Table of Contents

Exhibit 99.2

Table of Contents

CONTENTS

The Galapagos group | ||||

| 4 | ||||

| 7 | ||||

| 8 | ||||

| 9 | ||||

| 10 | ||||

Financial statements | ||||

| 13 | ||||

| 20 | ||||

Auditor’s report | ||||

Report on the limited review of the consolidated interim financial results | 29 | |||

Other information | ||||

| 30 | ||||

| 43 | ||||

| 43 | ||||

| 43 | ||||

- 2 -

Galapagos NV • Q1 Report 2018

Table of Contents

Table of Contents

THE GALAPAGOS GROUP

Dear shareholders,

We reported another quarter of solid pipeline progress in the first quarter of 2018, as we prepared for the next wave of late stage studies, finished up execution on several other patient studies, and moved our early pipeline forward.

In our osteoarthritis, atopic dermatitis, and cystic fibrosis programs, we are preparing for the next patient studies in the second quarter. Importantly, we received feedback from regulatory authorities for our ISABELA global pivotal studies with GLPG1690 in idiopathic pulmonary fibrosis, expected to start in the second half of 2018. We await the next round of filgotinib clinical study results, starting with the EQUATOR studies in psoriatic arthritis in the second quarter.

| The coming year will be data-rich, as we expect the first Phase 3 data with filgotinib in rheumatoid arthritis, along with an interim decision to move to Phase 3 in the ulcerative colitis trial and readouts in our trials in ankylosing spondylitis and psoriatic arthritis. In cystic fibrosis, we will see topline results from the PELICAN trial and a first interim readout with FALCON, a patient study of our first triple combination therapy. We expect to launch pivotal trials with GLPG1690 in IPF, building our fully proprietary IPF franchise. And with our planned start of Phase 2 studies for GLPG1205, GLPG1972, MOR106, and a second CF triple combination, we set the foundations for the next set of clinical results. Meanwhile, we continue to expand our organization to be able to execute the increasing number of clinical studies and to be ready for the anticipated market introduction of our drug candidates. |

Galapagos ended the first quarter of 2018 with a strong balance sheet. We are continuing to grow our late stage development organization to execute on our successful programs. The Galapagos share of proprietary late stage development is growing, leading to increased costs for our company. During 2018 we expect to be running 13 Phase 2 studies. All this will contribute to our financial guidance for operational cash burn between €220 and €240 million for full year 2018.

Operational overview Q1 2018

Inflammation

| • | Completed recruitment for the EQUATOR and TORTUGA Phase 2Proof-of-Concept trials with filgotinib |

| • | Reported good tolerability and dose-dependent decreases of biomarker ARGS neoepitope in the blood serum of osteoarthritis patients treated with GLPG1972 |

| • | Presented the key findings of the Phase 1b trial in atopic dermatitis patients with MOR106 at AAD 2018 |

Cystic fibrosis (CF)

| • | Reported activity and good tolerability with C1 corrector GLPG2222 in homozygous Class II patients in the FLAMINGO Phase 2 trial |

| • | Completed Phase 1 with the second triple combination therapy comprising GLPG3067, GLPG2222, and GLPG2737 |

| • | Completed recruitment for the Phase 2 PELICAN trial with C2 corrector GLPG2737 in combination with Orkambi®1 in Class II homozygous patients |

| 1 | A combination potentiator-corrector therapy marketed by Vertex Pharmaceuticals. |

- 4 -

Galapagos NV • Q1 Report 2018

Table of Contents

THE GALAPAGOS GROUP

Corporate & other

| • | Raised €3.9 million from warrant exercises |

Recent events

| • | Announced ISABELA, a global Phase 3 program with GLPG1690 in IPF based on feedback from FDA and EMA |

| • | Announced initiation of FALCON, our first clinical trial with an investigational triple combination therapy in CF patients |

Q1 2018 financial result

Revenues and other income

Our revenues and other income for the first three months of 2018 amounted to €44.8 million, compared to €39.9 million in the same period of 2017. Revenues (€37.9 million vs €34.0 million for the same period last year) were higher due to an increased recognition in revenue of the upfront payment related to the filgotinib program with Gilead, in line with the increased spending, but also due to the adoption of IFRS 15 – Revenue from contract with customers, on 1 January 2018, resulting in the recognition for the first quarter of 2018 of €10.4 million of deferred revenues related to previously recognized upfront and milestones under the former applicable standards of IAS 18. We refer to the notes to this interim consolidated financial report for additional information on the impact of the adoption of IFRS 15 on our consolidated financial statements.

Other income increased (€6.9 million vs €5.9 million for the same period last year), mainly driven by higher income from R&D incentives.

Results

We realized a net loss of €37.3 million for the first three months of 2018, compared to a net loss of €13.6 million in the first three months of 2017.

We reported an operating loss amounting to €32.0 million for the first quarter of 2018, compared to an operating loss of €11.2 million for the same period last year.

Our R&D expenses in the first three months of 2018 were €69.8 million, compared to €44.9 million for the first quarter of 2017. This planned increase was due mainly to an increase of €20.4 million in subcontracting costs primarily on our filgotinib and GLPG1690 programs. Furthermore, personnel costs increased explained by a planned headcount increase. Our G&A and S&M expenses were €7.1 million in the first quarter of 2018, compared to €6.2 million in the first quarter of 2017. This increase mainly resulted from higher personnel costs due to a planned headcount increase.

Net financial expenses in the first three months of 2018 amounted to €5.2 million, compared to net financial expenses of €2.4 million for the same period last year, and were primarily attributable to €5.6 million of unrealized exchange loss on our cash position in U.S. dollars. We expect to use this cash held in U.S. dollars to settle our future payables in U.S. dollars, which will be primarily linked to our global collaboration with Gilead for the development of filgotinib.

Liquid assets position

Cash and cash equivalents totaled €1,108.2 million on 31 March 2018.

A net decrease of €43.0 million in cash and cash equivalents was recorded during the first three months of 2018, compared to a net decrease of €19.9 million during the same period last year. Net cash flows used in operating activities amounted to €39.8 million in the first three months of 2018. Exercise of warrants in the first quarter of 2018 generated a financing cash inflow of €3.9 million. Furthermore, €1.5 million was used in investing activities and €5.6 million unrealized negative exchange rate differences were reported on cash and cash equivalents.

- 5 -

Galapagos NV • Q1 Report 2018

Table of Contents

THE GALAPAGOS GROUP

Finally, our balance sheet held a receivable from the French government (Crédit d’Impôt Recherche2) amounting to €39.1 million, payable in 4 yearly tranches. Our balance sheet also held a receivable from the Belgian Government for R&D incentives amounting to €41.7 million.

Outlook 2018

We aim to report topline results with the FINCH 2 (rheumatoid arthritis), EQUATOR (psoriatic arthritis), TORTUGA (ankylosing spondylitis) filgotinib trials as well as a decision to continue to Phase 3 in SELECTION (ulcerative colitis). Our collaboration partner Gilead expects to complete recruitment of FINCH 1 and FINCH 3, the remaining RA Phase 3 trials with filgotinib. In cystic fibrosis we anticipate the readout of the PELICAN patient trial and an interim readout in FALCON. We recently announced the design for the ISABELA pivotal trials with GLPG1690 in IPF. We expect to start dosing ISABELA and initiate Phase 2 trials with GLPG1205 (IPF), an additional CF triple combination, GLPG1972 (osteoarthritis), and MOR106 (atopic dermatitis) later in 2018.

The company expects an operational cash burn between €220 and €240 million in 2018.

We thank you again for your support of Galapagos. We aim to discover and to develop more novel medications, bring the successful therapies to the market, and improve patients’ lives.

Onno van de Stolpe

CEO

| 2 | Crédit d’Impôt Recherche refers to an innovation incentive system underwritten by the French government. |

- 6 -

Galapagos NV • Q1 Report 2018

Table of Contents

THE GALAPAGOS GROUP

Consolidated Key Figures

| (thousands of €, if not stated otherwise) | ||||||||

Income statement | 31/03/2018 | 31/03/2017 | ||||||

Revenues(1) | 37,907 | 33,992 | ||||||

Other income | 6,931 | 5,871 | ||||||

R&D expenditure | (69,765 | ) | (44,930 | ) | ||||

S, G&A expenses | (7,110 | ) | (6,158 | ) | ||||

Operating expenses | (76,875 | ) | (51,088 | ) | ||||

Operating loss | (32,036 | ) | (11,225 | ) | ||||

Net financial results | (5,184 | ) | (2,380 | ) | ||||

Taxes | (62 | ) | — | |||||

Net loss | (37,283 | ) | (13,605 | ) | ||||

Balance sheet | 31/03/2018 | 31/12/2017 | ||||||

Cash and cash equivalents | 1,108,186 | 1,151,211 | ||||||

R&D incentives receivables | 80,870 | 75,783 | ||||||

Assets | 1,229,864 | 1,286,274 | ||||||

Shareholders’ equity(1) | 899,345 | 1,011,983 | ||||||

Deferred income(1) | 268,654 | 219,892 | ||||||

Other liabilities | 61,865 | 54,399 | ||||||

Cash flow | 31/03/2018 | 31/03/2017 | ||||||

Operational cash burn(2) | (41,335 | ) | (23,878 | ) | ||||

Cash flow generated / used (-) in financing activities | 3,905 | (14 | ) | |||||

Effect of currency exchange rate fluctuation on cash and cash equivalents | (5,595 | ) | (2,496 | ) | ||||

Decrease in cash and cash equivalents | (43,025 | ) | (19,856 | ) | ||||

Cash and cash equivalents on 31 March | 1,108,186 | 953,385 | ||||||

Financial ratios | 31/03/2018 | 31/03/2017 | ||||||

Number of shares issued on 31 March | 51,234,962 | 46,256,078 | ||||||

Basic and diluted loss per share (in €) | (0.73 | ) | (0.29 | ) | ||||

Share price on 31 March (in €) | 81.30 | 81.58 | ||||||

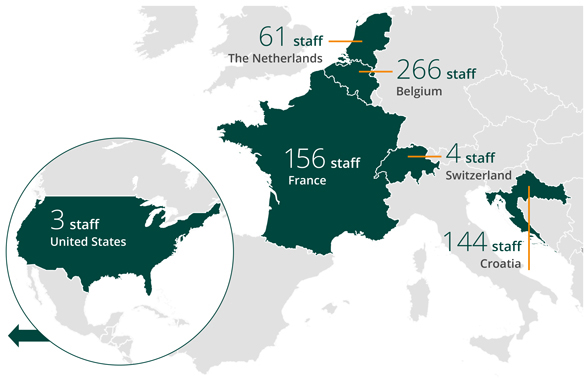

Total group employees on 31 March (number) | 634 | 530 | ||||||

| (1) | Our revenues, shareholders’ equity and deferred income for the period ended 31 March 2018 were influenced by the adoption of the new standard IFRS 15 – Revenue from contract with customers, on 1 January 2018. We refer to the notes of this interim consolidated financial report for additional information. |

| (2) | The operational cash burn (or operational cash flow if this performance measure is positive) is equal to the sum of the net cash flows generated / used (–) in operating activities and the net cash flows generated / used (–) in investing activities minus (i) the proceeds or cash used, if any, in acquisitions or disposals of businesses; and (ii) the movement in restricted cash, if any. This alternative performance measure is in our view an important metric for a biotech company in the development stage. |

- 7 -

Galapagos NV • Q1 Report 2018

Table of Contents

THE GALAPAGOS GROUP

Employees per site as of 31 March 2018

We refer to the description of risk factors in the 2017 annual report, pp.48-56, as supplemented by the description of risk factors in our annual report on Form20-F filed with the U.S. Securities and Exchange Commission, pp.5-45. In summary, the principal risks and uncertainties faced by us relate to: our financial position and need for additional capital; product development, regulatory approval and commercialization; our reliance on third parties; our competitive position; our intellectual property; our organization, structure and operation (including but not limited to certain risks related to our status as a U.S. publicly listed company following the public offering of shares (in the form of ADSs) and listing on NASDAQ in May 2015) and market risks relating to our shares and ADSs.

We also refer to the description of the group’s financial risk management given in the 2017 annual report, pp.132-135, which remains valid.

- 8 -

Galapagos NV • Q1 Report 2018

Table of Contents

THE GALAPAGOS GROUP

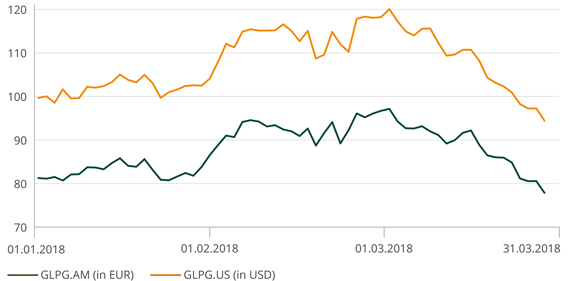

Performance of the Galapagos share on Euronext and NASDAQ

- 9 -

Galapagos NV • Q1 Report 2018

Table of Contents

THE GALAPAGOS GROUP

Disclaimer and other information

Galapagos NV is a limited liability company organized under the laws of Belgium, having its registered office at Generaal De Wittelaan L11 A3, 2800 Mechelen, Belgium. Throughout this report, the term “Galapagos NV” refers solely to thenon-consolidated Belgian company and references to “we,” “our,” “the group” or “Galapagos” include Galapagos NV together with its subsidiaries.

This report is published in Dutch and in English. In case of inconsistency between the Dutch and the English versions, the Dutch version shall prevail. Galapagos is responsible for the translation and conformity between the Dutch and English version.

This report is available free of charge and upon request to be addressed to:

Galapagos NV

Investor Relations

Generaal De Wittelaan L11 A3

2800 Mechelen, Belgium

Tel: +32 15 34 29 00

Email: ir@glpg.com

A digital version of this report is available on our website, www.glpg.com.

We will use reasonable efforts to ensure the accuracy of the digital version, but do not assume responsibility if inaccuracies or inconsistencies with the printed document arise as a result of any electronic transmission. Therefore, we consider only the printed version of this report to be legally valid. Other information on our website or on other websites does not form a part of this report.

Listings

Euronext Amsterdam and Brussels: GLPG

NASDAQ: GLPG

Forward-looking statements

This report contains forward-looking statements, all of which involve certain risks and uncertainties. These statements are often, but are not always, made through the use of words or phrases such as “believe,” “anticipate,” “expect,” “intend,” “plan,” “seek,” “estimate,” “may,” “will,” “could,” “stand to,” “continue,” as well as similar expressions. Forward-looking statements contained in this report include, but are not limited to, statements made in the “Letter from the management”, the information provided in the section captioned “Outlook 2018”, guidance from management regarding the expected operational use of cash during financial year 2018, statements regarding the development of a potential triple combination therapy for Class II cystic fibrosis patients and the possible activity and clinical utility of such potential triple combination therapy, statements regarding the expected timing, design and readouts of ongoing and planned clinical trials (i) with filgotinib in rheumatoid arthritis, Crohn’s disease, ulcerative colitis and other indications, (ii) with GLPG2222, GLPG2737, GLPG2851, GLPG2451, and GLPG3067 or combinations thereof in cystic fibrosis, (iii) with GLPG1690 and GLPG1205 in IPF, (iv) with GLPG1972 in osteoarthritis, and (v) with MOR106 in atopic dermatitis. We caution the reader that forward-looking statements are not guarantees of future performance. Forward-looking statements may involve known and unknown risks, uncertainties and other factors which might cause our actual results, financial condition and liquidity, performance or achievements, or the development of the industry in which we operate, to be materially different from any historic or future results, financial conditions, performance or achievements expressed or implied by such forward-looking statements. In addition, even if our results of operations, financial

- 10 -

Galapagos NV • Q1 Report 2018

Table of Contents

THE GALAPAGOS GROUP

condition and liquidity, and the development of the industry in which we operate are consistent with such forward-looking statements, they may not be predictive of results or developments in future periods. Among the factors that may result in differences are that our expectations regarding our 2018 revenues and financial results and our 2018 operating expenses may be incorrect (including because one or more of our assumptions underlying our revenue or expense expectations may not be realized), the inherent uncertainties associated with competitive developments, clinical trial and product development activities and regulatory approval requirements (including that data from our clinical research programs in rheumatoid arthritis, Crohn’s disease, ulcerative colitis, cystic fibrosis, idiopathic pulmonary fibrosis, osteoarthritis, atopic dermatitis, and other inflammatory indications may not support registration or further development of our product candidates due to safety, efficacy or other reasons), our reliance on collaborations with third parties (including our collaboration partner for filgotinib, Gilead, our collaboration partner for cystic fibrosis, AbbVie, our collaboration partner for GLPG1972, Servier, and our collaboration partner for MOR106, MorphoSys), and estimating the commercial potential of our product candidates. A further list and description of these risks, uncertainties and other risks can be found in our Securities and Exchange Commission filings and reports, including in our most recent annual report on Form20-F filed with the SEC and our other filings and reports. We also refer to the “Risk Factors” section of this report. Given these uncertainties, the reader is advised not to place any undue reliance on such forward-looking statements. These forward-looking statements speak only as of the date of publication of this document. We expressly disclaim any obligation to update any such forward-looking statements in this document to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based or that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements, unless specifically required by law or regulation.

- 11 -

Galapagos NV • Q1 Report 2018

Table of Contents

Table of Contents

FINANCIAL STATEMENTS

Consolidated interim financial statements for the first three months of 2018

Consolidated statements of income and comprehensive income

(unaudited)

Consolidated income statement

| Three months ended 31 March | ||||||||

(thousands of €, except share and per share data) | 2018 | 2017 | ||||||

Revenues | 37,907 | 33,992 | ||||||

Other income | 6,931 | 5,871 | ||||||

|

|

|

| |||||

Total revenues and other income | 44,838 | 39,863 | ||||||

|

|

|

| |||||

Research and development expenditure | (69,765 | ) | (44,930 | ) | ||||

General and administrative expenses | (6,697 | ) | (5,603 | ) | ||||

Sales and marketing expenses | (413 | ) | (556 | ) | ||||

|

|

|

| |||||

Total operating expenses | (76,875 | ) | (51,088 | ) | ||||

|

|

|

| |||||

Operating loss | (32,036 | ) | (11,225 | ) | ||||

|

|

|

| |||||

Financial income | 1,610 | 894 | ||||||

Financial expenses | (6,794 | ) | (3,274 | ) | ||||

|

|

|

| |||||

Loss before tax | (37,221 | ) | (13,605 | ) | ||||

|

|

|

| |||||

Income taxes | (62 | ) | — | |||||

Net loss | (37,283 | ) | (13,605 | ) | ||||

|

|

|

| |||||

Net loss attributable to: | ||||||||

Owners of the parent | (37,283 | ) | (13,605 | ) | ||||

|

|

|

| |||||

Basic and diluted loss per share | (0.73 | ) | (0.29 | ) | ||||

|

|

|

| |||||

Weighted average number of shares – Basic and diluted (in thousands of shares) | 50,973 | 46,256 | ||||||

|

|

|

| |||||

- 13 -

Galapagos NV • Q1 Report 2018

Table of Contents

FINANCIAL STATEMENTS

Consolidated statements of comprehensive income

| Three months ended 31 March | ||||||||

(thousands of €) | 2018 | 2017 | ||||||

Net loss | (37,283 | ) | (13,605 | ) | ||||

|

|

|

| |||||

Items that may be reclassified subsequently to profit or loss: | ||||||||

Fair value adjustment ofavailable-for-sale financial assets | (8 | ) | ||||||

Translation differences, arisen from translating foreign activities | (3 | ) | 39 | |||||

|

|

|

| |||||

Other comprehensive income, net of income tax | (3 | ) | 31 | |||||

|

|

|

| |||||

Total comprehensive income attributable to: | ||||||||

Owners of the parent | (37,286 | ) | (13,574 | ) | ||||

|

|

|

| |||||

- 14 -

Galapagos NV • Q1 Report 2018

Table of Contents

FINANCIAL STATEMENTS

Consolidated statements of financial position

(unaudited)

(thousands of €) | 31 March 2018 | 31 December 2017 | ||||||

Assets | ||||||||

Intangible assets | 2,555 | 2,495 | ||||||

Property, plant and equipment | 16,971 | 16,692 | ||||||

Deferred tax assets | 1,979 | 1,978 | ||||||

Non-current R&D incentives receivables | 69,285 | 64,001 | ||||||

Non-current restricted cash | 1,158 | 1,158 | ||||||

Othernon-current assets | 2,182 | 2,303 | ||||||

|

|

|

| |||||

Non-currents assets | 94,129 | 88,627 | ||||||

|

|

|

| |||||

Inventories | 293 | 279 | ||||||

Trade and other receivables | 8,501 | 27,966 | ||||||

Current R&D incentives receivables | 11,585 | 11,782 | ||||||

Cash and cash equivalents | 1,108,186 | 1,151,211 | ||||||

Other current assets | 7,171 | 6,409 | ||||||

|

|

|

| |||||

Current assets | 1,135,735 | 1,197,647 | ||||||

|

|

|

| |||||

Total assets | 1,229,864 | 1,286,274 | ||||||

|

|

|

| |||||

Equity and liabilities | ||||||||

Share capital | 235,027 | 233,414 | ||||||

Share premium account | 995,336 | 993,025 | ||||||

Other reserves | (641 | ) | (1,260 | ) | ||||

Translation differences | (1,757 | ) | (1,754 | ) | ||||

Accumulated losses | (328,620 | ) | (211,441 | ) | ||||

|

|

|

| |||||

Total equity | 899,345 | 1,011,983 | ||||||

|

|

|

| |||||

Pension liabilities | 3,660 | 3,582 | ||||||

Provisions | 65 | 65 | ||||||

Othernon-current liabilities | 677 | 1,597 | ||||||

Non-current deferred income | 102,486 | 97,348 | ||||||

|

|

|

| |||||

Non-current liabilities | 106,888 | 102,592 | ||||||

|

|

|

| |||||

- 15 -

Galapagos NV • Q1 Report 2018

Table of Contents

FINANCIAL STATEMENTS

(thousands of €) | 31 March 2018 | 31 December 2017 | ||||||

Finance lease liabilities | — | 9 | ||||||

Trade and other payables | 55,657 | 47,122 | ||||||

Current tax payable | 862 | 865 | ||||||

Accrued charges | 943 | 1,159 | ||||||

Current deferred income | 166,168 | 122,544 | ||||||

|

|

|

| |||||

Current liabilities | 223,631 | 171,699 | ||||||

|

|

|

| |||||

Total liabilities | 330,519 | 274,291 | ||||||

|

|

|

| |||||

Total equity and liabilities | 1,229,864 | 1,286,274 | ||||||

|

|

|

| |||||

- 16 -

Galapagos NV • Q1 Report 2018

Table of Contents

FINANCIAL STATEMENTS

Consolidated cash flow statements

(unaudited)

(thousands of €) | 2018 | 2017 | ||||||

Cash and cash equivalents at beginning of year | 1,151,211 | 973,241 | ||||||

Net loss | (37,283 | ) | (13,605 | ) | ||||

Adjustments for: | ||||||||

Tax expense | 62 | — | ||||||

Net financial expense | 5,184 | 2,380 | ||||||

Depreciation of property, plant and equipment | 914 | 870 | ||||||

Amortization of intangible fixed assets | 283 | 180 | ||||||

Net realized gain / loss (-) on foreign exchange transactions | 63 | (338 | ) | |||||

Share-based compensation | 3,943 | 3,023 | ||||||

Increase in pension liabilities | 78 | 72 | ||||||

|

|

|

| |||||

| (26,755 | ) | (7,418 | ) | |||||

|

|

|

| |||||

Increase in inventories | (14 | ) | (24 | ) | ||||

Decrease / Increase (-) in receivables | 12,928 | (11,586 | ) | |||||

Increase in payables | 7,568 | 11,092 | ||||||

Decrease in deferred income | (34,458 | ) | (15,259 | ) | ||||

|

|

|

| |||||

Cash used in operations | (40,732 | ) | (23,196 | ) | ||||

|

|

|

| |||||

Interest paid | (500 | ) | (16 | ) | ||||

Interest received | 1,428 | 370 | ||||||

|

|

|

| |||||

Net cash flows used in operating activities | (39,804 | ) | (22,843 | ) | ||||

|

|

|

| |||||

Purchase of property, plant and equipment | (1,192 | ) | (916 | ) | ||||

Purchase of and expenditure in intangible fixed assets | (340 | ) | (120 | ) | ||||

Proceeds from disposal of property, plant and equipment | 1 | 1 | ||||||

Decrease in restricted cash | — | 6,531 | ||||||

|

|

|

| |||||

Net cash flows generated / used (-) in investing activities | (1,531 | ) | 5,497 | |||||

|

|

|

| |||||

- 17 -

Galapagos NV • Q1 Report 2018

Table of Contents

FINANCIAL STATEMENTS

(thousands of €) | 2018 | 2017 | ||||||

Repayment of obligations under finance leases and other debts | (19 | ) | (14 | ) | ||||

Proceeds from capital and share premium increases from exercise of warrants | 3,924 | — | ||||||

|

|

|

| |||||

Net cash flows generated /used (-) in financing activities | 3,905 | (14 | ) | |||||

|

|

|

| |||||

Effect of exchange rate differences on cash and cash equivalents | (5,595 | ) | (2,496 | ) | ||||

|

|

|

| |||||

Decrease in cash and cash equivalents | (43,025 | ) | (19,856 | ) | ||||

|

|

|

| |||||

Cash and cash equivalents at end of the period | 1,108,186 | 953,385 | ||||||

|

|

|

| |||||

- 18 -

Galapagos NV • Q1 Report 2018

Table of Contents

FINANCIAL STATEMENTS

Consolidated statements of changes in equity

(unaudited)

(thousands of €) | Share capital | Share premium account | Translation differences | Other reserves | Accumul. losses | Total | ||||||||||||||||||

On 1 January 2017 | 223,928 | 649,135 | (1,090 | ) | (1,000 | ) | (112,272 | ) | 758,701 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Net loss | (13,605 | ) | (13,605 | ) | ||||||||||||||||||||

Other comprehensive income | 39 | (8 | ) | 31 | ||||||||||||||||||||

Total comprehensive income | 39 | (8 | ) | (13,605 | ) | (13,574 | ) | |||||||||||||||||

Share-based compensation | 3,023 | 3,023 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

On 31 March 2017 | 223,928 | 649,135 | (1,051 | ) | (1,008 | ) | (122,854 | ) | 748,150 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

On 31 December 2017 | 233,414 | 993,025 | (1,754 | ) | (1,260 | ) | (211,441 | ) | 1,011,983 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Change in accounting policy (modified retrospective application IFRS 15) | (83,220 | ) | (83,220 | ) | ||||||||||||||||||||

Change in accounting policy (modified retrospective application IFRS 9) | 619 | (619 | ) | — | ||||||||||||||||||||

Restated total equity at 1 January 2018 | 233,414 | 993,025 | (1,754 | ) | (641 | ) | (295,280 | ) | 928,764 | |||||||||||||||

Net loss | (37,283 | ) | (37,283 | ) | ||||||||||||||||||||

Other comprehensive income | (3 | ) | — | (3 | ) | |||||||||||||||||||

Total comprehensive income | (3 | ) | — | (37,283 | ) | (37,286 | ) | |||||||||||||||||

Share-based compensation | 3,943 | 3,943 | ||||||||||||||||||||||

Exercise of warrants | 1,613 | 2,311 | 3,924 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

On 31 March 2018 | 235,027 | 995,336 | (1,757 | ) | (641 | ) | (328,620 | ) | 899,345 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

- 19 -

Galapagos NV • Q1 Report 2018

Table of Contents

FINANCIAL STATEMENTS

Notes to the unaudited consolidated interim financial statements for the first three months of 2018

Basis of preparation

These condensed interim financial statements have been prepared in accordance with IAS 34 ‘Interim Financial Reporting’ as adopted by the European Union. The condensed interim financial statements do not contain all information required for an annual report and should therefore be read in conjunction with Galapagos’ annual report 2017.

The condensed interim financial statements were subject to a limited review by the statutory auditor, but have not been audited.

Details of the unaudited interim results

Revenues and other income

Revenues

The following table summarizes our revenues for the three months ended 31 March 2018 and 2017.

| Three months ended 31 March | ||||||||

(thousands of €) | 2018 | 2017 | ||||||

Recognition ofnon-refundable upfront payments and license fees | 25,824 | 15,225 | ||||||

Milestone payments | 8,809 | 16,564 | ||||||

Reimbursement income | 192 | 104 | ||||||

Other revenues | 3,081 | 2,099 | ||||||

|

|

|

| |||||

Total revenues | 37,907 | 33,992 | ||||||

|

|

|

| |||||

Revenues (€37.9 million vs €34.0 million for the same period last year) were higher due to an increase in the recognition of the upfront payment from Gilead related to the filgotinib program, which is recognized in function of the costs incurred for this program, but also due to the adoption of IFRS 15 – Revenue from contract with customers, on 1 January 2018, resulting in the recognition for the first quarter of 2018 of €10.4 million of deferred revenues related to previously recognized upfront and milestones under the former applicable standards of IAS 18.

- 20 -

Galapagos NV • Q1 Report 2018

Table of Contents

FINANCIAL STATEMENTS

The following table summarizes the recognition of the upfront, license fees and milestones payments received for the three months ended 31 March 2018 and 2017.

Agreement | Consideration | Consideration received | Collaboration | IAS 18 | Deferred income reclassified from equity following adoption of IFRS 15 | IFRS 15 | IFRS 15 | IAS 18 | IAS 18 | IFRS 15 | ||||||||||||||||||||||||||

| Outstanding balance in deferred income as at 31 December 2017 | Outstanding balance in deferred income as at 1 January 2018 | Revenue recognized, three months ended 31 March 2018 | Revenue recognized, three months ended 31 March 2018 | Revenue recognized, three months ended 31 March 2017 | Outstanding balance in deferred income as at 31 March 2018 | |||||||||||||||||||||||||||||||

(thousands of $) | (thousands of €) | (thousands of €) | ||||||||||||||||||||||||||||||||||

| Gilead collaboration agreement for filgotinib - Upfront payment | 300,000 | 275,558 | January 2016 | 187,449 | 187,449 | 20,914 | 20,914 | 13,337 | 166,535 | |||||||||||||||||||||||||||

| Gilead collaboration agreement for filgotinib - Sub-scription agreement(1) | N.A. | 39,003 | January 2016 | 26,532 | 26,532 | 2,960 | 2,960 | 1,888 | 23,572 | |||||||||||||||||||||||||||

| Servier collaboration agreement for osteo-arthritis - License fee | N.A. | 6,000 | June 2010 | 5,362 | (5,362 | ) | — | 383 | — | |||||||||||||||||||||||||||

| AbbVie collaboration agreement for CF - Upfront payments | 45,000 | 34,001 | September 2013 | 14,872 | 14,872 | 1,950 | 12,922 | |||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||

| Total upfront and license fees: | 219,343 | 9,510 | 228,853 | 25,824 | 24,257 | 15,225 | 203,028 | |||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||

| Gilead collaboration agreement for filgotinib - Milestone payments | 70,000 | 64,435 | January 2016 | 43,832 | 43,832 | 4,891 | 38,941 | |||||||||||||||||||||||||||||

| AbbVie collaboration agreement for CF - Milestone payments | 77,500 | 68,310 | September 2013 | 29,878 | 29,878 | 3,918 | 16,564 | 25,960 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||

| Total milestones: | — | 73,710 | 73,710 | 8,809 | — | 16,564 | 64,901 | |||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||

| Total: | 219,343 | 83,220 | 302,563 | 34,633 | 24,257 | 31,789 | 267,929 | |||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||

| (1) | deferred income of €39 million booked upon signing of the share subscription agreement with Gilead as required under IAS 39 Financial instruments: recognition and measurement |

The first adoption of IFRS 15 Revenue from contracts with customers negatively impacted the accumulated losses and increased the amount of deferred income (contract liabilities) with an amount of €83.2 million, as shown in the table above (column “Deferred income reclassified from equity following adoption of IFRS 15”). We elected the modified retrospective method for the transition which foresees that prior period figures remain as reported under the previous standard and the cumulative effect of applying IFRS 15 is recognized as an adjustment to the opening balance of equity as at the date of initial application (beginning of the year 2018).

The revenues recognized for the three months ended 31 March 2018 are presented in the table above under IFRS 15 standard as well as under IAS 18 standard, with a comparison to last year’s period under IAS 18 standard.

- 21 -

Galapagos NV • Q1 Report 2018

Table of Contents

FINANCIAL STATEMENTS

We applied the five step model detailed in the IFRS 15 standard to determine when, how and at what amount revenue is to be recognized depending on whether certain criteria are met. The significant judgements made in applying this standard are detailed below:

The substance of our current arrangements is that Galapagos is licensing its IP to collaborative partner entities and conducts research and development (“R&D”) activities. Such activities result in a service that is the output of Galapagos’ ordinary activities. We generate revenue through a number of these arrangements which include license fees, milestone payments, reimbursement income and future sales based milestones and sales based royalties. We assessed that the revenues from our current material licensing and collaboration agreements are in the scope of IFRS 15.

Collaboration with Gilead

We concluded as follows:

| • | We assessed that there is one single performance obligation under the new standards of IFRS 15; the transfer of a license combined with performance of R&D activities. This is because we considered that the license is not distinct in the context of the contract. |

| • | The transaction price of our agreement is currently composed of a fixed part, being an upfront license fee and a variable part, being milestone payments and cost reimbursements for R&D activities delivered. Milestone payments are included in our revenues only when achieved. Sales based milestones and sales based royalties are a part of our arrangement but are not yet included in our revenues as our program is still in phase 3 of development. |

| • | The transaction price has been allocated to the single performance obligation and revenues have been recognized over the estimated service period based on a pattern that reflects the transfer of the license and progress to complete satisfaction of the R&D activities. This is because we considered that there is a transformational relationship between the license and the R&D activities to be delivered. |

| • | We have chosen an input model to measure the satisfaction of the single performance obligation that considers percentage of costs incurred for this program that are completed each period (% of completion method). |

| • | Costs reimbursements received from Gilead are to be recognized in revenues when costs are incurred and agreed by the parties as we are acting as a principal in the scope of our stake of the R&D activities of our ongoing license and collaboration agreements. |

As a result of this analysis, for the first three months of 2018, €28.8 million of deferred income related to the Gilead collaboration agreement were recognized in revenue under IFRS 15 in function of costs incurred, applying the percentage of completion method. This revenue recognition consisted of (i) €20.9 million related to the upfront license fee, (ii) €3.0 million related to the deferred income triggered by the accounting treatment of the share subscription agreement under IAS 39 Financial Instruments: recognition and measurement, and (iii) €4.9 million related to milestone payments received. The outstanding balance of deferred income from the Gilead collaboration agreement at the end of March 2018 amounted to €229.0 million of which €83.9 million reported asnon-current deferred income.

As reflected in the table above, the impact of the IFRS 15 adoption on our revenues generated from our collaboration with Gilead was only related to the deferral of previously recognized milestones.

Collaboration with AbbVie

We concluded as follows:

| • | We assessed that there is one single performance obligation under the new standards of IFRS 15; the transfer of a license combined with performance of R&D activities. This is because we considered that the license is not capable of being distinct and is not distinct in the context of the contract. |

- 22 -

Galapagos NV • Q1 Report 2018

Table of Contents

FINANCIAL STATEMENTS

| • | The transaction price of our agreement is currently composed of a fixed part, being an upfront license fee, and a variable part, being milestone payments and cost reimbursements for R&D activities delivered. Milestone payments are included in our revenues only when achieved. Sales based milestones and sales based royalties are a part of our arrangement but are not yet included in our revenues as our program is still in phase 1 & 2 of development. |

| • | The transaction price has been allocated to the single performance obligation and revenues have been recognized over the estimated service period based on a pattern that reflects the transfer of the license and progress to complete satisfaction of the R&D activities. This is because we considered that there is a transformational relationship between the license and the R&D activities to be delivered. |

| • | We have chosen an input model to measure the satisfaction of the single performance obligation that considers a percentage of costs incurred for this program that are completed each period (% of completion method). |

| • | Costs reimbursements received from AbbVie could be recognized in revenues when costs are incurred and agreed by the parties as we are acting as a principal in the scope of our stake of the R&D activities of our ongoing license and collaboration agreements. |

As a result of this analysis, for the first three months of 2018, €5.9 million of deferred income related to the AbbVie collaboration agreement were recognized in revenue under IFRS 15 in function of costs incurred, applying the percentage of completion method. This revenue recognition consisted of (i) €2.0 million related to the upfront license fee and (ii) €3.9 million related to milestone payments received in previous years. The outstanding balance of deferred income from the AbbVie collaboration agreement at the end of March 2018 amounted to €38.9 million of which €18.6 million reported asnon-current deferred income.

As reflected in the table above, the impact of the IFRS 15 adoption on our revenues generated from our collaboration with AbbVie was related to the deferral of previously recognized upfront fee and milestones.

Finally, the deferred income balance on 31 December 2017 related to the license fee received from Servier in the scope of our license and collaboration agreement in the field of osteoarthritis (€5.4 million) was fully reclassified to equity as a consequence of the adoption of the new standard.

Other revenues

Other revenues mainly consisted in service revenues from ourfee-for-service business for €3.0 million, as reported under the segment information disclosure below.

Other income

The following table summarizes our other income for the three months ended 31 March 2018 and 2017.

| Three months ended 31 March | ||||||||

(thousands of €) | 2018 | 2017 | ||||||

Grant income | 549 | 293 | ||||||

Other income | 6,382 | 5,578 | ||||||

|

|

|

| |||||

Total other income | 6,931 | 5,871 | ||||||

|

|

|

| |||||

Other income increased (€6.9 million vs €5.9 million last year) in the first three months of 2018, mainly driven by higher income from R&D incentives.

Results

We realized a net loss of €37.3 million for the first three months of 2018, compared to a net loss of €13.6 million in the first three months of 2017.

- 23 -

Galapagos NV • Q1 Report 2018

Table of Contents

FINANCIAL STATEMENTS

We reported an operating loss amounting to €32.0 million for the first three months of 2018, compared to an operating loss of €11.2 million for the same period last year.

Our R&D expenses in the first three months of 2018 were €69.8 million, compared to €44.9 million in 2017. This planned increase was due mainly to an increase of €20.4 million in subcontracting costs primarily on our filgotinib and GLPG1690 programs. Furthermore, personnel costs increased, explained by a planned headcount increase.

Our G&A and S&M expenses were €7.1 million in the first quarter of 2018, compared to €6.2 million in the first quarter of 2017. This increase mainly resulted from higher personnel costs due to a planned headcount increase.

Net financial expenses in the first three months of 2018 amounted to €5.2 million compared to net financial expenses of €2.4 million in 2017, and were primarily attributable to €5.6 million of unrealized exchange loss on our cash position in U.S. dollars. We expect to use this cash held in U.S. dollars to settle our future payables in U.S. dollars, which will be primarily linked to our global collaboration with Gilead for the development of filgotinib.

Segment information

We have two reportable segments: R&D and ourfee-for-service business Fidelta, located in Croatia.

| Segment information for the three months ended 31 March 2018 | ||||||||||||||||

(thousands of €) | R&D | Fee-for-services | Inter-segment elimination | Group | ||||||||||||

External revenue | 34,888 | 3,019 | 37,907 | |||||||||||||

Internal revenue | 2,175 | (2,175 | ) | — | ||||||||||||

Other income | 6,931 | — | 6,931 | |||||||||||||

|

|

|

|

|

|

|

| |||||||||

Revenues & other income | 41,819 | 5,194 | (2,175 | ) | 44,838 | |||||||||||

|

|

|

|

|

|

|

| |||||||||

Segment result | (29,424 | ) | 1,330 | (28,093 | ) | |||||||||||

|

|

|

|

|

| |||||||||||

Unallocated expenses(1) | (3,943 | ) | ||||||||||||||

|

| |||||||||||||||

Operating loss | (32,036 | ) | ||||||||||||||

|

| |||||||||||||||

Financial (expenses) / income(2) | (5,184 | ) | ||||||||||||||

|

| |||||||||||||||

Result before tax | (37,221 | ) | ||||||||||||||

|

| |||||||||||||||

Income taxes(2) | (62 | ) | ||||||||||||||

|

| |||||||||||||||

Net loss | (37,283 | ) | ||||||||||||||

|

| |||||||||||||||

| (1) | Unallocated expenses consist of expenses for warrant plans under IFRS 2 Share based payments. |

| (2) | Financial results and taxes information are not being provided to management in our management reporting as segment results and therefore, their aggregate amount is disclosed at the level of the group in our segment reporting. |

- 24 -

Galapagos NV • Q1 Report 2018

Table of Contents

FINANCIAL STATEMENTS

| Segment information for the three months ended 31 March 2017 | ||||||||||||||||

(thousands of €) | R&D | Fee-for-services | Inter-segment elimination | Group | ||||||||||||

External revenue | 31,950 | 2,042 | 33,992 | |||||||||||||

Internal revenue | 1,005 | (1,005 | ) | — | ||||||||||||

Other income | 5,859 | 12 | 5,871 | |||||||||||||

|

|

|

|

|

|

|

| |||||||||

Revenues & other income | 37,809 | 3,059 | (1,005 | ) | 39,863 | |||||||||||

|

|

|

|

|

|

|

| |||||||||

Segment result | (7,745 | ) | (457 | ) | (8,202 | ) | ||||||||||

|

|

|

|

|

| |||||||||||

Unallocated expenses(1) | (3,023 | ) | ||||||||||||||

|

| |||||||||||||||

Operating loss | (11,225 | ) | ||||||||||||||

|

| |||||||||||||||

Financial (expenses) / income(2) | (2,380 | ) | ||||||||||||||

|

| |||||||||||||||

Result before tax | (13,605 | ) | ||||||||||||||

|

| |||||||||||||||

Income taxes(2) | — | |||||||||||||||

|

| |||||||||||||||

Net loss | (13,605 | ) | ||||||||||||||

|

| |||||||||||||||

| (1) | Unallocated expenses consist of expenses for warrant plans under IFRS 2 Share based payments. |

| (2) | Financial results and taxes information are not being provided to management in our management reporting as segment results and therefore, their aggregate amount is disclosed at the level of the group in our segment reporting. |

The basis of accounting for any transactions between reportable segments is consistent with the valuation rules and with transactions with third parties.

Liquid assets position

Cash and cash equivalents totaled €1,108.2 million on 31 March 2018.

A net decrease of €43.0 million in cash and cash equivalents was recorded during the first three months of 2018, compared to a decrease of €19.9 million during the same period last year. Net cash flows used in operating activities amounted to €39.8 million in the first quarter 2018. Exercise of warrants in the first quarter of 2018 generated a financing cash inflow of €3.9 million. Furthermore €1.5 million was used in investing activities and €5.6 million unrealized negative exchange rate differences were reported on cash and cash equivalents.

Cash and cash equivalents amounted to €1,108.2 million at the end of March 2018 and comprised cash and cash at banks, short term bank deposits and money market funds that are readily convertible to cash and are subject to an insignificant risk of changes in value. Our cash management strategy may allow short term deposits with an original maturity exceeding three months while monitoring all liquidity aspects. Cash and cash equivalents comprised €662.4 million of term deposits with an original maturity longer than three months but which are available upon one month notice period. Cash at banks were mainly composed of savings accounts and current accounts. We maintain our bank deposits in highly rated financial institutions to reduce credit risk. Cash invested in highly liquid money market funds represented €149.6 million and aim at meeting short-term cash commitments, while reducing the counterparty risk of investment.

(thousands of €) | 31 March 2018 | 31 December 2017 | ||||||

Cash at banks | 296,226 | 288,052 | ||||||

Term deposits | 662,355 | 713,446 | ||||||

Money market funds | 149,602 | 149,711 | ||||||

Cash on hand | 3 | 3 | ||||||

|

|

|

| |||||

Total cash and cash equivalents | 1,108,186 | 1,151,211 | ||||||

|

|

|

| |||||

- 25 -

Galapagos NV • Q1 Report 2018

Table of Contents

FINANCIAL STATEMENTS

On 31 March 2018, our cash and cash equivalents included $247.4 million held in U.S. dollars which could generate foreign exchange gain or loss in our financial results in accordance with the fluctuation of the EUR/U.S. dollar exchange rate as our functional currency is EUR. We expect to use this cash held in U.S. dollars to settle our future payables in U.S. dollars which will be primarily linked to our global collaboration with Gilead for the development of filgotinib.

Finally, our balance sheet held R&D incentives receivables from the French government (Crédit d’ImpôtRecherche) amounting to €39.1 million as of 31 March 2018, to be received in four yearly tranches. Our balancesheet also held R&D incentives receivables from the Belgian Government amounting to €41.7 million as at 31 March 2018.

Capital increase

On 31 March 2018, Galapagos NV’s share capital was represented by 51,234,962 shares. All shares were issued, fully paid up and of the same class. The below table summarizes our capital increases for the quarter ended 31 March 2018.

(thousands of €, except share data) | Number of shares | Share capital | Share premium | Share capital and share premium | Average exercise price warrants | Closing share price on date of capital increase | ||||||||||||||||||

On 1 January 2018 | 50,936,778 | 233,414 | 993,025 | 1,226,439 | ||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||

20 March 2018: exercise of warrants | 298,184 | 1,613 | 2,311 | 3,924 | 13.16 | 83.72 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

On 31 March 2018 | 51,234,962 | 235,027 | 995,336 | 1,230,363 | ||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||

Contingencies and commitments

Contractual obligations and commitments

We entered into lease agreements for office and laboratories which qualify as operating leases. We also have certain purchase commitments principally with CRO subcontractors and certain collaboration partners.

On 31 March 2018 we had outstanding obligations for future minimum rent payments and purchase commitments, which become due as follows:

(thousands of €) | Total | Less than 1 year | 1-3 years | 3-5 years | More than 5 years | |||||||||||||||

Operating lease obligations | 25,831 | 4,349 | 7,897 | 5,887 | 7,698 | |||||||||||||||

Purchase commitments | 68,930 | 54,983 | 13,259 | 688 | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total contractual obligations & commitments | 94,761 | 59,332 | 21,156 | 6,575 | 7,698 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

On 31 December 2017, we had outstanding obligations for future minimum rent payments and purchase commitments, which become due as follows:

(thousands of €) | Total | Less than 1 year | 1-3 years | 3-5 years | More than 5 years | |||||||||||||||

Operating lease obligations | 26,346 | 4,150 | 7,820 | 6,010 | 8,366 | |||||||||||||||

Purchase commitments | 65,246 | 53,010 | 11,233 | 1,002 | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total contractual obligations & commitments | 91,592 | 57,160 | 19,053 | 7,012 | 8,366 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

- 26 -

Galapagos NV • Q1 Report 2018

Table of Contents

FINANCIAL STATEMENTS

In addition to the tables above, we have a contractual cost sharing obligation related to our collaboration agreement with Gilead for filgotinib. The contractual cost sharing commitment amounted to €111.6 million at 31 March 2018 (€129.0 million at 31 December 2017), for which we have direct purchase commitments of €6.4 million at 31 March 2018 (€10.1 million at 31 December 2017) reflected in the tables above.

Contingent liabilities and assets

We refer to our annual report 2017 for contingent liabilities and assets.

Significant accounting policies

There were no significant changes in accounting policies applied by us in these condensed consolidated interim financial statements compared to those used in the most recent annual financial statements of 2017, except for the adoption of new standards and interpretations described below.

| • | IFRS 15 Revenue from Contracts with Customers, and clarifications on this IFRS (applicable for annual periods beginning on or after 1 January 2018) |

| • | IFRS 9 Financial Instruments, and subsequent amendments (applicable for annual periods beginning on or after 1 January 2018) |

The nature and the effect of these changes were taken into consideration, and the above amendments affected the interim condensed consolidated financial statements as follows:

IFRS 15 Revenue from Contracts with Customers. As a consequence of the adoption of the new IFRS standard on 1 January 2018, our consolidated accumulated losses and deferred income were both increased for an amount of €83.2 million, reflecting the impact of the new standard on the revenue recognition of the considerations received related to our ongoing license and collaboration agreements. Differences in accounting treatment compared to the former standard were identified for (i) the milestones payments previously received in the scope of our license and collaboration agreement for filgotinib with Gilead, and (ii) the upfront and milestone payments received related to the license and collaboration agreement with AbbVie for cystic fibrosis, which were fully recognized in revenue in the previous years under the former applicable IFRS standard. Finally, the deferred income balance related to the license fee received from Servier in the scope of our license and collaboration agreement in the field of osteoarthritis was fully reclassified to equity as a consequence of the adoption of the new standard. We refer to the revenues disclosure for further detail.

IFRS 9 Financial Instruments. The only financial instrument held by the company subject to change in accounting treatment following the adoption of IFRS 9 – Financial Instruments, was the equity investments in a French biotech company classified asavailable-for-sale financial asset. At 31 December 2017, our balance sheet held shares of this company which were acquired in 2016. The closing price of the share on Euronext as at the end of the year 2017 led to cumulative fair value loss amounting to €0.6 million recognized in other comprehensive income following the accounting treatment applied under IAS 39. Following the adoption of the new IFRS standard on 1 January 2018, and considering that the financial asset should be classified and measured at fair value, with changes in fair value recognized in profit and loss, the cumulative fair value loss of €0.6 million previously recognized in other comprehensive income was reclassified to accumulated losses. Fair value loss amounting to €0.1 million was additionally recognized in profit and loss for the first three months of 2018.

Other new standards and interpretations applicable for the annual period beginning on 1 January 2018 did not have any impact on our consolidated financial statements.

We have not early adopted any other standard, interpretation, or amendment that has been issued but is not yet effective.

- 27 -

Galapagos NV • Q1 Report 2018

Table of Contents

FINANCIAL STATEMENTS

Seasonality

The impact of seasonality or cyclicality on our operations is not regarded as applicable to the unaudited interim condensed consolidated financial statements.

Events after the end of the reporting period

On 19 April 2018, the board of directors of Galapagos approved the “Warrant Plan 2018,” a warrant plan intended mainly for certain (future) employees of the company and its subsidiaries, and also for directors and an independent consultant of the company, and the “Warrant Plan 2018 RMV,” a warrant plan intended for certain employees of its French subsidiary, Galapagos SASU, within the framework of the authorized capital. Under these warrant plans, 1,585,000 warrants were created, subject to acceptances, and offered to the beneficiaries of the plans. The warrants have an exercise term of eight years as of the date of the offer and have an exercise price of €79.88 (the average closing price of the share on Euronext Amsterdam and Brussels during the thirty days preceding the date of the offer). The warrants are not transferable and can in principle not be exercised prior to 1 January 2022. Each warrant gives the right to subscribe to one new Galapagos share.

Approval of interim financial statements

The interim financial statements were approved by the board of directors on 23 April 2018.

- 28 -

Galapagos NV • Q1 Report 2018

Table of Contents

AUDITOR’S REPORT

Report on the review of the consolidated interim financial information for the three-month period ended 31 March 2018

In the context of our appointment as the company’s statutory auditor, we report to you on the consolidated interim financial information. This consolidated interim financial information comprises the consolidated condensed statement of financial position as at 31 March 2018, the consolidated condensed statement of income and comprehensive income, the consolidated condensed cash flow statement and the consolidated condensed statement of changes in equity for the period of three months then ended, as well as selective notes.

Report on the consolidated interim financial information

We have reviewed the consolidated interim financial information of Galapagos NV (“the company”) and its subsidiaries (jointly “the group”), prepared in accordance with International Accounting Standard (IAS) 34, “Interim Financial Reporting” as adopted by the European Union.

The consolidated condensed statement of financial position shows total assets of 1 229 864 (000) EUR and the consolidated condensed income statement shows a consolidated loss (group share) for the period then ended of 37 283 (000) EUR.

The board of directors of the company is responsible for the preparation and fair presentation of the consolidated interim financial information in accordance with IAS 34, “Interim Financial Reporting” as adopted by the European Union. Our responsibility is to express a conclusion on this consolidated interim financial information based on our review.

Scope of review

We conducted our review of the consolidated interim financial information in accordance with International Standard on Review Engagements (ISRE) 2410, “Review of interim financial information performed by the independent auditor of the entity”. A review of interim financial information consists of making inquiries, primarily of persons responsible for financial and accounting matters, and applying analytical and other review procedures. A review is substantially less in scope than an audit performed in accordance with the International Standards on Auditing (ISA) and consequently does not enable us to obtain assurance that we would become aware of all significant matters that might be identified in an audit. Accordingly, we do not express an audit opinion on the consolidated interim financial information.

Conclusion

Based on our review, nothing has come to our attention that causes us to believe that the consolidated interim financial information of Galapagos NV has not been prepared, in all material respects, in accordance with IAS 34, “Interim Financial Reporting” as adopted by the European Union.

Zaventem, 23 April 2018

The statutory auditor

DELOITTE Bedrijfsrevisoren / Réviseurs d’Entreprises

BV o.v.v.e. CVBA / SC s.f.d. SCRL

Represented by Gert Vanhees

The original text of this report is in Dutch

- 29 -

Galapagos NV • Q1 Report 2018

Table of Contents

OTHER INFORMATION

Glossary of terms, to be read only in conjunction with this Q1 Report 2018.

100 points clinical response

Percentage of patients achieving a100-point decrease in CDAI score during a clinical trial in CD patients

ACR

American College of Rheumatology

ACR20 (ACR 20/50/70)

American College of Rheumatology 20% response rate signifies a 20% or greater improvement in the number of swollen and tender joints as well as a 20% or greater improvement in three out of five other disease-activity measures. ACR50 and ACR70 reflect the same, for 50% and 70% response rates, respectively

ADAMTS-5

ADAMTS-5 is a key enzyme involved in cartilage breakdown (Larkin 2015)

ADS

American Depositary Share; Galapagos has a Level 3 ADS listed on NASDAQ with ticker symbol GLPG and CUSIP number 36315X101. One ADS is equivalent to one ordinary share in Galapagos NV

AFM

Dutch Authority for the Financial Markets

ALBATROSS

A Phase 2 trial to evaluate GLPG2222 in ivacaftor-treated CF patients with the Class II mutation on one allele

Anemia

Condition in which the patient has an inadequate number of red blood cells to carry oxygen to the body’s tissues

Ankylosing spondylitis (AS)

AS is a systemic, chronic, and progressive spondyoloarthropathy primarily affecting the spine and sacroiliac joints, and progressing into severe inflammation that fuses the spine, leading to permanent painful stiffness of the back

(anti-)TNF

Tumor necrosis factor. Ananti-TNF drug acts by modulation of TNF

ASDAS

Ankylosing Spondylitis Disease Activity Score, a composite score of symptoms such as back pain, duration of morning stiffness, and peripheral pain and swelling. We measure ASDAS scores in the TORTUGA trial with filgotinib in AS

- 30 -

Galapagos NV • Q1 Report 2018

Table of Contents

OTHER INFORMATION

Atherogenic index

Total cholesterol over HDL ratio. Improvement of the atherogenic index may be a forecast of cardiovascular health

Atopic dermatitis (AtD)

Also known as atopic eczema, atopic dermatitis is a common pruritis inflammatory condition affecting the skin, which most frequently starts in childhood

Attrition rate

The historical success rate for drug discovery and development, based on publicly known development paths. Statistically seen, investment in at least 12 target-based programs is required to ensure that at least one of these will reach a Phase 3 study. Most new drug R&D programs are discontinued before reaching Phase 3 because they are not successful enough to be approved

Autotaxin (ATX)

An enzyme important for generating the signaling molecule lypophosphatidic acid (LPA). GLPG1690 targets autotaxin for IPF

BID dosing

Twice-daily dosing (bis in die)

Bioavailability

Assessment of the amount of product candidate that reaches a body’s systemic circulation after (oral) administration

Biomarker

Substance used as an indicator of a biological process, particularly to determine whether a product candidate has a biological effect

Black & Scholes model

A mathematical description of financial markets and derivative investment instruments that is widely used in the pricing of European options and warrants

Bleomycin model

Apre-clinical model involving use of bleomycin (a cancer medication) to induce IPF symptoms

CDAI

Crohn’s Disease Activity Index, evaluating patients on eight different factors, each of which has apre-defined weight as a way to quantify the impact of CD

CDAI remission

In the FITZROY trial, the percentage of patients with CD who showed a reduction of CDAI score to <150

CFTR

Cystic Fibrosis Transmembrane conductance Regulator protein. CFTR is an ion channel that transports chloride and thiocyanate ions across epithelial cell membranes. Mutations in the CFTR gene, that codes for the CFTR protein, cause CF

- 31 -

Galapagos NV • Q1 Report 2018

Table of Contents

OTHER INFORMATION

CIR

Crédit d’Impôt Recherche, or research credit. Under the CIR, the French government refunds up to 30% of theannual investment in French R&D operations, over a period of three years. Galapagos benefits from the CIR through its operations in Romainville, just outside Paris

Class II mutation

A genetic mutation in CF resulting in errors in CFTR folding, transport of functional CFTR to the cell membrane, and CFTR channel opening, whereby chloride ion flow at the cell surface in the membrane of affected organs is impacted negatively. About 90% of CF patients are carriers of the Class II mutation. It is believed that a potentiator and multiple correctors will be needed to address the CFTR malfunction of Class II mutation patients. Orkambi and Symdeko are the only approved disease-modifying therapies for Class II mutation patients today

Class III mutation

A genetic mutation in CF resulting in errors in CFTR channel opening, whereby chloride ion flow at the cell surface in the membrane of affected organs is impacted negatively. Approximately 8% of CF patients are carriers of the Class III mutation. It is believed that a potentiator is needed to address the malfunction of Class III mutation patients. Kalydeco is the only approved disease-modifying therapy for Class III mutation patients today

Clinical Proof of Concept (PoC)

Point in the drug development process where the product candidate shows efficacy in a therapeutic setting

Compound

A chemical substance, often a small molecule with drug-like properties

Contract research organization

Organization which provides drug discovery and development services

Corrector drug

Drug that restores the correct protein formation in CF patients. In most CF patients, a potentiator and corrector drug are needed in combination to restore the channel function of the CFTR. Galapagos and AbbVie are planning to combine a potentiator with two correctors to be investigated in CF patients with the most prevalent mutation of CFTR

Crohn’s disease (CD)

An IBD involving inflammation of the small and large intestines, leading to pain, bleeding, and ultimately in some cases surgical removal of parts of the bowel

CRP

C-reactive protein is a protein found in the blood, the levels of which rise in response to inflammation

Cystic fibrosis (CF)

A life-threatening genetic disease that affects approximately 80,000 people worldwide. Although the disease affects the entire body, difficulty breathing is the most serious symptom as a result of clogging of the airways due to mucusbuild-up and frequent lung infections

- 32 -

Galapagos NV • Q1 Report 2018

Table of Contents

OTHER INFORMATION

Cytokine

A category of small proteins which play important roles in signaling in processes in the body

Dactylitis

Dactylitis is inflammation of a digit (either finger or toe) and is derived from the Greek word dactylos meaning finger. The affected fingers and/or toes swell up into a sausage shape and can become painful. Dactylitis will be measured in the EQUATOR trial with filgotinib in psoriatic arthritis

DARWIN

Phase 2 program for filgotinib in RA. Completed and reported in 2015 (except for the currently still ongoing DARWIN 3 study). DARWIN 1 explored three doses, in twice-daily and once-daily administration, for up to 24 weeks in RA patients with insufficient response to methotrexate (MTX) and who remained on their stable background treatment with MTX. DARWIN 2 explored three once-daily doses for up to 24 weeks in RA patients with insufficient response to methotrexate (MTX) and who washed out of their treatment with MTX. DARWIN 1 and 2 were double-blind, placebo-controlled trials which recruited approximately 900 patients globally. DARWIN 3 is a long term extension trial currently ongoing; all patients are on 200 mg filgotinib, except for U.S. males who are on 100 mg

DAS28 (CRP)

DAS28 is an RA Disease Activity Score based on a calculation that uses tender and swollen joint counts of 28 defined joints, the physician’s global health assessment and a serum marker for inflammation, such asC-reactive protein. DAS28(CRP) includesc-reactive protein the score calculation: scores range from 2.0 to 10.0, with scores below 2.6 being considered remission

Development

All activities required to bring a new drug to the market. This includespre-clinical and clinical development research, chemical and pharmaceutical development and regulatory filings of product candidates

Discovery

Process by which new medicines are discovered and/or designed. At Galapagos, this is the department that oversees target and drug discovery research through to nomination ofpre-clinical candidates

Disease-modifying

Addresses the disease itself, modifying the disease progression, not just the symptoms of the disease

DIVERSITY

Phase 3 program evaluating filgotinib in CD

DLCO

DLCO (diffusion capacity of the lung for carbon monoxide) is the extent to which oxygen passes from the air sacs of the lungs into the blood. This is measured in IPF patients

Dose-range finding study

Phase 2 clinical study exploring the balance between efficacy and safety among various doses of treatment in patients. Results are used to determine doses for later studies

- 33 -

Galapagos NV • Q1 Report 2018

Table of Contents

OTHER INFORMATION

Double-blind

Term to characterize a clinical trial in which neither the physician nor the patient knows if the patient is taking placebo or the treatment being evaluated

Efficacy

Effectiveness for intended use

EMA

European Medicines Agency, in charge of European market authorization of new medications

Endoscopy

Anon-surgical procedure involving use of an endoscope to examine a person’s digestive tract

Enthesitis

Inflammation of the tendons or ligaments; this is one of the key symptoms of psoriatic arthritis

EQUATOR

A Phase 2 trial with filgotinib in psoriatic arthritis patients

Esbriet

An approved drug (pirfenidone) for IPF, marketed by Roche

FDA

The U.S. Food and Drug Administration is an agency responsible for protecting and promoting public health and in charge of American market approval of new medications

Fee-for-service

Payment system where the service provider is paid a specific amount for each procedure or service performed

FEV

Forced expiratory volume measures how much air a person can exhale during a forced breath. The amount of air exhaled may be measured during the first (FEV1), second (FEV2), and/or third seconds (FEV3) of the forced breath

Fibrotic score

The Ashcroft fibrotic score involves measuring pulmonary fibrosis through examination of histopathology tissue

FIH

First-in-human clinical trial, usually conducted in healthy volunteers with the aim to assess the safety, tolerability and pharmacokinetics of the product candidate

Filgotinib

Formerly known as GLPG0634. Small molecule selective JAK1 inhibitor which showed activity and favorable tolerability in RA and CD patients in Phase 2 trials. Filgotinib is partnered with Gilead. Galapagos and Gilead are running Phase 3 trials with filgotinib in RA, CD, and UC and Phase 2 trials with filgotinib in additional indications. Filgotinib is an investigational drug and its efficacy and safety have not been established

- 34 -

Galapagos NV • Q1 Report 2018

Table of Contents

OTHER INFORMATION

FINCH

Phase 3 program evaluating filgotinib in RA

Fistulizing CD

Fistulae are inflammatory tracts that most often occur between the distal colon and the perianal region. Fistulae are one of the most severe sequelae of luminal CD and the lifetime risk of occurrence is close to 50% of those with active CD

FITZROY

A double-blind, placebo controlled Phase 2 trial with filgotinib in 177 CD patients for up to 20 weeks. Full results were published in The Lancet in 2016

FLAMINGO

A Phase 2 study to evaluate GLPG2222 in patients with CF with the F508del mutation on both alleles

FLORA

A double-blind, placebo-controlled exploratory Phase 2a trial with GLPG1690 in up to 24 IPF patients; topline results were reported in August 2017

FRI

Functional respiratory imaging is a technology which enhances 3D visualization and quantification of a patient’s airway and lung geometry

FSMA

The Belgian market authority: Financial Services and Markets Authority, or Autoriteit voor Financiële Diensten en Markten

FTE

Full-time equivalent; a way to measure an employee’s involvement in a project. For example, an FTE of 1.0 means that the equivalent work of one full-time worker was used on the project

FVC

Forced vital capacity is the amount of air which can be forcibly exhaled from the lungs after taking the deepest breath possible. FVC is used to help determine both the presence and severity of lung diseases such as IPF

GLPG0634

Molecule number currently known as filgotinib

GLPG1205

A GPR84 inhibitor fully proprietary to us. We plan to initiate a patient trial with GLPG1205 in IPF

GLPG1690

A novel drug targeting autotaxin, with potential application in IPF. Fully proprietary to Galapagos. Topline results from the Phase 2a FLORA trial were reported in August 2017

GLPG1837

A potentiator product candidate which showed activity and favorable tolerability in the Phase 2 SAPHIRA 1 and 2 trials in Class III CF mutation patients

- 35 -

Galapagos NV • Q1 Report 2018

Table of Contents

OTHER INFORMATION

GLPG1972

A novelmode-of-action product candidate that is part of the OA alliance with Servier. Galapagos reported positive results in a Phase 1b trial with GLPG1972 in OA patients in the United States in 2017

GLPG2222

A C1 (early) corrector drug candidate which showed favorable tolerability in Phase 1 and activity and favorable tolerability in the ALBATROSS Phase 2 trial in combination with Kalydeco in Class III mutation patients and in the FLAMINGO trial as monotherapy in Class II mutation patients

GLPG2451

A potentiator drug candidate which showed favorable tolerability in Phase 1, also in combination with C1 corrector GLPG2222

GLPG2534

Apre-clinical candidate with a novel mode of action. GLPG2534 is expected to enter Phase 1 trials in 2018

GLPG2737

A C2 (late) corrector drug candidate which showed favorable tolerability in a Phase 1 safety trial. GLPG2737 is currently being tested in the PELICAN trial in combination with Orkambi in Class II mutation CF patients

GLPG2851

A C1 (early) corrector drug candidate which entered Phase 1 trials in 2017

GLPG3067

A potentiator drug candidate which showed favorable tolerability in a Phase 1 trial in 2017, in combination with GLPG2222

GLPG3121

Apre-clinical candidate with undisclosed novel mode of action directed toward inflammation

GLPG3221

A C2 (late) corrector drug candidate currently at thepre-clinical stage. GLPG3221 entered Phase 1 trials in 2017

GLPG3312

Apre-clinical candidate with undisclosed mode of action directed toward inflammation

GLPG3499

Apre-clinical candidate with undisclosed mode of action in the IPF program

GLPG3535

Apre-clinical candidate with undisclosed mode of action directed toward pain in the alliance with Calchan

GLPG3667

Apre-clinical candidate with novel mode of action directed toward inflammation

- 36 -

Galapagos NV • Q1 Report 2018

Table of Contents

OTHER INFORMATION

HDL

High-density lipoprotein. HDL scavenges and reduceslow-density lipoprotein (LDL) which contributes to heart disease at high levels. High levels of HDL reduce the risk for heart disease, while low levels of HDL increase the risk of heart disease

Hemoglobin

A protein inside red blood cells that carries oxygen from the lungs to tissues and organs in the body and carries carbon dioxide back to the lungs

Heterozygous

Genetic term meaning a cell containing different alleles for a gene

Histopathology

Microscopic examination of tissues for manifestations of a disease

Homozygous

Genetic term meaning identical alleles of the gene are present on both homologous chromosomes

IBD