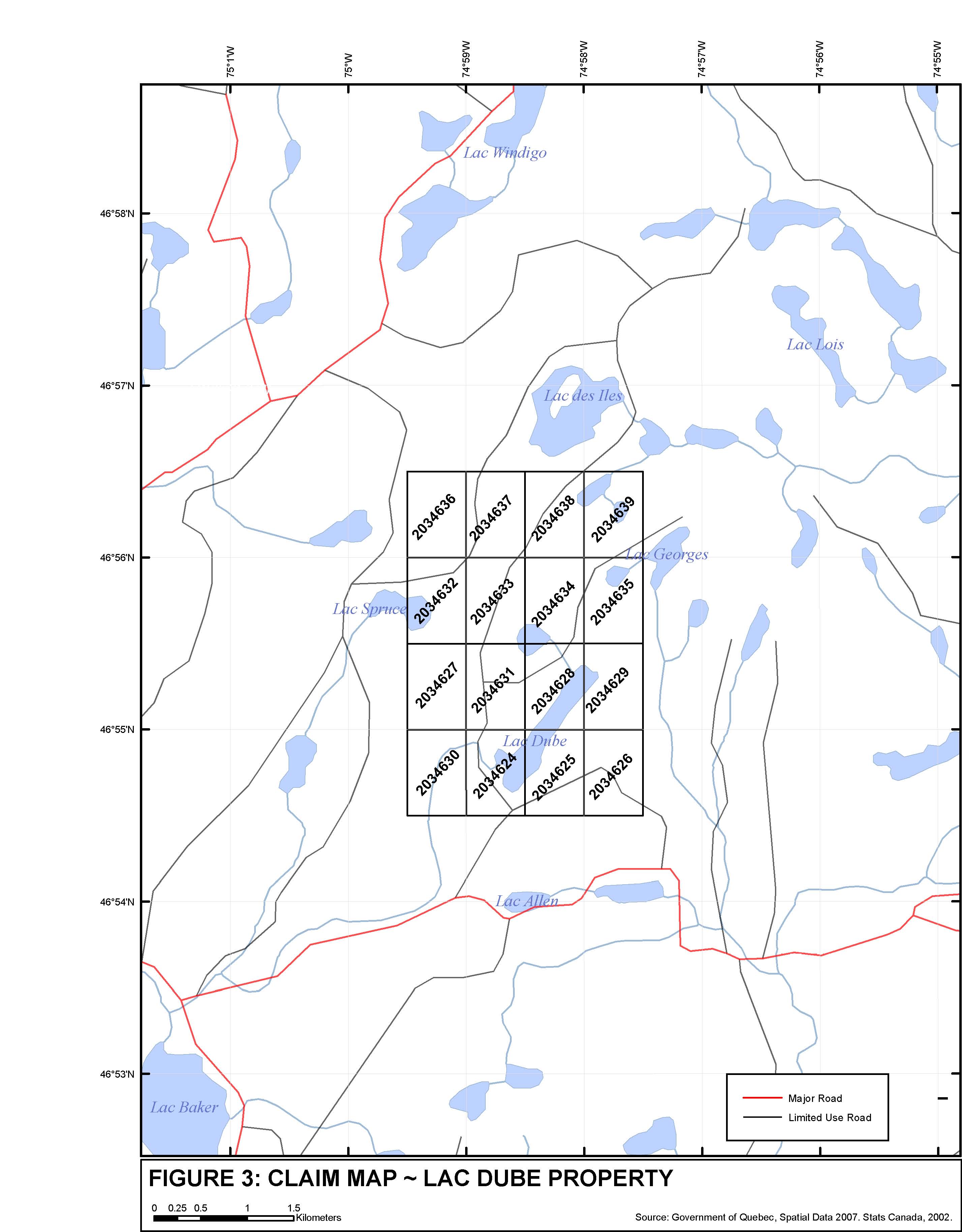

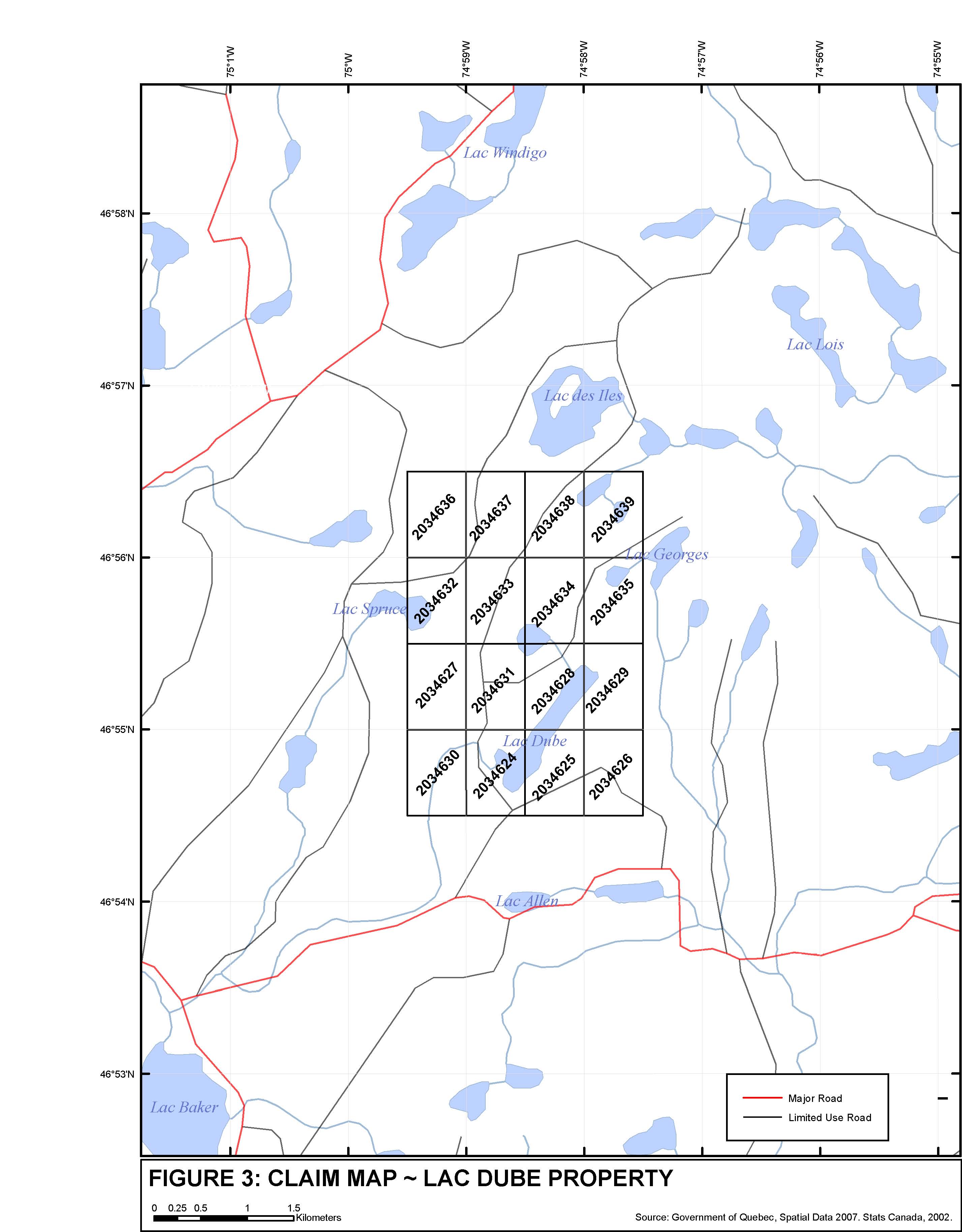

On March 19, 2007, we entered into an agreement with Mr. Michael Carr of Calgary, Alberta, Canada, whereby he agreed to sell us a total of 16 claim units comprising a large block of mineral claims located 200 km northwest of Montreal and 65-70 km northeast of a small city, Mont-Laurier (Figure 1 and 2). It is centered on Latitude 46°55¢30²North and Longitude 74°58¢30²West and occurs within NTS Map sheet 31J/15.

We agreed to have Mr. Carr hold these claims in trust on our behalf for the sum of $6,500 and 500,000 shares of our restricted stock for a 100% undivided right, title and interest in and to these claims.

Title to the Lac Dube claims

The Lac Dube claims consist of one large block of mineral claims covering an area of 940.04 hectares (2,323 acres). A “mineral claim” refers to a specific section of land over which a title holder owns rights to exploration to ground. Such rights may be transferred or held in trust. The claims comprising the Lac Dube claims are registered 100% in the name of Ridgestake Resources. These claims will only be valid as long as we spend a minimum of $1,200 in exploration work on each one each year. The minimum expenditure on our group of claims must be made on or before November 23, 2008.

13

If Michael Carr, as trustee, becomes bankrupt or transfers the claims to a third party, we may incur significant legal expenses in enforcing our interest in the claims in Quebec courts.

The registration of the claims in the name of a trustee does not impact a third party’s ability to commence an action against us respecting the Lac Dube claims or to seize the claims after obtaining judgment.

List of Claims – Lac Dube Property

-----------------------------------------------------------------------------------------------------------

NTS Sheet

Claim #

Area

Work Required

Expiry Date

(CDC)

(ha)

(CDN$)

-----------------------------------------------------------------------------------------------------------

31J/15

203 4624

58.76

1,200.00

Nov 23, 2008

31J/15

203 4625

58.76

1,200.00

Nov 23, 2008

33J/15

203 4626

58.76

1,200.00

Nov 23, 2008

31J/15

203 4627

58.76

1,200.00

Nov 23, 2008

31J/15

203 4628

58.76

1,200.00

Nov 23, 2008

31J/15

203 4629

58.76

1,200.00

Nov 23, 2008

31J/15

203 4630

58.76

1,200.00

Nov 23, 2008

31J/15

203 4631

58.76

1,200.00

Nov 23, 2008

31J/15

203 4632

58.75

1,200.00

Nov 23, 2008

31J/15

203 4633

58.75

1,200.00

Nov 23, 2008

31J/15

203 4634

58.75

1,200.00

Nov 23, 2008

31J/15

203 4635

58.75

1,200.00

Nov 23, 2008

31J/15

203 4636

58.74

1,200.00

Nov 23, 2008

31J/15

203 4637

58.74

1,200.00

Nov 23, 2008

31J/15

203 4638

58.74

1,200.00

Nov 23, 2008

31J/15

203 4639

58.74

1,200.00

Nov 23, 2008

-----------------------------------------------------------------------------------------------------------

TOTALS:

16 Claims

940.04

19,200.00

-----------------------------------------------------------------------------------------------------------

Description, Location and Access

The property is located approximately 200 km northwest of Montreal and 65-70 km northeast of a small city, Mont-Laurier (Figure 1 and 2). It is centered on Latitude 46°55¢30²North and Longitude 74°58¢30²West and occurs within NTS Map sheet 31J/15.

14

The property is easily accessible by provincial highways and paved roads from major centers of Quebec and Quebec (Figure 2). For example from Montreal, highways 15 and 117, and from Ottawa-Hull area, highways 309 and 311 are used to reach the city of Mont-Laurier, which is located 65-70 km southwest of Lac Dube property. From Mont-Laurier, the two paved roads (highways 309 and 311) linking the two logging/gravel roads (Chemin des Pionniers and Rivere du Lievre) can be used to access the northwestandsouth ends of the property. Several secondary but drivable logging roads and ATV trails, originating from these major logging roads, allow access to most of the claims.

Mont-Laurier is the closest full service community providing excellent infrastructure and skilled manpower. In addition to this city, two small farming communities of Lac St. Paul and Mont St. Michel, located approximately 25 and 20 kilometers southwest of the property, respectively, could also be used for a short term exploration base. A pair of high voltage power lines passing just few kilometers east of Lac Dube property.

15

QUEBEC

16

FIGURE 3

Claims Map

17

Mineralization and Exploration History

The Mont-Laurier area first experienced uranium exploration in 1956. However, it was not until 1967, when a prospector, Mr. L. Lavoie, collected a sample that yielded 2 pounds/ton U3O8 (1000 ppm) on the property presently held by Nova Uranium Corporation (Moore and Harris 2005), located few kilometers west of current Lac Dube property.

Following the uranium discovery, numerous exploration companies and individuals started the staking rush to acquire grounds in the area. The most active exploration and development work after the discovery was conducted from late 60’s to 70’s by Canadian Johns Manville Company Ltd. who explored the discovery area (also known as Mekoos area) in detail. Other companies, who also conducted significant work from early 70’s to mid-80 in the area, include Mont-Laurier Uranium Corp., Allied Mining Corp., Gulf Minerals Canada Ltd., Seneca Development Ltd., United Asbestos Corp., Perodeau Mining Inc. and Soquem. These companies and other individuals carried out exploration programs that included ground scintillometre prospecting, ground and airborne magnetic and radiometric surveys, line cutting, geological mapping, stream sediments and soil geochemical surveys, bulk sampling, trenching and diamond drilling.

The majority of historical work by these companies was concentrated in Leman Township that resulted into discoveries of Hanson Lake, Tom Dick, JRB-4 and few other prospects and numerous occurrences. Adjacent Franchere Township, host to current Lac Dube property, also experienced fair amount of exploration work by companies, such as Gulf Minerals Canada Ltd., Canadian Johns Manville and Bomet Mines Ltd., but no significant uranium mineralization was discovered.

Geological Report: Lac Dube claims

We have obtained a geological report on the Lac Dube claims that was prepared by Ike A. Osmani, M.Sc., P.Geo., Coast Mountain Geological Ltd., Vancouver, BC. In his report, Mr. Osami reports that the Lac Dube claims have no history of Uranium deposits but due to very little exploration on this property, further work should be done.

We do not have an agreement with Mr. Osami to provide further geological services for planned exploration work on the Lac Dube claims.

Compliance with Government Regulation

We will be required to comply with all regulations, rules and directives of governmental authorities and agencies applicable to the exploration of minerals in Canada generally, and in the province of Quebec, specifically. Under these laws, prior to production, we have the right to explore the property, subject only to a notice of work. We would avoid having to post a bond required if we do not significantly disturb the surface of the land.

In addition, production of minerals in the province of Quebec requires prior approval of applicable governmental regulatory agencies. This would almost certainly require a feasibility study and an environmental impact report. We can provide no assurance to investors that such approvals will be obtained. The cost and delay involved in attempting to obtain such approvals cannot be known at this time.

18

We will have to sustain the cost of reclamation and environmental mediation for all exploration and development work undertaken. The amount of these costs is not known at this time as we do not know the extent of the program that will be undertaken beyond completion of the currently planned work programs. Because there is presently no information on the size, tenor, or quality of any resource or reserve at this time, it is impossible to assess the impact of any capital expenditures on earnings or our competitive position in the event a potentially economic deposit is discovered.

If we enter into production, the cost of complying with permit and regulatory environment laws will be greater than in the exploration phases because the impact on the project area is greater. Permits and regulations will control all aspects of any production program if the project continues to that stage because of the potential impact on the environment. Examples of regulatory requirements include:

-

Water discharge will have to meet water standards;

-

Dust generation will have to be minimal or otherwise re-mediated;

-

Dumping of material on the surface will have to be re-contoured and re-vegetated;

-

An assessment of all material to be left on the surface will need to be environmentally benign;

-

Ground water will have to be monitored for any potential contaminants;

-

The socio-economic impact of the project will have to be evaluated and if deemed negative, will have to be re-mediated; and

-

There will have to be an impact report of the work on the local fauna and flora.

During the initial phases of exploration, there will be no significant costs of compliance with government regulations.

Liquidity and Capital Resources

The Company will need additional investments in order to continue operations. Additional investments are being sought, but the Company cannot guarantee that it will be able to obtain such investments. Financing transactions may include the issuance of equity or debt securities, obtaining credit facilities, or other financing mechanisms. The recent downturn in the U.S. stock and debt markets could make it more difficult to obtain financing through the issuance of equity or debt securities. Even if the Company is able to raise the funds required, it is possible that it could incur unexpected costs and expenses, fail to collect significant amounts owed to it, or experience unexpected cash requirements that would force it to seek alternative financing. Further, if the Company issues additional equity or debt securities, stockholders may experience additional dilution or the new equity securities may have rights, preferences or privileges senior to those of exi sting holders

19

Results of Operations

For the year ended January 31, 2009, compared to the year March 31, 2009.

Revenues

Revenues for the year ended March 31, 2009, and 2008 were $-0- and $-0-, respectively, reflecting our startup nature.

General and Administrative Expenses

General and administrative expenses for the year ended March 31, 2009, and 2008 were $14,106 and $24,617, respectively. General and administrative expenses consisted primarily of accounting and filing fees.

Net Loss

Our net loss for the year ended March 31, 2009, and 2008, amounted to ($40,323) and ($26,217), respectively.

From January 11, 2007 (Date of Inception) through March 31, 2009

Revenues

We have not earned any revenues from our incorporation on October 19, 2006 to March 31, 2009. We do not anticipate earning revenues until, if and when we drill, complete and produce from our first successful well.

Operating Expenses

We incurred operating expenses in the amount of $35,273for the period from our inception on January 11, 2007 to March 31, 2009. These operating expenses were comprised of exploration costs of 19,582 and general and administrative expenses of $15,691

Net Loss

Our net loss for the period from our inception on January 11, 2007 to March 31, 2009 was $35,273.

We have not attained profitable operations and are dependent upon obtaining financing to pursue exploration activities. For these reasons our auditors believe that there is substantial doubt that we will be able to continue as a going concern.

Operations Plans

1.

Construction of a grid, at 100 m line spacing, in selected areas, for example, the southwestern and northwestern parts of the property.

2. Ground magnetic and radiometric surveys over the newly cut grid as stated above.

20

3. Prospecting and extensive sampling for uranium mineralization to be carried out over the entire property but greater emphasis should be given in the areas of favorable geophysical anomalies. Although no rare metal occurrence (e.g., niobium, tantalum and lithium) has been reported to date on the property or in the general area, it is recommended here that selected pegmatite samples, especially those containing two-mica (biotite and muscovite) pegmatites, should also be analyzed for these metals. The uranium-bearing pegmatites are often enriched in rare metals.

4. Bedrock mapping, at a scale of 1:5,000 or 1:10,000, over the entire property with emphasis on structural aspects of the survey is recommended. The bedrock mapping should also be accompanied with selected sampling for whole rock and trace element analyses.

4.

A second phase of exploration program, including diamond drillingshould follow if positive results were achieved from the works stated in recommendations 1 to 4.

BUDGET

PHASE I

Line cutting (grid construction)………………………………………………$17,500

@$350/line-km x 50 line-km @100m spacing

Ground magnetometer survey………………………………………………..$5,000

(@$100/line-km x 50 km)

Ground radiometric Survey…………………………………………………...$5,000

Contingency (10%)…………………………………………………………....$2,750

Total………………………………………………………………………..….$30,000

PHASE II

Prospecting (15 days)…………………………………………………….….$25,000

(wages for two prospectors + accommodations,

meals, fuel and supplies)

Assays……………………………………………………………………….. $3,000

Contingency (10%)……………………………………………………… …..$2,800

Total……………………………………………………………………………$30,800

PHASE III

Geological mapping (20 days)……………………………………...……….$30,000

(wages for one project geologist and two assistants +

accommodations, meals, vehicles, fuel and supplies)

Assays and whole rock analyses……………………………………………..$3,000

Reports and maps…………………………………………………………..….$8,000

21

Contingency (10%)………………………………………………………….....$4,100

Total…………………………………………………………………………...$45,100

GRAND TOTAL (Phase I, II and III)……………………………………...$105,900

Our cash reserves are not sufficient to meet our obligations for the next twelve-month period. As a result, we will need to seek additional funding in the near future. We currently do not have a specific plan of how we will obtain such funding; however, we anticipate that additional funding will be in the form of equity financing from the sale of our common stock. Our management is prepared to provide us with short-term loans, although no such arrangement has been made. At this time, we cannot provide investors with any assurance that we will be able to raise sufficient funding from the sale of our common stock or through a loan from our directors to meet our obligations over the next twelve months. We do not have any arrangements in place for any future equity financing. Management feels that having our shares quoted on the OTC Bulletin Board quotation system may make attracting further capital easier.

We have not and do not intend to seek debt financing by way of bank loan, line of credit or otherwise. Financial institutions do not typically lend money to mineral exploration companies with no stable source of revenue.

If we do not secure additional funding for exploration expenditures, we may consider seeking an arrangement with a joint venture partner that would provide the required funding in exchange for receiving a part interest in the Lac Dube claims. We have not undertaken any efforts to locate a joint venture partner. There is no guarantee that we will be able to locate a joint venture partner who will assist us in funding exploration expenditures upon acceptable terms. We may also pursue acquiring interests in alternate mineral properties in the future.

ITEM 8: FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

The Reports of Registered Public Independent Accounting Firms, our Consolidated Financial Statements and Notes thereto appear in a separate section of this Form 10-K (beginning on Page F-1 following Part IV). The index to our Consolidated Financial Statements is included in Item 15.

ITEM 9: CHANGES AND DISAGREEMENTS WITH ACCOUNTANTS AND FINANCIAL DISCLOSURE

None.

22

ITEM 9A: CONTROLS & PROCEDURES

MANAGEMENT’S REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING

Our management, with the participation of our chief executive officer and chief financial officer, evaluated the effectiveness of our disclosure controls and procedures as defined in Rules 13a-15(e) and 15d-15(e) and pursuant to Rules 13a-15(b) and 15d-15(b) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) as of June 30, 2008. In designing and evaluating the disclosure controls and procedures, management recognizes that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objectives. In addition, the design of disclosure controls and procedures must reflect the fact that there are resource constraints and that management is required to apply its judgment in evaluating the benefits of possible controls and procedures relative to their costs.

Based on our evaluation, our chief executive officer and chief financial officer concluded that our disclosure controls and procedures are designed at a reasonable assurance level and were fully ineffective as of March 31, 2009 in providing reasonable assurance that information we are required to disclose in reports that we file or submit under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in Securities and Exchange Commission rules and forms, and that such information is accumulated and communicated to our management, including our chief executive officer and chief financial officer, as appropriate, to allow timely decisions regarding required disclosure.

Changes In Internal Control Over Financial Reporting.

We regularly review our system of internal control over financial reporting and make changes to our processes and systems to improve controls and increase efficiency, while ensuring that we maintain an effective internal control environment. Changes may include such activities as implementing new, more efficient systems, consolidating activities, and migrating processes.

There were no changes in our internal controls over financial reporting (as such term is defined under Rules 13a-15(f) and 15d-15(f) under the Exchange Act) that occurred during the period covered by this report on Form 10-Q that has materially affected, or is reasonably likely to materially affect our internal control over financial reporting.

23

PART III

ITEM 10: DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Directors and Executive Officers:

Directors, Executive Officers, Promoters and Control Persons

Our executive officers and directors and their respective ages as of the date of this prospectus are as follows:

Name of Director

Age

David Keating

38

Mathew Elsner

37

Executive Officers:

Name of Officer

Office

David Keating

President, Treasurer, Chief Executive Officer and Principal Accounting Officer

Mathew Elsner

Secretary

Set forth below is a brief description of the background and business experience of each of our executive officers and directors for the past five years.

David Keating, President, Treasurer Chief Executive Officer and Principal Accounting Officer

6/09 – Present Partner/Manager restaurant, Brooklyn, NY

1/05 – 6/09 PHOENIX/BEEHIVE BEVERAGES, Long Island City, NY

Sales Representative

.

8/03 – 3/04 UNION PLANTERS BANK, Ft. Lauderdale, FL

Vice President, Business Banking Relationship Manager

.

3/03 – 8/03 FLEETBOSTON FINANCIAL CORPORATION, Boca Raton, FL

Vice President, Business Development Advisor

24

Mathew Elsner, Secretary

EDUCATION:

9/02 – 5/04

BARUCH COLLEGE, Zicklin School of Business, New York, NY

Full-Time Honors Program

Master of Business Administration, June 2004

Concentration: Marketing

·

Jack Nash Scholar – 3.7 GPA (4.0 GPA for marketing coursework)

·

Founder and President,Corporate Responsibility, Ethics, and Governance Association

·

Co-author,Baruch Student Guide to Academic Integrity

NEW YORK UNIVERSITY, College of Arts and Sciences

New York, NY

Bachelor of Arts, May 1995

Concentrations: International Politics, History

·

Dean’s List

11/07 – PRES.

INDEPENDENT CONSULTANT (MARKETING AND MANAGEMENT)

7/07 – 11/07

PR NEWS WIRE

7/06 – 7/07

INDEPENDENT CONSULTANT (MARKETING)

7/04 – 7/06

SHOWTIME NETWORKS INC.

Senior Manager, Point of Sale Marketing/Training

12/03-5/04

INTERNATIONAL CENTER FOR CORPORATE ACCOUNTABILITY, INC.

New York, NY

Senior Research Associate

6/03-8/03

PEACEWORKS, LLP.

New York, NY

Public Relations/Marketing Maven (Summer MBA Internship)

Term of Office

Our directors have been appointed for a one-year term to hold office until the next annual general meeting of our shareholders or until removed from office in accordance with our bylaws. Our officers are appointed by our board of directors and hold office until removed by the board.

25

Security Ownership of Certain Beneficial Owners And Management

The following table provides the names and addresses of each person known to us to own more than 5% of our outstanding common stock as of the date of this prospectus, and by the officers and directors, individually and as a group as at July 21, 2004. Except as otherwise indicated, all shares are owned directly.

Title of Name and address beneficial Percent

Class of beneficial owner ownership of class

| | | |

Common | David Keating 2818 Fort Hamilton Parkway Brooklyn, NY 11218 | 600,000 | 11.76 |

| | | |

Common | Mathew Elsner 92 Newel Street Brooklyn, NY | 500,000 | 9.80 |

The percent of class is based on 5,100,000 shares of common stock issued and outstanding as of the date of this prospectus.

All directors are elected to serve until the next annual meeting of stockholders and until their successors are elected and qualified.

Officers are elected by the Board of Directors and serve until their successors are appointed.

Code of Ethics

We have not adopted a code of ethics that applies to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. We have not adopted such a code of ethics because all of management's efforts have been directed to building the business of the Company. A code of ethics may be adopted by the board of directors at a later date.

Committees of the Board of Directors

We presently do not have any committees of the Board of Directors. However, our board of directors intends to establish various committees at a later time.

26

ITEM 11: EXECUTIVE COMPENSATION

The following table sets forth certain information regarding the named executive officers for the fiscal years ended October 31, 2007 and March 31, 2009.

| | | | | | | | | |

Name and Principal Position (1) | Fiscal Year | Annual Salary ($) | Annual Bonus ($) | Stock Awards ($) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Change in Pension Value and Non-qualified Deferred Compensation ($) | All Other Compensation | Total ($) (4) |

David Keating CEO, President, Director | 2008 | -0- | -0- | -0- | -0- | -0- | -0- | -0- | -0- |

2007 | -0- | -0- | -0- | -0- | -0- | -0- | -0- | -0- |

Mathew Elsner CFO, Director | 2008 | -0- | -0- | -0- | -0- | -0- | -0- | -0- | -0- |

The Company did not pay salaries to directors or officers during the 2007 and 2008 fiscal years. The also company did not grant any plan-based compensation awards during the 2007 or 2008 fiscal year.

ITEM 13: CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

There have been no transactions, or proposed transactions, which have materially affected or will materially affect us in which any director, executive officer or beneficial holder of more than 5% of the outstanding common stock, or any of their respective relatives, spouses, associates or affiliates, has had or will have any direct or material indirect interest. We have no policy regarding entering into transactions with affiliated parties.

ITEM 14: PRINCIPAL ACCOUNTING FEES AND SERVICES

Audit Fees

Our current independent registered public accounting firm billed us $3750.00 during the fiscal year ended March 31, 2008 and $3,500 during the fiscal year ended March 31, 2009 for audit related services.

Tax Fees

Our current independent registered public accounting firm billed us $0.00for tax related work during fiscal years ended March 31, 2009, and billed us $ 0.00 for tax related work during the fiscal year ended March 31, 2008.

27

PART IV

ITEM 15: EXHIBITS, FINANCIAL STATEMENTS AND SCHEDULES

| |

Exhibit No. | Description |

| |

3.1 | Articles of Incorporation (filed as exhibit to S-1 filed on June 2, 2008) |

3.2 | Bylaws of the Company (filed as exhibit to S-1 filed on June 2, 2008) |

10.1 | Claims Purchase Agreement (filed as exhibit to SB-1 filed on June 2, 2008) |

23.1 | Auditor’s consent |

31.1 | Certification of Chief Executive Officer pursuant to Rule 13a-14 and Rule 15d-14(a), promulgated under the Securities and Exchange Act of 1934, as amended. |

31.2 | Certification of Chief Financial Officer pursuant to Rule 13a-14 and Rule 15d 14(a), promulgated under the Securities and Exchange Act of 1934, as amended. |

32.1 | Certification pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 (Chief Executive Officer). |

32.2 | Certification pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 (Chief Financial Officer). |

SIGNATURES

In accordance with Section 13 or 15(d) of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

BRAZOS INTERNATIONAL EXPLORATION

___________________________

By: David J. Keating

Chairman, President and Chief Executive Officer

In accordance with the Exchange Act, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

July 7, 2009

BRAZOS INTERNATIONAL EXPLORATION, INC.

___________________________

By: David J. Keating

Chairman, President and Chief Executive Officer

28

MOORE & ASSOCIATES, CHARTERED

ACCOUNTANTS AND ADVISORS

PCAOB REGISTERED

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors

Brazos International Exploration, Inc.

(An Exploration Stage Company)

We have audited the accompanying balance sheets of Brazos International Exploration, Inc. (An Exploration Stage Company) as of March 31, 2009 and March 31, 2008, and the related statements of operations, stockholders’ equity (deficit) and cash flows for the years ended March 31, 2009 and March 31, 2008 and since inception on January 11, 2007 through March 31, 2009. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conduct our audits in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Brazos International Exploration, Inc. (An Exploration Stage Company) as of March 31, 2009 and March 31, 2008, and the related statements of operations, stockholders’ equity (deficit) and cash flows for the years ended March 31, 2009 and March 31, 2008 and since inception on January 11, 2007 through March 31, 2009, in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 5 to the financial statements, the Company has an accumulated deficit of $40,323, which raises substantial doubt about its ability to continue as a going concern. Management’s plans concerning these matters are also described in Note 5. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ Moore & Associates, Chartered

Moore & Associates, Chartered

Las Vegas, Nevada

July 13, 2009

6490 West Desert Inn Rd, Las Vegas, NV 89146 (702) 253-7499 Fax (702) 253-7501

BRAZOS INTERNATIONAL EXPLORATION, INC.

(AN EXPLORATION STAGE COMPANY)

BALANCE SHEETS

| | |

ASSETS | | |

| March 31, | March 31, |

| 2009 | 2008 |

| | |

Current Assets: | | |

Cash | $ 27 | $ 10,383 |

| | |

Total Assets | $ 27 | $ 10,383 |

| | |

| | |

LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) | | |

| | |

Current Liabilities: | | |

Accounts payable | 3,750 | - |

Total Current Liabilities | 3,750 | - |

| | |

Stockholders' Equity (Deficit): | | |

Preferred stock, $.001 par value; authorized 5,000,000, none issued | - | - |

Common stock, $.001 par value; 70,000,000 shares authorized | | |

5,100,000 sharers issued and outstanding | 5,100 | 5,100 |

Additional paid in capital | 31,500 | 31,500 |

Accumulated deficit during the development stage | (40,323) | (26,217) |

| | |

Total Stockholders' Equity (Deficit) | (3,723) | 10,383 |

| | |

Total Liabilities and Stockholders' Equity (Deficit) | $ 27 | $ 10,383 |

The accompanying notes are an integral part of these financial statements

F-1

BRAZOS INTERNATIONAL EXPLORATION, INC.

(AN EXPLORATION STAGE COMPANY)

STATEMENTS OF OPERATIONS

| | | |

| For the year | For the year | From |

| ended | ended | January 11, 2007 |

| March 31, | March 31, | (Date of inception) |

| 2009 | 2008 | to March 31, 2009 |

| | | |

Revenue: | $ - | $ - | $ - |

Total Revenue | - | - | - |

| | | |

Operating Expenses: | | | |

Exploration costs | 5,000 | 14,582 | 19,582 |

General & administrative | 9,106 | 10,535 | 15,691 |

Total Operating Expenses | 14,106 | 25,117 | 35,273 |

| | | |

NET LOSS | $ (14,106) | $ (25,117) | $ (35,273) |

| | | |

Weighted Average Shares | | | |

Common Stock Outstanding | 5,100,000 | 2,160,109 | |

| | | |

Net Loss Per Share | | | |

(Basic and Fully Dilutive) | $ (0.00) | $ (0.01) | |

The accompanying notes are an integral part of these financial statements

F-2

BRAZOS INTERNATIONAL EXPLORATION, INC.

(AN EXPLORATION STAGE COMPANY)

STATEMENTS OF CASH FLOWS

| | | |

| ended | ended | January 11, 2007 |

| March 31, | March 31, | (Date of inception) |

| 2009 | 2008 | to March 31, 2009 |

Operating Activities: | | | |

Net Loss | $ (14,106) | $ (25,117) | $ (35,273) |

Adjustments to reconcile net (loss) | | | |

to net cash | | | |

provided by operating activites: | | | |

Issuance of stock for services rendered | - | - | 1,100 |

Issuance of stock for exploration claims | - | 500 | 500 |

Increase (Decrease) in Accounts payable | 3,750 | | - |

| | | |

| | | |

| | | |

Net Cash Used in Operating Activities | (10,356) | (24,617) | (33,673) |

| | | |

Investing Activities: | - | - | - |

| | | |

Financing Activities: | | | |

Issuance of common stock for cash | - | 35,000 | 35,000 |

Net Cash Provided by Financing Activities | - | 35,000 | 35,000 |

| | | |

Net Increase (Decrease) in Cash | (10,356) | 10,383 | 1,327 |

| | | |

Cash at Beginning of Period | 10,383 | - | - |

| | | |

Cash at End of Year | $ 27 | $ 10,383 | $ 1,327 |

| | | |

Non-Cash Investing & Financing Activities | | | |

Issuance of stock for management services rendered | $ - | $ - | $ 1,100 |

Issuance of stock for claims purchase | $ - | $ 500 | $ 500 |

The accompanying notes are an integral part of these financial statements

F-3

BRAZOS INTERNATIONAL EXPLORATION, INC.

(AN EXPLORATION STAGE COMPANY)

STATEMENTS OF STOCKHOLDERS' EQUITY (DEFICIT)

FROM JANUARY 11, 2007 (DATE OF INCEPTION) TO MARCH 31, 2009

| | | | | | | | | | | | | | | | | | | | | | | |

| | | Preferred Stock | Common Stock | | | | | | | |

| | | 5,000,000 shares authorized | 70,000,000 shares authorized | Additional | Stock | |

| | Shares | Par Value | Share | Par Value | Paid-In | Subscription | (Deficit) | |

| | Issued | $.001 per share | Issued | $.001 per share | Capital | Receivable | accumulated during the exploration stage | Total |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

BALANCE- January 11,2007 (inception) | - | $ - | 1,100,000 | $ 1,100 | $ - | $ - | $ (1,100) | $ - |

| | | | | | | | | |

| Issuance of common stock for cash at $.01 per share | | | | | | | |

| December 12, 2007 | | | 3,500,000 | 3,500 | 31,500 | | | 35,000 |

| | | | | | | | | |

| Issuance of common stock for claims @ $0.001 per | | | | | | | | |

| share March 25, 2008 | | | 500,000 | 500 | - | | | 500 |

| | | | | | | | | |

| Net Income (loss) | | | | | | | (25,117) | (25,117) |

| | | | | | | | | |

BALANCE- March 31, 2008 | - | - | 5,100,000 | 5,100 | 31,500 | - | (26,217) | 10,383 |

| | | | | | | | | |

| Net Income (loss) | | | | | | | (14,106) | (14,106) |

| | | | | | | | | |

BALANCE- March 31 31, 2009 | - | - | 5,100,000 | 5,100 | 31,500 | - | (40,323) | (3,723) |

The accompanying notes are an integral part of these financial statements

F-4

BRAZOS INTERNATIONAL EXPLORATION, INC.

for the period ended March 31, 2009

an Exploration Stage Company

NOTES TO FINANCIAL STATEMENTS

NOTE 1 – NATURE AND PURPOSE OF BUSINESS

Brazos International Exploration, Inc. (the “Company”) was incorporated under the laws of the State of Nevada on January 11, 2007. The Company’s activities to date have been limited to organization and capital formation. The Company is (SFAS NO.7)“an exploration stage company” and has acquired a series of mining claims for exploration and formulated a business plan to investigate the possibilities of a viable mineral deposit. The Company has adopted March 31 as its fiscal year end.

NOTE 2 – NATURE OF SIGNIFICANT ACCOUNTING POLICIES

CASH AND CASH EQUIVALENTS

The Company considers all highly liquid debt instruments purchased with maturity of three months or less to be cash equivalents.

REVENUE RECOGNITION

The Company considers revenue to be recognized at the time the service is performed.

USE OF ESTIMATES

The preparation of the Company’s financial statements requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from these estimates.

FAIR VALUE OF FINANCIAL INSTRUMENTS

The Company’s short-term financial instruments consist of cash and cash equivalents and accounts payable. The carrying amounts of these financial instruments approximate fair value because of their short-term maturities. Financial instruments that potentially subject the Company to a concentration of credit risk consist principally of cash. During the year the Company did not maintain cash deposits at financial institution in excess of the $100,000 limit covered by the Federal Deposit Insurance Corporation. The Company does not hold or issue financial instruments for trading purposes nor does it hold or issue interest rate or leveraged derivative financial instruments.

ADVERTISING

As of March 31st/2009, we have incurred no advertising costs.

F-5

EARNINGS PER SHARE

Basic Earnings per Share (“EPS”) is computed by dividing net income available to common stockholders by the weighted average number of common stock shares outstanding during the year. Diluted EPS is computed by dividing net income available to common stockholders by the weighted-average number of common stock shares outstanding during the year plus potential dilutive instruments such as stock options and warrant. The effect of stock options on diluted EPS is determined through the application of the treasury stock method, whereby proceeds received by the Company based on assumed exercises are hypothetically used to repurchase the Company’s common stock at the average market price

F6

during the period. Loss per share is unchanged on a diluted basis since the assumed exercise of common stock equivalents would have an anti-dilutive effect.

INCOME TAXES:

The Company uses the asset and liability method of accounting for income taxes as required by SFAS No. 109 “Accounting for Income Taxes”. SFAS 109 requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of temporary differences between the carrying amounts and the tax basis of certain assets and liabilities. Deferred income tax assets and liabilities are computed annually for the difference between the financial statement and tax bases of assets and liabilities that will result in taxable or deductible amounts in the future, based on enacted tax laws and rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established when necessary to reduce deferred tax assets to the amount expected to be realized. Income tax expense is the tax payable or refundable for the period, plus or minu s the change during the period in deferred tax assets and liabilities.

Deferred income taxes may arise from temporary differences resulting from income and expanse items reported for financial accounting and tax purposes in different periods. Deferred taxes are

classified as current or non-current, depending on the classification of the assets and liabilities to which they relate. Deferred taxes arising from temporary differences that are not related to an

asset or liability are classified as current or non-current depending on the periods in which the temporary differences are expected to reverse. The Company had no significant deferred tax items arise during any of the periods presented.

CONCENTRATION OF CREDIT RISK:

The Company does not have any concentration of related financial credit risk.

RECENT ACCOUNTING PRONOUNCEMENTS:

The Company does not expect that the adoption of other recent accounting pronouncements will have a material impact to its financial statements.

F-6

Recent Accounting Pronouncements

In April 2009, the FASB issued FSP No. FAS 157-4, “Determining Fair Value When the Volume and Level of Activity for the Asset or Liability Have Significantly Decreased and Identifying Transactions That Are Not Orderly” (“FSP FAS 157-4”). FSP FAS 157-4 provides guidance on estimating fair value when market activity has decreased and on identifying transactions that are not orderly. Additionally, entities are required to disclose in interim and annual periods the inputs and valuation techniques used to measure fair value. This FSP is effective for interim and annual periods ending after June 15, 2009. The Company does not expect the adoption of FSP FAS 157-4 will have a material impact on its financial condition or results of operation.

In October 2008, the FASB issued FSP No. FAS 157-3, “Determining the Fair Value of a Financial Asset When the Market for That Asset is Not Active,” (“FSP FAS 157-3”), which clarifies application of SFAS 157 in a market that is not active. FSP FAS 157-3 was effective upon issuance, including prior periods for which financial statements have not been issued. The adoption of FSP FAS 157-3 had no impact on the Company’s results of operations, financial condition or cash flows.