Exploratory work by Newmont in 1979 and 1980 included the drilling of two vertical holes several hundred metres apart. One of these, collared adjacent to South Lorne Creek and south of the intrusive contact, intersected quartz veinlet stockworks in hornfelsed sediments; a 12 metres interval returned values of 0.032% Mo. It is thought that a hole inclined toward the intrusive contact would have provided a more useful assessment of the potential of the property.

The Company began a single phase exploration program expected to cost a total of $44,750 on the claims in July 2007. The program will consist of geophysics at a cost of $ 41,750, surface sampling at a cost of $2,000 and geochemistry at a cost of $1,000. The program was completed in September 2007. This program is warranted because previous prospecting efforts in 2006 and historical data including limited diamond drilling activity. The results are being assayed.

This item is not applicable to the Company.

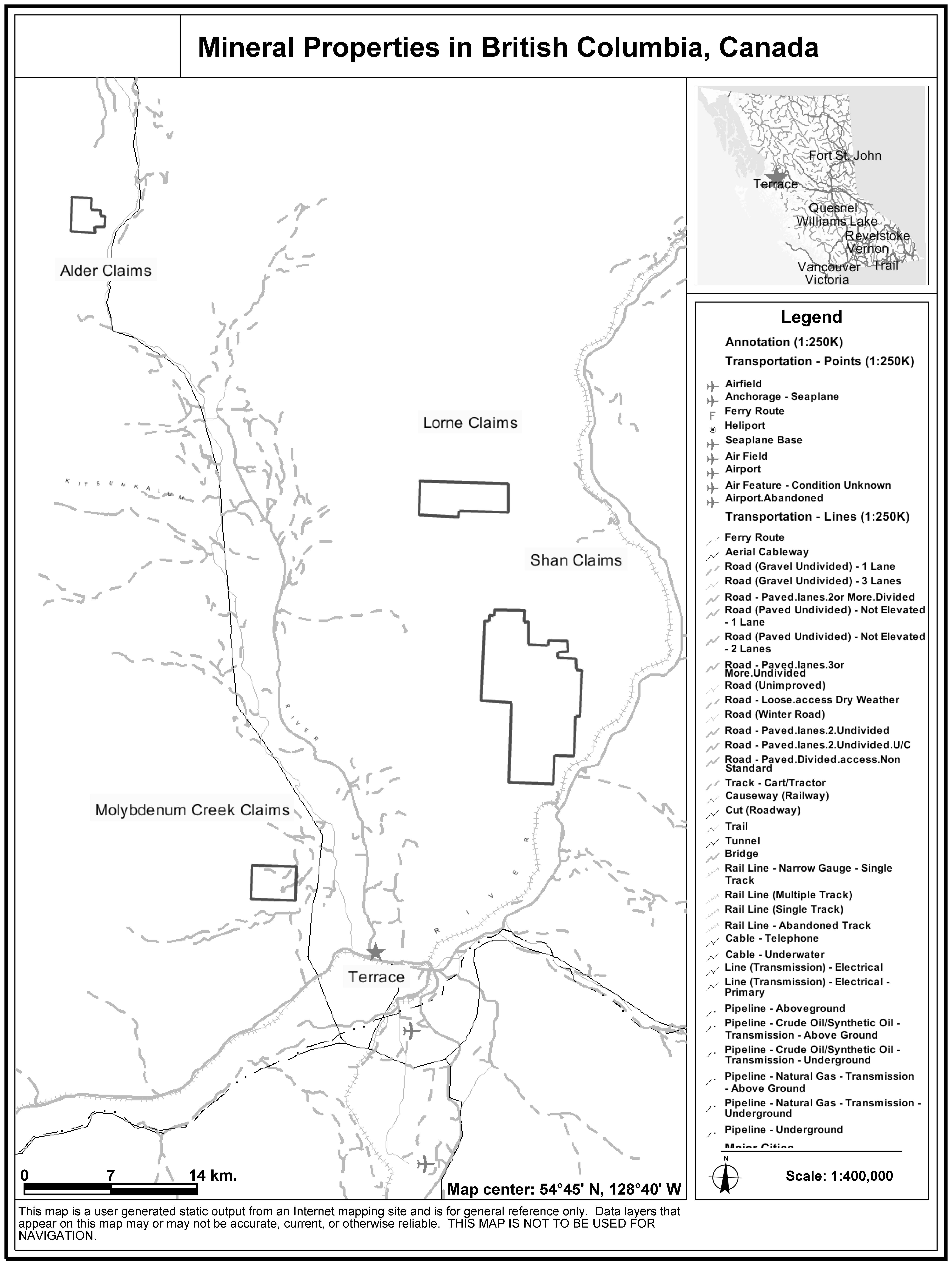

The Company is in the business of the acquisition and exploration of mineral properties, with the primary aim of developing them to a stage where they can be exploited at a profit. At that stage, the Company’s operations would, to some extent, be dependent on the prevailing market prices for any of the minerals produced by such operations. The Company does not currently have any producing properties or any revenues and, its current operations on its properties are exploratory searches for mineable deposits of minerals. During the fiscal period from incorporation on February 15, 2005 to the present the Company was primarily engaged in the exploration of the Molybdenum Ck. claims in the Skeena Mining Divisions, British Columbia, Canada. The Company’s expenses for its year ended August 31, 2007 were $947,457. The Company spent $2,982,302 on property related costs and expenses. The Company’s future mineral exploration and mining activities may be affected in varying degrees by Canadian government regulation, which is beyond the control of the Company. See “Item 3 — Key Information — D. Risk Factors”.

At August 31, 2005, the Company’s current assets totaled $1,049 and current liabilities and total liabilities of $31,956.

The Company had a working capital deficit of $30,907 at August 31, 2005, had no long-term debt and total assets of $12,417.

Share capital as at August 31, 2005 was $1,500 and the Company’s deficit was $19,539.

-34-

The entire contribution to working capital during the period from incorporation on February 15, 2005 to August 31, 2005 was from equity capital of $1,500 and shareholder loans of $23,000.

Fiscal Year Ended August 31, 2006

At August 31, 2006, the Company’s current assets totaled $49,289. Current liabilities, as well as total liabilities, were $363,354.

The Company had a working capital deficit of $314,065 and no long-term debt. The Company had total assets of $549,375.

Share capital as at August 31, 2006 was $341,499. The Company’s deficit at this date was $165,317.

The Company’s largest cash outflows for the year was $281,282 expended on the Carter Properties.

The entire contribution to working capital during the period from incorporation on February 15, 2005 to August 31, 2006 was equity financing as follows:

On December 30, 2005, the Company completed a private placement, on a flow-through basis of 1,102,000 common shares at a price of $0.25 per share for gross proceeds of $275,500. The net income tax effect of renouncing the exploration expenses of $275,500, financed by this share issue, was $94,001. This amount has been recorded as share issue costs. Also on that date, the Company completed a private placement of 310,000 non flow-through units, each unit consisting of one common share and one-half of a purchase warrant for total gross proceeds of $77,500. Each full share purchase warrant is convertible to one common share at an exercise price of $0.30 per common share and expired on December 30, 2006. All of these warrants were exercised.

On February 6, 2006, the Company completed a private placement of 324,000 units, each unit consisting of one common share and one-half of a purchase warrant for total gross proceeds of $81,000. Each full share purchase warrant is convertible to one common share at an exercise price of $0.30 per common share and expired on February 6, 2007. All of these warrants were exercised.

Fiscal Year Ended August 31, 2007

On September 25, 2006, the Company completed its initial public offering and began trading on the TSX Venture Exchange on September 27, 2006. Gross proceeds received by the Company for the offering was $1,500,000 (2,000,000 flow-through common shares at $0.50 per share and 1,000,000 non flow-through units at $0.50 per unit). Each unit comprised one non flow-through common share and one-half of a common share warrant. Each whole warrant is exercisable into one common share at $0.75 per common share for a one-year period from the closing of the offering.

In March, 2007, the Company completed a non-brokered private placement of 1,666,664 flow-through shares at $0.90 per share and 3,125,000 non flow-through units at $0.80 per unit for total gross proceeds of $3,999,998. Each non flow-through unit consisted of one non flow-through common share and one-half of a common share purchase warrant. Each whole warrant is exercisable for the purchase of one common share at a price of $1.00 per common share for one year. The Company paid finder’s fees of 7.5% cash and 8% common shares. The net proceeds received fund the exploration activities on the Shan Property.

-35-

At August 31, 2007, the Company’s current assets totaled $1,763,381 and current liabilities and total liabilities of $88,873.

The Company had working capital of $1,674,508 at August 31, 2007, had no long-term debt and total assets of $5,250,089.

Share capital as at August 31, 2007 was $5,601,686 and the Company’s deficit was $1,112,774.

The entire contribution to working capital during the period from incorporation on February 15, 2005 to August 31, 2007 was from equity capital.

The Company does not anticipate securing debt financing or making use of any financial instruments for hedging purposes in the current fiscal year.

In management’s view, given the nature of the Company’s activities, which consists of the acquisition, exploration, exploration management, development, and sale of mineral properties, the most meaningful and material financial information concerning the Company relates to its current liquidity and capital resources. The Company does not currently own or have an interest in any mineral producing properties and has not derived any revenues from the sale of any minerals since incorporation on February 15, 2005.

The Company’s mineral exploration activities have been funded through sales of common shares, and the Company expects that it will continue to be able to utilize this source of financing until it develops cash flow from its operations. There can be no assurance, however, that the Company will be able to obtain required financing in the future on acceptable terms, or at all. Based on its existing working capital, the Company expects to require additional financing for its currently held properties during the upcoming fiscal year. Accordingly, there is substantial doubt about its ability to continue as a going concern. The Company has not carried out debt financing nor has it made use of any financial instruments for hedging purposes. The Company had no material commitments for capital expenditures at the end of its most recent fiscal year other than the requirement to pay to Carter a further $20,000 on June 15, 2008 and to issue to Carter a further 100,000 common shares on September 26, 2008 to keep the Carter Property Agreement in good standing.

All expenses incurred during the initial 198-day period from incorporation on February 15, 2005 and ended August 31, 2005, as well as during the Company’s fiscal year ended August 31, 2006, and for the fiscal year ended August 31, 2007 that were associated with the Company’s mineral properties were capitalized during those periods. Management reviews annually the carrying value of the Company’s interest in each mineral property and where necessary, properties are written down to the estimated recoverable amount determined on a non-discounted basis after giving effect to any property option agreements and cost recovery agreements. Costs relating to properties abandoned are written off when the decision to abandon is made.

While the Company has been successful in raising the necessary funds to finance its exploration activities to date, there can be no assurance that it will be able to continue to do so. If such funds are not available or cannot be obtained and its joint venture arrangements are insufficient to cover the costs of the Company’s mineral exploration activities, the Company will be forced to curtail its exploration activities to a level for which funding is available or can be obtained.

Other than as discussed herein, the Company is not aware of any trends, demands, commitments, events or uncertainties that may result in the Company’s liquidity either materially increasing or decreasing at present or in the foreseeable future. Material increases or decreases in the Company’s

-36-

liquidity will be substantially determined by the Company’s ability to raise funds from equity offerings or joint venture agreements on its Carter Property.

Material Differences between Canadian and U.S. Generally Accepted Accounting Principles

The Company prepares its financial statements in accordance with accounting principles generally accepted in Canada (“Canadian GAAP”), which differ in certain respects from those principles that the Company would have followed had its financial statements been prepared in conformity with accounting principles generally accepted in the United States (“U.S. GAAP”). The significant measurement differences between Canadian and U.S. GAAP, which affect the Company’s financial statements, are described below:

Under U.S. GAAP, deferred exploration costs are written off as incurred and future income tax recovery would not be recognized. Had the Company presented its financial statements in accordance with U.S. GAAP, its losses would have increased for the initial 198-day fiscal period from incorporation to its fiscal year-end August 31, 2005 by $11,368 and would have increased by $549,768 for the year ended August 31, 2006 and would have increased by $2,992,141 for the year ended August 31, 2007.

Under Canadian GAAP, securities can be issued to investors whereby the deductions for tax purposes relating to resource expenditures may be claimed by the investors and not the enterprise. The tax effect of making this renunciation is recorded as a share issue cost and a future income tax recovery.

Outlook

Molybdenum Creek Claims

During the last six months of 2006, the Company incurred exploration expenses on the Company’s the north part Molybdenum Creek claims) including a geophysical survey, mapping and compilation, site preparation and drilling on the south part of the claims at a cost of $450,606. Results showed mineralization which was not sufficient to lead the Company to make further exploration expenditures. The Company began a single phase exploration program expected to cost a total of $4,000 on the south part of the claims in 2007. The program consists of surface sampling at a cost of $3,000 and geochemistry at a cost of $1,000. The program was completed in September, 2007. This program is warranted because the geophysical anomalies identified in 2005 and 2006 geophysical surveys, historical data and surface sampling in 2006. The results are being assayed.

Shan Claims

A drilling program from October 2006 to December 2007 on the Shan Property established it as a new discovery of noteworthy molybdenum mineralization and it became the Company’s primary focus for the balance of the year consisted of 20 diamond drill holes totaling 3550 metres. Drilling tested an area 750 m east-west by 400 m north-south. Molybdenite was observed in all holes. Seventeen of the 20 holes drilled represent a new area of mineralization not tested by previous drilling. Two holes drilled late in the program re-tested areas drilled in the 1960s (Camp Zone). The results are also encouraging in that the mineralization is found in a nearly equivalent grade in both major rock types encountered, the granodiorite and the intermediate volcanic rock. The Company undertook a Phase 2 program consisting of drilling totaling 5,682 meters from March to June 2007 which expenditures were $1,252,611 during the quarter ended May 31, 2007. The Company is considering the results and will decide on a further drilling program after the summer field program.

The Company began a single phase exploration program expected to cost a total of $145,000 on the claims in July 2007. The program consists of geophysics at a cost of $133,000, surface sampling at a

-37-

cost of $11,000 and geochemistry at a cost of $2,000. The program was completed in September, 2007. This program was warranted because of historical data and recent geological survey data that indicate similar geological setting and molybdenum showings at surface similar to the portion of the Shan property that has been drilled in our first two drill programs that have yielded significant molybdenum grade intercepts over significant lengths.

The Company planned a program of a minimum of 8 holes totaling approximately 2500 meters at an estimated cost of $650,000 and was completed by the end of November, 2007. The drill core is being logged for subsequent analysis. The first target area is on the south of the property. The Company’s summer program revealed steeply east-dipping NNW shear zones with grey fault gouge including molybdenite, pyrite and quartz veining. Also observed are a set of gently north-dipping molybdenum-quartz veins. Assay results for two of the samples were over 0.2% Mo (re-assays are pending). The third sample (interestingly the only one with definite visible molybdenum) ran 0.13% molybdenum. Two additional quartz vein samples from the dump, with some visible molybdenum, ran 0.012% and 0.025% molybdenum. Historical soil surveys indicate good values throughout this area and mineralized veins outcrop in the creeks that roughly bound the area. 3-D modeling of data obtained from the aeromag survey completed this past summer confirms that favorably altered rocks (with magnetite destruction) extend throughout the area.

A second target area in the north appears to be controlled by NW trending, steeply east-dipping mineralized structures, as well as potentially gently-dipping veins. While the zone is mostly covered by muskeg, some outcrop and float with molybdenum has been observed. Historically, there are relatively high molybdenum content soil samples from a 1980 survey across the area (similar to those found over the area already drilled at the south ridge from the same survey). 3-D modeling of data obtained from the aeromag survey completed this past summer indicates permissive alteration (magnetite destruction) throughout the zone to a depth of 300-400 metres below surface. Silt samples from the stream draining the target area have metal values for molybdenum and other elements similar to the silt samples from the creek draining the area drilled at the south ridge. A minimum of 4 drill holes comprising approximately 1200 metres will be drilled to test this zone. The area to be tested is over 1000 metres long by 400 metres wide.

Lorne Claims

The Company began a single phase exploration program expected to cost a total of $44,750 on the claims in July 2007. The program will consist of geophysics at a cost of $ 41,750, surface sampling at a cost of $2,000 and geochemistry at a cost of $1,000. The program is expected to be was completed in September 2007. This program is warranted because previous prospecting efforts in 2006 and historical data including limited diamond drilling activity. The results are being assayed.

Alder Claims

The Company began a single phase exploration program expected to cost a total of $3,000 on the Alder Claims in July 2007. The program will consist of surface sampling at a cost of $3,000. The program was completed in September 2007. This program is warranted because of results from prospecting activities in 2006. The results are being assayed.

The Company has approximately $564,600 working capital at December 10, 2007 with which to pay for these programs.

C. | | Research and Development, Patents and Licenses, etc. |

-38-

As the Company is an exploration company with no producing properties, the information required by this section is inapplicable.

As the Company is an exploration company with no producing properties, the information required by this section is inapplicable.

E. | | Off-Balance Sheet Arrangements |

The Company has no off-balance sheet arrangements required to be disclosed in this Registration Statement on Form 20-F.

F. | | Tabular Disclosure of Contractual Obligations |

As at August 31, 2007, the Company had the following contractual cash obligations and commercial commitments to keep the Carter Property Agreement in good standing. See “Item 4. Information on the Company — A. History and Development of the Company”.

Contractual Obligations

| | | | Payments Due by Period

|

|

|---|

|

|

|

| Total

|

| Less Than

One Year

|

| 1–3 Years

|

| 4–5 Years

|

| After 5 Years

|

|---|

| Long-Term Debt Obligations | | | | Nil | | Nil | | Nil | | Nil | | Nil |

| Capital Lease Obligations | | | | Nil | | Nil | | Nil | | Nil | | Nil |

| Operating Leases | | | | Nil | | Nil | | Nil | | Nil | | Nil |

| Purchase Obligations | | | | | | | | | | | | |

Other Long-Term Liabilities (1) | | | | $195,000 | | $20,000 | | $40,000 | | $35,000 | | $100,000 |

| TOTAL | | | | $195,000 | | $20,000 | | $40,000 | | $35,000 | | $100,000 |

| (1) | | Payments by the Company to Carter pursuant to the Carter Property Agreement. See “Item 4 — Information on the Company — A. History and Development of the Company — Acquisition of the Carter Property, British Columbia, Canada”. The agreement by which the Company acquired the Carter Property contains a default provision which provides that in the event that Company defaults on any of its obligations to make payments to the vendor and such default is continuing for more than sixty days after the Company receives notice in writing from the vendor of such default, then the Company will transfer the Claims to the vendor and the Company will have no continuing obligations to the vendor. |

As of August 31, 2007, the Company had total current liabilities of $88,873 and cash and term deposits of $1,576,713.

ITEM 6. | | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES |

A. | | Directors and Senior Management |

-39-

Following is information about the directors and members of senior management of the Company, including names, business experience, offices held in the Company and principal business activities performed outside the Company.

Dale McClanaghan, President, Chief Executive Officer and Director

Mr. McClanaghan has been President and CEO of the Company since February 16, 2005 and CFO from February 6, 2006 until May 9, 2006. He has been president and sole shareholder of Dale McClanaghan Consulting Ltd., a real estate development consulting company, from January 2002 to date. He has also been a director of Inland Explorations Ltd., a private company engaged in mineral exploration in Utah, U.S.A. from December 1, 2006 to the present and CFO from January 4, 2007 to the present. He was a director, CEO and President of Petaquilla Minerals Ltd. (formerly Adrian Resources Ltd.), a mineral exploration company listed on the TSX, from April 16, 2004 to December 14, 2004. From May 1995 to January 2002, he was CEO of VanCity Enterprises Ltd. (“VCE”), a real estate development subsidiary of VanCity Credit Union, the largest credit union in Canada, with over 250,000 members and total assets in excess of $9.0 billion specializing in both market and non-market housing. He has also been active on a number of community boards including: Member of Board of Directors of Langara College, Vancouver City Planning Commission, Dr. Peter Aids Foundation, Katherine Sandford Housing Society and the Vancouver Heritage Foundation. Mr. McClanaghan holds a Master of Business Administration degree from the University of British Columbia.

Mr. McClanaghan’s business experience is in particular in project management, finance and coordination which is his experience within the Company.

Allan Anderson, Chief Financial Officer and Director

Mr. Anderson is a banking and finance executive. He has been Chief Financial Officer of the Company since May 9, 2006. He has been Risk Manager, Enterprise Risk for BC Hydro since 2005. He was Treasury Manager for BC Hydro from 1999 to 2005. Prior to that from 1998 to 1999, he was Treasurer (Acting) at BC Hydro. From 1990 to 1998, he was Treasury Manager, Cash Management and Banking at BC Hydro. Mr. Anderson has a Master of Business Administration degree from the University of British Columbia and a Bachelor of Commerce degree from the University of Alberta.

Mr. Anderson has 30 years of business experience in risk management, treasury management and corporate banking. His responsibility within the Company as Chief Financial Officer and a member of the audit committee is to ensure financial statement disclosures are appropriate.

Lindsay Bottomer, Director

He has been a Director of TSX-V listed Entrée Gold Inc., a mineral exploration company, since June 2002 and its Vice President of Corporate Development since November 2005. He was President and CEO of TSX-V listed Southern Rio Resources Ltd. (now Silver Quest Resources Ltd.) from July 2001 to November 2005 and has been a director since July 2001. He has been a director of Yale Resources Ltd. since Dec 2005, of Strategem Capital Corp. since June 2003, of Amera Resources Corp. since February 2004, of Titan Uranium Inc. since February 2005, of Centrasia Mining Corp since September 2005, of Altima Resources Ltd. since November 2003 and of Inland Explorations Ltd. since December 1, 2006. He was also a director of CRMnet.com Inc. from July 2003 to April 2004 and of Pacific North West Capital from May 1998 to August 2005. Since moving to Vancouver, he has held senior positions with Prime Explorations (Pezim Group) from 1989–1994, Echo Bay Mines from 1994–1997, and since 1998 has consulted to numerous Vancouver-based companies worldwide. From 1998–

-40-

2000 he was President of the BC & Yukon Chamber of Mines, and is currently serving a second two-year term as a councilor of the Association of Professional Engineers and Geoscientists of British Columbia.

Mr. Bottomer’s business experience is as a geologist and in management of mineral exploration companies. His experience within the Company is in review of the Company’s geological information and advice with respect to mineral properties and exploration programs. Mr. Bottomer also serves as a member of the Company’s audit committee.

Scott Steeds, Director

Mr. Steeds was employed as a registered representative with Canaccord Capital Corporation from November 1989 to July 2003, where he was involved with the financing of numerous junior mineral exploration companies’ public offerings on both the TSX Exchange and TSX Venture Exchange. From July 2003 to January 2005 Mr. Steeds was a self employed consultant, and throughout that period he has been involved in the financing of companies traded on these exchanges. Mr. Steeds has been a consultant to the Company since February 2005. He has also been president and a director since December 2006 of Inland Explorations Ltd., a private company engaged in mineral exploration in Utah, U.S.A.

Mr. Steeds’ business experience is in corporate finance of mineral exploration and development companies. His experience within the Company has been to identify and negotiate the Company’s mineral property acquisitions to date and to negotiate financing of the Company’s exploration programs.

Stephen K. Winters, Director

Mr. Winters has been a lawyer in British Columbia from 1986 to the present and throughout that period has acted as solicitor for companies listed on the TSX Venture Exchange and its predecessor exchanges. He was a director of Uniserve Communications Inc. (formerly Technovision Systems Inc.) from March, 1998 to November, 2004, and secretary from March, 2003 to November, 2006, and a director of Xemplar Energy Corp. (formerly Consolidated Petroquin Resources Ltd.) from September, 1993 to October, 2005. He has been a director of United China International Enterprises Group Ltd. from January, 2004 to November, 2004 and from January, 2005 to April, 2007. He has been a director of Jupiter Resources Corporation, a private company, from January, 2007 to date and a director of Aura Ventures Corp., another private company, from August, 2007 to date. Mr. Winters holds a Bachelor of Arts (Hons.) degree from Queens University, an LL.B. degree from the University of Windsor and a Masters of Business Administration degree from the University of Southern California.

Mr. Winters’ experience has been as legal counsel to companies listing and listed on the TSX Venture Exchange and the Toronto Stock Exchange. His function within the Company has been to advise and coordinate the listing of the Company, and to advise on securities regulatory matters. Mr. Winters also serves as a member of the Company’s audit committee.

For the year ended August 31, 2007, the Company paid a total of $90,000 cash compensation to its directors and officers as set forth herein. No other funds were set aside or accrued by the Company during that period to provide pension, retirement or similar benefits for directors or officers of the Company pursuant to any existing plan provided or contributed to by the Company or its subsidiaries under applicable Canadian laws.

-41-

The Company is required, under applicable securities legislation in Canada to disclose to its shareholders details of compensation paid to its executive officers. The following fairly reflects all material information regarding compensation paid to the Company’s executive officers, which has been disclosed to the Company’s shareholders under applicable Canadian law.

Cash and Non-Cash Compensation — Executive Officers and Directors

The Company currently has two executive officers, Dale McClanaghan, who is President and CEO and Allan Anderson who is the CFO (the “Named Executive Officers”).

The following table sets forth all annual and long term compensation for services in all capacities to the Company for the year ended August 31, 2007 in respect of the individuals who were, at August 31, 2007, the Named Executive Officers:

Summary Compensation Table

Annual Compensation

|

| Long Term Compensation

|

|

|---|

|

|

|

|

|

|

|

|

|

|

|

| Awards

|

| Payouts

|

|

|

|

|---|

Name and

Principal Position

|

|

|

| Year

|

| Salary

($)

|

| Bonus

($)

|

| Other Annual

Compensation

($)

|

| Securities

Under

Options

granted

(#)

|

| Restricted

Shares or

Restricted

Share Units

($)

|

| LTIP

Payouts

($)

|

| All Other

Compen-

sation

($)

|

|---|

Dale McClanaghan

President and CEO

(and CFO until

May 9, 2006) | | | | Sep–Dec

2006 | | | 10,000 | | | | nil | | | | nil | | | | 100,000 | (1) | | | | | | | | | | | nil | |

| | | | | Jan–Aug

2007 | | | 35,000 | | | | | | | | | | | | 175,000 | (1) | | | N/A | | | | N/A | | | | nil | |

Allan Anderson

CFO (as of May 9,

2006) | | | | Sep–Dec

2006 | | | nil | | | | nil | | | | nil | | | | nil | | | | N/A | | | | N/A | | | | nil | |

| | | | | Jan–Aug

2007 | | | nil | | | | nil | | | | nil | | | | nil | | | | N/A | | | | N/A | | | | nil | |

| (1) | | Each of the optionees was issued 50,000 options on February 16, 2006. A further 50,000 options were issued to Mr. McClanaghan on October 10, 2006. A further 175,000 options were granted to Mr. McClanaghan on March 30, 2007 expiring March 30, 2012. |

Option Grants for the Fiscal Year Ended August 31, 2007

The following table sets forth stock options granted by the Company for the fiscal year ended August 31, 2007 to the Named Executive Officers of the Company:

-42-

Name

|

|

|

| Securities

Under

Options

Granted

(#)

|

| % of Total

Options

Granted in

Fiscal Year

|

| Exercise or

Base Price

($/Security) (2)

|

| Market Value of

Securities

Underlying Options

on Date of Grant

($/Security)

|

| Expiration Date

|

|---|

| Dale McClanaghan | | | | 50,000/175,000 | | 29 | | $0.50/$1.30 | | Nil | | October 10, 2011/

March 30, 2012 |

| Allan Anderson | | | | Nil | | Nil | | Nil | | Nil | | Nil |

| (2) | | The exercise price of stock options is set at not less than 100% of the market value (as defined in the Stock Option Plan referred to under “Share Ownership” below) of a common share of the Company on the date of grant. The exercise price of stock options may only be adjusted in the event that specified events cause dilution of the Company’s share capital. Options vest immediately upon grant. |

Aggregated Option Exercises During the Fiscal Year Ended August 31, 2007 and Option Values at August 31, 2007

There were no exercises of stock options during the fiscal year ended August 31, 2007 by the Named Executive Officers. The value of the unexercised options at August 31, 2007 is shown below:

Name

|

|

|

| Securities

Acquired on

Exercise

(#)

|

| Aggregate Value

Realized

($)

|

| Unexercised

Options at Fiscal

Year-End (#)

Exercisable/

Unexercisable

|

| Value of Unexercised In-

the-Money Options at

Fiscal Year-End

($)

Exercisable/

Unexercisable

|

|---|

| Dale McClanaghan | | | | N/A | | N/A | | 275,000(3)

All exercisable | | Nil/All exercisable |

| Allan Anderson | | | | N/A | | N/A | | 50,000

All exercisable | | Nil/All exercisable |

-43-

Defined Benefit or Actuarial Plan Disclosure

The Company does not provide retirement benefits for directors and executive officers.

Termination of Employment, Change in Responsibilities and Employment Contracts

On July 1, 2005 the Company entered into an employment agreement with Dale McClanaghan whereby the Company agreed to employ Mr. McClanaghan as President and CEO of the Company. The employment agreement is for a one year term. The employment agreement was extended to August 31, 2007 and has been further extended to August 31, 2008. Mr. McClanaghan, or a holding company beneficially owned by him, as Mr. McClanaghan shall decide, is paid $2,500 per month for his services commencing July 1, 2005. Beginning in March 2007 the Company agreed to pay Mr. McClanaghan $5,000 per month.

Directors

The Company has no arrangements, standard or otherwise, pursuant to which directors are compensated by the Company or its subsidiaries for their services in their capacity as directors, or for committee participation, or involvement in special assignments during the most recently completed financial year or at present, except that directors are compensated for their actual expenses incurred in the pursuance of their duties as directors. The Company also compensates directors who provide consulting, management and professional services. Since the commencement of his services in July, 2005, the Company has paid Dale McClanaghan $100,000 for his services as President and CEO. The Company has paid the same amount to Scott Steeds during the same period for consulting services. The Company has paid Stephen Winters $67,419 for legal services for the period from incorporation to September 25, 2006 and a further $49,326 since that time. Beginning in March 2007 the Company agreed to increase the amount paid to Mr. McClanaghan as President and CEO and Mr. Steeds as a manager each from $2,500 to $5,000 per month.

See “ — C. Board Practices” for information concerning a consulting agreement between Scott Steeds, a director, and the Company, and concerning legal fees paid by the Company to Stephen Winters, a director.

The following table sets forth stock options granted by the Company during the fiscal year ended August 31, 2007 to directors other than the Named Executive Officers of the Company:

Name

|

|

|

| Securities

Under

Options

Granted

(#)

|

| % of Total

Options

Granted in

Fiscal Year

|

| Exercise or

Base Price

($/Security)(2)

|

| Market Value of

Securities

Underlying

Options on Date

of Grant

($/Security)

|

| Expiration Date

|

|---|

| Scott Steeds | | | | 50,000/175,000 | | 29 | | $0.50/$1.30 | | Nil | | October 10, 2011/

March 30, 2012 |

| Stephen Winters | | | | 50,000 | | 6.5 | | $0.50 | | Nil | | October 10, 2011 |

-44-

| (2) | | The exercise price of stock options is set at not less than 100% of the market value (as defined in the Stock Option Plan referred to under “Share Ownership” below) of a common share of the Company on the date of grant. The exercise price of stock options may only be adjusted in the event that specified events cause dilution of the Company’s share capital. Options vest immediately upon grant. |

There were no exercises of stock options by directors other than the Named Executive Officers for the year ended August 31, 2007. The following table sets forth details of the value of unexercised options of directors other than the Named Executive Officers at August 31, 2007 on an aggregate basis:

Name

|

|

|

| Securities

Acquired on

Exercise

(#)

|

| Aggregate

Value Realized

($)

|

| Unexercised

Options at Fiscal

Year-End

(#)

Exercisable/

Unexercisable

|

| Value of Unexercised In-the-

Money Options at Fiscal Year-

End

($)

Exercisable/

Unexercisable

|

|---|

| Scott Steeds | | | | Nil | | Nil | | /275,000

/All exercisable | | Nil/All excercisable |

| Lindsay Bottomer | | | | Nil | | Nil | | 75,000/All exercisable | | Nil/All exercisable |

| Stephen Winters | | | | Nil | | Nil | | 50,000/All exercisable | | Nil/All exercisable |

The directors hold office for a term of one year or until the next annual general meeting of the Company, at which time all directors retire, and are eligible for re-election. On July 1, 2005 the Company entered into a consulting agreement with Scott Steeds, a director of the Company whereby the Company agreed to pay Mr. Steeds $2,500 per month for providing services in the area of corporate development for a period of one year. The consulting agreement with Mr. Steeds was extended to August 31, 2007 and has been further extended to August 31, 2008. Mr. Steeds, or a holding company beneficially owned by him, as Mr. Steeds shall decide, is to be paid $2,500 per month for his services. Beginning March 2007 the Company agreed to pay Mr. Steeds $5,000 per month. Other than the foregoing, the Company has no service contracts with the directors other than the employment contract with Mr. McClanaghan in his capacity of President and CEO, as set forth above under “Termination of Employment, Change in Responsibilities and Employment Contracts.” The Company paid $67,419.00 to Stephen Winters during the period from incorporation to September 25, 2006 for legal services provided by Mr. Winters to the Company and a further $49,326 since that time. The Company has no arrangement to provide

-45-

benefits to directors upon termination of employment or service as a director. The Company has as a provision of its management agreement with Scott Steeds that in the event of termination for just cause during the term of the agreement that Mr. Steeds will be granted stock options equal to 2.5% of all of the issued and outstanding shares of the Company at the termination date at the average price for the 20 days prior to termination for a term of five years.

The Company’s Audit Committee comprises Allan Anderson, Lindsay Bottomer and Stephen Winters. The Audit Committee is appointed by the Board of Directors and its members hold office until removed by the Board of Directors or until the next annual general meeting of the Company, at which time their appointments expire and they are then eligible for re-appointment. The Audit Committee reviews the audited financial statements of the Company and liaises with the Company’s auditors and recommends to the Board of Directors whether or not to approve such statements. At the request of the Company’s auditors, the Audit Committee must convene a meeting to consider any matters, which the auditor believes should be brought to the attention of the Board of Directors or the shareholders of the Company.

The Company does not currently have a Compensation Committee. The directors determined that, in light of the Company’s size and resources, setting up such a committee would be too expensive for the Company at this time. The Company has, however, set up an Independent Review Committee of the Board to review and approve all non-arm’s length contracts. This Committee has the same composition as the Audit Committee, and comprises a majority of non-management directors and unrelated directors.

During the fiscal year ended August 31, 2007, the Company had one employee, who worked out of the Company’s head office in a management role. The Company had no support staff and has undertaken its corporate development and exploration activities by the hiring of consultants, one of whom is a director, and independent contractors.

The following table sets forth the share ownership of those persons listed in subsection 6.A above and includes the details of all options or warrants to purchase shares of the Company held by such persons:

-46-

Name

|

|

|

| Number of

Common

Shares Held at

December 10,

2007

|

| Number of

Common Shares

Subject to

Options or

Warrants at

December 10,

2007

|

| Beneficial

Percentage

Ownership

(1)

|

| Exercise

Price

|

| Expiry Date

|

|---|

| Dale McClanaghan | | | | 750,000 | | 50,000/

| | 8.5% | | $0.50/

| | September 25, 2011/

|

| | | | | | | 50,000/175,000 | | | | $0.50/ | | October 10, 2011/

|

| | | | | | | | | | | $1.30 | | March 30, 2012 |

| Scott Steeds | | | | 750,000 | | 50,000/

| | 8.5% | | $0.50/

| | September 25, 2011/

|

| | | | | | | 50,000/175,000 | | | | $0.50/

| | October 10, 2011/

|

| | | | | | | | | | | $1.30 | | March 30, 2012 |

| Allan Anderson | | | | 12,000 | | 50,000 | | 0.5% | | $0.50 | | September 25, 2011 |

| Lindsay Bottomer | | | | 45,000 | | 75,000 | | 1.0% | | $0.50/ | | September 25, 2011/ |

| Stephen Winters | | | | 66,000 | | 50,000 | | 1.0% | | $0.50 | | October 10, 2011 |

| (1) | | Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission. In computing the number of shares owned by a person and the percentage ownership of that person, common shares subject to options and warrants held by that person that are currently exercisable or exercisable within 60 days of December 10, 2007, are deemed outstanding. Such shares, however, are not deemed outstanding for the purposes of computing the percentage ownership of any other person. This table has been prepared based on 12,075,511common shares outstanding as of December 10, 2007. |

The common shares held by Dale McClanaghan and Scott Steeds (the “Founders”) are subject to a Founders’ Share Escrow Agreement. See “Item 7. Major Shareholders and Related Party Transactions — A. Major Shareholders — Founders’ Share Escrow Agreement”.

Stock Option Plan

On February 19, 2007 the Company adopted a stock option plan (the “2007 Plan”) which authorizes the Company’s board of directors to grant incentive stock options to the directors, officers and employees of the Company or its associated, affiliated, controlled or subsidiary companies, in accordance with the terms of the Plan and the rules and policies of the TSX Venture Exchange. All of the options listed in the table above were granted pursuant to the Company’s 2007 Plan. The purpose of the 2007 Plan is to advance the interests of the Company and its shareholders and subsidiaries by attracting, retaining and motivating the performance of selected directors, officers, employees or consultants of the Company of high caliber and potential and to encourage and enable such persons to acquire and retain a proprietary interest in the Company by ownership of its stock.

-47-

The 2007 Plan provides that, subject to the requirements of the Exchange, the aggregate number of securities reserved for issuance, set aside and made available for issuance under the 2007 Plan may not exceed 10% of the issued and outstanding shares of the Company at the time of granting of options (including all options granted by the Company to date). The number of common shares which may be reserved in any 12 month period for issuance to any one individual upon exercise of all stock options held by that individual may not exceed 5% of the issued and outstanding common shares of the Company unless the Company has obtained disinterested shareholder approval. The number of common shares which may be reserved in any 12 month period for issuance to any one employee or consultant engaged in investor relations activities may not exceed 2% of the issued and outstanding common shares of the Company. The 2007 Plan provides that options issued to consultants performing investor relations activities will vest in stages over 12 months with no more than 1/4 of the options vesting in any three month period.

The 2007 Plan will be administered by the board of directors of the Company, which will have full and final authority with respect to the granting of all options there under. Options may be granted under the 2007 Plan to such directors, officers, employees or consultants of the Company and its affiliates, if any, as the board of directors may from time to time designate. Options may also be granted to employees of management companies providing management services to the Company. The exercise price of any options granted under the 2007 Plan shall be determined by the board of directors, but may not be less than the market price of the Company’s shares on the Exchange on the date of the grant (less any discount permissible under Exchange rules). The term of any options granted under the 2007 Plan shall be determined by the board of directors at the time of grant but, subject to earlier termination in the event of dismissal for cause, termination other than for cause or in the event of death, the term of any options granted under the 2007 Plan may not exceed five years (ten years if the Company becomes a Tier 1 Issuer under Exchange Policies). Tier 1 is the Exchange’s premier tier and is reserved for the Exchange’s most advanced issuers with the most significant financial resources. See additional description under “— Founders’ Share Escrow Agreement” below. If desired by the Board, options granted under the 2007 Plan may be subject to vesting.

ITEM 7. | | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS

|

The following table sets forth the names of the shareholders who, to the knowledge of management of the Company, as at December 10, 2007 beneficially own greater than 5% of any class of the Company’s voting securities:

Name

|

|

|

| Number of

Common

Shares Held at

October 15,

2007

|

| Number of

Common

Shares Subject

to Options or

Warrants at

October 15,

2007

|

| Beneficial

Percentage

Ownership

(1)

|

| Exercise

Price

|

| Expiry Date

|

|---|

| Dale McClanaghan | | | | 750,000 | | 50,000/50,000/

| | 8.5% | | $0.50/ $0.50/

| | September 25, 2011/ |

| | | | | | | 175,000 | | | | $1.30 | | October 10, 2011/ |

| | | | | | | | | | | | | March 30, 2012 |

| Scott Steeds | | | | 750,000 | | 50,000/50,000/

| | 8.5% | | $0.50/ $0.50/

| | September 25, 2011/

|

| | | | | | | 175,000 | | | | $1.30 | | October 10, 2011/

|

| | | | | | | | | | | | | March 30, 2012 |

-48-

Name

|

|

|

| Number of

Common

Shares Held at

October 15,

2007

|

| Number of

Common

Shares Subject

to Options or

Warrants at

October 15,

2007

|

| Beneficial

Percentage

Ownership

(1)

|

| Exercise

Price

|

| Expiry Date

|

|---|

| Pinetree Resource Partnership | | | | 1,000,000 | | 500,000 | | 12.4% | | $1.00 | | March 22, 2008 |

| Passport Materials Master Fund, LP | | | | 802,500 | | 401,250 | | 10.0% | | $1.00 | | March 22, 2008 |

| (1) | | Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission. In computing the number of shares owned by a person and the percentage ownership of that person, common shares subject to options and warrants held by that person that are currently exercisable or exercisable within 60 days of December 10, 2007, are deemed outstanding. Such shares, however, are not deemed outstanding for the purposes of computing the percentage ownership of any other person. This table has been prepared based on 12,075,511 common shares outstanding as of December 10, 2007. |

Dale McClanaghan and Scott Steeds acquired these shares in May, 2005 and options on February 16, 2006, October 10, 2006 and March 30, 2007.

The common shares held by Dale McClanaghan and Scott Steeds (the “Founders”) are subject to a Founders’ Share Escrow Agreement. See “Founders’ Share Escrow Agreement” below.

The Company’s major shareholders do not have different voting rights from the Company’s other shareholders. To the knowledge of the Company, it is not controlled by another corporation, any foreign government or by any other natural or legal persons severally or jointly.

As at December 10, 2007 there were 12,075,511 common shares of the Company issued and outstanding.

The Company does not know of any arrangements that may at subsequent date result in a change of control of the Company.

Founders’ Share Escrow Agreement

On September 25, 2006, the Company completed an initial public offering in Canada of 2,000,000 flow-through common shares and 1,000,000 units, with each unit consisting of one non-flow-through common share and one-half of a share purchase warrant. In connection with its initial public offering, the Company’s shares were listed on the TSX Venture Exchange. See “Item 5. Operating and Financial Review and Prospects—B. Liquidity and Capital Resources — Nine months ended May 31, 2007”

In accordance with Canadian National Policy 46-201 (“NP 46-201”)—Escrow for Initial Public Offerings, all common shares of an issuer owned or controlled by its principals are required to be placed in escrow at the time of the issuer’s initial public offering, unless the shares held by the principal or issuable to the principal upon conversion of convertible securities held by the principal collectively represent less than 1% of the total issued and outstanding shares of the issuer after giving effect to the initial public offering. At the time of an initial public offering, an issuer is classified for the purposes of NP 46-201 escrow as either an “exempt issuer”, an “established issuer” or an “emerging issuer”.

-49-

Uniform terms of automatic timed-release escrow apply to principals of issuers carrying out initial public offerings, differing only according to the classification of the issuer. The Company has been classified as an “emerging issuer” by virtue of being listed on Tier 2 of the TSX Venture Exchange.

The Company issued pre-IPO shares to its founders, Dale McClanaghan and Scott Steeds (the “Founders”). A total of 1,500,000 common shares were acquired by the Founders at a price of $0.001 per share. Pursuant to an escrow agreement entered into on December 21, 2005 (the “Founders’ Share Escrow Agreement”) among the Company, the Founders and Pacific Corporate Trust Company (the “Escrow Agent”), the 1,500,000 common shares were deposited in escrow.

The following automatic timed releases will apply to the securities held under the Founders’ Share Escrow Agreement.

| – | | 10% of each Principal’s holdings were released from escrow on the date on which the Company’s common shares are first listed for trading on the TSX Venture Exchange (the “Listing Date”); |

| – | | 15% of each Principal’s holdings were released from escrow 6 months following the Listing Date; |

| – | | 15% of each Principal’s holdings will be released from escrow 12 months following the Listing Date; |

| – | | 15% of each Principal’s holdings will be released from escrow 18 months following the Listing Date; |

| – | | 15% of each Principal’s holdings will be released from escrow 24 months following the Listing Date; |

| – | | 15% of each Principal’s holdings will be released from escrow 30 months following the Listing Date; and |

| – | | 15% of each Principal’s holdings will be released from escrow 36 months following the Listing Date. |

If within 18 months of the Listing Date the Company achieves “established issuer” status, under the terms of the Founders’ Share Escrow Agreement it will “graduate” resulting in a “catch-up” release and accelerated release of any securities remaining in escrow under the 18 month schedule applicable to established issuers as if the Company had originally been classified as an established issuer. “Established issuer” status may be achieved by becoming a Tier 1 issuer on the Exchange. Some of the minimum requirements of becoming a Tier 1 issuer are as follows:

| – | | the issuer must have net tangible assets of at least $2,000,000; |

| – | | the issuer must have a material interest in a property with substantial geological merit; |

| – | | the issuer must have adequate financial resources to conduct a recommended work program of at least $500,000, to satisfy general and administrative expenses for at least 18 months, to maintain properties in good standing for at least 18 months and to have at least $100,000 in unallocated funds. |

Pursuant to the terms of the Founders’ Share Escrow Agreement, the securities of the Company held in escrow may be transferred within escrow to an individual who is a director or senior officer of the Company or of a material operating subsidiary of the Company, subject to the approval of the Company’s board of directors, or to a person or company that before the proposed transfer holds more than 20% of the voting rights attached to the Company’s outstanding securities, or to a person or company that after the proposed transfer will hold more than 10% of the voting rights attached to the Company’s outstanding securities and that has the right to elect or appoint one or more directors or senior officers of the Company or of any of its material operating subsidiaries.

Pursuant to the terms of the Founders’ Share Escrow Agreement, upon the bankruptcy of a holder of escrowed securities, the securities held in escrow may be transferred within escrow to the trustee in bankruptcy or other person legally entitled to such securities. Upon the death of a holder of escrowed securities, all securities of the deceased holder will be released from escrow to the deceased holder’s legal representative.

-50-

B. | | Related Party Transactions |

On July 1, 2005 the Company entered into an employment agreement with Dale McClanaghan whereby the Company agreed to employ Mr. McClanaghan as President and CEO of the Company. The employment agreement is for a one year term. The employment agreement with Mr. McClanaghan was extended to August 31, 2007. Mr. McClanaghan, or a holding company beneficially owned by him, as Mr. McClanaghan shall decide, is paid $2,500 per month for his services commencing July 1, 2005. The Company agreed in March 2007 to increase the amount to $5,000 per month and extended the term to August 31, 2008. As part of these agreement, Mr. McClanaghan agreed to confidentiality and non-disclosure provisions.

On July 1, 2005 the Company entered into a consulting agreement with Scott Steeds, a director of the Company whereby the Company agreed to pay Mr. Steeds $2,500 per month for providing services in the area of corporate development for a period of one year. The consulting agreement with Mr. Steeds was extended to August 31, 2007. Mr. Steeds, or a holding company beneficially owned by him, as Mr. Steeds shall decide, is to be paid $2,500 per month for his services commencing July 1, 2005. The Company agreed in March 2007 to increase the amount to $5,000 per month and extended the term to August 31, 2008.

On December 21, 2005, in connection with the Company’s issuance to Dale McClanaghan and Scott Steeds of an aggregate 1,500,000 common shares at a price of $0.001 per share, Mr. McClanaghan, Mr. Steeds, the Company and Pacific Corporate Trust Company entered into the Founders’ Share Escrow Agreement as described above under “—A. Major Shareholders—Founders’ Share Escrow Agreement.”

The Company paid $67,419.00 to Stephen Winters during the period from incorporation to September 25, 2006 and a further $49,326 since that time for legal services provided by Mr. Winters to the Company. The Company believes that these services were obtained on terms comparable to those that would have been available from unrelated third parties.

Except with respect to these agreements, there were no material transactions in the period from incorporation on February 15, 2005 to the year ended August 31, 2007, or proposed material transactions between the Company or any of its subsidiaries and:

| (a) | | enterprises that directly or indirectly through one or more intermediaries, control or are controlled by, or are under common control with, the Company; |

| (c) | | individuals owning, directly or indirectly, an interest in the voting power of the Company that gives them significant influence over the Company, and close members of any such individual’s family; |

| (d) | | key management personnel, that is, those persons having authority and responsibility for planning, directing and controlling the activities of the Company, including directors or senior management of companies and close members of such individuals’ families; |

| (e) | | enterprises in which a substantial interest in the voting power is owned, directly or indirectly, by any person described in (c) or (d) or over which such a person is able to exercise significant influence including enterprises owned by directors or major shareholders of the Company and enterprises that have a member of key management in common with the Company. |

No officer or director of the Company, or any associate of such person, was indebted to the Company at any time during the period from incorporation on February 15, 2005 to May 31, 2007.

-51-

C. | | Interests of Experts and Counsel |

This Form 20-F is being filed as a Registration Statement under the Exchange Act and, as such, there is no requirement to provide any information under this Item.

ITEM 8. | | FINANCIAL INFORMATION

|

A. | | Statements and Other Financial Information |

This Registration Statement contains the audited financial statements for the Company for the initial 198-day period from incorporation on February 15, 2005 to August 31, 2005, for the year ended August 31, 2006 and for the year ended August 31, 2007 and contains an Independent Auditors’ Report to the Directors dated November 17, 2006 relating to the audited financial statements for the initial 198-day period from incorporation to August 31, 2005 and for the year ended August 31, 2006 and an Independent Auditors’ Rport to the Directors dated November 21, 2007 relating to the audited financial statements for the year ended August 31, 2007. These statements comprise Balance Sheets as at August 31, 2005, August 31, 2006, and August 31, 2007, Statements of Operations and Deficit for the initial 198-day period from incorporation on February 15, 2005 to August 31, 2005, the year ended August 31, 2006 and the year ended August 31, 2007, Statements of Cash Flows for the initial 198-day period from incorporation on February 15, 2005 to August 31, 2005, the year ended August 31, 2006 and year ended August 31, 2007 and Notes to the Financial Statements.

Legal Proceedings

The Company is not a party to any legal proceedings and is not aware of any such proceedings known to be contemplated.

Dividend Policy

The holders of common shares are entitled to participate equally in any dividends our Board of Directors declares out of funds legally available for the payment of dividends. There are no limitations on the payment of dividends. All of the Company’s available funds will be invested to finance the growth of the Company’s business and therefore investors cannot expect and should not anticipate receiving a dividend on the Company’s common shares in the foreseeable future.

Since the date of the annual financial statements for the year ended August 31, 2007, the Company has not had any significant financial changes.

-52-

ITEM 9. | | THE OFFER AND LISTING

|

A. | | Offer and Listing Details |

The Company’s common shares were first called for trading on the TSX Venture Exchange on September 27, 2006. The high and low sale prices for the common shares of the Company on the TSX Venture Exchange for each month and fiscal quarter since the shares of the Company were listed on the TSX Venture Exchange are as follows:

|

|

|

| High

|

| Low

|

|---|

2006 | | | | | | | | | | |

| September | | | | $0.55 | | $0.46 |

| October | | | | $0.90 | | $0.40 |

| November | | | | $2.10 | | $0.73 |

| December | | | | $1.60 | | $1.02 |

| |

2007 | | | | | | | | | | |

| January | | | | $1.14 | | $0.85 |

| February | | | | $1.00 | | $0.75 |

| March | | | | $1.67 | | $0.80 |

| April | | | | $1.50 | | $1.30 |

| May | | | | $1.55 | | $1.05 |

| June | | | | $1.25 | | $0.77 |

| July | | | | $0.85 | | $0.63 |

| August | | | | $0.62 | | $0.32 |

| September | | | | $0.60 | | $0.345 |

| October | | | | $0.75 | | $0.45 |

| November | | | | $0.55 | | $0.40 |

The closing price of the Company’s common shares on the TSX Venture Exchange on December 10, 2007 was $0.40.

The shares to be registered are the common shares of the Company. The Company has authorized an unlimited number of common shares, without par value, of which 12,075,511 were issued and outstanding as of December 10, 2007. None of the Company’s outstanding shares are in bearer form. The issued and outstanding common shares may be traded freely in Canada subject to applicable securities laws. Even though this Registration Statement will become effective automatically sixty days after being filed with the SEC, all sales into or within the United States must still be made pursuant to an effective registration statement under the Securities Act of 1933, or an exemption from Securities Act registration such as Rule 144.

This Form 20-F is being filed as a Registration Statement under the Exchange Act and, as such, there is no requirement to provide any information under this Item.

The Company’s common shares were called for trading on the TSX Venture Exchange on September 27, 2006 and continue trading on that Exchange on the date hereof.

-53-

This Form 20-F is being filed as a Registration Statement under the Exchange Act and, as such, there is no requirement to provide any information under this Item.

This Form 20-F is being filed as a Registration Statement under the Exchange Act and, as such, there is no requirement to provide any information under this Item.

This Form 20-F is being filed as a Registration Statement under the Exchange Act and, as such, there is no requirement to provide any information under this Item.

ITEM 10. | | ADDITIONAL INFORMATION |

Authorized

The authorized capital of the Company consists of an unlimited number of voting common shares without par value. No other class of shares is currently authorized.

Issued and Outstanding

The following table sets forth a summary of common shares outstanding at the incorporation of the Company in February 2005 and to December 10, 2007:

|

|

|

| Number of

Common Shares

|

| Amount

$

|

|---|

| Common shares issued in February 2005 pursuant to incorporation | | | | 2 | | 0.50 |

| Principals’ escrow shares issued in May 2005 | | | | 1,499,998 | | 1,499.98 |

| Shares issued for cash by way of December 2005 private financing | | | | 1,102,000 | | 275,500.00 |

| Shares issued for cash by way of December 2005 private financing (Units) | | | | 310,000 | | 77,500.00 |

| Shares issued for cash by way of February 2006 private financing (Units) | | | | 324,000 | | 81,000.00 |

Balance, August 31, 2006 | | | | 3,236,000 | | 435,500 |

| Shares issued for cash by way of September 2006 public offering (2,000,000 shares and 1,000,000 units) | | | | 3,000,000 | | 1,500,000 |

| Shares issued in September 2006 and March 2007 as partial compensation for finders’ fees | | | | 407,493 | | 331,744 |

| Shares issued in September 2006 pursuant to Carter property agreement | | | | 75,000 | | 37,500 |

| Shares issued for cash by way of March 2007 private financing (Flow-through shares and non flow-through units) | | | | 4,791,664 | | 4,000,000 |

-54-

|

|

|

| Number of

Common Shares

|

| Amount

$

|

|---|

| Shares issued on exercise of warrants | | | | 432,824 | | 181,968 |

| Shares issued on exercise of agent’s options | | | | 47,530 | | 26,225 |

| Shares issued on exercise of stock options | | | | 10,000 | | 5,000 |

Balance, August 31, 2007 | | | | 12,000,511 | | 6,517,937 (1) |

| Shares issued in September 2007 pursuant to the Carter property agreement | | | | 75,000 | | Pursuant to Carter Property Agreement |

Balance, December 10, 2007 | | | | 12,075,511 | | 6,517,937 |

| (1) | | This amount includes share issue costs of $927,571 and does not include fair value of options exercised of $11,320. Share issue costs of $927,571 are not included and fair value of options exercised is included in the share capital amount of $5,601,686 shown as share capital in Item 3 B. Capitalization and Indebtedness on page 8. |

Warrants

The following table summarizes the status of the Company’s share purchase warrants outstanding at December 10, 2007:

Price

|

|

|

| Expiry

date

|

| Balance,

February 28,

2006

|

| Issued

|

| Balance,

December 10,

2007

|

|---|

| $0.30 | | | | December 30, 2006 | | 155,000 (1) | | December 30, 2005 | | Expired |

| $0.30 | | | | February 6, 2007 | | 162,000 (2) | | February 6, 2006 | | Expired |

| $0.75 | | | | September 25, 2007 | | N/A | | September 25, 2006 | | Expired (3) |

| $0.75 | | | | September 25, 2007 | | N/A | | When exercised(4) | | Expired (4) |

| $1.00 | | | | March 19, 2008(5) | | N/A | | March 19, 2007 | | 12,500 |

| $1.00 | | | | March 22, 2008(5) | | N/A | | March 22, 2007 | | 1,550,000 |

| (1) | | Issued as part of a private placement of 310,000 units, each unit consisting of one common share and one-half of a share purchase warrant. All warrants were exercised. |

| (2) | | Issued as part of a private placement of 324,000 units, each unit consisting of one common share and one-half of a share purchase warrant. All warrants were exercised. |

| (3) | | Issued as part of public offering of 1,000,000 units and as partial compensation to Haywood Securities Inc, lead agent in the Company’s IPO, of 25,000 units, each unit consisting of one common share and one-half of a share purchase warrant, each full warrant exercisable to purchase one common share for a total of 512,500 warrants. There were 116,312 warrant exercised as at the expiry date. |

-55-

| (4) | | There were 18,844.5 warrants issued as part of the exercise of agent’s options at $0.50 per unit. Each unit consists of one common share and one-half of a share purchase warrant. There were 9,841 warrant exercised as at the expiry date. |

| (5) | | Issued as part of a private placement of 3,125,000 units, each unit consisting of one common share and one-half of a share purchase warrant. |

Stock Options

The Company has a stock option plan that allow it to grant options to its employees, officers, directors and consultants to acquire up to 10% of issued and outstanding common stock. The exercise price of each option shall be fixed by the Board of Directors of the Company but shall not be less than the minimum price permitted by the Exchange. Options have a maximum term of five years and terminate thirty days following the termination of the optionee’s employment. The right to exercise the options will vest in installments over the life of the option as determined at the time the option is granted. The following table provides details of options to purchase stock of the Company outstanding at December 10, 2007:

Class of Optionee

(Number of

Optionees in

Class)

|

|

|

| Number of

Common Shares

Under Option

|

| Date of

Grant

|

| Exercise Price

|

| Expiry

Date

|

|---|

| Directors (5) | | | | 225,000 | | Feb 16/2006 | | $0.50 | | Sep 25/2011 |

| | | | | 150,000 | | Oct 10/2006 | | $0.50 | | Oct 10/2011 |

| | | | | 350,000 | | Mar 30/2007 | | $1.30 | | Mar 30/2012 |

| |

| | | | | 50,000 | | Feb 16/2006 | | $0.50 | | Sep 25/2011 |

| | | | | 50,000 | | Feb 16/2006 | | $0.50 | | Sep 25/2011 |

| | | | | 50,000 | | Feb 16/2006 | | $0.50 | | Sep 25/2011 |

| | | | | 75,000 | | Feb 16/2006 | | $0.50 | | Sep 25/2011 |

| | | | | 50,000 | | Oct 10/2006 | | $0.50 | | Oct 10/2011 |

| | | | | 50,000 | | Oct 10/2006 | | $0.50 | | Oct 10/2011 |

| | | | | 50,000 | | Oct 10/2006 | | $0.50 | | Oct 10/2011 |

| | | | | 175,000 | | Mar 30/2007 | | $1.30 | | Mar 30/2012 |

| | | | | 175,000 | | Mar 30/2007 | | $1.30 | | Mar 30/2012 |

| |

Consultants

(7) | | | | 50,000 | | Feb 16/2006 | | $0.50 | | Sep 25/2011 |

| | | | | 100,000 | | Oct 10/2006 | | $0.50 | | Oct 10/2011 |

| | | | | 125,000 | | Feb 15, 2007 | | $0.90 | | Feb 15/2012 |

| | | | | 45,000 | | Mar 30/2007 | | $1.30 | | Mar 30/2012 |

| |

| | | | | 30,000 | | Feb 16/2006 | | $0.50 | | Sep 25/2011 |

| | | | | 20,000 | | Feb 16/2006 | | $0.50 | | Sep 25/2011 |

| | | | | 80,000 | | Oct 10/2006 | | $0.50 | | Oct 10/2011 |

| | | | | 10,000(1) | | Oct 10/2006 | | $0.50 | | Oct 10/2011 |

| | | | | 10,000 | | Oct 10/2006 | | $0.50 | | Oct 10/2011 |

| | | | | 75,000 | | Feb 15/2007 | | $0.90 | | Feb 15/2012 |

| | | | | 50,000 | | Feb 15/2007 | | $0.90 | | Feb 15/2012 |

| | | | | 25,000 | | Mar 30/2007 | | $1.30 | | Mar 30/2012 |

| | | | | 20,000 | | Mar 30/2007 | | $1.30 | | Mar 30/2012 |

| (1) | | These 10,000 options were exercised on April 25, 2007. |

-56-

History of Share Capital (Since Incorporation on February 15, 2005)

The table below provides the history of the Company’s share capital from incorporation on February 15, 2005 through December 10, 2007, identifying events during such period which have changed the amount of issued capital and/or number and classes of shares. The table includes details of price and terms of issuances, including particulars of non-cash consideration, as well as the resolutions, authorizations and approvals by virtue of which the shares have been issued, the nature of the issue and amount thereof and the number of shares which have been issued.

| Transaction

Description

|

| Average

Price Per

Share

(Cdn $)

|

| Common

Shares

|

| Amount

(Cdn $)

|

| Resolution

Authorizing

Transaction

|

|---|

| | Common shares issued

in February 2005

pursuant to

incorporation | | 0.25 | | 2 | | 0.50 | | Directors Resolution

dated February 18, 2005 |

| | Principals’ escrow

shares issued May 2005 | | 0.001 | | 1,499,998 | | 1,499.98 | | Directors Resolution

dated May 5, 2005 |

| | Shares issued for cash

by way of December

2005 private financing | | 0.25 | | 1,102,000 | | 275,500.00 | | Directors Resolution

dated December 30,

2005 |

| | Shares issued for cash

by way of December

2005 private financing

(Units) | | 0.25 | | 310,000 | | 77,500.00 | | Directors Resolution

dated December 30,

2005 |

| | Shares issued for cash

by way of February

2006 private financing

(Units) | | 0.25 | | 324,000 | | 81,000.00 | | Directors Resolution

dated February 6, 2006 |

-57-

| Transaction

Description

|

| Average

Price Per

Share

(Cdn $)

|

| Common

Shares

|

| Amount

(Cdn $)

|

| Resolution

Authorizing

Transaction

|

|---|

| | Balance, August 31, 2006 | | | | 3,236,000 | | 435,500 | | |

| | Shares issued for cash

by way of September

2006 public offering | | 0.50 | | 3,000,000 | | 1,500,000 | | Directors Resolution

dated June 9, 2006 |

| | Shares issued as partial

compensation to

Haywood Securities Inc.

(lead agent in the

Company’s initial public

offering) | | 0.50 | | 25,000 | | 12,500 | | Directors Resolution

dated June 9, 2006 |

| | Shares issued pursuant

to Carter Property

agreement | | 0.50 | | 75,000 | | 37,500 | | Directors Resolution

dated June 15, 2005 |

| | Shares issued pursuant

to warrant exercise | | 0.30/

0.75 | | 432,824 | | 181,968 | | Directors Resolutions

dated February 6, 2006

and June 9, 2006 |

| | Shares issued pursuant

to agent’s option

exercise | | 0.50/0.75 | | 47,530 | | 26,225 | | Directors Resolutions dated

June 9, 2006 |

| | Shares issued pursuant

to stock option exercise | | 0.50 | | 10,000 | | 5,000 | | Directors Resolutions dated

October 10, 2006 |

| | Shares issued for cash

by way of March 2007

private financing | | 0.90

0.80 | | 1,666,664

3,125,000 | | 1,499,997.60

2,500,000 | | Directors Resolutions

dated March 5, 2007,

March 19, 2007 and

March 22, 2007 |

| | Shares issued as part of

the finders’ fees for the

March 2007 private

financing | | 0.90/0.80 | | 382,493 | | 319,244 | | Directors Resolutions

dated March 5, 2007

and March 22, 2007 |

| | Shares issued pursuant

to Carter Property

agreement | | 0.50 | | 75,000 | | Pursuant to Carter Property Agreement | | Directors Resolution

dated June 15, 2005 |

| | Balance December 10, 2007 | | | | 12,075,511 | | 6,517,937 | | |

-58-

During the period from incorporation to September 30, 2006, the following changes in issued share capital occurred:

The Company completed a private placement on December 30, 2005 of 1,102,000 common shares at a price of $0.25 per share for gross proceeds of $275,500.

The Company completed a private placement on December 30, 2005, of 310,000 units at a price of $0.25 per Unit, each unit consisting of one common share and one-half of a purchase warrant for total gross proceeds of $77,500. Each full share purchase warrant is convertible to one common share at an exercise price of $0.30 per common share and expired on December 30, 2006. All warrants were exercised.

The Company completed a private placement on February 6, 2006, of 324,000 units at a price of $0.25 per Unit, each unit consisting of one common share and one-half of a purchase warrant for total gross proceeds of $81,000. Each full share purchase warrant is convertible to one common share at an exercise price of $0.30 per common share and expired on February 6, 2007. All warrants were exercised.

On September 25, 2006 the Company completed a public offering (the “Offering”) to purchasers resident in British Columbia and Alberta, Canada, through Haywood Securities Inc., of 2,000,000 flow-through common shares at a price of $0.50 per share and 1,000,000 units at a price of $0.50 per unit (the “Units”). Each Unit consisted of one non flow-through common share and one-half of a common share purchase warrant. Each whole warrant is exercisable for the purchase of one additional common share at $0.75 per common share for one year from the closing of the Offering.

In March, 2007, the Company completed a private placement of 1,666,664 flow-through common shares at a price of $0.90 per share and 3,125,000 units at $0.80 per unit , each unit consisting of one common share and one-half of a purchase warrant for total proceeds of $3,999,997.60. Each full share purchase warrant is convertible to one common share at an exercise price of $1.00 per common share. 12,500 warrants will expire on March 19, 2008 and 1,550,000 warrants will expire on March 22, 2008, 2007.

B. | | Memorandum and Articles of Association |

The Company’s Memorandum (termed “Notice of Articles”) and Articles of Association (“Articles”) are incorporated by reference herein from filed documents as noted in Item 19. The Company was incorporated on February 15, 2005 pursuant to the Business Corporations Act (British Columbia) (the “BC Act”) and registered with the Registrar of Companies for British Columbia under the name 716576 B.C. Ltd. under incorporation number BC716576. The Company changed its name to BC Moly Ltd. on June 15, 2005 and subsequently changed its name to its present name on February 16, 2006. The Company is not limited in its objects and purposes.

The following is a summary of certain provisions of the Company’s Notice of Articles and Articles:

Directors’ Power to Vote on Matters in Which the Director is Materially Interested

The Company’s Articles provide that it is the duty of any of the Company’s directors who are directly or indirectly interested in an existing or proposed contract or transaction with the Company to declare the nature of their interest at a meeting of the Company’s Board of Directors. In the case of a proposed contract or transaction, the declaration must be made at the meeting of the Company’s Board of Directors at which the question of entering into the contract or transaction is first taken into consideration, or if the interested directors are not present at that meeting, the Company’s directors are required to

-59-

declare their interest at the next meeting. A director shall not vote in respect of the approval of any such contract or transaction with the Company in which he is interested and if he shall do so, his vote shall not be counted, but he shall be counted in the quorum present at the meeting at which such vote is taken.

Directors’ Power to Vote on Compensation to Themselves

Subject to the BC Act, the Company’s Articles provide that the directors may determine the amount to be paid out of the Company’s funds or capital as remuneration for their service. The directors may also determine the proportions and manner that the remuneration will be divided among them.

Directors’ Borrowing Powers

The Company’s Articles provide that the directors, from time to time at their discretion, may authorize the company to:

| (a) | | borrow any sum of money; |

| (b) | | guarantee the repayment of any sum of money borrowed by any person or corporation; and |

| (c) | | guarantee the performance of any obligations of any other person or corporation. |

Retirement of Directors under an Age Limit Requirement

The Company’s Articles do not require directors to retire prior to a specified age.

Number of Shares Required for a Director’s Qualification

The Company’s Articles do not provide for a requirement of share ownership for a director’s qualification.

Share Rights, Preferences and Restrictions

All common shares are of the same class and have the same rights, preferences and limitations.