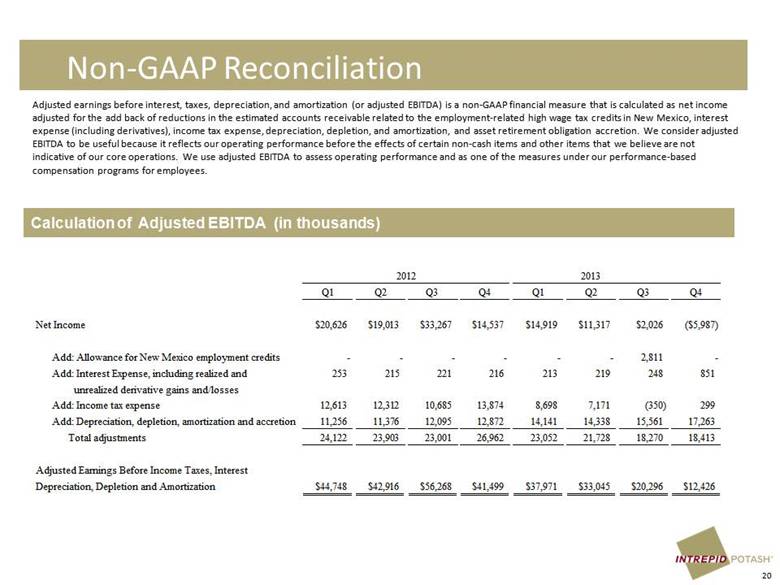

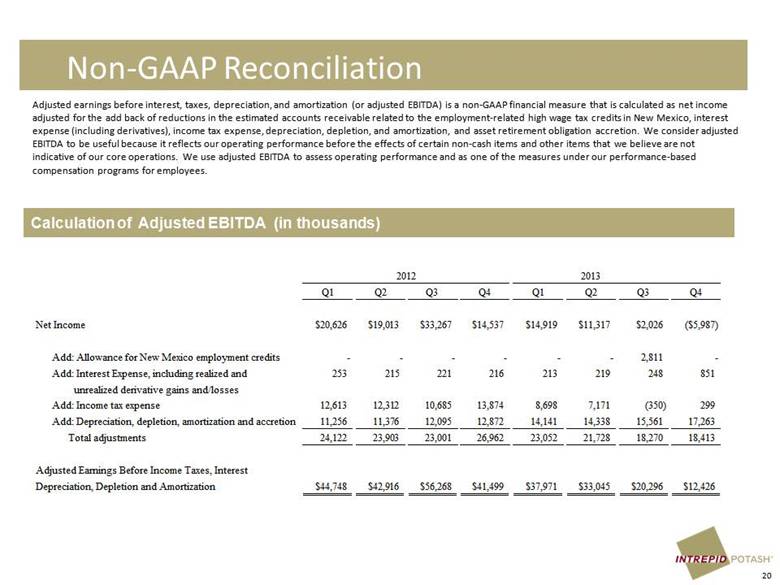

| Non-GAAP Reconciliation Calculation of Adjusted EBITDA (in thousands) Adjusted earnings before interest, taxes, depreciation, and amortization (or adjusted EBITDA) is a non-GAAP financial measure that is calculated as net income adjusted for the add back of reductions in the estimated accounts receivable related to the employment-related high wage tax credits in New Mexico, interest expense (including derivatives), income tax expense, depreciation, depletion, and amortization, and asset retirement obligation accretion. We consider adjusted EBITDA to be useful because it reflects our operating performance before the effects of certain non-cash items and other items that we believe are not indicative of our core operations. We use adjusted EBITDA to assess operating performance and as one of the measures under our performance-based compensation programs for employees. 20 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Net Income $20,626 $19,013 $33,267 $14,537 $14,919 $11,317 $2,026 ($5,987) Add: Allowance for New Mexico employment credits - - - - - - 2,811 - Add: Interest Expense, including realized and 253 215 221 216 213 219 248 851 unrealized derivative gains and/losses Add: Income tax expense 12,613 12,312 10,685 13,874 8,698 7,171 (350) 299 Add: Depreciation, depletion, amortization and accretion 11,256 11,376 12,095 12,872 14,141 14,338 15,561 17,263 Total adjustments 24,122 23,903 23,001 26,962 23,052 21,728 18,270 18,413 Adjusted Earnings Before Income Taxes, Interest Depreciation, Depletion and Amortization $44,748 $42,916 $56,268 $41,499 $37,971 $33,045 $20,296 $12,426 2012 2013 |