SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

| Filed by the Registrant | x |

| Filed by a party other than the Registrant | o |

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive additional materials |

| ¨ | Soliciting material under Rule 14a-12 |

Energy Recovery, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transactions applies: |

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No. |

| (3) | Filing Party: |

| (4) | Date Filed: |

Energy Recovery, Inc.

Notice of Annual Meeting of Stockholders

To Be Held On June 18, 2013

Dear Stockholders,

NOTICE IS HEREBY GIVEN that the 2013 Annual Meeting of Stockholders of Energy Recovery, Inc., a Delaware corporation (the “Company” or “Energy Recovery”) will be held on Tuesday, June 18, 2013, at 10:00 a.m. Pacific Daylight Time. The Annual Meeting will take place at the Company’s headquarters, located at 1717 Doolittle Drive, San Leandro, CA 94577.

The purpose of the meeting is:

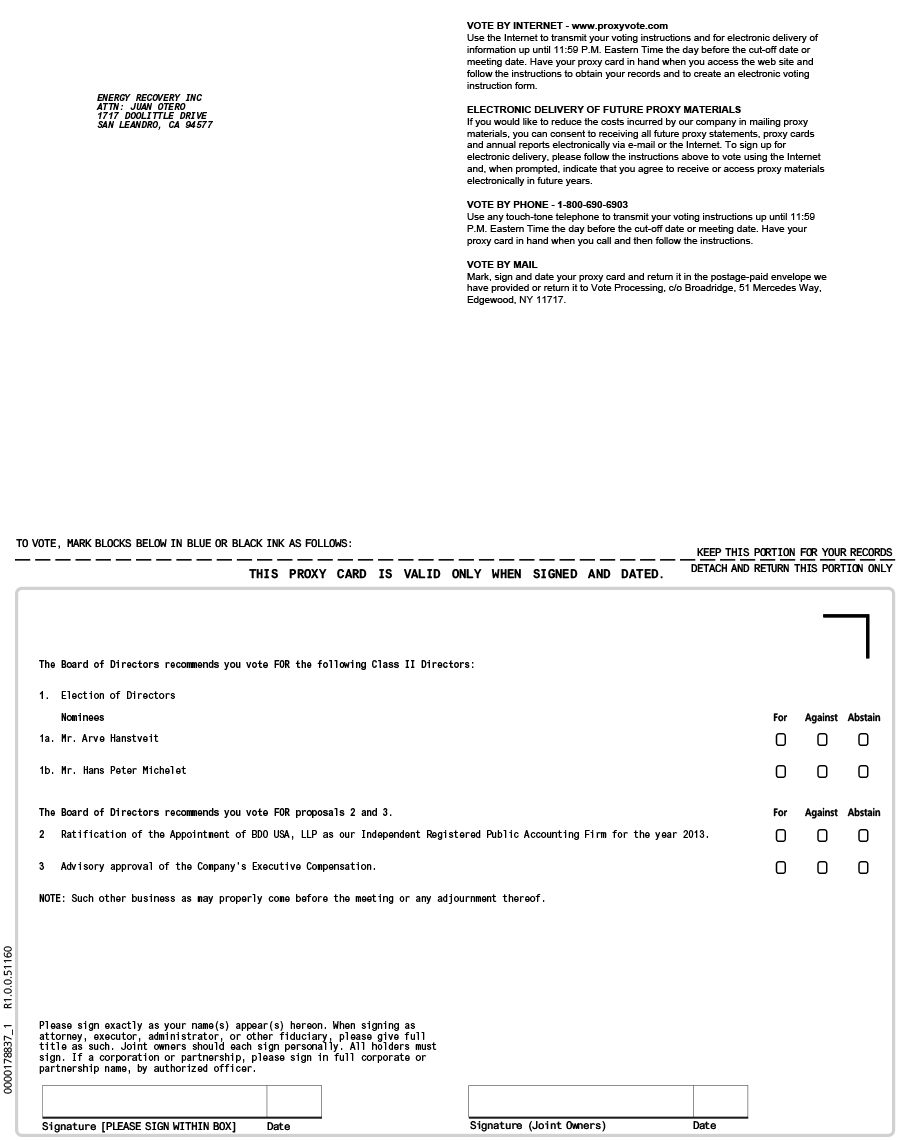

| 1. | the election of Mr. Arve Hanstveit and Mr. Hans Peter Michelet as Class II directors to serve until our 2016 annual meeting (or until their successors are elected and qualified); |

| 2. | the ratification of the appointment of BDO USA, LLP as our independent registered public accounting firm for the year ending December 31, 2013; |

| 3. | advisory approval of the Company’s executive compensation; and |

| 4. | other business that may properly come before the meeting and any adjournment or postponement. |

These items of business are more fully described in the attached Proxy Statement, which is part of this Notice.

Only stockholders who owned stock at the close of business on April 22, 2013 may attend and vote at the meeting or any postponement or adjournment of the meeting.

Whether or not you expect to attend the annual meeting of stockholders in person, you are urged to vote as promptly as possible to ensure your representation and the presence of a quorum at the annual meeting.

At the meeting, we will also report on our 2012 business results and other matters of potential interest to our stockholders.

| By Order of the Board of Directors, | |

| |

| Thomas S. Rooney, Jr. | |

| President and Chief Executive Officer |

San Leandro, California

April 26, 2013

Stockholders of record can vote their shares by using the internet or the telephone. Instructions for using these convenient services are set forth on the enclosed proxy card. Stockholders may also vote their shares by marking, signing, dating, and returning the proxy card in the enclosed postage-prepaid envelope.

If you send in your proxy card and then decide to attend the annual meeting to vote your shares in person, you may still do so. Your proxy is revocable in accordance with the procedures described in the proxy statement.

| TABLE OF CONTENTS | |

| Page | |

| PROXY STATEMENT | 1 |

| ABOUT THE MEETING | 1 |

| 1. What is the purpose of the meeting? | 1 |

| 2. How do I vote? | 1 |

| 3. How many votes do I have? | 2 |

| 4. Can I change my vote after submitting my proxy? | 2 |

| 5. What if I return a proxy card but do not make specific choices? | 2 |

| 6. Who pays for the expenses related to the preparation and mailing of the Proxy Statement? | 2 |

| 7. Who can vote at the Annual Meeting? | 2 |

| 8. Will there be any other items of business on the agenda? | 2 |

| 9. How many votes are required for the approval of each item? | 2 |

| 10. What is the quorum requirement? | 3 |

| 11. What is a record holder? | 3 |

| 12. What is a beneficial owner? | 3 |

| 13. How are votes counted? | 3 |

| 14. Who counts or tabulates the votes? | 4 |

| 15 How do I access the proxy materials and annual report via the Internet? | 4 |

| PROPOSAL NO. 1 — ELECTION OF DIRECTORS | 5 |

| PROPOSAL NO. 2 — RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 6 |

| Principal Accountant Fees and Services | 6 |

| Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm | 6 |

| PROPOSAL NO. 3 — ADVISORY APPROVAL OF THE COMPANY’S EXECUTIVE COMPENSATION | 7 |

| BOARD AND CORPORATE GOVERNANCE MATTERS | 9 |

| Board of Directors | 9 |

| Director Independence | 9 |

| Relationships Among Directors or Executive Officers | 9 |

| Committees and Meetings of the Board of Directors | 9 |

| The Audit Committee | 9 |

| The Compensation Committee | 10 |

| The Nominating and Corporate Governance Committee | 10 |

| Board Leadership Structure and Role in Risk Management | 11 |

| Compensation Committee Interlocks and Insider Participation | 11 |

| Communication between Stockholders and Directors | 11 |

| Director Compensation | 12 |

| Director Compensation for the Year Ended December 31, 2012 | 13 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 14 |

| EXECUTIVE COMPENSATION | 16 |

| Compensation Discussion and Analysis | 16 |

| Results of 2012 “Say on Pay” Vote | 16 |

| Executive Summary | 16 |

| Compensation Philosophy | 16 |

| 2012 Business Developments | 17 |

| Executive Compensation Decision-Making | 18 |

| Base Salaries for Named Executive Officers | 18 |

| Annual Cash Incentive Compensation | 19 |

| 2012 Cash Incentive Plan | 20 |

| 2013 Cash Incentive Plan | 21 |

| Equity-Based Incentive Compensation | 21 |

| 2012 Equity-Based Incentive Awards | 21 |

| 2013 Equity-Based Incentive Awards | 22 |

| Benefits | 22 |

i

| TABLE OF CONTENTS | |

| Page |

| Change in Control Severance Plan | 22 |

Severance and Termination Compensation | 23 |

| Tax Deductibility | 23 |

| Compensation Committee Report | 23 |

| Summary Compensation Table | 24 |

| Grants of Plan-Based Awards in 2012 | 25 |

| Employment Arrangements with Named Executive Officers | 26 |

| Outstanding Equity Awards as of December 31, 2012 | 29 |

| Option Exercises and Stock Vested in 2012 | 30 |

| Potential Payments Upon Termination or Change in Control | 30 |

| Key Defined Terms of the Change in Control Plan | 31 |

| Benefits under the Change in Control Plan | 33 |

| EQUITY COMPENSATION PLANS | 34 |

| REPORT OF THE AUDIT COMMITTEE | 34 |

| DIRECTORS AND MANAGEMENT | 35 |

| RELATED PERSON POLICIES AND TRANSACTIONS | 38 |

| CODE OF BUSINESS CONDUCT AND ETHICS | 38 |

| STOCKHOLDER PROPOSALS | 39 |

| OTHER MATTERS | 39 |

| Section 16(a) Beneficial Ownership Reporting Compliance | 39 |

| Other Matters | 39 |

| Form 10-K ANNUAL REPORT | 39 |

ii

ENERGY RECOVERY, INC.

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 18, 2013

This proxy statement (“Proxy Statement”) applies to the solicitation of proxies by the Board of Directors of Energy Recovery, Inc. for use at the 2013 Annual Meeting of Stockholders to be held on Tuesday, June 18, 2013 at 10:00 a.m. Pacific Daylight Time. The Annual Meeting will take place at the Company’s headquarters, located at 1717 Doolittle Drive, San Leandro, CA 94577. The telephone number at that location is (510) 746-7370. This Proxy Statement, the accompanying proxy, and our Form 10-K for the fiscal year ended December 31, 2012 (the “2012 Annual Report”) are being sent by mail to stockholders on or about May 10, 2013.

| 1. | What is the purpose of the meeting? |

All holders of shares of common stock of record at the close of business on April 22, 2013, (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting and all adjournments or postponements thereof. At the meeting, our stockholders will vote on:

| 1. | the election of Mr. Arve Hanstveit and Mr. Hans Peter Michelet as Class II directors to serve until our 2016 annual meeting (or until their successors are elected and qualified); |

| 2. | the ratification of the appointment of BDO USA, LLP as our independent registered public accounting firm for the year ending December 31, 2013; |

| 3. | advisory approval of the Company’s executive compensation; and |

| 4. | other business that may properly come before the meeting and any adjournment or postponement. |

| 2. | How do I vote? |

If you are a record holder of our common shares, you can vote either in person at the Annual Meeting or by proxy whether or not you attend the Annual Meeting. If you plan to vote in person, you must bring the enclosed proxy card and proof of identification to the meeting.

To vote by proxy, you can direct your vote as follows:

| · | By Mail: Fill out the enclosed proxy card, date and sign it, and return it in the enclosed postage-paid envelope, |

| · | By Telephone: Follow the instructions on the proxy card to vote by telephone, or |

| · | By Internet: Follow the instructions on the proxy card to vote by internet. |

To ensure that your vote is counted, please submit your vote by June 17, 2013.

If your shares are held for you in an account with a broker or other nominee, you will receive voting instructions from your nominee rather than a proxy card. To vote, please follow the voting instructions sent by your broker or other nominee. If you return your voting instructions timely, your broker or other nominee will then include your vote in the appropriate proxy card held by the record holder. If your shares are held in the name of a broker or other nominee, you cannot vote in person at the Annual Meeting unless you first obtain a legal proxy from your nominee and present it at the Annual Meeting.

1

| 3. | How many votes do I have? |

On each matter to be voted upon, you have one (1) vote for each share of common stock you own as of the Record Date.

| 4. | Can I change my vote after submitting my proxy? |

If you are the record holder of your shares, you can withdraw or revoke your proxy at any time before the final vote at our Annual Meeting by:

| · | delivering to the Company (to the attention of Juan Otero, the Company’s Secretary) a written notice of revocation or a duly executed proxy bearing a later date; |

| · | submitting a new proxy via the Internet or telephone in accordance with the instructions on your original form of proxy; or |

| · | attending the Annual Meeting and voting in person, in which case you must specifically revoke any previously returned proxy before you vote in person. Attending the Annual Meeting in person will not by itself revoke any prior proxy. |

| 5. | What if I return a proxy card but do not make specific choices? |

If you return a signed and dated proxy card without marking any voting selections, your shares will be voted “FOR” our two director nominees and “FOR” the other proposals made in this Proxy Statement. If any other matter is properly presented at the meeting, the Company representative authorized to vote on your behalf as your proxy will vote your shares using his or her best judgment.

| 6. | Who pays for the expenses related to the preparation and mailing of the Proxy Statement? |

The Company will bear the costs of soliciting proxies, including the costs for the preparation, assembly, printing, and mailing of the Proxy Statement and related proxy materials. In addition, the Company will reimburse brokerage firms and other nominees representing beneficial owners of shares for their expenses in forwarding solicitation materials to beneficial owners of those shares. Proxies may be solicited by certain of the Company’s directors, officers, and regular employees, without additional compensation, either personally, by telephone, facsimile, or mail.

| 7. | Who can vote at the Annual Meeting? |

Only stockholders of record at the close of business on April 22, 2013, the Record Date, will be entitled to notice of, and to vote at, our Annual Meeting. On the Record Date, the Company had 51,022,984 shares of common stock outstanding.

| 8. | Will there be any other items of business on the agenda? |

We do not know of any business to be considered at the meeting other than the proposals described in this Proxy Statement; however, the proxy holders (who are management representatives named on the proxy card) may vote using their discretion with respect to any other matters properly presented for a vote at the meeting.

| 9. | How many votes are required for the approval of each item? |

| · | Proposal No. 1 (election of directors): The candidates who receive the greatest number of votes cast at the Annual Meeting will be elected, provided that a quorum is present. The Board recommends a vote “FOR” all nominees. |

| · | Proposal No. 2 (ratification of BDO USA, LLP as our independent registered public accounting firm) and Proposal No. 3 (advisory approval of the Company’s executive compensation): An affirmative vote of a majority of the shares of the Company’s common stock present and entitled to vote is required to approve Proposals No. 2 and No. 3, provided that a quorum is present. The Board recommends a vote “FOR” each of the Proposals No. 2 and No. 3. |

2

| 10. | What is the quorum requirement? |

A “quorum” of stockholders must be present for us to hold a valid meeting of stockholders. Stockholders representing a majority (more than 50%) of the voting power of our outstanding common stock as of the Record Date, present in person or represented by proxy, constitute a quorum for the transaction of business at the Annual Meeting.

Your shares will be counted towards the quorum only if you submit a valid proxy or if you vote in person at the meeting. Stockholders who submit signed and dated proxies without specifying their votes and broker “non-votes” described below will be counted towards the quorum requirement. If there is no quorum, the chairperson of the meeting or a majority of the votes present at the meeting may adjourn the meeting to another date.

| 11. | What is a record holder? |

If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, you are considered a “record holder” of those shares. In this case, you will receive a form of proxy card for record holders along with the other proxy materials.

| 12. | What is a beneficial owner? |

If your shares are held in a stock brokerage account, by a bank, or by other nominee, those shares are registered with American Stock Transfer & Trust Company in the “street name” of the brokerage account, bank, or other nominee, and you are considered the “beneficial owner” of those shares. If you are a beneficial owner, your broker or other nominee will send you a form of voting instructions (rather than a proxy card) along with the other proxy materials.

As a beneficial owner, you have the right to direct your broker, bank, or other nominee on how to vote your shares by using the voting instruction form included in the mailing or by following the instructions on the voting instruction card for voting via the Internet or telephone.

If there are multiple beneficial owners in the same household, your broker or other nominee may send only one copy of the proxy materials to your household. If you would like a separate copy of either document, please contact Juan Otero, Corporate Counsel and Secretary, at (510) 746-2561 or by mail at 1717 Doolittle Drive, San Leandro, California 94577.

If you are receiving multiple copies of these materials and would like to receive a single copy in the future, please contact your broker, bank, or other nominee, or you may contact the Company’s investor relations department to request a single copy only in the future.

| 13. | How are votes counted? |

All shares of common stock represented by valid proxies will be voted in accordance with their instructions. In the absence of instructions, proxies will be voted “FOR” Proposals 1, 2, and 3.

Brokers, banks, and other nominees may submit a proxy card for shares of common stock that they hold for a beneficial owner, but decline to vote on certain items because they have not received instructions from the beneficial owner. These are called “Broker Non-Votes” and are not included in the tabulation of the voting results for the election of directors or for purposes of determining the number of votes cast with respect to a particular proposal. Consequently, Broker Non-Votes do not have an effect on the vote.

Brokers have the discretion to vote such shares for which they have not received voting instructions from the beneficial owners on routine matters, but not on non-routine matters. The only routine matter up for vote this year is the ratification of the independent registered public accounting firm (Proposal No. 2).

A broker is prohibited from voting on a non-routine matter unless the broker receives specific voting instructions from the beneficial owner of the shares. The election of directors (Proposal No. 1) and the advisory vote on executive compensation for 2012 (Proposal No. 3) are non-routine matters, and your broker cannot vote your shares on these proposals unless you have timely returned applicable voting instructions to your broker.

3

Abstentions have no effect on the outcome of voting for Proposal No. 1, election of directors. Abstentions are treated as shares present or represented and voting regarding Proposals No. 2 and No. 3, so abstentions have the same effect as negative votes on those proposals.

| 14. | Who counts or tabulates the votes? |

The votes of stockholders attending the Annual Meeting and voting in person will be counted or tabulated by an independent inspector of election. For our meeting, a representative of Broadridge Investor Communications Solutions, Inc. will tabulate votes cast by proxy and in person.

| 15. | How do I access the proxy materials and annual report via the Internet? |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be Held on June 18, 2013.

This proxy statement, the 2012 Annual Report, and related proxy materials are available electronically at http://ir.energyrecovery.com

We are mailing physical copies of our notice, Proxy Statement, proxy, and 2012 Annual Report to our stockholders; however, you may also access these materials at the website noted above.

If you have previously chosen to receive the Proxy Statement and the 2012 Annual Report over the Internet, you will be receiving an e-mail on or about May 10, 2013 with information on how to access stockholder information and instructions for voting over the Internet. Stockholders of record may vote via the Internet until 11:59 p.m. Eastern Daylight Time on June 17, 2013.

If a stockholder’s shares are registered in the name of a brokerage firm and the stockholder has not elected to receive the Proxy Statement and Annual Report over the Internet, the stockholder may still be eligible to vote shares electronically over the Internet. Many brokerage firms participate in programs that provide eligible stockholders who receive a paper copy of the Proxy Statement and Annual Report the opportunity to vote via the Internet. If a stockholder’s brokerage firm participates in such a program, a form from the broker will provide voting instructions.

Stockholders can elect to view future Proxy Statements and Annual Reports over the Internet instead of receiving paper copies. Stockholders of record wishing to receive future stockholder materials electronically can elect this option by following the instructions provided when voting over the Internet at www.proxyvote.com.

Upon electing to view future Proxy Statements and Annual Reports over the Internet, stockholders will receive an e-mail notification next year with instructions containing the Internet address of those materials. The choice to view future proxy statements and annual reports over the Internet will remain in effect until the stockholder contacts their broker or the Company to rescind the instructions. Internet access does not have to be elected each year.

Stockholders who elected to receive this Proxy Statement electronically over the Internet and who would now like to receive a paper copy of this Proxy Statement so that they may submit a paper proxy in lieu of an electronic proxy should contact either their broker or the Company.

4

ELECTION OF DIRECTORS

As set by the Board of Directors under the Bylaws of the Company, the authorized number of directors of the Company will be eight as of the date of the 2013 Annual Meeting.

The Nominating and Corporate Governance Committee of the Board of Directors has recommended, and the Board of Directors has nominated, the two nominees listed below for election as Class II directors at the Annual Meeting. If elected, each newly elected director will serve until the 2016 Annual Meeting of Stockholders, until each director’s successor is duly elected and qualified, or until the director’s earlier removal or resignation.

Each of the nominees is currently a director of the Company, and each of the nominees named below has consented, if elected as a director of the Company, to serve until his term expires.

In the event that any nominee of the Company is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who shall be designated by the present Board of Directors to fill the vacancy. In the event that additional persons are nominated for election as directors, the proxy holders intend to vote all proxies received by them in such a manner as will assure the election of as many of the nominees listed below as possible. In such event, the specific nominees to be voted for will be determined by the proxy holders. The Board has no reason to believe that any of the persons named below will be unable or unwilling to serve as a director, if elected. Each of the two nominees for director who receives the greatest number of votes will be elected.

Set forth below are the names, ages, and certain biographical information relating to the Class II director nominees as of April 22, 2013.

| Name of Nominee | Age | Position with Company | Director Since |

Arve Hanstveit (1)(2)(3) | 58 | Director | 1995 |

| Hans Peter Michelet | 53 | Director and Chairman of the Board | 1995 |

| (1) | Member and chairman of the Compensation Committee. |

| (2) | Member of the Audit Committee |

| (3) | Member of the Nominating and Corporate Governance Committee |

Arve Hanstveit has served as a member of our Board of Directors since 1995. From 1997 through 2010, Mr. Hanstveit served as Partner and Vice President of ABG Sundal Collier, a Scandinavian investment bank, where he was responsible for advising U.S. institutional investors on equity investments in Nordic companies. Prior to joining ABG Sundal Collier, Mr. Hanstveit worked as a Securities Analyst and as a Portfolio Manager for TIAA-CREF, a large U.S. institutional investor. From 2007 through 2010, Mr. Hanstveit served on the Board of Directors of Kezzler AS, a privately-held Norwegian company that delivers secure track-and-trace solutions. He is also a member of the Norwegian American Chamber of Commerce and the New York Angels, an independent consortium of accredited angel investors who provide equity capital for early-stage companies in the New York City area. Mr. Hanstveit holds a B.A. in Business from the Norwegian School of Management and an M.B.A. from the University of Wisconsin, Madison. The Board selected Mr. Hanstveit as a Director due to his early investment in the Company, his years of experience as a portfolio manager and securities analyst, his detailed understanding of global financial markets, and his extensive knowledge of the Company, its products, and markets.

Hans Peter Michelet joined our Board of Directors in August 1995 and was appointed Chairman of the Board in September 2004. From January 2005 to November 2007, Mr. Michelet served as our Interim Chief Financial Officer. Before joining our Board, Mr. Michelet was a Senior Manager with Delphi Asset Management, an asset management firm based in Norway, and served as Chief Executive Officer of Fiba Nordic Securities, a Scandinavian investment bank. He also held management positions with Finanshuset and Storebrand Insurance Corporation. He became our Executive Chairman in March 2008 and transitioned to Non-Executive Chairman in June 2011. Mr. Michelet is Executive Chairman of the Board of Directors of SynchroNet Logistics Inc., a maritime software-as-a-service (“SaaS”) provider, and a Director of Profunda AS, a commercial salmon breeding farm. Mr. Michelet holds a B.A. in Finance from the University of Oregon. The Board selected Mr. Michelet as a Director and its Chairman due to his experience as an investor and entrepreneur, his senior management experience in multi-cultural financial institutions, his strong organizational and leadership skills, and his knowledge of company operations and markets.

THE BOARD RECOMMENDS A VOTE FOR THE ELECTION OF THE NOMINEES NAMED ABOVE

5

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

BDO USA, LLP has been appointed by the Audit Committee to continue as the Company’s independent registered public accounting firm for the year ending December 31, 2013. Although the Company is not required to seek stockholder approval for its selection of independent registered public accounting firm, the Board believes that the practice constitutes sound corporate governance. If the appointment is not ratified, the Audit Committee will investigate the reasons for stockholder rejection and will reconsider its selection of independent registered public accounting firm.

A representative of BDO USA, LLP is expected to be present at the Annual Meeting. The representative will have an opportunity to make a statement and to respond to any questions.

The following table summarizes total fees that BDO USA, LLP, our independent registered public accounting firm, billed to us for its work in connection with fiscal years ended December 31, 2012 and 2011.

| 2012 | 2011 | |||||||

Audit Fees (1) | $ | 410,482 | $ | 431,305 | ||||

Tax Fees (2) | 1,340 | 7,500 | ||||||

| Total | $ | 411,822 | $ | 438,805 | ||||

| (1) | Audit fees represent fees for professional services related to the performance of the audit of our annual financial statements, review of our quarterly financial statements, and consents on SEC filings. |

| (2) | Tax fees include professional services related to the preparation of tax returns and for related compliance and consulting services. |

Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

The Audit Committee pre-approves audit, audit-related, tax, and non-audit services provided by our independent registered public accounting firm, BDO USA, LLP, and will not approve services that are impermissible under applicable laws and regulations. The pre-approval of services may be delegated to one or more of the Audit Committee’s members, but the decision of that member to pre-approve specific services must be reported to the full Audit Committee at its next scheduled meeting.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR RATIFICATION

OF THE APPOINTMENT OF BDO USA, LLP AS THE COMPANY’S

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR

THE YEAR ENDING DECEMBER 31, 2013

6

ADVISORY APPROVAL OF THE COMPANY’S EXECUTIVE COMPENSATION

The Compensation Discussion and Analysis beginning on page 16 of this proxy statement describes the Company’s executive compensation program and the compensation decisions made by the Compensation Committee for our fiscal year ended December 31, 2012 with respect to the executive officers named in the Summary Compensation Table on page 24. The Board of Directors is asking our stockholders to cast a non-binding advisory vote to approve the following resolution:

“RESOLVED, that the stockholders of Energy Recovery, Inc. approve the compensation of the executive officers named in the Summary Compensation Table for 2012, as disclosed in the Company’s proxy statement for the 2013 Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission (which disclosure includes the Compensation Discussion and Analysis, the executive compensation tables, and the related footnotes and narrative accompanying the tables).”

We believe that the compensation of our executive officers and directors in 2012 supported our corporate goals, aligned with the long-term strategy of the Company to maximize stockholder value, and provided incentive for key employees to drive market share gains, revenue growth, cost reduction, product innovation, and market expansion for the Company.

Significant compensation decisions in 2012 were based on the following:

| · | Substantial revenue growth due to a significant increase in market share, resulting from numerous awards of mega-projects around the world; |

| · | Strong improvement in gross profit margin due to cost savings realized through increased production volume, a favorable product mix, the consolidation of manufacturing operations in California, the vertical integration of ceramics processing, and other efficiency-enhancing measures; |

| · | Significant savings in operating expenses even in the context of an historically high investment in research and development; and |

| · | Tangible, measurable progress specific to expansion into the oil & gas market. |

Compensation decisions in 2012 included the following:

| · | The Company maintained the same compensation for directors in 2012 as that established in 2011, with an appropriate mix between fees and equity-based compensation; |

| · | Excluding new hire grants meant to attract new members of the management team along with the aforementioned director grants, the Company issued equity grants in accordance with the Long-Term Incentive Plan, with consideration given to position, years of service, individual performance, and existing levels of equity; |

| · | With input from the chief executive officer and the recommendation of the Compensation Committee, the Board of Directors approved certain increases in base compensation for named executive officers after considering individual performance, salary increases in prior years, and relative pay in comparison to other executives; and |

| · | With input from the chief executive officer and the recommendation of the Compensation Committee, the Board of Directors made a decision to fully fund the bonus pool for new and existing executives because the Company met or exceeded established financial and strategic objectives in 2012 that supported the Company’s annual budget and long-range strategic plan. In assessing actual results and individual performance, executives were awarded bonuses commensurate with their individual contributions. |

7

We believe that the compensation decisions enumerated above allowed the Company to retain and reward key employees in a manner that reflected their individual, respective contributions in the context of much-increased market share, significant revenue growth, vastly improved profitability, accelerated product innovation, and significant progress regarding expansion into the oil & gas market. For these reasons, the Board is asking our stockholders to vote “FOR” this proposal. Although your vote on this proposal is advisory and non-binding, the Compensation Committee values the views of our stockholders and will take into account the outcome of the vote when considering future compensation decisions for our named executive officers. We are providing this advisory vote pursuant to Section 14A of the Securities Exchange Act of 1934.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR PROPOSAL NO. 3

8

The authorized size of the Board of Directors is currently eight and is divided into three classes, with each class serving for a staggered three-year term. As of the date of the 2013 Annual Meeting, the Board of Directors will consist of three Class I directors, Mr. Paul Cook, Mr. Fred Olav Johannessen, and Dr. Marie-Elisabeth Paté-Cornell; two Class II directors, Mr. Arve Hanstveit and Mr. Hans Peter Michelet; and three Class III directors, Mr. Robert Yu Lang Mao, Mr. Thomas S. Rooney, Jr., and Mr. Dominique Trempont.

At each annual meeting of stockholders, a class of directors will be elected for a three-year term to succeed the directors of the same class whose terms are then expiring. The term of the Class I directors ends at the annual meeting in 2015. The current term of Class II directors ends at the annual meeting in June 2013, and the term of the Class II directors who are elected at the upcoming 2013 Annual Meeting will end at the annual meeting in 2016. The term of Class III directors ends at the annual meeting in 2014.

Our Board of Directors has determined that Mr. Cook, Mr. Hanstveit, Mr. Johannessen, Mr. Mao, Dr. Paté-Cornell, and Mr. Trempont, representing a majority of our directors, are “independent directors” as defined in the listing rules of the NASDAQ Global Market LLC. Consistent with the principles of the NASDAQ listing rules, the Board has also determined that ownership of the Company’s stock by a director is not inconsistent with a determination of independence.

There are no family relationships among any of the directors or executive officers of the Company.

During the year ended December 31, 2012, the Board of Directors met eight times. The Board has three committees: the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee. During the year ended December 31, 2012, no director attended fewer than 75% of all the meetings of the Board or its committees on which he or she served after becoming a member. The Company encourages, but does not require, its directors to attend the annual meeting of stockholders.

The Audit Committee held four meetings in the year ended December 31, 2012. The Committee consists of Mr. Hanstveit, Mr. Johannessen, Mr. Mao, and Mr. Trempont (committee chairman).

The Audit Committee is responsible for assisting the full Board of Directors in fulfilling its oversight responsibilities relating to:

| · | overseeing the accounting and financial reporting processes and audits of our financial statements; |

| · | selecting and hiring our independent registered public accounting firm and approving the audit and non-audit services to be performed by our independent registered public accounting firm; |

| · | assisting the Board of Directors in monitoring the integrity of our financial statements, our internal accounting and financial controls, our compliance with legal and regulatory requirements, and the qualifications, independence, and performance of our independent registered public accounting firm; |

| · | providing to the Board of Directors information and materials to make the Board aware of significant financial and audit-related matters that require attention; and |

| · | reviewing and discussing with management and our independent registered public accounting firm our annual and quarterly financial statements and annual and quarterly reports on Forms 10-K and 10-Q. |

9

The Board has determined that all members of the Audit Committee are independent directors as defined in the listing rules of NASDAQ. The Board has further determined that Mr. Trempont is an “audit committee financial expert” as defined by SEC rules. The Board of Directors has adopted and approved a charter for the Audit Committee, a copy of which can be viewed on the Company’s website at www.energyrecovery.com.

The Compensation Committee held six meetings in the year ended December 31, 2012. The members of the Compensation Committee are Mr. Cook, Mr. Hanstveit (committee chairman), Mr. Johannessen, Dr. Paté-Cornell, and Mr. Trempont. The Compensation Committee is responsible for, among other things:

| · | reviewing and approving, with respect to our chief executive officer and other executive officers, annual base salaries, annual incentive bonuses, equity compensation, employment agreements, severance arrangements, change of control agreements/provisions, and any other benefits, compensation, or arrangements; |

| · | administering our Amended and Restated 2008 Equity Incentive Plan and other employee benefit plans as may be adopted by us from time to time; and |

| · | recommending inclusion of the Compensation Discussion and Analysis in the Proxy Statement and our Annual Report on Form 10-K. |

The Board has determined that all members of the Compensation Committee are independent directors as defined in the listing rules of NASDAQ. The Board of Directors has adopted and approved a charter for the Compensation Committee, a copy of which can be viewed on the Company’s website at www.energyrecovery.com.

The Nominating and Corporate Governance Committee, which held one meeting in the year ended December 31, 2012, consists of Mr. Hanstveit and Mr. Trempont (committee chairman). The Nominating and Corporate Governance Committee is responsible for:

| · | assisting the Board of Directors in identifying prospective director nominees and recommending to the Board the Director nominees for each annual meeting of stockholders; |

| · | evaluating the performance of current members of the Board of Directors; |

| · | developing principles of corporate governance and recommending them to the Board of Directors; |

| · | recommending to the Board of Directors persons to be members of each committee; and |

| · | overseeing the evaluation of the Board of Directors and management. |

The Nominating and Corporate Governance Committee operated under a written charter setting forth the functions and responsibilities of the Committee. A copy of the charter can be viewed on the Company’s website at www.energyrecovery.com.

The Nominating and Corporate Governance Committee considers and makes recommendations to the Board of Directors regarding any stockholder recommendations for candidates to serve on the Board of Directors. Stockholders wishing to recommend candidates for consideration by the Nominating and Corporate Governance Committee may do so by writing to the Secretary of the Company at 1717 Doolittle Drive, San Leandro, California 94577 and providing: (a) the candidate’s name, biographical data, and qualifications, (b) a document indicating the candidate’s willingness to act if elected, and (c) evidence of the nominating stockholder’s ownership of the Company’s common stock at least 120 days prior to the next annual meeting to assure time for meaningful consideration by the Nominating and Corporate Governance Committee.

The Nominating and Corporate Governance Committee does not have a policy of considering diversity specifically or formally in identifying nominees for directors. In the past, when new directors have been added to our Board of

10

Directors, the Board or Nominating and Corporate Governance Committee has endeavored to select director candidates who have business, scientific, or regulatory specializations; technical skills; or other backgrounds that increased the range of experience and diversity of perspectives within our Board of Directors in ways that pertain to our current and future business goals. The Committee also considers diversity in terms of gender, ethnic background, and national origin.

There are no differences in the manner in which the Nominating and Corporate Governance Committee evaluates nominees for director based on whether the nominee is recommended by a stockholder or by the Nominating and Corporate Governance Committee itself. The Company does not pay any third party to identify or assist in identifying or evaluating potential nominees.

In reviewing potential candidates for the Board, the Nominating and Corporate Governance Committee considers numerous factors including:

| · | whether or not the person has any relationships that might impair his or her independence, such as any business, financial, or family relationships with the Company, its management, its stockholders, or their affiliates; |

| · | whether or not the person serves on boards of, or is otherwise affiliated with, competing companies; |

| · | whether or not the person is willing to serve as, and willing and able to commit the time necessary for the performance of the duties of, a director of the Company; and |

| · | the contribution that the person can make to the Board and the Company, with consideration given to the person’s experience in the fields of energy, technology, and manufacturing as well as leadership or entrepreneurial experience in business or education. |

Of greatest importance is the individual’s integrity and ability to bring to the Company experience and knowledge in areas related to the Company’s current and future business. The Board intends to continue using these criteria to evaluate candidates for election to the Board. The Board has determined that all members of the Nominating and Corporate Governance Committee are independent directors as defined in the listing rules of NASDAQ.

The offices of chairman and chief executive officer at our company are held by different individuals. Mr. Michelet is currently chairman of the board and has served as our board chairman since September 2004. Mr. Rooney has served as our president and chief executive officer since February 2011. Mr. Rooney was appointed by the Board as a director in February 2011 and elected as a director by the stockholders in June 2011. The Company believes that having the roles of chief executive officer and chairman of the board filled by different individuals enhances our internal system of checks and balances and the Board’s oversight role. The practice also enables the chief executive officer to focus on the Company’s operations.

The Board’s role in risk oversight includes approving material expenditures and significant changes in company business practices. The Board also receives and approves reports on key product development projects, organizational matters, and strategic initiatives. In addition, the Audit Committee periodically considers and approves the company’s corporate investment policy and practices. The Audit Committee also oversees and reviews related-person transactions.

None of our current executive officers serve on the Compensation Committee or the Board of Directors of another entity whose executive officer(s) serve(s) on the Company’s Compensation Committee or Board of Directors.

Our Board of Directors currently does not have a formal process for stockholders to send communications to the Board. The Company, however, makes every effort to ensure that the views of stockholders are heard by the Board or individual directors and that the Company responds to stockholders on a timely basis. The Board of Directors does not recommend that formal communication procedures be adopted at this time because it believes that informal communications are sufficient to convey questions, comments, and observations that could be useful to the

11

Board. Stockholders wishing to formally communicate with the Board of Directors may send communications directly to Juan Otero, Corporate Counsel and Secretary, c/o Energy Recovery, Inc., 1717 Doolittle Drive, San Leandro, California 94577.

Director Compensation

Directors who are non-employees of the Company received the following fees for their services on the Board during the year ending December 31, 2012:

| · | $50,000 annual retainer paid in quarterly installments for services as a member of the Board of Directors; or |

| · | $250,000 annual retainer paid in monthly installments for services as chairman of the Board of Directors. |

Additionally, directors receive:

| · | $15,000 annual retainer paid in quarterly installments for services as chairman of the Audit Committee; |

| · | $10,000 annual retainer paid in quarterly installments for services as chairman of the Compensation Committee; and |

| · | $5,000 annual retainer paid in quarterly installments for services as chairman of the Nominating and Corporate Governance Committee. |

Our non-employee directors also receive:

| · | an annual grant of stock options or restricted shares of common stock valued (based on market prices on the date of grant) at $45,000, with 100% vesting on the first anniversary of the grant date. |

We have granted our non-employee directors the following number of options to purchase our common stock:

| 2008 | 2009 | 2010 | 2011 | 2012 | ||||||||||||||||

| Paul Cook | 100,000 | 39,042 | 45,708 | |||||||||||||||||

| Arve Hanstveit | 100,000 | 39,042 | 45,708 | |||||||||||||||||

| Fred Olav Johannessen | 100,000 | 39,042 | 45,708 | |||||||||||||||||

| Robert Yu Lang Mao | 25,000 | 39,042 | 45,708 | |||||||||||||||||

| Hans Peter Michelet | 250,000 | 39,042 | 45,708 | |||||||||||||||||

| Dr. Marie-Elisabeth Paté-Cornell | 100,000 | 39,042 | 45,708 | |||||||||||||||||

| Dominique Trempont | 100,000 | 39,042 | 45,708 | |||||||||||||||||

All of the options to purchase shares of common stock granted to our directors before 2011 have a four-year vesting period, with 25% of the shares vesting one year after the vesting commencement date. After that date, 1/48 of the shares vest every month. Options granted in 2011 and 2012 have a one-year vesting period. All options to directors were granted at the fair market value on the date of grant.

In addition to the equity awards depicted in the table above, in August 2010, the Company issued 29,500 shares of restricted stock awards to Mr. Cook in consideration of his consulting services to the Company. These shares are fully vested.

12

Director Compensation for the Year Ended December 31, 2012

The table below summarizes the compensation paid to non-employee directors for the year ended December 31, 2012. Mr. Rooney, who served as chief executive officer during 2012 and also as a director, is not included in the table below because he received compensation in 2012 only as an employee and did not receive additional compensation for services provided as a director:

| Director | Fees Earned and Paid in Cash | Option Awards (1) | Total | |||||||||

| Paul Cook | $ | 50,000 | $ | 45,000 | $ | 95,000 | ||||||

Arve Hanstveit (2) | $ | 60,000 | $ | 45,000 | $ | 105,000 | ||||||

| Fred Olav Johannessen | $ | 50,000 | $ | 45,000 | $ | 95,000 | ||||||

| Robert Yu Lang Mao | $ | 50,000 | $ | 45,000 | $ | 95,000 | ||||||

Hans Peter Michelet (3) | $ | 250,000 | $ | 45,000 | $ | 295,000 | ||||||

| Dr. Marie-Elisabeth Paté-Cornell | $ | 50,000 | $ | 45,000 | $ | 95,000 | ||||||

Dominique Trempont (4) | $ | 70,000 | $ | 45,000 | $ | 115,000 | ||||||

| (1) | The amount in the Option Awards column sets forth the fair value on the grant date of the option awards granted in 2012. These amounts do not state cash payments realized by the individual. The method and assumptions used to calculate the fair value on the grant date of our equity awards is discussed in Note 12 of our notes to our financial statements included in our Annual Report on Form 10-K. As of December 31, 2012, the number of shares underlying vested and unvested stock options held by each of the directors was: Paul Cook, 184,750; Arve Hanstveit, 184,750; Fred Olav Johannessen, 184,750; Robert Yu Lang Mao, 109,750; Hans Peter Michelet, 334,750; Dr. Marie-Elisabeth Paté-Cornell, 184,750; and Dominique Trempont, 184,750. As of December 31, 2012, Mr. Cook also had 29,500 restricted stock awards that are fully vested and no longer restricted. |

| (2) | Mr. Hanstveit is a director and the chairman of the Compensation Committee. |

| (3) | Mr. Michelet is a director and chairman of the Board of Directors. |

| (4) | Mr. Trempont is a director, the chairman of the Audit Committee, and the chairman of the Nominating and Corporate Governance Committee. |

13

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of our common stock as of April 22, 2013 for (i) each person who is known by the Company to beneficially own more than 5% of the Company’s common stock, (ii) each of the Company’s directors, (iii) each of the officers appearing in the “Summary Compensation Table” on Page 24, and (iv) all directors and executive officers as a group.

To the Company’s knowledge, except as itemized in the footnotes to this table and subject to applicable community property laws, each person named in the table has sole voting and investment power with respect to the shares set forth opposite such person’s name. The address of each executive officer and director is c/o Energy Recovery, Inc., 1717 Doolittle Drive, San Leandro, CA 94577.

Shares Beneficially Owned (1) | Percent of Class (2) | |||||||

| 5% or Greater Common Stockholders: | ||||||||

Marius Skaugen (3) | 7,641,103 | 15.0 | % | |||||

| Parkv.57 c/o B. Skaugen AS 0256 | ||||||||

| Oslo, Norway | ||||||||

ZBI Equities, L.L.C, Ziff Brothers Investment, L.L.C., Samana Capital, L.P., Morton Holdings, Inc., and Philip B. Korsant (4) | 3,750,900 | 7.4 | % | |||||

| 35 Ocean Reef Drive, Suite 142 | ||||||||

| Key Largo, FL 33037 | ||||||||

Ludvig Lorentzen AS (5) | 3,176,059 | 6.2 | % | |||||

| Postboks A, Bygdoy, 0211 | ||||||||

| Oslo, Norway | ||||||||

BlackRock, Inc. (6) | 2,847,824 | 5.6 | % | |||||

40 East 52nd Street | ||||||||

| New York, NY 10022 | ||||||||

| Directors, Named Executive Officers, and Current Group: | ||||||||

Arve Hanstveit (7) | 1,834,750 | 3.6 | % | |||||

Fred Olav Johannessen (8) | 1,586,867 | 3.1 | % | |||||

Hans Peter Michelet (9) | 764,750 | 1.5 | % | |||||

Thomas S. Rooney, Jr. (10) | 730,493 | 1.4 | % | |||||

Borja Sanchez-Blanco (11) | 436,546 | * | ||||||

Dominique Trempont (12) | 337,140 | * | ||||||

Alexander J. Buehler (13) | 270,796 | * | ||||||

Paul Cook (14) | 234,550 | * | ||||||

Dr. Marie-Elisabeth Paté-Cornell (15) | 184,750 | * | ||||||

Robert Yu Lang Mao (16) | 109,298 | * | ||||||

Dr. Prem Krish (17) | 41,061 | * | ||||||

Nocair Bensalah (18) | 28,807 | * | ||||||

All current named executive officers and directors as a group (12 persons) (19) | 6,559,808 | 12.9 | % | |||||

*Less than 1%

| (1) | Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission (“SEC”). In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of Common Stock subject to options and warrants held by that person that are currently exercisable, or exercisable within 60 days after April 22, 2013, are deemed outstanding. Such shares, however, are not deemed outstanding for the purpose of computing the percentage ownership of each other person. |

14

| (2) | Percent of class is based on the number of shares of Common Stock outstanding as of April 22, 2013, the Record Date, which were 51,022,984 shares. |

| (3) | Based on a Schedule 13G/A and a Form 4 filed with the SEC on March 19, 2010 and April 29, 2010, respectively, which together showed 7,641,103 shares beneficially owned by Arvarius AS and 7,641,103 shares beneficially owned by Mr. Skaugen, the controlling stockholder of Arvarius. Each reported shared voting and dispositive power over the shares respectively reported for that beneficial owner. The shares reported by Arvarius include 800,000 shares that may be acquired under warrants exercisable within 60 days after April 22, 2013. |

| (4) | Based on a Schedule 13G/A filed with the SEC on February 14, 2013, which reported 3,750,900 shares beneficially owned by ZBI Equities, L.L.C., Ziff Brothers Investments, L.L.C., Samana Capital, L.P.; Morton Holdings, Inc., the general partner of Samana Capital, L.P.; and Philip B. Korsant. Each reported shared voting and dispositive power over the shares respectively reported for that beneficial owner. |

| (5) | Based on a Schedule 13G filed with the SEC on February 14, 2013, which reported 2,385,725 shares beneficially owned by Ludvig Lorentzen AS and 3,176,059 shares beneficially owned by its controlling shareholder, Mr. Ole Peter Lorentzen, which included the 2,385,725 shares and shares held by him in other accounts. Each reported shared voting and dispositive power over the shares respectively reported for that beneficial owner. |

| (6) | Based on a Schedule 13G/A filed with the SEC on February 8, 2013, which reported 2,847,824 shares beneficially owned by BlackRock, Inc. having sole voting and dispositive power. |

| (7) | Consists of 1,500,000 shares held by Mr. Hanstveit; 150,000 shares held by Mr. Hanstveit’s daughters; and options to purchase 184,750 shares of common stock that are exercisable within 60 days of April 22, 2013. Mr. Hanstveit has shared voting and investment power over the shares that are owned by his daughters. |

| (8) | Consists of 1,019,500 shares held by Mr. Johannessen; 25,000 shares held by Mr. Johannessen’s wife; 120,000 shares held by Mr. Johannessen’s child; 55,417 shares held by Gallissas Ltd.; 182,200 shares held by Kalamaris Invest AS; and options to purchase 184,750 shares of common stock that are exercisable within 60 days of April 22, 2013. Mr. Johannessen has shared voting and investment power over the shares that are owned by his child. Mr. Johannessen is the sole stockholder of Gallissas Ltd. and is a controlling stockholder of Kalamaris Invest AS. |

| (9) | Consists of 430,000 shares held by Mr. Michelet and options to purchase 334,750 shares of common stock that are exercisable within 60 days of April 22, 2013. |

| (10) | Consists of options to purchase 730,493 shares of common stock that may be exercised within 60 days of April 22, 2013. |

| (11) | Consists of 20,550 shares held by Mr. Sanchez-Blanco, 833 restricted stock units that will vest, and options to purchase 415,163 shares of common stock that may be exercised within 60 days of April 22, 2013. |

| (12) | Consists of 146,140 shares held by Mr. Trempont, 6,250 shares held by a household member, and options to purchase 184,750 shares of common stock that may be exercised within 60 days of April 22, 2013. |

| (13) | Consists of options to purchase 270,796 shares of common stock that may be exercised within 60 days of April 22, 2013. |

| (14) | Consists of 49,800 shares held by Mr. Cook and options to purchase 184,750 shares of common stock that may be exercised within 60 days of April 22, 2013. |

| (15) | Consists of options to purchase 184,750 shares of common stock that may be exercised within 60 days of April 22, 2013. |

15

| (16) | Consists of 7,361 shares held by Mr. Mao as trustee of The R. Mao Trust and options to purchase 101,937 shares of common stock that are exercisable within 60 days of April 22, 2013. |

| (17) | Consists of 3,000 shares held jointly by Dr. Krish and his wife; 5,000 shares held by Dr. Krish’s wife; and options to purchase 33,061 shares of common stock that may be exercised within 60 days of April 22, 2013. |

| (18) | Consists of options to purchase 28,807 shares of common stock that may be exercised within 60 days of April 22, 2013. |

| (19) | Consists of 3,720,218 shares held by the 12 executive officers and directors as a group, 833 restricted stock units and shares of restricted stock that will vest, and options to purchase 2,838,757 shares of common stock that may be exercised within 60 days of April 22, 2013. |

In the proxy statement for our 2012 Annual Meeting of Stockholders, we asked our stockholders for an advisory vote to approve the executive compensation disclosed in the proxy statement. Of the votes cast on that proposal, counting (for this purpose) shares voted for, against, and abstain, approximately 96% were voted in favor of our “say on pay” proposal.

We considered this favorable result as support for our executive compensation policies and practices and did not implement any changes in our executive compensation policies for 2012. Accordingly, we maintained a compensation framework necessary to attract and retain key employees with the capability to execute our strategic plan, to drive growth in existing markets and expansion into new markets, and to reward those employees for their respective contributions.

In the related “say on when” vote in 2011, we proposed, and a strong majority of the advisory votes cast approved, holding our “say on pay” vote annually. As previously reported, we intend to hold a “say on pay” advisory vote at each annual meeting until we review the results of our next “say on when” vote in 2017.

Our compensation philosophy is to maximize stockholder value by best aligning the compensation earned by executives and other employees with their efforts and achievements respective to the following critical areas: financial and operational improvement, revenue growth, product innovation, and market expansion. This is achieved by providing a trifurcated structure consisting of the following components; competitive base salary; determinative annual cash incentives tied to both Company and individual performance in accordance with measurable business objectives; and long-term equity-based incentives designed to address the extended periods required to develop both new markets and the products to support them. The Company periodically consults relevant compensation resources to stay informed about competitive practices within appropriate markets and to assess the ongoing effectiveness of its compensation programs, and the Company makes necessary adjustments to these programs to meet the evolving goals of the organization. This philosophy allows us to remain competitive in both the U.S. and global employment markets, while supporting the unique staffing and performance measurement metrics of the business. The Company issues stock options as the principal form of equity-based incentives, as we believe that options better capture stock appreciation over time and appropriately align with the interests of stockholders. For our named executive officers in 2012, total compensation as allocated among base salary, annual cash incentive, and equity-based compensation is depicted in the following table:

16

Distribution of Total Compensation for 2012

Named Executive Officer | Base Salary | Annual Cash Incentive (1) | Total Cash Incentive | Equity-Based Incentive (2) | Total Compensation | ||||||||||||||

| Thomas S. Rooney. Jr. | 33 | % | 33 | % | 66 | % | 34 | % | 100 | % | |||||||||

| Alexander J. Buehler | 43 | % | 22 | % | 65 | % | 35 | % | 100 | % | |||||||||

| Borja Sanchez-Blanco | 46 | % | 28 | % | 74 | % | 26 | % | 100 | % | |||||||||

| Dr. Prem Krish | 52 | % | 28 | % | 80 | % | 20 | % | 100 | % | |||||||||

| Nocair Bensalah | 67 | % | 16 | % | 83 | % | 17 | % | 100 | % | |||||||||

| (1) | Percentages are based upon actual payouts of Annual Cash Incentives in the first quarter of 2013. |

| (2) | Percentages are based upon the fair market value of Equity-Based Option Awards granted in the first quarter of 2012. For Mr. Rooney and Mr. Bensalah, the amount does not include awards granted in connection with each of their respective offer letters of employment. |

The following summary should be read in connection with the additional discussion in this section and the information provided in the compensation tables and narrative discussion that follow this section.

The following business developments were important factors underlying compensation decisions for executive officers in 2012 and relate primarily to restoring growth in the business while reclaiming our position in the core desalination market, reducing costs for the enterprise through value creation and efficiency-enhancing initiatives, and driving technological innovation to expand into new addressable markets with a preeminent focus on oil & gas:

| 1. | Our common stock provided an annual total stockholder return of 31.78% |

| 2. | Annual revenue increased by 52% in 2012, attributable to significant market share gains in the context of a surging market for mega-projects around the world; |

| 3. | The Company achieved approximately 90% market share through awards of the seven largest mega-projects globally; |

| 4. | Gross profit margin increased from 28% to 47% due to positive operating leverage attained through increased volume, a favorable product mix of PX® devices over turbochargers and pumps, and diminished costs realized through plant consolidation and vertical integration; |

| 5. | Even after investing nearly $5.0 million in research and development associated primarily with new market expansion (representative of the largest investment in the Company’s history), operating expenses decreased by more than $4.0 million due to restructuring expenses incurred in 2011 and cost savings realized in 2012; |

| 6. | Net loss was reduced by $18.2 million, or 69%, from $(26.4) million in 2011 to $(8.3) million in 2012. Similarly, loss per share was reduced from $(0.50) per share in 2011 to $(0.16) per share in 2012; |

| 7. | We designed and developed three new solutions for applications in the oil & gas industry while partnering with three high-profile customers on three continents. These new technologies are in various stages of field deployment and validation; |

| 8. | We launched a new brand identity to facilitate the Company’s evolution into a global leader in harnessing the reusable energy from industrial fluid flows and pressure cycles; |

| 9. | While investing heavily in new technological solutions for oil & gas applications, we also invested in our core product line to enhance the competitive cost position for centrifugal products; and |

| 10. | After an initial launch in 2011, the Company experienced considerable adoption of its PX-Q series of products, which offer the highest guaranteed efficiency, a 25-year design life, and the quietest operations. |

17

Executive Compensation Decision-Making

The Compensation Committee annually reviews our executive compensation philosophy, approves the components of executive officer compensation, and establishes strategic and financial objectives for the chief executive officer. At the request of the Committee, our chief executive officer provides recommendations for base salary, annual cash incentives, and equity-based incentives for the other executive officers in consultation with senior human resources staff. When the Committee deems appropriate, our chief executive officer attends and participates in Committee meetings, except when his own compensation is under consideration, due to his direct knowledge of individual performance and his role in setting annual performance goals for the other executive officers. The only executive officer who had a role in determining or recommending 2012 compensation for directors and named executive officers was Thomas S. Rooney, Jr., our president and chief executive officer.

We do not benchmark our executive compensation against a peer group of companies. Although we are still a relatively small company, we operate in a global industry (for the year ended December 31, 2012, approximately 92% of our net revenue was derived from sales outside of the U.S.). Importantly, the market for executive talent is specialized, considering our needs for cross-border management expertise, relevant industry knowledge, and experience working for U.S. publicly-traded companies. We have no direct competitors of a comparable size and in a similar stage of development that are publicly traded on a U.S. or other major stock exchange. Consequently, we believe that there is no set of directly related and comparable companies operating in similar labor markets against which benchmarking for executive compensation purposes would be meaningful.

Nevertheless, the Compensation Committee periodically reviews salary and other data from companies in the water, manufacturing, and high-tech industries; companies of a comparable size in terms of revenue and market capitalization; companies in a comparable stage of growth; and other companies located in the greater San Francisco Bay Area, where our headquarters is centered. The Committee uses this data as a reference to assess and consider relevant trends in executive compensation.

As part of the Committee’s determination of executive compensation for 2012, the Committee consulted the compensation data assembled by our human resources staff from a reputable compensation database. This data was based upon the following 15 publicly-traded peer companies identified for us in 2009 by Frederic W. Cook & Co.

American Superconductor Corporation

Badger Meter Inc.

Consolidated Water Co. Ltd.

Energy Conversion Devices, Inc.

Evergreen Solar Inc.

Fuel Systems Solutions, Inc.

Fuel Tech, Inc.

FuelCell Energy Inc.

Gorman-Rupp Co.

Graham Corp.

Met-Pro Corp.

PMFG, Inc.

Quantum Fuel Systems Technologies Worldwide Inc.

Sun Hydraulics Corp.

AeroVironment, Inc.

Frederic W. Cook & Co. selected these companies because they viewed them to be comparable to our company in terms of revenue and market capitalization and as a result of their product mix in the clean energy, water treatment, or natural resources sectors.

Base salaries are designed to provide our executives with a stable source of income commensurate with their responsibility, experience, and performance.

18

In 2012, the base salary of our chief executive officer, Mr. Thomas S. Rooney, Jr., was $400,000, unchanged from 2011. Details of Mr. Rooney’s compensation package are discussed below under the caption entitled “Employment Arrangements with Named Executive Officers.” Mr. Rooney’s base salary has increased to $420,000 for 2013, reflective of no salary increase in 2012 and strong performance in accordance with corporate and individual objectives.

In 2012, the base salary of our chief financial officer, Mr. Alexander J. Buehler, was $305,000, an increase from $300,000 in 2011. Details of Mr. Buehler’s compensation package are discussed below under the caption entitled “Employment Arrangements with Named Executive Officers.” Mr. Buehler’s base salary for 2013 has increased to $314,000, which is reflective of strong financial performance in the context of the Company’s approved business plan for 2012.

Mr. Borja Sanchez-Blanco, our senior vice president of sales, is employed by our Spanish subsidiary, Energy Recovery Iberia, S.L. In 2012, Mr. Sanchez-Blanco directly led sales efforts for our mega-projects group and oversaw activity for our OEM Sales and Service groups. His annual salary increased from €253,000 in 2011 to €259,000 in 2012, an amount equal to $333,022 based on the average interbank exchange rate in 2012 (€1.00/$1.29). Mr. Sanchez-Blanco’s base salary for 2013 has increased to €264,180, which is reflective of substantial market share gains and strong revenue growth.

On January 1, 2012, the Company appointed Mr. Nocair Bensalah as the new vice president of manufacturing. Under the terms of Mr. Bensalah’s offer letter dated October 27, 2011, Mr. Bensalah’s compensation included the following components:

| · | an annual base salary of $205,000; |

| · | a relocation payment of $50,000, remitted as a one-time, lump-sum disbursement; |

| · | an annual cash bonus of up to 30% of his annual base salary dependent upon his achievement of Company and individual objectives; and |

| · | options to purchase shares of the Company’s common stock under the 2008 Equity Incentive Plan with a grant date fair value estimated at $50,000 and subject to the Company’s standard four-year vesting schedule. |

On September 1, 2012, Mr. Bensalah’s base salary was increased from $205,000 to $215,000 in recognition of the successful consolidation of production operations in California and the full vertical integration of ceramics processing. Mr. Bensalah’s base salary for 2013 has increased further to $220,000, which is reflective of the Company’s substantially improved gross profit margin achieved through manufacturing volume and production efficiencies.

On March 1, 2012, the Company appointed Dr. Prem Krish as chief technology officer. In accordance with his promotion, Dr. Krish’s compensation included the following components:

| · | an annual base salary of $200,000; |

| · | an annual cash bonus of up to 60% of his annual base salary dependent upon his achievement of Company and individual objectives; and |

| · | options to purchase shares of the Company’s common stock under the 2008 Equity Incentive Plan with a grant date fair value estimated at $75,000 and subject to the Company’s standard four-year vesting schedule. |

On September 14, 2012, the base salary for Dr. Krish was increased from $200,000 to $230,000 due to the additional responsibility associated with a newly expanded research and development department and a much-increased R&D budget focused on oil & gas development. Dr. Krish’s base salary for 2013 has further increased to $242,000, reflective of significant progress on three new oil & gas solutions serving three major customers.

Our annual cash incentive plan is designed primarily to motivate and reward executives in achieving critical financial and operational objectives in support of the Company’s annual budget and strategic plan. Actual cash incentive

19

payments for 2012, paid in March 2013 to each named executive officer, are set forth in the “Summary Compensation Table” below under the column for “Non-Equity Incentive Plan Compensation.” We refer to these amounts in the discussion below for convenience as a “bonus.”

The objectives for our named executive officers under the 2012 cash incentive plan are enumerated in the table below. The column entitled “Target Bonus for 100% Goal Achievement” in the table conveys the targeted bonus for each officer if 100% of his or her objectives are achieved. The column entitled “Maximum Bonus Allowable” describes the maximum bonus the officer could receive in the event that the actual results exceed those specified in the objectives. In the context of extraordinary performance, however, the Compensation Committee can exercise its discretion to approve a cash incentive above the “Maximum Bonus Allowable,” although they did not do so in 2012.

| Named Executive Officer | 2012 Objectives | Maximum Bonus Allowable | Target Bonus for 100% Goal Achievement | |

| Thomas S. Rooney, Jr. | · | Achieve budgeted revenue and net income targets for 2012 | 100% of base salary | 100% of base salary |

· | Successfully complete product deployment targets for three new oil & gas products with three named customers | |||

| Alexander J. Buehler | · | Drive performance to business plan through operating reviews, forecasts, cost-out initiatives, and other activities to exceed business plan | 60% of base salary | 60% of base salary |

· | Support new initiatives to drive incremental and recurring revenue along with successful delivery of oil & gas devices | |||

· | Implement new ERP system in accordance with budget to improve managerial reporting and enhance internal control | |||

| Borja Sanchez-Blanco | · | Achieve targeted revenue and gross margin objectives to generate budgeted operating income | 60% of base salary | 60% of base salary |

· | Manage sales spend so as not to exceed approved budget | |||

· | Support and promote new business initiatives and opportunities in oil & gas | |||

· | Achieve required accuracy level for rolling forecasts | |||

| Dr. Prem Krish | · | Successfully deliver a working IsoBoost™ solution to named customer by target date | 60% of base salary | 60% of base salary |

· | Successfully deliver a working IsoGen™ solution to named customer by target date | |||

· | Successfully deliver a working IsoPro™ solution to named customer by target date | |||

· | Complete cost reduction initiative for centrifugal products and release to production by target date | |||

· | Manage R&D spend so as not to exceed approved budget | |||

| Nocair Bensalah | · | Achieve budgeted gross profit | 30% of base salary | 30% of base salary |

· | Improve inventory turnover to target | |||

· | Meet production dates to achieve on-time shipments | |||

· | Support new product development efforts by facilitating procurement activities and providing production infrastructure | |||

·. | Achieve required accuracy level for rolling forecasts |

20

The Compensation Committee determined that, based upon performance measured against the objectives outlined above, the following cash payments would be made under the 2012 annual cash incentive plan:

| Name | % Achievement | $ Incentive Payment | |||||

| Thomas S. Rooney, Jr. | 100 | % | $ | 400,000 | |||

| Alexander J. Buehler | 85 | % | $ | 155,600 | |||

Borja Sanchez-Blanco (1) | 100 | % | $ | 199,813 | |||

| Dr. Prem Krish | 85 | % | $ | 117,300 | |||

| Nocair Bensalah | 75 | % | $ | 48,400 | |||

| (1) | The payment represents the value in U.S. dollars based on the average interbank exchange rates for 2012 (€1.00/$1.29) |

Payment calculations for individual named executive officers were determined by corporate financial performance, individual performance in accordance with objectives, and time in position for the current year. Participants must be employed as of October 1 of the plan year and must be an employee in good standing at the time of payment. A participant’s bonus payment under this plan shall be calculated as:

| · | Base salary, multiplied by |

| · | Target % of base salary, multiplied by |

| · | The bonus pool allocation ratio, multiplied by |

| · | The % achievement of individual objectives, multiplied by |

| · | The time in the position for the plan year, expressed as a percentage |

For 2012, the allocation ratio was set at 1.0 due to the Company exceeding its approved business plan.

The Board of Directors had enumerated objectives for the chief executive officer in 2012, and the chief executive officer had specified objectives for other named executive officers in the context of the business plan and his own objectives. The Company evaluated and remitted bonuses for performance in 2012 during the first quarter of 2013.

2013 Cash Incentive Plan

For 2013, the Compensation Committee and the Board of Directors updated the cash incentive plan based on the approved business plan for the same year. To achieve the full funding related to annual cash incentives, the Company must achieve its approved budget, the amount of which is referred to as the “Performance Target”, where the budget is expressed in terms of Adjusted Operating Income. Importantly, Adjusted Operating Income is determined by correcting for certain non-recurring events that are approved in writing by the Board of Directors. For performance below a Minimum Performance Threshold, the Company would fund a modest bonus pool in a fixed amount for allocation among certain participants who exhibit extraordinary performance. Between the Minimum Performance Threshold and the Performance Target, the Company would apply a linear function to determine funding of the bonus pool. For achieving financial results in excess of the Performance Target, the Company would fund only the target annual bonus pool. The target bonus for all named executive officers will remain unchanged for 2013.

The Company grants stock options to executives and other key employees to provide long-term incentives to increase stockholder value pursuant to the Company’s Amended and Restated 2008 Equity Incentive Plan.

On February 16, 2012, as part of an annual stock option grant program for employees, the Compensation Committee granted options to purchase the Company’s common stock to the following named executive officers: Mr. Rooney, in the amount of 353,982 options; Mr. Buehler, in the amount of 212,389 options; Mr. Sanchez-Blanco, in the amount of

21

154,867 options; Dr. Krish, in the amount of 66,372 options; and Mr. Bensalah, in the amount of 44,248 options. The vesting schedule for these grants provides that 25% of the options vest on the one-year anniversary of the vesting commencement date, and thereafter, 1/36 of the remaining options vest at the end of each month of active service.