Except where the context otherwise requires, all references in this Quarterly Report on Form 10-Q (“Form 10-Q”) to the “Company”, “we”, “us”, “our”, “Trident” and “Trident Brands” or similar words and phrases are to Trident Brands Incorporated and its subsidiaries, taken together.

In this report, all currency amounts are expressed in thousands of United States (“U.S.”) dollars (“$”), except per share data, unless otherwise stated. Amounts expressed in other than U.S. dollars are noted accordingly. For example, amounts if expressed in Canadian dollars are expressed in thousands of Canadian dollars and preceded by the symbol “Cdn $”.

This Form 10-Q contains forward-looking statements which are based on our current expectations and assumptions and involve a number of risks and uncertainties. Generally, forward-looking statements do not relate strictly to historical or current facts and are typically accompanied by words such as “anticipate”, “estimate”, “intend”, “project”, “potential”, “continue”, “believe”, “expect”, “could”, “would”, “should”, “might”, “plan”, “will”, “may”, “predict”, the negatives of such terms, and words and phrases of similar impact and include, but are not limited to references to expected increases in revenues and margins, growth opportunities, the success of new product launches and line extensions, our ability to finance our business, potential strategic investments, business strategies, competitive strengths, goals, references to key markets where we operate and the market for our securities. These forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on certain assumptions and analyses we make in light of our experience and our interpretation of current conditions, historical trends and expected future developments, as well as other factors that we believe are appropriate in the circumstance.

Whether actual results and developments will agree with our expectations and predictions is subject to many risks and uncertainties. Accordingly, there are or will be important factors that could cause our actual results to differ materially from our expectations and predictions. We believe these factors include, but are not limited to, the following:

Consequently all forward-looking statements made herein are qualified by these cautionary statements and there can be no assurance that our actual results or the developments we anticipate will be realized. The foregoing factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this report.

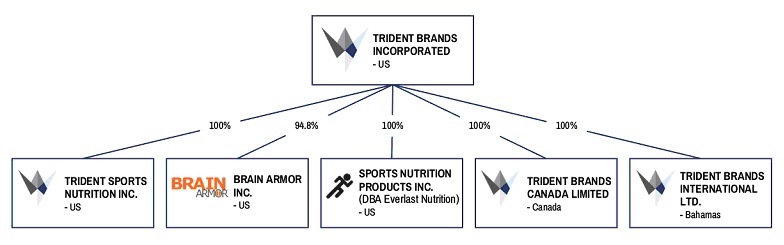

Trident Brands Incorporated has five legal subsidiaries, as detailed below.

The Company’s administrative office is located at 200 South Executive Drive, Suite 101, Brookfield, Wisconsin, 53005 and its fiscal year end is November 30th.

The Company has authorized capital of 300,000,000 common shares with a par value of $0.001 per share. 32,311,887 common shares were issued and outstanding as of May 31, 2019 and 32,311,887 as of July 22, 2019.

The unaudited financial statements for the quarter ended May 31, 2019 immediately follow.

NOTE 1. ORGANIZATION AND DESCRIPTION OF BUSINESS

Trident Brands Incorporated (f/k/a Sandfield Ventures Corp.) (“we”, “our”, “the Company”) was incorporated under the laws of the State of Nevada on November 5, 2007. The Company was formed to engage in the acquisition, exploration and development of natural resource properties.

The Company is now focused on the development of high growth branded and private label consumer products and ingredients within the nutritional supplement, life sciences and food and beverage categories. The Company is in its early growth stage and has transitioned out of its shell status with the Super-8 filing at the end of August, 2014. Activities to date have focused on capital formation, organizational development and execution of its branded and private label consumer products and ingredients business plan.

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying unaudited interim financial statements of Trident Brands Incorporated have been prepared in accordance with accounting principles generally accepted in the United States of America and the rules of the Securities and Exchange Commission, and should be read in conjunction with the audited financial statements and notes thereto contained in Trident’s Form 10-K filed with SEC. In the opinion of management, all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of financial position and the results of operations for the interim periods presented have been reflected herein. The results of operations for interim periods are not necessarily indicative of the results to be expected for the full year. Notes to the financial statements which would substantially duplicate the disclosure contained in the audited financial statements for fiscal 2018 as reported in the Form 10-K have been omitted.

Customer Concentration

The Company had three major customers that accounted for approximately 71.4% and $995,576 of sales for the six month period ended May 31, 2019 and 77.7% of the accounts receivable compared to one major customer that accounted for 90.5% and $5,116,161 of sales and 59.7% of the accounts receivable for the 12 month period ended November 30, 2018.

Fair Value of Financial Instruments

The Company measures its financial assets and liabilities in accordance with the requirements of FASB ASC 820, “Fair Value Measurements and Disclosures”. ASC 820 clarifies the definition of fair value, prescribes methods for measuring fair value, and establishes a fair value hierarchy to classify the inputs used in measuring fair value as follows:

Level 1 – Quoted prices are available in active markets for identical assets or liabilities as of the reporting date. Active markets are those in which transactions for the asset or liability occur in sufficient frequency and volume to provide pricing information on an ongoing basis. Level 1 primarily consists of financial instruments such as exchange-traded derivatives, marketable securities and listed equities.

Level 2 - Pricing inputs are other than quoted prices in active markets included in level 1, which are either directly or indirectly observable as of the reported date and includes those financial instruments that are valued using models or other valuation methodologies. These models are primarily industry-standard models that consider various assumptions, including quoted forward prices for commodities, time value, volatility factors, and current market and contractual prices for the underlying instruments, as well as other relevant economic measures.

Substantially all of these assumptions are observable in the marketplace throughout the full term of the instrument, can be derived from observable data or are supported by observable levels at which transactions are executed in the marketplace. Instruments in this category generally include non-exchange-traded derivatives such as commodity swaps, interest rate swaps, options and collars.

Level 3 – Pricing inputs include significant inputs that are generally less observable from objective sources. These inputs may be used with internally developed methodologies that result in management’s best estimate of fair value.

The carrying value of certain on-balance-sheet financial instruments approximated their fair values due to the short-term nature of these instruments. These financial instruments include cash and cash equivalents, accounts receivable, accounts payable and note payable. The fair value of the Company’s long-term debt is estimated based on current rates that would be available for debt of similar terms which is not significantly different from its stated value. As of May 31, 2019 the Company did not have any financial assets or liabilities measured and recorded at fair value on the Company’s consolidated balance sheets on a recurring basis, except for a derivative liability, related to the embedded conversion option on the 2018 convertible notes, with a fair value as of May 31, 2019 of $4,294,374. The derivative liability was fair valued using Level 3 inputs.

The following table provides a summary of the changes in fair value, including net transfers in and/or out, of the derivative financial instruments, measured at fair value on a recurring basis using significant unobservable inputs:

| Balance at November 30, 2018 | | $ | 892,000 | |

| Unrealized derivative loss included in other expense | | | 1,491,118 | |

| Debt discount related to derivative liability | | | 1,911,256 | |

| Balance at May 31, 2019 | | $ | 4,294,374 | |

The fair value of the derivative liabilities are calculated at the time of issuance and the Company records a derivative liability for the calculated value. Changes in the fair value of the derivative liabilities are recorded in other income (expense) in the consolidated statements of operations.

The following are the assumptions used for derivative instruments valued using the Black Scholes option pricing model as of May 31, 2019:

| Market value of stock on measurement date | | $ | 0.445 | |

| Market value of stock on May 31, 2019 | | $ | 0.440 | |

| Risk-fee interest rate | | | 1.96 | % |

| Dividend yield | | | 0 | % |

Volatility factor as of measurement date and balance sheet date | | 104.70% and 111.82 | %

|

Term as of measurement date and balance sheet date | | 1.13 yrs and 1.00 yr | |

Revenue Recognition

In May 2014, the FASB issued Accounting Standards Update No. 2014-09 (Topic 606) “Revenue from Contracts with Customers.” Topic 606 supersedes the revenue recognition requirements in Topic 605 “Revenue Recognition” (Topic 605). The new standard’s core principal is that an entity will recognize revenue at an amount that reflects the consideration to which the entity expects to be entitled in exchange for transferring good or services to a customer. The principles in the standard are applied in five steps: 1) Identify the contract(s) with a customer; 2) Identify the performance obligations in the contract; 3) Determine the transaction price; 4) Allocate the transaction price to the performance obligations in the contract; and 5) Recognize revenue when (or as) the entity satisfies a performance obligation. We adopted Topic 606 as of December 1, 2018 using the modified retrospective transition method. The adoption of Topic 606 did not have any material impact on the Company’s consolidated financial statements.

Recent Accounting Pronouncements

The Company has evaluated the following recent accounting pronouncements through the date the financial statements were issued and filed with the Securities and Exchange Commission and believe that none of them will have a material effect on the Company’s financial statements:

In May 2017, the FASB issued ASU 2017-09, Compensation-Stock Compensation (Topic 718), Scope of Modification Accounting. The amendments in this Update provide guidance about which changes to the terms or conditions of a share-based payment award require an entity to apply modification accounting in Topic 718. The amendments in this Update are effective for all entities for annual periods, and interim periods within those annual periods, beginning after December 15, 2017. Early adoption is permitted, including adoption in any interim period, for (1) public business entities for reporting periods for which financial statements have not yet been issued and (2) all other entities for reporting periods for which financial statements have not yet been made available for issuance. This became effective December 1, 2018. The adoption did not have any material impact on the Company’s consolidated financial statements.

In July 2017, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2017-11, Earnings Per Share (Topic 260), Distinguishing Liabilities from Equity (Topic 480), Derivatives and Hedging (Topic 815). The amendments in Part I of this Update change the classification analysis of certain equity-linked financial instruments (or embedded features) with down round features. When determining whether certain financial instruments should be classified as liabilities or equity instruments, a down round feature no longer precludes equity classification when assessing whether the instrument is indexed to an entity’s own stock. The amendments also clarify existing disclosure requirements for equity-classified instruments. As a result, a freestanding equity-linked financial instrument (or embedded conversion option) no longer would be accounted for as a derivative liability at fair value as a result of the existence of a down round feature. For freestanding equity classified financial instruments, the amendments require entities that present earnings per share (EPS) in accordance with Topic 260 to recognize the effect of the down round feature when it is triggered. That effect is treated as a dividend and as a reduction of income available to common shareholders in basic EPS. Convertible instruments with embedded conversion options that have down round features are now subject to the specialized guidance for contingent beneficial conversion features (in Subtopic 470-20, Debt—Debt with Conversion and Other Options), including related EPS guidance (in Topic 260). The amendments in Part II of this Update recharacterize the indefinite deferral of certain provisions of Topic 480 that now are presented as pending content in the Codification, to a scope exception. Those amendments do not have an accounting effect. For public business entities, the amendments in Part I of this Update are effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2018. For all other entities, the amendments in Part I of this Update are effective for fiscal years beginning after December 15, 2019, and interim periods within fiscal years beginning after December 15, 2020. Early adoption is permitted for all entities, including adoption in an interim period. If an entity early adopts the amendments in an interim period, any adjustments should be reflected as of the beginning of the fiscal year that includes that interim period. Management’s evaluation was that there was no potential impact to the Company’s consolidated financial statements.

NOTE 3. GOING CONCERN

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern, which contemplates realization of assets and the satisfaction of liabilities in the normal course of business within one year after the date the consolidated financial statements are issued. In accordance with Financial Accounting Standards Board, or the FASB, Accounting Standards Update No. 2014-15, Presentation of Financial Statements - Going Concern (Subtopic 205-40), our management evaluates whether there are conditions or events, considered in aggregate, that raise substantial doubt about our ability to continue as a going concern within one year after the date that the financial statements are issued.

As of May 31, 2019, the Company had $1,653,948 in cash and cash equivalents. However, the Company has generated losses, negative working capital and has an accumulated deficit as of May 31, 2019. These factors raise substantial doubt about the ability of the Company to continue as a going concern. The Company completed additional long term financing with the non-US institutional investor, receiving proceeds of $3,400,780 on November 30, 2018 and $2,804,187 on April 13, 2019 through the issuance of secured convertible promissory notes. The investor has agreed to make additional investments of $3,795,033 ($10,000,000 in the aggregate). Management believes that our present and available financial resources will be enough to fund our operations for the next twelve months from the date these financial statements are issued due to, i) the approval of new financing available to the Company of up to $10,000,000, of which $3,795,033 is still available, ii) anticipated growth of product sales from our current customer base and new customers, iii) introduction of higher margin products; and iv) controlling of our expenses. However, unless Management is able to extend the maturity date of the notes or obtain additional financing, the Company may not be able to meet it’s debt obligations which come due on May 31, 2019. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

NOTE 4. WARRANTS AND OPTIONS

On December 6, 2017, our Board of Directors authorized the issuance to its members and management stock options to purchase up to 2,615,000 share of our common stock. 1,307,500 of the options vest upon issuance and are exercisable for up to five years at $0.85 per share, while the remaining 1,307,500 will vest 12 months following issuance and be exercisable for up to five years at $1.00 per share. The Options were issued pursuant to the Company’s 2013 Stock Option Plan, which was registered with the Securities and Exchange Commission on Form S-8 in January, 2015. The 2013 Stock Option Plan authorizes Trident to issue incentive and non-qualified stock options to employees and consultants of the Company to purchase a number of shares not to exceed 15% of the Company’s currently issued and outstanding securities.

On January 4, 2019, our Board of Directors approved the re-pricing of the majority of options previously granted at $0.40 per share.

On May 5, 2019, our Board of Directors approved the extension of 750,000 previously issued and outstanding stock options originally issued on May 5, 2014 to certain individuals for an additional year. The extended option expiration date for those options is now May 5, 2020.

The total outstanding stock options as of May 31, 2019 are 3,215,000. The Company used the Black-Scholes model to value the stock options at $1,107,836 when first issued. For the period ended May 31, 2019, the Company expensed $8,875 as compensation expense compared to $924,078 in the comparable prior year period. The Company also used the Black-Scholes model to value the re-priced stock options at $275,024 and the options with the extended expiration date at $96,852 which were also expensed in the period. Following are the assumptions used in the valuation of the re-priced and extended options: Discount rates between 0.90% and 2.10%; Volatility between 85.51% and 79.75%; and with terms of 2.5 and 3.0 years for the re-priced options and discount rate of 1.93%, volatility of 107.15% and term of 1.33 year for the extended options.

The following table represents stock option activity for the period ended May 31, 2019:

| | | Number of Options | | | Weighted Average Exercise Price | | | Contractual Life in Years | | | Intrinsic Value | |

| | | | | | | | | | | | | |

| Outstanding - November 30, 2018 | | | 4,640,000 | | | $ | 1.02 | | | | 2.45 | | | | |

| Exercisable - November 30, 2018 | | | 3,332,500 | | | $ | 1.03 | | | | 1.84 | | | | -0- | |

| Granted | | | -0- | | | | | | | | | | | | | |

| Exercised or Vested | | | -0- | | | | | | | | | | | | | |

| Forfeited or Expired | | | 1,425,000 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Outstanding - May 31, 2019 | | | 3,215,000 | | | $ | 2.50 | | | | 2.92 | | | | | |

| Exercisable - May 31, 2019 | | | 3,215,000 | | | $ | 2.50 | | | | 2.92 | | | $ | 128,600 | |

All the outstanding warrants have expired as of May 31, 2019.

The following table represents warrant activity for the period ended May 31, 2019:

| | | Number of Warrants | | | Weighted Average Exercise Price | | | Contractual Life in Years | | | Intrinsic Value | |

| | | | | | | | | | | | | |

| Outstanding – November 30, 2018 | | | 225,000 | | | $ | 1.35 | | | | 0.20 | | | |

| |

| Exercisable - November 30, 2018 | | | -0- | | | | | | | | | | | | | |

| Granted | | | -0- | | | | | | | | | | | | | |

| Exercised or Vested | | | -0- | | | | | | | | | | | | | |

| Cancelled or Expired | | | 225,000 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Outstanding – May 31, 2019 | | | -0- | | | $ | 0.0 | | | | 0.00 | | | | | |

NOTE 5. RELATED PARTY TRANSACTIONS

The Company neither owns nor leases any real or personal property. The Company is paying a director $750 per month rent for use of office space and services.

NOTE 6. NOTE RECEIVABLE

On September 12, 2017 the Company entered into a note purchase agreement with Fengate Trident LP (“Fengate”) pursuant to which, in consideration for the issuance of 811,887 of our common shares to Fengate, we purchased outstanding secured convertible promissory notes of Mycell Technologies LLC having an aggregate balance due and payable of $511,141 in principal and $94,526 in interest accrued as at September 12, 2017. The purchased notes, which were originally issued to LPF (MCTECH) Investment Corp. on January 22, 2016, February 5, 2016, and May 19, 2016, bear simple interest on unpaid principal at the rate of ten percent per annum. The outstanding principal and accrued interest is convertible at the option of the note holder into securities of Mycell. The accrued interest as at May 31, 2019 is $105,869. The Company reserved a full allowance of $617,010 as of May 31, 2019.

NOTE 7. CONVERTIBLE DEBT

On January 29, 2015, the Company entered into a securities purchase agreement with a non-US institutional investor whereby it agreed to sell an aggregate principal amount of $2,300,000 of senior secured convertible debentures, convertible into shares of the company’s common stock.

The Company received $1,800,000 of the funds from the transaction on February 5, 2015. The balance of $500,000 was received on May 14, 2015. These convertible notes were subsequently acquired by Fengate on April 28, 2017.

The convertible debentures are convertible into shares of the Company’s common stock at an initial conversion price of $0.71 per share, for an aggregate of up to 3,239,437 shares. The debentures originally accrued interest at 6% per annum. On September 26, 2016 the Company entered into an amendment agreement related to these convertible debentures whereby the applicable interest rate was increased from 6% to 8% and provisions added to allow the investor to transfer, sell or hypothecate the convertible notes subject to applicable securities laws. The maturity date of the notes was also extended through September 30, 2019. We considered ASC Topic 470-50, Debt Modifications and Extinguishments, and determined that the modification was not deemed substantial.

Due to the note being convertible to common shares of the Company, a beneficial conversion feature analysis was performed. The intrinsic value of the conversion feature was $647,888 which was recognized as debt discount. As of November 30, 2017, the full amount of the debt discount has been amortized.

On September 26, 2016, the Company entered into a securities purchase agreement with a non-US institutional investor, pursuant to which, in consideration for proceeds of $4,100,000, the Company issued a secured convertible promissory note in the amount of $4,100,000. Pursuant to the securities purchase agreement, the investor has agreed, from time to time after January 1, 2017, to make additional investments at the Company’s request of up to $5,900,000 ($10,000,000 in the aggregate) in one or more tranches of not less than one tranche during any 60 day period. The funding of any tranche under the agreement (other than the first $4,100,000 which has been funded) is subject to the mutual agreement of the parties as to the use of funds.

On May 9, 2017, the Company received the second tranche of funding with proceeds of $4,400,000 and on May 16, 2018 the third tranche of $1,500,000 for a total investment by the investor of $10,000,000.

The Company used the proceeds of the secured convertible note for general working capital purposes including settlement of accounts payable and repayment of mature loans.

In consideration of each advance made by the investor pursuant to the securities purchase agreement, the Company issued to the investor a convertible promissory note of equal value, maturing on September 30, 2019, and bearing interest at the rate of 8% per annum. Each note is secured in first priority against the present and after acquired assets of the Company and is convertible in whole or in part at the option of the holder into common shares of the Company at a conversion price of $0.60 per share, for an aggregate of up to 16,666,667 shares. These convertible notes were subsequently acquired by Fengate on April 28, 2017.

Due to the notes being convertible to common shares of the Company, a beneficial conversion feature analysis was performed. The intrinsic value of the conversion feature of the notes amounted to $3,333,334 and was recognized as a debt discount. As of May 31, 2019, $2,855,377 of the debt discount was amortized to interest of which $713,018 was amortized during the current six month period compared to $546,684 for the six month period in the prior year. The unamortized discount as of May 31, 2019 is $477,957.

On November 30, 2018 the Company and Fengate entered into a Securities Purchase Amendment Agreement pursuant to which the Company has agreed to issue to Fengate an additional convertible promissory note (the “2018 Convertible Note”) of up to $10,000,000, subject to certain terms and conditions. Each portion of the principal amount advanced pursuant to the 2018 Convertible Note will bear interest at the rate of twelve percent (12%) per annum and will be payable monthly in arrears to Fengate. Outstanding principal and interest will continue to be secured by the general security agreement dated September 26, 2016, which forms a part of the Agreement. The holder of the note may also elect from time to time to convert all or a portion of the outstanding principal and interest into common shares of the Company at a 25% discount to the average closing price of the common shares during the 10 trading days immediately prior to the applicable conversion date. The 2018 Convertible Note will mature on May 31, 2020.

On November 30, 2018 the Company received the first tranche of funding with proceeds of $3,400,780. The 2nd tranche of $2,804,187 was received on April 13, 2019 while the balance of $3,795,033 shall be funded and issued in one or more tranches within 30 days of receipt of written request from the Company.

The Company intends to use the proceeds of the secured convertible note for general working capital purposes including, without limitation, product development, inventory, and marketing and selling expenses.

The Company analysed the embedded conversion option on the convertible notes for derivative accounting consideration under ASC 815-15 “Derivatives and Hedging” and determined that the conversion option on the 2018 Convertible Note qualified for derivative accounting. The Company used the Black-Scholes model to value the embedded conversion option at $892,000 on the issuance date of November 30, 2018 and $1,911,246 on the issuance date of April 13, 2019. The assumptions used were a discount rate of 2.80% and 1.96%, volatility rate of 79.57% and 104.7% and a term of 1.50 and 1.13 years respectively. The Company used the Black-Scholes model to re-value the embedded conversion options issued on November 30, 2018 at $2,353,634 and the one on April 13, 2019 at $1,940,740 as of May 31, 2019. The change of $1,491,118 was recorded as a derivative loss. The assumptions used were a discount rate of 1.96%, volatility of 111.98% and a term of 1.00 year. The fair value of the embedded conversion options were recorded as debt discount and will be amortized over the term of the 2018 and 2019 Convertible Notes. The amortization recognized in the current period was $523,610. The unamortized Discount for the two notes as of May 31, 2019 is $2,279,645.

NOTE 8. INTANGIBLE ASSETS

On December 22, 2017, Trident exercised its option under our Exclusive License Agreement (dated March 1, 2015) to purchase the Brain Armor® brand from DSM Nutrition Products LLC (“DSM”). Subsequently, the parties have executed applicable trademark assignment and purchase agreements necessary to transfer all global intellectual property rights in the Brain Armor brand to Trident. In lieu of a $400,000USD cash payment to DSM for the value of the Brain Armor® brand as initially intended, the Company agreed to meet certain conditions, that when satisfied will have an equivalent value of $400,000USD. The costs incurred to meet these conditions are being charged to intangible assets. As of May 31, 2019, the Company has recorded $400,000 of costs to the asset account. Of this amount $200,000 will be paid over time as the Company purchases omega-3 oil from DSM pursuant to its exclusive supply agreement. During the 6 months ended May 31, 2019, payments of $ 71,280 were made to DSM in connection with this liability and $49,680 in the prior year.