The establishment of a foreign-invested advertising enterprise, by means of either a new establishment or equity acquisition of an existing domestic advertising company, is subject to examination by the SAIC or its authorized branch at the provincial level and the issuance of an Opinion on the Examination and Approval of the Foreign-invested Advertising Enterprise Project. Upon obtaining such Opinion from the SAIC or its relevant branch, an approval from the Ministry of Commerce or its competent local counterparts is required before a foreign-invested advertising enterprise may apply for its business license. In addition, if a foreign-invested advertising enterprise intends to set up any branch, it must meet the requirements that (i) its registered capital has been fully subscribed and contributed and (ii) its annual advertising sales revenues are not less than RMB 20 million.

Employment laws

We are subject to laws and regulations governing our relationship with our employees, including: wage and hour requirements, working and safety conditions, and social insurance, housing funds and other welfare. These include local labor laws and regulations, which may require substantial resources for compliance.

China’s National Labor Law, which became effective on January 1, 1995, and China’s National Labor Contract Law, which became effective on January 1, 2008, permit workers in both state and private enterprises in China to bargain collectively. The National Labor Law and the National Labor Contract Law provide for collective contracts to be developed through collaboration between the labor union (or worker representatives in the absence of a union) and management that specify such matters as working conditions, wage scales, and hours of work. The laws also permit workers and employers in all types of enterprises to sign individual contracts, which are to be drawn up in accordance with the collective contract. The National Labor Contract Law has enhanced rights for the nation’s workers, including permitting open-ended labor contracts and severance payments. The legislation requires employers to provide written contracts to their workers, restricts the use of temporary labor and makes it harder for employers to lay off employees. It also requires that employees with fixed-term contracts be entitled to an indefinite-term contract after a fixed-term contract is renewed twice or the employee has worked for the employer for a consecutive ten-year period.

Regulations on Trademarks

Both the PRC Trademark Law, adopted in 1982 and revised in 1993 and 2001, and the Implementation Regulation of the PRC Trademark Law, adopted in 2002, provide protection to the holders of registered trademarks. The State Trademark Bureau, under the authority of the SAIC, handles trademark registrations and grants rights of a term of 10 years in connection with registered trademarks. License agreements with respect to registered trademarks must be filed with the State Trademark Bureau.

Foreign currency exchange

Under the PRC foreign currency exchange regulations applicable to us, the Renminbi is convertible for current account items, including the distribution of dividends, interest payments, trade and service-related foreign exchange transactions. Conversion of Renminbi for capital account items, such as direct investment, loan, security investment and repatriation of investment, however, is still subject to the approval of the PRC State Administration of Foreign Exchange, or SAFE. Foreign-invested enterprises may only buy, sell and/or remit foreign currencies at those banks authorized to conduct foreign exchange business after providing valid commercial documents and, in the case of capital account item transactions, obtaining approval from the SAFE. Capital investments by foreign-invested enterprises outside of China are also subject to limitations, which include approvals by the Ministry of Commerce (“MOFCOM”), SAFE and the State Reform and Development Commission. We currently do not hedge our exposure to fluctuations in currency exchange rates.

Dividend distributions

Under applicable PRC regulations, foreign-invested enterprises in China may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, a foreign-invested enterprise in China is required to set aside at least 10.0% of their after-tax profit based on PRC accounting standards each year to its general reserves until the accumulative amount of such reserves reach 50.0% of its registered capital. These reserves are not distributable as cash dividends. The board of directors of a foreign-invested enterprise has the discretion to allocate a portion of its after-tax profits to staff welfare and bonus funds, which may not be distributed to equity owners except in the event of liquidation.

Properties

We lease our principal corporate office located at Room 801, No. 7, Wenchanger Road, Jiangbei, Huizhou City, Guangdong Province, China under a 2 year lease that expires on November 1, 2011. Rental expenses under this lease total RMB322 (US$47) per month. We are in the process of filing and registering this lease with the relevant government authority in the PRC.

We lease office space at CD Media Beijing’s registered office, Room 119, No. 12 North Shi Long Road, Meng Tou Gou District, Beijing, pursuant to a lease that expires on October 25, 2011. Rental expenses under this lease totaled RMB 5,000 (US$755) per month.

CD Media Beijing also leases approximately 404.5 square meters of office space in Beijing for operations pursuant to a lease that expires on April 2, 2011. Rental expenses under this lease total RMB 55,000 (US$8,088) per month. We are in the process of filing and registering this lease with the relevant government authority in the PRC.

Legal Proceedings

We are not involved in any material legal proceedings outside of the ordinary course of our business.

MANAGEMENT

Executive Officers, Directors and Key Employees

The following individuals constitute our board of directors and executive management as of the date of this prospectus.

| Name | | Age | | Position |

| HaiMing Fu | | 36 | | Chief Executive Officer |

| HuiHua Li | | 38 | | Chairman of the Board |

| Dapeng “George” Duan | | 36 | | Chief Financial Officer and Corporate Secretary |

| ZhiFeng Yan | | 37 | | Director |

| David De Campo | | 58 | | Director |

| Yue Lu | | 37 | | Director |

| Fang Yuan | | 45 | | Director |

HaiMing Fu has served as the Chief Executive Officer of the Company since July 2010. Mr. Fu served as a director of the Company from April 2010 to July 2010. Mr. Fu served as General Manager of CD Media Beijing from January 2009 to June 2010. From May 2006 to December 2008, Mr. Fu served as Vice General Manager of CD Media Beijing. From March 2001 to April 2006, Mr. Fu served as the Vice President of Business Expansion and Implementation of Beijing Future Advertisement Company. Mr. Fu received a bachelor’s degree in mechanics engineering from Neimonggu Mechanics University in 1999.

HuiHua Li has been the Chairman of the Board of the Company since April 2010. Ms. Li served as Chief Executive Officer of the Company from April 2010 to July 2010. Ms. Li has served as Chief Executive Officer of CD Media BVI since November 2009. Ms. Li has also been a director of CD Media BVI since March 2010. Ms. Li has also served as the Executive Director of CD Media Beijing since August 1, 2010. From February 2003 to June 2009, Ms. Li was self-employed at a self-owned electronic products business. From January 1998 to December 2002, Ms. Li was a Financial Controller in the accounting and capital management department of Huizhou Tongda Electronic Co., Ltd. From February 1994 to December 1997, Ms. Li was an Accountant at Tuopu Technology Co., Ltd. (Huizhou). From July 1990 to October 1993 Ms. Li served as a Quality Assurance Supervisor at Zhongou Electronic Co., Ltd. (Huizhou). Ms. Li received a degree in accounting from the Accounting Department of Huizhou Business School in 1990. We believe that Ms. Li is qualified to serve a director of our Company due to her knowledge of our business operations from her prior and current employment positions with CD Media BVI and CD Media Beijing, as well as her prior employment experience in financial management.

Dapeng “George” Duan became the Chief Financial Officer and Corporate Secretary of the Company on August 3, 2010. From August 2006 to July 2010, Mr. Duan was a Senior Internal Auditor of CME Group. From October 2004 to July 2006, Mr. Duan was a Senior Associate/Associate at KPMG LLP. From June 2001 to September 2004, he was a Senior Accountant at Corbert, Duncan & Hubly P.C. and from August 1996 to July 1999, he was a Senior Accountant/Accountant at China National Overseas Trading Co. Mr. Duan received a Bachelor’s degree in Economics-Accounting from the University of International Business and Economics in Beijing, China in May 1996, a Master of Accounting from Western Illinois University in May 2001 and an MBA in Finance and Entrepreneurship from the University of Chicago Graduate School of Business in June 2009. Mr. Duan is also a licensed certified public accountant in the State of Illinois.

ZhiFeng Yan has served as a director of the Company since July 2010. Mr. Yan has served as General Manager of CD Media Beijing from June 2001 to December 2008. Since June 2007, Mr. Yan has served as the General Manager of Beijing Key Point Media Co. Ltd. From March 1999 to November 2002, Mr. Yan was the Vice Sales Director of Beijing Huashi Yide Advertising Co., Ltd. From June 1998 to March 1999, Mr. Yan was a Customer Manager of the CCTV Economic Move and Television Center. Mr. Yan has a Bachelor’s degree in Business Administration from the University of International Business and Economics. We believe that Mr. Yan is qualified to serve on our board of directors due to his extensive knowledge of our business acquired from his prior service as the General Manager of CD Media Beijing and his broad knowledge of the Chinese advertising industry in general from his prior employment at CCTV and other advertising companies in the PRC.

David De Campo has served as a director of the Company since November 2010. He was recently been appointed as a Director and Chairman of the Audit Committee for GRG International Ltd. a company listed on the Australian Stock Exchange (the “ASX”). Since August 2007, Mr. De Campo has served as the Execute Director of CHS Pty. Ltd., a wholesaler in the pharmaceutical industry in Australia. Mr. De Campo has also served as a Director and member of the Audit Committee of Open Universities Australia Pty. Ltd., a provider of tertiary education online, since May 2008. From May 2005 to February 2007 he served as the Executive Director of Business Development for Jumbo Ltd., an ASX listed company operating in the Internet Services market place. In May 2005 Jumbo Ltd. acquired TMS Global Services Pty. Ltd., of which Mr. De Campo was Chairman and Chief Executive Officer. TMS was an online seller of Australian lottery products. Mr. De Campo had been Chairman and Chief Executive Officer of TMS Global Services Pty. Ltd. since May 2003. From late 1999 to May 2003, he served as the Australian Operative for Cullen Investments Ltd., a private investment firm based in New Zealand. Cullen Investments, amongst other acquisitions, had acquired a controlling stake in TMS Global Services Pty. Ltd. in late 2000. During this period with Cullen Investments, Mr. De Campo served on the following companies Boards: Non Executive Director of RMG Ltd., an ASX listed company involved in Consumer Credit Collection; Canbet Ltd. (Chairman), an ASX listed company involved in on-line gaming activities; and Tasman Capital Pty. Ltd., a Funds Management entity. From May 1998 to September 1999, he served as the Managing Director of Liberty-One Services Pty. Ltd. Prior to that, he served as the Managing Director Australasia of Lucent Technology Ltd., a telecommunications equipment manufacturer. Mr. De Campo received a Bachelor’s degree in Electrical Engineering in 1974 and an MBA in 1979, both from Melbourne University. We believe that Mr. De Campo is qualified to serve on our board of directors due to his vast prior business experience and his knowledge of board of director and audit committee roles obtained from his current and prior service on the boards of directors and audit committee of several ASX-listed companies.

Yue Lu has served as a director of the Company since November 2010. He has also served as the Financial Controller of Towona Media Holding Company, a provider of outdoor advertising, since August 2009. Mr. Lu served as the Vice General Manager of the Finance Department of Simcere Pharmaceutical Group (NYSE: SCR) from November 2006 to July 2009. Prior to that, Mr. Lu served as a Senior Analyst at Kodak China from July 2006 to November 2006. From April 2006 to June 2006, Mr. Lu was served as financial controller at Sun New Media Group. From March 2003 to March 2006, Mr. Lu was served as financial controller of Lenovo-Asiainfo. Mr. Lu received a Bachelor’s degree in Accounting from the University of International Business and Economics in China in 1996 and a Master’s degree in Accounting from Iowa State University in 2002. Mr. Lu is a U.S. certified public accountant in Illinois. We believe that Mr. Lu is qualified to serve on the board of directors of our Company due to his current and prior experience as a financial manager, his accounting-related education and his status as a U.S. certified public accountant.

Fang Yuan has served as a director of the Company since November 2010. Dr. Yuan has also served as a Professor at China Media University since January 2006. From December 2000 to December 2005, Dr. Yuan was the Media Director of China Central Television (CCTV). Since 2000, Dr. Yuan has provided consulting services to over 20 of China’s main television stations. Dr. Yuan received a Ph.D. in Philosophy in 1995 from China People’s University. We believe that Mr. Yuan is qualified to serve as a director of our Company due to his extensive knowledge of the Chinese advertising industry and his prior employment with CCTV.

Family Relationships

There are no family relationships among any of the officers and directors.

Involvement in Certain Legal Proceedings

There have been no events under any bankruptcy act, no criminal proceedings and no judgments, injunctions, orders or decrees material to the evaluation of the ability and integrity of any director, executive officer, promoter or control person of the Company during the past ten years.

The Company is not aware of any legal proceedings in which any director, nominee, officer or affiliate of the Company, any owner of record or beneficially of more than five percent of any class of voting securities of the Company, or any associate of any such director, nominee, officer, affiliate of the Company, or security holder is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries.

Board of Directors and Committees and Director Independence

Under the listing standards of the NYSE Amex, a listed company’s board of directors must consist of a majority of independent directors. Certain exceptions are available for this requirement but we do not qualify for any such exception. Currently, our board of directors has determined that each of David De Campo, Yue Lu, and Fang Yuan is an “independent” director as defined by the listing standards of NYSE Amex currently in effect and all applicable rules and regulations of the SEC. All members of the Audit, Compensation and Nominating Committees satisfy the “independence” standards applicable to members of each such committee. The board of directors made this affirmative determination regarding these directors’ independence based on discussions with the directors and on its review of the directors’ responses to a standard questionnaire regarding employment and compensation history; affiliations, family and other relationships; and transactions with the Company. The board of directors considered relationships and transactions between each director or any member of his immediate family and the Company and its subsidiaries and affiliates.

Audit Committee

We established our Audit Committee in November 2010. The Audit Committee consists of David De Campo, Yue Lu, and Fang Yuan, each of whom is an independent director. Yue Lu, Chairman of the Audit Committee, is an “audit committee financial expert” as defined under Item 407(d) of Regulation S-K. The purpose of the Audit Committee is to represent and assist our board of directors in its general oversight of our accounting and financial reporting processes, audits of the financial statements and internal control and audit functions. The Audit Committee’s responsibilities include:

| | · | The appointment, replacement, compensation, and oversight of work of the independent auditor, including resolution of disagreements between management and the independent auditor regarding financial reporting, for the purpose of preparing or issuing an audit report or performing other audit, review or attest services. |

| | · | Reviewing and discussing with management and the independent auditor various topics and events that may have significant financial impact on our company or that are the subject of discussions between management and the independent auditors. |

The board of directors has adopted a written charter for the Audit Committee. A copy of the Audit Committee Charter is filed as Exhibit 99.1 to our Current Report on Form 8-K filed with the SEC on November 23, 2010.

Compensation Committee

We established our Compensation Committee in November 2010. The Compensation Committee consists of Yue Lu and Fang Yuan, each of whom is an independent director. Mr. Lu is the Chairman of the Compensation Committee. The Compensation Committee is responsible for the design, review, recommendation and approval of compensation arrangements for our directors, executive officers and key employees, and for the administration of our equity incentive plans, including the approval of grants under such plans to our employees, consultants and directors. The Compensation Committee also reviews and determines compensation of our executive officers, including our Chief Executive Officer. The board of directors has adopted a written charter for the Compensation Committee. A copy of the Compensation Committee Charter is filed as Exhibit 99.2 to our Current Report on Form 8-K filed with the SEC on November 23, 2010.

Nominating Committee

The Nominating Committee consists of Yue Lu and Fang Yuan, each of whom is an independent director. Mr. Yuan is the Chairman of the Nominating Committee. The Nominating Committee assists in the selection of director nominees, approves director nominations to be presented for stockholder approval at our annual general meeting, fills any vacancies on our board of directors, considers any nominations of director candidates validly made by stockholders, and reviews and considers developments in corporate governance practices. The board of directors has adopted a written charter for the Nominating Committee. A copy of the Nominating Committee Charter is filed as Exhibit 99.3 to our Current Report on Form 8-K filed with the SEC on November 23, 2010.

Code of Business Conduct and Ethics

On October 8, 2010, our Board of Directors approved an Amended and Restated Code of Conduct and Ethics (the "Code of Ethics") that applies to all of the directors, officers and employees of the Company. The Code of Ethics addresses, among other things, honesty and ethical conduct, conflicts of interest, compliance with laws, regulations and policies, including disclosure requirements under the federal securities laws, confidentiality, trading on inside information, and reporting of violations of the code. A copy of the Code of Ethics is filed as Exhibit 14.1 to our current report on Form 8-K filed with the Securities and Exchange Commission on October 13, 2010. Requests for copies of the Code of Ethics should be sent in writing to China Century Dragon Media, Inc., Attention: Secretary, Room 801, No. 7, Wenchanger Road, Jiangbei, Huizhou City, Guangdong Province, China.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Compensation Before the Share Exchange

Prior to the closing of the Share Exchange on April 30, 2010, we were a “blank check” shell company named SRKP 25, Inc. that was formed to investigate and acquire a target company or business seeking the perceived advantages of being a publicly held corporation. The only officers and directors of SRKP 25, Inc., Richard Rappaport and Anthony Pintsopoulos, SRKP 25’s President and Chief Financial Officer, respectively, did not receive any compensation or other perquisites for serving in such capacities. Messrs. Rappaport and Pintsopoulos resigned from all of their executive and director positions with SRKP 25 upon the closing of the Share Exchange and are no longer employed by or affiliated with our company.

Prior to the closing of the Share Exchange, our current named executive officers were compensated by CD Media Beijing until the closing of the Share Exchange, including for the year ended December 31, 2009 and the period from January 1, 2010 to April 30, 2010. The Executive Director of CD Media Beijing, HuiHua Li, determined the compensation for herself and the other executive officers of CD Media Beijing that was earned in fiscal 2009 and the period from January 1, 2010 to April 30, 2010. In addition, the Board of Directors of CD Media Beijing approved the compensation. From January 1, 2010 to April 30, 2010 and during the fiscal years of 2009, 2008 and 2007, the compensation for CD Media Beijing’s named executive officers consisted solely of each executive officer’s salary and cash bonus. The Board of Directors of CD Media Beijing believes that the salaries paid to our executive officers during 2009 and the period from January 1, 2010 to April 30, 2010 are indicative of the objectives of its compensation program and reflect the fair value of the services provided to CD Media Beijing, as measured by the local market in China.

Compensation After the Share Exchange

Upon the closing of the Share Exchange, the executive officers of CD Media BVI were appointed as our executive officers and we adopted the compensation policies of CD Media Beijing, as modified for a company publicly reporting in the United States. Compensation for our current executive officers is determined with the goal of attracting and retaining high quality executive officers and encouraging them to work as effectively as possible on our behalf. Compensation is designed to reward executive officers for successfully meeting their individual functional objectives and for their contributions to our overall development. For these reasons, the elements of compensation of our executive officers are salary and bonus. Salary is paid to cover an appropriate level of living expenses for the executive officers and the bonus is paid to reward the executive officer for individual and company achievement.

Salary is designed to attract, as needed, individuals with the skills necessary for us to achieve our business plan, to motivate those individuals, to reward those individuals fairly over time, and to retain those individuals who continue to perform at or above the levels that we expect. When setting and adjusting individual executive salary levels, we consider the relevant established salary range, the named executive officer’s responsibilities, experience, potential, individual performance and contribution. We also consider other factors such as our overall corporate budget for annual merit increases, unique skills, demand in the labor market and succession planning.

We determine the levels of salary as measured primarily by the local market in China. We determine market rate by conducting a comparison with the local geographic area averages and industry averages in China. In determining market rate, we review statistical data collected and reported by the Beijing Labor Bureau which is published monthly. The statistical data provides the high, median, low and average compensation levels for various positions in various industry sectors. In particular, we use the data for the advertising services sector as our benchmark to determine compensation levels because we operate in Beijing as a provider of advertising services. Our compensation levels are at roughly the 80th-90th percentile of the compensation spectrum for the manufacturing sector.

Corporate performance goals include selling more advertising time. Additional key areas of corporate performance taken into account in setting compensation policies and decisions are cost control, profitability, and innovation. The key factors may vary depending on which area of business a particular executive officer’s work is focused. Individual performance goals include subjective evaluation, based on an employee’s team-work, creativity and management capability, and objective goals such as sales targets. As motivation to our management team, we provide commission based bonuses to management personnel. We periodically evaluate the performance of our management personnel and pay seasonal bonuses three times per year and annual bonuses to each member of management in an amount up to .3% of the sales revenues generated by such staff member.

If we successfully complete our proposed listing of our common stock on the NYSE Amex, we may increase the amount of our bonuses to management personnel if corporate and individual performance goals are met. Generally, the amount of an annual bonus, when awarded, will be equal to one month’s salary plus 5% to 25% of the individual's annual salary. If the corporate and individual goals are fully met, the bonus will be closer to the top end of the range. If the goals are only partially met, the amount of the bonus will be closer to the bottom end of the range. In no event will there be a bonus equal to more than one month's salary if the corporate goals are not met by at least 50%.

Our board of directors established a compensation committee in November 2010 comprised of non-employee directors. The compensation committee will perform, at least annually, a strategic review of the compensation program for our executive officers to determine whether it provides adequate incentives and motivation to our executive officers and whether it adequately compensates our executive officers relative to comparable officers in other companies with which we compete for executives. Those companies may or may not be public companies or companies located in the PRC or even, in all cases, companies in a similar business. Prior to the formation of the compensation committee, HuiHua Li determined the compensation for our current executive officers. In 2011, our compensation committee will determine compensation levels for our executive officers. We have established a compensation program for executive officers for 2011 that is designed to attract, as needed, individuals with the skills necessary for us to achieve our business plan, to motivate those individuals, to reward those individuals fairly over time, and to retain those individuals who continue to perform at or above the levels that we expect. If paid, bonuses for executive officers in 2011 will be based on company and individual performance factors, as described above.

If we successfully complete our proposed listing on the NYSE Amex in 2011, we intend to adjust our compensation evaluations upwards in 2011, including through the payment of bonuses. However, in such case, we do not intend to increase compensation by more than 20%. We believe that adopting higher compensation in the future may be based on the increased amount of responsibilities and the expansion of our business to be assumed by each of the executive officers after we become a publicly listed company.

We also intend to expand the scope of our compensation, such as the possibility of granting options to executive officers and tying compensation to predetermined performance goals. We intend to adopt an equity incentive plan in the near future and issue stock-based awards under the plan to aid our company’s long-term performance, which we believe will create an ownership culture among our named executive officers that fosters beneficial, long-term performance by our company. We do not currently have a general equity grant policy with respect to the size and terms of grants that we intend to make in the future, but we expect that our compensation committee will evaluate our achievements for each fiscal year based on performance factors and results of operations such as revenues generated, cost of revenues, and net income.

Summary Compensation Table

The following table sets forth information concerning the compensation for the three fiscal years ended December 31, 2010 of the principal executive officer and principal financial officer. No other officer received annual compensation which exceeded $100,000.

| Name and Position | | Year | | Salary | | | Bonus | | | Total | |

| | | | | | | | | | | | |

| HaiMing Fu (1) | | 2010 | | $ | 27,235 | | | $ | 6,216 | | | $ | 33,451 | |

| Chief Executive Officer | | 2009 | | | 21,000 | | | | 1,700 | | | | 21,700 | |

| | | 2008 | | | 20,000 | | | | 1,600 | | | | 21,600 | |

| | | | | | | | | | | | | | | |

| HuiHua Li (1) | | 2010 | | $ | 11,309 | | | $ | 3,145 | | | $ | 14,454 | |

| Former Chief Executive Officer | | 2009 | | | 23,400 | | | | 2,000 | | | | 25,400 | |

| | | 2008 | | | 21,000 | | | | 1,800 | | | | 22,800 | |

| | | | | | | | | | | | | | | |

| Dapeng “George” Duan (2) | | 2010 | | $ | 37,500 | | | $ | - | | | $ | 37,500 | |

| Chief Financial Officer | | 2009 | | | - | | | | - | | | | - | |

| | | 2008 | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | |

| Le Zhang (2) | | 2010 | | $ | 11,735 | | | $ | 3,321 | | | $ | 15,056 | |

| Former Chief Financial Officer | | 2009 | | | 15,000 | | | | 1,250 | | | | 16,250 | |

| | | 2008 | | | 12,000 | | | | 1,000 | | | | 13,000 | |

| | | | | | | | | | | | | | | |

| Richard Rappaport (3) | | 2010 | | $ | - | | | $ | - | | | $ | - | |

| Former President | | 2009 | | | - | | | | - | | | | - | |

| and Former Director | | 2008 | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | |

| Anthony Pintsopoulos (3) | | 2010 | | $ | - | | | $ | - | | | $ | - | |

| Former Secretary, Former Chief | | 2009 | | | - | | | | - | | | | - | |

| Financial Officer, and Former | | 2008 | | | - | | | | - | | | | - | |

| Director | | | | | | | | | | | | | | |

(1) HiaMing Fu was appointed Chief Executive Officer of the Company on July 28, 2010 upon HuiHua Li’s resignation from that position on July 28, 2010.

(2) Dapeng “George” Duan was appointed Chief Financial Officer of the Company effective August 3, 2010, replacing Le Zhang.

(3) Upon the close of the Share Exchange on April 30, 2010, Messrs. Rappaport and Pintsopoulos resigned from all positions with the Company, which they held from the Company’s inception on December 17, 2007.

Grants of Plan-Based Awards in 2010

There were no option grants in 2010.

Outstanding Equity Awards at 2010 Fiscal Year End

There were no outstanding equity awards in 2010.

Option Exercises and Stock Vested in Fiscal 2010

There were no option exercises or stock vested in 2010.

Pension Benefits

There were no pension benefit plans in effect in 2010.

Nonqualified Defined Contribution and Other Nonqualified Deferred Compensation Plans

There were no nonqualified defined contribution or other nonqualified deferred compensation plans in effect in 2010.

Employment Agreements

HaiMing Fu

HaiMing Fu is party to an employment agreement with CD Media Beijing. The agreement expires on December 31, 2010. Pursuant to the agreement, Mr. Fu is paid a monthly salary of RMB12,000 ($1,765). Pursuant to the employment agreement, the CD Media Beijing may terminate the agreement without notice or severance if, among other things, Mr. Fu materially breaches CD Media Beijing’s rules and regulations, is convicted of a criminal offense, commits series dereliction of duty causing damages of over RMB50,000 (US$7,353) to CD Media Beijing, or is declared bankrupt. CD Media Beijing may terminate the agreement upon thirty (30) days written notice if Mr. Fu is unable to work due to illness or injury (not caused by work) after completing medical treatment. Mr. Fu may terminate the agreement without prior notice to CD Media Beijing if, among other things, CD Media Beijing does not provide labor protection or conditions specified in the agreement, CD Media Beijing does not pay his compensation in full and on time, our regulations are not in compliance with relevant PRC laws or CD Media Beijing coerces Mr. Fu to enter into changes to the agreement against his will. The agreement does not provide for severance upon termination.

Dapeng “George” Duan

Pursuant to an employment agreement with the Company, Mr. Duan will be entitled to a base salary at an annual rate of $90,000, as well as reimbursement for the cost of standard corporate-style healthcare insurance coverage and for reasonable travel, hotel, entertainment, and other business related expenses. Mr. Duan is entitled to accrue fifteen (15) days of paid leave each year.

The initial term of the employment agreement is twelve (12) months, with automatic one-year extensions, unless either party provides ninety (90) days written notice of termination prior to the expiration of then current term. Mr. Duan may terminate the agreement for any reason upon thirty (30) days written notice to the Company. The Company may terminate the agreement immediately for Cause (as defined in the agreement) and upon thirty (30) days written notice to Mr. Duan without Cause. In the event Mr. Duan’s employment with the Company is terminated, the Company will pay Mr. Duan on the date of termination only the amount of his salary that is earned but unpaid as of the date of termination, in addition to any accrued but unused paid leave and any unreimbursed business expenses incurred as of the date of termination. In the event of Mr. Duan’s termination of the agreement for Good Reason (as defined in the agreement), the Company will also pay to Mr. Duan a severance payment in an amount equal to three (3) months of Mr. Duan’s annual salary at the time of termination. In the event of Mr. Duan’s termination by the Company without Cause, Mr. Duan will also receive a severance payment in an amount equal to Mr. Duan’s annual salary at the time of termination for the remainder of the then-current term of the agreement.

Director Compensation

The following table shows information regarding the compensation earned during the fiscal year ended December 31, 2010 by members of board of directors.

| Name | | Fees Earned or Paid in Cash ($) | | | Stock Awards ($) | | | Option Awards ($) | | | Non-Equity Incentive Plan Compensation ($) | | | Change in Pension Value and Nonqualified Deferred Compensation Earnings | | | All Other Compensation ($) | | | Total ($) | |

| HuiHua Li | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| ZhiFeng Yan | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| David De Campo | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Yue Lu | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Fang Yuan | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

We do not have a formal policy with respect to the compensation of our board members. We pay our independent directors for their services at the rate of $3,000 per quarter.

Indemnification of Directors and Executive Officers and Limitations of Liability

Under Section 145 of the General Corporation Law of the State of Delaware, we can indemnify its directors and officers against liabilities they may incur in such capacities, including liabilities under the Securities Act of 1933, as amended (the “Securities Act”). Our Certificate of Incorporation provides for the indemnification, to the fullest extent permitted by Section 145 of the Delaware General Corporation Law, as amended from time to time, of officers, directors, employees and agents of the Company. We may, prior to the final disposition of any proceeding, pay expenses incurred by an officer or director upon receipt of an undertaking by or on behalf of that director or executive officer to repay those amounts if it should be determined ultimately that he or she is not entitled to be indemnified under the bylaws or otherwise. We shall indemnify any officer, director, employee or agent upon a determination that such individual has met the applicable standards of conduct specified in Section 145. In the case of an officer or director, the determination shall be made by (a) a majority vote of directors who are not parties to such proceeding, even though less than a quorum; (b) a committee of such directors designated by majority vote of such directors, even though less than a quorum; (c) if there are no such directors, independent legal counsel in a written opinion or (d) the stockholders.

Our certificate of incorporation provides that, pursuant to Delaware law, our directors shall not be liable for monetary damages for breach of the directors’ fiduciary duty of care to us and our stockholders. This provision in the certificate of incorporation does not eliminate the duty of care, and in appropriate circumstances equitable remedies such as injunctive or other forms of no monetary relief will remain available under Delaware law. In addition, each director will continue to be subject to liability for breach of the director’s duty of loyalty to us or our stockholders, for acts or omissions not in good faith or involving intentional misconduct or knowing violations of the law, for actions leading to improper personal benefit to the director, and for payment of dividends or approval of stock repurchases or redemptions that are unlawful under Delaware law. The provision also does not affect a director’s responsibilities under any other law, such as the federal securities laws or state or federal environmental laws.

We have been advised that in the opinion of the Securities and Exchange Commission, insofar as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers and controlling persons pursuant to the foregoing provisions, or otherwise, such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable. In the event a claim for indemnification against such liabilities (other than our payment of expenses incurred or paid by its director, officer or controlling person in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, we will, unless in the opinion of our counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question of whether such indemnification by us is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

We may enter into indemnification agreements with each of our directors and officers that are, in some cases, broader than the specific indemnification provisions permitted by Delaware law, and that may provide additional procedural protection. As of the date of the Share Exchange, we have not entered into any indemnification agreements with our directors or officers, but may choose to do so in the future. Such indemnification agreements may require us, among other things, to:

| | · | indemnify officers and directors against certain liabilities that may arise because of their status as officers or directors; |

| | · | advance expenses, as incurred, to officers and directors in connection with a legal proceeding, subject to limited exceptions; or |

| | · | obtain directors’ and officers’ insurance. |

At present, there is no pending litigation or proceeding involving any of our directors, officers or employees in which indemnification is sought, nor are we aware of any threatened litigation that may result in claims for indemnification.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

CD Media BVI

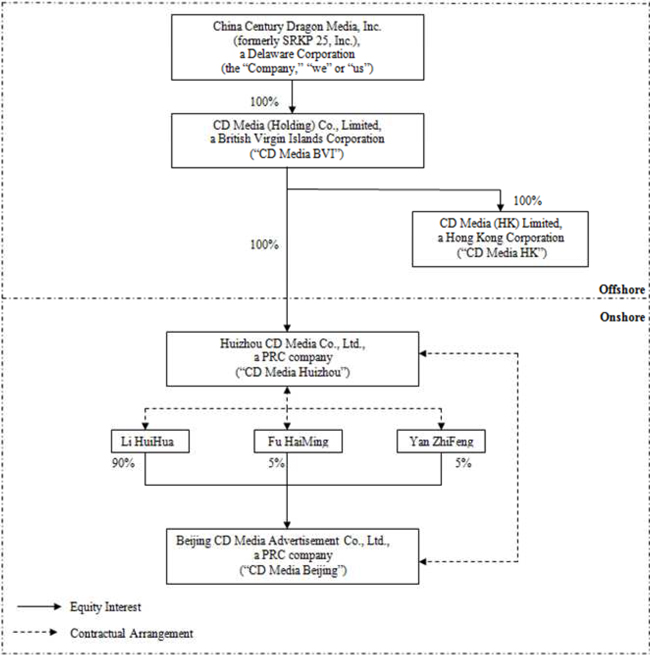

CD Media BVI, CD Media Huizhou and CD Media HK, which are either directly or indirectly wholly-owned subsidiaries of the Company, and CD Media Beijing, which is controlled by CD Media Huizhou through a series of contractual arrangements, each have interlocking executive and director positions with us and with each other.

Share Exchange

On December 17, 2007, the original stockholders of SRKP 25, Inc. purchased an aggregate of 2,057,960 shares of our common stock for aggregate proceeds equal to $5,000.12 and warrants (the “Warrants”) to purchase an aggregate of 2,057,960 shares of our common stock for aggregate proceeds of $2,500.05; the Warrants have an exercise price equal to $0.000344 per share and expire on April 30, 2015. These securities were the only items of value received by any such stockholders from SRKP 25, Inc.

On April 30, 2010, SRKP 25 completed the Share Exchange with CD Media BVI, the shareholders of CD Media BVI, CD Media Huizhou and CD Media Beijing. At the closing, CD Media BVI became a wholly-owned subsidiary of SRKP 25 and 100% of the issued and outstanding securities of CD Media BVI were exchanged for securities of SRKP 25. An aggregate of 5,539,000 shares of common stock were issued to the shareholders of CD Media BVI and their designee. As of the close of the Share Exchange, the former shareholders of CD Media BVI and their designee owned approximately 75.5% of the issued and outstanding stock of SRKP 25. Prior to the closing of the Share Exchange and the closing of the Private Placement, the stockholders of SRKP 25 agreed to the cancellation of an aggregate of 1,290,615 shares and 1,646,349 Warrants held by them such that the stockholders of SRKP 25 held 767,345 shares of common stock and Warrants to purchase 411,611 shares of common stock immediately after the Share Exchange and Private Placement as indicated below. The stockholders of SRKP 25 did not receive any consideration for the cancellation of the shares and warrants. The cancellation of the shares and warrants was accounted for as a contribution to capital. The number of shares and warrants cancelled was determined based on negotiations with the securityholders of SRKP 25, Inc. and CD Media BVI. The number of shares and warrants cancelled by SRKP 25, Inc. was not pro rata, but based on discussions between the securityholders and SRKP 25, Inc. The discussions regarding the relative amounts of share and warrant cancellations were arms-length discussions between all of the securityholders of SRKP 25. All SRKP 25 securityholders unanimously agreed as to the share and warrant allocations. No other criteria were involved nor was any additional compensation or monies paid or concessions given to any SRKP secuityholder in connection with the determination of the relative number of shares and warrants cancelled by each securityholder.

| Holder | | Number of Shares | | | Number of Warrants | | | Implied Aggregate Monetary Value of Retained Shares and Warrants (1) | |

| WestPark Financial Services, LLC (2) | | | 411,237 | | | | 272,181 | | | $ | 3,587,944.50 | |

| Richard Rappaport | | | 90,619 | | | | 35,481 | | | $ | 662,025.00 | |

| Amanda Rappaport Trust (2) | | | 26,309 | | | | 10,301 | | | $ | 192,202.50 | |

| Kailey Rappaport Trust (2) | | | 26,309 | | | | 10,301 | | | $ | 192,202.50 | |

| Debbie Schwartzberg | | | 79,463 | | | | 31,113 | | | $ | 580,524.00 | |

| The Julie Schwartzberg Trust dated 2/9/2000 | | | 8,239 | | | | 3,226 | | | $ | 60,191.25 | |

| The David N. Sterling Trust dated 2/3/2000 | | | 8,239 | | | | 3,226 | | | $ | 60,191.25 | |

| Anthony Pintsopoulos | | | 58,464 | | | | 22,891 | | | $ | 427,113.75 | |

| Janine Frisco (3) | | | 20,463 | | | | 8,012 | | | $ | 149,493.75 | |

| Kevin DePrimio | | | 20,463 | | | | 8,012 | | | $ | 149,493.75 | |

| Jason Stern | | | 11,693 | | | | 4,578 | | | $ | 85,422.75 | |

| Robert Schultz | | | 5,847 | | | | 2,289 | | | $ | 42,714.00 | |

| TOTAL | | | 767,345 | | | | 411,611 | | | $ | 6,189,519.00 | |

| (1) | Based on an assumed $5.25 per share offering price, the 767,345 shares retained by the SRKP 25 stockholders had an implied monetary value of approximately $4.0 million. Assuming exercise of the 411,611 warrants also retained by the SRKP 25 stockholders, 1,178,956 shares would have been retained by the SRKP 25 stockholders with an implied monetary value of approximately $6.2 million. The implied monetary value of the retained shares was calculated based on the $5.25 per share offering price, without regard to liquidity, marketability, or legal or resale restrictions; accordingly, such amounts should not be considered as an indication of the fair value of the retained shares. |

| | (2) | Richard A. Rappaport may be considered the indirect beneficial owner of the securities owned by these entities by nature of his position as the trustee of the Amanda Rappaport Trust and the Kailey Rappaport Trust and as CEO and Chairman of WestPark Capital Financial Services, LLC. |

| | (3) | Janine Frisco transferred all shares and warrants to her sister immediately after the Share Exchange. |

As indicated in the Share Exchange Agreement, the parties to the transaction acknowledged that a conflict of interest existed with respect to the negotiations for the terms of the Share Exchange due to, among other factors, the fact that WestPark Capital, Inc. (“WestPark Capital”) was advising CD Media BVI in the transaction. As further discussed below in “Certain Relationships And Related Transactions —Private Placement,” certain of the controlling stockholders and control persons of WestPark Capital were also, prior to the completion of the Share Exchange, controlling stockholders and control persons of SRKP 25, Inc. Under these circumstances, the shareholders of CD Media BVI and the stockholders of SRKP 25 negotiated an estimated value of CD Media BVI and its subsidiaries, an estimated value of the shell company (based on similar recent transactions by WestPark Capital involving similar public shells), and the mutually desired capitalization of the company resulting from the Share Exchange.

With respect to the determination of the amounts of shares and warrants cancelled, the value of the shell company was derived primarily from its utility as a public company platform, including its good corporate standing and its timely public reporting status, which we believe allowed us to raise capital at an appropriate price per share and subsequently list our stock on a national securities exchange. We believe that investors may have been unwilling to invest in our company in the Private Placement (as that term is defined below) on acceptable terms, if at all, in the absence of an investment in a public reporting vehicle and thus required us to effect the Share Exchange as a condition to the Private Placement. The services provided by WestPark Capital were not a consideration in determining this aspect of the transaction. Under these circumstances and based on these factors, the shareholders of CD Media BVI and the stockholders of SRKP 25 agreed upon the amount of shares and warrants to be cancelled. Further to such negotiations, we paid a $215,750 success fee to WestPark Capital for services provided in connection with the Share Exchange, including coordinating the share exchange transaction process, interacting with principals of the shell corporation and negotiating the definitive purchase agreement for the shell, conducting a financial analysis of CD Media BVI, conducting due diligence on CD Media BVI and its subsidiaries and managing the interrelationships of legal and accounting activities. All of the fees due to WestPark Capital in connection with the Share Exchange have been paid as of the date of this prospectus.

The Board resigned in full on April 30, 2010 and appointed HuiHua Li and HaiMing Fu to the board of directors of our company, with HuiHua Li serving as Chairman. On April 30, 2010, the Board also appointed HuiHua Li as our Chief Executive Officer and Le Zhang as our Chief Financial Officer and Corporate Secretary. Each of these executives and directors were executives and directors of CD Media BVI and/or its subsidiaries. On July 28, 2010, the Board appointed ZhiFeng Yan as a director of the Company. Additionally, on July 28, 2010, the Board appointed HaiMing Fu as our Chief Executive Officer, replacing HuiHua Li, and Dapeng “George” Duan as our Chief Financial Officer and Corporate Secretary, replacing Le Zhang. Mr. HaiMing Fu resigned as a director of the Company on July 30, 2010. In addition, we paid a $215,750 success fee to WestPark Capital for services provided in connection with the Share Exchange, including coordinating the share exchange transaction process, interacting with principals of the shell corporation and negotiating the definitive purchase agreement for the shell, conducting a financial analysis of CD Media BVI, conducting due diligence on CD Media BVI and its subsidiaries and managing the interrelationships of legal and accounting activities.

Private Placement

Richard Rappaport, the President of SRKP 25 and one of its controlling stockholders prior to the Share Exchange, indirectly holds a 100% interest in WestPark Capital the placement agent for the equity financing of approximately $5.35 million conducted by us on the close of the Share Exchange.

Anthony C. Pintsopoulos, an officer, director and significant stockholder of SRKP 25 prior to the Share Exchange, is the President and Treasurer of the placement agent. Kevin DePrimio, Jason Stern and Robert Schultz, each employees of WestPark Capital, are also stockholders of SRKP 25. In addition, Richard Rappaport is the sole owner of the membership interests of the parent of the placement agent. Each of Messrs. Rappaport and Pintsopoulos resigned from all of their executive and director positions with the Company upon the closing of the Share Exchange. We paid WestPark Capital a commission equal to 10.0% with a non-accountable fee of 4.0% of the gross proceeds from the Private Placement. We also retained WestPark Capital for a period of five months following the closing of the Private Placement to provide us with financial consulting services for which we paid WestPark Capital $4,000 per month. Out of the proceeds of the Private Placement, we paid $300,000 to Keen Dragon Group Limited, a third party unaffiliated with CD Media BVI, the Company, or WestPark Capital for services as an advisor to the Company, including assisting in preparations for the Share Exchange and the Company’s listing of securities in the United States.

Each of Messrs. Rappaport and Pintsopoulos may be considered a promoter of our company prior to the Share Exchange. In addition to the director and executive officer positions that each held with our company prior to the Share Exchange, each currently holds director and executive officer positions with SRKP 2, Inc., SRKP 3, Inc., SRKP 5, Inc., SRKP 10, Inc., SRKP 12, Inc., SRKP 14, Inc., SRKP 15, Inc., SRKP 16, Inc., SRKP 24, Inc., SRKP 26, Inc., SRKP 27, Inc., SRKP 28, Inc., SRKP 29, Inc., WRASP 30, Inc., WRASP 31, Inc. and WRASP 32, Inc., all of which are publicly-reporting, blank check and non-trading shell companies. None of the other original stockholders of SRKP 25 may be considered a promoter of our company because none of them were involved in founding or organizing the business of SRKP 25 and each received their securities of the Company solely in consideration for personal funds paid directly by such stockholders to the Company.

Mr. Rappaport and Pintsopoulos did not receive any benefits related to the transactions described above, except their retention of shares in the Company upon the closing of the Share Exchange described above in this section.

WestPark Capital, Inc.

WestPark Capital is one of the Underwriters in this offering. Subject to the terms and conditions of the underwriting agreement dated [_________], 2011, WestPark Capital has agreed to purchase from us the number of shares set forth in the “Underwriting” section of this prospectus at the public offering price less the underwriting discounts and commissions indicated in the “Underwriting” section. In addition, we have agreed to pay the Underwriters an aggregate non-accountable expense allowance of 2.5% of the gross proceeds of this offering. Based on an estimated per share offering price of $5.25 and the sale by us of 1,400,000 shares of common stock offered in this offering, we will pay the Underwriters a non-accountable fee equal to approximately $183,750. The Underwriters will also receive warrants to purchase a number of shares equal to 5% of the shares of our common stock sold in connection with this offering excluding the shares sold in the over-allotment option. The warrants will be exercisable at a per share price of $6.30, which is 120% of the anticipated offering price of this offering.

The table below identifies all the benefits that WestPark Capital and its affiliates have received and will receive in connection with the Share Exchange, the Private Placement and this offering.

| | | $ | | Other |

| Share Exchange | | | 235,750 | (1) | Registration rights for an aggregate of 650,941 shares and 366,034 shares underlying warrants (2) (3) |

| Retained Shares and Warrants | | | 5,339,119 | (4) | |

| Private Placement | | | 789,039 | (5) | |

| Public Offering | | [______] | (6) | Warrants to purchase 70,000 shares of common stock at an exercise price of $6.30 per share |

| Total | | [______] | | |

(1) Includes a success fee of $215,750 paid to WestPark Capital for services provided in connection with the Share Exchange and $20,000 for consulting fees paid to WestPark by the Company for five months of consulting services provided to the Company by WestPark.

(2) Pursuant to a Registration Rights Agreement executed in connection with the closing of the Share Exchange, affiliates of WestPark Capital received registration rights for an aggregate of 650,941 shares and 366,034 shares underlying warrants. The shares will be registered in a registration statement that we intend to file as soon as practicable after the SEC declares the registration statement of which this prospectus is a part effective. The shareholders of CD Media BVI immediately prior to the date of the Share Exchange and their designee holding an aggregate of 5,539,000 shares of our common stock have agreed with the Underwriters not to directly or indirectly sell, offer, contract or grant any option to sell, pledge, transfer (excluding intra-family transfers, transfers to a trust for estate planning purposes or to beneficiaries of officers, directors and shareholders upon their death), or otherwise dispose of or enter into any transaction which may result in the disposition of any shares of our common stock or securities convertible into, exchangeable or exercisable for any shares of our common stock, without the prior written consent of the Underwriters, for a period of 24 months after the date of this prospectus.

(3) Based on the anticipated per share offering price of $5.25, the 650,941 shares retained by SRKP 25 stockholders who are affiliates of WestPark Capital have an implied monetary value of approximately $3.4 million. Assuming the exercise of the 366,034 warrants also retained by the SRKP 25 stockholders who are affiliates of WestPark Capital, 1,016,975 shares would have been retained by such stockholders with an implied monetary value of approximately $5.3 million. The implied monetary value of the retained shares was calculated based on an estimated $5.25 per share offering price, without regard to liquidity, marketability, the likelihood of this offering being consummated, or legal or resale restrictions; accordingly, such amounts should not be considered an indication of the fair value of the retained shares.

(4) Represents the implied aggregate monetary value of 650,941 shares and 366,034 shares underlying warrants, assuming the exercise of warrants retained by WestPark Capital and its affiliates. The implied monetary value of the retained shares was calculated based on an estimated $5.25 per share offering price of the common shares to be sold in this offering, without regard to liquidity, marketability or legal or sale restrictions; accordingly, such amount should not be considered as an indication of the fair value of the retained shares and warrants.

(5) Represents commissions of $535,028, a non-accountable expense allowance of $214,011, and a reimbursement of WestPark Capital’s fees for legal counsel of $40,000.

(6) Represents underwriting discounts and commissions of $[__], plus a non-accountable fee of $[_____] and a reimbursement of $40,000 for WestPark Capital’s legal fees.

The Underwriters have a 45-day option to purchase up to 210,000 additional shares of common stock at the public offering price solely to cover over-allotments, if any, if the Underwriters sell more than 1,400,000 shares of common stock in this offering. If the Underwriters exercise this option in full, the total underwriting discounts and commissions will be $[__], and total proceeds to us, before expenses, from the over-allotment option exercise will be $[__].

See “Underwriting” on page 88 of this prospectus for more information.

Loans from Related Parties

During the quarter ended March 31, 2010, Hailan Zhang, one of our stockholders loaned a total of HKD 4,063,187 ($523,333) to the Company. The loan was made to provide the company with working capital. The loan was repaid in full by the Company prior to June 30, 2010. The loan was non-interest bearing and had no maturity date. During the quarter ended March 31, 2010, Huabiao Lin, the legal representative of CD Media Huizhou, loaned a total of RMB 15,954 ($2,341) to the Company. The loan was made to provide the Company with working capital. The loan was repaid in full by the Company prior to June 30, 2010. The loan was non-interest bearing and had no maturity date. The Company does not intend to engage in any related party financing in the future.

Policy for Approval of Related Party Transactions

In November 2010, we established an Audit Committee and adopted an Audit Committee Charter. The Charter contains our policy for approval of related party transactions. Our policy is to have our Audit Committee review and pre-approve any related party transactions and other matters pertaining to the integrity of management, including potential conflicts of interest, trading in our securities, or adherence to standards of business conduct as required by our policies.

BENEFICIAL OWNERSHIP OF CERTAIN BENEFICIAL OWNERS, AND MANAGEMENT

Beneficial ownership is determined in accordance with the rules of the SEC. In computing the number of shares beneficially owned by a person and the percentage of ownership of that person, shares of common stock subject to options and warrants held by that person that are currently exercisable or become exercisable within 60 days of the date of this prospectus are deemed outstanding even if they have not actually been exercised. Those shares, however, are not deemed outstanding for the purpose of computing the percentage ownership of any other person.

The following table sets forth certain information with respect to beneficial ownership of our common stock based on issued and outstanding shares of common stock before and after the offering, by:

| | · | Each person known to be the beneficial owner of 5% or more of our outstanding common stock; |

| | · | All of the executive officers and directors as a group. |

The number of shares of our common stock outstanding as of the date of this prospectus, excludes up to 1,400,000 shares of our common stock to be offered by us in a firm commitment public offering concurrently herewith. Unless otherwise indicated, the persons and entities named in the table have sole voting and sole investment power with respect to the shares set forth opposite the stockholder’s name, subject to community property laws, where applicable. Unless otherwise indicated, the address of each beneficial owner listed in the table is c/o China Century Dragon Media, Inc., Room 801, No. 7, Wenchanger Road, Jiangbei, Huizhou City, Guangdong Province, China.

| | | | | Beneficial Ownership Before the Offering | | | Beneficial Ownership After the Offering | |

Name and Address of Beneficial Owner | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Directors and Executive Officers | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| HuiHua Li | | Chairman of the Board | | | 1,815,835 | | | | 24.7 | % | | | 1,815,835 | | | | 21.8 | % |

| | | | | | | | | | | | | | | | | | | |

| Dapeng “George” Duan | | Chief Financial Officer and Corporate Secretary | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | |

| HaiMing Fu | | Chief Executive Officer | | | 203,000 | | | | 2.8 | % | | | 203,000 | | | | 2.4 | % |

| | | | | | | | | | | | | | | | | | | |

| Zhifeng Yan | | Director | | | 261,000 | | | | 3.6 | % | | | 261,000 | | | | 3.1 | % |

| | | | | Beneficial Ownership Before the Offering | | | Beneficial Ownership After the Offering | |

Name and Address of Beneficial Owner | | | | | | | | | | | | | | |

| David De Campo | | Director | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | |

| Yue Lu | | Director | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | |

| Fang Yuan | | Director | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | |

| Officers and Directors as a Group (total of 7 persons) | | | | | 2,279,835 | | | | 31.1 | % | | | 2,279,835 | | | | 27.3 | % |

| | | | | | | | | | | | | | | | | | | |

| 5% or More Owners | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Richard A. Rappaport (3) 1900 Avenue of the Stars, Suite 310 Los Angeles, CA 90067 | | | | | 882,738 | | | | 11.5 | % | | | 882,738 | | | | 9.7 | % |

| | | | | | | | | | | | | | | | | | | |

WestPark Capital Financial Services, LLC (4) 1900 Avenue of the Stars, Suite 310 Los Angeles, CA 90067 | | | | | 683,418 | | | | 9.0 | % | | | 683,418 | | | | 7.6 | % |

| | | | | | | | | | | | | | | | | | | |

| Zhang Hailan | | | | | 580,000 | | | | 7.9 | % | | | 580,000 | | | | 7.0 | % |

| (1) | Based on 7,340,748 shares of common stock issued and outstanding as of February 3, 2011. |

| (2) | Based on 8,740,748 shares of common stock, which consists of (i) 7,340,748 shares of common stock issued and outstanding as of February 3, 2011, and (ii) 1,400,000 shares of common stock issued in the public offering. This amount excludes (i) the 210,000 shares of our common stock that we may issue upon the Underwriters’ over-allotment option exercise, (ii) 411,611 shares of common stock underlying warrants that are exercisable at $0.000344 per share; and (iii) 70,000 shares of common stock underlying warrants that will be issued to the Underwriters upon the completion of this offering. |

| (3) | Richard A. Rappaport served as President and director of the Company prior to the Share Exchange. Includes 90,619 shares of common stock and a warrant to purchase 35,481 shares of common stock owned by Mr. Rappaport. Also includes 26,309 shares and warrants to purchase 10,301 shares of common stock owned by each of the Amanda Rappaport Trust and the Kailey Rappaport Trust, of which Mr. Rappaport serves as the trustee, and 411,237 shares and a warrant to purchase 272,181 shares of common stock owned by WestPark Capital Financial Services, LLC, of which Mr. Rappaport is CEO and Chairman. Mr. Rappaport may be deemed the indirect beneficial owner of these securities and disclaims beneficial ownership of the securities except to of his pecuniary interest in the securities. |

| (4) | Consists of 411,237 shares and a warrant to purchase 272,181 shares owned by WestPark Capital Financial Services, LLC, of which Mr. Rappaport is CEO and Chairman. Mr. Rappaport may be deemed the indirect beneficial owner of these securities and disclaims beneficial ownership of the securities except to the extent of his pecuniary interest in the securities. |

DESCRIPTION OF SECURITIES

Common Stock

We are authorized to issue 100,000,000 shares of common stock, $0.0001 par value per share. Prior to the Share Exchange and Private Placement, the stockholders of SRKP 25 held an aggregate of 2,057,960 shares, and an aggregate of 1,290,615 shares were cancelled in conjunction with the closing of the Share Exchange. There are currently 7,340,748 shares of common stock issued and outstanding. Each outstanding share of common stock is entitled to one vote, either in person or by proxy, on all matters that may be voted upon by their holders at meetings of the stockholders.

Holders of our common stock:

| | · | have equal ratable rights to dividends from funds legally available therefore, if declared by our Board of Directors; |

| | · | are entitled to share ratably in all of the Company’s assets available for distribution to holders of common stock upon our liquidation, dissolution or winding up; |

| | · | do not have preemptive, subscription or conversion rights or redemption or sinking fund provisions; and |

| | · | are entitled to one non-cumulative vote per share on all matters on which stockholders may vote at all meetings of our stockholders. |

The holders of shares of our common stock do not have cumulative voting rights, which means that the holders of more than fifty percent (50%) of outstanding shares voting for the election of directors can elect all of our directors if they so choose and, in such event, the holders of the remaining shares will not be able to elect any of our directors.

The former shareholders of CD Media BVI and their designee own approximately 75.5% of the outstanding shares of our common stock. Accordingly, these stockholders are in a position to control all of our affairs.

Preferred Stock

We may issue up to 10,000,000 shares of our preferred stock, par value $0.0001 per share, from time to time in one or more series. No shares of Preferred Stock have been issued.

Our Board of Directors, without further approval of our stockholders, is authorized to fix the dividend rights and terms, conversion rights, voting rights, redemption rights, liquidation preferences and other rights and restrictions relating to any series. Issuances of shares of preferred stock, while providing flexibility in connection with possible financings, acquisitions and other corporate purposes, could, among other things, adversely affect the voting power of the holders of our common stock and prior series of preferred stock then outstanding.

Warrants

Prior to the Share Exchange and Private Placement, the stockholders of SRKP 25 held an aggregate of 2,057,960 warrants to purchase shares of our common stock, and an aggregate of 1,646,349 warrants were cancelled in conjunction with the closing of the Share Exchange. As of the date of this prospectus, the stockholders held an aggregate of 411,611 warrants with an exercise price of $0.000344. The warrants are currently exercisable. According to the terms of the warrant agreement, the warrants expire on the earlier of December 17, 2017 or five years from the date we consummate a merger or other business combination with an operating business or any other event pursuant to which we cease to be a “shell company,” as defined by Rule 12b-2 under the Securities Exchange Act of 1934 and a “blank check company,” as defined by Rule 419 of the Securities Act of 1933. As a result of the close of the Share Exchange on April 30, 2010, the warrants will expire on April 30, 2015.

In addition, we plan to issue a warrant to the Underwriters as partial compensation for underwriting services in connection with this offering. The Underwriters will be able to purchase up to 70,000 shares of common stock at an exercise price equal to $6.30, which is 120% of the anticipated per share offering price of our shares of common stock in this offering. The warrants will have a term of five years. The warrants will be subject to standard anti-dilution adjustments for stock splits and similar transactions, and will become exercisable one year after the date of this prospectus and expire five years from the effective date of the registration statement of which this prospectus forms a part.

None of the warrants issued to the Underwriters will be exercisable unless at the time of exercise the Common Stock issuable upon the exercise of the warrants is covered by an effective registration statement filed with the Securities and Exchange Commission (the “SEC”) under the Securities Act and such securities are qualified for sale or exempt from qualification under applicable securities laws of the states or other jurisdictions in which the registered holders of the warrants reside.

Under the terms of the warrants issued to the Underwriters, we have agreed that prior to the date on which the warrants becomes exercisable, we will file with the SEC a post-effective amendment to the registration statement of which this prospectus is a part, or a new registration statement, for the registration under the Securities Act of, and that we shall take such action as is necessary to qualify for sale, in those states in which the warrants were initially offered by the Company, the shares of Common Stock issuable upon exercise of the warrants and any shares of Common Stock issued as (or issuable upon the conversion or exercise of any warrant, right or other security which is issued as) a dividend or other distribution with respect to, or in exchange for or in replacement of any of the shares of Common Stock issued upon exercise of the warrants. In either case, we agreed to use our commercially reasonable efforts to cause the same to become effective on or prior to the date on which the warrants first become exercisable and to maintain the effectiveness of such registration statement until the expiration of the warrants pursuant to their terms.

In no event will the holders of the warrants issued to the Underwriters be entitled to receive a net-cash settlement or other consideration in lieu of physical settlement in shares of Common Stock if the shares issuable upon exercise of the warrants are not covered by an effective registration statement filed with the SEC under the Securities Act. Accordingly, the warrants may expire unexercised and worthless if a current registration statement covering the shares of Common Stock issuable upon exercise of the warrants is not effective.

Market Price of Our Common Stock

The shares of our common stock are not currently listed or quoted for trading on any national securities exchange or national quotation system. NYSE Amex has approved the listing of our common stock under the ticker symbol “CDM”, subject to official notice of issuance and our being in compliance with all applicable listing standards on the date it begins trading. If and when our common stock is listed or quoted for trading, the price of our common stock will likely fluctuate in the future. The stock market in general has experienced extreme stock price fluctuations in the past few years. In some cases, these fluctuations have been unrelated to the operating performance of the affected companies. Many companies have experienced dramatic volatility in the market prices of their common stock. We believe that a number of factors, both within and outside our control, could cause the price of our common stock to fluctuate, perhaps substantially. Factors such as the following could have a significant adverse impact on the market price of our common stock:

| | · | Our financial position and results of operations; |

| | · | Our ability to obtain additional financing and, if available, the terms and conditions of the financing; |

| | · | Announcements of innovations or new services by us or our competitors; |

| | · | Federal and state regulatory actions and the impact of such requirements on our business; |

| | · | The commencement of litigation against us; |

| | · | Changes in estimates of our performance by any securities analysts; |

| | · | The issuance of new equity securities pursuant to a future offering or acquisition; |

| | · | Competitive developments, including announcements by competitors of new services or significant contracts, acquisitions, strategic partnerships, joint ventures or capital commitments; |

| | · | Period-to-period fluctuations in our operating results; |

| | · | Investor perceptions of us; and |

| | · | General economic and other national conditions. |

Delaware Anti-Takeover Law and Charter Bylaws Provisions

We are subject to Section 203 of the Delaware General Corporation Law. This provision generally prohibits a Delaware corporation from engaging in any business combination with any interested stockholder for a period of three years following the date the stockholder became an interested stockholder, unless:

| | · | prior to such date, the Board of Directors approved either the business combination or the transaction that resulted in the stockholder becoming an interested stockholder; |

| | · | upon consummation of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding for purposes of determining the number of shares outstanding those shares owned by persons who are directors and also officers and by employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or |

| | · | on or subsequent to such date, the business combination is approved by the Board of Directors and authorized at an annual meeting or special meeting of stockholders and not by written consent, by the affirmative vote of at least 66 2/3% of the outstanding voting stock that is not owned by the interested stockholder. |

Section 203 defines a business combination to include:

| | · | any merger or consolidation involving the corporation and the interested stockholder; |

| | · | any sale, transfer, pledge or other disposition of 10% or more of the assets of the corporation involving the interested stockholder; |

| | · | subject to certain exceptions, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation to the interested stockholder; |

| | · | any transaction involving the corporation that has the effect of increasing the proportionate share of the stock of any class or series of the corporation beneficially owned by the interested stockholder; or |

| | · | the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other financial benefits provided by or through the corporation. |

In general, Section 203 defines an “interested stockholder” as any entity or person beneficially owning 15% or more of the outstanding voting stock of a corporation, or an affiliate or associate of the corporation and was the owner of 15% or more of the outstanding voting stock of a corporation at any time within three years prior to the time of determination of interested stockholder status; and any entity or person affiliated with or controlling or controlled by such entity or person.

Our certificate of incorporation and bylaws contain provisions that could have the effect of discouraging potential acquisition proposals or making a tender offer or delaying or preventing a change in control of our company, including changes a stockholder might consider favorable. In particular, our certificate of incorporation and bylaws, as applicable, among other things, will:

| | · | provide our board of directors with the ability to alter our bylaws without stockholder approval; and |

| | · | provide that vacancies on our board of directors may be filled by a majority of directors in office, although less than a quorum. |

Such provisions may have the effect of discouraging a third-party from acquiring us, even if doing so would be beneficial to our stockholders. These provisions are intended to enhance the likelihood of continuity and stability in the composition of our board of directors and in the policies formulated by them, and to discourage some types of transactions that may involve an actual or threatened change in control of our company. These provisions are designed to reduce our vulnerability to an unsolicited acquisition proposal and to discourage some tactics that may be used in proxy fights. We believe that the benefits of increased protection of our potential ability to negotiate with the proponent of an unfriendly or unsolicited proposal to acquire or restructure our company outweigh the disadvantages of discouraging such proposals because, among other things, negotiation of such proposals could result in an improvement of their terms.

However, these provisions could have the effect of discouraging others from making tender offers for our shares that could result from actual or rumored takeover attempts. These provisions also may have the effect of preventing changes in our management.

Transfer Agent

The transfer agent and registrar for our common stock is Corporate Stock Transfer, Inc.

Listing

NYSE Amex has approved the listing of our common stock under the ticker symbol “CDM”, subject to official notice of issuance and our being in compliance with all applicable listing standards on the date it begins trading.

SHARES ELIGIBLE FOR FUTURE SALE