| 707 17th Street, Suite 4200 Denver, CO 80202 303.296.3006 main 303.298.7502 fax intrepidpotash.com |

October 30, 2023

Office of Energy & Transportation

U.S. Securities and Exchange Commission

Division of Corporation Finance

100 F Street, NE

Washington, D.C. 20549

Re: Intrepid Potash, Inc.

Form 10-K for the Fiscal Year ended December 31, 2022

Filed March 7, 2023

File No. 001-34025

Ladies and Gentlemen:

This letter is in response to your letter dated September 15, 2023, setting forth comments from the staff (the “Staff”) of the U.S. Securities and Exchange Commission (the “Commission”) on Intrepid Potash, Inc.’s Annual Report on Form 10-K for the year ended December 31, 2022 (the “Form 10-K). In this letter, we have recited the Staff's comments in italicized, bold type and have followed each comment with our response. Capitalized terms used herein and not otherwise defined herein have the meanings assigned to such terms in the Form 10-K.

Form 10-K for the Fiscal Year ended December 31, 2022

Properties

Overview of Properties, page 32

| 1. | Please expand your disclosures under the Overview sections on pages 32, 38, and 43 to include the book value of each material property to comply with Item 1304(b)(2)(iii) of Regulation S-K. |

Response: We respectfully acknowledge the Staff’s comment, and we will expand our disclosure in future filings to include the net book value of each of our material properties. As of December 31, 2022, the net book value of our material properties was as follows:

New Mexico Property - $172.3 million

Moab Property - $62.6 million

Wendover Property - $41.0 million

Leases and Permits, page 35

| 2. | Please expand your disclosures under Leases and Permits on pages 35, 40, and 45 to describe the royalty payments and associated rates pertaining to federal and state lands for each material property to comply with Item 1304(b)(1)(iii) of Regulation S-K. |

Response: We respectfully acknowledge the Staff’s comment, and we will expand our disclosure in our future fillings to include additional information regarding royalty payments and rates in the “Leases and Permits” sections for each material property, as set forth below.

New Mexico Facilities - Leases and Permits

We control the right to mine approximately 143,000 acres in New Mexico. Of that acreage, we lease 32,000 acres from the State of New Mexico, 106,000 acres from the federal government through the Bureau of Land Management (“BLM”), and 300 acres from private owners. We own 4,700 surface acres near the mine site, adjacent to the federal and state mining leases. Most mining operations are on properties leased from the State of New Mexico or the federal government. These leases generally contain stipulations that require us to commence mining operations within a specified term and to continue mining to retain the lease. The stipulations on our leases are subject to periodic readjustment by the State of New Mexico and the federal government. Federal leases are for indefinite terms subject to readjustment of the lease stipulations, including the royalty payable to the federal government, every 20 years. Royalty payments equal a percentage of product sales less freight. Most of our leases with the federal government stipulate a five percent royalty rate. However, certain federal leases contain a sliding scale royalty rate of a minimum of two percent and up to a maximum of five percent based on the grade of ore extracted under the lease. In 2022, IPNM paid royalties of $7.2 million to the federal government.

Our leases with the State of New Mexico are issued for terms of 10 years and for as long thereafter as potash is produced in commercial quantities and are subject to readjustment of the lease stipulations, including the royalty payable to the state. Royalty payments equal a percentage of product sales less freight. Our leases with the State of New Mexico stipulate a five percent royalty rate. In 2022, IPNM paid royalties of $2.7 million to the State of New Mexico.

Moab Property – Leases and Permits

At our Moab facility, we lease approximately 10,100 acres from the State of Utah and approximately 200 acres from the federal government through the BLM. We own approximately 3,800 surface acres overlying and adjacent to portions of acres leased from the State of Utah. These leases generally contain stipulations that require us to commence mining operations within a specified term and to continue mining to retain the leases.

Our lease with the federal government is for an indefinite term subject to readjustment of the lease stipulations, including the royalty payable to the federal government. Royalty payments equal a percentage of product sales less freight. The current royalty rate stipulated in the federal lease is five percent. In 2022, Moab made no royalty payments to the federal government.

Our Moab leases with the State of Utah are for terms of 10 years subject to extension and possible readjustment of the lease stipulations, including the royalty payable to the State of Utah. Our Moab leases with the State of Utah are operated as a unit under a unit agreement with the State of Utah, which extends the terms of all the Moab state leases as long as operations are conducted on any portion of these state leases. Our Moab leases with the State of Utah are currently extended until 2024 or so long as potash is being produced and stipulate royalty rates between 4.25% and 5.00%. In 2022, Moab paid $2.6 million of royalties to the State of Utah.

Wendover Property – Leases and Permits

We own approximately 57,500 acres of the Wendover site. The BLM and the State of Utah own approximately 32,800 acres of the Wendover site, which we lease (excluding lands used for highway and utility purposes).

We hold leases from the federal government that include 24,700 acres adjoining the Wendover property to the east. Our Wendover federal leases have an indefinite term subject to readjustment of the lease stipulations, including the royalty payable to the federal government. Royalty payments equal a percentage of product sales less freight. The current royalty rate stipulated in the federal leases is three percent. In 2022, Wendover made $0.3 million in royalty payments to the federal government.

The State of Utah owns several state land trust sections within the Wendover property site boundaries. We lease approximately 8,100 acres of property from the State of Utah under special use and mineral leases. The Wendover state leases are interspersed among our property and the Wendover federal leases. The Wendover state leases are for an indefinite term subject to readjustment of the lease stipulations, including the royalty payable to the State of Utah. Royalty payments equal a percentage of product sales less freight. The current royalty rate stipulated in our Wendover state leases is four percent. In 2022, we made $0.1 million in royalty payments to the State of Utah.

IPNM - Summary of Potash Mineral Reserves, page 37

| 3. | We note that disclosures of your reserves In-place, KCL, ROM Ore, and Sylvinite brine tonnages appear to represent estimates of your final product adjusted possibly for geologic factors, plant recovery, product purity, and/or cavern losses. |

However, this tonnage quantity appears to be unrelated to your grade disclosure and different from your resource tonnage disclosures.

Please revise as necessary to state the tonnage and grade of your reserves in alignment with your resource disclosures, or provide additional disclosure for your chosen metrics to include explanations of how these quantities were calculated or determined to comply with Item 1304(d)(1) of Regulation S-K.

Response: We respectfully acknowledge the Staff’s comment, and we will expand our disclosure in our future fillings to include additional information to describe how product tonnages are calculated from either the In-Place KCl or ROM Ore of our reserves, as follows:

IPNM - Summary of Potash Mineral Reserves effective December 31, 2022 based on 325 $/Product Ton Mine Site

| In-Place KCl | In-Situ Grade1 | Product2 | Brine Cutoff Grade3 | ||||||||||||||||

| (Mt) | (%K2O) | (Mt) | (%K2O) | Processing Recovery (%) | |||||||||||||||

| Proven Mineral Reserves | 5.4 | 21.7 | 4.3 | 2.0 | 85 | ||||||||||||||

| Probable Mineral Reserves | 0.3 | 19.1 | 0.2 | 2.0 | 85 | ||||||||||||||

| Total Mineral Reserves | 5.7 | 21.6 | 4.5 | ||||||||||||||||

IPNM - Summary of Langbeinite Mineral Reserves effective December 31, 2022 based on 340 $/Product Ton Mine Site

| ROM Ore4 | In-Situ Grade5 (Diluted) | Product6 | Cutoff Grade | ||||||||||||||||

| (Mt) | (%K2O) | (Mt) | (%K2O) | Processing Recovery (%) | |||||||||||||||

| Proven Mineral Reserves | 17.3 | 8.6 | 4.6 | 43 | 68 | ||||||||||||||

| Probable Mineral Reserves | 4.2 | 9.1 | 1.2 | 43 | 68 | ||||||||||||||

| Total Mineral Reserves | 21.5 | 8.7 | 5.8 | ||||||||||||||||

1In-situ grade is the amount of K2O in the contact area of the caverns and is used to calculate the In-Place KCl

2Product is calculated by multiplying In-Place KCl by: dissolution factor of 96%, areal recovery of 100%, geologic factor of 94.2%, plant recovery of 85%, cavern loss factor of 98%, and a product purity factor of (1/.95)

3Brine cutoff grade is the amount of K2O in the extracted brine necessary to cover the cash costs of production.

4ROM Ore is reported based on a detailed conventional mine plan adjusted for random impurities of 10%

5In-situ grade (diluted) is the amount of K20 in the ore body with consideration for dilution occuring during mining.

6Product tons are calculated by multiplying ROM Ore by: the In-Situ Grade (Diluted)/22.70%, plant recovery of 68%, and a product purity factor of (1/.944). In-situ Grade (Diluted) is divided by 22.70% to convert K20 grade to pure langbeinite by mass.

Mineral Reserves were prepared effective December 31, 2021, by Agapito Associates, Inc., a qualified firm for the estimate and independent of Intrepid, and updated to December 31, 2022, by Intrepid to account for depletion that occurred due to 2022 mining operations.

Mineral Reserves are reported exclusive of Mineral Resources, on a 100% basis.

Mt = million tons, % = percentage, K2O = potassium oxide, ft = feet

We note an immaterial clerical error in the calculated potash product tons as of December 31, 2022, which was reported as 4.0 Mt. The potash product tons calculation erroneously excluded the product purity factor adjustment. The correct potash product tons as of December 31, 2022 is 4.3 Mt. and will be updated appropriately in future filings.

Financial Statements

Note 17 - Business Segments, page 98

| 4. | You state that your segment measure of profitability is segment gross margin which you reconcile to consolidated gross margin; and indicate that you do not allocate other operating expenses or non-operating income and expenses to your reportable segments. |

Please revise your presentation as necessary to include a reconciliation of your segment measure of profitability to consolidated income before income taxes and discontinued operations as required by ASC 280-10-50-30.

Response: We respectfully acknowledge the Staff’s comment and in future filings we will add additional narrative information to our segment footnote to achieve the requirements of ASC 208-10-50-30 to reconcile segment measure of profitability to consolidated income before taxes as provided below:

“Our operations are organized into three segments: potash, Trio®, and oilfield solutions. The reportable segments are determined by management based on several factors including the types of products and services sold, production processes, markets served and the financial information available for our chief operating decision maker. We evaluate performance based on the gross margins of the respective business segments and do not allocate other operating expenses or non-operating income and expenses to our reportable segments. Segment gross margins are reconciled to consolidated gross margins in the segment tables. To reconcile segment gross margins to consolidated income before taxes, consolidated operating expense amounts and consolidated other income and expense amounts, expenses are subtracted from and income is added to consolidated gross margin to arrive at consolidated income before taxes, as shown on the statement of operations.”

Exhibits

Technical Report Summaries

General, page EA-1

| 5. | We have reviewed exhibits 96.1, 96.2, and 96.3 and have several comments that pertain to all three documents which immediately follow this general comment. This group of comments is followed by additional comments that are specific to the exhibits individually, as indicated. We expect that you will need to obtain and file revised exhibits to address the concerns identified in these comments. |

Please consult with the qualified persons involved in preparing those reports in conjunction with formulating your response. We suggest that you submit draft revisions for review prior to filing the revised reports.

Response: We respectfully acknowledge the Staff’s comments on Exhibits 96.1, 96.2, and 96.3 and we will update such exhibits, as necessary, as discussed below. We will file the revised exhibits with our Annual Report on Form 10-K for the year ended December 31, 2023 (the “Revised Exhibits”). Prior to filing the Revised Exhibits, we will provide draft revisions to the Staff for review.

Section 6: Geologic Setting, page EA-6

| 6. | The disclosures concerning mineralization should include at least one stratigraphic column and one cross-section of the local geology to comply with Item 601(b)(96)(iii)(B)(6)(iii) of Regulation S-K. |

Response: We respectfully acknowledge the Staff’s comment, and we will update our disclosures with respect to mineralization in the Revised Exhibits, as shown below.

We respectfully direct the Staff to Figure 6-1 in Section 6.3 “Property Geology” in Exhibit 96.1 that shows the cross section for the local geology of the Carlsbad, New Mexico Potash District, and Figure 6-2 in Exhibit 96.1 that shows a typical stratigraphic column Ochoan Series of the Permian Basin.

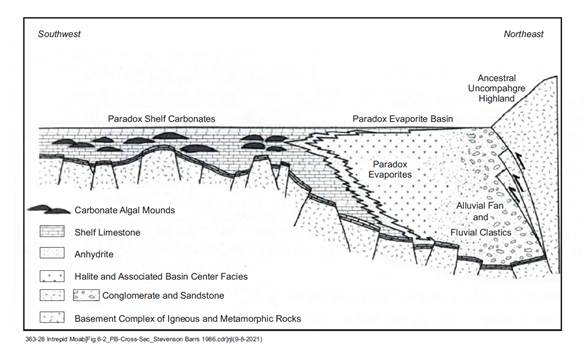

We acknowledge that we included the stratigraphic column in Exhibit 96.2 twice and did not include a cross-section of the local geology. Figure 6-2 of Exhibit 96.2 is correctly labeled as the “Paradox Basin Cross Section,” but the image provided is a stratigraphic column for the Paradox Basin. Figure 6-5 is also a stratigraphic column. We will replace Figure 6-2 with the graphic shown below in the revised Exhibit 96.2:

Figure 6-2. Paradox Basin Cross Section (after Stevenson and Barrs 1986)

We respectfully direct the Staff to Figure 6-3 in Section 6.1 “Regional. Local, and Property Geology” in Exhibit 96.3 that shows the stratigraphic column for the Intrepid-Wendover facility.

The cross-section of the property is included in Figure 13-1 of Exhibit 96.3. Within Section 6.3 of Exhibit 96.3, we will include a reference to see Figure 13-1 for the cross-section of the local geology.

Section 12: Mineral Reserve Estimates, page EA-12

| 7. | We note that disclosures of your reserves In-place, KCL, ROM Ore, and Sylvinite brine tonnages appear to represent estimates of your final product adjusted possibly for geologic factors, plant recovery, product purity, and/or cavern losses. |

However, this tonnage quantity appears to be unrelated to your grade disclosure and different from your resource tonnage disclosures.

Please revise as necessary to state the tonnage and grade of your reserves in alignment with your resource disclosures, or provide additional disclosure for your chosen metrics to include explanations of how these quantities were calculated or determined to comply with Item 601(b)(96)(iii)(B)(12)(i) and (ii) of Regulation S-K.

Response: We respectfully acknowledge the Staff’s comment, and we will update Table 12-5 in the Revised Exhibits to include additional information to describe how product tonnages are calculated from either the In-Place KCl or ROM Ore of our reserves, as follows:

IPNM - Summary of Potash Mineral Reserves effective December 31, 2022 based on 325 $/Product Ton Mine Site

| In-Place KCl | In-Situ Grade1 | Product2 | Brine Cutoff Grade3 | ||||||||||||||||

| (Mt) | (%K2O) | (Mt) | (%K2O) | Processing Recovery (%) | |||||||||||||||

| Proven Mineral Reserves | 5.4 | 21.7 | 4.3 | 2.0 | 85 | ||||||||||||||

| Probable Mineral Reserves | 0.3 | 19.1 | 0.2 | 2.0 | 85 | ||||||||||||||

| Total Mineral Reserves | 5.7 | 21.6 | 4.5 | ||||||||||||||||

IPNM - Summary of Langbeinite Mineral Reserves effective December 31, 2022 based on 340 $/Product Ton Mine Site

| ROM Ore4 | In-Situ Grade5 (Diluted) | Product6 | Cutoff Grade | |||||||||||||||||

| (Mt) | (%K2O) | (Mt) | (%K2O) | Processing Recovery (%) | ||||||||||||||||

| Proven Mineral Reserves | 17.3 | 8.6 | 4.6 | 43 | 68 | |||||||||||||||

| Probable Mineral Reserves | 4.2 | 9.1 | 1.2 | 43 | 68 | |||||||||||||||

| Total Mineral Reserves | 21.5 | 8.7 | 5.8 | |||||||||||||||||

1In-situ grade is the amount of K2O in the contact area of the caverns and is used to calculate the In-Place KCl

2Product is calculated by multiplying In-Place KCl by: dissolution factor of 96%, areal recovery of 100%, geologic factor of 94.2%, plant recovery of 85%, cavern loss factor of 98%, and a product purity factor of (1/.95)

3Brine cutoff grade is the amount of K2O in the extracted brine necessary to cover the cash costs of production.

4ROM Ore is reported based on a detailed conventional mine plan adjusted for random impurities of 10%

5In-situ grade (diluted) is the amount of K20 in the ore body with consideration for dilution occuring during mining.

6Product tons are calculated by multiplying ROM Ore by: the In-Situ Grade (Diluted)/22.70%, plant recovery of 68%, and a product purity factor of (1/.944). In-situ Grade (Diluted) is divided by 22.70% to convert K20 grade to pure langbeinite by mass.

Mineral Reserves were prepared effective December 31, 2021, by Agapito Associates, Inc., a qualified firm for the estimate and independent of Intrepid, and updated to December 31, 2022, by Intrepid to account for depletion that occurred due to 2022 mining operations.

Mineral Reserves are reported exclusive of Mineral Resources, on a 100% basis.

Mt = million tons, % = percentage, K2O = potassium oxide, ft = feet

Regarding the reserve disclosure in Exhibit 96.2, we will also include in the Revised Exhibits additional footnotes to clarify the relationship between In-Place KCl, In-Situ Grade, and Product. An updated Table 12-3 is shown below as an example:

Table 12-3 Potash Mineral Reserves Remaining Updip of Solution Mining from Bed 5 Old workings effective December 31, 2021 based on 325 $/Product Ton Mine Site

| Bed 5 | In-Place KCl | In-Situ Grade1 | Product2 | Brine Cutoff Grade3 | ||||||||||||||||

| (Mt) | (%K2O) | (Mt) | (%K2O) | Processing Recovery (%) | ||||||||||||||||

| Proven Mineral Reserves | 0.8 | 25.5 | 0.6 | 1.9 | 83 | |||||||||||||||

| Probable Mineral Reserves | ||||||||||||||||||||

| Total Mineral Reserves | 0.8 | 25.5 | 0.6 | |||||||||||||||||

1In-situ grade is the amount of K2O in the remaining pillars of the old works and is used to calculate the In-Place KCl

2Product tons are calculated by multiplying In-Place KCl by: dissolution factor of 89%, areal recovery of 94%, geologic factor of 94%, plant recovery of 83%, and product purity of 1/95%.

3Brine cutoff grade is the amount of K2O in the extracted brine necessary to cover the costs of production.

Mineral Reserves were prepared by Agapito Associates, Inc., a qualified firm for the estimate and independent of Intrepid Potash.

Mineral Reserves are reported exclusive of Mineral Resources, on a 100% basis.

Mt = million tons, % = percentage, K2O = potassium oxide, ft = feet

Regarding reserve disclosure in Exhibit 96.3, we will revise Table 12-2 in the Revised Exhibits to clarify the relationship between Brine, In-Situ Grade, and Product. An updated Table 12-2 is shown below:

Wendover - Potash Mineral Reserves effective December 31, 2021 based on 325 $/Product Ton Mine Site

| Reserves | ||||||||||||||||||||

| Brine1 | In-Situ Grade2 | Product3 | Brine Cutoff Grade4 | |||||||||||||||||

| (Mt) | (%K2O) | (Mt) | (%K2O) | Processing Recovery (%) | ||||||||||||||||

| Proven Mineral Reserves | ||||||||||||||||||||

| Probable Mineral Reserves | 850 | 0.5 | 1.8 | 0.3 | 85 | |||||||||||||||

| Total Mineral Reserves | 850 | 0.5 | 1.8 | 0.3 | ||||||||||||||||

1Brine advanced through the pond system

2In-situ grade is the amount of K2O contained in the brine.

3Potash Product tons are calculated by multiplying Brine by: the In-Situ Grade divided by 63.17% K2O/KCl conversion factor, an overall pond recovery factor of 30%, processing recovery of 85%, and a product purity factor of 105%.

4Solution mining reserve cutoff is the grade at which production covers operating costs.

Mineral Reserves were prepared by RESPEC, CO., a qualified firm for the estimate and independent of Intrepid Potash.

Mineral Reserves are reported exclusive of Mineral Resources, on a 100% basis.

Mt = million tons, % = percentage, K2O = potassium oxide, ft = feet

Section 16: Market Studies, page EA-16

| 8. | The disclosures concerning market studies should include explanations for how the forecast price projections were determined using historic prices to establish a price reference to comply with Item 601(b)(96)(iii)(B)(16) of Regulation S-K. |

Response: We respectfully acknowledge the Staff’s comment, and we will update each of the Revised Exhibits to include the following statement:

“Price projections are based on a combination of historic pricing trends and expectations of future potash consumption and production. Intrepid uses a variety of sources including, but not limited to, industry reports, company announcements, third-party market studies, and internal estimates when establishing a forecasted price. Intrepid compares its historic realized pricing to widely available benchmark prices, specifically the Midwest Warehouse potash price and the U.S. New Orleans Louisiana (“NOLA”) Barge Market potash price, to establish a historic price differential which it uses when analyzing future price expectations.”

Section 18: Capital and Operating Costs, page EA-18

| 9. | The disclosures concerning capital and operating costs should include your closing/reclamation costs and state the accuracy level of your capital and operating cost estimates to comply with Item 601(b)(96)(iii)(B)(18)(i) of Regulation S-K. |

Response: We respectfully acknowledge the Staff’s comment, and we will update the language in Section 18.3, “Accuracy Discussion” in each of the Revised Exhibits as follows:

Intrepid Potash New Mexico Technical Report Summary (Exhibit 96.1)

“Our operating costs, including warehouse, handling and royalty expenses are based on historical actual expenses and are detailed in Table 18-1. Because the costs are based on historical actual expenses, the cost estimates are at an accuracy of at least +/- 15%.

Our capital costs are based on actual bids or recent purchases of capital items plus an inflation factor. The capital costs estimates are at an accuracy of at least +/- 25% and contingency levels are less than 25%.

Because the life of our resources is more than 25 years, we have not included any closing/reclamation costs in our operating cost estimate or in our capital cost estimate.”

Moab Technical Report Summary (Exhibit 96.2)

“Our operating costs, including warehouse, handling and royalty expenses are based on historical actual expenses. The operating costs are at an accuracy of at least +/- 15%.

Our capital costs are based on actual bids or recent purchases of capital items plus an inflation factor. The capital costs estimates are at an accuracy of at least +/- 25% and contingency levels are less than 25%.

Because the life of our resources is more than 25 years, we have not included any closing/reclamation costs in our operating cost estimate or in our capital cost estimate.”

Wendover Technical Report Summary (Exhibit 96.3)

“Our operating costs, based on historical actual expenses. Because the costs are based on historical actual expenses, the cost estimates are at an accuracy of at least +/- 15%.

Our capital costs are based on actual bids or recent purchases of capital items plus an inflation factor. The capital costs estimates are at an accuracy of at least +/- 25% and contingency levels are less than 25%.

Because the life of our resources is more than 25 years, we have not included any closing/reclamation costs in our operating cost estimate or in our capital cost estimate.”

Section 19: Economic Analysis, page EA-19

| 10. | The disclosures concerning the economic analysis should include additional line items in support of your annual production estimate for mined tonnage and the associated grades, along with a description of the calculation, to comply with Item 601(b)(96)(iii)(B)(19) of Regulation S-K. |

Response: We respectfully acknowledge the Staff’s comment, and we will update the Revised Exhibits to include the following additional information to provide support for the annual production estimate for mined tonnage and the associated grades, along with a description of the calculation:

Exhibit 96.1 – We will include a reference to the annual life of mine production schedule to be included in Section 13: Mining Methods. The annual life of mine production schedule to be referred to was not included in Exhibit 96.1 previously, and we will add the life of mine production schedule in the updated Exhibit 96.1, as indicated in our response to the Staff’s comment number 12 (see response further below in this response letter). The updated narrative to be included in Section 19.2 Economic Analysis is present below:

“19.2 Economic Analysis

For a property in operation, the economic viability has been established. The cash flow was developed using the life of mine plan and is listed in Table 19-2 and shown graphically in Figure 19-1. Annual ore production, ore grade and tons of product produced used in the cash flow analysis are taken from the annual life of mine production schedule as shown in Section 13: Mining Methods included in this Technical Report Summary. The annual life of mine production schedule provides the calculation of product tons resulting from tons of ore mined and the associated grade of ore mined.”

Exhibit 96.2 – We will include a reference to the annual life of mine production schedule that shows annual ore production, ore grade and tons of product produced used in the cash flow analysis. An annual life of mine production schedule was not included in Exhibit 96.2 previously, and we will include an annual life of mine production schedule in Section 13: Mining Methods as shown below:

| R | S | T | U | V | W | |||||||||||||||||||||

| Brine | Brine | Product | Handling | |||||||||||||||||||||||

| Extracted | Grade | K2O | KCl | Losses | MOP | |||||||||||||||||||||

| (Gallons) | (%K2O) | (Tons) | (Tons) | (Tons) | (Tons) | |||||||||||||||||||||

| 2022 | Year 1 | 340,000,000 | 4.1 | 61,400 | 101,500 | 2,500 | 99,000 | |||||||||||||||||||

| 2023 | Year 2 | 340,000,000 | 4.3 | 64,100 | 106,000 | 2,700 | 103,300 | |||||||||||||||||||

| 2024 | Year 3 | 340,000,000 | 4.5 | 66,900 | 110,600 | 2,800 | 107,800 | |||||||||||||||||||

| 2025 | Year 4 | 340,000,000 | 4.4 | 66,500 | 109,900 | 2,700 | 107,200 | |||||||||||||||||||

| 2026 | Year 5 | 340,000,000 | 4.4 | 65,500 | 108,300 | 2,700 | 105,600 | |||||||||||||||||||

| 2027 | Year 6 | 340,000,000 | 4.3 | 65,000 | 107,400 | 2,700 | 104,700 | |||||||||||||||||||

| 2028 | Year 7 | 340,000,000 | 4.3 | 65,000 | 107,400 | 2,700 | 104,700 | |||||||||||||||||||

| 2029 | Year 8 | 340,000,000 | 4.3 | 64,600 | 106,800 | 2,700 | 104,100 | |||||||||||||||||||

| 2030 | Year 9 | 340,000,000 | 4.2 | 63,300 | 104,600 | 2,600 | 102,000 | |||||||||||||||||||

| 2031 | Year 10 | 340,000,000 | 4.2 | 63,600 | 105,100 | 2,600 | 102,500 | |||||||||||||||||||

| 2032 | Year 11 | 340,000,000 | 4.0 | 59,800 | 98,800 | 2,500 | 96,300 | |||||||||||||||||||

| 2033 | Year 12 | 340,000,000 | 3.9 | 59,300 | 98,000 | 2,500 | 95,500 | |||||||||||||||||||

| 2034 | Year 13 | 340,000,000 | 4.2 | 62,400 | 103,100 | 2,600 | 100,500 | |||||||||||||||||||

| 2035 | Year 14 | 340,000,000 | 4.3 | 65,000 | 107,400 | 2,700 | 104,700 | |||||||||||||||||||

| 2036 | Year 15 | 340,000,000 | 4.3 | 65,000 | 107,400 | 2,700 | 104,700 | |||||||||||||||||||

| 2037 | Year 16 | 340,000,000 | 4.3 | 64,600 | 106,800 | 2,700 | 104,100 | |||||||||||||||||||

| 2038 | Year 17 | 340,000,000 | 4.3 | 64,200 | 106,100 | 2,700 | 103,400 | |||||||||||||||||||

| 2039 | Year 18 | 340,000,000 | 4.3 | 64,100 | 106,000 | 2,700 | 103,300 | |||||||||||||||||||

| 2040 | Year 19 | 340,000,000 | 4.2 | 63,600 | 105,100 | 2,600 | 102,500 | |||||||||||||||||||

| 2041 | Year 20 | 340,000,000 | 4.2 | 63,600 | 105,100 | 2,600 | 102,500 | |||||||||||||||||||

| 2042 | Year 21 | 340,000,000 | 4.2 | 63,600 | 105,100 | 2,600 | 102,500 | |||||||||||||||||||

| 2043 | Year 22 | 340,000,000 | 4.2 | 63,600 | 105,100 | 2,600 | 102,500 | |||||||||||||||||||

| 2044 | Year 23 | 340,000,000 | 4.2 | 63,600 | 105,100 | 2,600 | 102,500 | |||||||||||||||||||

| 2045 | Year 24 | 340,000,000 | 4.2 | 63,100 | 104,300 | 2,600 | 101,700 | |||||||||||||||||||

| 2046 | Year 25 | 340,000,000 | 4.2 | 63,100 | 104,300 | 2,600 | 101,700 | |||||||||||||||||||

| *Numbers rounded for clarity |

| Extraction brine density -1.24 |

| KCl plant recovery - 86% |

| Product purity - 96% |

| Pure KCl equates to 63.17% K2O by mass |

| Handling losses - 3% |

| T = R*(S/100)*1.24*8.34/2000*0.86 |

| U = T/0.6317/0.96 |

| V = U*0.03 |

| W = U-V |

We will also update Section 19.2 Economic Analysis as follows:

“19.2 Economic Analysis

For a property in operation, the economic viability has been established. The cash flow was developed using the life of mine plan and is listed in Table 19-2. The after-tax cash flow is listed in Table 19-3. The cashflows are shown graphically in Figures 19-1 and 19-2 for pre- and after-tax cash flows, respectively. Annual ore production, ore grade and tons of product produced used in both the pre-tax and after-tax cash flow analyses are taken from the annual life of mine production schedule as shown in Section 13: Mining Methods included in this Technical Report Summary. The annual life of mine production schedule provides the calculation of product tons resulting from tons of ore mined and the associated grade of ore mined.”

Exhibit 96.3 – We will include a reference to the annual life of mine production schedule to be included in Section 13: Mining Methods. The annual life of mine production schedule to be referred to was not included in Exhibit 96.3 previously, and we will add the life of mine production schedule in the updated Exhibit 96.3, as indicated in our response to the Staff’s comment number 18 (see response further below in this response letter). The updated narrative will include Section 19.2 Economic Analysis, as present below:

“19.2 Economic Analysis

For a property in operation, the economic viability has been established. The pre-tax cash flow was developed using the production plan continuing as currently operating in Table 19-2. The after-tax cash flow is listed in Table 19-3. The cashflows are shown graphically in Figures 19-1 and 19-2 for pre- and after-tax cash flows, respectively. Annual ore production, ore grade and tons of product produced used in both cash flow analyses are taken from the annual life of mine production schedule as shown in Section 13: Mining Methods included in this Technical Report Summary. The annual life of mine production schedule provides the calculation of product tons resulting from tons of ore mined and the associated grade of ore mined.”

| 11. | The cash flow projections underlying the economic analysis for each material property would generally need to reflect amounts to be paid for the Federal and State royalties to comply with Item 601(b)(96)(iii)(B)(19)(i) of Regulation S-K. |

Response: We respectfully acknowledge the Staff’s comment and respectfully refer the Staff to Table 18-1 in the New Mexico Technical Report Summary (Exhibit 96.1). In Table 18-1 in Exhibit 96.1, royalties of $13 per product ton are included in the total Cost of Goods Sold per product ton of $200. In Table 19-2 “Estimated Pre-Tax Cash Flow,” the total Cost of Goods Sold of $200 is used to calculate the Cost of Goods Sold line-item amount of $84.83 million. The Cost of Goods sold amount is calculated by multiplying the combined tons of potash and Trio® produced multiplied by $200 per ton.

We also respectfully refer the Staff to Table 18-1 in the Moab Technical Report Summary (Exhibit 96.2). In Table 18-1 in Exhibit 96.2, royalties of $7 per ton are included in the total Cost of Goods Sold per product ton of $130. In Table 19-2 “Estimated Pre-Tax Cash Flow,” the total Cost of Goods Sold of $130 is used to calculate the Cost of Goods Sold line-item amount of $13.33 million. The Cost of Goods sold amount is calculated by multiplying the combined tons of potash produced by $130 per ton.

In Table 18-1 in the Wendover Technical Report Summary (Exhibit 96.3), royalties are not shown as a separate line item, but are included in the “Other” line-item total of $13. Other costs of $13 are included in the total Cost of Goods Sold total of $133 which is used in Table 19-2 “Estimated Pre-Tax Cash Flow” line-item amount of 9.3 million and is calculated by multiplying the Cost of Goods Sold total of $133 per ton by 70,000 tons of production. To help avoid confusion, we will include an updated Table 18-1 in Exhibit 96.3 in the Revised Exhibits to show royalties as a separate line-item as follows:

Table 18-1 Operating Cost Estimate

| Unit Cost per Ton | Percent of Total | |||||||

| Labor with Benefits | $ | 69 | 50 | % | ||||

| Maintenance | $ | 2 | 1 | % | ||||

| Energy and Fuels | $ | 22 | 16 | % | ||||

| Operating Supplies | $ | 27 | 20 | % | ||||

| Other | $ | 9 | 10 | % | ||||

| Subtotal | $ | 129 | 97 | % | ||||

| Royalties | $ | 4 | 3 | % | ||||

| Cost of Goods Sold | $ | 133 | 100 | % | ||||

New Mexico (Exhibit 96.1)

Section 13: Mining Methods, page EB-13

| 12. | An annual life of mine production schedule, which includes ore processed and the associated grades for the life of the mine, should be provided to comply with Item 601(b)(96)(iii)(B)(13) of Regulation S-K. |

Response: We respectfully acknowledge the Staff’s comment, and we will update the Revised Exhibits to include a life of mine production schedule in a form substantially similar to the following:

| Langbeinite | MOP | ||||||||||||||||||||||||||||||||||||||

| A | B | C | D | E | F | R | S | T | U | V | W | ||||||||||||||||||||||||||||

| Ore Production (Tons) | Ore Grade (%K2O) | Recovered K2O (Tons) | Product Langbeinite (Tons) | Handling Losses (Tons) | Langbeinite (Tons) | Brine Extracted (Gallons) | Brine Grade (%K2O) | K2O (Tons) | Product KCl (Tons) | Handling Losses (Tons) | MOP (Tons) | ||||||||||||||||||||||||||||

| 2022 | Year 1 | 1,200,000 | 9.64 | 64,000 | 293,600 | 11,700 | 281,900 | 510,000,000 | 5.05 | 113,500 | 185,200 | 5,600 | 180,000 | ||||||||||||||||||||||||||

| 2023 | Year 2 | 1,208,000 | 9.43 | 63,100 | 289,400 | 11,600 | 277,800 | 510,000,000 | 5.05 | 113,500 | 185,200 | 5,600 | 180,000 | ||||||||||||||||||||||||||

| 2024 | Year 3 | 1,206,000 | 8.69 | 58,000 | 266,100 | 10,600 | 255,500 | 510,000,000 | 5.05 | 113,500 | 185,200 | 5,600 | 180,000 | ||||||||||||||||||||||||||

| 2025 | Year 4 | 1,206,000 | 7.53 | 50,300 | 230,700 | 9,200 | 221,500 | 510,000,000 | 5.05 | 113,500 | 185,200 | 5,600 | 180,000 | ||||||||||||||||||||||||||

| 2026 | Year 5 | 1,204,000 | 8.14 | 54,300 | 249,100 | 10,000 | 239,100 | 510,000,000 | 5.05 | 113,500 | 185,200 | 5,600 | 180,000 | ||||||||||||||||||||||||||

| 2027 | Year 6 | 1,200,000 | 8.28 | 55,000 | 252,300 | 10,100 | 242,200 | 510,000,000 | 5.05 | 113,500 | 185,200 | 5,600 | 180,000 | ||||||||||||||||||||||||||

| 2028 | Year 7 | 1,202,000 | 8.82 | 58,700 | 269,300 | 10,800 | 258,500 | 510,000,000 | 5.05 | 113,500 | 185,200 | 5,600 | 180,000 | ||||||||||||||||||||||||||

| 2029 | Year 8 | 1,206,000 | 8.96 | 59,900 | 274,800 | 11,000 | 263,800 | 510,000,000 | 5.05 | 113,500 | 185,200 | 5,600 | 180,000 | ||||||||||||||||||||||||||

| 2030 | Year 9 | 1,206,000 | 8.53 | 57,000 | 261,500 | 10,500 | 251,000 | 510,000,000 | 5.05 | 113,500 | 185,200 | 5,600 | 180,000 | ||||||||||||||||||||||||||

| 2031 | Year 10 | 1,210,000 | 8.52 | 57,100 | 261,900 | 10,500 | 251,400 | 510,000,000 | 5.05 | 113,500 | 185,200 | 5,600 | 180,000 | ||||||||||||||||||||||||||

| 2032 | Year 11 | 1,200,000 | 8.76 | 58,200 | 267,000 | 10,700 | 256,300 | 510,000,000 | 5.05 | 113,500 | 185,200 | 5,600 | 180,000 | ||||||||||||||||||||||||||

| 2033 | Year 12 | 1,201,000 | 9.07 | 60,300 | 276,600 | 11,100 | 265,500 | 510,000,000 | 5.05 | 113,500 | 185,200 | 5,600 | 180,000 | ||||||||||||||||||||||||||

| 2034 | Year 13 | 1,202,000 | 8.50 | 56,600 | 259,600 | 10,400 | 249,200 | 510,000,000 | 5.05 | 113,500 | 185,200 | 5,600 | 180,000 | ||||||||||||||||||||||||||

| 2035 | Year 14 | 1,212,000 | 8.77 | 58,900 | 270,200 | 10,800 | 259,400 | 510,000,000 | 5.05 | 113,500 | 185,200 | 5,600 | 180,000 | ||||||||||||||||||||||||||

| 2036 | Year 15 | 1,206,000 | 8.80 | 58,800 | 269,700 | 10,800 | 258,900 | 510,000,000 | 5.05 | 113,500 | 185,200 | 5,600 | 180,000 | ||||||||||||||||||||||||||

| 2037 | Year 16 | 1,204,000 | 9.03 | 60,200 | 276,100 | 11,000 | 265,100 | 510,000,000 | 5.05 | 113,500 | 185,200 | 5,600 | 180,000 | ||||||||||||||||||||||||||

| 2038 | Year 17 | 1,201,000 | 8.59 | 57,100 | 261,900 | 10,500 | 251,400 | 510,000,000 | 5.05 | 113,500 | 185,200 | 5,600 | 180,000 | ||||||||||||||||||||||||||

| 2039 | Year 18 | 1,201,000 | 7.73 | 51,400 | 235,800 | 9,400 | 226,400 | 510,000,000 | 5.05 | 113,500 | 185,200 | 5,600 | 180,000 | ||||||||||||||||||||||||||

| 2040 | Year 19 | 1,206,000 | 7.76 | 51,800 | 237,600 | 9,500 | 228,100 | 510,000,000 | 5.05 | 113,500 | 185,200 | 5,600 | 180,000 | ||||||||||||||||||||||||||

| 2041 | Year 20 | 1,206,000 | 7.68 | 51,300 | 235,300 | 9,400 | 225,900 | 510,000,000 | 5.05 | 113,500 | 185,200 | 5,600 | 180,000 | ||||||||||||||||||||||||||

| 2042 | Year 21 | 1,206,000 | 7.44 | 49,700 | 228,000 | 9,100 | 218,900 | 510,000,000 | 5.05 | 113,500 | 185,200 | 5,600 | 180,000 | ||||||||||||||||||||||||||

| 2043 | Year 22 | 1,204,000 | 7.96 | 53,100 | 243,600 | 9,700 | 233,900 | 510,000,000 | 5.05 | 113,500 | 185,200 | 5,600 | 180,000 | ||||||||||||||||||||||||||

| 2044 | Year 23 | 1,201,000 | 7.66 | 51,000 | 233,900 | 9,400 | 224,500 | 510,000,000 | 5.05 | 113,500 | 185,200 | 5,600 | 180,000 | ||||||||||||||||||||||||||

| 2045 | Year 24 | 1,202,000 | 7.67 | 51,100 | 234,400 | 9,400 | 225,000 | 510,000,000 | 5.05 | 113,500 | 185,200 | 5,600 | 180,000 | ||||||||||||||||||||||||||

| 2046 | Year 25 | 1,206,000 | 8.56 | 57,200 | 262,400 | 10,500 | 251,900 | 510,000,000 | 5.05 | 113,500 | 185,200 | 5,600 | 180,000 | ||||||||||||||||||||||||||

| *Numbers rounded for clarity | |

| Ore Grade K2O to Langbeinite K2O - 81% (Core Grade K2O includes KCl) | Extraction brine density - 124 |

| Langbeinite plant recovery - 68% | KCl plant recovery - 85% |

| Product purity - 95.6% | Product purity - 97% |

| Pure Langbeinite equates to 22.7% K2O by mass | Pure KCl equates to 63.17% K2O by mass |

| Handling losses - 4% | Handling losses - 3% |

| C = A*(B/100)*0.81*0.68 | T = R*(S/100)*1.24*8.34/2000*0.85 |

| D = C/0.227/0.956 | U =T/0.6317/0.97 |

| E = D*0.04 | V = U*0.03 |

| F = D-E | W= U-V |

Section 19: Economic Analysis, page EB-19

| 13. | Please address the apparent inconsistency regarding MOP production in the Pre-Tax Cash Flow (Table 19-2) and After-Tax Cash Flow (Table 19-3). |

Response: We respectfully acknowledge the Staff’s comment, and we note that there is an immaterial typographical error in the After-Tax Cash Flow (Table 19-3) regarding MOP production and we will update the table in the Revised Exhibits. The column labeled 2042-2046 incorrectly states MOP production as 156, instead of the correct figure of 180 which is included in the Pre-Tax Cash Flow (Table 19-2).

Section 20: Adjacent Properties, page EB-20

| 14. | We understand that The Mosaic Company has potash deposits in Carlsbad, New Mexico that are similar and adjacent to your properties. Please ask the qualified persons to clarify the extent to which such properties are considered to be material in relation to your operations, and to explain how the guidance in Item 601(b)(96)(iii)(B)(20) of Regulation S-K was considered in preparing the report. |

Response: We respectfully acknowledge the Staff’s comment, and we will update Exhibit 96.1 with the following statement:

“In preparing the report, the qualified person indicated that the Intrepid Potash operations and The Mosaic Company operations, although mining in the same geologic deposit, each has its own plants and infrastructure and are entirely independent of each other. It is the qualified person’s opinion that The Mosaic Company operations are not material in relation to Intrepid.”

Moab (Exhibit 96.2)

Section 8: Sample Preparation, page EC-8

| 15. | The opinion of the qualified person regarding the adequacy of the sample preparation, security, and analytical procedures must be provided to comply with Item 601(b)(96)(iii)(B)(8)(iv) of Regulation S-K. |

Response: We respectfully acknowledge the Staff’s comment, and we will update the Revised Exhibits to include the following statement related to the qualified person’s opinion on the adequacy of the sample preparation, security, and analytical procedures in the updated Exhibit 96.2:

“In the qualified person’s opinion, the sample preparation, security, and laboratory analytical procedures are conventional industry practice and are adequate for the reporting of resources and reserves.”

Wendover (Exhibit 96.3)

Section 8: Sample Preparation, page ED-8

| 16. | The report should include details regarding sample preparation, security, and laboratory analytical procedures, as well as the opinion of the qualified person regarding the adequacy of the sample preparation, security, and analytical procedures to comply with Item 601(b)(96)(iii)(B)(8) of Regulation S-K. |

Response: We respectfully acknowledge the Staff’s comment, and we will update the Revised Exhibits to include the following statement related to the qualified person’s opinion on the adequacy of the sample preparation, security, and analytical procedures in the updated Exhibit 96.3:

“In the qualified person’s opinion, the sample preparation, security, and laboratory analytical procedures are conventional industry practice and are adequate for the reporting of resources and reserves.”

Section 11: Mineral Resource Estimates, page ED-11

| 17. | We note that the calculation of indicated resources in Table 11-2 does not correlate to the contained tons of K2O product in Table 11-4, which appears be related to the In-place KCl in 1967 prior to extraction. |

The report should include an updated estimate of tonnage and disclose resources exclusive of reserves to comply with Item 601(b)(96)(iii)(B)(11) of Regulation S-K.

Response: We respectfully acknowledge the Staff’s comment, and we note an immaterial error in the calculation shown in Table 11-2. We will update Table 11-2 in the Revised Exhibits as shown below:

Table 11-2. Shallow-Brine Aquifer KCl Resource Estimate

| Parameters | Calculation | Results | ||||||

| 92 drill-hole control indicated area (ft2) (A) | 2,152,518,168 | |||||||

| 92 drill-hole control inferred area (ft2) (Q) | 2,915,597,689 | |||||||

| Average thickness (ft) (B) | 18 | |||||||

| Porosity (C) | 0.45 | |||||||

| Average KCl grade (1967) (%) (D) | 1.26 | |||||||

| Brine density (lb/ft3) (E) | 72.4 | |||||||

| Cutoff grade (%) (F) | 0.30 | |||||||

| Recovery factor (G) | 60 | % | ||||||

| Product purity (H) | 95 | % | ||||||

| Plant efficiency | 85 | % | ||||||

| Product per year (tpy) (I) | 70,000 | |||||||

| Resource Calculation (in thousand tons) | ||||||||

| In-place KCl in 1967 (J) | J=A*B*C*D/100*E/2000000 | 7,960 | ||||||

| KCl depletion from 1967 to 2021 (K) | 1,981 | |||||||

| KCl under cutoff grade (L) | L=(J-K)/D*F | 1,442 | ||||||

| Remaining in-place KCl above cutoff grade (M) | M=J-K-L | 4,537 | ||||||

| Recoverable KCl (N) | N=M*G | 2,722 | ||||||

| 25 year plan (P) | 1,550 | |||||||

| Indicated resource exclusive of reserve (O) | O=M -(P/G) | 1,954 | ||||||

| Inferred resource (R) | R= Q*B*C*D/100*E/2000000 | 10,782 | ||||||

We will also replace Table 11-4 to include information to convert the information shown in Table 11-2 from KCl to K2O, as shown below:

Wendover - Sylvinite Brine Mineral Resource Estimate effective December 31, 2021 based on 406 $/Product Ton Mine Site

| Resources | ||||||||||||||||||||

| K2O Brine1 (Mt) | Grade (%K2O) | Contained K2O2 (Mt) | Cutoff3 (%K2O) | Processing Recovery (%) | ||||||||||||||||

| Measured Mineral Resources | ||||||||||||||||||||

| Indicated Mineral Resources | 250 | 0.5 | 1.2 | 0.19 | 85 | |||||||||||||||

| Measured + Indicated Mineral Resources | 250 | 0.5 | 1.2 | 0.19 | ||||||||||||||||

| Inferred Mineral Resources | 1,360 | 0.5 | 6.8 | 0.19 | 85 | |||||||||||||||

1 K2O Brine is the recovered KCl bearing brine in solution at average concentrations by weight.

2 Contained K2O is calculated by multiplying K2O Brine by the Grade.

3 Solution mining resource cutoff grade at which production covers operating costs.

Mineral Resources were prepared by RESPEC, CO., a qualified firm for the estimate and independent of Intrepid Potash.

Mineral Resources are reported exclusive of Mineral Reserves, on a 100% basis.

Mineral Resources are reported using inverse Distance Squared (ID2) estimation methods.

Mt = million tons, % = percentage, K2O = potassium oxide, ft = feet

Section 13: Mining Methods, page ED-13

| 18. | An annual life of mine production schedule, which includes ore processed and the associated grades for the life of the mine should be provided to comply with Item 601(b)(96)(iii)(B)(13) of Regulation S-K. |

Response: We respectfully acknowledge the Staff’s comment, and we will update the Revised Exhibits to include a life of mine production schedule in a form substantially similar to the following:

| A | B | C | D | E | F | |||||||||||||||||||||

| Brine | ||||||||||||||||||||||||||

| Volume | Brine | Product | Handling | |||||||||||||||||||||||

| (Million | Grade | K2O | KCl | Losses | MOP | |||||||||||||||||||||

| Gallons) | (%K2O) | (Tons) | (Tons) | (Tons) | (Tons) | |||||||||||||||||||||

| 2022 | Year 1 | 7,000 | 0.5 | 43,200 | 72,000 | 2,000 | 70,000 | |||||||||||||||||||

| 2023 | Year 2 | 7,000 | 0.5 | 43,200 | 72,000 | 2,000 | 70,000 | |||||||||||||||||||

| 2024 | Year 3 | 7,000 | 0.5 | 43,200 | 72,000 | 2,000 | 70,000 | |||||||||||||||||||

| 2025 | Year 4 | 7,000 | 0.5 | 43,200 | 72,000 | 2,000 | 70,000 | |||||||||||||||||||

| 2026 | Year 5 | 7,000 | 0.5 | 43,200 | 72,000 | 2,000 | 70,000 | |||||||||||||||||||

| 2027 | Year 6 | 7,000 | 0.5 | 43,200 | 72,000 | 2,000 | 70,000 | |||||||||||||||||||

| 2028 | Year 7 | 7,000 | 0.5 | 43,200 | 72,000 | 2,000 | 70,000 | |||||||||||||||||||

| 2029 | Year 8 | 7,000 | 0.5 | 43,200 | 72,000 | 2,000 | 70,000 | |||||||||||||||||||

| 2030 | Year 9 | 7,000 | 0.5 | 43,200 | 72,000 | 2,000 | 70,000 | |||||||||||||||||||

| 2031 | Year 10 | 7,000 | 0.5 | 43,200 | 72,000 | 2,000 | 70,000 | |||||||||||||||||||

| 2032 | Year 11 | 7,000 | 0.5 | 43,200 | 72,000 | 2,000 | 70,000 | |||||||||||||||||||

| 2033 | Year 12 | 7,000 | 0.5 | 43,200 | 72,000 | 2,000 | 70,000 | |||||||||||||||||||

| 2034 | Year 13 | 7,000 | 0.5 | 43,200 | 72,000 | 2,000 | 70,000 | |||||||||||||||||||

| 2035 | Year 14 | 7,000 | 0.5 | 43,200 | 72,000 | 2,000 | 70,000 | |||||||||||||||||||

| 2036 | Year 15 | 7,000 | 0.5 | 43,200 | 72,000 | 2,000 | 70,000 | |||||||||||||||||||

| 2038 | Year 17 | 7,000 | 0.5 | 43,200 | 72,000 | 2,000 | 70,000 | |||||||||||||||||||

| 2039 | Year 18 | 7,000 | 0.5 | 43,200 | 72,000 | 2,000 | 70,000 | |||||||||||||||||||

| 2040 | Year 19 | 7,000 | 0.5 | 43,200 | 72,000 | 2,000 | 70,000 | |||||||||||||||||||

| 2041 | Year 20 | 7,000 | 0.5 | 43,200 | 72,000 | 2,000 | 70,000 | |||||||||||||||||||

| 2042 | Year 21 | 7,000 | 0.5 | 43,200 | 72,000 | 2,000 | 70,000 | |||||||||||||||||||

| 2043 | Year 22 | 7,000 | 0.5 | 43,200 | 72,000 | 2,000 | 70,000 | |||||||||||||||||||

| 2044 | Year 23 | 7,000 | 0.5 | 43,200 | 72,000 | 2,000 | 70,000 | |||||||||||||||||||

| 2045 | Year 24 | 7,000 | 0.5 | 43,200 | 72,000 | 2,000 | 70,000 | |||||||||||||||||||

| 2046 | Year 25 | 7,000 | 0.5 | 43,200 | 72,000 | 2,000 | 70,000 | |||||||||||||||||||

| *Numbers rounded for clarity |

| Sylvinite brine density - 1.16 |

| Overall pond recovery - 30% |

| KCl plant recovery - 85% |

| Product purity - 95% |

| Pure KCl equates to 63.17% K2O by mass |

| Handling losses - 3% |

| C = A*1,000,000*l.16*8.34/2000*(B/100)*0.85*0.3 |

| D = C/0.6317/0.95 |

| E = D*0.03 |

| F = D-E |

Section 17: Environmental Studies, Permitting, and Plans, page ED-17

| 19. | The opinion of the qualified person as to the adequacy of current plans for environmental compliance, permitting, and addressing issues with local individuals or groups must be provided to comply with Item 601(b)(96)(iii)(B)(17)(vi) of Regulation S-K. |

Response: We respectfully acknowledge the Staff’s comment, and we will update the Revised Exhibits to include the following comment in Exhibit 96.3:

“Intrepid-Wendover is in operation and in adherence with the local, state, and federal regulations. It is the opinion of the qualified person that the current plans for environmental compliance, permitting, and addressing issues with local groups are adequate.”

* * * * *

If you have any further questions or comments regarding this letter, please contact me at 303-996-3048.

| Sincerely, | |||

| /s/ Matthew Preston | |||

| Matthew Preston | |||

| Chief Financial Officer | |||

| Intrepid Potash, Inc. | |||

| cc: | Ned Prusse, Perkins Coie LLP | ||