|

Exhibit 99.1

|

Creditor Diligence Materials

December 2015

Draft Subject to Material Revision Subject to FRE 408 Highly Confidential

Draft Subject to Material Revision Subject to FRE 408 Disclaimer Highly Confidential

This document contains highly confidential information and is solely for informational purposes. You should not rely upon or use it to form the definitive basis for any decision or action whatsoever, with respect to any proposed transaction or otherwise. You and your affiliates and agents must hold this document and any oral information provided in connection with this document, as well as any information derived by you from the information contained herein, in strict confidence and may not communicate, reproduce or disclose it to any other person, or refer to it publicly, in whole or in part at any time except with our prior written consent. If you are not the intended recipient of this document, please delete and destroy all copies immediately.

This document is “as is” and is based, in part, on information obtained from other sources. Our use of such information does not imply that we have independently verified or necessarily agree with any of such information, and we have assumed and relied upon the accuracy and completeness of such information for purposes of this document. Neither we nor any of our affiliates or agents, make any representation or warranty, express or implied, in relation to the accuracy or completeness of the information contained in this document or any oral information provided in connection herewith, or any data it generates and expressly disclaim any and all liability (whether direct or indirect, in contract, tort or otherwise) in relation to any of such information or any errors or omissions therein. Any views or terms contained herein are preliminary, and are based on financial, economic, market and other conditions prevailing as of the date of this document and are subject to change. We undertake no obligations or responsibility to update any of the information contained in this document. Past performance does not guarantee or predict future performance.

This document does not constitute an offer to sell or the solicitation of an offer to buy any security, nor does it constitute an offer or commitment to lend, syndicate or arrange a financing, underwrite or purchase or act as an agent or advisor or in any other capacity with respect to any transaction, or commit capital, or to participate in any trading strategies, and does not constitute legal, regulatory, accounting or tax advice to the recipient. This document does not constitute and should not be considered as any form of financial opinion or recommendation by us or any of our affiliates. This document is not a research report nor should it be construed as such.

This document may include information from the S&P Capital IQ Platform Service. Such information is subject to the following: “Copyright © 2015, S&P Capital IQ (and its affiliates, as applicable). This may contain information obtained from third parties, including ratings from credit ratings agencies such as Standard & Poor’s. Reproduction and distribution of third party content in any form is prohibited except with the prior written permission of the related third party. Third party content providers do not guarantee the accuracy, completeness, timeliness or availability of any information, including ratings, and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such content. THIRD PARTY CONTENT PROVIDERS GIVE NO EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. THIRD PARTY CONTENT PROVIDERS SHALL NOT BE LIABLE FOR ANY DIRECT, INDIRECT, INCIDENTAL, EXEMPLARY, COMPENSATORY, PUNITIVE, SPECIAL OR CONSEQUENTIAL DAMAGES, COSTS, EXPENSES, LEGAL FEES, OR LOSSES (INCLUDING LOST INCOME OR PROFITS AND OPPORTUNITY COSTS OR LOSSES CAUSED BY NEGLIGENCE) IN CONNECTION WITH ANY USE OF THEIR CONTENT, INCLUDING RATINGS. Credit ratings are statements of opinions and are not statements of fact or recommendations to purchase, hold or sell securities. They do not address the suitability of securities or the suitability of securities for investment purposes, and should not be relied on as investment advice.”

Copyright © 2015, PJT Partners LP (and its affiliates, as applicable). 1

Draft Subject to Material Revision Subject to FRE 408 Disclaimer Highly Confidential

Forward-Looking Statements

In this presentation, all statements that are not purely historical facts are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements may be identified by the words “believe,” “expect,” “anticipate,” “project,” “plan,” “estimate,” “intend” and other similar expressions. Forward-looking statements are based on currently available business, economic, financial and other information and reflect the current beliefs, expectations and views of the management team of Verso Corporation (the “Company”) with respect to future developments and their potential effects on the Company. Actual results could vary materially depending on risks and uncertainties that may affect the Company and its business. For a discussion of the risks and uncertainties affecting the Company and its business, please refer to the risks and uncertainties identified elsewhere in this presentation as well as those discussed in the

Company’s filings with the Securities and Exchange Commission. Neither the Company nor PJT assume any obligation to update forward-looking statements made in this presentation to reflect subsequent events or circumstances or actual outcomes.

Non-GAAP Measures

In this presentation, “EBITDA,” “Adjusted EBITDA” and “Adjusted EBITDA margin” are financial measures not prepared in accordance with U.S. GAAP. This confidential presentation does not contain a reconciliation to GAAP financial measures. Information in this presentation is preliminary and may be subject to further revision.

Draft Subject to Material Revision Subject to FRE 408 Highly Confidential

I Introduction 4 II General Market Overview 8 III Company Overview 16 IV Mill Overview 19 V Recent Performance & Historical Financials 27 VI Business Outlook (2016) 35 VII Financial Forecast (2016) 39 VIII Long-Term Forecast 44 IX Restructuring Considerations 47

I. Introduction

Draft Subject to Material Revision Subject to FRE 408 Highly Confidential

Draft Subject to Material Revision Subject to FRE 408 Situation Overview Highly Confidential

Paper market continues to face secular decline, driven largely by increasing digitization in traditional end-user markets (catalogs, magazines, and commercial printing)

Further, recent USD strength has increased competition from lower-cost imports, increasing pressure on domestic paper producers

Company has sought to mitigate the impact of these trends by moving aggressively to cut costs

Synergies enabled by January 2015 NewPage acquisition are on or above target

Mill-level operational improvements have resulted in additional savings

Strategic closure / reconfiguring and / or potential sale of mill assets

Notwithstanding these efforts, the Company’s current capital structure is no longer sustainable

Given the upcoming principal and interest payments in Q1 2016, the Company is focused on achieving consensus with creditors on a path forward prior to the due dates

Draft Subject to Material

Revision

Subject to FRE 408

Capital Structure Highly Confidential

($ in millions) Interest Par Value (9/30/15)(1) Market Value (12/8/2015)(2) Cash Annual

Maturity Payment Date Coupon Principal x EBITDA(3) x EBITDA(4) Price Market Value x EBITDA(3) x EBITDA(4) Rate Cash

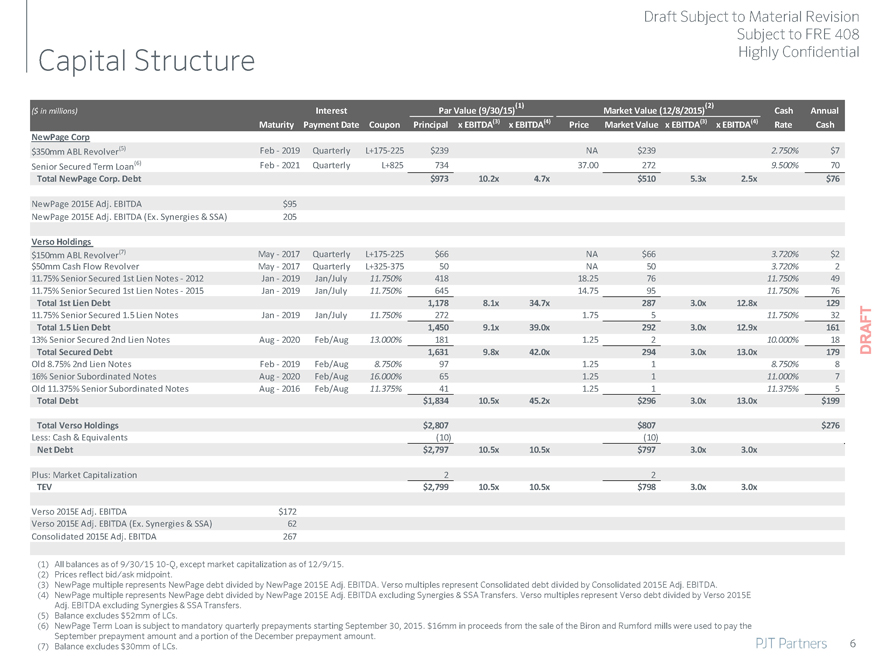

NewPage Corp

$350mm ABL Revolver(5) Feb—2019 Quarterly L+175-225 $239 NA $239 2.750% $7

Senior Secured Term Loan(6) Feb—2021 Quarterly L+825 734 37.00 272 9.500% 70

Total NewPage Corp. Debt $973 10.2x 4.7x $510 5.3x 2.5x $76

NewPage 2015E Adj. EBITDA $95

NewPage 2015E Adj. EBITDA (Ex. Synergies & SSA) 205

Verso Holdings

$150mm ABL Revolver(7) May—2017 Quarterly L+175-225 $66 NA $66 3.720% $2

$50mm Cash Flow Revolver May—2017 Quarterly L+325-375 50 NA 50 3.720% 2

11.75% | | Senior Secured 1st Lien Notes—2012 Jan—2019 Jan/July 11.750% 418 18.25 76 11.750% 49 |

11.75% | | Senior Secured 1st Lien Notes—2015 Jan—2019 Jan/July 11.750% 645 14.75 95 11.750% 76 |

Total 1st Lien Debt 1,178 8.1x 34.7x 287 3.0x 12.8x 129

11.75% | | Senior Secured 1.5 Lien Notes Jan—2019 Jan/July 11.750% 272 1.75 5 11.750% 32 |

Total 1.5 Lien Debt 1,450 9.1x 39.0x 292 3.0x 12.9x 161

13% Senior Secured 2nd Lien Notes Aug—2020 Feb/Aug 13.000% 181 1.25 2 10.000% 18

Total Secured Debt 1,631 9.8x 42.0x 294 3.0x 13.0x 179

Old 8.75% 2nd Lien Notes Feb—2019 Feb/Aug 8.750% 97 1.25 1 8.750% 8

16% Senior Subordinated Notes Aug—2020 Feb/Aug 16.000% 65 1.25 1 11.000% 7

Old 11.375% Senior Subordinated Notes Aug—2016 Feb/Aug 11.375% 41 1.25 1 11.375% 5

Total Debt $1,834 10.5x 45.2x $296 3.0x 13.0x $199

Total Verso Holdings $2,807 $807 $276

Less: Cash & Equivalents(10)(10)

Net Debt $2,797 10.5x 10.5x $797 3.0x 3.0x

Plus: Market Capitalization 2 2

TEV $2,799 10.5x 10.5x $798 3.0x 3.0x

Verso 2015E Adj. EBITDA $172

Verso 2015E Adj. EBITDA (Ex. Synergies & SSA) 62

Consolidated 2015E Adj. EBITDA 267

(1) | | All balances as of 9/30/15 10-Q, except market capitalization as of 12/9/15. |

(2) | | Prices reflect bid/ask midpoint. |

(3) NewPage multiple represents NewPage debt divided by NewPage 2015E Adj. EBITDA. Verso multiples represent Consolidated debt divided by Consolidated 2015E Adj. EBITDA.

(4) NewPage multiple represents NewPage debt divided by NewPage 2015E Adj. EBITDA excluding Synergies & SSA Transfers. Verso multiples represent Verso debt divided by Verso 2015E

Adj. EBITDA excluding Synergies & SSA Transfers.

(5) | | Balance excludes $52mm of LCs. |

(6) NewPage Term Loan is subject to mandatory quarterly prepayments starting September 30, 2015. $16mm in proceeds from the sale of the Biron and Rumford mills were used to pay the

September prepayment amount and a portion of the December prepayment amount.

(7) | | Balance excludes $30mm of LCs. 6 |

Draft Subject to Material Revision

Subject to FRE 408

Interest & Amortization Payment Dates Highly Confidential

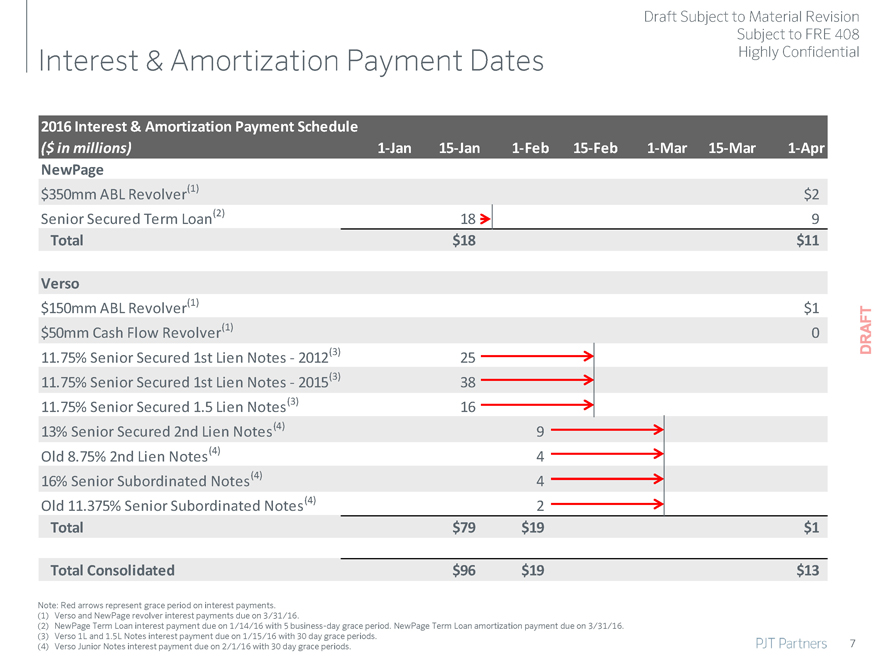

2016 Interest & Amortization Payment Schedule

($ in millions) 1-Jan 15-Jan 1-Feb 15-Feb 1-Mar 15-Mar 1-Apr

NewPage

$350mm ABL Revolver(1) $2

Senior Secured Term Loan(2) 18 9

Total $ 18 $11

Verso

$150mm ABL Revolver(1) $1

$50mm Cash Flow Revolver(1) 0

11.75% | | Senior Secured 1st Lien Notes—2012(3) 25 |

11.75% | | Senior Secured 1st Lien Notes—2015(3) 38 |

11.75% | | Senior Secured 1.5 Lien Notes(3) 16 |

13% Senior Secured 2nd Lien Notes(4) 9

Old 8.75% 2nd Lien Notes(4) 4

16% Senior Subordinated Notes(4) 4

Old 11.375% Senior Subordinated Notes (4) 2

Total $ 79 $ 19 $1

Total Consolidated $ 96 $ 19 $13

Note: Red arrows represent grace period on interest payments.

(1) | | Verso and NewPage revolver interest payments due on 3/31/16. |

(2) NewPage Term Loan interest payment due on 1/14/16 with 5 business-day grace period. NewPage Term Loan amortization payment due on 3/31/16.

(3) | | Verso 1L and 1.5L Notes interest payment due on 1/15/16 with 30 day grace periods. |

(4) | | Verso Junior Notes interest payment due on 2/1/16 with 30 day grace periods. 7 |

II. General Market Overview

Draft Subject to Material Revision

Subject to FRE 408

Highly Confidential

Draft Subject to Material Revision

Subject to FRE 408

Trends—US Highly Confidential

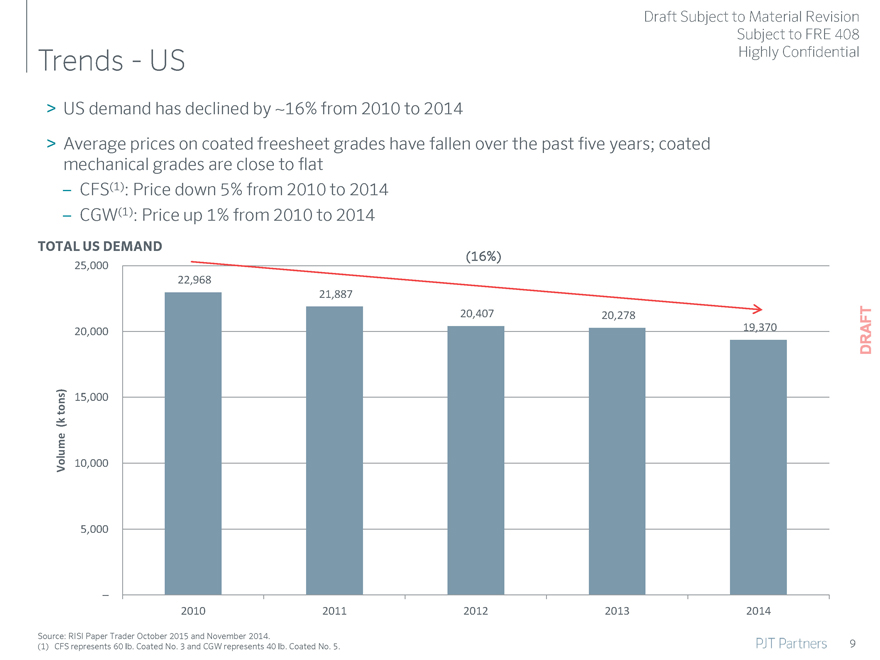

US demand has declined by ~16% from 2010 to 2014

Average prices on coated freesheet grades have fallen over the past five years; coated mechanical grades are close to flat

CFS(1): Price down 5% from 2010 to 2014

CGW(1): Price up 1% from 2010 to 2014

TOTAL US DEMAND(16%)

25,000

22,968

21,887

20,407 20,278

20,000 19,370

Volume (k tons)

10,000 15,000

5,000

–

2010 2011 2012 2013 2014

Source: RISI Paper Trader October 2015 and November 2014.

(1) | | CFS represents 60 lb. Coated No. 3 and CGW represents 40 lb. Coated No. 5. 9 |

Draft Subject to Material Revision

Subject to FRE 408

Industry Trends—US Highly Confidential

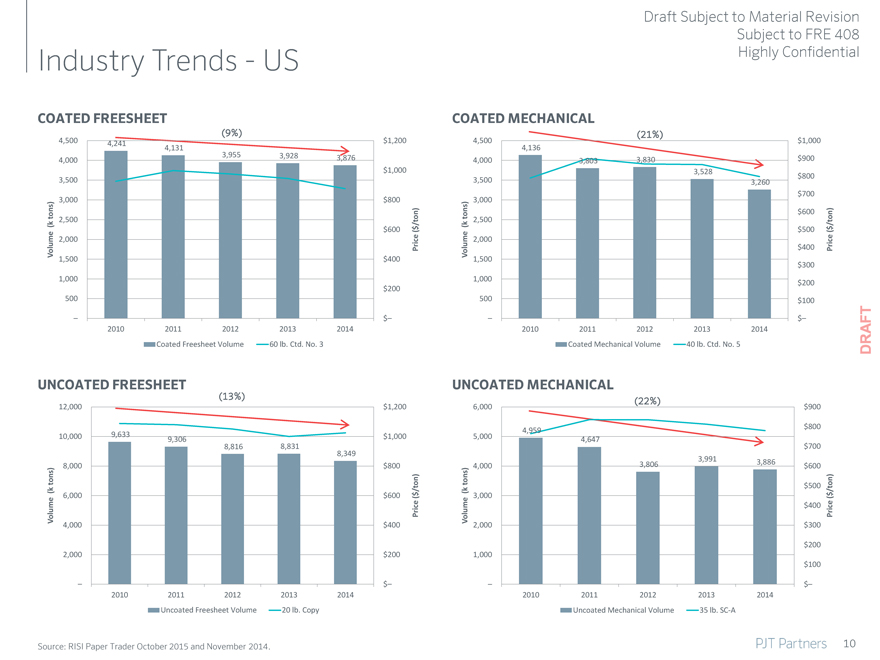

COATED FREESHEET COATED MECHANICAL

(9%)(21%)

4,500 4,241 $ 1,200 4,500 $1,000

4,131 4,136

4,000 3,955 3,928 3,876 4,000 3,803 3,830 $900

$ 1,000 3,528

3,500 3,500 3,260 $800

$700

3,000 $ 800 3,000

tons) on) tons) $600 on )

2,500 t 2,500

k

(k $ 600 $ /( $500 $ /t

((

2,000 2,000 Pr ice

Volume Pri ce Volume $400

1,500 $ 400 1,500

$300

1,000 1,000 $200

$ 200

500 500 $100

– $ – – $–

2010 2011 2012 2013 2014 2010 2011 2012 2013 2014

Coated Freesheet Volume 60 lb. Ctd. No. 3 Coated Mechanical Volume 40 lb. Ctd. No. 5

UNCOATED FREESHEET UNCOATED MECHANICAL

(13%)(22%)

12,000 $ 1,200 6,000 $900

4,959 $800

10,000 9,633 9,306 $ 1,000 5,000 4,647

8,816 8,831 $700

8,349

3,991 3,886

8,000 $ 800 4,000 3,806 $600

tons) on) tons) $500 /ton)

( k 6,000 $ 600 $ /t(k 3,000 $

((

Price Volume $400

Volume Price

4,000 $ 400 2,000 $300

$200

2,000 $ 200 1,000

$100

– $ – – $–

2010 2011 2012 2013 2014 2010 2011 2012 2013 2014

Uncoated Freesheet Volume 20 lb. Copy Uncoated Mechanical Volume 35 lb. SC-A

Source: RISI Paper Trader October 2015 and November 2014. 10

Draft Subject to Material Revision

Subject to FRE 408

Recent Trends—US Highly Confidential

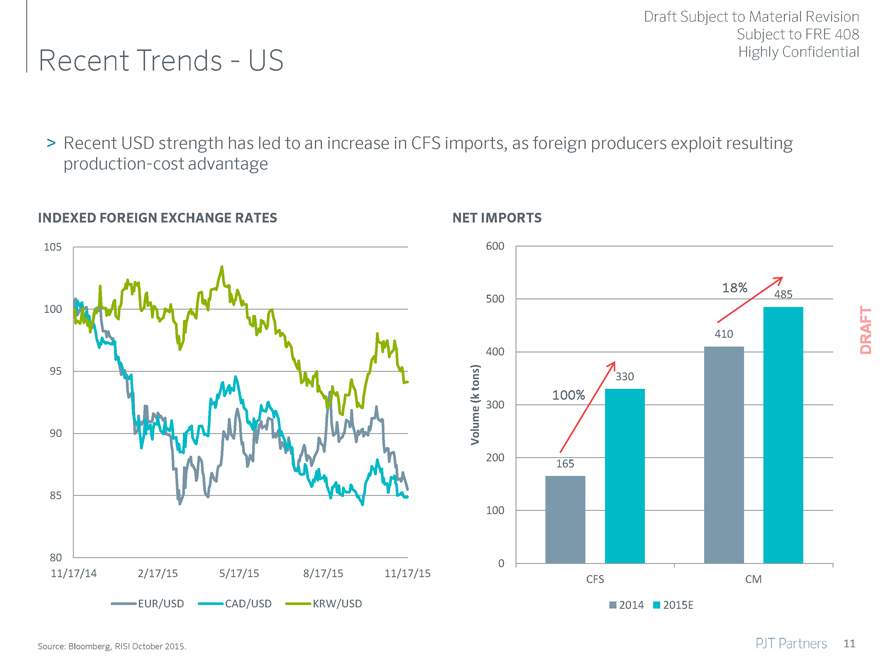

Recent USD strength has led to an increase in CFS imports, as foreign producers exploit resulting production-cost advantage

INDEXED FOREIGN EXCHANGE RATES NET IMPORTS

105 600

18%

500 485

100

410

400

(k 100%

ume 300

l

200 165

100

11/17/14 2/17/15 5/17/15 8/17/15 11/17/15 CFS CM

EUR/USD CAD/USD KRW/USD 2014 2015E

Source: Bloomberg, RISI October 2015. 11

Draft Subject to Material Revision

Subject to FRE 408

Recent Trends—US Highly Confidential

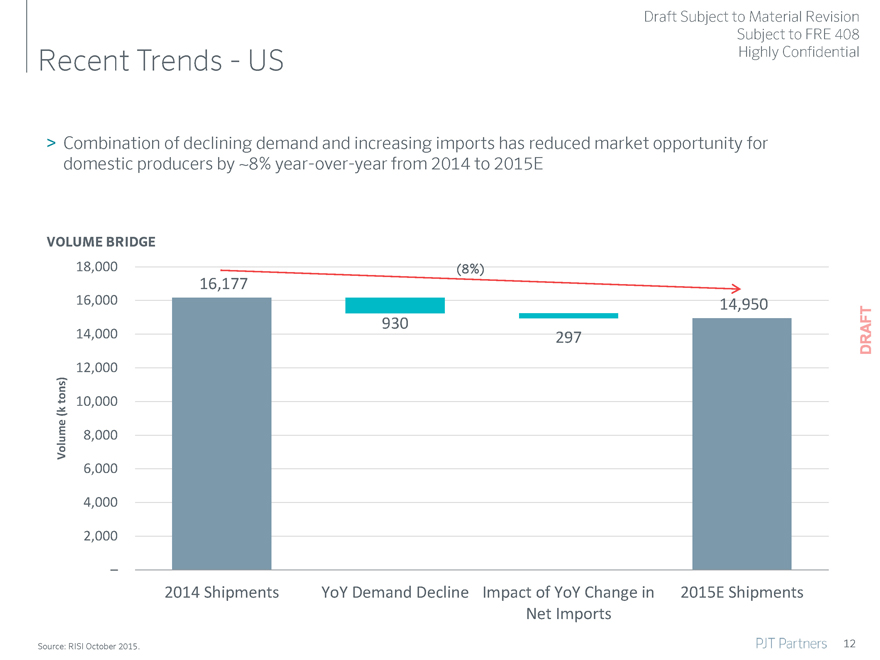

Combination of declining demand and increasing imports has reduced market opportunity for domestic producers by ~8% year-over-year from 2014 to 2015E

VOLUME BRIDGE

18,000(8%)

16,177

16,000 14,950

930

14,000 297

12,000

10,000

8,000

Volume (k tons)

6,000

4,000

2,000

–

2014 Shipments YoY Demand Decline Impact of YoY Change in 2015E Shipments

Net Imports

Source: RISI October 2015. 12

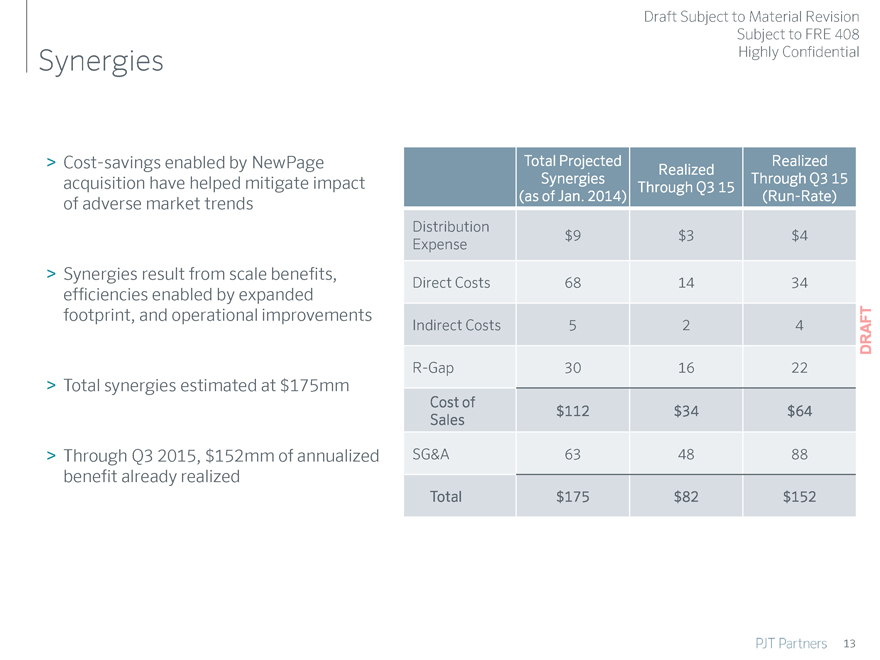

Synergies

Cost-savings enabled by NewPage acquisition have helped mitigate impact of adverse market trends

Synergies result from scale benefits, efficiencies enabled by expanded footprint, and operational improvements

Total synergies estimated at $175mm

Through Q3 2015, $152mm of annualized benefit already realized

Draft Subject to Material Revision

Subject to FRE 408

Highly Confidential

Total Projected Realized

Realized

Synergies Through Q3 15

Through Q3 15

(as of Jan. 2014)(Run-Rate)

Distribution $9 $3 $4

Expense

Direct Costs 68 14 34

Indirect Costs 5 2 4

R-Gap 30 16 22

Cost of $112 $34 $64

Sales

SG&A 63 48 88

Total $175 $82 $152

13

Draft Subject to Material Revision

Subject to FRE 408

Synergies—Detail Highly Confidential

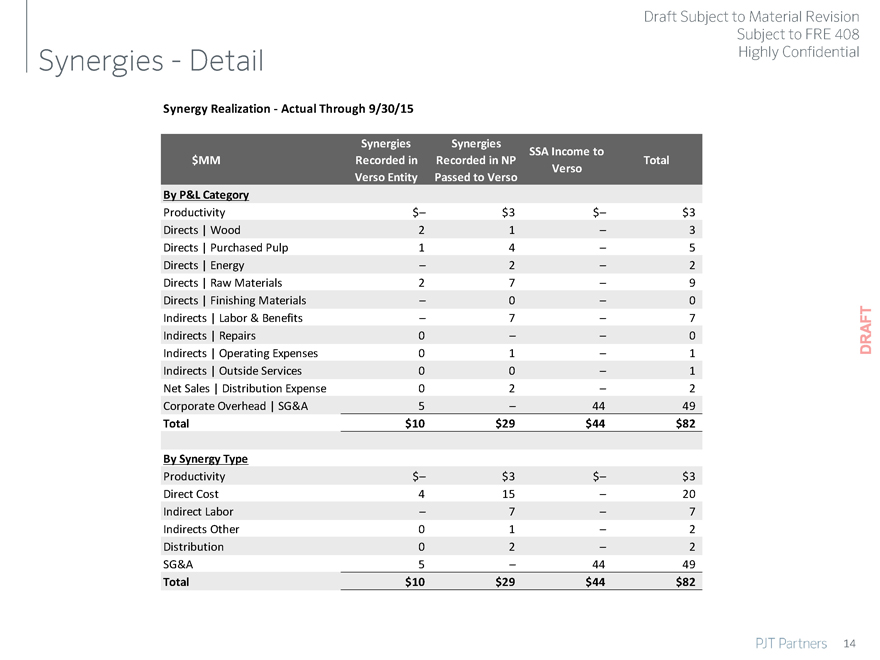

Synergy Realization—Actual Through 9/30/15

Synergies Synergies

SSA Income to

$MM Recorded in Recorded in NP Total

Verso

Verso Entity Passed to Verso

By P&L Category

Productivity $– $3 $– $3

Directs | Wood 2 1 – 3

Directs | Purchased Pulp 1 4 – 5

Directs | Energy – 2 – 2

Directs | Raw Materials 2 7 – 9

Directs | Finishing Materials – 0 – 0

Indirects | Labor & Benefits – 7 – 7

Indirects | Repairs 0 – – 0

Indirects | Operating Expenses 0 1 – 1

Indirects | Outside Services 0 0 – 1

Net Sales | Distribution Expense 0 2 – 2

Corporate Overhead | SG&A 5 – 44 49

Total $10 $29 $44 $82

By Synergy Type

Productivity $– $3 $– $3

Direct Cost 4 15 – 20

Indirect Labor – 7 – 7

Indirects Other 0 1 – 2

Distribution 0 2 – 2

SG&A 5 – 44 49

Total $10 $29 $44 $82

14

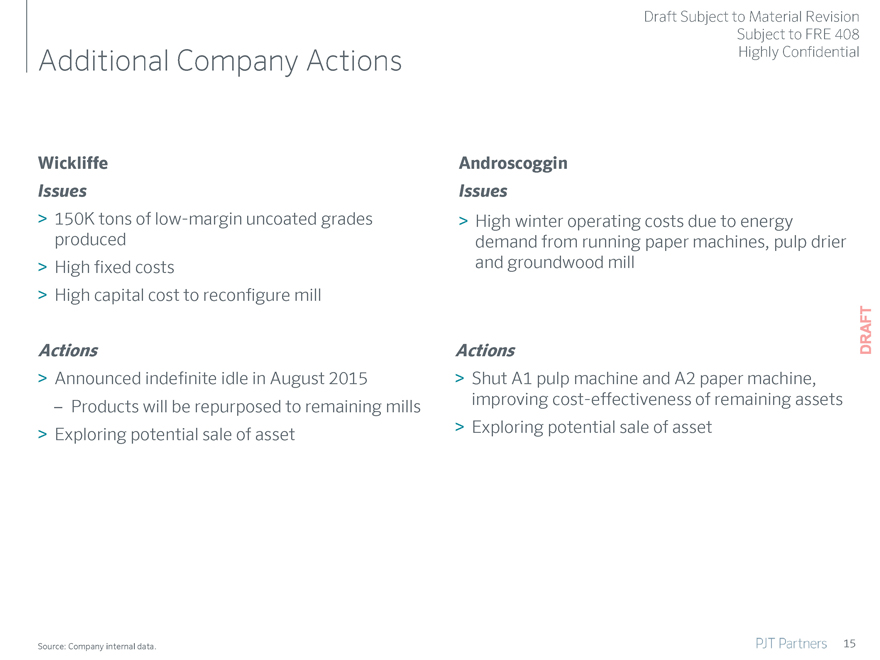

Additional Company Actions

Wickliffe

Issues

150K tons of low-margin uncoated grades produced

High fixed costs

High capital cost to reconfigure mill

Actions

Announced indefinite idle in August 2015 Products will be repurposed to remaining mills

Exploring potential sale of asset

Draft Subject to Material Revision Subject to FRE 408 Highly Confidential

Androscoggin

Issues

High winter operating costs due to energy demand from running paper machines, pulp drier and groundwood mill

Actions

Shut A1 pulp machine and A2 paper machine, improving cost-effectiveness of remaining assets

Exploring potential sale of asset

Source: Company internal data.

15

III. Company Overview

Draft Subject to Material Revision

Subject to FRE 408

Highly Confidential

16

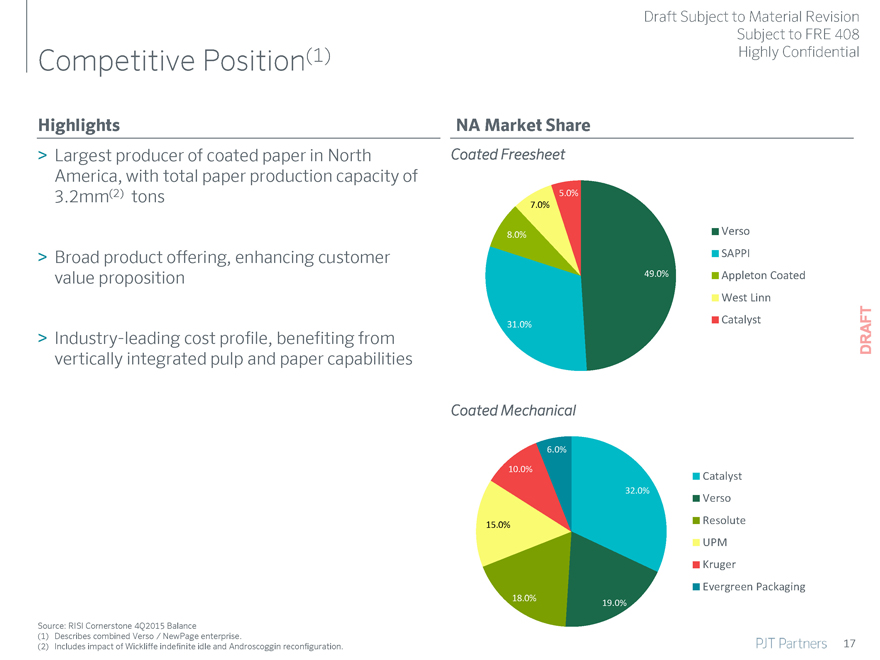

Competitive Position(1)

Highlights

Largest producer of coated paper in North America, with total paper production capacity of 3.2mm(2) tons

Broad product offering, enhancing customer value proposition

Industry-leading cost profile, benefiting from vertically integrated pulp and paper capabilities

Source: RISI Cornerstone 4Q2015 Balance

(1) | | Describes combined Verso / NewPage enterprise. |

(2) | | Includes impact of Wickliffe indefinite idle and Androscoggin reconfiguration. |

Draft Subject to Material Revision

Subject to FRE 408

Highly Confidential

NA Market Share

Coated Freesheet

5.0%

7.0%

SAPPI

West Linn

Coated Mechanical

6.0%

10.0%

Catalyst

32.0%

Verso

UPM

Kruger

Evergreen Packaging

Draft Subject to Material Revision

Subject to FRE 408

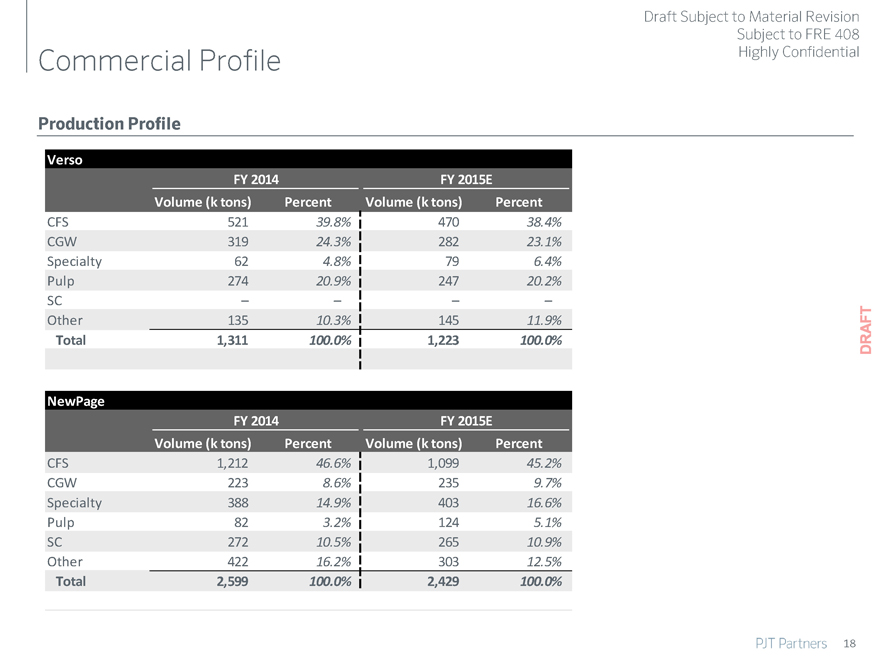

Commercial Profile Highly Confidential

Production Profile

Verso

FY 2014 FY 2015E

Volume (k tons) Percent Volume (k tons) Percent

CFS 521 39.8% 470 38.4%

CGW 319 24.3% 282 23.1%

Specialty 62 4.8% 79 6.4%

Pulp 274 20.9% 247 20.2%

SC – – – –

Other 135 10.3% 145 11.9%

Total 1,311 100.0% 1,223 100.0%

NewPage

FY 2014 FY 2015E

Volume (k tons) Percent Volume (k tons) Percent

CFS 1,212 46.6% 1,099 45.2%

CGW 223 8.6% 235 9.7%

Specialty 388 14.9% 403 16.6%

Pulp 82 3.2% 124 5.1%

SC 272 10.5% 265 10.9%

Other 422 16.2% 303 12.5%

Total 2,599 100.0% 2,429 100.0%

18

IV.Mill Overview

Draft Subject to Material Revision

Subject to FRE 408

Highly Confidential

19

Draft Subject to Material Revision

Subject to FRE 408

Mill Locations Highly Confidential

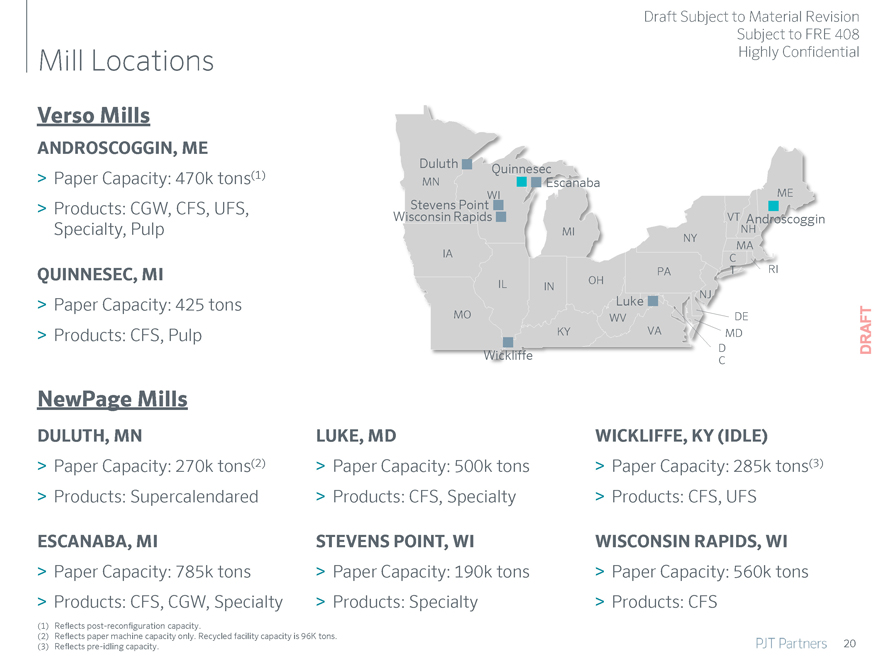

Verso Mills

ANDROSCOGGIN, ME

Duluth Quinnesec

Paper Capacity: 470k tons(1) MN Escanaba

WI ME

Products: CGW, CFS, UFS, Stevens Point

Wisconsin Rapids VT Androscoggin

Specialty, Pulp MI NH

NY MA

IA C

QUINNESEC, MI PA T RI

IL IN OH

Paper Capacity: 425 tons Luke NJ

MO WV DE

Products: CFS, Pulp KY VA MD

D

Wickliffe C

NewPage Mills

DULUTH, MN LUKE, MD WICKLIFFE, KY (IDLE)

Paper Capacity: 270k tons(2) Paper Capacity: 500k tons Paper Capacity: 285k tons(3)

Products: Supercalendared Products: CFS, Specialty Products: CFS, UFS

ESCANABA, MI STEVENS POINT, WI WISCONSIN RAPIDS, WI

Paper Capacity: 785k tons Paper Capacity: 190k tons Paper Capacity: 560k tons

Products: CFS, CGW, Specialty Products: Specialty Products: CFS

(1) | | Reflects post-reconfiguration capacity. |

(2) | | Reflects paper machine capacity only. Recycled facility capacity is 96K tons. |

(3) | | Reflects pre-idling capacity. 20 |

Draft Subject to Material Revision

Subject to FRE 408

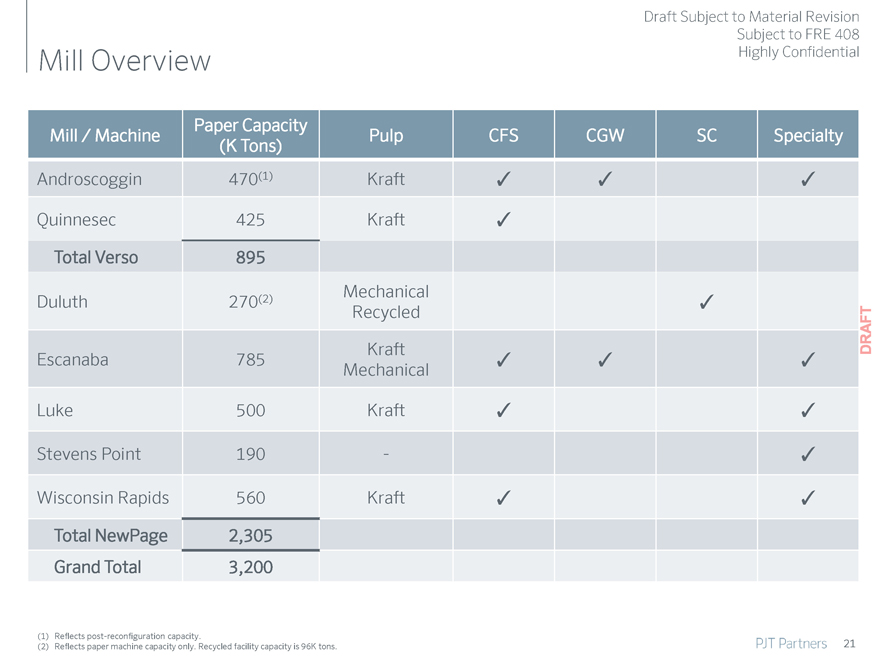

Mill Overview Highly Confidential

Paper Capacity

Mill / Machine Pulp CFS CGW SC Specialty

(K Tons)

Androscoggin 470(1) Kraft

Quinnesec 425 Kraft

Total Verso 895

Mechanical

Duluth 270(2)

Recycled

Kraft

Escanaba 785

Mechanical

Luke 500 Kraft

Stevens Point 190—

Wisconsin Rapids 560 Kraft

Total NewPage 2,305

Grand Total 3,200

(1) | | Reflects post-reconfiguration capacity. |

(2) | | Reflects paper machine capacity only. Recycled facility capacity is 96K tons. 21 |

Draft Subject to Material Revision

Subject to FRE 408

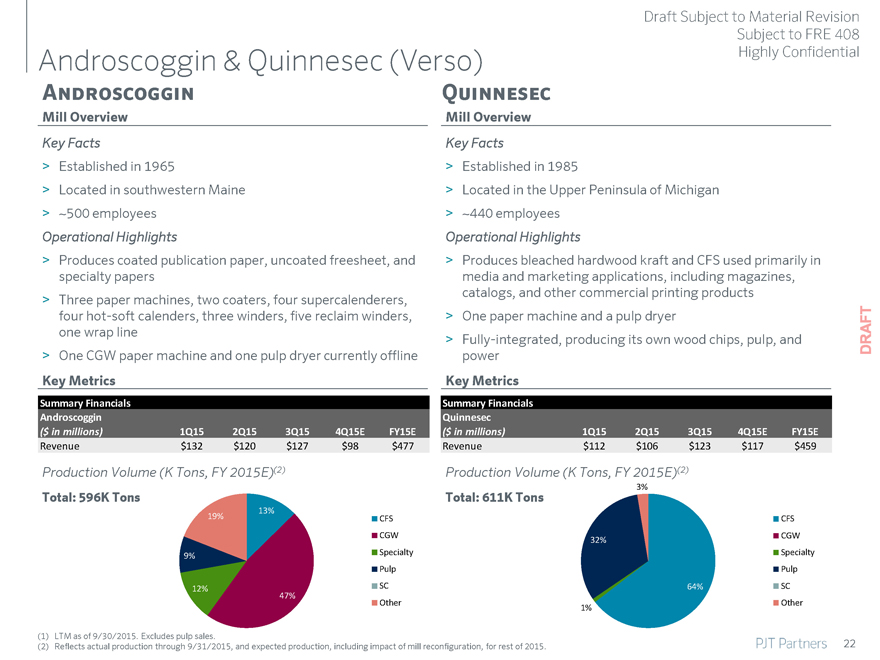

Androscoggin & Quinnesec (Verso) Highly Confidential

Androscoggin Quinnesec

Mill Overview Mill Overview

Key Facts Key Facts

Established in 1965

Located in southwestern Maine

~500 employees

Operational Highlights

Produces coated publication paper, uncoated freesheet, and specialty papers

Three paper machines, two coaters, four supercalenderers, four hot-soft calenders, three winders, five reclaim winders, one wrap line

One CGW paper machine and one pulp dryer currently offline

Established in 1985

Located in the Upper Peninsula of Michigan

~440 employees

Operational Highlights

Produces bleached hardwood kraft and CFS used primarily in media and marketing applications, including magazines, catalogs, and other commercial printing products

One paper machine and a pulp dryer

Fully-integrated, producing its own wood chips, pulp, and power

Key Metrics Key Metrics

Summary Financials Summary Financials

Androscoggin Quinnesec

($ in millions) 1Q15 2Q15 3Q15 4Q15E FY15E($ in millions) 1Q15 2Q15 3Q15 4Q15E FY15E

Revenue $132 $120 $127 $98 $477 Revenue $112 $106 $123 $117 $459

Production Volume (K Tons, FY 2015E)(2) Production Volume (K Tons, FY 2015E)(2)

3%

Total: 596K Tons Total: 611K Tons

13%

19% CFS CFS

CGW CGW

32%

9% Specialty Specialty

Pulp Pulp

12% SC 64% SC

47%

Other Other

1%

(1) | | LTM as of 9/30/2015. Excludes pulp sales. |

(2) Reflects actual production through 9/31/2015, and expected production, including impact of mill reconfiguration, for rest of 2015. 22

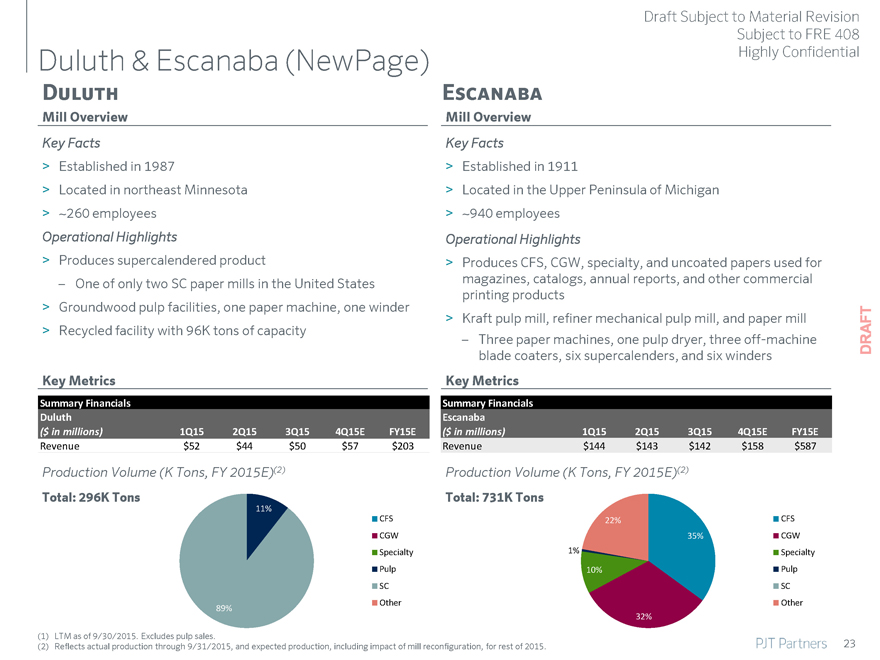

Duluth & Escanaba (NewPage)

Duluth

Mill Overview

Key Facts

Established in 1987

Located in northeast Minnesota

~260 employees

Operational Highlights

Produces supercalendered product

One of only two SC paper mills in the United States

Groundwood pulp facilities, one paper machine, one winder

Recycled facility with 96K tons of capacity

Draft Subject to Material Revision Subject to FRE 408 Highly Confidential

Escanaba

Mill Overview

Key Facts

Established in 1911

Located in the Upper Peninsula of Michigan

~940 employees

Operational Highlights

Produces CFS, CGW, specialty, and uncoated papers used for magazines, catalogs, annual reports, and other commercial printing products

Kraft pulp mill, refiner mechanical pulp mill, and paper mill

Three paper machines, one pulp dryer, three off-machine blade coaters, six supercalenders, and six winders

Key Metrics Key Metrics

Summary Financials Summary Financials

Duluth Escanaba

($ in millions) 1Q15 2Q15 3Q15 4Q15E FY15E($ in millions) 1Q15 2Q15 3Q15 4Q15E FY15E

Revenue $52 $44 $50 $57 $203 Revenue $144 $143 $142 $158 $587

Production Volume (K Tons, FY 2015E)(2) Production Volume (K Tons, FY 2015E)(2)

Total: 296K Tons Total: 731K Tons

11%

CFS 22% CFS

CGW 35% CGW

Specialty 1% Specialty

Pulp 10% Pulp

SC SC

Other Other

89%

32%

(1) | | LTM as of 9/30/2015. Excludes pulp sales. |

(2) Reflects actual production through 9/31/2015, and expected production, including impact of mill reconfiguration, for rest of 2015. 23

Draft Subject to Material Revision

Subject to FRE 408

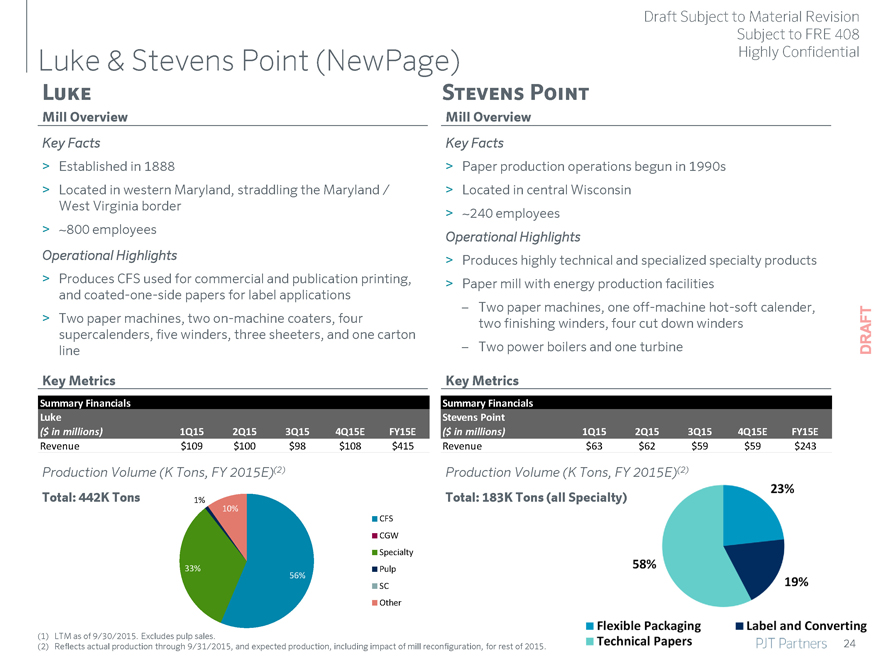

Luke & Stevens Point (NewPage) Highly Confidential

Luke Stevens Point

Mill Overview Mill Overview

Key Facts Key Facts

Established in 1888 Paper production operations begun in 1990s

Located in western Maryland, straddling the Maryland / Located in central Wisconsin

West Virginia border ~240 employees

~800 employees Operational Highlights

Operational Highlights Produces highly technical and specialized specialty products

Produces CFS used for commercial and publication printing, Paper mill with energy production facilities

and coated-one-side papers for label applications

Two paper machines, one off-machine hot-soft calender,

Two paper machines, two on-machine coaters, four two finishing winders, four cut down winders

supercalenders, five winders, three sheeters, and one carton

line Two power boilers and one turbine

Key Metrics Key Metrics

Summary Financials Summary Financials

Luke Stevens Point

($ in millions) 1Q15 2Q15 3Q15 4Q15E FY15E($ in millions) 1Q15 2Q15 3Q15 4Q15E FY15E

Revenue $109 $100 $98 $108 $415 Revenue $63 $62 $59 $59 $243

Production Volume (K Tons, FY 2015E)(2) Production Volume (K Tons, FY 2015E)(2)

Total: 442K Tons 1% Total: 183K Tons (all

10%

CFS

CGW

Specialty

33% Pulp

56%

SC

Other

LTM as of 9/30/2015. Excludes pulp sales.

Reflects actual production through 9/31/2015, and expected production, including impact of mill reconfiguration, for rest of 2015.

Draft Subject to Material Revision

Subject to FRE 408

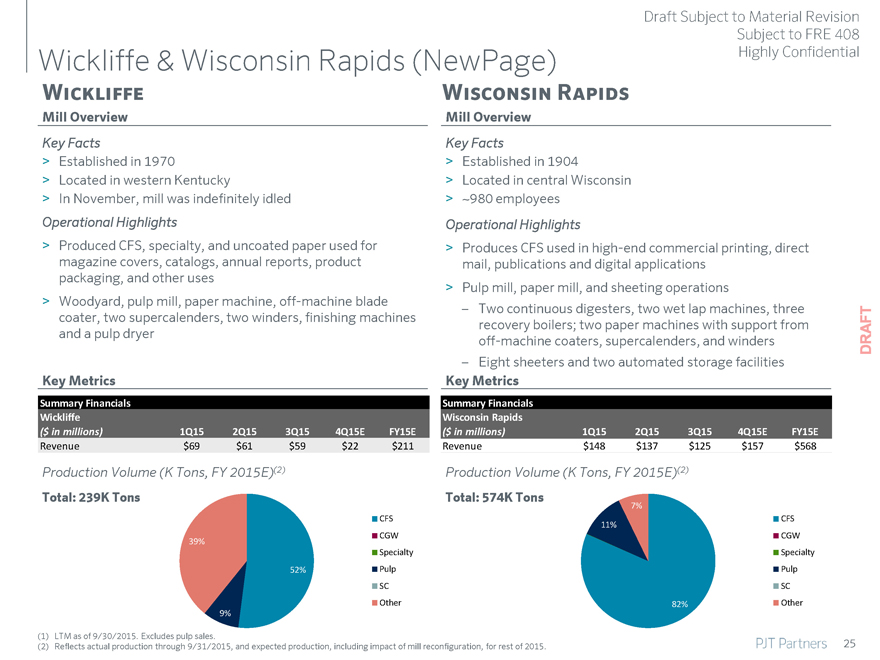

Wickliffe & Wisconsin Rapids (NewPage) Highly Confidential

Wickliffe Wisconsin Rapids

Mill Overview Mill Overview

Key Facts Key Facts

Established in 1970 Established in 1904

Located in western Kentucky Located in central Wisconsin

In November, mill was indefinitely idled ~980 employees

Operational Highlights

Produced CFS, specialty, and uncoated paper used for magazine covers, catalogs, annual reports, product packaging, and other uses

Woodyard, pulp mill, paper machine, off-machine blade coater, two supercalenders, two winders, finishing machines and a pulp dryer

Key Metrics

Operational Highlights

Produces CFS used in high-end commercial printing, direct mail, publications and digital applications

Pulp mill, paper mill, and sheeting operations

Two continuous digesters, two wet lap machines, three recovery boilers; two paper machines with support from off-machine coaters, supercalenders, and winders

Eight sheeters and two automated storage facilities

Key Metrics

Summary Financials Summary Financials

Wickliffe Wisconsin Rapids

($ in millions) 1Q15 2Q15 3Q15 4Q15E FY15E($ in millions) 1Q15 2Q15 3Q15 4Q15E FY15E

Revenue $69 $61 $59 $22 $211 Revenue $148 $137 $125 $157 $568

Production Volume (K Tons, FY 2015E)(2) Production Volume (K Tons, FY 2015E)(2)

Total: 239K Tons Total: 574K Tons

7%

CFS CFS

0% 11%

CGW CGW

39%

Specialty Specialty

52% Pulp Pulp

SC SC

Other 82% Other

9%

(1) | | LTM as of 9/30/2015. Excludes pulp sales. |

(2) Reflects actual production through 9/31/2015, and expected production, including impact of mill reconfiguration, for rest of 2015. 25

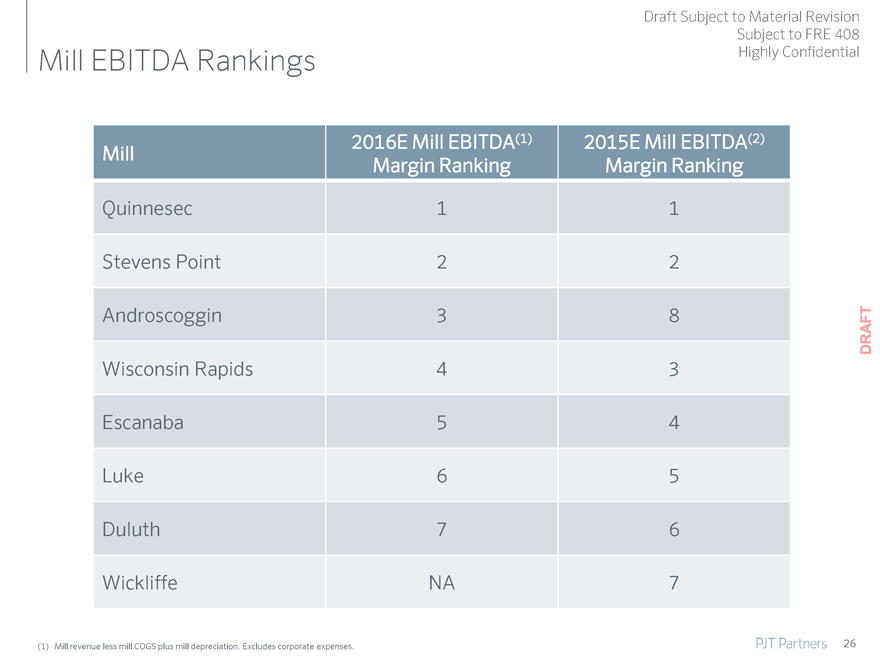

Draft Subject to Material Revision

Subject to FRE 408

Mill EBITDA Rankings Highly Confidential

Mill 2016E Mill EBITDA(1) 2015E Mill EBITDA(2)

Margin Ranking Margin Ranking

Quinnesec 1 1

Stevens Point 2 2

Androscoggin 3 8

Wisconsin Rapids 4 3

Escanaba 5 4

Luke 6 5

Duluth 7 6

Wickliffe NA 7

(1) | | Mill revenue less mill COGS plus mill depreciation. Excludes corporate expenses. |

26

Recent Performance & Historical Financials

Draft Subject to Material Revision

Subject to FRE 408

Highly Confidential

27

Draft Subject to Material Revision

Subject to FRE 408

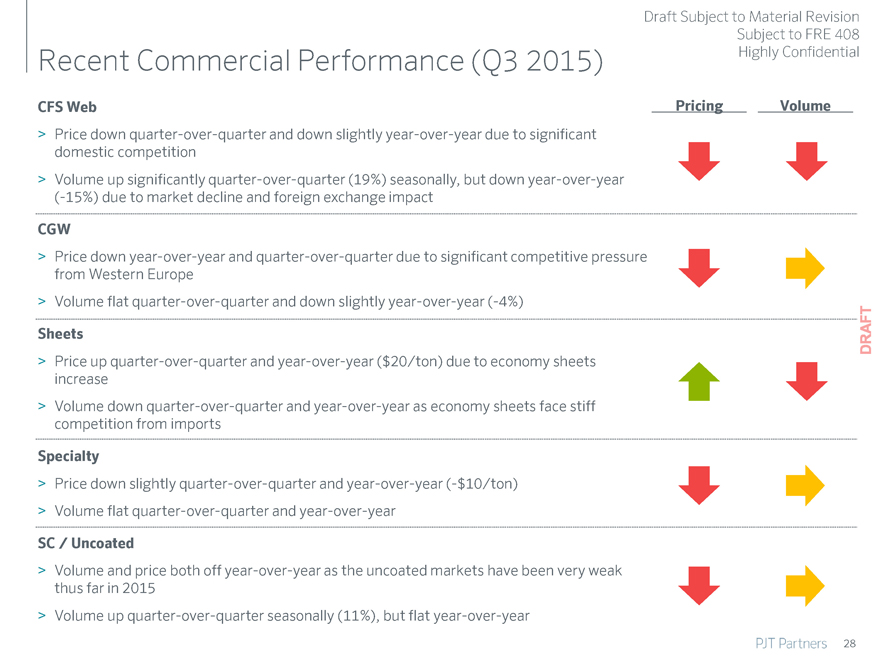

Recent Commercial Performance (Q3 2015) Highly Confidential

CFS Web

Pricing

Volume

Price down quarter-over-quarter and down slightly year-over-year due to significant domestic competition

Volume up significantly quarter-over-quarter (19%) seasonally, but down year-over-year (-15%) due to market decline and foreign exchange impact

CGW

Price down year-over-year and quarter-over-quarter due to significant competitive pressure from Western Europe

Volume flat quarter-over-quarter and down slightly year-over-year (-4%)

Sheets

Price up quarter-over-quarter and year-over-year ($20/ton) due to economy sheets increase

Volume down quarter-over-quarter and year-over-year as economy sheets face stiff competition from imports

Specialty

Price down slightly quarter-over-quarter and year-over-year (-$10/ton)

Volume flat quarter-over-quarter and year-over-year

SC / Uncoated

Volume and price both off year-over-year as the uncoated markets have been very weak thus far in 2015

Volume up quarter-over-quarter seasonally (11%), but flat year-over-year

28

Draft Subject to Material Revision

Subject to FRE 408

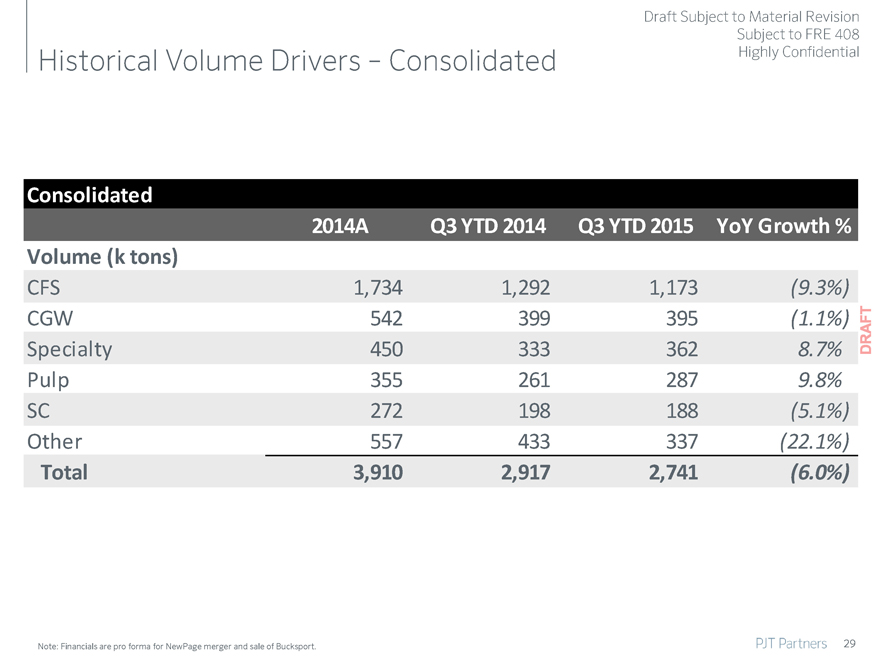

Historical Volume Drivers – Consolidated Highly Confidential

Consolidated

2014A Q3 YTD 2014 Q3 YTD 2015 YoY Growth %

Volume (k tons)

CFS 1,734 1,292 1,173(9.3%)

CGW 542 399 395(1.1%)

Specialty 450 333 362 8.7%

Pulp 355 261 287 9.8%

SC 272 198 188(5.1%)

Other 557 433 337(22.1%)

Total 3,910 2,917 2,741(6.0%)

Note: Financials are pro forma for NewPage merger and sale of Bucksport.

29

Draft Subject to Material Revision

Subject to FRE 408

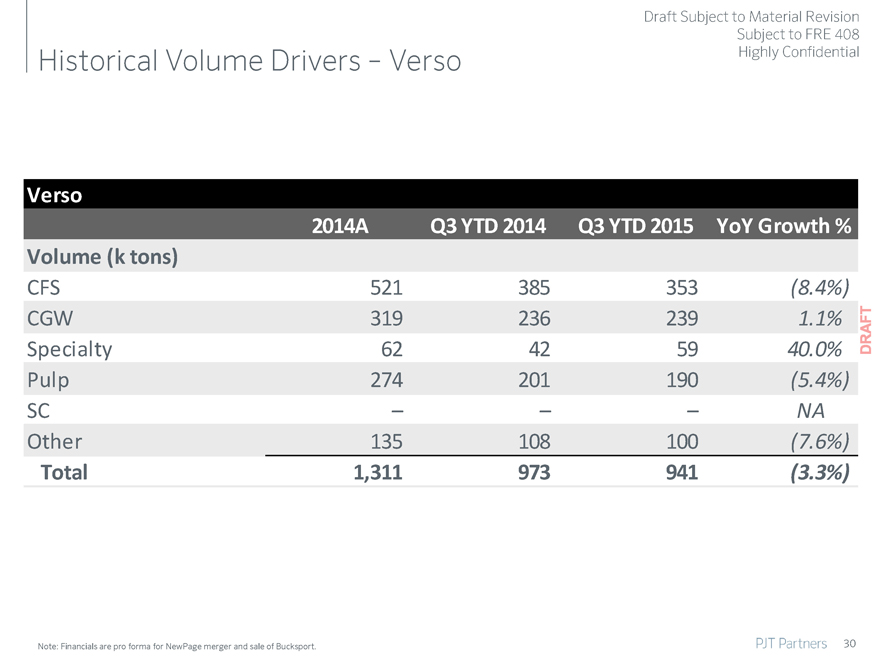

Historical Volume Drivers – Verso Highly Confidential

Verso

2014A Q3 YTD 2014 Q3 YTD 2015 YoY Growth %

Volume (k tons)

CFS 521 385 353(8.4%)

CGW 319 236 239 1.1%

Specialty 62 42 59 40.0%

Pulp 274 201 190(5.4%)

SC – – – NA

Other 135 108 100(7.6%)

Total 1,311 973 941(3.3%)

Note: Financials are pro forma for NewPage merger and sale of Bucksport.

30

Draft Subject to Material Revision

Subject to FRE 408

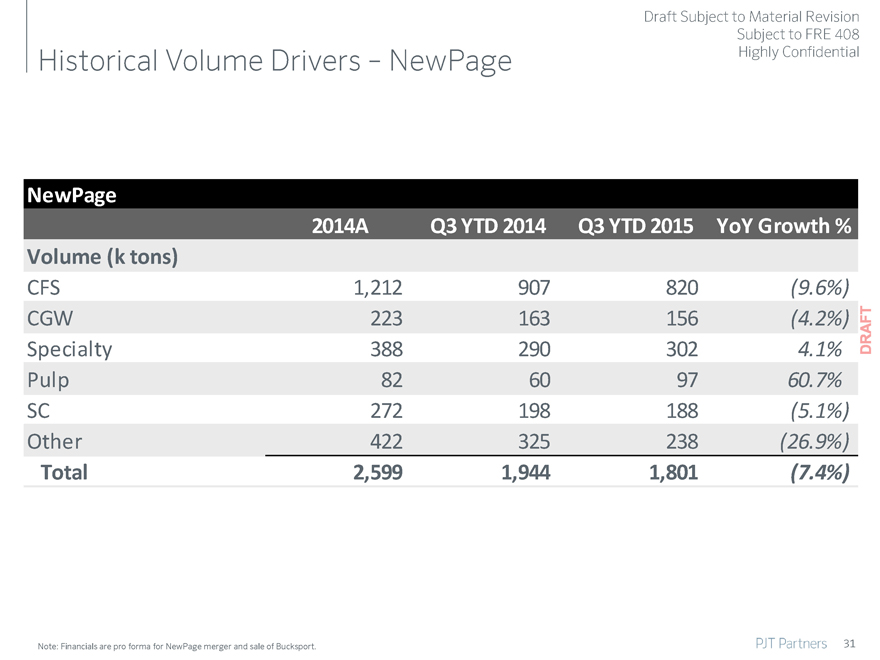

Historical Volume Drivers – NewPage Highly Confidential

NewPage

2014A Q3 YTD 2014 Q3 YTD 2015 YoY Growth %

Volume (k tons)

CFS 1,212 907 820(9.6%)

CGW 223 163 156(4.2%)

Specialty 388 290 302 4.1%

Pulp 82 60 97 60.7%

SC 272 198 188(5.1%)

Other 422 325 238(26.9%)

Total 2,599 1,944 1,801(7.4%)

Note: Financials are pro forma for NewPage merger and sale of Bucksport.

31

Draft Subject to Material Revision

Subject to FRE 408

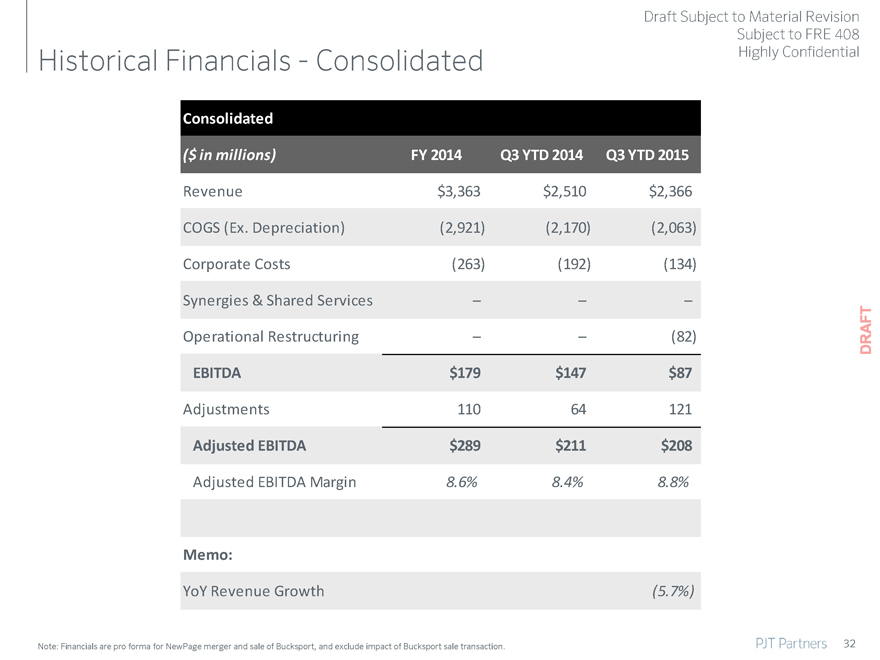

Historical Financials—Consolidated Highly Confidential

Consolidated

($ in millions) FY 2014 Q3 YTD 2014 Q3 YTD 2015

Revenue $3,363 $2,510 $2,366

COGS (Ex. Depreciation)(2,921)(2,170)(2,063)

Corporate Costs(263)(192)(134)

Synergies & Shared Services – – –

Operational Restructuring – –(82)

EBITDA $179 $147 $87

Adjustments 110 64 121

Adjusted EBITDA $289 $211 $208

Adjusted EBITDA Margin 8.6% 8.4% 8.8%

Memo:

YoY Revenue Growth(5.7%)

Note: Financials are pro forma for NewPage merger and sale of Bucksport, and exclude impact of Bucksport sale transaction.

32

Draft Subject to Material Revision

Subject to FRE 408

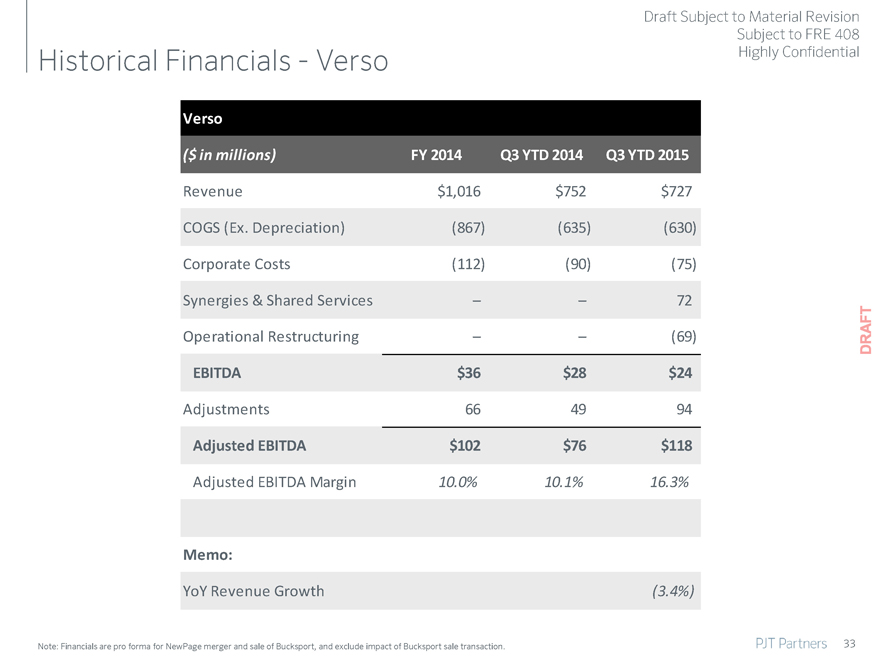

Historical Financials—Verso Highly Confidential

Verso

($ in millions) FY 2014 Q3 YTD 2014 Q3 YTD 2015

Revenue $1,016 $752 $727

COGS (Ex. Depreciation)(867)(635)(630)

Corporate Costs(112)(90)(75)

Synergies & Shared Services – – 72

Operational Restructuring – –(69)

EBITDA $36 $28 $24

Adjustments 66 49 94

Adjusted EBITDA $102 $76 $118

Adjusted EBITDA Margin 10.0% 10.1% 16.3%

Memo:

YoY Revenue Growth(3.4%)

Note: Financials are pro forma for NewPage merger and sale of Bucksport, and exclude impact of Bucksport sale transaction.

33

Draft Subject to Material Revision

Subject to FRE 408

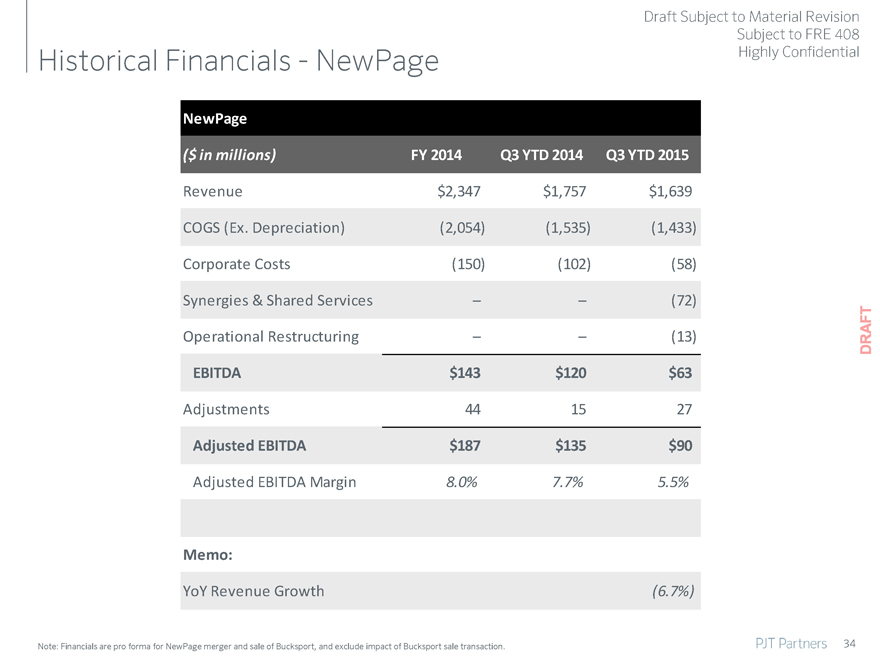

Historical Financials—NewPage Highly Confidential

NewPage

($ in millions) FY 2014 Q3 YTD 2014 Q3 YTD 2015

Revenue $2,347 $1,757 $1,639

COGS (Ex. Depreciation)(2,054)(1,535)(1,433)

Corporate Costs(150)(102)(58)

Synergies & Shared Services – –(72)

Operational Restructuring – –(13)

EBITDA $143 $120 $63

Adjustments 44 15 27

Adjusted EBITDA $187 $135 $90

Adjusted EBITDA Margin 8.0% 7.7% 5.5%

Memo:

YoY Revenue Growth(6.7%)

Note: Financials are pro forma for NewPage merger and sale of Bucksport, and exclude impact of Bucksport sale transaction.

34

VI.Business Outlook (2016)

Draft Subject to Material Revision

Subject to FRE 408

Highly Confidential

35

Draft Subject to Material Revision

Subject to FRE 408

Industry Projections—US Highly Confidential

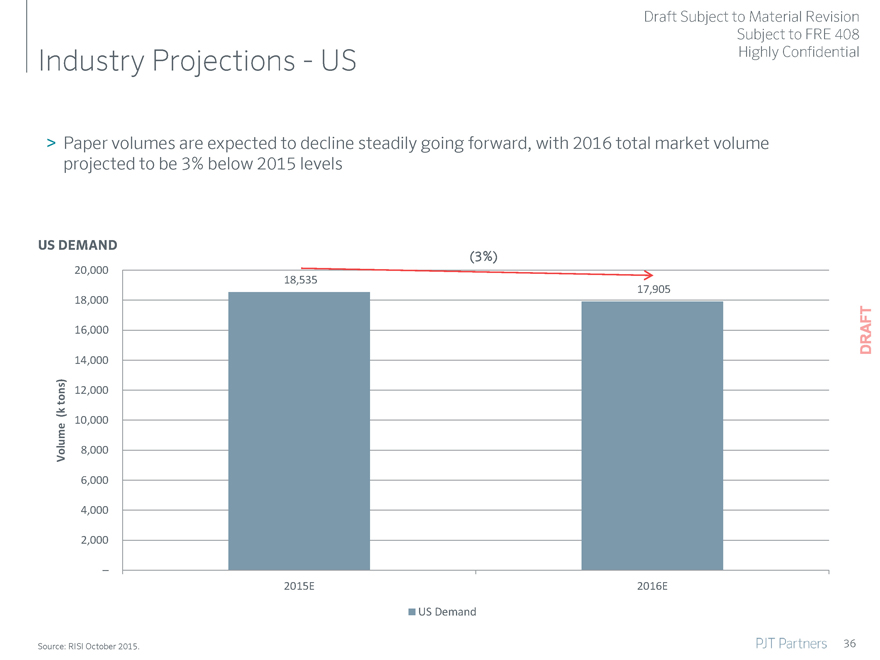

Paper volumes are expected to decline steadily going forward, with 2016 total market volume projected to be 3% below 2015 levels

US DEMAND

(3%)

20,000

18,535

17,905

18,000

16,000

14,000

tons) 12,000

(k 10,000

me

u

Vol 8,000

6,000

4,000

2,000

–

2015E 2016E

US Demand

Source: RISI October 2015. 36

Draft Subject to Material Revision

Subject to FRE 408

Industry Projections—US Highly Confidential

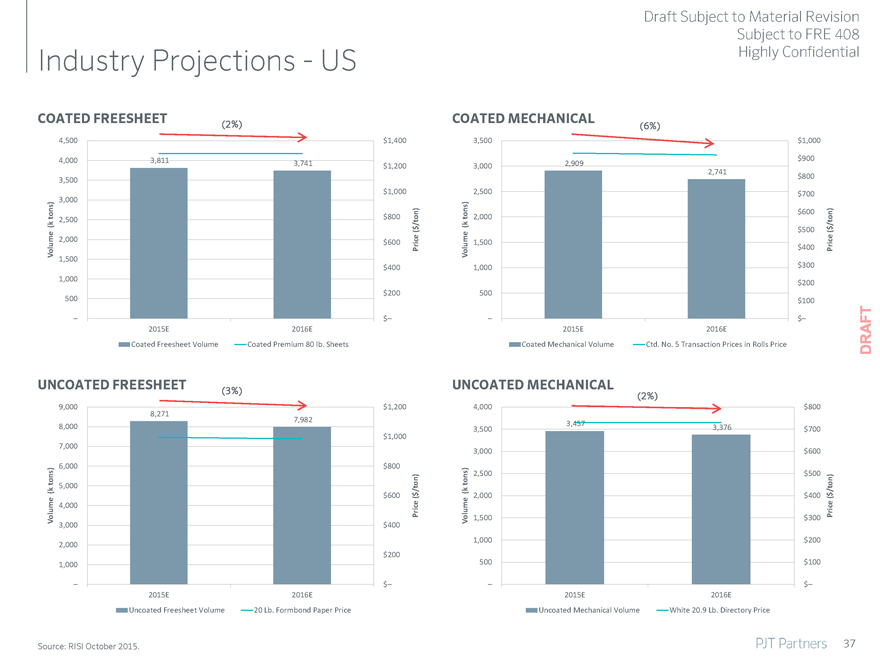

COATED FREESHEET COATED MECHANICAL

(2%)(6%)

4,500 $ 1,400 3,500 $1,000

4,000 3,811 3,741 2,909 $900

$ 1,200 3,000

2,741

3,500 $800

$ 1,000 2,500 $700

3,000

tons) $ 800 on) tons) 2,000 $600 on )

2,500 t

(k $ / ( k $500 $ /t

((

2,000 ce e

$ 600 1,500 ic

Volume Pri olume $400 Pr

1,500 V

$ 400 1,000 $300

1,000 $200

$ 200 500

500 $100

– $ – – $–

2015E 2016E 2015E 2016E

Coated Freesheet Volume Coated Premium 80 lb. Sheets Coated Mechanical Volume Ctd. No. 5 Transaction Prices in Rolls Price

UNCOATED FREESHEET(3%) UNCOATED MECHANICAL

(2%)

9,000 $ 1,200 4,000 $800

8,271

7,982 3,457

8,000 3,500 3,376 $700

$ 1,000

7,000

3,000 $600

6,000 $ 800

tons) tons) 2,500 $500

k 5,000 on) /ton)

( $ 600 $ /t (k 2,000 $400 $

((

me 4,000 ce

olu Pri olu me 1,500 $300 Price

V V

3,000 $ 400

1,000 $200

2,000

$ 200

1,000 500 $100

– $ – – $–

2015E 2016E 2015E 2016E

Uncoated Freesheet Volume 20 Lb. Formbond Paper Price Uncoated Mechanical Volume White 20.9 Lb. Directory Price

Source: RISI October 2015. 37

Draft Subject to Material Revision

Subject to FRE 408

Industry Projections—US Highly Confidential

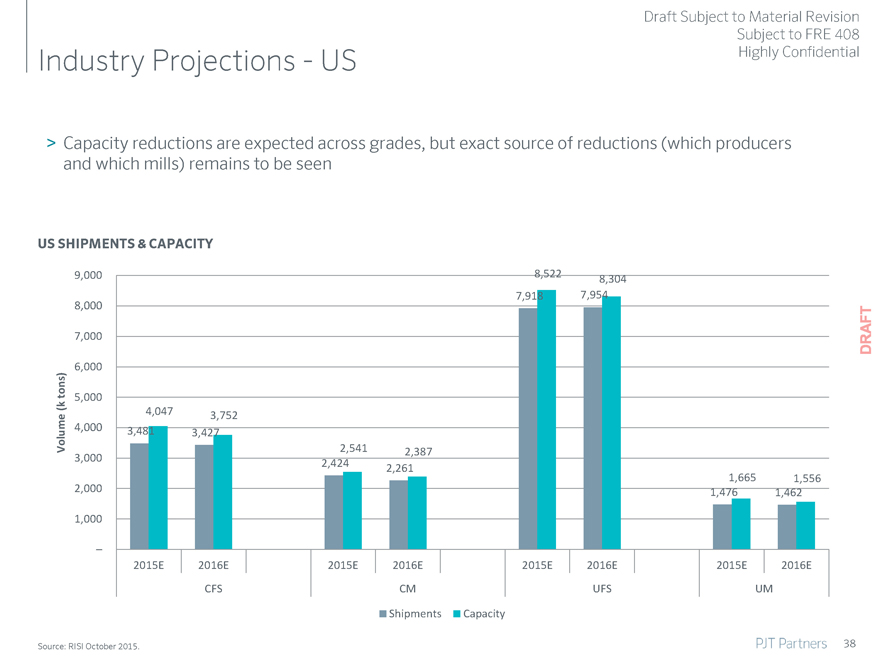

Capacity reductions are expected across grades, but exact source of reductions (which producers and which mills) remains to be seen

US SHIPMENTS & CAPACITY

9,000 8,522 8,304

7,918 7,954

8,000

7,000

6,000

5,000

4,047

3,752

4,000 3,481 3,427

Volume (k tons) 2,541 2,387

3,000

2,424 2,261

1,665 1,556

2,000 1,476 1,462

1,000

–

2015E 2016E 2015E 2016E 2015E 2016E 2015E 2016E

CFS CM UFS UM

Shipments Capacity

Source: RISI October 2015. 38

VII.Financial Forecast (2016)

Draft Subject to Material Revision

Subject to FRE 408

Highly Confidential

39

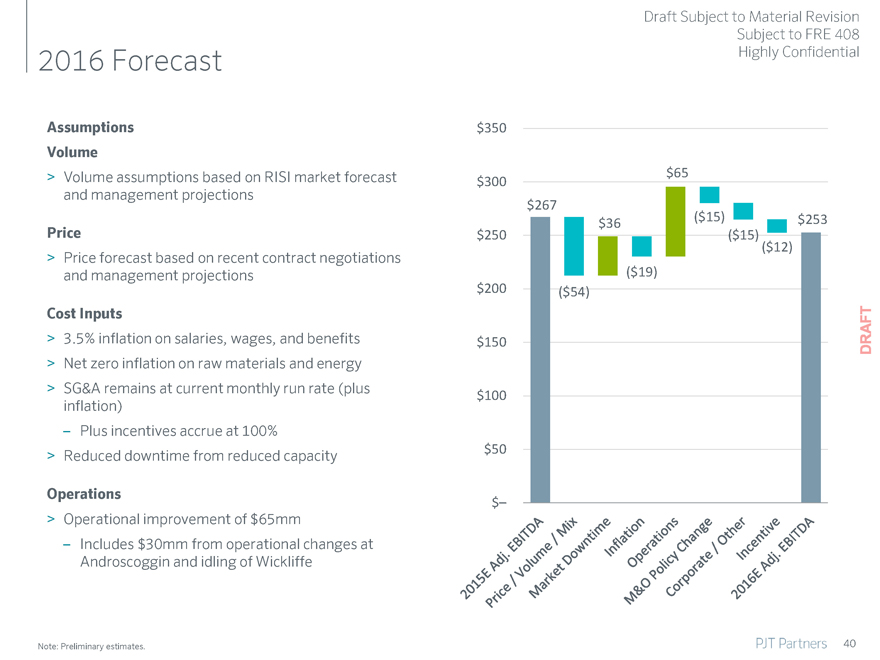

2016 Forecast

Assumptions

Volume

Volume assumptions based on RISI market forecast and management projections

Price

Price forecast based on recent contract negotiations and management projections

Cost Inputs

3.5% inflation on salaries, wages, and benefits

Net zero inflation on raw materials and energy

SG&A remains at current monthly run rate (plus inflation)

Plus incentives accrue at 100%

Reduced downtime from reduced capacity

Operations

Operational improvement of $65mm

Includes $30mm from operational changes at Androscoggin and idling of Wickliffe

Draft Subject to Material Revision Subject to FRE 408 Highly Confidential

$350

$65

$300

$267

$36($15) $253

$250($15)

($12)

($19)

$200($54)

$150

$100

$50

$–

Note: Preliminary estimates.

40

Draft Subject to Material Revision

Subject to FRE 408

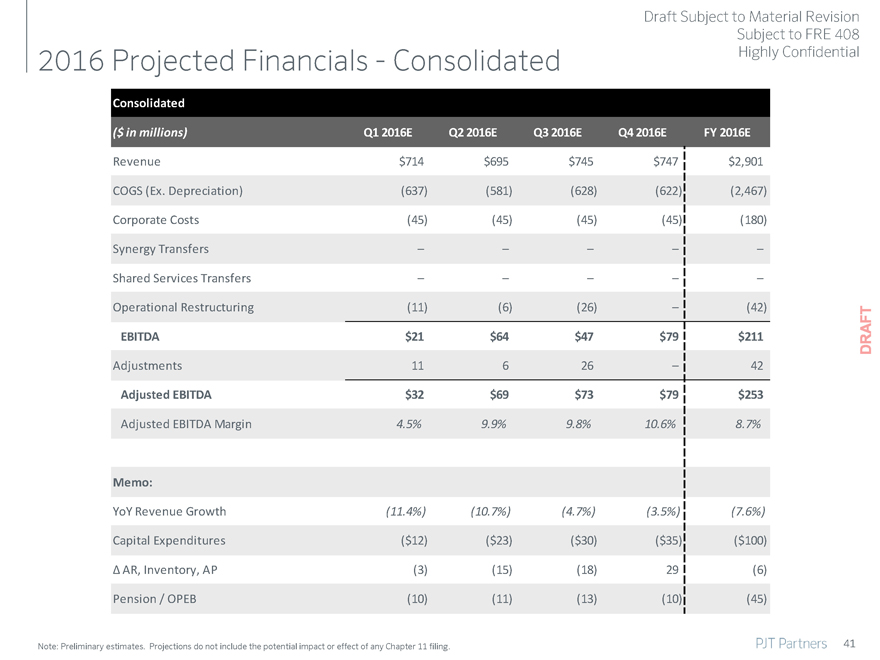

2016 Projected Financials—Consolidated Highly Confidential

Consolidated

($ in millions) Q1 2016E Q2 2016E Q3 2016E Q4 2016E FY 2016E

Revenue $714 $695 $745 $747 $2,901

COGS (Ex. Depreciation)(637)(581)(628)(622)(2,467)

Corporate Costs(45)(45)(45)(45)(180)

Synergy Transfers – – – – –

Shared Services Transfers – – – – –

Operational Restructuring(11)(6)(26) –(42)

EBITDA $21 $64 $47 $79 $211

Adjustments 11 6 26 – 42

Adjusted EBITDA $32 $69 $73 $79 $253

Adjusted EBITDA Margin 4.5% 9.9% 9.8% 10.6% 8.7%

Memo:

YoY Revenue Growth(11.4%)(10.7%)(4.7%)(3.5%)(7.6%)

Capital Expenditures($12)($23)($30)($35)($100)

Ä AR, Inventory, AP(3)(15)(18) 29(6)

Pension / OPEB(10)(11)(13)(10)(45)

Note: Preliminary estimates. Projections do not include the potential impact or effect of any Chapter 11 filing.

41

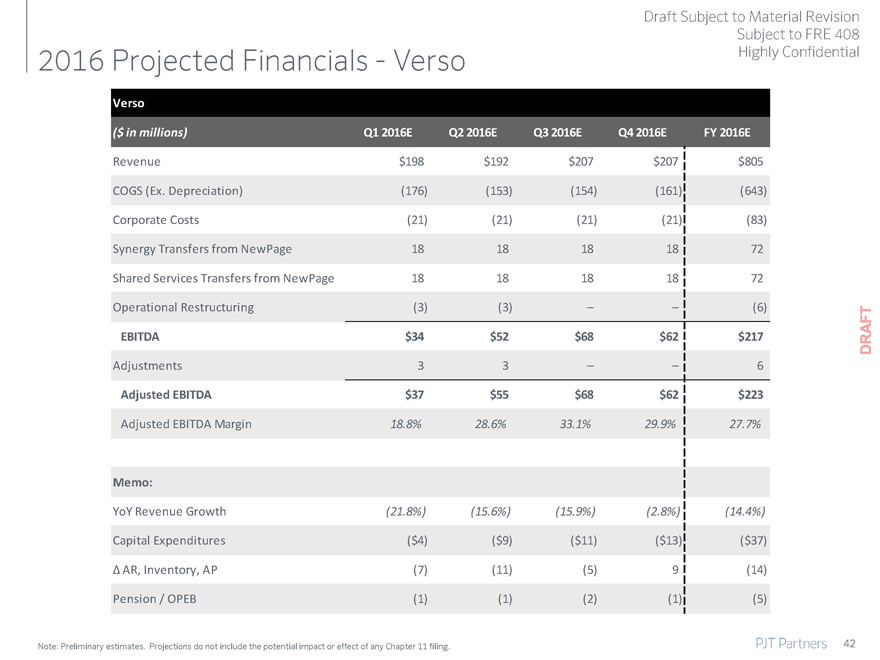

Draft Subject to Material Revision

Subject to FRE 408

2016 Projected Financials—Verso Highly Confidential

Verso

($ in millions) Q1 2016E Q2 2016E Q3 2016E Q4 2016E FY 2016E

Revenue $198 $192 $207 $207 $805

COGS (Ex. Depreciation)(176)(153)(154)(161)(643)

Corporate Costs(21)(21)(21)(21)(83)

Synergy Transfers from NewPage 18 18 18 18 72

Shared Services Transfers from NewPage 18 18 18 18 72

Operational Restructuring(3)(3) – –(6)

EBITDA $34 $52 $68 $62 $217

Adjustments 3 3 – – 6

Adjusted EBITDA $37 $55 $68 $62 $223

Adjusted EBITDA Margin 18.8% 28.6% 33.1% 29.9% 27.7%

Memo:

YoY Revenue Growth(21.8%)(15.6%)(15.9%)(2.8%)(14.4%)

Capital Expenditures($4)($9)($11)($13)($37)

Ä AR, Inventory, AP(7)(11)(5) 9(14)

Pension / OPEB(1)(1)(2)(1)(5)

Note: Preliminary estimates. Projections do not include the potential impact or effect of any Chapter 11 filing.

42

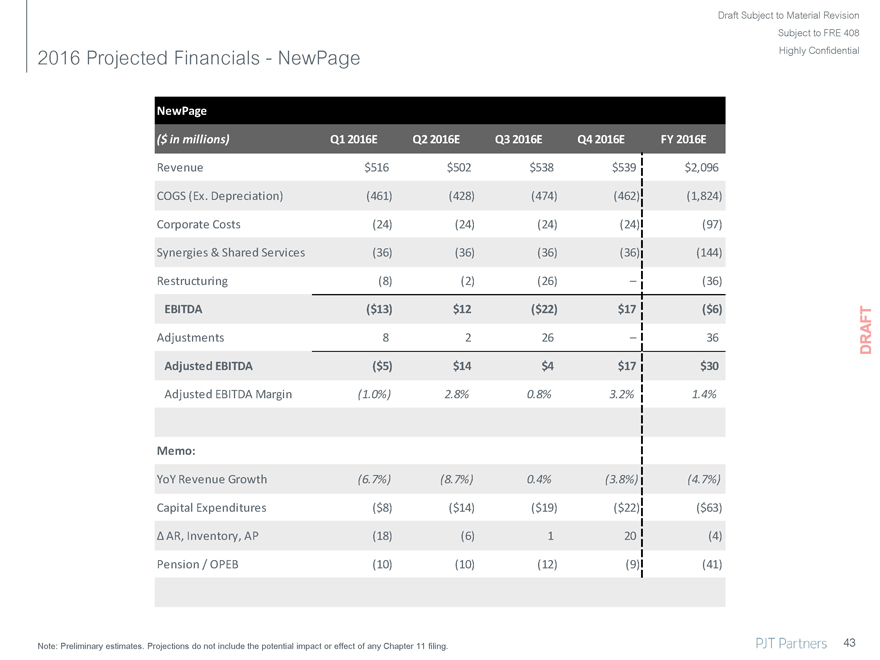

Draft Subject to Material Revision

Subject to FRE 408

2016 Projected Financials—NewPage Highly Confidential

NewPage

($ in millions) Q1 2016E Q2 2016E Q3 2016E Q4 2016E FY 2016E

Revenue $516 $502 $538 $539 $2,096

COGS (Ex. Depreciation)(461)(428)(474)(462)(1,824)

Corporate Costs(24)(24)(24)(24)(97)

Synergies & Shared Services(36)(36)(36)(36)(144)

Restructuring(8)(2)(26) –(36)

EBITDA($13) $12($22) $17($6)

Adjustments 8 2 26 – 36

Adjusted EBITDA($5) $14 $4 $17 $30

Adjusted EBITDA Margin(1.0%) 2.8% 0.8% 3.2% 1.4%

Memo:

YoY Revenue Growth(6.7%)(8.7%) 0.4%(3.8%)(4.7%)

Capital Expenditures($8)($14)($19)($22)($63)

Ä AR, Inventory, AP(18)(6) 1 20(4)

Pension / OPEB(10)(10)(12)(9)(41)

Note: Preliminary estimates. Projections do not include the potential impact or effect of any Chapter 11 filing.

43

VIII.Long-Term Forecast

Draft Subject to Material Revision

Subject to FRE 408

Highly Confidential

44

Draft Subject to Material Revision

Subject to FRE 408

Key Assumptions Highly Confidential

RISI 5-year forecast assumptions for 2017-2020 for volume, price, and cost inflation

Export tons held constant at 2016 levels

Production capacity increase of 0.9% in 2017 and 0.5% thereafter

Downtime to balance demand / capacity imbalance

Annual operational improvements of $40mm in 2016, 2017, and 2018, $35mm in 2019, and $25mm in 2020

Corporate costs held at 2016 levels

Working capital based on historical seasonal trends of business

45

Draft Subject to Material Revision

Subject to FRE 408

Summary Financials Highly Confidential

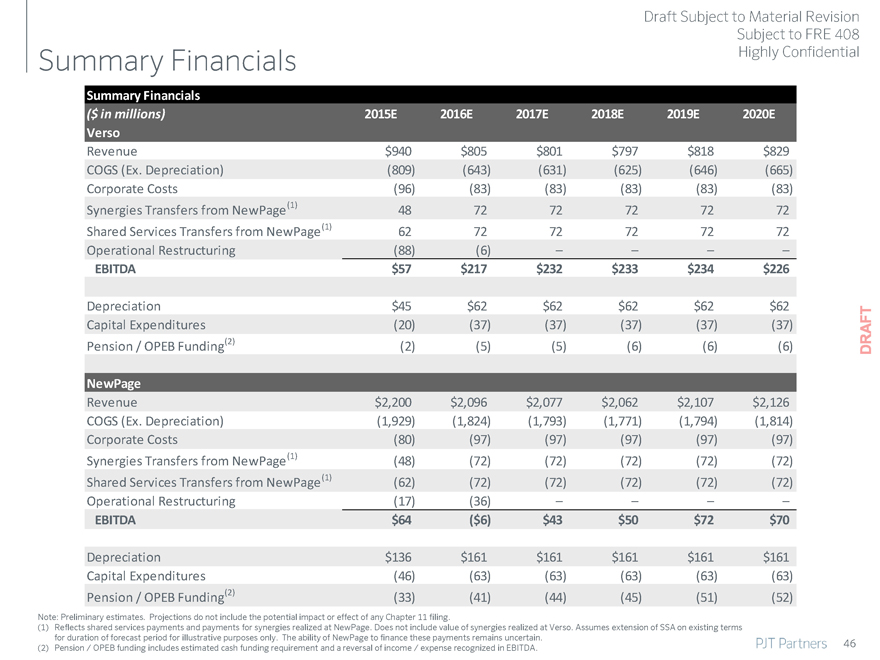

Summary Financials

($ in millions) 2015E 2016E 2017E 2018E 2019E 2020E

Verso

Revenue $940 $805 $801 $797 $818 $829

COGS (Ex. Depreciation)(809)(643)(631)(625)(646)(665)

Corporate Costs(96)(83)(83)(83)(83)(83)

Synergies Transfers from NewPage (1) 48 72 72 72 72 72

Shared Services Transfers from NewPage (1) 62 72 72 72 72 72

Operational Restructuring(88)(6) – – – –

EBITDA $57 $217 $232 $233 $234 $226

Depreciation $45 $62 $62 $62 $62 $62

Capital Expenditures(20)(37)(37)(37)(37)(37)

Pension / OPEB Funding(2)(2)(5)(5)(6)(6)(6)

NewPage

Revenue $2,200 $2,096 $2,077 $2,062 $2,107 $2,126

COGS (Ex. Depreciation)(1,929)(1,824)(1,793)(1,771)(1,794)(1,814)

Corporate Costs(80)(97)(97)(97)(97)(97)

Synergies Transfers from NewPage (1)(48)(72)(72)(72)(72)(72)

Shared Services Transfers from NewPage (1)(62)(72)(72)(72)(72)(72)

Operational Restructuring(17)(36) – – – –

EBITDA $64($6) $43 $50 $72 $70

Depreciation $136 $161 $161 $161 $161 $161

Capital Expenditures(46)(63)(63)(63)(63)(63)

Pension / OPEB Funding(2)(33)(41)(44)(45)(51)(52)

Note: Preliminary estimates. Projections do not include the potential impact or effect of any Chapter 11 filing.

(1) Reflects shared services payments and payments for synergies realized at NewPage. Does not include value of synergies realized at Verso. Assumes extension of SSA on existing terms for duration of forecast period for illustrative purposes only. The ability of NewPage to finance these payments remains uncertain. 46 (2) Pension / OPEB funding includes estimated cash funding requirement and a reversal of income / expense recognized in EBITDA.

IX.Restructuring Considerations

Draft Subject to Material Revision

Subject to FRE 408

Highly Confidential

47

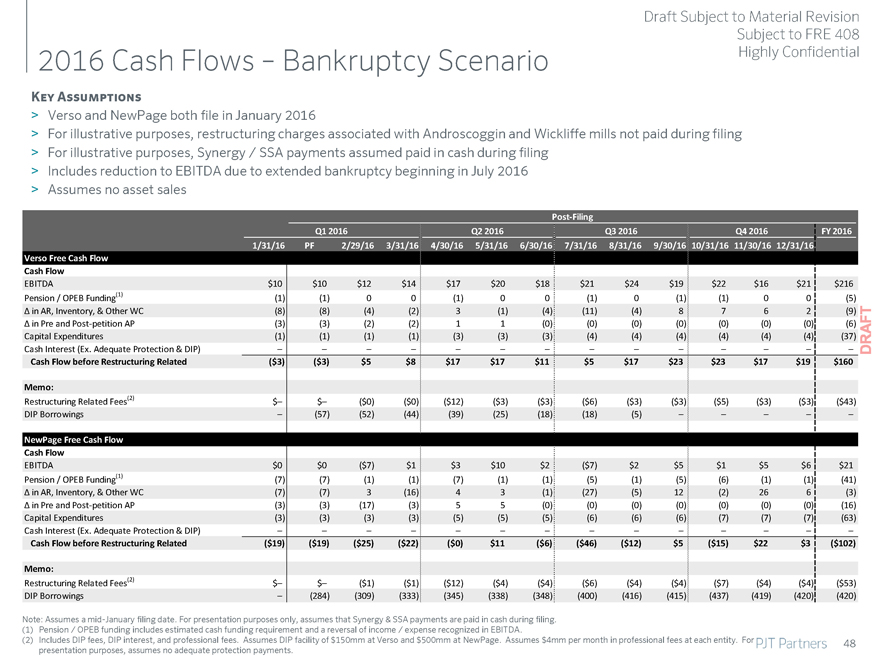

Draft Subject to Material Revision

Subject to FRE 408

2016 Cash Flows – Bankruptcy Scenario Highly Confidential

Key Assumptions

Verso and NewPage both file in January 2016

For illustrative purposes, restructuring charges associated with Androscoggin and Wickliffe mills not paid during filing

For illustrative purposes, Synergy / SSA payments assumed paid in cash during filing

Includes reduction to EBITDA due to extended bankruptcy beginning in July 2016

Assumes no asset sales

Post-Filing

Q1 2016 Q2 2016 Q3 2016 Q4 2016 FY 2016

1/31/16 PF 2/29/16 3/31/16 4/30/16 5/31/16 6/30/16 7/31/16 8/31/16 9/30/16 10/31/16 11/30/16 12/31/16

Verso Free Cash Flow

Cash Flow

EBITDA $10 $10 $12 $14 $17 $20 $18 $21 $24 $19 $22 $16 $21 $216

Pension / OPEB Funding(1)(1)(1) 0 0(1) 0 0(1) 0(1)(1) 0 0(5)

in AR, Inventory, & Other WC(8)(8)(4)(2) 3(1)(4)(11)(4) 8 7 6 2(9)

in Pre and Post-petition AP(3)(3)(2)(2) 1 1(0)(0)(0)(0)(0)(0)(0)(6)

Capital Expenditures(1)(1)(1)(1)(3)(3)(3)(4)(4)(4)(4)(4)(4)(37)

Cash Interest (Ex. Adequate Protection & DIP) – – – – – – – – – – – – – –

Cash Flow before Restructuring Related($3)($3) $5 $8 $17 $17 $11 $5 $17 $23 $23 $17 $19 $160

Memo:

Restructuring Related Fees(2) $– $–($0)($0)($12)($3)($3)($6)($3)($3)($5)($3)($3)($43)

DIP Borrowings –(57)(52)(44)(39)(25)(18)(18)(5) – – – – –

NewPage Free Cash Flow

Cash Flow

EBITDA $0 $0($7) $1 $3 $10 $2($7) $2 $5 $1 $5 $6 $21

Pension / OPEB Funding(1)(7)(7)(1)(1)(7)(1)(1)(5)(1)(5)(6)(1)(1)(41)

in AR, Inventory, & Other WC(7)(7) 3(16) 4 3(1)(27)(5) 12(2) 26 6(3)

in Pre and Post-petition AP(3)(3)(17)(3) 5 5(0)(0)(0)(0)(0)(0)(0)(16)

Capital Expenditures(3)(3)(3)(3)(5)(5)(5)(6)(6)(6)(7)(7)(7)(63)

Cash Interest (Ex. Adequate Protection & DIP) – – – – – – – – – – – – – –

Cash Flow before Restructuring Related($19)($19)($25)($22)($0) $11($6)($46)($12) $5($15) $22 $3($102)

Memo:

Restructuring Related Fees(2) $– $–($1)($1)($12)($4)($4)($6)($4)($4)($7)($4)($4)($53)

DIP Borrowings –(284)(309)(333)(345)(338)(348)(400)(416)(415)(437)(419)(420)(420)

Note: Assumes a mid-January filing date. For presentation purposes only, assumes that Synergy & SSA payments are paid in cash during filing.

(1) Pension / OPEB funding includes estimated cash funding requirement and a reversal of income / expense recognized in EBITDA.

(2) Includes DIP fees, DIP interest, and professional fees. Assumes DIP facility of $150mm at Verso and $500mm at NewPage. Assumes $4mm per month in professional fees at each entity. For presentation purposes, assumes no adequate protection payments.

48

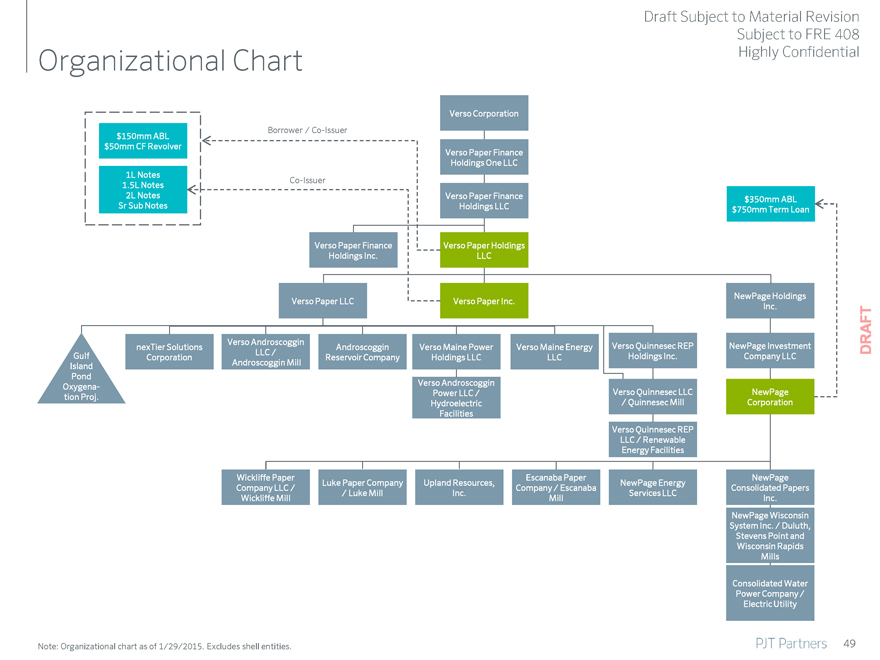

Draft Subject to Material Revision

Subject to FRE 408

Organizational Chart Highly Confidential

$150mm ABL $50mm CF Revolver

1L Notes 1.5L Notes

2L Notes Sr Sub Notes

Verso Corporation

Borrower / Co-Issuer

Verso Paper Finance

Holdings One LLC

Co-Issuer

Verso Paper Finance $350mm ABL

Holdings LLC $750mm Term Loan

Verso Paper Finance Verso Paper Holdings

Holdings Inc. LLC

NewPage Holdings

Verso Paper LLC Verso Paper Inc. Inc.

nexTier Solutions Verso Androscoggin Androscoggin Verso Maine Power Verso Maine Energy Verso Quinnesec REP NewPage Investment

Gulf Corporation LLC / Reservoir Company Holdings LLC LLC Holdings Inc. Company LLC

Island Androscoggin Mill

Pond

Oxygena- Verso Androscoggin

tion Proj. Power LLC / Verso Quinnesec LLC NewPage

Hydroelectric / Quinnesec Mill Corporation

Facilities

Verso Quinnesec REP

LLC / Renewable

Energy Facilities

Wickliffe Paper Escanaba Paper NewPage

Luke Paper Company Upland Resources, NewPage Energy

Company LLC / Company / Escanaba Consolidated Papers

/ Luke Mill Inc. Services LLC

Wickliffe Mill Mill Inc.

NewPage Wisconsin

System Inc. / Duluth,

Stevens Point and

Wisconsin Rapids

Mills

Consolidated Water

Power Company /

Electric Utility

Note: Organizational chart as of 1/29/2015. Excludes shell entities. 49

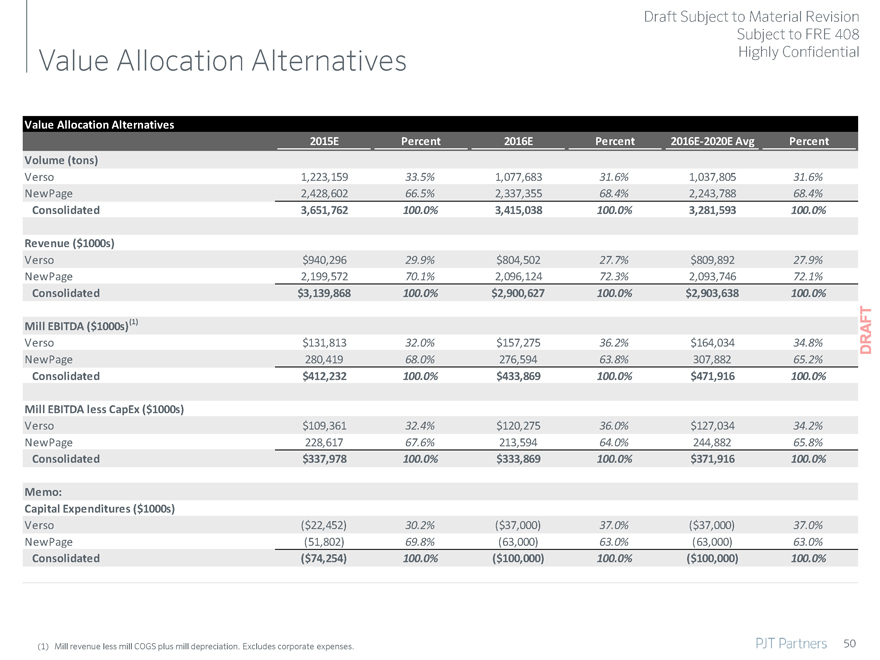

Draft Subject to Material Revision

Subject to FRE 408

Value Allocation Alternatives Highly Confidential

Value Allocation Alternatives

2015E Percent 2016E Percent 2016E-2020E Avg Percent

Volume (tons)

Verso 1,223,159 33.5% 1,077,683 31.6% 1,037,805 31.6%

NewPage 2,428,602 66.5% 2,337,355 68.4% 2,243,788 68.4%

Consolidated 3,651,762 100.0% 3,415,038 100.0% 3,281,593 100.0%

Revenue ($1000s)

Verso $940,296 29.9% $804,502 27.7% $809,892 27.9%

NewPage 2,199,572 70.1% 2,096,124 72.3% 2,093,746 72.1%

Consolidated $3,139,868 100.0% $2,900,627 100.0% $2,903,638 100.0%

Mill EBITDA ($1000s)(1)

Verso $131,813 32.0% $157,275 36.2% $164,034 34.8%

NewPage 280,419 68.0% 276,594 63.8% 307,882 65.2%

Consolidated $412,232 100.0% $433,869 100.0% $471,916 100.0%

Mill EBITDA less CapEx ($1000s)

Verso $109,361 32.4% $120,275 36.0% $127,034 34.2%

NewPage 228,617 67.6% 213,594 64.0% 244,882 65.8%

Consolidated $337,978 100.0% $333,869 100.0% $371,916 100.0%

Memo:

Capital Expenditures ($1000s)

Verso($22,452) 30.2%($37,000) 37.0%($37,000) 37.0%

NewPage(51,802) 69.8%(63,000) 63.0%(63,000) 63.0%

Consolidated($74,254) 100.0%($100,000) 100.0%($100,000) 100.0%

(1) | | Mill revenue less mill COGS plus mill depreciation. Excludes corporate expenses. |

50

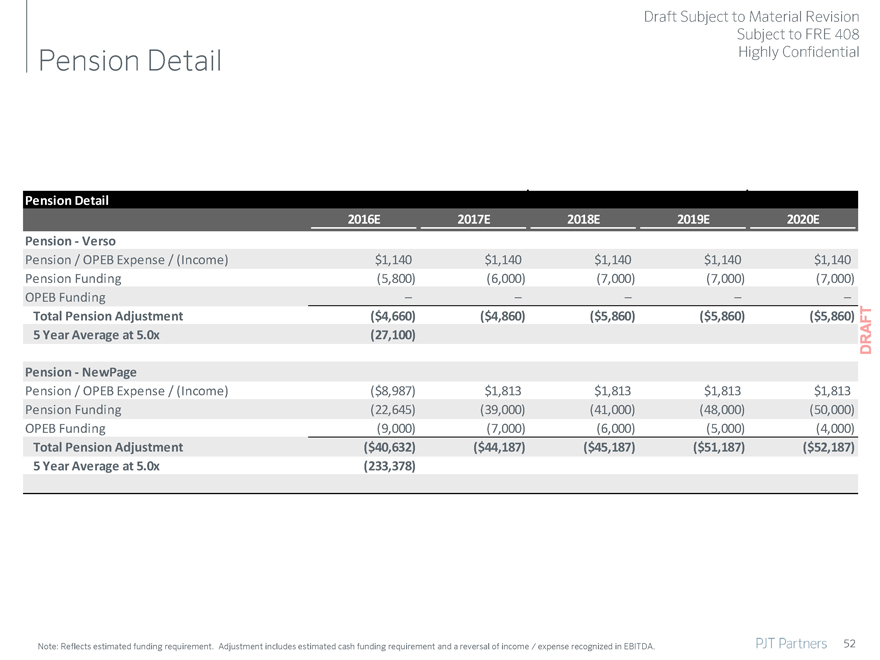

Draft Subject to Material Revision

Subject to FRE 408

Pension / OPEB Obligation Highly Confidential

($ in millions) FY 2014

Verso(1)

Verso Pension Benefit Obligation $103

Plan Assets 63

Verso Net Pension Benefit Obligation $40

NewPage(2)

NewPage Pension Benefit Obligation $1,601

Plan Assets 1,164

NewPage Net Pension Benefit Obligation $437

NewPage OPEB Obligation 47

Plan Assets -

NewPage Net OPEB Obligation $47

NewPage Total Net Pension / OPEB Obligation $484

(2) | | NewPage Pension values as of 12/31/14. OPEB values as of 1/7/15 and reflect opening balance sheet adjustments. 51 |

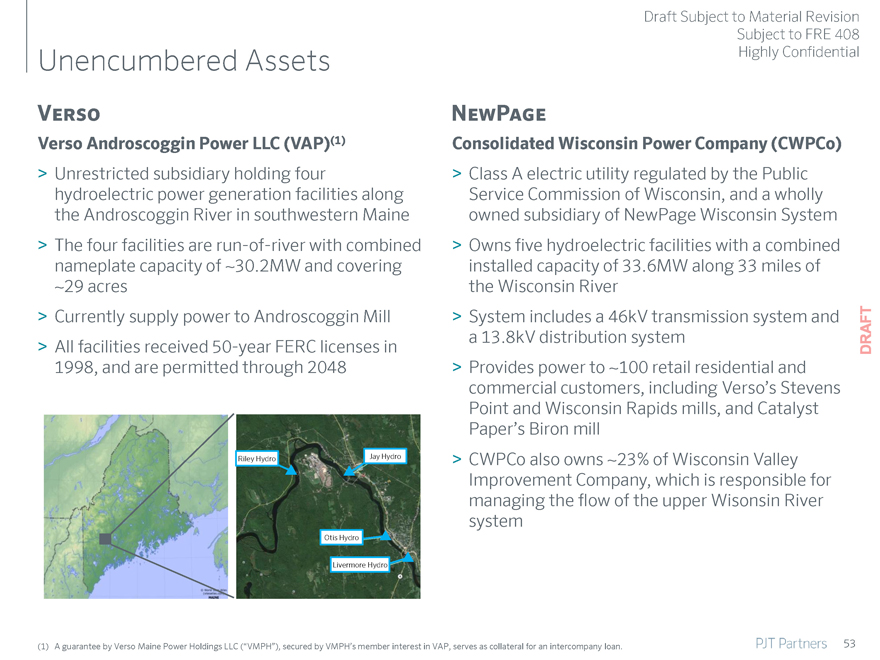

Verso NewPage

Riley Hydro Jay Hydro

Otis Hydro

Livermore Hydro

53

Draft Subject to Material Revision

Subject to FRE 408

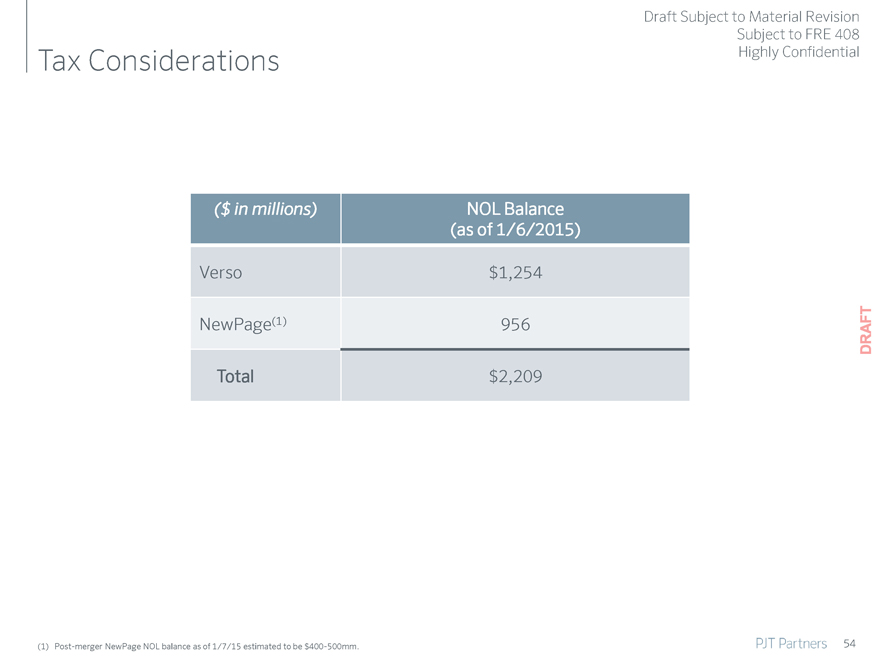

Tax Considerations Highly Confidential

($ in millions) NOL Balance

(as of 1/6/2015)

Verso $ 1,254

NewPage(1) 956

Total $ 2,209

(1) | | Post-merger NewPage NOL balance as of 1/7/15 estimated to be $400-500mm. |

54

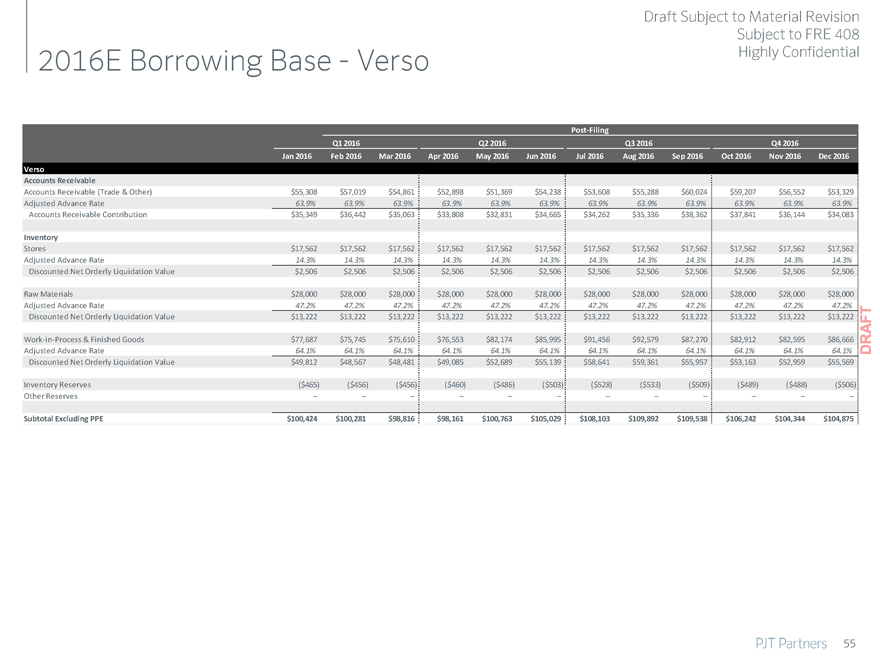

Draft Subject to Material Revision

Subject to FRE 408

2016E Borrowing Base—Verso Highly Confidential

Post-Filing

Q1 2016 Q2 2016 Q3 2016 Q4 2016

Jan 2016 Feb 2016 Mar 2016 Apr 2016 May 2016 Jun 2016 Jul 2016 Aug 2016 Sep 2016 Oct 2016 Nov 2016 Dec 2016

Verso

Accounts Receivable

Accounts Receivable (Trade & Other) $55,308 $57,019 $54,861 $52,898 $51,369 $54,238 $53,608 $55,288 $60,024 $59,207 $56,552 $53,329

Adjusted Advance Rate 63.9% 63.9% 63.9% 63.9% 63.9% 63.9% 63.9% 63.9% 63.9% 63.9% 63.9% 63.9%

Accounts Receivable Contribution $35,349 $36,442 $35,063 $33,808 $32,831 $34,665 $34,262 $35,336 $38,362 $37,841 $36,144 $34,083

Inventory

Stores $17,562 $17,562 $17,562 $17,562 $17,562 $17,562 $17,562 $17,562 $17,562 $17,562 $17,562 $17,562

Adjusted Advance Rate 14.3% 14.3% 14.3% 14.3% 14.3% 14.3% 14.3% 14.3% 14.3% 14.3% 14.3% 14.3%

Discounted Net Orderly Liquidation Value $2,506 $2,506 $2,506 $2,506 $2,506 $2,506 $2,506 $2,506 $2,506 $2,506 $2,506 $2,506

Raw Materials $28,000 $28,000 $28,000 $28,000 $28,000 $28,000 $28,000 $28,000 $28,000 $28,000 $28,000 $28,000

Adjusted Advance Rate 47.2% 47.2% 47.2% 47.2% 47.2% 47.2% 47.2% 47.2% 47.2% 47.2% 47.2% 47.2%

Discounted Net Orderly Liquidation Value $13,222 $13,222 $13,222 $13,222 $13,222 $13,222 $13,222 $13,222 $13,222 $13,222 $13,222 $13,222

Work-in-Process & Finished Goods $77,687 $75,745 $75,610 $76,553 $82,174 $85,995 $91,456 $92,579 $87,270 $82,912 $82,595 $86,666

Adjusted Advance Rate 64.1% 64.1% 64.1% 64.1% 64.1% 64.1% 64.1% 64.1% 64.1% 64.1% 64.1% 64.1%

Discounted Net Orderly Liquidation Value $49,812 $48,567 $48,481 $49,085 $52,689 $55,139 $58,641 $59,361 $55,957 $53,163 $52,959 $55,569

Inventory Reserves($465)($456)($456)($460)($486)($503)($528)($533)($509)($489)($488)($506)

Other Reserves – – – – – – – – – – – –

Subtotal Excluding PPE $100,424 $100,281 $98,816 $98,161 $100,763 $105,029 $108,103 $109,892 $109,538 $106,242 $104,344 $104,875

55

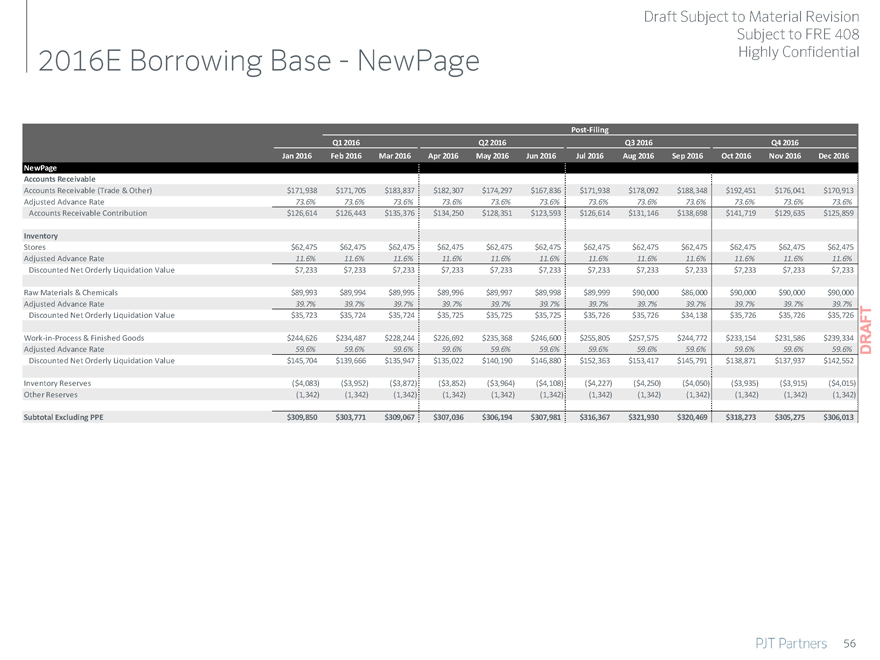

Draft Subject to Material Revision

Subject to FRE 408

2016E Borrowing Base—NewPage Highly Confidential

Post-Filing

Q1 2016 Q2 2016 Q3 2016 Q4 2016

Jan 2016 Feb 2016 Mar 2016 Apr 2016 May 2016 Jun 2016 Jul 2016 Aug 2016 Sep 2016 Oct 2016 Nov 2016 Dec 2016

NewPage

Accounts Receivable

Accounts Receivable (Trade & Other) $171,938 $171,705 $183,837 $182,307 $174,297 $167,836 $171,938 $178,092 $188,348 $192,451 $176,041 $170,913

Adjusted Advance Rate 73.6% 73.6% 73.6% 73.6% 73.6% 73.6% 73.6% 73.6% 73.6% 73.6% 73.6% 73.6%

Accounts Receivable Contribution $126,614 $126,443 $135,376 $134,250 $128,351 $123,593 $126,614 $131,146 $138,698 $141,719 $129,635 $125,859

Inventory

Stores $62,475 $62,475 $62,475 $62,475 $62,475 $62,475 $62,475 $62,475 $62,475 $62,475 $62,475 $62,475

Adjusted Advance Rate 11.6% 11.6% 11.6% 11.6% 11.6% 11.6% 11.6% 11.6% 11.6% 11.6% 11.6% 11.6%

Discounted Net Orderly Liquidation Value $7,233 $7,233 $7,233 $7,233 $7,233 $7,233 $7,233 $7,233 $7,233 $7,233 $7,233 $7,233

Raw Materials & Chemicals $89,993 $89,994 $89,995 $89,996 $89,997 $89,998 $89,999 $90,000 $86,000 $90,000 $90,000 $90,000

Adjusted Advance Rate 39.7% 39.7% 39.7% 39.7% 39.7% 39.7% 39.7% 39.7% 39.7% 39.7% 39.7% 39.7%

Discounted Net Orderly Liquidation Value $35,723 $35,724 $35,724 $35,725 $35,725 $35,725 $35,726 $35,726 $34,138 $35,726 $35,726 $35,726

Work-in-Process & Finished Goods $244,626 $234,487 $228,244 $226,692 $235,368 $246,600 $255,805 $257,575 $244,772 $233,154 $231,586 $239,334

Adjusted Advance Rate 59.6% 59.6% 59.6% 59.6% 59.6% 59.6% 59.6% 59.6% 59.6% 59.6% 59.6% 59.6%

Discounted Net Orderly Liquidation Value $145,704 $139,666 $135,947 $135,022 $140,190 $146,880 $152,363 $153,417 $145,791 $138,871 $137,937 $142,552

Inventory Reserves($4,083)($3,952)($3,872)($3,852)($3,964)($4,108)($4,227)($4,250)($4,050)($3,935)($3,915)($4,015)

Other Reserves(1,342)(1,342)(1,342)(1,342)(1,342)(1,342)(1,342)(1,342)(1,342)(1,342)(1,342)(1,342)

Subtotal Excluding PPE $309,850 $303,771 $309,067 $307,036 $306,194 $307,981 $316,367 $321,930 $320,469 $318,273 $305,275 $306,013

56

Draft Subject to Material Revision

Subject to FRE 408

2016E Borrowing Base - NewPage

Highly Confidential

Post-Filing

Q1 2016

Q2 2016

Q3 2016

Q4 2016

Jan 2016

Feb 2016

Mar 2016

Apr 2016

May 2016

Jun 2016

Jul 2016

Aug 2016

Sep 2016

Oct 2016

Nov 2016

Dec 2016

NewPage

Accounts Receivable

Accounts Receivable (Trade & Other)

$171,938

$171,705

$183,837

$182,307

$174,297

$167,836

$171,938

$178,092

$188,348

$192,451

$176,041

$170,913

Adjusted Advance Rate

73.6%

73.6%

73.6%

73.6%

73.6%

73.6%

73.6%

73.6%

73.6%

73.6%

73.6%

73.6%

Accounts Receivable Contribution

$126,614

$126,443

$135,376

$134,250

$128,351

$123,593

$126,614

$131,146

$138,698

$141,719

$129,635

$125,859

Inventory

Stores

$62,475

$62,475

$62,475

$62,475

$62,475

$62,475

$62,475

$62,475

$62,475

$62,475

$62,475

$62,475

Adjusted Advance Rate

11.6%

11.6%

11.6%

11.6%

11.6%

11.6%

11.6%

11.6%

11.6%

11.6%

11.6%

11.6%

Discounted Net Orderly Liquidation Value

$7,233

$7,233

$7,233

$7,233

$7,233

$7,233

$7,233

$7,233

$7,233

$7,233

$7,233

$7,233

Raw Materials & Chemicals

$89,993

$89,994

$89,995

$89,996

$89,997

$89,998

$89,999

$90,000

$86,000

$90,000

$90,000

$90,000

Adjusted Advance Rate

39.7%

39.7%

39.7%

39.7%

39.7%

39.7%

39.7%

39.7%

39.7%

39.7%

39.7%

39.7%

Discounted Net Orderly Liquidation Value

$35,723

$35,724

$35,724

$35,725

$35,725

$35,725

$35,726

$35,726

$34,138

$35,726

$35,726

$35,726

Work-in-Process & Finished Goods

$244,626

$234,487

$228,244

$226,692

$235,368

$246,600

$255,805

$257,575

$244,772

$233,154

$231,586

$239,334

Adjusted Advance Rate

59.6%

59.6%

59.6%

59.6%

59.6%

59.6%

59.6%

59.6%

59.6%

59.6%

59.6%

59.6%

Discounted Net Orderly Liquidation Value

$145,704

$139,666

$135,947

$135,022

$140,190

$146,880

$152,363

$153,417

$145,791

$138,871

$137,937

$142,552

Inventory Reserves

($4,083)

($3,952)

($3,872)

($3,852)

($3,964)

($4,108)

($4,227)

($4,250)

($4,050)

($3,935)

($3,915)

($4,015)

Other Reserves

(1,342)

(1,342)

(1,342)

(1,342)

(1,342)

(1,342)

(1,342)

(1,342)

(1,342)

(1,342)

(1,342)

(1,342)

Subtotal Excluding PPE

$309,850

$303,771

$309,067

$307,036

$306,194

$307,981

$316,367

$321,930

$320,469

$318,273

$305,275

$306,013

DRAFT

PJT Partners 56

Draft Subject to Material Revision

Subject to FRE 408

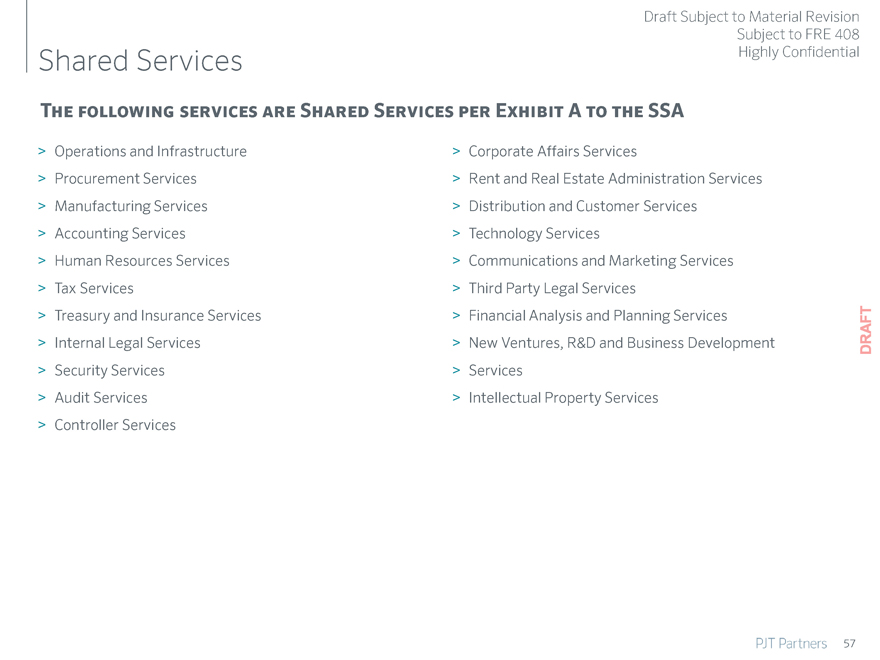

Shared Services Highly Confidential

The following services are Shared Services per Exhibit A to the SSA

Operations and Infrastructure Corporate Affairs Services

Procurement Services Rent and Real Estate Administration Services

Manufacturing Services Distribution and Customer Services

Accounting Services Technology Services

Human Resources Services Communications and Marketing Services

Tax Services Third Party Legal Services

Treasury and Insurance Services Financial Analysis and Planning Services

Internal Legal Services New Ventures, R&D and Business Development

Security Services Services

Audit Services Intellectual Property Services

Controller Services

57