*FOIA Confidential Treatment Request*

Confidential Treatment Requested by

China Century Dragon Media, Inc.

in connection with

Registration Statement on Form S-1

Filed May 14, 2010

File No. 333-166866

June 29, 2010

United States Securities and Exchange Commission

Division of Corporation Finance

Washington, DC 20549-6010

| China Century Dragon Media, Inc. |

| | Registration Statement on Form S-1 |

On behalf of China Century Dragon Media, Inc., a Delaware corporation (the “Company”), we hereby transmit for filing pursuant to Rule 101(a) of Regulation S-T, Pre-Effective Amendment No. 1 on Form S-1/A (“Amendment No. 1”) to the registration statement on Form S-1 that was originally filed on May 14, 2010 (the “Original Filing”). We are also forwarding to you via Federal Express two courtesy copies of this letter and Amendment No. 1, in a clean and marked version to show changes from the Original Filing. We have been advised that changes in Amendment No. 1 compared against the Original Filing, as submitted herewith in electronic format, have been tagged.

Based upon the Staff’s review of the Original Filing, the Commission issued a comment letter dated June 11, 2010. The following consists of the Company’s responses to the Staff’s comment letter in identical numerical sequence. For the convenience of the Commission, each comment is repeated verbatim with the Company’s response immediately following.

| 1. | Comment: We note a number of blank spaces throughout your registration statement for information that you are not entitled to omit under Rule 430A. Please include this disclosure as soon as practicable. Note that we may have additional comments once you have provided this disclosure. Therefore, allow us sufficient time to review your complete disclosure prior to any distribution of preliminary prospectuses. |

Response: We respectfully note your comment and have inserted information in the registration statement other than information that is permitted to be omitted under Rule 430A.

| 2. | Comment: As soon as practicable, please furnish to us a statement as to whether or not the amount of compensation to be allowed or paid to the underwriter(s) has been cleared with FINRA. Prior to the effectiveness of this registration statement, please provide us with a copy of the letter or a call from FINRA informing us that FINRA has no additional concerns. |

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT,

MARKED BY BRACKETED ASTERISKS, HAS BEEN OMITTED AND FILED

SEPARATELY WITH THE COMMISSION PURSUANT TO 17 CFR §200.83

*FOIA Confidential Treatment Request*

Confidential Treatment Requested by China Century Dragon Media, Inc.

in connection with

Registration Statement on Form S-1, Filed May 14, 2010, File No. 333-166866

Larry Spirgel

June 29, 2010

Page 2

Response: We respectfully note your comment and confirm that, prior to effectiveness of the registration statement, we will have provided to you the requested evidence that the amount of compensation to be allowed or paid to the underwriters has been cleared with FINRA.

| 3. | Comment: We encourage you to file all exhibits with your next amendment or otherwise furnish us drafts of your legality opinion and underwriting agreement. We must review these documents before the registration statement is declared effective, and we may have additional comments. |

Response: We respectfully note your comment and have filed additional exhibits with Amendment No. 1. We intend to file the remaining exhibits with Amendment No. 2.

Prospectus Summary, page 2

| 4. | Comment: Please balance your summary disclosure by identifying the most material risks, uncertainties and challenges facing your company. For example, you should note the risks, uncertainties and challenges associated with your contractual operating structure and with the PRC regulatory environment. You should also note that many of your strategies highlighted on page two are new initiatives that you have not historically engaged in. These are merely examples. |

Response: We respectfully note your comment and have added disclosure regarding its most material risks, uncertainties and challenges facing it to the prospectus summary.

| 5. | Comment: Please explain how the parties to the share exchange determined the numbers of shares and warrants that existing SRKP shareholders would retain following the share exchange. Disclose how the values of China Century, the shell company and the services provided by Westpark and affiliates contributed to the determination. To the extent value was attributed to the shell company, please disclose the basis for such valuation. Also disclose the value of the shares retained by Westpark affiliates based on the price paid by investors in the private placement which closed concurrently with the closing of the share exchange. |

Response: We respectfully note your comment and have revised the disclosure to explain how the parties to the share exchange agreement determined the number of shares and warrants that the existing stockholders of SRKP 25 would retain upon the completion of the share exchange and who the values of CD Media BVI, the shell company and the services provided by WestPark and its affiliates contributed to the determination. We have also revised the disclosure to disclose the value of the shares retained by WestPark affiliates based on the price paid by investors in the private placement.

| 6. | Comment: Please describe the nature of the services provided by Keen Dragon Group in arranging the reverse merger. |

Response: We respectfully note your comment and have revised the disclosure to describe the nature of the services provided by Keen Dragon Group.

| 7. | Comment: Please discuss why the company raised funds and issued common stock in a private placement when, two weeks later, you filed this registration statement for a public offering of common stock by the company. |

Response: We respectfully note your comment. We have revised the disclosure to indicate that the Company raised funds and issued common stock in a private placement to raise funds needed to pay expenses to be incurred in the public offering of its common stock and for operating expenses.

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT,

MARKED BY BRACKETED ASTERISKS, HAS BEEN OMITTED AND FILED

SEPARATELY WITH THE COMMISSION PURSUANT TO 17 CFR §200.83

*FOIA Confidential Treatment Request*

Confidential Treatment Requested by China Century Dragon Media, Inc.

in connection with

Registration Statement on Form S-1, Filed May 14, 2010, File No. 333-166866

Larry Spirgel

June 29, 2010

Page 3

| 8. | Comment: We note your disclosure on page four that you currently intend for this offering to be in an amount in excess of $10 million. However, based on an offering of 2.5 million shares at a price between $3 and $4, it does not appear that the offering will be in an amount in excess of $10 million. Please clarify. |

Response: We respectfully note your comment and have revised the disclosure to indicate that the Company does not currently expect its offering to be in an amount in excess of $10 million.

Contractual Arrangement, page 5

| 9. | Comment: Please disclose any material relationships between the CD Media Beijing shareholders and your company or its executive officers or directors. If there are none, please explain who these shareholders are and how they were chosen to perform this role. |

Response: We respectfully note your comment and have revised the disclosure to indicate that there are no material relationships between the CD Media Beijing shareholders and the Company or any of its officers or directors and to explain who the shareholders of CD Media Beijing are why they were chosen as shareholders.

| 10. | Comment: We note your disclosure that the fees payable under the Exclusive Business Cooperation Agreement are based on the rates set forth in the agreement or otherwise agreed upon. However, the agreement does not appear to set forth any rate of service. Section 2 of the agreement only states that the rate of service will be based upon further consultations. Please explain. |

Response: We respectfully note your comment and have revised the disclosure in the registration statement to state that CD Media Beijing has agreed to pay an annual service fee to CD Media in an amount equal to a certain percentage of its income for such year, which percentage will be negotiated by the parties, which is consistent with Section 2 of the agreement.

| 11. | Comment: Please confirm through disclosure that the equity interest pledges have become effective through registration with relevant authorities, as set forth in Section 3.1 of the pledge agreement. |

Response: We respectfully note your comment and have updated the disclosure to confirm that the equity pledge interests became effective through registration with the relevant authorities as contemplated by the pledge agreement.

| 12. | Comment: Under a separate captioned subsection in the prospectus summary and under “Certain Relationships and Related Transactions,” please provide tabular disclosure that identifies and quantifies all the benefits that WestPark Capital and its affiliates have received and will receive in connection with registering the shell company under the Securities Exchange Act of 1934, the March 2010 share exchange, the April 2010 private placement and the offering currently being registered. |

Response: We respectfully note your comment and have added tabular disclosure identifying and quantifying the benefits that WestPark Capital and its affiliates received and will receive in connection with the March 2010 share exchange, the April 2010 private placement and the offering currently being registered. No benefits were received in connection with the registration of the shell company.

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT,

MARKED BY BRACKETED ASTERISKS, HAS BEEN OMITTED AND FILED

SEPARATELY WITH THE COMMISSION PURSUANT TO 17 CFR §200.83

*FOIA Confidential Treatment Request*

Confidential Treatment Requested by China Century Dragon Media, Inc.

in connection with

Registration Statement on Form S-1, Filed May 14, 2010, File No. 333-166866

Larry Spirgel

June 29, 2010

Page 4

Risks Related to Our Corporate Structure, page 16

The PRC tax authorities may scrutinize our contractual arrangements… page 17

| 13. | Comment: Please provide more specific and quantitative information about the consequences of a finding by tax authorities that the contractual arrangements were not made on arm’s length basis. |

Response: We respectfully note your comment and have revised the disclosure to include more specific information about the consequences of a finding by PRC authorities that the contractual arrangements were not made on an arm’s length basis.

We rely principally on dividends and other distributions…page 17

| 14. | Comment: Please disclose what portion of CD Media Huizhou’s net assets is restricted and thus cannot be transferred to you in the form of dividends, loans or advances. |

Response: We respectfully note your comment and have revised the disclosure to indicate the portion of CD Media Huizhou’s net assets are restricted.

Risks Related to Us Doing Business in China, page 18

The scope of the business license for CD Media Beijing in China limited…page 19

| 15. | Comment: Please clarify whether there is a risk that CD Media Beijing’s business license in China will not cover each of the company’s planned expansions of its business set forth in the prospectus summary and business sections. |

Response: We respectfully note your comment and have updated the disclosure to clarify that this is a risk that CD Media Beijing’s business license in China will cover its planned expansions described in the registration statement.

Recent PRC regulations relating to acquisitions of PRC companies…page 19

| 16. | Comment: We note your reference to published news reports in China indicating that the CSRC may have curtailed or suspended overseas listings for Chinese private companies. Please provide more information about the nature of these reports so that investors may better assess how this risk could impact your company. |

Response: We respectfully note your comment and have revised the disclosure to remove the reference to published news reports relating to the CSRC’s curtailment or suspension of overseas listings for Chinese private companies.

We face uncertainty from China’s Circular on Strengthening the Administration of Enterprise Income Tax…page 21

| 17. | Comment: Please disclose whether you sought the opinion of Chinese counsel on the risks disclosed here. Also provide more specific and quantitative information about the consequences if you are taxed under Circular 698. |

Response: We respectfully note your comment and have revised the disclosure to indicate that it sought the advice of PRC counsel regarding the application of and risks associated with Circular 698 and to provide more specific and quantitative information regarding the consequences of taxation under Circular 698.

Under the New EIT Law…, page 23

Dividends payable by us…, page 23

| 18. | Comment: Disclose whether the company has sought the advice of PRC tax counsel on the taxation issues presented in both risk factors and, if so, whether counsel believes it is more likely than not that the PRC taxes will apply. Also provide more specific and quantitative information about the consequences of the risks described are realized. |

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT,

MARKED BY BRACKETED ASTERISKS, HAS BEEN OMITTED AND FILED

SEPARATELY WITH THE COMMISSION PURSUANT TO 17 CFR §200.83

*FOIA Confidential Treatment Request*

Confidential Treatment Requested by China Century Dragon Media, Inc.

in connection with

Registration Statement on Form S-1, Filed May 14, 2010, File No. 333-166866

Larry Spirgel

June 29, 2010

Page 5

Response: We respectfully note your comment and have revised the disclosure to indicate that the Company has not sought the advice of PRC tax counsel on the taxation issues presented in the risk factors. We have also included more specific and quantitative information about the consequences of the risks described.

Risks Related to Ownership of Our Common Stock and This Offering, page 25

The shareholders of CD Media BVI and their designees…, page 26

| 19. | Comment: So that investors may better assess the impact of this risk factor, please explain the nature of any material relationships among the former shareholders of CD Media BVI and your officers and directors and the designees. Please also explain what you mean by “designees.” |

Response: We respectfully note your comment and have revised the disclosure to disclose all material relationships among the former shareholders of CD Media BVI and its officers and directors and to explain what it means by “designees.”

| 20. | Comment: We note that you intend to use the proceeds of the offering for working capital and general corporate purposes. If you expect material changes in working capital or general corporate spending as a result of the funds available following the offering, please explain those changes. For example, we note that your disclosure in the prospectus summary and elsewhere of your broad strategic plans to develop regional television advertising opportunities, open a production studio, pursue acquisitions, and expand into new advertising media platforms. Refer to Regulation S-K Item 504. |

Response: We respectfully note your comment and have revised the disclosure to provide additional detail as to the Company’s intended use of the net proceeds from this offering.

| 21. | Comment: Discuss whether there are restrictions on the use of the proceeds from the offering for investments in your PRC subsidiary of CD Media Beijing. |

Response: We respectfully note your comment and have revised the disclosure to indicate that there are no restrictions on the use of proceeds from the offering for investments in CD Media Beijing.

| 22. | Comment: Explain how the PRC exchange control regulations may restrict your ability to convert RMB into US Dollars and your ability to distribute dividends outside of the PRC. Specifically describe how the regulations would apply to your corporate structure and contractual arrangements. |

Response: We respectfully note your comment and have added disclose to explain how the PRC exchange control regulations may restrict the Company’s ability to convert RMB into US Dollars and its ability to distribute dividends outside of the PRC. We have also added disclosure to describe how the regulations would apply to its corporate structure and contractual arrangements.

| 23. | Comment: Please include risk factor disclosure regarding the potential impact of foreign exchange controls. |

Response: We respectfully note your comment and have included a risk factor regarding the potential impact of foreign exchange controls in the Amendment.

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT,

MARKED BY BRACKETED ASTERISKS, HAS BEEN OMITTED AND FILED

SEPARATELY WITH THE COMMISSION PURSUANT TO 17 CFR §200.83

*FOIA Confidential Treatment Request*

Confidential Treatment Requested by China Century Dragon Media, Inc.

in connection with

Registration Statement on Form S-1, Filed May 14, 2010, File No. 333-166866

Larry Spirgel

June 29, 2010

Page 6

Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 36

| 24. | Comment: We note your quarterly information presented at page F-18. Provide a detailed, quantified discussion in MD&A that clearly explains the transactions and any other events that transpired in the fourth quarter of 2009 which resulted in the significant increase in revenues, gross profit, and net income in this quarter as compared to your results of operations in every other quarter over the past three years. With respect to each material transaction or event, clearly indicate whether you consider them to be recurring in nature. Also, explain to readers in a forward looking discussion whether you anticipate similar transactions or events in the future and clearly state whether you believe your future results of operations will be consistent with your fourth quarter results of operations or not. Describe the facts and circumstances that form the basis for your conclusions. |

Response: We respectfully note your comment and have revised the disclosure to add a discussion of events that transpired during the fourth quarter of 2009 which results in the significant increases in revenues, gross profit and net income during such quarter and to explain that the Company does not anticipate that results of operations for future quarters will be consistent with the results for the fourth quarter of 2009.

Factors Affecting Our Results of Operations, page 37

| 25. | Comment: In your prospectus summary and elsewhere, you highlight a growth strategy that includes purchasing advertising directly from CCTV, developing regional television business, enhancing production services and expanding into new platforms. For each of these initiatives, please identify the material internal and external factors that will impact your ability to execute your strategy. Disclose any material barriers, challenges or costs associated with each of the initiatives and how you intend to address those issues. Explain your expansion efforts to date in each of these areas. |

Response: We respectfully note your comment and we have revised the disclosure to identify the material factors that will impact the Company’s ability to execute its expansion strategy.

Levels of Advertising Spending, page 38

| 26. | Comment: Please clarify why the first and second quarters are expected to be slower seasons for the Chinese advertising industry. |

Response: We respectfully note your comment and inform you that we have removed the disclosure regarding slower seasons in the Chinese advertising industry. The Company’s business is not seasonal.

Sales and Marketing Expenses, page 39

General and Administrative Expenses, page 39

| 27. | Comment: Please discuss the extent to which you expect these categories of expenses to increase as a percentage of revenues in future periods. If there is uncertainty in this regard, please explain the reasons and the factors that could impact costs in future periods. |

Response: We respectfully note you comment and have added disclosure to indicate that we do not expect these categories of expenses to increase as a percentage of revenues in the future.

Results of Operations, page 41

| 28. | Comment: Please provide additional insight into the material underlying drivers of your revenue growth. For example, please explain the extent to which the volume of advertising time purchased and resold by your is based on known or estimated client demand, the amount of advertising inventory for sale, the funds available to you to make advances purchase of deposits, or a combination of these or other factors. |

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT,

MARKED BY BRACKETED ASTERISKS, HAS BEEN OMITTED AND FILED

SEPARATELY WITH THE COMMISSION PURSUANT TO 17 CFR §200.83

*FOIA Confidential Treatment Request*

Confidential Treatment Requested by China Century Dragon Media, Inc.

in connection with

Registration Statement on Form S-1, Filed May 14, 2010, File No. 333-166866

Larry Spirgel

June 29, 2010

Page 7

Response: We respectfully note your comment and have the disclosure to provide additional insight into the material underlying drivers of the Company’s revenue growth.

| 29. | Comment: For each period, disclose the percentage of advertising time purchased that remained unsold. Discuss any trends in this regard and how the extent of your unsold inventory of advertising time impacts your results of operations and liquidity and capital resources. |

Response: We respectfully note your comment and have added disclosure to indicate that no advertising time remains unsold for all periods.

Liquidity and Capital Resources, page 42

| 30. | Comment: Please provide a more detailed analysis of your cash used in operations and changes from the prior period. For example, although you attribute the increase in cash used in operations in 2009 to increases in deposits for the purchase of advertising time, that appears to be only one of several items impacting your cash usage in 2009. Your disclosure should not only identify these items, but explain the underlying reasons for changes so investors can assess the likelihood that past cash performance will be indicative of future performance. |

Response: We respectfully note your comment and have revised the disclosure to include a more detailed analysis of the Company’s cash used in operations and changes from the prior period.

| 31. | Comment: We note that you believe working capital, cash flow from operations and funds available through financing will be sufficient for the next 12 months. Please provide a more detailed assessment of your ability to meet your needs in the short-term and the long-term. Disclosure in both cases should distinguish between your ability to meet requirements through existing and internally generated funds, on the one hand, and through external financing, on the other hand. To the extent you may rely on financing, please analyze the sources and availability of such financing. Note that we consider “long-term” to be the period in excess of the next twelve months. See Section III.C of Release No. 33-6835 and footnote 43 of Release No. 33-8350. |

Response: We respectfully note your comment and have added disclosure to provide a more detailed assessment of its ability to meet its needs in the short term and long term.

Contractual Obligations, page 43

| 32. | Comment: We note that you had $7.6 million in prepayments and deposits for advertising time purchases on your balance sheet at the end of 2009. Please disclose the outstanding amounts due to suppliers for these purchases and the timing of required payments. If you do not believe you are required to include these amounts in the table of contractual obligations, please explain why. |

Response: We respectfully note your comment and have revised the disclosure to include the prepayments and deposits for advertising time purchases in the table of contractual obligations.

Change in Auditors, page 45

| 33. | Comment: The guidance in Item 304 of Regulation S-K requires that you disclose certain information for the two most recent fiscal years. We note that you have made these disclosures only for the year ended December 31, 2009. Please revise your disclosures to provide the information required by Item 304 of Regulations S-K for the year ended December 31, 2008 and ask your auditor to provide you with a revised letter, filed as Exhibit 16, stating whether it agrees with your disclosures. |

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT,

MARKED BY BRACKETED ASTERISKS, HAS BEEN OMITTED AND FILED

SEPARATELY WITH THE COMMISSION PURSUANT TO 17 CFR §200.83

*FOIA Confidential Treatment Request*

Confidential Treatment Requested by China Century Dragon Media, Inc.

in connection with

Registration Statement on Form S-1, Filed May 14, 2010, File No. 333-166866

Larry Spirgel

June 29, 2010

Page 8

Response: We respectfully note your comment and have revised the disclosure to provide information required by Item 304 of Regulation S-K for the year ended December 31, 2008. We have also included a revised letter stating that the auditor AJ Robbins agrees with the disclosures as Exhibit 16.1 to this Amendment.

Description of Business, page 46

| 34. | Comment: From your financial statements and the notes thereto, it is apparent that you spent significant funds during 2009 developing television programs and that you sold your rights to those programs in early 2010. In fact, on page F-12, you note that substantially all of the company’s resources are dedicated to the production of its films. However, there is no mention of these activities elsewhere in your prospectus. Please provide disclosure explaining this aspect of your business and how it impacts your results of operations and financial condition. |

Response: We respectfully note your comment and have provided additional disclosure explaining the film production aspect of our business and how it impacts our results of operations and financial condition.

| 35. | Comment: Please provide us with support for the industry and market statistics disclosed in this section. |

Response: We respectfully note your comment and have provided support for the industry and market statistics disclosed in this section, as follows:

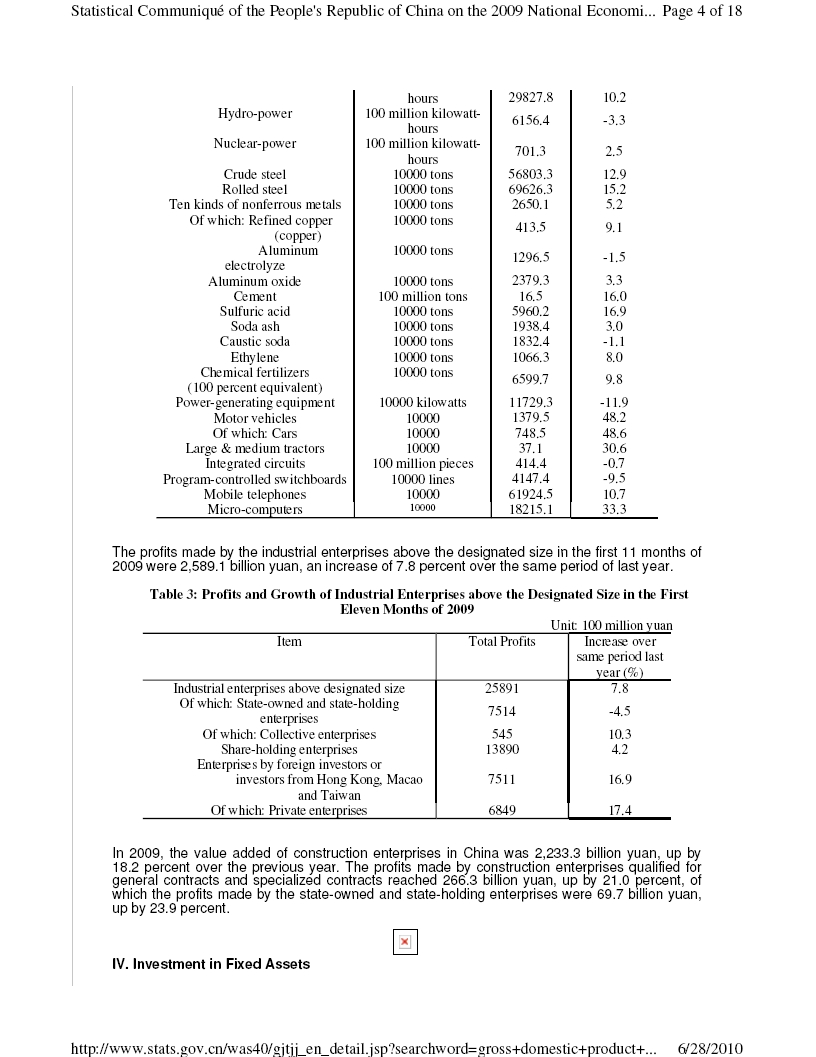

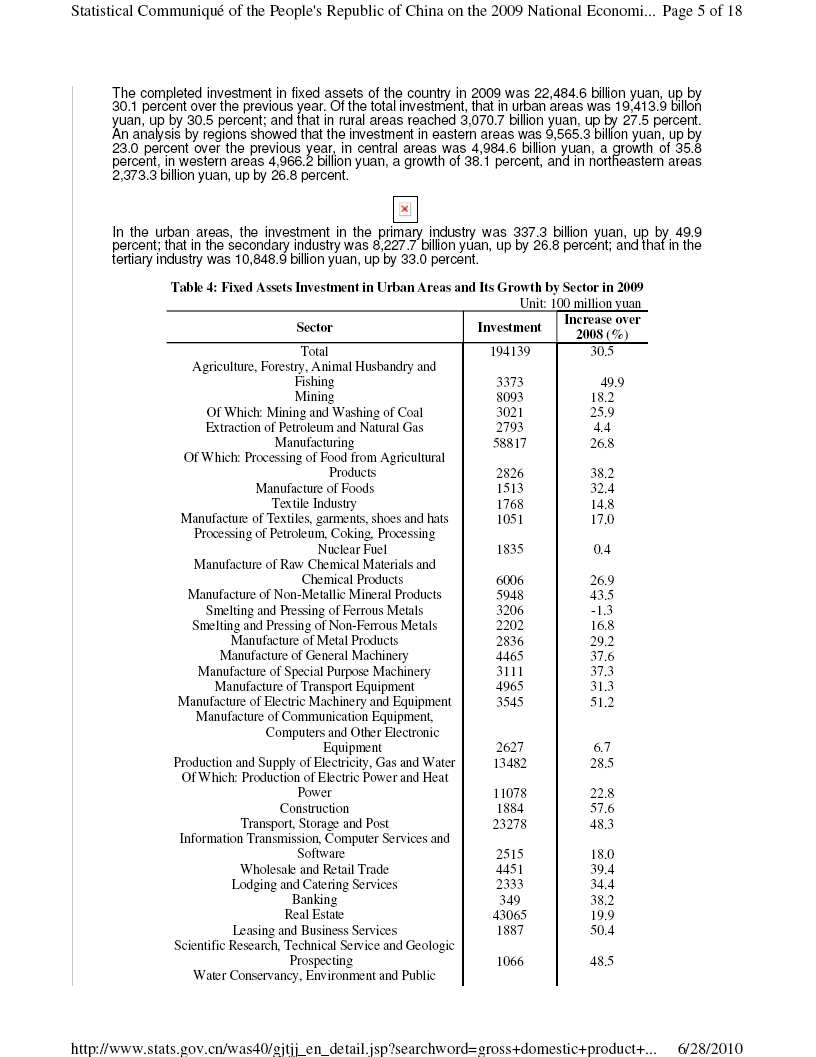

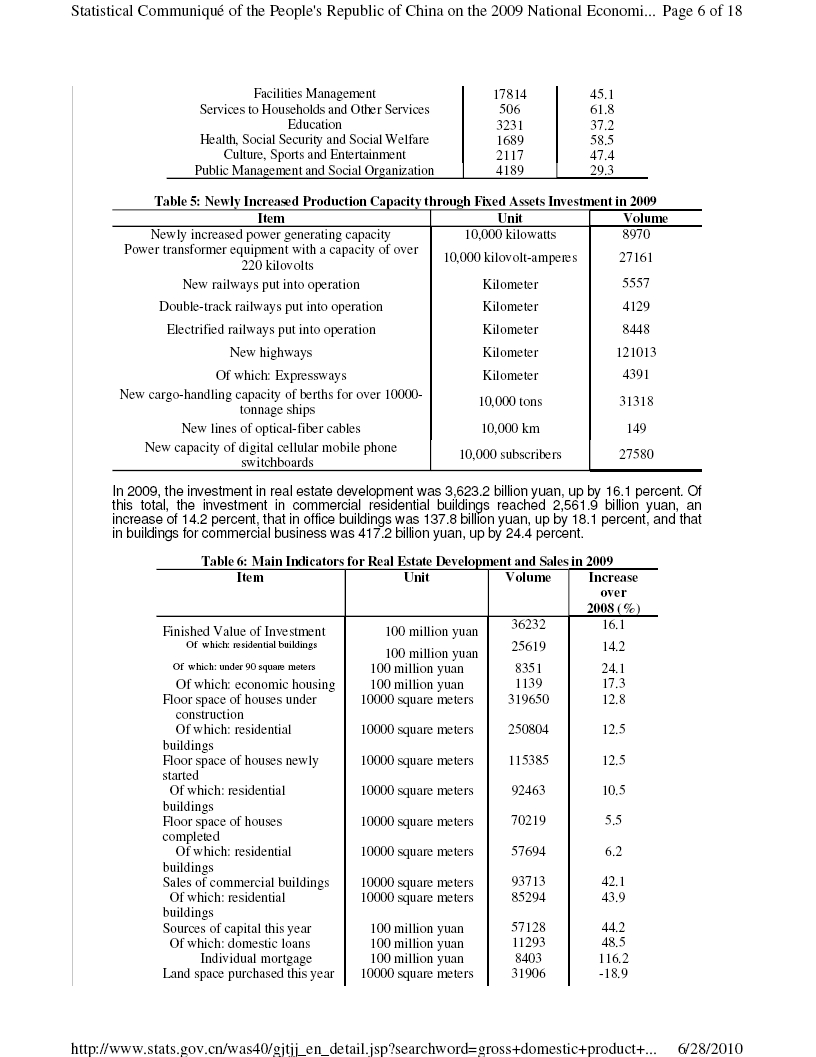

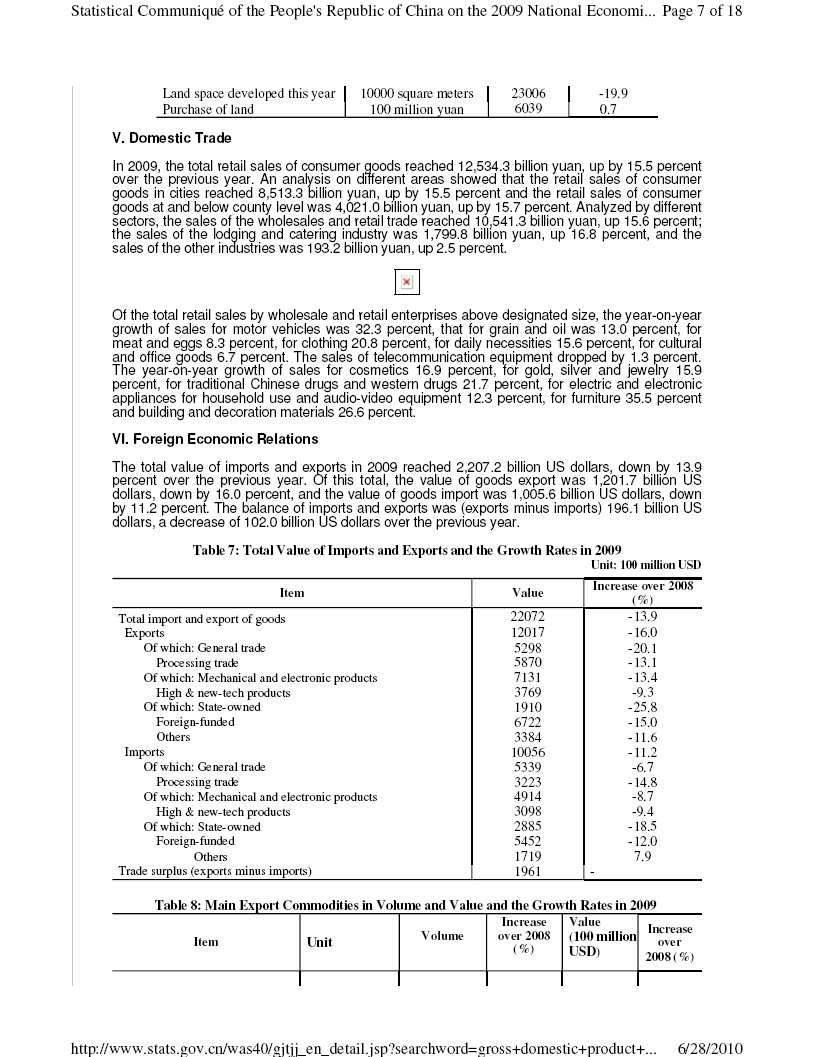

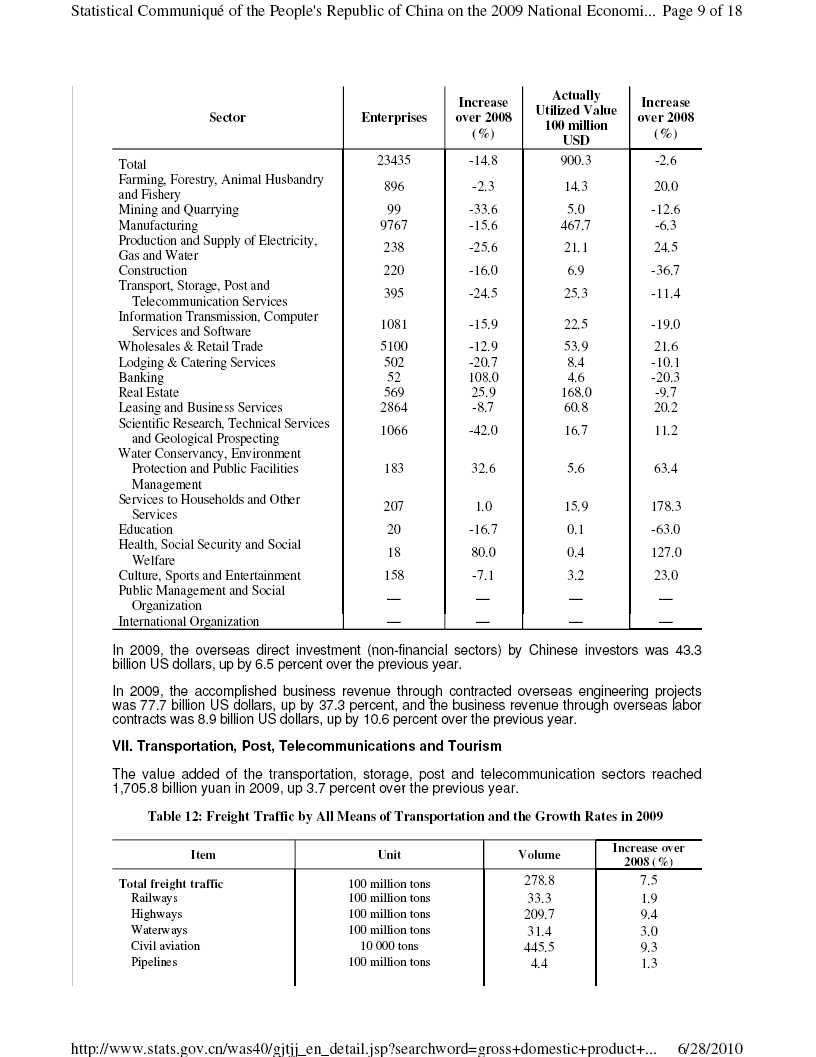

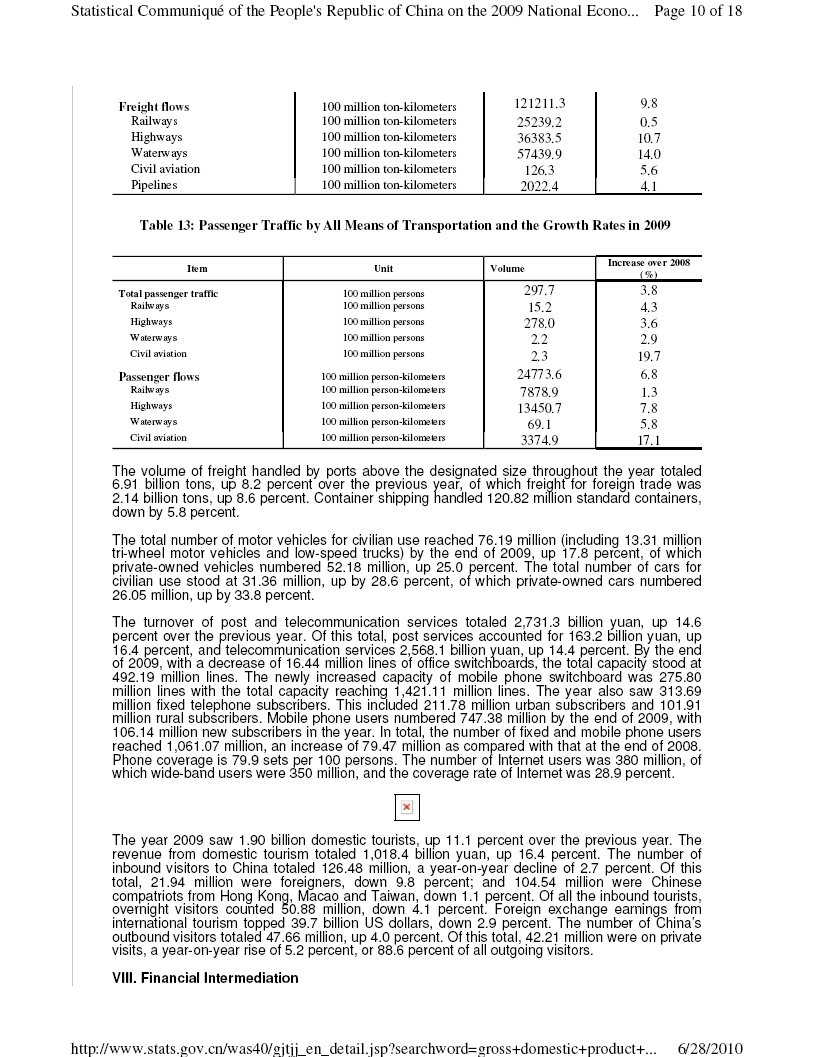

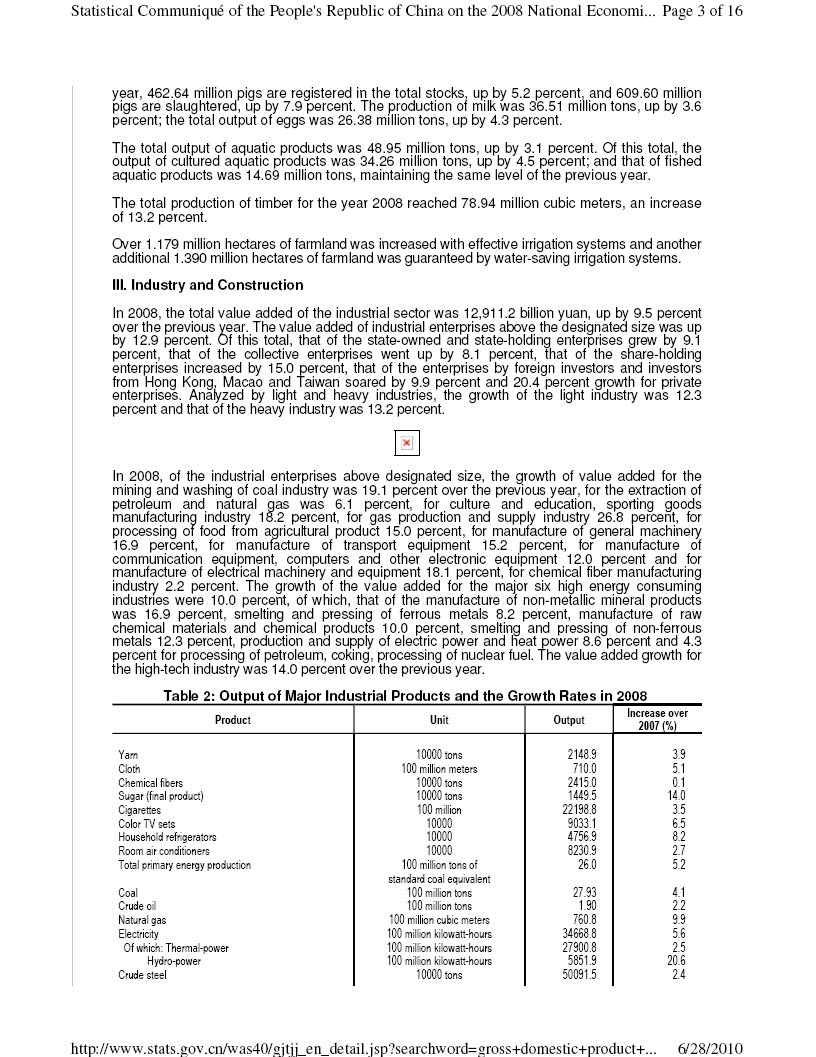

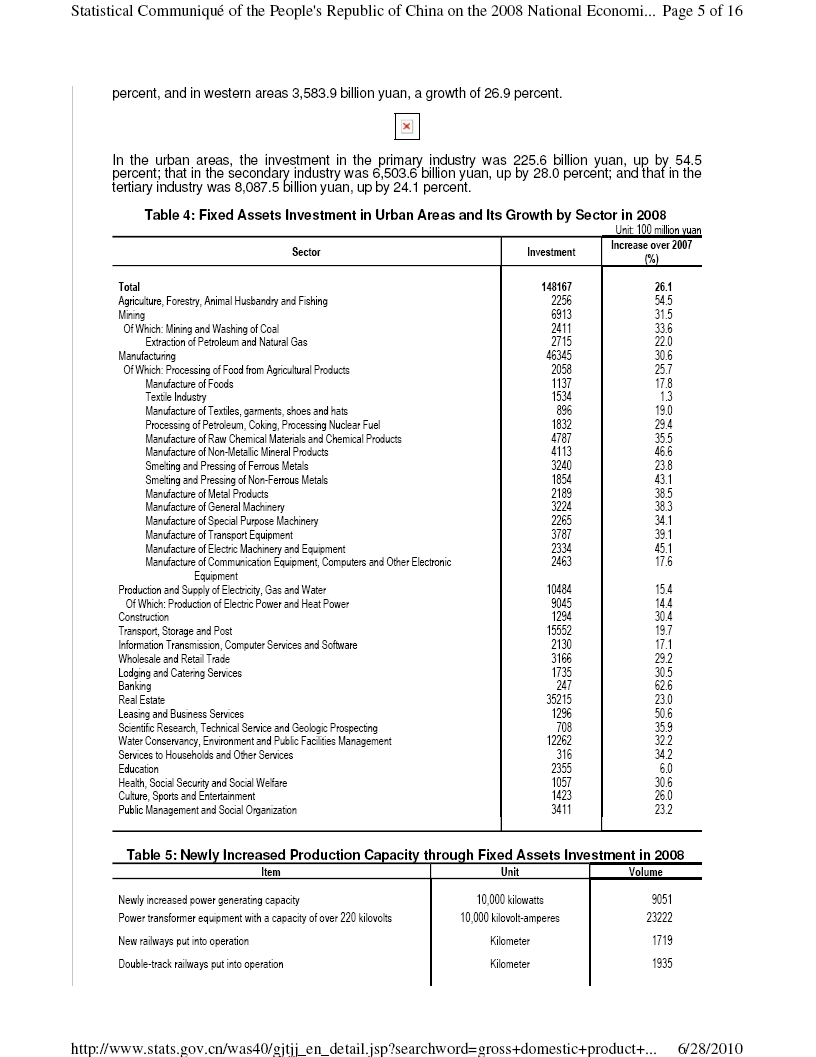

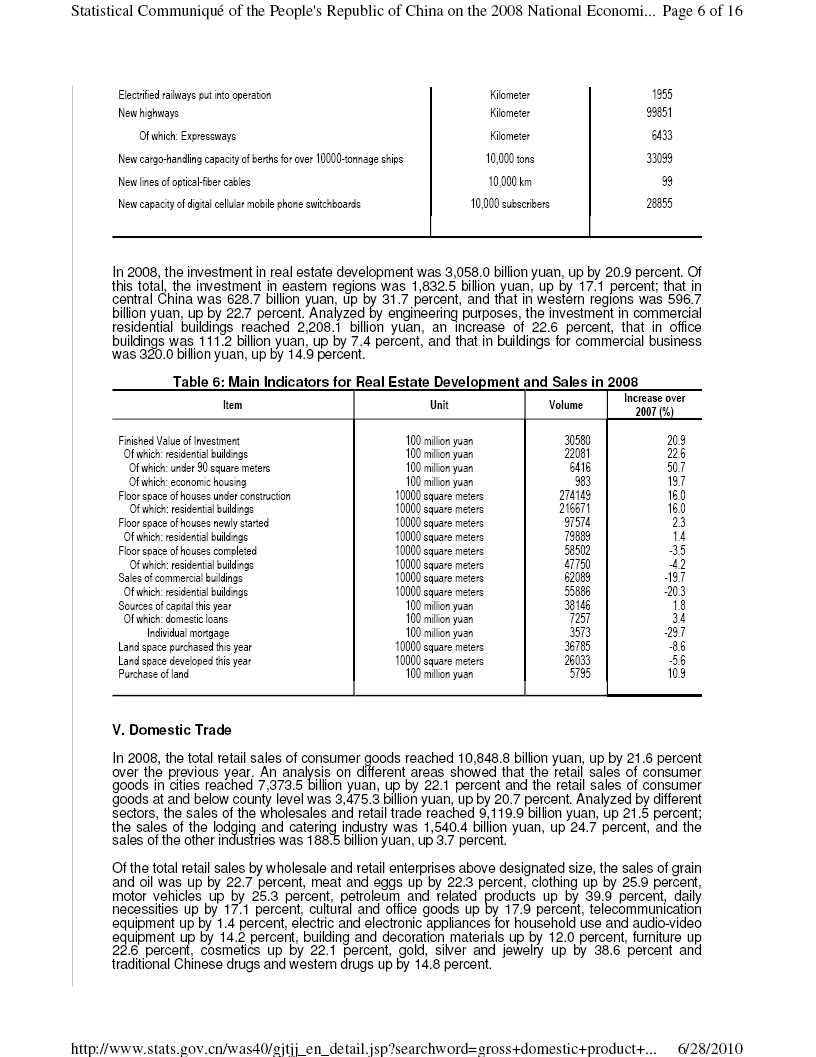

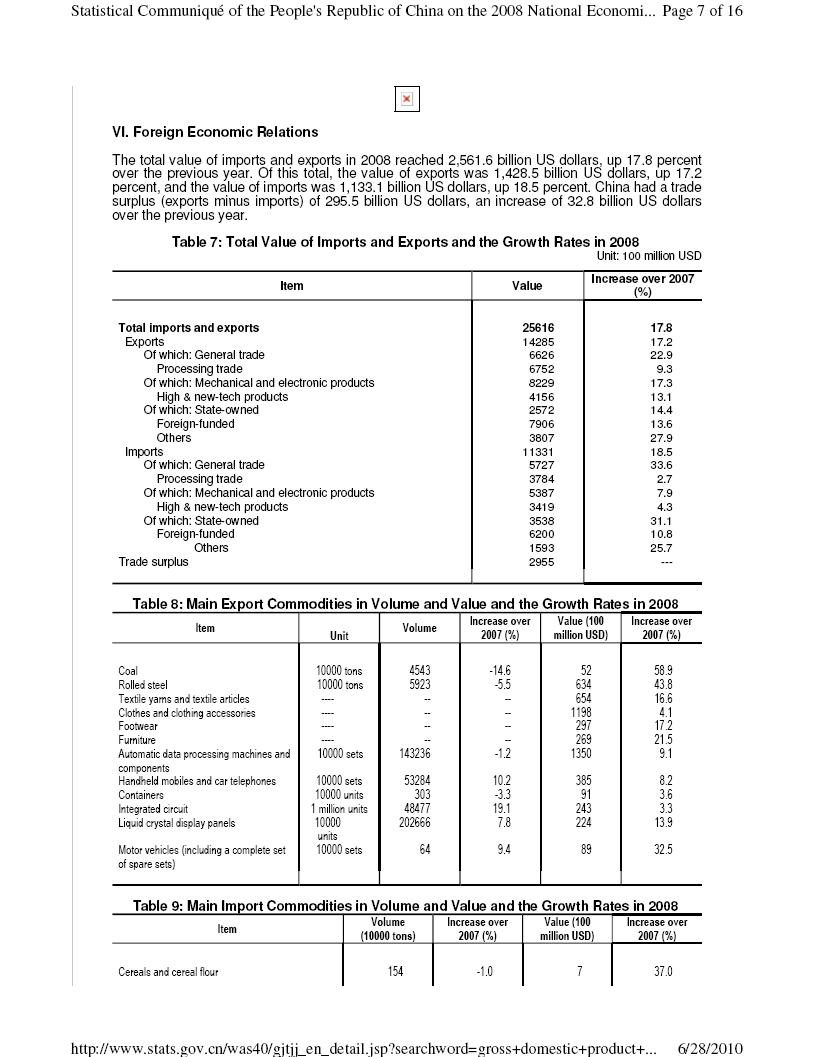

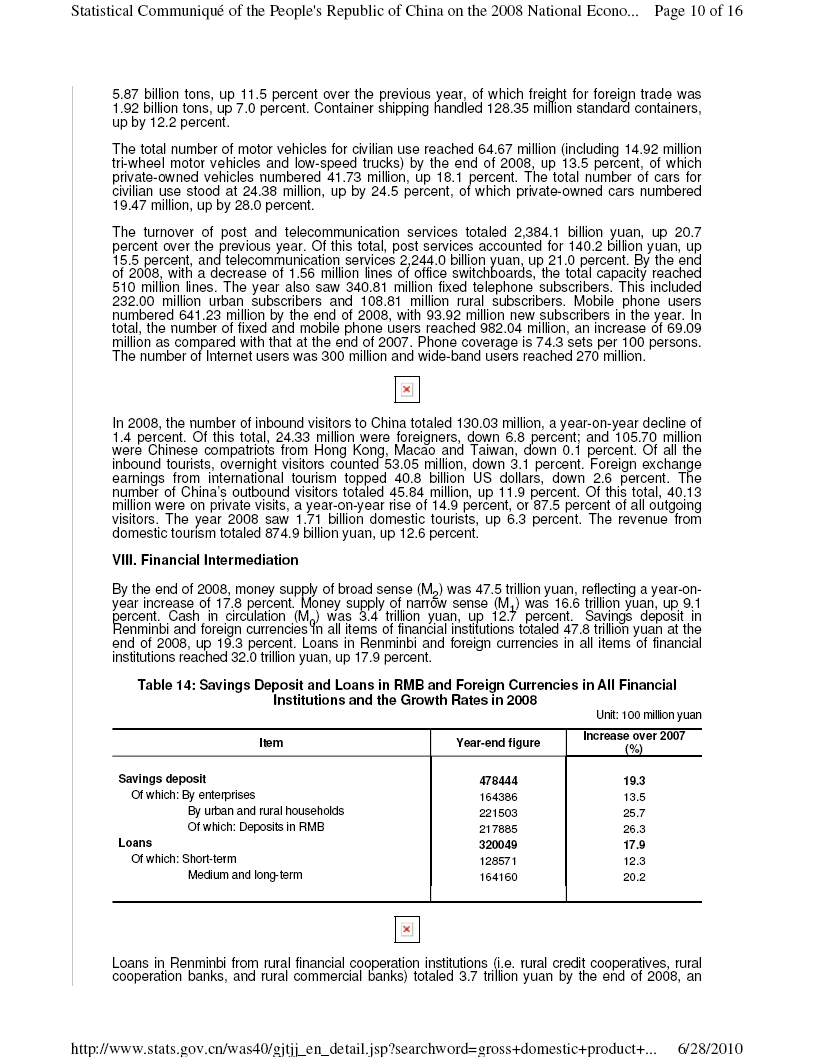

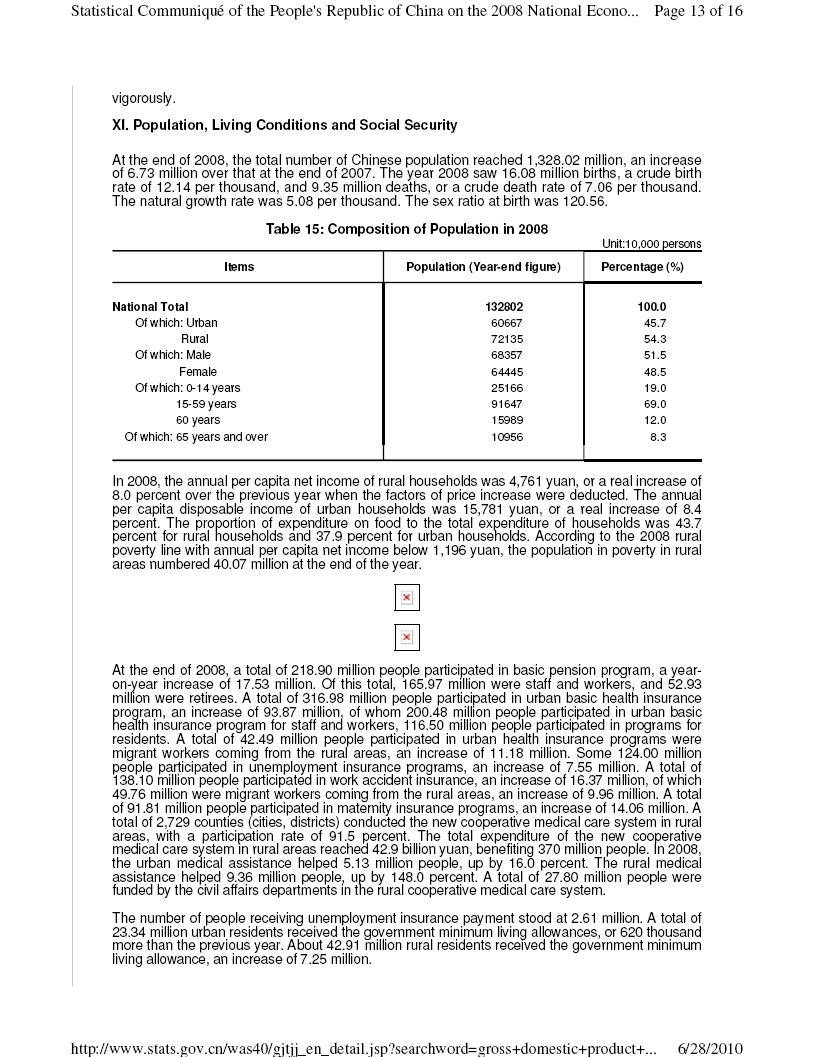

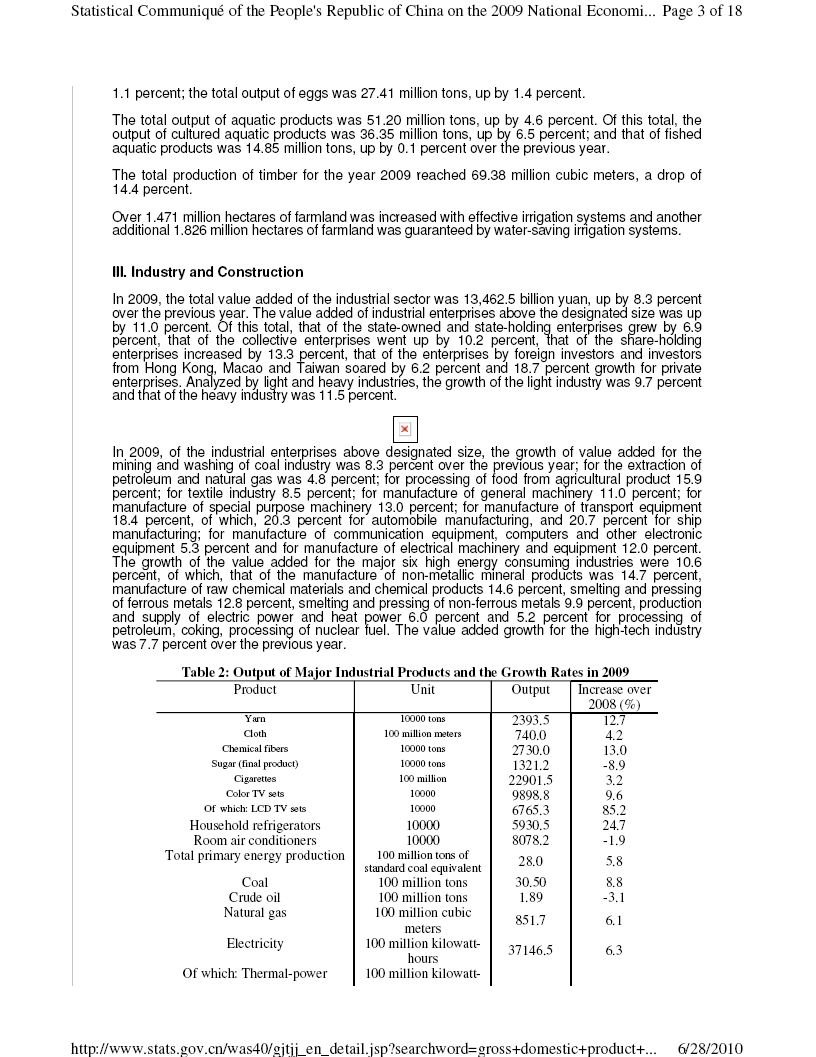

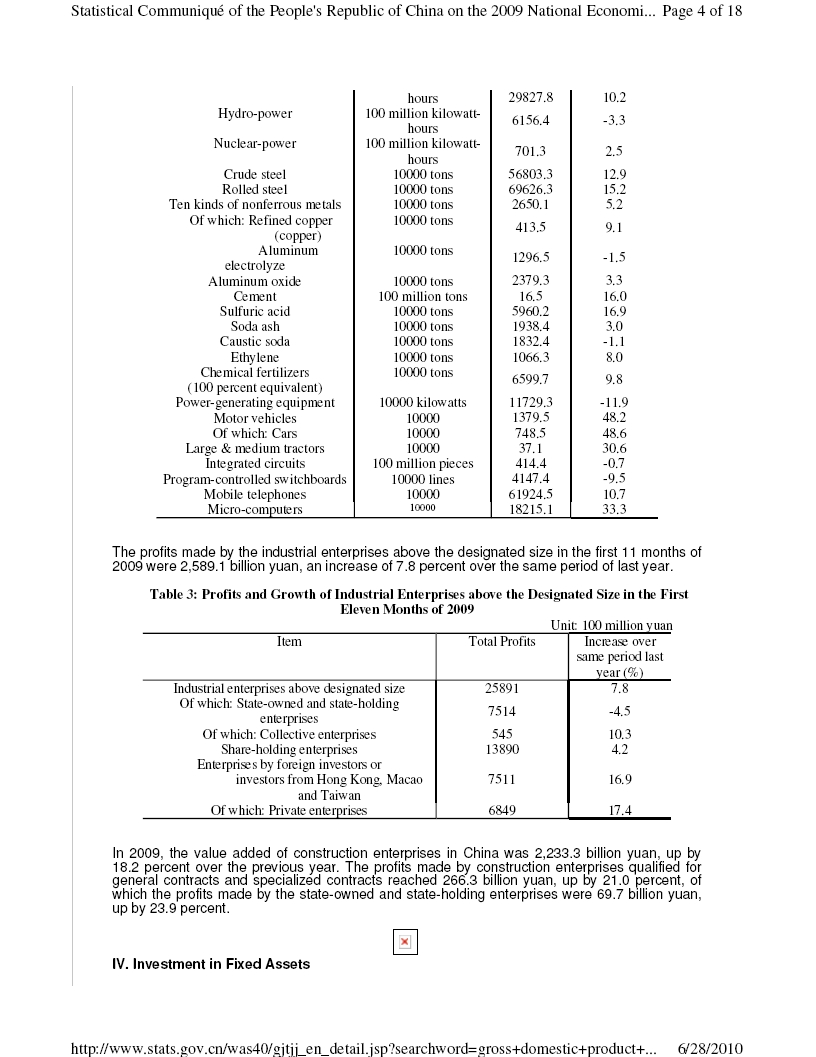

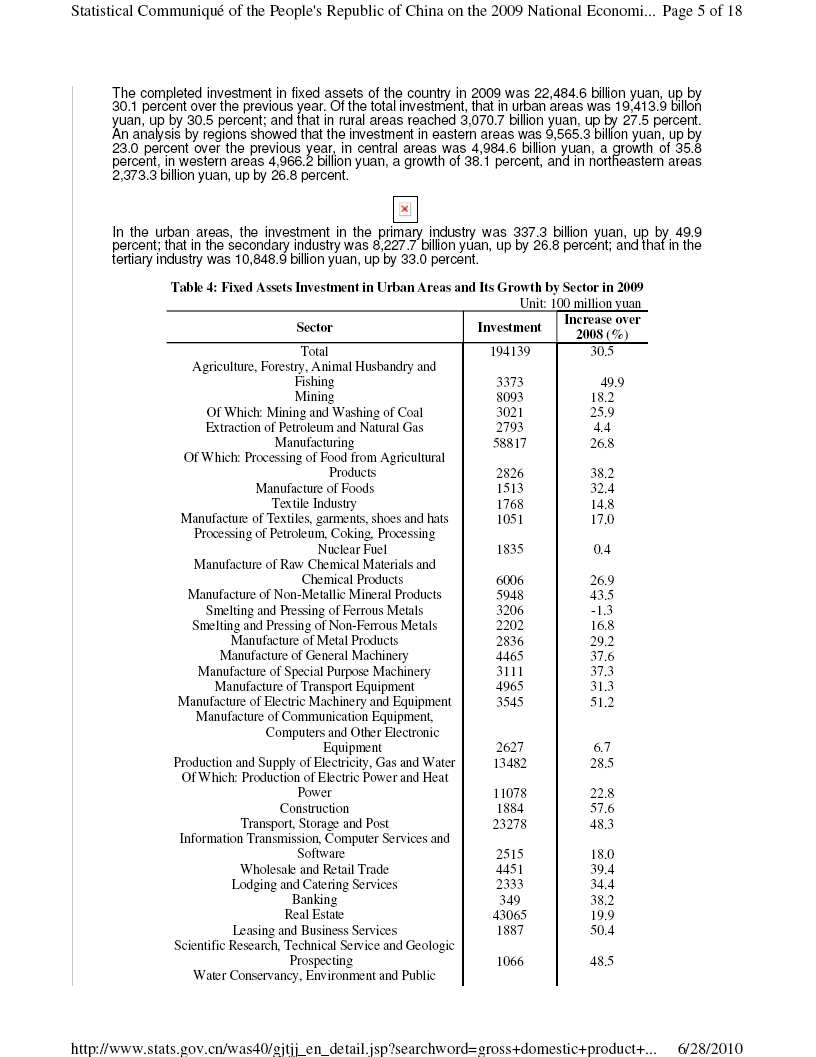

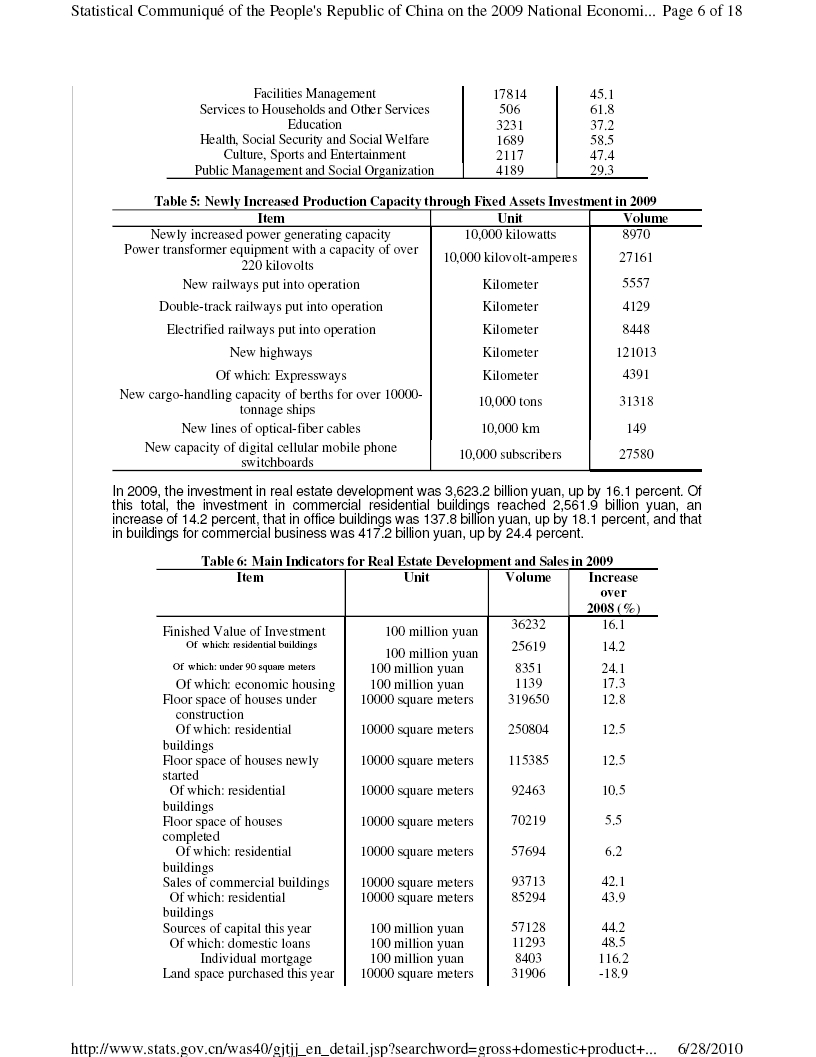

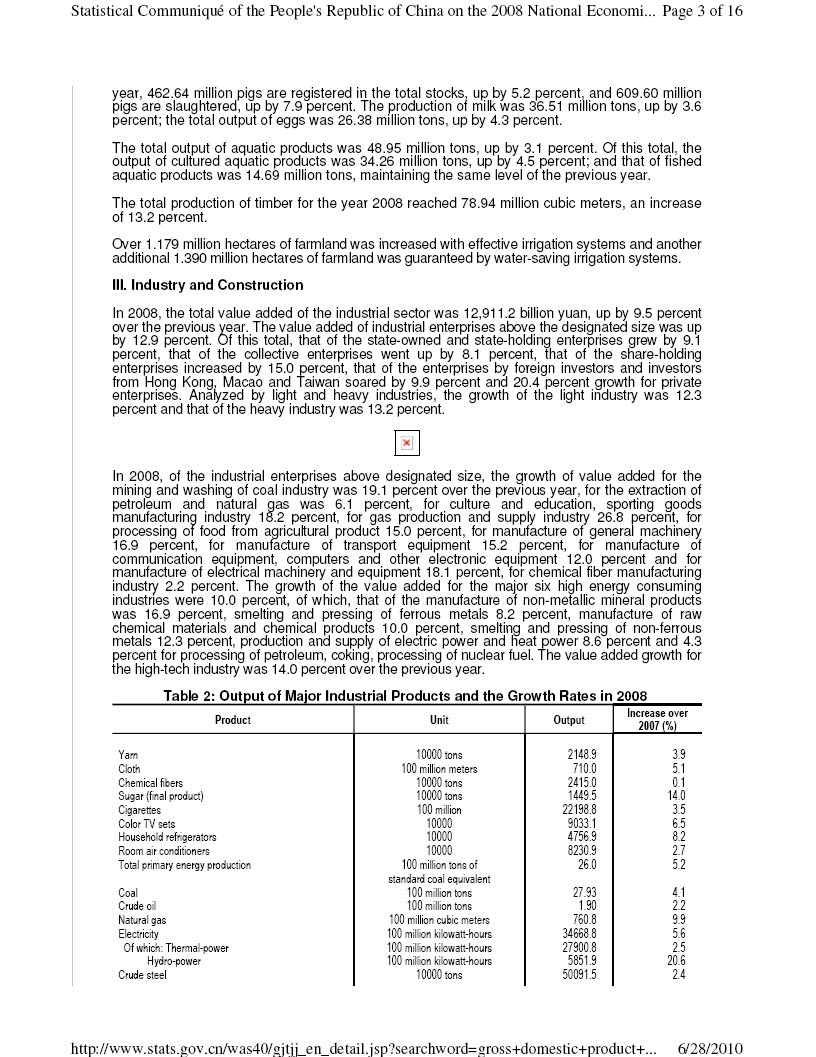

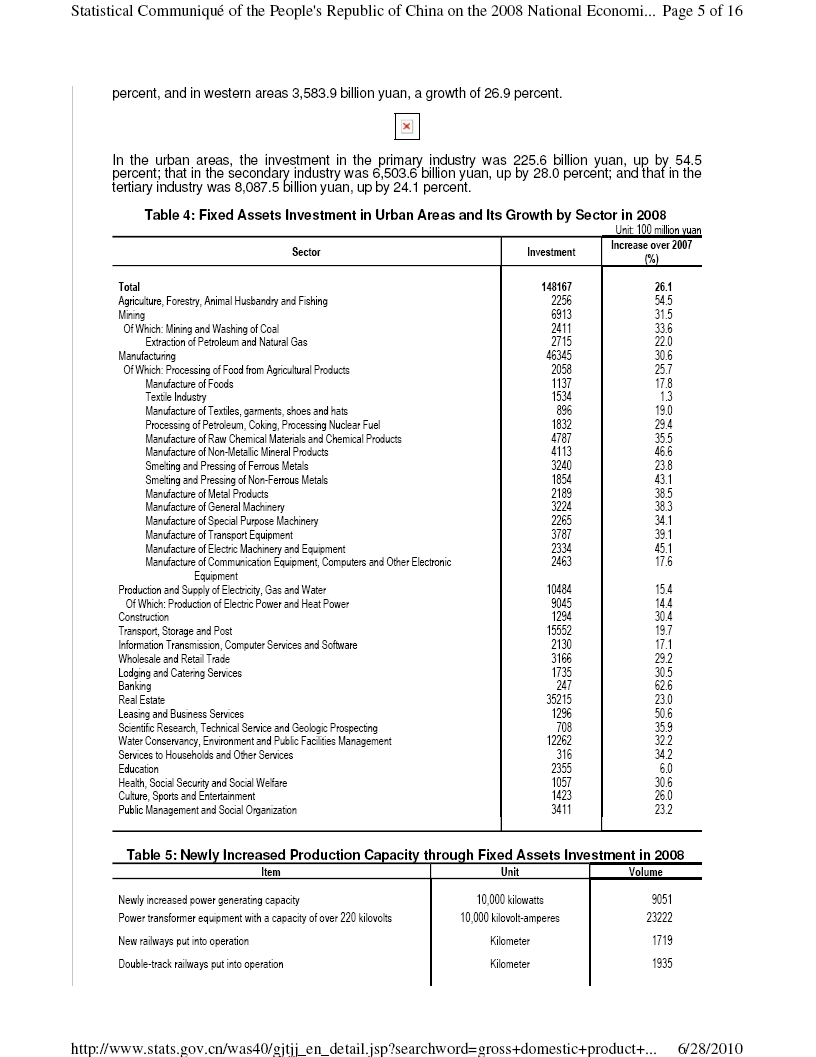

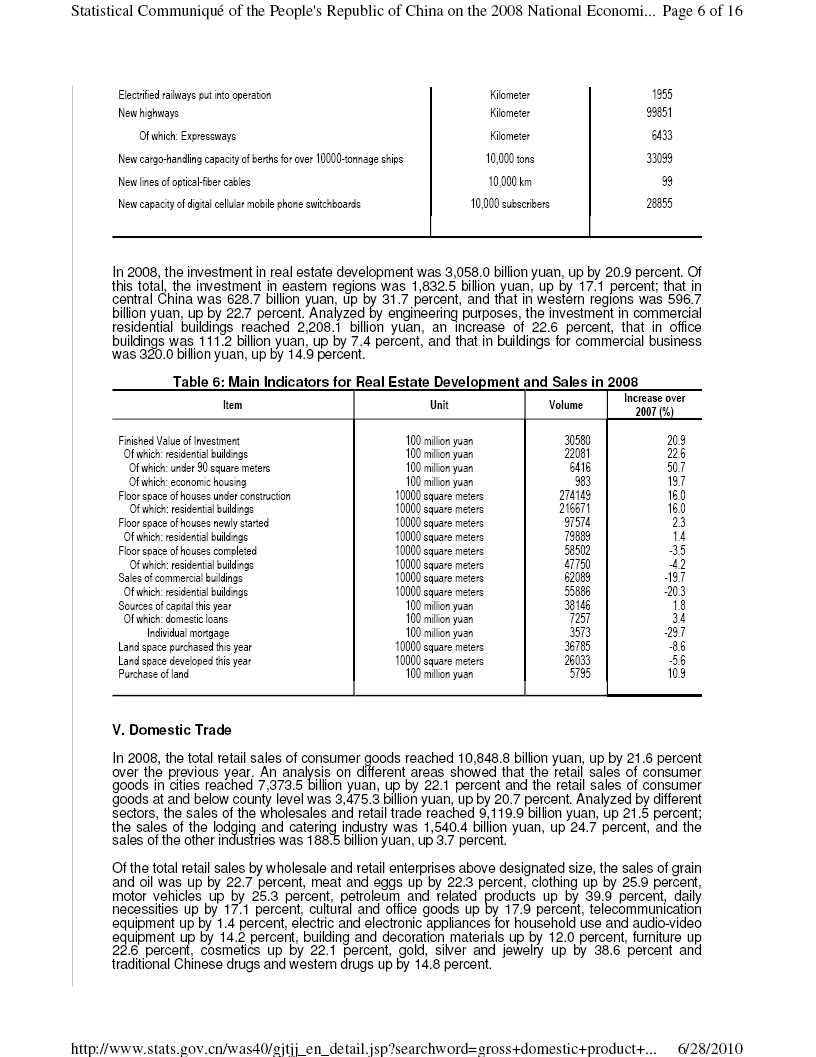

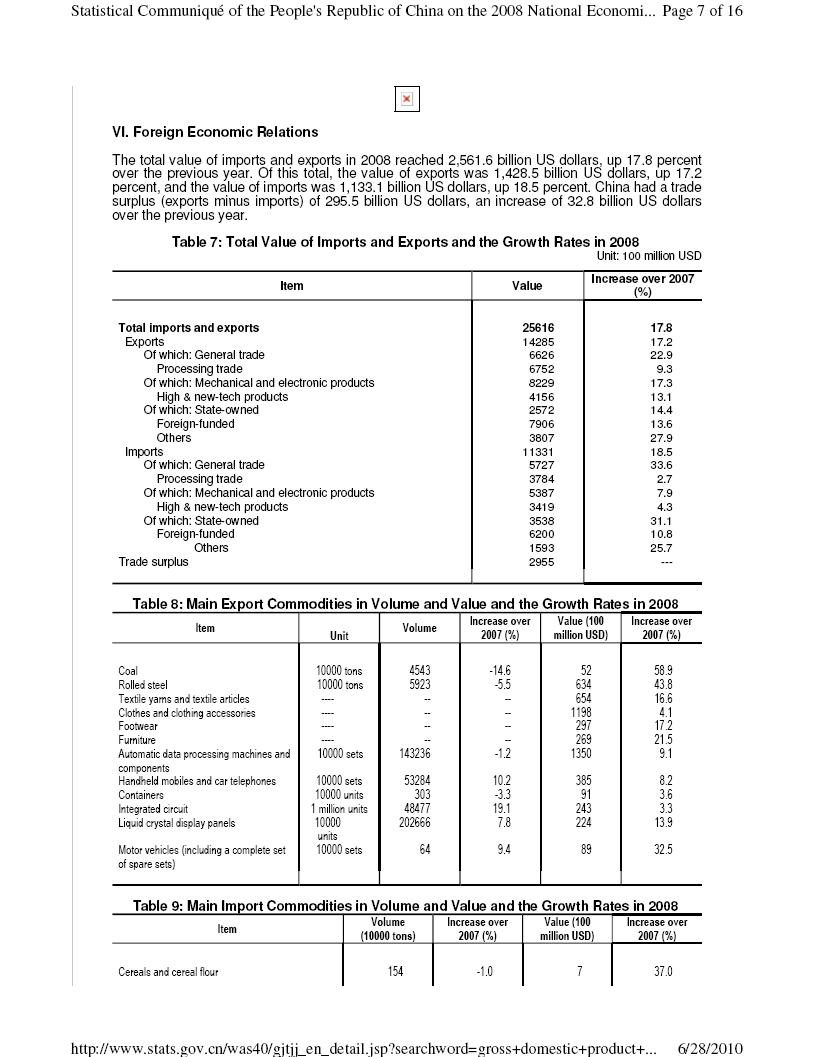

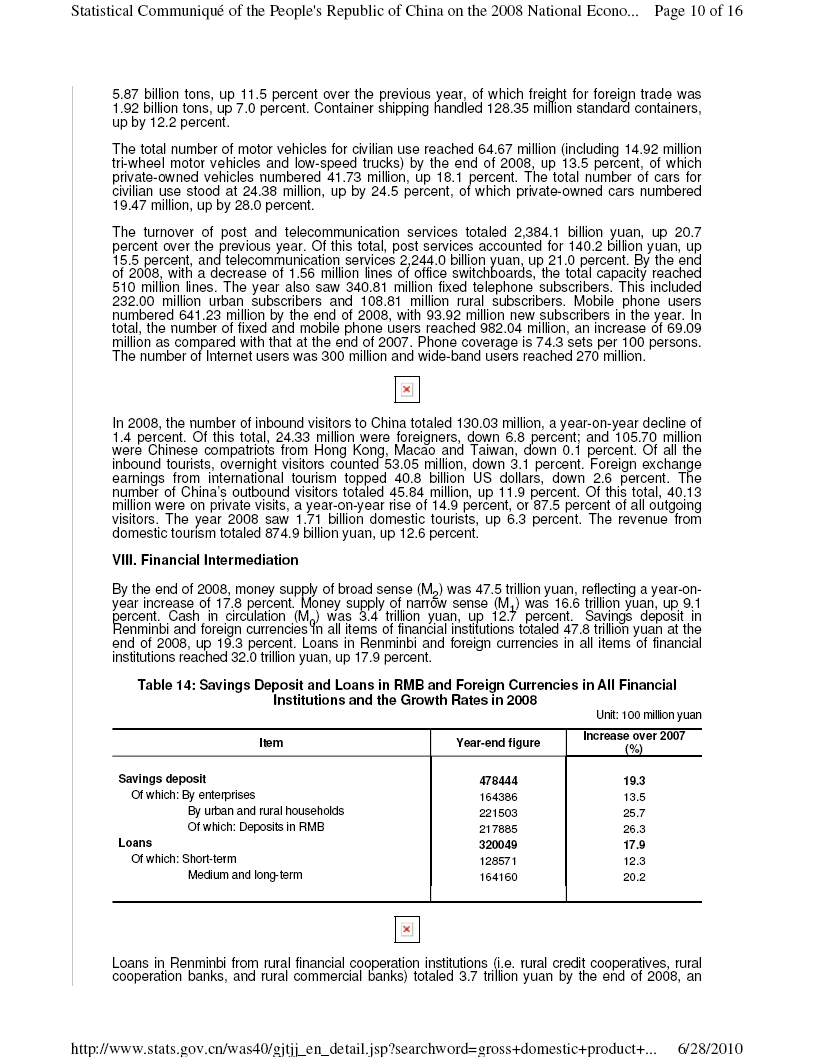

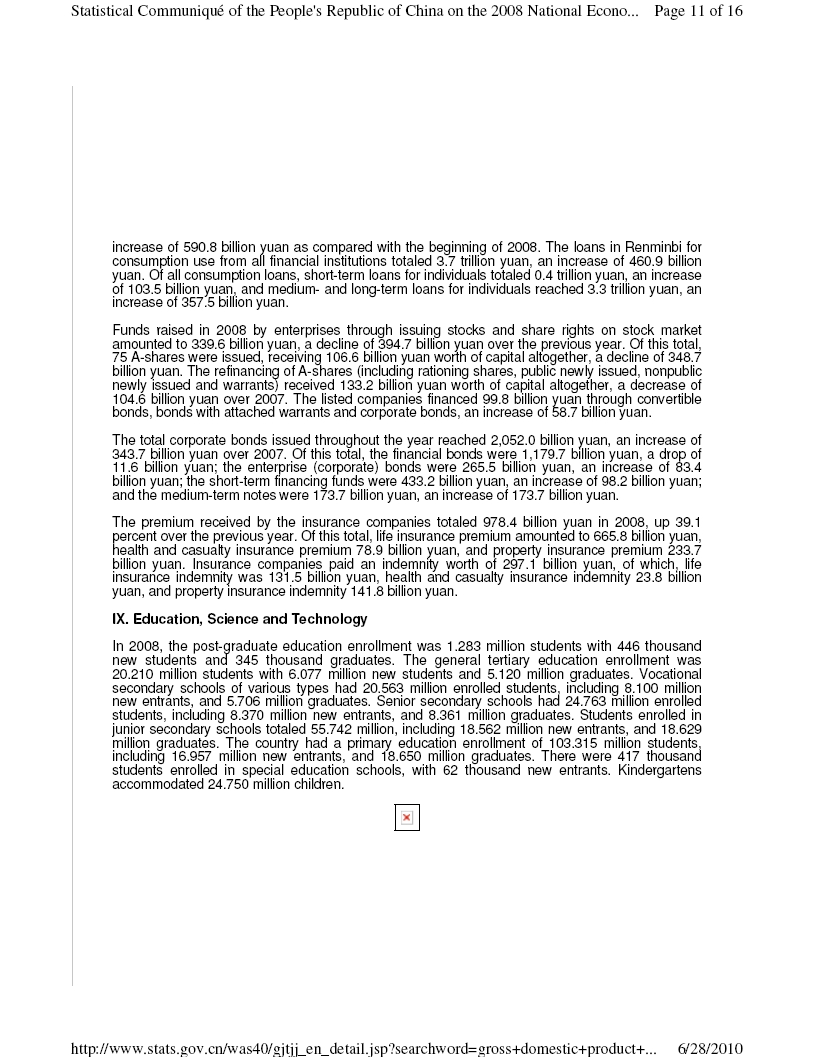

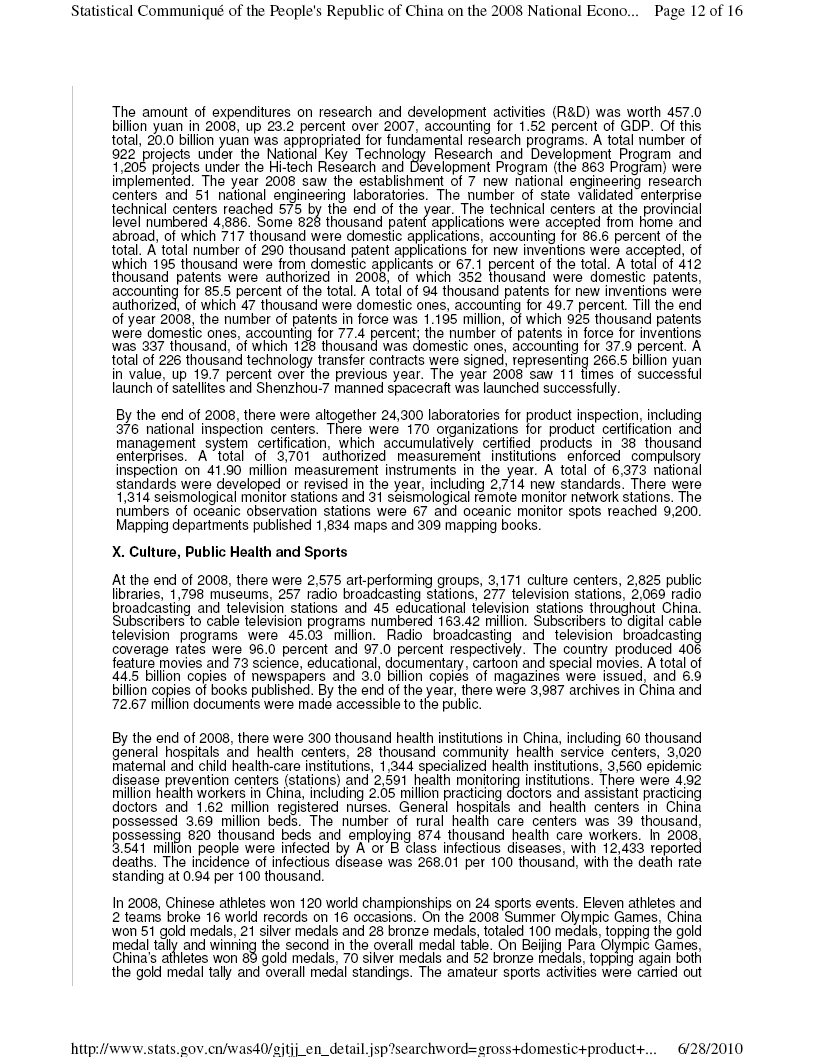

Statement: “In 2009, China’s gross domestic product (“GDP”) increased 8.7% over 2008 according to the National Bureau of Statistics of China. China’s GDP for 2008 increased 9% over 2007.”

Support – Reports from National Bureau of Statistics of Chain:

http://www.stats.gov.cn/was40/gjtjj_en_detail.jsp?searchword=gross+domestic+product+&channelid=9528&record=3 (under "I. GENERAL OUTLOOK").

http://www.stats.gov.cn/was40/gjtjj_en_detail.jsp?searchword=gross+domestic+product+&channelid=9528&record=12 (under "I. GENERAL OUTLOOK").

Each of these reports is also appended to this letter for your convenience.

Overview, page 46

| 36. | Comment: Please disclose the percentage of your 2009 revenues that Hualong Group, Dabao Group, Grace China Co., Ltd. and Hengan International Group Co., Ltd. accounted for individually or in the aggregate. |

Response: We respectfully note your comment and have disclosed the percentages of the Company’s 2009 revenue attributed by these companies.

Advertising Packages, page 48

| 37. | Comment: Please provide more information about your practices with respect to the purchase of advertising time. For example, explain the process by which you seek out and procure advertising time and whether there is any seasonality to your purchases. Disclose your material suppliers of advertising time and the percentage of advertising time you purchased from them in the last three years. Provide additional insight in to the timing between your initial purchase and when you resell the advertising to your clients. |

Response: We respectfully note your comment and have added additional information regarding the Company’s practices with respect to the purchase of advertising time to the disclosure.

| 38. | Comment: Please provide more information about your practices with respect to reselling advertising time. For example, explain the extent to which your advertising packages change from year to year as a result of changes in the advertising time you are able to purchase. In this regard, clarify whether the television advertising packages disclosed on pages 49 and 50 are just for 2010 or whether you may purchase other advertising time and offer different packages in the future. |

Response: We respectfully note your comment and have revised the disclosure to add additional information about the Company’s practices with respect to reselling advertising time.

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT,

MARKED BY BRACKETED ASTERISKS, HAS BEEN OMITTED AND FILED

SEPARATELY WITH THE COMMISSION PURSUANT TO 17 CFR §200.83

*FOIA Confidential Treatment Request*

Confidential Treatment Requested by China Century Dragon Media, Inc.

in connection with

Registration Statement on Form S-1, Filed May 14, 2010, File No. 333-166866

Larry Spirgel

June 29, 2010

Page 9

| 39. | Comment: To the extent practical, please include quantitative information with respect to you relative market shares as a reseller of CCTV advertising time. If you are unable to provide market share information, then please disclose this fact and explain the reason for that inability. |

Response: We respectfully note your comment and have revised the disclosure to indicate that the Company is unable to provide market share information and the reason for that inability.

Executive Officers, Directors and Key Employees, page 55

| 40. | Comment: Please disclose the positions that your officers and directors held with CD Media Beijing. In this regard, you disclose on page 56 that the executive officers of CD Media Beijing were appointed as your executive officers upon the closing of the share exchange. |

Response: We respectfully note your comment and have revised the disclosure to disclose the positions that the Company’s officers and director hold in CD Media Beijing.

Board of Directors and Committees, page 55

| 41. | Comment: When you have appointed independent directors and created board committees, please identify your independent directors and committee members. In addition, if you intend to rely on any exemption from the listing standards related to independence, including phase-in periods, please disclose such intention. Refer to Item 401(a) of Regulation S-K and Instruction 1 thereto. When you appoint additional directors, please comply with Item 401 of Regulation S-K, as most recently amended. |

Response: We respectfully note your comment and will provide the identities of all independent board members that the Company appoints upon appointment and will provide all information required by Item 401 of Regulation S-K. The Company will disclose the creation of board committees in the registration statement upon their creation.

Certain Relationships and Related Transactions, page 60

| 42. | Comment: Please provide your analysis of why the shareholders of the company prior to the share exchange would not be considered promoters or control persons for purposes of providing disclosure under Regulation S-K Item 404(c). In your analysis, please address the fact that the same persons who were shareholders in SRKP 25 prior to the share exchange are typically shareholders of the other SRKP shell companies that have been registered under the Securities Exchange Act. |

Response: We respectfully note your comment and have provided disclosure regarding which shareholders of the company prior to the share exchange may be considered promoters or control persons for purposes of providing disclosure under Regulation S-K Item 404(c).

| 43. | Comment: Please clarify whether each of the security holders of SRKP 25 retained some shares or warrants and how it was decided whose shares and warrants (and the amount) would be cancelled. |

Response: We respectfully note your comment and have revised the disclosure to clarify that each of the security holders of SRKP 25 retained shares and warrants upon the closing of the share exchange and how the number of shares and warrants cancelled was determined.

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT,

MARKED BY BRACKETED ASTERISKS, HAS BEEN OMITTED AND FILED

SEPARATELY WITH THE COMMISSION PURSUANT TO 17 CFR §200.83

*FOIA Confidential Treatment Request*

Confidential Treatment Requested by China Century Dragon Media, Inc.

in connection with

Registration Statement on Form S-1, Filed May 14, 2010, File No. 333-166866

Larry Spirgel

June 29, 2010

Page 10

| 44. | Comment: Please disclose the nature of K&L Gates’ or its affiliates’ interests, direct or indirect, in the company pursuant to Item 509 of Regulation S-K or explain to us why disclosure is not appropriate. In this regard, it appears that Mr. Poletti was involved with the founding of SRKP 25, that he or an affiliate was a five percent beneficial holder of SRKP 25, that he or an affiliate may still hold shares or warrants that he or an affiliate may be offering shares in the selling shareholder offering. Refer to Item 509 of Regulation S-K and Instruction 1 thereto. |

Response: We respectfully note your comment and confirm that neither K&L Gates LLP nor any of its affiliates holds any interest, either direct or indirect, in the Company and no disclosure of any interest in the Company is required to be disclosed pursuant to Item 509 of Regulation S-K. Neither Mr. Poletti nor any of his affiliates is a holder of any securities of the Company or is offering any of the shares in the selling shareholder offering.

Financial Statements, page F-1

| 45. | Comment: Please update your financial statements to comply with Rule 3-01 of Regulation S-X. |

Response: We respectfully note your comment and have updated the financial statements to comply with Rule 3-01 of Regulation S-X.

Report of Independent Registered Public Accounting Firm, page F-2

| 46. | Comment: We note that your auditors are located in Texas. It appears that the majority of your assets, liabilities, revenues and expenses relate to your operations in China. Please tell us how the audit of the operations in China, including the associated assets and liabilities, was conducted. Your response should include a discussion of the following: |

| | · | Whether another auditor was involved in the audit of the Chinese operations. If so, please tell the name of the firm and indicate whether they are registered with the Public Company Accounting Oversight Board (PCAOB). Additionally, please tell us how your U.S. auditor assessed the qualifications of the other auditor and the other auditor’s knowledge of US GAAP and PCAOB Standards; and |

| | · | Whether you U.S. auditor performed all of the required auditor procedures within the United States or whether a portion of the audit was conducted by your U.S. auditor within China. |

Response: We respectfully note your comment and the Company’s auditor, MaloneBailey, LLP, confirms that it used three contract auditors during its audit of the Company’s financial statements. These contractors are native Chinese speakers who are able to communicate with the Company in Mandarin. They are college graduates with majors in accounting and finance and have varying audit and accounting experience with PCAOB standards and U.S. GAAP. They performed procedures that the Company’s auditors deemed appropriate under the direct supervision of three experienced Mandarin speaking members of MaloneBailey that performed the audit with the contractors at the Company’s location in PRC. Substantially all of MaloneBailey’s testing procedures were performed by its audit team within China at the Company’s China offices. A portion or all of their review of the Company’s financial reporting and a few follow up procedures were completed by the auditors within the United States after they left China. The core audit team consisted of six personnel in China, all with the ability to read and speak Mandarin, and two personnel in the U.S., one of which can read and speak Mandarin. Based on the foregoing, MaloneBailey has concluded that its is appropriate for it to issue an audit report for the Company. No other auditor was involved in the audit.

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT,

MARKED BY BRACKETED ASTERISKS, HAS BEEN OMITTED AND FILED

SEPARATELY WITH THE COMMISSION PURSUANT TO 17 CFR §200.83

*FOIA Confidential Treatment Request*

Confidential Treatment Requested by China Century Dragon Media, Inc.

in connection with

Registration Statement on Form S-1, Filed May 14, 2010, File No. 333-166866

Larry Spirgel

June 29, 2010

Page 11

Note 2. Summaries of Significant Accounting Policies, page F-10

e. Accounts receivable, page F-10

| 47. | Comment: Tell us why you have recorded no allowance for doubtful accounts as of December 31, 2009 and 2008. |

Response: We respectfully note your comment and supplementally inform you that the Company did not record an allowance for doubtful accounts as of December 31, 2009 and 2008 because it has a history of collecting 100% of its receivables.

j. Revenue recognition, page F-11

| 48. | Comment: It is unclear to us why you believe that you are the primary obligor in your revenue arrangements. It appears to us that you may be functioning as an agent of CCTV. In this regard, please describe your agreements with your clients and tell us what rights your clients have to seek restitution from CCTV in the event that there is a problem with the airing of an advertisement. Please tell us how you considered the guidance in Example 10 in FASB ASC 605-45-55. |

Response: We respectfully note your comment and submit the following reasons for our belief that we are the primary obligor on our revenue arrangements:

(1) We do not act as an agent for CCTV.

(2) We purchase blocks of advertising time from third-party agents of CCTV and repackage the time blocks into smaller time slots, which are then sold to our customers.

(3) These third parties agents act as wholesale distributors of advertising time, and acquire the time blocks directly from CCTV.

(4) We acquire the rights to the advertising time from these agents.

(5) We are obligated to these agents and not the ultimate provider (CCTV).

In addition, the following facts support our conclusion that we are the primary obligor and not an agent for CCTV:

| | - | CCTV is not a party to the agreement between us and our customers |

| | - | We are responsible for seeking remedies from CCTV for defects in advertising space |

| | - | We provide other services, which includes advice on selection of time slots and limited production services |

| | - | We are required to purchase the time in advance and if we cannot resell the time we cannot seek refunds |

| | - | We have to collect from our customer and bear the full credit risk of the transaction |

| | - | We determine the pricing of the advertising time sold to our customers, which is not determined through the application of a formula based on cost |

Based on the factors above, we concluded that we are the primary obligor and that the factors required for gross revenue reporting as described in ASC 605 are met.

We have reviewed and considered the guidance in Example 10 - Advertising Match Services in FASB ASC 605-45-55-35 through 38. We do not believe this guidance applies as we are not in the Advertising Match Services business. Our model is to buy the time at one price from agents for CCTV and then sell the time to customers, bundled with other services, at a higher price as set by us. Unlike the Matchmaker in Example 10, we have a high degree of inventory risk, since we prepay for the advertising time and have full customer credit risk. For these reasons, we concluded that the example is not applicable to our business circumstances.

After careful reconsideration of the issues in your comment, we continue to conclude our accounting for revenues is appropriate and in accordance with ASC 605.

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT,

MARKED BY BRACKETED ASTERISKS, HAS BEEN OMITTED AND FILED

SEPARATELY WITH THE COMMISSION PURSUANT TO 17 CFR §200.83

*FOIA Confidential Treatment Request*

Confidential Treatment Requested by China Century Dragon Media, Inc.

in connection with

Registration Statement on Form S-1, Filed May 14, 2010, File No. 333-166866

Larry Spirgel

June 29, 2010

Page 12

| 49. | Comment: Describe for us the nature of the line item “Prepayments and deposits for advertising slot purchases.” Tell us the terms of these deposits and tell us how you determined that the entire balance should be classified as a current asset. |

Response: We respectfully note your comment and have added disclosure in Note 2 to the financial statements the description of line item “Prepayments and deposits for advertising slot purchases,” which includes cash deposits made by the Company to secure the rights to purchase specific advertising time blocks on CCTV’s network. In all cases, the advertising time block airs within 1 year, so the balance is properly recorded as a current asset.

| 50. | Comment: We note that you pay for blocks of advertising time in advance of reselling it to your customers and are committed to pay the remainder of the balance prior to broadcast. In this regard, tell us why you have not recorded a liability for the remaining time that you are obligated to purchase. |

Response: We respectfully note your comment. As of the end of fiscal 2009, a total of $7.6 million was already paid to the suppliers as advance of purchase by the agreed dates indicated in the contracts, and for any new additional payment, the Company and the suppliers signed another set of contracts in 2010 to define the remaining payment.

| 51. | Comment: We note your disclosure regarding multiple-element arrangements. Disclose the nature of your multiple-element arrangements, the types of elements included, and your method for determining the relative fair value for each element. |

Response: We respectfully note your comment. In addition to selling blocks of advertising time, the Company provides certain production-related services. Although revenue from these services was nominal for the periods presented, the Company expects these revenues to grow as it expands its service offerings. The Company expects to bundle its service offerings with advertising time in future periods and included a disclosure regarding multiple-element arrangements in anticipation future transactions.

Note 7. Income Tax, page F-16

| 52. | Comment: You state that there are no significant uncertain tax positions requiring recognition in your financial statements. We also note your disclosures at page 21 and 23 regarding various tax uncertainties and the risks associated with new tax regulations. In this regard, please tell us how you applied the guidance in FASB ASC 740-10-25-5 through 740-10-25-17 in assessing these tax positions. |

Response: We respectively submit the following responses. The disclosure on pages 21 and 23 of the registration statement discusses risk factors related to tax changes in the PRC. There are three basic risk factors:

1. The impact of Circular 698

2. The impact of the new PRC Enterprise Income Tax Law

3. Dividend and gain on sale PRC taxes and withholding

It is the Company’s view that these are future risks rather than past tax uncertainties that are required to be disclosed under FASB ASC 740-10-25-5 through 740-10-25-17. The Company’s evaluation is driven by the following facts and estimates.

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT,

MARKED BY BRACKETED ASTERISKS, HAS BEEN OMITTED AND FILED

SEPARATELY WITH THE COMMISSION PURSUANT TO 17 CFR §200.83

*FOIA Confidential Treatment Request*

Confidential Treatment Requested by China Century Dragon Media, Inc.

in connection with

Registration Statement on Form S-1, Filed May 14, 2010, File No. 333-166866

Larry Spirgel

June 29, 2010

Page 13

Impact of Circular 698

Circular 698 addresses the transfer of shares of Chinese resident companies by nonresident companies. Until the completion of the public offering in the United States, there have been no transfers of shares by a nonresident company at a gain. All shares sold have been sold and held by the transferors pending the public offering and the effect of the lockup agreements. Our interpretation cannot be precise because the taxing authority has not yet promulgated any formal provisions or formally declared or stated how to calculate the effective tax in the country or jurisdiction, and to what extent and the process of the disclosure to the tax authority in charge of that Chinese resident enterprise. However, we have concluded that no further disclosure other than the risk factor disclosure is appropriate until sell transactions take place after the public offering.

PRC Enterprise Income Tax Law

Under the new PRC Enterprise Income Tax Law (the “New EIT Law”) and its implementing rules, both of which became effective on January 1, 2008, enterprises are classified as either resident enterprises or non-resident enterprises. An enterprise established outside of China with its “de facto management bodies” located within China is considered a “resident enterprise,” meaning that it can be treated in a manner similar to a Chinese domestic enterprise for enterprise income tax purposes. The Company believes that its offshore companies, principally CD Media BVI and the US holding company, meet the qualifications of a resident enterprise in all financial periods presented, as their “de facto management bodies” are the same as the PRC management body. However, regardless of that fact, neither of these companies have had taxable income and will not have any taxable income until after the sale of shares in the public offering. We have concluded that no further disclosure other than the risk factor disclosure is appropriate because no tax uncertainty, as defined in FASB ASC 740, exists at the reporting dates.

Dividend and Gain on Sale PRC Taxes and Withholding

The central issue of this risk factor to the Company is a requirement to withhold taxes on dividends paid to the Company’s shareholders. The Company’s dividend policy is stated in the registration statement as follows:

We do not expect to declare or pay any cash dividends on our common stock in the foreseeable future, and we currently intend to retain future earnings, if any, to finance the expansion of our business. The decision whether to pay cash dividends on our common stock will be made by our board of directors, in its discretion, and will depend on our financial condition, operating results, capital requirements and other factors that the board of directors considers significant. We did not pay cash dividends for the years ended December 31, 2009, 2008, and 2007.

Since the Company does not expect to pay dividends and has not paid dividends in the last three years, the Company believes that this is a future Company risk factor for shareholders to consider, and no disclosures under the requirements of FASB ASC 740 in the financial statements is appropriate.

As to the law’s effect on transfers of the Company’s shares at a gain, the Company believes to date that no such transfers by non-residents have taken place at other than fair value, and there have been no resales by non-PRC residents due to lockup agreements. The Company believes that the real impact of this portion of the law will take place after the public offering is complete. At that time, the Company’s obligation will not be one where any tax is due; rather, in the case of equity transfer between two non-resident enterprises, the PRC Company whose equity has been transferred is required to assist the tax authorities to collect taxes from the relevant non-resident enterprise. Accordingly, since the Company believes the effect is a future risk for shareholders, no disclosures under the requirements of FASB ASC 740 is appropriate.

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT,

MARKED BY BRACKETED ASTERISKS, HAS BEEN OMITTED AND FILED

SEPARATELY WITH THE COMMISSION PURSUANT TO 17 CFR §200.83

*FOIA Confidential Treatment Request*

Confidential Treatment Requested by China Century Dragon Media, Inc.

in connection with

Registration Statement on Form S-1, Filed May 14, 2010, File No. 333-166866

Larry Spirgel

June 29, 2010

Page 14

Item 15. Recent sales of securities, page II-10

| 53. | Comment: Please disclose the number of persons to whom you sold securities in each transaction. |

Response: We respectfully note your comment and have updated the disclosure to disclose the number of person to whom it sold securities in each transaction.

Item 16. Exhibits, page II-11

| 54. | Comment: Please file as exhibits your agreements for the sales of television programs rights referenced on pages F-15 and F-16. |

Response: We respectfully note your comment and have filed the Company’s agreements for the sales of the television program rights as exhibits to the Amendment.

| 55. | Comment: We note that you have disclosed in the prospectus the opinion of PRC counsel regarding your contractual arrangements and other issues and have included a consent form such counsel as Exhibit 23.2. Please supplementally provide us with a copy of this legal opinion for review. |

Response: We respectfully note your comment and have supplementally provided a copy of this legal opinion for your review.

| 56. | Comment: Please ask your auditors to revise their consent to include a reference to the financial statements for the year ended December 31, 2007. |

Response: We respectfully note your comment and the Company’s auditor has revised its consent to include a reference to the financial statements for the year ended December 31, 2007.

Please do not hesitate to contact the undersigned or Anh Q. Tran, Esq. at (310) 552-5086 or (310) 552-5083 with any questions.

Sincerely,

/s/ Melissa Brown

Melissa Brown, Esq.

| cc: | Li HuiHua, China Century Dragon Media, Inc. |

John J. Harrington, United States Securities and Exchange Commission

Thomas J. Poletti, Esq.

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT,

MARKED BY BRACKETED ASTERISKS, HAS BEEN OMITTED AND FILED

SEPARATELY WITH THE COMMISSION PURSUANT TO 17 CFR §200.83

*FOIA Confidential Treatment Request*

Confidential Treatment Requested by China Century Dragon Media, Inc.

in connection with

Registration Statement on Form S-1, Filed May 14, 2010, File No. 333-166866

[***Copy of PRC counsel in response to Comment no. 55***]

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT,

MARKED BY BRACKETED ASTERISKS, HAS BEEN OMITTED AND FILED

SEPARATELY WITH THE COMMISSION PURSUANT TO 17 CFR §200.83