Exhibit (c)(3)

STRICTLY CONFIDENTIAL

Project Oslo

Fairness opinion materials

20 December 2007

Disclaimer

The accompanying material was compiled on a confidential basis for use solely by the Board of Directors of VimpelCom (the

“Company” or “VIP”) in evaluating the proposed transaction described therein. This material is not intended to provide the sole basis for evaluating the transaction, does not purport to contain all information that may be required and should not be considered a recommendation with respect to the transaction. This material was prepared for a specific use by specific persons and was not prepared with a view to public disclosure or to conform with any disclosure standards under securities laws or otherwise. Nothing contained in the accompanying material is, or shall be relied upon as, a promise or representation as to the past, the present or the future. UBS Limited (“UBS”) undertakes no obligation to update or revise the accompanying material.

It should be understood that any estimates, valuations and/or projections contained in the accompanying material were prepared or derived from information supplied by the Company and public sources without the assumption by UBS of responsibility for any independent verification thereof. Accordingly, neither UBS nor any of its officers, directors, employees, affiliates, advisors, agents or representatives warrants the accuracy or completeness of any such information, including, without limitation, the accuracy or achievability of any such estimates, valuations and/or projections. Actual results may vary from such estimates, valuations or projections and such variations may be material. This material must not be copied, reproduced, distributed or passed to others at any time without the prior written consent of UBS.

SECTION 1

Transaction background

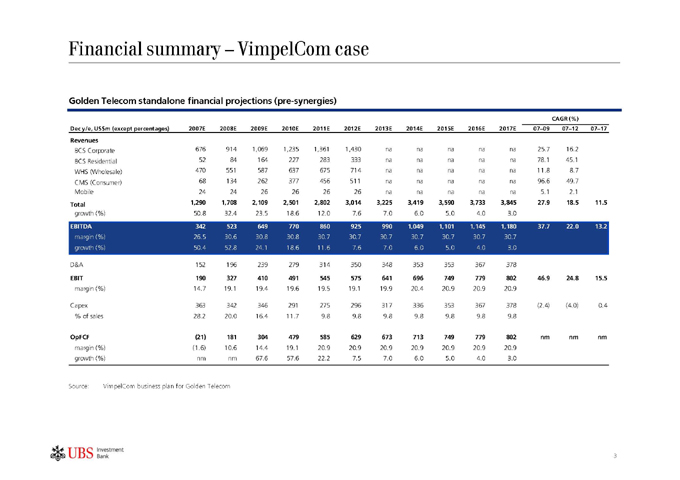

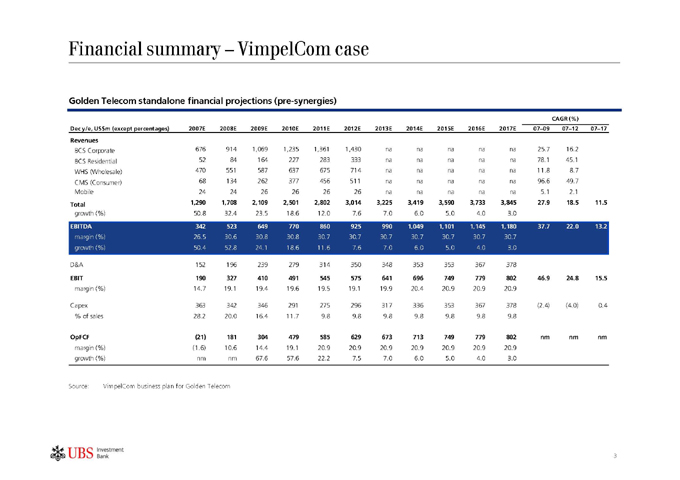

Financial summary – VimpelCom case

Golden Telecom standalone financial projections (pre-synergies)

CAGR (%)

Dec y/e, US$m (except percentages) 2007E 2008E 2009E 2010E 2011E 2012E 2013E 2014E 2015E 2016E 2017E 07–09 07–12 07–17

Revenues

BCS Corporate 676 914 1,069 1,235 1,361 1,430 na

BCS Residential 52 84 164 227 283 333 na

WHS (Wholesale) 470 551 587 637 675 714 na

CMS (Consumer) 68 134 262 377 456 511 na

Mobile 24 24 26 26 26 26 na

Total 1,290 1,708 2,109 2,501 2,802 3,014 3,225

growth (%) 50.8 32.4 23.5 18.6 12.0 7.6 7.0

na na na na 25.7 16.2

na na na na 78.1 45.1

na na na na 11.8 8.7

na na na na 96.6 49.7

na na na na 5.1 2.1

3,419 3,590 3,733 3,845 27.9 18.5 11.5

EBITDA 342 523 649 770 860 925 990 1,049 1,101 1,145 1,180 37.7 22.0 13.2

margin (%) 26.5 30.6 30.8 30.8 30.7 30.7 30.7 30.7 30.7 30.7 30.7

growth (%) 50.4 52.8 24.1 18.6 11.6 7.6 7.0 6.0 5.0 4.0 3.0

D&A 152 196 239 279 314 350 348 353 353 367 378

EBIT 190 327 410 491 545 575 641 696 749 779 802 46.9 24.8 15.5

margin (%) 14.7 19.1 19.4 19.6 19.5 19.1 19.9 20.4 20.9 20.9 20.9

Capex 363 342 346 291 275 296 317 336 353 367 378(2.4)(4.0) 0.4

% of sales 28.2 20.0 16.4 11.7 9.8 9.8 9.8 9.8 9.8 9.8 9.8

OpFCF(21) 181 304 479 585 629 673 713 749 779 802 nm nm nm

margin (%)(1.6) 10.6 14.4 19.1 20.9 20.9 20.9 20.9 20.9 20.9 20.9

growth (%) nm nm 67.6 57.6 22.2 7.5 7.0 6.0 5.0 4.0 3.0

Source: VimpelCom business plan for Golden Telecom

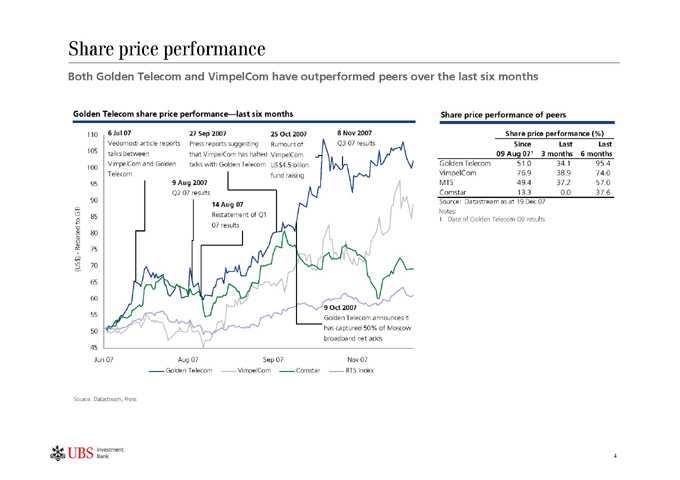

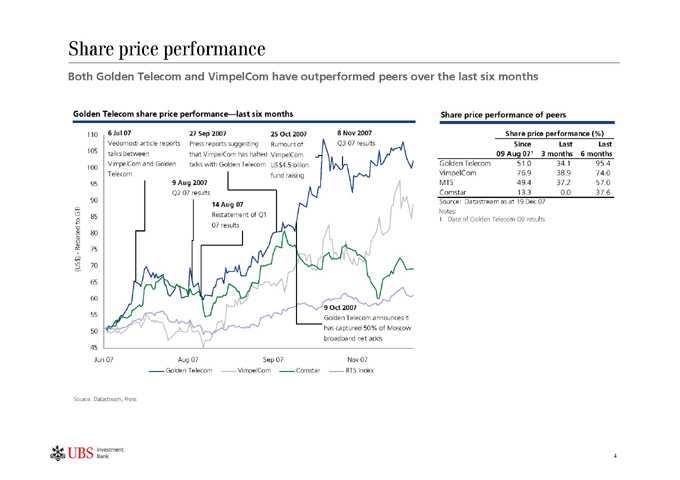

Share price performance

Both Golden Telecom and VimpelCom have outperformed peers over the last six months

Golden Telecom share price performance—last six months

Share price performance of peers

110

105

100

(US$ )—Rebased to GTI

Vedomosti article reports talks between VimpelCom and Golden Telecom

27 Sep 2007

Press reports suggesting that VimpelCom has halted talks with Golden Telecom

25 Oct 2007

Rumours of VimpelCom US$4.5 billion fund raising

Q3 07 results

9 Aug 2007

Q2 07 results

14 Aug 07

Restatement of Q1 07 results

Share price performance (%) Since Last Last 09 Aug 07¹ 3 months 6 months

Golden Telecom 51.0 34.1 95.4 VimpelCom 76.9 38.9 74.0 MTS 49.4 37.2 57.0 Comstar 13.3 0.0 37.6

Source: Datastream as at 19 Dec 07 Notes:

1 | | Date of Golden Telecom Q2 results |

9 Oct 2007

Golden Telecom announces it has captured 50% of Moscow broadband net adds

Jun 07 Aug 07 Sep 07 Nov 07 Golden Telecom VimpelCom Comstar RTS Index

Source: Datastream, Press

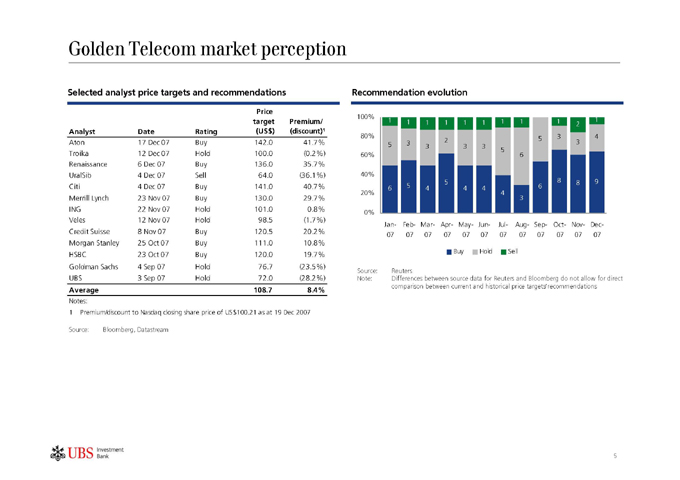

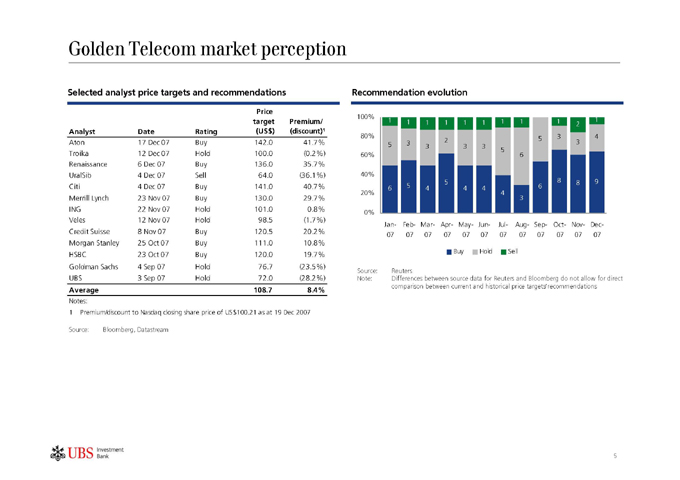

Golden Telecom market perception

Selected analyst price targets and recommendations

Price

target Premium/

Analyst Date Rating(US$)(discount)¹

Aton 17 Dec 07 Buy 142.0 41.7%

Troika 12 Dec 07 Hold 100.0(0.2%)

Renaissance 6 Dec 07 Buy 136.0 35.7%

UralSib 4 Dec 07 Sell 64.0(36.1%)

Citi 4 Dec 07 Buy 141.0 40.7%

Merrill Lynch 23 Nov 07 Buy 130.0 29.7%

ING 22 Nov 07 Hold 101.0 0.8%

Veles 12 Nov 07 Hold 98.5(1.7%)

Credit Suisse 8 Nov 07 Buy 120.5 20.2%

Morgan Stanley 25 Oct 07 Buy 111.0 10.8%

HSBC 23 Oct 07 Buy 120.0 19.7%

Goldman Sachs 4 Sep 07 Hold 76.7(23.5%)

UBS 3 Sep 07 Hold 72.0(28.2%)

Average 108.7 8.4%

Notes:

Recommendation evolution

100% 80% 60% 40% 20% 0%

Jan- Feb- Mar- Apr- May- Jun- Jul- Aug- Sep- Oct- Nov- Dec-

07 07 07 07 07 07 07 07 07 07 07 07

Buy Hold Sell

Source: Reuters

Note: Differences between source data for Reuters and Bloomberg do not allow for direct comparison between current and historical price targets/recommendations

1 | | Premium/discount to Nasdaq closing share price of US$100.21 as at 19 Dec 2007 Source: Bloomberg, Datastream |

SECTION 2

Valuation analysis

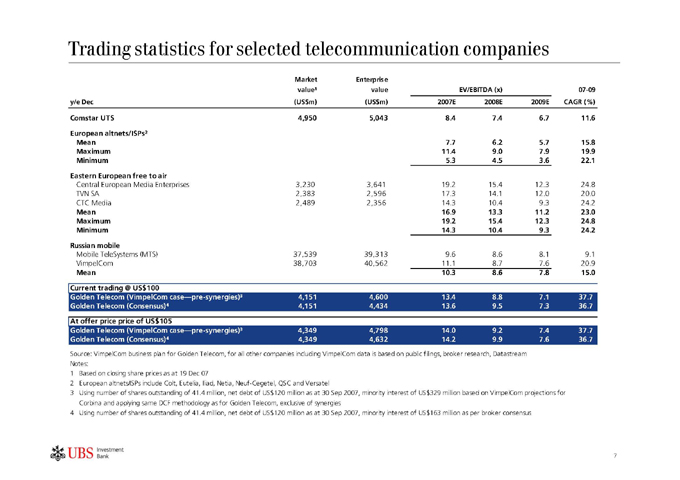

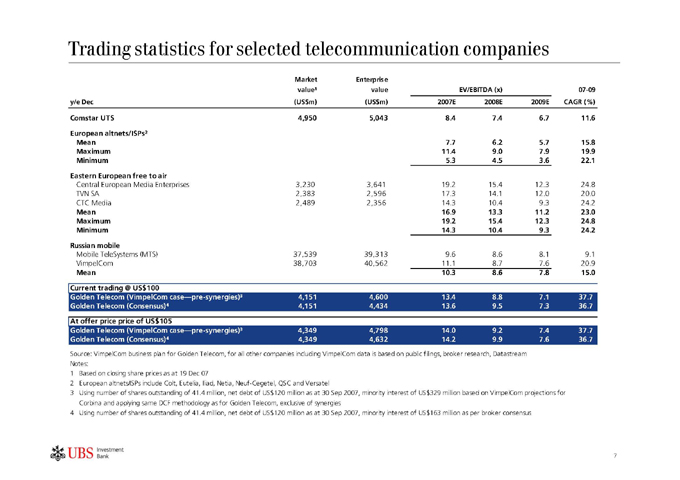

Trading statistics for selected telecommunication companies

Market Enterprise

value¹ value EV/EBITDA (x)

y/e Dec(US$m)(US$m) 2007E 2008E

Comstar UTS 4,950 5,043 8.4 7.4

European altnets/ISPs²

Mean 7.7 6.2

Maximum 11.4 9.0

Minimum 5.3 4.5

Eastern European free to air

Central European Media Enterprises 3,230 3,641 19.2 15.4

TVN SA 2,383 2,596 17.3 14.1

CTC Media 2,489 2,356 14.3 10.4

Mean 16.9 13.3

Maximum 19.2 15.4

Minimum 14.3 10.4

Russian mobile

Mobile TeleSystems (MTS) 37,539 39,313 9.6 8.6

VimpelCom 38,703 40,562 11.1 8.7

Mean 10.3 8.6

07-09

2009E CAGR (%)

Current trading @ US$100

Golden Telecom (VimpelCom case—pre-synergies)³ 4,151 4,600 13.4 8.8 7.1 37.7 Golden Telecom (Consensus)4 4,151 4,434 13.6 9.5 7.3 36.7 At offer price price of US$105 Golden Telecom (VimpelCom case—pre-synergies)³ 4,349 4,798 14.0 9.2 7.4 37.7 Golden Telecom (Consensus)4 4,349 4,632 14.2 9.9 7.6 36.7

Source: VimpelCom business plan for Golden Telecom, for all other companies including VimpelCom data is based on public filings, broker research, Datastream Notes:

1 | | Based on closing share prices as at 19 Dec 07 |

2 | | European altnets/ISPs include Colt, Eutelia, Iliad, Netia, Neuf-Cegetel, QSC and Versatel |

3 Using number of shares outstanding of 41.4 million, net debt of US$120 million as at 30 Sep 2007, minority interest of US$329 million based on VimpelCom projections for Corbina and applying same DCF methodology as for Golden Telecom, exclusive of synergies

4 Using number of shares outstanding of 41.4 million, net debt of US$120 million as at 30 Sep 2007, minority interest of US$163 million as per broker consensus

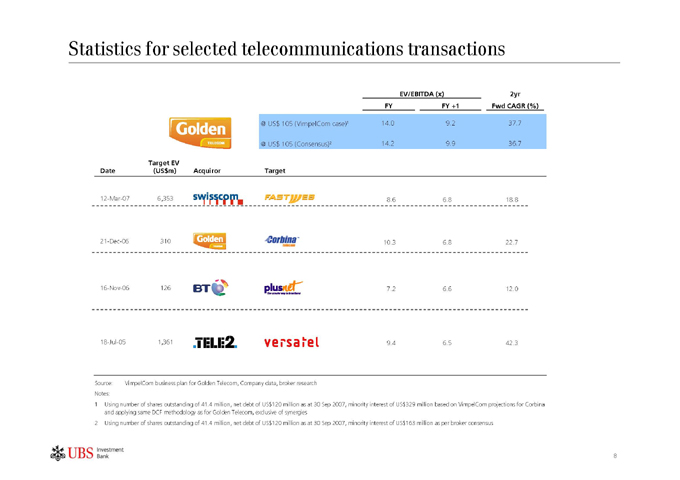

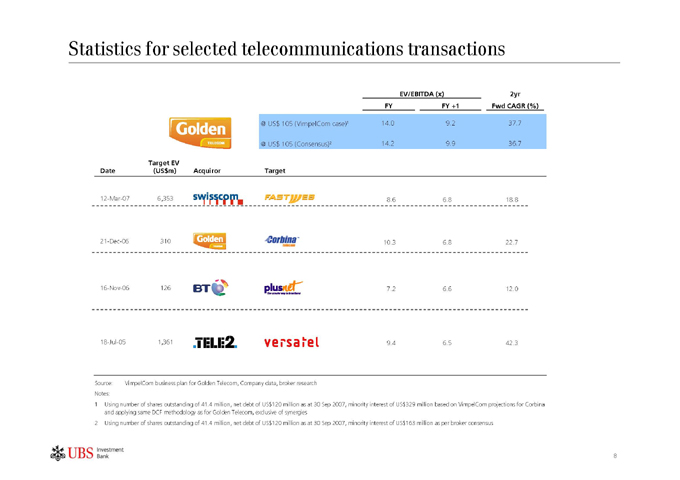

Statistics for selected telecommunications transactions

EV/EBITDA (x) 2yr

FY FY +1 Fwd CAGR (%)

@ US$ 105 (VimpelCom case)1 14.0 9.2 37.7

@ US$ 105 (Consensus)2 14.2 9.9 36.7

Target EV

Date (US$m) Acquiror Target

12-Mar-07 6,353 8.6 6.8 18.8 21-Dec-06 310 10.3 6.8 22.7 16-Nov-06 126 7.2 6.6 12.0 18-Jul-05 1,361 9.4 6.5 42.3

Source: VimpelCom business plan for Golden Telecom, Company data, broker research Notes:

1 Using number of shares outstanding of 41.4 million, net debt of US$120 million as at 30 Sep 2007, minority interest of US$329 million based on VimpelCom projections for Corbina and applying same DCF methodology as for Golden Telecom, exclusive of synergies

2 Using number of shares outstanding of 41.4 million, net debt of US$120 million as at 30 Sep 2007, minority interest of US$163 million as per broker consensus

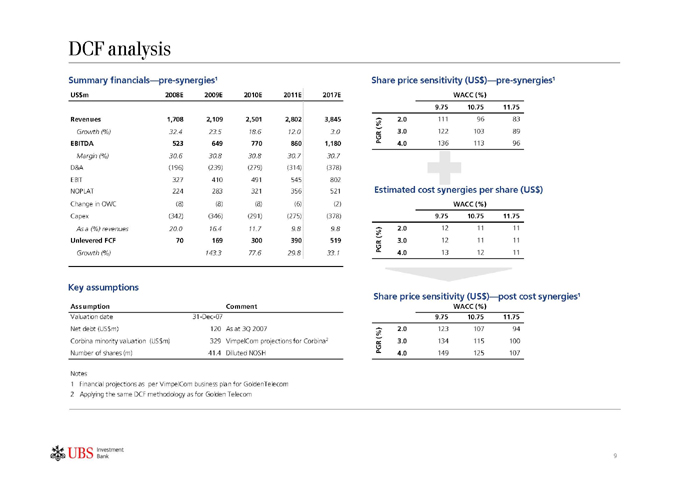

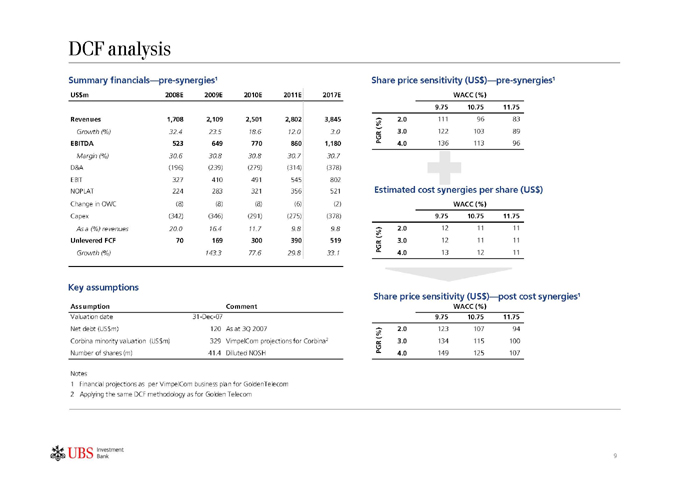

DCF analysis

Summary financials—pre-synergies¹

US$ m 2008E 2009E 2010E 2011E 2017E

Revenues 1,708 2,109 2,501 2,802 3,845

Growth (%) 32.4 23.5 18.6 12.0 3.0

EBITDA 523 649 770 860 1,180

Margin (%) 30.6 30.8 30.8 30.7 30.7

D&A(196)(239)(279)(314)(378)

EBIT 327 410 491 545 802

NOPLAT 224 283 321 356 521

Change in OWC(8)(8)(8)(6)(2)

Capex(342)(346)(291)(275)(378)

As a (%) revenues 20.0 16.4 11.7 9.8 9.8

Unlevered FCF 70 169 300 390 519

Growth (%) 143.3 77.6 29.8 33.1

Key assumptions

Assumption Comment

Valuation date 31-Dec-07

Net debt (US$m) 120 As at 3Q 2007

Corbina minority valuation(US$m) 329 VimpelCom projections for Corbina2

Number of shares (m) 41.4 Dilluted NOSH

Share price sensitivity (US$)—pre-synergies¹

WACC (%)

PGR (%) 3.0 122 103 89

Estimated cost synergies per share (US$)

WACC (%)

PGR (%) 3.0 12 11 11

Share price sensitivity (US$)—post cost synergies¹

WACC (%)

PGR (%) 3.0 134 115 100

Notes

1 | | Financial projections as per VimpelCom business plan for GoldenTelecom |

2 | | Applying the same DCF methodology as for Golden Telecom |

9

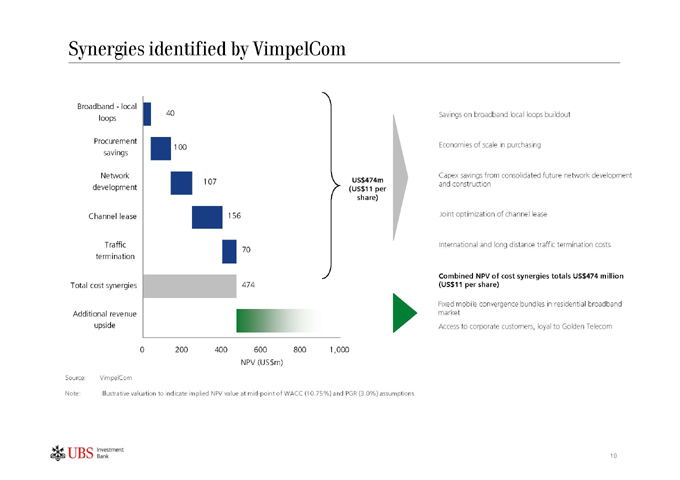

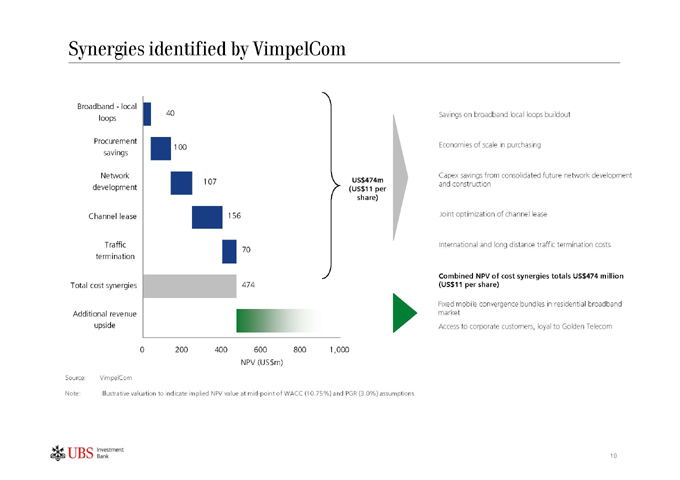

Synergies identified by VimpelCom

Broadband—local loops

Procurement savings

Network development

Channel lease

Traffic termination

Total cost synergies

Additional revenue upside

40

100

107

156

70

474

US$474m (US$11 per share)

Savings on broadband local loops buildout

Economies of scale in purchasing

Capex savings from consolidated future network development and construction

Joint optimization of channel lease

International and long distance traffic termination costs

Combined NPV of cost synergies totals US$474 million (US$11 per share)

Fixed mobile convergence bundles in residential broadband market Access to corporate customers, loyal to Golden Telecom

0 200 400 600 800 1,000 NPV (US$m)

Source: VimpelCom

Note: Illustrative valuation to indicate implied NPV value at mid-point of WACC (10.75%) and PGR (3.0%) assumptions

10

Contact information

UBS Limited

1 | | Finsbury Avenue London, EC2M 2PP Tel. +44-20-7567 8000 |

www.ubs.com

UBS Investment Bank is a business group of UBS AG UBS Limited is a subsidiary of UBS AG

11