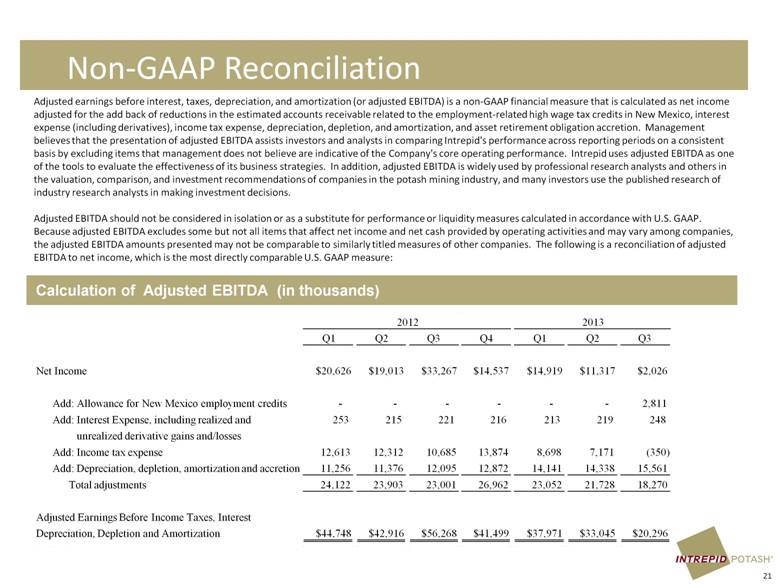

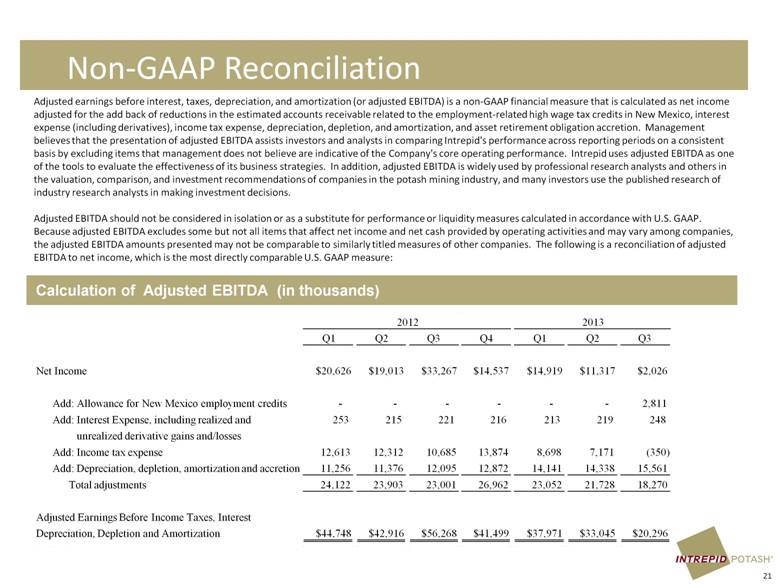

| Non-GAAP Reconciliation Calculation of Adjusted EBITDA (in thousands) Adjusted earnings before interest, taxes, depreciation, and amortization (or adjusted EBITDA) is a non-GAAP financial measure that is calculated as net income adjusted for the add back of reductions in the estimated accounts receivable related to the employment-related high wage tax credits in New Mexico, interest expense (including derivatives), income tax expense, depreciation, depletion, and amortization, and asset retirement obligation accretion. Management believes that the presentation of adjusted EBITDA assists investors and analysts in comparing Intrepid's performance across reporting periods on a consistent basis by excluding items that management does not believe are indicative of the Company's core operating performance. Intrepid uses adjusted EBITDA as one of the tools to evaluate the effectiveness of its business strategies. In addition, adjusted EBITDA is widely used by professional research analysts and others in the valuation, comparison, and investment recommendations of companies in the potash mining industry, and many investors use the published research of industry research analysts in making investment decisions. Adjusted EBITDA should not be considered in isolation or as a substitute for performance or liquidity measures calculated in accordance with U.S. GAAP. Because adjusted EBITDA excludes some but not all items that affect net income and net cash provided by operating activities and may vary among companies, the adjusted EBITDA amounts presented may not be comparable to similarly titled measures of other companies. The following is a reconciliation of adjusted EBITDA to net income, which is the most directly comparable U.S. GAAP measure: 21 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Net Income $20,626 $19,013 $33,267 $14,537 $14,919 $11,317 $2,026 Add: Allowance for New Mexico employment credits 2,811 Add: Interest Expense, including realized and 253 215 221 216 213 219 248 unrealized derivative gains and/losses Add: Income tax expense 12,613 12,312 10,685 13,874 8,698 7,171 (350) Add: Depreciation, depletion, amortization and accretion 11,256 11,376 12,095 12,872 14,141 14,338 15,561 Total adjustments 24,122 23,903 23,001 26,962 23,052 21,728 18,270 Adjusted Earnings Before Income Taxes, Interest Depreciation, Depletion and Amortization $44,748 $42,916 $56,268 $41,499 $37,971 $33,045 $20,296 2012 2013 - - - - - - |