Exhibit 99.1

FS Investment Corporation

FOURTH QUARTER 2013 FINANCIAL INFORMATION

www.fsinvestmentcorp.com

Important Disclosure Notice

This presentation may contain certain forward-looking statements, including statements with regard to the future performance of FS Investment

Corporation (FSIC, we or us). Words such as “believes,” “expects,” “projects” and “future” or similar expressions are intended to identify forward-looking statements. These forward-looking statements are subject to the inherent uncertainties in predicting future results and conditions. Certain factors could cause actual results to differ materially from those projected in these forward-looking statements. Factors that could cause actual results to differ materially include changes in the economy, risks associated with possible disruption in FSIC’s operations or the economy due generally to terrorism or natural disasters, future changes in laws or regulations and conditions in FSIC’s operating area, the ability of FSIC to complete the listing of its shares of common stock on the New York Stock Exchange LLC (NYSE), and the price at which shares of common stock may trade on the NYSE. Some of these factors are enumerated in the filings FSIC makes with the Securities and Exchange Commission (SEC). FSIC undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

This presentation contains summaries of certain financial and statistical information about FSIC. The information contained in this presentation is summary information that is intended to be considered in the context of FSIC’s SEC filings and other public announcements that FSIC may make, by press release or otherwise, from time to time. FSIC undertakes no duty or obligation to publicly update or revise the information contained in this presentation. In addition, information related to past performance, while helpful as an evaluative tool, is not necessarily indicative of future results, the achievement of which cannot be assured. Investors should not view the past performance of FSIC, or information about the market, as indicative of FSIC’s future results.

This presentation contains certain financial measures that have not been prepared in accordance with U.S. generally accepted accounting principles (GAAP). FSIC uses these non-GAAP financial measures internally in analyzing financial results and believes that the use of these non-GAAP financial measures is useful to investors as an additional tool to evaluate ongoing results and trends and in comparing FSIC’s financial results with other business development companies.

Non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP financial measures, and should be read only in conjunction with FSIC’s consolidated financial statements prepared in accordance with GAAP. A reconciliation of non-

GAAP financial measures to the most directly comparable GAAP measures has been provided in the tables on page 22 included in this presentation and investors are encouraged to review the reconciliation.

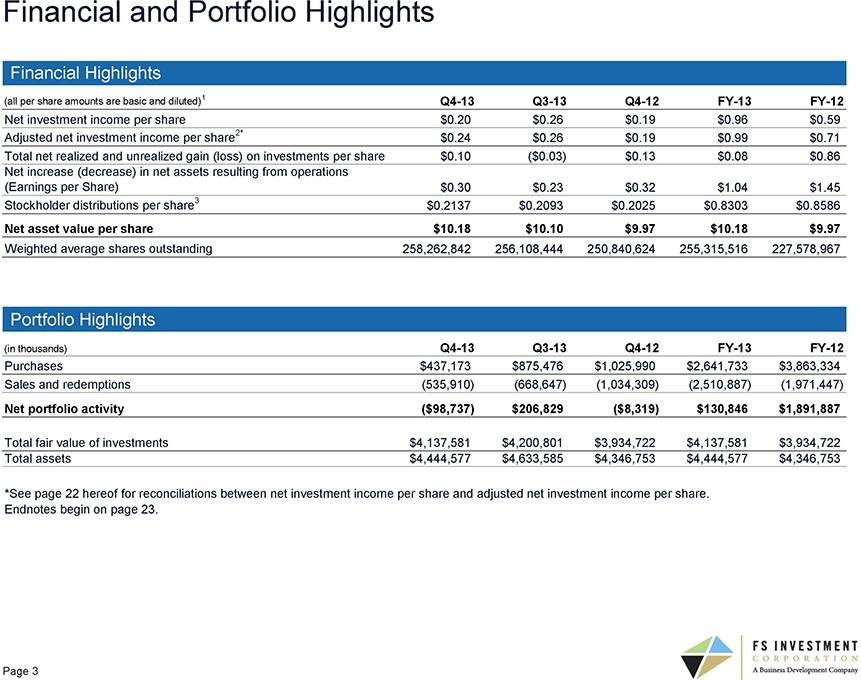

Financial and Portfolio Highlights

Financial Highlights

(all per share amounts are basic and diluted)1 Q4-13 Q3-13 Q4-12 FY-13 FY-12

Net investment income per share $0.20 $0.26 $0.19 $0.96 $0.59 Adjusted net investment income per share2* $0.24 $0.26 $0.19 $0.99 $0.71 Total net realized and unrealized gain (loss) on investments per share $0.10 ($0.03) $0.13 $0.08 $0.86 Net increase (decrease) in net assets resulting from operations (Earnings per Share) $0.30 $0.23 $0.32 $1.04 $1.45 Stockholder distributions per share3 $0.2137 $0.2093 $0.2025 $0.8303 $0.8586

Net asset value per share $10.18 $10.10 $9.97 $10.18 $9.97

Weighted average shares outstanding 258,262,842 256,108,444 250,840,624 255,315,516 227,578,967

Portfolio Highlights

(in thousands) Q4-13 Q3-13 Q4-12 FY-13 FY-12

Purchases $437,173 $875,476 $1,025,990 $2,641,733 $3,863,334 Sales and redemptions (535,910) (668,647) (1,034,309) (2,510,887) (1,971,447)

Net portfolio activity ($98,737) $206,829 ($8,319) $130,846 $1,891,887

Total fair value of investments $4,137,581 $4,200,801 $3,934,722 $4,137,581 $3,934,722 Total assets $4,444,577 $4,633,585 $4,346,753 $4,444,577 $4,346,753

*See page 22 hereof for recon

ciliations between net investment income per share and adjusted net investment income per share. Endnotes begin on page 23.

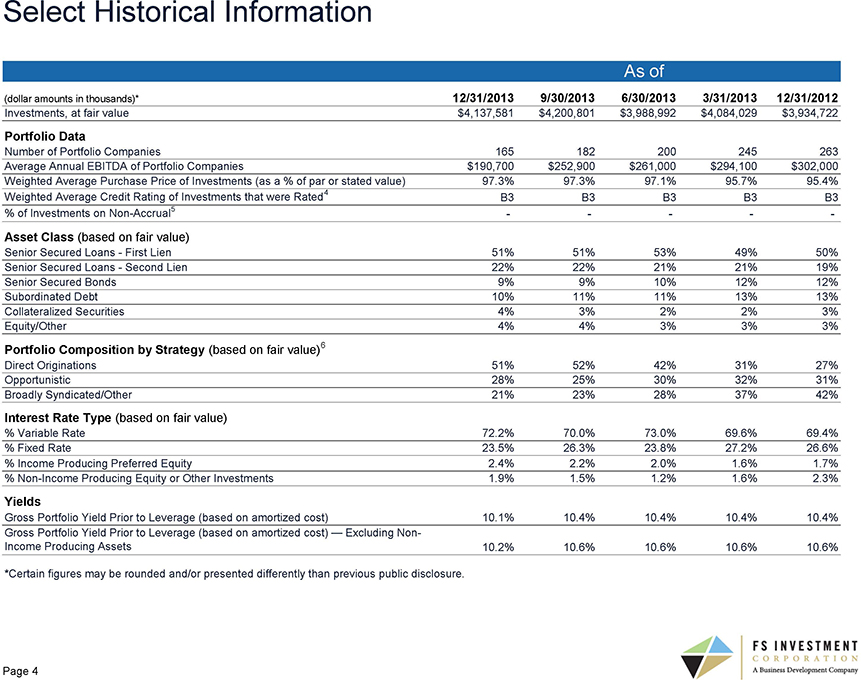

Select Historical Information

As of

(dollar amounts in thousands)* 12/31/2013 9/30/2013 6/30/2013 3/31/2013 12/31/2012

Investments, at fair value $4,137,581 $4,200,801 $3,988,992 $4,084,029 $3,934,722

Portfolio Data

Number of Portfolio Companies 165 182 200 245 263 Average Annual EBITDA of Portfolio Companies $190,700 $252,900 $261,000 $294,100 $302,000 Weighted Average Purchase Price of Investments (as a % of par or stated value) 97.3% 97.3% 97.1% 95.7% 95.4% Weighted Average Credit Rating of Investments that were Rated4 B3 B3 B3 B3 B3 % of Investments on Non-Accrual5 — ——

Asset Class (based on fair value)

Senior Secured Loans—First Lien 51% 51% 53% 49% 50% Senior Secured Loans—Second Lien 22% 22% 21% 21% 19% Senior Secured Bonds 9% 9% 10% 12% 12% Subordinated Debt 10% 11% 11% 13% 13% Collateralized Securities 4% 3% 2% 2% 3% Equity/Other 4% 4% 3% 3% 3%

Portfolio Composition by Strategy (based on fair value)6

Direct Originations 51% 52% 42% 31% 27% Opportunistic 28% 25% 30% 32% 31% Broadly Syndicated/Other 21% 23% 28% 37% 42%

Interest Rate Type (based on fair value)

% Variable Rate 72.2% 70.0% 73.0% 69.6% 69.4%

% Fixed Rate 23.5% 26.3% 23.8% 27.2% 26.6%

% Income Producing Preferred Equity 2.4% 2.2% 2.0% 1.6% 1.7%

% Non-Income Producing Equity or Other Investments 1.9% 1.5% 1.2% 1.6% 2.3%

Yields

Gross Portfolio Yield Prior to Leverage (based on amortized cost) 10.1% 10.4% 10.4% 10.4% 10.4%

Gross Portfolio Yield Prior to Leverage (based on amortized cost) — Excluding Non-

Income Producing Assets 10.2% 10.6% 10.6% 10.6% 10.6%

*Certain figures may be rounded and/or presented differently than previous public disclosure.

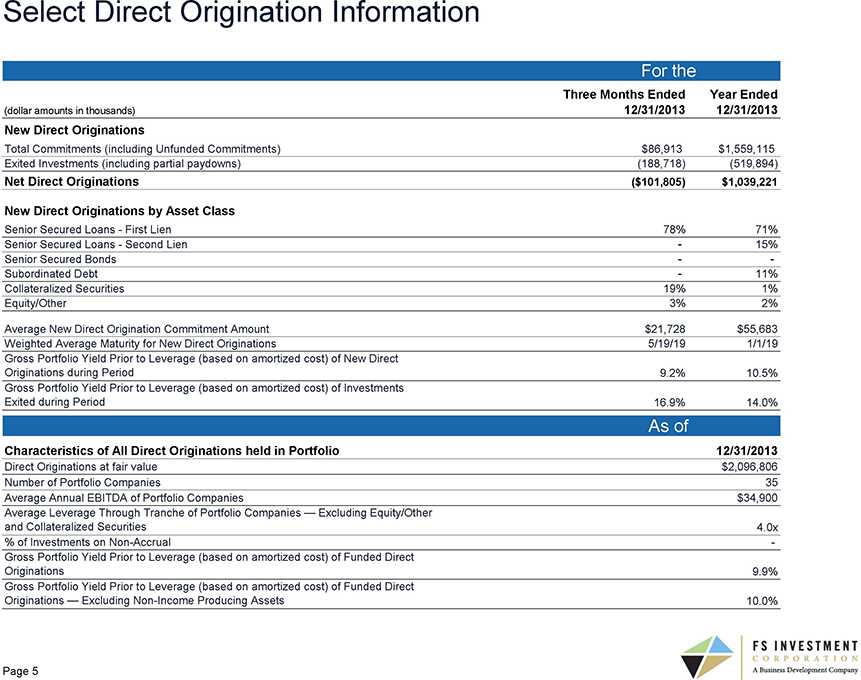

Select Direct Origination Information

For the

Three Months Ended Year Ended

(dollar amounts in thousands) 12/31/2013 12/31/2013 New Direct Originations

Total Commitments (including Unfunded Commitments) $86,913 $1,559,115 Exited Investments (including partial paydowns) (188,718) (519,894)

Net Direct Originations ($101,805) $1,039,221

New Direct Originations by Asset Class

Senior Secured Loans—First Lien 78% 71% Senior Secured Loans—Second Lien—15% Senior Secured Bonds — Subordinated Debt—11% Collateralized Securities 19% 1% Equity/Other 3% 2%

Average New Direct Origination Commitment Amount $21,728 $55,683 Weighted Average Maturity for New Direct Originations 5/19/19 1/1/19 Gross Portfolio Yield Prior to Leverage (based on amortized cost) of New Direct Originations during Period 9.2% 10.5% Gross Portfolio Yield Prior to Leverage (based on amortized cost) of Investments Exited during Period 16.9% 14.0%

As of

Characteristics of All Direct Originations held in Portfolio 12/31/2013

Direct Originations at fair value $2,096,806 Number of Portfolio Companies 35 Average Annual EBITDA of Portfolio Companies $34,900

Average Leverage Through Tranche of Portfolio Companies — Excluding Equity/Other and Collateralized Securities 4.0x % of Investments on Non-Accrual—Gross Portfolio Yield Prior to Leverage (based on amortized cost) of Funded Direct Originations 9.9% Gross Portfolio Yield Prior to Leverage (based on amortized cost) of Funded Direct

Originations — Excluding Non-Income Producing Assets 10.0%

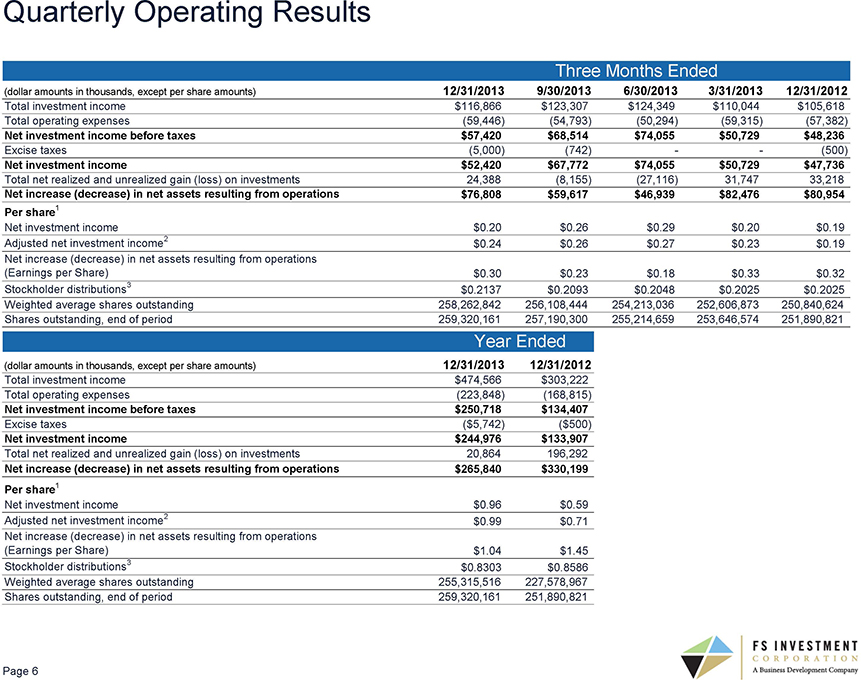

Quarterly Operating Results

Three Months Ended

(dollar amounts in thousands, except per share amounts) 12/31/2013 9/30/2013 6/30/2013 3/31/2013 12/31/2012

Total investment income $116,866 $123,307 $124,349 $110,044 $105,618 Total operating expenses (59,446) (54,793) (50,294) (59,315) (57,382)

Net investment income before taxes $57,420 $68,514 $74,055 $50,729 $48,236

Excise taxes (5,000) (742) — (500)

Net investment income $52,420 $67,772 $74,055 $50,729 $47,736

Total net realized and unrealized gain (loss) on investments 24,388 (8,155) (27,116) 31,747 33,218

Net increase (decrease) in net assets resulting from operations $76,808 $59,617 $46,939 $82,476 $80,954 Per share1

Net investment income $0.20 $0.26 $0.29 $0.20 $0.19 Adjusted net investment income2 $0.24 $0.26 $0.27 $0.23 $0.19 Net increase (decrease) in net assets resulting from operations (Earnings per Share) $0.30 $0.23 $0.18 $0.33 $0.32 Stockholder distributions3 $0.2137 $0.2093 $0.2048 $0.2025 $0.2025 Weighted average shares outstanding 258,262,842 256,108,444 254,213,036 252,606,873 250,840,624 Shares outstanding, end of period 259,320,161 257,190,300 255,214,659 253,646,574 251,890,821

Year Ended

(dollar amounts in thousands, except per share amounts) 12/31/2013 12/31/2012

Total investment income $474,566 $303,222 Total operating expenses (223,848) (168,815)

Net investment income before taxes $250,718 $134,407

Excise taxes ($5,742) ($500)

Net investment income $244,976 $133,907

Total net realized and unrealized gain (loss) on investments 20,864 196,292

Net increase (decrease) in net assets resulting from operations $265,840 $330,199 Per share1

Net investment income $0.96 $0.59 Adjusted net investment income2 $0.99 $0.71 Net increase (decrease) in net assets resulting from operations (Earnings per Share) $1.04 $1.45 Stockholder distributions3 $0.8303 $0.8586 Weighted average shares outstanding 255,315,516 227,578,967 Shares outstanding, end of period 259,320,161 251,890,821

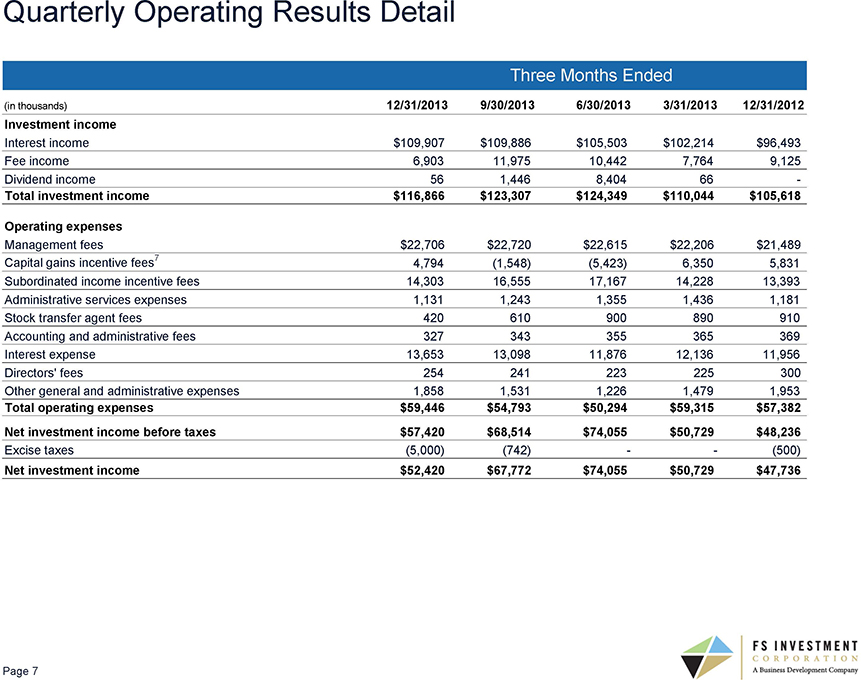

Quarterly Operating Results Detail

Three Months Ended

(in thousands) 12/31/2013 9/30/2013 6/30/2013 3/31/2013 12/31/2012 Investment income

Interest income $109,907 $109,886 $105,503 $102,214 $96,493 Fee income 6,903 11,975 10,442 7,764 9,125 Dividend income 56 1,446 8,404 66—

Total investment income $116,866 $123,307 $124,349 $110,044 $105,618

Operating expenses

Management fees $22,706 $22,720 $22,615 $22,206 $21,489 Capital gains incentive fees7 4,794 (1,548) (5,423) 6,350 5,831 Subordinated income incentive fees 14,303 16,555 17,167 14,228 13,393 Administrative services expenses 1,131 1,243 1,355 1,436 1,181 Stock transfer agent fees 420 610 900 890 910 Accounting and administrative fees 327 343 355 365 369 Interest expense 13,653 13,098 11,876 12,136 11,956 Directors’ fees 254 241 223 225 300 Other general and administrative expenses 1,858 1,531 1,226 1,479 1,953

Total operating expenses $59,446 $54,793 $50,294 $59,315 $57,382

Net investment income before taxes $57,420 $68,514 $74,055 $50,729 $48,236

Excise taxes (5,000) (742) — (500)

Net investment income $52,420 $67,772 $74,055 $50,729 $47,736

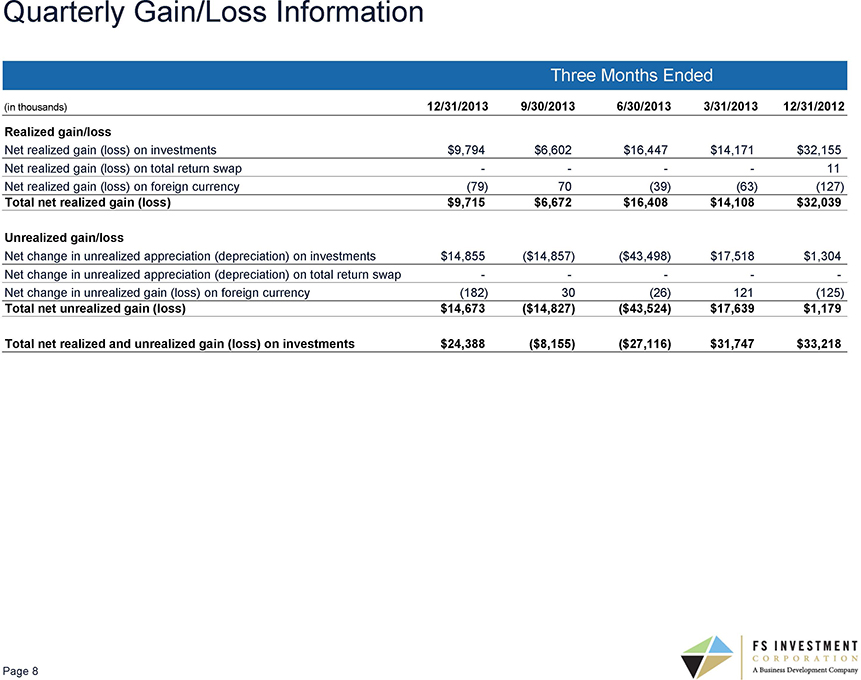

Quarterly Gain/Loss Information

Three Months Ended

(in thousands) 12/31/2013 9/30/2013 6/30/2013 3/31/2013 12/31/2012

Realized gain/loss

Net realized gain (loss) on investments $9,794 $6,602 $16,447 $14,171 $32,155 Net realized gain (loss) on total return swap — — 11 Net realized gain (loss) on foreign currency (79) 70 (39) (63) (127)

Total net realized gain (loss) $9,715 $6,672 $16,408 $14,108 $32,039

Unrealized gain/loss

Net change in unrealized appreciation (depreciation) on investments $14,855 ($14,857) ($43,498) $17,518 $1,304 Net change in unrealized appreciation (depreciation) on total return swap — ——Net change in unrealized gain (loss) on foreign currency (182) 30 (26) 121 (125)

Total net unrealized gain (loss) $14,673 ($14,827) ($43,524) $17,639 $1,179

Total net realized and unrealized gain (loss) on investments $24,388 ($8,155) ($27,116) $31,747 $33,218

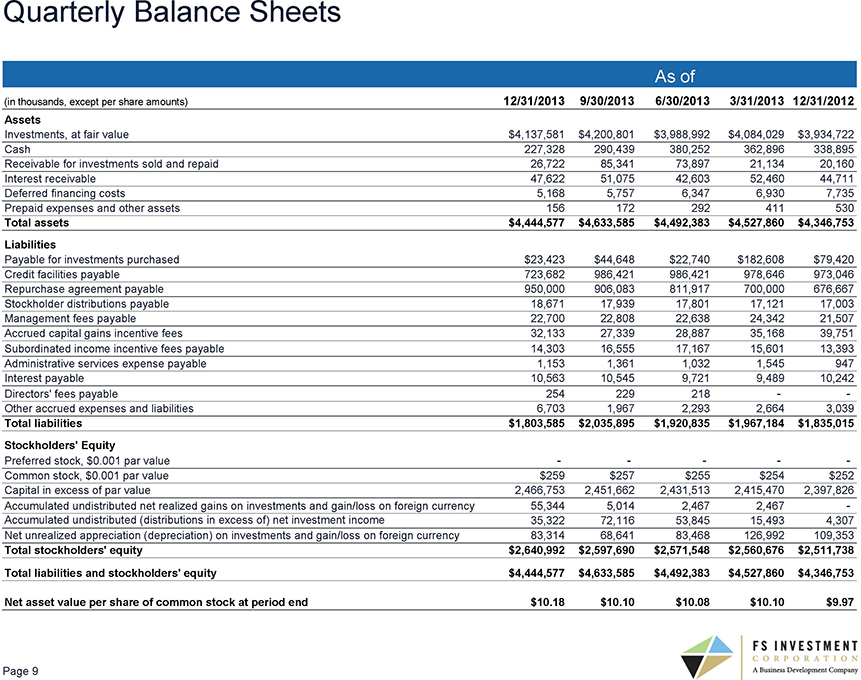

Quarterly Balance Sheets

As of

(in thousands, except per share amounts) 12/31/2013 9/30/2013 6/30/2013 3/31/2013 12/31/2012

Assets

Investments, at fair value $4,137,581 $4,200,801 $3,988,992 $4,084,029 $3,934,722 Cash 227,328 290,439 380,252 362,896 338,895 Receivable for investments sold and repaid 26,722 85,341 73,897 21,134 20,160 Interest receivable 47,622 51,075 42,603 52,460 44,711 Deferred financing costs 5,168 5,757 6,347 6,930 7,735 Prepaid expenses and other assets 156 172 292 411 530

Total assets $4,444,577 $4,633,585 $4,492,383 $4,527,860 $4,346,753

Liabilities

Payable for investments purchased $23,423 $44,648 $22,740 $182,608 $79,420 Credit facilities payable 723,682 986,421 986,421 978,646 973,046 Repurchase agreement payable 950,000 906,083 811,917 700,000 676,667 Stockholder distributions payable 18,671 17,939 17,801 17,121 17,003 Management fees payable 22,700 22,808 22,638 24,342 21,507 Accrued capital gains incentive fees 32,133 27,339 28,887 35,168 39,751 Subordinated income incentive fees payable 14,303 16,555 17,167 15,601 13,393 Administrative services expense payable 1,153 1,361 1,032 1,545 947 Interest payable 10,563 10,545 9,721 9,489 10,242 Directors’ fees payable 254 229 218 — Other accrued expenses and liabilities 6,703 1,967 2,293 2,664 3,039

Total liabilities $1,803,585 $2,035,895 $1,920,835 $1,967,184 $1,835,015

Stockholders’ Equity

Preferred stock, $0.001 par value — ——Common stock, $0.001 par value $259 $257 $255 $254 $252 Capital in excess of par value 2,466,753 2,451,662 2,431,513 2,415,470 2,397,826 Accumulated undistributed net realized gains on investments and gain/loss on foreign currency 55,344 5,014 2,467 2,467—Accumulated undistributed (distributions in excess of) net investment income 35,322 72,116 53,845 15,493 4,307 Net unrealized appreciation (depreciation) on investments and gain/loss on foreign currency 83,314 68,641 83,468 126,992 109,353

Total stockholders’ equity $2,640,992 $2,597,690 $2,571,548 $2,560,676 $2,511,738

Total liabilities and stockholders’ equity $4,444,577 $4,633,585 $4,492,383 $4,527,860 $4,346,753

Net asset value per share of common stock at period end $10.18 $10.10 $10.08 $10.10 $9.97

Financing Arrangements

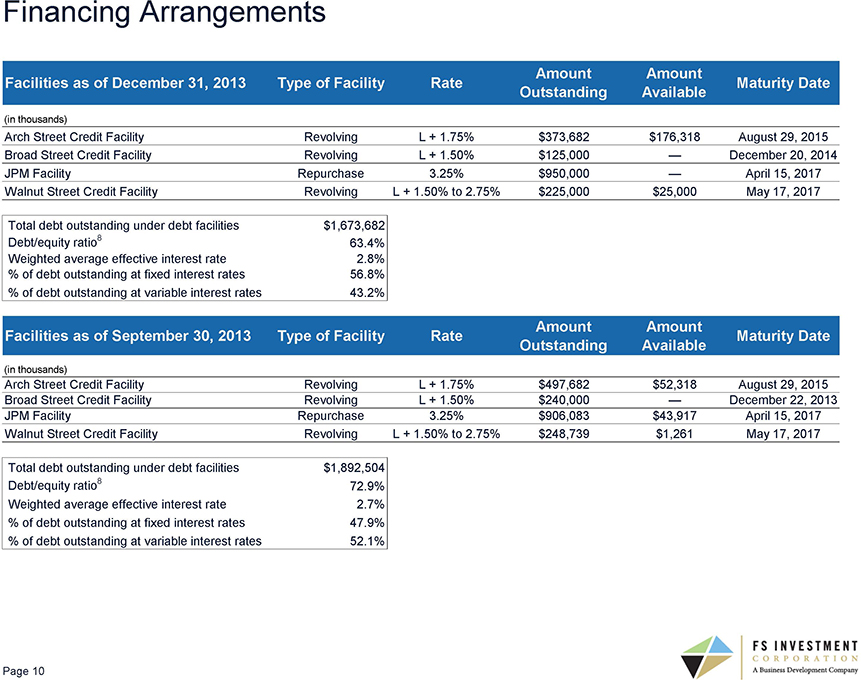

Amount Amount

Facilities as of December 31, 2013 Type of Facility Rate Maturity Date Outstanding Available

(in thousands)

Arch Street Credit Facility Revolving L + 1.75% $373,682 $176,318 August 29, 2015 Broad Street Credit Facility Revolving L + 1.50% $125,000 — December 20, 2014 JPM Facility Repurchase 3.25% $950,000 — April 15, 2017 Walnut Street Credit Facility Revolving L + 1.50% to 2.75% $225,000 $25,000 May 17, 2017

Total debt outstanding under debt facilities $1,673,682 Debt/equity ratio8 63.4% Weighted average effective interest rate 2.8% % of debt outstanding at fixed interest rates 56.8% % of debt outstanding at variable interest rates 43.2%

Amount Amount

Facilities as of September 30, 2013 Type of Facility Rate Maturity Date Outstanding Available

(in thousands)

Arch Street Credit Facility Revolving L + 1.75% $497,682 $52,318 August 29, 2015 Broad Street Credit Facility Revolving L + 1.50% $240,000 — December 22, 2013 JPM Facility Repurchase 3.25% $906,083 $43,917 April 15, 2017 Walnut Street Credit Facility Revolving L + 1.50% to 2.75% $248,739 $1,261 May 17, 2017

Total debt outstanding under debt facilities $1,892,504 Debt/equity ratio8 72.9% Weighted average effective interest rate 2.7% % of debt outstanding at fixed interest rates 47.9% % of debt outstanding at variable interest rates 52.1%

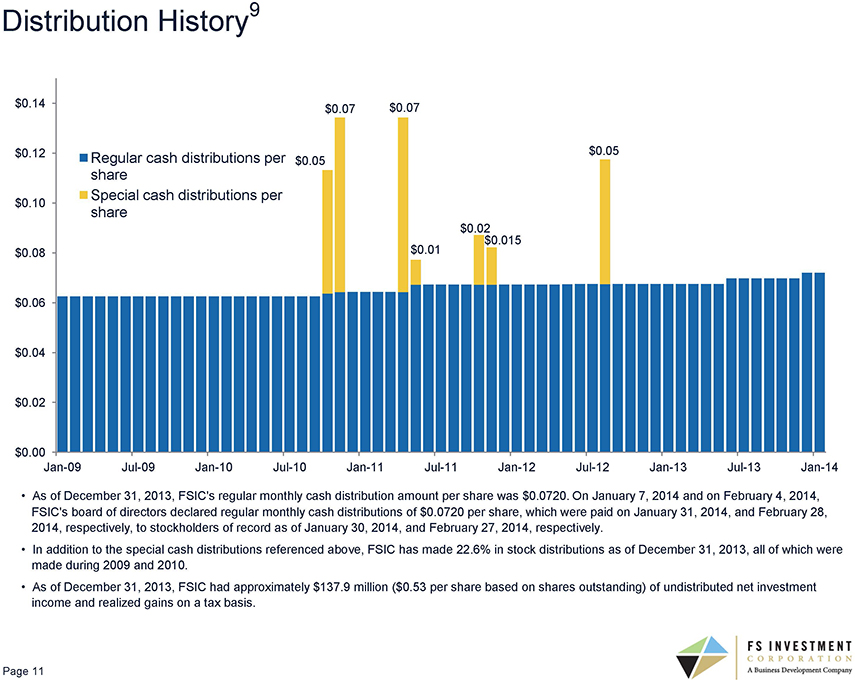

Distribution History9

$0.14 $0.07 $0.07

$0.12 $0.05

Regular cash distributions per $0.05 share Special cash distributions per

$0.10

share

$0.02 $0.015 $0.08 $0.01

$0.06 $0.04 $0.02

$0.00

Jan-09 Jul-09 Jan-10 Jul-10 Jan-11 Jul-11 Jan-12 Jul-12 Jan-13 Jul-13 Jan-14

As of December 31, 2013, FSIC’s regular monthly cash distribution amount per share was $0.0720. On January 7, 2014 and on February 4, 2014, FSIC’s board of directors declared regular monthly cash distributions of $0.0720 per share, which were paid on January 31, 2014, and February 28, 2014, respectively, to stockholders of record as of January 30, 2014, and February 27, 2014, respectively.

In addition to the special cash distributions referenced above, FSIC has made 22.6% in stock distributions as of December 31, 2013, all of which were made during 2009 and 2010.

As of December 31, 2013, FSIC had approximately $137.9 million ($0.53 per share based on shares outstanding) of undistributed net investment income and realized gains on a tax basis.

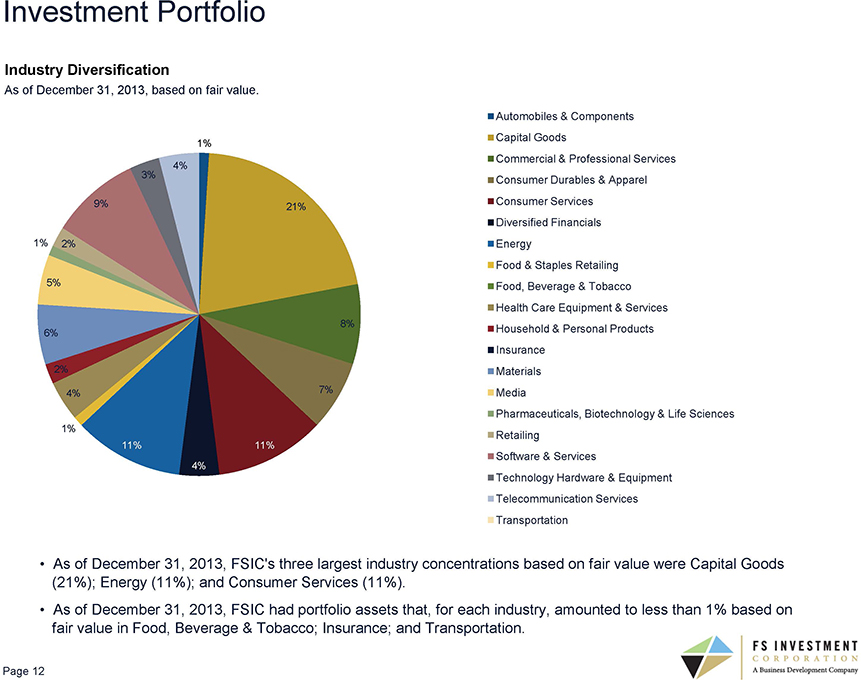

Investment Portfolio

Industry Diversification

As of December 31, 2013, based on fair value.

Automobiles & Components Capital Goods

Commercial & Professional Services Consumer Durables & Apparel Consumer Services Diversified Financials Energy Food & Staples Retailing Food, Beverage & Tobacco Health Care Equipment & Services Household & Personal Products Insurance Materials Media

Pharmaceuticals, Biotechnology & Life Sciences Retailing Software & Services Technology Hardware & Equipment Telecommunication Services Transportation

As of December 31, 2013, FSIC’s three largest industry concentrations based on fair value were Capital Goods

(21%); Energy (11%); and Consumer Services (11%).

As of December 31, 2013, FSIC had portfolio assets that, for each industry, amounted to less than 1% based on fair value in Food, Beverage & Tobacco; Insurance; and Transportation.

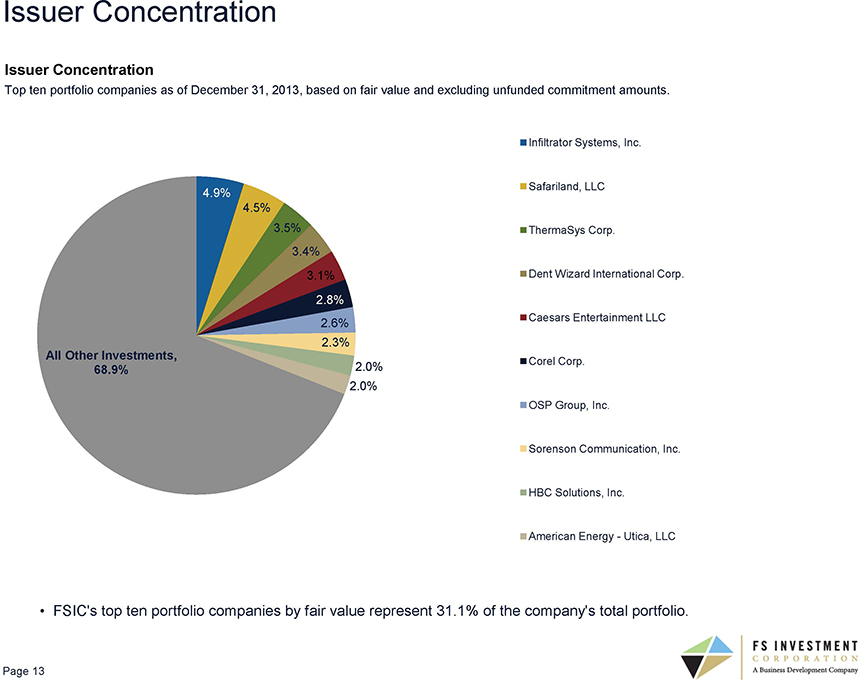

Issuer Concentration

Issuer Concentration

Top ten portfolio companies as of December 31, 2013, based on fair value and excluding unfunded commitment amounts.

Infiltrator Systems, Inc.

Safariland, LLC

ThermaSys Corp.

Dent Wizard International Corp. Caesars Entertainment LLC Corel Corp.

OSP Group, Inc.

Sorenson Communication, Inc.

HBC Solutions, Inc.

American Energy—Utica, LLC

FSIC’s top ten portfolio companies by fair value represent 31.1% of the company’s total portfolio.

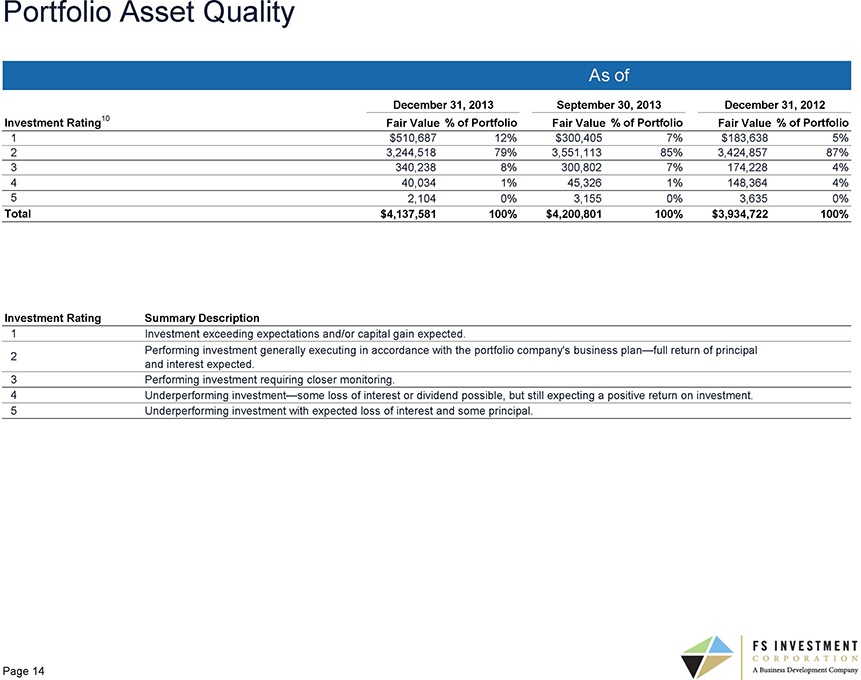

Portfolio Asset Quality

As of

December 31, 2013 September 30, 2013 December 31, 2012 Investment Rating10 Fair Value % of Portfolio Fair Value % of Portfolio Fair Value % of Portfolio

1 $510,687 12% $300,405 7% $183,638 5% 2 3,244,518 79% 3,551,113 85% 3,424,857 87% 3 340,238 8% 300,802 7% 174,228 4% 4 40,034 1% 45,326 1% 148,364 4% 5 2,104 0% 3,155 0% 3,635 0%

Total $4,137,581 100% $4,200,801 100% $3,934,722 100%

Investment Rating Summary Description

1 | | Investment exceeding expectations and/or capital gain expected. |

Performing investment generally executing in accordance with the portfolio company’s business plan—full return of principal

3 | | Performing investment requiring closer monitoring. |

4 Underperforming investment—some loss of interest or dividend possible, but still expecting a positive return on investment.

5 | | Underperforming investment with expected loss of interest and some principal. |

2013 FINANCIAL INFORMATION &

SELECT FINANCIAL AND PORTFOLIO INFORMATION AS OF FEBRUARY 28, 2014

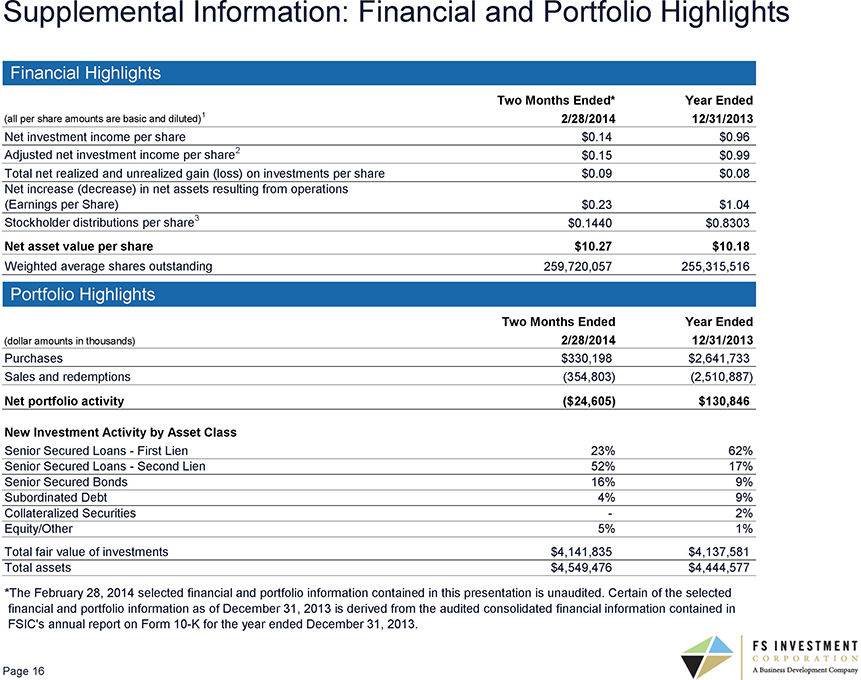

Supplemental Information: Financial and Portfolio Highlights

Financial Highlights

Two Months Ended* Year Ended

(all per share amounts are basic and diluted)1 2/28/2014 12/31/2013

Net investment income per share $0.14 $0.96 Adjusted net investment income per share2 $0.15 $0.99 Total net realized and unrealized gain (loss) on investments per share $0.09 $0.08 Net increase (decrease) in net assets resulting from operations (Earnings per Share) $0.23 $1.04 Stockholder distributions per share3 $0.1440 $0.8303

Net asset value per share $10.27 $10.18

Weighted average shares outstanding 259,720,057 255,315,516

Portfolio Highlights

Two Months Ended Year Ended

(dollar amounts in thousands) 2/28/2014 12/31/2013

Purchases $330,198 $2,641,733 Sales and redemptions (354,803) (2,510,887)

Net portfolio activity ($24,605) $130,846

New Investment Activity by Asset Class

Senior Secured Loans—First Lien 23% 62% Senior Secured Loans—Second Lien 52% 17% Senior Secured Bonds 16% 9% Subordinated Debt 4% 9% Collateralized Securities—2% Equity/Other 5% 1% Total fair value of investments $4,141,835 $4,137,581 Total assets $4,549,476 $4,444,577

*The February 28, 2014 selected financial and portfolio information contained in this presentation is unaudited. Certain of the selected financial and portfolio information as of December 31, 2013 is derived from the audited consolidated financial information contained in FSIC’s annual report on Form 10-K for the year ended December 31, 2013.

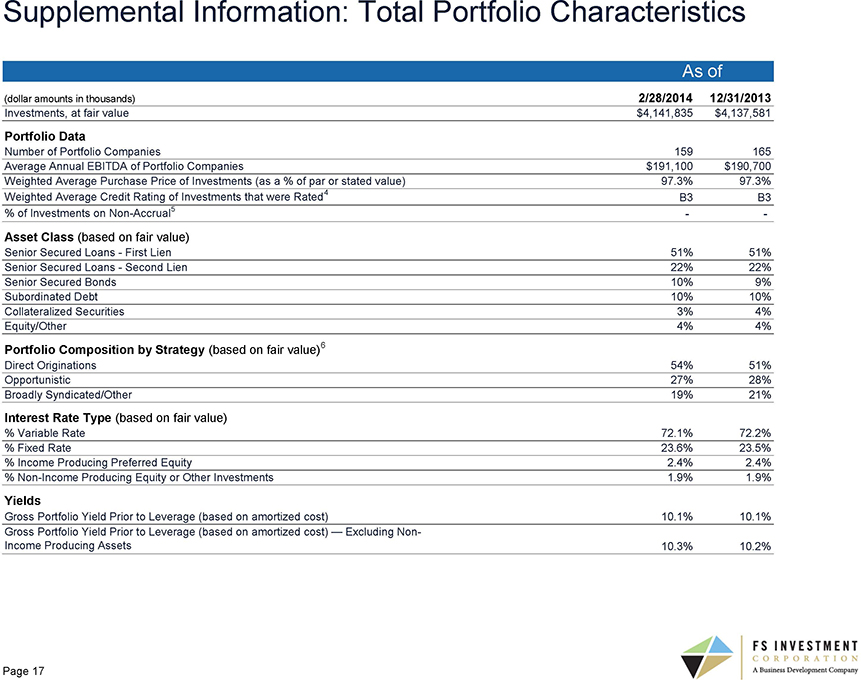

Supplemental Information: Total Portfolio Characteristics

As of

(dollar amounts in thousands) 2/28/2014 12/31/2013

Investments, at fair value $4,141,835 $4,137,581

Portfolio Data

Number of Portfolio Companies 159 165 Average Annual EBITDA of Portfolio Companies $191,100 $190,700 Weighted Average Purchase Price of Investments (as a % of par or stated value) 97.3% 97.3% Weighted Average Credit Rating of Investments that were Rated4 B3 B3 % of Investments on Non-Accrual5 —

Asset Class (based on fair value)

Senior Secured Loans—First Lien 51% 51% Senior Secured Loans—Second Lien 22% 22% Senior Secured Bonds 10% 9% Subordinated Debt 10% 10% Collateralized Securities 3% 4% Equity/Other 4% 4%

Portfolio Composition by Strategy (based on fair value)6

Direct Originations 54% 51% Opportunistic 27% 28% Broadly Syndicated/Other 19% 21%

Interest Rate Type (based on fair value)

% Variable Rate 72.1% 72.2%

% Fixed Rate 23.6% 23.5%

% Income Producing Preferred Equity 2.4% 2.4%

% Non-Income Producing Equity or Other Investments 1.9% 1.9%

Yields

Gross Portfolio Yield Prior to Leverage (based on amortized cost) 10.1% 10.1%

Gross Portfolio Yield Prior to Leverage (based on amortized cost) — Excluding Non-

Income Producing Assets 10.3% 10.2%

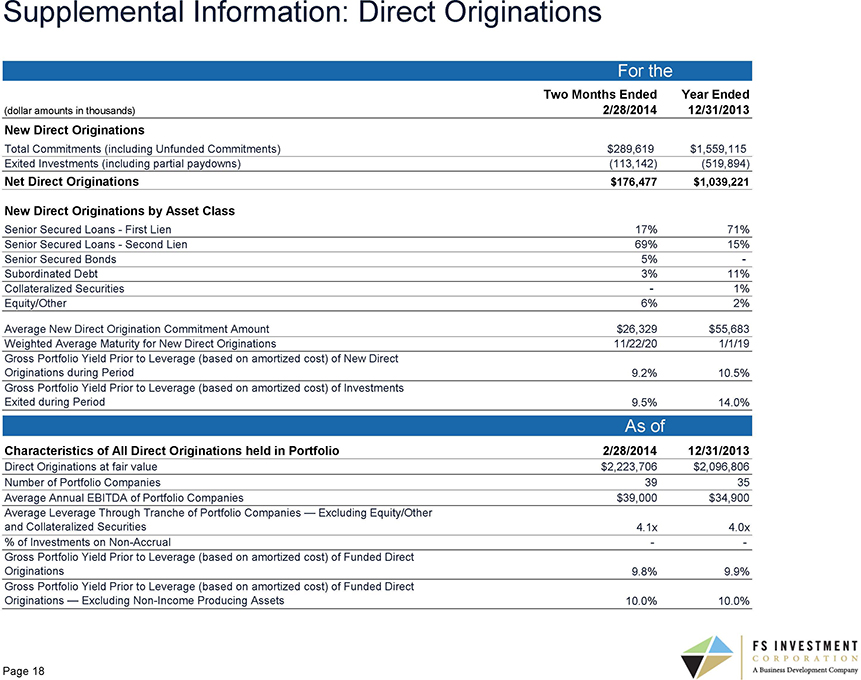

Supplemental Information: Direct Originations

For the

Two Months Ended Year Ended

(dollar amounts in thousands) 2/28/2014 12/31/2013 New Direct Originations

Total Commitments (including Unfunded Commitments) $289,619 $1,559,115 Exited Investments (including partial paydowns) (113,142) (519,894)

Net Direct Originations $176,477 $1,039,221

New Direct Originations by Asset Class

Senior Secured Loans—First Lien 17% 71% Senior Secured Loans—Second Lien 69% 15% Senior Secured Bonds 5%—Subordinated Debt 3% 11% Collateralized Securities—1% Equity/Other 6% 2%

Average New Direct Origination Commitment Amount $26,329 $55,683 Weighted Average Maturity for New Direct Originations 11/22/20 1/1/19 Gross Portfolio Yield Prior to Leverage (based on amortized cost) of New Direct Originations during Period 9.2% 10.5% Gross Portfolio Yield Prior to Leverage (based on amortized cost) of Investments Exited during Period 9.5% 14.0%

As of

Characteristics of All Direct Originations held in Portfolio 2/28/2014 12/31/2013

Direct Originations at fair value $2,223,706 $2,096,806 Number of Portfolio Companies 39 35 Average Annual EBITDA of Portfolio Companies $39,000 $34,900

Average Leverage Through Tranche of Portfolio Companies — Excluding Equity/Other and Collateralized Securities 4.1x 4.0x % of Investments on Non-Accrual — Gross Portfolio Yield Prior to Leverage (based on amortized cost) of Funded Direct Originations 9.8% 9.9% Gross Portfolio Yield Prior to Leverage (based on amortized cost) of Funded Direct

Originations — Excluding Non-Income Producing Assets 10.0% 10.0%

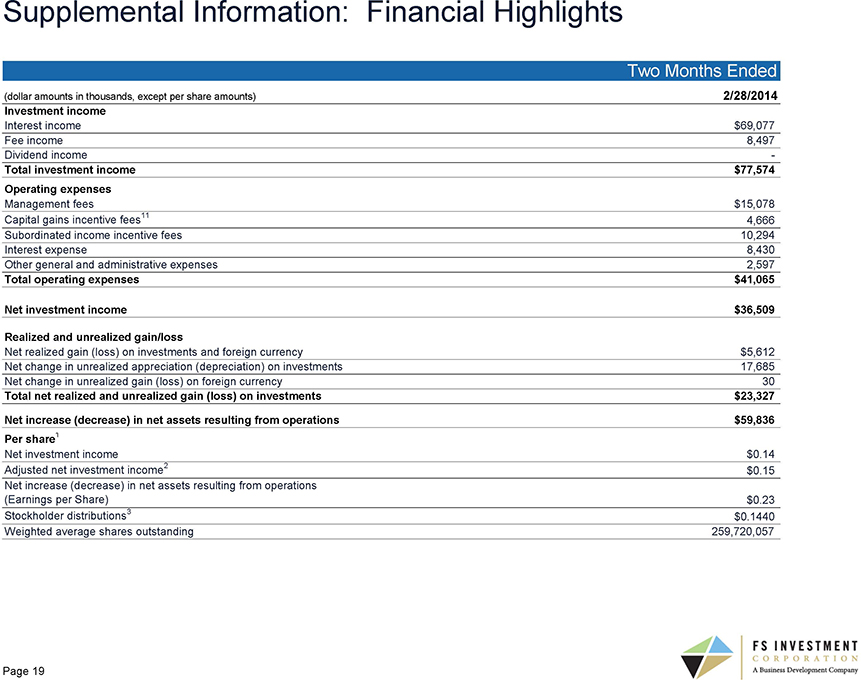

Supplemental Information: Financial Highlights

Two Months Ended

(dollar amounts in thousands, except per share amounts) 2/28/2014

Investment income

Interest income $69,077 Fee income 8,497 Dividend income—

Total investment income $77,574 Operating expenses

Management fees $15,078 Capital gains incentive fees11 4,666 Subordinated income incentive fees 10,294 Interest expense 8,430 Other general and administrative expenses 2,597

Total operating expenses $41,065

Net investment income $36,509

Realized and unrealized gain/loss

Net realized gain (loss) on investments and foreign currency $5,612 Net change in unrealized appreciation (depreciation) on investments 17,685 Net change in unrealized gain (loss) on foreign currency 30

Total net realized and unrealized gain (loss) on investments $23,327

Net increase (decrease) in net assets resulting from operations $59,836 Per share1

Net investment income $0.14 Adjusted net investment income2 $0.15 Net increase (decrease) in net assets resulting from operations (Earnings per Share) $0.23 Stockholder distributions3 $0.1440 Weighted average shares outstanding 259,720,057

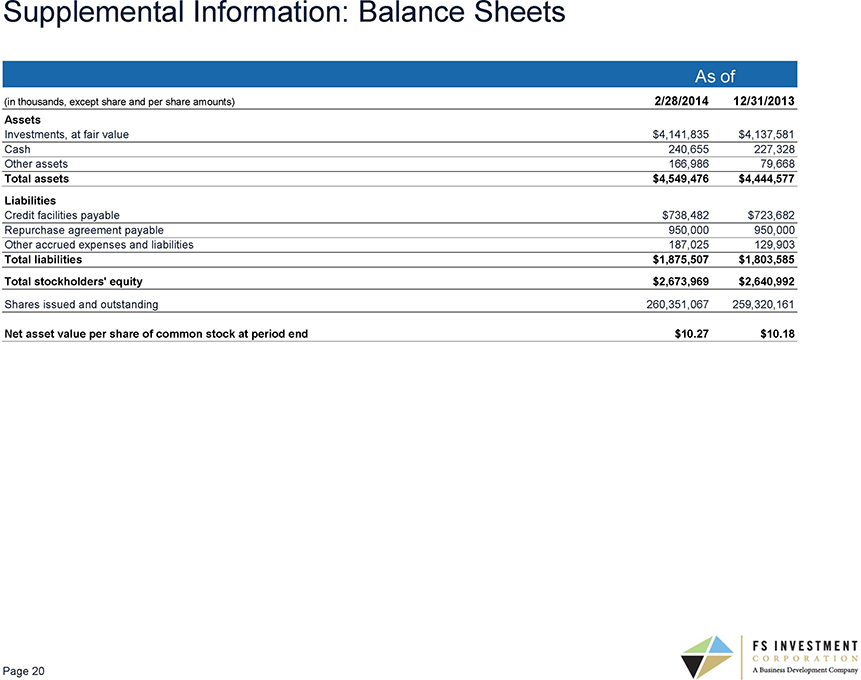

Supplemental Information: Balance Sheets

As of

(in thousands, except share and per share amounts) 2/28/2014 12/31/2013

Assets

Investments, at fair value $4,141,835 $4,137,581 Cash 240,655 227,328 Other assets 166,986 79,668

Total assets $4,549,476 $4,444,577

Liabilities

Credit facilities payable $738,482 $723,682 Repurchase agreement payable 950,000 950,000 Other accrued expenses and liabilities 187,025 129,903

Total liabilities $1,875,507 $1,803,585

Total stockholders’ equity $2,673,969 $2,640,992

Shares issued and outstanding 260,351,067 259,320,161

Net asset value per share of common stock at period end $10.27 $10.18

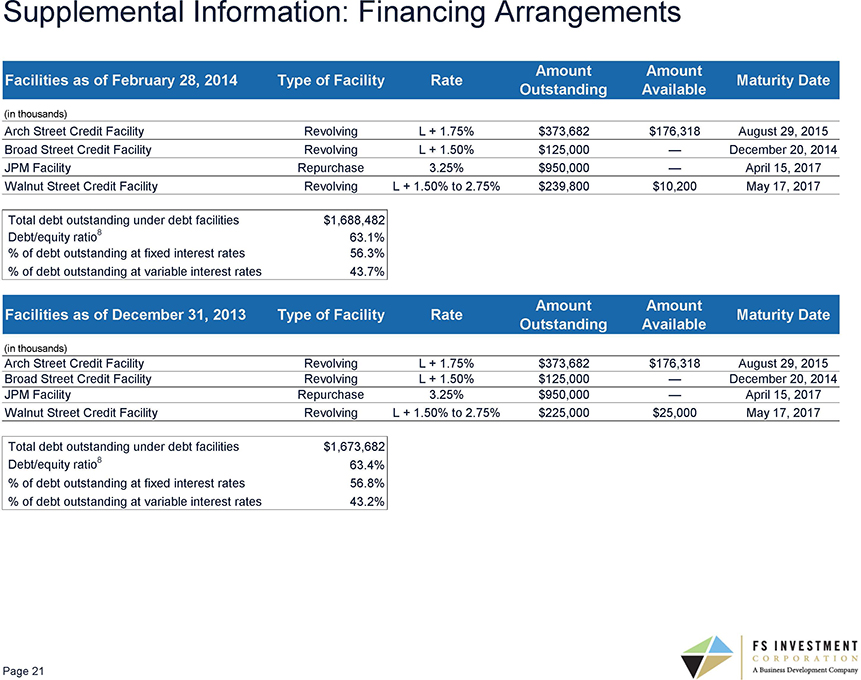

Supplemental Information: Financing Arrangements

Amount Amount

Facilities as of February 28, 2014 Type of Facility Rate Maturity Date Outstanding Available

(in thousands)

Arch Street Credit Facility Revolving L + 1.75% $373,682 $176,318 August 29, 2015 Broad Street Credit Facility Revolving L + 1.50% $125,000 — December 20, 2014 JPM Facility Repurchase 3.25% $950,000 — April 15, 2017 Walnut Street Credit Facility Revolving L + 1.50% to 2.75% $239,800 $10,200 May 17, 2017

Total debt outstanding under debt facilities $1,688,482 Debt/equity ratio8 63.1% % of debt outstanding at fixed interest rates 56.3% % of debt outstanding at variable interest rates 43.7%

Amount Amount

Facilities as of December 31, 2013 Type of Facility Rate Maturity Date Outstanding Available

(in thousands)

Arch Street Credit Facility Revolving L + 1.75% $373,682 $176,318 August 29, 2015 Broad Street Credit Facility Revolving L + 1.50% $125,000 — December 20, 2014 JPM Facility Repurchase 3.25% $950,000 — April 15, 2017 Walnut Street Credit Facility Revolving L + 1.50% to 2.75% $225,000 $25,000 May 17, 2017

Total debt outstanding under debt facilities $1,673,682 Debt/equity ratio8 63.4% % of debt outstanding at fixed interest rates 56.8% % of debt outstanding at variable interest rates 43.2%

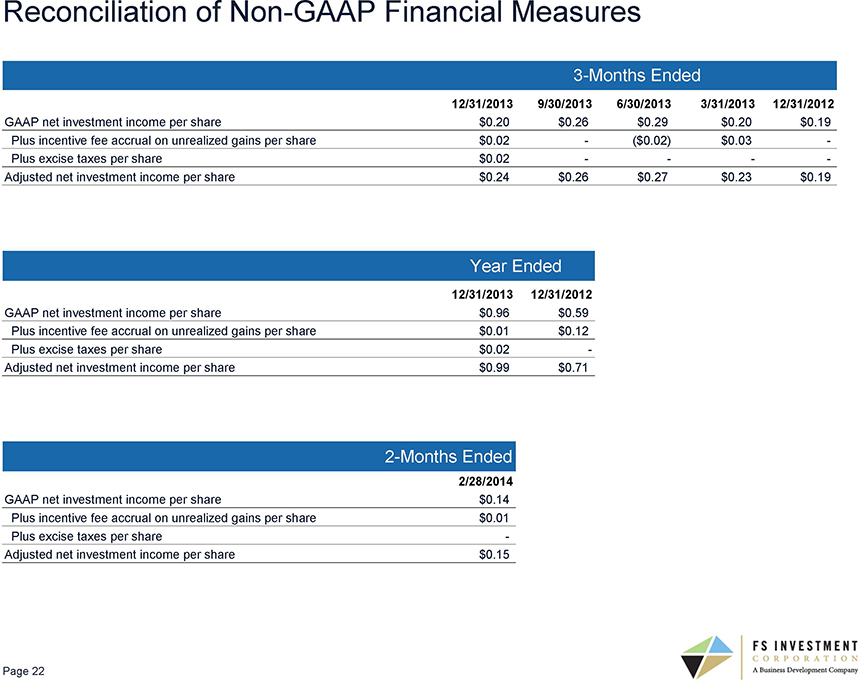

Reconciliation of Non-GAAP Financial Measures

3-Months Ended

12/31/2013 9/30/2013 6/30/2013 3/31/2013 12/31/2012

GAAP net investment income per share $0.20 $0.26 $0.29 $0.20 $0.19 Plus incentive fee accrual on unrealized gains per share $0.02—($0.02) $0.03— Plus excise taxes per share $0.02 — — Adjusted net investment income per share $0.24 $0.26 $0.27 $0.23 $0.19

Year Ended

12/31/2013 12/31/2012

GAAP net investment income per share $0.96 $0.59 Plus incentive fee accrual on unrealized gains per share $0.01 $0.12 Plus excise taxes per share $0.02 -Adjusted net investment income per share $0.99 $0.71

2-Months Ended

2/28/2014

GAAP net investment income per share $0.14 Plus incentive fee accrual on unrealized gains per share $0.01 Plus excise taxes per share—Adjusted net investment income per share $0.15

End Notes

1) The per share data was derived by using the weighted average shares of our common stock outstanding during the applicable period.

2) Adjusted net investment income is a non-GAAP financial measure. Adjusted net investment income equals GAAP net investment income excluding the accrual for capital gains incentive fee attributable to unrealized gains and excise taxes. We accrue the capital gains incentive fee based on net realized and unrealized gains; however, under the terms of our investment advisory and administrative services agreement with FB Income Advisor, LLC, or FB Advisor, dated as of February 12, 2008, as amended on August 5, 2008, the fee payable by us is based on realized gains and no such fee is payable with respect to unrealized gains unless and until such gains are actually realized. The presentation of this additional information is not meant to be considered in isolation or as a substitute for financial results prepared in accordance with GAAP. Reconciliations of GAAP net investment income to adjusted net investment income can be found on page 22 of this presentation.

3) The per share data for distributions reflects the actual amount of distributions paid per share of our common stock during the applicable period.

4) The weighted average credit rating of investments is the weighted average credit rating of the investments in our portfolio that were rated, based upon the scale of Moody’s Investors Service, Inc. As of December 31, 2013, approximately 40.7% of our portfolio (based on the fair value of our investments) was rated.

5) We record interest income on an accrual basis. Generally, investments are placed on non-accrual when the collection of future interest and principal payments is uncertain.

6) We have identified and intend to focus on the following investment categories, which we believe will allow us to generate an attractive total return with an acceptable level of risk.

Direct Originations : We intend to leverage our relationship with GSO / Blackstone Debt Funds Management LLC and their global sourcing and origination platform to directly source investment opportunities. Such investments are originated or structured specifically for us or made by us and are not generally available to the broader market. These investments may include both debt and equity components, although we do not expect to make equity investments independent of having an existing credit relationship. We believe directly originated investments may offer higher returns and more favorable protections than broadly syndicated transactions.

Opportunistic : We intend to seek to capitalize on market price inefficiencies by investing in loans, bonds and other securities where the market price of such investment reflects a lower value than deemed warranted by our fundamental analysis. We believe that market price inefficiencies may occur due to, among other things, general dislocations in the markets, a misunderstanding by the market of a particular company or an industry being out of favor with the broader investment community. We seek to allocate capital to these securities that have been misunderstood or mispriced by the market and where we believe there is an opportunity to earn an attractive return on our investment. Such opportunities may include event driven investments, anchor orders and collateralized securities.

Broadly Syndicated/Other : Although our primary focus is to invest in directly originated transactions and opportunistic investments, in certain circumstances we will also invest in the broadly syndicated loan and high yield markets. Broadly syndicated loans and bonds are generally more liquid than our directly originated investments and provide a complement to our less liquid strategies. In addition, and because we typically receive more attractive financing terms on these positions than we do on our less liquid assets, we are able to leverage the broadly syndicated portion of our portfolio in such a way that maximizes the levered return potential of our portfolio.

End Notes (Cont’d)

7) During the year ended December 31, 2013, we accrued capital gains incentive fees of $4,173 based on the performance of our portfolio, of which $2,583 was based on unrealized gains and $1,590 was based on realized gains. During the year ended December 31, 2012, we accrued capital gains incentive fees of $39,751 based on the performance of our portfolio, of which $27,960 was based on unrealized gains and $11,791 was based on realized gains. No capital gains incentive fees are actually payable by us with respect to unrealized gains unless and until those gains are actually realized. We paid FB Advisor $11,791 in capital gains incentive fees during the year ended December 31, 2013. As of December 31, 2013, $1,590 in capital gains incentive fees were payable to FB Advisor.

8) The debt/equity ratio is the ratio of total debt outstanding to stockholder’s equity as of the applicable date.

9) To date, no portion of any distributions paid to stockholders have been paid from offering proceeds or borrowings. A portion of our future distributions to stockholders may be deemed to constitute a return of capital for tax purposes due to the character of the amounts received by us from our portfolio companies. Any such return of capital will not reduce the amounts available to us for investments. The payment of future distributions on our common stock is not guaranteed and is subject to the discretion of our board of directors and applicable legal restrictions, and therefore there can be no assurance as to the amount or timing of any such future distributions.

10) Based on the investment rating system as described in our annual report on Form 10-K for the period ended December 31, 2013, under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Portfolio Asset Quality.”

11) During the two months ended February 28, 2014, we accrued capital gains incentive fees of $4,666 based on the performance of our portfolio, of which $1,358 was based on unrealized gains and $3,308 was based on realized gains. No capital gains incentive fees are actually payable by us with respect to unrealized gains unless and until those gains are actually realized.

Corporate Information

Board of Directors Executive Officers Investor Relations Contact

Michael C. Forman Michael C. Forman Ben Holman

Chairman of the Board Chairman of the Board Phone: (215)-220-6266

Chief Executive Officer Chief Executive Officer Email: ben.holman@franklinsquare.com

David J. Adelman Gerald F. Stahlecker

Vice Chairman President President and Chief Executive Officer of Campus Apartments, Inc.

Michael J. Hagan Zachary Klehr

Lead Independent Director Executive Vice President Chairman, President and Chief Executive of LifeShield Security, Inc.

Gregory P. Chandler Sean Coleman

Chief Financial Officer of Emtec, Inc. Managing Director

Barry H. Frank William Goebel

Partner with law firm of Archer & Greiner, P.C. Chief Financial Officer

Thomas J. Gravina Salvatore Faia

Executive Chairman of GPX Enterprises, L.P. Chief Compliance Officer

Jeffrey K. Harrow Stephen S. Sypherd

Chairman of Sparks Marketing Group, Inc. Vice President, Treasurer and Secretary

Michael Heller

President and Chief Executive Officer of Cozen O’Conner

Paul Mendelson

Senior Advisor for Business Development for Lincoln Investment Planning, Inc

Pedro A. Ramos

Partner with law firm of Schnader Harrison Segal & Lewis, LLP