Filed Pursuant to Rule 424(b)(3)

File Number 333-162459

PROSPECTUS SUPPLEMENT NO. 2

to Prospectus dated January 28, 2010

(Registration No. 333-162459)

CHINA ELECTRIC MOTOR, INC.

This Prospectus Supplement No. 2 supplements our Prospectus dated January 28, 2010 and our Prospectus Supplement No. 1 dated February 23, 2010. The shares that are the subject of the Prospectus have been registered to permit their resale to the public by the selling stockholders named in the Prospectus. We are not selling any shares of common stock in this offering and therefore will not receive any proceeds from this offering. You should read this Prospectus Supplement No. 2 together with the Prospectus and Prospectus Supplement No. 1.

This Prospectus Supplement No. 2 includes the attached report, as set forth below, as filed by us with the Securities and Exchange Commission (the “SEC”): Annual Report on Form 10-K filed with the SEC on March 31, 2010.

Our common stock is traded on the NASDAQ Global Market under the symbol “CELM.”

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS SUPPLEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this Prospectus Supplement No. 2 is April 6, 2010.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2009

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM _______ TO ___________

COMMISSION FILE NO. 001-34613

CHINA ELECTRIC MOTOR, INC.

(Exact Name Of Registrant As Specified In Its Charter)

| Delaware | 26-1357787 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

Sunna Motor Industry Park Jian’an, Fuyong Hi-Tech Park Baoan District, Shenzhen, Guangdong, China | N/A | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (86) 755-81499969

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

| Title of Each Class | Name of Each Exchange on Which Registered | |

| Common Stock, $0.0001 par value | NASDAQ Global Market |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:.

Large accelerated filer o | Accelerated filer o | |

Non-accelerated filer x | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

There were an aggregate of 20,744,743 shares outstanding of registrant’s common stock, par value $0.0001 per share, as of March 29, 2010. The registrant’s common stock commenced trading on the NASDAQ Global Market on January 29, 2010 under the ticker symbol “CELM.” There was no public market for the registrant’s securities prior to listing on the NASDAQ Global Market.

DOCUMENTS INCORPORATED BY REFERENCE: None.

TABLE OF CONTENTS

CHINA ELECTRIC MOTOR, INC.

TABLE OF CONTENTS TO ANNUAL REPORT ON FORM 10-K

For the Fiscal Year Ended December 31, 2009

| PAGE | ||||

| PART I | 2 | |||

| Item 1. | Business | 2 | ||

| Item 1A. | Risk Factors | 11 | ||

| Item 1B. | Unresolved Staff Comments | 27 | ||

| Item 2. | Properties | 27 | ||

| Item 3. | Legal Proceedings | 27 | ||

| Item 4. | (Reserved) | 27 | ||

| PART II | 27 | |||

| Item 5. | Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 27 | ||

| Item 6. | Selected Financial Data | 28 | ||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 30 | ||

| Item 7A. | Quantitative and Qualitative Disclosures about Market Risk | 40 | ||

| Item 8. | Financial Statements and Supplementary Data | 41 | ||

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 41 | ||

| Item 9A. | Controls and Procedures | 41 | ||

| Item 9B. | Other Information | 42 | ||

| PART III | 42 | |||

| Item 10. | Directors, Executive Officers and Corporate Governance | 42 | ||

| Item 11. | Executive Compensation | 45 | ||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholders Matters | 49 | ||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 50 | ||

| Item 14. | Principal Accountant Fees and Services | 51 | ||

| PART IV | 52 | |||

| Item 15. | Exhibits and Financial Statement Schedules | 52 | ||

| SIGNATURES | 53 | |||

| EXHIBIT INDEX | 54 | |||

| FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | F-1 | |||

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The information contained in this Form 10-K, includes some statements that are not purely historical and that are “forward-looking statements.” Such forward-looking statements include, but are not limited to, statements regarding our company’s and our management’s expectations, hopes, beliefs, intentions or strategies regarding the future, including our financial condition, results of operations, and the expected impact of the share exchange. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipates,” “believes,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “might,” “plans,” “possible,” “potential,” “predicts,” “projects,” “seeks,” “should,” “will,” “would” and similar expressions, or the negatives of such terms, may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained in this Form 10-K are based on current expectations and beliefs concerning future developments and the potential effects on the Company. There can be no assurance that future developments actually affecting us will be those anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond the parties’ control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements, including the following:

· Our reliance on our major customers for a large portion of our net sales;

· Our ability to develop and market new products;

· Our ability to continue to borrow and raise additional capital to fund our operations;

· Our ability to collect aging trade receivables and the effect of a growing doubtful account allowance;

· Our ability to accurately forecast amounts of supplies needed to meet customer demand;

· Exposure to market risk through sales in international markets;

· The market acceptance of our products;

· Exposure to product liability and defect claims;

· Fluctuations in the availability of raw materials and components needed for our products;

· Protection of our intellectual property rights;

· Changes in the laws of the PRC that affect our operations;

· Inflation and fluctuations in foreign currency exchange rates;

· Our ability to obtain all necessary government certifications, approvals, and/or licenses to conduct our business;

· Development of a public trading market for our securities;

· The cost of complying with current and future governmental regulations and the impact of any changes in the regulations on our operations; and

· The other factors referenced in this report, including, without limitation, under the sections entitled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Business.”

These risks and uncertainties, along with others, are also described above under the heading “Risk Factors.” Should one or more of these risks or uncertainties materialize, or should any of the Company’s assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. Moreover, we operate in a very competitive and rapidly changing environment. New risk factors emerge from time to time and we cannot predict all such risk factors, nor can we assess the impact of all such risk factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward looking statements. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

1

PART I

ITEM 1. BUSINESS

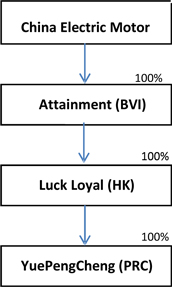

With respect to this discussion, the terms, “we,” “us,” “our” or “the Company” refer to China Electric Motor, Inc., and our 100%-owned subsidiary Attainment Holdings Limited, a British Virgin Islands corporation (“Attainment Holdings”) and its subsidiaries, including Luck Loyal International Investment Limited, a company organized under the laws of Hong Kong (“Luck Loyal”) and Luck Loyal’s wholly-owned subsidiary, Shenzhen YuePengCheng Motor Co., Ltd., a company organized under the laws of the PRC (“Shenzhen YPC”).

Overview

We, through Shenzhen YPC, are engaged in the design, manufacture, sale and marketing of micro-motors and micro-motor components with a range of applications in automobiles, power tools, home appliances and consumer electronics.

Industry

General

We are engaged in the design, manufacture and sale of specialized micro-motors to the Chinese and international market. We are focused on providing micro-motor products that meet the growing demand for efficient, quiet and compact motors from manufacturers of consumer electronics, automobiles, power tools, toys and household appliances. Micro-motors are simple to control, easy to operate and are generally very reliable. We believe that the market for micro-motor products will expand as manufacturers look to offer more automated features in their products.

The micro-motor industry has considerably raised the barriers to enter the industry. Currently there are three main obstacles to entering the industry:

| · | Due to the rapid technological progress in the micro-motor industry and since products necessitate higher technology, it is very difficult for ordinary enterprises to enter the industry if they do not already possess a high degree of technological capability. |

| · | The industry requires a large-scale production capability. If an enterprise does not have an adequate production capability, their products will not have a competitive price advantage in the market. |

| · | Industry users have formed a stable user-supplier concentration. If the newly entered rivals do not have a very strong competitiveness, it is very difficult for them to enter the original market. |

Automobile specialty micro-motors are used for various automation functions in automobiles. In order to stay competitive and attract customers, automobile manufacturers have been trying to keep costs down while offering more features in their automobiles, which particularly increases the degree of automation in an automobile offered by automakers. This trend has creased a new market for new types of automobile specialty micro-motors that automate different parts of an automobile including car seats, windows, trunks, door locks, mirrors, sliding doors and roofs. We believe that the worldwide demand for specialty automobile micro-motors with low costs and high quality is rapidly growing. Global automakers are increasingly sourcing auto parts from low costs countries, such as China.

China

China is one of the world’s largest consumer markets. China’s market for home appliances and automobiles has been growing, due in part to the country’s rapid economic growth. In 2009, China’s gross domestic product (“GDP”) increased 8.7% over 2008 according to the National Bureau of Statistics of China. Economic growth in China has led to greater levels of personal disposable income and increased spending among China’s expanding middle-class consumer base. Notwithstanding China’s economic growth, with a population of 1.3 billion people, China’s economic output and consumption rates are still small on a per capita basis compared to developed countries. As China’s economy develops, we believe that disposable income and consumer spending levels will continue to become closer to that of developed countries like the United States.

The micro-motor industry is a fast-growing industry in China. In recent years, the production of motor products has moved to China, making China the largest global manufacturer of small household appliances. China’s market share of the manufacture of small electronic appliances and micro-motor products is expected to increase. China has a number of benefits in the manufacture of micro-motors which are expected to drive this growth, including:

2

| · | Low costs. China continues to have a relatively low cost of raw materials, land and labor, which is especially important given the labor-intensive nature of the manufacture of our micro-motors. |

| · | Proximity to supply chain. Manufacturing of consumer products in general continues to shift to China, giving China-based manufacturers a further cost and cycle time advantage. |

| · | Proximity to end-markets. China has focused in recent years on building its research, development and engineering skill base in all aspects of higher end manufacturing. |

Competitive Strengths

We believe the following strengths contribute to our competitive advantages and differentiate us from our competitors:

Market position

Since our inception, we have focused on the research, development and manufacture of specialized micro-motor products. We have developed significant expertise in the key technologies and large-scale manufacturing that enables us to improve the quality of our products, reduce costs, and keep pace with current standards of the rapidly evolving consumer electronics industry. We are able to bring to the market well-differentiated products that perform well against competitive offerings based on price, quality, and brand recognition. To meet the changing needs of our customers, we intend to continue to improve and strengthen our in-depth capabilities to meet the changing needs of our customers and to continue to differentiate ourselves from our competitors in the global marketplace.

Design and manufacturing capabilities

We continue to focus on the development of new products for existing and new customers to meet the needs of existing customers and to broaden our customer base. We employ a rigorous and systematic approach to product design and manufacturing. Our design team develops and tracks new concepts and ideas from a variety of sources, including direct customer feedback, trade shows, and industry conferences. Our products are manufactured in our 15,000 square meter factory by approximately 780 production employees. Our production workshop includes a mold and molding workshop, a semi-finished products workshop, an assembly workshop and a finished products testing workshop. Our use of manual labor during the production process benefits from the availability of relatively low-cost, skilled labor in China.

Emphasis on providing our customer high value

We provide value to our customers by offering a broad range of high quality products, short lead times on custom products, quick delivery for stock products and local customer service and support. We also offer the capability to design and manufacture custom products that address the needs of our customers. We believe that we are well positioned relative to many of our competitors who emphasize low price.

Diversified customer base and end markets

During the year ended December 31, 2009, our products were sold to more than 17 OEMs and 11 distributors across a wide variety of end markets. For 2009, approximately 53.6% of our sales were to OEMs and 46.4% were to distributors. There were eight distributors that accounted for over 5% of our sales for the year ended December 31, 2009. We believe that the different purchasing patterns among our customers in the various end markets served allow us to reduce the overall sensitivity of demand of our products due to changes in the economy. Also, we believe that our large installed base and specification of our products by leading OEMs on original equipment creates significant replacement demand.

Brand awareness

Our self-branded micro-motor products, marketed under our “Sunna” brand-name, have become a recognized brand name in China, which we expect will assist us in growing our business over the course of the next few years. Our micro-motor products have a solid reputation and established a brand name in the PRC.

Experienced management team

Our senior management team has extensive business and industry experience, including an understanding of changing market trends, consumer needs, technologies and our ability to capitalize on the opportunities resulting from these market changes. Members of our senior management team also have significant experience with respect to key aspects of our operations, including research and development, product design, manufacturing, and sales and marketing.

3

Strategy

Our goal is to become a global leader in the development and manufacture of micro-motor products. We intend to achieve this goal by implementing the following strategies:

Expand existing and new product offerings

Since the commencement of our manufacturing operations in 1999, we have expanded our product offerings to produce a range of Alternating Current (“AC”) and Direct Current (“DC”) micro-motors. We currently produce products in 28 different series that include more than 1,200 different product specifications. We intend to expand our micro-motor product offerings for incorporation into new applications, such as Precision Slowdown Servo Drives. Additionally we intend to focus our research and development activities to address industry trends to reduce noise, vibration and energy consumption in our micro-motor products.

Enhance brand awareness

We believe that continuing to strengthen our brand is critical to our increasing demand for, and achieving widespread acceptance of, our micro-motor products. We believe a strong brand offers a competitive advantage and we intend to devote additional resources to strategic marketing promotion in order to increase brand awareness and product recognition and heighten customer loyalty. We aim to develop our “Sunna” brand into an internationally recognizable brand. We intend to exhibit our products at trade fairs around the world and devote additional resources into print, audio, television and outdoor advertising to promote our brand. Additionally, we will hold press conferences for the launch of new products and invite members of the local media and current and potential customers.

Build partnerships with new and existing clients

We intend to strengthen relationships with our existing clients and explore opportunities for product expansion with new and existing customers. Our strategy is to establish partnerships with our current clients whereby we develop and manufacture new products based on client needs.

Pursue acquisitions to broaden product application and enhance cost-savings

We will consider strategic acquisitions that will provide us with a broader range of product offerings and access to new markets. Additionally, we intend to consider acquiring manufacturers of micro-motor component parts, such as rotors, which will provide cost savings in our manufacturing operations.

Expand sales network and distribution channels

We intend to expand our sales network in China and develop relationships with a broader set of distributors and resellers, all in order to expand the market availability of our products in China. In addition, we intend to increase the percentage of our sales made directly to OEMs, machinery accessory manufacturers and repair facilities. We feel the Chinese markets are underserved and there exists vast opportunities to expand market presence. We hope that our relationships will allow us to diversify our customer base and significantly increase the availability and exposure of our products.

Products

We develop, design, manufacture, and sell a wide range of micro-motor products. The current annual output capacity of our factory is 24 million units, and we operate at 100% capacity.

Motors

We produce both Direct Current (“DC”) motors and Alternating Current (“AC”) motors, each of which has different functions and uses. References to DC or AC refer to how the electrical current is transferred through and from the motor. Our motors are designed as both stock and custom products. Stock motors represented approximately 4.2% of our motor sales for 2009 and are available for immediate shipment. Custom motors are built to customer specifications and are typically built and shipped with 2-3 weeks of order date.

DC Motors

DC motors are categorized into various types of motors, including brushless motors, brushed motors, servo motors, and gear motors. DC motors require a direct current or voltage source in order to work. DC motors provide a stable and continuous current and work well in applications where controlling speed and torque are important. Brushed DC motors use rings (or “brushes”) that conduct the current and form the magnetic drive that powers the rotor. Brushless DC motors use a switch to produce the magnetic drive that powers the rotor. While brushed motors tend to wear out faster than brushless motors due to the wear on the brushes, brushless motors are generally more expensive than brushed motors.

4

Under development is our variable frequency brushless motor. Our variable frequency brushless DC motor and its control devices were created from our own research and development. This motor has passed the provincial level new product certification. It is listed in the year 2000’s “China’s High-Tech Products Directory” (optical-electric-mechanical integration sector). It closely combines the motor body with electrical and micro-electronic control devices to form a new type of electromechanical integration product. We hope to introduce this product in mid-year 2010.

AC Motors

AC motors require an alternating current or voltage source, which can usually be obtained from places such as wall outlets, in order to work. AC motors can be categorized into various types of motors, including single and multiphase motors, universal motors, servo motors, induction motors, synchronous motors, and gear motors. AC motors generally work better than DC motors in situations that require a high starting power.

Single phase AC motors are general purpose motors and can be used in a variety of applications. Our primary AC motor is our industry drive and control motor. This product’s notable feature is its energy efficiency, targeted to and applied to specific occasions. These high efficiency energy saving motors are included in the year 2000’s “China’s High-Tech Products Directory” (new energy and highly efficient energy-saving sector). This product has reached the advanced level of similar foreign products and is already at the mass production stage in our factory.

Drives

Drives are electronic controls used to adjust the speed and torque of an electric motor to match an end application. Our precision slowdown servo drive is still in the development stage. It can accomplish such tasks as non-deviation precise positioning, complex contour processing, exact angle and speed synchronization (with dynamic tracking) and other complex servo control tasks. It is an important servo component in electromechanical integration and artificial intelligence and has wide applications in various industrial automatic control equipments. This product was introduced in the fourth quarter of 2009.

Mechanical power transmission products

Sunna brand power transmission products include mounted bearings, enclosed shaft mount, helical and worm gearing, and other power transmission components such as bearings, sheaves and conveyor pulleys. Our mechanical power transmission products are used in many applications and industries, including mining, petroleum, aggregate, unit handling, power generation and package handling.

We currently produce products in 28 different series that include more than 1,200 different product specifications. Our various types of motors are designed for incorporation into a variety of applications, including:

| · | Home appliances: including hairdryers, air conditioners, paper shredders, soy milk makers, juice makers, electric fans, heaters and massagers. |

| · | Automobiles: including automobile air conditioners, windshield wipers, automatic window mechanisms and ignitions. |

| · | Digital controls: including devices used to start mechanical equipment and other larger motors. |

| · | Tools: including lawn mowers, trimmers, branch cutters, channeling machines and other garden tools. |

Revenues by product series as a percentage of total revenues is set forth below:

| Year Ended December 31, | ||||||||||||

| 2009 | 2008 | 2007 | ||||||||||

| Home Appliance | 63.9 | % | 59.3 | % | 70.4 | % | ||||||

| Auto Parts | 22.1 | % | 26.9 | % | 24.6 | % | ||||||

| Digital Motor | 14.0 | % | 13.8 | % | 5.0 | % | ||||||

| 100 | % | 100 | % | 100 | % | |||||||

5

Supply of Raw Materials

The cost of the raw materials used to produce our products is a key factor in the pricing of our products. Our company has built long-term partnerships with key materials suppliers. We currently work with over 50 suppliers to establish a stable and reliable supply of high-quality raw materials. We maintain at least four suppliers for each of our key raw materials which include silicon, steel materials and lacquered wire and at least two suppliers for all of our other raw materials, which include various wrapping materials. We strive to use only suppliers who have previously demonstrated quality control and reliability. If any materials do not satisfy our quality or supply requirements, we can easily obtain our needed materials from another supplier. While we do not maintain long-term contracts with our suppliers, and we believe that alternative suppliers are available. We believe that the location of our manufacturing facility and design center in Shenzhen, China, provides us with flexibility in obtaining our necessary supplies, which allows us to reduce delays and costs for our materials.

Pricing and availability of raw materials can be volatile, attributable to numerous factors beyond our control, including general economic conditions, currency exchange rates, industry cycles, production levels or a supplier’s limited supply. To the extent that we experience cost increases we may seek to pass such cost increases on to our customers, but cannot provide any assurance that we will be able to do so successfully or that our business, results of operations and financial condition would not be adversely affected by increased volatility of the cost and availability of raw materials.

Our suppliers for our key raw materials are located in China, in the Zhejiang and Guangdong Provinces. Our top three suppliers accounted for a total of approximately 34%, 34% and 27% of our raw material purchases for the years ended December 31, 2009, 2008 and 2007, respectively. Our largest supplier accounted for 13%, 22% and 17%, respectively, of our raw material purchases for the years ended December 31, 2009, 2008 and 2007.

Presently, our relationships with our suppliers are good and we expect that our suppliers will be able to meet the anticipated demand for our products in the future. However, due to our dependence on a few suppliers for certain raw materials, we could experience delays in development and/or the ability to meet demand for our products. Although we have not been subject to shortages for any of our materials, we may be subject to cutbacks and price increases which we may not be able to pass on to our customers in the event that the demand for components generally exceeds the capacity of our suppliers.

Manufacturing

The manufacture of our micro-motor products requires coordinated use of machinery and raw materials at various stages of manufacturing. Our manufacturing facilities are located in Shenzhen, Guangdong in our 15,000 square meter (approximately 161,000 square feet) factory. Our facilities consist of a mold and molding workshop, a semi-finished products workshop, and assembly workshop and a finished products testing workshop.

Our modern production equipment consists of both domestic and foreign-manufactured equipment as well as in-house custom designed equipment. Production capability at our manufacturing facilities encompasses assembling, machining, pressing, tooling, mold making and plastic injection molding to produce components and final products. Our modern production facilities allow us to produce high quality products at competitive prices.

We periodically evaluate the production layout of our factory in order to maximize our production capacity. We currently produce approximately 24 million micro-motor units annually. We intend to further streamline our production process and continue investing in our manufacturing infrastructure to further increase our manufacturing capacity, helping us to control the per unit cost of our products.

We manufacture substantially all of the products that we sell, including some of the components used in our products, such as hardware struts, stators and rotors. We purchase other components for our products, such as lacquered wire, commutators, spindle, and bearings from third party suppliers. In addition to manufacturing components, our motor manufacturing operations include machining, welding, winding, assembling, and finishing operations. Manufacturing many of our own components permits us to better manage cost, quality and availability.

Quality Control

Quality control an important element of our business practices. We have stringent quality control systems that are implemented by approximately 30 company-trained staff members to ensure quality control over each phase of the production process, from the purchase of raw materials through each step in the manufacturing process. Supported by advanced equipment, we utilize a scientific management system and precision inspection measurement capable of ensuring our products are of high quality.

Our quality control department executes the following functions:

| · | setting internal controls and regulations for semi-finished and finished products; |

6

| · | testing samples of raw materials from suppliers; |

| · | implementing sampling systems and sample files; |

| · | maintaining quality of equipment and instruments; and |

| · | articulating the responsibilities of quality control staff. |

We have obtained certifications and accreditations that we believe exhibit our ability to efficiently manufacture quality products. We first obtained ISO9001:2000 quality system accreditation in 2001. The International Organization for Standardization (ISO) defines the ISO 9000 quality management system as one of international references for quality management requirements in business-to-business dealings. In 2003 we obtained the Chinese 3Cquality certification. In 2005, we obtained certification for compliance with the Directive on the Restriction of the Use of Certain Hazardous Substances in Electrical and Electronic Equipment, which is commonly referred to as the Restriction of Hazardous Substances Directive, or RoHS. RoHS restricts the use of various hazardous materials in the manufacture of electronic and electrical equipment.

Sales and Marketing

We employ a sales and marketing team of 15 people that focus on selling and marketing our products. We mainly sell our products directly to original equipment manufacturers (“OEMs”). We sell our vehicle micro-motors directly to automobile manufacturers. Sales directly to OEMs and vehicle manufacturers accounted for 53.6% of our total sales during the year ended December 31, 2009. In addition, we also sell our micro-motor products to distributors and resellers and through our website. Sales to distributors and resellers accounted for 46.4% of our sales for the year ended December 31, 2009. We did not make any sales through our website in 2008 and 2009.

We participate in industry trade shows and technical conferences in order to promote our products and increase our brand awareness. In the future, we intend to utilize various traditional media advertising to sell and promote our products, including print advertisements in magazines and newspapers, and audio and television advertisements. We also intend to hold press conferences for launching our new products.

A small number of customers account for a very significant percentage of our revenue. During the year ended December 31, 2009, we had eight customers who each accounted for 5% of total sales, who together accounted for 60% of our total sales for the period. None of those customers accounted for 10.0% of our total sales in 2009, but three of them accounted for 9% each of our total sales for the year ended December 31, 2009. During the year ended December 31, 2008, we had eight customers that generated at least 5% of our total sales, with three of those customers, Shenzhen Hongxingyu Trading Co., Ltd., Shanghai Keyu International Trading Co., Ltd. and Shenzhen Hongji Investment Development Co., Ltd. accounting for 11%, 10% and 10% respectively, of our total sales for the year ended December 31, 2008. These eight customers accounted for a total of approximately 59.5% of our total sales for the year ended December 31, 2008. For the year ended December 31, 2007, we had seven customers that accounted for at least 5% of total sales, with one of those customers, Shanghai Keyu International Trading Co., Ltd., accounting for approximately 17.1% of our total sales. Unless we replace a customer, the loss of any of these customers could have a material adverse effect upon our revenue and net income.

The loss of any of these customers could have a material adverse effect upon our revenue and net income.

Research and Development

Our product design efforts include both the development of new products, which extend our product lines, and the improvement and modification of our existing products for incorporation into new applications. To enhance our product quality, reduce cost, and keep pace with technological advances and evolving market trends, we have established an advanced research and development center. Our research and development center concentrates on researching the areas of industrial automation, office automation and home automation.

We employ 29 scientific and technical personnel who are directly engaged in the research and development of new products and their applications, including persons holding senior professional titles, electrical machine and control professionals, mechanical design and manufacturing professionals and electrical and electronics professionals. This represents approximately 4% of our total number of company employees. Among them, there are 9 people holding senior professional titles, 14 electrical machine and control professionals, 11 mechanical design and manufacturing professionals, and 4 electrical and electronics professionals. Our research professionals closely observe industry trends in consumer products to design motors for incorporation into new products. By working closely with our customers to design new products, we have been able to improve our competitive position in the micro-motor industry.

7

We also work with universities including Shenzhen University, and other scientific research institutes to develop new products and technology and enhance our current products.

For the years ended December 31, 2009, 2008 and 2007, we expended $1,649,504, $1,032,722 and $445,841, respectively, in research and development.

Backlog

We have historically shipped the majority of our products in the month the order is received. Due to the short-cycle nature of our business, we did not sustain significant backlogs and had no backlog of unfilled orders as of December 31, 2009, 2008 and 2007.

Warranties and Return Policy

We offer limited warranties for our products, comparable to those offered by our competitors in China. We typically offer a warranty of up to 1 year, under which we will pay for labor and parts, or offer a new or similar unit in exchange for a non-performing unit. Our customers may return products to us for a variety of reasons, such as damage to goods in transit, cosmetic imperfections and mechanical failures, if within the warranty period.

Product Liability and Insurance

We do not have product liability insurance. Because of the nature of the products sold by us, we may be periodically subject to product liability claims resulting from personal injuries. We may become involved in various lawsuits incidental to our business. To date, we have not been subject to products liability litigation. Product liability insurance is expensive, restrictive and difficult to obtain. Accordingly, there can be no assurance that we will have capital sufficient to cover any successful product liability claims made against us in the future, which could have a material adverse effect on our financial condition and results of operations.

Competition

We face competition from many other micro-motor manufacturers, most of which have significantly greater name recognition and financial, technical, manufacturing, personnel, marketing, and other resources than we have. Our competitors may be able to respond more rapidly than we can to new or emerging technologies or changes in customer requirements. They may also devote greater resources to the development, promotion and sale of their products than we do. We compete primarily on the basis of quality, price, reliability, brand recognition, and quality assurance and support to our customers. Our primary competitors include Wolong Holding Group Co., Ltd., a manufacturer of micro and specialty motors; Shanghai Motor Co., Ltd., a manufacturer of turbo generators and large-scale TAC DC motors; Shangdong Electric Group, a maker of general motors; Nanyang Explosion-proof Electrical Group and Jiamusi Electric Corp., both manufacturers of explosion-proof and high-voltage motors; Xinagtan Electric Group Co., a producer of traction motors and high-voltage motors; Zhangqiu Haier Appliances Motor Co., Ltd., a maker of appliance motors; and Xima Motor Group, Co., Ltd. and Jiangsu Dazhong Electric Corp., manufacturers of high-voltage motors and DC motors.

Intellectual Property

We rely on a combination of patent, trademark and trade secret protection and other unpatented proprietary information to protect our intellectual property rights and to maintain and enhance our competitiveness in the micro-motor industry. We currently have one patent application pending in China for technology related to shaded-pole motors. We do not currently own any patents or license any patents from third parties.

We also rely on unpatented technologies to protect the proprietary nature of our product and manufacturing processes. We require that our management team and key employees enter into confidentiality agreements that require the employees to assign the rights to any inventions developed by them during the course of their employment with us. All of the confidentiality agreements include non-competition and non-solicitation provisions that remain effective during the course of employment and for periods following termination of employment, which vary depending on position and location of the employee.

We have one registered trademark in China. Our trademark registration certificate expires in September 2011.

Our success will depend in part on our ability to obtain patents and preserve other intellectual property rights covering the design and operation of our products. We intend to continue to seek patents on our inventions when we deem it commercially appropriate. The process of seeking patent protection can be lengthy and expensive, and there can be no assurance that patents will be issued for currently pending or future applications or that our existing patents or any new patents issued will be of sufficient scope or strength or provide meaningful protection or any commercial advantage to us. We may be subject to, or may initiate, litigation or patent office interference proceedings, which may require significant financial and management resources. The failure to obtain necessary licenses or other rights or the advent of litigation arising out of any such intellectual property claims could have a material adverse effect on our operations.

8

Employees

As of December 31, 2009, we had approximately 920 employees, all of whom are full-time employees. All of our employees are based inside China. We have not experienced any work stoppages and we consider our relations with our employees to be good.

All of our employees in China are represented by a labor union formed on October 18, 2007, pursuant to the requirements of the China’s National Labor Law. The members of Shenzhen YPC’s labor union represent the interests of each of Shenzhen YPC’s employees. On October 15, 2009, Shenzhen YPC entered into a new 3-year collective contract with the labor union covering various policies on various employment matters such as recruitment, leave, wages and allowances, benefits, employment security, and discipline and punishment.

We are required to contribute a portion of our employees’ total salaries to the Chinese government’s social insurance funds, including pension insurance, medical insurance, unemployment insurance, and job injuries insurance, and maternity insurance, in accordance with relevant regulations. Total contributions to the funds were approximately $27,229, $29,300 and $14,700 for the years ended December 31, 2009, 2008 and 2007, respectively. We expect that the amount of our contribution to the government’s social insurance funds will increase in the future as we expand our workforce and operations.

We also provide housing facilities for our employees. Currently, approximately 99% of our employees live in company-provided housing facilities. Under PRC laws, we may be required to make contributions to a housing assistance fund for employees based in Shenzhen, China, which could increase the costs and expenses of conducting our business operations and could have negative effect on our results of operations.

PRC Government Regulations

Business license

Any company that conducts business in the PRC must have a business license that covers a particular type of work. Our business license covers our present business of the production and marketing of micro-motor products and relevant components. Prior to expanding our business beyond that of our business license, we are required to apply and receive approval from the PRC government.

Employment laws

We are subject to laws and regulations governing our relationship with our employees, including: wage and hour requirements, working and safety conditions, citizenship requirements, work permits and travel restrictions. These include local labor laws and regulations, which may require substantial resources for compliance.

China’s National Labor Law, which became effective on January 1, 1995, and China’s National Labor Contract Law, which became effective on January 1, 2008, permit workers in both state and private enterprises in China to bargain collectively. The National Labor Law and the National Labor Contract Law provide for collective contracts to be developed through collaboration between the labor union (or worker representatives in the absence of a union) and management that specify such matters as working conditions, wage scales, and hours of work. The laws also permit workers and employers in all types of enterprises to sign individual contracts, which are to be drawn up in accordance with the collective contract.

Environmental regulations

We are subject to various state and local environmental laws and regulations of the PRC, including those governing the use, discharge and disposal of hazardous substances in the ordinary course of our manufacturing process. The major environmental regulations applicable to us include the PRC Environmental Protection Law, the PRC Law on the Prevention and Control of Water Pollution and its Implementation Rules, the PRC Law on the Prevention and Control of Air Pollution and its Implementation Rules, the PRC Law on the Prevention and Control of Solid Waste Pollution, and the PRC Law on the Prevention and Control of Noise Pollution. We believe that our current manufacturing operations comply in all material respects with applicable environmental laws and regulations. Although we believe that our current manufacturing operations comply in all material respects with applicable environmental laws and regulations, it is possible that future environmental legislation may be enacted or current environmental legislation may be interpreted to create environmental liability with respect to our other facilities, operations, or products.

We constructed our manufacturing facilities with the PRC’s environmental laws and requirements in mind. If we fail to comply with the provisions of environmental laws, we could be subject to fines, criminal charges or other sanctions by regulators, including the suspension or termination of our manufacturing operations.

9

Patent protection in China

The PRC’s intellectual property protection regime is consistent with those of other modern industrialized countries. The PRC has domestic laws for the protection of rights in copyrights, patents, trademarks and trade secrets.

The PRC is also a signatory to most of the world’s major intellectual property conventions, including:

| · | Convention establishing the World Intellectual Property Organization (WIPO Convention) (June 4, 1980); |

| · | Paris Convention for the Protection of Industrial Property (March 19, 1985); |

| · | Patent Cooperation Treaty (January 1, 1994); and |

| · | The Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPs) (November 11, 2001). |

Patents in the PRC are governed by the China Patent Law and its Implementing Regulations, each of which went into effect in 1985. Amended versions of the China Patent Law and its Implementing Regulations came into effect in 2001 and 2003, respectively. The current effective amended China Patent Law was further amended by the Standing Committee of the National People’s Congress of the PRC on December 27, 2008 and will come into effect on October 1, 2009. To our knowledge, the current effective amended Implementing Regulations of the China Patent Law are in the progress of further amendment and will be released in the near future so that the amended Implementing Regulations are in compliance with the newly amended China Patent Law.

The PRC is signatory to the Paris Convention for the Protection of Industrial Property, in accordance with which any person who has duly filed an application for a patent in one signatory country shall enjoy, for the purposes of filing in the other countries, a right of priority during the period fixed in the convention (12 months for inventions and utility models, and 6 months for industrial designs).

The Patent Law covers three kinds of patents—patents for inventions, utility models and designs. The Chinese patent system adopts the principle of first to file; therefore, where more than one person files a patent application for the same invention, a patent can only be granted to the person who first filed the application. Consistent with international practice, the PRC only allows the patenting of inventions or utility models that possess the characteristics of novelty, inventiveness and practical applicability. For a design to be patentable, it cannot be identical with or similar to any design which, before the date of filing, has been publicly disclosed in publications in the country or abroad or has been publicly used in the country, and should not be in conflict with any prior right of another.

PRC law provides that anyone wishing to exploit the patent of another must conclude a written licensing contract with the patent holder and pay the patent holder a fee. One broad exception to this rule, however, is that, where a party possesses the means to exploit a patent but cannot obtain a license from the patent holder on reasonable terms and in reasonable period of time, the PRC State Intellectual Property Office, or SIPO, is authorized to grant a compulsory license. A compulsory license can also be granted where a national emergency or any extraordinary state of affairs occurs or where the public interest so requires. SIPO, however, has not granted any compulsory license to date. The patent holder may appeal such decision within three months from receiving notification by filing a suit in a people’s court.

PRC law defines patent infringement as the exploitation of a patent without the authorization of the patent holder. Patent holders who believe their patent is being infringed may file a civil suit or file a complaint with a PRC local Intellectual Property Administrative Authority, which may order the infringer to stop the infringing acts. Preliminary injunction may be issued by the People’s Court upon the patentee’s or the interested parties’ request before instituting any legal proceedings or during the proceedings. Damages in the case of patent infringement is calculated as either the loss suffered by the patent holder arising from the infringement or the benefit gained by the infringer from the infringement. If it is difficult to ascertain damages in this manner, damages may be reasonably determined in an amount ranging from one to more times of the license fee under a contractual license. The infringing party may be also fined by Administration of Patent Management in an amount of up to three times the unlawful income earned by such infringing party. If there is no unlawful income so earned, the infringing party may be fined in an amount of up to RMB500,000, or approximately US$73,200.

Tax

Pursuant to the amended Provisional Regulation of China on Value Added Tax and their Implementing Rules which came into effect on January 1, 2009, all entities and individuals that are engaged in the sale of goods, the provision of repairs and replacement services and the importation of goods in China are generally required to pay Value Added Tax (“VAT”) at a rate of 17.0% of the gross sales proceeds received, less any deductible VAT already paid or borne by the taxpayer. Further, when exporting goods, the exporter is entitled to a portion of or all the refund of VAT that it has already paid or borne. Our imported raw materials that are used for manufacturing export products and are deposited in bonded warehouses are exempt from import VAT.

10

Foreign currency exchange

Under the PRC foreign currency exchange regulations applicable to us, the Renminbi is convertible for current account items, including the distribution of dividends, interest payments, trade and service-related foreign exchange transactions. Conversion of Renminbi for capital account items, such as direct investment, loan, security investment and repatriation of investment, however, is still subject to the approval of the PRC State Administration of Foreign Exchange, or SAFE. Foreign-invested enterprises may only buy, sell and/or remit foreign currencies at those banks authorized to conduct foreign exchange business after providing valid commercial documents and, in the case of capital account item transactions, obtaining approval from the SAFE. Capital investments by foreign-invested enterprises outside of China are also subject to limitations, which include approvals by the Ministry of Commerce (“MOFCOM”), the SAFE and the State Reform and Development Commission. We currently do not hedge our exposure to fluctuations in currency exchange rates.

Dividend distributions

Under applicable PRC regulations, foreign-invested enterprises in China may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, a foreign-invested enterprise in China are required to set aside at least 10.0% of their after-tax profit based on PRC accounting standards each year to its general reserves until the accumulative amount of such reserves reach 50.0% of its registered capital. These reserves are not distributable as cash dividends. The board of directors of a foreign-invested enterprise has the discretion to allocate a portion of its after-tax profits to staff welfare and bonus funds, which may not be distributed to equity owners except in the event of liquidation.

ITEM 1A: RISK FACTORS

Any investment in our common stock involves a high degree of risk. Potential investors should carefully consider the material risks described below and all of the information contained in this Form 10-K before deciding whether to purchase any of our securities. Our business, financial condition or results of operations could be materially adversely affected by these risks if any of them actually occur. The trading price could decline due to any of these risks, and an investor may lose all or part of his investment. Some of these factors have affected our financial condition and operating results in the past or are currently affecting us. This report also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks faced described below and elsewhere in this Form 10-K.

RISKS RELATED TO OUR OPERATIONS

We depend on a small number of customers for the vast majority of our sales. A reduction in business from any of these customers could cause a significant decline in our sales and profitability.

The vast majority of our sales are generated from a small number of customers. For the year ended December 31, 2009, we had eight customers that each accounted for at least 5% of our total sales during such period, with one of those customers accounting for at least 10% of our total sales. Those eight customers accounted for 60% of our total sales for the year ended December 31, 2009. For the year ended December 30, 2008, we had eight customers that each accounted for at least 5% of total sales, with three of those customers accounting for at least 10% of total sales. These eight customers accounted for a total of approximately 59.5% of our total sales for that period. During the year ended December 31, 2007, we had seven customers that generated revenues of at least 5% of our total sales, with one of those customers accounting for at least 10% of our total sales in 2007. These seven customers accounted for a total of approximately 54.0% of our total sales for the year ended December 31, 2007. We expect that we will continue to depend upon a small number of customers for a significant majority of our sales for the foreseeable future.

Because we do not have long-term contracts with our customers, our customers can terminate their relationship with us at any time, which could cause a material adverse effect on our results of operations.

We do not have written long term agreements with our customers. As a result, our customers may, without notice or penalty, terminate their relationship with us at any time or delay the delivery of products on relatively short notice. We cannot assure you that any of our current customers will continue to purchase our products in the future. Additionally, even if customers decide to continue their relationship with us, there can be no guarantee that they will purchase the same amounts of products as in the past. Any loss of a customer, or decrease in the volume of products purchased by a customer could have a material adverse effect on our business, operating results and financial condition.

11

We cannot rely on long-term purchase orders or commitments to protect us from the negative financial effects of a decline in demand for our products. The limited certainty of product orders can make it difficult for us to forecast our sales and allocation our resources in a manner consistent with our actual sales. Moreover, our expense levels are based in part on our expectations of future sales and, if our expectations regarding future sales are inaccurate, we may be unable to reduce costs in a timely manner to adjust for sales shortfalls. Furthermore, because we depend on a small number of customers for the vast majority of our sales, the magnitude of the ramifications of these risks is greater than if our sales were less concentrated with a small number of customers. As a result of our lack of long-term purchase orders and purchase commitments we may experience a rapid decline in our sales and profitability.

Historically, a substantial portion of our assets has been comprised of accounts receivable representing amounts owed by a small number of customers. If any of these customers fails to timely pay us amounts owed, we could suffer a significant decline in cash flow and liquidity which, in turn, could cause us to be unable pay our liabilities and purchase an adequate amount of inventory to sustain or expand our sales volume.

Our accounts receivable represented approximately 32.4%, 34.6% and 32.1% of our total current assets as of December 31, 2009, 2008 and 2007, respectively. As of December 31, 2009, 24.5% of our accounts receivable represented amounts owed by two customers, each of whom represented over 10% of the total amount of our accounts receivable. As of December 31, 2008, 30% of our accounts receivable represented amounts owed by three customers, each of which represented over 10% of the total amount of our accounts receivable. As a result of the substantial amount and concentration of our accounts receivable, if any of our major customers fails to timely pay us amounts owed, we could suffer a significant decline in cash flow and liquidity which could adversely affect our ability to borrow funds to pay our liabilities and to purchase inventory to sustain or expand our current sales volume.

Micro-motors for electronics products are subject to rapid technological changes. If we fail to accurately anticipate and adapt to these changes, the products we sell will become obsolete, causing a decline in our sales and profitability.

Micro-motors for electronics products are subject to rapid technological changes which often cause product obsolescence. Companies within our industry are continuously developing new products with heightened performance and functionality. This puts pricing pressure on existing products and constantly threatens to make them, or causes them to be, obsolete. Our typical product's life cycle is short, generating lower average selling prices as the cycle matures. If we fail to accurately anticipate the introduction of new technologies, we may possess significant amounts of obsolete inventory that can only be sold at substantially lower prices and profit margins than we anticipated. In addition, if we fail to accurately anticipate the introduction of new technologies, we may be unable to compete effectively due to our failure to offer products most demanded by the marketplace. If any of these failures occur, our sales, profit margins and profitability will be adversely affected.

We may incur design and development expenses and purchase inventory in anticipation of orders which are not placed.

In order to transact business, we assess the integrity and creditworthiness of our customers and suppliers and we may, based on this assessment, incur design and development costs that we expect to recoup over a number of orders produced for the customer. Such assessments are not always accurate and expose us to potential costs, including the write off of costs incurred and inventory obsolescence if the orders anticipated do not materialize. We may also occasionally place orders with suppliers based on a customer’s forecast or in anticipation of an order that is not realized. Additionally, from time to time, we may purchase quantities of supplies and materials greater than required by customer orders to secure more favorable pricing, delivery or credit terms. These purchases can expose us to losses from cancellation costs, inventory carrying costs or inventory obsolescence, and hence adversely affect our business and operating results.

The micro-motor industry is subject to significant fluctuations in the availability of raw materials and components. If we do not properly anticipate the need for critical raw materials and components, we may be unable to meet the demands of our customers and end-users, which could reduce our competitiveness, cause a decline in our market share and have a material adverse effect on our results of operations.

As the availability of raw materials and components decreases, the cost of acquiring those raw materials and components ordinarily increases. The prices of such materials are volatile, with price fluctuations due to supply and demand, market fluctuations, currency fluctuations, and changes in governmental regulation. If we fail to procure adequate supplies of raw materials and components in anticipation of our customers' orders or end-users’ demand, our gross margins may be negatively impacted due to higher prices that we are required to pay for raw materials and components in short supply. We currently do not engage in hedging activities to reduce our risk to price increases in our raw materials. High growth product categories have experienced chronic shortages of raw materials and components during periods of exceptionally high demand. If we do not properly anticipate the need for critical raw materials and components, we may pay higher prices for the raw materials and components, we may be unable to meet the demands of our customers and end-users, which could reduce our competitiveness, cause a decline in our market share and have a material adverse effect on our results of operations. Price increases for our raw materials will result in increases in cost of sales and we may not be able to pass on the increased production costs to our customers in the form of higher prices for our products. Increases in the prices for our products may result in reduced sales volume and profitability. Any increase in operating costs that we cannot pass on to our customers or any decrease in sales due to higher product prices may result in reduced profitability and a material adverse effect on our results of operations.

12

Adverse capital and credit market conditions may significantly affect our ability to meet liquidity needs, access to capital and cost of capital.

The capital and credit markets have been experiencing extreme volatility and disruption for more than twelve months. In recent weeks, the volatility and disruption have reached unprecedented levels. In some cases, the markets have exerted downward pressure on availability of liquidity and credit capacity for certain issuers. We have historically relied on credit to fund our business and we need liquidity to pay our operating expenses. Without sufficient liquidity, we will be forced to curtail our operations, and our business will suffer. Disruptions, uncertainty or volatility in the capital and credit markets may also limit our access to capital required to operate our business. Such market conditions may limit our ability to replace, in a timely manner, maturing liabilities and access the capital necessary to operate and grow our business. As such, we may be forced to delay raising capital or bear an unattractive cost of capital which could decrease our profitability and significantly reduce our financial flexibility. Our results of operations, financial condition, cash flows and capital position could be materially adversely affected by disruptions in the financial markets.

We derive the majority of our revenues from sales in the PRC and any downturn in the Chinese economy could have a material adverse effect on our business and financial condition.

A substantial portion of our revenues are generated from sales in the PRC. We anticipate that revenues from sales of our products in the PRC will continue to represent a substantial portion of our total revenues in the near future. Our sales and earnings can also be affected by changes in the general economy since purchases of most household appliances and tools are generally discretionary for consumers. Our success is influenced by a number of economic factors which affect disposable consumer income, such as employment levels, business conditions, interest rates, oil and gas prices and taxation rates. Adverse changes in these economic factors, among others, may restrict consumer spending, thereby negatively affecting our sales and profitability.

We do not carry any business interruption insurance, products liability insurance or any other insurance policy except for a limited property insurance policy. As a result, we may incur uninsured losses, increasing the possibility that you would lose your entire investment in our company.

We could be exposed to liabilities or other claims for which we would have no insurance protection. We do not currently maintain any business interruption insurance, products liability insurance, or any other comprehensive insurance policy. As a result, we may incur uninsured liabilities and losses as a result of the conduct of our business. There can be no guarantee that we will be able to obtain insurance coverage in the future, and even if we are able to obtain coverage, we may not carry sufficient insurance coverage to satisfy potential claims. Should uninsured losses occur, any purchasers of our common stock could lose their entire investment.

Because we do not carry products liability insurance, a failure of any of the products marketed by us subjects us to the risk of product liability claims and litigation arising from injuries allegedly caused by the improper functioning or design of our products. We cannot assure that we will have enough funds to defend or pay for liabilities arising out of a products liability claim. To the extent we incur any product liability or other litigation losses, our expenses could materially increase substantially. There can be no assurance that we will have sufficient funds to pay for such expenses, which could end our operations and you would lose your entire investment.

We are subject to market risk through our sales to international markets.

A growing percentage of our sales are being derived from international markets. These international sales are primarily focused in Korea. These operations are subject to risks that are inherent in operating in foreign countries, including the following:

| · | foreign countries could change regulations or impose currency restrictions and other restraints; |

| · | changes in foreign currency exchange rates and hyperinflation or deflation in the foreign countries in which we operate; |

| · | exchange controls; |

| · | some countries impose burdensome tariffs and quotas; |

| · | political changes and economic crises may lead to changes in the business environment in which we operate; |

| · | international conflict, including terrorist acts, could significantly impact our financial condition and results of operations; and |

| · | economic downturns, political instability and war or civil disturbances may disrupt distribution logistics or limit sales in individual markets. |

13

If our third party sales representatives and distributors fail to adequately promote, market and sell our products, our revenues could significantly decrease.

A significant portion of our product sales are made through third party sales representative organizations, whose members are not our employees. Our level of sales depends on the effectiveness of these organizations, as well as the effectiveness of our own employees. Some of these third party representatives may sell (and do sell), with our permission, competitive products of third parties as well as our products. During our fiscal years ended December 31, 2009, 2008 and 2007, these organizations were responsible for approximately 46.4%, 42% and 35%, respectively, of our net revenues during such periods. Significant terms and conditions of distributor agreements include FOB source, net 30 days payment terms, with no return or exchange rights, and no price protection. If any of the third party sales representative organizations engaged by us fails to adequately promote, market and sell our products, our revenues could be significantly decreased until we can retain a replacement organization or distributor. Finding replacement organizations and distributors can be a time consuming process during which our revenues could be negatively impacted. Our success is dependent on these distributors finding new customers and receiving new orders from existing customers.

Unanticipated disruptions in our operations or slowdowns by our suppliers and shipping companies could adversely affect our ability to deliver our products our customers which could materially and adversely affect our revenues and our relationships with our customers.

Our ability to provide high quality customer service, process and fulfill orders and manage inventory depends on:

| · | the efficient and uninterrupted operation of our distribution centers; and |

| · | the timely and uninterrupted performance of third party suppliers, shipping companies, and dock workers. |

Any material disruption or slowdown in the operation of our distribution centers, manufacturing facilities or management information systems, or comparable disruptions or slowdowns suffered by our principal suppliers and shippers could cause delays in our ability to receive, process and fulfill customer orders and may cause orders to be canceled, lost or delivered late, goods to be returned or receipt of goods to be refused. As a result, our revenues and operating results could be materially and adversely affected.

We are subject to intense competition in the industry in which we operate, which could cause material reductions in the selling price of our products or losses of our market share.

The micro-motor industry is highly competitive, especially with respect to pricing and the introduction of new products and features. Our products compete primarily on the basis of:

| · | reliability; |

| · | brand recognition; |

| · | quality; |

| · | price; |

| · | design; |

| · | consumer acceptance of our trademark; and |

| · | quality service and support to retailers and our customers. |

In recent years, we and many of our competitors, have regularly lowered prices, and we expect these pricing pressures to continue. If these pricing pressures are not mitigated by increases in volume, cost reductions from our supplier or changes in product mix, our revenues and profits could be substantially reduced. As compared to us, many of our competitors have:

| · | significantly longer operating histories; |

| · | significantly greater managerial, financial, marketing, technical and other competitive resources; and |

| · | greater brand recognition. |

14

As a result, our competitors may be able to:

| · | adapt more quickly to new or emerging technologies and changes in customer requirements; |

| · | devote greater resources to the promotion and sale of their products and services; and |

| · | respond more effectively to pricing pressures. |

These factors could materially adversely affect our operations and financial condition. In addition, competition could increase if:

| · | new companies enter the market; |

| · | existing competitors expand their product mix; or |

| · | we expand into new markets. |

An increase in competition could result in material price reductions or loss of our market share.

We may not be able to effectively recruit and retain skilled employees, particularly scientific, technical and management professionals.

Our ability to compete effectively depends largely on our ability to attract and retain certain key personnel, including scientific, technical and management professionals. We anticipate that we will need to hire additional skilled personnel in all areas of our business. Industry demand for such employees, however, exceeds the number of personnel available, and the competition for attracting and retaining these employees is intense. Because of this intense competition for skilled employees, we may be unable to retain our existing personnel or attract additional qualified employees to keep up with future business needs. If this should happen, our business, operating results and financial condition could be adversely affected.

Our labor costs are likely to increase as a result of changes in Chinese labor laws.

We expect to experience an increase in our cost of labor due to recent changes in Chinese labor laws which are likely to increase costs further and impose restrictions on our relationship with our employees. In June 2007, the National People’s Congress of the PRC enacted new labor law legislation called the Labor Contract Law and more strictly enforced existing labor laws. The new law, which became effective on January 1, 2008, amended and formalized workers’ rights concerning overtime hours, pensions, layoffs, employment contracts and the role of trade unions. As a result of the new law, the Company has had to increase the salaries of its employees, provide additional benefits to its employees, and revise certain other of its labor practices. The increase in labor costs has increased the Company’s operating costs, which increase the Company has not always been able to pass through to its customers. In addition, under the new law, employees who either have worked for the Company for 10 years or more or who have had two consecutive fixed-term contracts must be given an “open-ended employment contract” that, in effect, constitutes a lifetime, permanent contract, which is terminable only in the event the employee materially breaches the Company’s rules and regulations or is in serious dereliction of his duty. Such non-cancelable employment contracts will substantially increase its employment related risks and limit the Company’s ability to downsize its workforce in the event of an economic downturn. No assurance can be given that the Company will not in the future be subject to labor strikes or that it will not have to make other payments to resolve future labor issues caused by the new laws. Furthermore, there can be no assurance that the labor laws will not change further or that their interpretation and implementation will vary, which may have a negative effect upon our business and results of operations.

Our business could be materially adversely affected if we cannot protect our intellectual property rights or if we infringe on the intellectual property rights of others.

Our ability to compete effectively will depend on our ability to maintain and protect our proprietary rights. We have one pending patent application in China. We also own a trademark related to the sale of our products, which is materially important to our business. Our trademark is registered in China. However, third parties may seek to challenge, invalidate, circumvent or render unenforceable any proprietary rights owned by or licensed to us. In addition, in the event third party licensees fail to protect the integrity of our trademark, the value of our mark could be materially adversely affected.

Our inability to protect our proprietary rights could materially adversely affect the license of our trade names and trademarks to third parties as well as our ability to sell our products. Litigation may be necessary to:

| · | enforce our intellectual property rights; |

15

| · | protect our trade secrets; and |

| · | determine the scope and validity of such intellectual property rights. |

Any such litigation, whether or not successful, could result in substantial costs and diversion of resources and management’s attention from the operation of our business.