2019 Annual Shareholders’ Meeting May 23, 2019

Safe Harbor Statement This presentation (and oral statements made regarding the subject of this presentation) contains certain “forward- looking statements” that are based on various facts and derived utilizing numerous important assumptions and are subject to known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements include information about our future financial performance, business and growth strategy, projected plans and objectives, as well as projections of macroeconomic and industry trends, which are inherently unreliable due to the multiple factors that impact economic trends, and any such variations may be material. Statements preceded by, followed by or that otherwise include the words “believes,” “expects,” “anticipates,” “intends,” “projects,” “estimates,” “plans” and similar expressions or future or conditional verbs such as “will,” “should,” “would,” “may” and “could” are generally forward-looking in nature and not historical facts, although not all forward-looking statements include the foregoing. Forward-looking statements are based on management’s current expectations and involve risks and uncertainties that could cause actual results to differ materially from the Company’s historical results or those described in our forward-looking statements. Pacific City Financial Corporation disclaims any obligation to update any forward-looking statement. This presentation contains certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of non-GAAP financial measures to GAAP financial measures are provided at the end of this presentation. Numbers in the presentation may not sum due to rounding. 2 your Partner • Choice • Bank

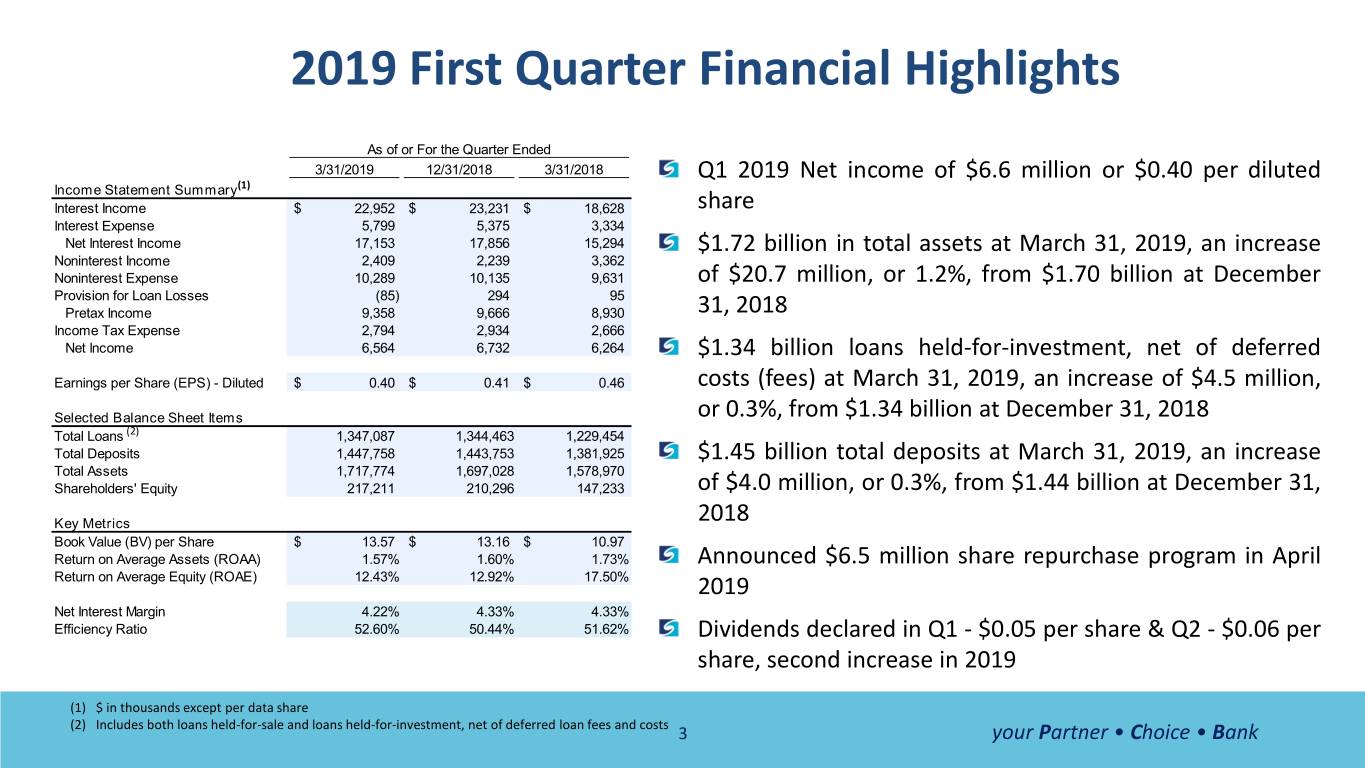

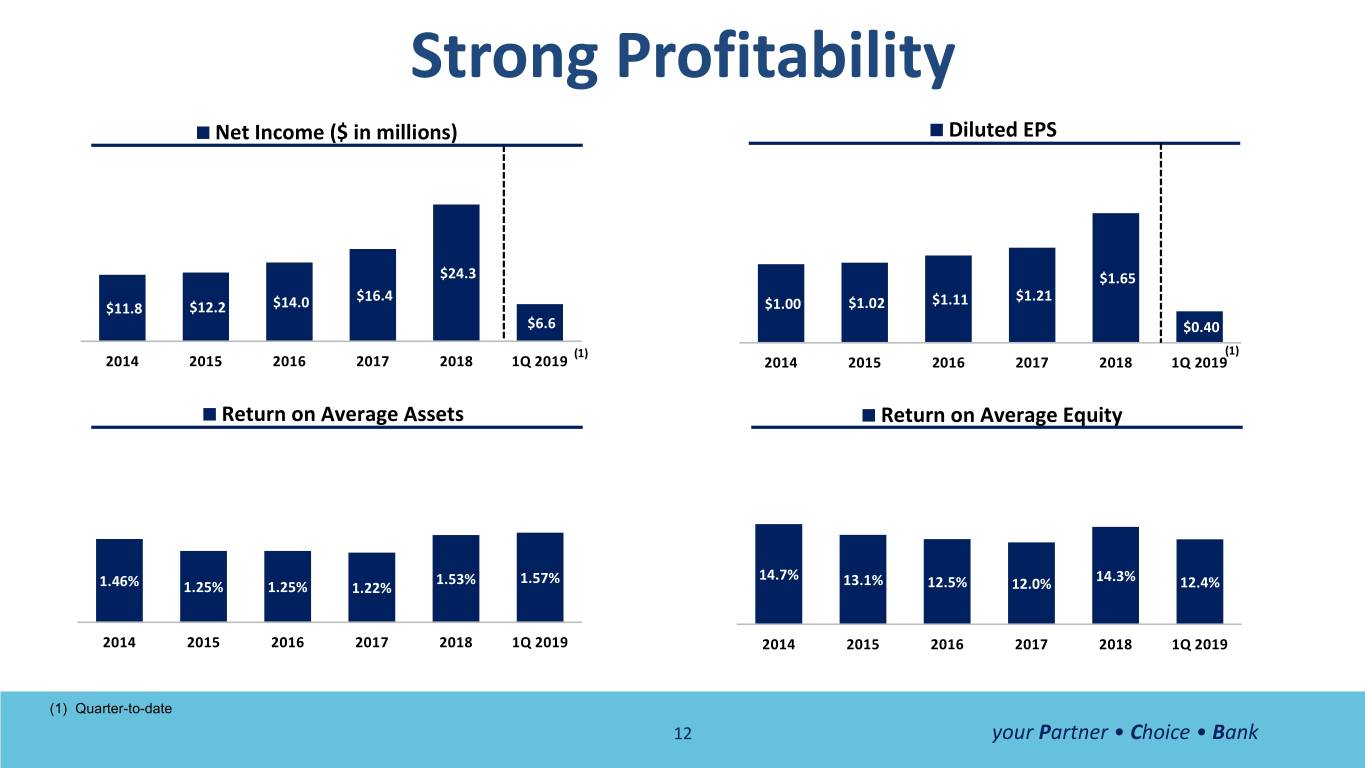

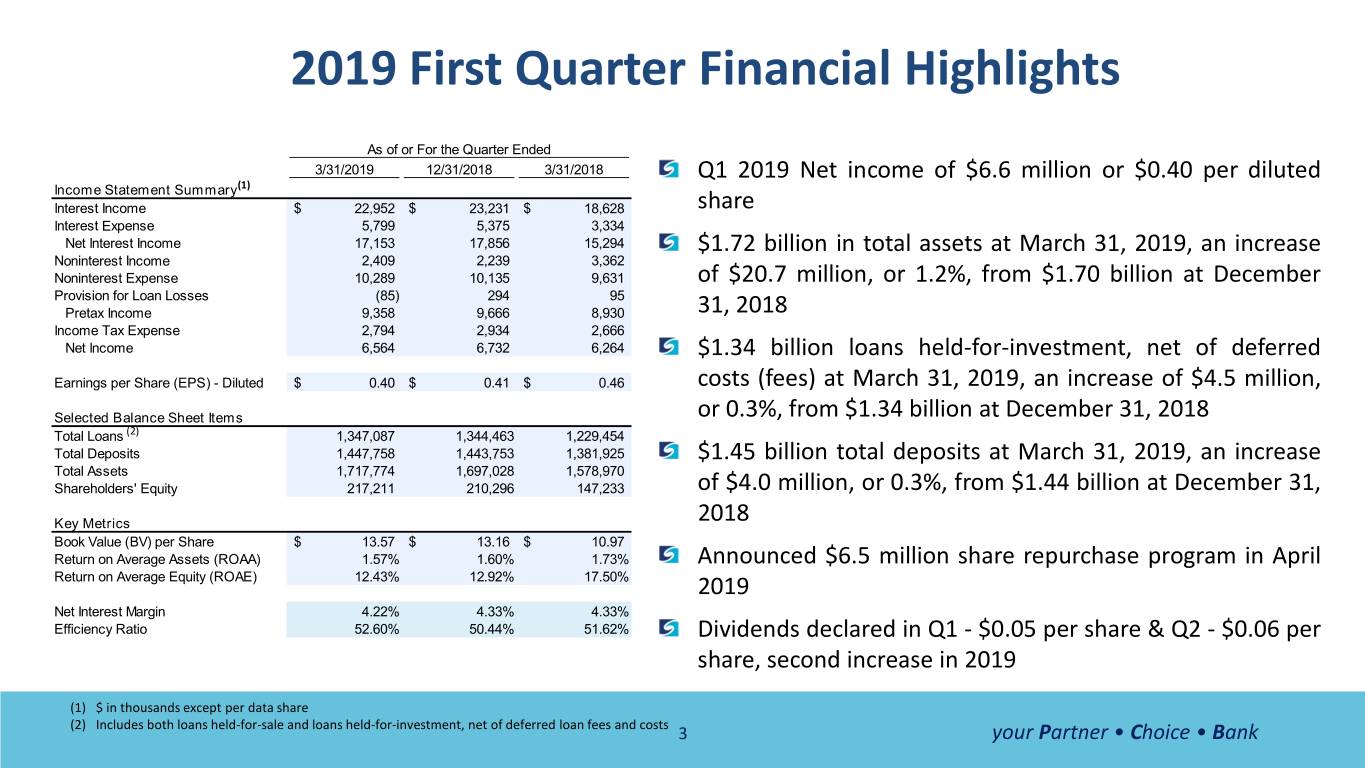

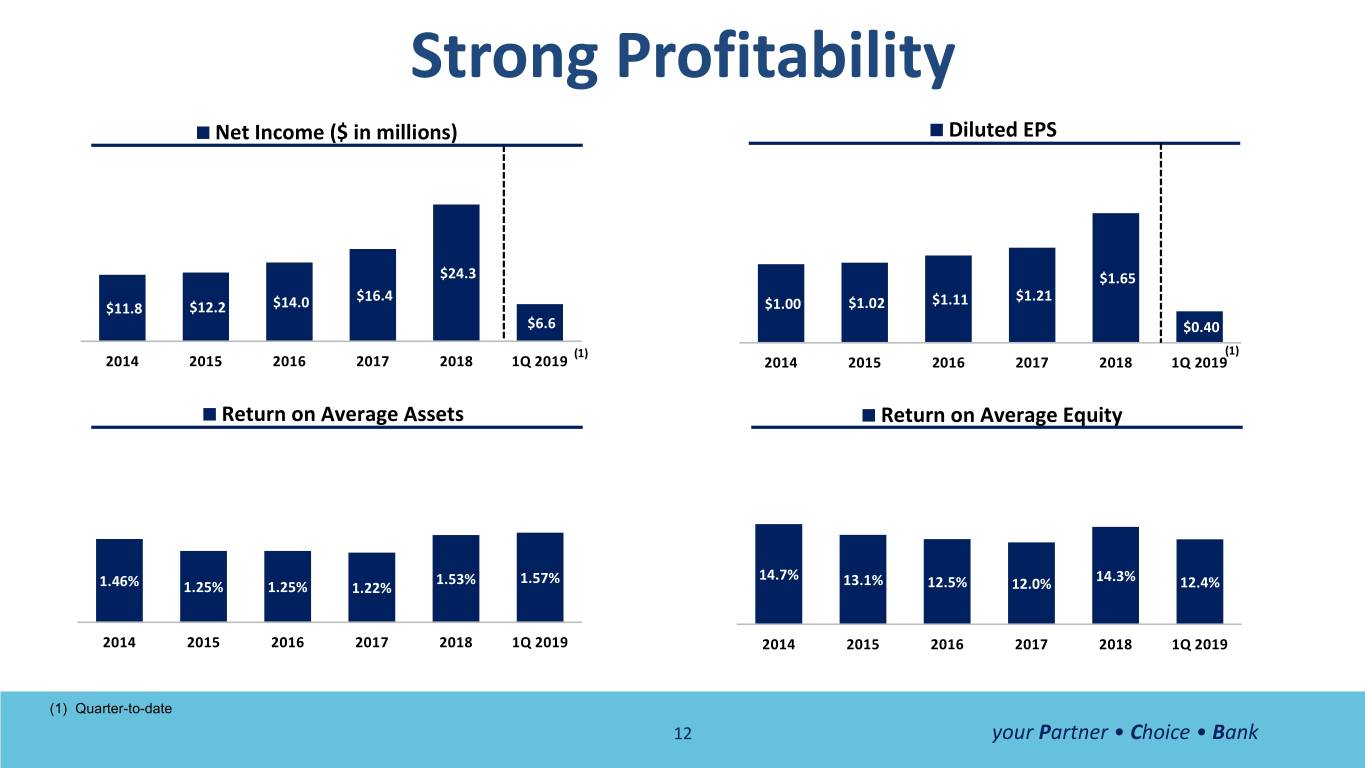

2019 First Quarter Financial Highlights As of or For the Quarter Ended 3/31/2019 12/31/2018 3/31/2018 Q1 2019 Net income of $6.6 million or $0.40 per diluted Income Statement Summary(1) Interest Income $ 22,952 $ 23,231 $ 18,628 share Interest Expense 5,799 5,375 3,334 Net Interest Income 17,153 17,856 15,294 $1.72 billion in total assets at March 31, 2019, an increase Noninterest Income 2,409 2,239 3,362 Noninterest Expense 10,289 10,135 9,631 of $20.7 million, or 1.2%, from $1.70 billion at December Provision for Loan Losses (85) 294 95 Pretax Income 9,358 9,666 8,930 31, 2018 Income Tax Expense 2,794 2,934 2,666 Net Income 6,564 6,732 6,264 $1.34 billion loans held-for-investment, net of deferred Earnings per Share (EPS) - Diluted $ 0.40 $ 0.41 $ 0.46 costs (fees) at March 31, 2019, an increase of $4.5 million, Selected Balance Sheet Items or 0.3%, from $1.34 billion at December 31, 2018 Total Loans (2) 1,347,087 1,344,463 1,229,454 Total Deposits 1,447,758 1,443,753 1,381,925 $1.45 billion total deposits at March 31, 2019, an increase Total Assets 1,717,774 1,697,028 1,578,970 Shareholders' Equity 217,211 210,296 147,233 of $4.0 million, or 0.3%, from $1.44 billion at December 31, Key Metrics 2018 Book Value (BV) per Share $ 13.57 $ 13.16 $ 10.97 Return on Average Assets (ROAA) 1.57% 1.60% 1.73% Announced $6.5 million share repurchase program in April Return on Average Equity (ROAE) 12.43% 12.92% 17.50% 2019 Net Interest Margin 4.22% 4.33% 4.33% Efficiency Ratio 52.60% 50.44% 51.62% Dividends declared in Q1 - $0.05 per share & Q2 - $0.06 per share, second increase in 2019 (1) $ in thousands except per data share (2) Includes both loans held-for-sale and loans held-for-investment, net of deferred loan fees and costs 3 your Partner • Choice • Bank

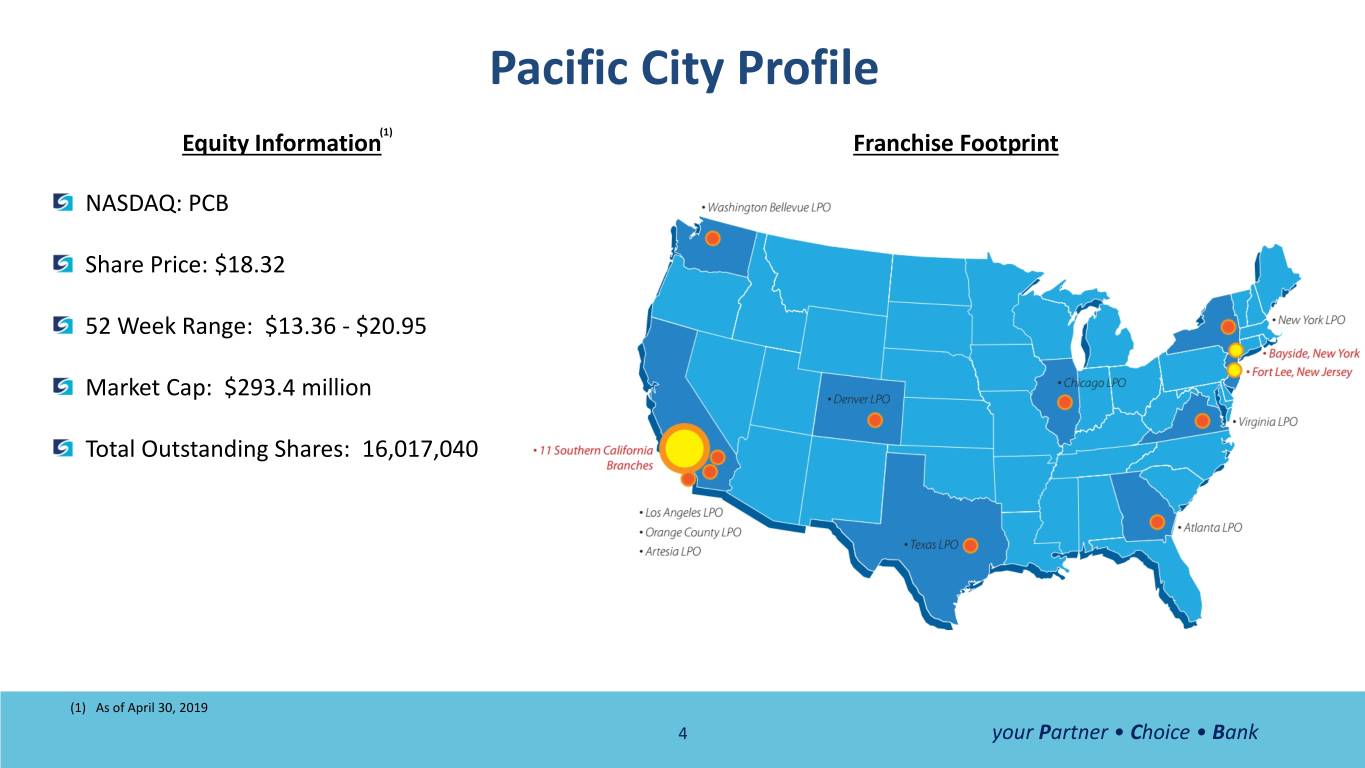

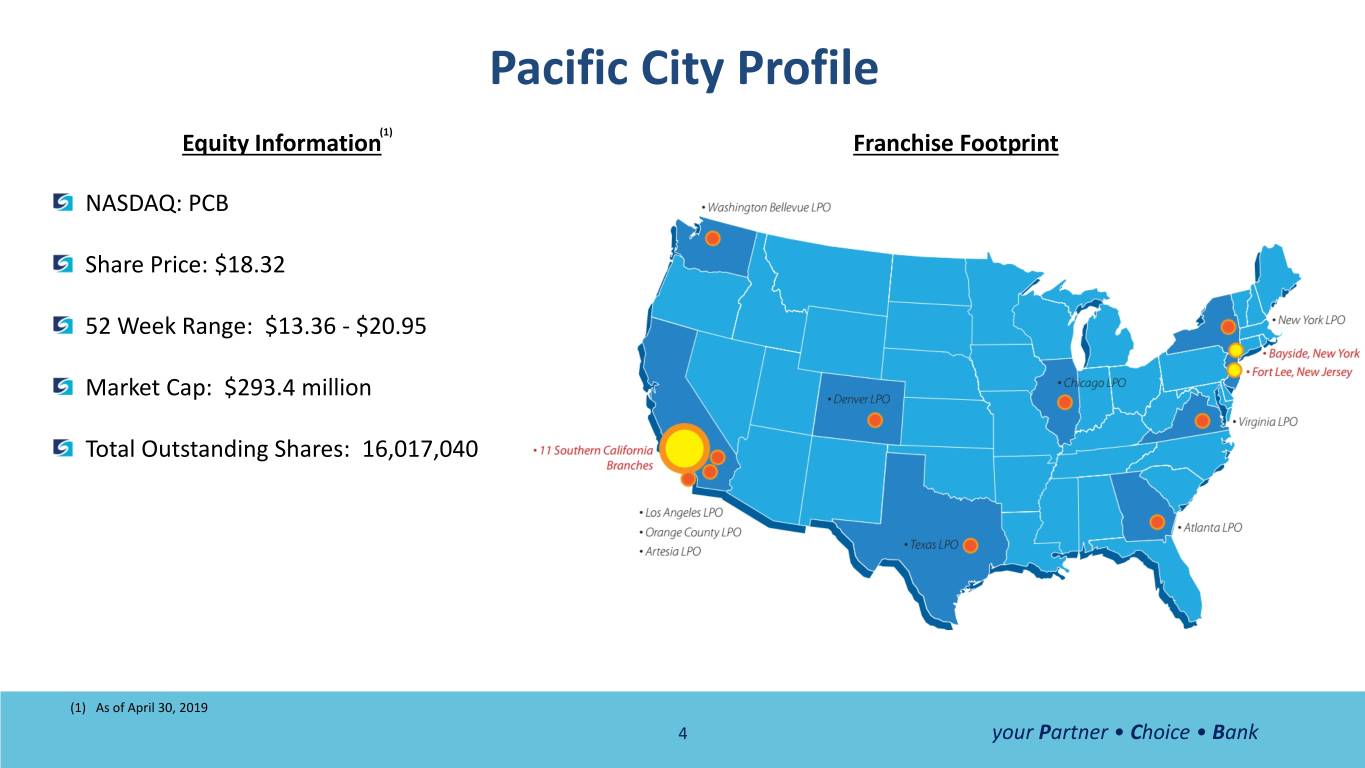

Pacific City Profile Equity Information(1) Franchise Footprint NASDAQ: PCB Share Price: $18.32 52 Week Range: $13.36 - $20.95 Market Cap: $293.4 million Total Outstanding Shares: 16,017,040 (1) As of April 30, 2019 4 your Partner • Choice • Bank

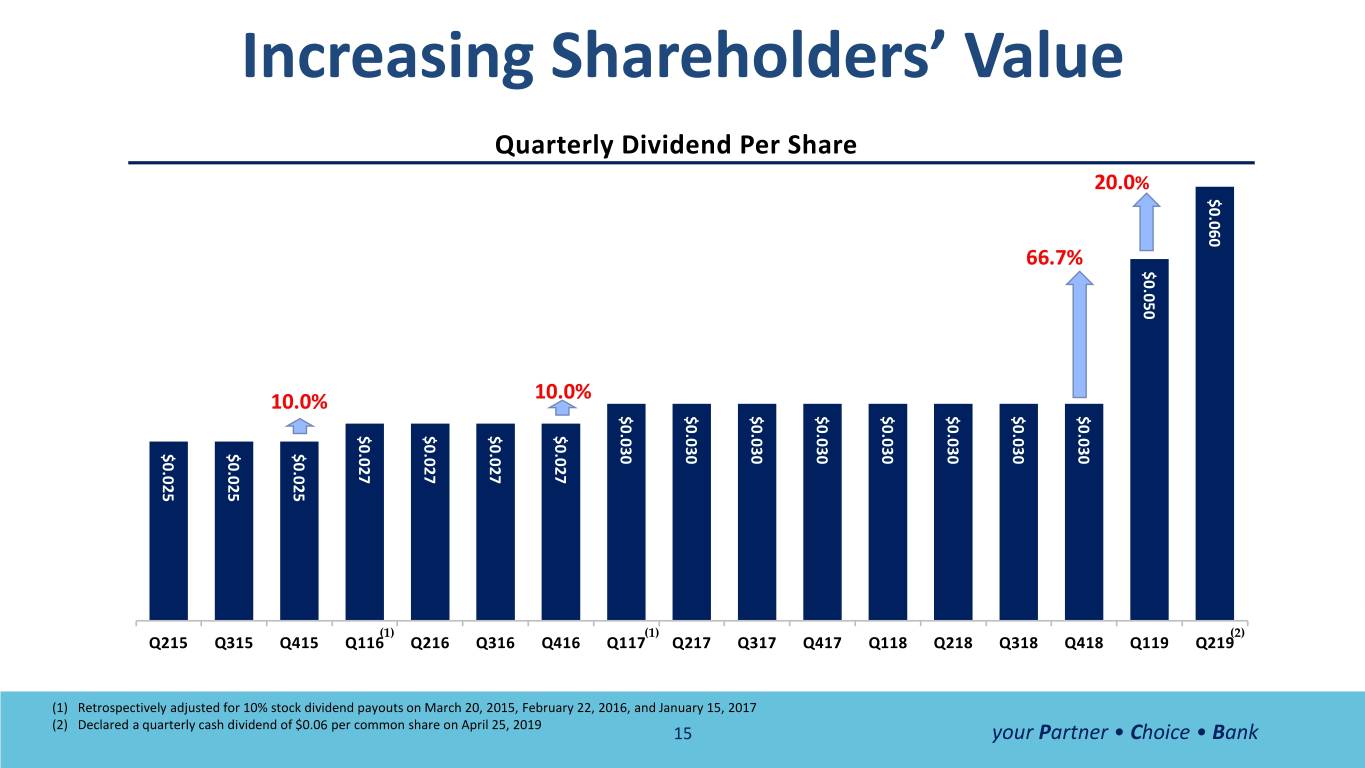

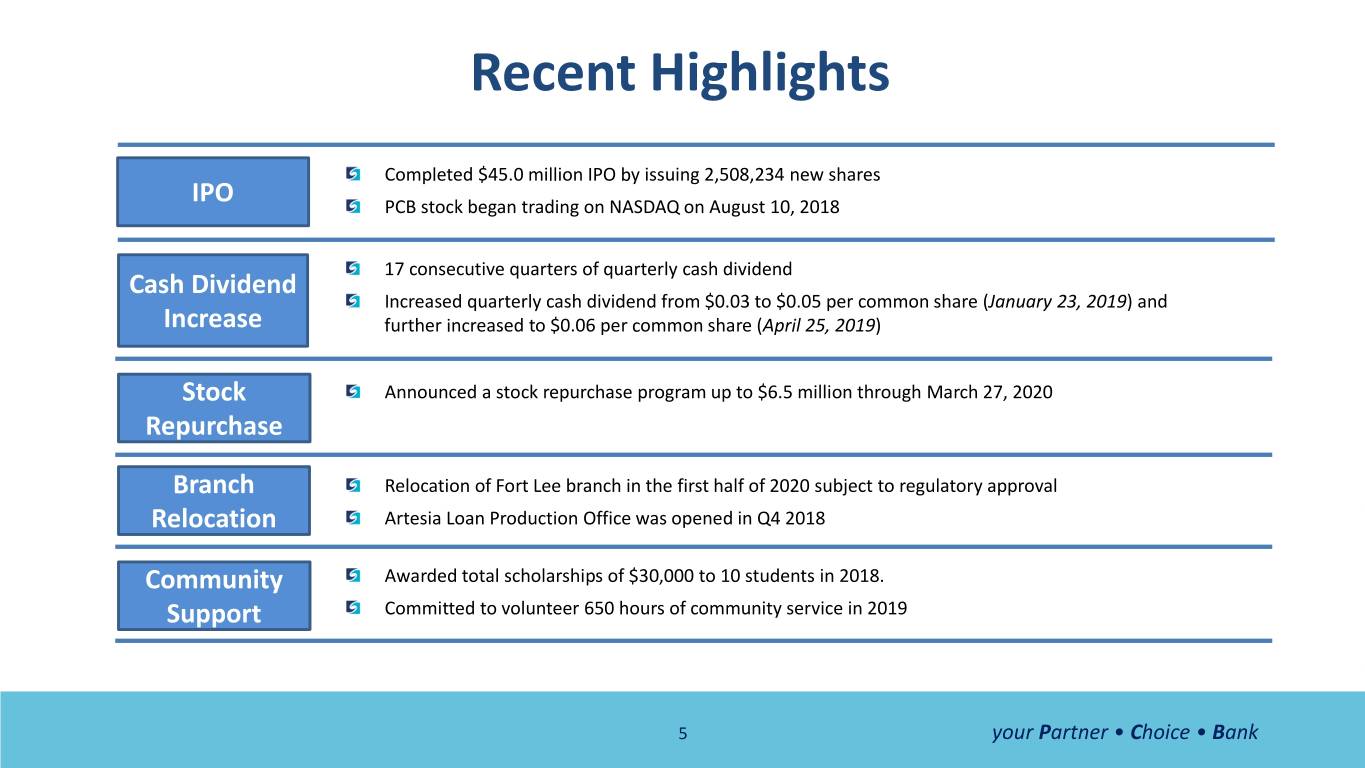

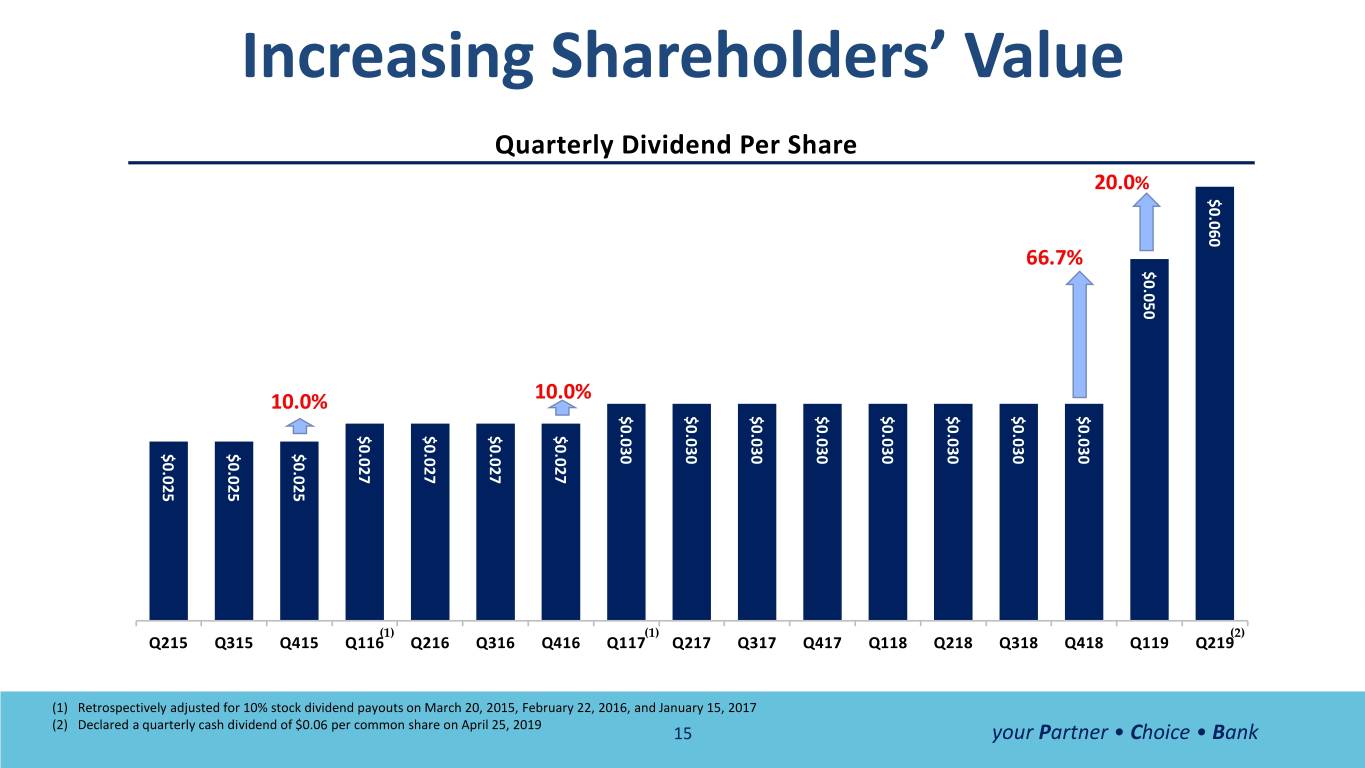

Recent Highlights Completed $45.0 million IPO by issuing 2,508,234 new shares IPO PCB stock began trading on NASDAQ on August 10, 2018 17 consecutive quarters of quarterly cash dividend Cash Dividend Increased quarterly cash dividend from $0.03 to $0.05 per common share (January 23, 2019) and Increase further increased to $0.06 per common share (April 25, 2019) Stock Announced a stock repurchase program up to $6.5 million through March 27, 2020 Repurchase Branch Relocation of Fort Lee branch in the first half of 2020 subject to regulatory approval Relocation Artesia Loan Production Office was opened in Q4 2018 Community Awarded total scholarships of $30,000 to 10 students in 2018. Support Committed to volunteer 650 hours of community service in 2019 5 your Partner • Choice • Bank

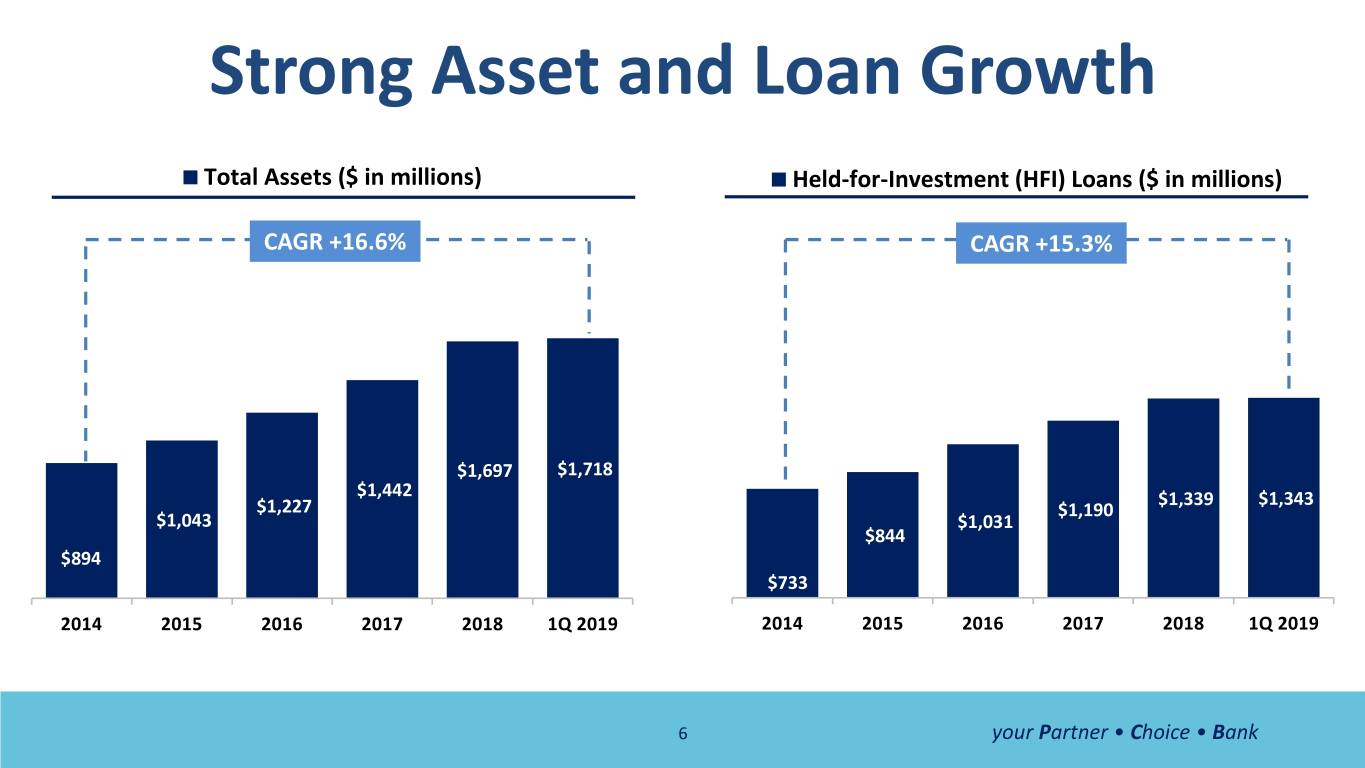

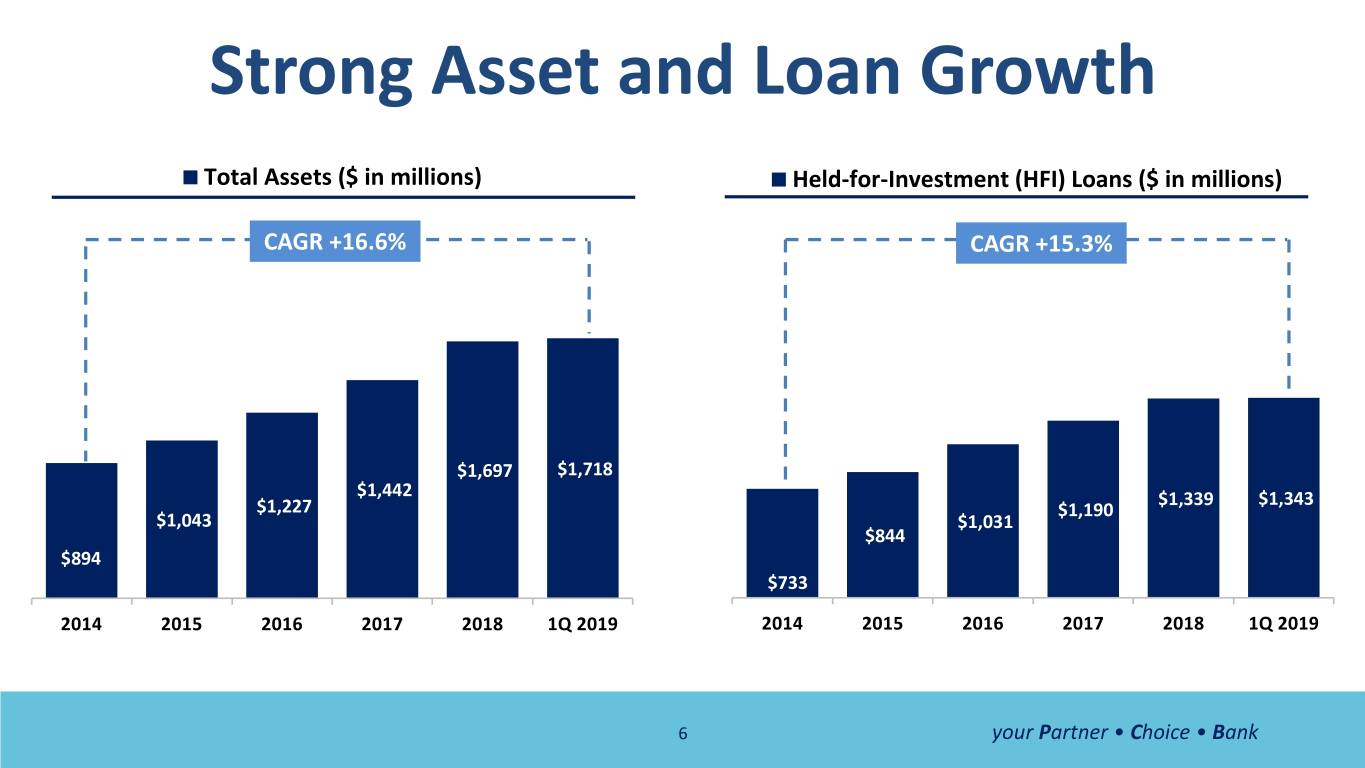

Strong Asset and Loan Growth Total Assets ($ in millions) Held-for-Investment (HFI) Loans ($ in millions) CAGR +16.6% CAGR +15.3% $1,697 $1,718 $1,442 $1,339 $1,343 $1,227 $1,190 $1,043 $1,031 $844 $894 $733 2014 2015 2016 2017 2018 1Q 2019 2014 2015 2016 2017 2018 1Q 2019 6 your Partner • Choice • Bank

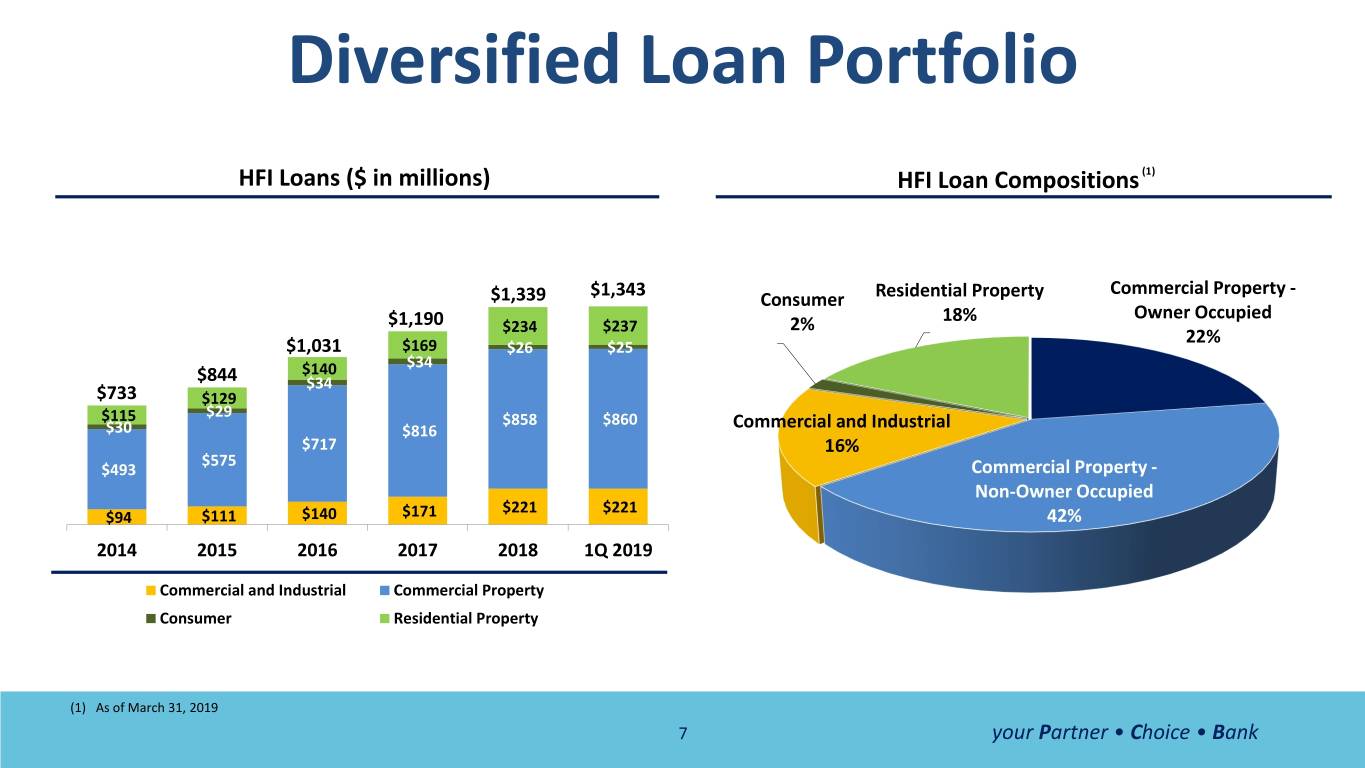

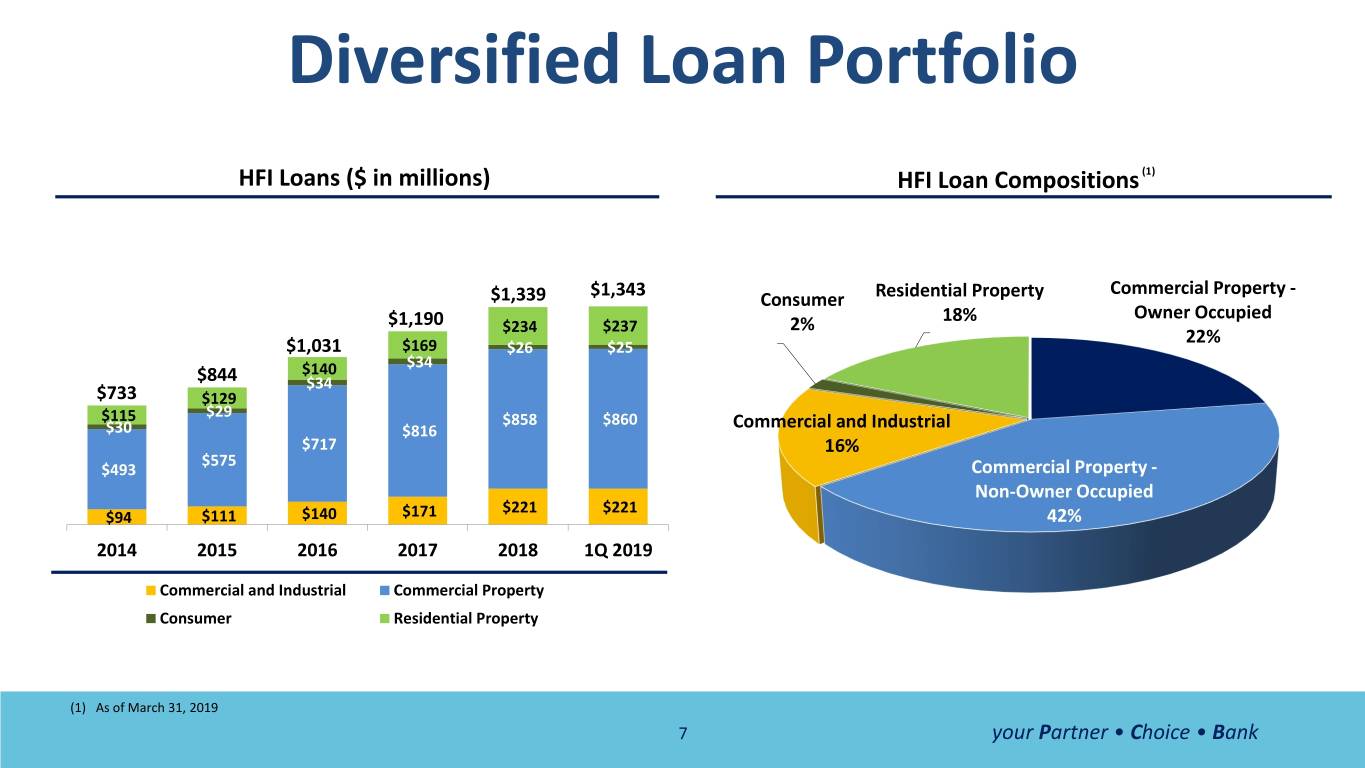

Diversified Loan Portfolio HFI Loans ($ in millions) HFI Loan Compositions (1) $1,343 Commercial Property - $1,339 Consumer Residential Property 18% Owner Occupied $1,190 $237 2% $234 22% $1,031 $169 $26 $25 $140 $34 $844 $34 $733 $129 $115 $29 $858 $860 $30 $816 Commercial and Industrial $717 16% $575 $493 Commercial Property - Non-Owner Occupied $221 $221 $94 $111 $140 $171 42% 2014 2015 2016 2017 2018 1Q 2019 Commercial and Industrial Commercial Property Consumer Residential Property (1) As of March 31, 2019 7 your Partner • Choice • Bank

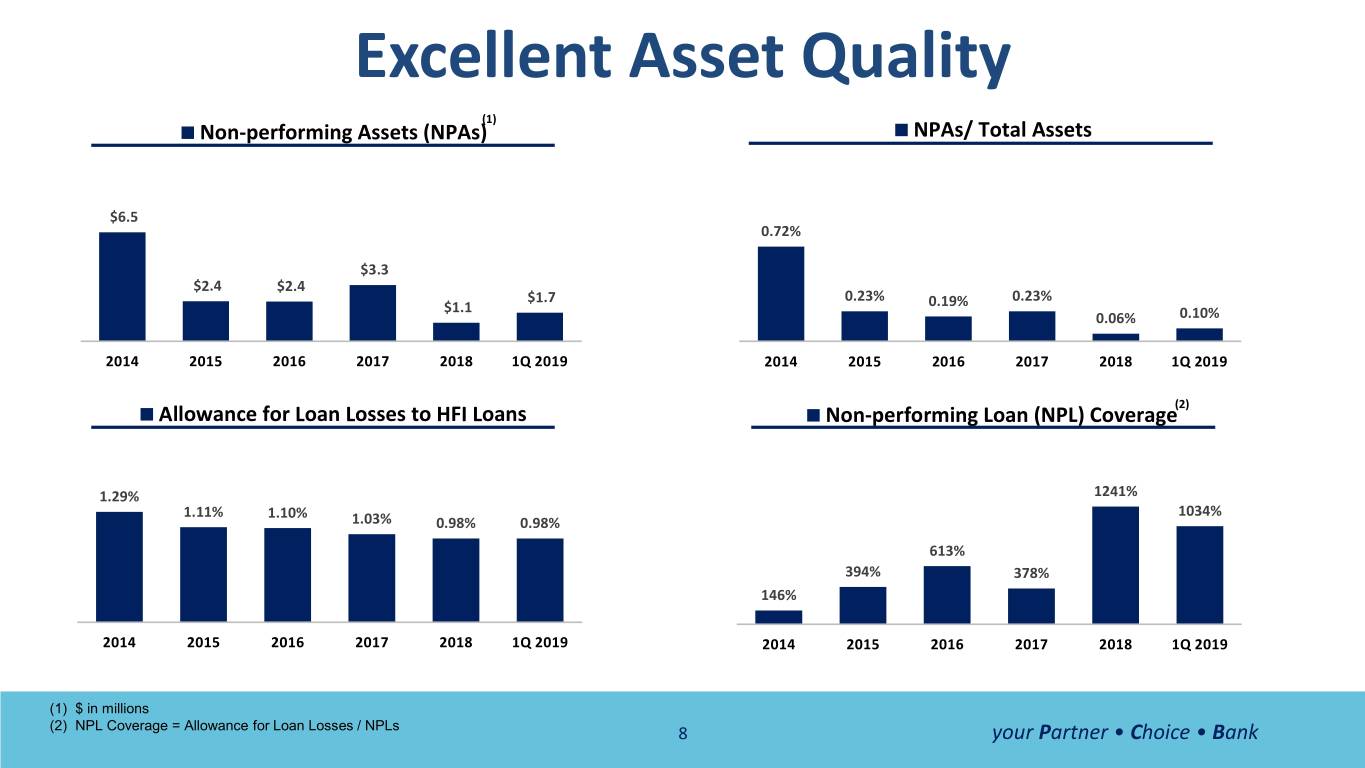

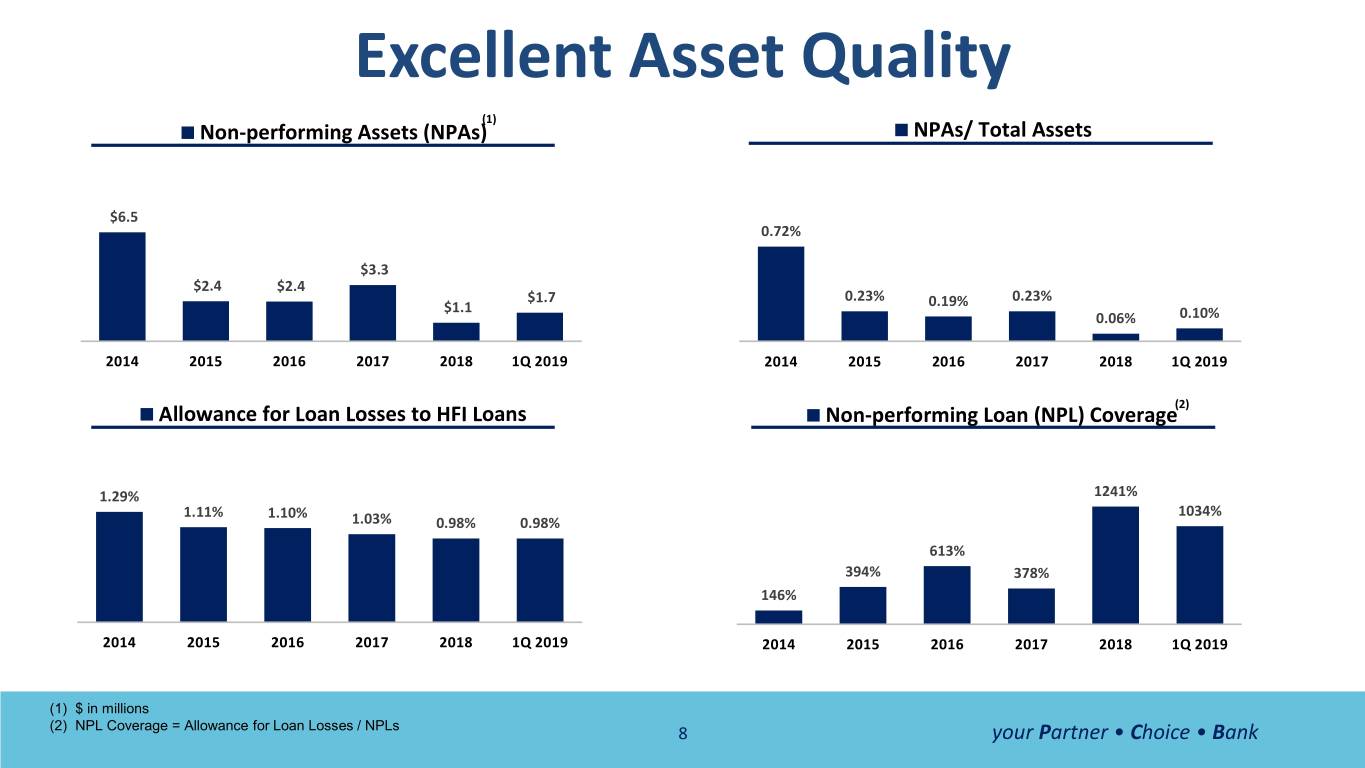

Excellent Asset Quality (1) Non-performing Assets (NPAs) NPAs/ Total Assets $6.5 0.72% $3.3 $2.4 $2.4 $1.7 0.23% 0.23% $1.1 0.19% 0.06% 0.10% 2014 2015 2016 2017 2018 1Q 2019 2014 2015 2016 2017 2018 1Q 2019 Allowance for Loan Losses to HFI Loans Non-performing Loan (NPL) Coverage(2) 1.29% 1241% 1.11% 1.10% 1034% 1.03% 0.98% 0.98% 613% 394% 378% 146% 2014 2015 2016 2017 2018 1Q 2019 2014 2015 2016 2017 2018 1Q 2019 (1) $ in millions (2) NPL Coverage = Allowance for Loan Losses / NPLs 8 your Partner • Choice • Bank

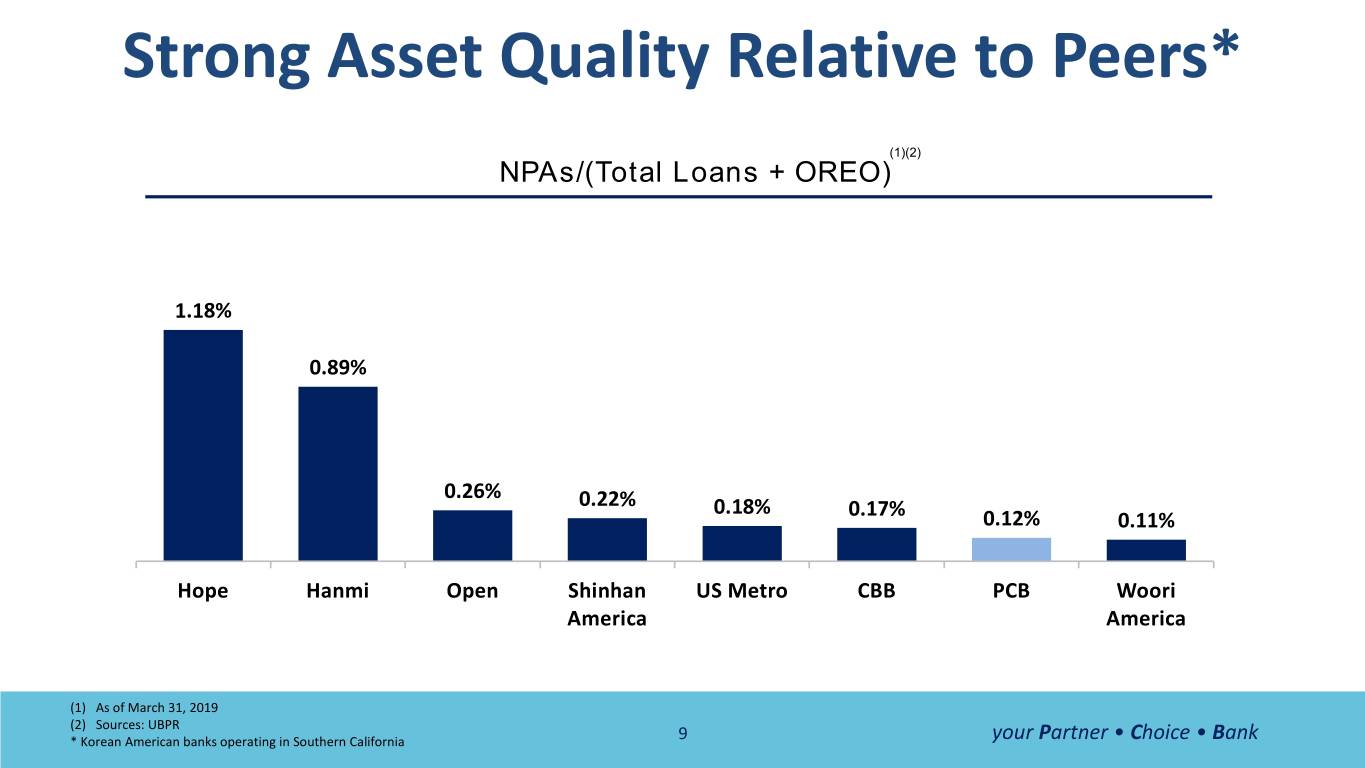

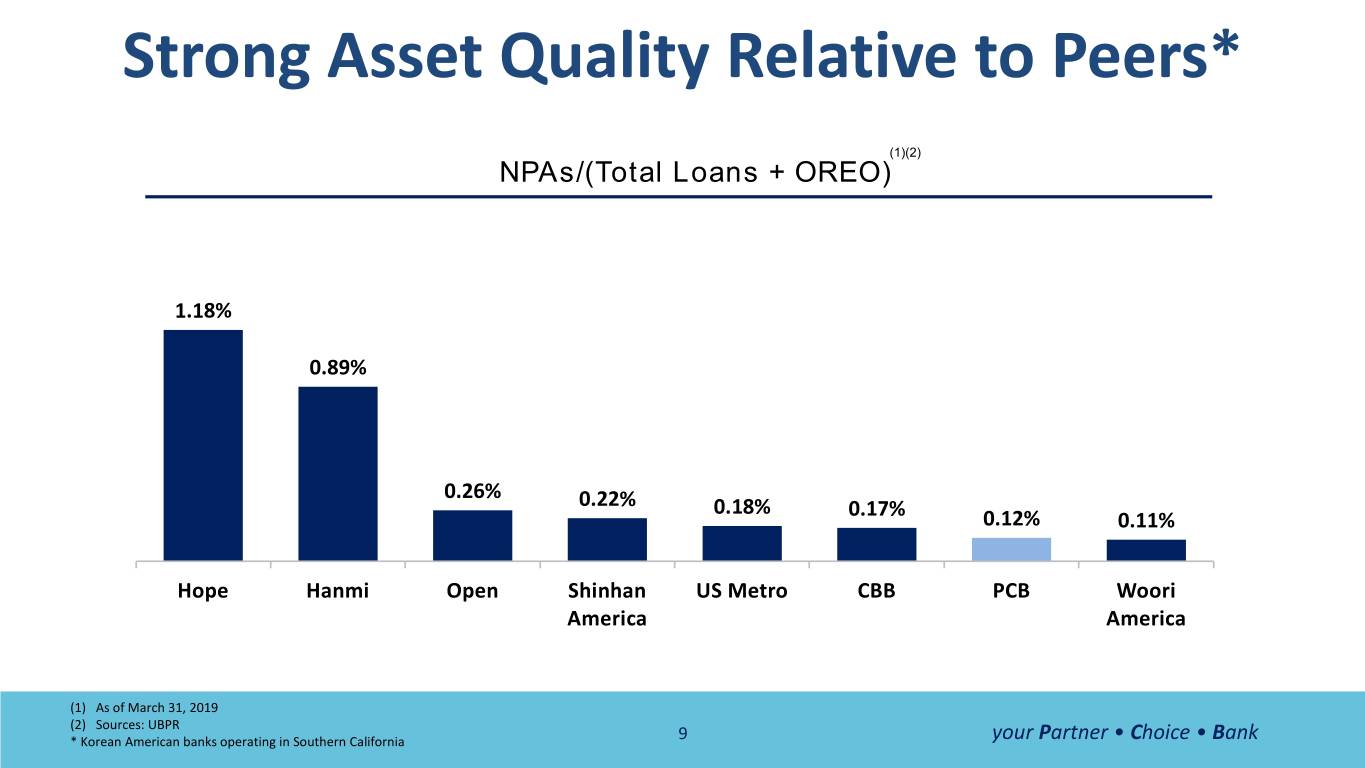

Strong Asset Quality Relative to Peers* (1)(2) NPAs/(Total Loans + OREO) 1.18% 0.89% 0.26% 0.22% 0.18% 0.17% 0.12% 0.11% Hope Hanmi Open Shinhan US Metro CBB PCB Woori America America (1) As of March 31, 2019 (2) Sources: UBPR * Korean American banks operating in Southern California 9 your Partner • Choice • Bank

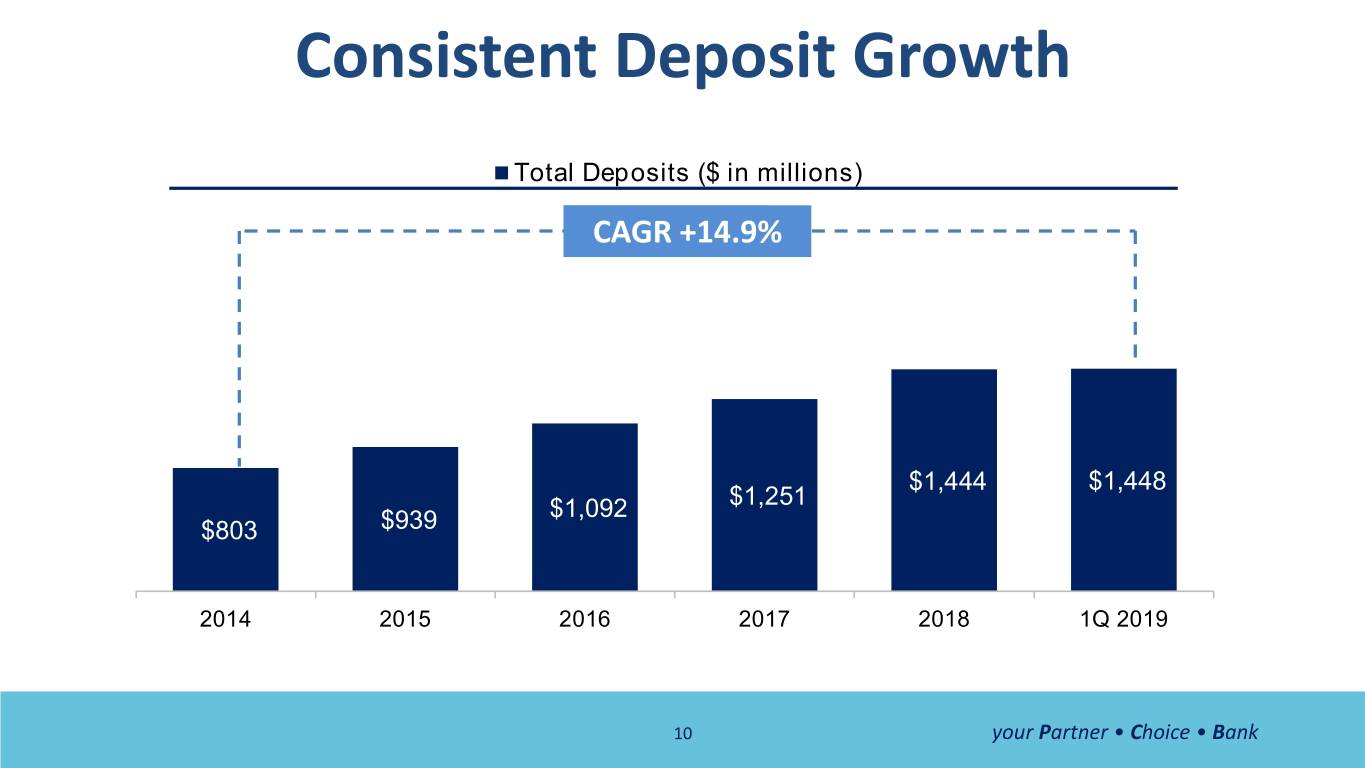

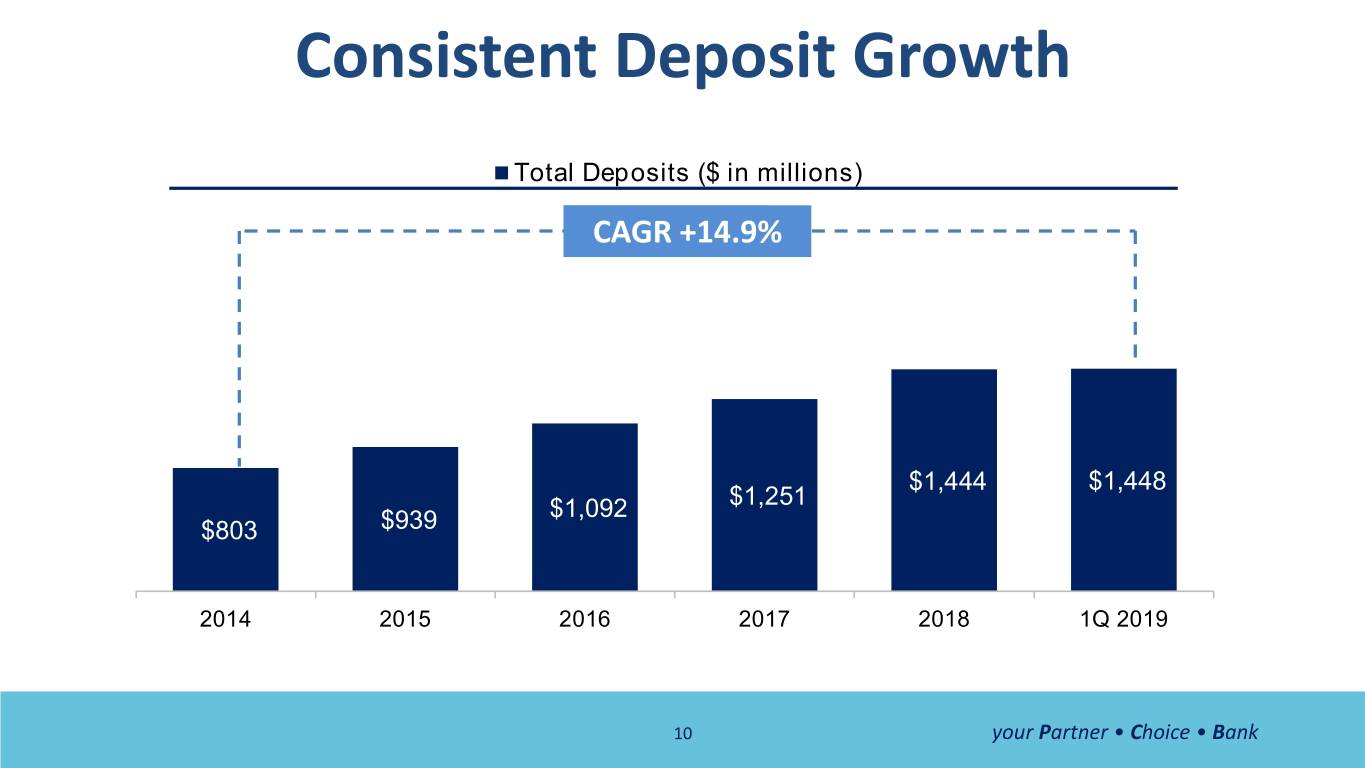

Consistent Deposit Growth Total Deposits ($ in millions) CAGR +14.9% $1,444 $1,448 $1,092 $1,251 $803 $939 2014 2015 2016 2017 2018 1Q 2019 10 your Partner • Choice • Bank

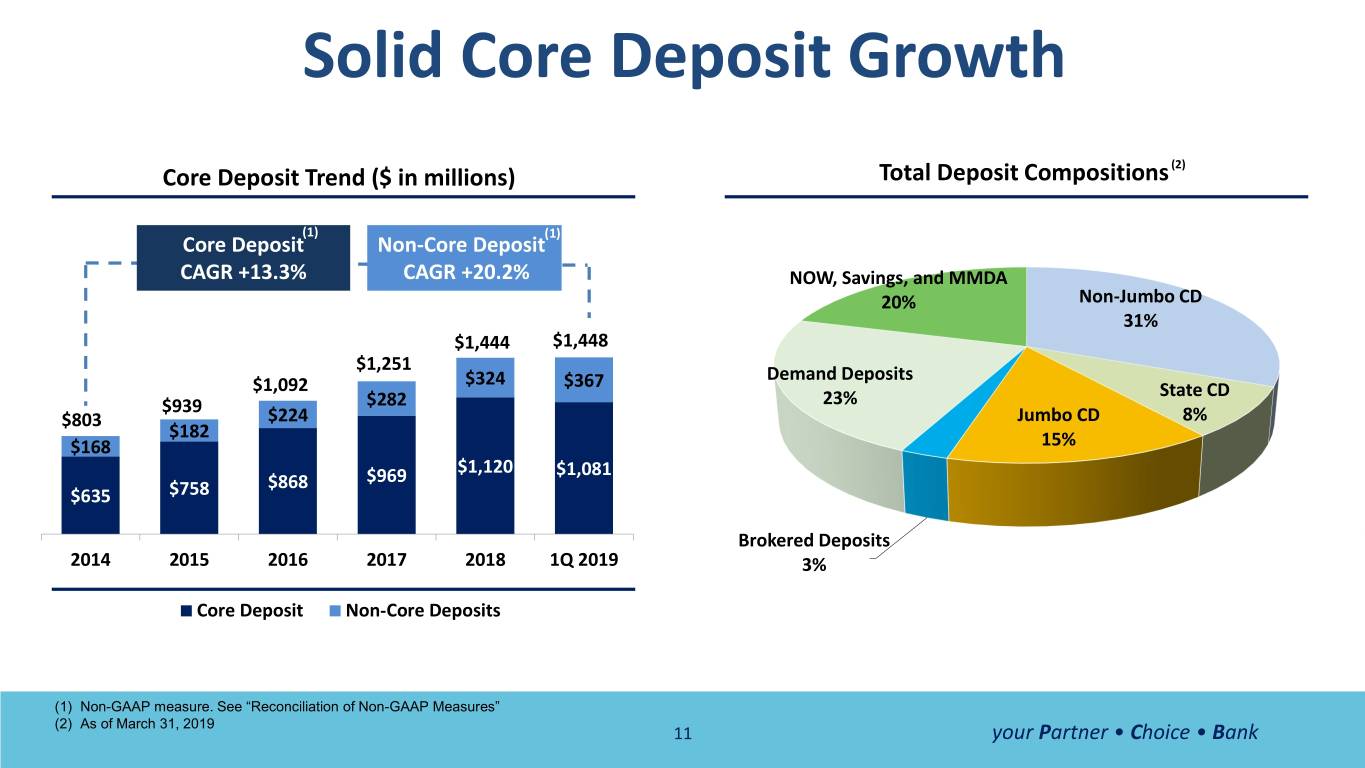

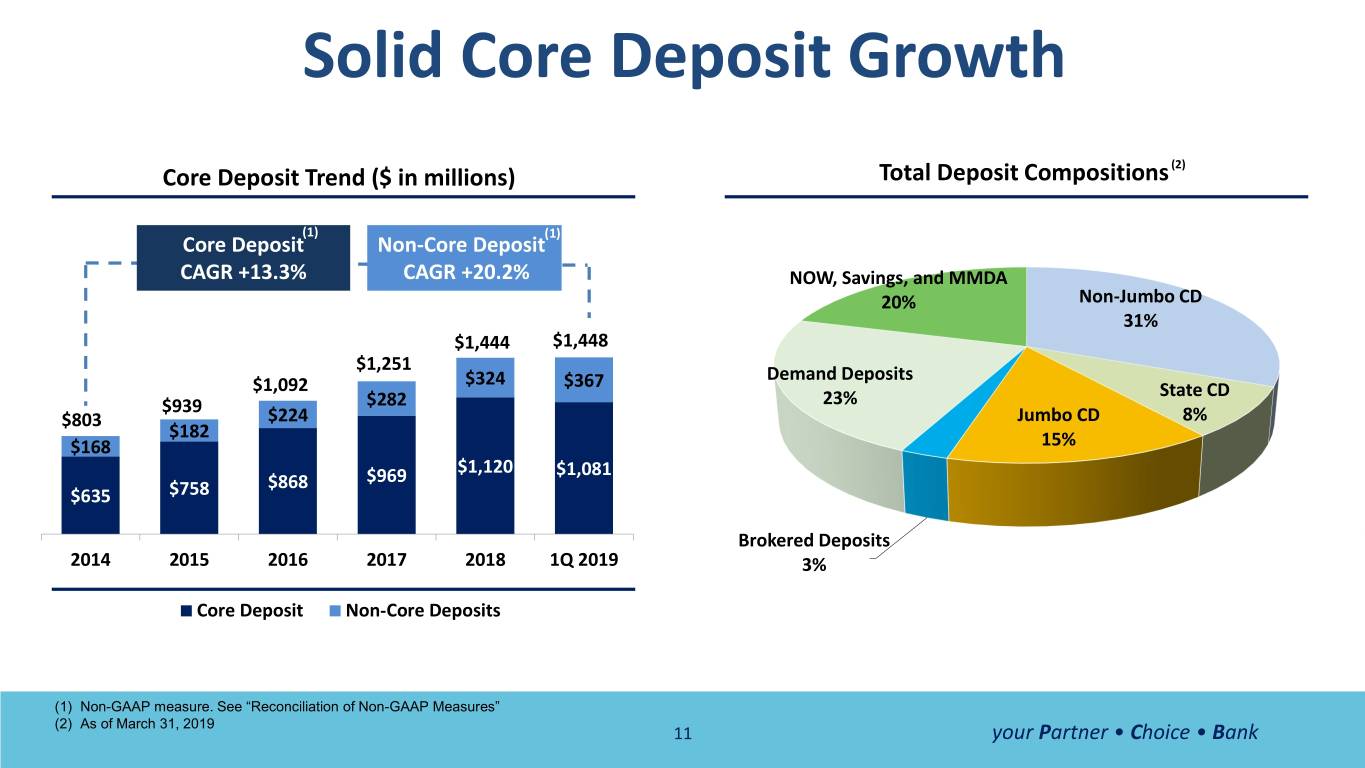

Solid Core Deposit Growth (2) Core Deposit Trend ($ in millions) Total Deposit Compositions (1) (1) Core Deposit Non-Core Deposit CAGR +13.3% CAGR +20.2% NOW, Savings, and MMDA 20% Non-Jumbo CD 31% $1,444 $1,448 $1,251 $324 Demand Deposits $1,092 $367 State CD $939 $282 23% $803 $224 Jumbo CD 8% $182 $168 15% $1,120 $1,081 $868 $969 $635 $758 Brokered Deposits 2014 2015 2016 2017 2018 1Q 2019 3% Core Deposit Non-Core Deposits (1) Non-GAAP measure. See “Reconciliation of Non-GAAP Measures” (2) As of March 31, 2019 11 your Partner • Choice • Bank

Strong Profitability Net Income ($ in millions) Diluted EPS $24.3 $1.65 $16.4 $1.11 $1.21 $11.8 $12.2 $14.0 $1.00 $1.02 $6.6 $0.40 (1) (1) 2014 2015 2016 2017 2018 1Q 2019 2014 2015 2016 2017 2018 1Q 2019 Return on Average Assets Return on Average Equity 1.53% 1.57% 14.7% 13.1% 14.3% 1.46% 1.25% 1.25% 1.22% 12.5% 12.0% 12.4% 2014 2015 2016 2017 2018 1Q 2019 2014 2015 2016 2017 2018 1Q 2019 (1) Quarter-to-date 12 your Partner • Choice • Bank

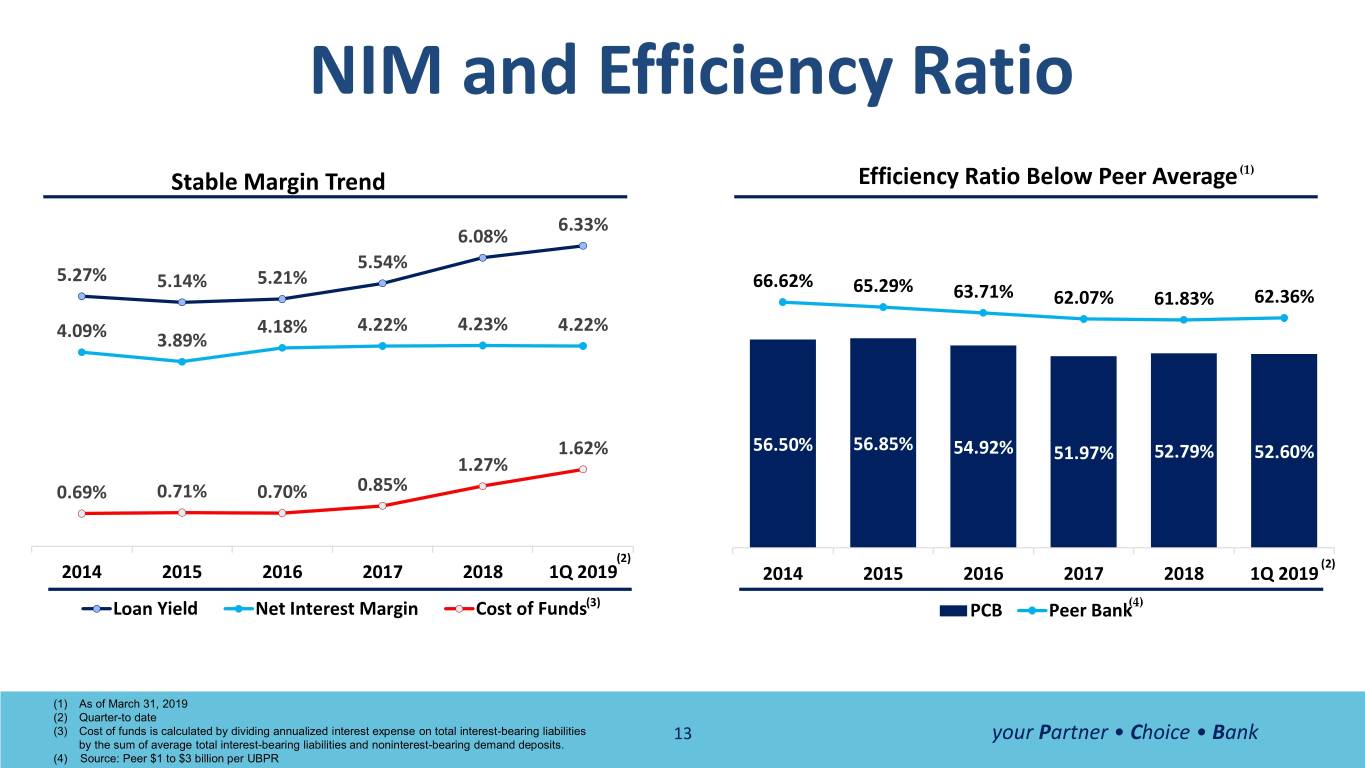

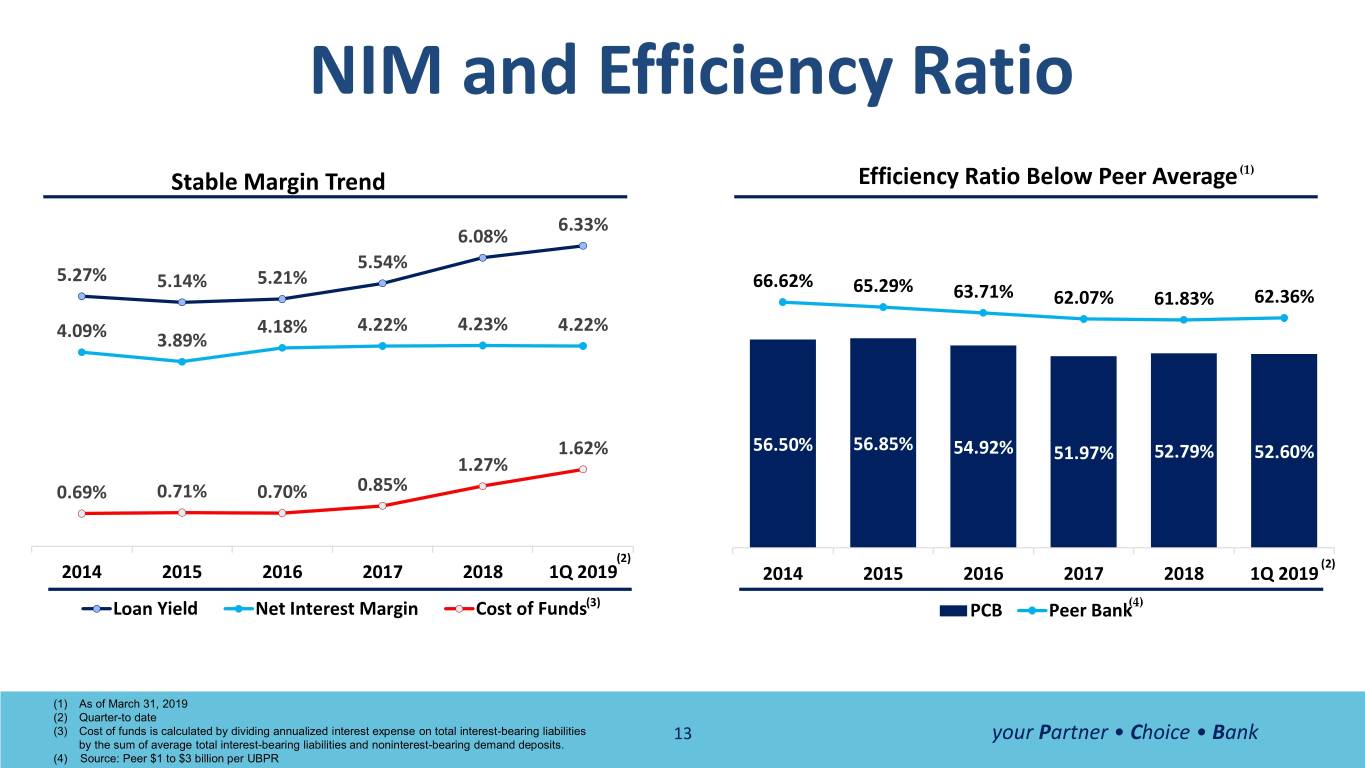

NIM and Efficiency Ratio Stable Margin Trend Efficiency Ratio Below Peer Average (1) 6.33% 6.08% 5.54% 5.27% 5.14% 5.21% 66.62% 65.29% 63.71% 62.07% 61.83% 62.36% 4.18% 4.22% 4.23% 4.22% 4.09% 3.89% 1.62% 56.50% 56.85% 54.92% 51.97% 52.79% 52.60% 1.27% 0.69% 0.71% 0.70% 0.85% (2) (2) 2014 2015 2016 2017 2018 1Q 2019 2014 2015 2016 2017 2018 1Q 2019 Loan Yield Net Interest Margin Cost of Funds(3) PCB Peer Bank(4) (1) As of March 31, 2019 (2) Quarter-to date (3) Cost of funds is calculated by dividing annualized interest expense on total interest-bearing liabilities 13 your Partner • Choice • Bank by the sum of average total interest-bearing liabilities and noninterest-bearing demand deposits. (4) Source: Peer $1 to $3 billion per UBPR

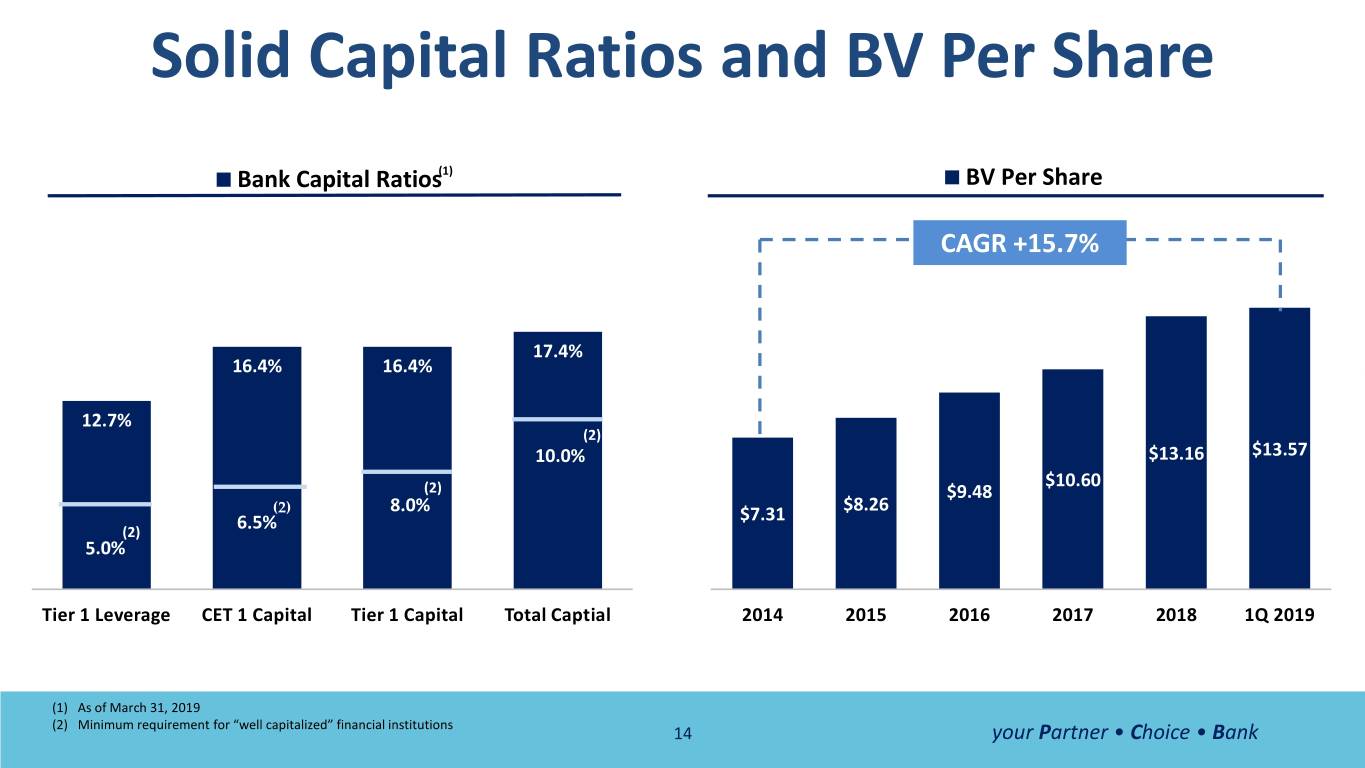

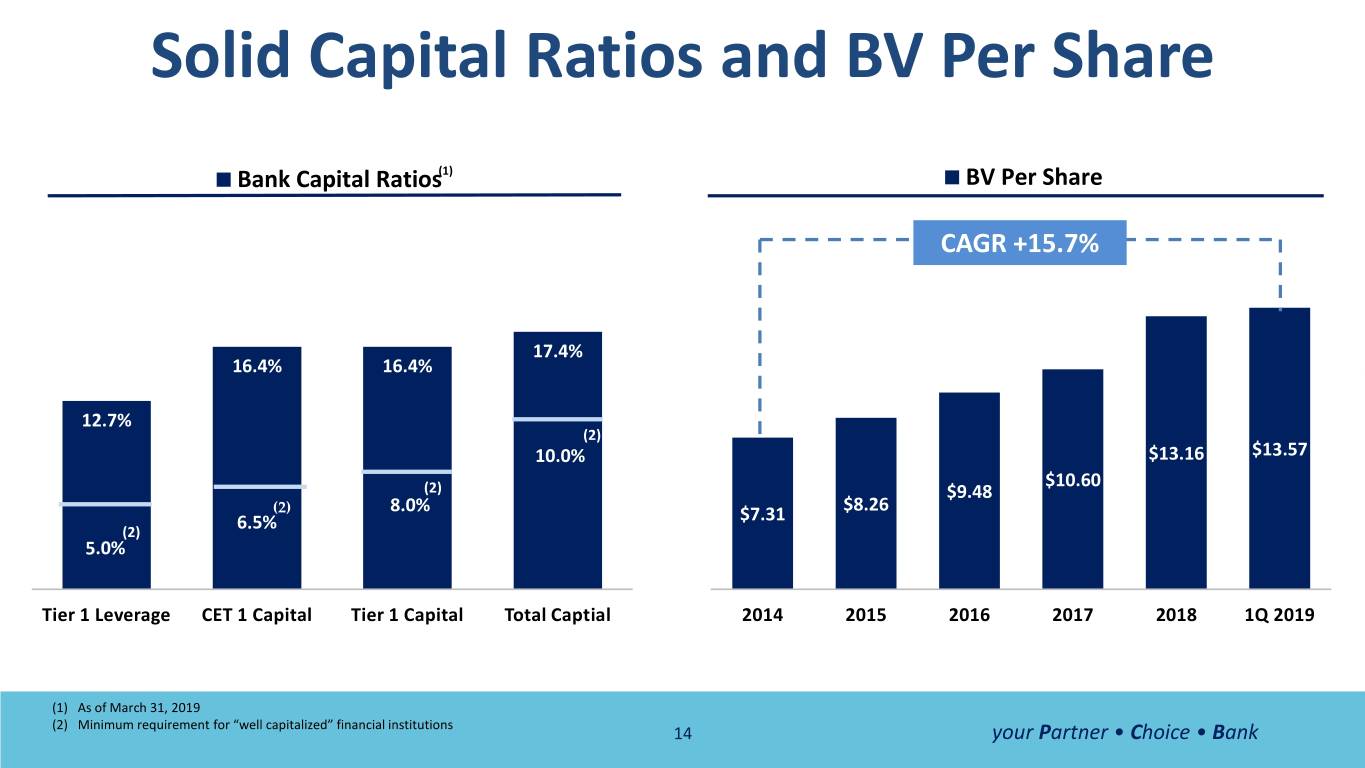

Solid Capital Ratios and BV Per Share Bank Capital Ratios(1) BV Per Share CAGR +15.7% 17.4% 16.4% 16.4% 12.7% (2) 10.0% $13.16 $13.57 $10.60 (2) $9.48 (2) 8.0% $7.31 $8.26 (2) 6.5% 5.0% Tier 1 Leverage CET 1 Capital Tier 1 Capital Total Captial 2014 2015 2016 2017 2018 1Q 2019 (1) As of March 31, 2019 (2) Minimum requirement for “well capitalized” financial institutions 14 your Partner • Choice • Bank

Increasing Shareholders’ Value Quarterly Dividend Per Share 20.0% $0.060 $0.060 66.7% $0.050 $0.050 10.0% 10.0% $0.030 $0.030 $0.030 $0.030 $0.030 $0.030 $0.030 $0.030 $0.030 $0.027 $0.027 $0.027 $0.027 $0.027 $0.025 $0.025 $0.025 $0.025 (1) (1) (2) Q215 Q315 Q415 Q116 Q216 Q316 Q416 Q117 Q217 Q317 Q417 Q118 Q218 Q318 Q418 Q119 Q219 (1) Retrospectively adjusted for 10% stock dividend payouts on March 20, 2015, February 22, 2016, and January 15, 2017 (2) Declared a quarterly cash dividend of $0.06 per common share on April 25, 2019 15 your Partner • Choice • Bank

Name Change Pacific City PCB Financial Bancorp Corporation 16 your Partner • Choice • Bank

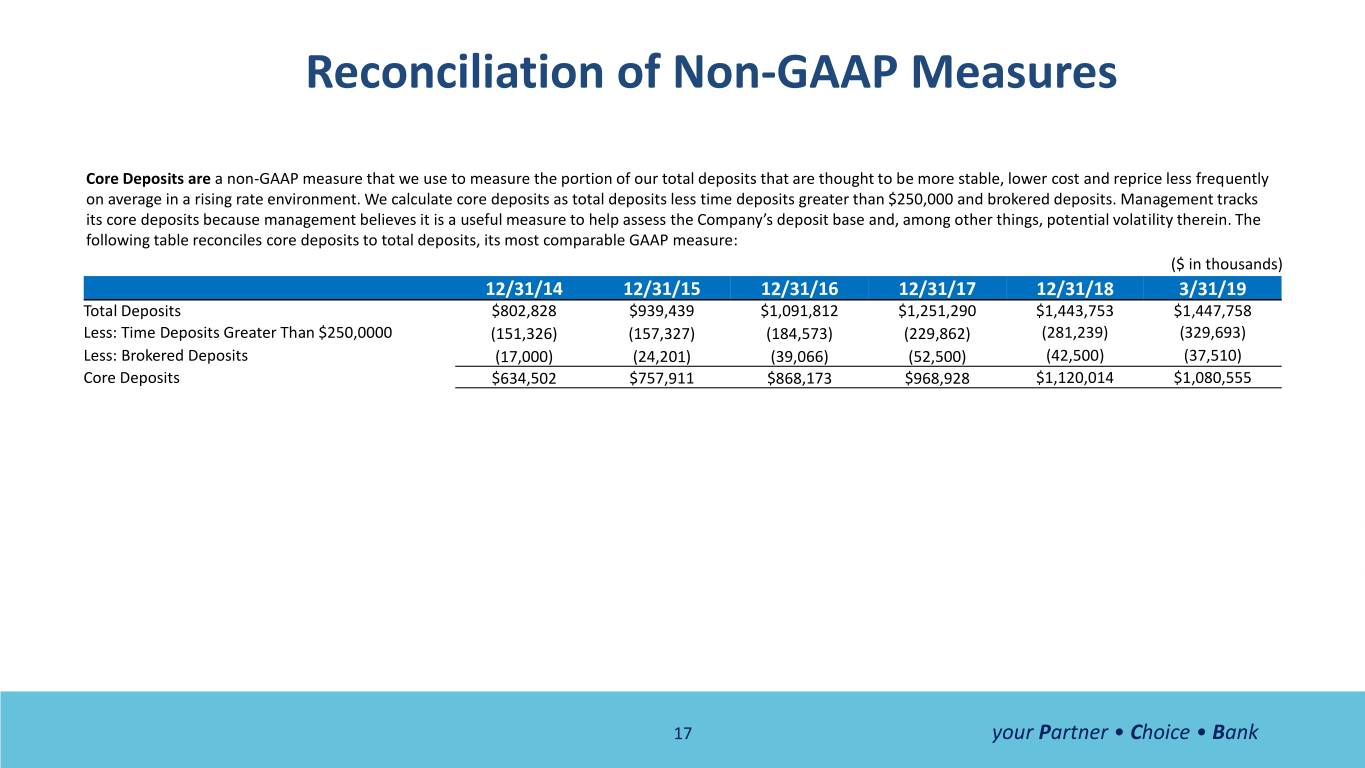

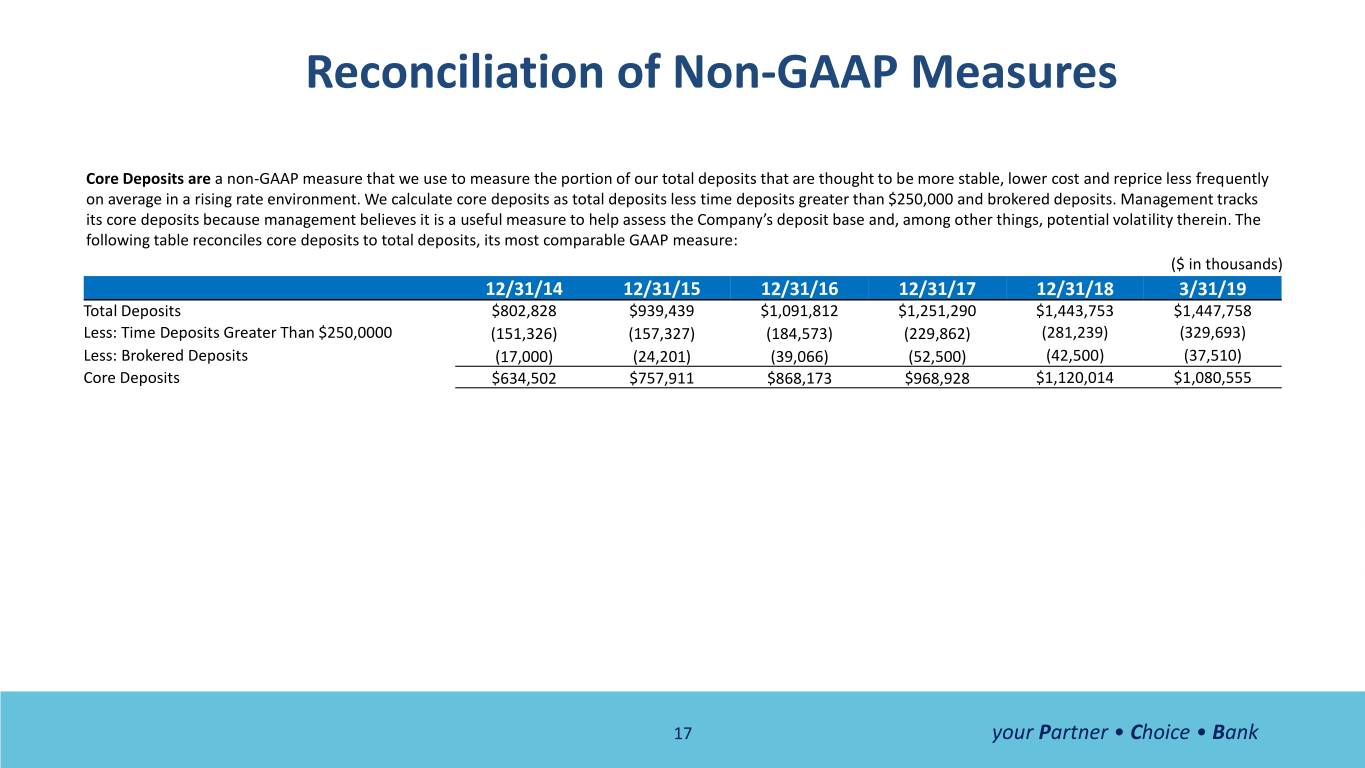

Reconciliation of Non-GAAP Measures Core Deposits are a non-GAAP measure that we use to measure the portion of our total deposits that are thought to be more stable, lower cost and reprice less frequently on average in a rising rate environment. We calculate core deposits as total deposits less time deposits greater than $250,000 and brokered deposits. Management tracks its core deposits because management believes it is a useful measure to help assess the Company’s deposit base and, among other things, potential volatility therein. The following table reconciles core deposits to total deposits, its most comparable GAAP measure: ($ in thousands) 12/31/14 12/31/15 12/31/16 12/31/17 12/31/18 3/31/19 Total Deposits $802,828 $939,439 $1,091,812 $1,251,290 $1,443,753 $1,447,758 Less: Time Deposits Greater Than $250,0000 (151,326) (157,327) (184,573) (229,862) (281,239) (329,693) Less: Brokered Deposits (17,000) (24,201) (39,066) (52,500) (42,500) (37,510) Core Deposits $634,502 $757,911 $868,173 $968,928 $1,120,014 $1,080,555 17 your Partner • Choice • Bank

“Thank You!” 18