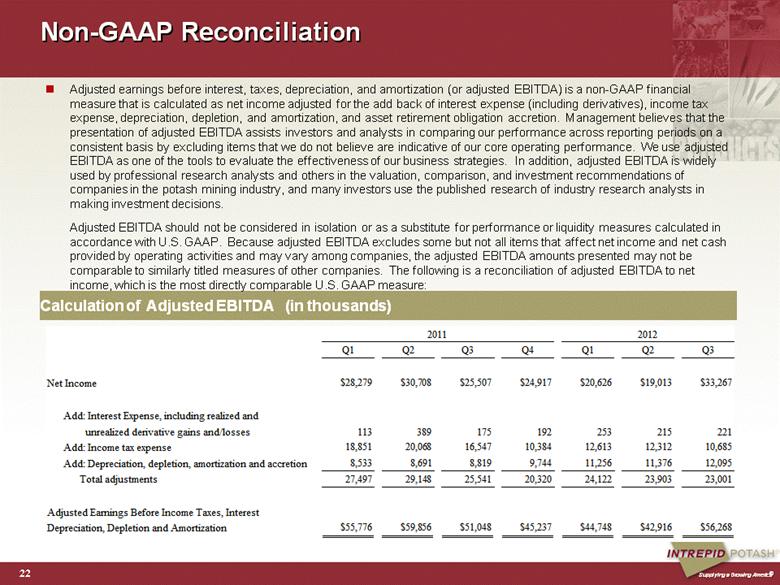

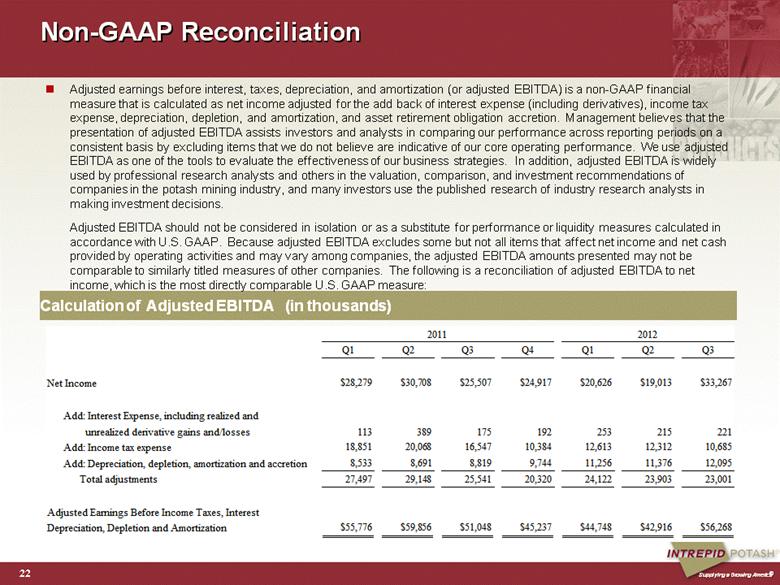

| Non-GAAP Reconciliation Calculation of Adjusted EBITDA (in thousands) 22 Adjusted earnings before interest, taxes, depreciation, and amortization (or adjusted EBITDA) is a non-GAAP financial measure that is calculated as net income adjusted for the add back of interest expense (including derivatives), income tax expense, depreciation, depletion, and amortization, and asset retirement obligation accretion. Management believes that the presentation of adjusted EBITDA assists investors and analysts in comparing our performance across reporting periods on a consistent basis by excluding items that we do not believe are indicative of our core operating performance. We use adjusted EBITDA as one of the tools to evaluate the effectiveness of our business strategies. In addition, adjusted EBITDA is widely used by professional research analysts and others in the valuation, comparison, and investment recommendations of companies in the potash mining industry, and many investors use the published research of industry research analysts in making investment decisions. Adjusted EBITDA should not be considered in isolation or as a substitute for performance or liquidity measures calculated in accordance with U.S. GAAP. Because adjusted EBITDA excludes some but not all items that affect net income and net cash provided by operating activities and may vary among companies, the adjusted EBITDA amounts presented may not be comparable to similarly titled measures of other companies. The following is a reconciliation of adjusted EBITDA to net income, which is the most directly comparable U.S. GAAP measure: Q1 Q2 Q3 Q4 Q1 Q2 Q3 $28,279 $30,708 $25,507 $24,917 $20,626 $19,013 $33,267 18,851 20,068 16,547 10,384 12,613 12,312 10,685 8,533 8,691 8,819 9,744 11,256 11,376 12,095 Total adjustments 27,497 29,148 25,541 20,320 24,122 23,903 23,001 $55,776 $59,856 $51,048 $45,237 $44,748 $42,916 $56,268 Add: Depreciation, depletion, amortization and accretion Adjusted Earnings Before Income Taxes, Interest 175 2011 Net Income Add: Income tax expense Add: Interest Expense, including realized and unrealized derivative gains and/losses 192 389 215 221 2012 Depreciation, Depletion and Amortization 113 253 |