Earnings Results 2Q24 July 25, 2024 PCB BANCORP

2 Forward-Looking Statement & Non-GAAP Cautionary Note Regarding Forward-Looking Statements This presentation contains forward-looking statements. These forward-looking statements represent plans, estimates, objectives, goals, guidelines, expectations, intentions, projections and statements of our beliefs concerning future events, business plans, objectives, expected operating results and the assumptions upon which those statements are based. Forward-looking statements include without limitation any statement that may predict, forecast, indicate or imply future results, performance or achievements, and are typically identified with words such as “may,” “could,” “should,” “will,” “would,” “believe,” “anticipate,” “estimate,” “expect,” “aim,” “intend,” “plan,” or words or phases of similar meaning. We caution that the forward-looking statements are based largely on our expectations and are subject to a number of known and unknown risks and uncertainties that are subject to change based on factors which are, in many instances, beyond our control, including but not limited to the health of the national and local economies including the impact to the Company and its customers resulting from changes to, and the level of, inflation and interest rates; the Company’s ability to maintain and grow its deposit base; loan demand and continued portfolio performance; the impact of adverse developments at other banks, including bank failures, that impact general sentiment regarding the stability and liquidity of banks that could affect our financial performance and our stock price; changes to valuations of the Company’s assets and liabilities including the allowance for credit losses, earning assets, and intangible assets; changes to the availability of liquidity sources including borrowing lines and the ability to pledge or sell certain assets; the Company's ability to attract and retain skilled employees; customers' service expectations; cyber security risks; the Company's ability to successfully deploy new technology; the success of acquisitions and branch expansion; operational risks including the ability to detect and prevent errors and fraud; the effectiveness of the Company’s enterprise risk management framework; costs related to litigation; changes in laws, rules, regulations, or interpretations to which the Company is subject; the effects of severe weather events, pandemics, other public health crises, acts of war or terrorism, and other external events on our business. These and other important factors are detailed in various securities law filings made periodically by the Company, copies of which are available without charge on the SEC’s website at www.sec.gov and the on the investor relations section of the Company’s website at www.mypcbbank.com. Actual results, performance or achievements could differ materially from those contemplated, expressed, or implied by the forward-looking statements. Any forward- looking statements presented herein are made only as of the date of this presentation, and we do not undertake any obligation to update or revise any forward-looking statements to reflect changes in assumptions, the occurrence of unanticipated events, or otherwise, except as required by law. Non-GAAP Financial Measures This presentation contains non-GAAP financial measures. A non-GAAP financial measure is a numerical measure of historical or future financial performance, financial position or cash flows that excludes amounts or is subject to adjustments that have the effect of excluding amounts that are included in the most directly comparable measure calculated and presented in accordance with GAAP. Reconciliations of non-GAAP measures to the most directly comparable GAAP measures are provided in the Non-GAAP Measures section of this presentation. References to the “Company,” “we,” or “us” refer to PCB Bancorp and references to the “Bank” refer to the Company’s subsidiary, PCB Bank.

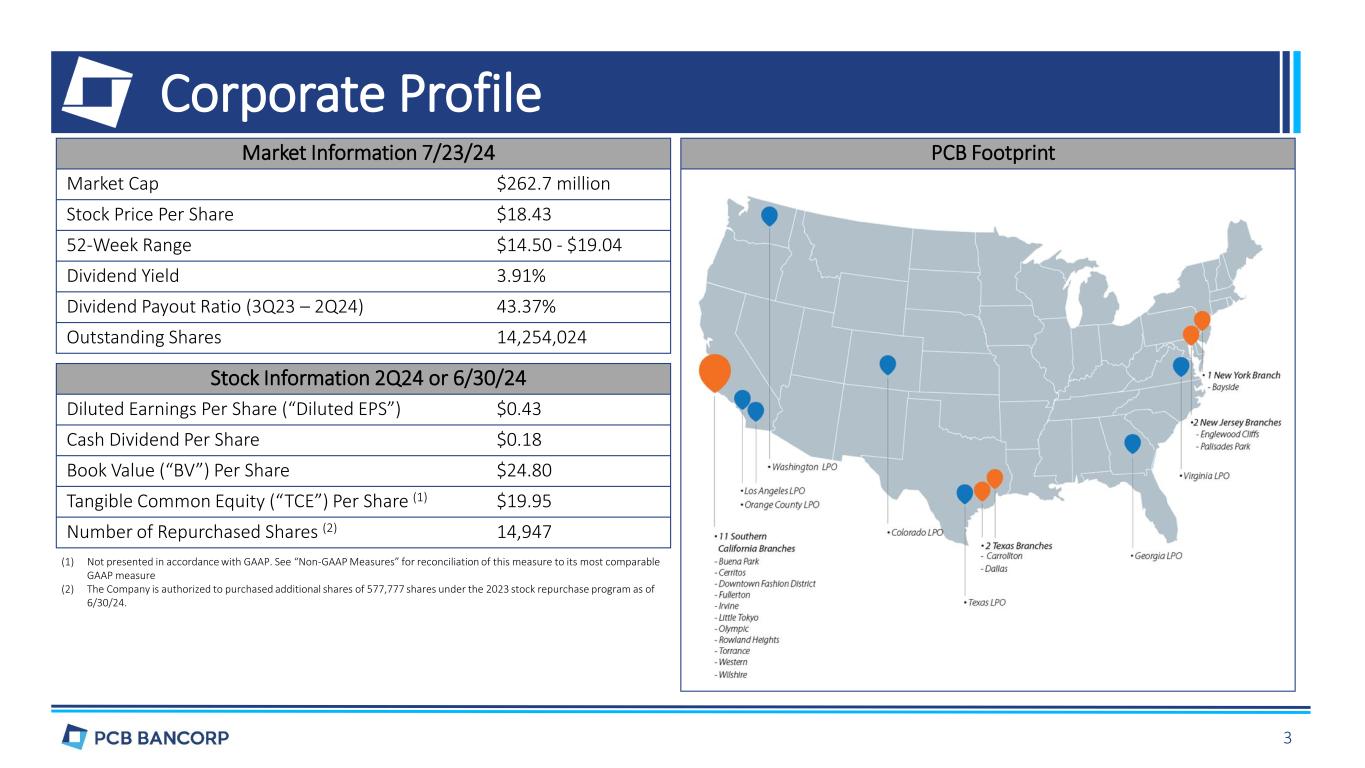

Market Information 7/23/24 Market Cap $262.7 million Stock Price Per Share $18.43 52-Week Range $14.50 - $19.04 Dividend Yield 3.91% Dividend Payout Ratio (3Q23 – 2Q24) 43.37% Outstanding Shares 14,254,024 Stock Information 2Q24 or 6/30/24 Diluted Earnings Per Share (“Diluted EPS”) $0.43 Cash Dividend Per Share $0.18 Book Value (“BV”) Per Share $24.80 Tangible Common Equity (“TCE”) Per Share (1) $19.95 Number of Repurchased Shares (2) 14,947 (1) Not presented in accordance with GAAP. See “Non-GAAP Measures” for reconciliation of this measure to its most comparable GAAP measure (2) The Company is authorized to purchased additional shares of 577,777 shares under the 2023 stock repurchase program as of 6/30/24. PCB Footprint Corporate Profile 3

Historical Performance $1.45 $1.58 $1.73 $2.05 $2.32 $2.45 0.000 0.500 1.000 1.500 2.000 2.500 3.000 2019 2020 2021 2022 2023 Jun-24 Held-For-Investment Loans ($bn) $1.48 $1.59 $1.87 $2.05 $2.35 $2.41 0.000 0.500 1.000 1.500 2.000 2.500 3.000 2019 2020 2021 2022 2023 Jun-24 Deposits ($bn) $24.1 $16.2 $40.1 $35.0 $30.7 $11.0 $38.6 $36.2 $52.4 $53.0 $43.1 $16.6 0.000 10.000 20.000 30.000 40.000 50.000 60.000 2019 2020 2021 2022 2023 06/24 YTD Net Income/PTPP Income ($mm) Net Income PTPP Income CAGR +12.5% CAGR +12.3% $0.25 $0.40 $0.44 $0.60 $0.69 $0.36$1.49 $1.05 $2.62 $2.31 $2.12 $0.75 $14.44 $15.19 $17.24 $22.94 $24.46 $24.80 $18.21 $19.62 $19.95 -$5.00 $0.00 $5.00 $10.00 $15.00 $20.00 $25.00 $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 2019 2020 2021 2022 2023 06/24 YTD Cash Dividend/Diluted EPS & BV/TCE Per Share Cash Dividend Per Share Diluted EPS BV Per Share TCE Per Share (1) At period end (2) Not presented in accordance with GAAP. See “Non-GAAP Measures” for reconciliation of these measures to their most comparable GAAP measures (1), (2)(1) (2) Annualized +10.8% Annualized +4.6% 4

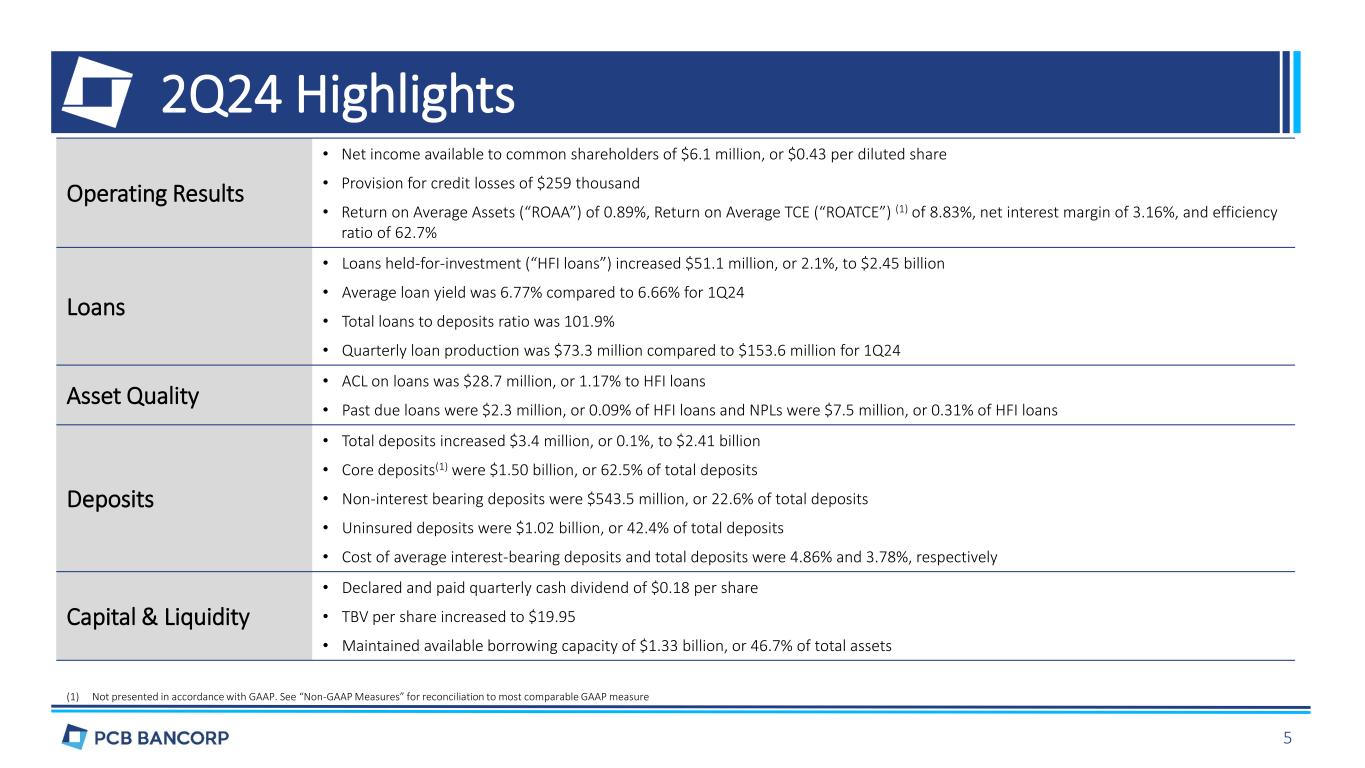

2Q24 Highlights Operating Results • Net income available to common shareholders of $6.1 million, or $0.43 per diluted share • Provision for credit losses of $259 thousand • Return on Average Assets (“ROAA”) of 0.89%, Return on Average TCE (“ROATCE”) (1) of 8.83%, net interest margin of 3.16%, and efficiency ratio of 62.7% Loans • Loans held-for-investment (“HFI loans”) increased $51.1 million, or 2.1%, to $2.45 billion • Average loan yield was 6.77% compared to 6.66% for 1Q24 • Total loans to deposits ratio was 101.9% • Quarterly loan production was $73.3 million compared to $153.6 million for 1Q24 Asset Quality • ACL on loans was $28.7 million, or 1.17% to HFI loans • Past due loans were $2.3 million, or 0.09% of HFI loans and NPLs were $7.5 million, or 0.31% of HFI loans Deposits • Total deposits increased $3.4 million, or 0.1%, to $2.41 billion • Core deposits(1) were $1.50 billion, or 62.5% of total deposits • Non-interest bearing deposits were $543.5 million, or 22.6% of total deposits • Uninsured deposits were $1.02 billion, or 42.4% of total deposits • Cost of average interest-bearing deposits and total deposits were 4.86% and 3.78%, respectively Capital & Liquidity • Declared and paid quarterly cash dividend of $0.18 per share • TBV per share increased to $19.95 • Maintained available borrowing capacity of $1.33 billion, or 46.7% of total assets (1) Not presented in accordance with GAAP. See “Non-GAAP Measures” for reconciliation to most comparable GAAP measure 5

Selected Financial As of or For the Three Months Ended Compared to 3/31/24 Compared to 6/30/23 ($ in Thousands, Except Per Share Data) 6/30/24 3/31/24 6/30/23 Amount Percentage Amount Percentage Income Statement Summary: Interest Income $ 44,945 $ 43,555 $ 36,838 $ 1,390 3.2% $ 8,107 22.0% Interest Expense 23,210 22,556 15,121 654 2.9% 8,089 53.5% Net Interest Income 21,735 20,999 21,717 736 3.5% 18 0.1% Noninterest Income 2,485 2,945 2,657 (460) -15.6% (172) -6.5% Noninterest Expense 15,175 16,352 13,627 (1,177) -7.2% 1,548 11.4% Provision (Reversal) for Credit Losses 259 1,090 197 (831) -76.2% 62 31.5% Pretax Income 8,786 6,502 10,550 2,284 35.1% (1,764) -16.7% Income Tax Expense 2,505 1,817 3,073 688 37.9% (568) -18.5% Net Income 6,281 4,685 7,477 1,596 34.1% (1,196) -16.0% Diluted EPS $ 0.43 $ 0.33 $ 0.52 $ 0.10 30.3% $ (0.09) -17.3% Selected Balance Sheet Items: HFI loans $ 2,449,074 $ 2,397,964 $ 2,122,427 $ 51,110 2.1% $ 326,647 15.4% HFS loans 2,959 3,256 13,065 (297) -9.1% (10,106) -77.4% Total Deposits 2,406,254 2,402,840 2,188,232 3,414 0.1% 218,022 10.0% Total Assets 2,852,964 2,854,292 2,556,345 (1,328) -0.1% 296,619 11.6% Shareholders’ Equity 353,469 350,005 340,411 3,464 1.0% 13,058 3.8% TCE (2) 284,328 280,864 271,270 3,464 1.2% 13,058 4.8% Key Metrics: BV Per Share $ 24.80 $ 24.54 $ 23.77 $ $ TCE Per Share (1) $ 19.95 $ 19.69 $ 18.94 $ 0.26 1.1% $ 1.03 4.3% ROAA (2) 0.89% 0.67% 1.19% 0.26 1.3% 1.01 5.3% Return on Average Equity (“ROAE”) (2) 7.19% 5.39% 8.82% 0.22% -0.30% ROATCE (1), (2) 8.83% 6.63% 11.08% 1.80% -1.63% Net Interest Margin (2) 3.16% 3.10% 3.55% 2.21% -2.24% Efficiency Ratio (3) 62.65% 68.29% 55.91% 0.06% -0.39% (1) Not presented in accordance with GAAP. See “Non-GAAP Measures” for reconciliation of these measures to their most comparable GAAP measures (2) Annualized (3) Calculated by dividing noninterest expense by the sum of net interest income and noninterest income 6

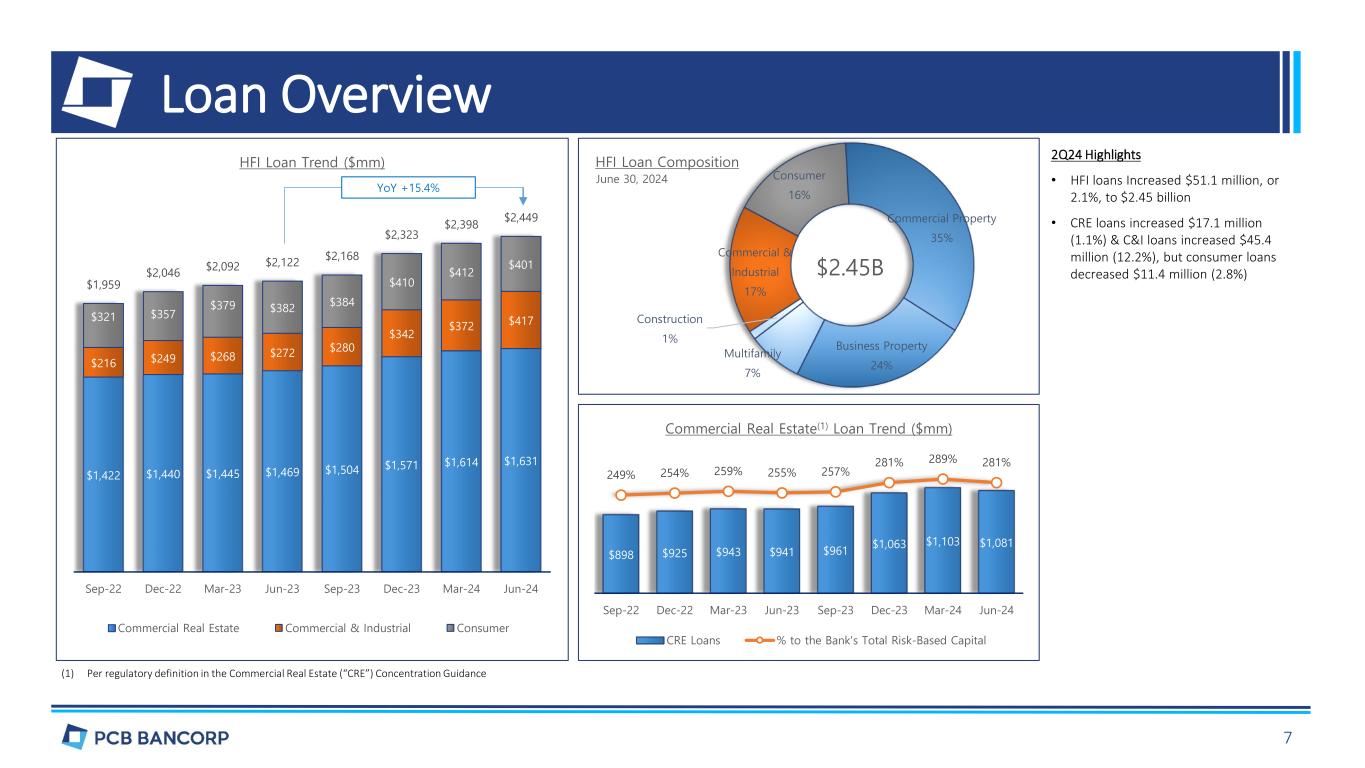

$1,422 $1,440 $1,445 $1,469 $1,504 $1,571 $1,614 $1,631 $216 $249 $268 $272 $280 $342 $372 $417$321 $357 $379 $382 $384 $410 $412 $401 $1,959 $2,046 $2,092 $2,122 $2,168 $2,323 $2,398 $2,449 - 500 1,000 1,500 2,000 2,500 Sep-22 Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 HFI Loan Trend ($mm) Commercial Real Estate Commercial & Industrial Consumer 7 Loan Overview YoY +15.4% (1) Per regulatory definition in the Commercial Real Estate (“CRE”) Concentration Guidance $898 $925 $943 $941 $961 $1,063 $1,103 $1,081 249% 254% 259% 255% 257% 281% 289% 281% 0% 50% 100% 150% 200% 250% 300% 300.0 400.0 500.0 600.0 700.0 800.0 900.0 1,000.0 1,100.0 1,200.0 Sep-22 Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 Commercial Real Estate(1) Loan Trend ($mm) CRE Loans % to the Bank's Total Risk-Based Capital Commercial Property 35% Business Property 24% Multifamily 7% Construction 1% Commercial & Industrial 17% Consumer 16% HFI Loan Composition June 30, 2024 $2.45B 2Q24 Highlights • HFI loans Increased $51.1 million, or 2.1%, to $2.45 billion • CRE loans increased $17.1 million (1.1%) & C&I loans increased $45.4 million (12.2%), but consumer loans decreased $11.4 million (2.8%)

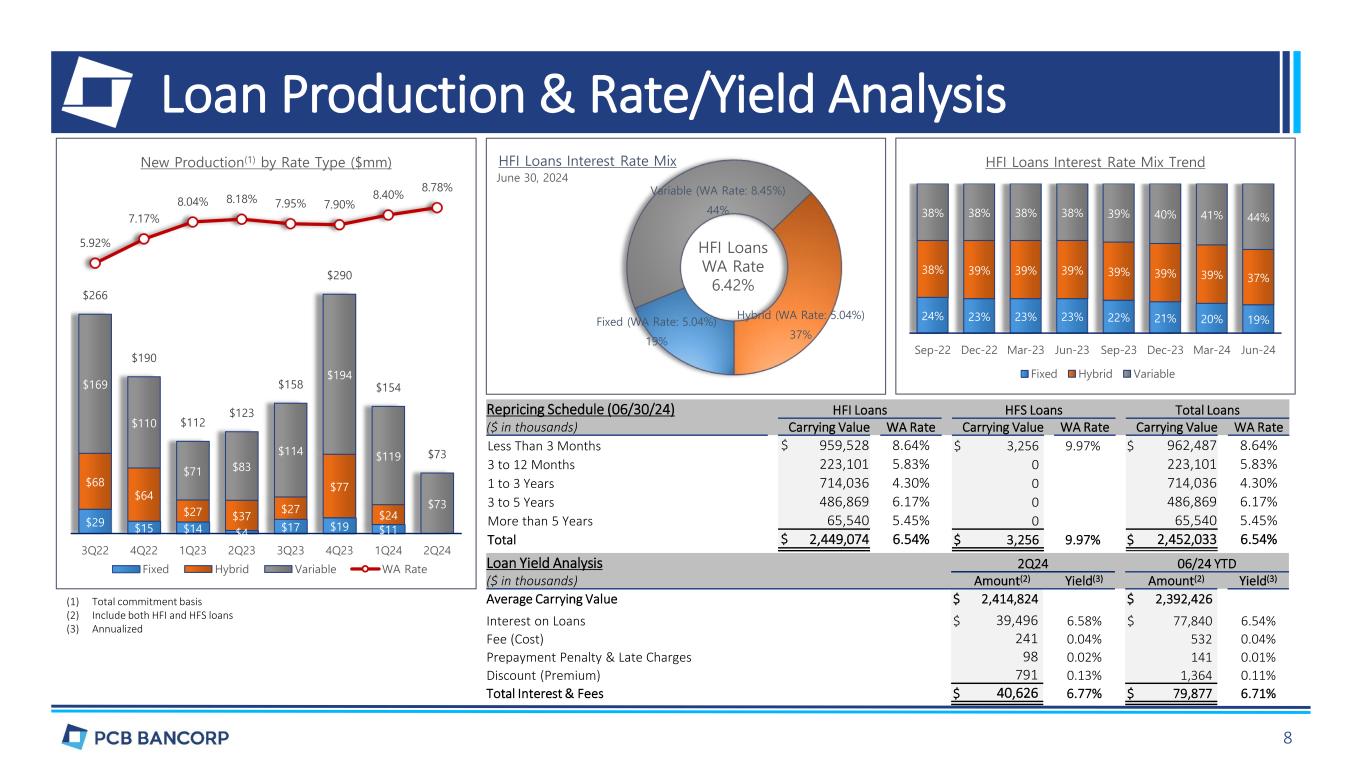

8 Loan Production & Rate/Yield Analysis (1) Total commitment basis (2) Include both HFI and HFS loans (3) Annualized $29 $15 $14 $4 $17 $19 $11 $68 $64 $27 $37 $27 $77 $24 $169 $110 $71 $83 $114 $194 $119 $73 $266 $190 $112 $123 $158 $290 $154 $73 5.92% 7.17% 8.04% 8.18% 7.95% 7.90% 8.40% 8.78% -8% -6% -4% -2% 0% 2% 4% 6% 8% 0 50 100 150 200 250 300 350 400 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 New Production(1) by Rate Type ($mm) Fixed Hybrid Variable WA Rate Fixed (WA Rate: 5.04%) 19% Variable (WA Rate: 8.45%) 44% Hybrid (WA Rate: 5.04%) 37% HFI Loans Interest Rate Mix 24% 23% 23% 23% 22% 21% 20% 19% 38% 39% 39% 39% 39% 39% 39% 37% 38% 38% 38% 38% 39% 40% 41% 44% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Sep-22 Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 HFI Loans Interest Rate Mix Trend Fixed Hybrid Variable June 30, 2024 HFI Loans WA Rate 6.42% Repricing Schedule (06/30/24) HFI Loans HFS Loans Total Loans ($ in thousands) Carrying Value WA Rate Carrying Value WA Rate Carrying Value WA Rate Less Than 3 Months $ 959,528 8.64% $ 3,256 9.97% $ 962,487 8.64% 3 to 12 Months 223,101 5.83% 0 223,101 5.83% 1 to 3 Years 714,036 4.30% 0 714,036 4.30% 3 to 5 Years 486,869 6.17% 0 486,869 6.17% More than 5 Years 65,540 5.45% 0 65,540 5.45% Total $ 2,449,074 6.54% $ 3,256 9.97% $ 2,452,033 6.54% Loan Yield Analysis 2Q24 06/24 YTD ($ in thousands) Amount(2) Yield(3) Amount(2) Yield(3) Average Carrying Value $ 2,414,824 $ 2,392,426 Interest on Loans $ 39,496 6.58% $ 77,840 6.54% Fee (Cost) 241 0.04% 532 0.04% Prepayment Penalty & Late Charges 98 0.02% 141 0.01% Discount (Premium) 791 0.13% 1,364 0.11% Total Interest & Fees $ 40,626 6.77% $ 79,877 6.71%

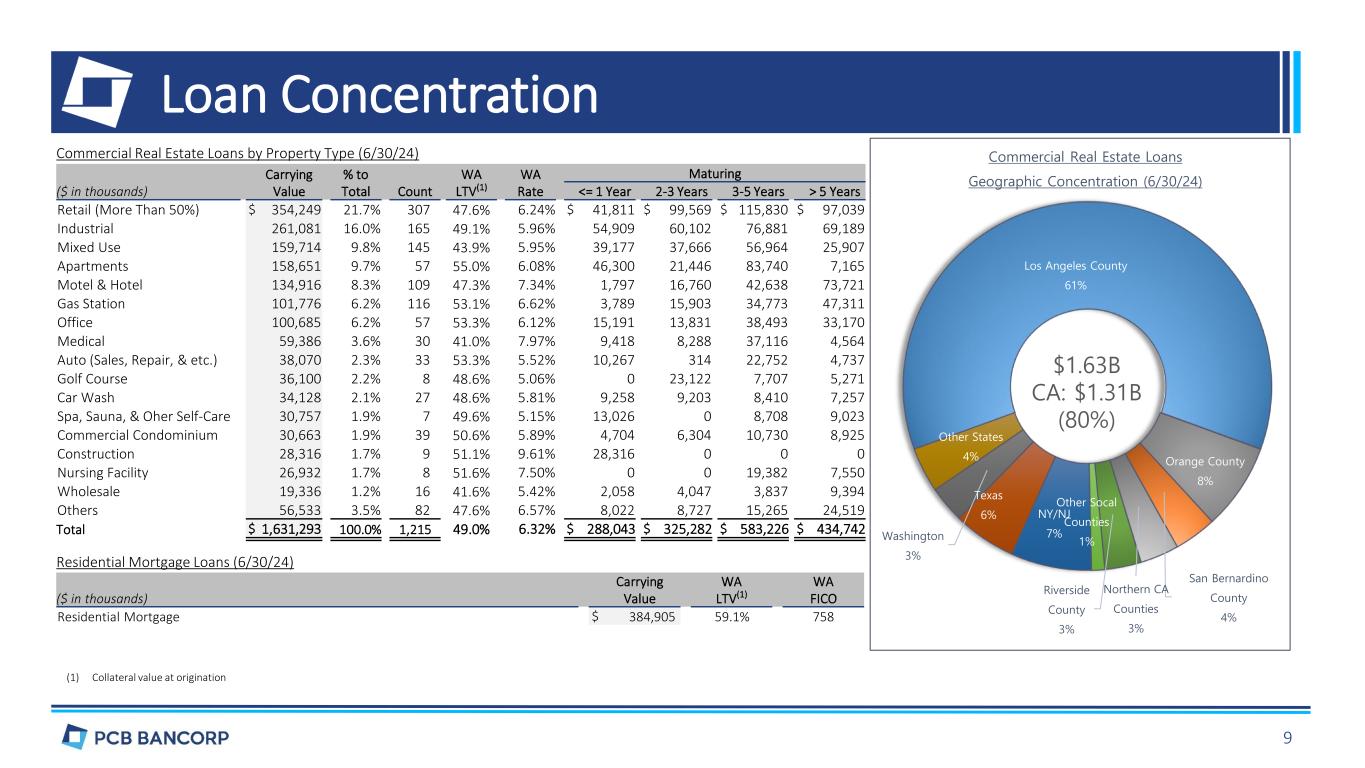

Carrying Value % to Total Count WA LTV(1) WA Rate Maturing ($ in thousands) <= 1 Year 2-3 Years 3-5 Years > 5 Years Retail (More Than 50%) $ 354,249 21.7% 307 47.6% 6.24% $ 41,811 $ 99,569 $ 115,830 $ 97,039 Industrial 261,081 16.0% 165 49.1% 5.96% 54,909 60,102 76,881 69,189 Mixed Use 159,714 9.8% 145 43.9% 5.95% 39,177 37,666 56,964 25,907 Apartments 158,651 9.7% 57 55.0% 6.08% 46,300 21,446 83,740 7,165 Motel & Hotel 134,916 8.3% 109 47.3% 7.34% 1,797 16,760 42,638 73,721 Gas Station 101,776 6.2% 116 53.1% 6.62% 3,789 15,903 34,773 47,311 Office 100,685 6.2% 57 53.3% 6.12% 15,191 13,831 38,493 33,170 Medical 59,386 3.6% 30 41.0% 7.97% 9,418 8,288 37,116 4,564 Auto (Sales, Repair, & etc.) 38,070 2.3% 33 53.3% 5.52% 10,267 314 22,752 4,737 Golf Course 36,100 2.2% 8 48.6% 5.06% 0 23,122 7,707 5,271 Car Wash 34,128 2.1% 27 48.6% 5.81% 9,258 9,203 8,410 7,257 Spa, Sauna, & Oher Self-Care 30,757 1.9% 7 49.6% 5.15% 13,026 0 8,708 9,023 Commercial Condominium 30,663 1.9% 39 50.6% 5.89% 4,704 6,304 10,730 8,925 Construction 28,316 1.7% 9 51.1% 9.61% 28,316 0 0 0 Nursing Facility 26,932 1.7% 8 51.6% 7.50% 0 0 19,382 7,550 Wholesale 19,336 1.2% 16 41.6% 5.42% 2,058 4,047 3,837 9,394 Others 56,533 3.5% 82 47.6% 6.57% 8,022 8,727 15,265 24,519 Total $ 1,631,293 100.0% 1,215 49.0% 6.32% $ 288,043 $ 325,282 $ 583,226 $ 434,742 Loan Concentration (1) Collateral value at origination Los Angeles County 61% Orange County 8% San Bernardino County 4% Northern CA Counties 3% Riverside County 3% Other Socal Counties 1% NY/NJ 7% Texas 6% Washington 3% Other States 4% Commercial Real Estate Loans Geographic Concentration (6/30/24) $1.63B CA: $1.31B (80%) Commercial Real Estate Loans by Property Type (6/30/24) ($ in thousands) Carrying Value WA LTV(1) WA FICO Residential Mortgage $ 384,905 59.1% 758 Residential Mortgage Loans (6/30/24) 9

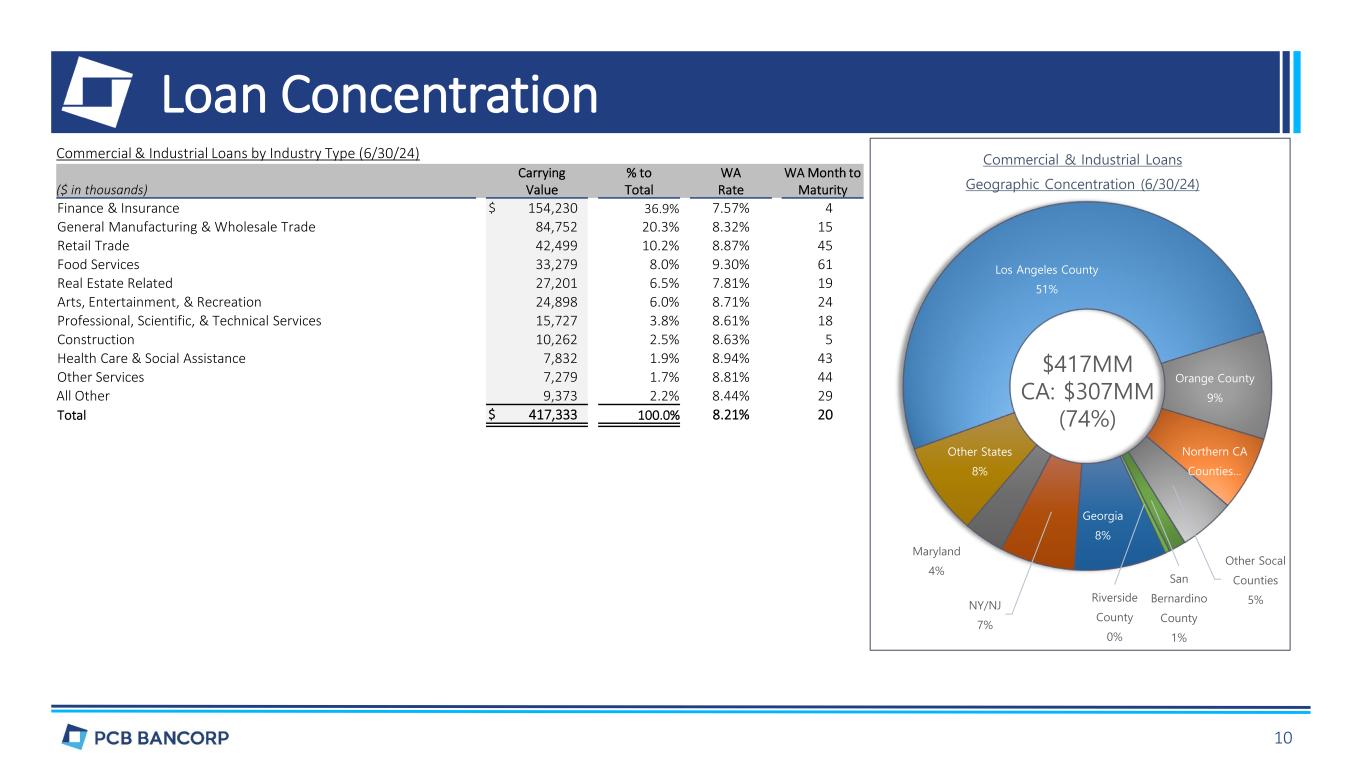

Loan Concentration Carrying Value % to Total WA Rate WA Month to Maturity($ in thousands) Finance & Insurance $ 154,230 36.9% 7.57% 4 General Manufacturing & Wholesale Trade 84,752 20.3% 8.32% 15 Retail Trade 42,499 10.2% 8.87% 45 Food Services 33,279 8.0% 9.30% 61 Real Estate Related 27,201 6.5% 7.81% 19 Arts, Entertainment, & Recreation 24,898 6.0% 8.71% 24 Professional, Scientific, & Technical Services 15,727 3.8% 8.61% 18 Construction 10,262 2.5% 8.63% 5 Health Care & Social Assistance 7,832 1.9% 8.94% 43 Other Services 7,279 1.7% 8.81% 44 All Other 9,373 2.2% 8.44% 29 Total $ 417,333 100.0% 8.21% 20 Los Angeles County 51% Orange County 9% Northern CA Counties… Other Socal Counties 5% San Bernardino County 1% Riverside County 0% Georgia 8% NY/NJ 7% Maryland 4% Other States 8% Commercial & Industrial Loans Geographic Concentration (6/30/24) Commercial & Industrial Loans by Industry Type (6/30/24) $417MM CA: $307MM (74%) 10

Credit Quality & Peer(1) Comparison $7.4 $7.4 $3.0 $3.8 $3.7 $6.5 $4.9 $7.5 0 1 2 3 4 5 6 7 8 Sep-22 Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 Non-Performing Assets (“NPAs”) ($mm) 0.32% 0.30% 0.12% 0.15% 0.15% 0.23% 0.17% 0.26% 0% 0% 0% 0% 0% 0% 0% 0% Sep-22 Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 NPAs to Total Assets 1.21% 1.22% 1.18% 1.17% 1.18% 1.19% 1.18% 1.17% 1% 1% 1% 1% 1% 1% 1% 1% 1% 1% Sep-22 Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 ACL on Loans to HFI Loans 321% 742% 834% 647% 686% 703% 574% 383% 0 1 2 3 4 5 6 7 8 9 Sep-22 Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 ACL on Loans to Non-Performing HFI Loans 0.87% 0.57% 0.56% 0.51% 0.47% 0.31% 0.28% 0.23% 0.19% 0% 0% 0% 0% 0% 1% 1% 1% 1% 1% 1% Hope Open Shinhan Peer CBB PCB Woori Hanmi USM NPAs / (Total Loans + OREO)(2) June 30, 2024 Peer Information: March 31, 2024 1.14% 0.71% 0.51% 0.34% 0.32% 0% 0% 0% 1% 1% 1% 1% Hope CBB Open PCB Hanmi Classified Assets to Total Assets(4) June 30, 2024 Peer Information: March 31, 2024 (1) Korean-American banks operating in Southern California (2) Source: UBPR (3) PCB Bank’s Peer Group per UBPR (4) Source: press releases concerning financial performance (3) 11

Deposits (1) Not presented in accordance with GAAP. See “Non-GAAP Measures” for reconciliation of this measure to its most comparable GAAP measure. $810 $735 $654 $635 $611 $595 $538 $544 $553 $515 $460 $489 $459 $421 $484 $484 $476 $649 $811 $844 $861 $972 $1,021 $1,036 $139 $147 $217 $220 $261 $364 $360 $343 $1,978 $2,046 $2,142 $2,188 $2,192 $2,352 $2,403 $2,407 0 500 1,000 1,500 2,000 2,500 3,000 Sep-22 Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 Deposit Trend ($mm) Noninterest DDA Retail Other Interest-Bearing Retail Time Deposits Wholesale Deposits Noninterest DDA 23% Retail Other Interest-Bearing 20% Retail Time Deposits 43% Whoelsae Deposits 14% Deposit Composition $2.41B $1,600 $1,545 $1,470 $1,516 $1,476 $1,472 $1,494 $1,503 81% 76% 69% 69% 67% 63% 62% 63% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% $500 $700 $900 $1,100 $1,300 $1,500 $1,700 Sep-22 Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 Core Deposits(1) ($mm) Core Deposits % to Total Deposits Time Deposit Maturity Schedule (6/30/24) Retail Wholesale Total ($ in thousands) Amount WA Rate Amount WA Rate Amount WA Rate Less Than 3 Months $ 140,477 4.81% $ 167,954 5.28% $ 308,431 5.06% 3 to 6 Months 390,142 5.24% 162,041 5.35% 552,183 5.27% 6 to 9 Months 340,775 5.12% 0 340,775 5.12% 9 to 12 Months 159,617 4.99% 13,038 5.25% 172,655 5.01% More than 12 Months 4,744 3.02% 0 4,744 3.02% Total $ 1,035,755 5.09% $ 343,033 5.32% $ 1,378,788 5.15% YoY +10.0% 2Q24 Highlight • Total deposits increased $3.4 million (0.1%) • Retail deposits increased $20.2 million (1.0%), but wholesale deposits decreased $16.7 million (4.7%) • Uninsured deposits were $1.02 billion (42.4% of total deposits) compared to $1.02 billion (42.4% of total deposits) at 3/31/24 June 30, 2024 12

Profitability (1) PTPP (Pre-Tax Pre-Provision) income, and adjusted EPS, ROAA and ROAE for PTPP are not presented in accordance with GAAP. See “Non-GAAP measure” for reconciliations of these measures to their most comparable GAAP measures. $7.0 $8.7 $10.3 $7.5 $7.0 $5.9 $4.7 $6.3 $13.5 $13.5 $11.7 $10.7 $10.7 $10.0 $7.6 $9.0 -1 1 3 5 7 9 11 13 15 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 Net Income PTPP Net Income & PTPP(1) Income ($mm) $0.46 $0.58 $0.70 $0.52 $0.49 $0.41 $0.33 $0.43 $0.89 $0.91 $0.80 $0.75 $0.74 $0.69 $0.53 $0.62 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 Diluted EPS Adjusted Diluted EPS Diluted EPS & Adjusted Diluted EPS(1) 1.19% 1.44% 1.69% 1.19% 1.09% 0.89% 0.67% 0.89% 2.31% 2.24% 1.92% 1.71% 1.66% 1.50% 1.09% 1.28% 0% 1% 1% 2% 2% 3% 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 ROAA Adjusted ROAA ROAA & Adjusted ROAA(1) 8.16% 10.31% 12.46% 8.82% 8.12% 6.82% 5.39% 7.19% 15.84% 16.04% 14.13% 12.68% 12.42% 11.49% 8.73% 10.36% 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 ROAE Adjusted ROAE ROAE & Adjusted ROAE(1) 2Q24 Highlights • Net interest income increased $736 thousand and noninterest expense decreased $1.2 million, but noninterest income decreased $460 thousand. 13

Noninterest Income & Expense $27.3 $17.4 $27.1 $16.8 $17.7 $20.8 $19.4 $13.6 $46.1 $22.3 $22.5 $19.2 $16.2 $25.1 $20.6 $12.7 7.5% 6.3% 7.5% 7.2% 6.3% 6.0% 8.2% 7.8% 5.2% 4.4% 4.8% 4.6% 3.9% 3.9% 5.6% 5.6% -8% -3% 2% 7% 12% 0 20 40 60 80 100 120 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 SBA 7(A) Loans ($mm) Sold Production Premium % Gain % $8.5 $7.9 $8.9 $8.7 $8.6 $8.4 $9.2 $9.2 $5.2 $5.2 $4.8 $4.9 $5.6 $6.1 $7.2 $6.0 2.36% 2.19% 2.23% 2.16% 2.22% 2.19% 2.33% 2.13% 0% 1% 1% 2% 2% 3% 0 2 4 6 8 10 12 14 16 18 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 Noninterest Expense Trend ($mm) Compensation All Other Expenses % to Average Total Assets 50.4% 49.2% 54.1% 55.9% 56.9% 59.2% 68.3% 62.7% 59.2% 62.1% 61.0% 61.6% 62.1% 62.8% 66.0% 0% 10% 20% 30% 40% 50% 60% 70% 80% 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 Efficiency Ratio (2) PCB Peer Average 274 272 276 272 272 270 272 265 258 260 262 264 266 268 270 272 274 276 278 Sep-22 Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 Number of FTE(3) Employees (1) Annualized (2) Calculated by dividing noninterest expense by the sum of net interest income and noninterest income. Peer average data from UBPR (3) Full-time equivalent (1) $1.8 $1.6 $1.7 $1.9 $1.8 $1.7 $1.8 $1.7 $1.4 $0.8 $1.3 $0.8 $0.7 $0.8 $1.1 $0.8 45% 32% 43% 29% 28% 32% 37% 31% -40% -30% -20% -10% 0% 10% 20% 30% 40% 50% 0 1 1 2 2 3 3 4 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 Noninterest Income Trend ($mm) All Other Income Gain on Sale of Loans % of Gain on Sale of Loans

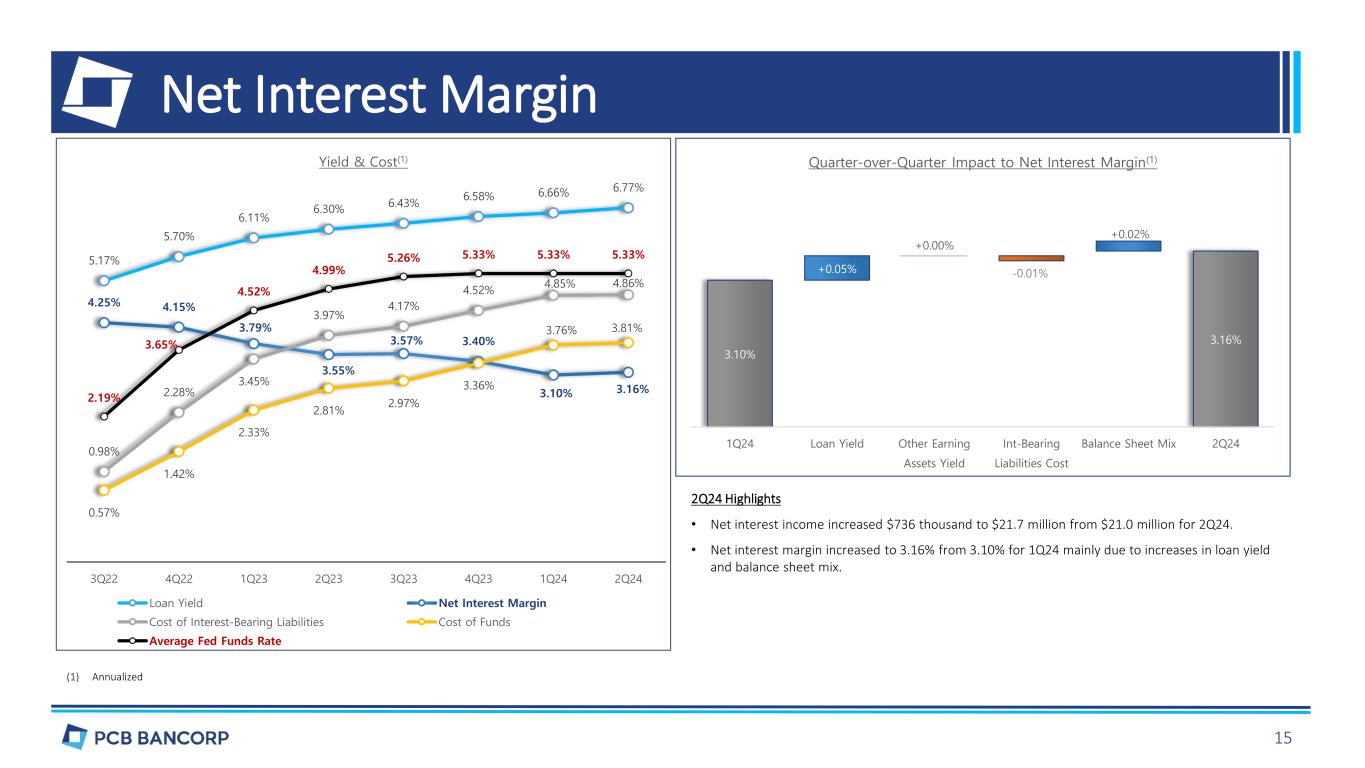

Net Interest Margin (1) Annualized 5.17% 5.70% 6.11% 6.30% 6.43% 6.58% 6.66% 6.77% 4.25% 4.15% 3.79% 3.55% 3.57% 3.40% 3.10% 3.16% 0.98% 2.28% 3.45% 3.97% 4.17% 4.52% 4.85% 4.86% 0.57% 1.42% 2.33% 2.81% 2.97% 3.36% 3.76% 3.81% 2.19% 3.65% 4.52% 4.99% 5.26% 5.33% 5.33% 5.33% -1% 0% 1% 2% 3% 4% 5% 6% 7% 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 Yield & Cost(1) Loan Yield Net Interest Margin Cost of Interest-Bearing Liabilities Cost of Funds Average Fed Funds Rate 3.10% 3.16% +0.05% +0.00% -0.01% +0.02% 2.80% 2.90% 3.00% 3.10% 3.20% 3.30% 1Q24 Loan Yield Other Earning Assets Yield Int-Bearing Liabilities Cost Balance Sheet Mix 2Q24 Quarter-over-Quarter Impact to Net Interest Margin(1) 2Q24 Highlights • Net interest income increased $736 thousand to $21.7 million from $21.0 million for 2Q24. • Net interest margin increased to 3.16% from 3.10% for 1Q24 mainly due to increases in loan yield and balance sheet mix. 15

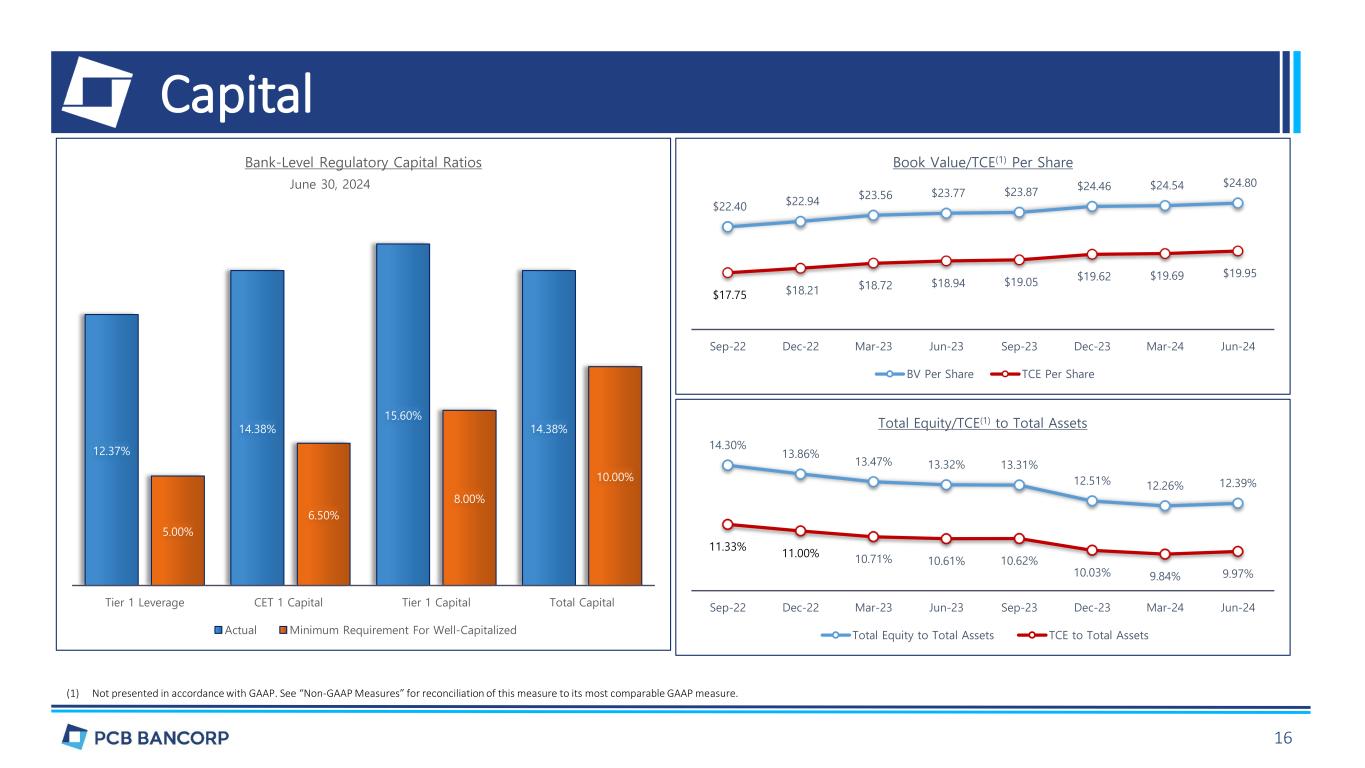

Capital 12.37% 14.38% 15.60% 14.38% 5.00% 6.50% 8.00% 10.00% 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% Tier 1 Leverage CET 1 Capital Tier 1 Capital Total Capital Bank-Level Regulatory Capital Ratios Actual Minimum Requirement For Well-Capitalized $22.40 $22.94 $23.56 $23.77 $23.87 $24.46 $24.54 $24.80 $17.75 $18.21 $18.72 $18.94 $19.05 $19.62 $19.69 $19.95 $12 $14 $16 $18 $20 $22 $24 $26 Sep-22 Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 Book Value/TCE(1) Per Share BV Per Share TCE Per Share June 30, 2024 14.30% 13.86% 13.47% 13.32% 13.31% 12.51% 12.26% 12.39% 11.33% 11.00% 10.71% 10.61% 10.62% 10.03% 9.84% 9.97% 8% 9% 10% 11% 12% 13% 14% 15% Sep-22 Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 Total Equity/TCE(1) to Total Assets Total Equity to Total Assets TCE to Total Assets (1) Not presented in accordance with GAAP. See “Non-GAAP Measures” for reconciliation of this measure to its most comparable GAAP measure. 16

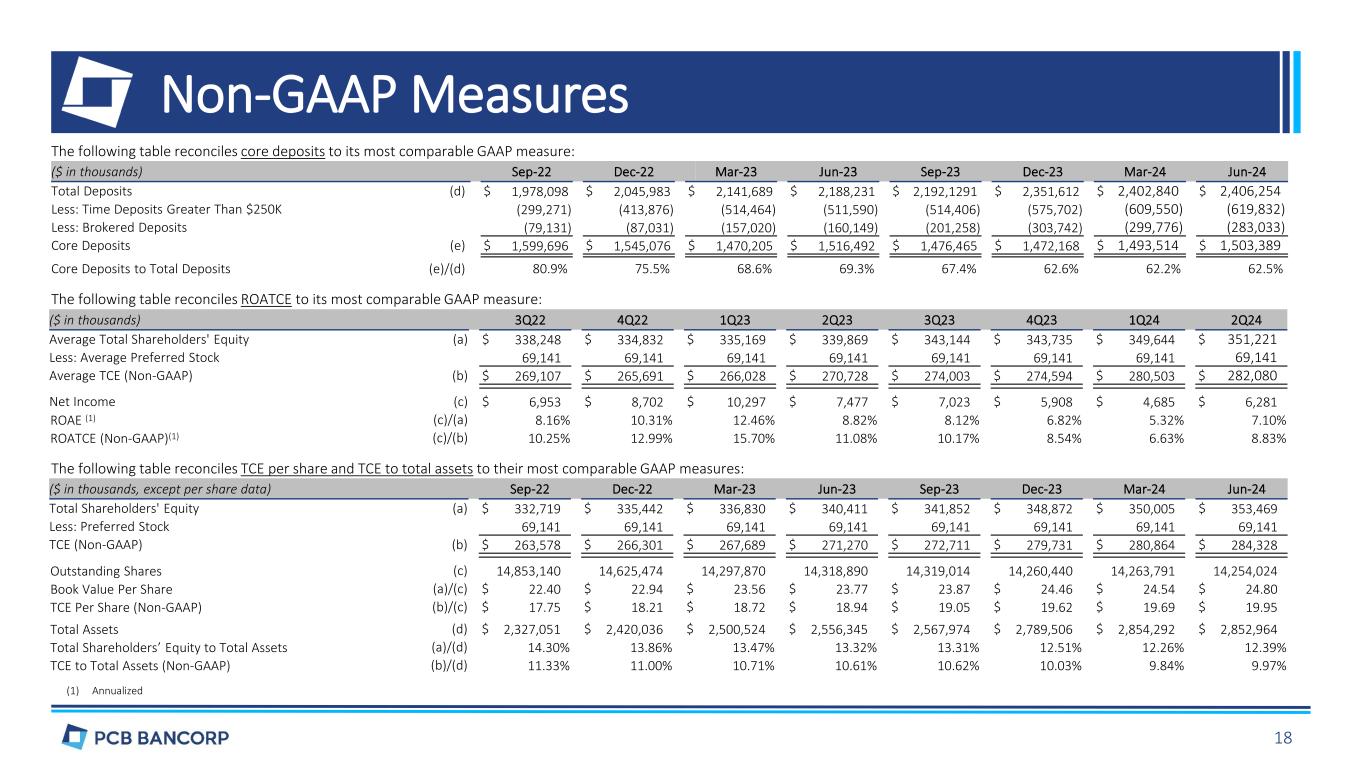

Non-GAAP Measures To supplement the financial information presented in accordance with GAAP, we use certain non-GAAP financial measures. Management believes the non-GAAP measures enhance investors’ understanding of the Company’s business and performance. These measures are also useful in understanding performance trends and facilitate comparisons with the performance of other financial institutions. Risks associated with non-GAAP measures are the risk that persons might disagree as to the appropriateness of items comprising these measures and that different companies might calculate these measures differently. In the information below, we provide reconciliations of the non-GAAP financial measures used in this presentation to the most direct comparable GAAP measures. Core Deposits Core Deposits are a non-GAAP measure that we use to measure the portion of our total deposits that are thought to be more stable, lower cost and reprice less frequently on average in a rising rate environment. We calculate core deposits as total deposits less time deposits greater than $250,000 and brokered deposits. Management tracks its core deposits because management believes it is a useful measure to help assess the Company’s deposit base and, among other things, potential volatility therein. ROATCE, TCE Per Share and TCE to Total Assets ROATCE, TCE per share and TCE to total assets measures that we use to measure the Company’s performance. We calculated TCE as total shareholders’ equity excluding preferred stock. Management believes the non-GAAP measures provide useful supplemental information, and a clearer understanding of the Company’s performance. PTPP Income, and Adjusted ROAA, ROAE and Diluted EPS for PTPP PTPP income, and adjusted ROAA, ROAE and Diluted EPS are non-GAAP measures that we use to measure the Company’s performance and believe these presentations provide useful supplemental information, and a clearer understanding of the Company’s performance. We calculated PTPP income as net income excluding income tax provision and provision for loan losses. 17

Non-GAAP Measures The following table reconciles core deposits to its most comparable GAAP measure: ($ in thousands) Sep-22 Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 Total Deposits (d) $ 1,978,098 $ 2,045,983 $ 2,141,689 $ 2,188,231 $ 2,192,1291 $ 2,351,612 $ 2,402,840 $ 2,406,254 Less: Time Deposits Greater Than $250K (299,271) (413,876) (514,464) (511,590) (514,406) (575,702) (609,550) (619,832) Less: Brokered Deposits (79,131) (87,031) (157,020) (160,149) (201,258) (303,742) (299,776) (283,033) Core Deposits (e) $ 1,599,696 $ 1,545,076 $ 1,470,205 $ 1,516,492 $ 1,476,465 $ 1,472,168 $ 1,493,514 $ 1,503,389 Core Deposits to Total Deposits (e)/(d) 80.9% 75.5% 68.6% 69.3% 67.4% 62.6% 62.2% 62.5% The following table reconciles ROATCE to its most comparable GAAP measure: ($ in thousands) 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 Average Total Shareholders' Equity (a) $ 338,248 $ 334,832 $ 335,169 $ 339,869 $ 343,144 $ 343,735 $ 349,644 $ 351,221 Less: Average Preferred Stock 69,141 69,141 69,141 69,141 69,141 69,141 69,141 69,141 Average TCE (Non-GAAP) (b) $ 269,107 $ 265,691 $ 266,028 $ 270,728 $ 274,003 $ 274,594 $ 280,503 $ 282,080 Net Income (c) $ 6,953 $ 8,702 $ 10,297 $ 7,477 $ 7,023 $ 5,908 $ 4,685 $ 6,281 ROAE (1) (c)/(a) 8.16% 10.31% 12.46% 8.82% 8.12% 6.82% 5.32% 7.10% ROATCE (Non-GAAP)(1) (c)/(b) 10.25% 12.99% 15.70% 11.08% 10.17% 8.54% 6.63% 8.83% The following table reconciles TCE per share and TCE to total assets to their most comparable GAAP measures: ($ in thousands, except per share data) Sep-22 Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 Total Shareholders' Equity (a) $ 332,719 $ 335,442 $ 336,830 $ 340,411 $ 341,852 $ 348,872 $ 350,005 $ 353,469 Less: Preferred Stock 69,141 69,141 69,141 69,141 69,141 69,141 69,141 69,141 TCE (Non-GAAP) (b) $ 263,578 $ 266,301 $ 267,689 $ 271,270 $ 272,711 $ 279,731 $ 280,864 $ 284,328 Outstanding Shares (c) 14,853,140 14,625,474 14,297,870 14,318,890 14,319,014 14,260,440 14,263,791 14,254,024 Book Value Per Share (a)/(c) $ 22.40 $ 22.94 $ 23.56 $ 23.77 $ 23.87 $ 24.46 $ 24.54 $ 24.80 TCE Per Share (Non-GAAP) (b)/(c) $ 17.75 $ 18.21 $ 18.72 $ 18.94 $ 19.05 $ 19.62 $ 19.69 $ 19.95 Total Assets (d) $ 2,327,051 $ 2,420,036 $ 2,500,524 $ 2,556,345 $ 2,567,974 $ 2,789,506 $ 2,854,292 $ 2,852,964 Total Shareholders’ Equity to Total Assets (a)/(d) 14.30% 13.86% 13.47% 13.32% 13.31% 12.51% 12.26% 12.39% TCE to Total Assets (Non-GAAP) (b)/(d) 11.33% 11.00% 10.71% 10.61% 10.62% 10.03% 9.84% 9.97% (1) Annualized 18

Non-GAAP Measures (1) Provision (reversal) for credit losses does not include provision (reversal) for off-balance sheet credit exposures for periods prior to January 1, 2023. (2) Annualized. The following table reconciles PTPP income, and adjusted ROAA, ROAE and diluted EPS for PTPP to their most comparable GAAP measures: ($ in thousands) 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 Net Income (a) $ 6,953 $ 8,702 $ 10,297 $ 7,477 $ 7,023 $ 5,908 $ 4,685 $ 6,281 Add: Provision (Reversal) for Credit Losses(1) 3,753 1,149 (2,778) 197 751 1,698 1,090 259 Add: Income Tax Provision 2,798 3,688 4,162 3,073 2,970 2,352 1,817 2,505 PTPP Income (Non-GAAP) (b) $ 13,504 $ 13,539 $ 11,681 $ 10,747 $ 10,744 $ 9,958 $ 7,592 $ 9,045 Average Total Assets (c) $ 2,319,439 $ 2,395,712 $ 2,470,876 $ 2,520,752 $ 2,563,233 $ 2,642,175 $ 2,809,808 $ 2,853,152 ROAA (2) (a)/(c) 1.19% 1.44% 1.69% 1.19% 1.09% 0.89% 0.67% 0.89% Adjusted ROAA (Non-GAAP)(2) (b)/(c) 2.31% 2.24% 1.92% 1.71% 1.66% 1.50% 1.09% 1.28% Average Total Shareholders' Equity (d) $ 338,248 $ 334,832 $ 335,169 $ 339,869 $ 343,144 $ 343,735 $ 349,644 $ 351,221 ROAE (2) (a)/(d) 8.16% 10.31% 12.46% 8.82% 8.12% 6.82% 5.39% 7.19% Adjusted ROAE (Non-GAAP)(2) (b)/(d) 15.84% 16.04% 14.13% 12.68% 12.42% 11.49% 8.73% 10.36% Net Income available to common shareholders $ 6,953 $ 8,702 $ 10,297 $ 7,477 $ 7,023 $ 5,908 $ 4,685 $ 6,139 Less: Income Allocated to Participating Securities (30) (37) (33) (24) (21) (17) (9) (11) Net Income Allocated to Common Stock (e) 6,923 8,665 10,264 7,453 7,002 5,891 4,676 6,128 Add: Provision for Loan Losses 3,753 1,149 (2,778) 197 751 1,698 1,090 259 Add: Income Tax Provision 2,798 3,688 4,162 3,073 2,970 2,352 1,817 2,505 PTPP Income Allocated to Common Stock (f) $ 13,474 $ 13,502 $ 11,648 $ 10,723 $ 10,723 $ 9,941 $ 7,583 $ 8,892 WA common shares outstanding, diluted (g) 15,088,089 14,904,106 14,574,929 14,356,776 14,396,216 14,316,581 14,330,204 14,312,949 Diluted EPS (e)/(g) $ 0.46 $ 0.58 $ 0.70 $ 0.52 $ 0.49 $ 0.41 $ 0.33 $ 0.43 Adjusted Diluted EPS (Non-GAAP) (f)/(g) $ 0.89 $ 0.91 $ 0.80 $ 0.75 $ 0.74 $ 0.69 $ 0.53 $ 0.62 ($ in thousands) 2019 2020 2021 2022 2023 06/24 YTD Net Income $ 24,108 $ 16,175 $ 40,103 $ 34,987 $ 30,705 $ 10,966 Add: Provision (Reversal) for Credit Losses(1) 4,237 13,219 (4,596) 3,602 (132) 1,349 Add: Income Tax Provision 10,243 6,836 16,856 14,416 12,557 4,322 PTPP Income (Non-GAAP) $ 38,588 $ 36,230 $ 52,363 $ 53,005 $ 43,130 $ 16,637 19