November 19, 2019

VIA EDGAR AND OVERNIGHT DELIVERY

U.S. Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, DC 20549

Attention: Kathleen Collins, Accounting Branch Chief

Rebekah Lindsey, Staff Accountant

Re: Zuora, Inc.

Form 10-K for Fiscal Period Ended January 31, 2019

Filed April 18, 2019

File No. 001-38451

Ladies and Gentlemen:

We are submitting this letter on behalf of Zuora, Inc. (the “Company”) in response to comments from the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) received by electronic mail on October 27, 2019 that relate to the Company’s Form 10-K for the fiscal period ended January 31, 2019, filed with the Commission on April 18, 2019 (File No. 001‑34511). The numbered paragraphs below correspond to the numbered comments in the Staff’s letter and the Staff’s comments are presented in bold italics.

Form 10-K for Fiscal Period Ended January 31, 2019

Risk Factors

Provisions in our charter documents and under Delaware law..., page 34

1.We note the revised disclosures provided in your July 31, 2019 Form 10-Q in response to prior comment 1. In future filings, please further revise to clarify that shareholders can file claims in either state or federal court even when the Delaware Chancery Court has jurisdiction over a claim pursuant to the Securities Act of 1933. Clearly disclose whether your provision applies to claims under the Exchange Act and if so, clarify that those claims may only be brought in federal court. Lastly, disclose that stockholders will not be deemed to have waived the company’s compliance with the federal securities laws and the rules and regulations thereunder.

United States Securities and Exchange Commission

Division of Corporation Finance

November 19, 2019

Page 2

Response:

The Company acknowledges the Staff's comment and, in future filings, beginning with the Company’s Form 10-Q for the fiscal period ended October 31, 2019, will include clarifying disclosure as requested by the Staff. The below reflects proposed revised disclosures with deleted text shown in strikethrough and added or moved text shown as underlined:

“In addition, our restated certificate of incorporation provides that, to the fullest extent permitted by law, the Court of Chancery of the State of Delaware is the exclusive forum for: any derivative action or proceeding brought on our behalf; any action asserting a breach of fiduciary duty; any action asserting a claim against us arising pursuant to the Delaware General Corporation Law, or (DGCL), our restated certificate of incorporation, or our restated bylaws; or any action asserting a claim against us that is governed by the internal affairs doctrine. This choice of forum provision does not apply to claims that are vested in the exclusive jurisdiction of a court or forum other than the Court of Chancery of the State of Delaware, or for which the Court of Chancery of the State of Delaware does not have subject matter jurisdiction. For instance, the provision would not preclude the filing of claims brought to enforce any liability or duty created by the Securities Act of 1933, as amended (the Securities Act) or the Exchange Act, or the rules and regulations thereunder in federal court.

The choice of forum provision in our restated certificate of incorporation may limit a stockholder’s ability to bring a claim in a judicial forum that it finds favorable for disputes with us or any of our directors, officers, or other employees, which may discourage lawsuits with respect to such claims. Alternatively, if a court were to find the choice of forum provision contained in our restated certificate of incorporation to be inapplicable or unenforceable in an action, we may incur additional costs associated with resolving such action in other jurisdictions, which could harm our business, operating results, and financial condition.

Section 27 of the Exchange Act creates exclusive federal jurisdiction over all claims brought to enforce any duty or liability created by the Exchange Act or the rules and regulations thereunder. Section 22 of the Securities Act of 1933, as amended (the Securities Act), creates concurrent jurisdiction for federal and state courts over all claims brought to enforce any duty or liability created by the Securities Act or the rules and regulations thereunder. The exclusive forum provision will not apply to suits brought to enforce any duty or liability created by the Exchange Act or the Securities Act. Accordingly, actions by our stockholders to enforce any duty or liability created by (i) the Exchange Act or the rules and regulations thereunder must be brought in federal court and (ii) the Securities Act or the rules and regulations thereunder can be brought in either federal or state court. Our stockholders will not be deemed to have waived our compliance with the federal securities laws and the regulations promulgated thereunder.”

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Key Operational and Financial Metrics, page 41

United States Securities and Exchange Commission

Division of Corporation Finance

November 19, 2019

Page 3

2.You state in your response to prior comment 2 that subscription billings on a trailing 12-month basis will correlate to your long-term subscription revenue growth rate over time, which you believe is a more reliable measure to manage your business and assess financial performance. Also, in your Q2 2020 earnings call you state that in order to normalize the fluctuations in quarterly billings, you generally look at billings growth over a longer period of time. Please tell us how management uses these longer term billings measures in managing your business and revise to include a quantified discussion of such measures in future filings, as applicable. Refer to Section III.B.1 of SEC Release No. 33-8350.

Response:

The Company acknowledges the Staff's comment and advises the Staff that management does not use billings or long-term billings as a key metric in operating its business, measuring its performance, identifying trends, formulating business plans, or making strategic decisions.

In the Company's October 4, 2019 response to the Staff's prior comment 2, the Company noted that subscription billings growth on a trailing 12-month basis will correlate to its long-term subscription revenue growth rate over time. While these two metrics correlate over the long-term, the Company tracks and discloses long-term subscription revenue growth because it believes it to be the better and more reliable measure to manage its business.

Billings fluctuate period over period due to variables that tend to skew the data and limit the value of the measure. These variables include (i) the dates on which customers choose to renew or purchase additional features (“upsell”) and (ii) the mix of payment terms (e.g. monthly, quarterly, or annually). When a customer chooses to upsell, they can choose to re-start their entire subscription term from that upsell date, which can significantly skew the correlation between billings and revenue in the short-term. For example, if a customer's natural subscription term runs from January 1 to December 31, but the customer decides to purchase additional features during that term on June 15th, the customer may either: (i) incrementally purchase that specific feature for the remaining term, or (ii) re-start their entire subscription with a new subscription start date of June 15th. The overall billings for the period will differ significantly based on which approach the customer chooses. In addition, unlike many other companies that sell their products and services on a subscription basis on standardized terms and conditions, the Company’s products and services are often sold to large enterprises and often involve enterprise-wide adoption, which often results in a complex selling process. Due to this, the Company's billing terms often vary significantly from customer to customer, which has a significant impact on the billings calculation. Some customers are on annual billing terms, while others are billed monthly or quarterly.

The Company further advises the Staff that the billings information discussed on its prior earnings calls can be determined with information readily available from the financial information the Company discloses in its earnings press release and periodic reports on Form 10-Q or Form 10-K, and is equal to the sum of subscription revenue plus the change in deferred revenue, minus the change in contract asset. Accordingly, this metric does not provide any new information to investors that they would not be able to obtain on their own.

In light of the reasons described above, the Company advises the Staff that it does not intend to disclose billings, including longer term billings measures, in its future periodic filings with the Commission.

United States Securities and Exchange Commission

Division of Corporation Finance

November 19, 2019

Page 4

Results of Operations

Fiscal Years Ended January 31, 2019 and 2018

Revenue, page 45

3.We note your response to prior comment 3. Please explain further why you believe it would be misleading to quantify revenue attributable to new customers as a percentage of total subscription revenue growth for periods longer than three months. In this regard, tell us why you only contemplate revenue from new customers in one quarter when calculating the percentage growth for the longer six, nine or twelve month periods in the denominator. Please provide further support as to why this disclosure is misleading for any period other than quarterly periods or revise to include such information for each period in which you provide a results of operations discussion.

Response:

The Company acknowledges the Staff's comment and, in future filings, beginning with its Form 10-Q for the fiscal period ended October 31, 2019, the Company will quantify the factors driving the change in subscription revenue for both quarter-to-date and year-to-date periods by providing the amount of subscription revenue growth relating to new customers. The Company revised its method of calculating subscription revenue from new customers for the year-to-date period to better align with the change in revenue over the comparable period.

The revised calculation sums the subscription revenue recognized from new customers for each discrete quarter within the year-to-date period, which is calculated as subscription revenue recognized from new customers acquired in the 12 months prior to each respective quarter end. This is illustrated in the revised disclosure below of the revenue discussion within Management's Discussion and Analysis of the Company's previously filed Form 10-K for the fiscal year ended January 31, 2019:

"

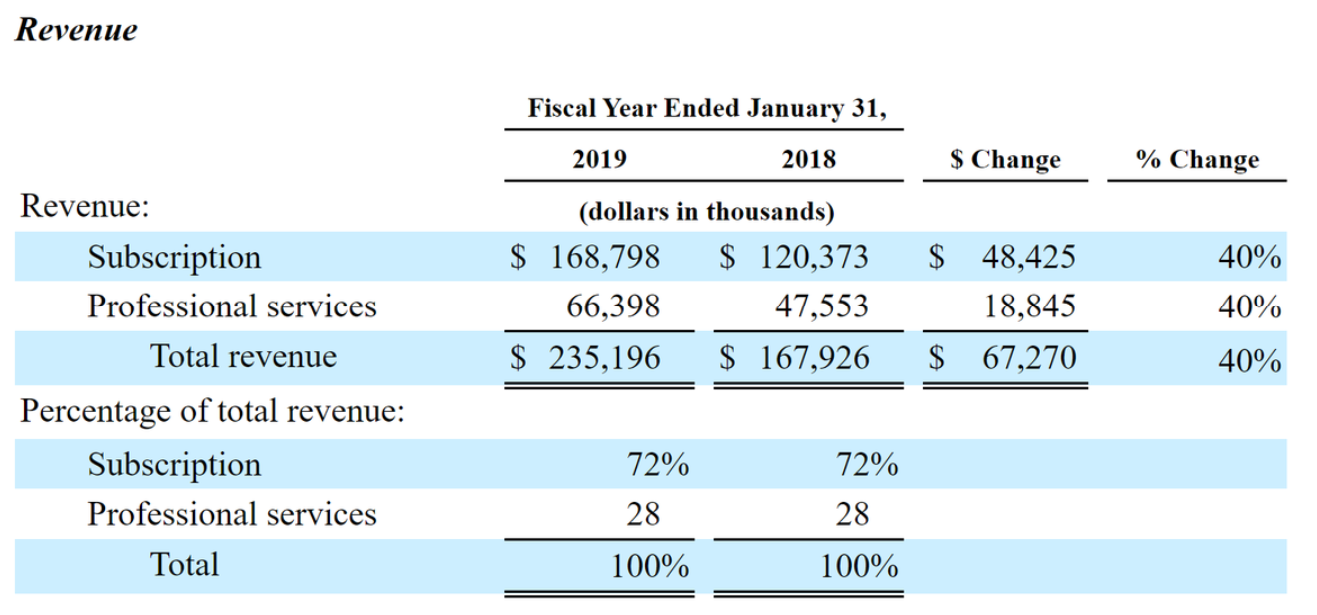

Subscription revenue increased by $48.4 million, or 40%, for fiscal 2019 compared to fiscal 2018. The increase in subscription revenue was primarily attributable to growth in our

United States Securities and Exchange Commission

Division of Corporation Finance

November 19, 2019

Page 5

customer base, including both new and existing customers. Nnew customers contributed approximately $21.6 million of the increase compared to last year whileacquired during the period and an increase in usage and sales of additional products to our existing customers contributed the remainder. We calculate subscription revenue from new customers by adding the revenue recognized from new customers acquired in the 12 months prior to each discrete quarter within the year-to-date period. Additionally, aAs a result of our acquisition of Leeyo in May 2017, we recognized more subscription revenue in fiscal 2019 compared to fiscal 2018 due to the impact of purchase accounting from the acquisition and recognizing a full year of revenue from Zuora RevPro.

Professional services revenue increased by $18.8 million, or 40%, for fiscal 2019 compared to fiscal 2018, primarily due to increased revenue from customer deployments of our products."

* * *

United States Securities and Exchange Commission

Division of Corporation Finance

November 19, 2019

Page 6

Should the Staff have additional questions or comments regarding the foregoing, please do not hesitate to contact me at (650) 335-7613.

Sincerely,

/s/ Ran D. Ben-Tzur

Ran D. Ben-Tzur

cc:

Tien Tzuo, Chairman of the Board of Directors and Chief Executive Officer

Tyler R. Sloat, Chief Financial Officer

Jennifer W. Pileggi, Senior Vice President, General Counsel, and Secretary

Zuora, Inc.

Gordon K. Davidson, Esq.

Fenwick & West LLP