Exhibit 99.2

2022 Q1 Report Foundation & Future

Table of Contents

| The Galapagos group | ||||

Letter to our shareholders | 4 | |||

Potential external impact | 8 | |||

Financial highlights | 11 | |||

Risk factors | 16 | |||

The Galapagos share | 17 | |||

Disclaimer and other information | 18 | |||

Financial statements | ||||

Unaudited condensed consolidated interim financial statements | 22 | |||

Notes | 30 | |||

Other information | ||||

Glossary | 41 | |||

Financial calendar | 57 | |||

Colophon | 58 | |||

Contact | 59 | |||

2

Galapagos Q1 Report 2022

The Galapagos group An overview of Galapagos, its strategy and portfolio in the first three months of 2022 Foundation & Future

Letter to our shareholders

Dear shareholders,

It is an honor to address you for the first time as CEO of Galapagos. I want to express my respect and appreciation to previous CEO and founder Onno van de Stolpe, who successfully built Galapagos from a start-up to an independent, established publicly listed company.

| Galapagos today is a truly unique company: we have the people, the science, the R&D capabilities, and the commercial infrastructure to cover the complete value chain from target discovery to market, with our first medicine, Jyseleca®, available to patients throughout Europe and Japan.

We also have the financial resources to push forward our internal programs and to execute on smart business development opportunities. This should allow us to broaden our pipeline and accelerate our product portfolio. Moreover, we are supported by the long-term collaboration with our partner Gilead, anchoring our independence as a growing fully-fledged European biopharma company for years to come.

I am confident that we have access to all the tools to deliver on what continues to be our core mission: bringing novel medicines to patients around the world, and helping them by adding years of life and improving quality of life.

Together with the board and the teams across the entire organization, we are thoroughly reviewing our R&D portfolio to shape our business strategy and lay the foundations for accelerated growth with the aim to bring transformational medicines to patients. I look forward to sharing my vision and strategy for the future later this year. |

4

Galapagos Q1 Report 2022

| In the meantime, we continue to work hard on making Jyseleca a success. We started the year with the approval in Great Britain of filgotinib 200mg in ulcerative colitis (UC), followed by the approval in Japan in this indication in March. Our commercial teams are fully operational, and our Jyseleca franchise continued to gain momentum with robust sales growth in the first quarter of this year. As of 31 March 2022, Jyseleca is reimbursed in 15 countries, and we realized €14.4 million in net sales.

We ended the first three months of the year with a strong balance sheet of €4.6 billion in cash and current financial investments, which provides us with the necessary means to look for external innovation and accelerate our R&D portfolio. We continue to focus on operational excellence and reiterate our cash burn1 guidance of €450-€490 million for the full year, compared to €564.8 million in 2021, including anticipated net sales for Jyseleca of €65-€75 million. |

Year-to-date operational review

Commercial & regulatory progress with filgotinib in RA and UC:

| • | Strong progress with the roll-out by our own commercial organization across Europe, with reimbursement in 15 countries and a fast uptake in RA and now also in UC since the approval by the EMA (European Medicines Agency) in November 2021 |

| • | Sobi, our distribution and commercialization partner in Eastern and Central Europe, Portugal, Greece, and the Baltic countries, launched Jyseleca in RA in the Czech Republic, resulting in a €1 million milestone payment to Galapagos in Q1 |

| • | The MHRA (Medicines and Healthcare products Regulatory Agency) in Great Britain and the MHLW (Ministry of Health, Labour and Welfare) in Japan approved filgotinib 200mg for the treatment of moderate to severe UC |

| • | Nine presentations at ECCO (European Crohn’s and Colitis Organisation), including 4 new analyses from the Phase 3 SELECTION and SELECTION LTE studies in UC. Initial results from European real-world survey demonstrate the importance of taking an innovative holistic approach to the management of UC |

| • | Article 20 pharmacovigilance procedure ongoing, investigating the safety data of all JAK inhibitors used to treat certain chronic inflammatory disorders |

| 1 | We refer to the financial highlights for an explanation and reconciliation of this alternative liquidity measure |

5

Galapagos Q1 Report 2022

Pipeline and corporate update:

| • | Multiple Phase 1 studies are being finalized with data read-outs expected before year-end Dr. Paul Stoffels2 appointed as Chief Executive Officer, effective as of 1 April 2022 |

| • | Third instalment of €50 million received from Gilead in Q1 as part of the revised filgotinib agreement as announced in December 2020, following payments of earlier instalments totalling €110 million in 2021 |

Raised €2.2 million through the exercise of subscription rights

| • | Received a transparency notification from EcoR1 Capital indicating that its shareholding in Galapagos increased and crossed the 5% threshold, to 5.2% of the current outstanding Galapagos shares |

| • | Created 2 new subscription rights plans within the framework of the authorized capital, offered to certain new members of the personnel of Galapagos or any of its subsidiaries |

Post-period events

| • | Our distribution partner Sobi recently launched Jyseleca in RA in Portugal |

| • | AbbVie announced that a Phase 2 PoC study evaluating a triple combination therapy in cystic fibrosis (CF) did not meet the prespecified criteria. The company plans to start a Phase 2 study with a new triple combo, including the existing C1 corrector and potentiator licensed from Galapagos, early next year. In the event AbbVie receives regulatory approval and realizes commercial sales in CF, Galapagos is eligible to receive royalties ranging from single digit to low teens |

| • | All proposed resolutions regarding the extraordinary and annual shareholders’ meetings have been adopted by our shareholders on 26 April 2022, including the implementation of a one- tier governance structure in accordance with the Belgian Companies and Associations Code, the appointment of Stoffels IMC BV (permanently represented by Dr. Paul Stoffels) as director and the appointments of Jérôme Contamine and Dr. Dan Baker as independent directors of the board. Subsequently, the (new) unitary board has appointed Stoffels IMC BV (permanently represented by Dr. Paul Stoffels) as chair of the board of directors |

Q1 2022 financial result

| • | Jyseleca net sales amount to €14.4 million |

| • | Collaboration revenues of €121.9 million |

| • | R&D expenditures of €99.9 million |

| • | S&M and G&A expenses amounting to €62.3 million |

| • | Net loss of €13.3 million |

| • | Operational cash burn of €77.4 million |

| • | Cash position at end of March 2022 of €4,643.4 million |

| 2 | Acting via Stoffels IMC BV |

6

Galapagos Q1 Report 2022

Outlook 2022

For 2022, we anticipate a significantly lower cash burn compared to 2021 of €450-€490 million, including anticipated net sales for Jyseleca between €65 and €75 million.

We expect reimbursement decisions in most key European markets for Jyseleca in UC this year and anticipate that Sobi will further progress with reimbursement discussions in RA and UC in Eastern and Central Europe, Greece, and the Baltic countries. Following the ongoing article 20 pharmacovigilance procedure on all JAK inhibitors, we expect that the EMA will give its opinion by end of September 2022.

We expect the read out from a Phase 1b trial with JAK1 inhibitor GLPG0555 and a Phase 1 trial with JAK1/TYK2i GLPG3121 in healthy volunteers. In addition, we aim to progress TYK2 inhibitor GLPG3667 into a Phase 2 program, considering the current regulatory and competitive landscape for TYK2 as a class, and to advance selected compounds with optimized pharmacology and selectivity from our SIKi portfolio into the clinic. Furthermore, we are evaluating the start of a Phase 2 trial with chitinase inhibitor GLPG4716 in lung fibrosis.

While we push forward our internal programs and further roll out Jyseleca in RA and UC, we continue to diligently scout for external opportunities. We are confident that in 2022 we will make significant progress to accelerate our innovative pipeline with the aim to address unmet medical needs.

We want to thank you for your continued support, and we look forward to presenting an in-depth update on our future plans and strategy later this year.

Respectfully,

Dr. Paul Stoffels2

CEO

Bart Filius

President, COO & CFO

| 2 | Acting via Stoffels IMC BV |

7

Galapagos Q1 Report 2022

Potential external impact

COVID-19

As the start of 2022 was globally marked by steeply increasing infection rates of COVID-19 mainly due to the spread of the highly infectious Omicron-variant, we continue to innovate to accommodate for the new situation and minimize the impact to our operations. We closely follow local governmental measures and apply these as appropriate within our organization, guided and supported by our dedicated COVID-19 task force teams. All local and global task force teams meet regularly and make recommendations directly to the COO. We report the following impact:

| • | Staff |

At Galapagos, we maintained the strict measures put in place by local governments to help prevent the spread of the COVID-19 virus and protect the physical and mental health of our staff. The majority of our research staff continued to work from the office/labs. For teleworkable functions we continued the implementation of our hybrid working model launched in 2021, in locations where the ongoing COVID-19 situation and corresponding local governmental measures permitted us to do so. For those employees coming to the office, we maintained stringent cleaning and sanitation protocols, and we strictly respected social distancing policies at all times in order to minimize risk of exposure. We further kept our global and site-specific business continuity plans up-to-date and continued to take appropriate recommended precautions.

We learned during the pandemic that most of the international travel could be replaced by virtual meetings, resulting in improved cost efficiency, a better work-life balance, and a reduced carbon footprint. The impact of this new way-of-working has been retained and has become part of our corporate travel guidance. On the other hand, we noticed during the month of March 2022, when infection rates lowered significantly, an increasing appetite to start meeting in person again and to attend professional (international) events. For those who needed to attend or organize events, we did implement a global policy providing guidance on how to safely organize or attend any such professional events, both internally and externally.

| • | Research portfolio |

By prioritizing the most advanced projects very early on, and increasing the flexibility of our staff in the labs within projects, we sustained our research delivery timelines, kept the compound management facility running at all times, and continued our early drug research and the implementation of new modalities for target or drug discovery.

The scorecard of the research department objectives shows a similar productivity compared to previous years, indicating that we were able to minimize the impact, at least in the short term.

8

Galapagos Q1 Report 2022

| • | Development portfolio |

We have a business continuity plan for our clinical development programs. We closely monitor each program in the context of the current global and local situation of the COVID-19 pandemic and the associated specific regulatory, institutional, government guidance and policies related to COVID-19. Within the boundaries of these guidelines and policies, and in consultation with our CROs and clinical trial sites, we applied various measures to minimize the impact of the COVID-19 pandemic on our clinical development programs, with the primary aim to ensure the safety of our trial participants and to preserve the data integrity and scientific validity of the trials. These measures were implemented on a case-by-case basis, tailored to the specific study and country needs at any given time, with specific attention paid to vulnerable populations and the use of investigational medicines with immunosuppressive properties. The measures include, amongst others, increased, transparent communication to all stakeholders and the direct supply of investigational medicines to patients. For each clinical trial, we actively monitor and document the impact of COVID-19 to mitigate its effect on the study where necessary and to facilitate the interpretation and reporting of results.

| • | Manufacturing and supply chain |

To date, there has been no impact to the commercial supply of filgotinib as the result of the COVID-19 pandemic. All sites involved in the manufacturing of filgotinib are established sites that currently manufacture other marketed products and are in good standing with the FDA and are GMP certified. Galapagos became marketing authorization holder of filgotinib in the European Economic Area and Great Britain at the end of 2021, and is responsible for the manufacturing of filgotinib. The same manufacturing sites that supplied Gilead continue to supply filgotinib except for secondary packaging and labelling for which a new vendor has been selected.

| • | Commercial organization |

The form of outreach of our commercial teams to physicians and hospitals was impacted by the COVID-19 pandemic and consequent travel restrictions, and thus became partially virtual. The teams invested in digital channels as part of the overall commercial build strategy, and these channels are being utilized during our ongoing commercial launch. Thus far we note no material impact on the relative competitiveness of our commercial operations due to travel restrictions, nor have the effects of COVID-19 impacted our ability to engage in market access discussions. Nevertheless, healthcare systems are under pressure across Europe, increasing the volatility in reimbursement procedures and potentially reducing the number of new therapy options initiated by healthcare providers.

9

Galapagos Q1 Report 2022

Conflict in Ukraine

The armed conflict between Russia and Ukraine could cause a disruption in our operations. We currently have ongoing clinical studies for filgotinib with CROs located in Ukraine and Russia. If our CROs experience disruptions to their business due to the military conflict in Ukraine and the sanctions against Russia, it could result in delays in our clinical development activities, including delay of our clinical development plans and timelines, or could cause interruptions in operations of regulatory authorities. The impact on ongoing pivotal studies such as DIVERSITY 1 has remained limited. We continue to monitor the situation and are taking measures to mitigate the impact on our ability to conduct clinical development activities. Interruptions or delays in our and our CROs’ ability to meet expected clinical development deadlines or to comply with contractual commitments with respect to the same, could lead to delays in our overall developmental and commercialization timelines, which would adversely impact our ability to conduct clinical development activities and complete them on a timely basis. Since 24 February 2022, we have extended the focus of the business continuity plan to closely monitor each program in context of the currently ongoing Ukraine-Russia conflict and the associated specific regulatory, institutional, and government guidance and policies.

10

Galapagos Q1 Report 2022

Financial highlights

Consolidated Key Figures

(thousands of €, if not stated otherwise) | Three months ended 31 March 2022 | Three months ended 31 March 2021 | Year ended 31 December 2021 | |||||||||

Income statement | ||||||||||||

Product net sales | 14,411 | 79 | 14,753 | |||||||||

Collaboration revenues | 121,936 | 113,813 | 470,093 | |||||||||

Cost of sales | (2,912 | ) | (38 | ) | (1,629 | ) | ||||||

R&D expenditure | (99,921 | ) | (129,960 | ) | (491,707 | ) | ||||||

S&M, G&A expenses | (62,339 | ) | (44,958 | ) | (210,855 | ) | ||||||

Other operating income | 7,680 | 10,266 | 53,749 | |||||||||

Operating loss | (21,146 | ) | (50,798 | ) | (165,596 | ) | ||||||

Net financial results | 9,561 | 38,125 | 42,598 | |||||||||

Taxes | (1,724 | ) | (157 | ) | (2,423 | ) | ||||||

Net loss from continuing operations | (13,310 | ) | (12,830 | ) | (125,422 | ) | ||||||

Net profit from discontinued operations, net of tax | — | 22,191 | 22,191 | |||||||||

Net profit/loss (-) | (13,310 | ) | 9,361 | (103,231 | ) | |||||||

Balance sheet | ||||||||||||

Cash and cash equivalents | 1,254,279 | 2,553,950 | 2,233,368 | |||||||||

Current financial investments | 3,389,098 | 2,560,743 | 2,469,809 | |||||||||

R&D incentives receivables | 149,477 | 142,304 | 144,013 | |||||||||

Assets | 5,100,315 | 5,615,059 | 5,193,160 | |||||||||

Shareholders’ equity | 2,646,589 | 2,701,462 | 2,643,362 | |||||||||

Deferred income | 2,269,223 | 2,698,417 | 2,364,701 | |||||||||

Other liabilities | 184,503 | 215,180 | 185,097 | |||||||||

11

Galapagos Q1 Report 2022

(thousands of €, if not stated otherwise) | Three months ended 31 March 2022 | Three months ended 31 March 2021 | Year ended 31 December 2021 | |||||||||

Cash flow | ||||||||||||

Operational cash burn | (77,382 | ) | (127,669 | ) | (564,840 | ) | ||||||

Cash flow used in operating activities | (61,969 | ) | (121,209 | ) | (503,827 | ) | ||||||

Cash flow generated from/used in (-) investing activities | (933,453 | ) | 499,859 | 541,238 | ||||||||

Cash flow generated from/used in (-) financing activities | (25 | ) | 478 | (3,876 | ) | |||||||

Increase/decrease (-) in cash and cash equivalents | (995,446 | ) | 379,129 | 33,535 | ||||||||

Effect of currency exchange rate fluctuation on cash and cash equivalents | 16,358 | 31,750 | 56,763 | |||||||||

Cash and cash equivalents at the end of the period | 1,254,279 | 2,553,950 | 2,233,368 | |||||||||

Current financial investments at the end of the period | 3,389,098 | 2,560,743 | 2,469,809 | |||||||||

Total current financial investments and cash and cash equivalents at the end of the period | 4,643,377 | 5,114,693 | 4,703,177 | |||||||||

Financial ratios | ||||||||||||

Number of shares issued at the end of the period | 65,648,221 | 65,511,581 | 65,552,721 | |||||||||

Basic income/loss (-) per share (in €) | (0.20 | ) | 0.14 | (1.58 | ) | |||||||

Diluted income/loss (-) per share (in €) | (0.20 | ) | 0.14 | (1.58 | ) | |||||||

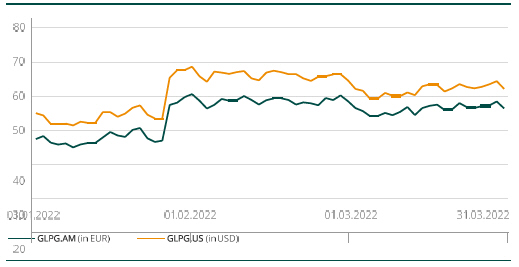

Share price at the end of the period (in €) | 56.30 | 66.12 | 49.22 | |||||||||

Total group employees at the end of the period (number) | 1,305 | 1,328 | 1,309 | |||||||||

12

Galapagos Q1 Report 2022

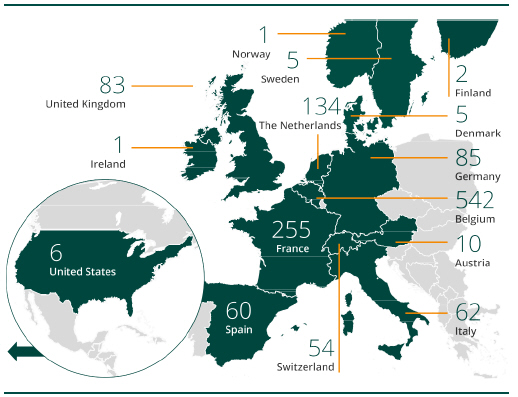

Employees per site as of 31 March 2022

(total: 1,305 employees)

Q1 2022 financial results

We reported product net sales of Jyseleca in Europe for the first three months of 2022 amounting to €14.4 million (€0.1 million in the first quarter of 2021). Our counterparties for the sales of Jyseleca were mainly hospitals and wholesalers located in Belgium, the Netherlands, France, Italy, Spain, Germany, the United Kingdom, Ireland, Austria, Norway, Sweden and Finland.

Cost of sales related to Jyseleca net sales in the first three months of 2022 amounted to €2.9 million.

Collaboration revenues amounted to €121.9 million for the first three months of 2022, compared to €113.8 million for the first three months of 2021.

Revenues recognized related to the collaboration agreement with Gilead for the filgotinib development were €59.0 million in the first three months of 2022 compared to €55.3 million for the same period last year. This slight increase was mainly due to higher revenue recognition of milestone payments strongly influenced by the milestone achieved related to the regulatory approval in Japan for UC in the first quarter of 2022.

13

Galapagos Q1 Report 2022

The revenue recognition related to the exclusive access rights for Gilead to our drug discovery platform amounted to €57.3 million for the first three months of 2022 (€57.8 million for the same period last year).

We have recognized royalty income from Gilead for Jyseleca for €4.6 million in the first three months of 2022 (compared to €0.7 million in the same period last year) of which €3.6 million royalties on milestone income for UC approval in Japan.

Additionally, we recorded a milestone of €1.0 million triggered by the first sale of Jyseleca in Czech Republic by our distribution and commercialization partner Sobi, in the first quarter of 2022.

Our deferred income balance on 31 March 2022 includes €1.7 billion allocated to our drug discovery platform that is recognized linearly over the remaining period of our 10 year collaboration, and €0.6 billion allocated to filgotinib development that is recognized over time until the end of the development period.

Our R&D expenditure in the first three months of 2022 amounted to €99.9 million, compared to €130.0 million for the first three months of 2021. This decrease was primarily explained by a decrease in subcontracting costs from €73.0 million in the first quarter of 2021 to €41.7 million in the first quarter of 2022, primarily due to the winding down of the ziritaxestat (IPF) program and reduced spend on our Toledo (SIKi) and other programs. This was partly offset by cost increases for our filgotinib program, on a three months basis compared to the same period in 2021.

Our S&M expenses were €29.0 million in the first three months of 2022, compared to €14.5 million in the first three months of 2021. This increase was primarily due to an increase in personnel costs (€16.0 million for the first three months of 2022 compared to €10.3 million for the same period last year) explained by an increase in the commercial work force from 170 average FTEs in the first quarter of 2021 to 301 average FTEs in the first quarter of 2022 driven by the commercial launch of filgotinib in Europe. The cost increase was also explained by the termination of our 50/50 filgotinib co-commercialization cost sharing agreement with Gilead which explains €6.6 million of variance as in the first quarter of 2021 €6.6 million of costs were expensed to Gilead compared to nil in the first quarter of 2022.

Our G&A expenses were €33.4 million in the first three months of 2022, compared to €30.4 million in the first three months of 2021. The cost increase was primarily due to an increase in personnel costs (€20.4 million for the first three months of 2022 compared to €16.2 million for the same period last year) primarily explained by higher costs for our RSU plans.

Other operating income (€7.7 million for the first three months of 2022, compared to €10.3 million for the first three months of 2021) decreased by €2.6 million, mainly driven by lower grant and R&D incentive income.

We reported an operating loss amounting to €21.1 million for the first three months of 2022, compared to an operating loss of €50.8 million for the same period last year.

14

Galapagos Q1 Report 2022

Net other financial income in the first three months of 2022 amounted to €9.7 million (as compared to net other financial income of €36.2 million in the same period last year). Net financial income in the first three months of 2022 was primarily attributable to €13.8 million of unrealized currency exchange gain on our cash and cash equivalents and current financial investments at amortized cost in U.S. dollar (as compared to €45.5 million currency exchange gain on cash and cash equivalents and current financial investments in the first three months of 2021) and €0.2 million negative changes in (fair) value of current financial investments (€3.6 million in the same period last year). The other financial expenses also contained the effect of discounting our long term deferred income of €1.9 million (€2.4 million in the same period last year), as well as interest expenses of €2.1 million (€1.4 million in the same period last year). The fair value loss of financial assets held at fair value through profit or loss amounted to nil in the first three months in 2022 (as compared to €2.9 million in the same period last year),

We realized a net loss from continuing operations of €13.3 million for the first three months of 2022, compared to a net loss of €12.8 million for the first three months of 2021.

The net profit from discontinued operations for the first three months of 2021 consisted of the gain on the sale of Fidelta, our fee-for-services business, for €22.2 million.

We reported a group net loss for the first three months of 2022 of €13.3 million, compared to a net profit of €9.4 million for the same period last year.

Cash, cash equivalents and current financial investments

Cash and cash equivalents and current financial investments totaled €4,643.4 million on 31 March 2022 (€4,703.2 million on 31 December 2021).

A net decrease of €59.8 million in cash and cash equivalents and current financial investments was recorded during the first three months of 2022, compared to a net decrease of €54.6 million during the first three months of 2021. This net decrease was composed of (i) €77.4 million of operational cash burn, (ii) offset by €2.2 million of cash proceeds from capital and share premium increase from exercise of subscription rights in the first three months of 2022, and (iii) €0.2 million of negative changes in (fair) value of current financial investments and €15.6 million of mainly positive exchange rate differences.

The operational cash burn (or operational cash flow if this liquidity measure is positive) is a financial measure that is not calculated in accordance with IFRS. Operational cash burn/cash flow is defined as the increase or decrease in our cash and cash equivalents (excluding the effect of exchange rate differences on cash and cash equivalents), minus:

i. the net proceeds, if any, from share capital and share premium increases included in the net cash flows generated from/used in (–) financing activities

ii. the net proceeds or cash used, if any, in acquisitions or disposals of businesses; the movement in restricted cash and movement in current financial investments, if any, included in the net cash flows generated from/used in (–) investing activities.

This alternative liquidity measure is in our view an important metric for a biotech company in the development stage.

15

Galapagos Q1 Report 2022

The following table provides a reconciliation of the operational cash burn:

| Three months ended 31 March | ||||||||

(thousands of €) | 2022 | 2021 | ||||||

Increase/decrease (-) in cash and cash equivalents (excluding effect of exchange differences) | (995,446 | ) | 379,129 | |||||

Less: | ||||||||

Net proceeds from capital and share premium increases | (2,160 | ) | (2,258 | ) | ||||

Net purchase/sale (-) of current financial investments | 920,224 | (475,844 | ) | |||||

Cash in from disposals of subsidiaries, net of cash disposed of | — | (28,696 | ) | |||||

|

|

|

| |||||

Total operational cash burn | (77,382 | ) | (127,669 | ) | ||||

|

|

|

| |||||

Risk factors

We refer to the description of risk factors in the 2021 annual report, pp. 57-69, as supplemented by the description of risk factors in our annual report on Form 20-F filed with the U.S. Securities and Exchange Commission, pp. 6-50. In summary of the foregoing, the principal risks and uncertainties faced by us relate to and include, but are not limited to: commercialization, product development and regulatory approval; our financial position and need for additional capital; our reliance on third parties; our competitive position; our intellectual property; our organization, structure and operation (including the emergence of pandemics such as COVID-19); and market risks relating to our shares and ADSs.

We also refer to the description of the group’s financial risk management given in the 2021 annual report, pp. 250-254, which remains valid and unaltered.

16

Galapagos Q1 Report 2022

Disclaimer and other information

Galapagos NV is a limited liability company organized under the laws of Belgium, having its registered office at Generaal De Wittelaan L11 A3, 2800 Mechelen, Belgium. Throughout this report, the term “Galapagos NV” refers solely to the non-consolidated Belgian company and references to “we,” “our,” “the group” or “Galapagos” include Galapagos NV together with its subsidiaries.

With the exception of filgotinib’s approval as Jyseleca® for the treatment of rheumatoid arthritis and ulcerative colitis by the European Commission, Great Britain’s Medicines and Healthcare Products Regulatory Agency and Japanese Ministry of Health, Labour and Welfare, our drug candidates mentioned in this report are investigational; their efficacy and safety have not been fully evaluated by any regulatory authority.

This report is published in Dutch and in English. In case of inconsistency between the Dutch and the English versions, the Dutch version shall prevail. Galapagos is responsible for the translation and conformity between the Dutch and English version.

This report is available free of charge and upon request addressed to:

Galapagos NV

Investor Relations

Generaal De Wittelaan L11

A3 2800 Mechelen, Belgium

Tel: +32 15 34 29 00

Email: ir@glpg.com

A digital version of this report is available on our website, www.glpg.com.

We will use reasonable efforts to ensure the accuracy of the digital version, but we do not assume responsibility if inaccuracies or inconsistencies with the printed document arise as a result of any electronic transmission. Therefore, we consider only the printed version of this report to be legally valid. Other information on our website or on other websites does not form a part of this report.

Jyseleca® is a trademark of Galapagos NV and Gilead Sciences, Inc. or its related companies.

Listings

Euronext Amsterdam and Brussels:

GLPG Nasdaq: GLPG

18

Galapagos Q1 Report 2022

Forward-looking statements

This report contains forward-looking statements, all of which involve certain risks and uncertainties. These statements are often, but are not always, made through the use of words or phrases such as “believe,” “anticipate,” “expect,” “intend,” “plan,” “seek,” “estimate,” “may,” “will,” “could,” “stand to,” “continue,” “should,” “encouraging,” “aim,” “further” as well as similar expressions. Forward-looking statements contained in this report include, but are not limited to, statements made in the “Letter to our shareholders”, the information provided in the section captioned “Outlook 2022”, guidance from management regarding the expected operational use of cash during financial year 2022, statements regarding expected financial results, statements regarding the amount and timing of potential future milestones, opt-in and/or royalty payments by Gilead, Galapagos’ R&D strategy, including progress on our fibrosis portfolio and our SIK platform, and potential changes in such strategy, statements regarding the strategic re- evaluation, our statements and expectations regarding commercial sales of filgotinib, statements regarding the global R&D collaboration with Gilead and regarding the amendment of our arrangement with Gilead for the commercialization and development of filgotinib, statements regarding the expected timing, design and readouts of ongoing and planned clinical trials (i) with filgotinib in rheumatoid arthritis, ulcerative colitis and Crohn’s disease, (ii) with GLPG0555 in osteoarthritis, (iii) with GLPG3121 in IBD, (iv) with GLPG3667 in psoriasis and ulcerative colitis, (v) with GLPG4399 in inflammation, (vi) with compounds from our SIKi portfolio, (vii) with GLPG4716 in IPF, (viii) with GLPG4586 and GLPG4605 in fibrosis, and (ix) with GLPG2737 in ADPKD, statements related to the EMA’s planned safety review of JAK inhibitors used to treat certain inflammatory disorders, including filgotinib, initiated at the request of the European Commission (EC) under article 20 of Regulation (EC) No 726/2004, statements relating to interactions with regulatory authorities, the timing or likelihood of additional regulatory authorities’ approval of marketing authorization for filgotinib for RA, UC or any other indication, including the UC and IBD indications for filgotinib in Europe, Great Britain, Japan, and the U.S., such additional regulatory authorities requiring additional studies, statements regarding changes in our executive committee and key personnel, our ability to effectively transfer knowledge during this period of transition, the search and recruitment of a CSO, statements regarding the anticipated benefits from its leadership transition plan, the timing or likelihood of pricing and reimbursement interactions for filgotinib, statements relating to the build-up of our commercial organization, commercial sales for filgotinib and rollout in Europe, statements regarding the effect of the conflict between Russia and Ukraine on our operations and ongoing studies (including the impact on our DIVERSITY 1 study), statements regarding the expected impact of COVID-19, and statements regarding our strategy, business plans and focus. We caution the reader that forward-looking statements are based on management’s current expectations and beliefs, and are not guarantees of future performance. Forward-looking statements may involve known and unknown risks, uncertainties and other factors which might cause our actual results, financial condition and liquidity, performance or achievements, or the industry in which we operate, to be materially different from any historic or future results, financial conditions, performance or achievements expressed or implied by such forward-looking statements. Such risks include, but are not limited to, the risk that our beliefs, assumptions and expectations regarding our 2022 revenues and financial results and/or our 2022 operating expenses may be incorrect (including because one or more of our assumptions underlying our revenue or expense expectations may not be realized), the inherent risks and uncertainties associated with competitive developments, clinical trial and product development activities and regulatory approval requirements (including

19

Galapagos Q1 Report 2022

the risk that data from our ongoing and planned clinical research programs in rheumatoid arthritis, Crohn’s disease, ulcerative colitis, idiopathic pulmonary fibrosis, osteoarthritis, other inflammatory indications and kidney disease may not support registration or further development of our product candidates due to safety, or efficacy concerns, or other reasons), risks related to our reliance on collaborations with third parties (including our collaboration partner, Gilead), risks related to the implementation of the transition of the European commercialization responsibility of filgotinib from Gilead to us, the risk that the transition will not be completed on the currently contemplated timeline or at all, including the transition of the supply chain, and the risk that the transition will not have the currently expected results for our business and results of operations, the risk that estimates regarding our filgotinib development program and the commercial potential of our product candidates and Galapagos’ expectations regarding the costs and revenues associated with the transfer of European commercialization rights to filgotinib may be incorrect, the risk that Galapagos will not be able to continue to execute on its currently contemplated business plan and/or will revise its business plan, the risk that Galapagos will be unable to successfully achieve the anticipated benefits from its leadership transition plan, the risk that Galapagos will encounter challenges retaining or attracting talent, risks related to disruption in our operations due to the conflict between Russia and Ukraine, the risks related to continued regulatory review of filgotinib following approval by relevant regulatory authorities and the EMA’s planned safety review of JAK inhibitors used to treat certain inflammatory disorders, including the risk that the EMA and/or other regulatory authorities determine that additional non-clinical or clinical studies are required with respect to filgotinib, the risk that the EMA may require that the market authorization for filgotinib in the EU be amended, the risk that the EMA may impose JAK class-based warnings, the risk that the EMA’s planned safety review may negatively impact acceptance of filgotinib by patients, the medical community and healthcare payors and the risks and uncertainties relating to the impact of the COVID-19 pandemic. A further list and description of these risks, uncertainties and other risks can be found in our filings and reports with the Securities and Exchange Commission (SEC), including in our most recent annual report on Form 20-F filed with the SEC and our subsequent filings and reports filed with the SEC. We also refer to the “Risk Factors” section of this report. Given these risks and uncertainties, the reader is advised not to place any undue reliance on such forward- looking statements. In addition, even if our result of operations, financial condition and liquidity, and the industry in which we operate are consistent with such forward-looking statements, they may not be predictive of results or developments in future periods. These forward-looking statements speak only as of the date of publication of this document. We expressly disclaim any obligation to update any such forward-looking statements in this document to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based or that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements, unless specifically required by law or regulation.

20

Galapagos Q1 Report 2022

Financial Statements Unaudited condensed consolidated interim financial statements for the first three months of 2022

Foundation & Future

Unaudited condensed consolidated

interim financial statements for the first

three months of 2022

Consolidated statements of income and

comprehensive income/loss (-)

(unaudited)

Consolidated income statement

| Three months ended 31 March | ||||||||

(thousands of €, except per share data) | 2022 | 2021 | ||||||

Product net sales | 14,411 | 79 | ||||||

Collaboration revenues | 121,936 | 113,813 | ||||||

|

|

|

| |||||

Total net revenues | 136,347 | 113,892 | ||||||

|

|

|

| |||||

Cost of sales | (2,912 | ) | (38 | ) | ||||

Research and development expenditure | (99,921 | ) | (129,960 | ) | ||||

Sales and marketing expenses | (28,984 | ) | (14,536 | ) | ||||

General and administrative expenses | (33,355 | ) | (30,422 | ) | ||||

Other operating income | 7,680 | 10,266 | ||||||

|

|

|

| |||||

Operating loss | (21,146 | ) | (50,798 | ) | ||||

|

|

|

| |||||

Fair value re-measurement of warrants | (185 | ) | 1,970 | |||||

Other financial income | 15,058 | 47,500 | ||||||

Other financial expenses | (5,312 | ) | (11,345 | ) | ||||

|

|

|

| |||||

Loss before tax | (11,586 | ) | (12,673 | ) | ||||

|

|

|

| |||||

22

Galapagos Q1 Report 2022

| Three months ended 31 March | ||||||||

(thousands of €, except per share data) | 2022 | 2021 | ||||||

Income taxes | (1,724 | ) | (157 | ) | ||||

|

|

|

| |||||

Net loss from continuing operations | (13,310 | ) | (12,830 | ) | ||||

|

|

|

| |||||

Net profit from discontinued operations, net of tax | — | 22,191 | ||||||

|

|

|

| |||||

Net profit/loss (-) | (13,310 | ) | 9,361 | |||||

|

|

|

| |||||

Net profit/loss (-) attributable to: | ||||||||

Owners of the parent | (13,310 | ) | 9,361 | |||||

|

|

|

| |||||

Basic income/loss (-) per share | (0.20 | ) | 0.14 | |||||

|

|

|

| |||||

Diluted income/loss (-) per share | (0.20 | ) | 0.14 | |||||

|

|

|

| |||||

Basic and diluted loss per share from continuing operations | (0.20 | ) | (0.20 | ) | ||||

|

|

|

| |||||

The accompanying notes form an integral part of these condensed consolidated financial statements.

23

Galapagos Q1 Report 2022

Consolidated statement of comprehensive income / loss (–)

| Three months ended 31 March | ||||||||

(thousands of €) | 2022 | 2021 | ||||||

Net profit/loss (-) | (13,310 | ) | 9,361 | |||||

|

|

|

| |||||

Items that may be reclassified subsequently to profit or loss: | ||||||||

Translation differences, arisen from translating foreign activities | (19 | ) | 298 | |||||

Realization of translation differences upon sale of foreign operations | — | 731 | ||||||

|

|

|

| |||||

Other comprehensive income/loss (-), net of income tax | (19 | ) | 1,029 | |||||

|

|

|

| |||||

Total comprehensive income/loss (-) attributable to: | ||||||||

Owners of the parent | (13,329 | ) | 10,390 | |||||

|

|

|

| |||||

Total comprehensive income/loss (-) attributable to owners of the parent arises from: | ||||||||

Continuing operations | (13,329 | ) | (12,532 | ) | ||||

Discontinued operations | — | 22,922 | ||||||

|

|

|

| |||||

Total comprehensive income/loss (-) | (13,329 | ) | 10,390 | |||||

|

|

|

| |||||

The accompanying notes form an integral part of these condensed consolidated financial statements.

24

Galapagos Q1 Report 2022

Consolidated statements of financial position

(unaudited)

(thousands of €) | 31 March | 31 December | ||||||

| 2022 | 2021 | |||||||

Assets | ||||||||

Intangible assets | 59,151 | 60,103 | ||||||

Property, plant and equipment | 145,896 | 137,512 | ||||||

Deferred tax assets | 4,037 | 4,032 | ||||||

Non-current R&D incentives receivables | 132,650 | 127,186 | ||||||

Other non-current assets | 7,881 | 2,473 | ||||||

|

|

|

| |||||

Non-current assets | 349,615 | 331,306 | ||||||

|

|

|

| |||||

Inventories | 18,398 | 20,569 | ||||||

Trade and other receivables | 61,694 | 111,337 | ||||||

Current R&D incentives receivables | 16,827 | 16,827 | ||||||

Current financial investments | 3,389,098 | 2,469,809 | ||||||

Cash and cash equivalents | 1,254,279 | 2,233,368 | ||||||

Other current assets | 10,403 | 9,945 | ||||||

|

|

|

| |||||

Current assets | 4,750,700 | 4,861,854 | ||||||

|

|

|

| |||||

Total assets | 5,100,315 | 5,193,160 | ||||||

|

|

|

| |||||

Equity and liabilities | ||||||||

Share capital | 292,592 | 292,075 | ||||||

Share premium account | 2,732,034 | 2,730,391 | ||||||

Other reserves | (10,230 | ) | (10,177 | ) | ||||

Translation differences | (1,688 | ) | (1,722 | ) | ||||

Accumulated losses | (366,119 | ) | (367,205 | ) | ||||

|

|

|

| |||||

Total equity | 2,646,589 | 2,643,362 | ||||||

|

|

|

| |||||

25

Galapagos Q1 Report 2022

(thousands of €) | 31 March | 31 December | ||||||

| 2022 | 2021 | |||||||

Retirement benefit liabilities | 11,866 | 11,699 | ||||||

Non-current lease liabilities | 18,289 | 19,655 | ||||||

Other non-current liabilities | 9,575 | 7,135 | ||||||

Non-current deferred income | 1,851,100 | 1,944,836 | ||||||

|

|

|

| |||||

Non-current liabilities | 1,890,830 | 1,983,325 | ||||||

|

|

|

| |||||

Current lease liabilities | 7,065 | 7,204 | ||||||

Trade and other liabilities | 134,668 | 137,418 | ||||||

Current tax payable | 2,651 | 1,782 | ||||||

Current financial instruments | 389 | 204 | ||||||

Current deferred income | 418,124 | 419,866 | ||||||

|

|

|

| |||||

Current liabilities | 562,896 | 566,474 | ||||||

|

|

|

| |||||

Total liabilities | 2,453,725 | 2,549,798 | ||||||

|

|

|

| |||||

Total equity and liabilities | 5,100,315 | 5,193,160 | ||||||

|

|

|

| |||||

The accompanying notes form an integral part of these condensed consolidated financial statements.

26

Galapagos Q1 Report 2022

Consolidated cash flow statements

(unaudited)

| Three months ended 31 March | ||||||||

(thousands of €) | 2022 | 2021 | ||||||

Net profit/loss (-) of the period | (13,310 | ) | 9,361 | |||||

|

|

|

| |||||

Adjustment for non-cash transactions | 9,652 | (7,980 | ) | |||||

Adjustment for items to disclose separately under operating cash flow | 3,125 | 792 | ||||||

Adjustment for items to disclose under investing and financing cash flows | — | (28,842 | ) | |||||

Change in working capital other than deferred income | 40,111 | 19,673 | ||||||

Decrease in deferred income | (97,418 | ) | (113,164 | ) | ||||

|

|

|

| |||||

Cash used in operations | (57,840 | ) | (120,161 | ) | ||||

|

|

|

| |||||

Interest paid | (3,964 | ) | (1,482 | ) | ||||

Interest received | 633 | 648 | ||||||

Corporate taxes paid | (799 | ) | (214 | ) | ||||

|

|

|

| |||||

Net cash flows used in operating activities | (61,969 | ) | (121,209 | ) | ||||

|

|

|

| |||||

Purchase of property, plant and equipment | (9,178 | ) | (8,488 | ) | ||||

Purchase of and expenditure in intangible fixed assets | (487 | ) | (243 | ) | ||||

Purchase of current financial investments | (1,422,417 | ) | (201,188 | ) | ||||

Interest received related to current financial investments | — | 6 | ||||||

Sale of current financial investments | 502,193 | 677,032 | ||||||

Cash in from disposals of subsidiaries, net of cash disposed of | — | 28,696 | ||||||

Acquisition of financial assets | (3,564 | ) | — | |||||

Proceeds from sale of financial assets held at fair value through profit or loss | — | 4,045 | ||||||

|

|

|

| |||||

Net cash flows generated from/used in (-) investing activities | (933,453 | ) | 499,859 | |||||

|

|

|

| |||||

27

Galapagos Q1 Report 2022

| Three months ended 31 March | ||||||||

(thousands of €) | 2022 | 2021 | ||||||

Payment of lease liabilities | (2,184 | ) | (1,780 | ) | ||||

Proceeds from capital and share premium increases from exercise of subscription rights | 2,160 | 2,258 | ||||||

|

|

|

| |||||

Net cash flows generated from/used in (-) financing activities | (25 | ) | 478 | |||||

|

|

|

| |||||

Increase/decrease (-) in cash and cash equivalents | (995,446 | ) | 379,129 | |||||

|

|

|

| |||||

Cash and cash equivalents at beginning of year | 2,233,368 | 2,143,071 | ||||||

|

|

|

| |||||

Increase/decrease (-) in cash and cash equivalents | (995,446 | ) | 379,129 | |||||

Effect of exchange rate differences on cash and cash equivalents | 16,358 | 31,750 | ||||||

|

|

|

| |||||

Cash and cash equivalents at end of the period | 1,254,279 | 2,553,950 | ||||||

|

|

|

| |||||

The accompanying notes form an integral part of these condensed consolidated financial statements.

| 31 March | ||||||||

(thousands of €) | 2022 | 2021 | ||||||

Current financial investments | 3,389,098 | 2,560,743 | ||||||

Cash and cash equivalents | 1,254,279 | 2,553,950 | ||||||

|

|

|

| |||||

Current financial investments and cash and cash equivalents | 4,643,377 | 5,114,693 | ||||||

|

|

|

| |||||

The accompanying notes form an integral part of these condensed consolidated financial statements.

28

Galapagos Q1 Report 2022

Consolidated statements of changes in equity

(unaudited)

(thousands of €) | Share capital | Share premium account | Translation differences | Other reserves | Accumul. losses | Total | ||||||||||||||||||

On 1 January 2021 | 291,312 | 2,727,840 | (3,189 | ) | (10,907 | ) | (334,701 | ) | 2,670,355 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Net profit | 9,361 | 9,361 | ||||||||||||||||||||||

Other comprehensive income | 822 | 207 | 1,029 | |||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||

Total comprehensive income | 822 | 207 | 9,361 | 10,390 | ||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||

Share-based compensation | 18,459 | 18,459 | ||||||||||||||||||||||

Exercise of subscription rights | 540 | 1,718 | 2,258 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

On 31 March 2021 | 291,852 | 2,729,558 | (2,367 | ) | (10,700 | ) | (306,881 | ) | 2,701,462 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

On 1 January 2022 | 292,075 | 2,730,391 | (1,722 | ) | (10,177 | ) | (367,205 | ) | 2,643,362 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Net loss | (13,310 | ) | (13,310 | ) | ||||||||||||||||||||

Other comprehensive income/loss (-) | 34 | (53 | ) | (19 | ) | |||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||

Total comprehensive income/loss (-) | 34 | (53 | ) | (13,310 | ) | (13,329 | ) | |||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||

Share-based compensation | 14,397 | 14,397 | ||||||||||||||||||||||

Exercise of subscription rights | 517 | 1,643 | 2,160 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

On 31 March 2022 | 292,592 | 2,732,034 | (1,688 | ) | (10,230 | ) | (366,119 | ) | 2,646,589 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

The accompanying notes form an integral part of these condensed consolidated financial statements.

29

Galapagos Q1 Report 2022

Notes to the unaudited condensed

consolidated interim financial statements

for the first three months of 2022

Basis of preparation

These condensed consolidated interim financial statements have been prepared in accordance with IAS 34 ‘Interim Financial Reporting’ as adopted by the European Union and as issued by the IASB. The condensed consolidated interim financial statements do not contain all information required for an annual report and should therefore be read in conjunction with our Annual Report 2021.

Impact of COVID-19 on the financial statements

To date, we have experienced limited impact on our financial performance, financial position, cash flows and significant judgements and estimates, although we continue to face additional risks and challenges associated with the impact of the outbreak.

Significant accounting policies

There were no significant changes in accounting policies applied by us in these condensed consolidated interim financial statements compared to those used in the most recent annual consolidated financial statements of 31 December 2021.

New standards and interpretations applicable for the annual period beginning on 1 January 2022 did not have any material impact on our condensed consolidated interim financial statements.

We have not early adopted any other standard, interpretation, or amendment that has been issued but is not yet effective.

30

Galapagos Q1 Report 2022

Details of the unaudited condensed consolidated interim results

Product net sales

We reported net sales of Jyseleca for the first three months of 2022 amounting to €14.4 million (€0.1 million in the first three months of 2021).

Related costs of sales in the first quarter of 2022 amounted to €2.9 million.

Collaboration revenues

The following table summarizes our collaboration revenues for the three months ended 31 March 2022 and 2021:

| Three months ended 31 March | ||||||||||||||||

(thousands of €) | Over time | Point in time | 2022 | 2021 | ||||||||||||

Recognition of non-refundable upfront payments and license fees | 98,917 | 105,226 | ||||||||||||||

|

|

|

| |||||||||||||

Gilead collaboration agreement for filgotinib |  | 41,602 | 47,405 | |||||||||||||

Gilead collaboration agreement for drug discovery platform |  | 57,316 | 57,821 | |||||||||||||

|

|

|

| |||||||||||||

Milestone payments | 18,374 | 7,865 | ||||||||||||||

|

|

|

| |||||||||||||

Gilead collaboration agreement for filgotinib |  | 17,374 | 7,865 | |||||||||||||

Sobi distribution agreement for Jyseleca |  | 1,000 | — | |||||||||||||

|

|

|

| |||||||||||||

Royalties | 4,645 | 721 | ||||||||||||||

|

|

|

| |||||||||||||

Gilead royalties on Jyseleca |  | 4,601 | 678 | |||||||||||||

Other royalties |  | 44 | 43 | |||||||||||||

|

|

|

| |||||||||||||

Total collaboration revenues | 121,936 | 113,813 | ||||||||||||||

|

|

|

| |||||||||||||

31

Galapagos Q1 Report 2022

The rollforward of the outstanding balance of the current and non-current deferred income between 1 January 2022 and 31 March 2022 can be summarized as follows:

(thousands of €) | Total | Gilead collaboration agreement for filgotinib | Gilead collaboration agreement for drug discovery platform(1) | Other deferred income (grants & goods in transit) | ||||||||||||

On 1 January 2022 | 2,364,701 | 604,875 | 1,759,828 | — | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Milestones achieved | 18,238 | 18,238 | ||||||||||||||

Significant financing component(2) | 1,939 | 1,939 | ||||||||||||||

Revenue recognition of upfront | (98,917 | ) | (41,602 | ) | (57,316 | ) | ||||||||||

Revenue recognition of milestones | (17,374 | ) | (17,374 | ) | ||||||||||||

Other movements | 634 | 634 | ||||||||||||||

|

|

|

|

|

|

|

| |||||||||

On 31 March 2022 | 2,269,223 | 566,077 | 1,702,513 | 634 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

| (1) | The upfront received and the outstanding balance at 1 January 2022 and at 31 March 2022 comprise the issuance liabilities for the warrants and the upfront payment allocated to the drug discovery platform. |

| (2) | With regard to the additional consideration received for the extended cost sharing for filgotinib, we assume the existence of a significant financing component reflecting the time value of money on the estimated recognition period. |

32

Galapagos Q1 Report 2022

Operating costs and other operating income

Operating costs

Research and development expenditure

The following table summarizes our research and development expenditure for the three months ended 31 March 2022 and 2021:

| Three months ended 31 March | ||||||||

(thousands of €) | 2022 | 2021 | ||||||

Personnel costs | (40,205 | ) | (40,382 | ) | ||||

Subcontracting | (41,728 | ) | (72,980 | ) | ||||

Disposables and lab fees and premises costs | (5,207 | ) | (5,917 | ) | ||||

Depreciation and amortization | (3,386 | ) | (3,283 | ) | ||||

Professional fees | (4,408 | ) | (3,213 | ) | ||||

Other operating expenses | (4,985 | ) | (4,185 | ) | ||||

|

|

|

| |||||

Total research and development expenditure | (99,921 | ) | (129,960 | ) | ||||

|

|

|

| |||||

The table below summarizes our R&D expenditure for the three months ended 31 March 2022 and 2021, broken down by program.

| Three months ended 31 March | ||||||||

(thousands of €) | 2022 | 2021 | ||||||

Filgotinib program | (44,867 | ) | (36,932 | ) | ||||

Toledo program | (13,354 | ) | (27,823 | ) | ||||

TYK2 program on GLPG3667 | (3,467 | ) | (5,990 | ) | ||||

Ziritaxestat program | (532 | ) | (10,513 | ) | ||||

Other programs | (37,701 | ) | (48,702 | ) | ||||

|

|

|

| |||||

Total research and development expenditure | (99,921 | ) | (129,960 | ) | ||||

|

|

|

| |||||

33

Galapagos Q1 Report 2022

Sales and marketing expenses

The following table summarizes our sales and marketing expenses for the three months ended 31 March 2022 and 2021:

| Three months ended 31 March | ||||||||

(thousands of €) | 2022 | 2021 | ||||||

Personnel costs | (16,033 | ) | (10,302 | ) | ||||

Depreciation | (215 | ) | (51 | ) | ||||

External outsourcing costs | (10,378 | ) | (10,115 | ) | ||||

Sales and marketing expenses recharged to Gilead | 31 | 6,642 | ||||||

Professional fees | (369 | ) | (18 | ) | ||||

Other operating expenses | (2,019 | ) | (692 | ) | ||||

|

|

|

| |||||

Total sales and marketing expenses | (28,984 | ) | (14,536 | ) | ||||

|

|

|

| |||||

General and administrative expenses

The following table summarizes our general and administrative expenses for the three months ended 31 March 2022 and 2021:

| Three months ended 31 March | ||||||||

(thousands of €) | 2022 | 2021 | ||||||

Personnel costs | (20,418 | ) | (16,207 | ) | ||||

Depreciation and amortization | (1,914 | ) | (1,670 | ) | ||||

Legal and professional fees | (4,508 | ) | (5,859 | ) | ||||

Other operating expenses | (6,515 | ) | (6,686 | ) | ||||

|

|

|

| |||||

Total general and administrative expenses | (33,355 | ) | (30,422 | ) | ||||

|

|

|

| |||||

Other operating income

The following table summarizes our other operating income for the three months ended 31 March 2022 and 2021:

| Three months ended 31 March | ||||||||

(thousands of €) | 2022 | 2021 | ||||||

Grant income | 437 | 1,272 | ||||||

R&D incentives | 7,085 | 8,846 | ||||||

Other | 158 | 148 | ||||||

|

|

|

| |||||

Total other operating income | 7,680 | 10,266 | ||||||

|

|

|

| |||||

34

Galapagos Q1 Report 2022

Other financial income/expenses

The following table summarizes our other financial income/expenses (-) for the three months ended 31 March 2022 and 2021:

| Three months ended 31 March | ||||||||

(thousands of €) | 2022 | 2021 | ||||||

Other financial income: | ||||||||

Interest income | 662 | 746 | ||||||

Effect of discounting long term R&D incentives receivables | 23 | 23 | ||||||

Currency exchange gain | 14,362 | 46,662 | ||||||

Other finance income | 10 | 69 | ||||||

|

|

|

| |||||

Total other financial income | 15,058 | 47,500 | ||||||

|

|

|

| |||||

Other financial expenses: | ||||||||

Interest expenses | (2,063 | ) | (1,375 | ) | ||||

Effect of discounting long term deferred income | (1,939 | ) | (2,447 | ) | ||||

Currency exchange loss | (912 | ) | (953 | ) | ||||

Fair value loss on financial assets held at fair value through profit or loss | — | (2,913 | ) | |||||

Fair value loss on current financial investments | (193 | ) | (3,572 | ) | ||||

Other finance charges | (204 | ) | (86 | ) | ||||

|

|

|

| |||||

Total other financial expenses | (5,312 | ) | (11,345 | ) | ||||

|

|

|

| |||||

Total net other financial income | 9,746 | 36,155 | ||||||

|

|

|

| |||||

Cash position

Cash and cash equivalents and current financial investments totaled €4,643.4 million on 31 March 2022 (€4,703.2 million on 31 December 2021).

Cash and cash equivalents and current financial investments comprised cash at banks, term deposits, treasury bills and money market funds. Our cash management strategy monitors and optimizes our liquidity position. Our cash management strategy allows short-term deposits with an original maturity exceeding three months while monitoring all liquidity aspects.

35

Galapagos Q1 Report 2022

Cash and cash equivalents comprised €783.6 million of term deposits which all had an original maturity longer than three months. All cash and cash equivalents are available upon maximum three months notice period and without significant penalty. Cash at banks were mainly composed of notice accounts and current accounts. Our credit risk is mitigated by selecting a panel of highly rated financial institutions for our deposits.

Current financial investments comprised €1,102.8 million of term deposits which all had an original maturity longer than three months and which are not available on demand within three months. Our current financial investments also comprised money market funds and treasury bills. Our portfolio of treasury bills contains only AAA rated paper, issued by Germany. Our money market funds portfolio consists of AAA short-term money market funds with a diversified and highly rated underlying portfolio managed by established fund management companies with a proven track record.

| 31 March | 31 December | |||||||

(thousands of €) | 2022 | 2021 | ||||||

Money market funds | 1,407,986 | 1,317,460 | ||||||

Treasury bills | 878,333 | 877,349 | ||||||

Term deposits | 1,102,779 | 275,000 | ||||||

|

|

|

| |||||

Total current financial investments | 3,389,098 | 2,469,809 | ||||||

|

|

|

| |||||

Cash at banks | 470,667 | 1,225,860 | ||||||

Term deposits | 783,612 | 1,007,508 | ||||||

|

|

|

| |||||

Total cash and cash equivalents | 1,254,279 | 2,233,368 | ||||||

|

|

|

| |||||

Total current financial investments and cash and cash equivalents | 4,643,377 | 4,703,177 | ||||||

|

|

|

| |||||

On 31 March 2022, our cash and cash equivalents and current financial investments included $949.4 million held in U.S. dollars ($942.5 million on 31 December 2021) which could generate foreign exchange gains or losses in our financial results in accordance with the fluctuation of the EUR/U.S. dollar exchange rate as our functional currency is EUR. The foreign exchange loss (–)/gain in case of a 10% change in the EUR/U.S. dollar exchange rate amounts to €85.5 million.

36

Galapagos Q1 Report 2022

Capital increase

On 31 March 2022, Galapagos NV’s share capital was represented by 65,648,221 shares. All shares were issued, fully paid up and of the same class. The below table summarizes our capital increases for the period ended 31 March 2022.

(thousands of €, except share data) | Number of shares | Share capital | Share premium | Share capital and share premium | Average exercise price subscription rights (in €/ subscription right) | Closin gshare price on date of capital in- crease (in €/ share) | ||||||||||||||||||

On 1 January 2022 | 65,552,721 | 292,075 | 2,730,391 | 3,022,467 | ||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||

18 March 2022: exercise of subscription rights | 95,500 | 517 | 1,643 | 2,160 | 22.61 | 57.38 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

On 31 March 2022 | 65,648,221 | 292,592 | 2,732,034 | 3,024,626 | ||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||

Note to the cash flow statement

| Three months ended 31 March | ||||||||

(thousands of €) | 2022 | 2021 | ||||||

Adjustment for non-cash transactions | ||||||||

Depreciation and amortization | 5,516 | 5,019 | ||||||

Share-based compensation expenses | 14,397 | 18,459 | ||||||

Increase in retirement benefit obligations and provisions | 135 | 95 | ||||||

Unrealized exchange gains and non-cash other financial result | (13,873 | ) | (38,515 | ) | ||||

Discounting effect of deferred income | 1,940 | 2,447 | ||||||

Fair value re-measurement of warrants | 185 | (1,970 | ) | |||||

Net change in (fair) value of current financial investments | 193 | 3,572 | ||||||

Fair value adjustment financial assets held at fair value through profit or loss | — | 2,913 | ||||||

Other non-cash expenses | 1,159 | — | ||||||

|

|

|

| |||||

Total adjustment for non-cash transactions | 9,652 | (7,980 | ) | |||||

|

|

|

| |||||

37

Galapagos Q1 Report 2022

| Three months ended 31 March | ||||||||

(thousands of €) | 2022 | 2021 | ||||||

Adjustment for items to disclose separately under operating cash flow | ||||||||

Interest expense | 2,063 | 1,375 | ||||||

Interest income | (662 | ) | (740 | ) | ||||

Tax expense | 1,724 | 157 | ||||||

|

|

|

| |||||

Total adjustment for items to disclose separately under operating cash flow | 3,125 | 792 | ||||||

|

|

|

| |||||

Adjustment for items to disclose under investing and financing cash flows | ||||||||

Gain on sale of subsidiaries | — | (22,191 | ) | |||||

Realized exchange gain on sale of current financial investments | — | (6,645 | ) | |||||

Interest income on current financial assets | — | (6 | ) | |||||

|

|

|

| |||||

Total adjustment for items to disclose separately under investing and financing cash flow | — | (28,842 | ) | |||||

|

|

|

| |||||

Change in working capital other than deferred income | ||||||||

Increase (-)/decrease in inventories | 1,006 | (300 | ) | |||||

Decrease in receivables | 41,888 | 31,883 | ||||||

Decrease in liabilities | (2,783 | ) | (11,911 | ) | ||||

|

|

|

| |||||

Total change in working capital other than deferred income | 40,111 | 19,673 | ||||||

|

|

|

| |||||

38

Galapagos Q1 Report 2022

Contingencies and commitments

Contractual obligations and commitments

We have certain purchase commitments principally with CRO subcontractors and certain collaboration partners.

On 31 March 2022, we had outstanding obligations for purchase commitments, which become due as follows:

(thousands of €) | Total | Less than 1 year | 1 – 3 years | 3 – 5 years | More than 5 years | |||||||||||||||

Purchase commitments | 456,078 | 269,252 | 134,626 | 49,385 | 2,814 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

In addition to the table above, we have a contractual cost sharing obligation related to our collaboration agreement with Gilead for filgotinib. The contractual cost sharing commitment amounted to €342.2 million at 31 March 2022 for which we have direct purchase commitments of €242.0 million at 31 March 2022 reflected in the table above.

Contingent liabilities and assets

We refer to our Annual Report 2021 for a description of our contingent liabilities and assets.

Related party transactions

On 26 January 2022, the supervisory board approved Subscription Right Plan 2022 (B) for the benefit of a new member of the personnel of Galapagos within the framework of the authorized capital. Under this subscription right plan 1,000,000 subscription rights were offered to the beneficiary of the plan, which are accepted by the beneficiary on 24 March 2022. The subscription rights have an exercise term of eight years as of the date of the offer and have an exercise price of €50. The subscription rights can in principle not be exercised prior to 1 January 2026.

During the first three months of 2022, other than as disclosed in the paragraph above, there were no changes to related party transactions disclosed in the 2021 annual report that potentially had a material impact on the financials of Galapagos of the first three months of 2022.

Events after the end of the reporting period

On 26 April 2022, Galapagos held an extraordinary shareholders’ meeting, followed by its annual shareholders’ meeting. All agenda items were approved. The extraordinary shareholders’ meeting resolved to amend the articles of association in light of the implementation of a one- tier board structure in accordance with the Belgian Companies and Associations Code, with the board of directors replacing the supervisory board and the executive committee replacing the management board. The annual shareholders’ meeting approved (a) the appointment of Stoffels

39

Galapagos Q1 Report 2022

IMC BV (permanently represented by Dr. Paul Stoffels) as director, and (b) the appointments of Jérôme Contamine and Dr. Dan Baker as independent directors within the meaning of article 7:87 of the Belgian Companies and Associations Code and article 3.5 of the Belgian Corporate Governance Code 2020. Subsequently, the (new) unitary board has appointed Stoffels IMC BV (permanently represented by Dr. Paul Stoffels) as chair of the board of directors.

The mandates of Howard Rowe and Katrine Bosley as members of the board of directors came to an end on 26 April 2022.

On 3 May 2022, the members of the executive committee were offered Restricted Stock Units (‘RSUs’), subject to acceptance. The RSUs are offered for no consideration. Each RSU represents the right to receive, at Galapagos’ discretion, one Galapagos share or a payment in cash of an amount equivalent to the volume weighted average price of the Galapagos share on Euronext Brussels over the 30-calendar day period preceding the relevant vesting date. The first RSU grant will vest in full three years after the offer date. The second RSU grant has a four-year vesting period, with 25% vesting each year and a first vesting date on 1 May 2023. For the members of the executive committee, any vesting prior to the third anniversary of the offer date will always give rise to a payment in cash. The RSUs are not transferable.

The table below sets forth the total number of RSUs offered to each member of the executive committee (subject to acceptance):

Name | Title | Number of 2022 RSUs offered | ||||||

Stoffels IMC BV(1) | CEO | 74,408 | ||||||

Bart Filius | President, CFO & COO | 61,442 | ||||||

Walid Abi-Saab | CMO | 37,274 | ||||||

André Hoekema | CBO | 1,530 | ||||||

Michele Manto | CCO | 27,354 | ||||||

| (1) | Stoffels IMC BV (permanently represented by Dr. Paul Stoffels) |

Approval of interim financial statements

The interim financial statements were approved by the board of directors on 2 May 2022.

40

Galapagos Q1 Report 2022

100 points clinical response

Percentage of patients achieving a 100-point decrease in CDAI score during a clinical trial in CD patients

ACR

American College of Rheumatology

ACR20 (ACR 20/50/70)

American College of Rheumatology 20% response rate signifies a 20% or greater improvement in the number of swollen and tender joints as well as a 20% or greater improvement in three out of five other disease-activity measures. ACR50 and ACR70 reflect the same, for 50% and 70% response rates, respectively

ADPKD

Autosomal dominant polycystic kidney disease, a disease where typically both kidneys become enlarged with fluid-filled cysts, leading to kidney failure. Other organs may be affected as well

ADS

American Depositary Share; Galapagos has a Level 3 ADS listed on Nasdaq with ticker symbol GLPG and CUSIP number 36315X101. One ADS is equivalent to one ordinary share in Galapagos NV

AFM

Dutch Authority for the Financial Markets

Anemia

Condition in which the patient has an inadequate number of red blood cells to carry oxygen to the body’s tissues

Anti-TNF

Tumor necrosis factor. An anti-TNF drug acts by modulation of TNF

Assays

Laboratory tests to determine characteristics

41

Galapagos Q1 Report 2022

Attrition rate

The historical success rate for drug discovery and development, based on publicly known development paths. Statistically seen, investment in at least 12 target-based programs is required to ensure that at least one of these will reach a Phase 3 study. Most new drug R&D programs are discontinued before reaching Phase 3 because they are not successful enough to be approved

BID dosing

Twice-daily dosing (bis in die)

Bioavailability

Assessment of the amount of product candidate that reaches a body’s systemic circulation after (oral) administration

Biomarker

Substance used as an indicator of a biological process, particularly to determine whether a product candidate has a biological effect

Black & Scholes model

A mathematical description of financial markets and derivative investment instruments that is widely used in the pricing of European options and subscription rights

Bridging trial

Clinical trial performed to “bridge” or extrapolate one dataset to that for another situation, i.e. to extrapolate data from one population to another for the same drug candidate, or to move from IV to subcutaneous dosing

CALOSOMA

Phase 1 program with GLPG3970 in psoriasis

CDAI

Crohn’s Disease Activity Index, evaluating patients on eight different factors, each of which has a pre-defined weight as a way to quantify the impact of CD

CDAI remission

In the FITZROY trial, the percentage of patients with CD who showed a reduction of CDAI score to <150

CFTR

Cystic fibrosis transmembrane conductance regulator (CFTR) is a membrane protein and chloride channel in vertebrates that is encoded by the CFTR gene. It is hypothesized that inhibition of the CFTR channel might reduce cyst growth and enlargement for patients with ADPKD. GLPG2737 is a CFTR inhibitor

42

Galapagos Q1 Report 2022

CHIT1/AMCase

Chitotriosidase (CHIT1) is a protein coding gene, and AMCase is an inactive acidic mamalian chitinase. CHIT1 is predominantly involved in macrophage activation. Inhibition of chitinase activity translates into a potential therapeutic benefit in lung diseases like IPF, as shown in preclinical models. GLPG4716 is a CHIT1/AMCase inhibitor targeting a key pathway in tissue remodeling

CHMP

Committee for Medicinal Products for Human Use is the European Medicines Agency’s (EMA) committee responsible for human medicines and plays a vital role in the authorization of medicines in the European Union (EU)

CIR

Crédit d’Impôt Recherche, or research credit. Under the CIR, the French government refunds up to 30% of the annual investment in French R&D operations, over a period of three years. Galapagos benefits from the CIR through its operations in Romainville, just outside Paris

CRP

C-reactive protein is a protein found in the blood, the levels of which rise in response to inflammation

Cash position

Current financial investments and cash and cash equivalents

Chitinase

Chitinase is an enzyme that degrades chitin, involved in the human innate immunity. Inhibition of chitinase activity translates into a potential therapeutic benefit in lung diseases like IPF, as shown in preclinical models

Clinical Proof of Concept (PoC)

Point in the drug development process where the product candidate first shows efficacy in a therapeutic setting

Complete Response Letter (CRL)

A letter send by the FDA to indicate that the review cycle for an application is complete and the application is not ready for approval in its present form

Compound

A chemical substance, often a small molecule with drug-like properties

43

Galapagos Q1 Report 2022

Contract research organization (CRO)

Organization which provides drug discovery and development services to the pharmaceutical, biotechnology and medical devices industry

Corticosteroids

Any of a group of steroid hormones produced in the adrenal cortex or made synthetically. They have various metabolic functions and some are used to treat inflammation

Crohn’s disease (CD)

An IBD involving inflammation of the small and large intestines, leading to pain, bleeding, and ultimately in some cases surgical removal of parts of the bowel

Cytokine