Welcome

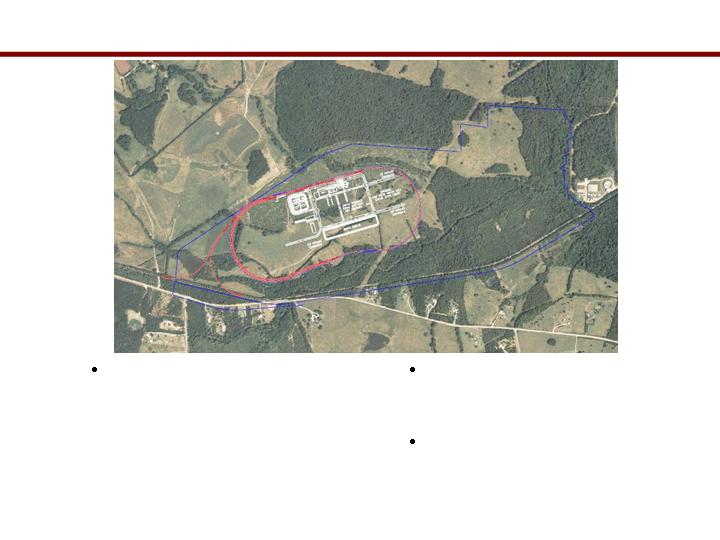

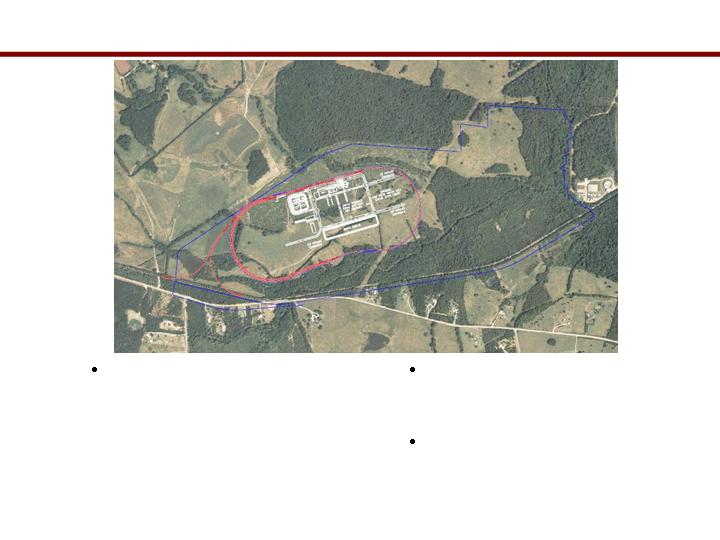

ECE will build four 110 MGY Fagen plants like this one.

East Coast Ethanol, LLC

1

C. Thompson & Associates

Disclosure

East Coast Ethanol, LLC

2

C. Thompson & Associates

EAST COAST ETHANOL, LLC (“ECE”) has filed a registration statement

(including a prospectus) with the SEC for the offering to which this

communication relates. Before you invest, you should read the prospectus in that

registration statement and other documents ECE has filed with the SEC for more

complete information about ECE and this offering. You may get this information

for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively,

ECE will arrange to send you the prospectus if you request it by calling (877) 323-

3835; emailing us at investors@eastcoastethanol.us or visiting our web site at

www.eastcoastethanol.us.

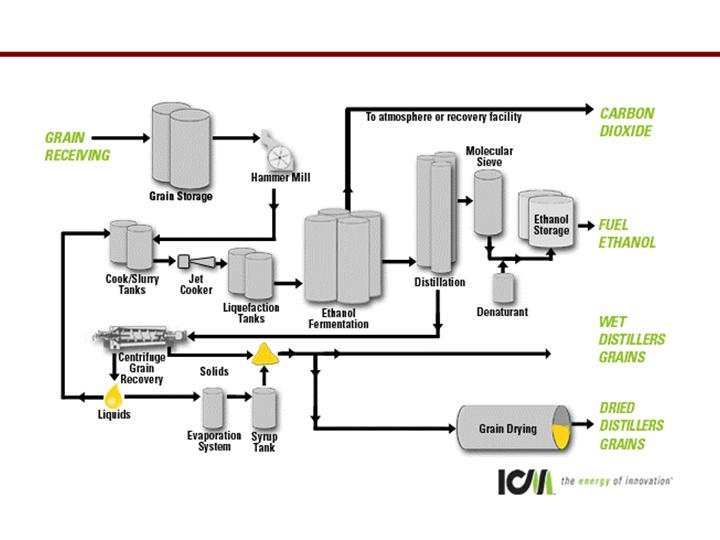

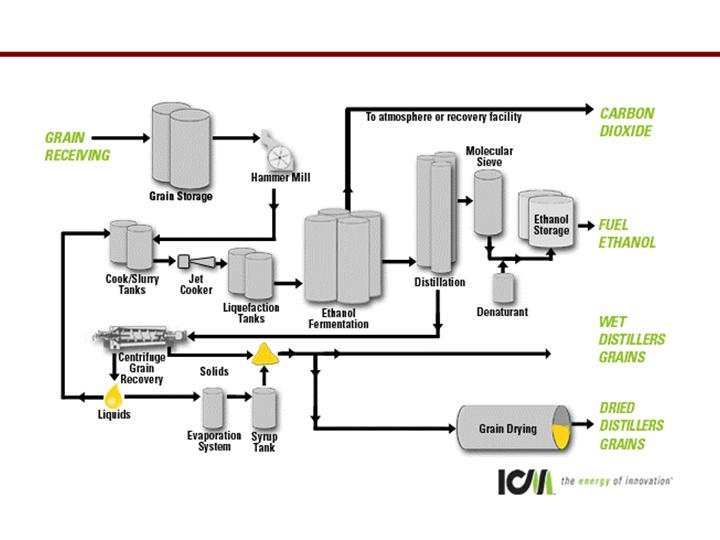

Dry Mill Ethanol Process Overview

East Coast Ethanol, LLC

3

C. Thompson & Associates

Distiller’s Grains (DDGS)

East Coast Ethanol, LLC

4

C. Thompson & Associates

Co-Product from Ethanol

production

Highly palatable feed

ingredient

Fagen estimates 350,000 tons

per year – 90% of which will

be dried

Typical analysis: 27% protein,

11% fat, and 9% fiber

Available at 10% moisture

within 75 mile radius of plant

Price usually tracks with corn

DDG Consumption – Commodity Specialist Co.

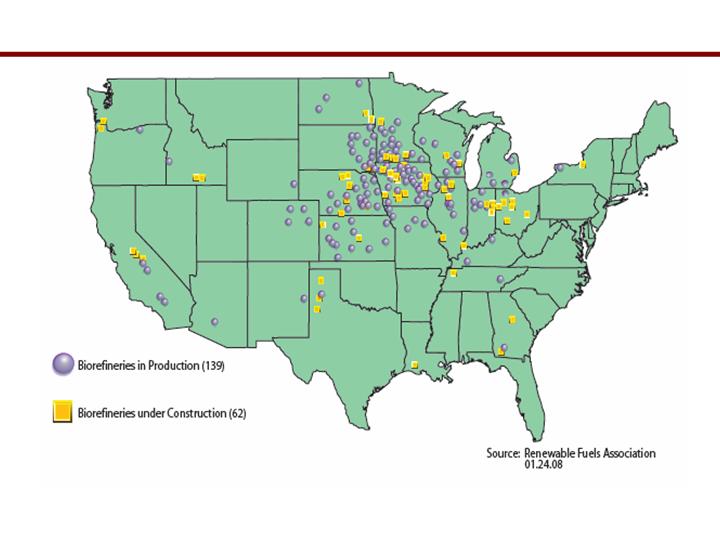

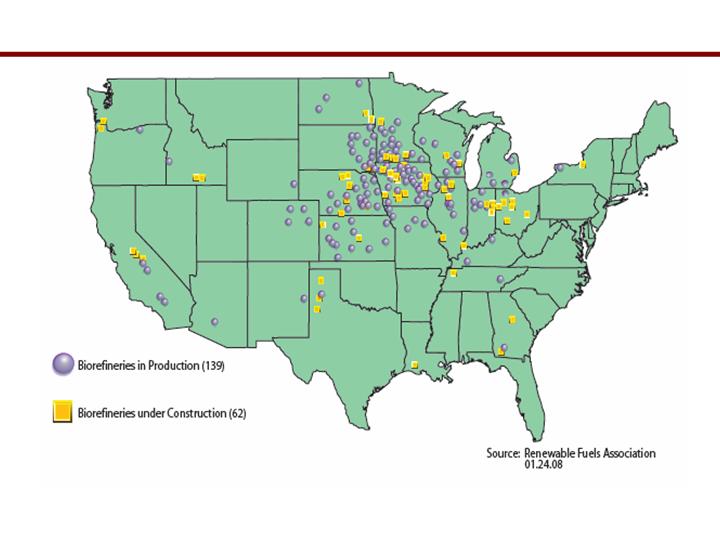

US Ethanol Plant Locations

East Coast Ethanol, LLC

5

C. Thompson & Associates

*Map represents most recent RFA update.

PADD III-

2 Billion

(Gallons Per Year, Based On 10% Blend)

PADD I-

5.1 Billion

PADD II-

4 Billion

PADD V-

2.6 Billion

PADD IV-

500 Million

Ethanol Volume Potential

East Coast Ethanol, LLC

6

C. Thompson & Associates

Source: American Coalition For Ethanol

Petroleum Administration Defense Districts

Questions?

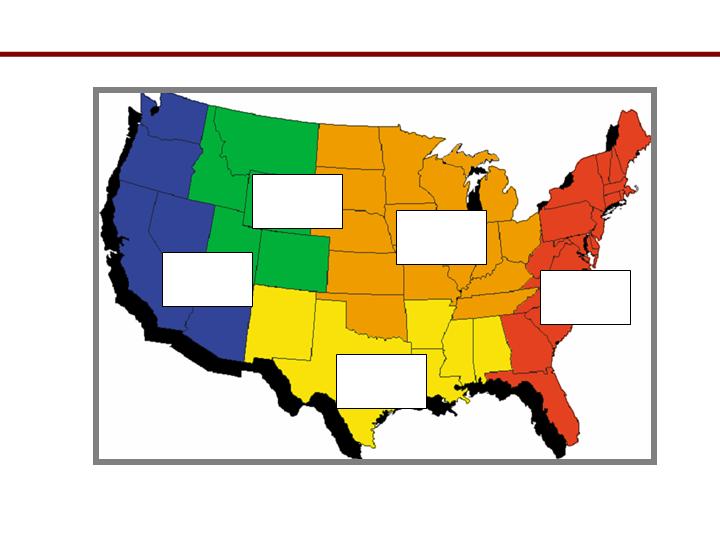

Southeast Ethanol Market

East Coast Ethanol, LLC

7

C. Thompson & Associates

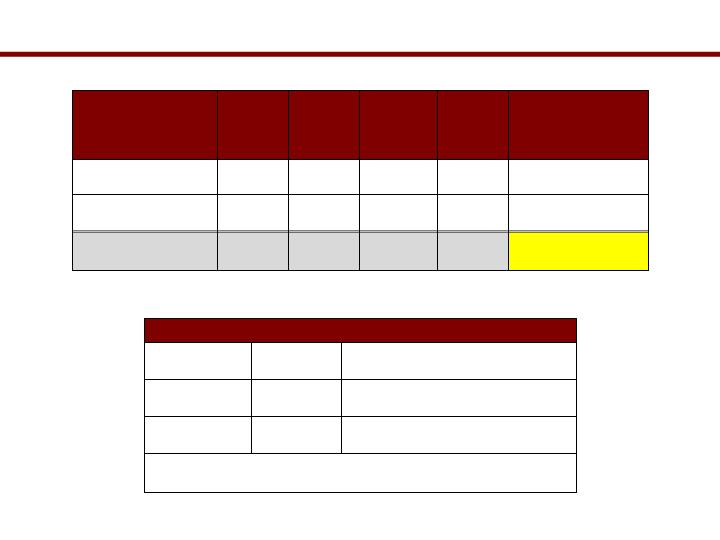

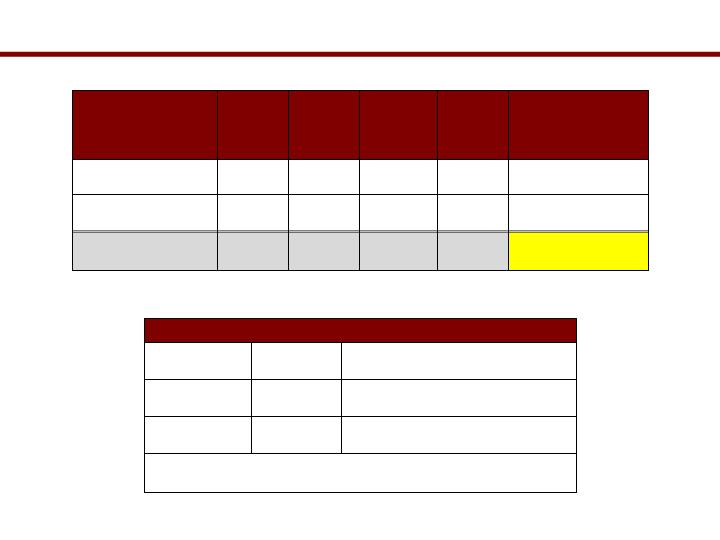

State

Ethanol

Production

Ethanol

Plants Under

Construction

Total

Production

and Under

Construction

10% Ethanol

Market

85% Ethanol

Market

Georgia

100.4 MGY

10 MGY*

110.4 MGY

513 MGY

4,365 MGY

Florida

0 MGY

0 MGY

0 MGY

871 MGY

7,407 MGY

North

Carolina

0 MGY

60 MGY

60 MGY

444 MGY

3,776 MGY

South

Carolina

0 MGY

0 MGY

0 MGY

249 MGY

2,117 MGY

Table Source: Energy Information Administration * - based on press reports for Range Fuels. Soperton, GA

Be the low cost provider of ethanol on the East

Coast

Construct and operate four 110 MGY Fagen dry

grind ethanol plants

Explore expansion opportunities

Plant improvements

Additional dry grind plants

Cellulosic technology

East Coast Ethanol - Mission

8

East Coast Ethanol, LLC

C. Thompson & Associates

Limited Liability Company

Open to all investors in states in which ECE shares will be registered, so long as they

meet suitability requirements

10% down payment due at time of subscription but investor does not become an owner

until funds are released from escrow

In order to release funds from escrow, ECE must raise at least the minimum offering

amount and obtain a debt financing commitment for all of the debt necessary to fund the

project*

ECE has up to 12 months from the date the offering begins to meet these conditions or

investors’ funds must be returned from escrow to the investors

If investor becomes owner - One unit, One vote

Income allocation not subject to self-employment tax (may not apply to investors who are

full-time employees of ECE)

Pass through entity – single level taxation

Like any investment, stock in ECE can appreciate or depreciate based on inherent

project risks

*A debt financing commitment is not the same as executing debt agreements and there may be a risk that

ECE releases funds from escrow based on the commitment but then does not close the debt financing

transaction. In that event, your investment may be held until a replacement lender is found, may be returned

to you or may be used by ECE to start building the project. Without sufficient debt financing, ECE will have

difficulty completing the project and your investment could lose significant value.

East Coast Ethanol is a…

East Coast Ethanol, LLC

9

C. Thompson & Associates

Industry Leading Partners

East Coast Ethanol

Board of Directors

(17 Members)

Project Management

C.Thompson & Associates

Design/Build

Partners

Professional

Services

Strategic

Partners

Strategic

Resources

Fagen, Inc.

ICM

Brown Winick – Legal

Counsel

Christianson & Associates –

Forecasts

Hein & Associates –

External Auditing

US Water

US Energy

Ethanol Marketing

Grain Marketing &

Procurement

Norfolk Southern

CSX

TranSystems

PRX

Southern Ethanol Council

Local and State Economic

Development Resources

East Coast Ethanol, LLC

10

C. Thompson & Associates

Executive Committee

GA, FL, NC, SC Site

Development Committees

Regional Fuel Terminals and Plant Locations

East Coast Ethanol, LLC

11

C. Thompson & Associates

ECE Comparative Advantage

East Coast Ethanol, LLC

12

C. Thompson & Associates

Business Model

Corn

Ethanol

DDGS

Gross

Margin

Ext.

Origination

$ 5.00

$ 5.65

$ 1.61

$ 2.25

$ 88,524,827.49

Destination

$ 5.50

$ 6.27

$ 1.88

$ 2.64

$ 103,799,224.29

ECE Advantage

$ (0.50)

$ 0.62

$ 0.27

$ 0.39

$ 15,274,396.80

*Margins and pricing are quoted per bushel. Each plant will consume 39,286,000 bushels of corn annually.

Price Spreads from Iowa to Jacksonville as of 9/15/08

Corn

$0.50/bu

Source - Palmetto Grains

Ethanol1

$0.22/gal

Source - Eco Energy

DDGS

$30.00/ton

Source - Palmetto Grains

(1) – rail cost minus local trucking cost

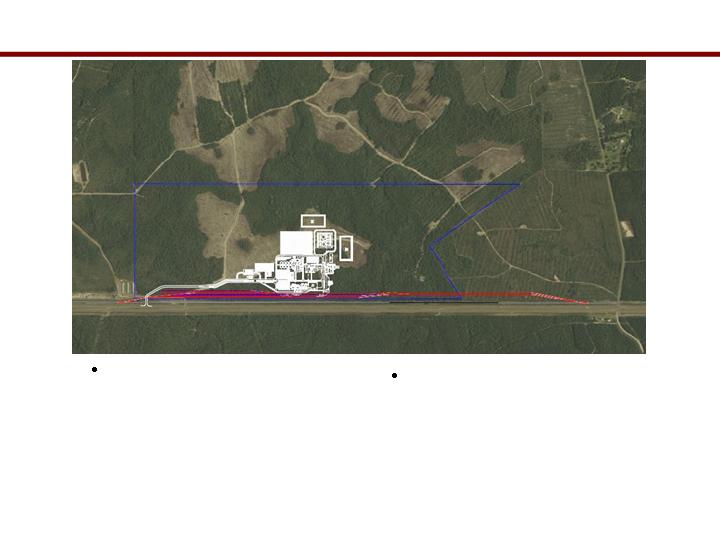

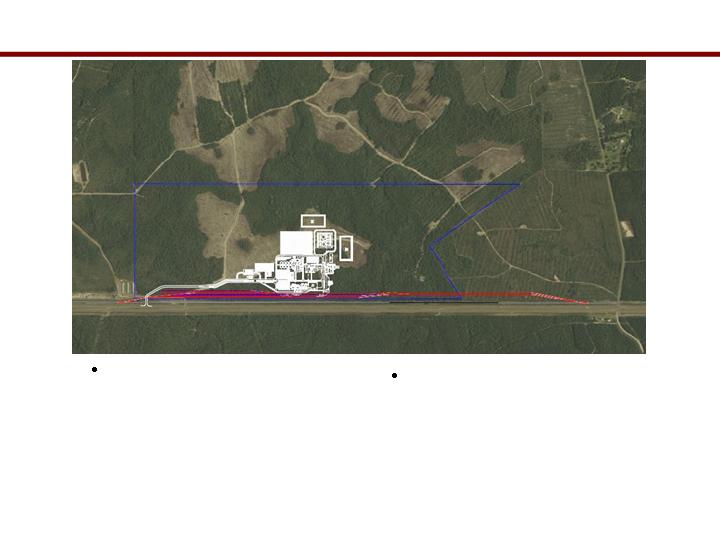

Campbellton, FL Site Plan

East Coast Ethanol, LLC

13

C. Thompson & Associates

Terminals

- Panama City (60 mi)

- Freeport (60 mi)

- Niceville (60 mi)

- Tampa (275 mi)

Ports

- Panama City (60 mi)

Dual rail access via

Bayline Railroad

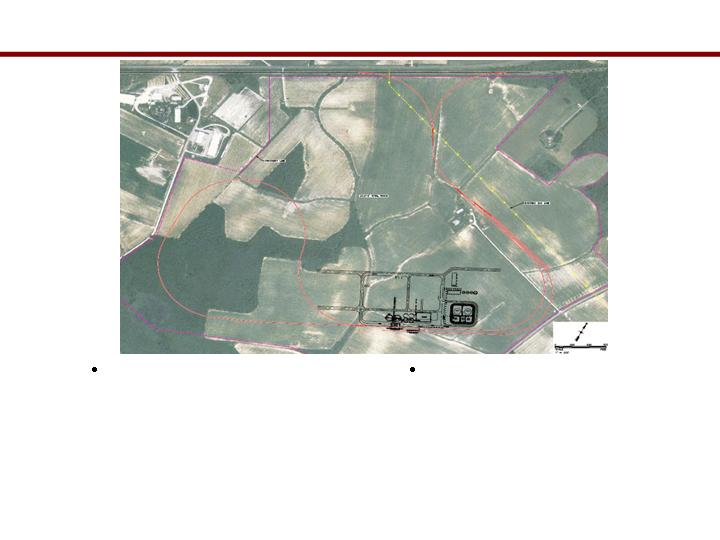

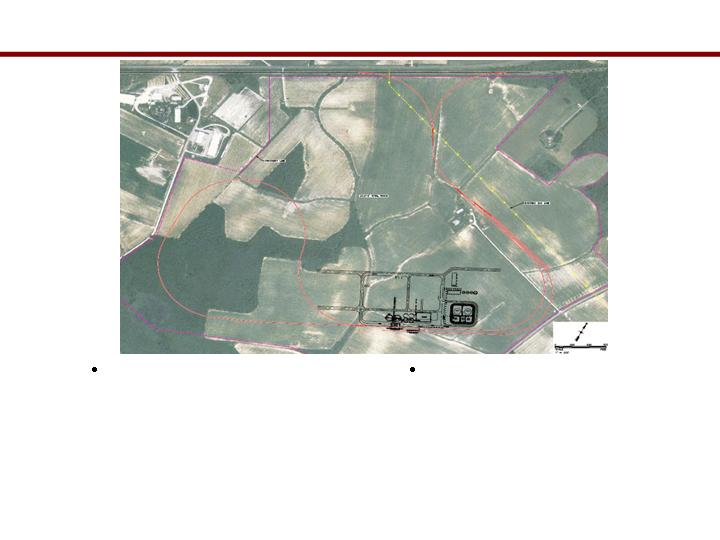

Jesup, GA Site Plan

East Coast Ethanol, LLC

14

C. Thompson & Associates

Terminals

- Savannah (65 mi)

- Jacksonville (95 mi)

- Macon (125 mi)

- N. Augusta (125 mi)

Ports

- Brunswick (50 mi)

- Savannah (65 mi)

- Jacksonville (95 mi)

Chester, SC Site Plan

East Coast Ethanol, LLC

15

C. Thompson & Associates

Terminals

- Charlotte (50 mi)

- Spartanburg (55 mi)

- Belton (90 mi)

- N. Augusta (120 mi)

Ports

- Charleston (160 mi)

Dual rail access via

Lancaster & Chester

Railroad

Seaboard, NC Site Plan

East Coast Ethanol, LLC

16

C. Thompson & Associates

Terminals

- Chesapeake (75 mi)

- Richmond (65 mi)

- Greensboro (125 mi)

- Selma (100 mi)

Ports

- Norfolk (75 mi)

- Wilmington (130 mi)

We expect to receive approximately $126,000,000

in incentives from the states of North Carolina,

South Carolina, Georgia and Florida.

Some of these incentives may be structured over

a period of time, however, the final amounts and

time periods will be determined once we finalize

and sign the incentive agreements.

State Incentives

East Coast Ethanol, LLC

17

C. Thompson & Associates

Start indication of interest meetings – March 2008

Planned effective date with SEC – September 2008

Financial close – December 2008

Start construction – January 2009

Fagen can begin construction simultaneously

Construction schedule – 18 to 22 months per plant

First plant start-up – Summer 2010

Timeline is contingent upon successful sale of membership units and financial close.

Other potential project risks include construction delays, problems obtaining

required permits, and unknown environmental issues related to plant sites.

Time Line Goals

East Coast Ethanol, LLC

18

C. Thompson & Associates

Sources of Funds

Senior Debt

Term Loan

Revolving Line of Credit

Member Equity – seed capital

Member Equity

Total of funds

ECE Financing Plan

East Coast Ethanol, LLC

19

C. Thompson & Associates

Total of funds will remain constant - additional debt may be raised to cover any equity shortfalls.

We can give no assurance or guarantee that we will be able to obtain sufficient debt financing or that

debt financing will be available on favorable terms especially in the current tight credit environment.

$374,000,000

$66,000,000

$9,800,000

$421,700,000

$871,500,000

Plant Construction

Site Development, Rail, Utilities,

Insurance, Contingencies, Misc.

Inventory & Working Capital

Financing, Costs of Raising Capital,

Organizational, and Preproduction

Costs

Total

Approximate Use of Funds

East Coast Ethanol, LLC

20

C. Thompson & Associates

These figures are estimates only and the actual use of funds may vary significantly depending on

factors encountered as projects develop.

$587,800,000

$142,320,000

$74,640,000

$66,540,000

$871,500,000

Investor Requirements

Meet suitability requirements in states where ECE is registered

Minimum purchase - $15,000 (equals one unit)

Additional purchases made in increments of $5,000

Unit Transfers

East Coast Ethanol will establish a qualified matching service

for transferring membership units – units will not be listed on a

national exchange. Units will be considered illiquid securities

and you will not be able to readily sell your securities.

Transfers can commence after first plant start-up

Stock Facts

East Coast Ethanol, LLC

21

C. Thompson & Associates

10% subscription payment due at signing with promissory note for balance (this

down payment is non-refundable and ECE may pursue legal options for balance

if not paid in a timely manner)

Balance due within 20 days after Board calls balance, which can occur any time

after the minimum offering amount is subscribed

Escrow terminates when:

equity is raised, and

debt financing commitment for the project is obtained*

Failure of East Coast Ethanol to achieve financial close and terminate escrow

within 12 months of date of effectiveness results in funds returned with interest

and in no event will less than the full amount of the principal investment be

returned to investors

Investor does not become an owner until ECE satisfies conditions for releasing

funds from escrow

Minimum offering amount to terminate escrow is $253,650,000

Escrow Procedures

East Coast Ethanol, LLC

22

C. Thompson & Associates

*A debt financing commitment is not the same as executing debt agreements and there may be a

risk that ECE releases funds from escrow based on the commitment but then does not close the

debt financing transaction. In that event, your investment may be held until a replacement lender

is found, may be returned to you or may be used by ECE to start building the project. Without

sufficient debt financing, ECE will have difficulty completing the project and your investment

could lose significant value

Categories

Ethanol Price (net price)

Ethanol per bushel of corn (gal)

DDGS Price (gross price/ton)

CO2 (gross sales/ton)

Corn Price (per Bu.)

Energy Use (BTU/Gal.)

Electricity (per kilowatt)

Natural Gas (per million BTUs)

Employees (per plant)

Estimated ROI (year 5)

*Unfavorable moves in commodity and energy prices can have a significant negative impact on

ECE’s profitability.

ECE Assumptions

East Coast Ethanol, LLC

23

C. Thompson & Associates

$1.96

2.8

$147.00

$12.00

$4.11

32,000

$.06

$9.00

45-50

22.22%

ROE Matrix (Year 5)

East Coast Ethanol, LLC

24

C. Thompson & Associates

7 Year Historical Price Averages (Source: Pro Exporters): Corn = $2.58/bu Ethanol = $1.68/gal

The above matrix is not a guarantee of future results and should not be relied on as such. You should evaluate this information in

conjunction with the Company's prospectus which can be accessed at our website: www.eastcoastethanol.us

Ethanol

$1.60

$1.90

$1.96

$2.20

$2.50

$2.80

$3.00

Corn

$8.00

-117.86%

-87.63%

-81.59%

-57.40%

-27.17%

3.06%

23.21%

$7.50

-104.90%

-74.67%

-68.62%

-44.44%

-14.21%

16.02%

36.18%

$6.50

-78.98%

-48.75%

-42.70%

-18.52%

11.71%

41.94%

62.10%

$6.00

-66.02%

-35.79%

-29.74%

-5.56%

24.67%

54.91%

75.06%

$5.50

-53.06%

-22.83%

-16.78%

7.41%

37.64%

67.87%

88.02%

$5.00

-40.09%

-9.86%

-3.82%

20.37%

50.60%

80.83%

100.98%

$4.50

-27.13%

3.10%

9.14%

33.33%

63.56%

93.79%

113.94%

$4.11

-17.02%

13.21%

22.22%

43.44%

73.67%

103.90%

124.05%

$4.00

-14.17%

16.06%

22.10%

46.29%

76.52%

106.75%

126.90%

Failure of Fagen or ICM to perform contractually could jeopardize

some or all ECE plants

Construction delays could devalue investment units if the sale of

ethanol or co-products are delayed

ECE will rely solely on Fagen and ICM to supply all of the

technology necessary to build and operate all plants – we expect that

they will either own or license this technology

ECE has no operating history and is not experienced in selling

securities

Current credit conditions have tightened and could inhibit ECE’s

ability to fully capitalize its projects

ECE could have to modify plans to construct 4 plants simultaneously

if it is unable to raise the required financing

Corn prices sustained at current historical highs would negatively

impact ECE’s profitability

Project Risks

East Coast Ethanol, LLC

25

C. Thompson & Associates

A Clear Choice?

East Coast Ethanol, LLC

26

C. Thompson & Associates

www.kickoil.co

m

Time.com

Time.com

Time.com

Time.com

For more information and a prospectus,

please visit us at:

www.eastcoastethanol.us

Investors in North Carolina, Virginia and Maryland

can obtain more information from our broker-dealer,

Thomas Securities LLC, at 404-504-6050 or by visiting

its website at:

www.thomassec.com

ECE Website and Prospectus

East Coast Ethanol, LLC

27

C. Thompson & Associates