Filed Pursuant to Rule 424(B)(3)

Registration Statement No. 333-148905

a Delaware Limited Liability Company

September 26, 2008

The securities being offered by East Coast Ethanol, LLC are Limited Liability Company Membership Units

| Minimum Offering Amount | | $ | 253,650,000* | | | Minimum Number of Units | | | 16,910 | |

| Maximum Offering Amount | | $ | 591,825,000* | | | Maximum Number of Units | | | 39,455 | |

* Our placement agent, Thomas Group Capital, will receive (i) a placement agent fee equal to 4.5% of the gross proceeds of the sales of our securities made to investors identified and solicited by Thomas Group Capital, (ii) warrants to purchase up to 3.5% of the total amount of securities sold by Thomas Group Capital as described in further detail below and (iii) 1.5% of any debt financing raised by it. Our financial advisor, Jasper Corporate Finance Limited, will receive a ‘success fee’ equal to 1.25% of any debt raised, 2.0% of any mezzanine financing raised and 3.0% of any equity raised by it.

Offering Price: $15,000 per Unit

Minimum Purchase Requirement: One Unit ($15,000)

Additional Purchases in Increments of one-third of one Unit ($5,000)

We are offering limited liability company membership units in East Coast Ethanol, LLC, a development stage Delaware limited liability company. This is a self-written best efforts offering that is being conducted primarily by our officers and directors, except that we have engaged a licensed broker-dealer, Thomas Group Capital as our exclusive placement agent for sales of our securities in North Carolina, Virginia and Maryland and as our non-exclusive placement agent in other states in which we are registering our securities for sale. In addition to receiving 4.5% of the gross proceeds from its sales of our securities, our agreement provides that Thomas Group Capital will receive warrants to purchase up to 3.5% of the total amount of securities it sells; these warrants are exercisable at the same offering price per unit as the units being sold under this registration statement and will be exercisable for a period of 10 years from the date we release funds from escrow. We have also engaged a licensed financial advisor, Jasper Corporate Finance Limited, to assist us in obtaining financing from investors and banks located outside the United States.

We intend to use the offering proceeds to develop, construct and operate four 110 million gallon per year dry mill corn-processing ethanol manufacturing plants expected to be located in the Southeast United States. We estimate the total project, including operating capital, will cost approximately $871,500,000. We expect to use debt financing to complete project capitalization. The offering will end no later than September 26, 2009. If we sell the maximum number of units prior to September 26, 2009, the offering will end on or about the date that we sell the maximum number of units. We may also end the offering any time after we sell the minimum number of units and prior to September 26, 2009. In addition, if we abandon the project for any reason prior to September 26, 2009, we will terminate the offering and promptly return offering proceeds to investors. Proceeds from subscriptions for the units will be deposited in an interest-bearing escrow account under a written escrow agreement. We will not release funds from the escrow account until specific conditions are satisfied. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense. These securities are speculative securities and involve a significant degree of risk. You should read this prospectus including the “RISK FACTORS” beginning on page 3. You should consider these risk factors before investing in us:

| | Ø | YOU ARE INVESTING IN ILLIQUID SECURITIES AND WILL NOT BE ABLE TO READILY SELL YOUR UNITS; |

| | Ø | WE WILL NEED TO OBTAIN SIGNIFICANT DEBT FINANCING TO FUND CONSTRUCTION OF OUR PROPOSED ETHANOL PLANTS; |

| | Ø | OVERCAPACITY WITHIN THE ETHANOL INDUSTRY COULD REDUCE THE VALUE OF YOUR INVESTMENT; |

| | Ø | DECLINING ETHANOL AND DISTILLERS GRAINS PRICES WILL NEGATIVELY AFFECT YOUR INVESTMENT; |

| | Ø | POTENTIAL COST INCREASES FOR CRITICAL INPUTS SUCH AS CORN AND NATURAL GAS COULD REDUCE THE VALUE OF YOUR INVESTMENT; |

| | Ø | CHANGES IN OR ELIMINATION OF GOVERNMENTAL LAWS, TARIFFS, TRADE OR OTHER CONTROLS OR ENFORCEMENT PRACTICES SUCH AS NATIONAL, STATE OR LOCAL ENERGY POLICY; FEDERAL ETHANOL TAX INCENTIVES; OR ENVIRONMENTAL LAWS AND REGULATIONS THAT APPLY TO OUR PLANT OPERATIONS AND THEIR ENFORCEMENT COULD REDUCE THE VALUE OF YOUR INVESTMENT; AND |

| | Ø | OTHER FACTORS DESCRIBED ELSEWHERE IN THIS REGISTRATION STATEMENT. |

TABLE OF CONTENTS

| | Page |

PROSPECTUS SUMMARY | 1 |

IMPORTANT NOTICES TO INVESTORS | 5 |

RISK FACTORS | 5 |

| INDUSTY AND MARKET DATA | 21 |

FORWARD LOOKING STATEMENTS | 21 |

DETERMINATION OF OFFERING PRICE | 22 |

DILUTION | 22 |

CAPITALIZATION | 23 |

DISTRIBUTION POLICY | 24 |

SELECTED FINANCIAL DATA | 24 |

MANAGEMENT’S DISCUSSION AND ANALYSIS AND PLAN OF OPERATION | 27 |

ESTIMATED SOURCES OF FUNDS | 31 |

ESTIMATED USE OF PROCEEDS | 31 |

INDUSTRY OVERVIEW | 32 |

DESCRIPTION OF BUSINESS | 42 |

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS | 63 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 66 |

EXECUTIVE COMPENSATION | 66 |

INDEMINIFICATION FOR SECURITIES ACT LIABILITIES | 68 |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 68 |

PLAN OF DISTRIBUTION | 68 |

DESCRIPTION OF MEMBERSHIP UNITS | 73 |

SUMMARY OF OUR OPERATING AGREEMENT | 77 |

LEGAL MATTERS | 87 |

EXPERTS | 87 |

TRANSFER AGENT | 87 |

ADDITIONAL INFORMATION | 87 |

INDEX TO FINANCIAL STATEMENTS | F-1 |

EXHIBITS | |

| Certificate of Formation | Appendix A |

| Operating Agreement | Appendix B |

| Form of Subscription Agreement | Appendix C |

PROSPECTUS SUMMARY

This summary only highlights selected information from this prospectus and may not contain all of the information that is important to you. You should carefully read the entire prospectus, the financial statements, and attached exhibits before you decide whether to invest.

OUR COMPANY

East Coast Ethanol, LLC (“East Coast Ethanol”) was formed as a Delaware limited liability company on July 27, 2007 and was created to facilitate the merger of four entities – Mid Atlantic Ethanol, LLC, Palmetto Agri-Fuels, LLC, Atlantic Ethanol, LLC, and Florida Ethanol, LLC. Each of the four entities was in the process of developing a 110 million gallon ethanol plant in the states of North Carolina, South Carolina, Georgia and Florida, respectively. These four companies merged in order to maximize efficiencies and take advantage of economies of scale.

We are a development stage company with no prior operating history. We do not expect to generate any revenue until our plants become operational, which we currently expect will be in winter 2010. Our ownership interests are represented by membership interests, which are designated as units. Our principal address and location is 1907 Thurmond Mall, Post Office Box 2226, Columbia, South Carolina 29202. Our toll-free telephone number is 877-323-3835 and our website is www.eastcoastethanol.us.

OUR PROJECT

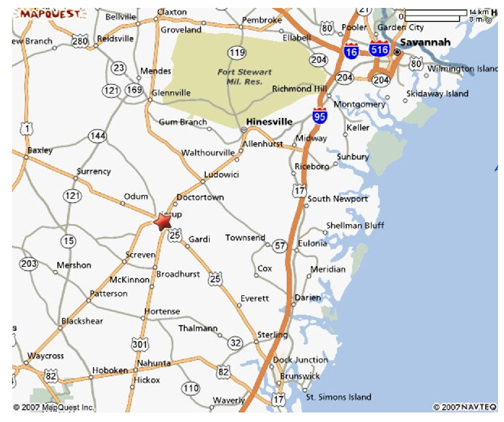

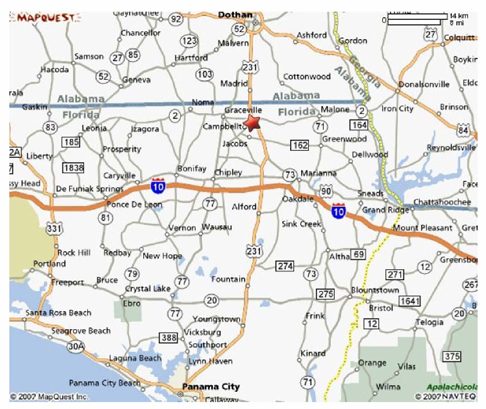

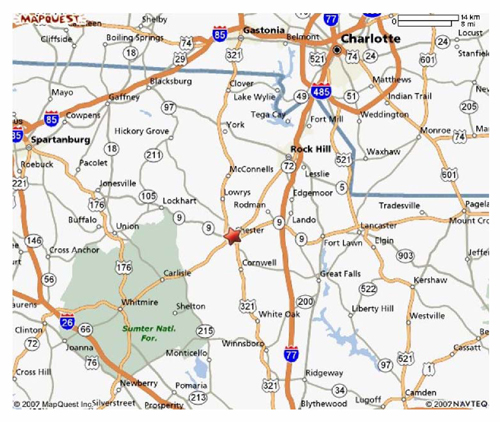

East Coast Ethanol was formed for the purpose of developing and financing a project to build and operate four 110 million gallon dry mill corn-processing ethanol plants expected to be located in the Southeastern region of the United States, namely Wayne County, Georgia, Jackson County, Florida, Chester County, South Carolina and Northampton County, North Carolina.

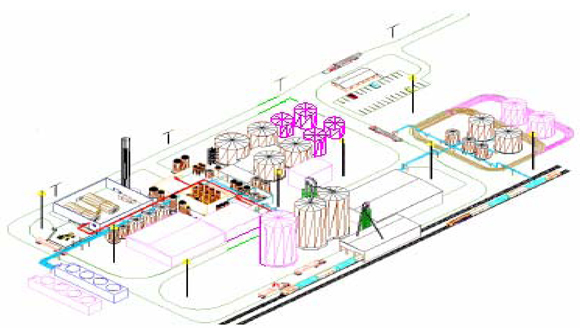

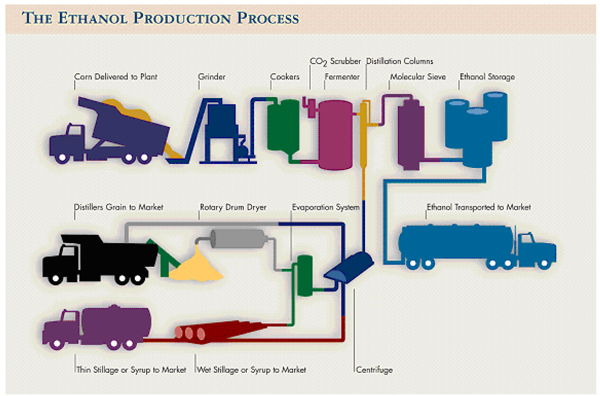

Although the anticipated plants each have a nameplate production capacity of 110 million gallons per year, historical operating performances of similar plants constructed by our anticipated design-builder, Fagen, Inc., indicate that the plants are each likely to produce approximately 120 million gallons of ethanol annually. Therefore, our discussion throughout this prospectus assumes aggregate annual production from all four plants of 480 million gallons of ethanol and our input requirements and co-product production levels are based on ethanol production of 120 million gallons per year per plant. For reference purposes, we refer to our plants by their nameplate production capacities rather than anticipated production levels. Additionally, while we plan on financing and constructing the four ethanol plants concurrently, at our sole discretion, we may choose to finance and develop each plant individually. According to the engineering specifications from our anticipated design-builder, Fagen, Inc., on an annual basis the plants will be able to produce in the aggregate approximately 480 million gallons of ethanol, 1,540,000 tons of dried distiller’s grains with solubles, and 1,058,400 tons of carbon dioxide.

Construction of each of our plants is expected to take approximately 18 to 22 months. Our anticipated completion date is currently scheduled for winter 2010. This anticipated completion date assumes that we are able to complete our financing arrangements, including this offering and debt financing in a timely fashion. Fagen, Inc.’s commitments to build other plants may potentially delay construction of our plants and postpone our start-up date. As of the date of this prospectus, we have signed letters of intent with Fagen, Inc., for the design and construction of three of our facilities. We are currently performing site due diligence on the location for our fourth plant and have not yet signed a letter of intent for it. We have no any binding or non-binding agreements with any other contractor or supplier for labor or materials necessary to construct our plants.

Our anticipated construction schedule is as follows:

| | Ø | February 2008 – December 2008: Conduct equity drive and negotiate and close debt financing. |

| | Ø | January 2009: Commence construction of first plant. Fagen, Inc. is expected to commence construction of the other three plants shortly thereafter. |

| | Ø | Summer 2010: Commencement of operations at first plant. |

| | Ø | Winter 2010: Commencement of operations at final plant. |

OUR COMPETITIVE STRENGTHS

Our competitive strengths include:

| | Ø | Location. The southeast United States does not produce nearly enough ethanol to meet its needs and imports most of its ethanol, primarily from the Midwest and the Eastern corn-belt. According to the Renewable Fuels Association (“RFA”), as of the current time, there is no ethanol production occurring in South Carolina and Florida; there is a 60 million gallon ethanol plant under construction in North Carolina, and there is one ethanol plant producing 0.4 million gallons per year in Georgia and two plants with a combined nameplate capacity of 120 million gallon currently under construction. Please see “GENERAL ETHANOL DEMAND AND SUPPLY.” According to the latest figures released by the Energy Information Administration, the Southeast ethanol market is estimated at 2.3 billion gallon per year. Our four facilities (if and when they become operational) can supply ethanol to the Southeast United States at a much cheaper rate than imported ethanol because of reduced transportation costs given our geographical location. We estimate that our transportation costs will be a third of that of the Midwestern ethanol plants supplying ethanol to the Southeast, and half of the ethanol plants located in the Eastern corn-belt supplying ethanol to the area. Moreover, since most of the ethanol produced in the Eastern corn-belt is delivered to population centers in the East and Northeast, we are mainly competing in the Southeast against ethanol produced in the Midwest, over which we expect to have a decided transportation cost advantage. Thus, our strategy is to become one of the foremost suppliers of ethanol to the Southeast U.S. market. |

| | Ø | Reduced transportation costs. Since our proposed ethanol plants are expected to be located close to each other, we intend to consolidate and manage a deck of trains for four facilities rather than a set of trains for each facility. Additionally, we have selected plant sites that are conveniently located with easy access to major highways, fuel terminals and ports, which we expect will generally reduce our transportation costs and allow us to sell our ethanol at competitive prices to a greater number of terminals. Please see “PLANT SITE INFORMATION.” |

| | Ø | Economies of Scale. Our proposed size is advantageous in several respects. First, we expect to streamline senior management by eliminating the standard positions of General Manager, Commodity Manager and Controller at each of our plants (replacing these positions with a Chief Executive Officer, Chief Financial officer, Chief Operating Officer and two administrative support personnel) for all four plants. Second, we anticipate that the size of our proposed operations will allow us to increase our borrowing capacity. Finally, if and when our plants commence production, we intend to become one of the largest producers of ethanol in the Southeast United States (as of the present time, including production from competitors’ plants under construction, our total capacity of 480 million gallons would make us the fourth largest ethanol producer in the U.S.) and our size should generally assist our operations. |

OUR CHALLENGES

Our notable challenges to implementing our business strategy include:

| | Ø | Raising Sufficient Capital. We will need to raise a substantial amount of capital – approximately $871,500,000 in equity and debt financing to equip us with the necessary capital to proceed as planned. During 2007 and 2008, investment activity in the domestic ethanol industry has diminished considerably due to a number of factors including unfavorable market conditions and concerns regarding potential oversupply. In addition, the overall credit environment tightened considerably as a result of the subprime mortgage crises. Given the uncertain credit environment and the recent decreased investment interest in our industry, we may find it difficult to obtain the requisite financing. |

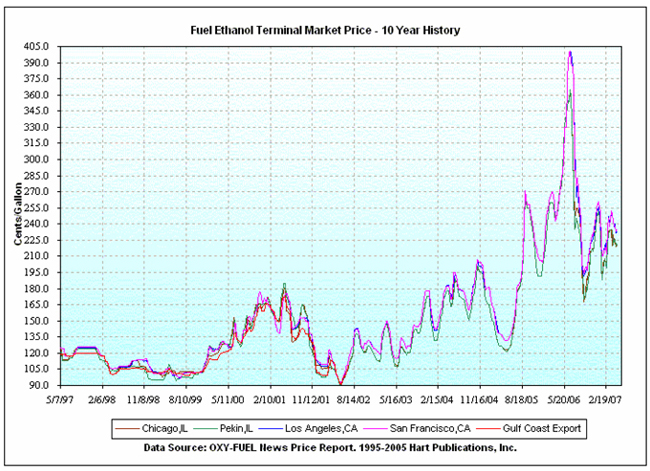

| | Ø | Ethanol Prices. Our performance will be heavily dependent on ethanol prices. Ethanol prices declined in the first half of 2007, likely owing to an increase in supply and infrastructure difficulties, but rebounded in the latter half of 2007 and have held steady throughout the first half of 2008. While the newly enacted Energy Independence and Security Act of 2007 is likely to increase demand for ethanol, we believe an increase in voluntary consumption of ethanol is required for prices to reach levels at which we may operate profitably. |

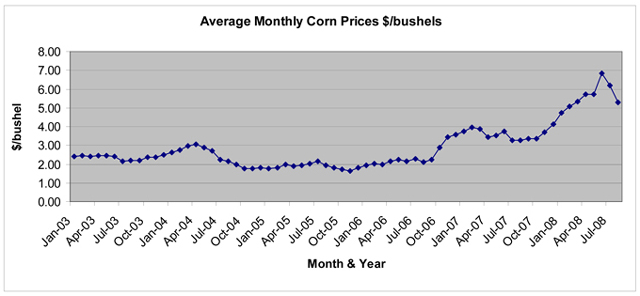

| | Ø | Corn Prices. Corn is a key input for our plants. We expect to require approximately 176 million bushels of corn in aggregate each year for our plants. We will be especially sensitive to corn prices (which have increased substantially in recent times) since our plants will not be located near an abundant supply of corn. We expect to import corn for our plants from the Midwestern United States, which will require us to incur additional transportation costs thereby increasing our overall corn costs. |

ETHANOL INDUSTRY

Ethanol is ethyl alcohol, a fuel component made primarily from corn and various other grains, and can be used as: (i) an octane enhancer in fuels; (ii) an oxygenated fuel additive for the purpose of reducing ozone and carbon monoxide vehicle emissions; and (iii) a non-petroleum-based gasoline substitute. Approximately 95 percent of all ethanol is used in its primary form for blending with unleaded gasoline and other fuel products. Used as a fuel oxygenate, ethanol provides a means to control carbon monoxide emissions in large metropolitan areas. The principal purchasers of ethanol are generally the wholesale gasoline marketer or blender. Oxygenated gasoline is commonly referred to as reformulated gasoline.

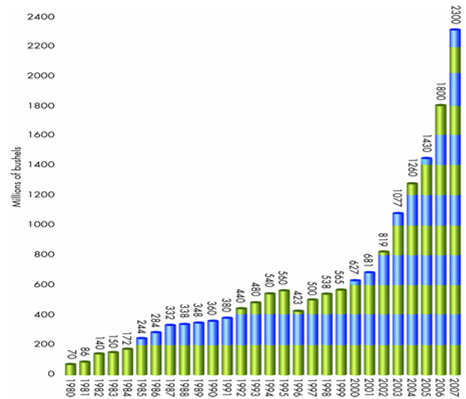

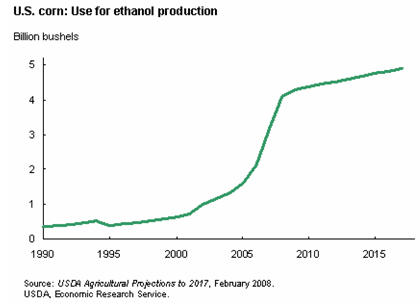

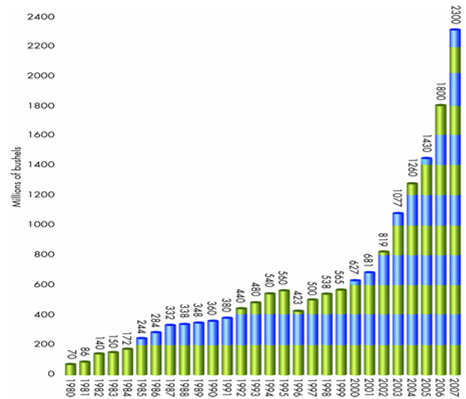

Over the past twenty years the U.S. fuel ethanol industry has grown tremendously from almost nothing to over 7 billion gallons of ethanol production per year. According to the RFA, as of September 16, 2008, there are 171 ethanol production facilities producing ethanol throughout the United States with 38 new ethanol plants in various stages of completion. Most of these facilities are based in the Midwest because of the nearby access to the corn and grain feedstocks necessary to produce ethanol.

RISK FACTORS

Our business involves various risks, including: our ability to obtain significant debt financing to fund construction of our proposed ethanol plants; the volatility and uncertainty of commodity prices; changes in current legislation or regulations that affect ethanol supply and demand; changes in ethanol supply and demand; our ability to compete effectively in the ethanol industry; our lack of any operating history and history of operating losses; development of infrastructure related to the sale and distribution of ethanol; difficulties in constructing and operating our ethanol plants; the adverse effect of environmental, health and safety laws, regulations and liabilities; disruptions to infrastructure or in the supply of raw materials; the division of our management’s time and energy among our different ethanol plants; competition for qualified employees in the ethanol industry; our ability to keep pace with technological advances; lack of experience of our directors and officers in the ethanol business; increase in construction and equipment costs; and competition from alternative fuels and alternative fuel additives. Please carefully study “RISK FACTORS” to gain an appreciation of the risks involved in investing in East Coast Ethanol.

THE OFFERING

| Minimum number of units offered | 16,910 units |

| | |

| Maximum number of units offered | 39,455 units |

| | |

| Purchase price per unit | $15,000 |

| | |

| Minimum purchase amount | One ($15,000) |

| | |

| Additional purchases | One-third of one unit increments ($5,000) |

| | |

| Offering start date | As soon as practicable following declaration of effectiveness of our registration statement. |

| | |

| Offering end date | September 26, 2009 |

| Subscription procedures | Before purchasing units, you must read and complete the subscription agreement, draft a check payable to “BB&T Corporation, Escrow Agent for East Coast Ethanol, LLC” in the amount of not less than 10% of the amount due for units for which subscription is sought, which amount will be deposited in the escrow account; sign a full recourse promissory note for the remaining 90% of the total subscription price; and deliver to us these items and an executed copy of the signature page of our operating agreement. Investors may pay the entire investment amount at the time of signing the subscription agreement. The promissory note will become due within 20 days of your receipt of written notice from East Coast Ethanol. We expect to issue this notice once we have received subscriptions for the necessary amount of equity to fund our project. We will pursue all legal remedies against investors who do not timely pay the balances due. Based on current market conditions, we expect to finance the project at a debt to equity ratio of 50% debt and 50% equity. Therefore, we expect to need approximately $435,750,000 in equity in order to attract sufficient debt to complete our financing. |

| | Because of fluctuating market conditions, we have set our minimum offering amount at approximately 30% of the total project cost even though we currently expect to need at least 50% equity in order to attract sufficient debt to complete our financing. |

| Escrow procedures | Proceeds from the subscriptions for the units will be deposited in an interest bearing account that we have established with BB&T Corporation, as escrow agent under a written escrow agreement. We do not expect to release funds from the escrow account until the following conditions are satisfied: (1) cash proceeds from unit sales deposited in the escrow account equals or exceeds the minimum offering amount of $253,650,000, exclusive of interest; (2) we obtain a written debt financing commitment for debt financing ranging from approximately $269,875,000 to $608,050,000, less any grants and/or tax increment financing we are awarded; (3) we elect, in writing, to terminate the escrow agreement; 4) an affidavit prepared by our escrow agent has been sent to the states in which we have registered units stating that the conditions set out in (1), (2) and (3) have been met; and (5) in each state in which consent is required, the state securities commissioner has consented to release of the funds on deposit. Upon satisfaction of these conditions, the escrow agreement will terminate, and the escrow agent will disburse the funds on deposit, including interest, to us to be used in accordance with the provisions set out in this prospectus. If we have not satisfied these conditions for releasing funds from escrow by September 26, 2009, we will return all equity proceeds to investors and terminate the escrow agreement. In that event, investors will receive the entire amount of their paid-in investment being held in escrow plus any allocable interest earned during the escrow period. |

| States in which we plan to register | Florida, Maryland, New York, South Carolina, North Carolina, Georgia and Virginia. |

| | |

| Method of sales | The directors and officers identified on Page 60 of this prospectus will be involved in offering securities directly to investors on behalf of the Company as an issuer. We have engaged a placement agent, Thomas Group Capital (a licensed broker-dealer), to sell our securities on a best-efforts basis in North Carolina, Virginia and Maryland. Thomas Group Capital is our exclusive placement agent in these states and is our non-exclusive placement agent in other states in which we are registering our securities. It is possible that we may engage other placement agents to sell our securities in other states but we do not have any other placement agent agreements or engagements at this time. Further, we have engaged a licensed financial advisor, Jasper Corporate Finance Limited, to assist us in obtaining financing from investors and banks located outside the United States. |

| Suitability of investors | Persons (excluding North Carolina residents) cannot invest in this offering unless they meet one of the following suitability tests: Ø Persons who have annual income from whatever source of at least $45,000 and have a net worth of at least $45,000 exclusive of home, furnishings and automobiles; or Ø Persons who have a net worth of at least $150,000 exclusive of home, furnishings and automobiles. For married persons, the tests will be applied on a joint husband and wife basis regardless of whether the purchase is made by one spouse or the husband and wife jointly. |

| | Residents of North Carolina must meet one of the following suitability tests: Ø Persons who have minimum net worth of $70,000 and minimum annual gross income of $70,000 or Ø Persons who have a net worth of at least $250,000 exclusive of home, home furnishings and automobiles. |

IMPORTANT NOTICE TO INVESTORS

This prospectus does not constitute an offer to sell or the solicitation of an offer to purchase any securities in any jurisdiction in which, or to any person to whom, it would be unlawful to do so. Investing in our units involves significant risk. Please see “RISK FACTORS” to read about important risks you should consider before purchasing units in East Coast Ethanol.

In making an investment decision, investors must rely upon their own examination of the entity creating the securities and the terms of the offering, including the merits and risks involved. Investors should not invest any funds in this offering unless they can afford to lose their entire investment. There is no public market for the resale of the units in the foreseeable future. Furthermore, state securities laws and our operating agreement place substantial restrictions on the transferability of the units. Investors should be aware that they will be required to bear the financial risks of this investment for an indefinite period of time.

During the course of the offering of the units and prior to the sale of the units, each prospective purchaser and his or her representatives, if any, are invited to ask questions of, and obtain additional information from, our representatives concerning the terms and conditions of this offering, us, our business, and other relevant matters. We will provide the requested information to the extent that we possess such information or can acquire it without unreasonable effort or expense. Prospective purchasers or representatives having questions or desiring additional information should contact us at (877) 323-3835, or at our business address: East Coast Ethanol, LLC, 1907 Thurmond Mall, Post Office Box 2226, Columbia, South Carolina 29202. Also, you may contact any of the following directors or officers directly at the phone numbers listed below:

NAME | | POSITION | | PHONE NUMBER |

| Randall Dean Hudson | | Chairman/CEO & Director | | 229-425-2044 |

| D. Keith Parrish | | Vice Chairman/Vice President & Director | | 919-207-2676 |

| John F. Long | | Treasurer/Chief Financial Officer & Director | | 803-924-4446 |

| Julius P. Thompson | | Secretary/Director | | 803-682-4902 |

| Leon Dupree Hatch, Jr. | | Director | | 386-362-9785 |

| Brian Howell | | Director | | 912-682-9709 |

| Roy Lawrence Smith III | | Director | | 912-682-4940 |

| Kenneth Dasher | | Director | | 386-364-8806 |

| Carlie McLamb, Jr. | | Director | | 910-286-4398 |

Investors located in North Carolina, Virginia and Maryland may contact our registered broker dealer, Thomas Group Capital at 404-504-6050 for additional information or to answer questions.

RISK FACTORS

The purchase of units involves substantial risks and the investment is suitable only for persons with the financial capability to make and hold long-term investments not readily converted into cash. Investors must, therefore, have adequate means of providing for their current and future needs and personal contingencies. Prospective purchasers of the units should carefully consider the Risk Factors set forth below, as well as the other information appearing in this prospectus, before making any investment in the units. Investors should understand that there is a possibility that they could lose their entire investment in us.

Risks Related to East Coast Ethanol as a Development Stage Company

We have a history of losses and may never operate profitably.

From our inception through June 30, 2008, we have incurred an accumulated net loss of $2,469,302. We will continue to incur significant losses until we successfully complete construction and commence operation of the plants. There is no assurance that we will be successful in completing this offering and/or in our efforts to build and operate the ethanol plants. Even if we successfully meet all of these objectives and begin operations at the ethanol plants, there is no assurance that we will be able to operate profitably.

East Coast Ethanol has no operating history, which could result in errors in management and operations causing a reduction in the value of your investment.

We were recently formed and have no history of operations. We may not be able to manage our start-up effectively or properly staff our operations, and any failure to manage our start-up effectively could delay the commencement of operations at our plants. A delay in start-up operations is likely to further delay our ability to generate revenue and satisfy our debt obligations. We anticipate a period of significant growth, involving the construction and start-up of operations of the plants. This period of growth and the start-up of the plants are likely to be a substantial challenge to us. If we fail to manage start-up effectively, you could lose all or a substantial part of your investment.

We have little to no experience in the ethanol industry, which increases the risk of our inability to build and operate the ethanol plants.

We are presently, and are likely for some time to continue to be, dependent upon our board of directors. Most of these individuals are experienced in business generally but have very little or no experience in raising capital from the public, organizing and building ethanol plants, and governing and operating a public company. Please see “DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS.” In addition, certain directors on our board are presently engaged in business and other activities which impose substantial demands on the time and attention of such directors. You should not purchase units unless you are willing to entrust all aspects of our management to our board of directors.

We expect to enter into a design-build agreement with Fagen, Inc. for each of our proposed ethanol facilities. If we are unable to enter into such agreements, or if this relationship is subsequently terminated, we could be placed at a decided competitive disadvantage.

We plan on entering into design-build agreements with Fagen, Inc. for all of our plants; however, we have yet to do so. We will be highly dependent on Fagen, Inc. and its employees; any loss of this relationship, particularly during the construction and start-up period for the plants, may prevent us from commencing operations and result in the failure of our business. The time and expense of locating new consultants and contractors would result in unforeseen expenses and delays. Unforeseen expenses and delays may reduce our ability to generate revenue and profitability and significantly damage our competitive position in the ethanol industry such that you could lose some or all of your investment.

If we fail to finalize critical agreements, such as the co-product marketing agreements and utility supply agreements, or the final agreements are unfavorable compared to what we currently anticipate, our project may fail or be harmed in ways that significantly reduce the value of your investment.

You should be aware that this prospectus makes reference to documents or agreements that are not yet final or executed, and plans that have not been implemented. In some instances such documents or agreements are not even in draft form. The definitive versions of those agreements, documents, plans or proposals may contain terms or conditions that vary significantly from the terms and conditions described. These tentative agreements, documents, plans or proposals may not materialize or, if they do materialize, may not prove to be profitable.

Our lack of business diversification could result in the devaluation of our units if our revenues from our primary products decrease.

We expect our business to solely consist of ethanol and distillers grains and any other co-product we are able to market. We do not have any other lines of business or other sources of revenue if we are unable to complete the construction and operation of the plants. Our lack of business diversification could cause you to lose all or some of your investment if we are unable to generate revenues by the production and sale of ethanol, distillers grains and other co-products since we do not expect to have any other lines of business or alternative revenue sources.

Your investment may decline in value due to decisions made by our initial board of directors and until the plants are built, your only recourse to replace these directors will be through amendment to our operating agreement.

Our operating agreement provides that the initial board of directors will serve until the first annual or special meeting of the members following commencement of substantial operations of the ethanol plants, expected in winter 2010. If our project suffers delays due to financing or construction, our initial board of directors could serve for an extended period of time. In that event, your only recourse to replace these directors would be through an amendment to our operating agreement which could be difficult to accomplish.

We may not be able to hire or retain employees capable of effectively operating the ethanol plants, which may hinder our ability to operate profitably.

We are a development stage company and we currently do not have any full-time employees. All services are being provided to us by independent contractors. If we are not able to hire or retain employees who can effectively operate the plants, our ability to generate revenue will be significantly reduced or prevented altogether such that you could lose all or a substantial portion of your investment.

Since we intend to operate and manage four ethanol plants concurrently in the Southeast United States, our management team may find it difficult to effectively control all the plants which could hurt our business.

While we plan on having offices near all our ethanol plants and assigning specific personnel to manage each plant, it is possible that senior management may find it difficult to manage, oversee and supervise all four of our plants simultaneously, which could adversely affect our performance and consequently the value of your investment. Moreover, while we anticipate being able to effectively supervise all of our ethanol plants without hiring a General Manger, Commodity Manger and a Controller for each plant, if we are mistaken in such a belief, our performance could be compromised which could reduce the value of your investment.

Our board of directors will have considerable discretion in allocating a substantial portion of the proceeds of this offering.

Our board of directors will determine how we will spend the funds raised through this offering. Our board will make decisions concerning all facets of our project, including but not limited to, the number of plants we will construct, whether we will construct each plant individually instead of all the plants concurrently and where we will construct the plants. If you are dissatisfied with our board of directors, there is no readily available means of dismissing them and you may have to postpone any replacement until the first annual meeting following substantial completion of the ethanol plants. Until that time, the only other replacement mechanism is through an amendment to our operating agreement, which could be difficult to accomplish.

Our board does not have a majority of independent directors as defined by North American Securities Administrators Association (“NASAA”) corporate governance rules.

Since our board is comprised mainly of our promoters and founders, it is not comprised of a majority of independent directors as defined by NASAA rules. Thus, our directors may take action without approval of an independent majority of directors as defined by NASAA rules. In the event such actions are influenced by the directors’ status as founders and seed capital investors rather than independent directors, the value of your investment could be reduced.

Risks Related to Conflicts of Interest

Our directors and officers have other business and management responsibilities which may cause conflicts of interest in the allocation of their time and services to our project.

Since our project is currently managed by the board of directors rather than a professional management group, the devotion of the directors’ time to the project is critical. However, all of our directors and officers have other management responsibilities and business interests apart from our project. As a result, all of our directors and officers will experience conflicts of interest in allocating their time and services between us and their other business responsibilities. In addition, conflicts of interest may arise if the directors and officers, either individually or collectively, hold a substantial percentage of the units because of their position to substantially influence our business and management.

We may have conflicting financial interests with Fagen, Inc., and ICM, Inc., which could cause Fagen, Inc. and ICM, Inc. to put their financial interests ahead of ours.

Fagen, Inc. and ICM, Inc. and their affiliates may have conflicts of interest because Fagen, Inc., ICM, Inc. and their employees or agents are involved as owners, creditors and in other capacities with other ethanol plants in the United States. We cannot require Fagen, Inc. or ICM, Inc. to devote their full time or attention to our activities. As a result, Fagen, Inc. and ICM, Inc. may have, or come to have, a conflict of interest in allocating personnel, materials and other resources to the construction of our plants.

Affiliated investors may purchase additional units and influence decisions in their favor.

We may sell units to affiliated or institutional investors and they may acquire enough units to influence the manner in which we are managed. These investors may influence our business in a manner more beneficial to themselves than to our other investors. This may reduce the value of your units, impair the liquidity of your units and/or reduce our profitability.

Risks Related to Our Financing Plan

Even if we raise the minimum amount of equity in this offering, we may not obtain the debt financing necessary to construct and operate our ethanol plants, which would result in the failure of the project and East Coast Ethanol.

Our financing plan requires a significant amount of debt financing. While we are actively investigating various lenders in this regard, we have not yet entered into any commitment with any bank, lender, governmental entity, underwriter or financial institution for debt financing. We will not release funds from escrow until we secure a written debt financing commitment sufficient to construct and operate the ethanol plants. If debt financing on acceptable terms is not available for any reason, we will be forced to abandon our business plan and return your investment from escrow plus nominal interest.

Depending on the level of equity raised in this offering, we expect to require debt financing ranging from approximately $269,875,000 to $608,050,000 (less any grants we are awarded and any tax increment financing we can procure) in senior long term debt from one or more commercial banks or other lenders. Based on current market conditions, we expect to finance the project at a debt to equity ratio of 50% debt and 50% equity. Therefore, we expect to need approximately $435,750,000 in equity in order to attract sufficient debt to complete our financing. Because the amounts of equity, tax increment financing and grant funding are not yet known, the exact amount and nature of total debt is also unknown. If we do not sell the minimum amount of units, the offering will not close. Even though we must receive a debt financing commitment as a condition of closing escrow, the agreements to obtain debt financing may not be fully negotiated when we close on escrow. Therefore, there is no assurance that such commitment will be received, or if it is received, that it will be on terms acceptable to us. If we close our debt financing, which means agreements to obtain debt financing are arranged and executed, we expect that we will be required to use the funds raised from this offering prior to receiving the debt financing funds.

Given the unfavorable credit environment, we can provide no assurances or guarantees that we will be able to obtain the requisite debt financing or that the debt financing will be on favorable terms.

The subprime mortgage lending crisis has contributed to a generally unfavorable credit environment. We can offer no assurances or guarantees that we will be able to obtain debt financing to fully capitalize this project. If we are unable to obtain debt financing, or if the debt financing is at unfavorable terms, we may be unable to begin construction of the proposed plants or they may not be as profitable as currently expected and your investment could lose value.

We intend to seek equity, mezzanine and debt financing from investors and banks located outside the United States. In the event we use international financing sources, we may have to incur additional compliance costs and it may be more difficult for you to pursue legal remedies against foreign investors or lenders.

Given that we will require approximately $871,500,000 to fully capitalize the project, we intend to seek a portion or all of the equity and debt financing from foreign investors and/or lenders. We have entered into a financial advisory agreement with Jasper Corporate Finance Limited according to which Jasper Corporate Finance Limited shall attempt to raise equity, mezzanine and debt financing for us from investors and banks located outside the United States. Please see “PLAN OF DISTRIBUTION – The Offering – Jasper Corporate Finance Limited.” We expect that we will incur additional expenses to facilitate such an international financing. In addition, it may be more difficult for you to pursue your legal remedies against foreign investors or lenders.

We will be subject to the laws of foreign countries; if we do not wholly comply with such laws, we could be subject to penalties or fines.

We expect to be subject to the laws of the countries where Jasper Corporate Finance Limited attempts to obtain debt and equity financing for us. While we intend to hire local counsel in such countries, if for any reason, we do not or are unable to comply with applicable foreign law, we may be subject to adverse legal consequences, including but not limited to penalties and fines, which could reduce the value of your investment.

If we decide to spend equity proceeds and begin plant construction before we have fulfilled all of the loan commitment conditions, signed binding loan agreements or received loan proceeds, we may be unable to close the loan and you may lose all of your investment.

If we sell the aggregate minimum number of units prior to September 26, 2009 and satisfy the other conditions of releasing funds from escrow, including our receipt of a written debt financing commitment, we may decide to begin spending the equity proceeds to begin plant construction or for other project-related expenses. If, after we begin spending equity proceeds, we are unable to close the loan, we may have to seek another debt financing source or abandon the project. If that happens, you could lose some or all of your investment.

If we successfully release funds from escrow but are unable to close our loan, we may wait to start spending the funds until we close on debt financing and may decide to hold your investment while we search for alternative debt financing sources, which means your investment will continue to be unavailable to you and may decline in value.

We must obtain a written debt financing commitment prior to releasing funds from escrow. However, a debt financing commitment does not guarantee that we will be able to successfully close the loan. If we fail to close the loan, we may choose to seek alternative debt financing sources. While we search for alternative debt financing, we may continue to hold your investment in our regular depositary institution account. Your investment will continue to be unavailable while we search for alternative debt financing and might decline in value while we search for the debt financing necessary to complete our project.

Future loan agreements with lenders may hinder our ability to operate the business by imposing restrictive loan covenants, which could delay or prohibit us from making cash distributions to our unit holders.

Our debt load necessary to implement our business plan will result in substantial debt service requirements. Our debt load and service requirements could have important consequences which could hinder our ability to operate, including our ability to:

| | Ø | Incur additional indebtedness; |

| | Ø | Make capital expenditures or enter into lease arrangements in excess of prescribed thresholds; |

| | Ø | Make distributions to unit holders, or redeem or repurchase units; |

| | Ø | Make certain types of investments; |

| | Ø | Create liens on our assets; |

| | Ø | Utilize the proceeds of asset sales; and |

| | Ø | Merge or consolidate or dispose of all, or substantially all, of our assets. |

In the event that we are unable to pay our debt service obligations, our creditors could force us to either reduce or eliminate distributions to unit holders (even for tax purposes), or reduce or eliminate needed capital expenditures. It is possible that we could be forced to sell assets, seek to obtain additional equity capital or refinance or restructure all or a portion of our debt. In the event that we would be unable to refinance our indebtedness or raise funds through asset sales, sales of equity or otherwise, our ability to operate our plants would be greatly affected and we may be forced to liquidate.

Risks Related to the Offering

If we are unable to sell the minimum number of units, the offering will fail and your investment will be returned to you with nominal interest.

We may not be able to sell the minimum amount of units required to close on this offering. We must sell at least $253,650,000 worth of units by September 26, 2009 to close the offering. If we are unable to close the offering, your money will be returned with the nominal interest earned during the time it was in escrow. We do not expect the termination date to be later than September 26, 2009.

We are not experienced in selling securities and as of the current time no one has agreed to purchase any units that we cannot sell ourselves, which may result in the failure of this offering.

We are making this offering as a self-written best efforts offering and if we are unsuccessful in selling the minimum aggregate offering amount by September 26, 2009, we will be required to return your investment. We have no firm commitment from any prospective buyer to purchase our units and there can be no assurance that the offering will be successful. We plan to offer the units directly to investors by registering our securities in the states of Georgia, Florida, North Carolina, South Carolina, New York, Maryland and Virginia. We expect to hold investor meetings in each of these states. While we will use a placement agent in North Carolina, Virginia and Maryland and for foreign investors; our engagement of these placement agents is on a best efforts basis. We may also contract with other placement agents to assist us in selling securities in other states as well. Most of our directors have significant responsibilities in their primary occupations in addition to trying to raise capital. All of our directors have full-time outside employment. See “BUSINESS EXPERIENCE OF OUR DIRECTORS AND OFFICERS.”

Each of our directors involved in the sale of our units believes that he/she will be able to devote a significant portion (10-20 hours per week) of his or her time to the offering. Nonetheless, the time that our directors spend on our activities may prove insufficient to result in a successful equity offering. These individuals have no broker-dealer experience or any experience with public offerings of securities. There can be no assurance that our directors will be successful in securing investors for the offering.

Proceeds of this offering are subject to promissory notes due after the offering is closed and investors unable to pay the 90% balance on their investment may have to forfeit their 10% cash deposit and may be subject to other legal consequences.

As much as 90% of the total offering proceeds of this offering could be subject to promissory notes that may not be due until after the offering is closed. If we sell the minimum number of units by September 26, 2009, we will be able to break escrow without closing the offering. The offering will be closed upon the earlier of (i) when our board of directors decides that we will no longer accept subscriptions from potential investors and (ii) September 26, 2009. The promissory note will become due within 20 days after the subscriber’s receipt of written notice from East Coast Ethanol.

The success of our offering will depend on the investors’ ability to pay the outstanding balances on these promissory notes. If we wait to call the balance on the notes for a significant period of time after we sell the minimum, the risk of nonpayment on the notes may increase. We intend to retain the initial payment and to seek damages from any investor who defaults on the promissory note obligation. This means that if you are unable to pay the 90% balance of your investment within 20 days of our notice, you may have to forfeit your 10% cash deposit. In addition, we may pursue collection of the balance by any legal means including judgment on promissory note, recovery of costs incurred including attorneys’ fees and interest at the rate of 12% per annum from the due date. Accordingly, the success of the offering depends on the payment of these amounts by the obligors.

Investors will not be allowed to withdraw their investment, which means that you should invest only if you are willing to have your investment unavailable to you for an indefinite period of time.

Investors will not be allowed to withdraw their investments for any reason, absent a rescission offer tendered by East Coast Ethanol. We do not anticipate making a rescission offer. You should only invest in us if you are willing to have your investment be unavailable until we break escrow, which could be up to one year after the effective date of our registration statement. If we are able to close the offering, we will convert your cash investment into units of East Coast Ethanol. There are significant transfer restrictions on our units. You will not have a right to withdraw from East Coast Ethanol and demand a cash payment from us. Therefore, your investment may be unavailable to you for an indefinite period of time.

The initial investment by our promoters is lower than the amount required by NASAA, and in the event that our project is unsuccessful, losses of investors from this offering could be proportionately greater than those of our promoters.

According to NASAA’s Statement of Policy regarding Equity Investment, investments by promoters in developmental stage companies should equal ten percent of the first $1,000,000 of the aggregate public offering, seven percent of the next $500,000, five percent of the next $500,000, and two and one-half percent of the balance over $2,000,000. In our case, this would require investment by our promoters of approximately $15,860,000. Our promoters invested approximately $9,800,000 in East Coast Ethanol, LLC. Consequently, our promoters’ investment is substantially lower than the amount required by NASAA. Our promoters have lower at-risk amounts that promoters of developmental stage companies typically have and in the event our project is unsuccessful, losses of investors from this offering could be proportionally higher.

Risks Related to the Units

There has been no independent valuation of the units, which means that the units may be worth less than the purchase price.

The per unit purchase price has been determined by us without independent valuation of the units. We established the offering price based on our estimate of capital and expense requirements, not based on perceived market value, book value, or other established criteria. We did not obtain an independent appraisal opinion on the valuation of the units. The units may have a value significantly less than the offering prices and there is no guarantee that the units will ever obtain a value equal to or greater than the offering price.

No public trading market exists for our units and we do not anticipate the creation of such a market, which means that it will be difficult for you to liquidate your investment.

There is currently no established public trading market for our units and an active trading market will not develop despite this offering. To maintain partnership tax status, you may not trade the units on an established securities market or readily trade the units on a secondary market (or the substantial equivalent thereof). We do not intend to apply for listing of the units on any national securities exchange or on the NASDAQ Stock Market. As a result, you will not be able to readily sell your units.

We have placed significant restrictions on transferability of the units, limiting an investor’s ability to withdraw from the company.

The units are subject to substantial transfer restrictions pursuant to our operating agreement. In addition, transfers of the units may be restricted by state securities laws. As a result, you may not be able to liquidate your investment in the units and, therefore, may be required to assume the risks of investment in us for an indefinite period of time. See “SUMMARY OF OUR OPERATING AGREEMENT.” To help ensure that a secondary market does not develop, our operating agreement prohibits transfers without the approval of our board of directors. The board of directors will not approve transfers unless they fall within “safe harbors” contained in the publicly-traded partnership rules under the tax code, which include, without limitation, the following:

| | Ø | transfers by gift to the member’s spouse or descendants; |

| | Ø | transfer upon the death of a member; |

| | Ø | transfers between family members; and |

| | Ø | transfers that comply with the “qualifying matching services” requirements. |

Please see “PUBLICLY TRADED PARTNERSHIP RULES.”

Public investors will experience immediate and substantial dilution as a result of this offering.

Our seed capital investors paid a purchase price of $5,000 per unit, which is substantially less per unit for our membership units than the current public offering price of $15,000 per unit. Accordingly, if you purchase units in this offering, you will experience immediate and substantial dilution of your investment. Based upon the issuance and sale of the maximum number of units (39,455) at the public offering price of $15,000 per unit, you will incur immediate dilution of $1,064.20 per unit or 7.09% in the net tangible book value per unit if you purchase units in this offering. Based upon the issuance and sale of the minimum number of units (16,910) at the public offering price of $15,000 per unit, you will incur immediate dilution of $2,321.00 per unit or 15.47% in the net tangible book value per unit if you purchase units in this offering.

There is no assurance that an investor will receive cash distributions, which could result in an investor receiving little or no return on his or her investment.

Distributions are payable at the sole discretion of our board of directors, subject to the provisions of the Delaware Limited Liability Company Act, our operating agreement and the requirements of our creditors. We do not know the amount of cash that we will generate, if any, once we begin operations. Cash distributions are not assured, and we may never be in a position to make distributions. See “DESCRIPTION OF MEMBERSHIP UNITS.” Our board may elect to retain future profits to provide operational financing for the plants, debt retirement and possible plant expansion or the construction of additional plants. This means that you may receive little or no return on your investment and you will be unable to liquidate your investment due to transfer restrictions and lack of a public trading market. This could result in the loss of your entire investment.

These units will be subordinate to company debts and other liabilities, resulting in a greater risk of loss for investors.

The units are unsecured equity interests and are subordinate in right of payment to all our current and future debt. In the event of our insolvency, liquidation, dissolution or other winding up of our affairs, all of our debts, including winding-up expenses, must be paid in full before any payment is made to the holders of the units. In the event of our bankruptcy, liquidation, or reorganization, all units will be paid ratably with all our other equity holders, and there is no assurance that there would be any remaining funds after the payment of all our debts for any distribution to the holders of the units. As of June 30, 2008, our most recent financial statements, East Coast Ethanol did not have any debt. We do not anticipate having any debt until we execute a debt financing loan in an amount ranging from approximately $269,875,000 to $608,050,000. Once we have executed a debt financing loan, our membership units will be subordinated in right of payment to all of East Coast Ethanol’s debt.

The presence of members holding 25% or more of the outstanding units is required to take action at a meeting of our members, which could result in members not being able to take actions which are in the best interest of the Company.

In order to take action at a meeting, a quorum of members holding at least 25% of the outstanding units must be represented in person, by proxy or by mail ballot. See “SUMMARY OF OUR OPERATING AGREEMENT.” Assuming a quorum is present, members take action by a vote of the majority of the units represented at the meeting and entitled to vote on the matter. The requirement of a 25% quorum protects the company from actions being taken when less than 25% of the members have not considered the matter being voted upon. The requirement of a 25% quorum also means that members will not be able to take actions which may be in the best interests of the Company if we cannot secure the presence in person, by proxy, or by mail ballot of members holding 25% or more of the outstanding units.

After the plants are substantially operational, our operating agreement provides for staggered terms for our elected directors, meaning the replacement of certain directors will be difficult.

The terms of our initial directors expire at the first annual meeting following substantial completion of the ethanol plants which is not expected until winter 2010. At that time, our members will elect at least four directors for staggered three-year terms. Because these directors will serve on the board for staggered terms, it will be difficult for our members to replace such directors. In that event, your only recourse to replace these directors would be through an amendment to our operating agreement, which could be difficult to accomplish.

Risks Related to Construction of the Ethanol Plants

We will depend on Fagen, Inc. and ICM, Inc. to design and build our ethanol plants and their failure to perform could force us to abandon our business, hinder our ability to operate profitably or decrease the value of your investment.

We expect to be heavily dependent upon Fagen, Inc. and ICM, Inc. to design and build the plants. We have entered into letters of intent with Fagen for three of our proposed plants. We anticipate that Fagen, Inc. will serve as our general contractor and that Fagen, Inc. will engage ICM, Inc. to provide design and engineering services. If Fagen, Inc. terminates its relationship with us after initiating construction, there is no assurance that we would be able to obtain a replacement general contractor. Any such event may force us to abandon our business.

We expect to solely rely on Fagen, Inc. and ICM, Inc. to supply all of the technology necessary for the construction of our plants and the production of fuel-grade ethanol and distillers grains and we expect they will either own this technology or obtain a license to utilize it.

We expect to be dependent upon Fagen, Inc. and/or ICM, Inc. for all of the technology used in our plants that relates to construction of the plants and the plants’ production of fuel-grade ethanol and distillers grains. We expect that Fagen, Inc. or ICM, Inc. will either own the technology or obtain a license necessary for its use. If either Fagen, Inc. or ICM, Inc. fails to provide the necessary technology, we may not be able to build our plants or successfully operate them.

Construction delays could result in devaluation of our units if our production and sale of ethanol and its co-products are delayed.

We currently expect our plants to be complete and operational by winter 2010; however, construction projects often involve delays in obtaining permits, delays due to weather conditions and other unforeseen events. Further, Fagen, Inc.’s involvement in the construction of a number of other plants while constructing our plants could cause delays in our construction schedule. Also, any changes in interest rates or the credit environment or any changes in political administrations at the federal, state or local level that result in policy changes toward ethanol or this project, could also cause construction and operation delays. If it takes longer to construct the plants than we anticipate, it would delay our ability to generate revenue and make it difficult for us to meet our debt service obligations which could reduce the value of your units.

Fagen, Inc. and ICM, Inc. may have current or future commitments to design and build other ethanol manufacturing facilities ahead of our plants and those commitments could delay construction of our plants and our ability to generate revenues.

We do not know how many ethanol plants Fagen, Inc. and ICM, Inc. have currently contracted to design and build. It is possible that Fagen, Inc. and ICM, Inc. have outstanding commitments to other facilities that may cause the construction of our plants to be delayed. We expect that Fagen, Inc. and ICM, Inc. will continue to contract with new facilities for plant construction and with currently operating facilities for expanding them. These current and future building commitments may reduce the available resources of Fagen, Inc. and ICM, Inc. to such an extent that construction of our plants is significantly delayed. If this occurs, our ability to generate revenue will also be delayed and the value of your investment will be reduced.

Defects in plant construction could result in devaluation of our units if our plants do not produce ethanol and its co-products as anticipated, or could put our plants at an increased risk for fire or an explosion.

There is no assurance that defects in materials and/or workmanship in the plants will not occur. Such defects could delay the commencement of operations of the plants, or, if such defects are discovered after operations have commenced, could cause us to halt or discontinue the plants’ operations. Halting or discontinuing plant operations could delay our ability to generate revenues and reduce the value or your units. In addition, defects in materials or workmanship could put us at an increased risk of loss due to fire or an explosion. A loss due to fire or an explosion could cause us to slow or halt production which could reduce the value of your investment.

The plant sites may have unknown environmental problems that could be expensive and time consuming to correct, which may delay or halt plant construction and delay our ability to generate revenue.

While we will examine each proposed plant site in great detail, we cannot guarantee that the plant sites will be free of any environmental problems. If there are any environmental problems related to any of our properties where our plants will be constructed, our operations could be adversely affected which could lead to a loss of your investment.

We will need to obtain numerous permits before beginning operations and failure to obtain these permits would prevent operation of the plants.

We will require numerous permits before we can commence operations of our ethanol plants. If we are unable to obtain their permits in a timely fashion or are unable to obtain them altogether, it is likely to lead to a loss of your investment. There can be no assurances that these permits will be granted to us. If these permits are not granted, then our plants may not be allowed to operate.

We will heavily rely on our project management consultant, C. Thompson & Associates (“Thompson”), to assist us in the development and management of our projects and the implementation of our business strategy and any loss of this relationship could harm our performance.

We have a project management and consulting agreement with Thompson and anticipate that it will play a very important role in the success of our projects. Thompson will be assisting us with all aspects of our project from helping us obtain the requisite permits and recruiting personnel for our plants to identifying potential lenders. Please see “PLANT SITE INFORMATION – Management Consultants – C. Thompson & Associates.” Any loss of relationship with Thompson could adversely affect our performance and could lead to a loss of your investment.

Risks Related to the Production of Ethanol

Our financial performance will critically depend on corn and natural gas prices and market prices for ethanol and distillers dried grains, and the value of your investment in us will be directly affected by changes in these market prices.

Our results of operations and financial condition will be significantly affected by the cost and supply of corn and natural gas. Changes in the price and supply of corn and natural gas are subject to and determined by market forces over which we have no control. Corn supplies, as with most other crops, can be subject to interruption or shortages caused by weather, transportation difficulties, disease and other various planting, growing or harvesting problems. A significant reduction in the quantity of corn harvested due to these factors could result in increased corn costs, which will reduce our profitability and the value of your units. Competition for corn origination may increase our costs of corn and harm our financial performance and the value of your investment. Additionally, any hedging strategies which we employ may not effectively protect us against price volatility.

We will rely on third parties for our supply of natural gas, which is consumed in the production of ethanol. The prices for and availability of natural gas are subject to volatile market conditions. These market conditions often are affected by factors beyond our control such as higher prices resulting from colder than average weather conditions, overall economic conditions and foreign and domestic governmental regulations. Significant disruptions in the supply of natural gas could impair our ability to manufacture ethanol for our customers. Furthermore, increases in natural gas prices or changes in our natural gas costs relative to natural gas costs paid by competitors may adversely affect our results of operations and financial condition. Please see “DESCRIPTION OF BUSINESS” for a discussion on natural gas prices.

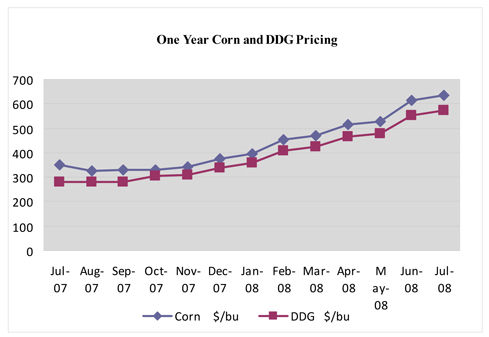

Finally, our revenues will be greatly affected by the price at which we can sell our ethanol and distillers grains. These prices can be volatile as a result of a number of factors. These factors include the overall supply and demand, the price of gasoline, level of government support, and the availability and price of competing products. For instance, the price of ethanol tends to increase as the price of gasoline increases, and the price of ethanol tends to decrease as the price of gasoline decreases. Any lowering of gasoline prices will likely also lead to lower prices for ethanol, which may decrease our ethanol sales and reduce revenues, causing a reduction in the value of your investment. Similarly, a decrease in the price of distillers grains could negative impact our operations. Please see “DESCRIPTION OF BUSINESS” for charts of prices of corn, ethanol and distillers grains.

We will be especially sensitive to corn prices since we will have to import corn from the Midwest and incur transportation expenses in this regard.

Since our ethanol plants are not likely to be located near an abundant supply of corn, we will have to import corn from the Midwest. Thus, our costs for procuring corn will be higher because of costs involved in transporting corn from the Midwest to our ethanol plants rendering us especially sensitive to any increase in corn prices.

Growth in the sale and distribution of ethanol is dependent on the changes in and expansion of related infrastructure which may not occur on a timely basis, if at all, and our ability to operate profitably could be adversely affected by infrastructure disruptions and your investment could lose value as a result.

Substantial development of infrastructure by persons and entities outside our control will be required for our operations and the ethanol industry generally, to grow. Areas requiring expansion include, but are not limited to:

| | Ø | Expansion of refining and blending facilities to handle ethanol; |

| | Ø | Growth in service stations equipped to handle ethanol fuels; |

| | Ø | Growth in the fleet of flexible fuel vehicles capable of using E85 fuel; |

| | Ø | Additional storage facilities for ethanol; |

| | Ø | Additional rail capacity; and |

| | Ø | Increase in truck fleets capable of transporting ethanol within localized markets. |

Substantial investments required for these infrastructure changes and expansions may not be made or they may not be made on a timely basis. Any delay or failure in making the changes in or expansion of infrastructure could hurt the demand or prices for our products, impede our delivery of our products, impose additional costs on us or otherwise harm our financial performance and reduce the value of your investment. Our business will depend on the continuing availability of infrastructure and any infrastructure disruptions could significantly harm our ability to generate revenues and operate profitably thereby causing your investment to lose value.

We will depend on others for sales of our products, which may place us at a competitive disadvantage and reduce profitability.

We expect to hire a third-party marketing firm to market all of the ethanol and most of the distillers grains we plan to produce. As a result, we expect to be dependent on the ethanol broker and distillers grains broker we engage. There is no assurance that we will be able to enter into contracts with any ethanol broker or distillers grains broker on terms that are favorable to us. If the ethanol or distillers grains broker breaches the contract or does not have the ability, for financial or other reasons, to market all of the ethanol or distillers grains we produce, we will not have any readily available means to sell our products. Our lack of a sales force and reliance on third parties to sell and market our products may place us at a competitive disadvantage. Our failure to sell all of our ethanol and distillers dried grains may result in less income from sales, reducing our revenue stream, which could reduce the value of your investment.

Changes and advances in ethanol production technology could require us to incur costs to update our ethanol plants or could otherwise hinder our ability to compete in the ethanol industry or operate profitably.

Advances and changes in the technology of ethanol production are expected to occur. Such advances and changes may make the ethanol production technology installed in our plants less desirable or obsolete. These advances could also allow our competitors to produce ethanol at a lower cost than us. If we are unable to adopt or incorporate technological advances, our ethanol production methods and processes could be less efficient than our competitors, which could cause our plants to become uncompetitive or completely obsolete. If our competitors develop, obtain or license technology that is superior to ours or that makes our technology obsolete, we may be required to incur significant costs to enhance or acquire new technology so that our ethanol production remains competitive. Alternatively, we may be required to seek third-party licenses, which could also result in significant expenditures. We cannot guarantee or assure you that third-party licenses will be available or, once obtained, will continue to be available on commercially reasonable terms, if at all. These costs could negatively impact our financial performance by increasing our operating costs and reducing our net income, both of which could reduce the value of your investment.

Our ethanol plants will require a significant supply of water. If we are unable to obtain the water required by our plants on a cost-effective basis, our profitability could be adversely affected which could lead to the loss of your investment.

While a considerable amount of the water required in our ethanol plants can be recycled, we will require substantial amounts of fresh water. If we are unable to obtain fresh water cost-effectively because of droughts or other adverse weather conditions, our profitability could be reduced and we may even have to abandon our project, which could lead to a loss of your investment.

Risks Related to the Ethanol Industry

New ethanol plants under construction or decreases in the demand for ethanol may result in excess U.S. production capacity, causing ethanol prices to decline and the value of your investment to be reduced.

Excess capacity may also result from decreases in the demand for ethanol, which could result from a number of factors, including regulatory developments and reduced U.S. gasoline consumption. Reduced gasoline consumption could occur as a result of increased prices for gasoline or crude oil, which could cause businesses and consumers to reduce driving or acquire vehicles with more favorable gasoline mileage. There is some evidence that this has occurred in the recent past as U.S. gasoline prices have increased.

The Renewable Fuels Standard (“RFS”) which is driving ethanol demand has already been met until 2012.

The RFS is a key driver of ethanol demand; however, there is already enough ethanol being produced to meet the 2012 RFS of 7.5 billion gallons. While the newly enacted Energy Independence and Security Act of 2007 has increased the RFS to 20.5 billion gallons in 2015 and 36 billion gallons in 2022, starting 2009, a substantial part of the increase in the RFS must come from advanced biofuels such as cellulosic ethanol and ethanol derived from waste materials such as crop residue and animal waste. Since we expect to produce our ethanol from corn, we anticipate that the increase in the RFS will not significantly increase the demand for our ethanol. Thus, we believe that an increase in voluntary private usage will be essential for our long-term sustainability. It is our position that unless ethanol demand from other sources increases appreciably in the upcoming years, we might be unable to sell our ethanol which would substantially reduce the value of your investment.

The ethanol industry is a feedstock limited industry. An inadequate supply of corn, our primary feedstock, could cause the price of corn to increase and threaten the viability of our plants and cause you to lose some or all of your investment.

The number of ethanol manufacturing plants either in production or in the planning or construction phases continues to increase at a rapid pace. This increase in the number of ethanol plants will affect both the supply and the demand for corn. As more plants develop and go into production there may not be an adequate supply of feedstock to satisfy the demand of the ethanol industry and the livestock industry, which uses corn in animal rations. Consequently, the price of corn may rise to the point where it threatens the viability of our project, or significantly decreases the value of your investment or threatens your investment altogether. In recent times, the price of corn has increased substantially. Please see “PLAN OF OPERATIONS UNTIL START-UP OF ETHANOL PLANTS.”

Consumer resistance to the use of ethanol based on the belief that ethanol is expensive, adds to air pollution, harms engines, reduces fuel efficiency and takes more energy to produce than it contributes may affect the demand for ethanol which could affect our ability to market our product and reduce the value of your investment.

Media reports in the popular press indicate that some consumers believe that use of ethanol will have a negative impact on gasoline prices at the pump. Many also believe that ethanol adds to air pollution and harms car and truck engines. It is also widely reported that ethanol products such as E-85 significantly reduce fuel economy and cause overall fuel costs to substantially increase. Researchers have published studies reporting that the production of ethanol actually uses more fossil energy, such as oil and natural gas, than the amount of ethanol that is produced. These consumer beliefs could potentially be widespread. If consumers choose not to buy ethanol, it would affect the demand for the ethanol we produce which could lower demand for our product and negatively affect our profitability.

Competition from the advancement of alternative fuels may lessen the demand for ethanol and negatively impact our profitability, which could reduce the value of your investment.

Alternative fuels, gasoline oxygenates and ethanol production methods are continually under development. A number of automotive, industrial and power generation manufacturers are developing alternative clean power systems using fuel cells or clean burning gaseous fuels. Like ethanol, the emerging fuel cell industry offers a technological option to address increasing worldwide energy costs, the long-term availability of petroleum reserves and environmental concerns. Fuel cells have emerged as a potential alternative to certain existing power sources because of their higher efficiency, reduced noise and lower emissions. Fuel cell industry participants are currently targeting the transportation, stationary power and portable power markets in order to decrease fuel costs, lessen dependence on crude oil and reduce harmful emissions. If the fuel cell and hydrogen industries continue to expand and gain broad acceptance, and hydrogen becomes readily available to consumers for motor vehicle use, we may not be able to compete effectively. This additional competition could reduce the demand for ethanol, which would negatively impact our profitability, causing a reduction in the value of your investment.