Filed Pursuant to Rule 424(b)(3)

Registration No. 333-162507

PROSPECTUS

6,397,507 Shares

Common Stock

This prospectus relates to the resale of 6,397,507 shares of our common stock, by the selling stockholders identified in the selling stockholders tables beginning on page 13 of this prospectus (“Selling Stockholders”). We will not receive any proceeds from the sale of these shares by the selling stockholders.

The prices at which the Selling Stockholders may sell their shares will be determined by the prevailing market price for the shares or in privately negotiated transactions or in any other manner as described in the “Plan of Distribution” section of this prospectus. Information regarding the Selling Stockholders is provided under the “Selling Stockholders” section of this prospectus.

Our common stock is quoted on the Over-the-Counter Bulletin Board (the “OTCBB”) and on the Pinksheets under the symbol “GNSZ.” On September 20, 2011, the closing price of our common stock was $1.85 per share. You are urged to obtain current market quotations of our common stock before purchasing any of the shares being offered for sale pursuant to this prospectus.

Our principal executive offices are located at 2511 N Loop 1604 W, Suite 204, San Antonio, Texas, 78258, telephone number 210-479-8112.

Investing in our common stock is highly speculative and involves a high degree of risk. You should consider carefully the risks and uncertainties contained in the section of this prospectus entitled “Risk Factors” beginning on page 3.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this Prospectus is October 14, 2011.

TABLE OF CONTENTS

| | Page |

| FORWARD LOOKING STATEMENTS | 3 |

| RISK FACTORS | 3 |

| USE OF PROCEEDS | 10 |

| DETERMINATION OF OFFERING PRICE | 11 |

| SELLING STOCKHOLDERS | 11 |

| PLAN OF DISTRIBUTION | 19 |

| DESCRIPTION OF SECURITIES | 20 |

| DESCRIPTION OF BUSINESS | 21 |

| DESCRIPTION OF PROPERTY | 29 |

| LEGAL PROCEEDINGS | 29 |

| MARKET FOR COMMON EQUITY & RELATED STOCKHOLDER MATTERS | 29 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 30 |

| MANAGEMENT | 36 |

| EXECUTIVE COMPENSATION | 38 |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 43 |

| PRINCIPAL STOCKHOLDERS | 44 |

| INDEMNIFICATION OF DIRECTORS AND OFFICERS | 45 |

| EXPERTS | 46 |

| INTERESTS OF NAMED EXPERTS AND COUNSEL | 46 |

| WHERE YOU CAN FIND MORE INFORMATION | 46 |

| FINANCIAL STATEMENTS | F-1 |

You may rely only on the information contained in this prospectus. We have not authorized anyone to provide information or to make representations not contained in this prospectus. This prospectus is neither an offer to sell nor a solicitation of an offer to buy any securities other than those registered by this prospectus, nor is it an offer to sell or a solicitation of an offer to buy securities where an offer or solicitation would be unlawful. Neither the delivery of this prospectus, nor any sale made under this prospectus, means that the information contained in this prospectus is correct as of any time after the date of this prospectus.

We urge you to read this entire prospectus carefully, including the” Risk Factors” section and the financial statements and related notes included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2010, filed with the Securities and Exchange Commission (“SEC”) on March 30, 2011 as well as all subsequent Quarterly Reports on Form 10-Q. As used in this prospectus, unless context otherwise requires, the words “we,” “us,”“our,” “the Company” and “GenSpera” refer to GenSpera, Inc. Also, any reference to “common shares” or “common stock” refers to our $.0001 par value common stock.

FORWARD LOOKING STATEMENTS

This prospectus contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. Any statements about our expectations, beliefs, plans, objectives, assumptions or future events or performance that are not historical in nature may be forward-looking. These forward-looking statements include, but are not limited to, statements about:

| | · | the development of our drug candidates, including when we expect to undertake, initiate and complete clinical trials of our product candidates; |

| | · | the regulatory approval of our drug candidates; |

| | · | our use of clinical research centers and other contractors; |

| | · | our ability to sell, license or market any of our products; |

| | · | our ability to compete against other companies; |

| | · | our ability to secure adequate protection for our intellectual property; |

| | · | our ability to attract and retain key personnel; and |

| | · | our ability to obtain adequate financing. |

These statements are often, but not always, made through the use of words or phrases such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “believe,” “intend” and similar words or phrases. Accordingly, these statements involve estimates, assumptions and uncertainties that could cause actual results to differ materially from those expressed in them. Discussions containing these forward-looking statements may be found throughout this prospectus, including the section entitled Management’s Discussion and Analysis of Financial Condition and Results of Operations. These forward-looking statements involve risks and uncertainties, including the risks discussed under the caption “Risk Factors” that could cause our actual results to differ materially from those in the forward-looking statements. We undertake no obligation to publicly release any revisions to the forward-looking statements or reflect events or circumstances after the date of this document. The risks discussed in this report should be considered in evaluating our prospects and future financial performance.

RISK FACTORS

Investing in our common stock involves a high degree of risk. You should carefully consider the following risk factors and all other information contained in this prospectus before purchasing our common stock. If any of the following events were to occur, our business, financial condition or results of operations could be materially and adversely affected. In these circumstances, the market price of our common stock could decline, and you could lose your entire investment.

General Risks Relating to Our Business and Business Model

We are not profitable and may never be profitable.

Our net loss for the six months ended June 30, 2011 is $2,044,964. Our net losses for the two most recent fiscal years ended December 31, 2010 and 2009 have been $4,257,839 and $5,132,827, respectively. Since inception, we have generated no revenue. We intend to develop our drug compounds through Phase I/II, and then license our drug compounds to third parties after Phase I/II clinical trials. It is expected that such third parties would then continue to develop, market, sell, and distribute the resulting products. Even if we succeed in developing one or more product candidates, we expect to incur substantial losses for the foreseeable future and may never become profitable.

As a result of our limited operating history, you cannot rely upon our historical performance to make an investment decision.

Our limited operating history means that there is a high degree of uncertainty in our ability to: (i) develop and commercialize our technologies and proposed products; (ii) obtain regulatory approval to commence marketing our products; (iii) achieve market acceptance of our proposed product, if developed; (iv) respond to competition; or (v) operate the business, as management has not previously undertaken such actions as a company. No assurances can be given as to exactly when, if at all, we will be able to fully develop, license, commercialize, market, sell and derive any revenues from our proposed products in development.

We currently have no product revenues and will need to raise additional capital to operate our business.

Since inception in 2003 and through June 30, 2011, we have raised approximately $17,026,000 in capital. During this same period, we have recorded accumulated losses totaling $16,494,332. As of June 30, 2011 and December 31, 2010, we had working capital of $7,110,073 and $3,414,465, respectively, and stockholders’ equity of $5,537,370 and $1,285,030 respectively. To date, we have generated no product revenues. Until, and unless, we receive approval from the United States Food and Drug Administration (“FDA”) and other regulatory authorities for our product candidates, we cannot sell our drugs and will not have product revenues. Currently, our only product candidates are G-202 and G-115. Neither of these products is approved for sale by the FDA. Therefore, for the foreseeable future, we will have to fund all of our operations and capital expenditures from cash on hand and potential future offerings. As of June 30, 2011, we had cash of approximately $7,914,000. Our current monthly cash burn rate is approximately $500,000. This will increase to $800,000 per month in the 4th quarter 2011 primarily due to G-115 development costs. The monthly burn rate is expected to be $600,000 during the first half of 2012 as we embark upon Phase II clinical studies with G-202 and a Phase I study for G-115. Accordingly, based on our cash at June 30, 2011, we believe that we have sufficient cash on hand to fund our operations until July 2012. However, changes may occur that would consume our available capital before that time, including changes in and progress of our development activities, acquisitions of additional product candidates and changes in regulation. Accordingly, we will need additional capital to fund our continuing operations. Since we do not generate any revenue, the most likely sources of such additional capital include the sale of our securities or funds from a potential strategic licensing or collaboration transaction involving the rights to one or more of our product candidates or from grants. To the extent that we raise additional capital by issuing equity securities, our stockholders will likely experience dilution, which may be significant. If we raise additional funds through collaborations and licensing arrangements, it may be necessary to relinquish some rights to our technologies, product candidates or products, or grant licenses on terms that are not favorable to us. If we raise additional funds by incurring debt, we could incur significant interest expense and become subject to covenants in the related transaction documentation that could affect the manner in which we conduct our business.

We have no committed sources of additional capital and our access to capital funding is always uncertain. Accordingly, despite our ability to secure adequate capital in the past, there is no assurance that additional equity or debt financing will be available to us when needed, on acceptable terms or even at all. In the event that we are not able to secure financing, we may have to delay, reduce the scope of, or eliminate one or more of our research, development or commercialization programs, product launches, or marketing efforts. Any such change may materially harm our business, financial condition, and operations.

Raising needed capital may be difficult as a result of our limited operating history.

When making investment decisions, investors typically look at a company’s historical performance in evaluating the risks and operations of the business and the business’s future prospects. Our limited operating history makes such evaluation and an estimation of our future performance substantially more difficult. As a result, investors may be unwilling to invest in us or such investment may be on terms or conditions which are not acceptable. If we are unable to secure such additional finance, we may need to cease operations.

We may not be able to commercially develop our technologies.

We have concentrated our research and development on our pro-drug technologies. Our ability to generate revenue and operate profitably will depend on us being able to develop these technologies for human applications. Our technologies are primarily directed toward the development of cancer therapeutic agents. We cannot guarantee that the results obtained in the pre-clinical and clinical evaluation of our therapeutic agents will be sufficient to warrant approval by the FDA. Even if our therapeutic agents are approved for use by the FDA, there is no guarantee that they will exhibit an enhanced efficacy relative to competing therapeutic modalities such that they will be adopted by the medical community. Without significant adoption by the medical community, our agents will have limited commercial potential which could harm our ability to generate revenues, operate profitably or remain a viable business.

Inability to complete pre-clinical and clinical testing and trials will impair our viability.

During the first quarter of 2010, we commenced our first clinical trials of G-202 at the University of Wisconsin Carbone Cancer Center in Madison, Wisconsin and at the Sydney Kimmel Comprehensive Cancer Center at Johns Hopkins University. We expanded the study during the first quarter of 2011, by opening a third Phase I clinical trial site at the Cancer Therapy and Research Center at the University of Texas Health Science Center at San Antonio. Although our clinical trials are underway, the outcome of the trials is uncertain and, if we are unable to satisfactorily complete such trials, or if such trials yield unsatisfactory results, we will be unable to commercialize our proposed products. No assurances can be given that our clinical trials will be successful. The failure of such trials could delay or prevent regulatory approval and could harm our ability to generate revenues, operate profitably or remain a viable business.

Future financing will result in dilution to existing stockholders.

We will require additional financing in the future. We are authorized to issue 80 million shares of common stock and 10 million shares of preferred stock. Such securities may be issued without the approval or consent of our stockholders. The issuance of our equity securities in connection with a future financing will result in a decrease of our current stockholders’ percentage ownership.

We depend on Craig A. Dionne, PhD, our Chief Executive Officer, and Russell Richerson, PhD, our Chief Operating Officer, for our continued operations.

We only have 2 full time employees. The loss of Craig A. Dionne, PhD, our Chief Executive Officer, or Russell Richerson, PhD, our Chief Operating Officer, would be detrimental to us. Although we have entered into employment agreements with Messrs. Dionne and Richerson, there can be no assurance that these individuals will continue to provide services to us. A voluntary or involuntary termination of employment by Messrs. Dionne or Richerson could have a materially adverse effect on our business.

We may be required to make significant payments to members of our management in the event their employment with us is terminated or if we experience a change of control.

We are a party to employment agreements with each of Craig Dionne, our Chief Executive Officer, and Russell Richerson, our Chief Operating Officer. In the event we terminate the employment of either of these executives, we experience a change in control, or in certain cases, if such executive terminates his employment with us, such executive will be entitled to receive certain severance and related payments. Additionally, in such instance, certain securities held by Messrs. Dionne and Richerson will become immediately vested and exercisable. Upon the occurrence of any such event, our obligation to make such payments could significantly impact our working capital and accordingly, our ability to execute our business plan which could have a materially adverse effect to our business. Also, these provisions may discourage potential takeover attempts.

We will require additional personnel to execute our business plan.

Our anticipated growth and expansion into areas and activities requiring additional expertise, such as clinical testing, regulatory compliance, manufacturing and marketing, may require the addition of new personnel and the development of additional expertise by existing management. There is intense competition for qualified personnel in such areas. There can be no assurances that we will be able to continue to attract and retain the qualified personnel necessary for the development of our business.

Our competitors have significantly greater experience and financial resources.

We compete against numerous companies, many of which have substantially greater financial and other resources than us. Several such competitors have research programs and/or efforts to treat the same diseases we target. Companies such as Merck, Ipsen, Johnson and Johnson, and Sanofi, as well as others, have substantially greater resources and experience than we do and are situated to compete with us effectively. As a result, our competitors may bring competing products to market that would result in a decrease in demand for our product, if developed, which could have a materially adverse effect on the viability of the company.

We are dependent upon third-parties to develop our product candidates, and such parties are, to some extent, outside of our control.

We depend upon independent investigators and collaborators, such as universities and medical institutions, to conduct our pre-clinical and clinical trials under agreements with us. These individuals and/or entities are not our employees and we cannot control the amount or timing of resources that they devote to our programs. These investigators may not assign as great a priority to our programs or pursue them as diligently as we would if we were undertaking such programs ourselves. If outside collaborators fail to devote sufficient time and resources to our drug-development programs, or if their performance is substandard, the approval of our FDA applications, if any, and our introduction of new drugs, if any, will be delayed. These collaborators may also have relationships with other commercial entities, some of whom may compete with us.

We intend to rely exclusively upon the third-party FDA-approved manufacturers and suppliers for our products.

We currently have no internal manufacturing capability, and will rely exclusively on FDA-approved licensees, strategic partners or third party contract manufacturers or suppliers. Should we be forced to manufacture our products, we cannot give you any assurance that we will be able to develop internal manufacturing capabilities or procure third party suppliers. In the event we seek third party suppliers, they may require us to purchase a minimum amount of materials or could require other unfavorable terms. Any such event would materially impact our prospects and could delay the development of our products. Moreover, we cannot give you any assurance that any contract manufacturers or suppliers that we select will be able to supply our products in a timely or cost effective manner or in accordance with applicable regulatory requirements or our specifications.

Our business is dependent upon securing sufficient quantities of a natural product that currently grows in very specific locations outside of the United States.

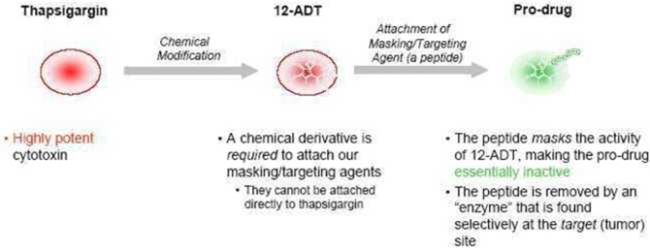

The therapeutic component of our products, including our lead compound G-202, is referred to as 12ADT. 12ADT functions by dramatically raising the levels of calcium inside cells, which leads to cell death. 12ADT is derived from a material called thapsigargin. Thapsigargin is derived from the seeds of a plant referred to as Thapsia garganica which grows along the coastal regions of the Mediterranean Sea. We currently secure the seeds from Thapsibiza, SL, a third-party supplier. There can be no assurances that the countries from which we can secure Thapsia garganica will continue to allow Thapsibiza, SL to collect such seeds and/or export the seeds derived from Thapsia garganica to the United States. In the event we are no longer able to import these seeds, we will not be able to produce our proposed drug and our business will be adversely affected.

We may be required to secure land for cultivation and harvesting of Thapsia garganica.

We believe that we can satisfy our needs for clinical development of G-202, through completion of Phase III clinical studies, from Thapsia garganica that grows naturally in the wild. In the event G-202 is approved for commercial marketing, our current supply of Thapsia garganica may not be sufficient for the anticipated demand. We estimate that in order to secure sufficient quantities of Thapsia garganica for the commercialization of a product comprising G-202, we will need to secure approximately 1000 acres of land to cultivate and grow Thapsia garganica. We anticipate the cost to lease such land would be $400,000 per year but have not yet fully assessed what other costs would be associated with a full-scale farming operation. There can be no assurances that we can secure such acreage, or that even if we are able to do so, that we could adequately grow sufficient quantities of Thapsia garganica to satisfy any commercial objectives that involve G-202. Our inability to secure adequate seeds will result in us not being able to develop and manufacture our proposed drug and will adversely impact our business.

Thapsia garganica and Thapsigargin can cause severe skin irritation and is highly toxic.

The plant Thapsia garganica can cause severe skin irritation when contact is made between the plant and the skin. ��In 1978, thapsigargin was determined to be the skin-irritating component of the plant Thapsia garganica. The therapeutic component of our products, including our lead product G-202, is derived from thapsigargin. We obtain thapsigargin from the above-ground seeds of Thapsia garganica. These seeds are harvested by hand and those conducting the harvesting must wear protective clothing and gloves to avoid skin contact. Although we obtain the seeds from a third-party contractor located in Spain, and although the contractor has contractually waived any and all liability associated with collecting the seeds, it is possible that the contractor or those employed by the contractor may suffer medical issues related to the harvesting and subsequently seek compensation from us via, for example, litigation. No assurances can be given, despite our contractual relationship with the third-party contractor, that we will not be the subject of litigation related to the harvesting of Thapsia garganica.

The synthesis of 12ADT must be conducted in special facilities.

There are a limited number of manufacturing facilities qualified to handle and manufacture therapeutic toxic agents and compounds. This limits the potential number of possible manufacturing sites for our therapeutic compounds derived from Thapsia garganica. No assurances can be provided that these facilities will be available for the manufacture of our therapeutic compounds under our time schedules or within the parameters of our manufacturing budget. In the event facilities are not available for manufacturing our therapeutic compounds, our business and future prospects will be adversely affected.

Our current manufacturing process requires acetonitrile.

The current manufacturing process for our compounds requires the common solvent acetonitrile. From late 2008 through 2009 there was a worldwide shortage of acetonitrile for a variety of reasons. We observed during that time that the available supply of acetonitrile was of variable quality, some of which is not suitable for our purposes. If we are unable to successfully change our manufacturing methods to avoid the reliance upon acetonitrile, we may incur prolonged production timelines and increased production costs. In an extreme case this situation could adversely affect our ability to manufacture our compounds altogether, thus significantly impacting our future operations.

Our proposed products may not be accepted by the health care community.

Our proposed products, if approved for marketing, may not achieve market acceptance since hospitals, physicians, patients or the medical community in general may decide not to accept and utilize them. We are attempting to develop products that will likely be first approved for marketing in late stage cancer where there is no truly effective standard of care. If approved for use in late stage cancer, the drugs will then be evaluated in earlier stage where they would represent substantial departures from established treatment methods and will compete with a number of more conventional drugs and therapies manufactured and marketed by major pharmaceutical companies. It is too early in the development cycle of the drugs for us to accurately predict our major competitors. Nonetheless, the degree of market acceptance of any of our developed products will depend on a number of factors, including but not limited to:

| | · | our demonstration to the medical community of the clinical efficacy and safety of our proposed products; |

| | · | our ability to create products that are superior to alternatives currently on the market; |

| | · | our ability to establish in the medical community the potential advantage of our treatments over alternative treatment methods; and |

| | · | the reimbursement policies of government and third-party payors. |

If the health care community does not accept our products, our business will be materially harmed.

Our therapeutic compounds have not been subjected to large scale manufacturing procedures.

To date, G-202 and G-115 have only been manufactured at a scale which is adequate to supply early stage clinical trials. There can be no assurances that the current procedures for manufacturing G-202 and G-115 will work at a larger scale which is adequate for commercial needs. In the event our therapeutic compounds cannot be manufactured in sufficient commercial quantities, our future prospects could be significantly impacted.

We face product liability risks for which we may not be able to obtain adequate insurance to protect us against losses.

We currently have no products that have been approved for commercial sale. However, the current and future use of our product candidates by us in clinical trials, and the sale of any approved products in the future, may expose us to liability claims. These claims might be made directly by consumers or healthcare providers or indirectly by pharmaceutical companies, or others selling such products. We may experience financial losses in the future due to product liability claims. We have obtained limited general commercial liability insurance coverage for our clinical trials. However, we may not be able to maintain insurance coverage at a reasonable cost or in sufficient amounts to protect us against all losses. If a successful product liability claim or series of claims is brought against us for uninsured liabilities or in excess of insured liabilities, our assets may not be sufficient to cover such claims and our business operations could be impaired.

Risks Relating to Intellectual Property and Government Regulation

We may not be able to withstand challenges to our intellectual property rights.

We rely on our intellectual property, including our issued and applied for patents and our licenses, as the foundation of our business. Our intellectual property rights may come under challenge. No assurances can be given that our patents or licenses will survive claims alleging invalidity or infringement on other patents and/or licenses. The viability of our business will suffer if our intellectual property protection becomes limited or is eliminated.

We may not be able to adequately protect our intellectual property.

Considerable research with regard to our technologies has been performed in countries outside of the United States. The laws protecting intellectual property in some of those countries may not provide protection for our trade secrets and intellectual property. If our trade secrets or intellectual property are misappropriated in those countries, we may be without adequate remedies to address the issue. In addition to our patents, we rely on confidentiality and assignment of invention agreements to protect our intellectual property. These agreements provide for contractual remedies in the event of misappropriation. We do not know to what extent, if any, these agreements and any remedies for their breach will be enforced by a foreign or domestic court. In the event our intellectual property is misappropriated or infringed upon and an adequate remedy is not available, our future prospects will greatly diminish.

Our proposed products may not receive FDA approval.

The FDA and comparable government agencies in foreign countries impose substantial regulations on the manufacture and marketing of pharmaceutical products through lengthy and detailed laboratory, pre-clinical and clinical testing procedures, sampling activities and other costly and time-consuming procedures. Satisfaction of these regulations typically takes several years or more and varies substantially based upon the type, complexity and novelty of the proposed product. Although our G-202 Phase I clinical trials are underway, we cannot assure you that we will successfully complete the trial. As of June 30, 2011, we had dosed 19 patients. It is still too early to predict when we might first submit any product license application for FDA approval or whether any such product license application would be granted on a timely basis, if at all. Any delay in obtaining, or failure to obtain, such approvals could have a materially adverse effect on the commercialization of our products and the viability of the company.

Risks Relating To Our Common Stock

Our limited market is relatively illiquid.

On September 18, 2009, our common shares began quotation on the Over-the-Counter Bulletin Board (“OTCBB”) and Pinksheets. The shares were initially sporadically traded and as a result, we did not consider that a public market for our securities existed. Commencing in the first quarter of 2010, our common shares began trading regularly but with limited volume. Accordingly, although a limited public market for our securities now exists, it is still relatively illiquid. Any prospective investor in our common stock should consider the limited market when making an investment decision. No assurances can be given that the trading volume of our common shares will increase or that a liquid public market will ever materialize. Additionally, due to the limited trading volume, it may be difficult for an investor to sell his or her shares.

Our stock price may be particularly volatile because we are a drug development company.

The market prices for securities of biotechnology companies in general, and early-stage drug development companies in particular, have been highly volatile and may continue to be highly volatile in the future. The following factors, in addition to other risk factors described in this section, may have a significant impact on the market price of our common stock:

| | · | the development status of our drug candidates, particularly the results of our clinical trials of G-202; |

| | · | market conditions or trends related to the biotechnology and pharmaceutical industries, or the market in general; |

| | · | announcements of technological innovations, new commercial products, or other material events by our competitors or us; |

| | · | disputes or other developments concerning our proprietary rights; |

| | · | changes in, or failure to meet, securities analysts’ or investors’ expectations of our financial and developmental performance; |

| | · | additions or departures of key personnel; |

| | · | discussions of our business, products, financial performance, prospects, or stock price by the financial and scientific press and online investor communities such as chat rooms; |

| | · | public concern as to, and legislative action with respect to, testing or other research areas of biopharmaceutical companies, the pricing and availability of prescription drugs, or the safety of drugs; |

| | · | regulatory developments in the United States or foreign countries; and |

| | · | economic and political factors. |

In the past, following periods of volatility in the market price of a particular company’s securities, securities class action litigation has often been brought against that company. We may become subject to this type of litigation, which is often extremely expensive and diverts management’s attention.

We face risks related to compliance with corporate governance laws and financial reporting standards.

The Sarbanes-Oxley Act of 2002, as well as related new rules and regulations implemented by the United States Securities and Exchange Commission (“SEC”) and the Public Company Accounting Oversight Board, require changes in the corporate governance practices and financial reporting standards for public companies. These new laws, rules and regulations, including compliance with Section 404 of the Sarbanes-Oxley Act of 2002 relating to internal control over financial reporting (���Section 404”), will materially increase the Company's legal and financial compliance costs and make some activities more time-consuming and more burdensome. As a result, management will be required to devote more time to compliance which could result in a reduced focus on development thereby adversely affecting the Company’s development activities. Also, the increased costs will require the Company to seek financing sooner that it may otherwise have had to.

Presently we qualify as a non-accelerated filer and, accordingly, are exempt from the requirements of 404b and our independent registered public accounting firm is not required to audit the design and operating effectiveness of our internal controls and management's assessment of the design and the operating effectiveness of such internal controls. In the event we become an accelerated filer, we will be required to expend substantial capital in connection with compliance.

Because of our limited resources, management has concluded that our internal control over financial reporting may not be effective in providing reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with U.S. generally accepted accounting principles. To mitigate the current limited resources and limited number of employees, we rely heavily on direct management oversight of transactions, along with the use of legal and accounting professionals. As we grow, we expect to increase our number of employees, which will enable us to implement adequate segregation of duties within the Committee of Sponsoring Organizations of the Treadway Commission internal control framework.

Compliance with changing regulation of corporate governance and public disclosure will result in additional expenses and will divert time and attention away from revenue generating activities.

Changing laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act of 2002 and related SEC regulations, have created uncertainty for public companies and significantly increased the costs and risks associated with accessing the public markets and public reporting. For example, on January 30th, 2009, the SEC adopted rules requiring companies to provide their financial statements in interactive data format using the eXtensible Business Reporting Language, or XBRL. Our management team will need to invest significant management time and financial resources to comply with both existing and evolving standards for public companies, which will lead to increased general and administrative expenses and a diversion of management time and attention from developing our business to compliance activities which could have an adverse effect on our business.

Our common stock may be considered a “penny stock,” and thereby be subject to additional sale and trading regulations that may make it more difficult to sell.

Our common stock, which currently trades on the Over-the-Counter Bulletin Board and Pinksheets, may be considered to be a “penny stock” if it does not qualify for one of the exemptions from the definition of “penny stock” under Section 3a51-1 of the Securities Exchange Act for 1934, as amended (the “Exchange Act”). Our common stock may be a “penny stock” if it meets one or more of the following conditions (i) the stock trades at a price less than $5.00 per share; (ii) it is NOT traded on a “recognized” national exchange; (iii) it is NOT quoted on the Nasdaq Capital Market, or even if so, has a price less than $5.00 per share; or (iv) is issued by a company that has been in business less than three years with net tangible assets less than $5 million.

The principal result or effect of being designated a “penny stock” is that securities broker-dealers participating in sales of our common stock will be subject to the “penny stock” regulations set forth in Rules 15-2 through 15g-9 promulgated under the Exchange Act. For example, Rule 15g-2 requires broker-dealers dealing in penny stocks to provide potential investors with a document disclosing the risks of penny stocks and to obtain a manually signed and dated written receipt of the document at least two business days before effecting any transaction in a penny stock for the investor’s account. Moreover, Rule 15g-9 requires broker-dealers in penny stocks to approve the account of any investor for transactions in such stocks before selling any penny stock to that investor. This procedure requires the broker-dealer to (i) obtain from the investor information concerning his or her financial situation, investment experience and investment objectives; (ii) reasonably determine, based on that information, that transactions in penny stocks are suitable for the investor and that the investor has sufficient knowledge and experience as to be reasonably capable of evaluating the risks of penny stock transactions; (iii) provide the investor with a written statement setting forth the basis on which the broker-dealer made the determination in (ii) above; and (iv) receive a signed and dated copy of such statement from the investor, confirming that it accurately reflects the investor’s financial situation, investment experience and investment objectives. Compliance with these requirements may make it more difficult and time consuming for holders of our common stock to resell their shares to third parties or to otherwise dispose of them in the market or otherwise.

As an issuer of “penny stock” the protection provided by the federal securities laws relating to forward-looking statements does not apply to us.

Although the federal securities law provide a safe harbor for forward-looking statements made by a public company that files reports under the federal securities laws, this safe harbor is not available to issuers of penny stocks. As a result, if we are a penny stock issuer, we will not have the benefit of this safe harbor protection in the event of any claim that the material provided by us contained a material misstatement of fact or was misleading in any material respect because of our failure to include any statements necessary to make the statements not misleading.

If securities or industry analysts do not publish research or reports or publish unfavorable research about our business, the price and trading volume of our common stock could decline.

The trading market for our common stock will depend in part on the research and reports that securities or industry analysts publish about us or our business. We do not currently have and may never obtain research coverage by securities and industry analysts. If no securities or industry analysts commence coverage, the trading price for our common stock will be negatively affected. In the event we obtain securities or industry analyst coverage, if one or more of the analysts who covers us downgrades our securities, the price of our securities would likely decline. If one or more of these analysts ceases to cover us or fails to publish regular reports on us, interest in the purchase of our securities could decrease, which could cause the price of our common stock and other securities and their trading volume to decline.

We do not intend to pay cash dividends.

We do not pay, and do not anticipate paying cash dividends in the foreseeable future. Accordingly, any gains on your investment will need to come through an increase in the price of our common stock. The lack of a liquid market for our common stock makes such gains highly unlikely.

Our board of directors has broad discretion to issue additional securities.

We are entitled under our certificate of incorporation to issue up to 80,000,000 common and 10,000,000 “blank check” preferred shares. Blank check preferred shares provide the board of directors broad authority to determine voting, dividend, conversion, and other rights. As of June 30, 2011, we have issued and outstanding 21,443,735 common shares and we have 16,371,218 common shares reserved for future grants under our equity compensation plans and issuances upon the exercise of current outstanding options, warrants and convertible securities. Accordingly, we are entitled to issue up to 42,185,047 additional common shares and 10,000,000 additional preferred shares. Our board may generally issue those common and preferred shares, or options or warrants to purchase those shares, without further approval by our shareholders. Any preferred shares we may issue will have such rights, preferences, privileges and restrictions as may be designated from time-to-time by our board, including preferential dividend rights, voting rights, conversion rights, redemption rights and liquidation provisions. It is likely that we will be required to issue a large amount of additional securities to raise capital to further our development and marketing plans. It is also likely that we will be required to issue a large amount of additional securities to directors, officers, employees and consultants as compensatory grants in connection with their services, both in the form of stand-alone grants or under our various stock plans. The issuance of additional securities may cause substantial dilution to our shareholders.

Our Officers and Scientific Advisors beneficially own approximately 31% of our outstanding common shares.

Our Officers and Scientific Advisors own approximately 31% of our issued and outstanding common shares. As a consequence of their level of stock ownership, the group retains substantial ability to influence the elect or remove members of our board of directors, and thereby control our management. This group of shareholders has the ability to significantly control the outcome of corporate actions requiring shareholder approval, including mergers and other changes of corporate control, going private transactions, and other extraordinary transactions any of which may be in opposition to the best interest of the other shareholders and may negatively impact the value of your investment.

Provisions in Delaware law and executive employment agreements may prevent or delay a change of control.

We are subject to the Delaware anti-takeover laws regulating corporate takeovers. These anti-takeover laws prevent Delaware corporations from engaging in a merger or sale of more than 10% of its assets with any stockholder, including all affiliates and associates of the stockholder, who owns 15% or more of the corporation’s outstanding voting stock, for three years following the date that the stockholder acquired 15% or more of the corporation’s assets unless:

| | · | the Board of Directors approved the transaction in which the stockholder acquired 15% or more of the corporation’s assets; |

| | · | after the transaction in which the stockholder acquired 15% or more of the corporation’s assets, the stockholder owned at least 85% of the corporation’s outstanding voting stock, excluding shares owned by directors, officers and employee stock plans in which employee participants do not have the right to determine confidentially whether shares held under the plan will be tendered in a tender or exchange offer; or |

| | · | on or after this date, the merger or sale is approved by the Board of Directors and the holders of at least two-thirds of the outstanding voting stock that is not owned by the stockholder. |

A Delaware corporation may opt out of the Delaware anti-takeover laws if its certificate of incorporation or bylaws so provide. We have not opted out of the provisions of the anti-takeover laws. As such, these laws could prohibit or delay mergers or other takeover or change of control of GenSpera and may discourage attempts by other companies to acquire us.

In addition, employment agreements with certain executive officers provide for the payment of severance and acceleration of the vesting of options and restricted stock in the event of termination of the executive officer following a change of control of GenSpera. These provisions could have the effect of discouraging potential takeover attempts.

USE OF PROCEEDS

We will not receive any of the proceeds from the sale of the shares by any of the selling stockholders, but we will receive up to $7,362,427 upon the exercise of warrants in the event they are exercised for cash. We will use the proceeds received from the exercise of warrants, if any, for working capital.

DETERMINATION OF OFFERING PRICE

The Selling Stockholders will offer their shares at the prevailing market prices, privately negotiated prices, or in any other fashion and manner as described in the section of this Prospectus entitled “Plan of Distribution.”

SELLING STOCKHOLDERS

This prospectus relates to the offering and sale, from time to time, of up to 6,397,507 shares of our common stock held by the stockholders named in the tables below (“Selling Stockholders”), which amount includes common shares issuable upon the exercise of warrants held by the Selling Stockholders. Of the shares being included, 6,397,507 have been previously registered and this prospectus will constitute a post-effective amendment to the prior registration statement.

The shares previously registered relate to: (i) shares and shares underlying warrants issued during our September 2009 offering (“2009 September Offering”); (ii) shares and shares underlying warrants issued during our June and July 2009 offering (“2009 June Offering”); (iii) shares and shares underlying warrants issued during our February 2009 offering (“2009 February Offering”); (iv) shares and shares underlying warrants issued to consultants for services provided (“Consultant Warrants”); (v) shares underlying warrants issued as a result of anti-dilution provisions (“Anti-Dilution Warrants”); and (vi) shares and shares underlying warrants issued during our July and August 2008 offering (“2008 July Offering”).

2009 September Offering

Pursuant to the terms of the September 2, 2009 offering, we sold an aggregate of 160,000 units resulting in gross proceeds of $240,000 or $1.50 per unit. Each unit consists of: (i) one share of common stock, and (ii) one half common stock purchase warrant. The warrants have a term of five years and allow the investors to purchase our common shares at a price per share of $3.00. The warrants also contain anti-dilution protection in the event of stock splits, stock dividends and other similar transactions. The warrants are callable by us in the event our shares are publically traded in the future and certain price and volume conditions are met. We paid a total of $23,100 in fees and expenses incurred in connection with the offering. We also issued warrants to purchase 12,267 common shares, with identical terms to the warrant, as a partial finder’s fee in connection with the offering. We previously registered the: (i) 160,002 common shares, and (ii) 92,269 common shares underlying the warrants, issued pursuant to the offering. The selling shareholders have previously sold shares pursuant to rule 144 or the prior prospectus: 0 common shares and 0 common shares underlying warrants. Accordingly, we are including herein the remaining unsold: 160,002 common shares and 92,269 common shares underlying warrants.

2009 June Offering

In June and July of 2009 we completed the offering of 2,025,344 units resulting in gross proceeds of $3,038,000 or $1.50 per unit. Each unit consists of: (i) one share of common stock; and (ii) one half common stock purchase warrant. The warrants have a term of five years and allow the investors to purchase our common shares at a price per share of $3.00. The Warrants also contain anti-dilution protection in the event of stock splits, stock dividends and other similar transactions. The warrants are callable by us in the event the Company’s shares are publically traded in the future and certain price and volume conditions are met. We previously registered herein the: (i) 2,025,344 common shares, and (ii) 1,012,679 common shares underlying the warrants, issued pursuant to the June Offering.. The selling shareholders have previously sold shares pursuant to rule 144 or the prior prospectus: 467,780 common shares and 0 common shares underlying warrants. Accordingly, we are including herein the remaining unsold: 1,557,564 common shares and 1,012,679 common shares underlying warrants. We are also registering the remaining unsold: (i) 33,334 common shares; and (ii) 100,562 common shares underlying warrants that were issued to finders in connection with the offering. No shares arising out of the finders’ 33,334 common shares or 100,562 common shares underlying warrants have been sold.

Anti-Dilution Warrants

In our 2008 Offering, we sold an aggregate of 2,320,000 units resulting in gross proceeds of $2,320,000 or $1.00 per unit. Each unit consisted of: (i) 1 share of common stock; and (ii) one half common stock purchase warrant. The warrants have a term of 5 years and an exercise price of $2.00 per shares subject to certain anti-dilution adjustments. During February of 2009 the Company completed the 2009 February Offering and sold an aggregate of $750,000 units at a price per unit of $1.50. As a result of the 2009 February Offering, certain anti-dilution provisions in the warrants held by investors who participated in our July and August, 2008 offering were triggered. The result of these anti-dilution provisions was that the exercise price of warrants issued during our July and August 2008 offering were reduced from $2.00 to $1.50; and we issued the investors in the offering warrants to purchase an additional 506,754 common shares at $1.50. We previously included herein the shares underlying 394,187 of the additional 506,754 warrants which we issued. The selling shareholders have previously sold shares pursuant to rule 144 or the prior prospectus: 12,501 common shares underlying warrants. Accordingly, we are including herein the remaining unsold: 381,686 common shares underlying warrants.

2009 February Offering

In February and April of 2009 we completed the offering of 500,000 units resulting in gross proceeds of $750,000 or $1.50 per unit. Each unit consists of: (i) one share of common stock; and (ii) one half common stock purchase warrant. The warrants have a term of five years and allow the investors to purchase our common shares at a price per share of $3.00. The Warrants also contain anti-dilution protection in the event of stock splits, stock dividends and other similar transactions. The warrants are callable by us in the event the Company’s shares are publically traded in the future and certain price and volume conditions are met. We previously included herein the: (i) 500,008 common shares, and (ii) 250,006 common shares underlying the warrants, issued pursuant to the 2009 February Offering. The selling shareholders have previously sold shares pursuant to rule 144 or the prior prospectus: 150,003 common shares and 0 common shares underlying warrants. Accordingly, we are including herein the remaining unsold: 350,005 common shares and 250,006 common shares underlying warrants.

2008 July Offering

In July and August of 2008 we completed the offering of 2,320,000 units resulting in gross proceeds of $2,320,000 or $1.00 per unit. Each unit consists of: (i) 1 share of common stock; and (ii) one half common stock purchase warrant. The warrants have a term of 5 years and an exercise price of $2.00 per shares subject to certain anti-dilution adjustments. The warrants are also callable by the Company in the event the Company’s shares are publically traded in the future and certain price and volume conditions are met. As part of the offering, TR Winston & Company, LLC acted as the Company’s placement agent with respect to the transaction. Pursuant to a placement agent agreement with TR Winston & Company, LLC we agreed to the following compensation: (i) cash fee equal to 8% of gross proceeds raised, including any payments made to the Company upon the exercise of the warrants; (ii) the issuance of a warrant to purchase 8% of all securities issued; and (iii) payment of legal expenses totaling $20,000. Accordingly, we issued to TR Winston & Company, LLC a warrant to purchase 278,400 common shares of which 22,500 were assigned to Mercer Capital, Ltd. and associated persons for their assistance in the offering. The warrant has an exercise price per common shares of $2.00 and a term of 5 years. Also, as an accommodation to the Company, TR Winston & Company, LLC agreed to receive a convertible debenture in the principal amount of $163,600 and warrants to purchase an additional 81,800 common shares, in lieu of its $163,600 cash fee. The convertible debenture accrues interest at 5% per annum and has a maturity date of July 14, 2009. It is convertible into the shares of the Company’s common stock, at the sole discretion of the holder, at $1.00 per share subject to certain anti-dilution adjustments. The warrant has the same terms as those issued to investors in the offering. We previously registered herein: (i) 2,195,000 common shares, and (ii) 1,438,400 common shares underlying the warrants, issued pursuant to the July Offering. The selling shareholders have previously sold shares pursuant to rule 144 or the prior prospectus in the amount of 1,795,500 common shares and 37,500 common shares underlying warrants. Accordingly, we are including herein the remaining unsold: 399,500 common shares and 1,400,900 common shares underlying warrants.

In addition we previously registered along with the July 2008 offering, 2,295,000 shares and 84,000 warrants underlying common shares. Of these, 2,105,000 common shares have been sold and 0 shares have been sold underlying warrants. We are including herein the remaining 190,000 common shares.

The exercise price of the warrants issued as part of the 2008 July Offering have previously been adjusted to $1.50.

Consultant Warrants and Common Shares

We are also registering 385,000 shares issued to consultants and service providers in exchange for services and reimbursement of expenses. We previously registered: (i) 25,000 common shares, (ii) and 444,000 common shares underlying warrants. The selling shareholders have previously sold shares pursuant to rule 144 or the prior prospectus: 0 common shares and 0 common shares underlying warrants. Accordingly, we are including herein the remaining unsold: 25,000 common shares and 444,000 common shares underlying warrants.

The Selling Stockholders may exercise their warrants at any time in their sole discretion. All of the Selling Stockholders named below acquired their common stock and warrants directly from us in private transactions.

| | | Common Shares Owned Before Sale (1) | | | Shares | | | Common Shares Owned After Sale (2) | |

| | | Held Outright | | | Warrants/ Options | | | Amount | | | % of class | | | being registered | | | Amount | | | % of Class | |

| | | | | | | | | | | | | | | | | | | | | | |

| Bristol Investment Fund, Ltd.(3) | | | - | | | | 216,667 | | | | 216,667 | | | | * | | | | 166,667 | | | | 50,000 | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| G. Tyler Runnels or Jasmine Niklas Runnels TTEES The Runnel Family Trust dtd 1-11-20(4) | | | - | | | | 83,334 | | | | 83,334 | | | | * | | | | 83,334 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Richard Hull, PhD | | | - | | | | 48,334 | | | | 48,334 | | | | * | | | | 33,334 | | | | 15,000 | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| IRA FBO J. Steven Emerson Rollover II Pershing LLC as Custodian | | | 125,000 | | | | 229,167 | | | | 354,167 | | | | 1.65 | % | | | 166,667 | | | | 187,500 | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| T.R. Winston & Company, LLC (5) | | | - | | | | 518,267 | | | | 518,267 | | | | 2.42 | % | | | 255,900 | | | | 262,367 | | | | 1.22 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Steven Michell Sack PSP U/A DTD 01/01/1994 | | | 50,000 | | | | 91,667 | | | | 141,667 | | | | * | | | | 66,667 | | | | 75,000 | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Charles S. and Kathryn F. Hopper, JTWROS (was Kathryn F. Hopper) | | | - | | | | 20,000 | | | | 20,000 | | | | * | | | | 20,000 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Robert O'Mara | | | 163,334 | | | | 43,334 | | | | 206,668 | | | | * | | | | 206,668 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Subhash C. Gulati | | | - | | | | 19,167 | | | | 19,167 | | | | * | | | | 6,667 | | | | 12,500 | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ajax Partners (6) | | | 100,000 | | | | 66,667 | | | | 166,667 | | | | * | | | | 166,667 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| JAG MULTI INVESTMENTS LLC (7) | | | - | | | | 66,667 | | | | 66,667 | | | | * | | | | 66,667 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Robert R. Kauffman | | | - | | | | 66,667 | | | | 66,667 | | | | * | | | | 66,667 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Steven Mitchell Sack | | | 80,000 | | | | 106,667 | | | | 186,667 | | | | * | | | | 66,667 | | | | 120,000 | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| New Giles, LLC (8) | | | - | | | | 50,000 | | | | 50,000 | | | | * | | | | 50,000 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Samax Family Limited Partnership (9) | | | 50,000 | | | | 75,000 | | | | 125,000 | | | | * | | | | 50,000 | | | | 75,000 | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Jay R. Solan | | | 25,000 | | | | 29,167 | | | | 54,167 | | | | * | | | | 16,667 | | | | 37,500 | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Thomas E. Genna | | | 50,000 | | | | 25,000 | | | | 75,000 | | | | * | | | | 50,000 | | | | 25,000 | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Richard W. Green | | | - | | | | 16,667 | | | | 16,667 | | | | * | | | | 16,667 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| D. Carl Lustig, III | | | - | | | | 50,000 | | | | 50,000 | | | | * | | | | 50,000 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| The Verrazano Group, LLC (10) | | | - | | | | 233,625 | | | | 233,625 | | | | 1.09 | % | | | 184,000 | | | | 49,625 | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Windermere Insurance Co. Ltd. (11) | | | 50,000 | | | | 33,334 | | | | 83,334 | | | | * | | | | 83,334 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Christopher Miglino | | | - | | | | 33,334 | | | | 33,334 | | | | * | | | | 33,334 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Doris Sutz Roth IRA | | | - | | | | 33,334 | | | | 33,334 | | | | * | | | | 33,334 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dr. Arnold Yoskowitz and Regina Yoskowitz | | | - | | | | 33,334 | | | | 33,334 | | | | * | | | | 33,334 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gerald B. Lichtenberger | | | 7,000 | | | | 33,334 | | | | 40,334 | | | | * | | | | 40,334 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| John Peter Christensen | | | 50,000 | | | | 33,334 | | | | 83,334 | | | | * | | | | 83,334 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Philip S. Sassower | | | - | | | | 33,334 | | | | 33,334 | | | | * | | | | 33,334 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Mitchell J. Sassower | | | - | | | | 33,334 | | | | 33,334 | | | | * | | | | 33,334 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Jerry A. Lubliner, M.D. | | | - | | | | 33,334 | | | | 33,334 | | | | * | | | | 33,334 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Beatrice Slomiuc | | | 50,000 | | | | - | | | | 50,000 | | | | * | | | | 50,000 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sheila Sugerman | | | 50,000 | | | | - | | | | 50,000 | | | | * | | | | 50,000 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Alan Schwartz | | | - | | | | 16,667 | | | | 16,667 | | | | * | | | | 16,667 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Arthur Dunkin | | | - | | | | 16,667 | | | | 16,667 | | | | * | | | | 16,667 | | | | - | | | | * | |

| | | Common Shares Owned Before Sale (1) | Shares | | | Common Shares Owned After Sale (2) | |

| | | Held Outright | | | Warrants/ Options | | | Amount | | | % of class | | | being registered | | | Amount | | | % of Class | |

| | | | | | | | | | | | | | | | | | | | | | |

| Faith Griffin & John A. Lenhart JTWROS | | | 25,000 | | | | 16,667 | | | | 41,667 | | | | * | | | | 41,667 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Patrick Hund | | | - | | | | 16,667 | | | | 16,667 | | | | * | | | | 16,667 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Rhonda Wesolak, Individual Retirement Account, RBC Capital Markets Corp Cust | | | 25,000 | | | | 16,667 | | | | 41,667 | | | | * | | | | 41,667 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| John G. Korman | | | - | | | | 16,667 | | | | 16,667 | | | | * | | | | 16,667 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| A.C. Providenti | | | - | | | | 16,667 | | | | 16,667 | | | | * | | | | 16,667 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Benjamin Hill | | | 21,667 | | | | 12,501 | | | | 34,168 | | | | * | | | | 25,001 | | | | 9,167 | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| John Toedtman | | | 10,000 | | | | | | | | 10,000 | | | | * | | | | 10,000 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Donald L. Stahl | | | - | | | | 8,334 | | | | 8,334 | | | | * | | | | 8,334 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Leslie M. James | | | 12,500 | | | | 8,334 | | | | 20,834 | | | | * | | | | 20,834 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nathan Sugerman | | | 12,500 | | | | 8,334 | | | | 20,834 | | | | * | | | | 20,834 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Robert B. Greene | | | 12,500 | | | | 8,334 | | | | 20,834 | | | | * | | | | 20,834 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Klaus Peter Eichner | | | - | | | | 8,334 | | | | 8,334 | | | | * | | | | 8,334 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gary J. Faden | | | - | | | | 8,334 | | | | 8,334 | | | | * | | | | 8,334 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Brian H. Reis | | | - | | | | 20,667 | | | | 20,667 | | | | * | | | | 20,667 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Andrew B. Dorman | | | - | | | | 5,667 | | | | 5,667 | | | | * | | | | 5,667 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| David S. Lustig | | | - | | | | 2,774 | | | | 2,774 | | | | * | | | | 2,774 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nicole H. Tavernier | | | - | | | | 667 | | | | 667 | | | | * | | | | 667 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Mark P. Eichner | | | - | | | | 227 | | | | 227 | | | | * | | | | 227 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Jeffrey J. Kraws | | | - | | | | 25,000 | | | | 25,000 | | | | * | | | | 25,000 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Karen B. Goldfarb | | | - | | | | 25,000 | | | | 25,000 | | | | * | | | | 25,000 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Peter Nejes | | | - | | | | 30,000 | | | | 30,000 | | | | * | | | | 30,000 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dennis Powers | | | - | | | | 30,000 | | | | 30,000 | | | | * | | | | 30,000 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Karen Kemmerer | | | - | | | | 90,000 | | | | 90,000 | | | | * | | | | 90,000 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| John L. Kemmerer, JR. 1970 Trust (12) | | | 690,000 | | | | 345,000 | | | | 1,035,000 | | | | 4.83 | % | | | 1,035,000 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Photon Global Ltd. (13) | | | 125,000 | | | | 229,167 | | | | 354,167 | | | | 1.65 | % | | | 166,667 | | | | 187,500 | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gregory P. Zeller | | | 166,667 | | | | 83,334 | | | | 250,001 | | | | 1.17 | % | | | 250,001 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Far Hills Capital, LLC (14) | | | 183,334 | | | | 91,667 | | | | 275,001 | | | | 1.28 | % | | | 200,001 | | | | 75,000 | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cynthia P. Stafford Trust | | | 133,334 | | | | 66,667 | | | | 200,001 | | | | * | | | | 200,001 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Jonathan Meyers | | | 66,667 | | | | 33,334 | | | | 100,001 | | | | * | | | | 100,001 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gene Mulvihill | | | - | | | | 33,334 | | | | 33,334 | | | | * | | | | 33,334 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Robert L. and Natacha Stafford | | | 66,667 | | | | 33,334 | | | | 100,001 | | | | * | | | | 100,001 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Horemheb Investments, LLC (15) | | | 66,667 | | | | 33,334 | | | | 100,001 | | | | * | | | | 100,001 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Robert L. Stafford Jr. Trust | | | 96,667 | | | | 48,334 | | | | 145,001 | | | | * | | | | 100,001 | | | | 45,000 | | | | * | |

| | | Common Shares Owned Before Sale (1) | | | Shares | | | Common Shares Owned After Sale (2) | |

| | | Held Outright | | | Warrants/ Options | | | Amount | | | % of class | | | being registered | | | Amount | | | % of Class | |

| | | | | | | | | | | | | | | | | | | | | | |

| Equity Trust Company, d.b.a. Sterling Trust, Custodian FBO: John Sanderford | | | 46,667 | | | | 23,334 | | | | 70,001 | | | | * | | | | 70,001 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Peter Cunningham | | | 78,334 | | | | 39,167 | | | | 117,501 | | | | * | | | | 50,001 | | | | 67,500 | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gordon W. Clark, Jr. | | | - | | | | 16,667 | | | | 16,667 | | | | * | | | | 16,667 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Edward J. Foley, III | | | 33,334 | | | | 16,667 | | | | 50,001 | | | | * | | | | 50,001 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Held Under Will of Joan P. Foley FBO Edward J. Foley, III - Lifetime Trust | | | 45,834 | | | | 22,917 | | | | 68,751 | | | | * | | | | 50,001 | | | | 18,750 | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Edward J. Foley, III, 2009 GRAT | | | 33,334 | | | | 16,667 | | | | 50,001 | | | | * | | | | 50,001 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Francis O'Connor | | | - | | | | 16,667 | | | | 16,667 | | | | * | | | | 16,667 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Frank E. Walsh, III | | | 33,334 | | | | 16,667 | | | | 50,001 | | | | * | | | | 50,001 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Bass Family Trust | | | 58,334 | | | | 29,167 | | | | 87,501 | | | | * | | | | 50,001 | | | | 37,500 | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Brian Thebault | | | 33,334 | | | | 16,667 | | | | 50,001 | | | | * | | | | 50,001 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Voiceified Technologies, LLC (16) | | | - | | | | 16,667 | | | | 16,667 | | | | * | | | | 16,667 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Kihong Kwon, M.D. | | | 33,334 | | | | 16,667 | | | | 50,001 | | | | * | | | | 50,001 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Iroquois Master Fund, Ltd. (17) | | | 33,334 | | | | 16,667 | | | | 50,001 | | | | * | | | | 50,001 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Roxy Transportation Co., Inc. (18) | | | 25,000 | | | | 12,500 | | | | 37,500 | | | | * | | | | 37,500 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| William Stewart | | | 42,223 | | | | 21,112 | | | | 63,335 | | | | * | | | | 33,335 | | | | 30,000 | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Bernard B. Markey | | | 20,000 | | | | 26,112 | | | | 46,112 | | | | * | | | | 11,112 | | | | 35,000 | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Diamond II Investments, LLC (19) | | | - | | | | 11,112 | | | | 11,112 | | | | * | | | | 11,112 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ravenwood Partners, LLC (20) | | | 19,446 | | | | 19,723 | | | | 39,169 | | | | * | | | | 10,000 | | | | 29,169 | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| John Sanderford | | | - | | | | 10,000 | | | | 10,000 | | | | * | | | | 10,000 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Terry Sholty Strada | | | 16,667 | | | | 8,334 | | | | 25,001 | | | | * | | | | 25,001 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| John Amorosa | | | - | | | | 8,334 | | | | 8,334 | | | | * | | | | 8,334 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Glen Bliwise | | | 16,667 | | | | 8,334 | | | | 25,001 | | | | * | | | | 25,001 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Joseph C. Roselle | | | - | | | | 8,334 | | | | 8,334 | | | | * | | | | 8,334 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Schuyler L. Merrihew | | | 44,445 | | | | 22,223 | | | | 66,668 | | | | * | | | | 25,001 | | | | 41,667 | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Kihong Kwon, M.D., Custodian, UGMA for Connor Merrihew | | | 56,694 | | | | 28,347 | | | | 85,041 | | | | * | | | | 24,000 | | | | 61,041 | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Kihong Kwon, M.D., Custodian, UGMA for Mason Kwon | | | 82,444 | | | | 41,222 | | | | 123,666 | | | | * | | | | 24,000 | | | | 99,666 | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Timothy V. O'Connor | | | 10,000 | | | | 5,000 | | | | 15,000 | | | | * | | | | 15,000 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Jarmila Cunningham | | | 8,334 | | | | 4,167 | | | | 12,501 | | | | * | | | | 12,501 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Bernard B. Markey, Individual 401(K) ETRADE Custodian | | | 6,667 | | | | 3,334 | | | | 10,001 | | | | * | | | | 10,001 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Timothy V. O'Connor Roth IRA | | | 6,667 | | | | 3,334 | | | | 10,001 | | | | * | | | | 10,001 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Brandon Hill | | | 17,334 | | | | 9,500 | | | | 26,834 | | | | * | | | | 5,001 | | | | 21,833 | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sequoia Global Partners, LLC (21) | | | - | | | | 83,228 | | | | 83,228 | | | | * | | | | 73,228 | | | | 10,000 | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Walter H. Bass, LLC (21) | | | 291,464 | | | | 453,028 | | | | 744,492 | | | | 3.47 | % | | | 52,934 | | | | 691,558 | | | | 3.22 | % |

| | | Common Shares Owned Before Sale (1) | | | Shares | | | Common Shares Owned After Sale (2) | |

| | | Held Outright | | | Warrants/ Options | | | Amount | | | % of class | | | being registered | | | Amount | | | % of Class | |

| | | | | | | | | | | | | | | | | | | | | | |

| Robert Scherne (22) | | | 3,334 | | | | 81,667 | | | | 85,001 | | | | * | | | | 5,001 | | | | 80,000 | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Craig Petralia (22) | | | 1,667 | | | | 834 | | | | 2,501 | | | | * | | | | 2,501 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Todd Shapiro (22) | | | 1,667 | | | | 834 | | | | 2,501 | | | | * | | | | 2,501 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| The Alec and Evelyn Sabo Trust (23) | | | 233,334 | | | | 116,667 | | | | 350,001 | | | | 1.63 | % | | | 200,001 | | | | 150,000 | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cataracta Aps (24)(25) | | | 312,500 | | | | 80,000 | | | | 392,500 | | | | 1.83 | % | | | 60,000 | | | | 332,500 | | | | 1.55 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Treskerby Clinical Solutions, LLC (24)(26) | | | 25,000 | | | | - | | | | 25,000 | | | | * | | | | 25,000 | | | | - | | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 4,235,231 | | | | 5,094,619 | | | | 9,329,850 | | | | 43.51 | % | | | 6,397,507 | | | | 2,932,343 | | | | 13.67 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares Outstanding as of 8/8/2011 | | | 21,443,735 | | | | | | | | | | | | | | | | | | | | | | | | | |

* Represents less than 1%

**Unless otherwise stated, the individual(s) with voting and dispositive control of securities offered on behalf of trusts or custodial accounts is the individual or entity referenced in the name of such accounts.

(1) Pursuant to Rules 13d-3 and 13d-5 of the Exchange Act, beneficial ownership includes any common shares as to which a shareholder has sole or shared voting power or investment power, and also any common shares which the shareholder has the right to acquire within 60 days, including upon exercise of common shares purchase options or warrants. There were 21,443,735 common shares outstanding as of August 12, 2011.

(2) Assumes the sale of all common shares previously registered and included herein but does not include shares initially being registered which may be part of the Initial Registration shares contained above.

(3) Bristol Capital Advisors, LLC (“BCA”) is the investment advisor to Bristol Investment Fund, Ltd. (“Bristol”). Paul Kessler is the manager of BCA and as such has voting and investment control over the securities held by Bristol. Mr. Kessler disclaims beneficial ownership of these securities.

(4) G. Tyler Runnels and Jasmine Niklas Runnels, as Trustees, have voting and dispositive control with respect to the securities being offered.